Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Aadhar Seeds Capital Budgeting

Caricato da

Sakhamuri Ram'sCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Aadhar Seeds Capital Budgeting

Caricato da

Sakhamuri Ram'sCopyright:

Formati disponibili

INTRODUCTION OF THE STUDY

Introduction

Capital budgeting or capital expenditure decision is a systematic program for

investing funds in the long-term or fixed assets of a firm in expectation of future profit. It

may be referred to as the process of identifying, evaluating and selecting investment

projects who expected returns are received for more than one year-generally, for a

considerable period of time in the future

According to T. Horn Green

Capital budgeting is a long term planning for making and financing

proposed capital out lays.

In general a project is an activity in which, we will spend money in expansion of

returns in which logically seems to lead it self planning. Financing and implementations

as a unit, is a specific activity with a specific point and a specific ending point intended to

a accomplish a specific objective of the study.

An efficient allocation of capital is the most important finance function in the

modern times. It involves decisions to commit the firms funds to the long term assets.

Capital budgeting for investment decisions is of considerable importance to the firm since

they tend to determine its value by influencing its growth, evaluation of capital budgeting

decisions.

A capital budgeting decisions may be defined as the firms decision to invest is

current funds most effectively & efficiently in the long term assets in anticipation of an

expected flow of benefits over a series of years. The long term assets are those that

affect the firms operations beyond the one year period. The firms investment decisions

would generally includes expansion, acquisition modernization and replacement of long

term assets. Sale of a division or business is also an investment decision. The quality of

these decision is improved by capital budgeting. Capital budgeting decision can be of two

types:

1) To those which expand revenues and

2) To those which reduce costs.

So that I conducted my study regarding capital budgeting in this organization to

know how effectively investment decision taken in the organization. I think it would be a

great achievement for my future also.

Introduction to Capital Budgeting

Capital budgeting is the process of making investment may be defined as an

expenditure the benefits of which are expected to be received over period of time

exceeding one year. The main characteristic of a capital expenditure is that the

expenditure is incurred at one point of time whereas benefits of the expenditure are

realized at different points of time in future. In simple language we may say that a capital

expenditure is an expenditure incurred for acquiring or improving the fixed assets, the

benefits of which are expected to be received over a number of years in future.

This project presents two versions of heuristic algorithm to solve a model of

capital budgeting problems in a decentralized multidivisional firm involving no more

than two exchanges of information between headquarters and divisions. Head quarter

make an allocation of funds to each division based upon its cash demand and its potential

growth rate. Each division determines which projects to accept. Then, an additional

iteration is performed to define the solution.

To take up a new project, involves a capital investment decision and it is the top

managements duty to make a situation and feasibility analysis of that particular project

and means of financing and implementing it financing is a rapidly expanding field, which

focuses not on the credit status of a company, but on cash flows that will be generated by

a specific project.

The capital budgeting decisions procedure basically involves the evaluation of the

desirability of an investment proposal. It is obvious that the firm must have a systematic

procedure for making capital budgeting decisions. The procedure for making capital

budgeting decisions must be consistent with objective of wealth maximization.

Definition

Capital Budgeting is along term planning for making and financing proposed

capital outlays

- T. Horn green

A budget is an estimate of future needs arranged according to at an orderly basis

covering some or all the activities of an enterprise for a definite period of time.

- George R. Terry

Budget as a financial and / or quantitative statement prepared to a definite period

of time, of the policy to be pursued during that period for the purpose of attaining given

objective.

Need of capital budgeting

The importance of capital budgeting can be well understood from the fact that

unsound investment decision may prove to be fatal to the very existence of the concern.

The need, significance or importance of capital budgeting arises mainly due to the

following.

Large investments

Long term commitment of funds

Irreversible nature

Long ter effect on profitability

Difficulties of investment mdecisions

National importance

Objectives for Capital Budgeting

It determines the capital projects on which work can be started during the budget

period after taking into account their urgency and the expected rate of return on each

project.

It estimates the expenditure that would have to be incurred on capital projects

approved by the management together with the sources from which the required funds

would be obtained.

It restricts the capital expenditure on projects within authorized limits.

Types of Capital Budgeting decisions

Capital budgeting decisions are of paramount importance in financial decision

making. In first place they affect the profitability of the firm. They also have a bearing

on the competitive position of the firm because they relate to fixed assets. The fixed

assets are true goods than can ultimately be sold for profit. Generally the capital

budgeting of investment decision includes addition, disposition, modification and

replacement of fixed assets.

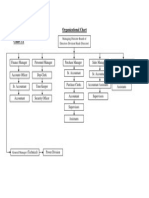

Diagram 3.1

Expansion of existing business

A company may add capacity to its existing product lines to expand existing

operations. For example Amaravathi Textiles Pvt.Ltd may increase its plant capacity to

manufacture more detergents soaps & powder. It is an example of related expansion.

EXPANSION OF

EXISTING BUSINESS

TYPES OF CAPITAL

BUDGETING

EXPANSION OF NEW

BUSINESS

REPLACEMENT

& MODERNIZATION

Expansion of new business

A firm may expand its activities in a new business expansion of a new business

requires investment and new kind of production activating with in the firm. If packing

manufacturing company invests in a new plant and machinery to produce ball bearings,

which the firm has not manufactured before, this represents expansion of new business or

unrelated diversification. Sometimes accompany acquires existing firms to expand its

business.

Replacement and modernization

The main objective of modernization and replacement is to improve operating

efficiency reduce costs. Cost saving will reflect in the increased profits, but the firms

revenue may remain unchanged. Assets become outdated and absolute with technological

changes. The firm must decide to replace those with new assets that operate more

efficient and economical assets and therefore, are also called cost reduction investment.

However replacement decision that involves substantial modernization and

technological improvements expand revenues as well as reduce costs. Yet another useful

way to classify investment is as follows:

Mutually exclusive investment

Independent investment

Contingent investment

Capital budgeting involves

Committing significant resources

Planning for the long term 5 to 50 years.

Decision making by senior management

Forecasting long term cash flows

Estimating long term discount rates & analyzing risk.

Factors for Capital Budgeting

Cost of acquisition of permanent asset as land and building, plant and machinery,

goodwill etc.

Cost of addition, expansion, improvement or alteration in the fixed assets.

Cost of replacement of permanent assets.

Research and development projects cost, etc.

Significance of Capital Budgeting

Capital budgeting decisions deserve to be treated in a different manner as there

are conceptual problems involved which necessarily make the decision process more

complex, which this makes things more difficult for the decision process maker, it also

makes the problem more challenging. There are several practical reasons for placing

greater emphasis on capital expenditure decisions. These are:

1. Long term Period

The consequences of capital expenditure decisions extended far into future.

The scope of current manufacturing activities of an organization is governed largely by

capital expenditures in the past. Likewise, current capital expenditures decision provides

the frame work for future activities. Capital investment decisions have an enormous

bearing on the basic character of a organization.

2. Irreversibility

The markets are used for capital equipment in general is ill organized.

Further, for some types of capital equipment, custom made to meet specific requirements,

the market may virtually be non existent.

3. Substancial Outlay

Capital expenditure usually involves substantial outlays. An integrated steel

plant, for example, involves an outlay of several thousand millions. Capital costs tend to

increase with advanced technology.

Capital Budgeting Process

The preparation of the capital budget is a process that lasts many months and is

intended to take into account neighborhood and bough needs as well as organization

wide. The process begin in the fall, when each of the segment holds public hearings,

each community board submits a statements of its capital priorities for the next fiscal year

to the managing director and appropriate borough chairmen.

The capital budgeting process involves 8 steps explained in theoretic as

Follows:

Identification of investment proposals

Screen proposals

Evolution of various proposals

Fixing priorities

Final approval

Implementing proposals

Performance review

Feed back.

1. Identification of Investment Proposals

The capital budgeting process begins with the identification of investment

proposals. The investment proposals may originate from the top management or from

any officer of the organization. The department head analyses the various proposals in

the light of the corporate strategies and submit the suitable proposal to the capital

budgeting committee in case of the organizations concerned with process of long term

investment proposals.

Identification of investment ideas it is helpful to:

Monitor external environment regularly to scout investment opportunities.

Formulate a well defined corporate strategy based on through analysis of strengths,

weaknesses, opportunities and threats

Share corporate strategy and respective with persons.

Motivate employees to make suggestions.

2. Screen Proposals

The expenditure planning committee screen the various proposals received

from different departments in different angles to ensure that these are in selection criteria

of the organization and also do not lead to department imbalances.

3. Evalution of Various Proposals

The next steps in capital budgeting process in to evaluate the probability of

various probability the independent proposals are those which do not complete with one

another and the same way be either accepted or rejected on the basic of a minimum return

on investment required.

4. Fixing priorities

After evaluating various proposals, the unprofitable or uneconomic proposals

may be rejected straight away. But it may not be possible for the organization to invest

immediately in all the acceptable proposals due to limitations of funds. Hence, it is very

essential to rank the various proposals and to establish priorities after considering

urgency, risk & profitability involved the criteria.

5. Final approval

Proposals meeting the evaluation and other criteria are finally approved to be

included in the capital expenditure budget. However proposals involving smaller

investment may be decided at the lower levels for expeditious action. The capital

expenditure budget lay down of estimated expenditure to be incurred on fixed assets

during the budget period.

6. Implementing Proposals

Preparation of a capital expenditure budgeting & incorporation of a particular

proposals in the budget does not itself authorize to go ahead with implementation of the

project. A request for authority to spend the amount should be made to be the capital

expenditure committee which may like to review the profitability of the project in

changed circumstances. In the implementation of the projects networks techniques such

as PERT & CPM are applied for project management.

7. Performance review

In this stage the process of capital budgeting is the evaluation of he

performance of the project. The evaluation is made through post completion audit by

way of comparison of actual expenditure on the project with the budgeted one and also

by comparing the actual return from the investment with the anticipated return. The

unfavorable variances if any should be looked into and the causes the same is identified

so that identified so that corrective action may be taken in future.

It throws light on how realistic were the assumptions underlying the project.

It provided a documented log of experience that is highly valuable for decision

making.

8. Feedback

The last step in the capital budgeting process is feedback from employee

involved in the organization. If any consequences are there the process come to 1

st

step

of the process.

Guideline for Capital Budgeting

There are many guidelines for capital budgeting process either it is long term

plan.

The major points are:

Need and objectives of owner

Size of market in terms of existing & proposed product lines and anticipated growth

of the market share

Size of existing plants & plans for new plant sites and plant

Economic conditions which may affect the firms operations and

Business and financial risk associated with the replacement & existing assets of the

purchases of new assets.

Contents of the Project Report

Raw material

Market and marketing

Site of project

Project engineering dealing with technical aspects of the project

Location and layout of the project building

Building

Production capacity

Work schedule

Criteria for Capital Budgeting

Potentially, there is a wide array of criteria for selecting projects. Some

shareholders may want the firm to select projects that will show immediate surges in cash

flow, others may want to emphasize long - term growth with little importance on short

term performance viewed in this way, it would be quite difficult to satisfy the differing

interests of all the shareholders. Fortunately, there is a solution.

Methods for evaluation

In view of the significance of capital budgeting decisions, it is absolutely

necessary that the method adopted for appraisal of capital investment proposals is a

sound one. Any appraisal method should provide for the following.

A basis of distinguishing between acceptable and non acceptable project.

Ranking of projects in order of their desirability.

Choosing among several alternatives

A criterion which is applicable to any conceivable project.

Recognizing the fact that bigger benefits are preferable to smaller ones and early

benefits to later ones.

There are several methods for evaluating the investment proposals. In case of

all these methods the main emphasis is one the return which will be derived on the capital

invested in the project.

Diagram 3.4

Capital Budgeting Techniques

Traditional Modals Discounted Cash Flow Models

Payback period (PBP) Net present value (NPV)

Accounting rate of return (ARR) Internal rate of return (IRR)

Profitability index (PI)

Traditional Modals

Pack Back Period

The payback period one of the most popular and widely recognized

Additional method of evaluation investment proposals. Payback period is number of

years required to recover the original cash outlay invested in a project.

If the project generates constant annual cash flows, the payback period can be

computed by dividing cash outlay by the annual cash inflows.

Payback period =

|

.

|

\

|

C

C

s cashinflow Annual

investment Initial

0

UN equal cash inflows, Payback period =

CFAT year Next

CFAT Required

Baseyear +

C

o

= Initial investment

C = Annual cash inflows

In the case of UN equal cash inflows, the payback period can be found out

by adding up the cash inflow until the total is equal to the initial cash outlay.

Merits

This method is simple to understand and easy to calculate.

Surplus arises only if the initial investment is fully recovered. Hence, there is no

profit on any project unless the payback period is over.

Administrative difficulties may be faced in determining the maximum acceptable

payback period.

Limitations

It stresses on capital recovery rather than profitability.

It does not consider the return from the project after its payback period.

Administrative difficulties may be faced in determining the maximum acceptable pay

back period.

(b) Accounting Rate of Return (ARR)

The accounting rate of return (ARR) also known as the return on investment (ROI)

uses accounting information, as revealed by financial statements, to measure to

profitability of an investment. The accounting rate of return is the ratio of the average

after fax profit divided by the average investment if it were depreciated constantly.

ARR = X100

estment Averageinv

ome AverageInc

Merits

This method is simple to understand

It is easy to operate and compute

Income throughout the project life is considered.

It can be readily calculated using the accounting data.

Limitations

It does not consider cash inflows which is important project evaluation rather than

PAT

It takes the rough average of profits of future years. The pattern or fluctuations in

profits are ignored.

It ignores time value of money, which is important in capital budgeting decisions.

Discounted Cash Flow Models

(a) Net Present Value (NPV)

The Net Present Value (NPV) method is the classic method of evaluating the

investment proposals. If is a DCF technique that explicitly recognizes the time value at

different time periods differ in value and comparable only when their equipment present

values are found out.

NPV =

( )

( ) ( ) ( )

0

3

3

2

2 1

1 1 1

1

C

k

C

k

C

k

C

k

C

n

n

+

+ +

+

+

+

+

+

NPV =

( )

0

1

1

0 1

C

k

C

n

i

+

=

Where

NPV = Net Present Value

C

fi

= Cash flows occurring at time

K = The discount rate

C

o

= Cash outlay.

Merits

NPV method takes account the time value of money

All cash inflows are considered

All cash inflows are converted into present value

It satisfies value additively principle i.e., NPV of two or more projects can be added.

Limitations

It may not satisfactory answer when the projects being compared involved different

amounts of investment.

It is difficult to use

It may mix lead when dealing with alternative projects or limited funds.

It involves difficult calculations

In involves forecasting cash flows and applications of discount rate.

(b) Internal Rate of Return (IRR)

The internal rate of return (IRR) method is another discounted cash flow technique

which takes account of the magnitude and thing of cash flows, other terms used to

describe the IRR method are yield on an investment, marginal efficiency of capital, rate

of return over cost, time adjusted rate of internal return and so on.

NPV =

( ) ( )

n 1

fi

n

0 i

k 1

WC SV

k 1

C

+

+

+

+

=

Where

C

fi

= Cash flows occurring at different point of time

K = The discount rate

N = Life of the project in year

C

o

= Cash out lay

SV & WC = Salvage value and working capital at the end of the n years.

IRP =

( )

( ) L H

b a

A

L

+

Where

L = Lower discount rate at which NPV is positive

H = Higher discount rate at which NPV is negative

A = NPV at lower discount rate, L

B = NPV at higher discount rate, H

Merits

This method considers the time value of money

All cash flows are considered

It has psychological appeal to the users.

The percentage figure calculated under this method is more meaningful and

acceptable, because it satisfies them in terms of rate of return on capital.

Limitations

It may not give unique answer in all situations.

It is difficult to understand and use in practices.

It implies that the intermediate cash inflows generated by the project.

(c) Profitability Index (PI)

Yet another time adjusted method of evaluating the investment proposals is the

benefit cost (B/C) ratio or profitability index (PI) required rate of return, to the initial

cash out of the investment.

PI =

houtlay InitialCas

flow PVofCashin

Where

PV = Present Value

Merits

This method considers the time value of money.

All cash inflows are considered.

It is better evaluation technique than NPV.

Limitations

It fails as a guide in resolving capital rationing when projects are indivisible.

Capital Commitment Plan

The progress of projects included in the capital budget, a capital commitment plan

is issued three times a year. The commitment plan lays out the anticipated

implementation schedule for there current fiscal and the next three years. The first

commitment plan is published within 90days of the adoption of the capital budget.

Updated commitment plans are issued in January & April along with the companys

budget proposals.

The commitment plan translates the appropriations approved under the adopted

capital budget into schedule for implementing individual projects. The fact that funds are

appropriated for a project in the capital budget does not necessarily mean that work will

start or be completed that fiscal year. He choice of priorities and timing of projects is

decided by office management & budget in consultation with the agencies along with

considerations of how much the managing director thinks the organization can afford to

append on capital projects overall.

The capital commitment plan lays out the anticipated implemented schedule for

capital projects and is one source of information on how far along projects are although

not a consistent or always useful one. The adopted commitment plan is usually published

in September, & then updated in January & April.

In the capital budgeting for every two adjacent years there will be gap. The gap

between authorized commitments and the target is presented in capital commitment plan

as diminishing over the course of the year plan, in practice many of the unattained

commitments will be rolled over into the next years plan, so that the current year gap

will remain large. The gap has grown in recent year exceeding in last two executive

capital plans.

Kinds of Capital Budgeting

Capital budgeting refers to the total process of generating, evaluating, selecting

and following up a capital expenditure alternatives. The firm allocates or budgets

financial recourses to new investment proposals. Basically, the firm may be confronted

with three types of capital budgeting decisions:-

The accept or reject decision,

The mutually exclusive choice decisions, and

The capital rationing decision

Difficulties of Capital Budgeting

While capital expenditure decisions are extremely important, they also pose

difficulties which stem from three principal sources:

Identifying & measuring the costs & benefits of a capital expenditure proposal tends

to be difficult

There is great deal of uncertainty for capital expenditure decision which involves cost

& benefits that extend far into the future

It is impossible to product exactly what will happen in the future

The time period creates some problems in estimating discount rates & establishing

equivalences.

Limitations of Capital Budgeting

Capital budgeting techniques suffer from the following limitations:

All the techniques of capital budgeting presume that various investment proposals

under consideration are mutually exclusive which may not practically be true in some

particular circumstances.

The techniques of capital budgeting require estimation of future cash inflows and

outflows. The future is always uncertain and the data collected for future may not be

exact. Obliviously the results based upon wrong data may not be good.

There are certain factors like morale of the employees, goodwill of the firm, etc.,

which cannot be correctly quantified but which other wise substantially influence the

capital decision.

Urgency is another limitation in the evaluation of capital investment decisions.

Uncertainty and risk pose the biggest limitation to the techniques of capital budgeting.

OBJECTIVES OF THE STUDY

To study the financial aspects of Aadhar seeds Pvt.Ltd for future expansion of

project.

To study the various capital budgeting techniques of Aadhar seeds Pvt.Ltd.

To compare the projects A&B for future expansion.

Understand the nature and importance of investment decisions.

Find out the profitability of projects A&B.

NEED OF THE STUDY

To know the investment performance of the company.

To have a exposure by visiting the organization for many times.

To study the role of capital budgeting in the organization.

To know more information about the capital budget management both theoretically

and practically.

The search for new and more profitable investment proposals.

METHODOLOGY OF THE STUDY

Methodology has systematic process of collecting information. Methodology is

divided into two parts. One is primary data and another is secondary data.

Primary data

The primary data is the data, which is collected from questionnaire, and from

concerned officers of finance department of Aadhar seeds Pvt. Ltd.

Secondary data

The secondary data is the data collected from annual records of the company text

books and journals relating to financial management.

At present for my study I gathered information mostly through secondary data from

Annual records of the company.

Text books and journals relating to financial management.

SCOPE OF THE STUDY

This study represents capital budget management in the Aadhar seeds Pvt.ltd, Mature

Orly.

The avalable information was taken from annuel reports only.

The study relates to past data of 2008 Jun to 2013 May.

LIMITATIONS OF THE STUDY

Information collected from secondary data.

The project period of study is only 45 days.

The study is related to future project returns, there may be number of factors effect the

decisions taken now.

INDUSTRY PROFILE

The prospects of the seed industry would require changes in Government policy,

facilitating its development and removing controls and restrictions. In brief seed industry

requires a simple policy and legislation.

Historically, the importance of seed has been recognized since the Vedic times for

increasing food production and quality. However organized production and supply of

quality seed at the national level started in 1963 as a consequence of the introduction of

hybrid technology during 1961- 65.

GROWTH:

The release of high yield dwarf varieties of wheat and rice by the mid 1960s gave

further impetus to the growth of seed industry. This period also saw the constitution of

the Seed Review Team, enactment of Seeds Act, 1996 for regulating the quality of seed

and formation of the National Commission of Agriculture.

This was the period in which the private sector took significant steps into the seed

business.

The 1980s witnessed two more important developments viz., granting of

permission to MRTP/FERA companies for investment in the seed sector in 1987 and the

introduction of NEW POLICY on seed development in 1988.

The new policy on seed development while helping liberalize import of vegetable

and flower seeds in general and seeds of other crops in a restricted manner encouraged

global seed companies to enter the seed business of India

CURRENT STATUS

To supply the seeds necessary for the five hundred thousand Indian villages is a

big problem. Storage, transportation and timely distribution of pure seed from village to

village calls for careful organization within the State Department of Agriculture and the

willing cooperation of farmers.

Indians seed industry has grown in size and level of performance over the past

four decades. It represents a blend of private and public sector companies / corporations.

The private sector comprises approximately 140 seed companies, which includes

national, global, regional and other seed producing and/or selling companies.

The industry has made impressive strides from a modest beginning in 1962-63 to

over 5 lakh hectares in seed production in 1995-96. The quantum of seed distributed also

grew from 14 lakh to 70 lakh quintals during this period.

On the inputs supply the certified quality seeds distribution touched a new high of

one million tones during the year 2000 2001. It was 0.91 million tones the previous

year.

CHALLENGES:

Use of new techniques requires dissemination and training for their beneficial use.

To achieve these goal radical changes will be required in the existing extension systems.

In many cases entirely new approaches for dissemination of knowledge will be required.

These will have to be constant learning and up gradation of skills to enable transmission

of knowledge to the user.

To realization of the prospects of the industry will also changes in the government

policy, which would facilitate the development of the Indian Agriculture and seed

industry. The policy must aim at governing greater self-discipline and removing controls

and restrictions which inhibit growth and development.

ROLE OF THE GOVERNMENT:

To achieve self-sufficiency in the production through planned programmers, the

distribution of quality seed was rightly considered as a key factor by the government. The

far-sighted and liberal policies of Government of India has always laid emphasis to build

a sound seed industry in the country and has supported both public and private sector

organizations to develop and to meet the increasing seed demand and also to produce

surplus stocks require for export.

To support expanded activities the National Seed Programmed was launched

with the financial assistance of the World Bank (International Bank for Reconstruction

and Development). In order to make available the right quality of seed to the Indian

farmers in adequate quantities and at reasonable price in time, the Government of India

took various steps including promulgation of Seed Act during 1996 which became

operative throughout the country from October 1969.

The main objective of the Act is to produce quality seed of different crop varieties

under a system of seed certification and testing is voluntary but the farmers have

recognized the importance of quality seed to get higher production with limited resources

available at their end.

High yielding varieties are being released for cultivation in quick succession by

various Agricultural Universities and ICAR institutions through massive research project

and Screening of planting materials. Steps have been taken during early 1984 to bring

seeds within the purview of the Essential Commodities Act to strengthen the regulation

of seed quality and to economies production at desired levels.

PROBLEMS

Many problems are being faced by the seed industries and farmers for many years.

A number of Multinational corporations have stepped into our agricultural country to

gain control over the seeds and their distribution. Recently, a new variety of seeds have

entered the country. This created many new problems for the seed industries and farmers.

Generally, a seed may be used either as a food material or as a seed for another

crop. But now, the life in the seed is being taken out for making it to be used only as a

food material and not as a seed for another crop. These types of seeds are called genetic

change or genetic engineering seeds. For example, BT cotton seed. The farmers are made

to purchase those seeds which are manufactured by the corporation for their crops.

Once the farmers or industries have used these types of seeds, they face many

problems. They have to use only those pesticides which are produces by those

associations for protecting their crops from the pests, diseases etc. Those would wide

Associations use that type of formula itself while making the seed.

The seed industries in India are facing a big problem with the entering the world

wide organizations into the country. Also the production is down grading. In 1992, the

Experiments conducted by the Monsanto scientist in Porrtoriko show that these

has been approximately 11.5 percent decrease in the production of cotton.

SEED INDUSTRY IN GLOBAL PERSPECTIVE

The population has been growing at a faster rate in the country. To increase the

production accordingly an All India Co-coordinated organization has been established

in 1951 with the assistance of Rockefeller Foundation which belongs to America. As a

part of this project, it produced new seeds of maize in 1961 and cotton seeds in 1971.

With a view that the State Governments are unable to meet the demand for seeds

correctly, two associations have been established with the help of Rockefeller

Foundation. They are National Seed Association 1963 and State Farm Corporation of

India, 1969. Due to the Development Programme Which came into existence in 1988,

many multi-national corporations have stepped into the seed production.

At present there are more than 700 multinational corporations in India doing seed

business directly or indirectly. 19 multinational companies have made an agreement with

the Indian seed Industries and have been enjoying the leadership in the seed market.

Monsanto, an American Multinational corporation, has acquired one-fourth part of the

MICO seeds industry, one of the biggest seed industries in India. The acquisition value

given by the Monsanto Corporation is more than 17 times the real value.

SEED INDUSTRY IN INDIA

Indians seed industry has grown in size and level of performance over the past

four decades. India stands in the 8

th

position all over the world in the production of

different variety of crops. Again in each crop there are thousands of varieties.

To coordinate the seeds research centres and private organizations in the country

and to support the expanded activities, the National Seed Programme was launched in

1967 with the financial assistance of the World Bank. In 1960 many private organizations

have participated in the production of seeds. Many seed industries have laid a strong

foundation in the country. Following are some of the major seed industries in India.

MICO Seeds Private Limited, Mumbai

Monsanto Holdings Private Limited, Mumbai

Namdhari Seeds Private Limited, Bangalore

National Seeds Corporation Limited, New DelhRallis India Limited, New

Delhi

Sungro seeds Limited, Delhi

Cargill Hybrids Private Limited, New Delhi

Pioneer India Limited, Kolkota

Proagro Seeds Private limited, Chennai

Sasys Seeds Private Limited, Bangalore

Sinjent India Limited, Pune

Nunhams Seeds Private Limited, Gurgaon.

SEED INDUSTRY IN ANDHRA PRADESH

In Andhra Pradesh the seed industries are many in number. Though Andhra

Pradesh is one among the states in India who have been producing different varieties of

crops, it does not have the major seed industries in it when compared to other states.

Many seed industries have formed recently in the state. Also the state is growing

industrially and there is sample scope and potential for the entry and success of new

industries.

The crop producing seasons are different for different states. In Andhra Pradesh,

the crop producing season starts from June and ends with the month of September.

Generally the rain fed crop in situated in the state. Irrigated crop may not have better

results when compared. The stock to be sold by the seed industries is kept ready during

the starting of the year as the period during which the demand will be more fall between

March ad August. The industries in the state start the crop again the month June Itself.

The seed industries in the state market with other states which form the boundaries of it.

The selling period for those states will vary.

The following are some of the seed industries in Andhra Pradesh.

Indo American Hybrid Seeds (India) Pvt. Ltd., Hyderabad

Seed Works India Limited, Hyderabad

Mourya Agri Tech, Hyderabad

Sriram Bioseed Genetics India Ltd., Hyderabad

Nath Seeds Limited, Hyderabad

Jk Seeds Limited, Secunderabad

Nujiveedu Seeds, Limited, Hyderabad

Tulasai Seeds Private Limited, Guntur

Venus Crane Seeds Pvt, Ltd, Guntur

Tammareddy Seeds, Vijayawada

Gopikrishna Seeds, Mahaboobnagar.

Role of Cotton Industry in Indian Economy

Over the years, country has achieved significant quantitative increase in

cotton production. Till 1970s, country used to import massive quantities of cotton in the

range of 8.00 to 9.00 lakh bales per annum. However, after Government launched special

schemes like intensive cotton production programmes through successive five-year plans,

that cotton production received the necessary impetus through increase in area and

sowing of Hybrid varieties around mid 70s.

Since then country has become self-sufficient in cotton production barring

few years in the late 90s and early 20s when large quantities of cotton had to be imported

due to lower crop production and increasing cotton requirements of the domestic textile

industry.

Cotton production areas in India

India is an important grower of cotton on a global scale. It ranks third in

global cotton production after the United States and China; with 9.50 million hectares

grown each year, India accounts for approximately 21% of the world's total cotton area

and 13% of global cotton production.

The Cotton producing areas in India are spread throughout the country. But

the major cotton producing states which account for more than 95% of the area under and

output are:

1. Punjab.

2. Haryana.

3. Rajasthan.

4. Maharastra.

5. Gujarat.

6. Madhya Pradesh.

7. Andhra Pradesh.

8. Tamil Nadu.

Of the nine cotton producing States in India, average yields are highest in

Punjab where most of the cotton area is irrigated.

But the yields of cotton in India are low, with an average yield of 503 kg/ha

compared to the world average of 734 kg/ha. The problem is also compounded by higher

production costs and poor quality in terms of varietals purity and trash content. However

the Cotton plays an important role in the National economy providing large employment

in the farm, marketing and processing sectors. Cotton textiles along with other textiles

also contribute about 1/3rd of the Indian exports.

Contribution of Cotton industry for Textile Industry

Cotton is the most important raw material for India's Rs. 1,50,000 crores

textile industry, which accounts for nearly 20% of the total national industrial production.

The cotton Industry is the backbone of our textile industry, accounting for 70% of total

fiber consumption in textile sector. It also accounts for more than 30% of exports, making

it India's largest net foreign exchange industry. India earns foreign exchange to the tune

of $10-12 billion annually from exports of cotton yarn, thread, fabrics, apparel and made-

ups.

Policy of Government of India towards Cotton Industry

The Cotton production policies in India historically have been oriented

toward promoting and supporting the textile industry. The Government of India

announces a minimum support price for each variety of seed cotton (kapas) based on

recommendations from the Commission for Agricultural Costs and Prices. The

Government of India is also providing subsidies to the production inputs of the cotton in

the areas of fertilizer, power, etc

The cotton Industry provides employment to over 15 million people. And

the area under cotton cultivation in India (9.5 million ha) is the highest in the world, i.e.,

25% of the world area.

Markets for Indian Cotton

The three major groups in the cotton market are

Private traders,

State-level cooperatives,

The Cotton Corporation of India Limited.

Of these three groups, private traders handle more than 70 percent of

cottonseed and lint, followed by cooperatives and the CCI. The Cotton Corporation of

India Ltd. for the year 2006-07 had purchased 60.30 lakh quintals of kapas equivalent to

11.77 lakh bales valuing Rs.1218.70 crores in Andhra Pradesh, Maharashtra, Madhya

Pradesh, Orissa and Karnataka. Beside these the Corporation had also carried out

commercial operations and purchased 2.71 lakh bales valuing Rs.285.82 crores in the

year 2006-07 as compared to around 1.00 lakh bales valuing Rs.108.81 crores during the

previous year (i.e. for the year 2005-06).

COMPANY PROFILE

INTRODUCTION:

Aadhaar which means Reliability itself states the companys motto of being a reliable partner

in the farming. The Aadhaar Seeds Pvt. Ltd is an organization born out of the vision of like

minded individuals who dream to see sparkling smiles on the face of farmer. Aadhaar is

committed to provide top quality, cost-effective and integrated approaches for improving farm

productivity to produce better quality foods, strictly adhering to stringent standards for eco-care

and safety. The company has started its R&D in the year 2001, upon thorough clinical research

and understanding of farming needs, entered the market in the year 2006. The company has its

own R&D facilities and world-class sophisticated modern seed processing, conditioning and

storage units/ware houses at Hyderabad. Since inception the company has been supplying research

proved best quality hybrid seeds for field crop varieties such as Maize, Jowar, Bajra, Cotton,

Redgram, Paddy, Sunflower, Castor, S.S.G and vegetable crops like Chillis, Bhendi, Tomato,

Gourds, Watermelon.

The company has been offering services in the major market areas like Andhra Pradesh,

Karnataka, Rajasthan, UP, Bihar, Jharkhand and won accolades & great trust theose farming

communities. The company is also entering in to the markets of Maharastra form this year. The

company has a strong network of 2500 dealers and P.Ds. 120 Distributors and 6 C&Fagents in

the above markets. The company certified as an ISO 9001:2008 organization. The after sales team

of the company often visits farmers fields and guides them in technical know-how matters. That

helps farmers to get most out of the developed sed and thus a good yield. Under the flagship of

Aadhaar Seeds Pvt. Ltd., two associated companies namely

1. Aadhaar Bio Organics & Chemicals

2. Aadhaar Agro Farms & Nurseries are in incepted in the year 2009 at Hyderabad. The

company is making strides towards becoming a panIndia and global player with initial interests

in countries like China, Bangladesh, and Pakistan. Company is determined to bring many

revolutionary products and technological breakthroughs in the agricultural sciences. With a

constant dedication to make the farming a profitable occupation the company marching ahead,

and in this endeavor it seeks everyone support.

Cosidered as the Tech-genius of the company, He is the erudite in agricultural sciences. He is the

head of the company's line development, R&D activities, and also a founder member. He is rich

experience in the seed industry is an asset to organization. The many of company's products are

trial tested under his supervision. Being from the farmin community has made him cultivate a

deep understanding towards farmer's problems and marshalling company's technical teams.

Under his guidance and support.

He is the chief architect in the growth of the organization and also the co-founder of the

organization. He is childhood as a farmer's son has taught him a lot about farming and the

difficulties involved in it. With a mission to eliminated them, and make farming a good

occupation he joined in the renowned university of N.G Ranga and came out with good grades.

Having worked with some of the best organizations in the field over a period of two decades, the

visionary in him has laid the seed for "Aadhaar". Under his able leadership the company is

growing at a healthy rate. The setting up world-class research and processing facilities in such a

short span is one of the remarkable fetes achieved by company under his illustrious heading. His

relent less efforts are shaping the company as an ideal seed supplying company not just at Pan-

India but also at global level.

Aadhaar Seeds Private Limited has been started in May 2006 and managed by Mr.M.S.Sai Babu

and N.R.S.Praveen, techno professionals with more than 18 years of experience in seed industry.

The activity of the company can be broadly categorized into :

Research and Development for new varieties & hybrids seed of field & vegetable crops

Commercial production and marketing of hybrid and OP (open pollinated) seeds

ASPL is research driven enterprise committed to evolve superior products which have

improved characteristics such as better yield, adoptability and disease resistance etc.

The company has special focus on hybrid maize, sunflower, and paddy which has huge

potential in the market.

Apart from above, the companys product profile includes Cotton, Jowar, Bajra, Red

Gram, Castor, Tomato, Chillis, Brinjal, Gourds, and other vegetables. The company has

been focusing on both hybrids and OPs.

The company has already successfully commercialized 62 varieties of 23 crops and 36

are in pipeline to be commercialised in 1-2 years.

ASPL has marketing tie up with Kaveri seeds pvt ltd, Secundrabad, A.P. for transgenic

genes in cotton.

It also has tie-ups with research institutes(like DRR,DOR)), reputed R&D house (like

SEHGAL foundation etc) and freelance breeders for product sourcing and exchange of

technology & germplasm in order to achieve its broad- based objective of evolving

versatile hybrids.

Germplasm is the key R&D asset which is utilized in hybridization of seed and evolving

new varieties.The company has collection of around 1500 varieties of germplasm of

different crops.

Currently ASPL is adequately equipped with infrastructure for R&D, seed processing

and testing.

The company has 31 acres of farm space for carrying out research operations (6 R&D

farms) and 2 seed processing plants having a cumulative capacity of 6 metric tonnes per

hour and two ware houses for a storage capacity of 2000 tons.

The company has an established network of around 50 Distributors and over 2000

dealers spread across 7 states in India.

The companys activities are managed by experienced personnel engaged in various

functional groups like R&D production, marketing, administration, accounting, customer

service and field support.

INTRODUCTION:

The company is engaged in plant breeding & transgenic research offering innovative

products of several field & vegetable crops for better productivity, adoptability and pest

and disease resistance/tolerance.

The company carries research on versatile germplasm for developing new hybrid seeds

The company adheres to three generation system of seed multiplication, namely, breeder,

foundation and labelled/certified seed

The company has its own processing and quality testing facilities where the commercial

seed are processed and are tested for purity.

Activity flow & Description

Research & Development:

Aadhaar seeds have a collection of around 1500 different germplasm lines of various

crops. This germplasm is evaluated and maintained for further research work.

The evaluated germplasm are being utilized for hybridization and genetic enhancement.

After hybridization, hybrids are being tested in R & D as well as in different locations

across the country and seasons to evaluate the yielding performance and adoptability.

The selected hybrids from trials are sending to farmer fields as minikits for macro level

testing. Simultaneously the parental multiplication can be taken care from breeders seed

to foundation seed.

The nucleus seed that developed in R&D is directly used for production of breeder seed.

Breeder seed is then planted in controlled environment (R&D farms) for initial and uses

the same for production of foundation seed.

Foundation seed production:

The foundation seed developed in R&D farms goes through technical scrutiny for its

purity level before F1 Hybrid multiplication

Seed production & Quality Control:

Foundation seed pertaining to the new product is given to production organizers who

in turn distribute it among farmers for large scale production. production organizers are

responsible for collection of the produce (Raw seed) and sending it to companys

processing unit as per the terms of contract.

Quality control at field level is taken care by production & quality control staff. They are

responsible for maintaining prescribed genetic purity as per the norms stipulated by govt.

of India under minimum standards.

Seed processing/chemical treatment/quality testing:

After the harvest, the produce (raw seed) is moved to the companys seed processing

plant where these seeds are divided into lots for conditioning and inspection as per seed

certification standards set by central government.

The same lots are being sent to Quality control dept. for assessing the genetic purity.

Seed is also subject to inspection which includes tests for physical and genetic purity,

germination, presence of noxious weed seeds and moisture content.

After receiving satisfactory pass results on various tests further processing of seeds such

as seed grading, gravity separation are made.

The conditioning process typically includes drying, cleaning, sorting and treating the

seed with insecticides and fungicides.

The processed and graded seeds are packed in labelled bags and are sent to distributors

and dealers for marketing.

Marketing & sales:

On obtaining large scale exposure, the product gets established in the market by virtue of

its USPs (unique selling proposition) & better performance and is taken into the fold of

regular product-range.

The company has established marketing network of distributors and preferred dealers to

market its wide range of products.

The marketing activity begins 5 months before the actual crop season. The company

offers booking schemes/coupons so as to book the requirements of seed in advance.

The Demand generation and publicity programme in villages is started at least 2

months before commencement of season.

The company on a temporary basis hires additional marketing personnel who either Agri-

graduates or diploma holders for sales promotion. These marketing personnel known as

ASPs (Aadhaar sales promoters) are engaged in addition to regular marketing staff.

Season (Kharif/Rabi/summer) wise finished products saleable in particular season are

consigned for distribution through the company established trade network.

Distribution of seed begins 15 days before commencement of season so as to be on

shelves of retail dealers so as to be available to farmers in time.

The company has necessary infrastructure to handle the existing production and processing

requirements. In this connection the company has constructed its own huge seed

processing/conditioning facility with a floor area of 28,000 square feet with a capacity of 6 metric

tons/hr for which the company has invested an amount of Rs. 450 lacks.

R&D Infrastructure

The company is focused on its core objective of strengthening its R&D activity and to develop

genetically superior planting material.

ASPL is collecting seed germplasm from various sources and is using this core set of

germplasm in developing new hybrid varieties.

Procurement of germplasm from government institutions such as Directorate of Rice Research,

Directorate of Oilseeds Research, Directorate of Maize Research and several crop specific

research stations under agriculture universities is another source for germplasm enrichment.

The company has own research farms where they test the adoptability, stability and specific

resistance of new varieties developed. In-house breeding program of various crops is also

carried out at these research farms.

MAIZE

In Maize, we have identified and released 3 double cross hybrids in 2006 followed by one single

cross and one doubled cross hybrids in 2008 and four double cross hybrids in 2009.We have

evaluated over 200 germplasm lines which we acquired from different public and private sector

organizations. Some of these lines were used as parents and developed over 100 new in breds

which later used in hybridization to produce hybrids for different segments.

SUN FLOWER

We have a range of versatile germplasm in sunflower (i.e. early, medium and late maturity) with

oil content ranging from 40 to 44% and volume weight (50 or >50 gr/100ml). We have evaluated

good number of germplasm lines and developed new ABR lines with high oil content, good vol.

weight and tolerance to necrosis.

At present hybrids SUNGENE, SUNTOP, SUNRISE & SUNGOLD are being marketed for the

last 3 years and these are highly potential and receiving good response from farmers.

HYBRIDE RICE

Rice is the most important food crop in India contributing about 45% of the total food grain

production, and its demand is increasing year by year, to sustain self sufficiency on food front.

Our companys main emphasis has been for development of hybrids of RICE.

Developing hybrids of rice, a self pollinating crop, must involve an effective male sterility

system. Use of CMS system has been the most effective and practically successful, so far.

Successful use of a CMS line in breeding hybrids depends on its stability and adaptability across

diverse environments. Out of hundreds of CMS lines developed in china over the years, less than

about 20 have been used to develop commercial rice hybrids, but in India, only the IR 58025 A

is a stable MS line being exploited t develop the rice hybrids.

Initially we got the breeder seed of different male steriles, maintainers and restorer lines from

Directorate of Rice Research and also collected from farmers fields. These were evaluated in

our research farm. Purification and maintenance of the lines and utilization in heterosis breeding

program is being continued

First year, we have produced about ten hybrids using different restores on CMS lines, out of

which two hybrids were found to be better in yielding than the local improved varieties in a

multilocational trials and minikit trials conducted in rice growing areas of Andhra Pradesh &

Karnataka. Out of two, one has released on the name of SRESHTA for commercial cultivation in

A.P. & KARNATAKA.

So far, we have been conducted six initial hybrid trials, and three advanced hybrids trials tested

about 30 hybrids including the popular check entries of hybrid rice, in our R&D farm.

RESEARCH OP/VARIETAL PADDY

In our R&D, we have also a programme on development of elite high yielding varieties of

paddy, under which, we have released a fine grain (short Slender) variety, RUCHI (a medium

maturing, non lodging and tolerant to pests and diseases) and now there is huge demand for this

variety. We have released another early maturing fine grain variety SIRI (medium, dwarf

compact, non lodging) in kharif 2007 which has performed well. This early OP variety has

created a niche for our brand along with RUCHI.

Brief Report on Development of other Crop Hybrids

COTTON

Over the last few years we have evaluated about 100 new germplasm lines of cotton against

different attributes. Some these lines are used as parents in connection with developing new

inbreds which would be used in hybridization. Many of new hybrids are in different stages of

testing and few advanced hybrids are in multi location trials. Two new hybrids were identified

and released on the name of BHOOMIJA (early), and RAJA (medium) in year of 2006.

Finally with the advantage of the Bt Cotton, the PRIOROTY is to get the source of BT gene for

which we are planning to tie-up arrangement with a provider of this technology of transferring

Cry1Ac & Cry2Ab genes for BG II with Monsanto. With this, companys all leading cotton

hybrids will have to be injected by BT gene into them and this will provide our brand a sharp

edge over competition.

BAJRA

Developed and released two hybrids in Bajra in the year of 2006 and 2009 on the name of ASHA

and ABHAY respectively. We have evaluated good number of germplasm lines and developed

new ABR lines. Many hybrids are under testing in IETs and few hybrids are in AHTs.

SORGHUM

In grain sorghum, high yielding hybrid AISHWARYA and AJANTA were launched in 2006 and

2009 respectively for A.P. & Karnataka markets. Many new ABR lines are developed and

utilizing in hybridization programme. Newly generated hybrids are under evaluating from initials

to test marketing. In forage sorghum (Sorghum Sudan Grass), improved variety SUDHA has

been released in the year of 2008.

HYBRID VEGETABLES

CHILLI

In 2007, five hybrids AADHAAR 373, AASHIRWAD, WESTERN HOT, INDU-35 (red chilly

segment) and KAREENA (green chilli segment) were commercialized. In 2009, three more

hybrids were commercialized named AADHAAR-504, AADHAAR-555 in red chilli segment

and UJWALA in green chilli segment of AP and Karnataka. In same year two improved varieties

named JYOTHI and SURYA-285 also been released in keeping farmers preferences in mind. So

far we have evaluated a wide range of germplasm in connection with developing new lines that

used in hybridization. Many hybrids are in different stages of testing and few advanced hybrids

are in multi location trials to check the adoptability and disease incidence

TOMATO

Over the last three years we have evaluated about 49 new germplasm lines of tomato against

diseases, TSS content and other important attributes. Some these lines are used as parents in

connection with developing new inbreeds which would be used in hybridization. Many new

hybrids are in different stages of testing and few advanced hybrids are in multi location trials.

Three new hybrids were released in 2007 named POORNA, APOORVA, AND SWATHI and

another hybrid SRAVANI was released in succession year 2009

BHENDI

Developed and released a hybrid AADHAAR 10 with medium green fruits, high yield and

moderate tolerant to YVM disease. It has been in the market for the last 3 years and given good

result everywhere. We have also released another hybrid in the year of 2007 named KOMAL

which is tolerant to YVM disease and having good quality dark green fruits. An Improved

BHENDI variety SNEHA also been introduced in same year. We have evaluated good number

of germplasm lines and developed new lines and being utilised in hybridization. Few hybrids are

under testing for higher fruit yield, quality and YVM resistance.

BRINJAL

Evaluated a large number (120) of germplasm lines of brinjal during last three years and

maintenance of selected lines is in progress. Some of these lines are used as parents in

connection with developing new inbreed which would be used in hybridization. Many new

hybrids are in different stages of testing and few advanced hybrids are in multi location trials.

Four hybrids have been commercialized in the year of 2007 named ANJALI, NAYANA,

SURABHI, and SUMATHI.

RIDGE GOURD

The Improved KAVYA has been released in the year of 2007 and hybrid NAVYA has been

released in 2009.Different germplasm lines have been evaluated for the past three years and

maintenance of selected line is in progress.

BOTTLE GOURD

A hybrid named RAMBA and improved variety SHREYA has been released in the years of 2008

and 2009 respectively. Different germplasm lines have been evaluated for the past three years

and maintenance of selected line is in progress.

WATERMELON

Released hybrid MADHU in 2007 and hybrids MADHUBALA and PRIYA were released in

2009. Different germplasm lines have been evaluated for the past three years and maintenance of

selected line is in progress. A few selections are used for hybridization and hybrids are

evaluating in trials.

BITTER GOURD

Released two hybrids INDIANA and INDICA in the year of 2007 to AP and Karnataka markets.

Different germplasm lines have been evaluated for the past three years and maintenance of

selected line is in progress. A few selections are used for hybridization and hybrids are

evaluating in trials.

SEED PRODUCTION:

Companys seed production is organized through experienced and skilled seed growers in

Andhra Pradesh and Karnataka. At present companys Executive Director, Mr. N.R.S.PRAVEEN

is responsible head for this function and jointly with Mr. V.SHIVAPRASAD and Mr.Prabhakar

Reddy. All statutory requirements for quality control par excellence are fulfilled at field level on

the strength of 12 technically qualified & experienced personnel.

First and foremost point in the quality seed production is supplying genetically pure foundation

seed followed by selection of good organizers/production agent/farmer. The quality control and

production staff will be monitoring other parameters like checking isolation distance from other

varieties of the same crop, inspection of fields at different crop stages, and rouging of any off-

types in both male and female parents and also pollen shedders (if seed parent is a male sterile)

and at maturity, harvest the male rows and separate them before harvesting female rows so as to

avoid any admixture of male seed in female. This assures the quality seed production.

Seed Quality Tests are being carried out at our seed testing laboratory, Koheda (vill) nearby

Hyderabad and the genetic purity tests (GOTs) at field level are undertaken at our R&D farms at

main farm Rajabollaram (V), Medchal (M).

We have a full fledged seed quality control laboratory furnished with walk in germinator,

incubator, moisture testing machines, seed physical purity board, weighing machines,

germination papers and plastic trays etc. and the required chemicals.

SEED PROCESSING:

Our seeds are perfectly graded, gravity separated & treated with latest fungicides/insecticides

before going into packaging channel at following seed processing plants equipped with modern

machineries and trained & skilled manpower.

PROCESSING:

KOHEDA,

HAYATHNAGAR

PLANT-I 12,000SFT 2 MT/HOUR

RANGAREDDY

(Dt). A.P.

KOHEDA,

HAYATHNAGAR

PLANT-II 16,000SFT 4 MT/HOUR

RANGAREDDY

(Dt). A.P.

At Koheda, we have 2 seed processing units having an area of about 28000 square feet, having

installed two machines with 4 & 2 metric tons per hour capacity respectively to facilitate huge

quantities of seeds getting conditioned and packed in shorter time. The machinery comprise pre-

cleaners, graders, destoners, gravity separators, chemical treators, seed dryers, besides large bins

and elevators, conveyors, packing machines (weigh metric and volumetric) and also sufficient

weighing machines & sealing machines.

QUALITY CONTROL PROCESS:

When raw seed is received at companys seed processing plant, it is put for physical purity,

germination & genetic purity tests for each lot and then seed grading, gravity separation and

chemical treatment is completed on receipt of satisfactory PASS result from seed testing lab and

GOT department for each lot, the packing in containers is undertaken and then it is sent to

markets.

DATA ANLYSIS AND INTERPRETATION

Criterian Table

In the evaluation process or capital budgeting techniques there will be a criteria to

accept or reject the project. The criteria will be expressed as

Criteria / Method Accept Reject

Pay Back Period (PBP) <Target Period > Target Period

Accounting Rate of Return (ARR) >Target Rate < Target Rate

Net Present Value (NPV) >0 <0

Internal Rate of Return (IRR) > Cost of Capital <Cost of Capital

Profitability Index (PI) >1 <1

Company New projects A and B

Project A belongs to only spinning activity in Aadhar seeds means the process of

preparing seeds.

Project B belongs to activity the process under Seed Company.

YEAR Project A

Cash inflows

Project B

Cash inflows

1 6,62,08,767 6,25,27,806

2 6,74,50,149 6,54,14,055

3 15,06,71,995 15,15,17,500

4 23,93,77,038 22,76,05,759

5 29,71,32,363 26,55,67,272

6 31,69,12,772 29,47,73,936

Initial outlay 42,86,36,698 48,65,88,986

Cost of capital 10% 10%

PROJECT A

TRADITIONAL MODEL

(a) Payback period (PBP)

Table 4.1

YEARS INCOME

(CFAT)

(Rs)

DEPRECIATIO

N

(Rs)

CASH

INFLOW (Rs)

(CFAT+DEP)

CUMULATI

VE

CASH

INFLOWS

(Rs)

2012-2013 3,12,08,767 3,50,00,000 6,62,08,767 6,62,08,767

2013-2014 3,24,50,149 3,50,00,000 6,74,50,149 13,36,58,916

2014-2015 11,56,71,995 3,50,00,000 15,06,71,995 28,43,30,911

2015-2016 20,43,77,038 3,50,00,000 23,93,77,038 52,37,07,949

2016-2017 26,21,32,363 3,50,00,000 29,21,32,363 81,58,40,312

2017-2018 28,69,12,772 3,50,00,000 31,69,12,772 113,27,53,084

Payback period =

|

.

|

\

|

C

C

lows cash Annual

investment Initial

0

inf

Payback period =

CFAT year Next

CFAT Required

Baseyear +

Initial outlay = 42,86,36,698

Base year

= 3

CFAT Required

= 87 14,43,05,7

Next year CFAT = 23,93,77,038

Payback period =

11 28,43,30,9 - 49 52,37,07,9

11 28,43,30,9 - 98 42,86,36,6

3+

=

38 23,93,77,0

87 14,43,05,7

3+

= 3+0.60

= 3.60 years

Criteria for evaluation

The payback period computed for a project is less than the payback period set by

management of the company, it would be accepted. A project actual payback period is

more than the determined period by the management, it will be rejected.

Decision

The standard payback period is set by Aadhar Seeds Pvt.Ltd for considering

expansion project is six years, whereas actual payback period is 3.75years. Hence we

accept the project.

Table 4.2

(b) Average rate of return (ARR)

YEARS INCOME

2012-2013 3,12,08,767

2013-2014 3,24,50,149

2014-2015 11,56,71,995

2015-2016 20,43,77,038

2016-2017 26,21,32,363

2017-2018 28,69,12,772

TOTAL 93,27,53,084

Average rate of return = 100

investment Average

Tax after profit net Average

X

Average net Profit after tax =

s no.of.year

Tax After prifit net Total

=

6

84 93,27,53,0

= 15,54,58,847

Average investment =

2

Investment Instial

=

2

89 42,86,36,6

= 21,43,18,349

Average rate of return(ARR) = 100

349 , 18 , 43 , 21

47 15,54,58,8

X

= 0.7253 x 100

= 72.53%

Criteria for evaluation

According to this method ARR is higher than minimum rate of return established

by the management are accepted. It reject the project have less ARR then the minimum

rate set by the management.

Decision

The standard ARR set by Aadhar Seeds Pvt.Ltd management is 21%. The actual

ARR is 72.53% is higher than the standard ARR set by the management, hence we accept

the project

Discounted Cash flow Criteria

Table 4.3

(a) Net Present Value

YEAR CASH

INFLOWS

DCF (10%) PRESENT

VALUE

2012-2013 6,62,08,767 0.909 6,01,83,769

2013-2014 6,74,50,149 0.826 5,57,13,823

2014-2015 15,06,71,995 0.751 11,31,54,668

2015-2016 23,93,77,038 0.683 16,34,94,517

2016-2017 29,21,32,363 0.621 18,45,19,197

2017-2018 31,69,12,772 0.564 17,87,38,803

TOTAL 75,58,04,777

Net Present Value = Total present value-Initial Investment

Total present value = 75,58,04,777

Initial Investment = 42,86,36,698

Net Present Value = 75,58,04,777-42,86,36,698

= 32,71,68,079 Rs.

Criteria for evaluation

In case of calculated NPV is positive or zero, the project should be accepted.

If the calculated NPV is negative, the project is rejected.

Decision : The project is accepted due to calculate NPV is positive

(b) Internal rate of return (IRR)

Table 4.4

YEARS CASH

INFLOWS

DCF (10%) PRESENT

VALUE

2012-2013 6,62,08,767 0.909 6,01,83,769

2013-2014 6,74,50,149 0.826 5,57,13,823

2014-2015 15,06,71,995 0.751 11,31,54,668

2015-2016 23,93,77,038 0.683 16,34,94,517

2016-2017 29,21,32,363 0.621 18,45,19,197

2017-2018 31,69,12,772 0.564 17,87,38,803

TOTAL 75,58,04,777

YEARS CASH

INFLOWS

DCF (14%) PRESENT

VALUE

2012-2013 6,62,08,767 0.877 5,80,65,089

2013-2014 6,74,50,149 0.769 5,18,69,165

2014-2015 15,06,71,995 0.675 10,17,03,597

2015-2016 23,93,77,038 0.592 14,17,11,206

2016-2017 29,21,32,363 0.519 15,42,11,696

2017-2018 31,69,12,772 0.455 14,41,95,311

TOTAL 65,17,56,064

IRR = Xr R

PV

PVC - CFAT PV

A

+

Where

R = Lower rate of return

PV = PV of cash inflows at lower rate

PVC = PV of investment

PV = difference between the calculate pvc

r = difference between the discount rares chosen

IRR = ) 10 14 (

64 65,17,56,0 - 77 75,58,04,7

98 42,86,36,6 - 77 75,58,04,7

10 +

= ) 4 (

13 10,40,48,7

79 32,71,68,0

10 +

=10+3.144(4)

=10+12.576

=22.576%

Criteria for evaluation

In this method the project is accepted when IRR is higher than its cost of capital or

cut out rate. If the project is not accepted when the IRR is less than cost of capital.

Decision

The project is accepted because of the calculation IRR is higher than its cost of

capital. The cost of capital fixed by management is 10%, the actual is more than its

standard. Hence, the project is accepted

(c) Profitability index

Table 4.5

YEARS CASH IN FLOW (Rs)

2012-2013 6,62,08,767

2013-2014 6,74,50,149

2014-2015 15,06,71,995

2015-2016 23,93,77,038

2016-2017 29,21,32,363

2017-2018 31,69,12,772

TOTAL 113,27,53,084

PI =

outlay cash Initial

inflow cash of PV

=

98 42,86,36,6

084 113,27,53,

= 2.64 Rs.

Criteria for evaluation

A project can be accepted if its PI index is greater than one. If the PI is less than

one we should reject the project.

Decision

Profitability index of proposed expansion project is found our 2.64 this is more

than the PI. Hence we accept the project.

PROJECT B

Traditional Model

Payback period

Table 4.6

YEARS INCOME

(CFAT)

(Rs)

DEPRECIATION

(Rs)

CASH

INFLOW

(Rs)

(CFAT+DEP)

CUMULATIVE

CASH

INFLOWS

(Rs)

2012-13 2,75,27,806 3,50,00,000 6,25,27,806 6,25,27,806

2013-14 3,04,14,055 3,50,00,000 6,54,14,055 12,79,41,861

2014-15 11,65,17,500 3,50,00,000 15,15,17,500 27,94,59,361

2015-16 19,26,05,759 3,50,00,000 22,76,05,759 50,70,65,120

2016-17 23,05,67,272 3,50,00,000 26,55,67,272 77,26,32,392

2017-18 25,97,73,936 3,50,00,000 29,47,73,936 106,74,06,328

Initial outlay = 48,65,88,986

Payback period =

CFAT year Next

CFAT Required

+ Baseyear

Payback period =

361 , 59 , 94 , 27 120 , 65 , 70 , 50

361 , 59 , 94 , 27 986 , 88 , 65 , 48

3

+

=

759 , 05 , 76 , 22

625 , 29 , 71 , 20

3+

= 3+0.91

=3.91 Years

Criteria for evaluation

The payback period computed for a project is less than the payback period set by

management of the company, it would be accepted. A project actual payback period is

more than the determined period by the management, it will be rejected.

Decision

The standard payback period is set by Aadhar Seeds for considering expansion project

is six years, whereas actual payback period is 3.91 years. Hence we accept the project.

(c) Average Rate of Return (ARR)

Table 4.7

YEARS INCOME(CFAT)

2012-2013 2,75,27,806

2013-2014 3,04,14,055

2014-2015 11,65,17,500

2015-2016 19,26,05,759

2016-2017 23,05,67,272

2017-2018 25,97,73,936

TOTAL 85,74,06,328

Average Rate of Return = 100

investment Average

Tax after profit net Average

X

Average investment =

2

Investment Initial

=

2

86 48,65,88,9

= 24,32,94,493

Average net Profit after tax=

s no.of.year

Tax After prifit net Total

=

6

28 85,74,06,3

= 14,29,01,055

Average Rate of Return = 100

93 24,32,94,4

55 14,29,01,0

_

= 0.5873X100

=58.73%

Criteria for evaluation

According to this method ARR is higher than minimum rate of return established

by the management are accepted. It reject the project have less ARR then the minimum

rate set by the management.

Decision