Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sample Valuation Report

Caricato da

99873037260 valutazioniIl 0% ha trovato utile questo documento (0 voti)

52 visualizzazioni17 paginedf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentodf

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

52 visualizzazioni17 pagineSample Valuation Report

Caricato da

9987303726df

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 17

Valuation Report: DUMMY

Executive Summary INDUSTRY: XX

XYZ Company Limited (hereinafter referred to as XYZ or the company) is a XX manufacturing

company and markets its products under the brand name XX in the XX region of India.

Business valuation summary of XYZ

Multiple used Equity value Rs mn Value per share (Rs)

EV/tonne method Rs 5,809 per tonne

EV/EBITDA method 4.5x

Discounted Cash Flow method NA

Book value (FY10) NA

Equity value of Rs 100 based on EV/tonne metric

The XX industry is inherently cyclical in nature and the most preferred valuation method for this industry is

EV/tonne. As XYZ is a regional XX player, we are benchmarking it against the EV/tonne of the listed

regional players, which are currently trading at Rs 4,840 per tonne of capacity. We have valued XYZ at a

20% premium to the listed regional players as XYZ enjoys significantly higher EBITDA per tonne. XYZs

EBITDA per tonne is __ (FY10) as against the industry average of Rs 1,255 during the same period. After

XYZ, the next highest EBITDA per tonne amongst the listed peers is ABC (ticker:, Rs 1,870) Rs 1,455.

DCF and EV/tonne methodology give similar valuations, while EV/EBITDA gives a higher valuation.

However, we note that EBITDA is highly sensitive to industry cycles and hence prefer to use EV/tonne.

Valuation factors in future capex plans

The company has plans to expand its grinding capacity from __ mn tonnes to __ mn tonnes by the second

half of FY12 and clinker capacity from __ mn tonnes to __ mn tonnes. According to the management, the

company intends to fund one-third of the capex of Rs __ mn by internal accruals and the balance by debt,

for which it has already tied-up with banks. Accordingly, our valuation is based on the expanded capacity.

Key risks

Factors affecting raw material price realisations: XYZ currently enjoys higher..

Geographic concentration risks: The companys plant is at a single location in XX

Summary of financials

Key forecast

(Rs Mn) FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Operating income

EBITDA

Adj Net income

EPS-Rs

EPS growth (%)

RoCE(%)

RoE(%)

Source: Company, CRISIL Forecast

XYZ Company Limited

Date

Disclaimer:

CRISIL has taken due care and caution in preparing this valuation report (report) solely for the internal use only of XYZ

Company Ltd. (company) on the basis of the information / documents provided by the company and/or obtained by CRISIL

from sources considered reliable. CRISIL does not guarantee the accuracy, adequacy or completeness of the information /

documents / report and is not responsible for any errors or for the results obtained from the use of the same. CRISIL

especially states that it has no financial liability whatsoever to the company / any other user of the report.

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of

this report

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 2

Engagement Background

Scope and purpose

XYZ Company Limited (hereinafter referred to as XYZ or the company) is an

integrated XX manufacturing company and markets its products under the brand name

BBB in the XX region.

We understand that the management of XYZ wants to evaluate the business of the

company for the purpose of internal analysis. In this regard, the management of the

company has engaged CRISIL Limited (hereinafter referred to as CRISIL Research or

CRISIL Equities) to conduct a report on a valuation analysis of the business of the

company as at 21 July 2010.

This descriptive report is our deliverable against the same.

Sources of information

Company-specific information All company-specific information, including but not

limited to, past profit and loss accounts and balance sheet of XYZ Company, future

profitability and cash flow projections and qualitative information on the company, were

sourced from the management of the company, either in the written hard copy or digital

form, or through a series of discussions with the management of the company. The

information provided by the management of the company includes historical annual

reports, company presentations and other relevant data.

Industry and economy information

Interviews with management of the company

Press clippings and other publicly available information

CRISIL Industry Research

Other databases subscribed by CRISIL Research

It may be mentioned that the management of the company has been provided an

opportunity to review our draft report as part of our standard practice to make sure that

factual inaccuracies are avoided in our final report.

Statement of limiting factors

Affecting valuation results

Valuation analysis and results are specific to the purpose of valuation and the valuation

date mentioned in the report as agreed per terms of our engagement. It may not be valid

for any other purpose or as at any other date. Also, it may not be valid if done on behalf

of any other entity.

Valuation analysis and results are also specific to the date of this report. A valuation of

this nature involves consideration of various factors including those impacted by

prevailing stock market trends in general and industry trends in particular. As such,

CRISIL Equities valuation results are, to a significant extent, subject to continuance of

current trends beyond the date of the report. We, however, have no obligation to update

this report for events, trends or transactions relating to the company or the

market/economy in general and occurring subsequent to the date of this report. We

provide no assurance that a sale or acquisition deal can be completed successfully at or

close to our recommended valuation within a particular time frame. Our valuation only

represents the most likely price around which a deal can happen if more than one

independently acting potential buyers/sellers are to be found after adequate efforts but

within a limited timeframe after our analysis such that they have similar knowledge of the

business being transacted and its environmental factors and who have no other strategic

factors weighing upon their mind as regards potential of this business.

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 3

In the course of the valuation, CRISIL Equities was provided with both written and verbal

information, including market, technical, financial and operating data. We have, however,

evaluated the information provided to us by the company through broad inquiry, analysis

and review (but have not carried out a due diligence or audit of the company for the

purpose of this engagement, nor have we independently investigated or otherwise verified

the data provided). Through the above evaluation, nothing has come to our attention to

indicate that the information provided was materially mis-stated/incorrect or would not

afford reasonable grounds upon which to base the report. We do not imply and it should

not be construed that we have verified any of the information provided to us, or that our

inquiries could have verified any matter, which a more extensive examination might

disclose. The terms of our engagement were such that we were entitled to rely upon the

information provided by the company without detailed inquiry. Also, we have been given

to understand by the management that it has not omitted any relevant and material factors

and that it has checked out relevance or materiality of any specific information to the

present exercise with us in case of any doubt. Accordingly, we do not express any opinion

or offer any form of assurance regarding its accuracy and completeness. Our conclusions

are based on these assumptions, forecasts and other information given by/on behalf of the

company. The management of the company has indicated to us that it has understood that

any omissions, inaccuracies or misstatements may materially affect our valuation

analysis/results. Accordingly, we assume no responsibility for any errors in the above

information furnished by the company and their impact on the present exercise. Also, we

assume no responsibility for technical information furnished by the company and believe

it to be reliable.

We express no opinion on the achievability of the forecasts given to us. The assumptions

used in their preparation, as we have been explained, are based on the managements

present expectation of both - the most likely set of future business events and

circumstances, and the managements course of action related to them. It is usually the

case that some events and circumstances do not occur as expected or are not anticipated.

Therefore, actual results during the forecast period may differ from the forecast and such

differences may be material.

No investigation of the companys claim to title of assets has been made for the purpose

of this valuation and the companys claim to such rights has been assumed to be valid. No

consideration has been given to liens or encumbrances against the assets, beyond the

loans disclosed in the accounts. Therefore, no responsibility is assumed for matters of a

legal nature. The fee for the report is not contingent upon the results reported.

Others

We owe responsibility to only the directors of the company that has retained us and

nobody else.

CRISIL Equities does not accept any liability to any third party in relation to the issue of

this valuation report.

Neither the valuation report nor its contents may be referred to or quoted in any

registration statement, prospectus, offering memorandum, annual report, loan agreement

or other agreement or document given to third parties without our prior written consent.

We retain the right to deny permission for the same.

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 4

Key factors affecting projections and valuations

Key factors affecting RM prices

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Key factors affecting costs and profitability

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 5

Industry Overview

XXXX is a regional play

An explanation on the Indian XXX industry details on current peculiarities, trends, etc.

CHART

Source: CMA, CRISIL Equities

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 6

Company Positioning

Positioning of the company vis-avis peers; geographic presence sales mix/market share

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 7

SWOT Analysis

Strengths Weakness

xx xx

Opportunities Threats

xx xx

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 8

Financial Summary

Revenues to grow at a

XXXX

.

Revenues Table

Key forecast

(Rs Mn) FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Net Revenues

% growth (Y-o-Y)

Source: Company, CRISIL Equities Estimates

Installed Capacity

FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Grinding Capacity (MTPA)

Additions

Clinker Capacity

Additions

Particulars Capacity Cost (Rs mn)

Expected

commissioning date

Cement grinder ,000 MTPA FY12

Clinker ,000 MTPA FY12

Power plant MW FY12

Total capacity post expansion

Cement grinder MTPA

Clinker MTPA

Power plant MW

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 9

XYZs PAT margin and return ratios to..

Total debt-equity ratio to

In FY10, XYZs total debt-equity ratio was 0.5x compared to 0.4x. The marginal rise in

the ratio was due to the capex incurred by the company.

Debt-to-equity to remain at comfortable levels

Trends in Total Debt and Debt-Equity Ratio FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Total Debt (Rs Mn)

Debt-Equity

Source: Company, CRISIL Equities Estimates

Going forward, we expect the companys total debt-equity to peak in FY11E at __x and

then decline to __x in FY12E and __x in FY13E, respectively.

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 10

Valuation

Valuation methodology

We have used the following methods for valuation:

Comparable company multiples

o EV/EBITDA

o EV/tonne

Discounted cash flow

Book value

Business valuation summary of XYZ

Equity Valuation Multiple used Equity Value Rs mn Value per share (Rs)

EV/Tonne Method Rs5,809 per tonne

EV/EBITDA Method 4.5x

Discounted Cash Flow Method -

Book Value (FY10) -

AN EXPLANATION OF ALL METHODS USED

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 11

Income Statement

(Rs mn) FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Net sales

Operating Income

EBITDA

Depreciation

Interest

Other Income

PBT

PAT

No. of shares

Earnings per share (EPS)

Balance Sheet

(Rs mn) FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Equity capital (FV - Rs 10)

Reserves and surplus

Debt

Current Liabilities and Provisions

Deferred Tax Liability/(Asset)

Minority Interest

Capital Employed

Net Fixed Assets

Capital WIP

Intangible assets

Investments

Loans and advances

Inventory

Receivables

Cash & Bank Balance

Applications of Funds

Source: Company, CRISIL Equities Estimates

Valuation Analysis XYZ Company Limited

This report has to be read in full but especially with the statement of limiting conditions appearing in pages 2 & 3 of this report 12

Cash Flow

(Rs mn) FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Pre-tax profit

Total tax paid

Depreciation

Change in working capital

Cash flow from operating activities

Capital expenditure

Investments and others

Cash flow from investing activities

Equity raised/(repaid)

Debt raised/(repaid)

Dividend (incl. tax)

Others (incl extraordinaries)

Cash flow from financing activities

Change in cash position

Opening Cash

Closing Cash

Ratios

FY08 FY09 FY10 FY11E FY12E FY13E FY14E FY15E

Growth ratios

Sales growth (%)

EBITDA growth (%)

EPS growth (%)

Profitability Ratios

EBITDA Margin (%)

PAT Margin (%)

Return on Capital Employed (RoCE) (%)

Return on equity (RoE) (%)

Dividend and Earnings

Dividend per share (Rs)

Dividend payout ratio (%)

Dividend yield (%)

Earnings Per Share (Rs)

Efficiency ratios

Asset Turnover (Sales/GFA)

Asset Turnover (Sales/NFA)

Sales/Working Capital

Financial stability

Net Debt-equity

Interest Coverage

Current Ratio

Source: Company, CRISIL Equities Estimates

Notes

Notes

Notes

CRISIL Independent Equity Research Team

Mukesh Agarwal magarwal@crisil.com +91 (22) 3342 3035

Director

Tarun Bhatia tbhatia@crisil.com +91 (22) 3342 3226

Director- Capital Markets

Analytical Contacts

Chetan Majithia chetanmajithia@crisil.com +91 (22) 3342 4148

Sudhir Nair snair@crisil.com +91 (22) 3342 3526

Sector Contacts

Nagarajan Narasimhan nnarasimhan@crisil.com +91 (22) 3342 3536

Ajay D'Souza adsouza@crisil.com +91 (22) 3342 3567

Manoj Mohta mmohta@crisil.com +91 (22) 3342 3554

Sachin Mathur smathur@crisil.com +91 (22) 3342 3541

Sridhar C sridharc@crisil.com +91 (22) 3342 3546

Business Development Contacts

Vinaya Dongre vdongre@crisil.com +91 99 2022 5174

Sagar Sawarkar ssawarkar@crisil.com +91 98 2163 8322

Client Servicing

Client Servicing clientservicing@crisil.com +91 22 3342 3561

CRISILs Equity Offerings

The Equity Group at CRISIL Research provides a wide range of services including:

Independent Equity Research

IPO Grading

White Labelled Research

Valuation on companies for use of Institutional Investors, Asset Managers, Corporate

Other Services by the Research group include

CRISINFAC Industry research on over 60 industries and Economic Analysis

Customised Research on Market sizing, Demand modelling and Entry strategies

Customised research content for Information Memorandum and Offer documents

For further details

or more information, please contact:

Client Servicing

CRISIL Research

CRISIL House

Central Avenue

Hiranandani Business Park

Powai, Mumbai - 400 076, India.

Phone +91 (22) 3342 3561/ 62

Fax +91 (22) 3342 3501

E-mail: clientservicing@crisil.com

E-mail: research@crisil.com

www.ier.co.in

About CRISIL Limited

CRISIL is India's leading Ratings, Research, Risk and Policy Advisory Company

About CRISIL Research

CRISIL Research is India's largest independent, integrated research house. We leverage our unique,

integrated research platform and capabilities spanning the entire economy-industry-company

spectrum to deliver superior perspectives and insights to over 600 domestic and global clients,

through a range of subscription products and customised solutions.

Mumbai

CRISIL House

Central Avenue

Hiranandani Business Park

Powai, Mumbai - 400 076, India.

Phone +91 (22) 3342 8026/29/35

Fax +91 (22) 3342 8088

New Delhi

The Mira

G-1 (FF),1st Floor, Plot No. 1&2

Ishwar Nagar, Near Okhla Crossing

New Delhi -110 065, India.

Phone +91 (11) 4250 5100, 2693 0117-21

Fax +91 (11) 2684 2212/ 13

Bangaluru

W-101, Sunrise Chambers

22, Ulsoor Road

Bengaluru - 560 042, India.

Phone +91 (80) 4117 0622

Fax +91 (80) 2559 4801

Kolkata

Horizon, Block B, 4th floor

57 Chowringhee Road

Kolkata - 700 071, India.

Phone +91 (33) 2283 0595

Fax +91 (33) 2283 0597

Chennai

Mezzanine Floor, Thappar House

43 / 44, Montieth Road

Egmore

Chennai - 600 008, India.

Phone +91 (44) 2854 6205/06, 2854 6093

Fax +91 (44) 2854 7531

Potrebbero piacerti anche

- Practical Solution For Issues in ITC Reporting in GSTR-9Documento9 paginePractical Solution For Issues in ITC Reporting in GSTR-9d s p jianNessuna valutazione finora

- Chetna AdhiyaDocumento5 pagineChetna AdhiyaVikash MauryaNessuna valutazione finora

- Account statement summary for Hyderabad service stationDocumento2 pagineAccount statement summary for Hyderabad service stationtawhide_islamicNessuna valutazione finora

- GSTR1 33cfhpd2441a1zb 122022Documento4 pagineGSTR1 33cfhpd2441a1zb 122022Prabhu SNessuna valutazione finora

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocumento68 pagineCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNessuna valutazione finora

- Profit and Loss AccountDocumento9 pagineProfit and Loss AccountAvi HaiNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento8 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancesumit das100% (1)

- Probe42.in: Usha International LimitedDocumento66 pagineProbe42.in: Usha International LimitedrajvvkNessuna valutazione finora

- Executive Summary Format for Credit Proposal Rs.10Lacs-Rs.500LacsDocumento11 pagineExecutive Summary Format for Credit Proposal Rs.10Lacs-Rs.500LacsTripurari KumarNessuna valutazione finora

- 6 MNTH STMNTDocumento22 pagine6 MNTH STMNTVikrant VermaNessuna valutazione finora

- GSTR 1Documento69 pagineGSTR 1admin bhagirathiNessuna valutazione finora

- ITR-1 filing acknowledgement for AY 2022-23Documento7 pagineITR-1 filing acknowledgement for AY 2022-23Yogesh SharmaNessuna valutazione finora

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocumento22 pagineTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMukul DubeyNessuna valutazione finora

- GSTR2 052018Documento77 pagineGSTR2 052018DIN ESH MARUNessuna valutazione finora

- OpMiniStatementUX315 06 2021 PDFDocumento1 paginaOpMiniStatementUX315 06 2021 PDFsaritaNessuna valutazione finora

- Detailed Project Report Proposal For Term Loan of Rs Lakh and Working Capital Limit of Rs .Lakh For Setting Up A New Project For Manufacture of .. I. Introductory, Promoters and ManagementDocumento25 pagineDetailed Project Report Proposal For Term Loan of Rs Lakh and Working Capital Limit of Rs .Lakh For Setting Up A New Project For Manufacture of .. I. Introductory, Promoters and ManagementKrishna PrasadNessuna valutazione finora

- Small and Medium Enterprises LoansDocumento12 pagineSmall and Medium Enterprises LoansSathishNessuna valutazione finora

- Sample Green ReportDocumento12 pagineSample Green ReportSyed Abid HussainiNessuna valutazione finora

- Vishal Mega Mart Private Limited - Company Reports and Balance Sheets - ToflerDocumento4 pagineVishal Mega Mart Private Limited - Company Reports and Balance Sheets - ToflerDebolin DeyNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento4 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceP. C. BaloniNessuna valutazione finora

- Finova - PD Format Oct 2019Documento8 pagineFinova - PD Format Oct 2019Madhusudan ParwalNessuna valutazione finora

- GSTR2B 20CHSPM6149M1ZS 032023 10062023Documento7 pagineGSTR2B 20CHSPM6149M1ZS 032023 10062023laxmi handloommdpNessuna valutazione finora

- GSTR1 Excel Workbook Template-V1.2Documento40 pagineGSTR1 Excel Workbook Template-V1.2vkpamulapatiNessuna valutazione finora

- GSTR-3B SummaryDocumento7 pagineGSTR-3B SummaryAtul VermaNessuna valutazione finora

- Crif VishalDocumento6 pagineCrif VishalKUSHAGRANessuna valutazione finora

- SME Application FormDocumento12 pagineSME Application FormSomnath DasGuptaNessuna valutazione finora

- Form PDF 337279780310722Documento7 pagineForm PDF 337279780310722hitendraNessuna valutazione finora

- GSTR 1Documento70 pagineGSTR 1vassudevanrNessuna valutazione finora

- GSTR3B 33aaofk8082e1z5 092019Documento2 pagineGSTR3B 33aaofk8082e1z5 092019mohanNessuna valutazione finora

- Gstr3b Ms TradersDocumento2 pagineGstr3b Ms TradersBRIGHT TAX CENTERNessuna valutazione finora

- Capsa UnitedDocumento12 pagineCapsa Unitedvenkat rajNessuna valutazione finora

- 15612283995900iqH9Ujij3mWubWM PDFDocumento6 pagine15612283995900iqH9Ujij3mWubWM PDFRohit Kumar DasNessuna valutazione finora

- Commercial Credit Information Report (CCR) - GuideDocumento22 pagineCommercial Credit Information Report (CCR) - Guidecyber ageNessuna valutazione finora

- GSTR-2B ITC StatementDocumento8 pagineGSTR-2B ITC StatementNaga DineshNessuna valutazione finora

- Account Statement: PrakashDocumento1 paginaAccount Statement: PrakashRny buriaNessuna valutazione finora

- GSTR1 08CMBPK3397K2ZL 022023Documento4 pagineGSTR1 08CMBPK3397K2ZL 022023shiva khandelwalNessuna valutazione finora

- Sample Format Form GSTR 2aDocumento2 pagineSample Format Form GSTR 2aDeepanshu JaiswalNessuna valutazione finora

- GSTR1 07afmpv0281r1zk 012022Documento5 pagineGSTR1 07afmpv0281r1zk 012022company workNessuna valutazione finora

- Form GSTR 2aDocumento2 pagineForm GSTR 2aparam.ginniNessuna valutazione finora

- Crisil Annual Report 2019 PDFDocumento256 pagineCrisil Annual Report 2019 PDFYoYoNessuna valutazione finora

- Dhawaj Enterprises Profit & Loss and Balance Sheet for 2022Documento5 pagineDhawaj Enterprises Profit & Loss and Balance Sheet for 2022sanket bhadaleNessuna valutazione finora

- Consumer Base Report GANGANDHARANDocumento4 pagineConsumer Base Report GANGANDHARANgangarajathiNessuna valutazione finora

- Account statement summaryDocumento4 pagineAccount statement summarytawhide_islamicNessuna valutazione finora

- The Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayDocumento6 pagineThe Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayNitin BhatnagarNessuna valutazione finora

- Canara Bank Form 589-RSNDocumento13 pagineCanara Bank Form 589-RSNshardaashish0075% (4)

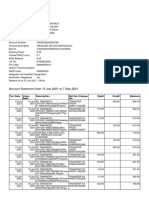

- Account Statement From 15 Jun 2021 To 7 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento13 pagineAccount Statement From 15 Jun 2021 To 7 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceHARSH KUMARNessuna valutazione finora

- Projections - Civil Contractor Material SupplierDocumento16 pagineProjections - Civil Contractor Material SupplierRahul LipareNessuna valutazione finora

- Cma For Less Than 1 Crore With CalculationDocumento18 pagineCma For Less Than 1 Crore With CalculationArun KumarNessuna valutazione finora

- H TNB Ga Oy 2 KL I7 CSSDocumento15 pagineH TNB Ga Oy 2 KL I7 CSSEVD18I019 NIMMAKAYALA SUMANTH GOURI MANJUNADHNessuna valutazione finora

- GSTR3B 07arbpb8459q1z8 122021Documento2 pagineGSTR3B 07arbpb8459q1z8 122021Ajit GuptaNessuna valutazione finora

- Loan Application Form for Pashudhan Kisan Credit Card (PKCCDocumento6 pagineLoan Application Form for Pashudhan Kisan Credit Card (PKCCKarmbir KumarNessuna valutazione finora

- FIN AL: Form GSTR-1Documento5 pagineFIN AL: Form GSTR-1Aditya TiwaryNessuna valutazione finora

- GSTR3B 10cespr1366g1ze 012023Documento3 pagineGSTR3B 10cespr1366g1ze 012023Mega GuideNessuna valutazione finora

- Ram Kripal Nishad - PRAT230728CR689051147Documento2 pagineRam Kripal Nishad - PRAT230728CR689051147AmanNessuna valutazione finora

- HDFC ReportDocumento10 pagineHDFC Reportvishal kharvaNessuna valutazione finora

- Msme EnterprisesDocumento6 pagineMsme EnterprisesRavi Shonam KumarNessuna valutazione finora

- Credit Appraisal of Term Loans and Working Capital LimitsDocumento66 pagineCredit Appraisal of Term Loans and Working Capital LimitsmaddyvickyNessuna valutazione finora

- Financial Statements of A Sole Proprietorship FirmDocumento3 pagineFinancial Statements of A Sole Proprietorship FirmsureshNessuna valutazione finora

- HDFC Apr To As On DateDocumento10 pagineHDFC Apr To As On DatePDRK BABIUNessuna valutazione finora

- Investor Presentation For September 30, 2016 (Company Update)Documento64 pagineInvestor Presentation For September 30, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- PK Sinah - Computer FundamentalsDocumento536 paginePK Sinah - Computer FundamentalsAleeza KhanNessuna valutazione finora

- Information Security Guidelines For Insurers-07!04!2017-CleanDocumento80 pagineInformation Security Guidelines For Insurers-07!04!2017-CleanabhidadNessuna valutazione finora

- Chain of Custody FormDocumento3 pagineChain of Custody FormSanjana Iyer67% (3)

- Project Mutual Fund in IndiaDocumento16 pagineProject Mutual Fund in Indiasidhantha94% (31)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- LLC or Corporation?: Choose the Right Form for Your BusinessDa EverandLLC or Corporation?: Choose the Right Form for Your BusinessValutazione: 3.5 su 5 stelle3.5/5 (4)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsDa EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNessuna valutazione finora

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionDa EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionValutazione: 5 su 5 stelle5/5 (3)

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EDa EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EValutazione: 4.5 su 5 stelle4.5/5 (6)

- Will Work for Pie: Building Your Startup Using Equity Instead of CashDa EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNessuna valutazione finora