Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Analysis of Nepalese Commercial Bank

Caricato da

शिशिर ढकाल0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

99 visualizzazioni4 pagineFinancial analysis of nepalese commercial banks.

Titolo originale

Financial analysis of nepalese commercial bank

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoFinancial analysis of nepalese commercial banks.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

99 visualizzazioni4 pagineFinancial Analysis of Nepalese Commercial Bank

Caricato da

शिशिर ढकालFinancial analysis of nepalese commercial banks.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

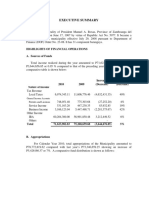

A.

Comparative Financial Position of Bank

1. Comparison of Balance Sheet items of the Bank for 2066/67 and 2067/68:

(Amount in 000)

Particulars

Ashadh

2068

Ashadh

2067

Increase/

(Decrease)

Growth

(%)

Liabilities

Share Capital 1,610,168 1,608,256 1,912 0.12

Reserves and Funds 2,872,693 1,761,453 1,111,240 63.09

Debentures and Bonds - - -

Borrowings 350,000 - 350,000 100.00

Deposits 37,999,242 35,182,721 2,816,521 8.01

Bills Payables 65,966 89,220 (23,254) (26.06)

Proposed and Dividend Payables - 769,166 (769,166) (100)

Income Tax Liabilities - - -

Other Liabilities 912,450 802,503 109,947 13.70

Total Liabilities 43,810,520 40,213,320 3,597,200 8.95

Assets -

Cash Balance 610,691 509,031 101,660 19.97

Balance with Nepal Rastra Bank 1,638,277 819,509 818,768 99.91

Balance with Banks / Financial Institutions 726,828 600,767 126,061 20.98

Money at Call and Short Notice 4,280,888 1,669,460 2,611,428 156.42

Investments 17,258,682 19,847,511 (2,588,829) (13.04)

Loan Advances and Bills Purchase 18,427,270 15,956,955 2,470,315 15.48

Fixed Assets 106,071 118,540 (12,469) (10.52)

Non - Banking Assets - - -

Other Assets 761,812 691,547 70,265 10.16

Total Assets 43,810,520 40,213,320 3,597,200 8.95

Compared to the previous year, the loan portfolio has increased by 15.48% to Rs. 18,427

million. Deposits are up by 8.01% to Rs. 37,999 million. Cash balance with bank and

financial institutions increased by 20.98 % and the balance with NRB has increased by

99.91%. The decrease in investments is on account of the reduction in the placement with the

foreign banks.

In overall, the total assets of the bank have increased by Rs. 3.597 billion (8.95%) which is

mainly represented by the increase in liquid assets, loans and advances and decrease in

investments. The overall financial position of the bank remains strong.

2. Profitability Analysis

(Amount in 000)

Particulars

Current

Year

Previous

Year

Increase/

(Decrease)

Changes

(%)

Interest Income 2,718,699 2,042,109 676,590 33.13

Interest Expenses 1,003,100 575,741 427,360 74.23

Net Interest Income 1,715,599 1,466,369 249,230 17

Commission and Discount 321,771 338,298 (16,527) (4.89)

Other Operating Income 36,753 34,479 2,274 6.59

Exchange Fluctuation Income 387,134 458,564 (71,430) (15.58)

Total Operating Income. 2,461,257 2,297,710 163,547 7.12

Staff Expenses 365,986 312,964 53,022 16.94

Other Operating Expenses 305,215 295,305 9,911 3.36

Exchange Fluctuation Loss - - -

Operating Profit before provision for

Possible losses 1,790,055 1,689,441 100,614 5.96

Provision for Possible Losses 82,739 76,974 5,765 7.49

Operating Profit 1,707,316 1,612,467 94,849 5.88

Non Operating Income /Loss 6,445 36,268 (29,823) (82.23)

Loan Loss Provision Written Back 67,159 58,293 8,866 15.21

Profit from Regular Activities 1,780,921 1,707,028 73,893 4.33

Loss from extra-ordinary Activities (22,765) (17,024) (5,740) 33.72

Net profit after considering all activities 1,758,156 1,690,004 68,152 4.03

Provision for Staff Bonus 159,832 153,637 6,196 4.03

Provision for Income Tax 479,153 450,496 28,657 6.36

* Current Year's 485,713 465,686 20,028 4.30

* Up to Previous year - 23 (23) (100)

* Deferred tax (6,561) (15,213) 8,652 (56.87)

Net Profit 1,119,171 1,085,872 33,300 3.07

The bank continued progress in its performance during the year. However, the rate of growth

slightly decreased from 7.06% in the previous year to 5.88% this year. The main reasons are

the decline in interest rate spread caused mainly by increased rate and volume of high cost

fixed deposits. Reduction in Commission and Discount income and exchange fluctuation gain

has also contributed to slow growth in profitability.

The main reasons for relatively lower rate of growth in net profit this year compared to

previous year is that there was an extraordinary income on account of profit on sale of fixed

assets of Rs. 30.74 million which not there in the year under audit. And also there is increase

in the loss from extra-ordinary activities during the year.

The movement in the key indicators of the banks performance during the year 2067/68

compared to the previous year 2066/67 are as follows:

Net Interest Income: The net interest income has increased by 17%.

Operating Profit: Operating profit has increased by 5.88%.

Net Profit: The net profit has increased by 3.07% reaching to Rs. 1,119 million.

3. Classification of Loans and Advances

The banks classification of loans and advances as per NRB directives is as follows:

(Amount in 000)

Ashadh

2068 %

Ashadh

2067 %

Increase/

(Decrease)

Performing Loan 18,546,674 99.38 16,078,447 99.39 2,468,227

Pass Loan 18,546,674 99.38 16,078,447 99.39 2,468,227

Non-Performing Loan 115,804 0.62 98,136 0.61 17,668

Substandard 85,727 0.46 50,940 0.31 34,787

Doubtful 3,536 0.02 2,175 0.01 1,360

Loss 26,541 0.14 45,020 0.28 (18,479)

Total Loan 18,662,478 100 16,176,583 100 2,485,895

The bank has classified total outstanding loan and advances and bills purchased on the basis

of the ageing of the overdue loans and in compliance with other conditions stipulated in the

relevant directives issued by NRB. Of the total loan outstanding, 0.62% has been classified as

non-performing loans as compared to 0.61% in the last year. Our audit has found the

classification done by the bank to be in line with NRB directives.

4. Loan Loss Provision

The bank has made the following loan loss provision based on the above classification:

(Amount in 000)

Loan Classification

Ashadh 2068 Outstanding Ashadh 2067 Outstanding Change in

Provision Loan Provision Loan Provision

Pass 18,546,674 185,467 16,078,447 160,784 24,682

Substandard 85,727 21,432 50,940 12,735 8,697

Doubtful 3,536 1,768 2,175 1,088 680

Loss 26,541 26,541 45,020 45,020 (18,479)

Total Provisioning 18,662,478 235,207 16,176,583 219,627 15,580

Loan loss provision has been made as per NRB directives.

As per the above table, the total loan loss provision is 1.26 % of the total loan outstanding at

the year-end, as compared to 1.36 % in the previous year.

5. Capital Adequacy Position

(Amount in 000)

RISK WEIGHTED EXPOSURES This Year Previous Year

Risk Weighted Exposure for Credit Risk 23,454,639 20,779,883

Risk Weighted Exposure for Operational Risk 3,461,857 3,058,847

Risk Weighted Exposure for Market Risk 111,025 345,855

Total Risk Weighted Exposures 27,027,520 24,184,585

CAPITAL FUND

Core Capital 4,147,131 3,050,712

Supplementary Capital 521,197 479,783

Total Capital Fund 4,668,327 3,530,495

CAPITAL ADEQUACY RATIOS

Tier 1 Capital to Total Risk Weighted Exposures 15.34% 12.61%

Tier 1 and Tier 2 Capital to Total Risk Weighted Exposures 17.27% 14.60%

The bank is in comfortable position with regard to capital adequacy ratio prescribed by NRB.

As against the statutory requirement of maintaining total capital fund equal to 10% and tier 1

capital fund equal to 6% of total risk weighted assets, banks total capital fund amounts to

17.27% whereas tier 1 capital fund amounts to 15.34% of total risk weighted assets at the year

end. This situation provides the bank potential for further growth in its asset size.

6. Composition of Deposits

The movement in the deposits is presented in the table below.

(Amount in 000)

Particulars Ashadh 2068 % Ashadh 2067 %

Non Interest Bearing accounts

Current Deposits 11,545,604 30.38 9,763,155 27.75

Local Currency 6,114,286 16.09 4,942,470 14.05

Foreign Currency 5,431,318 14.29 4,820,685 13.70

Margin Deposit 291,684 0.77 251,242 0.71

Others - 0 - 0

Total of Non-Interest Bearing Accounts 11,837,288 31.15 10,014,397 28.46

Interest Bearing accounts 0

0

Saving Deposit 11,619,815 30.58 12,430,009 35.33

Local Currency 9,669,940 25.45 10,561,341 30.02

Foreign Currency 1,949,875 5.13 1,868,668 5.31

Fixed Deposit 10,136,244 26.67 9,175,070 26.08

Local Currency 5,491,688 14.45 3,603,055 10.24

Foreign Currency 4,644,556 12.22 5,572,016 15.84

Call Deposit 4,405,895 11.59 3,563,245 10.13

Local Currency 4,378,271 11.52 3,552,367 10.10

Foreign Currency 27,624 0.07 10,878 0.03

Certificate of Deposit 0 0 0 0

Total of Interest Bearing Accounts 26,161,954 68.85 25,168,324 71.54

Total Deposit 37,999,242 100 35,182,721 100

The total deposit of the Bank has increased during the year by 8.01%. Non-interest bearing

deposits have increased by 18.20 % whereas interest bearing deposits have increased by

3.95%. As a result, the proportion of interest bearing accounts has decreased to 68.85% of the

total deposits compared to previous years proportion of 71.54%.

Potrebbero piacerti anche

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsDa EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNessuna valutazione finora

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Documento2 pagineUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNessuna valutazione finora

- Credit Union Revenues World Summary: Market Values & Financials by CountryDa EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Premier BankDocumento14 paginePremier Bankanower.hosen61Nessuna valutazione finora

- 2021 Financial PerformanceDocumento14 pagine2021 Financial PerformanceVicxie Fae CupatanNessuna valutazione finora

- Assignment: Topic: Financial Statement Analysis of National Bank of PakistanDocumento28 pagineAssignment: Topic: Financial Statement Analysis of National Bank of PakistanSadaf AliNessuna valutazione finora

- HDFC Bank Ratio AnalysisDocumento14 pagineHDFC Bank Ratio Analysissunnykumar.m2325Nessuna valutazione finora

- HDFC Bank - FM AssignmentDocumento9 pagineHDFC Bank - FM AssignmentaditiNessuna valutazione finora

- Financial Analysis of Perpetual Help Community Cooperative (PHCCI)Documento17 pagineFinancial Analysis of Perpetual Help Community Cooperative (PHCCI)Jasmine Lilang ColladoNessuna valutazione finora

- United Bank Limited (UBL) : Balance SheetDocumento7 pagineUnited Bank Limited (UBL) : Balance SheetZara ImranNessuna valutazione finora

- Balance Sheet2006Documento50 pagineBalance Sheet2006malikzai777Nessuna valutazione finora

- MArcentile Bank Full Review AssignmentDocumento5 pagineMArcentile Bank Full Review AssignmentJonaed Ashek Md. RobinNessuna valutazione finora

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Documento32 pagine4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNessuna valutazione finora

- HDFC Bank Equity Research ReportDocumento9 pagineHDFC Bank Equity Research ReportShreyo ChakrabortyNessuna valutazione finora

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Documento36 pagineNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNessuna valutazione finora

- Finman Chapter 5 EditedDocumento4 pagineFinman Chapter 5 EditedCarlo BalinoNessuna valutazione finora

- 9M 2013 Unaudited ResultsDocumento2 pagine9M 2013 Unaudited ResultsOladipupo Mayowa PaulNessuna valutazione finora

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Documento17 pagineRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNessuna valutazione finora

- Kaspi Bank 21Documento4 pagineKaspi Bank 21Serikkizi FatimaNessuna valutazione finora

- UBL Analysis 2018Documento4 pagineUBL Analysis 2018Zara ImranNessuna valutazione finora

- BUY Bank of India: Performance HighlightsDocumento12 pagineBUY Bank of India: Performance Highlightsashish10mca9394Nessuna valutazione finora

- Jai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Documento4 pagineJai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Meghana SushmaNessuna valutazione finora

- June Financial Soundness Indicators - 2007-12Documento53 pagineJune Financial Soundness Indicators - 2007-12shakira270Nessuna valutazione finora

- Bajaj Finance Limited Fra ProjectDocumento12 pagineBajaj Finance Limited Fra ProjectSUBASH S 2019Nessuna valutazione finora

- Pran Group MIS ReportDocumento14 paginePran Group MIS ReportNazer HossainNessuna valutazione finora

- Jollibee Foods Corp - Comparative AnalysisDocumento15 pagineJollibee Foods Corp - Comparative AnalysisJ. Kylene C. Lumusad100% (1)

- Wa 2Documento2 pagineWa 2Areeba QureshiNessuna valutazione finora

- Summit Bank Annual Report 2012Documento200 pagineSummit Bank Annual Report 2012AAqsam0% (1)

- 06 Chapter 3Documento31 pagine06 Chapter 3Kiran VinnuNessuna valutazione finora

- SSS Income StatementDocumento16 pagineSSS Income StatementAriel DimalantaNessuna valutazione finora

- Desco Final Account AnalysisDocumento26 pagineDesco Final Account AnalysiskmsakibNessuna valutazione finora

- HDFC BankDocumento4 pagineHDFC BankKshitiz BhandulaNessuna valutazione finora

- JansevaDocumento21 pagineJansevaHarshil KoushikNessuna valutazione finora

- ICICI ReportDocumento10 pagineICICI ReportCoding playgroundNessuna valutazione finora

- Vertical and Horizontal Analysis of PidiliteDocumento12 pagineVertical and Horizontal Analysis of PidiliteAnuj AgarwalNessuna valutazione finora

- Liabilities & Shareholders' EquityDocumento3 pagineLiabilities & Shareholders' Equitydwi adiNessuna valutazione finora

- Industry Overview Bu InamullahDocumento7 pagineIndustry Overview Bu InamullahZahid UsmanNessuna valutazione finora

- Afm AssignmentDocumento11 pagineAfm Assignmentakansha mehtaNessuna valutazione finora

- Financially Distressed State of The Company: Flow-Based Financial DistressDocumento5 pagineFinancially Distressed State of The Company: Flow-Based Financial DistressMd Shakawat HossainNessuna valutazione finora

- Axis Bank ValuvationDocumento26 pagineAxis Bank ValuvationGermiya K JoseNessuna valutazione finora

- Student Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalDocumento19 pagineStudent Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalSavithri NandadasaNessuna valutazione finora

- Banking Survey 2010Documento60 pagineBanking Survey 2010Fahad Paracha100% (1)

- BUS 635 Project On BD LampsDocumento24 pagineBUS 635 Project On BD LampsNazmus Sakib PlabonNessuna valutazione finora

- Interim Results June 2008Documento12 pagineInterim Results June 2008Huseyin BozkinaNessuna valutazione finora

- Project Report PDFDocumento13 pagineProject Report PDFMan KumaNessuna valutazione finora

- Roxas ZDN ES2010Documento7 pagineRoxas ZDN ES2010J JaNessuna valutazione finora

- MCB - Standlaone Accounts 2007Documento83 pagineMCB - Standlaone Accounts 2007usmankhan9Nessuna valutazione finora

- Introduction of MTM: StatementDocumento23 pagineIntroduction of MTM: StatementALI SHER HaidriNessuna valutazione finora

- Consolidated Accounts June-2011Documento17 pagineConsolidated Accounts June-2011Syed Aoun MuhammadNessuna valutazione finora

- BDO-Roxas-Cruz-Tagle ABI 2018 Year-End Report - FinalDocumento28 pagineBDO-Roxas-Cruz-Tagle ABI 2018 Year-End Report - FinalAnonymous gV9BmXXHNessuna valutazione finora

- NBL 2070-71Documento65 pagineNBL 2070-71Kulung KiranNessuna valutazione finora

- Financial Statement AnalysisDocumento5 pagineFinancial Statement AnalysisMohammad Abid MiahNessuna valutazione finora

- Yes Bank: CMP: Target Price: BuyDocumento4 pagineYes Bank: CMP: Target Price: BuyramanathanseshaNessuna valutazione finora

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Documento4 pagineNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNessuna valutazione finora

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocumento32 pagineFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNessuna valutazione finora

- Balance SheetDocumento6 pagineBalance SheetMohammad Abid MiahNessuna valutazione finora

- Preeti 149Documento16 paginePreeti 149Preeti NeelamNessuna valutazione finora

- Axis Bank: Performance HighlightsDocumento13 pagineAxis Bank: Performance HighlightsAngel BrokingNessuna valutazione finora

- Stock PitchDocumento8 pagineStock PitchRaksha ShettyNessuna valutazione finora

- Kbank enDocumento356 pagineKbank enchead_nithiNessuna valutazione finora

- MisDocumento1 paginaMisशिशिर ढकालNessuna valutazione finora

- Basics of Management AccountingDocumento2 pagineBasics of Management Accountingशिशिर ढकालNessuna valutazione finora

- Instructions - FDP On SEMDocumento1 paginaInstructions - FDP On SEMशिशिर ढकालNessuna valutazione finora

- Host EL Boy Host EL Girl: KMC School Students' Out Pass KMC School Students' Out PassDocumento1 paginaHost EL Boy Host EL Girl: KMC School Students' Out Pass KMC School Students' Out Passशिशिर ढकालNessuna valutazione finora

- Objective of The StudyDocumento1 paginaObjective of The Studyशिशिर ढकालNessuna valutazione finora

- Development of Water Park at BiratnagarDocumento1 paginaDevelopment of Water Park at Biratnagarशिशिर ढकालNessuna valutazione finora

- Family HealthDocumento148 pagineFamily Healthशिशिर ढकालNessuna valutazione finora

- Prabhu BankDocumento2 paginePrabhu Bankशिशिर ढकालNessuna valutazione finora

- 2 Statement of Problem For CAMEL AnalysisDocumento1 pagina2 Statement of Problem For CAMEL Analysisशिशिर ढकालNessuna valutazione finora

- Marketing Budget Plan PersonnelDocumento2 pagineMarketing Budget Plan Personnelशिशिर ढकालNessuna valutazione finora

- Beta Management Company AnalysisDocumento1 paginaBeta Management Company Analysisशिशिर ढकाल0% (1)

- List of Commercial Banks in NepalDocumento1 paginaList of Commercial Banks in Nepalशिशिर ढकालNessuna valutazione finora

- Sample Businesss PlanDocumento17 pagineSample Businesss Planशिशिर ढकालNessuna valutazione finora

- Case AssignmentDocumento9 pagineCase Assignmentशिशिर ढकालNessuna valutazione finora

- Questionnaire DesignDocumento24 pagineQuestionnaire Designशिशिर ढकालNessuna valutazione finora

- Questionnaire On Preference On Smart PhoneDocumento4 pagineQuestionnaire On Preference On Smart Phoneशिशिर ढकालNessuna valutazione finora

- Bowzo CaseDocumento3 pagineBowzo Caseशिशिर ढकालNessuna valutazione finora

- Causes of Unemployment in NepalDocumento3 pagineCauses of Unemployment in Nepalशिशिर ढकाल100% (1)

- Uwamungu Et Al 2022 - Contaminacion de Suelos Por MicroplasticosDocumento14 pagineUwamungu Et Al 2022 - Contaminacion de Suelos Por MicroplasticosXXUHAJNessuna valutazione finora

- Module 2 2023Documento14 pagineModule 2 2023ubpi eswlNessuna valutazione finora

- ConsignmentDocumento2 pagineConsignmentKanniha SuryavanshiNessuna valutazione finora

- Hatch Waxman Act OverviewDocumento7 pagineHatch Waxman Act OverviewPallavi PriyadarsiniNessuna valutazione finora

- Slavfile: in This IssueDocumento34 pagineSlavfile: in This IssueNora FavorovNessuna valutazione finora

- Contemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitDocumento1 paginaContemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitGab RabagoNessuna valutazione finora

- Assets Book Value Estimated Realizable ValuesDocumento3 pagineAssets Book Value Estimated Realizable ValuesEllyza SerranoNessuna valutazione finora

- Literature Component SPM'13 Form 4 FullDocumento12 pagineLiterature Component SPM'13 Form 4 FullNur Izzati Abd ShukorNessuna valutazione finora

- Our Identity in Christ Part BlessedDocumento11 pagineOur Identity in Christ Part BlessedapcwoNessuna valutazione finora

- Case Report On Salford Estates (No. 2) Limited V AltoMart LimitedDocumento2 pagineCase Report On Salford Estates (No. 2) Limited V AltoMart LimitedIqbal MohammedNessuna valutazione finora

- Theodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Documento4 pagineTheodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Scribd Government DocsNessuna valutazione finora

- People Vs MaganaDocumento3 paginePeople Vs MaganacheNessuna valutazione finora

- WOREL Q2 Week 2Documento8 pagineWOREL Q2 Week 2Pearl CuarteroNessuna valutazione finora

- SWI Quiz 001Documento4 pagineSWI Quiz 001Mushtaq ahmedNessuna valutazione finora

- Tugas Etik Koas BaruDocumento125 pagineTugas Etik Koas Baruriska suandiwiNessuna valutazione finora

- Adidas Case StudyDocumento5 pagineAdidas Case StudyToSeeTobeSeenNessuna valutazione finora

- Descartes and The JesuitsDocumento5 pagineDescartes and The JesuitsJuan Pablo Roldán0% (3)

- Service Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type TempDocumento2 pagineService Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type Tempshiripalsingh0167Nessuna valutazione finora

- Addressing Flood Challenges in Ghana: A Case of The Accra MetropolisDocumento8 pagineAddressing Flood Challenges in Ghana: A Case of The Accra MetropoliswiseNessuna valutazione finora

- Timeline of American OccupationDocumento3 pagineTimeline of American OccupationHannibal F. Carado100% (3)

- Why Study in USADocumento4 pagineWhy Study in USALowlyLutfurNessuna valutazione finora

- 00 NamesDocumento107 pagine00 Names朱奥晗Nessuna valutazione finora

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersDocumento13 pagineMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkNessuna valutazione finora

- The Holy Rosary 2Documento14 pagineThe Holy Rosary 2Carmilita Mi AmoreNessuna valutazione finora

- Deed OfAdjudication Cresencio Abuluyan BasilioDocumento4 pagineDeed OfAdjudication Cresencio Abuluyan BasilioJose BonifacioNessuna valutazione finora

- Year 1 Homework ToysDocumento7 pagineYear 1 Homework Toyscyqczyzod100% (1)

- Unit 2 Organisational CultureDocumento28 pagineUnit 2 Organisational CultureJesica MaryNessuna valutazione finora

- July 22, 2016 Strathmore TimesDocumento24 pagineJuly 22, 2016 Strathmore TimesStrathmore TimesNessuna valutazione finora

- Alkyl Benzene Sulphonic AcidDocumento17 pagineAlkyl Benzene Sulphonic AcidZiauddeen Noor100% (1)

- First Summative Test in TLE 6Documento1 paginaFirst Summative Test in TLE 6Georgina IntiaNessuna valutazione finora