Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

E&Y Whitepaper

Caricato da

Mitali Awasthi0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

819 visualizzazioni58 pagineproject report prepared by E&Y

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoproject report prepared by E&Y

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

819 visualizzazioni58 pagineE&Y Whitepaper

Caricato da

Mitali Awasthiproject report prepared by E&Y

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 58

Logi(sti)cally Speaking

Association of Multimodal Transport Operators of India (AMTOI)

AMTOI & Ernst and Young White Paper Page 2

Foreword

From a Logistics perspective, India is in an interesting

space. Logistics is an important driver of world economic

growth. Globally, market pressures are challenging

current approaches to both international and domestic

logistics activities.

New innovations are the need of the hour to allow trade

globally to move beyond its current state. If actions are

not taken by all parties in a timely manner the window of

opportunity may narrow.

With this food for thought, questions were asked and

ideas were exchanged between the AMTOI members and

the team at E&Y to conclude the recommendations

provided at the end of this report.

The historical statistical analysis was conducted on data

available from the secondary domain to deduce the

dependencies between macro factors of a given nation

with its Logistics Performance Index guided by the World

Bank.

We hope that through this White Paper, we can continue

conversations and collaborations to enable the sector to

reach its fullest potential.

AMTOI - President

Biren Parekh

Partner

Advisory Services

Ernst & Young Pvt. Ltd.

AMTOI & Ernst and Young White Paper Page 3

Table of Contents

! Overview of Logistics

! Industry overview

! Value Chain

! Drivers

! The India Advantage

! Global statistical correlation between a countrys economy and its

impact on Logistics

! Way forward

! Future Drivers/ Outlook

! Industry growth characterized by: Inorganic Growth

! Suggested future operating models

! Success stories: Case studies

! Conclusion

AMTOI & Ernst and Young White Paper Page 4

Moving products to market is vital

There is no debate on the notion that Logistics is an important facilitator of world economic growth. Supply

chain demands globally are growing every day with rising need to trade finished goods, raw materials etc. from

one location to another.

Thus, companies seeking to lower production costs by sourcing from and supplying to far-away markets are

constantly seeking ways to:

! Reduce shipping costs

! Find reliable, well managed logistics services provider

! Move freight as per their planned schedule rather than that of the carrier's schedule

! Find quality staff for effective control of their logistics services needs

Several organizations are now turning to service providers who can maximize the supply chain efficiency while

reducing supply chain costs while they can continue to focus on their core competencies such as

manufacturing, production, processing, trading etc.

This has given rise to the concept of multi modal transport. Multimodal transport (also known as combined

transport) is the transportation of goods under a single contract, but performed with at least two different means

of transport; the carrier is liable (in a legal sense) for the entire carriage, even though it is performed by several

different modes of transport (by rail, sea and road, for example).

The carrier does not have to possess all the means of transport, and in practice usually does not; the carriage is

often performed by sub-carriers (referred to in legal language as "actual carriers"). The carrier responsible for

the entire carriage is referred to as a multimodal transport operator, or MTO

AMTOI & Ernst and Young White Paper Page 5

however, there exist challenges and risks

common to the Logistics sector

Poor port productivity, port and inland bottlenecks are

making it increasingly difficult to meet customers

demands for reliability at low prices while optimizing use of

assets

Integration across multi-modes of transport is not yet

seamless

Infrastructure

constraints

Inefficient asset utilization owing to trade mismatches and

poor planning

Lack of connectivity to port or origin/ destination to door

adds to these costs

Imbalanced trade flows

MNC players with an end-to-end (integrated supply chain)

proposition pose the risk of domestic market share

New entrants in the market who challenge the current

business models by either offering low-cost or premium

services continue to pose threats to the way traditional

family-run businesses operate

New entrants

As suppliers cater to the needs of a global customer, the

need for reliable service persists

Real-time visibility of shipment needs to be accurate and

timely, while shipping processes more streamlined

Customer demands

Globally, freight forwarding largely unregulated

MTOs not recognized as SSI (Small Scale Industry)

Lack of clarity on what kind of changes will be brought about

on regulations which are not conducive for industry growth

License granted under Served from India Scheme (SFIS ) is

not tradable

Lack of regulatory

support

AMTOI & Ernst and Young White Paper Page 6

Industry value chain

*Shipping origination,

routing and capacity

procurement

Facilitate

transport

Provide and

operate

Load and unload

shipments

Inland delivery

Customer sales

Shipment

routing

Capacity

procurement

Customer

service

Billing

Tracking

Ownership of

asset (ULD,

Containers,

Reefers, etc.)

Storage and

maintenance

Repositioning

Ownership &

operation of

facility/ asset

Terminal / Port/

Airport control

(ownership or

lease)

Terminal operation

Handling and

clearance

Storage

Control of trucks

(specialized

services)

Ownership of

railroad

Container handling

Key Activities across the value chain

Container carriers,

Airlines,

Transportation

companies, Rail

Forwarders/

NVOCCs

Container / ULD

carriers

Container / ULD

leasing companies

Reefer operators

Container carriers

Outsourced/ Third

party

Container carriers

Captive terminal

operators

Third party terminal

operators

FF

Agents

Customs

CFA

Railroads

TL trucks

Drayage truckers

Container carriers

(limited)

Competitor types / Flow of Info

A closer look at the operating models of leading logistics players indicates that market leaders (especially

global players) are gradually playing a larger role across the value chain through various means to add value

through diversification and enhancement. Many, have sought seamless intermodal services, extending their

operations to include inland haulage and offering door-to-door transportation. Some have developed other

elements of the logistics chain, expanding into warehousing and related activities. On the other hand, few

have formulated the strategy of transforming from a global shipping carrier to a global logistics provider. With

the expansion of the value chain, players are lifting the competition platform from low level price competition

to the total logistics services value competition. The logistics supply chain has expanded from mere

transportation to include custom clearance, billing & Tracking, warehousing and container handling.

Booking Waybill Invoice Manifest Delivery Instruction Release of Cargo

AMTOI & Ernst and Young White Paper Page 7

..leading to evolving role of logistics facilitators

Standard 3PL

provider

1. Pick & Pack

2. Warehousing

3. Distribution

Service Developer

1. Freight Forwarding

2. Tracking & tracing

3. Cross Docking

4. Packaging

Customer Adapter

& Developer

1. Handle all the end to

end logistical functions

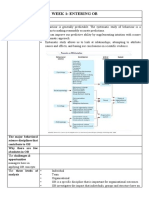

Thus, the world of Logistics has evolved to include various functions and is set to get more complex as

globalization has opened up new markets and created a wealth of opportunities. A closer look at Indias

Logistics market throws light on the dynamics of this segment and its future growth trajectory based on the

global comparatives we have looked at in the subsequent sections.

According to the Council of Supply Chain Management Professionals, 3PL is defined as "a firm [that] provides

multiple logistics services for use by customers. Preferably, these services are integrated, or bundled together,

by the provider. Among the services 3PLs provide are transportation, warehousing, cross-docking, inventory

management, packaging, and freight forwarding. The evolution of 3PL providers can be depicted as follows:

AMTOI & Ernst and Young White Paper Page 8

So what is driving the domestic market?

India

Advantage

R&D

capabilities

Proximity to

emerging

markets

Rising

domestic

demand

Shift in

consumption

patterns

Export

potential

Rising

consumption

from tier 2/3

cities

Availability

of manpower

pool

Continued

interest from

MNCs/ Investors

! Investment in logistics infrastructure

! Indian government scaling up investment in core infrastructure

! Public private partnership (PPP) expected to play key role

! Integrated services: Expected to reduce costs and facilitate movement of goods

! Change in tax laws : VAT/ CST

! Change in Supply Chain Orchestration; Industry moving towards outsourcing Logistics function

! Macroeconomic:

! Continued economic liberalization and relaxation in FDI norms

! Cost for talent in India, lower than global benchmarks

Supply drivers

! Economy and trade growth

! Changing demographics, rising disposable incomes, increased domestic consumption for goods from global markets

! Due to proximity to emerging markets; shipments from India, cost-effective

! Opportunity to reduce logistics costs with increasing Infrastructure spend

! Increased liberalization leading to rise in Logistics outsourcing

! Growth across diversified industries with marked entry of foreign players leading to investment in logistics: Retail,

Agri, Pharma, Automobile, FMCG, etc.

! Gradual phase out of central sales tax (CST)

! CST phase out likely to boost movement of goods

Demand drivers

AMTOI & Ernst and Young White Paper Page 9

..and how have players tapped on this opportunity?

Successful logistics companies have adopted new management resources and technologies to successfully

ride the wave of globalization. The cross-border flow of goods, more than 80 percent of which is carried by sea,

has been packaged into standard-dimension steel container boxes that have enabled the integration of ocean

freight, rail, and trucking.

Further, customer preferences have brought about buoyancy in the way logistics players are doing their

business. While some of the global market leaders being family-owned businesses (Kuehne Nagel) have been

prompt in adopting new business strategies, others have used a wait-and-watch approach to mitigate business

risks. Several have achieved inorganic growth through mergers with players either operating in a similar model

or spread across the value chain, on the other hand, some have been entirely organic. Whatever the strategy

adopted, the objectives are all the same; one for cost competitiveness, two for higher service quality to meet the

customers' global requirements, thus to support the desired growth. While infrastructure constraints and threat

from new agile entrants continue to challenge the way industry players approach their business conduct,

demand for efficient logistics will only rise with globalization; as greater number of firms continue to source,

manufacture, and distribute on a global scale, making their supply chains very complex to manage. Below is an

overview of the opportunity landscape:

Segment

dynamics &

competitive

scenario

Major growth

driver: EXIM

trade

Manpower:

Ability to

retain

Entry

barriers:

Low

Differentiator

End-to-end

& Value

added

Service

Competitive

differentiator:

Global

networks

AMTOI & Ernst and Young White Paper Page 10

With an intent to facilitate trade at greater speed,

lower costs

It has therefore become all the more imperative for Multi Modal Transport Operators to leverage

the window of opportunity global trade has presented given the positive spillover effects of

efficient logistics, especially on productivity of trade and industry:

! Minimize time-loss at trans-shipment points

! Multimodal transport, which is planned and co-ordinated as a single operation, minimizes the loss of

time and the risk of loss, pilferage and damage to cargo at trans-shipment points

! MTOs maintain their own communication links and coordinate interchange and onward carriage

smoothly at trans-shipment points.

! Faster transit of goods

! The faster transit of goods made possible under multimodal transport reduces the disadvantages of

distance from markets and the tying-up of capital

! In an era of globalization, the distance between origin or source materials and consumer is

increasing thanks to the development of multimodal transport

! Reduce burden of documentation and formalities

! The burden of issuing multiple documentation and other formalities connected with each segmented

of the transport chain is reduced

! Cost savings

! The savings in costs resulting from these advantages are usually reflected through freight rates

charged by the multimodal transport operator and also in the cost of cargo insurance

! As savings are passed onto the consumer, demand increases

! Single point of contact

! The consignor has to deal with only the multimodal transport operator in all matters relating to the

transportation of his goods, including the settlement of claims for loss of goods, or damage to them,

or delay in delivery at destination

! Reduce cost of exports

! The inherent advantages of multimodal transport system has helped reduce the cost of exports and

improve their competitive position in the international market

AMTOI & Ernst and Young White Paper Page 11

Regulations also moving towards business-friendly

approach..

! The Multimodal Transportation of Goods Act, 1993 was introduced to facilitate the exporters and give

them a sense of security in transporting their goods. As per the MMTG Act, three categories of

companies are eligible to be registered as MTO's. They are (1) Shipping Companies (2) Freight

Forwarding Companies (3) Companies which do not fall in either of the above two categories.

Unlike other contracts MTO acts as the principal and not the agent of

the shipper, in containerized transport it is often difficult to determine

the point at which the cargo was damaged , while in case of multi

modal transport cargo owner will have no difficulty because he is

bound by just one contract, and is liable for the same, while in case of

other transport contracts, cargo owner will have to determine the

stage at which the goods were damaged, this is particularly important

when customer wants to put up a claim damage from the carrier. In

instances where he is not able to determine the stage of journey at

which goods were damaged, then he might be forced to claim against

all carriers involved and this shall lead to additional expenses

How is Multi-

Modal Transport

Contract different

from other

contracts

A Multi-Modal Law was needed for reducing costs and delays& for

improving upon the quality of transportation services.

For determining liabilities & responsibilities of multi-modal transport

operator for loss or damage to goods

To reduce and eliminate interruption in continuous movement of

goods from their place of origin to that of ultimate destination

Multi-Modal law was also necessary to enhance trade and commerce

Purpose and

objective behind

enactment of

Multi Modal

Transportation

law

AMTOI & Ernst and Young White Paper Page 12

With special Government impetus to upgrade

infrastructure

Key Government Strategies for improving transport infrastructure facilities:

Indias Eleventh Five Year Plan identifies various deficits in the transport sector. Hence the Government has

made substantial efforts to tackle the sectors shortcomings and to reform its transport institutions which

Include:

National Highway Development

Program to improve connectivity

Increasing public funding for

transportation in its Five Year

Plan

Accelerated Road Development

Program for the North East

Region to provide road

connectivity to all State capitals

and district headquarters in the

region

Financing the development and

maintenance of roads by

creating a Central Road Fund

(CRF) through an earmarked tax

on diesel and petrol

Operationalising the National

Highway Authority of India

(NHAI) to act as an

infrastructure procurer and not

just provider

Improving rural access by

launching the Pradhan Mantri

Gram Sadak Yojana (Prime

Ministers Rural Roads Program)

Reducing the congestion on rail

corridors along the highly

trafficked Golden Quadrilateral

and improving port connectivity

by launching the National Rail

Vikas Yojana (National Railway

Development Program)

The development of two

Dedicated Freight Corridors from

Mumbai to Delhi and Ludhiana

to Dankuni

Improving urban transport under

Jawaharlal Nehru National

Urban Renewal Mission

(JNNURM)

Upgrading infrastructure and

connectivity in the country's

twelve major ports by initiating

the National Maritime

Development Program (NMDP).

Privatization and expansion of

the Mumbai and New Delhi

Airports and development of

new international airports at

Hyderabad and Bangalore.

Enhancing sector capacity and

improving efficiencies through

clear policy directive for greater

private sector participation. Large

parts of the NHDP and NMDP are

to be executed through public

private partnerships (PPP)

The Ministry of Roads, Transport

and Highways (MoRTH)

envisages up gradation of

national highways to a minimum

two-lane standard by December

2014

Minister of Railways Vision 2020

Upgradation of existing cargo

terminal and construction of

greenfield cargo terminal was

undertaken at the Indira Gandhi

International Airport (IGIA), Delhi

AMTOI & Ernst and Young White Paper Page 13

Future Industry Drivers

! Boost in rail transportation

! The railway freight traffic has grown by 8 to 11%, which is projected to cross 1100 million tonnes

by the end of 11th Five Year Plan

! In mid-2006, the foundation stone was laid at Ludhiana in Punjab for the Dedicated Freight

Corridor (DFC) and the Indian Railways embarked on a multi-crore project to set up a direct freight

link from the manufacturing bases in the northern hinterland of the country to ports on the west

coast and with the coal fields and steel plants in the east coast ports. DFC will cover approximately

3300 route kilometres on two corridors Eastern and Western corridors- and will greatly improve

the freight transportation.

! Salient features of the DFC are:

Exclusively for running freight trains at speeds upto 100 km/h

Parallel to existing Indian Railways Corridors and connection at important junction points

This corridor will bypass populated cities/towns to minimise social and environmental impacts

Facilitate running of longer and heavier trains

Reduce unit cost of transportation

Ensure guaranteed transit time thus providing quicker and reliable service

Accelerated industrial development in the region

AMTOI & Ernst and Young White Paper Page 14

Future Industry Drivers

Road

The road freight volume is projected to grow to 1,200 billion tonne kilometer (BTKM) and goods vehicles

requirement will increase to six million by 2012

Rail

A growth in volume with an increase of 5.66% to 583,061 mn tonne/km in FY12 is expected

Rake capacity in the Indian rail freight industry is bound to grow from the present 300 rakes to 500 rakes by

2013.

Air

Air freight tonnage growth forecast is expected to average 7.95% by 2015

Projections for growth in freight volumes:

Source-Companies & Market 2011 freight transport report

AMTOI & Ernst and Young White Paper Page 15

Future Industry Drivers

! Retail boom in India

! Retail is amongst the fastest growing sectors in the country. India ranks 1st, ahead of Russia, in

terms of emerging markets potential in retail and is deemed a 'Priority 1' market for international

retail

! Total retail sales in India will grow from US$ 395.96 billion in 2011 to US$ 785.12 billion by 2015,

according to the Business Monitor International (BMI) India Retail Report for the second-quarter of

2011.

! Indias underlying economic growth, population expansion, and the increasing wealth of individuals

will boost the rapid construction of organized retail infrastructure, which in turn will help the

transportation sector in increasing volumes

! There is also considerable investment in the cold chain industry by Multinational Corporations and

PE firms which is poised to be the next growth mantra for the Logistics industry in India

! India, at present does not have a comprehensive cold chain network, and is estimated to grow to

INR 32,000 cr by 2015.

! With phenomenal growth in production of horticulture produce, dairy products, and meat products,

there has been tremendous pressure on improving supply chain and reducing losses during

produce handling and movement. Most of the new cold storages in the last decade have been

constructed as multipurpose facilities focusing on all fruits and vegetables, poultry, dairy and

FMCG product categories

! The Indian cold chain market is highly fragmented with over 3,500 companies in the whole value

system

! Cold storage solutions form about 85 percent of the Indian cold chain market by value while the

balance 15 percent is contributed by transportation. There are various standalone, integrated

companies and 3PL service providers offering cold storage and transportation solutions to various

food companies. However, these are not enough to cater to the growing food demand

! High growth prospects for the food processing sector along with attractive government incentives

(including 51 per cent FDI) make cold chain business a lucrative proposition for foreign investors

as well

AMTOI & Ernst and Young White Paper Page 16

Future Industry Drivers

! Multimodal Logistics Hubs in India

! The demand for logistics has increased with increased share of manufacturing in the national

GDP. The essential components of a logistics park are suitable location, rail terminal, air cargo

complex, intermediate container terminal, warehousing (temperature controlled and ambient),

value-added logistics services, food processing zones, open stocking yards, ancillary production

etc. Logistics parks also create community and economic benefits, such as, reduced pollution,

single window clearances, greater industrialisation, focused environment management, and

greater use of environment-friendly rail systems.

! Some recent developments on the Multimodal parks in India:

1. The Dedicated Freight Corridor Corporation of India (DFCCIL) is in the process of setting up

three parks along the Eastern corridor from Ludhiana to Dankuni in West Bengal. One of

these will be at Kanpur apart from other two at Ludhiana and Durgapur. Around 32 per cent

(1,002 km) of the corridor passes through the state while Kanpur has been proposed

because of its industrial significance and its central location, being well connected by rail

and road to all parts of the country.

2. The Container Corporation of India Ltd (CONCOR) is setting up a multimodal logistics park

at the hi-tech special economic zone (SEZ) in Sriperumbudur. Industries situated in the SEZ

will be able to utilize the facility to transport goods. Initially, goods from Sriperumbudur

would be moved to the railway station by road and a rail link would later directly extend to

the SEZ, he added.

3. MP State Agricultural Marketing Board plans to set up Multi-Modal Composite Logistics Hub

in Madhya Pradesh .As of March 2011, work on the project is under planning stage.

Expression of Interest/ Request for Qualification were invited for setting up Multi Modal

Logistics Hub near Itarsi on PPP mode, last date of submission: 31st March 2011.

4. State-owned diversified conglomerate Balmer Lawrie is setting up four multi-modal logistics

hub in India in four zones -- east, west, north and south

5. After West Bengal, the second multi-modal aerotropolis will come up at Rajasthan's Jaipur

city as the government has given 'in principle' approval for the setting up of a new greenfield

airport there.

AMTOI & Ernst and Young White Paper Page 17

Future Industry Outlook

Inorganic growth

According to experts, the Indian logistics industry is likely to continue its growth momentum in 2011 as in

the previous year and the sector is forecast to witness a consolidation wave in the coming months in view

of the reviving fortunes of the sector with booming end-user industries. Companies have been actively

looking to expand their size in India through the inorganic way.

! Allcargo Global Logistics acquisition plans

! Allcargo is looking at various acquisition opportunities and it is confident of finalising it in this

calendar year. They are looking across the three verticals they are operating in, the less than

container load (LCL) space, the project and engineering solutions and also in the container freight

stations (CFS) vertical.

! Logistics Corporation of India

! From early 2011,there is a proposal for a `Logistics Corporation of India' to be created jointly by

three public sector undertakings. Shipping Corporation of India, Concor and Central Warehousing

Corporation of India will be the equity partners in the multi-modal joint venture logistics company,

according to the proposal made by an expert group headed by the Director-General of Shipping,

Mr S.B. Agnihotri.

! The proposed corporation will provide integrated transport services.

! Such an entity should be able to resolve the problems in ensuring seamless movement of cargo.

The idea is to provide an "end-to-end transport solution

! Concor and the Warehousing Corporation can take care of the rail and road segments of the chain

and Shipping Corporation can provide the shipping link.

! FedEx acquired AFL

! In 2010, the worlds largest package delivery company, FedEx, completed the acquisition of

Mumbai-based integrated logistics services provider AFL through its subsidiary, FedEx Express

! The acquisition of the AFL and UFL businesses has enhanced the leadership position of FedEx in

the Indian express market and offers our customers access to a range of service options, including

air express, domestic ground and value added-services,

! With this transaction, FedEx Express will now provide all international services for AFL and UFL

customers, who will have direct access to the FedEx international air and ground network in more

than 220 countries and territories worldwide

AMTOI & Ernst and Young White Paper Page 18

Leading to changing dynamics of the sector

Transport Express Shipping Supply

Chain

Industry Growth

Curve

Entry Dynamics

Mature

Fragmented

Low barriers

to entry

Growth

niche

High entry

barriers

Growth

High entry

barriers

Nascent

Knowledge

based

High entry

barriers

Industry Growth 5 - 10 % 15 20% 10 15% 50% +

Customer

Requirements

Low-cost

Non-time

sensitive

Cost

efficiency

High time

sensitive

Scheduled

services

Cost

optimization

Value driven

Single

window

Single point

of contact

(end-to-end)

AMTOI & Ernst and Young White Paper Page 19

Dynamics of Multimodal Transport Industry

AMTOI & Ernst and Young White Paper Page 20

What do the statistics say?

Across country analysis of Logistics Performance Index (LPI):

! The World Banks LPI as of 2010, is a comprehensive index created to help countries identify the

challenges and opportunities they face in trade logistics performance.

! The LPI assesses the performance of countries in the six areas identified below and is an equally

weighted average of the following six components :

! Customs: Efficiency of the customs clearance process

! Infrastructure: Quality of trade and transport-related infrastructure

! International Shipments: Ease of arranging competitively priced shipments

! Logistics Competence: Competence and quality of logistics services

! Tracking & Tracing: Ability to track and trace consignments

! Timeliness: Frequency with which shipments reach consignee within the scheduled or expected

time

! The index ranges from 1 to 5, with a higher score representing better performance. Data is from Logistics

Performance Index surveys conducted by the World Bank in partnership with academic and international

institutions and private companies and individuals engaged in international logistics.

! Ernst &Young analysis:

To understand the correlation and regression between LPI and various other relevant macro-economic

indicators, we analyzed the regression of LPI against Imports, Exports, Merchandise Trade, Gross

Domestic Product (GDP), Industry (%GDP), Services (%GDP) and Gross National Income (GNI).

Regression analysis has been used in this paper for 2 purposes:

! To establish the dependence of the Logistics Performance Index on certain macroeconomic

factors for a data set of 55 countries as of 2009. This regression gives the trend of how the

logistics performance of an economy is related to its general economic condition.

! To establish the trend of the revenue generated by the logistics sector of India and to find its

dependence on various growth drivers. This is a time-series analysis, meaning the trend is

checked from 2004-2010 based on annual data.

AMTOI & Ernst and Young White Paper Page 21

Country LPI Exports

(%GDP)

Imports

(%GDP)

GDP growth

(annual %)

GNI per

capita

(current US$)

Industry, value

added (%GDP)

Services,

value added

(%GDP)

Germany 4.11 47.4718 41.0455 0.988 42670 29.6436 69.4593

Singapore 4.09 220.5319 202.583 1.7825 37650 25.9362 73.9951

Sweden 4.08 53.2558 46.4015 -0.4088 52440 27.4969 70.7446

Netherlands 4.07 76.5986 68.4423 1.9958 48520 25.5883 72.6033

Switzerland 3.97 56.497 45.1088 1.8972 56770 27.6857 71.0468

United Kingdom 3.95 29.1982 31.8053 0.5479 45760 22.5594 76.6584

Belgium 3.94 85.6927 84.8336 1.0042 44720 23.2019 76.1255

Norway 3.93 48.1225 29.2066 1.8151 84840 45.0713 53.7316

Finland 3.89 46.955 42.9545 0.9221 48100 32.2531 64.8733

Ireland 3.89 82.6004 73.6331 -3.0358 49810 31.078 67.6359

India* 3.12 23.4809 28.912 28.217 1080 28.217 54.1964

Macroeconomic factors of top 10 countries with highest LPI and India*

Source-World Bank data 2010

*India does not feature in the list of top 10 countries with highest LPI. It is mentioned here for the purpose of comparison with

the top performing countries

Implications from cross-country analysis of the Logistics Performance Index:

What do the statistics say: a comparison of LPI

with countrys economic growth

Parameter Impact

Trade

variables

Trade variables (Imports and Exports as a % of GDP) have a positive impact on the LPI.

Countries with a higher contribution of trade to the GDP will have better logistics performance

Gross

National

Income (GNI)

Logistics performance is directly related to the GNI per capita

Services

sector

Services sector performance has a positive impact on the LPI. Countries where the services

sector is dominant show better logistics performance

Industrial

sector

Industrial sector performance has a negative impact on the LPI. Countries where the industrial

sector is dominant show poorer logistics performance possibly due to:

1.Cheap availability of labour and raw materials promotes industrial production without

improvement of the infrastructure required for better logistics

2.Inefficiency of customs facilities, clearance processes which are not necessary for industrial

production

3. Nascent stage of technology usage inability to track consignments, inefficient supply chain

management

AMTOI & Ernst and Young White Paper Page 22

What do the statistics say: In terms of Trade

Based on the implications of the macroeconomic indicators on the Logistics

Performance Index (LPI), the key drivers for the logistics sector in India can be

concluded to be:

Taking the analysis forward, all of the above variables are taken as regressors. The regressand for the analysis

is the total revenue generated by the logistics sector (total revenues of 20 companies selected by the ISI

Emerging Markets* as an overall indicator of companies comprising of all sizes present in the sector). A time-

series analysis is performed on the variables and the dependency of the revenues generated by the logistics

sector is measured against each of the above mentioned drivers.

*List of 20 companies selected by ISI Emerging market, ISI, EMIS, CEIC: ABC India Ltd. Aegis Logistics Ltd. Agarwal Industrial

Corporation Ltd. Allcargo Global Logistics Ltd. Aqua Logistics Ltd. Arshiya International Ltd. Asian Logistics Ltd Balurghat

Technologies Ltd. Chartered Carriers Ltd. Coastal Roadways Ltd. Container Corpn. Of India Ltd. Frontline Corporation Ltd. Gateway

Distriparks Ltd. Inter State Oil Carrier Ltd. NR International Ltd. Patel Integrated Logistics Ltd. SER Industries Ltd. Sical Logistics Ltd.

Transport Corporation Of India Ltd. VRL Logistics Ltd

The result of time-series analysis is mentioned in the subsequent pages

Trade- import and export

Extent of containerization

Total spending on infrastructure road, rail, ports

Services sector performance of the country

AMTOI & Ernst and Young White Paper Page 23

What do the statistics say: In terms of trade

1. Trade

Trade primarily consists of imports and exports. Indian imports and exports have risen in

volume over the years. An increase in trade also leads to increased need for peripheral

industries.

! The growth in export

volumes since January 2009

to January 2012 has been

around 52%. With rising trade

volumes the need for

transporting them within time

and at minimal cost also rises

! The growth in import

volumes has been 52.63%

form January 2009 to January

2012. The import trade

specifically needs services that

have the capability of reaching

to the remote areas of India

AMTOI & Ernst and Young White Paper Page 24

What do the statistics say: In terms of trade

Trade Portfolio

From being a largely agricultural- traded economy, India has emerged as a nation dealing with multiple

products. The major export items include agricultural products, gems and jewelery, leather products,

textile and handicrafts, whereas the major import items include capital goods, fuel, iron and steel, food

grains and equipments. The export pie chart is represented below:

Source: Handbook of Statistics on the Indian Economy, RBI 2010

! With increasing trade volumes, the scope for logistical providers also increases. The trade gateways

open the potential for logistic players. Since the trade volumes are high the capacity utilization can

optimized, thereby reducing the idle time cost.

! A diverse product portfolio requires the logistics service providers to specialize the services based on the

product handled. This specialization could act a key differentiator in the market. With products like fuel,

gems and jewelery & agricultural products being the major trade components, they require special

handling during transportation. Such specialized handling also claims higher margins. For example DHL

provides logistical services to different industries like cold chain transport, Warehousing and Order

Fulfillment Services for the Chemical industry whereas reverse logistics and distribution to stores for the

retail industry

8.74

2.87

38.15

1.11

7.57

12.73

6.57

9.58

0.07

0.53

9.26

2.84

Primary Products

Ores and Minerals

Manufactured Goods

Leather and Manufactures

Chemicals and Related Products

Engineering Goods

Textile and Textile Products

Gems and Jewellery

Handicrafts (excluding

Handmade Carpets)

Other Manufactured Goods

Petroleum Products

AMTOI & Ernst and Young White Paper Page 25

What do the statistics say: Growth of

containerization

! On account of encouraged trade between emerging countries the flow of goods is expected to increase.

The multi modal service providers will have to cater to the demands arising from these markets as well.

Underlying Opportunity

! Logistical service providers can use this opportunity of distinguished needs of different industries to as a

selling proposition. These service providers can work back with the various supply chain players like

warehouse agents, movers and packers etc. to provide an end to end package to the customers. Due to

the need for specialized services increasing LPI can afford to invest in trainings provided to staff for

sensitive handling.

2. Containerization

! Containerization incorporates supply, transportation, packaging, storage, and security together with

visibility of container and its contents into a distribution system from source to user. The containers make

the entire goods handling process very standardized thereby reducing stoppages at every stage of the

shipment.

! Containerization in India, which is at 68%, is expected to see significant growth since the current level is

well below international levels of around 80%.

! Container traffic at major ports has almost doubled in the last 5-6 years and shows growth at an average

rate of 13.27 percent per year

! Even though movement is small as compared to some of the largest ports and shippers in the world, it

has shown stable growth and is likely to be an increasingly important mode of transport in India and the

South Asian region in the coming years. Also, the size of the country and the hinterland region from the

ports makes for a variety of choices for land movement

Source: Ministry of Shipping

AMTOI & Ernst and Young White Paper Page 26

What do the statistics say: Proportionate demand

for Logistics with growth in Services

3. Service sector performance

! The graph above draws a relationship between the Logistic Performance Index and the contribution of

service sector to the GDP of the economy. The term R^2 depicts the extent of dependence of LPI and

Service contribution.

! Countries like Hong Kong, China, Singapore and the USA share a highly positive relation between

Service sector contribution and LPI. These countries have a good score (above 3.5 out of 5) on the LI as

per the World Bank statistics.

! This phenomenon can be substantiated as follows:

Czech

France

Germany

Hong Kong

Italy

Singapore

South Korea

UK

USA

Brazil

Russia

India

China

Malaysia

Mexico

Phillipines

South Africa

Thailand Turkey

Poland

Saudi Arabia

Cuba

Pakistan

R" = 0.22797

1.5

2

2.5

3

3.5

4

4.5

20 30 40 50 60 70 80 90 100

L

P

I

Services, value added (%GDP)

Services, value added (%GDP) Line Fit Plot

Source: World Bank for the year 2010

COUNTRY HONG KONG CHINA SINGAPORE UNITED STATES

LPI 3.88 4.09 3.86

Export (% GDP) 212.57 220.53 12.82

Import (% GDP) 202.38 202.58 17.77

Industry, value added %( GDP) 7.98 25.93 21.29

GDP Growth 2.16 1.78 -0.0008

AMTOI & Ernst and Young White Paper Page 27

What do the statistics say: Investments in

Infrastructure to facilitate Logistics

4. Infrastructure

Infrastructure is one of the biggest enablers for the Logistics sector. As mentioned in the earlier part of the

report, India faces typical infrastructural challenges such as poor hinterland connectivity, gateway productivity,

utility constraints, etc.

The time-series analysis carried out between three important constituents of infrastructure (i.e. Indian

Government expenditure on transportation, Gross Fixed Capital Formation in roads, railways, ports and

storage, FDI in construction (includes roads and highways) Planning Commission 2011 data) reveal the

following results on impact of the above parameters on the revenue of logistics players.

Also, statistics released by the World Bank, reveals the following cross-country comparative analysis on the

overall operational excellence (for the year 2010):

Parameter Impact on revenue

Government expenditure on

transportation

A 1% increase in the government spending on transport will lead to

a 0.759% increase in the revenues generated by the logistics

sector

Gross Fixed Capital Formation in

roads, railways, ports and storage

a 1% increase in the GFCF in roads, railways, ports and storage

will lead to a 0.739% increase in the revenues generated by the

logistics sector

FDI in construction (includes roads

and highways)

a 1% increase in the FDI in construction sector will lead to a

0.172% increase in the revenues generated by the logistics sector

Parameter India China US UK

Exports (% GDP) 23.4809 34.9795 12.8289 29.1982

Imports (% GDP) 28.912 27.2643 17.7729 31.8053

Cost to export (US$ per container) 1055 500 1050 950

Cost to import(US$ per container) 1025 545 1315 1045

Time to export (days) 17 21 6 7

Time to import (days) 20 24 5 6

Burden of customs procedure, WEF (1=extremely inefficient

to 7=extremely efficient)

4.0382 4.5344 4.4798 4.842

Quality of port infrastructure, WEF (1=extremely

underdeveloped to 7=well developed and efficient by

international standards)

3.8603 4.3215 5.5372 5.4887

AMTOI & Ernst and Young White Paper Page 28

2

8

So how do we get there

Consolidation

Service-driven

strategy

Talent Management

IT Capability

& Value Added Services

Current

State

Time & Growth in Market Share

Future State

Global Networks

The need to efficiently meet a countrys demand for Logistics services requires a relook at the organizations

operating model from various dimensions such that it is able to cater to the dynamic changes in the external

environment through a robust internal operating mechanics. Some of these areas of focus have been

highlighted below:

AMTOI & Ernst and Young White Paper Page 29

Proposed Operating Model Dimensions

Organization:

Cultures

Structure/ Ownership

Asset base

Employees

Geog presence

Customers:

Types, services

Services offered: in-

house/ outsourced

Technology:

Automation, security

Processes:

Standardization

AMTOI & Ernst and Young White Paper Page 30

Future Operating Model Dimension: Organization

AMTOI & Ernst and Young White Paper Page 31

Organization: Service-driven

! Service driven organizations are required to understand the customers better and mine their insights

accurately in serving them.

! The main idea of service driven logistics systems is to meet predefined service goals.

Ideally all logistics service systems are defined along the following lines:

! Identify customers' service needs

! Define customer service objectives

! Design the multi-modal route

! Fulfill the need i.e. transport the cargo accordingly

! Identify customers service needs

The approach to service segmentation suggested here follows a three stage process:

! Identify the key components of customer service as seen by customers themselves

! Establish the relative importance of those service components to customers.

! Identify 'clusters' of customers according to similarity of service preferences

! Defining customer service objectives

! Exactly defining the value proposition for the customer, and understanding their unmet need

! Design the multi-modal route

! Depending on the cost and time of transportation, urgency of the cargo, service route availability,

value added services and customer preferences, the multi modal route is designed by the MTO

! Fulfill the need i.e. transport the cargo

! Finally, the cargo is transported to the set destination, adhering to the schedule and safety means

AMTOI & Ernst and Young White Paper Page 32

Organization: Structure

! A matrix structure groups employees by both function and product

! This structure can combine the best of both separate structures

! A matrix organization frequently uses teams of employees to accomplish work, in order to take

advantage of the strengths, as well as make up for the weaknesses, or functional and decentralized

forms

! In case of MTOs, the matrix structure can be based on the functional heads and the type of route

serviced

Functional

heads

Sales Marketing HR

Routes

A

B

AMTOI & Ernst and Young White Paper Page 33

Organization: Performance-linked growth

! Employee Ownership is a relatively new concept in India (primarily started by software development

companies) as far as ESOP is concerned. But, a century back, job opportunities were not many and

employees felt morally responsible to do their best without much incentives other than salary. But today,

Managers like to believe that simply introducing ESOP would lead to the creation of an ownership

culture (causing culture effect ) within the organization. In this culture, it is assumed, managers and

workers would always think of the company first when faced with any sort of problems in the course of

their day-to-day activities.

! One of the ways to link productivity can be achieved through Employee ownership only if there is parity

and fairness in the proposed plans (ESOP) affecting actual employee commitment, easy access to

decision making to all involved, besides realizing a culture effect conducive to better performance. Most

of the companies (other than MNCs) in India are family owned and unfortunately in such a scenario,

factors other than employee performance are considered pivotal. Close proximity to the owner ( or his

family) for reasons not related to job creates an undue advantage for the one who is close and in effect

results in loss of parity in remuneration scales. In such conditions, productivity does not play any role to

earn employee ownership.

! Employee ownership plans have positive effects on the employees if they perceive that it helps in

bringing greater income, better control over their jobs and builds job security. On the contrary, it may

have negative effects if employees do not perceive any difference in their work lives despite the plans,

have unfulfilled expectations or feel the plans bring forth an extra risk to their current income levels.

! Eg. Allcargo Global Logistics Ltd announced that the Committee of the Board of Directors of the

Company at their meeting held in January 2011 that the company has issued and allotted 12,236 equity

shares of Rs. 2 each fully paid of the Company to its employees in exercise of options granted to them

under 'Allcargo Employee Stock Option Plan 2006.

AMTOI & Ernst and Young White Paper Page 34

Organization: Talent Management

! A look at the financials of a set of 80 logistics companies in India across sectors reveals that manpower

spends comprise 8-10 percent of overall sales of the sector. This roughly translates to about an INR 500

billion spend on logistics manpower in the country annually. Only about 13 -14 percent of the overall

manpower costs are spent on non-salary, manpower development items (welfare, training etc.). This

share for the unorganized companies would expectedly be much less. As against this leading global

logistics companies spend around 20 percent of their employee expenditure on non-salary items.

Position Skill Gap Skill Required

Manager/

Owner

Inadequate knowledge of:

Procedures, paper-work for inter-state

movement, taxation related aspects

Importance of long term investments in

capacity building, manpower development,

etc.

Training needs of personnel employed with

them, leading to no incremental skill

improvement

Sound knowledge of taxation policies

and inter state laws to train and

educate supervisors and drivers for

applicable laws and policies

Ability to undertake activities such as

fleet management, network

optimisation, etc.

Ability to take decisions on long term

and short term investments or spends,

new equipment etc.

Ability to be conversant with new

technologies such as the use of GPS

in road transportation and ensure

efficient usage this helps keep pace

with emerging needs of clients

Effective communication skills to be

able to correspond with customers on

a daily basis

AMTOI & Ernst and Young White Paper Page 35

Organization: Talent Management

Position Skill Gap Skill Required

Supervisor Inadequate knowledge of:

Best warehousing practices

Technologies such as IT in the

transportation sector, SCM techniques such

as LIFO, FIFO, inventory management etc.

Taxation policies

Ability to ensure efficient route

planning, so that it is cost effective,

entails less turnaround and highest

safety levels

Practical knowledge of equipment

usage in loading or unloading goods in

trucks - such as the optimum or

efficient use of truck loading racks,

lorry loaders, etc.

Adequate spoken and written

language skills for efficient record

keeping and effective communication

even locally with diverse agencies

such as client, the driver, truck owners

Knowledge of inter-state transport

laws applicable

Ability to record and track transactions

AMTOI & Ernst and Young White Paper Page 36

Organization: Talent Management

Position Skill Gap Skill Required

Driver/

Helper

Characterized by a largely illiterate workforce

that has inadequate formal training in:

Driving

Handle increasing tonnage and higher

capacity trucks

Safety and first-aid

Octroi, applicable VAT

Safe driving practices and special

precautionary measures in case of handling

sensitive materials such as chemicals,

petroleum tankers, etc.

Basic reading and writing skills to be

able to read signage, proper

documentation of tax levied, octroi paid

etc.

Ability to understand routes and the

geographical profile of the route being

traversed

Ability to handle increasing tonnage

and heavier trucks

Excellent driving skills - Apart from the

basic driving skills, knowledge of

precautions in case of transporting is

critical

Knowledge of road safety practices,

basic knowledge of the tax regime

(region wise), traffic permit rules, etc.

Ability to handle dangerous, sensitive

and perishable cargo

Basic spoken language skills for

communication with supervisors and

fellow drivers or unloaders and

supervisors at the customers end

Ability to understand basic sanitation

and hygiene requirements

! Some of the training institutes offering specialized course to service this skill gap include:

! Indian Institute of Logistics, Chennai

! CII Institute of Logistics

! ISB&M, Pune

! All India Institute of Management Studies

! Indian Institute of Materials Management

AMTOI & Ernst and Young White Paper Page 37

Future Operating Model Dimension: Customer

AMTOI & Ernst and Young White Paper Page 38

Customer: 5PL

! The 5PL solutions focus on providing overall logistics solutions for the entire supply chain.

! 5PL is a business field with very good prospects for the future: more and more companies are

recognising that they have to concentrate on their core activities and are outsourcing all their logistics

operations. 5PL organizations are providers who plan, organize and implement logistics solutions on

behalf of a contracting party (mainly information systems) by exploiting the appropriate technologies

! The drivers of for the 5PL industry are:

! Economic imperatives

! Technological innovation

! Managerial competence in the provision advanced logistics services

! Some types of services offered by a 5PL are mentioned below:

Intermediary 5PL

Types of Services Strategic-IT Supply Chain

Basic Idea Turns customers supply chain into a function that

is completely driven by technology

Resources Few physical assets, extensive knowledge, and

technology based-assets

Potential Benefits Large companies with highly complex supply

chains

Potential Drawbacks Loss of control and relationships with supply chain

members, risk in long-term partnerships

AMTOI & Ernst and Young White Paper Page 39

Customer: Value Added Services

! Value added services are services that enhance transportation, warehousing, and certain logistics

offerings.

! By using value added logistics it helps companies and providers to lower inventory footprints of finished

goods by postponing the labeling and final assembly of the products until the customers orders are

received.

! Value added services can be performed directly by the participants in a business relationship or may

involve specialists.

! Some of the value added services offered by 3PLs and MTOs globally are:

! Transportation management

! Order management

! Vendor managed inventory capabilities

! Repacking

! Kitting

! Specialised labelling

! Reverse logistics

! Swap service

! Cleaning and disposal management

! Returnable packaging management

! Subassembly

AMTOI & Ernst and Young White Paper Page 40

Customer: Value Added Services

! The value added processes that are performed on customer returns, as well as the whole returns

process, have been described by the term Reverse Logistics.

! This process covers the method by which items are returned from the customer and the processing of

the returns by servicing and returning to the customer, putting the material back into stock or refurbishing

the items for resale. The returns process has now become an important part of the processing that takes

place in the warehouse.

! Remanufacturing and refurbishment activities may be part of the procedure.

! For an MTO, the disposition choice is determined by the expertise and the most profitable alternative:

! Reconditioning when a product is cleaned and repaired to return it to a like new state

! Refurbishing similar to reconditioning, except with perhaps more work involved in repairing the

product.

! Remanufacturing similar to refurbishing, but requiring more extensive work; often requires

completely disassembling the product

! Recycle when a product is reduced to its basic elements, which are reused also referred to as

asset recovery.

! Specialised Indian reverse logistics companies such as RT Outsourcing Services have grown in

response to the niche service environment bridging the gap between 3PL and 3PSP

AMTOI & Ernst and Young White Paper Page 41

Future Operating Model Dimension: Technology

AMTOI & Ernst and Young White Paper Page 42

Technology Enablers

! The logistics value chain in India is characterized by lack of transparency and existence of legacy

systems, which result in huge inefficiencies causing delays, penalties and lack of shipment visibility

! Therefore, it is not surprising that in India the logistics costs are as high as 11-13% of the countrys GDP

! Communication technologies like Electronic Data Interchange (EDI) and automated vehicle movements

like digitalized toll gates can help address these industry issues to bring in greater transparency, visibility

and real-time tracking ability

! The features of EDI include standard templates, standard protocols for data interchange and access to

statutory authorities. This Web-enabled enterprise application has drastically reduced communication

costs and integration complexity

! The real benefits of EDI are its ability to incorporate back office applications and legacy systems with the

information received and sent from/to clients, generate operational efficiencies, lower costs and higher

consumer satisfaction levels

! In addition to changing demographic profile and increasing consumer awareness, the online payment

service providers can help bridge the gap between the service provider, customers, and payment

channels with their customized, secure, and relevant e-commerce solutions, and are largely instrumental

in the turnaround and growth in e-commerce

! EDI can be used for filing of details by the MTOs who are Authorized Economic Operators. These

operators may be allowed to consolidate cargo in a private warehouse without customs supervision after

Out of Charge and move the container under self certification/sealing without customs supervision.

AMTOI & Ernst and Young White Paper Page 43

Technology Enablers

! Each of the entities in the cargo community such as shippers/consignees, carriers, customs and freight

forwarders realize the numerous benefits of EDI, some of which are as follows:

Supply Chain

entities

EDI system features Benefits

Shippers Single point data entry

Enables multiple Request for Quotation (RFQ)

floating to multiple service providers

Single window view to manage and track multiple

RFQs floated

Receive online scheduled updates of status via

SMS/e-mail

Facilitates cost savings, ensures

reliability and ease of process monitoring

Facilitates transmission and storage of

documents and e-payments

Carriers Data is received in the correct format

Automated status inquiry and booking processes

Significant cost and time reduction

Minimal human intervention

Quick response to enquiries, thereby

enhancing customer service and sales

Freight

Forwarders

Shipment data can be shared by shippers

electronically

Data is received and processed by internal system

without any manual intervention

Reduced shipment turnaround time

EDI messages giving status updates

provide complete shipment visibility

Customs Ensures e-governance Increased data security

Reduced congestion at customs station

Better connectivity with regulatory

authorities involved in transportation and

commerce

Industry Error-free order registration 2-3 days earlier to the

system of the sub-agent

Gain from reduced data transmission

time from 3 weeks to 1 day

Enhanced speed and accuracy in data

transmission to suppliers

Banks/

License

Authorities

Availability of post shipment confirmation Reduced documentation like receipt and

export promotion copy of the shipping bill

AMTOI & Ernst and Young White Paper Page 44

Future Operating Model Dimension: Process

AMTOI & Ernst and Young White Paper Page 45

Processes

! With proposed growth through either organic or inorganic route, it becomes imperative to be

structured in a manner which best meets business objectives

! Processes need to be defined taking all dimensions into consideration:

! People

! Technology

! Strategy

! Support

! Organizational culture

! Processes should be benchmarked against leading practices while customizing to meet existing and

future business needs and which enable users to follow them efficiently thereby, making them task-

oriented

! Benefits to customers should be measurable

! Processes should be standardized, uniform across locations and should promote SLA-driven culture

to best meet customer expectations

AMTOI Page 46

Success Stories

AMTOI Page 47

Success Stories: Deutsche Post DHL

Strengths:

Large scale and global

network

Exposure to high growth

geographies and

services

Diversified port-folio of

customers

Weaknesses:

Service and

geographical coverage

gaps

Underperforming freight

management business

Opportunities:

Asia-Pacific market

Cost savings from

integration and

restructuring

Threats:

Middle East and Latin

America

Low economic growth

and high input costs

Growth Story primarily through increasing network coverage and offering innovative

solutions

Through collaborative approach with group companies, DHL remains one of the prominent market players

with dominant market share. With its Express, Global Forwarding, Freight, Supply Chain divisions, DHL

offers International Express, Air Freight, Ocean Freight, European Road Freight, Contract Logistics,

Document Management and Outsourcing.

Deutsche Post AG progressively acquired DHL as global air express service provider from 1998 to 2002

and enhanced its expertise by purchasing other leading logistics companies, e.g. 1999 acquisition of

Danzas, 2004/2005 acquisition of 88 percent of shares of Indian express company Blue Dart, and acquired

Exel in the end of 2005

Source: Company annual report, Press Releases

AMTOI Page 48

Success Stories: Deutsche Post DHL (Contd.)

Broker intermediaries between customer and freight carrier

DHL being an asset light business model based on brokerage of transport services between their

customers and freight carriers. This enables consolidation of cargo and ability to carry higher volumes.

Due to wide network coverage DHL can manage to optimize the goods routing

Providing services to a range of industries

Caters to wide range of clientele - Technology, Automotive, Chemicals, Consumer, Retail (including

Fashion & Apparel) and Energy sectors

Depending upon the nature of the industry, offers products and services ranging from standard transport,

multi-link transport chains and specialized industrial projects for specific sectors, including temperature-

controlled and secure shipments and customized solutions to niche industries such as motor sports

Technology usage

DHL uses one of the most advanced technology interventions to enhance their operational excellence:

Two examples of the same are mentioned below

1. SmarTruck- intelligent technology for route planning based on satellite-supported geo and telematic

data, which locates the vehicle and analyzes the traffic situation

2. Parcel Robot: It is the first unloading system that can independently unload containers with loose

parcels. The robot now makes it possible to automate the physically strenuous work of loading on the

ramp, which was previously performed manually

Strong focus on strengthening brand DHL

In addition to traditional advertising, they continue to use sponsorships as a vehicle to strengthen their

brand image. In 2011, they maintained international logistics partnerships with Formula 1, IMG Fashion

Weeks and the Leipzig Gewandhausorchester.

Involved in the Volvo Ocean Race for the first time. Likewise, they became a main sponsor and the

official logistics partner of Manchester United

As the official logistics partner of the 2011 Rugby World Cup in the autumn of 2011 in New Zealand, DHL

was also able to showcase its brand.

Took part in around 120 events in 40 countries in the financial year 2010-11 as part of the DHL partner

programme

Key differentiators:

Source: Company annual report, Press Releases

AMTOI Page 49

Success Stories: UPS Supply Chain

Strength:

Global reach and

scale

Inorganic growth

Financial strength

Weaknesses:

Unionized labor

European contract

logistics

Opportunities:

Expanding Asia

Pacific market

Growth in e-

commerce

services

Threats:

Slowdown of US

economy

Rising oil prices

Growth Story primarily through acquisition and unique value propositions:

UPS Inc. introduced supply chain management into its service portfolio in 1993. In 1998 , it invested in

technology to promote traceability of its services and to sustain the owner-managed philosophy of its

operations.

UPS also formed a financial services subsidiary which offered lines of credit for small business owners

further expanding this offering to companies in the emerging markets.

The company became public in 1999, when it floated on the NYSE. Since becoming a publicly traded

company in 1999, UPS has expanded its capabilities primarily through the acquisition of more than 40

companies, including industry leaders in trucking and air freight, retail shipping and business services,

customs brokerage, finance and international trade services.

Source: Company annual report, Press Releases

AMTOI Page 50

Success Stories: UPS Supply Chain (Contd.)

Integrated Global Network

Integrated global ground and air network

Handle all levels of service (air, ground, domestic, international, commercial and residential) through a

single pickup and delivery service network

Sophisticated engineering systems allows them to optimize network efficiency and asset utilization on a

daily basis

Global Presence

UPS serves more than 220 countries and territories around the world. They have a presence in all of the

worlds major economies

Leading-edge Technology

New keyless entry systems automatically enable the ignition, unlock the doors, and open the bulkhead

door

Telematics sensor technology gathers and analyzes data from vehicles to improve safety, efficiency, and

customer service

Next Generation Small Sort (NGSS) improves efficiency of small sort operations by eliminating the

memorization of ZIP codes

With the Network Planning Tool (NPT) and the On Road Integrated Optimization and Navigation

(ORION), UPS links its operations technology with advanced analytics Broad Portfolio of Services

Customized services

Service portfolio enables customers to choose the delivery option that is most appropriate for their

requirements. Increasingly, customers benefit from business solutions that integrate many UPS services

in addition to package delivery. For example, their supply chain servicessuch as freight forwarding,

customs brokerage, order fulfillment, and returns managementhelp improve the efficiency of the supply

chain management process.

Employee-friendly distinctive culture

Employees dedication results in large part from their distinctive employee-owner concept. Their

employee stock ownership tradition dates from 1927, from their founders, who believed that employee

stock ownership was a vital foundation for successful business

To facilitate employee stock ownership, they maintain several stock-based compensation programs.

Their long-standing policy of promotion from within complements the tradition of employee ownership

Key differentiators:

Source: Company annual report, Press Releases

AMTOI Page 51

Success Stories: Sree Kailash Logistics

Strength:

Infrastructure

development in logistics

parks

Technology and System

integration

Weaknesses:

Over dependence on in-

house facilities

Opportunities:

Capitalize on clientele

from other segments

Growth in cities other

than Chennai

Threats:

Instability among the

construction clients

which form a main

composition of the client

base

Growth Story primarily through acquisition and unique value propositions:

Sree Kailas group was founded by Sri. S.Sivathanupillai with a modest beginning in the year 1983. Sree

Kailas Group has planned its Logicity in Chennai, Asias Detroit, for its strategic positioning in the world

market in terms of growth, connectivity and proximity

The group has its interests in Paper, Logistics, Residential Projects and Construction. It has a turnover of

over 400 crores for over a decade.

Source: Company annual report, Press Releases

AMTOI Page 52

Success Stories: Sree Kailash Logistics (Contd.)

Infrastructure Facilities

Warehouses of different measurements to handle electronic appliances, pharmaceuticals, sanitary,

furniture, garments, automobiles and retail

Spaciously designed for easy diagonal movement of 40 ft. containers.

Individual electric supply to each warehouse

Adequate water supply with overhead tanks.

Well-planned and connected drainage and sewage network.

Storm water management and rainwater harvesting.

Investments in expansion plans

Shri Kailash Logistics Limited (SKLL) to INR 800 crore in five warehouses.

Out of these five parks, three will be large warehouses spread over 10 lakh sq.ft each in North Chennai,

Pune and Bangalore. and two will be small of about 5 lakh sq ft each

The bookings for the first park have already begun

Logistics Park facilities

Information kiosk and helpdesk

User-friendly directional signage and guide maps at various points.

Resting lounge for drivers and support staff.

State-of-the-art bus stop inside the park.

CCTV cameras for enhanced security.

Presence of National transporters and clearing agents.

High-end security for the entire park.

Mobile communication tower.

Professionally-run park administrative office

Global Alliances

Sree Kailash is planning to launch a logistic park in Chennai in technical collaboration with BPS

Global,Singapore.

The group is planning for a 300 crores project specializing in Logistics Park, Villas and Comfort Homes

The project is very near to industries viz, Nokia, Hyundai, Saint Gobain Glass, Flextronics, Dell, Delfi

Nissan, Komatsdu, Avera, Tristler Ltd, Ashok Leyland , Ford Ltd, etc.

Key differentiators:

Source: Company annual report, Press Releases

AMTOI Page 53

Success Stories: Transcon Freight Systems Pvt.

Ltd.

Strength:

Single Window

Logistical Services

Trained Personnel

Weaknesses:

Network coverage only

in Maharashtra

Opportunities:

Developing owned tank

containers and

container freight

stations

Threats:

Congestion in the

containerization market

Growth achievement through integration:

Transcon freight Systems Pvt. Ltd. was established in 1984 in Biriya House, Fort in a rented office with a

only a table space. Since then it grew to own its offices in Biriya House, Wadala truck terminal, Afzhar

Building Fort, Kalamboli, Pune, Dronagiri, Raigad and Belgium. It has its head quarters in Ghatkopar.

Transcon has expanded its gamut of services from Sea and Air freight Forwarding to Container

transportation, Cargo Consolidation, Warehousing and Distribution, Haz ChemicalExpert, Multimodal

Logistics and Tank Management.

Source: Company Profiles, Annual Reports

AMTOI Page 54

Success Stories: Transcon Freight Systems Pvt.

Ltd. (Contd.)

Container Fleet

The company owns a fleet of 45 trailers

Ownership of these assets allows the customers to avail competitive prices under one roof

These containers are used for transporting dry boxes and liquid cargo in tanks from various parts of the

country

End to end (in bound and out bound) solutions can be provided due to in-house infrastructural facilities.

Tie ups with small and medium players across the value chain:

Transcon provides services across the supply chain by leveraging on their internal capabilities as well

as by using the best of medium and small players to allow flexibility

This allows Transcon to diversify risks and take advantage of the regional and geographical networks

of the small players

Online Vale Add Services:

The customers can check details of their shipment and evaluate shipment options based on the

following online services available:-

Currency Calculations

Shipment Schedules

World weather conditions

Online Tracking

Distance Calculator

Container Specifications

Metric Conversions

Expertise in handling hazardous substances:

Transon has experience in handling primary and subsidiary chemicals like explosives, compressed

liquefied or dissolved under pressure gases, flammable solids, oxidizing substances, toxic and

infectious substances, radioactive substances and corrosives.

Key differentiators:

Source: Press Releases, Annual Reports

AMTOI Page 55

Success Stories: Hind Terminals

Strength:

Self owned

transportation vehicles

In-House maintenance

technicians

Weaknesses:

Type of cargo handled

Opportunities:

Expansion of transport

routes to the east and

South of India

Threats:

Inability to provide sea

and air transportation

services

Growth achievement through diversification of services:

Hind Terminals started its operations December 2005 at Nhava Sheva. The Container Freight Station is