Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pluginfile - PHP - 19988 - Mod - Resource - Content - 3 - OCN-596-PR-M01 HRD ACB Loss Mitigation Manual V3 2013 Short Sale

Caricato da

phillipwardjrDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pluginfile - PHP - 19988 - Mod - Resource - Content - 3 - OCN-596-PR-M01 HRD ACB Loss Mitigation Manual V3 2013 Short Sale

Caricato da

phillipwardjrCopyright:

Formati disponibili

Ocwen Financial Corporation Version 3.

0 Page 285

Corporate Training

Chapter 12: Short Sale

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 287

Corporate Training

A Short Sale is specifically designed to help borrowers who are unable to afford their mortgage and

want to sell their home to avoid foreclosure, even if the sale price may not pay off the entire amount

owed on their mortgage. A short sale requires a number of parties (the homeowner, the buyer, the real

estate broker, and sometimes mortgage insurance companies and other lenders) to work together to

make this option successful.

Once we receive the complete documentation from the customer along with the package, it will take

approximately 30 days for processing, and if approved, the customer will receive an approval offer letter

that has to be signed and returned with the payoff funds.

If the customer has more than one lien on the property, both liens will have to be paid through the short

sale.

The following are the types of short sale:

1. Home Affordable Foreclosure Alternatives (HAFA) Short Sale

2. In-house Short Sale (aka Non-HAFA Short Sale)

12.1 HAFA Short Sale

For homeowners looking for help selling their home and avoiding foreclosure, the federal

government has introduced the HAFA Program. As a mortgage servicer, we are offering the

customer the opportunity to participate in this program by utilizing HAFA short sale option if the

loan qualifies. If the loan does not qualify, we may still be able to assist with an Ocwen short sale

program.

If the homeowner qualifies for the HAFA program, they will receive $3,000 to help pay some of

the moving expenses (this is referred to as Cash for Keys CFK). The check will be paid to the

homeowner by the settlement agent as a part of the closing, and this amount will be included in

the short sale offer and the HUD-1 Settlement Statement. In the event there is any money left

over from the sale after paying the entire amount owed on the mortgage plus the approved sale

costs, the homeowner will not be eligible to receive the $3,000.

Effective June 1st 2012, customers are eligible for HAFA incentive only if the property was

Owner Occupied and the customer has to relocate as a result of the HAFA resolution, provided

the resolution is completed on or before 09/30/2012.

12.1.1 HAFA Eligibility Criteria

First Lien

Closing on or before January 1, 2009

Property up to 4 units

Loan is in default or default is reasonably foreseeable

UPB

a. 1 Unit (Single Family): $729,750.00

b. 2 Units: $934,200.00

c. 3 Units: $1,129,150.00

Home Retention Department

Loss Mitigation Manual Short Sale

Page 288 Version 3.0 Ocwen Financial Corporation

Corporate Training

d. 4 Units: $1,403,400.00

e. Multi Family: Not eligible

Customers who meet the HAFA eligibility criteria should go for HAFA if trying for the short sale

of the property, but can choose to apply for an in-house short sale, as long as they send a letter

stating they withdraw their application to HAFA. Once that letter is received, the account will

reflect HAFADW code (HAFA application withdrawn by customer). You are not allowed to enter

this code if the customer verbally states he/she does not want to apply for HAFA and has to ask

the borrowers to send a letter.

Changes/Updates to HAFA

MHA issued Supplemental Directive 13-04 on June 13, 13 which announced the extension for

MHAs HAFA December 31, 2015.

Thus, the HAFA transaction must be completed on or before September 30, 2016.

Simply put, the HAFA Short Sale or Deed-in-Lieu must have a transaction closing date on or

before September 30, 2016.

If Ocwen has had contact with a borrower in connection with any of the above MHA programs,

but is not in receipt of the minimum program participation documentation described above on

or before December 31, 2015, or has determined it will be unable to complete (as described

above) the HAFA transaction on or before September 30, 2016, Ocwen will must notify the

borrower in writing that he or she cannot be considered for the applicable MHA program and

provide information about other loss mitigation alternatives.

Investors who do not allow HAFA

The following Investors do not participate in the HAFA program: 2489, 2563, 2635, 2636, 2638,

2645, 2648, 2649, 2650, 2651, 2663, 2665, 2666, and 2667.

Short Sale Checklist

When you have spoken directly with the borrower (specially required when the borrower is

represented by an authorized third party that is, a broker) and have determined that the

borrower cannot qualify for a modification, attempt to work with the borrower towards a Short

Sale.

The initial contact with the borrower will determine what kind of resolution will be offered.

12.1.2 Short Sale Requirements

The following are the short sale requirements:

Authorizations from the borrower for a third party, if the third party will be negotiating on

the borrowers behalf

A completed copy of Ocwens Short Sale Package

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 289

Corporate Training

o You can send the borrower or their authorized representative a completed copy of

Ocwens Short Sale Package by entering the SSPK code into REALServicingand under

the comments supply the name of the person to whom the package should be sent and

the delivery method-fax #, email, and/or mailing address

Written or updated verbal financials, not older than 60 days (the package will include a

financial form anyways)

Borrowers Hardship Letter

Updated copy of Signed Sales Contract/Sale agreement

A copy of the listing agreement (listing history also if required)

The copies of last 2 years W-2 statements

The copies of last 2 years Federal Tax Returns

The copies of 2 most recent pay stubs (if the borrower is salaried)

The copies of last 2 months bank statement (both savings and checking accounts)

HUD 1 (preliminary) or estimated Net Sheet

o However, we will need a copy of the final HUD 1 when the borrower closes

o Realtors commission (including both realtors) fees can be up to 6%

o Six thousand dollars maximum to all junior liens not serviced by Ocwen in a case of an

in-house short sale

o Eight thousand fife hundred dollars will be the maximum to all junior liens not serviced

by Ocwen in a case of an in-house short sale

o Closing cost must not exceed 2% (exception is when the property value is very low we

may allow up to 4%)

o If 1st and 2nd liens are serviced by Ocwen and belong to the same Investor, then the full

net to Ocwen (for both liens) should be in line 504 (net to 1st Lien) and line 505 (net to

2nd lien) should reflect $1.00

12.1.3 Short Sale Approval Criteria

The following are short sale approval criteria:

Check Investor Rule to see if the Investor allows Short Sale and the requirement

The Mid Market Value should be updated in the last 6 months unless the investor requires a

more recent value

The closing cost cannot be more than 2%(exception is when the property value is very low

we may allow up to 4%)

The brokers commission should not be more than 6%

Home Retention Department

Loss Mitigation Manual Short Sale

Page 290 Version 3.0 Ocwen Financial Corporation

Corporate Training

It is imperative that Ocwen receives all the required documents in order to conclude the

discounted payoff resolution and Ocwens Discounted Payoff Letter will NOT be issued to

the borrower or their authorized representative until Ocwen has received the documents

for a thorough review by the short sale team

When Ocwen has received all of the required aforementioned documents, a CSRVD Alias

Code will be placed in REALServicingby the HRC processors once they have processed the

documents

o Once this code is entered, an acknowledgment letter will be sent out to the customer

o This letter is only sent out once, and it is reflected under SRVD code

If the documents received are incomplete, the HRC processors will enter an INSRVD Alias

Code indicating the SS Package was returned incomplete

o Further the HRC processors will send out a missing documents letter indicating what is

missing and will close the workflow on the loan

You use the UPD to view process to look up these codes to see the status of the short sale

offer

12.1.4 Short Sale Offer Review Process

The following is the short sale offer review process:

If the negotiated offer losses in LRM and the borrower and/or authorized third party are

unwilling to negotiate a different net to Ocwen, then an SSOR code (short sale offer

rejected) is entered into REALServicingwhich causes a short sale denial letter to be issued

to the borrower/authorized third party

o Finally the workflow on the loan is closed

If you can find a counter offer in the system (for example, the investor requested a

minimum of $100,000.00 to accept the short sale), you can provide that amount to the

customer

o In the case where the offer is rejected for being too low, but no counter offer in the

system, you should not provide any amounts to the customer and just advise to try to

get a higher offer and send it to us

If the negotiated offer wins in LRM, which means the required SS criteria is met, LRM will

place the following codes in REALServicing:

o SSRA =Short Sale Review Approved

o CMAP =Generates the workflow for underwriters to approve and send out the

discounted payoff letter, indicates to whom and how the letter is to be delivered This

is also the HRCs pending code

The underwriting team reviews the CMAP and sends a Discount Payoff Agreement and

Release of Claims upon approval under the code DISC.

o The Discounted Payoff Letter will have a date by when it must be returned signed by all

appropriate parties along with a final HUD-1 and funds due to Ocwen

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 291

Corporate Training

o The final HUD-1 must be signed by seller, buyer, and both parties realtors

Funds received must be in the form of a certified check or a bank wire transfer. If the

underwriters deny the CMAP, they cancel the workflow for DISC and enter DLWC, and you

need to review and re-enter CMAP if applicable

When the negotiated offer requires upper management and/or Investor review for further

processing the short sale, the codes to use include:

o SSSR Management approval)

o MIIV Investor and/or Mortgage Insurance team approval

All approvals will lead to CMAP and all denials need to be countered for better offers.

Note: When you enter a CMAP and there is a need for investor and/or mortgage insurance approval,

underwrites will have to wait until the approvals are granted before being able to enter the DIC code.

Hence, they will enter a DLWC code 13 (DISC Letter Workflow Cancelled code 13). This is not that the

offer is being rejected, is just that the underwriters will have to continue the review only after the

approvals are obtained. You do not have to re-submit the CMAP.

o SSSR is for submission of the short sale for review by management (for 2nd liens as

CMAP has to be entered manually as they cannot be run through LRM Review

Discounted Payoff Procedures section). Upon review of the offer, they will note

REALServicingwith either a SSRA (approved) or a SSRD (denied). SSRD will happen in

cases where the loss is more than $300,000 and also when the net to 2nd lien is more

than $6,000 or if any other requirement is not met

o MIIV is entered if an Investor or Mortgage Insurance (MI) Company approval is required

to further process the short sale. Code IRAR is for investor review and INVAPD for

approval code while IRRC/INVINF is for a denial. Code MIAR is entered for MI review and

MIAPP is for an approval while MIRC is for a denial

To complete the resolution, Ocwen should receive the signed discounted payoff letter, a

signed final HUD-1 (SDLR), and the certified funds owed to Ocwen (SFPA). If the signed

documents are not received, code ISDLR is entered

12.1.5 Foreclosure and Short Sale

As a companys procedure, Ocwen will not postpone FC sale dates due to short sale offers being

received. Hence, if a customer wants to process a short sale and has a confirmed sale date,

he/she will need to close before the sale date.

Usually, when there is a confirmed FC sale date within 30 days and the application has missing

documents, the file will show an SSOR9 (unable to close before the confirmed foreclosure sale

date). If the customer wants the review to continue, then the SOSA code must be entered.

The SOSA code is for the short sale review to continue, however you must advise the customer

that the sale date will not be postponed and the closing will have to occur before the sale date.

The following information is required in the SOSA:

Confirmed FC sale date

Home Retention Department

Loss Mitigation Manual Short Sale

Page 292 Version 3.0 Ocwen Financial Corporation

Corporate Training

GTD for the short sale

Has the Borrower/Authorized third party been advised about the No Postponement policy?

o You need to enter Yes or No

Cash Deal?

o You need to enter Yes or No

Is escrow Open?

o You need to enter Yes or No

Borrower/Authorized third party acknowledged the CSD?

o You need to enter Yes or No

Borrower/Authorized third party acknowledged that they will close before the sale date and

will not call back for postponement if unable to close?

o You need to enter Yes or No

Additional Comments: Not mandatory

12.1.6 HAFA Review Process

SSPK Short Sale Package Requested

You will be able to place a request for the package to be sent out via fax, email, or mailing

address.

SSNT Short Sale Package Sent

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 293

Corporate Training

HSRVD Home Affordable Foreclosure Alternative - Short Sale package received

Once the customer sends the package, the documents will be uploaded in CIS, should You

have any question.

HAQSS HAFA Eligibility Review in Process

Home Retention Department

Loss Mitigation Manual Short Sale

Page 294 Version 3.0 Ocwen Financial Corporation

Corporate Training

HAFACO HAFA Review in Progress Additional Information Required

This code indicates if there are any missing, incomplete, or incorrect documents.

HAFACO1 HAFA Review in Progress: Incomplete Documents Received

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 295

Corporate Training

The agent may also see this code instead of HAFACO showing the missing, incorrect, or

incomplete documents.

HSSMDLS HAFA Short Sale Missing Documents Letter Sent.

This code indicates that the letter showing the missing documents was sent to the

customer. It also indicates the delivery method used.

HRASSR Alternate to RASS Package Requested

Home Retention Department

Loss Mitigation Manual Short Sale

Page 296 Version 3.0 Ocwen Financial Corporation

Corporate Training

This code is seen when the approval letter is requested as the short sale offer is approved.

HRASSS HAFA Short Sale Pre-Approval Letter Sent

When the approval letter is actually mailed to the customer, this code will be entered in

REALServicing.

HARASSA HAFA short sale offer accepted

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 297

Corporate Training

Once the customer sends the signed approval letter and it is received and accepted by

Ocwen, this code is entered to indicate the same. The customer just needs to send the funds

by the specified date for the short sale to be completed.

HSFPA HAFA Short Fall Payoff via Pre-Approved Sale

This code is entered once the funds are received, showing the date when the funds were

received and the amount.

Home Retention Department

Loss Mitigation Manual Short Sale

Page 298 Version 3.0 Ocwen Financial Corporation

Corporate Training

12.2 In-house (Non-HAFA) Short Sale Process

In the eventuality of the loan not qualifying for HAFA, the account will be reviewed for a Non-

HAFA Short Sale

SSPK Short Sale Package Requested

You use this to place a request for the package to be sent out via fax, email, or mailing

address.

SSNT Short Sale Package Sent

CSRVD Short Sale Correspondence Received

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 299

Corporate Training

Once the customer sends the package, the documents will be uploaded in CIS, should you have any

question.

INSRVD Incomplete Short Sale Package Received

This code indicates what is missing or it just give a code (for example, incomplete Short Sake

Received: 9. Please refer to the following tables for the INSRVD codes)

If there are missing documents in the application, the processing team will review whether there is a

confirmed FC sale date within 30 days. If there is, then the offer will be rejected under SSOR9.

If the customer wants to continue the review of the file, then the agent must enter code SOSA with

the pertinent details.

SSDM Short Sale Missing Documents Letter Sent

Home Retention Department

Loss Mitigation Manual Short Sale

Page 300 Version 3.0 Ocwen Financial Corporation

Corporate Training

Whenever there are missing documents a letter will go out to the customer informing of the same. Once

the missing documents are received, the system will show a new CSRVD code.

SSRA Short Sale Resolution Approved

After you run LRM, if the short sale scenario wins, the system will enter an SSRA. Please note that

this is not a final approval, but only the systems approval. The short sale still needs to be reviewed

by underwriting to determine if it can be finally approved and the approval letter can be sent to the

customer.

CMAP Collateral Resolution Approved Pending Execution

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 301

Corporate Training

This is the pending code for you and will also get entered through LRM. This code triggers

the workflow for underwriters to review the offer and send the approval letter.

DLWC DISC Letter Workflow Cancelled

If there is anything incorrect in the CMAP submission or in the documents, the underwriting

team will enter this code to cancel the processing of the DISC. You will need to solve the

issue and re-submit the resolution if applicable.

SSOR Short Sale Offer Rejected

You may also find this code if there is anything incorrect in the application documents.

This example shows code as the reason for rejection. The code used to mean that the Net to

Ocwen was not clearly mentioned in the HUD-1.

Same as with the DLWC, the agent needs to solve the issue and re-submit the resolution.

DISC Discounted Payoff Agreement and Release of Claims

Home Retention Department

Loss Mitigation Manual Short Sale

Page 302 Version 3.0 Ocwen Financial Corporation

Corporate Training

This code is the final approval for the short sale. It also means that the approval letter

(agreement) was sent out. The borrowers will need to sign this agreement and send it back

to Ocwen (via mail, email, or fax) along with a copy of the signed final HUD-1 and the funds.

The DISC has a GTD by when all of these need to be received by Ocwen.

SFPA Short Sale Payment Accepted

12.2.1 Final HUD Approval Requests

If a customer is requesting final HUD approval before closing, please advise the customer to

send a copy of the HUD to the below-mentioned email address or fax number. Please ensure to

remind the customer to mention the loan account number in the subject line of the email or

cover sheet of the fax and to mention a return fax number or return email address along with

the account number in the cover page in case its being faxed.

After the final HUD approval is sent, the account will be coded with the alias code FHAS.

This code is entered by the person who reviews and approves the final HUD submitted by the

customer. This mailbox will be monitored and reviewed by the short sale team supervisors.

Please be advised that this email address is only to be used when the caller is asking for a final

HUD approval on an account where an active approval letter (DISC, HRASSS, or HRASSE) has

already been released. Freddie Mac and Fannie Mae accounts will follow the same procedure.

This process does not include GS, VA, FHA, Litigated, CU, HCU, ADVC, or any other specialized

accounts.

The turnaround time to process this request is 24 to 48 business hours.

Do not give this email address or fax to request for an approval letter or for an extension. Any

inappropriate request should not be processed.

Please advise the customer that the final HUD approval is not mandatory with Ocwen. The DISC

or HRASSS we send is already an approval to the preliminary HUD they have sent. If there are

any changes to the HUD, they have to send it prior to the approval. After the approval, we do

not need to review the file again unless there is a change to the Net to Ocwen or Net to second

lien which is not with Ocwen. If they state that the buyer has changed, they can send the final

HUD with those changes and an addendum along with it.

Email address: finalhudapproval@ocwen.com

Fax Number: 561-682-8010

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 303

Corporate Training

In-house Short Sale Flowchart

Home Retention Department

Loss Mitigation Manual Short Sale

Page 304 Version 3.0 Ocwen Financial Corporation

Corporate Training

HAFA Short Sale Flowchart

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 305

Corporate Training

Complete Short Sale Review Flowchart

Home Retention Department

Loss Mitigation Manual Short Sale

Page 306 Version 3.0 Ocwen Financial Corporation

Corporate Training

12.3 Requesting Valuations

When the customer is attempting to work on a resolution, Ocwen may need to conduct a

valuation of the property to determine the type of resolution that can be offered to the

customer and whether a certain resolution can be approved.

Valuations are required when working on a short sale to ensure the value at which the property

is being sold matches the actual market value of the property.

There are different types of valuations that can be done:

BPO Brokers Price Opinion: The estimated value of a property as determined by a real

estate broker or other qualified individual or firm

A broker price opinion is based on the characteristics of the property being considered.

Some of the factors that a broker may consider when pricing a property include: The value

of similar surrounding properties, sales trends in the neighborhood, an estimate of any of

the costs associated with getting the property ready for sale, and/or the cost of any needed

repairs. It is important to note that a BPO is not the same as an appraisal.

A BPO can be exterior or interior, depending on whether the property is analyzed from the

outside only (exterior) or from the outside and inside (interior). An interior BPO provides a

far more accurate result.

Appraisal The valuation of the property by the estimate of an authorized person

For a valid appraisal, the authorized person will have a designation from a regulatory body

governing the jurisdiction the appraiser operates within.

Appraisals are typically used either for taxation purposes or to determine a possible selling

price of a property in question. The appraiser can use a number of valuation methods in

order to determine the appropriate value to assign, including the current market value of

similar properties, the quality of property, and valuation models.

CMA Comparative Market Analysis: A CMA is usually done when trying to sell a property. It

compares the property to be sold with similar properties in the area to ensure the value at

which the property is being listed is fair in comparison.

This is usually done by the real estate agent or broker. Some investor-servicers may require

this procedure to be done and the results sent when working on Short Sale resolutions

(Ocwen is not requesting CMA anymore)

Ordering a Valuation in REALServicing

Anyone needing to request a valuation to be done on a property will have to select first the type

of valuation needed. Once the valuation type is selected, you must follow the following steps:

Appraisal: To request for an appraisal to be done on the property, you can enter code

AVMRQ, which will create a workflow for the appraisal to be done in the property

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 307

Corporate Training

BPO: To request for a BPO to be done on the property, the code BPOO needs to be entered

in the account, specifying any details needed. It is important to remember that this code

does not trigger a workflow, so it is mandatory to go to the Order Valuations tab in the

scrolling buttons of REALServicingand place the request through there as well

o Interior BPO: In the Order Valuations tab, you must select the order type B BPO. If an

interior BPO needs to be done, then we will need to contact the person living at the

property in order to notify them of the need of this valuation and ensure we will be able

to access the property. So, in the section for Special Instructions, you should enter the

contact details (contact name, phone number, email address)

o Exterior BPO: To request an exterior BPO, you must select the order type E Exterior.

Since we do not access the property, there is no need to contact the customer, but any

clarifications needed can be entered in the Special instructions field, as well as in the

BPOO comment

CMA: To request for a CMA, you must go to the Order valuations tab in the scrolling buttons

of REALServicingand select the order type as Comparative market Analysis

State Restrictions

The type of valuation conducted depends on what it is needed for, the programs requirements,

and the investor requirements, as well as, State Laws.

Certain States do not allow some type of valuations to be done by a servicer while evaluating a

Short Sale offer. Whenever State Laws do not allow a certain type of valuation to be conducted,

REALServicingwill show the following message.

To replace B-type valuation, the system will prompt you to request E-type valuation

To replace M-type valuation, the system will prompt you to request for A-type valuation

Trigger the request as per the requirement and notate comments on REALServicing

accordingly.

The comment codes used are SSIMA (for interior valuation) and BPOO (for exterior valuations).

Mention the type of request placed and the contact information to access property.

Home Retention Department

Loss Mitigation Manual Short Sale

Page 308 Version 3.0 Ocwen Financial Corporation

Corporate Training

The following is a list of the States in which valuations type B (drive-by) and type M (interior

BPO) are not allowed:

Alabama

Connecticut

Delaware

New Mexico

North Carolina

Pennsylvania

West Virginia

Note: request the valuations as stated above.

Closing Costs

The following is a list of possible Closing Costs involved in a Short Sale transaction:

Items Included in closing cost

2009/2010 Tax No

Abstract Yes

Admin & Process services to solicited LLC Yes

Affidavit Yes

All costs under Government section - County/Sales Tax Yes

Appraisal Fee Yes

Assessments No

Association Dues No

Association Fees Outstanding No

Association Fees/Past Due Association Fee No

Attorney fees Yes

Bankruptcy Carve Out Yes

Bankruptcy Search yes

Carpet Replacement Yes

Certificate of Redemption Yes

City of Allentown Rental Inspection Yes

City of Palm Beach Lien Letter No

City of Plantation(1st page) No

City Violations No

Closing Fee(COST)/Settlement Fee Yes

Code Violation No

Condo Association No

Condo Dues(condo maintenance owed) No

Condo Estoppel Fees No

Condo Lien No

Conveyance Fee Yes

County Transfer Tax/Estate Yes

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 309

Corporate Training

Items Included in closing cost

County Transfer Tax Deed Yes

Credit for Buyer Closing Cost Yes

Credit owners Policy Yes

Credit to Buyer for County No

Deed Yes

Deed Draft Yes

Deed Tax No

Delinquent Taxes No

Delinquent Utility Lien to City/Country No

Delinquent Escrow Party No

Dept. of Building and Safety 9A Yes

Dept. of Housing Prevention and Development Yes

Discharge Tracking Yes

Discount fee to IRES yes

Doc Sales/Preparation Yes

Document Fee Yes

Document Fee to HOA No

Document Preparation Yes

Driveway Lien No

Dues No

ECBs & Open Sanitation Fines No

Emergency Repairs Yes

Endorsements (Infinity Title) Yes

Environment Control Broad (ECB) Violation. (not a Judgment

Lien) No

Equity Law Office Yes

Error & Omissions to Risk Mgmt Yes

Escrow Fees No

Escrow Payments No

Estimate Fee to HOA No

estimate NHD Yes

Estimated Estoppel Fees/Letter Yes

Estoppel Request Reimbursement No

Estoppel Letter to Lien Write Solution Yes

Estoppel PD in Advance No

Excess Deposit yes

Fedex & C.Chk For 3 Mtg Payoff yes

FHA Credit to Buyer from Seller yes

Final Lienable Utilities No

For Work Performed No

Home Retention Department

Loss Mitigation Manual Short Sale

Page 310 Version 3.0 Ocwen Financial Corporation

Corporate Training

Items Included in closing cost

Foreclosure Prevention yes

FTHB State Transfer Tax Yes

Ftitle No

Gap Risk Update Yes

Gas Bill No

Georgia Mitigation Loss Mitigation Yes

Govt Recording Charges. Yes

Grantors Tax No

Gross Receipts Tax on Commission Yes

Hazard/Flood/H/O Ins No

Hazard Report Yes

HOA Dues (also TBD) No

HOA Fees (also TBD) No

HOA Lien No

HOA Transfer Fee No

Home Owners Warranty Yes

Home Warranty Yes

Home Warranty Policy Estimated Yes

Home Warranty to be Determined Yes

Homeowners Association (HOA) No

Homeowners Policy No

Kingham Law Group Yes

Lien No

Lien Search Yes

Lien City Examination & Negotiation Yes

Lien Letter No

Loss Mitigation/Short Sale Admins to Olga Mena P.A. Yes

Mobile Notary Fees Yes

Mortgage Search Yes

Mortgage Policy Premium Yes

Municipal Line Search Yes

Municipal Fees yes

Natural Hazard Policy Yes

Natural Hazard Disclosure Yes

Natural Hazard Report Yes

NHD Report Yes

Notary Fees Yes

NRCC & RCC (nonrecurring & recurring closing cost) Yes

NY State Nondisclosure Credit Yes

NYC Dept. of finance No

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 311

Corporate Training

Items Included in closing cost

NYC Finance Tax Lien No

NYC PCDS No

Obtain Mortgage Discharged Yes

Oil Tank Yes

Open Permits Yes

Open Violation No

Open Water No

Outstanding Homeowner Fees No

Owners Association Charges No

Owners Coverage Yes

Owners Title Insurance Yes

Owners Title Policy Yes

Painting Yes

Past Due Condo Fees No

patriot Act Search Yes

Pay Prb, Pay Draper and Kramer No

Payoff of Judgment No

Payoff of Judgment No

PCDA Yes

PDCA Credit Yes

PDCS/PCDC Yes

pension of Owners Policy Paid by Seller yes

Pest Control Yes

Pest inspection Yes

pest Treatment Yes

Pine Key Past Due Maintenance No

PMG LLC to PMG LLC Yes

Processing Fee Yes

Property Condition Disclosure Report Yes

Property Disclosure Report Yes

Property Tax No

Public Nuisance Violation No

Reconveyance tracking Yes

Recording Fee Yes

Reimburse Chris Handy Yes

Reimbursement Yes

Relocation Fees or Expenses /HAFA Incentive No

relocation($3000.000) No

Repairs Yes

Required Services that you can Shop for Yes

Home Retention Department

Loss Mitigation Manual Short Sale

Page 312 Version 3.0 Ocwen Financial Corporation

Corporate Training

Items Included in closing cost

Retained by Realtor Yes

Roofing bill Yes

Sales Tax Yes

Sales Tax Yes

sandy City Est Yes

sandy Suburban Est Yes

Seller Title Services Yes

Seller's Paid Closing Cost Yes

Sellers Subsidy(same as sellers

concession)/Credit/Contribution /Closing Cost Yes

Septic Certification Yes

Service Fee (Line 704) Yes

Service Fees given below Broker Commission Yes

Sewer Fee/Est to Clark County Water Reclamation No

Sewer/Garbage/Drainage No

Short Sale Services to Sea2Sky Capital LLC Yes

Short Sale Processing Fees Yes

Smoke/CO Certification Yes

southwestern University Yes

State Tax Stamps Yes

Stamp/Tax Yes

State Recordation Tax Deed Yes

State Transfer Tax Deed Yes

Subescrow Fees Yes

Summer/Winter taxes No

Supplementary Summary No

Survey Yes

Survey to Preferred Surveyors Yes

Tax Bill No

Tax Certification No

Tax Defaults No

Tax Payments No

Tax service Yes

Termite Estimated Yes

Termite inspection Yes

Termite Report Yes

The citations are like liens they fall into the lien bucket of the

max $6000 payout they are not closing cost. No

Title Examination Yes

Title Insurance (any)/Fee Yes

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 313

Corporate Training

Items Included in closing cost

Title Search Yes

Town Violation Fees No

Transfer Fee Yes

Transfer Tax Yes

Transfer/Disclosure to Estimate Yes

Trash Fee No

trustee Fee Yes

Underwriting Fee Yes

Unifund CCR Partners To Unifund CCR Partners Yes

Unpaid Maintenance Yes

Unrecorded Lien Search Yes

Utility Companies/Lienable Utilities No

Warranty Deed Yes

Water & Power Fees No

Water Bills No

water Certification No

Water Hold NYC Dept. No

WDO Inspection Yes

Well to TBD No

Wire Fees Yes

Yard Work Yes

Zone Disclosure Report Yes

Home Protection Plan Yes

Delinquent Association Dues No

Retrofitting to be Determined Yes

Cash for Keys No

Payoff Demand Statement No

Short Sale Important Codes

SSPK Request for a Short Sale Package

INSRVD Incomplete Short Sale Package Received

CSRVD Complete Short Sale Package Received

SRVD Short Sale Acknowledgment Letter Sent to Customer

SSSR Short Sale offer Submitted for Management Approval

SSRA Short Sale Offer Approved by FC Manager

SSRD Short Sale Offer Denied

CMAP (Pending Code) Requesting Discount Letter for Short Sale Offer

DISC Discount Letter Sent to Customer

Home Retention Department

Loss Mitigation Manual Short Sale

Page 314 Version 3.0 Ocwen Financial Corporation

Corporate Training

DLWC Discount Letter Workflow Cancelled

SSOR Short Sale Offer Rejected

This list is not exhaustive; however the above list is to help understand the very basic codes used in

the Short Sale process.

12.4 Short Sale Extensions

There are 2 scenarios pertaining to request for extension on short sale offer, they are:

Scenario 1

- Loans where the GTD on DISC comment has expired

- Requirement We require a request of extension letter or an Addendum to the sale

contract with an extended closing date and HUD with the future closing date

Scenario 2

- If the GTD on the DISC comment is active and borrower needs an extension

- Requirement We require a HUD settlement statement with an updated closing date (i.e.

the date the realtors wanted to close the sale) and Addendum for extension of the purchase

contract

The following is a screenshot of settlement date/closing date and addendum for extension.

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 315

Corporate Training

On the receipt of the above-mentioned requirements, the short sale processing group will either

enter SSREX or CSRVD comments for the review of extension of short sale request and necessary

approval/denial comments will be posted.

12.5 Accelerated Short Sale Program

In an effort to increase short sale offers, generate the highest offer and minimize fraud, Ocwen

and Altisource have partnered to develop a new short sale submission process.

Key changes:

Offer Submission: When the borrower presents a short sale offer to Ocwen, the borrower(s)

and their listing agent will be required to list the property on Hubzu.com. Hubzu.com is

Altisources online auction and offer management website. Ocwen will send property

information to Altisource/Hubzu in order to auction the property.

Listing/Auction Process: Altisource will work with the borrowers listing agent; manage the

auction process and transaction closing. Altisource will attempt to negotiate all junior liens

associated with the property..

Winning Bid: Once a winning bid has been identified as the highest and best net offer,

Altisource will send the offer to Ocwen for review. Ocwen will continue to coordinate with the

investor, insurer and communicate the decision of approval or denial of the offer to the

borrower/authorized third party.

Note:

This program is applicable only for Non-HAFA short sales

The following loans do not qualify for this program:

GSE portfolio loans

Loans in active bankruptcy

Loans with FDD flags

Loans with Mortgage Insurance

Loans with confirmed sale date within 30 days

Home Retention Department

Loss Mitigation Manual Short Sale

Page 316 Version 3.0 Ocwen Financial Corporation

Corporate Training

This program will initially be rolled out for properties in the following states:

Arizona

Florida

Colorado

Michigan

Ohio

Texas

Nevada

More states will be added as the program progresses. Eventually all short sale offers received by

Ocwen will be sent to Altisource / Hubzu to participate in the program.

Altisource will provide a dedicated Customer Support Team to answer questions from

borrowers, buyers and agents regarding the marketing and sales support services of the

property. Ocwen will continue to answer all loan-servicing related questions.

Starting May 7, 2013, a comment code SSOR20 will be placed on all loans with incoming short

sale offers in the states of Arizona, Florida, Colorado, Michigan, Ohio, Texas and Nevada (where

new program is being piloted) and sent to Altisource to list the property on Hubzu.com.

All short sale calls regarding the program should be transferred to the short sale call queue

(SSATP team)

12.6 Relationship between Ocwen, RHSS, Hubzu, and

Altisource?

Real Home Services and Solutions (RHSS) and Hubzu are part of Altisource. Altisource is an

authorized vendor for Ocwen.

Two components of Accelerated Short Sale:

1. Reactive Short Sale:

Borrower comes to Ocwen with their property already listed with a realtor and the property

may or may not be under contract with a buyer

Ocwen will require the borrower and realtor to agree to list the property on Hubzu.com.

Ocwen will only consider the highest and best offer as submitted through Hubzu.com

Ocwen will refer the loan to Altisource Solutions (Altisource), who will arrange for

REALHome Services and Solutions, Inc. (RHSS) to list on Hubzu.com, and will appoint a

Residential Sales Coordinator (RSC) to each transaction as a Point of Contact (POC) to assist

with all real estate-related questions

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 317

Corporate Training

If borrower and realtor refuse to list property on Hubzu.com, the property will not be

eligible for short sale. Ocwen will then offer Deed-in-Lieu (DIL) resolution to borrower

Our Accelerated Short Sale Program provides assistance in junior lien negotiation by PTS

(arranged through Altisource), and therefore relieves the listing agent of this task

2. Proactive Short Sale:

Ocwen arranges with borrower to list their property directly with REALHome Services and

Solutions, Inc. (RHSS) for exposure on Hubzu.com

RHSS will assign a listing agent from their network to work directly with the homeowner, as

well as appoint an RSC to answer questions regarding the real estate transaction

This will save the homeowner the time and effort of interviewing and securing their own

listing agent, and fits nicely with the Cooperative Short Sale Program, as Ocwen will refer

the borrower directly to RHSS upon issuing the pre-approval letter

Our Accelerated Short Sale Program provides assistance in junior lien negotiation by PTS

(arranged through Altisource), and therefore relieves the listing agent of this task

What is different about Assisted Short Sale?

Eligible properties requesting short sale approval will be listed for auction on the website

www.Hubzu.com, in an effort to obtain the highest and best offer

Ocwen will refer qualifying properties to Altisource

Altisource will manage the auction process, offer acceptance and transaction closing

Ocwen will approve or deny all offers submitted by Altisource

Altisource will provide a dedicated Residential Sales Coordinator (RSC) to answer borrowers,

buyers, and agents questions regarding the property as it relates to marketing and sales

support services

Premium Title Services (PTS), an Altisource affiliate, will attempt to negotiate all junior liens

associated with the subject property (with signed authorization for borrower)

All loan servicing related questions will remain Ocwens responsibility. The Relationship

Manager (RM) will still play a key role in helping the homeowner achieve loan resolution

Listing the property for auction provides several advantages:

For the Borrower:

Transparent and predictable approval process

Time saving auction bidding to decrease the delinquency period and achieve faster loan

resolution

Open market listing to increase the likelihood of higher sales value

Home Retention Department

Loss Mitigation Manual Short Sale

Page 318 Version 3.0 Ocwen Financial Corporation

Corporate Training

For the Existing Listing Agent:

Ability to maintain the short sale listing

Increased likelihood of an approved sale and earning a commission

Increased buyer traffic and marketing reach on Hubzu.com and syndicated listings

Predictable closing process with junior liens searched and negotiated by PTS prior to

marketing

Parties Involved in Accelerated Short Sale Process and their responsibilities:

Altisource

Accept referral from Ocwen and update their servicing tool RESWARE with accurate

information

Arrange Short Sale Referral Agreement to be signed by the borrower and the Listing Agent

Determine listing price based on Ocwens valuation report

Order preliminary title report and junior lien negotiation (if applicable) with PTS

Monitor auction activities and provide feedback to Ocwen

Review all submitted offers and submit highest and best offer to Ocwen

Obtain a fully executed Purchase and Sales Agreement (PSA) for the winning bid

Submit PSA and preliminary HUD to Ocwen for review and approval

Coordinate communication between Ocwen, buyer, borrower, listing and selling agents, and

settlement agent

RSC will be the primary contact for listing agent, buyers agent and settlement agent

Coordinate successful closing and settlement of the short sale

Hubzu.com

Post all pertinent property information to the website

Activate the auction period

Monitor all auction activities

Send timely notifications to the involved parties

Start and stop auction cycles as required

Premium Title Services (PTS)

Order title report to identify junior liens

With authorization from the borrower, will negotiate and arrange for payoff of junior liens

If selected by the buyer as their settlement agent:

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 319

Corporate Training

o PTS will prepare the preliminary and final HUD statements

o Schedule closing of the transaction

o Execute closing documents and disburse funds to close the short sale

Ocwens Responsibilities:

SS Processing Team SS ATP Team

Check loan eligibility criteria (Non-HAFA,

Non-Agency, Non-MI)

Send out missing document letter and

order updated valuation report, if required

Enter SSOR20 code to send referral to

Altisource

Accept / Reject the offer received from

Altisource within 15 days of receipt of the

complete documents

Short Sale Processing Team will ensure all

communication to the customer/ ATP will

also be copied to Altisource

Follow normal short sale process,

underwrite the loan and update the

required codes on REALServicing

SS ATP Team will handle general

questions and inquiries and refer to

Altisource RSC as needed

Establish a small SWAT Team to triage

issues such as title issues with

Altisource

Maintain contact with Listing Agent

(ATP) as provided by the borrower or

RSC as assigned by Altisource

Continue call outs to the ATP in regards

to missing documents

Altisource to transfer calls to SS ATP

Team when necessary (for loan related

questions)

SS ATP Team to pursue DIL option with

homeowner if short sale fails

Exclusion Criteria for Assisted Short Sale (as of March 2013)

HAFA eligible loans (see HAQSS code)

Mortgage Insured loans

Agency and Government Loans (i.e. Freddie Mac, Fannie Mae, Ginnie Mae, FHA, VA)

Standalone Junior Liens

Litigated and Contested Loans

Special Servicing Loans (SPEC Flag Loan) and Goldman Sachs Loans

Loans with a Confirmed Foreclosure Sale Date within 30 days of the request

Home Retention Department

Loss Mitigation Manual Short Sale

Page 320 Version 3.0 Ocwen Financial Corporation

Corporate Training

Following are the new Alias Codes and will be used in the initial part of the process:

Post receipt of the complete short sale package along with Purchase and Sales Agreement (PSA) and the

estimated HUD 1 settlement statement, current process codes will be used to notate REALServicingand

the process will flow accordingly.

Codes REALServicingCode Description Explanation and Purpose

SSOR20

Your short sale offer cannot be considered at this

time. Your property must first be listed with

REALHome Solutions and Services, Inc. (RHSS),

Ocwens business partner for short sale activity.

After sufficient auction exposure, all offers will be

reviewed for a final decision. In this way we will

ensure that the best price is obtained for your

property.

Notify the homeowner of Hubzu.com

requirement and triggers request for

Altisource team to arrange listing on auction

website

To discuss this or other possible loan resolution

alternatives that may be available, please contact

us at 800-746-2936, Monday through Friday 8:00

am to 9:00 pm, Saturday 8:00 am to 5:00 pm or

Sunday 09:00 am to 9:00 pm ET.

RHLP

REALHome Team listed the subject property on the

Hubzu.com website

Indicates that the property has been listed

on Hubzu.com website for auction

RHLBF

REALHome Team listed the subject property on the

Hubzu.com website, Buyer Found

Indicates that a potential buyer was found

for short sale on the listed property through

Hubzu.com website

RHLBN

REALHome Team listed the subject property on the

Hubzu.com website, Buyer Not Found

Indicates that no acceptable offer has been

received for the listed property through the

auction process on Hubzu.com website.

Pursue DIL resolution on such accounts

RHLOR1

Seller no longer wishes to pursue short sale

resolution

Notifies the Altisource team that seller does

not want to pursue a Short Sale resolution

RHLOA

REALHome Listed Offer Accepted, kindly proceed

further with legal formalities

Ocwen accepts the offer presented by

Altisource, please proceed

RHLOR2

REALHome Listed Offer Rejected, Reason Code 2 -

Offer not acceptable as higher offer required

Ocwen rejects the offer presented by

Altisource

RHLOR3

REALHome Listed Offer Rejected, Reason Code 3 -

Kindly restart the auction process to find new

buyer for the subject property.

Instructs Altisource team to restart the

auction process and find a new buyer for the

subject property. (buyer Fallout)

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 321

Corporate Training

12.7 Cooperative Short Sale Program

Ocwen has implemented a Cooperative Short Sale Program as required under the Department

of Justices (DOJ) Settlement Program. This program will only be available to loans under specific

Investor codes. The program will be offered upon request for eligible borrowers who wish to be

pre-qualified for a Short Sale prior to listing their property. Ocwen will not solicit homeowners

for this program.

The program will be made available to borrowers who request a Short Sale but do not have a

confirmed buyer. However, homeowners are required to send the complete Short Sale or RMA

package.

The Sales Contract/Purchase Agreement, Listing Agreement and the HUD 1 Settlement

Statement are not a requirement for the eligibility review.

Benefits of Cooperative Short Sale Program:

Under this program, eligible borrowers will be given 120 days to market the property and find a

suitable buyer, during which time a foreclosure sale date will not be set.

Salient Features of the Program:

1. The Short Sale Team will review a submitted request. If eligible, a HAFA or non-HAFA pre-

approval letter with a recommended list price will be issued. NOTE: An Interior BPO will be

completed prior to the issuance of a pre-approval letter.

2. The borrower is given 14 days to return the signed pre-approval agreement along with a copy

of the Property Listing Agreement, evidencing that the property has now been listed for sale.

3. The borrower now has 120 days (from the issue date of their pre-approval letter) to sell their

home, during which time no foreclosure sale date will be set.

4. The borrower must submit a fully executed sales contract, preliminary HUD 1 Settlement

Statement and the Program Terms and Conditions page (from the pre-approval letter) with the

terms of the sale filled in, before the 120 day expiration date of the pre-approval agreement.

5. Upon receipt of the documents with the terms of the offer, the Short Sale processing team

will review the offer and the documents as per our standard Short Sale process. If approved, a

final approval letter will be issued with a 45 day expiration date.

6. If the borrower is unable to secure a buyer within the 120 days of the pre-approval letter,

they can be reviewed under the existing guidelines for a standard HAFA or non-HAFA short

sale once they secure a buyer.

7. Scripting is provided for all alias codes associated with the cooperative short sale program. In

addition, scripting is in place that will guide our agents when an eligible borrower inquires

about doing a short sale. The scripting will prompt the agent to determine if the property is

already listed or sold. If it is not, the agent will be prompted to discuss the pre-approval option.

Home Retention Department

Loss Mitigation Manual Short Sale

Page 322 Version 3.0 Ocwen Financial Corporation

Corporate Training

Exhibit 1.2: HUD 1 or Settlement Statement (Page1.)

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 323

Corporate Training

HUD 1 or Settlement Statement (Page2).

Home Retention Department

Loss Mitigation Manual Short Sale

Page 324 Version 3.0 Ocwen Financial Corporation

Corporate Training

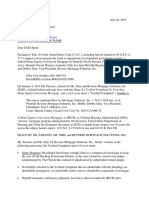

Sample Discounted Payoff Agreement and Release of Claims Document

November 11, 2013

VIA FAX (888) 555-1212

Mr. .

Re: Loan Number

Property Address: 362 Thompson Street

Morrow, OH. 45152

Dear Mr..:

Ocwen Loan Servicing, LLC has approved a discount payoff on the above referenced loan in the amount

of $______________. This discount payoff option expires on _______________, that is, if you do not

comply with the terms described below by this expiration date, this payoff option offer will no longer

be available to you. To accept the discount payoff, you (i.e., any of the borrower(s) shown above) must

perform the following prior to the expiration date of this offer:

1. Each l of the above-named borrowers must sign this letter, which includes a Release of Claims, on the

appropriate line under Acknowledged and Accepted.

2. You must fax a fully signed copy of this letter to my attention at the below listed fax number by

_______________; and you must send the original signed copy of this letter via regular or overnight mail

to my attention to the following address:

Ocwen Loan Servicing, LLC

1661 Worthington Road

Suite 100

West Palm Beach, Florida 33409

Attention: ___________________, Loan Resolution Consultant

3. Ocwen must receive the entire payoff amount, either by bank wire transfer, bank check, money order,

or certified funds, by no later than the close of business on --------, to the address listed at the bottom of

this agreement.

4. You must fax a copy of the signed HUD-1 Settlement Statement to my attention at the below listed fax

number by __________________. The HUD-1 Settlement Statement must be in accordance with the

Good Faith Estimate, which Ocwen relied upon to approve this discount payoff. Any surplus funds must

be paid directly to Ocwen Loan Servicing, LLC in accordance with the instructions in item 3 above. Under

no circumstances shall any funds go the borrower

5. You authorize Ocwen to apply any funds which may be in your impound account, or in your suspense

account, to any deficiency balance that you may owe to Ocwen.

6. (Optional) You (i.e., the Borrowers shown above) have/has agreed to sign a promissory note in the

amount of $ , the full amount of which shall be applied to reduce any

deficiency balance you owe Ocwen on your home loan account. The original of this promissory note

must be sent to us along with the payoff funds.

Upon our timely receipt of the entire payoff amount and a copy of this letter, properly signed by each of the

above-named borrower(s), we will advise our Client, Ocwen, to execute a release and a discharge of the Deed of

Trust/Mortgage and, if necessary, to file a withdrawal in connection with any legal action it may already have

taken, as of the date of your response to this letter, to collect this obligation.

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 325

Corporate Training

RELEASE OF CLAIMS

As consideration for this discount payoff offer, which Ocwen is not otherwise obligated to make

available to Borrowers, the receipt and sufficiency of which consideration is hereby acknowledged by

Borrowers, and as a condition to your (i.e., Borrowers shown above) acceptance of this discount payoff

offer, Borrower, for himself or herself and his or her heirs, personal representatives, successors, and

assigns, hereby jointly and severally, knowingly and voluntarily releases, discharges, and covenants not

to sue, Ocwen and its predecessors, successors and assigns, representatives, agents, affiliates, parents,

subsidiaries, officers, employees, directors and shareholders, including this law firm (collectively, the

Released Parties) from any and all claims, demands, liabilities, defenses, setoffs, counterclaims,

actions, and causes of action of whatsoever kind or nature, whether known or unknown, whether legal

or equitable, which he or she has, or may assert in the future, against Ocwen and the Released Parties

directly or indirectly, or in any manner connected with this offer and with any event, circumstance,

notice of default, action, or failure to act, of any sort or type, whether known or unknown, whether

legal or equitable, which was related or connected in any manner, directly or indirectly, to the Property

or to the servicing of this Loan. Borrower hereby further acknowledges and agrees that, to the extent

that any such claims may exist, the value to the Borrower of the discount payoff offer by Ocwen

contained in this letter, substantially and materially exceeds any and all value of any kind or nature

whatsoever of any such claims.

Nothing in this letter shall be construed to prejudice, waive, modify or alter any of Ocwens rights or

remedies in law or in equity in collecting the entire amounts due and to come due on the Loan or be

construed to waive any defense of Ocwen. Ocwen reserves the right to terminate this offer at any time

prior to your timely acceptance of the terms set forth above.

OCWEN LOAN SERVICING, LLC IS ATTEMPTING TO COLLECT A DEBT AND ANY INFORMATION

OBTAINED WILL BE USED FOR THAT PURPOSE.

Yours truly,

Ocwen Loan Servicing, LLC

_______________________

Home Retention Consultant

Toll Free Phone: Fax:

ACKNOWLEDGED AND ACCEPTED:

By:______________________ ______________________

(NAME) (NAME)

Date: ____________________

Home Retention Department

Loss Mitigation Manual Short Sale

Page 326 Version 3.0 Ocwen Financial Corporation

Corporate Training

PAYMENT REMITTANCE INFORMATION

(Always include Loan number with your payment)

VIA Bank Wire Transfer

Ocwen Loan Servicing, LLC

Fort Lee, NJ

ABA #021000021

Ref:

Attn:

VIA Federal Express

Ocwen Loan Servicing, LLC

12650 Ingenuity Drive

Orlando, FL 32826

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 327

Corporate Training

The following are a list of codes for short sale denials and the reasons why the code may be

documented:

INSRVD

Reasons Codes

Complete signed short sale package with updated financial(exhibit C) 1

Discount payoff requirements page 1 2

Discount payoff requirements page 2 3

Discount payoff requirements page 1 &2 4

Signed Exhibit A(authorization) 5

Signed Exhibit B (Hardship Letter) 6

Signed complete filled exhibit C( Financial Form) 7

Signed Exhibit D( authorization to access property) 8

Signed HUD with correct property address same as in real servicing 9

Signed typed HUD with correct property address same as in REALServicing(Saxon

investor) 10

Listing History( Saxon Investor) 11

Death Certificate(Saxon Investor) 12

DLWC

Reasons Codes

2nd lien amount not mentioned in CMAP/CMAP not entered on 2nd lien 1

BK approval required 2

Book Loss >150K or >300K 3

Charged Off/RE account 4

CMAP not entered via LRM 5

CMAP undone 6

Commission Incorrect/Not mentioned in CMAP 7

Details not entered correctly in LRM 8

GTD incorrect (Non-working day/expired) 9

HUD Missing/Not Clear 10

Interior BPO required 11

Listing History Missing 12

Manager/Investor/MI Approval Required 13

Manager/Investor/MI Denied 14

Market Value not updated 15

MMV <80% 16

Net to Ocwen Not mentioned in HUD/Does not match the HUD 17

Scenario does not win 18

Home Retention Department

Loss Mitigation Manual Short Sale

Page 328 Version 3.0 Ocwen Financial Corporation

Corporate Training

DLWC

Discount Letter sent out on 1st Lien (Same Investor) 19

Eligible For HAFA 20

Eligible For HAFA; HAMP review pending 21

SSOR

Reasons Codes

The terms of the sale contract are not acceptable SSOR1

Mortgage Insurer denied the short sale offer. SSOR2

Investor does not allow Ocwen to accept a short sale offer SSOR3

Ocwen denied the short sale offer your loan is ineligible for a discounted payoff. SSOR4

No consent order received from Bankruptcy Counsel for Short Sale Offer. SSOR5

Ocwen is no longer your servicer SSOR6

Ocwen countered the short sale offer. Please call to discuss this offer further SSOR7

Excessive payments to subordinate liens/mortgages. SSOR8

Unable to close before the confirmed foreclosure sale date SSOR9

Tax information missing SSOR10

You have failed to provide the required HAMP documents SSOR11

Previously Used SSOR Codes

Book Gain is not between 15000.00 and (150000.00) SSOR11

Broker commission more than 6%of the sales price SSOR12

Mid market value less than 75%of the market value SSOR13

Net to Ocwen is not mentioned clearly in HUD SSOR14

Interior BPO valuation cancelled/Valuation cannot be ordered due to access issues SSOR15

Additional Information required by Investor / MI company SSOR16

Net to Ocwen is greater than total debt in LRW for 2nd lien SSOR17

SSOD

Reasons Codes

No short sale offer on the property SSOD1

Unable to establish contact after repeated attempts SSOD2

Ocwen is no longer your loan servicer SSOD3

Current offer denied, Requesting for a better offer SSOD4

Offer countered, But no offers for the past 15 days SSOD5

Does not meet investor requirement SSOD6

Short sale Offer withdrawn by the Borrower SSOD7

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 329

Corporate Training

SSOD

Short sale offer not available currently SSOD8

Unable to access the property for valuation, Please call us SSOD9

Short sale approval has expired SSOD10

Home Retention Department

Loss Mitigation Manual Short Sale

Page 330 Version 3.0 Ocwen Financial Corporation

Corporate Training

12.8 Request for Mortgage Assistance (RMA) Package

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 331

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 332 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 333

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 334 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 335

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 336 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 337

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 338 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 339

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 340 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 341

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 342 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 343

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 344 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 345

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 346 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 347

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 348 Version 3.0 Ocwen Financial Corporation

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Ocwen Financial Corporation Version 3.0 Page 349

Corporate Training

Home Retention Department

Loss Mitigation Manual Short Sale

Page 350 Version 3.0 Ocwen Financial Corporation

Corporate Training

Potrebbero piacerti anche

- FBI 18 USC 371 Fraud or Impairment of A Legitimate Government Activity RMS - MRLPDocumento48 pagineFBI 18 USC 371 Fraud or Impairment of A Legitimate Government Activity RMS - MRLPNeil GillespieNessuna valutazione finora

- ClaimLetter 2023 4 21Documento17 pagineClaimLetter 2023 4 21cottontop187Nessuna valutazione finora

- Unemployment Insurance Oui/Duio April 27, 2020Documento25 pagineUnemployment Insurance Oui/Duio April 27, 2020Jennifer JohnsonNessuna valutazione finora

- Cash For Keys AgreementDocumento2 pagineCash For Keys AgreementLarry Leach33% (3)

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocumento10 pagineHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersQFQEWFWQEFwqNessuna valutazione finora

- East FL HIPAA Authorization FormDocumento2 pagineEast FL HIPAA Authorization Formfelix ariasNessuna valutazione finora

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDocumento6 pagineYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNessuna valutazione finora

- Different Branches of LawDocumento3 pagineDifferent Branches of Lawgo foreducationNessuna valutazione finora

- Contract To Sell BlankDocumento3 pagineContract To Sell Blankmarc marcNessuna valutazione finora

- 68 Quirino v. Grospe DigeestDocumento3 pagine68 Quirino v. Grospe DigeestJames Evan I. ObnamiaNessuna valutazione finora

- Texas Foreclosure Timeline Chart For Non-Judicial ForeclosuresDocumento1 paginaTexas Foreclosure Timeline Chart For Non-Judicial Foreclosuresglallen01Nessuna valutazione finora

- Deed of AdjudicationDocumento2 pagineDeed of AdjudicationMona Lee100% (4)

- This Is Only A Summary.: Important Questions Answers Why This MattersDocumento10 pagineThis Is Only A Summary.: Important Questions Answers Why This MattersAnonymous D47ZzQZDtNessuna valutazione finora

- Inversiones Alsacia Disclosure StatementDocumento648 pagineInversiones Alsacia Disclosure StatementDealBookNessuna valutazione finora

- National Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPDocumento17 pagineNational Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPAccessible Journal Media: Peace Corps DocumentsNessuna valutazione finora

- Amendment of Solicitation/Modification of ContractDocumento45 pagineAmendment of Solicitation/Modification of Contractb4031429Nessuna valutazione finora

- Blue Cross Writ and Presuit Irog Regarding HK Porter Trust ClaimsDocumento25 pagineBlue Cross Writ and Presuit Irog Regarding HK Porter Trust ClaimsKirk HartleyNessuna valutazione finora

- Disclosure StatementDocumento3 pagineDisclosure StatementWhoNessuna valutazione finora

- Dental BS Delta 1500 PPO Benefit Summary 2018Documento4 pagineDental BS Delta 1500 PPO Benefit Summary 2018deepchaitanyaNessuna valutazione finora

- Postmates Letter Re NYSLA Draft AdvisoryDocumento3 paginePostmates Letter Re NYSLA Draft AdvisoryThe Capitol PressroomNessuna valutazione finora

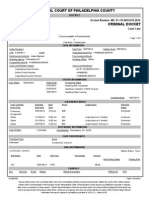

- Commonwealth of Pennsylvania v. Cameron CountrymanDocumento5 pagineCommonwealth of Pennsylvania v. Cameron CountrymanPenn Buff NetworkNessuna valutazione finora

- OHRA Application FormDocumento4 pagineOHRA Application FormwangchanghuiNessuna valutazione finora

- Fannie Mae REMIC Trust AgreementDocumento84 pagineFannie Mae REMIC Trust Agreementwinstons2311Nessuna valutazione finora

- Title/License Plate Application How To Complete This ApplicationDocumento4 pagineTitle/License Plate Application How To Complete This Applicationashishgaur007Nessuna valutazione finora

- Disaster Unemployment Assistance Certification QuestionsDocumento5 pagineDisaster Unemployment Assistance Certification Questionsdavid wheelerNessuna valutazione finora

- Iowa Applicarion FormDocumento4 pagineIowa Applicarion FormRajat PatelNessuna valutazione finora

- 111 Trustee's Status Report of Noncompliance With 1) Order Finding Eric C. Blue in Contempt of CourtDocumento7 pagine111 Trustee's Status Report of Noncompliance With 1) Order Finding Eric C. Blue in Contempt of CourtEric GreenNessuna valutazione finora

- DocumentDocumento4 pagineDocumentIrwin William DavisNessuna valutazione finora

- Jahrid Burgess Court Summary ReportDocumento2 pagineJahrid Burgess Court Summary ReportLeigh EganNessuna valutazione finora

- GL Request Form Master Revised - Downloaded 2016 - GL S1584 For 1804Documento351 pagineGL Request Form Master Revised - Downloaded 2016 - GL S1584 For 1804Edwin TandryNessuna valutazione finora

- REG 195, Application For Disabled Person Placard or PlatesDocumento3 pagineREG 195, Application For Disabled Person Placard or Platestech20000Nessuna valutazione finora

- pptc203 Eng 3 PDFDocumento2 paginepptc203 Eng 3 PDFKerren PerdomoNessuna valutazione finora

- Susan Clickner Chapter 13 Bankruptcy 2004Documento59 pagineSusan Clickner Chapter 13 Bankruptcy 2004mannylulzNessuna valutazione finora

- RMV1Documento2 pagineRMV1auredrelleNessuna valutazione finora

- GetR229Form PDFDocumento3 pagineGetR229Form PDFGerson RegisNessuna valutazione finora

- Military Out of State Vehicle Registration Forms For FloridaDocumento17 pagineMilitary Out of State Vehicle Registration Forms For Floridapnguin1979Nessuna valutazione finora

- Rebate FormDocumento1 paginaRebate FormDrew MoretonNessuna valutazione finora

- Immunization Verification Form 2018Documento2 pagineImmunization Verification Form 2018Jawad JamilNessuna valutazione finora

- Eticket 0149564965066 2Documento1 paginaEticket 0149564965066 2carlo boniolNessuna valutazione finora

- 452Documento1 pagina452Davah Emiel OzNessuna valutazione finora

- CignaDocumento7 pagineCignaUNKNOWN LSANessuna valutazione finora

- License Expiration AshleyfrostromDocumento2 pagineLicense Expiration Ashleyfrostromapi-522084500Nessuna valutazione finora

- MV 82Documento2 pagineMV 820selfNessuna valutazione finora

- Document PDFDocumento1 paginaDocument PDFAnonymous 1Ggwu1yNessuna valutazione finora

- Horizon Medical Health Insurance Claim Form: Please Read This Important InformationDocumento2 pagineHorizon Medical Health Insurance Claim Form: Please Read This Important InformationBrianReagerNessuna valutazione finora

- 16-15595 - 8400 Edes Ave PDFDocumento11 pagine16-15595 - 8400 Edes Ave PDFRecordTrac - City of OaklandNessuna valutazione finora

- Consular Electronic Application Center - Print ApplicationDocumento6 pagineConsular Electronic Application Center - Print ApplicationmeesumNessuna valutazione finora

- Image PDFDocumento2 pagineImage PDFJames LarsenNessuna valutazione finora

- Chetan GehlotDocumento1 paginaChetan GehlotSamaNessuna valutazione finora

- Rop PDFDocumento4 pagineRop PDFelmyrNessuna valutazione finora

- Documents Form Medical Claim Il PDFDocumento4 pagineDocuments Form Medical Claim Il PDFAnonymous isUyKYK1zwNessuna valutazione finora

- R 229Documento1 paginaR 229Muneer A ShNessuna valutazione finora

- Lab ReportDocumento2 pagineLab Reporttuyennt_1990Nessuna valutazione finora

- Application For Ignition Interlock License/Return of Regular Driver LicenseDocumento2 pagineApplication For Ignition Interlock License/Return of Regular Driver LicenseLee KellyNessuna valutazione finora

- Kiralee Arlene Ruck Booking DocumentsDocumento4 pagineKiralee Arlene Ruck Booking DocumentsKevin StoneNessuna valutazione finora

- Tween 80 MsdsDocumento4 pagineTween 80 Msdserkilic_umut1344Nessuna valutazione finora

- 7 SAc LJ303Documento53 pagine7 SAc LJ303armsarivu100% (1)

- Cna Liscense NumberDocumento2 pagineCna Liscense Numberapi-548066065Nessuna valutazione finora

- Remington & Vernick Engineers II, Inc.-2020 - BE - FormDocumento140 pagineRemington & Vernick Engineers II, Inc.-2020 - BE - FormRise Up Ocean CountyNessuna valutazione finora

- Motor Vehicle Inspection Appointment 15052018165442Documento1 paginaMotor Vehicle Inspection Appointment 15052018165442Gilbert KamanziNessuna valutazione finora

- 15 G Form (Pre-Filled)Documento2 pagine15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionDa EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNessuna valutazione finora

- Ocwen HAFA MatrixDocumento5 pagineOcwen HAFA MatrixkwillsonNessuna valutazione finora