Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Guide To Client Protection Assessments

Caricato da

Smart CampaignTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Guide To Client Protection Assessments

Caricato da

Smart CampaignCopyright:

Formati disponibili

Keeping clients rst

in micronance

VERSION 1

1 MAY 2014

A Guide to

Client Protection

Assessments

Overview

How to conduct an in-depth,

condential diagnostic of

your client protection policies

and practices

This guide describes the

client protection assessment

options available to nancial

institutions, walks you through

the assessment process,

and explains how to use your

assessment once it is complete.

Anyone can use this guide.

This guide and all of its

annexes can be found on

the Smart Campaign website:

www.smartcampaign.org/

certication/assessments

1. Why Should Your Institution Do a Client

Protection Assessment? 2

2. Which Type of Assessment is

Best for Your Institution? 4

3. What is the Process for Undergoing an Assessment? 7

4. Making the Most of Results 12

5. Going Further Getting Certied 13

SECTION

THE SMART CAMPAIGN 2

Why Should Your

Institution Do a

Client Protection

Assessment?

REASON 1

In order to assess

your practices know

just how well you are

protecting your clients

Many Financial Institutions (FIs)

aim to operate under the belief

that the client is king. After all,

positive relationships with clients

lead to benets such as customer

retention, repaid loans, a strong

reputation, and new clients. Yet

putting this guiding philosophy into

action can be difcult because FIs

must implement client protection

while juggling numerous priorities,

adhering to national regulations, and

trying to stay competitive against

peer institutions which may not be

so client-minded. Unfortunately,

poor client protection can cause your

institution pain; clients default on

loans, new loan products are not

successful, client data is breached

leading to nes and fraud all issues

which can hurt your prots. An

assessment is key for knowing how

your institution is doing compared

to a minimum industry standard

and for establishing whether or not

you need to be concerned about

these risks. In addition to guiding

your offense, an assessment also

gives you defense; if you nd that

you are adequately implementing

client protection, it is also a way of

demonstrating your good practices

to stakeholders using a standard

that is universally respected and

understood. For instance, you can

use it to defend yourself against

overarching regulation and to give

condence to your investors.

Since the assessment we made adjustments in

our Code of Ethics and Collection Manual, we give

updated talks to our staff so that they know acceptable

practices and behaviors,, and we implemented a

brochure of client rights and duties (given to clients

at disbursement), and greater transparency around

credit documentation and contracts. We did this

with the objective of being transparent and treating

the client in a fair and respectful way.

BancoDelta in Panama

IN THIS SECTION

An assessment can benet your

institution by evaluating how

well you are meeting standards

of client protection, by setting a

starting point for strengthening

your practices, by minimizing

your risks and improving your

prots, and by preparing you

for Certication.

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 3

1 For an example of an institution that has

published its report; http://sidbi.in/sites/default/

les/Ujjivan_Report.pdf

REASON 2

To set a starting point

for improvement

efciently address

weaknesses and

minimize risk

Perhaps you feel that you have some

weaknesses in your practices tied

to client protection which must be

xed. For instance, maybe you need

to improve your collections manual,

train your staff on acceptable

practices, or rewrite your code of

ethics. Maybe you are wondering

where to start, which resources and

examples to use, or when to take

action. Of course, your institution

cant afford to waste personnel

time tackling client protection

until you have identied specic

priorities, stafng, and an action

plan. An assessment identies an

FIs strengths and weaknesses and

lays the groundwork for next steps

by providing recommendations

and tools for what to do next. It is

ultimately a way to both identify

your quick wins and to also nd the

best path over your bigger, longer

term hurdles.

REASON 4

The business case for

an assessment to

turn client protection

into commercial success

and minimize risk

An assessment can boost your

commercial returns because it is

the blueprint for client protection,

which in turn allows you to improve

your efciency and capacity. Client

protection is the foundation of

providing high quality services to

clients. It supports increased client

retention and builds the brand of

the FI. It will support your bottom

line internally as well by boosting

staff retention, aligning staff

incentives to client outreach targets,

identifying and removing product

design barriers, helping you adhere

to regulation, and boosting risk

management. If an FI is willing to

publish the assessment outcomes, it

can distinguish itself in the market as

a pro-client organization; attracting

attention from key stakeholders

including clients, investors, donors,

and regulators.

1

REASON 3

To prepare for

Certication get

ready to become

Smart Certied

An Assessment is a key step in

preparing for Smart Certication,

an independent seal to publicly

recognize FIs that have met adequate

standards of client care, based on an

evaluation conducted by a third-

party ratings agency. An assessment

is NOT required before Certication,

but it does prepare your institution

for Certication because all of the

standards indicators are the same.

They are so identical in format

that Certiers can even use the

assessment report for consultation

during their mission. The crucial

difference is that Certication

is pass/fail and public unlike an

assessment, which is condential

and provides number scores and

guidance. The assessment reports

recommendations and analysis

can be used toward a workplan for

preparing to pass Certication.

We were able to improve the policy for collection

processes and add an annex that touched upon

the ethics of in collection process [The Assessment]

has allowed us to educate our clients in preventing

and minimizing claims because they are aware

of the process.

Acorde in Costa Rica

SECTION

THE SMART CAMPAIGN 4

2 The CPPs are an industry standard for doing

business with clients, developed and identied

via industry consensus and the collaboration of

providers, international networks, and national

micronance associations.

Which Type

of Assessment

is Best for Your

Institution?

Why all the options?

There are three types of assessments

so that client protection can be

evaluated and implemented by

an FI no matter what their level of

resources, experiences, objectives,

or how much time they have. Having

several assessment options help

avoid bottlenecks such as cost or

availability of a consultant that might

prevent institutions from evaluating

their client practices.

How do the

assessment types

differ?

First, the three types of assessments

all evaluate your practices against

the seven Client Protection

Principles (CPPs), a framework

that encompasses the standards

of acceptable practices set by the

industry.

2

In terms of difference, as

Table 1 below summarizes, a Smart

Assessment, a self assessment, and

an accompanied self-assessment

are differentiated based on the level

of analysis you want, how much

effort you want to devote to the

assessment, and which outcome

you are seeking.

Do I need to do

more than one type

of assessment?

No. An FI does NOT need to do

more than one type of assessment

and it is not necessary to do one

type of assessment before being

allowed to do another. However, if

you are preparing for Certication,

the Campaign recommends a

Smart Assessment in addition to a

self-assessment to benet from an

external perspective and more in

depth evaluation.

Can I conduct an

assessment during

another type of

social performance

evaluation?

Sometimes institutions that are

conducting or working with a

technical assistance provider to

conduct another type of evaluation

such as a social performance

evaluation choose to do an

assessment as well. They expand

their review and audit of practices

and policies to include a more in

depth look at client protection in

order to minimize duplicate work

down the road. This is perfectly

acceptable and particularly well

suited for the accompanied self-

assessment.

IN THIS SECTION

There are three types of

assessments for you to assess

your client protection practices.

Your choice will depend on

what your objectives are and

what resources you can devote.

The three types evaluate your

institution against the seven

Client Protection Principles.

Your options include: a self-

assessment done internally

by staff at your institution, an

accompanied self-assessment

done by your staff and a

person trained in the Smart

Assessment methodology to

guide you through the process,

or a third-party external

assessment referred to as a

Smart Assessment.

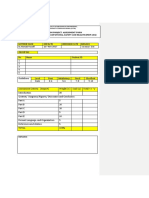

TABLE 1

Summary of Assessment Options

OBJECTIVE

DEPTH OF ANALYSIS

ASSESSMENT TEAM

PROCESS

OUTPUT

COST

LEVEL OF EFFORT ON-SITE

3

Self-Assessment

JUST FI

Become familiar with CP

Check how your institution

is doing in CP

Summary or extended

MFI focal point (who has

attended CPP training)

Self-reported by MFI

Graphic overview of ndings

Free

Summary 35 days

Extended 510 days

Accompanied

Self-Assessment

FI WITH 1 EXTERNAL

(AN ACCREDITED ASSESSOR)

Start integrating CP

into operations

Recognize practices

that meet the standards

Fine tune and improve

emerging CP practices

Summary or extended

2 person team, with one

external member who

is an assessor

Self-reported by FI with

on-site support from assessor

Summary narrative report

with recommendations

$

Cost of Assessor

(38 days)

Summary 35 days

Extended 38 days

Smart Assessment

2 EXTERNAL (ACCREDITED

LEAD AND SUPPORT ASSESSOR)

Start integrating CP

into operations

Recognize practices

that meet the standards

Fine tune and improve

emerging CP practices

Prepare for Certication

Extended

2 person team, with

two external members

(2 assessors)

Off-site and on-site

evaluation by assessors

Detailed narrative

report with action plan

$$

Cost of 2 assessors

(2025 days)

Extended 57 days

4

3 Estimated time is indicative. Level of effort will depend on a number of factors, such as the level of assessment, the FI size, the level

of participation of FI management, the number of interviews, client visits, etc.

4 A Smart Assessment typically takes less time in the eld, thanks to productivity gains from having an experienced, two-person team.

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 5

THE SMART CAMPAIGN 6

If you do want to do a self-

assessment, the Smart Campaign

offers many resources on its website

to guide you along the way. For

instance, there are training modules

(ranging from two hours to one-

day training) to introduce the CPPs,

their standards and indicators, as

well as examples of how to score

performance adequately.

An accompanied self-assessment is

right for your institution if your team

is hoping for some guidance during

the process and if it is important

that the results come from and

are validated by an external source.

For an accompanied self-assessment,

the FI works with a Smart Assessor

5

throughout the process, allowing

the institution to benet from an

experienced third-party who can

probe relatively deeper than a

self-assessment validate ndings,

produce a summary report, and

develop recommendations.

So how do I decide

which assessment

is right for my

institution?

All assessments will evaluate

your client protection practices

and provide a starting point for

implementing changes. Essentially,

your choice of an assessment type

will depend on 1) the extent to which

your FI wants to conduct the work in

house vs. outsource it, 2) the extent

to which results must be validated

by an external party, and 3) the

resources available to you.

A self-assessment is right for

you if you are looking for a low-cost

option, able to use internal staff time,

and want a quick review of major

strengths and weaknesses.

Self-assessments generate a graphic

overview and so are likely to produce

less in-depth and less objective

analysis than the others that benet

from an outsiders perspective.

Ultimately, a self-assessment gives

the FI responsibility for determining

the time they want to spend and the

depth of analysis they want.

Here again, you have some

independence and can adjust

the level of involvement of the

accompanying assessor depending

on your resources and the depth

of analysis you would like to use

(summary or extended).

For any questions about the

accompanied self-assessment

specically, we recommend

Annex A: The FAQs for the

Accompanied Self-Aassessment.

6

Finally, a Smart Assessment

(external assessment) is right for

your FI if you are willing to use

more resources to work with a

specially trained Smart Campaign

accredited CPP assessor who will

conduct a more in-depth analysis

and conclude the assessment with

a full narrative report.

A Smart Assessment provides

an exhaustive, independent

view of a nancial institutions

client protection practices and is

likely to get into more detail than

accompanied self-assessments, in

part because they are conducted

by two or more highly experienced

accredited assessors.

This option generates a full

narrative report on the strengths

and areas of improvement for the FI,

accompanied by recommendations

and a tailored action plan for

improvement.

An external assessment is a genuine

capacity-building tool that can

help prepare the FI for Certication,

guide management decisions,

and can even be used to support

fundraising proposals.

5 The Smart Campaign accredits assessors by

requiring them to attend a three-day training,

pass an exam, and conduct two supervised

assessments.

6 All annexes can be found in PDF or excel form

on the Smart Campaign assessment webpage:

www.smartcampaign.org/certication/

assessments

After the assessment we included nancial education,

timely communication, responding to client complaints

and suggestions as part of our business. We included

the CPPs in new staff training programs and in the

information we provide to both nancial providers

and our stakeholders. We are very grateful for the

opportunity the assessment gave us to move towards

continuous improvement and being efcient with

high levels of satisfaction among our clients. This

had a positive impact on our indicator of retention.

Acorde in Costa Rica

SECTION

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 7

What is the

Process for

Undergoing an

Assessment?

7 Both tool forms are in a single spreadsheet.

When you open the assessor le, you choose

the form of the tool, Extended or Summary,

on the rst tab. Automatically, the spreadsheet

will adjust to what you have asked for simply

press the update spreadsheet tab.

8 You should check the contract you receive from

an assessor with the sample contract and assessor

level of effort included in Annex C.

All three Assessments have

three main phases:

A) On Your Mark [Preparation]

B) Get Set. [Desk review]

C) Go!!! [On site review and reporting]

3.1

ON YOUR MARK

Preparing for an Assessment

3.1.1

Get to know the

Standards and the

Assessment Tool

Every assessment begins with

the seven CPPs, their standards,

and the indicators for each standard.

It is important to get to know these

CPPs, standards, and indicators,

to understand what your institution

is measuring.

Your institution should also get

to know the yardstick that is being

used; every assessment uses the

Smart Campaign Assessment Tool

in Annex B to verify performance to

standards. It may look like a simple

Excel spreadsheet but it is the roadmap

for an institutions practices to be

evaluated against the seven CPPs. It

comes in two forms: 1) the Summary/

Getting Started Questionnaire

(Summary/GSQ) tool, which is a

simplied tool using 95 indicators and

2) the Extended tool, a more complex

version using 300 questions.

7

Both

versions evaluate the same seven

CPPs and provide the assessment

conclusions you need. The Extended

version is simply more in depth and

for use by a more experienced user.

When completing a self-assessment

or accompanied self-assessment, you

may choose which form to use but

we recommend at least starting with

the Summary/GSQ tool because it is

more appropriate for FIs who are new

to client protection and want a quick,

low-cost way to evaluate their CP

practices. On the other hand, the more

in depth extended tool is required for

Smart Assessments. This is because

it is appropriate for FIs aiming for

eventual Client Protection Certication

who are ready to invest the time and

resources to ensure that they fully

meet the client protection standards.

In the tool every indicator is

assessed according to the scale in

Figure 1.

3.1.2

Figure out how

much to budget for

the assessment cost

A self-assessment is free. A

Smart Assessment typically costs

between USD $14,00017,000. An

accompanied self-assessment costs

somewhere between the two but

of course depends on what terms

you set with the assessor that is

assisting your FI. These costs pay for

the time of the assessors the money

does NOT go to the Smart Campaign.

The exact cost can vary by location

(to accommodate travel needs), by

assessor rates, and by the duration of

the assessment. The FI negotiates the

cost and deliverables directly with

the assessor.

8

An assessment is costly in

the short term. But it is also an

investment and it will minimize

IN THIS SECTION

The key steps of the Assessment

process are off site preparation

and desk review of documents,

on-site interviews and

information collection, and report

preparation and presentation.

FIGURE 1

Scoring

Does not meet

the indicator

Does not meet

any part of the

indicator

Absent practice

Partially meets

the indicator

Does not fully

meet all parts of

the indicator

Meets the

indicator

Meets all parts of

the indicator

Not applicable

This does not

apply to the

organization

N/A

For a Smart Assessment?

AN ACCREDITED ASSESSOR

An accredited lead assessor

and at least one accredited

support assessor.

The difference between a lead

assessor and a support is that the

lead takes a bigger role than the

support who serves as an assistant

and the lead is someone with

more experience, having led

assessments before.

Our accredited assessors are

experienced evaluators with

a strong technical background

in micronance and good

knowledge of client protection.

For an Accompanied

Self-Assessment?

AN ACCREDITED LEAD OR SUPPORT ASSESSOR

An accredited lead or an accredited

support assessor.

This could be an assessor in

training (a consultant who has

attended one of our trainings

and who has passed a test we

administered) or an accredited

assessors (someone who we have

trained and who became formally

accredited with the Campaign).

Additionally, the FI should appoint

a focal point to work with this

assessor. Ideally, the focal point

will be familiar with doing

evaluations, and may have

knowledge of client protection

or social performance issues.

For a Self-Assessment?

YOU

Your FI must appoint a point person

to conduct the self-assessment.

It helps if this person has been

trained on the CPPs, is in a high

level management position

and/or has institutional buy-in,

and has experience with auditing.

Ideally, the focal point will be

familiar with doing evaluations,

and has knowledge of social

performance issues such as

an internal auditor, product

development manager, client

service representative but

there is no requirement.

Mainly, the focal point needs

to have the time available to

help prepare and support the

assessment.

THE SMART CAMPAIGN 8

costly risks down the road. Using

the assessment as your blueprint

can help grow your business and

reputation. Overall, institutions have

found that protecting clients is of high

enough value to make the short-term

operational cost burden worth it.

In the past, institutions have

found different ways to pay for

assessments. They do so out of their

own institutional budget; they have

obtained funding from partner

organizations such as networks or

investors; and on rare occasions the

Smart Campaign has helped cover or

helped identify a funding partner to

cover the cost of an assessment.

3.1.3

Finding an assessor. Who can do the assessment?

Our accredited lead assessors are listed here:

http://smartcampaign.org/certication/assessments/lead-assessors

And our accredited support assessors are listed here:

http://smartcampaign.org/certication/assessments/support-assessors

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 9

3.2.2

Provide documents

and answer questions

during the desk review

An assessment begins with a desk

review of key documents and

materials such as the FIs policies,

national context, and nancial data

as they relate to the CPPs indicators.

For instance, if one indicator calls

for a non-discrimination policy, the

assessor will review the FIs loan

ofcer manual or Code of Conduct

and lls out the Tool accordingly.

Similarly, if the assessor nds during

an internet check that a regulation in

the country sets PAR at a particular

level which the MFI must comply

with, the assessor includes this

information in the report and when

evaluating CPP4 (Responsible Pricing).

The purpose of a desk review is to

make the on-site visit as efcient

as possible by establishing all

background contextual information

and MFI policies. It allows assessors

to come to the off-site visit prepared

to ask the right questions and

conrm that written policies are

applied in practice.

3.3

GO!

The On-Site Visit

3.3.1

Evidence is collected

at the FI, interviews

are conducted,

and the indicators

are all scored

During the on-site visit, the tool is

lled out based on evidence collected

in person such as condential

interviews and observations of

3.2

GET SET

Off-Site Steps

The off-site portion of the assessment

is important for ensuring that the

onsite visit is productive and that the

assessor has the information needed

to complete the assessment process.

3.2.1

Set the plan in motion

with the assessor

It is crucial for your institutions

leadership to give their full support

to the assessor team or to the staff

member doing a self-assessment.

For a self-assessment, the point

person should introduce the staff

to the process, set a timeframe, and

explain what the point person will

need to collect from them in order to

carry out the self-assessment. For an

accompanied or Smart Assessment,

the assessor will typically hold

a series of virtual meetings to

familiarize the FI with the process,

to request key documents, and to

describe the sort of information

they will need and questions they

might be asking. These conversations

will cover subjects such as setting

a time frame, choosing specic

dates for visits, planning interviews,

answering your questions, and

setting deadlines for deliverables. In

such opening meetings, the assessors

will also request key documents.

In relation, your institution

should establish a scope of work

for an assessor doing a Smart

Assessment or an accompanied

self-assessment in order to identify

deadlines and deliverables. See

Annex C for sample Scopes of Work

for both. You may also want to set

a modied scope of work for your

staff member leading the self-

assessment so deliverables and

deadlines are clear.

operations (e.g. staff-customer

interactions at the branch level).

During a Smart Assessment, the

assessor will specically hold

interviews with your institutions

leadership, eld and branch ofcers,

and (to the extent possible) clients.

Annex D provides a list of the people

who are usually interviewed during

a Smart Assessment.

A preliminary score will be

chosen for each indicator and

documented in the tool along with

relevant evidence. Evidence must

be comprehensive so that a reader

unfamiliar with the institution

would understand the rationale

behind the score. After all, for

example, if your SPM Director retires,

you want his/her replacement to be

able to review the self-assessment

and understand where things stand

with client protection.

3.3.2

The assessor begins

to prepare the

nal report using

information from

the tool

For a self-assessment, the MFIs

focal point reviews and nalizes

the Summary/GSQ tool with a

nal read-through and by adding

information anywhere that the basis

of the score is not clear. For a Smart

Assessment and an accompanied

self-Assessment, the results from

the tool are presented in a report

based on a template the Smart

Campaign has created (see Annex E).

A Smart Assessment report includes

graphs of scoring, peer comparisons,

recommendations, and all scores.

THE SMART CAMPAIGN 10

3.3.3

The preliminary

results are presented

and discussed

For a self-assessment, your

institutions focal point who

implemented the evaluation will

present results to your management

and can circulate the summary/

GSQ tool for reference. FI staff can

offer insights into scores and provide

additional evidence if they feel a

score is inaccurate. For a Smart

Assessment and an accompanied

self-assessment, the on-site phase

ends with an ofcial closing meeting

and presentation. During an

accompanied self-assessment, once

the tool has been completely lled

out, the institutions point person

will present it to colleagues. For a

Smart Assessment, this meeting

serves a debrieng by the assessor

to the FIs management in order

to review results, including CPP

strengths and weaknesses, and to

discuss recommendations to address

identied weaknesses. The FI has

the opportunity to make the case

for a review of scoring and provide

missing evidence during this

meeting. Further, the assessor will

lead a discussion of potential next

steps and suggestions for initiatives

to take action. The assessor can

also provide advice about how to

plan for and begin an Upgrading

(a project which aims at improving

Client Protection Practices) and what

must be done to attain Certication.

An upgrading project takes place

after an assessment is complete

and involves working with the

Smart Campaign directly to address

gaps in client protection as identied

in the assessment.

3.3.4

The assessor sends the

nal report to you

For a Smart Assessment, after the

closing meeting, once the FI has had

a chance to give nal feedback on

scoring and missing evidence, the

Assessment Report is nalized.

9

This

draft is sent to the Smart Campaign

secretariat for a nal review and

validation. Finally, about four weeks

after the assessment, the assessor

team will provide the FI with the nal

validated report that contains the

Smart Assessors diagnostic ndings

and recommendations for action. The

steps for the report production and

nal submission to you from the MFI

are outlined in Annex F.

Similarly, for an accompanied

self-assessment, the assessor will

produce a 1015-page report that

provides an overview of practices

at the CPP level, and scoring details

for each indicator. Most importantly,

it includes a gap analysis i.e., a

list of indicators that need further

improvement with specic

recommendations for each one.

Wherever possible, recommendations

include links to tools on the Smart

Campaign website, to help FI start

improving practice.

Summary table of MFI and peer

data (1 page)

One paragraph summary of the

ndings for each principle (12 pages)

Graphic results by principle (1 page)

Full scoring table for each indicator

(6 pages)

Gap analysis that provides

recommendations for the indicators

the need improvement. (15 pages)

See the Accompanied Self-

Assessment Report Template at

www.smartcampaign.org/

certication/assessments. FIs

should expect to receive the report

either at the end of the assessment

or at the latest within several

days of completing the assessment.

For a self-assessment, you

can choose how you would like the

nal report to be presented to your

institution by your staff focal person.

For Smart Assessments, please

REMEMBER TO SEND YOUR FINAL

REPORT TO THE SMART CAMPAIGN.

For purposes of tracking client

protection globally and our assessor

performance, we appreciate having

a copy of the report. All reports are

100 percent condential and used

purely for benchmarking purposes.

3.4.5

Evaluate your

assessors

performance

Finally, remember to evaluate your

assessor and assessment experience

using the Assessment Evaluation

Form found in Annex G.

Table 2 provides a summary of

the steps for each type of assessment.

9 This report is organized into two sections.

Part 1 reviews some key contextual elements

relevant to client protection in the country. Part 2

presents a principle-by-principle analysis of key

strengths and areas of improvement, followed by

recommendations, and an action plan. The report

includes graphs depicting percentage of compliance

per principle, followed by an overall gap analysis.

It also shows a list of staff interviewed for the

assessment and documents consulted.

TABLE 2

Main Phases per Assessment Type

PHASE

Get ready:

PREPARATION

Get Set:

DESK REVIEW

Go:

ON SITE AND REPORTING

Self-Assessment

(FI POINT PERSON USING

SUMMARY/GSQ TOOL)

Introductory workshop with

FI staff to explain the process

Set timeframe, organize agenda

Communicate to staff

documents/data needed

Desk review and/or ofce

interviews

Pricing and peer analysis

Check national and sector

information via online searches

Debrieng of ndings to

management, ask for input

Prepare summary report of

strengths, weaknesses and

recommendations (optional

but recommended)

Prepare proposed action and

monitoring plan (optional

but recommended)

Accompanied

Self-Assessment

(FI POINT PERSON WITH 1 ASSESSOR

USING SUMMARY/GSQ OR EXTENDED)

Contact an accredited assessor

to request support

Assessor and FI Focal Point hold

a meeting to discuss objectives,

dene Terms of Reference

10

Provide assessor w/ necessary

materials to start planning,

desk review

Have assessor sign

condentiality agreement

Opening meeting (optional)

Interviews

Pricing and peer analysis

Check national and sector

information via online searches

Field visits (optional for

summary analysis)

Debrieng presentation

by assessor (optional)

Prepare summary report

of strengths, weaknesses

and recommendations

Prepare proposed action

and monitoring plan

Smart Assessment

(2 ASSESSORS USING EXTENDED)

Appoint a focal point

Join virtual meeting to discuss

objectives, preparations,

timeframe, agenda w. assessor

Receive and review agenda,

document and interview

checklist and nancial

indicators from assessor

prior to assessment

Have assessor sign a contract

and condentiality agreement

Assessor does pricing and

peer analysis

Interviews and eld visits

Debrieng presentation

by assessor

Assessor prepares summary

report of strengths, weaknesses

and recommendations

Assessor prepares proposed

action and monitoring plan

Assessor sends report to

Smart for validation if needed

Assessor revises the report

based on Smart comments

Assessor sends the report to

FI for comments

Assessor revises the report

based on FIs comment

10 See Annex 4.

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 11

SECTION

THE SMART CAMPAIGN 12

There are many things you

can do with your assessment results:

1. Use them to inform your

practices and make changes.

Create an action plan to ll the

gaps based on your priority.

2. Communicate your results

An institution can choose to share

its results with external stakeholders

such as the Smart Campaign, donors,

and investors as a signal of further

engagement and commitment to

improve on specic areas.

The full text of the Smart

Assessment belongs to the FI being

assessed, and the institution may

publish it on their websites and/or in

other promotional materials.

If the institution grants permission,

the Smart Campaign will publish a

one-page results summary, giving an

overall result with a brief comment

on each of the seven principles.

3. Secure funding by being

transparent about your gaps

Smart Assessed MFIs could use

their assessment reports to support

requests to investors and donors for

TA and even nancing.

IN THIS SECTION

There are several things an

institution can do to make

the most of results. An

assessment can be used to

inform an action plan directly

from the gap analysis in order

to address weaknesses and

prepare for Upgrading or a

Client Protection Certication.

Additionally, an institution can

share its results with clients,

investors, and peers.

4. Prepare for Certication

(see next page)

5. Brag about your best

practices and help the

Smart Campaign develop

a Smart Note

A Smart Note is a case study or

an example the Smart Campaign

will share of a best practice.

The Smart Campaign can prepare it

about one of your best practices and

publish it with your assistance.

6. Apply for an

Upgrading Project

An upgrading project is one which

aims at improving one or several

Client Protection Practices (see

Annex H for a sample template

for an Upgrading Project).

For example, the Smart Campaign,

worked with the staff at Swadhaar

to create a more active complaint

resolution mechanism by helping to

upgrade its Grievance Policy, revising

the tracker, introducing a tracking

sheet at branch level and ensuring

that staff was trained to register

complaints at branch level. The team

also provided recommendations

and monitored how feedbacks from

tracking system were consolidated

at the MIS Department. As a result

of the upgrade project, Swadhaar

succeeded in making its complaint

resolution mechanism more effective,

clients awareness in pilot branches

increased on how to register their

complaints. And overall there was

rise in the feedbacks from Clients.

The Smart Campaign has resources

for developing an action plan and

identifying the resources and tools

which will assist upgrading. We

recommend you check out the tools

listed in Annex H as a starting point.

Making the

Most of Results

SECTION

A GUIDE TO CLIENT PROTECTION ASSESSMENTS 13

For institutions that have committed

to the Client Protection Principles

and implemented them at their

organization, the Certication

Program is a high-potential next

step. The assessment experience

facilitates attaining Certication.

How does an

assessment prepare

my institution for

Smart Certication?

After an assessment, you are

particularly well placed to prepare

for and eventually pass Certication

because you now know your

strengths and weaknesses and have

recommendations to move you

forward. Smart Certication goes

by the same specic indicators for

each standard as an assessment, but

rather than be scored, it is all pass/

fail. Rather than being done by an

assessor, Certication uses a third-

party evaluation by a rating agency.

Why get certied?

Whereas an assessment helps

you implement client protection,

evaluate your practices, and improve

your business, a Certication is

external facing and enables FIs

to demonstrate adherence to the

Smart Campaigns Client Protection

Principles. It contributes to a more

stable micronance industry by

encouraging practices that aim to

ensure prudent, transparent, and

respectful treatment of clients.

Organizations that fully implement

the standards and pass Certication

will be able to hold themselves out

publicly as Client Protection Certied,

giving a clear signal to all their

stakeholders clients, investors,

regulators, peers, and others that

they treat clients with all the care

implied by the Client Protection

Principles.

IN THIS SECTION

We describe Smart Certication

and make the case for why

your institution should consider

it if you have completed

an assessment.

Going Further

Getting Certied

We engaged in the client protection certication

because we wanted a conrmation from the

international community that we are on the right

track. Achieving the certicate proves that we keep

the promise of protecting our clients. The certication

was a useful learning process.

Nejira Nalic Executive Director of MiBospo, Bosnia

FIGURE 2

The Path to Certication

Endorse the

Client Protection

Principles

Self-Assessment

Not Certication

Ready

Certication

Ready

Certied

Assessment and

Use of Tools

Systematic

Efforts to Upgrade

Practices

Certication

Ready

THE SMART CAMPAIGN 14

Potrebbero piacerti anche

- Smart AccreditationDocumento1 paginaSmart AccreditationSmart CampaignNessuna valutazione finora

- Handbook On Consumer Protection For Financial InclusionDocumento2 pagineHandbook On Consumer Protection For Financial InclusionSmart CampaignNessuna valutazione finora

- Savings Disclosure Key FactsDocumento1 paginaSavings Disclosure Key FactsSmart CampaignNessuna valutazione finora

- What Happens To Microfinance Clients Who DefaultDocumento44 pagineWhat Happens To Microfinance Clients Who DefaultSmart CampaignNessuna valutazione finora

- Smart Campaign Progress Report July 2015Documento16 pagineSmart Campaign Progress Report July 2015Smart CampaignNessuna valutazione finora

- MCWG Key Facts StatementDocumento1 paginaMCWG Key Facts StatementSmart CampaignNessuna valutazione finora

- Guide To Client Protection Assessments RussianDocumento20 pagineGuide To Client Protection Assessments RussianSmart CampaignNessuna valutazione finora

- Collecting Using Exit Data 2014Documento21 pagineCollecting Using Exit Data 2014Smart CampaignNessuna valutazione finora

- MicroNOTE 23 Client Protection - The State of PracticeDocumento16 pagineMicroNOTE 23 Client Protection - The State of PracticeSmart CampaignNessuna valutazione finora

- Mechanisms For Complaints ResolutionDocumento19 pagineMechanisms For Complaints ResolutionSmart Campaign100% (1)

- Client Protection in The Business Correspondent's ModelDocumento19 pagineClient Protection in The Business Correspondent's ModelSmart CampaignNessuna valutazione finora

- Resolving Client Complaints: The Example of Ujjivan, IndiaDocumento19 pagineResolving Client Complaints: The Example of Ujjivan, IndiaSmart Campaign100% (2)

- Training Tool On Data PrivacyDocumento10 pagineTraining Tool On Data PrivacySmart Campaign100% (1)

- Comprehensive List of Tools 2014Documento31 pagineComprehensive List of Tools 2014Smart Campaign50% (2)

- Certification BrochureDocumento4 pagineCertification BrochureSmart CampaignNessuna valutazione finora

- Client Protection For Youth ClientsDocumento14 pagineClient Protection For Youth ClientsSmart CampaignNessuna valutazione finora

- Smart Operations Tool (English)Documento50 pagineSmart Operations Tool (English)Smart Campaign100% (1)

- Smart Lending Member Protection in SHG ManagementDocumento20 pagineSmart Lending Member Protection in SHG ManagementSmart CampaignNessuna valutazione finora

- Implementing Client Protection in Indian Microfinance (State of Practice Report)Documento53 pagineImplementing Client Protection in Indian Microfinance (State of Practice Report)Smart CampaignNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- SpEd 9Documento11 pagineSpEd 9Charina May Lagunde-Sabado100% (1)

- LP July 17-21Documento20 pagineLP July 17-21JeruNessuna valutazione finora

- FS 1 Le10Documento3 pagineFS 1 Le10Jorebell W. QuiminoNessuna valutazione finora

- Customer Service Representative Training ModuleDocumento107 pagineCustomer Service Representative Training ModuleShreevesh Saraswat90% (10)

- MEM 603 MINI Project Assessment - Noriah Sept 2017-Mac2018Documento4 pagineMEM 603 MINI Project Assessment - Noriah Sept 2017-Mac2018Farrina AzizNessuna valutazione finora

- Lesson Plan 2 by LinaDocumento12 pagineLesson Plan 2 by LinaalinasimutNessuna valutazione finora

- Ubd Lesson Plan Template 1Documento6 pagineUbd Lesson Plan Template 1api-533349058Nessuna valutazione finora

- Problem-Based Learning (PBL) What It Is, Principles, and ExamplesDocumento21 pagineProblem-Based Learning (PBL) What It Is, Principles, and ExamplesCeazah Jane Mag-asoNessuna valutazione finora

- Action Research Proposal: Division of Guimaras San Lorenzo National High School-Suclaran AnnexDocumento8 pagineAction Research Proposal: Division of Guimaras San Lorenzo National High School-Suclaran AnnexSheena P. OcoNessuna valutazione finora

- Guide To Starting A PHD - Feldt PDFDocumento21 pagineGuide To Starting A PHD - Feldt PDFnotonectalNessuna valutazione finora

- LetDocumento9 pagineLetDvy D. VargasNessuna valutazione finora

- Mikel Hoffman Field Observation Report Visit 4 5-6-14Documento3 pagineMikel Hoffman Field Observation Report Visit 4 5-6-14api-243298110Nessuna valutazione finora

- Library & Information Science - 4th - Sem - Syllabus PDFDocumento15 pagineLibrary & Information Science - 4th - Sem - Syllabus PDFLibrary & Information ScienceNessuna valutazione finora

- Learning Centres PDFDocumento6 pagineLearning Centres PDFapi-315937410Nessuna valutazione finora

- Janice Hartman - ResumeDocumento3 pagineJanice Hartman - Resumeapi-233466822Nessuna valutazione finora

- Frankenstein Unit PlanDocumento3 pagineFrankenstein Unit PlanKhadra ZeroualiNessuna valutazione finora

- Creative Lesson RedesignDocumento10 pagineCreative Lesson Redesignapi-490031600Nessuna valutazione finora

- CIT 212 NotesDocumento46 pagineCIT 212 NotesKevon Kbulimo100% (1)

- Social 20-2 Unit PlansDocumento18 pagineSocial 20-2 Unit Plansapi-341952960100% (2)

- CMO 98 S. 2017 BS Sanitary EngineeringDocumento133 pagineCMO 98 S. 2017 BS Sanitary EngineeringRAIZZNessuna valutazione finora

- Final Ncate Report 2013 SubmittedDocumento46 pagineFinal Ncate Report 2013 Submittedapi-239913797Nessuna valutazione finora

- Syllabus: Cambridge IGCSE First Language English 0500Documento36 pagineSyllabus: Cambridge IGCSE First Language English 0500Kanika ChawlaNessuna valutazione finora

- Quiz Navigation: /bridgeteflinsider/) /bridgetefl) /bridgetefl/) /User/BridgeteflDocumento7 pagineQuiz Navigation: /bridgeteflinsider/) /bridgetefl) /bridgetefl/) /User/BridgeteflRota Ray100% (1)

- PBL Project Planning Guide Cell MembraneDocumento2 paginePBL Project Planning Guide Cell MembraneJohn OsborneNessuna valutazione finora

- Cadet GuideDocumento17 pagineCadet Guidemaronnam100% (4)

- Activity Plan - The Very Hungry Caterpillar - Preschool PracticumDocumento5 pagineActivity Plan - The Very Hungry Caterpillar - Preschool Practicumapi-491273915Nessuna valutazione finora

- Final Assessment ProjectDocumento43 pagineFinal Assessment ProjectDrew SommerNessuna valutazione finora

- Det Technical Manual CurrentDocumento44 pagineDet Technical Manual CurrenthabibNessuna valutazione finora

- Measuring Violence-Related Attitudes, Behaviors, and Influences Among Youths - Assessment ToolDocumento373 pagineMeasuring Violence-Related Attitudes, Behaviors, and Influences Among Youths - Assessment ToolStacie Martin100% (1)

- Family and Friends 2nd Edition 6 Tests Assesment IntroductionDocumento2 pagineFamily and Friends 2nd Edition 6 Tests Assesment Introductiondime dime100% (1)