Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Executive Summary

Caricato da

Shehbaz HameedDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Executive Summary

Caricato da

Shehbaz HameedCopyright:

Formati disponibili

Executive Summary

This project has been embarked on to apply all the important concept of Managerial Accounting,

and analyze the financial situation of Punjab Oil Mill Limited. The income statement of the years

2011-2013 have been studied and a horizontal and vertical analysis have been conducted of the

income statement and the cost of sales. The Breakeven point has also been determined. Apart

from these the report aims to identify how the concepts of Managerial accounting would benefit

the Firm.

Contents

Punjab oil mills .............................................................................................................................................. 3

Introduction: ................................................................................................................................................. 3

Income Statement Analysis........................................................................................................................... 4

Income Statement .................................................................................................................................... 4

Profitability Ratios ..................................................................................................................................... 4

Vertical Analysis of Income Statement ..................................................................................................... 5

Horizontal analysis of income statement ................................................................................................. 7

Cost of Sales Analysis .................................................................................................................................... 8

Cost of Sales Statement ............................................................................................................................ 8

Horizontal/Vertical Analysis of Cost of Sales ............................................................................................ 9

Punjab oil mills

Introduction:

Punjab Oil Mills Limited is a leading manufacturer of edible oils and fats based in Islamabad,

Pakistan. We make and market a wide range of cooking and baking mediums and other specialty

fats under the flagship brand names of Zaiqa and CanOlive. All our products are prepared under

the strict supervision of qualified professionals to ensure the highest quality standards. We are an

ISO 9001 : 2008 & HACCP certified company and take pride in making products that

consistently exceed customer expectations. As a result the Zaiqa and CanOlive brands enjoy a

valuable brand franchise today and are synonymous with uncompromising quality and constant

innovation. Apart from edible oils we also make a line of laundry soap products marketed under

the brand name of Raja.

Punjab Oil Mills Limited (POML) was founded In 1983 as a manufacturer of Banaspati and

Cooking Oil. Our production facilities were established In Islamabad, Pakistan and commercial

production commenced In 1984. Since then we have greatly expanded our product portfolio by

introducing specialized products to better meet our customers needs. This has been done by

continuously investing in new technology and capital equipment to improve product quality,

reduce costs and expand our production capabilities. Today, apart from our wide range of

Banaspati and Cooking 0il products, we are also producing specialty fats targeted to the baking

and food processing industries, while an ongoing Research and Development process is striving

to come up with new and better products, In addition, as part of our "Transfer Free Initiative", we

have already switched to a Transfat Free formulation for our Banaspati targeted to household

consumers, and are working on providing Transfat Free solutions to our other customers as well.

Income Statement Analysis

Income Statement

Profitability Ratios

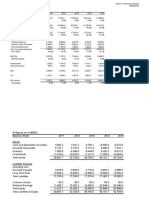

The Gross Profit Margin Ratio of the company remained steady over the course of 2010-2012

however it increases in 2013 primarily due to a jump in the companys Gross profit which

increased by nearly 66.7%. The NP margins do not present a very favorable picture as the ratios

2013 2012 2011 2010

RUPEES RUPEES RUPEES RUPEES

Sales - net 4,525,960,699 4,168,048,880 3,710,266,602 3,018,441,736

Cost of sales 4,120,585,644 3,924,977,126 3,473,834,763 2,837,147,451

Gross profit 405,375,055 243,071,754 236,431,839 181,294,285

Operating expenses

Selling and distribution cost 152,426,296 84,749,722 66,336,186 55,120,077

Administrative expenses 77,760,141 66,060,468 61,621,323 47,973,674

230,186,437 150,810,190 127,957,509 103,093,751

Operating profit 175,188,618 92,261,564 108,474,330 78,200,534

Finance cost 4,321,063 5,010,773 1,892,040 719,488

Other operating charges 12,948,508 6,939,678 8,379,160 6,434,776

17,269,571 11,950,451 10,271,200 7,154,264

157,919,047 80,311,113 98,203,130 71,046,270

Other income 5,296,673 3,027,620 4,298,067 6,073,121

Profit before taxation 163,215,720 83,338,733 102,501,197 77,119,391

Taxation 100,177,604 74,195,902 65,437,264 26,799,599

Profit for the year 63,038,116 9,142,831 37,063,933 50,319,792

Profitability Ratios 2013 2012 2011 2010

GP Margin 9% 6% 6% 6%

NP Margin 1% 0% 1% 2%

are quite low this is primarily due to high level of selling and distribution charges levied on the

companys operating income which in turn is reducing their Net Income.

Vertical Analysis of Income Statement

It shows that cost of sales has been increased over the period of 2011-2013 but the cost of sales

is highest in the year 2012 as compared to other two years that is 94.17%. Increase in cost of

sales is not a good sign for the production of company as it decreases the efficiency in operations

of the company. Other expenses like selling and administrative expenses have also increased

over this period but there is higher increase in selling expenses from 1% to 3% as compared to

administrative expenses. Finance cost has also increased but with the lower amount. So from

2,013 2,012 2,011 2,013 2,012 2,011

RUPEES RUPEES RUPEES Variance % Variance % Variance %

Sales - net 4,525,960,699 4,168,048,880 3,710,266,602 100.00% 100.00% 100.00%

Cost of sales 4,120,585,644 3,924,977,126 3,473,834,763 91.04% 94.17% 93.63%

Gross profit 405,375,055 243,071,754 236,431,839 8.96% 5.83% 6.37%

Operating expenses

Selling and distribution cost 152,426,296 84,749,722 66,336,186 3.37% 2.03% 1.79%

Administrative expenses 77,760,141 66,060,468 61,621,323 1.72% 1.58% 1.66%

230,186,437 150,810,190 127,957,509 5.09% 3.62% 3.45%

Operating profit 175,188,618 92,261,564 108,474,330 3.87% 2.21% 2.92%

Finance cost 4,321,063 5,010,773 1,892,040 0.10% 0.12% 0.05%

Other operating charges 12,948,508 6,939,678 8,379,160 0.29% 0.17% 0.23%

17,269,571 11,950,451 10,271,200 0.38% 0.29% 0.28%

157,919,047 80,311,113 98,203,130 3.49% 1.93% 2.65%

Other income 5,296,673 3,027,620 4,298,067 0.12% 0.07% 0.12%

Profit before taxation 163,215,720 83,338,733 102,501,197 3.61% 2.00% 2.76%

Taxation 100,177,604 74,195,902 65,437,264 2.21% 1.78% 1.76%

Profit for the year 63,038,116 9,142,831 37,063,933 1.39% 0.22% 1.00%

vertical analysis by keeping our sales as base we can see that highest expenditures that we are

facing over the course of three years are from cost of goods sold.

Company can reduce its COGS by different methods.

1. Buy in Larger Quantities When you buy in larger quantities you will often be able to take

advantage of quantity discounts. You may also benefit from shipping discounts

2. Automate

for each job you can replace with a machine, your cost of goods sold will decrease

drastically. Machines dont form unions, they dont go on strike, they dont need health

insurance, and they get to work on time

3. Lock in Long Term Pricing for Raw Materials This is a bit of a risk, but for some

companies this strategy really pays off. The price of a raw material that is core to your business

is poised to increase, you may consider entering into a long term agreement with a supplier.

So by using these methods COGS can be improved and so can be the production efficiency.

Horizontal analysis of income statement:

The company has declined with a negative profit or loss of 240364000 in 2012.

The sales value has been increased from 2010-2013 but the variances show that the sales are

increasing with the smaller volume every next year but the growth rate is still positive. This can

hurt the company as the ultimate goal of any company is to generate higher sales. Talking about

the cost of goods sold they have also increased. Moreover there is so much fluctuation in the

sales that from 2010-2011 company sales has been decreased. There are so many factors that can

cause this decrease in sales one may be the competition that there are other oil companies in the

market that are contributing in this decrease in net sales of Punjab Oil Mills. From 2011-2013

there is a positive trend in net sales that mean company was able to sustain its position and was

able to snatch its market share back from its competitors. Talking about selling and distribution

costs they have increased with a tremendous amount from about from 2012-2013.Their variance

shows the value of about 27.76% to 79.85%. The other expenses have also increased but with the

smaller amount there variance are as follows from 2012-2013 (7.20% - 17.71%)

Financing cost has the increasing trend in first three years but in the last year it has decreased. So

it can be seen that due to increase in cogs there is fluctuating trends in net profit.

2013 2012 2011 2010 2013 2012 2011

RUPEES RUPEES RUPEES RUPEES VARIANCE% VARIANCE% VARIANCE%

Sales - net 4,525,960,699 4,168,048,880 3,710,266,602 3,018,441,736 8.59% 12.34% 22.92%

Cost of sales 4,120,585,644 3,924,977,126 3,473,834,763 2,837,147,451 4.98% 12.99% 22.44%

Gross profit 405,375,055 243,071,754 236,431,839 181,294,285 66.77% 2.81% 30.41%

Operating expenses

Selling and distribution cost 152,426,296 84,749,722 66,336,186 55,120,077 79.85% 27.76% 20.35%

Administrative expenses 77,760,141 66,060,468 61,621,323 47,973,674 17.71% 7.20% 28.45%

230,186,437 150,810,190 127,957,509 103,093,751 52.63% 17.86% 24.12%

Operating profit 175,188,618 92,261,564 108,474,330 78,200,534 89.88% -14.95% 38.71%

Finance cost 4,321,063 5,010,773 1,892,040 719,488 -13.76% 164.83% 162.97%

Other operating charges 12,948,508 6,939,678 8,379,160 6,434,776 86.59% -17.18% 30.22%

17,269,571 11,950,451 10,271,200 7,154,264 44.51% 16.35% 43.57%

157,919,047 80,311,113 98,203,130 71,046,270 96.63% -18.22% 38.22%

Other income 5,296,673 3,027,620 4,298,067 6,073,121 74.95% -29.56% -29.23%

Profit before taxation 163,215,720 83,338,733 102,501,197 77,119,391 95.85% -18.69% 32.91%

Taxation 100,177,604 74,195,902 65,437,264 26,799,599 35.02% 13.38% 144.17%

Profit for the year 63,038,116 9,142,831 37,063,933 50,319,792 589.48% -75.33% -26.34%

Cost of Sales Analysis

Cost of Sales Statement

The cost of sales have generally seen an increasing trend from 2010 to 2013.

2013 2012 2011 2010

RUPEES RUPEES RUPEES RUPEES

Raw material consumed 3,642,232,639 3,491,857,285 3,090,461,402 2530711037

Stores and spare parts consumed 6,540,920 4,659,463 4,056,579 3346911

Chemicals consumed 40,298,495 33,332,968 32,676,677 31251899

Packing materials consumed 261,939,876 223,475,354 217,384,152 201181610

Salaries, wages and benefits 27,614,957 23,512,580 19,573,643 18448336

Power, fuel and lubricants 101,841,432 112,188,701 79,220,767 74633665

Repair and maintenance 4,237,151 4,724,082 4,263,043 3210436

Filling and Loading 8,999,857 4,740,713 5,120,713 5186105

2,633,981 2,399,481 1,746,610 1604437

Depreciation 23,161,491 12,272,115 10,344,136 9650349

4,119,500,799 3,913,162,742 3,464,847,722 2879224785

Work in process:

Opening 27,429,536 35,719,286 32,893,295 20196335

Closing (50,591,382) (27,429,536) (35,719,286) -32893295

(23,161,846) 8,289,750 (2,825,991) -12696960

Cost of goods manufactured 4,096,338,953 3,921,452,492 3,462,021,731 2866527825

Finished goods:

Opening 76,972,990 80,497,624 92,310,656 62930282

Closing (52,726,299) (76,972,990) (80,497,624) -92310656

24,246,691 3,524,634 11,813,032 -29380374

COST OF SALES 4,120,585,644 3,924,977,126 3,473,834,763 2837147451

COST OF SALE

Horizontal/Vertical Analysis of Cost of Sales

The cost of sales of Punjab Oil Mills Limited have been continously increasing since 2012

however this scenario is usually prevalent for majority of the companies due to the increasing

inflation rate in Pakistan and this increase might simply be off-set by the increase in sales of a

compnay. Therefore to analyse deeper in this issue cost of sales were represented as percentage

of sales(Vertical Analysis) and then the true picture emerged because the cost of sales as a

percentage of sales has decreased from 2010 to 2013 from 94% to 91% respectively. This denote

that the production efficiency of Punjab Oil Mills have increased and would in turn translate into

higher profits for the company.

The cost of filling and loading have increased drastically in the year 2013 with a rapid increase

of 90% this is resulting in higher costs for the company. However the inventory management of

Punjab Oil Mills have increased as the opening inventory of finished goods and work in progress

2013 2012 2011 2010 2013 2012 2011

RUPEES RUPEES RUPEES RUPEES

Raw material consumed 3,642,232,639 3,491,857,285 3,090,461,402 2530711037 4% 13% 22%

Stores and spare parts consumed 6,540,920 4,659,463 4,056,579 3346911 40% 15% 21%

Chemicals consumed 40,298,495 33,332,968 32,676,677 31251899 21% 2% 5%

Packing materials consumed 261,939,876 223,475,354 217,384,152 201181610 17% 3% 8%

Salaries, wages and benefits 27,614,957 23,512,580 19,573,643 18448336 17% 20% 6%

Power, fuel and lubricants 101,841,432 112,188,701 79,220,767 74633665 -9% 42% 6%

Repair and maintenance 4,237,151 4,724,082 4,263,043 3210436 -10% 11% 33%

Filling and Loading 8,999,857 4,740,713 5,120,713 5186105 90% -7% -1%

2,633,981 2,399,481 1,746,610 1604437 10% 37% 9%

Depreciation 23,161,491 12,272,115 10,344,136 9650349 89% 19% 7%

4,119,500,799 3,913,162,742 3,464,847,722 2879224785 5% 13% 20%

Work in process:

Opening 27,429,536 35,719,286 32,893,295 20196335 -23% 9% 63%

Closing (50,591,382) (27,429,536) (35,719,286) -32893295 84% -23% 9%

(23,161,846) 8,289,750 (2,825,991) -12696960 -379% -393% -78%

Cost of goods manufactured 4,096,338,953 3,921,452,492 3,462,021,731 2866527825 4% 13% 21%

Finished goods:

Opening 76,972,990 80,497,624 92,310,656 62930282 -4% -13% 47%

Closing (52,726,299) (76,972,990) (80,497,624) -92310656 -32% -4% -13%

24,246,691 3,524,634 11,813,032 -29380374 588% -70% -140%

COST OF SALES 4,120,585,644 3,924,977,126 3,473,834,763 2837147451 5% 13% 22%

COST OF SALE

2013 2013 2012 2012 2011 2011 2010 2010

RUPEES % of Sales RUPEES % of Sales RUPEES % of Sales RUPEES % of Sales

COST OF SALES 4,120,585,644 91% 3,924,977,126 94% 3,473,834,763 94% 2837147451 94%

have decreased and the closing inventories of both work in progress and finished goods have also

increased. This results in lower storage costs and ultimalety lowers the overall costs to some

extent.

Break Even Analysis

TOTAL FIXED COSTS

Fixed Cost 2013 2012 2011

Administration expenses 77,760,141 66,060,468 61,621,323

Finance Cost 4,321,063 5,010,773 1,892,040

Depreciation 2,573,499 1,363,568 1,149,348

Insurance 2,633,981 2,399,481 1,746,610

Salaries, wages and benefits(20%) 5,522,991 4,702,516 3,914,729

SELLING AND DISTRIBUTION COST

Salaries, wages and benefits(20%) 6,491,035 6,598,255 6,368,812

Advertisement 84,948,001 37,409,873 20,932,470

Amortization 7,374,997 1,229,167 -

Other Operating Charges

Auditor Renumeration 655,000 655,000 655,000

Total Fixed Cost 192,280,709 125,429,101 98,280,332

Total Variable Cost Calculation

BREAKEVEN 2013 2012 2011

C.M% 6% 3% 4%

Breakeven Sales 3,215,899,149 3,669,948,274 2,600,140,258

Variable Cost 2013 2012 2011

Income tax expense 100,177,604 74,195,902 65,437,264

Cost of Sales component

Raw material consumed 3,642,232,639 3,491,857,285 3,090,461,402

Stores and spare parts consumed 6,540,920 4,659,463 4,056,579

Chemicals consumed 40,298,495 33,332,968 32,676,677

Packing materials consumed 261,939,876 223,475,354 217,384,152

Salaries, wages and benefits 22,091,966 18,810,064 15,658,914

Power, fuel and lubricants 101,841,432 112,188,701 79,220,767

Repair and maintenance 4,237,151 4,724,082 4,263,043

Filling and Loading 8,999,857 4,740,713 5,120,713

Work In Process

Opening 27,429,536 35,719,286 32,893,295

closing (50,591,382) (27,429,536) (35,719,286)

Opening Finished goods 76,972,990 80,497,624 92,310,656

closing finished goods (52,726,299) (76,972,990) (80,497,624)

SELLING AND DISTRIBUTION COST

Salaries, wages and benefits(80%) 25,964,142 26,393,021 25,475,250

Travelling and conveyance 2,091,464 1,928,188 2,014,256

Carriage outward 25,556,657 11,191,218 11,545,398

Other Expenses

Workers' profit participation fund 8,783,323 4,492,210 5,519,653

Workers' welfare fund 3,510,185 1,792,468 2,204,507

TOTAL VARIABLE COST 4,255,350,555 4,025,596,021 3,570,025,616

CONTRIBUTION MARGIN 2013 2012 2011

C.M% 6% 3% 4%

SALES 2013 2012 2011

NET SALES 4,525,960,699 4,168,048,880 3,710,266,602

Potrebbero piacerti anche

- A1.2 Roic TreeDocumento9 pagineA1.2 Roic TreemonemNessuna valutazione finora

- Coffee Shop - Industry ReportsDocumento17 pagineCoffee Shop - Industry ReportsCristina Garza0% (1)

- 17020841116Documento13 pagine17020841116Khushboo RajNessuna valutazione finora

- Robusta Coffee Shop - A Feasibility StudyDocumento26 pagineRobusta Coffee Shop - A Feasibility StudyLeonard Salonga57% (23)

- Financial Statement Analysis of Samsung ElectronicsDocumento19 pagineFinancial Statement Analysis of Samsung ElectronicsSangita GautamNessuna valutazione finora

- Heritage CaseDocumento3 pagineHeritage CaseGregory ChengNessuna valutazione finora

- Project Report (JK Paper LTD)Documento92 pagineProject Report (JK Paper LTD)Tmesibmcs Mandvi56% (9)

- NINSIIMA MABLE Final Project Report MBADocumento75 pagineNINSIIMA MABLE Final Project Report MBAkeisha babyNessuna valutazione finora

- SMC's Future Hinges on Strategic Marketing DecisionsDocumento10 pagineSMC's Future Hinges on Strategic Marketing Decisionsmotor121212Nessuna valutazione finora

- CHAPTER 12 - Interim Financial ReportingDocumento47 pagineCHAPTER 12 - Interim Financial ReportingChristian Gatchalian100% (1)

- University of Kelaniya: Higher Diploma in BusinessDocumento17 pagineUniversity of Kelaniya: Higher Diploma in BusinessMohamed Ashraff Mohamed HakeemNessuna valutazione finora

- Cafe - Industry ReportsDocumento17 pagineCafe - Industry ReportsCristina GarzaNessuna valutazione finora

- Introduction of MTM: StatementDocumento23 pagineIntroduction of MTM: StatementALI SHER HaidriNessuna valutazione finora

- Group Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDDocumento16 pagineGroup Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDTamim ChowdhuryNessuna valutazione finora

- General Insurance Corporation of IndiaDocumento6 pagineGeneral Insurance Corporation of IndiaGukan VenkatNessuna valutazione finora

- Xyz Company: Profit and Loss Account For The Year EndedDocumento19 pagineXyz Company: Profit and Loss Account For The Year EndedYaswanth MaripiNessuna valutazione finora

- Industry Financial Report: Release Date: December 2016Documento17 pagineIndustry Financial Report: Release Date: December 2016Iqra JawedNessuna valutazione finora

- Learning Competencies: Let's Recall (Review)Documento7 pagineLearning Competencies: Let's Recall (Review)hiNessuna valutazione finora

- KUANGLU RESTAURANT , BUSINESS PLANDocumento10 pagineKUANGLU RESTAURANT , BUSINESS PLANDonjulie HoveNessuna valutazione finora

- Wipro's Financial Performance Over 5 YearsDocumento9 pagineWipro's Financial Performance Over 5 Yearshitesh rathodNessuna valutazione finora

- Analisis Laporan KeuanganDocumento30 pagineAnalisis Laporan KeuanganDedi SutrisnaNessuna valutazione finora

- EVA ExampleDocumento27 pagineEVA Examplewelcome2jungleNessuna valutazione finora

- Group 2 - VNM - Ver1Documento11 pagineGroup 2 - VNM - Ver1Ánh Lê QuỳnhNessuna valutazione finora

- Managerial Accounting FiDocumento32 pagineManagerial Accounting FiJo Segismundo-JiaoNessuna valutazione finora

- Suzuki Ibf ReportDocumento30 pagineSuzuki Ibf ReportSyed Usarim Ali ShahNessuna valutazione finora

- Atlas Exports Limited FinalDocumento22 pagineAtlas Exports Limited FinalKinza AsimNessuna valutazione finora

- EDGR Audited Results For The 52 Weeks To 04 Jan 14Documento1 paginaEDGR Audited Results For The 52 Weeks To 04 Jan 14Business Daily ZimbabweNessuna valutazione finora

- GTR TyreDocumento3 pagineGTR TyreABUBAKAR FawadNessuna valutazione finora

- Aisha Final Enterpreneurship ReportDocumento6 pagineAisha Final Enterpreneurship Reportaisha malikNessuna valutazione finora

- Financial Statement PresentationDocumento17 pagineFinancial Statement PresentationAbdul RehmanNessuna valutazione finora

- Financial Accounting - Term Project: ROA, ROC, Inventory TurnoverDocumento9 pagineFinancial Accounting - Term Project: ROA, ROC, Inventory TurnoverNiraj ThakurNessuna valutazione finora

- Financial Analysis of Lucky Cement LTD For The Year 2013Documento11 pagineFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErNessuna valutazione finora

- Confidence Cement sales growth and profit over timeDocumento20 pagineConfidence Cement sales growth and profit over timeIftekar Hasan SajibNessuna valutazione finora

- Group 2 RSRMDocumento13 pagineGroup 2 RSRMAbid Hasan RomanNessuna valutazione finora

- Financial Statement Analysis - Dabur India LTDDocumento17 pagineFinancial Statement Analysis - Dabur India LTDVishranth Chandrashekar100% (1)

- HABT Model 5Documento20 pagineHABT Model 5Naman PriyadarshiNessuna valutazione finora

- New ExcelDocumento25 pagineNew Excelred8blue8Nessuna valutazione finora

- Bright Packaging Industry Berand Income Statement Analysis 2015-2016Documento2 pagineBright Packaging Industry Berand Income Statement Analysis 2015-2016Joanna JacksonNessuna valutazione finora

- Acc105 CaDocumento12 pagineAcc105 CaAaryan DwivediNessuna valutazione finora

- REF: Year-End 31 December 2018 Financial Performance and Financial Position Analysis of Zambia BreweriesDocumento8 pagineREF: Year-End 31 December 2018 Financial Performance and Financial Position Analysis of Zambia BreweriesMubanga kanyantaNessuna valutazione finora

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Documento11 pagineProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNessuna valutazione finora

- M Saeed 20-26 ProjectDocumento30 pagineM Saeed 20-26 ProjectMohammed Saeed 20-26Nessuna valutazione finora

- PTC and Phillip Morris Financial AnalysisDocumento15 paginePTC and Phillip Morris Financial AnalysisYasir Saeed100% (1)

- Vertical Analysis FS Shell PHDocumento5 pagineVertical Analysis FS Shell PHArjeune Victoria BulaonNessuna valutazione finora

- BSBFIM601___Task_1.docxDocumento10 pagineBSBFIM601___Task_1.docxKitpipoj PornnongsaenNessuna valutazione finora

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocumento12 pagineIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNessuna valutazione finora

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDocumento12 pagineIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNessuna valutazione finora

- FHA JolibeeDocumento1 paginaFHA JolibeebenedickNessuna valutazione finora

- Shoppers Stop 4qfy11 Results UpdateDocumento5 pagineShoppers Stop 4qfy11 Results UpdateSuresh KumarNessuna valutazione finora

- Task 1 Finance ManagementDocumento17 pagineTask 1 Finance Managementraj ramukNessuna valutazione finora

- MS7SL800 - Assignment - 1 - UniliverDocumento23 pagineMS7SL800 - Assignment - 1 - UniliverDaniel AjanthanNessuna valutazione finora

- PUREGOLD PRICE CLUB INC FINANCIAL STATEMENT ANALYSISDocumento90 paginePUREGOLD PRICE CLUB INC FINANCIAL STATEMENT ANALYSISHanz SoNessuna valutazione finora

- FSADocumento4 pagineFSAAreeba AslamNessuna valutazione finora

- Financial Statements Analysis: Arsalan FarooqueDocumento31 pagineFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNessuna valutazione finora

- Al-Ghazi Tractors Ltd (AGTL) Balance Sheet and Financial Ratios AnalysisDocumento13 pagineAl-Ghazi Tractors Ltd (AGTL) Balance Sheet and Financial Ratios AnalysisM.ShahnamNessuna valutazione finora

- Financial Statement AnalysisDocumento4 pagineFinancial Statement AnalysisUmer Farooq MirzaNessuna valutazione finora

- Financial Analysis of Trusted Health Services Private LimitedDocumento12 pagineFinancial Analysis of Trusted Health Services Private LimitedAnoop KumarNessuna valutazione finora

- Financial Results Up To DateDocumento24 pagineFinancial Results Up To DateWilliam HernandezNessuna valutazione finora

- Finance Profit & Loss HDFC Bank LTD: Year 2021 2020 2019 2018 IncomeDocumento12 pagineFinance Profit & Loss HDFC Bank LTD: Year 2021 2020 2019 2018 IncomeYash SinghalNessuna valutazione finora

- Análisis Caso New Heritage - Nutresa LinaDocumento27 pagineAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONessuna valutazione finora

- SWOT of EIH Ltd.Documento13 pagineSWOT of EIH Ltd.Sahil AhammedNessuna valutazione finora

- India Infoline Q2 Results 2005Documento6 pagineIndia Infoline Q2 Results 2005Shatheesh LingamNessuna valutazione finora

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerDa EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNessuna valutazione finora

- Profit Building: Cutting Costs Without Cutting PeopleDa EverandProfit Building: Cutting Costs Without Cutting PeopleValutazione: 4 su 5 stelle4/5 (1)

- Mastering Operational Performance : The Ultimate KPI HandbookDa EverandMastering Operational Performance : The Ultimate KPI HandbookNessuna valutazione finora

- Final Questionnaire VoiceDocumento3 pagineFinal Questionnaire VoiceShehbaz HameedNessuna valutazione finora

- Punjab Oil Mills LTD - Manufacturer To DistributorDocumento4 paginePunjab Oil Mills LTD - Manufacturer To DistributorShehbaz HameedNessuna valutazione finora

- Ardl Estimates: Long Run CoefficientsDocumento2 pagineArdl Estimates: Long Run CoefficientsShehbaz HameedNessuna valutazione finora

- Mediquip SDocumento5 pagineMediquip SShehbaz Hameed0% (1)

- Assignment 2 MotivationDocumento1 paginaAssignment 2 MotivationShehbaz HameedNessuna valutazione finora

- Lec 10 Forecasting and Its Limitations EditedDocumento7 pagineLec 10 Forecasting and Its Limitations EditedShehbaz HameedNessuna valutazione finora

- Internship Report On: Financial Analysis of KDS Accessories LimitedDocumento50 pagineInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNessuna valutazione finora

- Implementing Lean in Aerospace - Challenging The ADocumento13 pagineImplementing Lean in Aerospace - Challenging The AMohammed Yassin ChampionNessuna valutazione finora

- Session 15 Hand OutDocumento54 pagineSession 15 Hand OutRashi ChoudharyNessuna valutazione finora

- Inventory System DesignDocumento3 pagineInventory System Designbua bobsonNessuna valutazione finora

- 15 KRM Om10 Tif ch12Documento35 pagine15 KRM Om10 Tif ch12Dingyuan OngNessuna valutazione finora

- The Fundamentals of CostingDocumento13 pagineThe Fundamentals of Costingmy tràNessuna valutazione finora

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Documento10 pagineACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- AIS Week 5 QuizDocumento2 pagineAIS Week 5 QuizMarvina Paula Vierneza LayuganNessuna valutazione finora

- Ra 9165 LectureDocumento26 pagineRa 9165 LectureJanetGraceDalisayFabrero100% (1)

- Annex F - SOP For Warehouse and Inventory Management in UNHCRDocumento38 pagineAnnex F - SOP For Warehouse and Inventory Management in UNHCRWilliam LeungNessuna valutazione finora

- Week 5 Tutorial Solutions for Unit 4 Costing MethodsDocumento10 pagineWeek 5 Tutorial Solutions for Unit 4 Costing MethodsSheenam SinghNessuna valutazione finora

- Retail Team Resumes Visualcv ResumeDocumento1 paginaRetail Team Resumes Visualcv ResumeAbhishek GuptaNessuna valutazione finora

- Working Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerDocumento83 pagineWorking Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerPranay Jindal71% (7)

- Role of Inventory Management On Company's Profitability: by Faizan Pervaiz 2142106Documento72 pagineRole of Inventory Management On Company's Profitability: by Faizan Pervaiz 2142106Muhammad HamzaNessuna valutazione finora

- Chapter 19Documento51 pagineChapter 19Yasir MehmoodNessuna valutazione finora

- Production Planning and Execution (PP) : © Sap AgDocumento55 pagineProduction Planning and Execution (PP) : © Sap AgSatishKumarChowdary100% (1)

- Odoo Documentation: Inventory Module GuideDocumento171 pagineOdoo Documentation: Inventory Module GuidePetrus Idi DarmonoNessuna valutazione finora

- 3.7 Logistics Execution PDFDocumento11 pagine3.7 Logistics Execution PDFIndian Chemistry100% (1)

- P1 May 2010 Answers + Brief GuideDocumento12 pagineP1 May 2010 Answers + Brief GuidemavkaziNessuna valutazione finora

- Impor 2014Documento151 pagineImpor 2014SoùFian AitNessuna valutazione finora

- Eco-10 em PDFDocumento11 pagineEco-10 em PDFAnilLalvaniNessuna valutazione finora

- 74938bos60526 cp5Documento36 pagine74938bos60526 cp5Deshu MittalNessuna valutazione finora

- Inventory transactions tablesDocumento6 pagineInventory transactions tablesangra11Nessuna valutazione finora

- Secondary Tools in Lean ManufacturingDocumento26 pagineSecondary Tools in Lean ManufacturingAshishBohraNessuna valutazione finora

- The Case of ButterflyDocumento2 pagineThe Case of ButterflyNiranjan ParkhiNessuna valutazione finora