Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

210427429-Nego - pdf12345 (Dragged) 1

Caricato da

Christian Lemuel Tangunan Tan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 paginarqqer

Titolo originale

210427429-Nego.pdf12345 (dragged) 1

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentorqqer

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 pagina210427429-Nego - pdf12345 (Dragged) 1

Caricato da

Christian Lemuel Tangunan Tanrqqer

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

NEGOTIABLE INSTRUMENTS NOTES

BASED ON AGBAYANIS BOOK AND ATTY. MERCADOS LECTURES

Page 188 of 190

BY: MA. ANGELA LEONOR C. AGUINALDO

ATENEO LAW 2D BATCH 2010

! As stated, Under banking laws and practices, by the certification, the

funds represented by the check were transferred from the credit of the

maker to that of the payee or holder, and for all intents and purposes,

the latter became the depositor of the bank, with rights and duties of

one in such relation. But the transfer of the corresponding funds from

the credit of the depositor to that of the payee had to be co-extensive

with the life of the checks, which in this case was 90 days. If the

checks were not presented for payment within that period they

became invalid and the funds were automatically restored to the credit

of the drawer though not as a current deposit but as special deposit.

UNCERTIFIED CHECK IS NOT AN ASSIGNMENT OF FUNDS

! A check of itself is not an assignment of the funds of the drawer in the

bank

! A general deposit in the bank is so much money to the depositors

credit. It is a debt to him by the bank, payable on demand to his

order, not property capable of identification and specific appropriation.

A check drawn upon the bank in usual form, not accepted or certified

by its cashier to be good, doesnt constitute transfer of any money to

the credit of the holder. It is simply an order which may be

countermanded and payment forbidden by the drawer at any time

before it is actually cashed. It creates no lien on the money which the

holder can enforce against the bank. It doesnt of itself operate as an

equitable assignment.

DRAWEE BANK NOT LIABLE TO HOLDER ON CHECK UNLESS ACCEPTED OR

CERTIFIED

! Before acceptance or certification, the bank isnt liable and the holder

has no right to sue the drawee bank on the check

! On this question, we conclude that the general rule is that an action

cannot be maintained by the payee of the check against the bank on

which it is drawn, unless the check has been certified or accepted by

the bank in compliance with the statute, even though at the time the

check is that an action cannot be maintained by the payee of the

drawer of the check out of which the check is legally payable; and that

the payment of the check by the bank on which it is drawn, even

though paid on the unauthorized indorsement of the name of the

holder; doesnt constitute as certification thereof, neither is it an

acceptance thereof; and without acceptance or certification, as

provided by statute, there is no privity of contract between the drawee

bank and the payee, or the holder of the check. Neither is there

assignment of the funds where the check isnt drawn on a particular

fund, or doesnt show on its face that it is an assignment of a

particular fund.

SUMMARY OF RIGHTS AND LIABILITIES OF PARTIES

1. The holder has no action against it as a check is not in itself an

assignment of funds of the drawer in the hands of the drawee

bank, and the drawee bank isnt liable on the check until it has

accepted or certified it

2. Neither has the holder a right of action against the drawer where

the drawee bank refuses to accept or certify the check but he has

a right of action against the drawer where the drawee bank

refuses to pay

3. And while the holder has no right of action against the drawee

bank which refuses to pay, accept or certify the check, the drawer

has a right of action against the drawee bank so refusing. Such

right of action, however, isnt based on the check drawn but on

the original contract of deposit between them

DUTY OF DEPOSITOR TO BANK

! Where a drawer of a check has prepared his check so negligentlythat it

can be altered easily without giving the instrument a suspicious

appearance and alterations are afterwards made, he cannot blame

anyone but himself and in such case, he cannot hold the bank liable

for the consequences of his own negligence in the respect

! But negligence of depositor in drawing a check will not excuse the

paying bank unless it is misled by such negligent act, and if the drawer

of a check is first in fault and if his negligence contributes directly to

its wrongful and fraudulent appropriation, he isnt entitled to recover

DUTY OF DEPOSITOR WHERE PASSBOOK RETURNED TO HIM

! It is his duty to examine such checks within a reasonable time and if

they disclose forgeries or alterations, to report them to the bank,

dispute the correctness of payments thereafter made by it on similar

checks.

! This rule assumes that the bank itself hasnt been guilty of negligence

in making the payment for when, by the exercise of proper case, it

could have discovered the alteration of forgery, it must bear the loss

notwithstanding that the depositor failed in his duty to examine the

accounts

STOPPING PAYMENT

! As a check is itself doesnt operate as an assignment of funds to the

credit of the drawer, the latter may countermand payment before its

acceptance or certification.

! The order to stop payment must be communicated to the bank before

the check to which it refers has been paid; and in the absence of this

Potrebbero piacerti anche

- Certified Cheque and Cashier ChequeDocumento2 pagineCertified Cheque and Cashier ChequeS K MahapatraNessuna valutazione finora

- Kinds of ChequesDocumento6 pagineKinds of ChequesRae De CastroNessuna valutazione finora

- Law of Negligence PDFDocumento122 pagineLaw of Negligence PDFRamesh Babu TatapudiNessuna valutazione finora

- Quamto Civil Law 2017Documento108 pagineQuamto Civil Law 2017Glomarie Gonayon90% (21)

- 210427429-Nego - pdf12345 (Dragged) 5Documento1 pagina210427429-Nego - pdf12345 (Dragged) 5Christian Lemuel Tangunan TanNessuna valutazione finora

- CHEQUESDocumento3 pagineCHEQUESAmbrose YollahNessuna valutazione finora

- Check, DefinedDocumento17 pagineCheck, DefinedMykee NavalNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 2Documento1 pagina210427429-Nego - pdf12345 (Dragged) 2Christian Lemuel Tangunan TanNessuna valutazione finora

- Gempesaw V CADocumento3 pagineGempesaw V CAChil BelgiraNessuna valutazione finora

- Bouncing Checks Law: June 29, 1979Documento40 pagineBouncing Checks Law: June 29, 1979Anabel Lajara AngelesNessuna valutazione finora

- Negotiable InstrumentsDocumento7 pagineNegotiable InstrumentsClaudine SumalinogNessuna valutazione finora

- Banking Chapter FourDocumento13 pagineBanking Chapter FourfikremariamNessuna valutazione finora

- Kinds of Cheques: Cabigting, Maria Queenie Lilirae Purzuelo, DanielleDocumento51 pagineKinds of Cheques: Cabigting, Maria Queenie Lilirae Purzuelo, DanielleRae De CastroNessuna valutazione finora

- Collection of ChequesDocumento5 pagineCollection of ChequesArshdeep KaurNessuna valutazione finora

- Westmont Bank V. OngDocumento3 pagineWestmont Bank V. OngJames WilliamNessuna valutazione finora

- Gempesaw v. CA Case DigestDocumento4 pagineGempesaw v. CA Case DigestKian FajardoNessuna valutazione finora

- TPB - Module 4 - Reference MaterialDocumento8 pagineTPB - Module 4 - Reference MaterialSupreethaNessuna valutazione finora

- Cheques in Negotiable InstrumentsDocumento7 pagineCheques in Negotiable InstrumentsAkello Winnie princesNessuna valutazione finora

- Cheques and BankingDocumento18 pagineCheques and BankingTomSeddyNessuna valutazione finora

- Nego Cases DigestedDocumento82 pagineNego Cases DigestedMark AnthonyNessuna valutazione finora

- Paying and Collecting BankerDocumento12 paginePaying and Collecting BankerartiNessuna valutazione finora

- Associated Bank vs. CADocumento4 pagineAssociated Bank vs. CAMaster GanNessuna valutazione finora

- Crossing of Cheques BLDocumento27 pagineCrossing of Cheques BLVikash kumarNessuna valutazione finora

- Nego Finals DoctrinesDocumento4 pagineNego Finals DoctrinesejNessuna valutazione finora

- PNB V National City Bank of New YorkDocumento3 paginePNB V National City Bank of New Yorkmma100% (1)

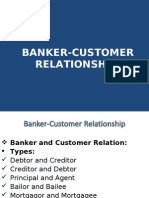

- Banker Customer RelationDocumento8 pagineBanker Customer RelationVIKASH KUMAR BAIRAGINessuna valutazione finora

- Digest NegoDocumento16 pagineDigest Negoiceiceice023Nessuna valutazione finora

- Associated Bank vs. CA, Province of Tarlac and PNB: RD THDocumento10 pagineAssociated Bank vs. CA, Province of Tarlac and PNB: RD THJoshua AmancioNessuna valutazione finora

- Cheque Paying and Collecting BankDocumento5 pagineCheque Paying and Collecting BankSyed RedwanNessuna valutazione finora

- Nego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheDocumento8 pagineNego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheKarla BeeNessuna valutazione finora

- Duties and Obligations of Paying Bankers and Collecting BankersDocumento27 pagineDuties and Obligations of Paying Bankers and Collecting Bankersrajin_rammstein70% (10)

- Gempesaw V CADocumento2 pagineGempesaw V CARubyNessuna valutazione finora

- The International Corporate Bank Vs Sps Gueco DigestDocumento1 paginaThe International Corporate Bank Vs Sps Gueco DigestcolleenNessuna valutazione finora

- Banking Law 1Documento21 pagineBanking Law 1MAYANK GUPTANessuna valutazione finora

- 0306 Collection of ChequesDocumento17 pagine0306 Collection of ChequesJitendra Virahyas100% (1)

- Topic: The Holder of A Manager'S / Cashier'S Check Is Still Subject To DefensesDocumento3 pagineTopic: The Holder of A Manager'S / Cashier'S Check Is Still Subject To DefensesKythkatNessuna valutazione finora

- Collection of ChequeDocumento3 pagineCollection of Chequevijay8484Nessuna valutazione finora

- NIL 77-109jhjDocumento39 pagineNIL 77-109jhjBenedict AlvarezNessuna valutazione finora

- NIL - Chapter 10 - ChecksDocumento11 pagineNIL - Chapter 10 - ChecksElaine Dianne Laig SamonteNessuna valutazione finora

- BP 22Documento29 pagineBP 22Jutajero, Camille Ann M.Nessuna valutazione finora

- Banking Operations: Cheques & EndorsementsDocumento12 pagineBanking Operations: Cheques & EndorsementsSharath SaunshiNessuna valutazione finora

- Notes On Negotiable Instruments 05Documento2 pagineNotes On Negotiable Instruments 05Roni MangalusNessuna valutazione finora

- PUP Banking LawsDocumento57 paginePUP Banking LawsCharsen MagallonesNessuna valutazione finora

- Digest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsDocumento2 pagineDigest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsMarj CenNessuna valutazione finora

- Banker CustomerDocumento38 pagineBanker CustomerUmer ChaudharyNessuna valutazione finora

- Westmont Bank V OngDocumento4 pagineWestmont Bank V Ongmodernelizabennet100% (4)

- Nil - Bar Lecture.2019Documento20 pagineNil - Bar Lecture.2019John SanchezNessuna valutazione finora

- Gempesaw V CaDocumento2 pagineGempesaw V Caבנדר-עלי אימאם טינגאו בתולהNessuna valutazione finora

- Banco de Oro vs. Equitable Banking Corp. 157 SCRA 188, Jan. 20, 1988Documento1 paginaBanco de Oro vs. Equitable Banking Corp. 157 SCRA 188, Jan. 20, 1988David Lawrenz SamonteNessuna valutazione finora

- Negotiable InstrumentDocumento27 pagineNegotiable InstrumentKhurshid KhanNessuna valutazione finora

- Welcome To My Presentation: Presented by Saimom Mostafa 19 FIN 061Documento18 pagineWelcome To My Presentation: Presented by Saimom Mostafa 19 FIN 061Saimom Mostafa EmonNessuna valutazione finora

- CaseDocumento2 pagineCasetheamerNessuna valutazione finora

- Banker Customer RelationshipDocumento7 pagineBanker Customer RelationshipJitendra VirahyasNessuna valutazione finora

- Ramon D. Villanueva Jr. Jd-2BDocumento6 pagineRamon D. Villanueva Jr. Jd-2BJean Jamailah TomugdanNessuna valutazione finora

- Banker CustomerDocumento4 pagineBanker CustomerM KashifNessuna valutazione finora

- 252 Scra 620Documento5 pagine252 Scra 620Jan MadejaNessuna valutazione finora

- BP 22 Nego NotesDocumento5 pagineBP 22 Nego NotesAnna Lesava100% (2)

- Westmont Bank V. Eugene Ong FactsDocumento18 pagineWestmont Bank V. Eugene Ong FactsJasmin CuliananNessuna valutazione finora

- Natividad Gempesaw v. CADocumento16 pagineNatividad Gempesaw v. CALouvanne Jessa Orzales BesingaNessuna valutazione finora

- Group 5 Set B HandoutsDocumento4 pagineGroup 5 Set B HandoutsMaria Nova MosiclarNessuna valutazione finora

- Bouncing Checks and Insurance LawDocumento7 pagineBouncing Checks and Insurance Lawiveyzel quitanNessuna valutazione finora

- TheDocumento1 paginaTheChristian Lemuel Tangunan TanNessuna valutazione finora

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 183 of 190Documento1 paginaNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 183 of 190Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 25Documento1 pagina210427429-Nego - pdf12345 (Dragged) 25Christian Lemuel Tangunan TanNessuna valutazione finora

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Documento1 paginaNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 6Documento1 pagina210427429-Nego - pdf12345 (Dragged) 6Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 7Documento1 pagina210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 8Documento1 pagina210427429-Nego - pdf12345 (Dragged) 8Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 8Documento1 pagina210427429-Nego - pdf12345 (Dragged) 8Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 4Documento1 pagina210427429-Nego - pdf12345 (Dragged) 4Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 7Documento1 pagina210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 7Documento1 pagina210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 3Documento1 pagina210427429-Nego - pdf12345 (Dragged) 3Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 28Documento1 pagina210427429-Nego - pdf12345 (Dragged) 28Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 26Documento1 pagina210427429-Nego - pdf12345 (Dragged) 26Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 30Documento1 pagina210427429-Nego - pdf12345 (Dragged) 30Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 33Documento1 pagina210427429-Nego - pdf12345 (Dragged) 33Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 31Documento1 pagina210427429-Nego - pdf12345 (Dragged) 31Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 27Documento1 pagina210427429-Nego - pdf12345 (Dragged) 27Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 22Documento1 pagina210427429-Nego - pdf12345 (Dragged) 22Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 25Documento1 pagina210427429-Nego - pdf12345 (Dragged) 25Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 24Documento1 pagina210427429-Nego - pdf12345 (Dragged) 24Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 20Documento1 pagina210427429-Nego - pdf12345 (Dragged) 20Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 18Documento1 pagina210427429-Nego - pdf12345 (Dragged) 18Christian Lemuel Tangunan TanNessuna valutazione finora

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 98 of 190Documento1 paginaNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 98 of 190Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 19Documento1 pagina210427429-Nego - pdf12345 (Dragged) 19Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 17Documento1 pagina210427429-Nego - pdf12345 (Dragged) 17Christian Lemuel Tangunan TanNessuna valutazione finora

- 210427429-Nego - pdf12345 (Dragged) 16Documento1 pagina210427429-Nego - pdf12345 (Dragged) 16Christian Lemuel Tangunan TanNessuna valutazione finora

- Agreement: at - Along With Fixtures and Fittings (HereinafterDocumento5 pagineAgreement: at - Along With Fixtures and Fittings (HereinafterNikhil PomalNessuna valutazione finora

- The Family Code of The PhilippinesDocumento3 pagineThe Family Code of The Philippinesgcaragan_makaniNessuna valutazione finora

- GLIBLCH1ShearmanSterling 2Documento17 pagineGLIBLCH1ShearmanSterling 2Nattapong POkpaNessuna valutazione finora

- Nicxon Perez v. Avegail Perez-SenerpidaDocumento2 pagineNicxon Perez v. Avegail Perez-SenerpidaSheryll Aleth BaccayNessuna valutazione finora

- EbscohostDocumento100 pagineEbscohostMuhammad NizarNessuna valutazione finora

- How To Compute Separation Pay in The PhilippinesDocumento6 pagineHow To Compute Separation Pay in The Philippinesronaldodigma0% (1)

- LBP Vs Chico - Just CompensationDocumento2 pagineLBP Vs Chico - Just CompensationRogelio Rubellano IIINessuna valutazione finora

- 1.sutton Vs Lim - G.R.no.191660Documento5 pagine1.sutton Vs Lim - G.R.no.191660patricia.aniyaNessuna valutazione finora

- Property and Casualty InsuranceDocumento2 pagineProperty and Casualty InsuranceGene'sNessuna valutazione finora

- Lecture6 - RPGT Class Exercise QDocumento4 pagineLecture6 - RPGT Class Exercise QpremsuwaatiiNessuna valutazione finora

- Core Text by GilikerDocumento1.326 pagineCore Text by Gilikersaad.makhdoomofficialNessuna valutazione finora

- Revised Deed of SaleDocumento2 pagineRevised Deed of Salejethro chanNessuna valutazione finora

- Ching vs. Bantolo, G.R. No. 177086 - Case Digest (Contract of Agency Coupled With Interest)Documento2 pagineChing vs. Bantolo, G.R. No. 177086 - Case Digest (Contract of Agency Coupled With Interest)Alena Icao-AnotadoNessuna valutazione finora

- USJR - Provrem - Support (2017) EDocumento27 pagineUSJR - Provrem - Support (2017) EPeter AllanNessuna valutazione finora

- Corporate & Business LawDocumento9 pagineCorporate & Business LawJaveria MahamNessuna valutazione finora

- WPM v. LabayenDocumento2 pagineWPM v. LabayenVanya Klarika Nuque100% (4)

- Estrellado vs. Judge of MTCC 3Documento2 pagineEstrellado vs. Judge of MTCC 3Harry Dave Ocampo PagaoaNessuna valutazione finora

- Form 30Documento2 pagineForm 30SAROJ KUMAR PAIKARAYNessuna valutazione finora

- Transfer of Title by A Non-Owner (Nemo Dat)Documento9 pagineTransfer of Title by A Non-Owner (Nemo Dat)Dennis GreenNessuna valutazione finora

- EPO Proceeding FormsDocumento82 pagineEPO Proceeding FormsOla SvenssonNessuna valutazione finora

- This Content Downloaded From 15.206.238.150 On Thu, 22 Jul 2021 06:26:05 UTCDocumento24 pagineThis Content Downloaded From 15.206.238.150 On Thu, 22 Jul 2021 06:26:05 UTCaryan sharmaNessuna valutazione finora

- 13 - Sample Circular Resolution - Section 289Documento3 pagine13 - Sample Circular Resolution - Section 289Khalid MahmoodNessuna valutazione finora

- MBF Mid ExamDocumento3 pagineMBF Mid ExamEfrem Wondale100% (2)

- PEB Foundation Certificate Trade Mark Law FC5 (P7)Documento13 paginePEB Foundation Certificate Trade Mark Law FC5 (P7)Pradeep KumarNessuna valutazione finora

- Banker Customer RelationshipDocumento101 pagineBanker Customer Relationshipmasudranabd100% (1)

- 01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFDocumento2 pagine01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFCheska VergaraNessuna valutazione finora

- GR NO. L-9605, September 30, 1957: Erezo V JepteDocumento1 paginaGR NO. L-9605, September 30, 1957: Erezo V JepteElaizza ConcepcionNessuna valutazione finora

- The Digester: NG V Asian Crusader G.R. No. L-30685 May 30, 1983 PDFDocumento4 pagineThe Digester: NG V Asian Crusader G.R. No. L-30685 May 30, 1983 PDFroy rebosuraNessuna valutazione finora