Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Levy of Penal Interest On Delayed Reporting

Caricato da

mevrick_guyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Levy of Penal Interest On Delayed Reporting

Caricato da

mevrick_guyCopyright:

Formati disponibili

Cash Systems and Procedures A Handout (Module - 6)

Chapter or

Module

Cash Systems and Procedures Screen No. 1

Chapter or

Screen title

Levy of Penal Interest for Delayed Reporting / Welcome

Voice-over Text

Welcome to the Module on Levy of Penal Interest for Delayed Reporting

Welcome to the Module on Levy of Penal Interest for Delayed Reporting

Chapter or

Module

Cash Systems and Procedures Screen No. 2

Chapter or

Screen title

Levy of Penal Interest for Delayed Reporting / Objectives

Voice-over Text

By the end of this module, you should be able to: Describe Reporting of Currency Chest

Transactions and Explain Shortages in currency chest balances due to pilferage .

By the end of this module, you should be able to:

Describe Reporting of Currency Chest Transactions

Explain Shortages in currency chest balances due to pilferage

Chapter or

Module

Cash Systems and Procedures Screen No. 3

Chapter or

Screen title

Levy of Penal Interest for Delayed Reporting / Introduction

Voice-over Text

In super session of all existing instructions/guidelines relating to levy of penal interest for

delayed reporting/wrong reporting/non-reporting of currency chest transactions and

cases of shortages/inclusion of counterfeit banknotes in the chest balances/chest

remittances, the following fresh instructions/guidelines are issued:

Reporting of Currency Chest Transactions

Shortages in currency chest balances due to pilferage/frauds

In super session of all existing instructions/guidelines relating to levy of penal interest for delayed

reporting/wrong reporting/non-reporting of currency chest transactions and cases of

shortages/inclusion of counterfeit banknotes in the chest balances/chest remittances, the following

fresh instructions/guidelines are issued:

Reporting of Currency Chest Transactions

Shortages in currency chest balances due to pilferage/frauds

Rahul Ghosh Page 1 22/07/2009

Chapter or

Module

Cash Systems and Procedures Screen No. 4

Chapter or

Screen title

Reporting of Currency Chest Transactions

Voice-over Text

Reporting of Currency Chest Transactions are:

The minimum amount of deposit

Time limit for reporting

Relaxation in respect of strike period in banks

Levy of penal interest for delays

In case of persistent/continued delays/discrepancies in reporting

Wrong reporting and levy of penal interest

Counterfeit banknotes in remittances received from currency chests

Re-issuable banknotes in remittances received from currency chests

Minimum penal interest to be charged

Click the Bulleted points for details.

Reporting of Currency Chest Transactions are:

The minimum amount of deposit

Time limit for reporting

Relaxation in respect of strike period in banks

Levy of penal interest for delays

In case of persistent/continued delays/discrepancies in reporting

Wrong reporting and levy of penal interest

Counterfeit banknotes in remittances received from currency chests

Re-issuable banknotes in remittances received from currency chests

Minimum penal interest to be charged

The Minimum Amount of Deposit

The minimum amount of deposit into/withdrawal from currency chest will Rs.1,00,000 and thereafter,

in multiples of Rs.50,000/- .

Time Limit for Reporting

(i) The currency chests should invariably report all transactions to their Link Offices on the

same day and the Link Offices in turn should report the consolidated position to the Issue

Offices positively on the next working day .

However, in Issue circles where reporting of chest transactions through ICCOMS has been

operationalised, chest transactions should invariably be reported on the same day by uploading over

the Secured Website (SWS) latest by 11 PM.

(ii) The Sub-Treasury Offices should report all transactions direct to the Issue Office of the Reserve

Bank on the same day.

Relaxation in respect of Strike Period in Banks

Relaxation in the reporting period on account of general/specific strike situation will be considered.

Further, as normal internal work is carried out on holidays observed for half-yearly/annual closing by

banks, these days should be treated as working days for the purpose of reckoning the permissible

reporting period.

Levy of Penal Interest for Delays

In the event of delay beyond three clear working days (including the date of transaction) in reporting

of figures relating to a particular chest in the Link Office statement, or delay in submission of the

Rahul Ghosh Page 2 22/07/2009

chest slip in the case of single chest or STOs directly linked to Issue Department of the circle, penal

interest at the rate indicated in paragraph 3 of this circular will be levied for the period of delay

excluding the date of transaction and date of receipt of figures/chest slip. Such penal interest will be

levied on the amount due from the chest holding bank.

In the Issue circles where reporting is through ICCOMS, penal interest will be calculated on T+0

basis i.e. penal interest will be levied in respect of transactions not reported by Link Office to the

Issue Office by 11 PM on the same business day.

However, till the new system stabilizes, the Bank may at its discretion grant appropriate grace

period in the matter of levy of penal interest.

Discrepancies in Reporting

In case of persistent/continued delays/discrepancies in reporting, our Regional Offices will take up

the matter with controlling offices of the bank concerned after issuing suitable warnings to the

currency chests.

Wrong Reporting and Levy of Penal Interest

Wrong reporting and levy of penal interest Penal interest will also be levied in respect of all cases of

wrong reporting in the same manner till the date of receipt of corrected advice by the Bank. It is

expected that Link Offices would ensure the correctness of figures reported by the respective

currency chests. Particular care should be taken to ensure that 'remittance' transactions are not

reported as 'deposit' transactions in the Link Office Statements.

Counterfeit Banknotes in Remittances Received from Currency Chests

Counterfeit banknotes in remittances received from currency chests In case counterfeit banknotes

are found in remittances from currency chests, entire amount equal to the value of counterfeit

banknotes will be debited to the bank's current account and penal interest will be levied on the

amount of counterfeit banknotes from the date of previous remittance to RBI. FIRs will also be

lodged with the Police in all cases of detection of counterfeit banknotes in chest remittances.

Re-issuable Banknotes in Remittances Received from Currency Chests

Re-issuable banknotes in remittances received from currency chests In case re-issuable banknotes

are found to be in excess of 5% in any soiled note remittance, the entire remittance will be returned

to the bank at its cost besides debiting the amount of the remittance to the account of the bank

maintained with the Reserve Bank of India.

Minimum Penal Interest to be Charged

Minimum penal interest to be charged there is no stipulation regarding the minimum amount of

penal interest leviable for wrong/delayed reporting. As the intention is to ensure timely and correct

reporting of chest transactions, penal interest will be recovered in all applicable cases, irrespective

of the amount of the transaction concerned/amount of penal interest subject to rounding off the

interest amount to the nearest Rupee.

Rahul Ghosh Page 3 22/07/2009

Chapter or

Module

Cash Systems and Procedures Screen No. 5

Chapter or

Screen title

Need for Cash Regulations Procedures

Voice-over Text

Scene-1:

Shortages in currency chest balances due to pilferage/frauds or otherwise and inclusion

of amounts of safe custody deposits in chest balances.

Penal interest will be levied in all cases where the bank has enjoyed 'ineligible' credit in

its current account with RBI on account of discrepancies in chest balances/reporting of

transactions (wrong/delayed/non-reporting, shortages in chest balances/remittances,

counterfeit banknotes detected in chest balances/remittances).

Further, only cash held in the custody of joint custodians and 'freely available' to them is

eligible for inclusion in the chest balances.

Thus, cash kept for safe custody in sealed covers for whatever reasons/cash in

trunks/bins under the lock and key of any official/s other than the Joint Custodians or

bearing a third lock put by any official in addition to the two locks of the Joint Custodians

is not eligible for being included in the chest balances. Such amounts, if included in

chest balances will attract penal interest.

Scene-2:

In all the cases, penal interest will be leviable from the date of inclusion of 'ineligible'

amounts in chest balances/date of occurrence of shortage (if identifiable) till the

exclusion of such amounts from chest balances.

Otherwise, penal interest will be levied from the date of last remittance (in case of

discrepancies detected in remittances)/last verification of cash balances by RBI/bank's

own/Government inspectors (in case of discrepancies in chest balances).

Rate of penal interest

Levy of penal interest in respect of currency chests at treasuries

Representations

The penal interest shall be levied at the rate of 2% over the prevailing Bank Rate for the

period of irregularity.

The above instructions shall be applicable to currency chests at treasury/sub-treasury

offices also.

Scene-3:

As the sole criterion for levy of penal interest for delayed reporting is the

number of days of delay, there should ordinarily be no occasion for banks to

request for reconsideration of the Bank's decision in individual cases.

However, representations, if any, on account of genuine difficulties faced by

chests especially in hilly/remote areas and other chests affected by natural

calamities, etc., should be made only to the Issue Office concerned. In the case

of wrong reporting representations for waiver will not be considered.

As the intention behind the levy of penal interest is to inculcate discipline

among banks so as to ensure prompt/correct reporting, pleas by banks such as

non-utilization of the Bank's funds, no shortfall in the maintenance of

CRR/SLR, clerical mistake, unintentional or arithmetical error, first time error,

inexperience of staff etc., will not be considered as valid grounds for waiver of

penal interest.

As debits/credits to banks' current accounts are raised on the basis of the

figures reported in the Link Office Statements, penal interest will be invariably

Rahul Ghosh Page 4 22/07/2009

levied in all cases of reporting correctly in the chest slips but wrongly in the Link

Office Statements.

This Master Circular is available on our website www.rbi.org.in.

Scene-1:

Shortages in currency chest balances due to pilferage/frauds or

otherwise and inclusion of amounts of safe custody deposits in chest

balances

Penal interest will be levied in all cases where the bank has enjoyed 'ineligible' credit in its

current account with RBI on account of discrepancies in chest balances/reporting of

transactions (wrong/delayed/non-reporting, shortages in chest balances/remittances,

counterfeit banknotes detected in chest balances/remittances).

Further, only cash held in the custody of joint custodians and 'freely available' to them is

eligible for inclusion in the chest balances.

Thus, cash kept for safe custody in sealed covers for whatever reasons/cash in trunks/bins

under the lock and key of any official/s other than the Joint Custodians or bearing a third

lock put by any official in addition to the two locks of the Joint Custodians is not eligible for

being included in the chest balances. Such amounts, if included in chest balances will

attract penal interest.

Scene-2:

In all the cases, penal interest will be leviable from the date of inclusion of

'ineligible' amounts in chest balances/date of occurrence of shortage (if

identifiable) till the exclusion of such amounts from chest balances.

Otherwise, penal interest will be levied from the date of last remittance (in case

of discrepancies detected in remittances)/last verification of cash balances by

RBI/bank's own/Government inspectors (in case of discrepancies in chest

balances).

Rate of penal interest

Levy of penal interest in respect of currency chests at treasuries

Representations

The penal interest shall be levied at the rate of 2% over the prevailing Bank

Rate for the period of irregularity.

The above instructions shall be applicable to currency chests at treasury/sub-

treasury offices also.

Scene-3:

As the sole criterion for levy of penal interest for delayed reporting is the

number of days of delay, there should ordinarily be no occasion for banks to

request for reconsideration of the Bank's decision in individual cases.

However, representations, if any, on account of genuine difficulties faced by

chests especially in hilly/remote areas and other chests affected by natural

calamities, etc., should be made only to the Issue Office concerned. In the

case of wrong reporting representations for waiver will not be considered.

Rahul Ghosh Page 5 22/07/2009

As the intention behind the levy of penal interest is to inculcate discipline

among banks so as to ensure prompt/correct reporting, pleas by banks such

as non-utilization of the Bank's funds, no shortfall in the maintenance of

CRR/SLR, clerical mistake, unintentional or arithmetical error, first time error,

inexperience of staff etc., will not be considered as valid grounds for waiver of

penal interest.

As debits/credits to banks' current accounts are raised on the basis of the

figures reported in the Link Office Statements, penal interest will be invariably

levied in all cases of reporting correctly in the chest slips but wrongly in the

Link Office Statements.

This Master Circular is available on our website www.rbi.org.in.

Chapter or

Module

Cash Systems and Procedures Screen No. 6

Chapter or

Screen title

Summary

Voice-over Text

In this module you have learned about the Reporting of Currency Chest Transactions

and Shortages in currency chest balances due to pilferage.

In this module, you have learned:

Reporting of Currency Chest Transactions

Shortages in currency chest balances due to pilferage

Rahul Ghosh Page 6 22/07/2009

Potrebbero piacerti anche

- 9th Issue E-Gyan May, 2014 PDFDocumento17 pagine9th Issue E-Gyan May, 2014 PDFmevrick_guyNessuna valutazione finora

- Yuva Savings Bank AccountDocumento1 paginaYuva Savings Bank Accountmevrick_guyNessuna valutazione finora

- NIOS Culture NotesDocumento71 pagineNIOS Culture Notesmevrick_guy0% (1)

- A StudyDocumento12 pagineA Studymevrick_guyNessuna valutazione finora

- Banking Glossary 2011Documento27 pagineBanking Glossary 2011Praneeth Kumar NaganNessuna valutazione finora

- 01.15 Bod EodDocumento25 pagine01.15 Bod Eodmevrick_guy100% (1)

- 1st Issue E-Gyan, July-2013Documento13 pagine1st Issue E-Gyan, July-2013mevrick_guyNessuna valutazione finora

- 47-Corporate Salary Package - CSPDocumento3 pagine47-Corporate Salary Package - CSPmevrick_guyNessuna valutazione finora

- 01 21-RBIremittanceDocumento11 pagine01 21-RBIremittancemevrick_guyNessuna valutazione finora

- IBPS Interview Prep - Graduation Related Questions BE, BCom, BADocumento33 pagineIBPS Interview Prep - Graduation Related Questions BE, BCom, BAmevrick_guyNessuna valutazione finora

- 01 06-CashDocumento21 pagine01 06-Cashmevrick_guyNessuna valutazione finora

- 2nd Issue E-Gyan, October-2013Documento28 pagine2nd Issue E-Gyan, October-2013mevrick_guyNessuna valutazione finora

- 01.20 Government BusinessDocumento48 pagine01.20 Government Businessmevrick_guyNessuna valutazione finora

- 01.10 RemittancesDocumento40 pagine01.10 Remittancesmevrick_guyNessuna valutazione finora

- 01.19 Safe CustodyDocumento9 pagine01.19 Safe Custodymevrick_guyNessuna valutazione finora

- 8 To 8 Functionality: Section Section DescriptionDocumento7 pagine8 To 8 Functionality: Section Section Descriptionmevrick_guyNessuna valutazione finora

- 01.13 ClearingDocumento38 pagine01.13 Clearingmevrick_guy0% (1)

- 01.14 Maker Checker FunctionalitiesDocumento19 pagine01.14 Maker Checker Functionalitiesmevrick_guyNessuna valutazione finora

- 01.15 Bod EodDocumento25 pagine01.15 Bod Eodmevrick_guy100% (1)

- 01.09-User System ManagementDocumento12 pagine01.09-User System Managementmevrick_guyNessuna valutazione finora

- 01 08-BGLDocumento40 pagine01 08-BGLmevrick_guy100% (2)

- 01.05 Transaction ProcessingDocumento23 pagine01.05 Transaction Processingmevrick_guyNessuna valutazione finora

- 01.17 Currency ChestDocumento10 pagine01.17 Currency Chestmevrick_guyNessuna valutazione finora

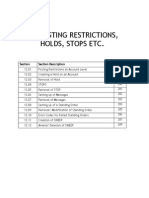

- 01.12 Posting RestrictionsDocumento14 pagine01.12 Posting Restrictionsmevrick_guyNessuna valutazione finora

- 01.04-DepositAccounts Other FunctionalitiesDocumento30 pagine01.04-DepositAccounts Other Functionalitiesmevrick_guyNessuna valutazione finora

- 01.03-Deposit Accounts OpeningDocumento38 pagine01.03-Deposit Accounts Openingmevrick_guy0% (1)

- 00.01 PrefaceDocumento1 pagina00.01 Prefacemevrick_guyNessuna valutazione finora

- 01 02-CifDocumento25 pagine01 02-Cifmevrick_guyNessuna valutazione finora

- 01.01 IntroductionDocumento16 pagine01.01 Introductionmevrick_guyNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- LCIA Vs UNCITRAL - WEIGHING THE PROS AND CONSDocumento1 paginaLCIA Vs UNCITRAL - WEIGHING THE PROS AND CONSShahrukh NawazNessuna valutazione finora

- Stanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11Documento81 pagineStanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11stanwichNessuna valutazione finora

- Notes On Qawaid FiqhiyaDocumento2 pagineNotes On Qawaid FiqhiyatariqsoasNessuna valutazione finora

- Physical Education ProjectDocumento7 paginePhysical Education ProjectToshan KaushikNessuna valutazione finora

- 2021 TaxReturnDocumento11 pagine2021 TaxReturnHa AlNessuna valutazione finora

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDocumento2 paginePastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNessuna valutazione finora

- Create An Informational Flyer AssignmentDocumento4 pagineCreate An Informational Flyer AssignmentALEEHA BUTTNessuna valutazione finora

- Request For Inspection: Ain Tsila Development Main EPC Contract A-CNT-CON-000-00282Documento1 paginaRequest For Inspection: Ain Tsila Development Main EPC Contract A-CNT-CON-000-00282ZaidiNessuna valutazione finora

- Retainer Contract - Atty. AtoDocumento2 pagineRetainer Contract - Atty. AtoClemente PanganduyonNessuna valutazione finora

- Terre vs. Terre DigestDocumento1 paginaTerre vs. Terre DigestPMVNessuna valutazione finora

- Birch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Documento88 pagineBirch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Shivananda2012100% (2)

- COM670 Chapter 5Documento19 pagineCOM670 Chapter 5aakapsNessuna valutazione finora

- Labour and Industrial Law: Multiple Choice QuestionsDocumento130 pagineLabour and Industrial Law: Multiple Choice QuestionsShubham SaneNessuna valutazione finora

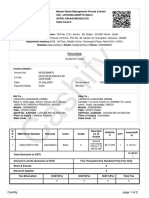

- Bill Iphone 7fDocumento2 pagineBill Iphone 7fyadawadsbNessuna valutazione finora

- Chapter 1 - Electricity and MagnetismDocumento41 pagineChapter 1 - Electricity and MagnetismDarwin Lajato TipdasNessuna valutazione finora

- A Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsDocumento290 pagineA Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsAbdul SalamNessuna valutazione finora

- This Succession-Reviewer JethDocumento184 pagineThis Succession-Reviewer JethMary Robelyn de Castro100% (1)

- UtilitarianismDocumento37 pagineUtilitarianismLeiya Lansang100% (2)

- 6 Kalimas of Islam With English TranslationDocumento5 pagine6 Kalimas of Islam With English TranslationAfaz RahmanNessuna valutazione finora

- PAS 7 and PAS 41 SummaryDocumento5 paginePAS 7 and PAS 41 SummaryCharles BarcelaNessuna valutazione finora

- New Mexico V Steven Lopez - Court RecordsDocumento13 pagineNew Mexico V Steven Lopez - Court RecordsMax The Cat0% (1)

- InstitutionalismDocumento15 pagineInstitutionalismLowel DalisayNessuna valutazione finora

- The LetterDocumento13 pagineThe Letterkschofield100% (2)

- Arthur Andersen Case PDFDocumento12 pagineArthur Andersen Case PDFwindow805Nessuna valutazione finora

- 2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsDocumento6 pagine2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsWilliam SantosNessuna valutazione finora

- MCS Demonstration - Plaintiff MemorialDocumento23 pagineMCS Demonstration - Plaintiff MemorialMegha NautiyalNessuna valutazione finora

- Swadhar Greh SchemeDocumento12 pagineSwadhar Greh SchemeShuchi SareenNessuna valutazione finora

- IEEE Guide For Power System Protection TestingDocumento124 pagineIEEE Guide For Power System Protection TestingStedroy Roache100% (15)

- Jashim Otobi Furniture: Proprietor: Md. Jashim SheikhDocumento2 pagineJashim Otobi Furniture: Proprietor: Md. Jashim SheikhAr-rahbar TravelsNessuna valutazione finora

- Install HelpDocumento318 pagineInstall HelpHenry Daniel VerdugoNessuna valutazione finora