Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

EY Natural Gas Pricing in India

Caricato da

nessfern0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

84 visualizzazioni12 pagineArticle on NG pricing

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoArticle on NG pricing

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

84 visualizzazioni12 pagineEY Natural Gas Pricing in India

Caricato da

nessfernArticle on NG pricing

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 12

Natural gas pricing in India

Current policy and potential impact

2

Natural gas pricing in India Current policy and potential impact

Current scenario in Indias

natural gas market

Intricacies of natural gas

pricing in India

Potential impact of new

pricing on energy industry

C

o

n

t

e

n

t

s

3

Natural gas pricing in India Current policy and potential impact

Current scenario in Indias natural gas market

Chapter 1

Indias natural gas consumption far behind the global average

1

Indias expanding economy and growing population have led to increased consumption

of primary energy resources such as coal, oil and natural gas in the country. In line

with this, its primary energy consumption grew at a compounded annual growth rate

(CAGR) of 6% to 563.5 million tonnes of oil equivalent (MTOE) in 2012 from 420.1

MTOE in 2007. The share of natural gas in its primary energy mix increased marginally

from 8% in 2008 to 8.7% in 2012.

This is fairly low, compared to the global average

of 24%, primarily due to supply-side constraints. Furthermore, in terms of individual

consumption, Indias annual gas consumption of 44 cubic meters (cm) per capita is far

behind the global average of 470 cm per person.

Figure 1: Low consumption of natural gas in India, 2012

-500

0

500

1,000

1,500

2,000

2,500

3,000

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0%

P

e

r

c

a

p

i

t

a

g

a

s

c

o

n

s

u

m

p

t

i

o

n

,

c

u

b

i

c

m

e

t

e

r

Gas share in energy mix, %

Source: BP Statistical Review of World Energy 2013, The World Bank and EY analysis

China

India

Brazil

France

Singapore

South Korea

Australia

Germany

Japan

Canada

US

UK

Turkey

Malaysia

Russia

Sinihcant as dehcit ~ demand fcr suppIy traiIs; increasin

reliance on imported LNG

lndia's naLural qas markeL is seeinq a supply delciL, primarily due Lo low domesLic

production and an inadequate transmission and distribution infrastructure. Domestic

qas producLion received a siqnilcanL impeLus wiLh commencemenL ol producLion aL

Lhe KCD6 leld, locaLed in Lhe counLry's Lhe easL coasL, in 2009. However, Lhe leld's

output has been steadily declining after reaching 60 million standard cubic metres per

day (mmscmd) in 2010, and has hit a trough of 12 mmscmd in 3QFY14

2

. According

to Reliance Industries Limited (RIL), the fall in KG-D6s production is mainly due to

qeoloqical complexiLy and a naLural decline in Lhe lelds. 1he decline in mosL ol Lhe

counLry's aqeinq lelds has lurLher compounded Lhe supply delciL.

On Lhe oLher hand, Lhe demand lor naLural qas in lndia has increased siqnilcanLly due

to the demand from the power and fertilizer sectors, and cumulatively accounted for

more than 61% of gas consumption in FY13. The demand is also driven by its growing

usaqe in Lhe ciLy qas disLribuLion (CCD) secLor and indusLrial secLors, such as relninq

4

Natural gas pricing in India Current policy and potential impact

and petrochemicals. Rising concerns on carbon emission have also contributed to the

demand for natural gas in the country.

3

1his has led Lo lndia's increased dependence on imporLed liqueled naLural qas (LNC).

1he counLry's LNC imporLs have increased lrom approximaLely 8 million meLric Lons

(mmL) in FY09 Lo 11 mmL in FY13, accounLed lor 287 ol Lhe LoLal supply.

4

According

to the BP Statistical Review of World Energy 2013, India is the worlds fourth-largest

imporLer ol LNC in Lhe world.

LikeIihccd cf !ndian as market remainin in suppIy dehcit

despite rising production and import of gas

Over the next few years, the shortfall in natural gas production in the country is

expected to continue with its supply trailing demand. Shortage of gas is likely to reach

its peak in FY15, with around 37% of the demand being unmet.

5

However, lrom FY16

onwards, Lhe delciL may decrease, primarily due Lo Lhe planned producLion ol privaLe/

|oinL venLure companies and increased LNC imporL capaciLy. Power and lerLilizers are

expected to remain the anchor segments that consume natural gas and are likely to

account for around 68% of the total demand for it in FY17. Furthermore, deregulated

pricing of petroleum products and an increasing focus on addressing environmental

concerns are expected to drive the demand for natural gas from industrial users,

residenLial users Lhrouqh piped naLural qas (PNC), and in Lhe LransporLaLion seqmenL

Lhrouqh Lhe demand lor compressed naLural qas (CNC). However, Lhis demand is hiqhly

price-sensitive and will depend on the price affordability of end users, especially in the

power and fertilizer sectors.

6

Figure 2: Future natural gas demand-supply scenario (mmscmd)

Source: Ministry of Petroleum and Natural Gas

87 87 129 150 149 170 177 209 371 405 446 473

135

148

140

114

FY14 FY15 FY16 FY17

LNG imports

Domestic

production

Natural gas

demand

Delcit

1he LoLal supply ol naLural qas is expecLed Lo reach Lo 359 mmscmdin FY17, a CACR

of 15% from FY14 in India. Most of this incremental supply is expected to be met

by LNC imporLs, since Lhe qrowLh in domesLic supply will lail Lo keep pace wiLh Lhe

anLicipaLed rise in demand. 1he counLry's poLenLial Lo imporL LNC is expecLed Lo

increase to 150 mmscmd in FY17, contributing around 42% of the total supply.

Domestic production is expected to increase at a CAGR of around 12%.

7

This is likely

to come from new discoveries which are currently under development, expectation

of partial recovery in the output from KG-D6 and increased production from

unconventional sources, particularly coal bed methane.

5

Natural gas pricing in India Current policy and potential impact

Intricacies of natural gas pricing in India

Chapter 2

PrevaiIin naturaI as pricin reime in the ccuntry

complex and heterogeneous

There are multiple natural gas pricing regimes in India. These can be divided into the

following:

Administered Pricing Mechanism (APM)

NonAPM

APM gas pricing: NaLural qas produced lrom Lhe exisLinq lelds ol Lhe nominaLed

blocks ol lndian sLaLeowned companies, OlL lndia LLd. (OlL) and ONCC, caLers Lo

fertilizer and power plants, court-mandated customers and those requiring less than

50 thousand standard cubic metres per day (mscmpd) at APM rates. The price of APM

gas has been set by the Government on a cost-plus basis and is US$4.2 per mmbtu in

lndia (USS2.52 per mmbLu in Lhe NorLheasL). 1he price in Lhe NorLheasL is 607 ol Lhe

APM price elsewhere in the country (the balance 40% is paid by the Government to

naLional oil companies or NOCs as subsidies).

8

Indias move toward a market-based pricing regime: In June 2013, the Cabinet

Committee on Economic Affairs (CCEA) approved a market-based pricing formula

for produced natural gas produced in India. The revised prices are based on

recommendations made by the Rangarajan Committee. The pricing formula, valid for

Lhe nexL lve years, peqs Lhe base price ol naLural qas aL around USS8.^ per mmbLu,

up from US$4.2 per mmbtu currently. The upward revision in prices is based on the

weiqhLed averaqe ol Lhe neLback price aL Lhe wellhead ol counLries exporLinq LNC Lo

lndia and qas prices in Lhe Lradinq hubs ol NorLh America, Lurope and Japan. 1hese

are calculated on a trailing 12-month basis. Prices will be revised every quarter.

Non-APM gas pricing: NonAPM qas is divided inLo Lwo caLeqories (i) imporLed LNC,

for which prices are determined by the market, and (ii) domestically produced gas from

Lhe New LxploraLion Licensinq Policy (NLLP) and preNLLP lelds.

Pre-NELP PSC pricing: This is applicable for gas produced from in Panna-Mukta,

1apLi and Ravva lelds. Cas prices are deLermined on Lhe basis ol Lhe lormula

speciled in Lhe producLionsharinq conLracL (PSC). All Lhe qas produced is sold Lo

CAlL. CurrenLly, Lhe preNLLP pricinq is beLween USS3.5 and USS5.7 per mmbLu.

NELP gas pricing: 1his applies Lo qas lelds awarded under NLLP rounds. 1he

price of gas is determined on the basis of arms length prices (market prices),

subject to the Governments approval, and is controlled by PSC terms. This pricing

regime was valid until March 2014. After this, a new pricing mechanism has come

into force, based on the Ranagrajan Committees recommendations. Currently,

NLLP qas is priced aL beLween USS^.2 and USS^.7 per mmbLu.

Price of imported gas (LNG): 1he price ol lonqLerm LNC imporLed lrom OaLar has

been linked to Japanese Custom Cleared (JCC) prices and varies on a monthly basis for

PeLroneL LNC. However, lndia's dependence on expensive spoL LNC Lo meeL Lhe bulk ol

its demand sees limited growth from this source. According to industry estimates, the

imporLed qas lrom lonqLerm LNC conLracLs cosLs around USS13 per mmbLu, while Lhe

spot price was at around US$18 per mmbtu in January 2014

9

.

6

Natural gas pricing in India Current policy and potential impact

Potential impact of new pricing on

energy industry

Chapter 3

Overall, the new gas pricing policy augurs well for Indias natural gas market. It is

expected to increase domestic production by encouraging upstream investment.

This will improve Indias energy security and increase availability of gas for its key

gas-consuming industries.

So far, the gas market has been adversely affected by the Governments current

gas-pricing policy and investment in the upstream sector declined to US$1.8 billion

in FY12 lrom USS6.3 billion in FY09. 1he new policy, which has been puL on hold due

to the on-going General Elections in the country, is expected to increase certainty and

transparency in pricing of natural gas in India.

Upstream sector

The increase in natural gas prices is expected to encourage investment in the upstream

segment and boost production. It will also improve the commercial viability of

marqinal, deepwaLer and lronLier lelds, which require cuLLinqedqe Lechnoloqy and

increased capiLal spendinq. Accordinq Lo lHS CLRA's esLimaLes, lndia's recoverable qas

reserves could increase by 55 Lrillion cubic leeL (Lcl) Lo 91 Lcl aL qas prices ol USS10

US$12 per mmbtu due to the factors mentioned above.

10

lncreased domesLic producLion due Lo Lhe enhanced commercial viabiliLy ol qas lelds

is expecLed Lo decrease Lhe prevalenL qas supply delciL in lndia. lL could reduce Lhe

counLry's LNC imporL bill.

11

According to Morgan Stanley, gas prices of more than

USS8 per mmbLu could resulL in incremenLal producLion ol nearly 95 mmscmd over 20

years. 1his would help Lo reduce lndia's LNC imporL cosLs by around USS16 billion.

12

The proposed hike in gas prices will help to boost the revenues of indigenous gas

producers. CurrenLly, ONCC, OlL and RlL accounL lor 857 ol Lhe LoLal ouLpuL ol

domestic gas. According to Moodys estimates, the proposed increase in gas prices

will auqmenL ONCC's revenue by USS1.5USS2 billion and RlL's revenue by USS300

US$500 million in FY15.

13

Furthermore, the rise in gas prices will augment the

CovernmenL's revenue in Lhe lorm ol increased Laxes, royalLy, prolLs and dividends.

Increased production of gas will help to alleviate the existing supply crunch, and

reduce the countrys reliance on high-priced LNG. However, price-sensitive sectors

such as power and Iertilizers may hnd it diIhcult to absorb this hike. ThereIore,

there is a need for the Governments policy to effectively address the concerns of

the consuming sector.

7

Natural gas pricing in India Current policy and potential impact

Power sector

The power sector is the largest consumer of natural gas in India. Gas-powered power

plants are plagued by high generation costs and a low average plant load factor (PLF).

Currently, around 6,000 MW of commissioned and 1,000 MW of un-commissioned

(aL an advanced sLaqe ol consLrucLion/commissioninq) qasbased power planLs are

non-functional due to unavailability of gas. While the new pricing regime is expected

to increase domestic gas supply, which can be used to bring these power plants on

stream, the demand for natural gas for gas-based power generation remains highly

price-sensitive. Power plants are currently being supplied APM gas at US$4.2 per

mmbLu aL a variable cosL ol lNR2.1 per uniL. AL a PLF ol 507, Lhis LranslaLes inLo a

qeneraLion cosL ol lNR^.8 per uniL lor new commissioned planLs owned by privaLe

players. The increase in gas prices to US$8.4 per mmbtu is expected to result in a rise

in iLs variable cosL ol lNR2 per uniL and increase Lhe LoLal cosL Lo lNR6.7 per uniL. 1his

will only make iL allordable lor peak load purposes. FurLhermore, iL will be dillculL lor

the companies to switch from natural gas to coal due to high conversion costs, a longer

gestation period, their reliance on imported coal and environmental constraints

14

.

Fertilizer sector

In the case of the fertilizer sector, another major consumer of gas, increased gas prices

would result in a rise in feedstock costs and working capital requirements.

8

Natural gas pricing in India Current policy and potential impact

NeverLheless, any rise in domesLic qas producLion will be a posiLive developmenL in

the fertilizer industry, since it enjoys a top priority position for allocation of gas.

15

In

addiLion, Lhis would reduce Lhe indusLry's dependence on hiqhpriced LNC

.

According to a report submitted by the Governments Parliamentary Standing

CommiLLee on Finance, producLion cosLs would increase by lNR1,38^ per Lonne wiLh

every rise of US$1 per mmbtu in gas prices. Consequently, this would lead to an

increase in the Governments subsidy burden. An increase in gas prices to around 8.4

per mmbLu will increase Lhe CovernmenL's subsidy burden by lNR120 billion (USS2

billion). This subsidy burden can be offset by additional revenues received by the

CovernmenL lrom increased royalLy, prolLsharinq and Lax collecLions lrom upsLream

operations expected in development of new gas resources.

City as distributicn sectcr

The CGD sector is another key consumer and has witnessed rapid growth in recent

years. The sector will continue to create a demand due to the addition of gas networks

in new ciLies, Lhe price advanLaqe ol CNC over auLo luels and increased use ol PNC in

Lhe domesLic, indusLrial and commercial secLors. However, Lhe new qas pricinq policy

will increase sourcing costs for CGD companies with a high APM gas allocation. CGD

companies are expected to witness a decline in their earnings due to an increase in

their input costs. These companies are unlikely to pass on the increase in gas prices to

industrial and domestic consumers due to their limited headroom with alternative fuels

(domesLic LPC and lurnace oil). 1he new qas pricinq will noL have a siqnilcanL impacL

on operaLions in reqions wiLh a predominanL mix ol LNC in Lheir sourcinq ol qas, e.q., in

lndia's wesLern reqion. 1his is because CNC prices are already hiqh in such qeoqraphies.

However, Lhe LhreaL ol depreciaLion ol currency will conLinue Lo be a cause ol concern,

since the cost of sourcing is dollar-dominated

16

. Overall, increased availability of

domesLic qas lrom new pro|ecLs is likely Lo increase invesLors' conldence in Lhe secLor.

Petrochemicals and other consuming sectors

The petrochemicals sector uses natural gas to extract ethane and produce

polyethylene, propane and butane for production of LPG. Input costs account for

around 80% of manufacturing costs. Increased gas prices would mean reduced

prolLabiliLy lor peLrochemical companies. 1his would also hold Lrue lor oLher indusLries

such as ceramics and glass, since their input costs are also likely to go up with the price

revision. On the other hand, companies that have replaced expensive fuels such as

naphLha and diesel wiLh naLural qas will sLand Lo benelL lrom Lhis revision, since iL will

remain compeLiLive aL revised prices. Relninq would remain unallecLed lrom Lhe hike in

gas prices, since the sector meets most of its demand from imported gas or naphtha.

9

Natural gas pricing in India Current policy and potential impact

1. "BP SLaLisLical Review ol World Lnerqy 2013", BP websiLe, hLLp://www.bp.com/en/qlobal/corporaLe/abouLbp/

enerqyeconomics/sLaLisLicalreviewolworldenerqy2013.hLml, accessed 17 April 201^; "CounLries and

Lconomies," 1he World Bank websiLe, hLLp://daLa.worldbank.orq/counLry, accessed 16 April 201^; LY analysis.

2. "Reliance lndusLries LimiLed 3O FY 20131^ lnancial resulLs," Reliance lndusLries websiLe, hLLp://www.ril.com/

rporLal/|sp/eporLal/LisLDownloadLibrary.|sp, accessed 16 April 201^.

3. "lndian PeLroleum & NaLural Cas SLaLisLics 201213," MinisLry ol PeLroleum & NaLural Cas, hLLp://peLroleum.

nic.in/pnqsLaL.pdl, accessed 16 April 201^.

4. "NaLural Cas," PeLroleum Planninq & Analysis Cell, hLLp://ppac.orq.in/, accessed 16 April 201^.

5. "1wellLh Five Year PlanVolume ll (201217)," Planninq Commission ol lndia, hLLp://planninqcommission.qov.

in/plans/planrel/12Lhplan/pdl/12lyp_vol2.pdl, accessed 16 April 201^.

6. "1wellLh Five Year PlanVolume ll (201217)," Planninq Commission ol lndia, hLLp://planninqcommission.qov.

in/plans/planrel/12Lhplan/pdl/12lyp_vol2.pdl, accessed 16 April 201^.

7. "lndian PeLroleum & NaLural Cas SLaLisLics 201213," MinisLry ol PeLroleum & NaLural Cas, hLLp://peLroleum.

nic.in/pnqsLaL.pdl, accessed 16 April 201^.

8. "Price APM qas," MinisLry ol PeLroleum and NaLural Cas, hLLp://peLroleum.nic.in/PriceAPMCas1.pdl, accessed

16 April 2014.

9. "LNC opporLuniLies in lndia enqulled wiLh serious problems," Moneylile, 21 January 2013, via FacLiva 2013

Moneywise Media Pvt. Ltd.

10. "New qas price Lo boosL ONCC, OlL boLLom lines il qovL doesn'L play spoilsporL," Financial express, 17 July

2013, via FacLiva 2013 lndian Lxpress Online Media PvL. LLd.

11. "China, lndia qas price relorms open door Lo more LNC imporLs," ReuLers News, ^ July 2013, via FacLiva

2013 Reuters Limited.

12. "lndia Oil & Cas Asia lnsiqhL 201^: Year ol lndian Oils," Morqan SLanley, 27 January 201^, via 1homson

Research.

13. "RLSLND: Cas price hike welcomed by lndian upsLream oil and qas companies," PlaLLs CommodiLy News, 30

June 2013, via FacLiva 2013 PlaLLs.

14. "Cas power planLs may come Lo qrindinq halL," DNA lndia, hLLp://www.dnaindia.com/money/reporLqaspower

planLsmaycomeLoqrindinqhalL195838^, 31 January 201^; "lndia Oil & Cas Asia lnsiqhL 201^: Year ol

lndian Oils," Morqan SLanley, 27 January 201^, via 1homson Research; "ALLOCA1lON AND PRlClNC OF

CAS," MinisLry ol PeLroleum and NaLural qas, hLLp://16^.100.^7.13^/lsscommiLLee/PeLroleum720&720

NaLural720Cas/15_PeLroleum_And_NaLural_Cas_19.pdl , 18 OcLober 2013; "UncerLainLy doqs new qas price

announcemenL," Business Line,hLLp://www.Lhehindubusinessline.com/economy/uncerLainLydoqsnewqas

priceannouncemenL/arLicle5810978.ece, 20 March 201^.

15. "ALLOCA1lON AND PRlClNC OF CAS," MinisLry ol PeLroleum and NaLural qas, hLLp://16^.100.^7.13^/

lsscommiLLee/PeLroleum720&720NaLural720Cas/15_PeLroleum_And_NaLural_Cas_19.pdl, 18 OcLober 2013.

16. "ALLOCA1lON AND PRlClNC OF CAS," MinisLry ol PeLroleum and NaLural qas, hLLp://16^.100.^7.13^/

lsscommiLLee/PeLroleum720&720NaLural720Cas/15_PeLroleum_And_NaLural_Cas_19.pdl, 18 OcLober 2013;

"Vision 2030 NaLural qas inlrasLrucLure in lndia," PeLroleum & NaLural Cas RequlaLory Board, hLLp://www.

pnqrb.qov.in/newsiLe/pdl/vision/visionNCPV203006092013.pdl, accessed 17 April 201^.

References

10

Natural gas pricing in India Current policy and potential impact

For more information, visit www.ey.com/in

Connect with us

Assurance, Tax, Transactions, Advisory

A comprehensive range of high-quality services to

help you navigate your next phase of growth

Read more on www.ey.com/India/Services

Our services

Centers of excellence for key sectors

Our sector practices ensure our work with you is

tuned in to the realities of your industry

Read about our sector knowledge at ey.com/India/industries

Sector focus

Easy access to our

knowledge publications.

Any time.

http://webcast.ey.com/thoughtcenter/

Webcasts and podcasts

www.ey.com/subscription-form

Follow us @EY_India Join the Business network

from Ernst & Young

Stay connected

11

Natural gas pricing in India Current policy and potential impact

Ahmedabad

2nd loor, Shivalik lshaan

Near. C.N Vidhyalaya

Ambawadi,

Ahmedabad-380015

1el: +91 79 6608 3800

Fax: +91 79 6608 3900

Bengaluru

12Lh & 13Lh loor

U B City Canberra Block

No.2^, ViLLal Mallya Road

Bengaluru-560 001

1el: +91 80 ^027 5000

+91 80 6727 5000

Fax: +91 80 2210 6000 (12Lh loor)

Fax: +91 80 222^ 0695 (13Lh loor)

1st Floor, Prestige Emerald

No.^, Madras Bank Road

Lavelle Road Junction

Bengaluru-560 001

1el: +91 80 6727 5000

Fax: +91 80 2222 ^112

Chandigarh

1st Floor, SCO: 166-167

SecLor 9C, Madhya Marq

Chandiqarh160 009

1el: +91 172 671 7800

Fax: +91 172 671 7888

Chennai

Tidel Park

6th & 7th Floor

A Block, No.^, Ra|iv Candhi Salai

Taramani,

Chennai-600113

1el: +91 ^^ 665^ 8100

Fax: +91 ^^ 225^ 0120

Hyderabad

Oval Ollce, 18, iLabs CenLre

HiLech CiLy, Madhapur

Hyderabad 500081

1el: +91 ^0 6736 2000

Fax: +91 ^0 6736 2200

Kochi

9Lh Floor "ABAD Nucleus"

NH^9, Maradu PO

Kochi - 682 304

1el: +91 ^8^ 30^ ^000

Fax: +91 ^8^ 270 5393

Kolkata

22, Camac Street

3rd Floor, Block C

Kolkata-700 016

1el: +91 33 6615 3^00

Fax: +91 33 2281 7750

Mumbai

14th Floor, The Ruby

29 SenapaLi BapaL Marq

Dadar (west)

Mumbai-400 028, India

1el: +91 22 6192 0000

Fax: +91 22 6192 1000

5th Floor Block B-2

Nirlon Knowledqe Park

Oll. WesLern Lxpress Hiqhway

Goregaon (E)

Mumbai-400 063, India

1el: +91 22 6192 0000

Fax: +91 22 6192 3000

NCR

Golf View Corporate

1ower B, Near DLF Coll Course

Sector 42

Curqaon122 002

1el: +91 12^ ^6^ ^000

Fax: +91 12^ ^6^ ^050

6Lh loor, H1 House

18-20 Kasturba Gandhi Marg

New Delhi110 001

1el: +91 11 ^363 3000

Fax: +91 11 ^363 3200

^Lh & 5Lh Floor, PloL No 2B

Tower 2, Sector 126

NOlDA201 30^

CauLam Budh Naqar, U.P. lndia

1el: +91 120 671 7000

Fax: +91 120 671 7171

Pune

C^01, ^Lh loor

Panchshil Tech Park

Yerwada (Near Don Bosco School)

Pune-411 006

1el: +91 20 6603 6000

Fax: +91 20 6601 5900

Our ollces

PHD Chamber contacts:

Hydrocarbon Committee,

PHD Chamber of Commerce & Industry

Rajeev Mathur

Chairman

Dilip Khanna & S. K. Jain

Co-Chairman

Dr. Ranjeet Mehta

Senior SecreLary & Head

ranjeetmehta@phdcci.in

Gurpreet Kaur

Joint Secretary

gurpreet@phdcci.in

Mahima Tyagi

Assistant Secretary

mahima@phdcci.in

Khushboo Khanna

LxecuLive ollcer

khushboo@phdcci.in

PHD House, ^/2, Siri lnsLiLuLional Area,

AuqusL KranLi Marq, New Delhi110016

Phone : (+91 11) ^95^5^5^,26863801 Lo 0^,

Fax : (+91 11) 26855^50, 26863135

Web: www.phdcci.in

EY contacts:

Dilip Khanna

Partner, Transaction Advisory Services

dilip.khanna@in.ey.com

Raju Lal

Partner, Risk Advisory Services

raju.lal@in.ey.com

Devinder Chawla

Partner, Business Advisory Services

devinder.chawla@in.ey.com

Sanjay Grover

Partner, Tax & Regulatory Services

sanjay.grover@in.ey.com

About EY

EY is a global leader in assurance, tax, transaction and

advisory services. The insights and quality services we

deliver help build trust and confidence in the capital markets

and in economies the world over. We develop outstanding

leaders who team to deliver on our promises to all of our

stakeholders. In so doing, we play a critical role in building a

better working world for our people, for our clients and for

our communities.

EY refers to the global organization, and may refer to one or

more, of the member firms of Ernst & Young Global Limited,

each of which is a separate legal entity. Ernst & Young

Global Limited, a UK companylimited by guarantee, does not

provide services to clients. For more information about our

organization, please visit ey.com.

Ernst & Young LLP is one of the Indian client serving member

firms of EYGM Limited. For more information about our

orqanizaLion, please visiL www.ey.com/in.

Ernst & Young LLP is a Limited Liability Partnership,

registered under the Limited Liability Partnership Act, 2008

in India, having its registered office at 22 Camac Street, 3rd

Floor, Block C, Kolkata - 700016

201^ LrnsL & Younq LLP. Published in lndia.

All Rights Reserved.

LYlN1^0^0^0

ED 0115

This publication contains information in summary form

and is therefore intended for general guidance only. It is

not intended to be a substitute for detailed research or the

exercise ol prolessional |udqmenL. NeiLher LrnsL & Younq

LLP nor any other member of the global Ernst & Young

organization can accept any responsibility for loss occasioned

to any person acting or refraining from action as a result

of any material in this publication. On any specific matter,

reference should be made to the appropriate advisor.

RS

LY relers Lo Lhe qlobal orqanizaLion, and/or

one or more of the independent member

firms of Ernst & Young Global Limited

Ernst & Young LLP AbouL PHD Chamber

EY | Assurance | Tax | Transactions | Advisory

PHD Chamber ol Commerce and lndusLry is 109 years

old proactive and dynamic multi-State apex organization

working at the grass-root level and with strong national

and inLernaLional linkaqes. PHD Chamber serves 12 NorLh

and Central Indian States along with Bihar, Jharkhand in

the Eastern region and UT of Chandigarh. It has direct

and indirecL membership ol abouL ^8,000. PHD Chamber

acts as a catalyst in the promotion of industry, trade and

enLrepreneurship. PHD Chamber, Lhrouqh iLs research

based policy advocacy role, positively impacts the

economic growth and development of the nation.

We are globally connected through institutional linkages

with over 60 important foreign Chambers of Commerce.

Government of India has authorised us to issue certificate

of origin (non-preferential) to Indian exporters. We

also attest commercial documents of various types.

Recommendation letters for visas for business promotion

to foreign diplomatic missions in India are also issued for

representatives of Indian companies.

In its endeavour towards capacity building in the country,

PHD Chamber orqanises locussed enLrepreneurial

development training programmes in cooperation with

the Konrad Adenauer Foundation of Germany. Through

the support of its members, the Chamber has been

regularly contributing in cash and kind towards relief

and rehabilitation of the victims of natural calamities

and disasters. In keeping with the motto adopted 'Ethics

is Cood Business', PHD Chamber conlers Awards lor

Excellence annually.

AL lasL buL noL Lhe leasL PHD Chamber's ollices aL New

Delhi and Chandigarh provide modern conferencing and

catering facilities for corporate events, board meetings,

training programmes, etc. With a modern auditorium,

several conference and meeting rooms to suit different

requirements and also a business centre, while the

ambience is international, the cost is economical.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Aristo Interactive Geography 2nd Edition Book C5Documento81 pagineAristo Interactive Geography 2nd Edition Book C5thomas011122100% (1)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Tender For Cable Car FeasibilityDocumento26 pagineTender For Cable Car FeasibilityaqhammamNessuna valutazione finora

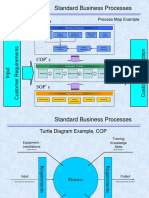

- Process Maps and Turtle Diagrams ExampleDocumento2 pagineProcess Maps and Turtle Diagrams ExampleJohn Oo100% (1)

- RCA2600 User Manual Rev C PDFDocumento9 pagineRCA2600 User Manual Rev C PDFMarcus DragoNessuna valutazione finora

- DO 178B DetailedDocumento25 pagineDO 178B DetailedSenthil KumarNessuna valutazione finora

- 2010-06-14 1300 Project Management Broad Spectrum Overview WikibookDocumento522 pagine2010-06-14 1300 Project Management Broad Spectrum Overview WikibookKits Sri100% (1)

- Yellow Belt Overview With QC3 - Define PDFDocumento60 pagineYellow Belt Overview With QC3 - Define PDFApple MonderinNessuna valutazione finora

- Working Method For Piping Installation - Add Method For Boom Lift 227KgDocumento58 pagineWorking Method For Piping Installation - Add Method For Boom Lift 227KgPhát NguyễnNessuna valutazione finora

- Bid For Consultant Feeder Separation WorkDocumento100 pagineBid For Consultant Feeder Separation Workbalajisuguna100% (1)

- Scope of WorkDocumento8 pagineScope of WorkGlenda CambelNessuna valutazione finora

- Best Practices For Global MES RolloutsDocumento8 pagineBest Practices For Global MES RolloutsCognizantNessuna valutazione finora

- SCM Asian PaintsDocumento22 pagineSCM Asian PaintsDhaval lokhande100% (2)

- Tubes Properties Arcelor MittalDocumento20 pagineTubes Properties Arcelor Mittalanil-kumar-singh-6674Nessuna valutazione finora

- 2013 State Gun SaleDocumento12 pagine2013 State Gun SaleSkyler rylerNessuna valutazione finora

- Tokyo Metro 10000 SeriesDocumento3 pagineTokyo Metro 10000 SeriesKim Tak GooNessuna valutazione finora

- Eureka Forbes CRMDocumento65 pagineEureka Forbes CRMMonalisha DasNessuna valutazione finora

- Bangladesh Machine Tools Factory (BMTF)Documento7 pagineBangladesh Machine Tools Factory (BMTF)Kaniz AlmasNessuna valutazione finora

- MYOB AE Practice Manager ViztopiaDocumento14 pagineMYOB AE Practice Manager Viztopiarjmv busisolutionsNessuna valutazione finora

- Us 20190016231 A 1Documento27 pagineUs 20190016231 A 1Fred Lamert100% (1)

- e-GMAT+ Applicant Lab - RESUME WRITING WebinarDocumento51 paginee-GMAT+ Applicant Lab - RESUME WRITING WebinarRonBNessuna valutazione finora

- SP, JPC, CPDocumento25 pagineSP, JPC, CPfoxtrot mikeNessuna valutazione finora

- Fm/Am Compact Disc Player: CDX-GT660US CDX-GT660UDocumento2 pagineFm/Am Compact Disc Player: CDX-GT660US CDX-GT660UjipercriperNessuna valutazione finora

- Summary Journal: From Asia To Africa: The International Expansion of Hon Chuan EnterpriseDocumento1 paginaSummary Journal: From Asia To Africa: The International Expansion of Hon Chuan EnterpriseFynNessuna valutazione finora

- International Journal 'Glass Bottle Industry'Documento20 pagineInternational Journal 'Glass Bottle Industry'Rikhi SobariNessuna valutazione finora

- Datashhet 4012-46tag2aDocumento5 pagineDatashhet 4012-46tag2aacrotech100% (1)

- JT Series Miter Gearbox: Jacton Electromechanical Co.,LtdDocumento32 pagineJT Series Miter Gearbox: Jacton Electromechanical Co.,LtdWarren LeeNessuna valutazione finora

- Chapter 17 - Waiting LinesDocumento4 pagineChapter 17 - Waiting Lineshello_khayNessuna valutazione finora

- Bow Tie ModelDocumento5 pagineBow Tie ModelJOENessuna valutazione finora

- Vendor Rating Mechanism of Purchase DepartmentDocumento6 pagineVendor Rating Mechanism of Purchase DepartmentPANKAJNessuna valutazione finora

- I.E IMP QuestionsDocumento13 pagineI.E IMP QuestionsSoban KasmaniNessuna valutazione finora