Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Artificial Inventory Profit - II

Caricato da

vgr10 valutazioniIl 0% ha trovato utile questo documento (0 voti)

28 visualizzazioni2 pagineAverage Inventory Calculation

Average Inventory Overview

Average inventory is used to estimate the amount of inventory that a business typically has on hand over a longer time period than just the last month. Since the inventory balance is calculated as of the end of the last business day of a month, it may vary considerably from the average amount over a longer time period, depending upon whether there was a sudden draw-down of inventory or perhaps a large supplier delivery at the end of the month.

Average inventory is also useful for comparison to revenues. Since revenues are typically presented in the income statement not only for the most recent month, but also for the year-to-date, it is useful to also calculate the average inventory for the year-to-date, and then match the average inventory balance to year-to-date revenues, to see how much inventory investment was needed to support a given level of sales.

Average Inventory Calculation

In the first case, where you are simply trying to avoid using a sudden spike or drop in the month-end inventory number, the average inventory calculation is to add together the beginning and ending inventory balances for a single month, and divide by two. The formula is:

(Beginning inventory + Ending inventory) / 2

In the second case, where you want to obtain an average inventory figure that is representative of the period covered by year-to-date sales, add together the ending inventory balances for all of the months included in the year-to-date, and divide by the number of months in the year-to-date. For example, if it is now March 31 and you want to determine the average inventory to match against sales for the January through March period, then the calculation could be:

January ending inventory $185,000

February ending inventory $213,000

March ending inventory $142,000

Total $540,000

Average inventory = Total / 3 $180,000

Days of Inventory

A variation on the average inventory concept is to calculate the exact number of days of inventory on hand, based on the amount of time it has historically taken to sell the inventory. This calculation is:

365 / (Annualized cost of goods sold / Inventory)

Thus, if a company has annualized cost of goods sold of $1,000,000 and an ending inventory balance of $200,000, its days of inventory on hand is calculated as:

365 / ($1,000,000 / $200,000) = 73 Days of inventory

Average Inventory Problems

The following are all problems with the average inventory calculation:

Month-end basis. The calculation is based on the month-end inventory balance, which may not be representative of the average inventory balance on a daily basis. For example, a company may traditionally have a huge sales push at the end of each month in order to meet its sales forecasts, which may artificially drop month-end inventory levels to well below their usual daily amounts.

Seasonal sales. If you are using an inventory average that is based on the month-end balances for the year-to-date, results can be skewed if the company’s sales are seasonal. This can cause abnormally low inventory balances at the end of the main selling season, as well as a major ramp-up in inventory balances just before the start of the main selling season.

Estimated balance. Sometimes the month-end inventory balance is estimated, rather than being based on a physical inventory count. This means that a portion of the averaging calculation may itself be based on an estimate, which in turn makes the average inventory amount less valid.

Titolo originale

Artificial Inventory Profit -II

Copyright

© © All Rights Reserved

Formati disponibili

TXT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAverage Inventory Calculation

Average Inventory Overview

Average inventory is used to estimate the amount of inventory that a business typically has on hand over a longer time period than just the last month. Since the inventory balance is calculated as of the end of the last business day of a month, it may vary considerably from the average amount over a longer time period, depending upon whether there was a sudden draw-down of inventory or perhaps a large supplier delivery at the end of the month.

Average inventory is also useful for comparison to revenues. Since revenues are typically presented in the income statement not only for the most recent month, but also for the year-to-date, it is useful to also calculate the average inventory for the year-to-date, and then match the average inventory balance to year-to-date revenues, to see how much inventory investment was needed to support a given level of sales.

Average Inventory Calculation

In the first case, where you are simply trying to avoid using a sudden spike or drop in the month-end inventory number, the average inventory calculation is to add together the beginning and ending inventory balances for a single month, and divide by two. The formula is:

(Beginning inventory + Ending inventory) / 2

In the second case, where you want to obtain an average inventory figure that is representative of the period covered by year-to-date sales, add together the ending inventory balances for all of the months included in the year-to-date, and divide by the number of months in the year-to-date. For example, if it is now March 31 and you want to determine the average inventory to match against sales for the January through March period, then the calculation could be:

January ending inventory $185,000

February ending inventory $213,000

March ending inventory $142,000

Total $540,000

Average inventory = Total / 3 $180,000

Days of Inventory

A variation on the average inventory concept is to calculate the exact number of days of inventory on hand, based on the amount of time it has historically taken to sell the inventory. This calculation is:

365 / (Annualized cost of goods sold / Inventory)

Thus, if a company has annualized cost of goods sold of $1,000,000 and an ending inventory balance of $200,000, its days of inventory on hand is calculated as:

365 / ($1,000,000 / $200,000) = 73 Days of inventory

Average Inventory Problems

The following are all problems with the average inventory calculation:

Month-end basis. The calculation is based on the month-end inventory balance, which may not be representative of the average inventory balance on a daily basis. For example, a company may traditionally have a huge sales push at the end of each month in order to meet its sales forecasts, which may artificially drop month-end inventory levels to well below their usual daily amounts.

Seasonal sales. If you are using an inventory average that is based on the month-end balances for the year-to-date, results can be skewed if the company’s sales are seasonal. This can cause abnormally low inventory balances at the end of the main selling season, as well as a major ramp-up in inventory balances just before the start of the main selling season.

Estimated balance. Sometimes the month-end inventory balance is estimated, rather than being based on a physical inventory count. This means that a portion of the averaging calculation may itself be based on an estimate, which in turn makes the average inventory amount less valid.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato TXT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

28 visualizzazioni2 pagineArtificial Inventory Profit - II

Caricato da

vgr1Average Inventory Calculation

Average Inventory Overview

Average inventory is used to estimate the amount of inventory that a business typically has on hand over a longer time period than just the last month. Since the inventory balance is calculated as of the end of the last business day of a month, it may vary considerably from the average amount over a longer time period, depending upon whether there was a sudden draw-down of inventory or perhaps a large supplier delivery at the end of the month.

Average inventory is also useful for comparison to revenues. Since revenues are typically presented in the income statement not only for the most recent month, but also for the year-to-date, it is useful to also calculate the average inventory for the year-to-date, and then match the average inventory balance to year-to-date revenues, to see how much inventory investment was needed to support a given level of sales.

Average Inventory Calculation

In the first case, where you are simply trying to avoid using a sudden spike or drop in the month-end inventory number, the average inventory calculation is to add together the beginning and ending inventory balances for a single month, and divide by two. The formula is:

(Beginning inventory + Ending inventory) / 2

In the second case, where you want to obtain an average inventory figure that is representative of the period covered by year-to-date sales, add together the ending inventory balances for all of the months included in the year-to-date, and divide by the number of months in the year-to-date. For example, if it is now March 31 and you want to determine the average inventory to match against sales for the January through March period, then the calculation could be:

January ending inventory $185,000

February ending inventory $213,000

March ending inventory $142,000

Total $540,000

Average inventory = Total / 3 $180,000

Days of Inventory

A variation on the average inventory concept is to calculate the exact number of days of inventory on hand, based on the amount of time it has historically taken to sell the inventory. This calculation is:

365 / (Annualized cost of goods sold / Inventory)

Thus, if a company has annualized cost of goods sold of $1,000,000 and an ending inventory balance of $200,000, its days of inventory on hand is calculated as:

365 / ($1,000,000 / $200,000) = 73 Days of inventory

Average Inventory Problems

The following are all problems with the average inventory calculation:

Month-end basis. The calculation is based on the month-end inventory balance, which may not be representative of the average inventory balance on a daily basis. For example, a company may traditionally have a huge sales push at the end of each month in order to meet its sales forecasts, which may artificially drop month-end inventory levels to well below their usual daily amounts.

Seasonal sales. If you are using an inventory average that is based on the month-end balances for the year-to-date, results can be skewed if the company’s sales are seasonal. This can cause abnormally low inventory balances at the end of the main selling season, as well as a major ramp-up in inventory balances just before the start of the main selling season.

Estimated balance. Sometimes the month-end inventory balance is estimated, rather than being based on a physical inventory count. This means that a portion of the averaging calculation may itself be based on an estimate, which in turn makes the average inventory amount less valid.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato TXT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Average Inventory Calculation

Average Inventory Overview

Average inventory is used to estimate the amount of inventory that a business ty

pically has on hand over a longer time period than just the last month. Since th

e inventory balance is calculated as of the end of the last business day of a mo

nth, it may vary considerably from the average amount over a longer time period,

depending upon whether there was a sudden draw-down of inventory or perhaps a l

arge supplier delivery at the end of the month.

Average inventory is also useful for comparison to revenues. Since revenues are

typically presented in the income statement not only for the most recent month,

but also for the year-to-date, it is useful to also calculate the average invent

ory for the year-to-date, and then match the average inventory balance to year-t

o-date revenues, to see how much inventory investment was needed to support a gi

ven level of sales.

Average Inventory Calculation

In the first case, where you are simply trying to avoid using a sudden spike or

drop in the month-end inventory number, the average inventory calculation is to

add together the beginning and ending inventory balances for a single month, and

divide by two. The formula is:

(Beginning inventory + Ending inventory) / 2

In the second case, where you want to obtain an average inventory figure that is

representative of the period covered by year-to-date sales, add together the en

ding inventory balances for all of the months included in the year-to-date, and

divide by the number of months in the year-to-date. For example, if it is now Ma

rch 31 and you want to determine the average inventory to match against sales fo

r the January through March period, then the calculation could be:

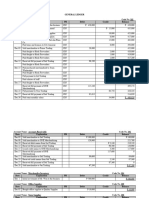

January ending inventory $185,000

February ending inventory $213,000

March ending inventory $142,000

Total $540,000

Average inventory = Total / 3 $180,000

Days of Inventory

A variation on the average inventory concept is to calculate the exact number of

days of inventory on hand, based on the amount of time it has historically take

n to sell the inventory. This calculation is:

365 / (Annualized cost of goods sold / Inventory)

Thus, if a company has annualized cost of goods sold of $1,000,000 and an ending

inventory balance of $200,000, its days of inventory on hand is calculated as:

365 / ($1,000,000 / $200,000) = 73 Days of inventory

Average Inventory Problems

The following are all problems with the average inventory calculation:

Month-end basis. The calculation is based on the month-end inventory balance

, which may not be representative of the average inventory balance on a daily ba

sis. For example, a company may traditionally have a huge sales push at the end

of each month in order to meet its sales forecasts, which may artificially drop

month-end inventory levels to well below their usual daily amounts.

Seasonal sales. If you are using an inventory average that is based on the m

onth-end balances for the year-to-date, results can be skewed if the companys sal

es are seasonal. This can cause abnormally low inventory balances at the end of

the main selling season, as well as a major ramp-up in inventory balances just b

efore the start of the main selling season.

Estimated balance. Sometimes the month-end inventory balance is estimated, r

ather than being based on a physical inventory count. This means that a portion

of the averaging calculation may itself be based on an estimate, which in turn m

akes the average inventory amount less valid.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Sam Chapter - IDocumento13 pagineSam Chapter - IsamsanthanamNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Stamp Duty BookDocumento18 pagineStamp Duty BookGeetika Anand100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Chapter 1 Monetary Policy IntroductionDocumento53 pagineChapter 1 Monetary Policy IntroductionBrian Ferndale Sanchez GarciaNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A4Documento2 pagineA4Sayed Atique NewazNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Case Study On Equity ValuationDocumento3 pagineCase Study On Equity ValuationUbaid DarNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- A Bank Clerk and A Bank CustomerDocumento2 pagineA Bank Clerk and A Bank CustomerADINDA PUSPITA CECILIANessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Obligasi - PembahasanDocumento18 pagineObligasi - Pembahasangaffar aimNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Strat Cost 8-24Documento4 pagineStrat Cost 8-24Vivienne Rozenn LaytoNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Butler Lumber Company Case SolutionDocumento18 pagineButler Lumber Company Case SolutionNabab Shirajuddoula71% (7)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Final Reviewer Mathematics InvestmentDocumento2 pagineFinal Reviewer Mathematics InvestmentChello Ann AsuncionNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- CVP ExerciseDocumento7 pagineCVP ExerciseKhiks ObiasNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- General LedgerDocumento4 pagineGeneral Ledger21-53070Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Mcit and CWTDocumento5 pagineMcit and CWTOlan Dave LachicaNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Investment Analysis and Portfolio Management: Lecture 6 Part 2Documento35 pagineInvestment Analysis and Portfolio Management: Lecture 6 Part 2jovvy24Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Garage Lease AgreementDocumento3 pagineGarage Lease Agreementmckenzie.lynnn.91Nessuna valutazione finora

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Documento6 paginePhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Jo Lariz OcliasoNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- YakDocumento35 pagineYakImran PathanNessuna valutazione finora

- CFA Institute Research ChallengeDocumento3 pagineCFA Institute Research ChallengeAritra BhowmikNessuna valutazione finora

- Audit Practice Manual - IndexDocumento4 pagineAudit Practice Manual - IndexIftekhar IfteNessuna valutazione finora

- Tata AIG Motor Policy Schedule 3189 6301019675-00Documento5 pagineTata AIG Motor Policy Schedule 3189 6301019675-00BOC ClaimsNessuna valutazione finora

- Inscaping: Exploring The Connection Between Experiential Surfacing and Social InnovationDocumento11 pagineInscaping: Exploring The Connection Between Experiential Surfacing and Social InnovationNesta100% (1)

- Is The U.S. Market in A Bubble?Documento2 pagineIs The U.S. Market in A Bubble?Leslie LammersNessuna valutazione finora

- Requirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)Documento4 pagineRequirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)MyunimintNessuna valutazione finora

- CFA-Chapter 7 Relative ValuationDocumento62 pagineCFA-Chapter 7 Relative ValuationNoman MaqsoodNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Contract CostingDocumento9 pagineContract CostingrajangargcaNessuna valutazione finora

- Working CapitalDocumento75 pagineWorking CapitalJayavardhan 2B1 8Nessuna valutazione finora

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDocumento1 paginaCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNessuna valutazione finora

- RWJ Chapter 1 - EUDocumento17 pagineRWJ Chapter 1 - EULokkhi BowNessuna valutazione finora

- Insurance MRPDocumento30 pagineInsurance MRPritesh0201100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Handbook Iberico 2018 WebDocumento329 pagineHandbook Iberico 2018 WebspachecofdzNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)