Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lioc 27.06.2014

Caricato da

Randora LkTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lioc 27.06.2014

Caricato da

Randora LkCopyright:

Formati disponibili

NDB Securities (Pvt) Ltd,

5th Floor,

# 40, NDB Building,

Nawam Mawatha,

Colombo 02.

Tel: +94 11 2314170

Fax: +9411 2314180

Research Team Waruna Singappuli, Suvimal De Costa, Akila Devendra, Vaishalie Shakespeare

P

o

w

e

r

a

n

d

E

n

e

r

g

y

S

e

c

t

o

r

Main Shareholders As At 31.03.14 No. of Shares %

Indian Oil Corporation Limited, India 400,000,005 75.12

Bank of Ceylon A/c Ceybank Unit Trust 17,524,839 3.29

Employee Provident Fund 15,911,915 2.99

National Savings Bank 12,980,951 2.44

JB Cocoshell (pvt) Ltd 8,308,083 1.56

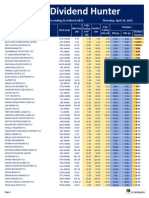

LKR Mn FY10/11(A) FY11/12(A) FY12/13(A) FY13/14(A) FY14/15(E) FY15/16(E)

Turnover 51,743 60,436 75,111 81,793 83,053 90,757

Net profits 877 907 2,909 4,813 2,996 3,042

EPS (LKR) 1.65 1.70 5.46 9.04 5.63 5.71

Forward P/E*(X) 10.69 11.39 3.73 4.26 7.20 7.09

DPS (LKR) 0.00 0.00 1.00 2.00 2.00 2.00

Dividend Yield (%) 0.00 0.00 4.90 5.19 4.94 4.94

BV (LKR) 17.30 19.00 24.46 32.01 35.63 39.35

PBV* (X) 1.02 1.02 0.83 1.20 1.14 1.03

ROE (%) 9.99 9.39 25.14 32.01 16.64 15.24

Total debt/Equity (X) 0.66 0.50 0.42 0.34 0.36 0.26

*P/E and PBV from FY10/11-FY12/13 have been calculated using the year-end share price,whilst current share price has been used for FY13/14-FY15/16.

Market Price As at 26.06.2014

52 Week Range

Shares in Issue

Average Daily Volume (52 Weeks)

Estimated Free Float (%) 24.88

Share Data

LKR 38.00

LKR 24.20 - 44.50

532,529,905

310,612

0

1

1

2

2

3

3

4

4

10

15

20

25

30

35

40

45

Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 Jan-14

Volume, Mn LKR,

Volume Adjusted ASPI Price

Lanka IOC PLC (LIOC)

Earnings update

Margins for auto fuel segment threatened The latest

estimated increase of 4.0% in Brent crude oil price for 2014

to USD 110.26 per bbl (Source: Bloomberg) will bring

down profit margins for FY14/15. This anticipated increase

is as a result of the current unrest in Iraq, which happens to

be OPECs second largest oil producer. To account for

these margin pressures, we revise our previous revenue

estimation downwards to LKR 59,297 Mn from LKR

60,094 Mn from total fuel distribution for FY14/15.

Overall reduction in revenue from Bunkering Sri

Lanka saw a contraction in the bunkering industry due to

lacklustre industry conditions and increasing regional

competition. In addition, during the year the entry of new

players to the local industry may have led to intense

competition and loss of market share for LIOC. LIOC has

experienced over 25% decline in revenue from bunkering in

FY13/14. However, considering this significant fall for last

year, we anticipate the volumes to remain stagnant for

FY14/15.

Sturdy cash balance to retain - According to our

estimates, LIOC has the ability to retain a robust cash

balance of above LKR 6,500 Mn even after paying out

dividends and incurring capital expenditure for the next 3

years from FY14/15 to FY16/17.

Change in recommendation - Since our previous

recommendation to BUY in April, the share has edged

down by 4.8% compared to a rise in ASPI of 5.2%.

Considering the likely reduction in earnings for FY14/15H1

compared to FY13/14H1 we have reduced the forward PER

from 8.0X to 7.0X and therefore, the intrinsic value has

declined.

(Please refer annexure for a description of the company)

Price Performance

Target Price LKR 42.10

Recommendation HOLD

Analysts Akila Devendra

Date 27.06.2014

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 2

Bitumen and Lubricants showing positivity

The bitumen and lubricant industries have been growing with the expansion in the

motor sector and growth in the economy. GDP growth of Sri Lanka for 2014 is

expected to be 7.2% according to World Bank projections. Lubricants for FY13/14

saw an increase of 34% which is the highest for LIOC since FY08/09. We have

estimated the lubricants to continue to witness gains with a CAGR of 13% for

FY14/15-FY16/17 while bitumen is estimated to witness gains of 7.0% for FY14/15.

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 3

Income Statement

LKR Mn FY10/11(A) FY11/12(A) FY12/13(A) FY13/14(A) FY14/15(E) FY15/16(E)

Revenue 51,743 60,436 75,111 81,793 83,053 90,757

Cost of Sales (50,217) (56,080) (69,721) (73,481) (76,927) (84,134)

Gross Profit 1,526 4,357 5,389 8,312 6,126 6,623

Other Operating Income 109 36 38 31 34 38

Selling and distribution costs (24) (1,425) (1,676) (1,748) (1,973) (2,209)

Administrative expenses (840) (1,011) (889) (875) (844) (990)

Operating profit 770 1,956 2,862 5,719 3,343 3,462

Net finance (expense)/income 124 (1,026) 128 43 242 173

Profit before tax 893 931 2,991 5,762 3,585 3,635

Tax (17) (24) (82) (948) (589) (593)

Net profit after tax 877 907 2,909 4,813 2,996 3,042

Balance Sheet

LKR Mn FY10/11(A) FY11/12(A) FY12/13(A) FY13/14(A) FY14/15(E) FY15/16(E)

Non current assets

Property,plant & equipment 3,313 3,276 3,265 3,341 5,708 5,865

Long term investment 4,394 4,394 4,394 4,394 4,394 4,394

Intangible assets 681 679 678 677 675 674

8,388 8,348 8,337 8,412 10,777 10,933

Current assets

Inventories 6,710 8,813 10,240 7,929 8,400 9,385

Current tax receivable 186 282 365 0 0 0

Trade & other receivables 3,012 2,980 2,570 1,886 1,933 2,217

Cash & cash equivalents 693 1,698 3,187 8,758 7,031 7,736

10,601 13,774 16,363 18,573 17,364 19,338

Total assets 18,989 22,122 24,700 26,985 28,141 30,271

Equity

Stated capital 7,577 7,577 7,577 7,577 7,577 7,577

Retained earnings 1,635 2,541 5,452 9,466 11,398 13,374

Total equity 9,211 10,117 13,028 17,043 18,974 20,951

Non current liabilities

Retirement benefit obligations 41 39 41 47 52 57

Deferred tax lability 0 0 5 30 30 30

41 39 47 77 82 87

Current liabilities

Trade & other payables 5,115 7,705 7,258 3,213 3,583 4,356

Borrowings 4,622 4,260 4,367 6,123 4,974 4,348

Total current liabilities and provisions 9,737 11,966 11,625 9,864 9,085 9,233

Total liabilities 9,778 12,005 11,672 9,942 9,167 9,320

Total equity & liabilities 18,989 22,122 24,700 26,985 28,141 30,271

Segmental breakdown

FY10/11(A) FY11/12(A) FY12/13(A) FY13/14(A) FY14/15(E) FY15/16(E)

Revenue

Fuel distribution 41,112 38,642 47,969 59,548 59,297 66,413

Bunkering 7,305 14,587 17,336 12,905 13,531 13,650

Lubricants 1,434 1,601 1,742 2,253 2,646 2,964

Bitumen 1,891 5,606 7,262 7,086 7,579 7,730

Other 0 0 801 0 0 0

51,743 60,436 75,111 81,793 83,053 90,757

Financials

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 4

Cash Flow Statement

LKR Mn FY13/14(A) FY14/15(E) FY15/16(E)

Profit Before Tax 5,762 3,585 3,635

Depreciation 221 233 343

Amortization 2 1 1

Interest Income (301) (395) (369)

Interest Expense 258 153 196

Change in Recievables 684 (47) (285)

Change in Inventories 2,312 (471) (985)

Change in Payables (4,045) 370 773

Change in retirement benefit obligations 6 5 5

Cash generated from operations 4,898 3,435 3,315

Interest paid (115) (120) (105)

Interest received 301 395 369

Economic service charge and income tax paid (558) (589) (593)

Net cash generated from operating activities 4,526 3,120 2,986

CF from investing activities

Purchase of property plant and equipment (304) (2,600) (500)

(313) (2,600) (500)

CF from financing activities

Net proceeds from borrowings 1,612 (1,182) (717)

Dividend paid (533) (1,065) (1,065)

1,079 (2,246) (1,782)

Net increase/(decrease) in cash and cash equivalents 5,292 (1,726) 704

Movement in cash & cash equivalents

At start of year 3,187 8,758 7,031

(Decrease)/ increase 5,292 (1,726) 704

At end of year 8,479 7,031 7,736

Key Ratios FY10/11(A) FY11/12(A) FY12/13(A) FY13/14(A) FY14/15(E) FY15/16(E)

Growth Ratios

Turnover Growth (%) 3.04 16.80 24.28 8.90 1.54 9.28

Gross Profit Growth (%) 510.82 185.52 23.71 54.22 -26.30 8.11

Net Profit Growth (%) 307.36 3.51 220.62 65.47 -37.75 1.52

Profitability Ratios

Gross Profit Margin (%) 2.95 7.21 7.18 10.16 7.38 7.30

Net Profit Margin (%) 1.69 1.50 3.87 5.88 3.61 3.35

ROE (%) 9.99 9.39 25.14 32.01 16.64 15.24

Share Ratios

EPS (LKR) 1.65 1.70 5.46 9.04 5.63 5.71

DPS (LKR) 0.00 0.00 1.00 2.00 2.00 2.00

Dividend Yield (%) 0.00 0.00 4.90 5.19 4.94 4.94

BV (LKR) 17.30 19.00 24.46 32.01 35.63 39.35

Gearing

Total Debt/Equity (%) 50.18 42.11 33.52 35.92 26.21 20.75

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 5

Appendix

Company Description

Lanka IOC (LIOC) is a subsidiary of Indian Oil Corporation, a fortune 500

Company, which was established in Sri Lanka in 2002. LIOC was listed in

the Colombo Stock Exchange in 2004. LIOC is currently one of the largest

players in import and distribution of petroleum products in Sri Lanka.

LIOC has interest in following segments

Fuel distribution

Bunkering

Bitumen

Lubricants

LIOC also holds a 33% stake in Ceylon Petroleum Storage Terminals Ltd,

which is the Common User Facility in Colombo for storage and distribution

of petroleum products in Sri Lanka. Further the company has heavily

invested in tank storage development, China Bay tank farm, in Trincomalee.

Fuel distribution

LIOC sources its fuel from Singapore and Dubai through competitive bidding

and distributes following fuels through 157 fuel outlets (105 owned, 52

franchise).

Petrol (Octane 92)

Petrol (Octane 95)

Diesel

Super Diesel

Xtra Mile

Xtra Premium

LIOC is the second largest importer and distributor of fuel in Sri Lanka with

about 12% market share. The fuel distribution takes place from the Common

User Facility in Colombo and the China Bay tank farm.

Fuel distribution contributed to roughly 40.4% of the turnover in FY13/14

making it the largest business segment for LIOC in terms of revenue while it

accounted for approximately 59% of gross profits.

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 6

Bunker operations

Since the start of its operations in 2009, LIOC has become one of the largest

bunkering companies at the Port of Colombo. The bunker operations cater to

vessels calling on the harbour for trade activities (approximately 60% of the

sales volumes) as well as shipping vessels passing through on the east west

sea trade route, one of the worlds busiest shipping lanes.

Following types of fuel are available at Colombo Port.

Fuel Oil 380 cst

Fuel Oil 180 cst

Marine Gas Oil (MGO)

Fuel Oils are generally used to power ship engines and the two variants

combined constitute to about 75% of the sales at the port of Colombo. MGO

is used to power ship generators, which is used to power other on board

equipment. Therefore in normal practice, ships when bunkering, purchase

both Fuel Oil and MGO.

The SLPA operates a common storage facility with a capacity of 40,000 MT

which is shared by the all the bunkering players. The bunker fuel is brought

to the harbour by bunkering operators in their own vessels or chartered

vessels and pumped into the common storage facility. The SLPA charges for

the usage of storage facilities depending on the quantity and number of days

at storage.

The bunkering at Port of Colombo is dominated by three main players.

LIOC

Lanka Marine Services

Lanka Maritime Services

Source : NDBS research

Lanka Marine Services

LIOC

Lanka Maritime Services

Other

Colombo port bunkering market share

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 7

Bunkering contributed to roughly 15.8% of the turnover in FY13/14 while it

accounted for approximately 12% of gross profits.

Source : Shipping density data adapted from National Center for Ecological Analysis and

Synthesis, United States

Bitumen operation

LIOC started import and distribution of Bitumen in FY09/10 with the

increasing public investments in infrastructure development. Bitumen, also

known commonly as asphalt, is used as a binder mixed with aggregate to

create asphalt cement in road works and other construction projects.

CPC is the largest distributor of bitumen in Sri Lanka, with bitumen produced

as a by-product of refining crude oil. LIOC has however gained significant

market share accounting for approximately 43.0% of imported bitumen in

FY12/13.

Bitumen contributed to roughly 8.66% of the turnover in FY13/14 while it

accounted for approximately 13% of gross profits.

Lubricants operation

LIOC started marketing lubricant under the Servo brand and in 2007 started

operating a blending plant in Trincomalee. It is currently the second largest

distributor of lubricants in Sri Lanka with majority of the products marketed

in Sri Lanka blended in Trincomalee.

Lubricants contributed to roughly 2.8% of the turnover in FY13/14 while it

accounted for approximately 3% of gross profits.

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 8

Board of Directors

Mr. Makrand Nene Chairman

Mr. Subodh Dakwale Managing Director

Mr. Lakshman Ravendra Watawala

Mr. Rajiv Khanna

Mr. B. Ashok

Mr. Amitha Gooneratne

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 9

Mrs. Prasansini Mendis Chief Executive Officer prasansini@ndbs.lk 011 2131005

Sales Branches

Head Office CSE

Mr. Gihan R. Cooray gihan@ndbs.lk 011 2131010 Mr. Sujeewa Athuorala sujeewa@ndbs.lk 011 3135495

Mr. !ayantha Sa"arasin#he jayantha@ndbs.lk 011 2131011 Mrs. Shiro"i $e Silva shiromi@ndbs.lk 011 2335054

Mr. Channaa Munasin#he channaka@ndbs.lk 011 2131014 Kiribathgoda

Mr. Aroos %aleel aroosaleel@ndbs.lk 011 2131012 Mr. Gayan Pathirana gayan@ndbs.lk 011 290!515

Mr. Au&urn Senn auburn@ndbs.lk 011 2131013 Matara

Mr. 'ditha Silva uditha@ndbs.lk 011 213101" Mr. (ithsiri )ishantha kithsiri@ndbs.lk 041 223"!5!

Mr. *aa"ara $e Silva taamara@ndbs.lk 011 213101# Mr. Sri"al Gunawardana srimal@ndbs.lk 041 223"!5!

Mr. +"ran Reyal imran@ndbs.lk 012 2131021 Galle

Mr. Ra"esh Anthony ramesh@ndbs.lk 011 2131023 Mr. * A A Aravinda ara$inda@ndbs.lk 091 222544!

Mr. )i"al (u"ara kumara@ndbs.lk 011 2131022 Gampaha

Mr. Sanjaya Pra&ath sanjaya@ndbs.lk 011 2131024 Mr. Cha"esh ,ettiarachchi chamesh@ndbs.lk 033 223111!

Mr. Ara" *hadani akram@ndbs.lk 011 2131025 Mr. 'ddee-a Peiris uddeepa@ndbs.lk 033 223111!

Mr. +shana %ernando ishanka@ndbs.lk 011 2131054 Mr. Priyashantha Senevirathne priyashantha@ndbs.lk 033 223111!

Mr. ,arsha Sritharan harsha@ndbs.lk 011 213101! Kaluthara

Mr. Sajed Sallay sajed@ndbs.lk 011 2131019 Ran#anath .ijethun#e ranganath@ndbs.lk 034 22215#9

Mr. Stefan $e Alwis stean@ndbs.lk 011 2131015 Mr. A A !eewantha jeewantha@ndbs.lk 035 22215#9

O-erations Jaffna

Mr. C Pad"anathan chandru@ndbs.lk 021 5"!1155

Contacts 's mail@ndbs.lk 011 2131000 Ms. Sanjia Ranjithu"ar sanjika@ndbs.lk 021 5"!1155

Rathnapura

)$B Securities /Pvt0 1td Mr. +ndrajith 1ouhetti#e indrajith@ndbs.lk 045 2230#00

5th %loor& '() )uilding& Ampara

40& 'awam *awatha& +olombo 02 Mr. Ravi $e Mel ra$i@ndbs.lk 0"3 2224245

)$B Securities /Pvt0 1td

NDB Securities (Pvt) Ltd Lanka IOC PLC 27

th

June 2014 10

Disclaimer

This document is based on information obtained from sources believed to be reliable, but NDB Securities

(Pvt) Ltd., (NDBS) accepts no responsibility or makes no warranties or representations, express or

implied, as to whether the information provided in this document is accurate, complete or up-to-date.

Furthermore, no representation or warranty is made by NDBS as to the sufficiency, relevance, importance,

appropriateness, completeness or comprehensiveness of the information contained herein for any specific

purpose. Prices, opinions and estimates reflect our judgment on the date of original publication and are

subject to change at any time without notice. NDBS reserves the right to change their opinion at any point

in time as they deem necessary. There is no guarantee that the target price for the stock will be met or that

predicted business results for the company will be met. NDBS accepts no liability whatsoever for any

direct or consequential loss or damage arising from any use of these reports or their contents. References

to tax are based on our understanding of current law and Inland Revenue practices, which may change

from time to time.

Any recommendation contained in this document does not have regard to the specific investment

objectives, financial situation and the particular needs of any specific addressee. This document is for the

information of addressee only and is not to be taken as substitution for the exercise of judgment by

addressee. The information contained in any research report does not constitute an offer to sell securities

or the solicitation of an offer to buy, or recommendation for investment in, any securities within Sri Lanka

or any other jurisdiction. The information in any research report is not intended as financial advice.

Moreover, none of the research reports is intended as a prospectus within the meaning of the applicable

laws of any jurisdiction and none of the research reports is directed to any person in any country in which

the distribution of such research report is unlawful. Past results do not guarantee future performance.

NDBS cautions that any forward-looking statements in any research report implied by such words as

anticipate, believe, estimate, expect, and similar expressions as they relate to a company or its

management are not guarantees of future performance. The investments in undertakings, securities or

other financial instruments involve risks. Any discussion of the risks contained herein should not be

considered to be a disclosure of all risks or complete discussion of the risks which are mentioned.

NDBS and its associates, their directors, and/or employees may have positions in, and may affect

transactions in securities mentioned herein and may also perform or seek to perform broking, investment

banking and other financial services for these companies.

Potrebbero piacerti anche

- Wei 20150904 PDFDocumento18 pagineWei 20150904 PDFRandora LkNessuna valutazione finora

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocumento4 pagineWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNessuna valutazione finora

- Weekly Update 04.09.2015 PDFDocumento2 pagineWeekly Update 04.09.2015 PDFRandora LkNessuna valutazione finora

- Daily 01 09 2015 PDFDocumento4 pagineDaily 01 09 2015 PDFRandora LkNessuna valutazione finora

- 03 September 2015 PDFDocumento9 pagine03 September 2015 PDFRandora LkNessuna valutazione finora

- Global Market Update - 04 09 2015 PDFDocumento6 pagineGlobal Market Update - 04 09 2015 PDFRandora LkNessuna valutazione finora

- Global Market Update - 04 09 2015 PDFDocumento6 pagineGlobal Market Update - 04 09 2015 PDFRandora LkNessuna valutazione finora

- Sri0Lanka000Re0ounting0and0auditing PDFDocumento44 pagineSri0Lanka000Re0ounting0and0auditing PDFRandora LkNessuna valutazione finora

- Earnings Update March Quarter 2015 05 06 2015 PDFDocumento24 pagineEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNessuna valutazione finora

- Press 20150831ebDocumento2 paginePress 20150831ebRandora LkNessuna valutazione finora

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocumento3 pagineICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNessuna valutazione finora

- Earnings & Market Returns Forecast - Jun 2015 PDFDocumento4 pagineEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNessuna valutazione finora

- Press 20150831ea PDFDocumento1 paginaPress 20150831ea PDFRandora LkNessuna valutazione finora

- CCPI - Press Release - August2015 PDFDocumento5 pagineCCPI - Press Release - August2015 PDFRandora LkNessuna valutazione finora

- Results Update Sector Summary - Jun 2015 PDFDocumento2 pagineResults Update Sector Summary - Jun 2015 PDFRandora LkNessuna valutazione finora

- Dividend Hunter - Mar 2015 PDFDocumento7 pagineDividend Hunter - Mar 2015 PDFRandora LkNessuna valutazione finora

- Results Update For All Companies - Jun 2015 PDFDocumento9 pagineResults Update For All Companies - Jun 2015 PDFRandora LkNessuna valutazione finora

- Dividend Hunter - Apr 2015 PDFDocumento7 pagineDividend Hunter - Apr 2015 PDFRandora LkNessuna valutazione finora

- BRS Monthly (March 2015 Edition) PDFDocumento8 pagineBRS Monthly (March 2015 Edition) PDFRandora LkNessuna valutazione finora

- Dividend Hunter - Mar 2015 PDFDocumento7 pagineDividend Hunter - Mar 2015 PDFRandora LkNessuna valutazione finora

- Daily - 23 04 2015 PDFDocumento4 pagineDaily - 23 04 2015 PDFRandora LkNessuna valutazione finora

- The Morality of Capitalism Sri LankiaDocumento32 pagineThe Morality of Capitalism Sri LankiaRandora LkNessuna valutazione finora

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Documento5 pagineN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNessuna valutazione finora

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocumento12 pagineCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNessuna valutazione finora

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocumento9 pagineJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNessuna valutazione finora

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocumento9 pagineChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNessuna valutazione finora

- Microfinance Regulatory Model PDFDocumento5 pagineMicrofinance Regulatory Model PDFRandora LkNessuna valutazione finora

- Daily Stock Watch 08.04.2015 PDFDocumento9 pagineDaily Stock Watch 08.04.2015 PDFRandora LkNessuna valutazione finora

- GIH Capital Monthly - Mar 2015 PDFDocumento11 pagineGIH Capital Monthly - Mar 2015 PDFRandora LkNessuna valutazione finora

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocumento4 pagineWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Solar TimeDocumento28 pagineSolar TimeArdi KotoNessuna valutazione finora

- Bus Bar Sizing Calculation For SubstatioDocumento11 pagineBus Bar Sizing Calculation For SubstatioMuhammad AdeelNessuna valutazione finora

- Technial Date SheetDocumento1 paginaTechnial Date SheetYeco MachineryNessuna valutazione finora

- Ho-SolarToday-April13 - v2Documento4 pagineHo-SolarToday-April13 - v2Danny Sánchez YánezNessuna valutazione finora

- John Dirk Walecka - Introduction To Classical Mechanics-WSPC (2020)Documento184 pagineJohn Dirk Walecka - Introduction To Classical Mechanics-WSPC (2020)Saiyad AliNessuna valutazione finora

- RCC RESO 20 06 - (Central - Scheduling) PDFDocumento57 pagineRCC RESO 20 06 - (Central - Scheduling) PDFSherwin SabandoNessuna valutazione finora

- InstrumentationDocumento7 pagineInstrumentationEmmanuel Enriquez0% (1)

- EASAQUESTIONPAPERS BLOGSPOT PART 66 MODULE 7 PART 3Documento15 pagineEASAQUESTIONPAPERS BLOGSPOT PART 66 MODULE 7 PART 3Ye Min OoNessuna valutazione finora

- اسئلة بيئة ةعمارة ت1 ك2-signedDocumento1 paginaاسئلة بيئة ةعمارة ت1 ك2-signedAli AlibrahimiNessuna valutazione finora

- Rock Eval 6Documento24 pagineRock Eval 6Mukul GoyalNessuna valutazione finora

- Specifying Windows and Doors Using Performance StandardsDocumento78 pagineSpecifying Windows and Doors Using Performance StandardsghadasaudiNessuna valutazione finora

- CSP Team 2 (1) Modify PDFDocumento29 pagineCSP Team 2 (1) Modify PDFPranay ChalumuriNessuna valutazione finora

- Acura TSX 2004 Electronic Throttle Control SystemDocumento89 pagineAcura TSX 2004 Electronic Throttle Control Systemjorge antonio guillen100% (1)

- Practice Problems On Air Conditioning SystemDocumento1 paginaPractice Problems On Air Conditioning Systemsushil.vgiNessuna valutazione finora

- Moving Coil GalvanometerDocumento5 pagineMoving Coil GalvanometerGauri Sakaria100% (2)

- ReportFileDocumento31 pagineReportFileRohan MehtaNessuna valutazione finora

- Role of Acoustics in Curtain Wall DesignDocumento77 pagineRole of Acoustics in Curtain Wall DesignbatteekhNessuna valutazione finora

- METHER1 - Machine Problems 2 PDFDocumento2 pagineMETHER1 - Machine Problems 2 PDFJhon Lhoyd CorpuzNessuna valutazione finora

- UC3842 Inside SchematicsDocumento17 pagineUC3842 Inside Schematicsp.c100% (1)

- Low Cost Housing: Ar. Yatra SharmaDocumento28 pagineLow Cost Housing: Ar. Yatra SharmaSaurav ShresthaNessuna valutazione finora

- Condair Gea Cairplus Gaisa Apstrades Iekartas Tehn Kat enDocumento36 pagineCondair Gea Cairplus Gaisa Apstrades Iekartas Tehn Kat enpolNessuna valutazione finora

- Building Code PDFDocumento227 pagineBuilding Code PDFBgee Lee100% (2)

- Essential Oils From Conventional To Green ExtractionDocumento13 pagineEssential Oils From Conventional To Green ExtractionNajihah RamliNessuna valutazione finora

- Manual Usuario Regal Raptot Daytona 350Documento48 pagineManual Usuario Regal Raptot Daytona 350cain985100% (1)

- Camphor BallsDocumento8 pagineCamphor BallsGurunath EpiliNessuna valutazione finora

- Sentra Aircon PDFDocumento98 pagineSentra Aircon PDFMed KevlarNessuna valutazione finora

- G Series 2-Cylinder Power PackageDocumento8 pagineG Series 2-Cylinder Power PackageIAN.SEMUT100% (1)

- 4368 PDFDocumento153 pagine4368 PDFAhmed AmirNessuna valutazione finora

- SA GuascorDocumento52 pagineSA GuascorcihanNessuna valutazione finora

- M3013-E Micropack 15 User ManuelDocumento54 pagineM3013-E Micropack 15 User ManuelhaizammNessuna valutazione finora