Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Meaning and Scope of Financial Engineering

Caricato da

saravana saravanaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Meaning and Scope of Financial Engineering

Caricato da

saravana saravanaCopyright:

Formati disponibili

Meaning and scope of financial engineering

Financial engineering

is the process of employing mathematical finance and computer modeling skills to make pricing,hedging,

trading and portfolio management decisions. Utilizing various derivative securities and other methods,

financialengineering aims to precisely control the financial risk that an entity takes on. Methods can be

employed to take onunlimited risks under certain events, or completely eliminate other risks by utilizing

combinations of derivative and othersecurities.

Areas where financial engineering techniques are employed include:

nvestment banking

!orporate strategic planning

"isk management

#rimary and derivative securities valuation

$waps % derivatives trading or dealing

&inancial information systems management

#ortfolio management

$ecurities trading

TOOLS OF FINANCIAL ENGINEERING

FACTORS CONTRIBUTING TO THE GROWTH OF FINANCIAL ENGINEERING

#rice 'olatility

(lobalisation of Market

)a* Asymmetry

"egulatory !hanges

+iquidity ,eeds

Accounting -enefits

Financial Engineering

Financial Engineering is a multidisciplinary field that include finance, computer

science, methods of engineering, mathematics, statistics and actually is the

focus of variety kinds of research.

The complexity of the business as well as the financial market and all markets

interaction demands today more diverse and accurate financial tools.

Financial Engineering can consider any business and can look at all the process,

translating on financial equation all the operational system. Many markets

participants, even non financial firms, would greatly benefit from financial

engineering tools and capital markets if they can understand financial products

that are available.

Firms want to capitali!e through the market.

Entrepreneurs need to evaluate their business viability and cash flow

estimation.

"nvestors want revenues#risk pro$ections before decisions.

%rowers need to understand and theirs market risks metrics &from

commodities or exchange rates fluctuation or climate changes' and protect

themselves from future uncertain.

(peculators want to get information about markets dynamics to profit on

prices changes.

)anks need to know risk metrics &volatility, credit risk' of diverse assets

exposures, to provide financial services.

*ublic and *rivate "nstitutions need to manage their assets and liabilities.

Many "nstitutions decide to interact directly with the capital market and,

differently from others software#based industries, the interaction with the

market have particularities.

(ome of this technologies is controversial because of the danger of a bad

pro$ected software can cause. +uality procedures, such design#prototype#

develop#track, software engineering process, simulation, sensitivity analysis,

robust optimi!ation can address the technological risk as well other financial

risks.

Potrebbero piacerti anche

- 2013MFE Program Fact Sheet AdminVersion X1a UpdatedDocumento2 pagine2013MFE Program Fact Sheet AdminVersion X1a UpdatedDinesh ReddyNessuna valutazione finora

- Asset Classes Equity and Derivatives: Product CoverageDocumento6 pagineAsset Classes Equity and Derivatives: Product Coveragetc2912Nessuna valutazione finora

- Goldman Sachs - Summer AnalystDocumento2 pagineGoldman Sachs - Summer AnalystMachana vinay krishnaNessuna valutazione finora

- Quantitative and Technical Roles at Goldman Sachs IndiaDocumento1 paginaQuantitative and Technical Roles at Goldman Sachs IndiaMriganabh ChoudhuryNessuna valutazione finora

- 2018 MSCF Careers GuideDocumento12 pagine2018 MSCF Careers GuidesurajkaulNessuna valutazione finora

- Day Trading 101: How to Master the Art and Science of Day TradingDa EverandDay Trading 101: How to Master the Art and Science of Day TradingNessuna valutazione finora

- Quantitative Finance: Victor Chandra, M.SCDocumento9 pagineQuantitative Finance: Victor Chandra, M.SCUzùmákî Nägäto TenshøûNessuna valutazione finora

- Liquidity Metrics1Documento2 pagineLiquidity Metrics1AltansukhDamdinsurenNessuna valutazione finora

- Launching A Digital Asset Exchange: Introductory GuideDocumento7 pagineLaunching A Digital Asset Exchange: Introductory Guidenormand67Nessuna valutazione finora

- Strategic - Risk MGMTDocumento23 pagineStrategic - Risk MGMTNiraj AcharyaNessuna valutazione finora

- Financial EngineeringDocumento5 pagineFinancial Engineeringfivero viNessuna valutazione finora

- Sensitivity AnalysisDocumento5 pagineSensitivity AnalysisMohsin QayyumNessuna valutazione finora

- OTC Derivative Pricing and Risk Subject Matter Expert (SME)Documento3 pagineOTC Derivative Pricing and Risk Subject Matter Expert (SME)nekougolo3064Nessuna valutazione finora

- Univ Exam 2000 SolutionsDocumento10 pagineUniv Exam 2000 SolutionsPriyesh SolkarNessuna valutazione finora

- Financial EngineeringDocumento42 pagineFinancial Engineeringqari saibNessuna valutazione finora

- Data Mining in Banking and FinanceDocumento14 pagineData Mining in Banking and Financeshweta_46664100% (1)

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongDa EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNessuna valutazione finora

- Financial Engineering Section A Definition of Financial EngineeringDocumento10 pagineFinancial Engineering Section A Definition of Financial Engineeringqari saibNessuna valutazione finora

- FMM Project Class 12Documento11 pagineFMM Project Class 12zgr24657Nessuna valutazione finora

- Financial Engineering AnuDocumento11 pagineFinancial Engineering AnuThaiseer MohammedNessuna valutazione finora

- A Primer for Financial Engineering: Financial Signal Processing and Electronic TradingDa EverandA Primer for Financial Engineering: Financial Signal Processing and Electronic TradingNessuna valutazione finora

- Understanding Financial Engineering: October 2018Documento6 pagineUnderstanding Financial Engineering: October 2018hihenryNessuna valutazione finora

- Certifiedinvestmentresearchanalyst (Cira) : Certified Investment Research AnalystDocumento6 pagineCertifiedinvestmentresearchanalyst (Cira) : Certified Investment Research Analystprithvisingh thakurNessuna valutazione finora

- Vijit Survey PaperDocumento6 pagineVijit Survey PaperHimanshu GaurNessuna valutazione finora

- Technical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesDa EverandTechnical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesValutazione: 4.5 su 5 stelle4.5/5 (39)

- Technology Banking ReportDocumento20 pagineTechnology Banking Reportrevahykrish93Nessuna valutazione finora

- Strategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementDa EverandStrategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementNessuna valutazione finora

- Ingenieria Financiera SyllabusDocumento6 pagineIngenieria Financiera SyllabusCarlos Enrique Tapia MechatoNessuna valutazione finora

- KYC Solutions 2022 - Market Update and Vendor LandscapeDocumento26 pagineKYC Solutions 2022 - Market Update and Vendor Landscapegreeshma chandranNessuna valutazione finora

- Strategic Financial ManagementDocumento9 pagineStrategic Financial ManagementHarish.PNessuna valutazione finora

- Operational RiskDocumento17 pagineOperational RiskSreenadh EPNessuna valutazione finora

- Risk Management of Financial Derivatives Grand ProjectDocumento127 pagineRisk Management of Financial Derivatives Grand ProjectMohit Bhendarkar60% (5)

- FE Presentation4Documento29 pagineFE Presentation4qweNessuna valutazione finora

- Consulting Financial Risk Management: The OpportunityDocumento2 pagineConsulting Financial Risk Management: The OpportunityArissa ISSNessuna valutazione finora

- Financial EngineeringDocumento12 pagineFinancial Engineeringpatrice bayleyNessuna valutazione finora

- 01 Task Performance 1 - AuditingDocumento6 pagine01 Task Performance 1 - AuditingMillania ThanaNessuna valutazione finora

- Market Risk ManagementDocumento10 pagineMarket Risk ManagementAnonymous fSNbc5q1HgNessuna valutazione finora

- Unec 1697222080Documento14 pagineUnec 1697222080Aysu AhmedNessuna valutazione finora

- 8 Gentzoglanis enDocumento52 pagine8 Gentzoglanis enAssad ZulfiqarNessuna valutazione finora

- Hussnain AhmadDocumento6 pagineHussnain AhmadShivani MalhotraNessuna valutazione finora

- Synopsis: Stock Agent - A Java Stock Market Trading ProgramDocumento27 pagineSynopsis: Stock Agent - A Java Stock Market Trading ProgramsanjaykumarguptaaNessuna valutazione finora

- Pan African Enetwork Project: Masters of Business AdministrationDocumento69 paginePan African Enetwork Project: Masters of Business AdministrationLepotlapotlaBruceTsutsumaNessuna valutazione finora

- Data 10Documento10 pagineData 10merc9876Nessuna valutazione finora

- Engineering Economics & Accountancy :Managerial EconomicsDa EverandEngineering Economics & Accountancy :Managerial EconomicsNessuna valutazione finora

- Risk Analysis & Assessment in Nigerian Banks IIDocumento16 pagineRisk Analysis & Assessment in Nigerian Banks IIShowman4100% (1)

- Note On Data Mining & BI in Banking SectorDocumento15 pagineNote On Data Mining & BI in Banking SectorAlisviviNessuna valutazione finora

- Quantitative Analysis (Finance) - ThesisDocumento8 pagineQuantitative Analysis (Finance) - ThesisJennifer AdvientoNessuna valutazione finora

- Fernbach FlexFinance Solutions 2022Documento32 pagineFernbach FlexFinance Solutions 2022palmkodokNessuna valutazione finora

- Chartered Market Technician (CMT) : Dravyaniti Consulting LLPDocumento4 pagineChartered Market Technician (CMT) : Dravyaniti Consulting LLPAtiharsh GuptaNessuna valutazione finora

- Financial EngineeringDocumento26 pagineFinancial EngineeringRajan100% (6)

- Wallstreet Suite Risk Management For GovernmentsDocumento8 pagineWallstreet Suite Risk Management For GovernmentsghaeekNessuna valutazione finora

- Advanced Options Trading: Approaches, Tools, and Techniques for Professionals TradersDa EverandAdvanced Options Trading: Approaches, Tools, and Techniques for Professionals TradersValutazione: 4 su 5 stelle4/5 (4)

- OrganisationalasdfDocumento40 pagineOrganisationalasdfsaravana saravanaNessuna valutazione finora

- KBD Sugars and Distilleries LimitedefsfsDocumento5 pagineKBD Sugars and Distilleries Limitedefsfssaravana saravanaNessuna valutazione finora

- Sratergic Management MaterialDocumento50 pagineSratergic Management Materialsaravana saravanaNessuna valutazione finora

- Strategic Management Notes For MBA 3rd Sem UTUDocumento55 pagineStrategic Management Notes For MBA 3rd Sem UTUManisha Verma80% (5)

- Dividend DecisionzxDocumento0 pagineDividend Decisionzxsaravana saravanaNessuna valutazione finora

- Option TradingfdhhDocumento56 pagineOption Tradingfdhhsaravana saravanaNessuna valutazione finora

- 3 Unit Transaction Processing SystemsDocumento19 pagine3 Unit Transaction Processing Systemssaravana saravanaNessuna valutazione finora

- Mis and Decision Making ConceptsDocumento7 pagineMis and Decision Making Conceptssaravana saravanaNessuna valutazione finora

- Transaction Processing System (TPS) Office Automation System (OAS)Documento66 pagineTransaction Processing System (TPS) Office Automation System (OAS)kimsr100% (17)

- Industry ProfileDocumento63 pagineIndustry Profilesaravana saravanaNessuna valutazione finora

- 05 Project MohangggfdgDocumento60 pagine05 Project Mohangggfdgsaravana saravanaNessuna valutazione finora

- Recruitment and Selection Project ReportDocumento46 pagineRecruitment and Selection Project Reportrichamishra1488% (33)

- Final 2 DSGDFGDFDGFDGFDHGDocumento72 pagineFinal 2 DSGDFGDFDGFDGFDHGsaravana saravanaNessuna valutazione finora

- Company Profile: TASA Foods Pvt. LTDDocumento35 pagineCompany Profile: TASA Foods Pvt. LTDsaravana saravanaNessuna valutazione finora

- Varma International Balance Sheet For The Year 2006-2007Documento5 pagineVarma International Balance Sheet For The Year 2006-2007saravana saravanaNessuna valutazione finora

- International Bussiness ManagementasDocumento1 paginaInternational Bussiness Managementassaravana saravanaNessuna valutazione finora

- Sales Training LG1sdfDocumento65 pagineSales Training LG1sdfsaravana saravanaNessuna valutazione finora

- Types of Risk of An EntrepreneurDocumento15 pagineTypes of Risk of An Entrepreneurvinayhn0783% (24)

- Kertas Tugasan: (Assignment Sheet)Documento5 pagineKertas Tugasan: (Assignment Sheet)Danish HasanahNessuna valutazione finora

- Accounts ReceivableDocumento6 pagineAccounts ReceivableNerish PlazaNessuna valutazione finora

- ACC221 Quiz1Documento10 pagineACC221 Quiz1milkyode9Nessuna valutazione finora

- Invitation To Bid-Kalibo and Laguindingan Airport 01.2018Documento2 pagineInvitation To Bid-Kalibo and Laguindingan Airport 01.2018zaccNessuna valutazione finora

- EduCBA - Equity Research TrainingDocumento90 pagineEduCBA - Equity Research TrainingJatin PathakNessuna valutazione finora

- POM TopicsDocumento2 paginePOM TopicsAnkit SankheNessuna valutazione finora

- National IP Policy Final 1EDocumento11 pagineNational IP Policy Final 1EsandeepNessuna valutazione finora

- A Study On Customer Satisfaction of Santoor Soap Virudhunagar TownDocumento2 pagineA Study On Customer Satisfaction of Santoor Soap Virudhunagar Townvishnuvishnu07100Nessuna valutazione finora

- FAQ International StudentsDocumento2 pagineFAQ International StudentsНенадЗекавицаNessuna valutazione finora

- Scheme of WorkDocumento45 pagineScheme of WorkZubair BaigNessuna valutazione finora

- Bse Data PolicyDocumento6 pagineBse Data Policyvishalsharma8522Nessuna valutazione finora

- HLB Receipt-2023-03-08Documento2 pagineHLB Receipt-2023-03-08zu hairyNessuna valutazione finora

- LandersMembership PDFDocumento2 pagineLandersMembership PDFRoiland Atienza BaybayonNessuna valutazione finora

- Nonprofit Director in Grand Rapids MI Resume Susan PutnamDocumento2 pagineNonprofit Director in Grand Rapids MI Resume Susan PutnamSusanPutnamNessuna valutazione finora

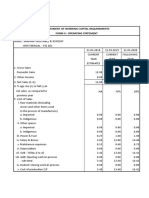

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocumento12 pagineAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNessuna valutazione finora

- SegmentationDocumento11 pagineSegmentationmridz11Nessuna valutazione finora

- Chart of AccountzsDocumento22 pagineChart of AccountzsMuddser ShahidNessuna valutazione finora

- Security Analysis of Bharat Forge LTDDocumento38 pagineSecurity Analysis of Bharat Forge LTDRanjan Shetty100% (1)

- Wipro WInsights Sustainability ReportingDocumento3 pagineWipro WInsights Sustainability ReportingHemant ChaturvediNessuna valutazione finora

- Interesting Cases HbsDocumento12 pagineInteresting Cases Hbshus2020Nessuna valutazione finora

- Mgea02 TT1 2011F ADocumento9 pagineMgea02 TT1 2011F AexamkillerNessuna valutazione finora

- Literature ReviewDocumento6 pagineLiterature Reviewanon_230550501Nessuna valutazione finora

- United States Court of Appeals, Eleventh CircuitDocumento10 pagineUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNessuna valutazione finora

- Nationalization of Oil in Venezuela Re-Defined Dependence and Legitimization ofDocumento23 pagineNationalization of Oil in Venezuela Re-Defined Dependence and Legitimization ofDiego Pérez HernándezNessuna valutazione finora

- Ethical DileemaasDocumento46 pagineEthical DileemaasRahul GirdharNessuna valutazione finora

- True-False Perfect CompetitionTrue-false Perfect CompetitionDocumento37 pagineTrue-False Perfect CompetitionTrue-false Perfect CompetitionVlad Guzunov50% (2)

- Digital Banking, Customer PDFDocumento27 pagineDigital Banking, Customer PDFHafsa HamidNessuna valutazione finora

- Competitive Analysis AnsysDesignSpaceDocumento7 pagineCompetitive Analysis AnsysDesignSpaceArjun SriNessuna valutazione finora