Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Soberanosinternet

Caricato da

CredServicos SADescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Soberanosinternet

Caricato da

CredServicos SACopyright:

Formati disponibili

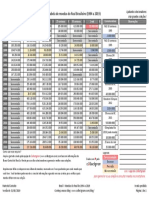

DVIDA MOBILIRIA EXTERNA

Caractersticas das Emisses Voluntrias

Foreign Bond Debt

Characteristics of the Voluntary Issuances

Valores (na emisso)

TTULOS

ISIN

BONDS

ISIN

Data do

Lanamento

Data da

Emisso

Vencimento

Preo

Emisso (%)

Moeda

Local

Maturity

Date

Offer

Price (%)

Local

Currency

Manager(s)

100.000

100.500

100.000

100.000

100.394

JPY

DEM

JPY

ESC

GBP

Nomura Sec.

Dresdner Bank

Nomura Sec.

Finantia

Midland Bank

J.P.Morgan

Swiss Bank

Credit Suisse F.Boston

80,000,000,000

1,000,000,000

30,000,000,000

12,000,000,000

100,000,000

945,540,418

724,055,289

280,906,767

76,180,319

153,522,575

750,000,000

1,000,000,000

Banque Paribas

ING Barings

Creditanstalt BankVerein

J.P.Morgan

24.05.95

21.06.95

04.03.96

16.04.96

29.05.96

19.06.95

20.07.95

22.03.96

15.05.96

11.06.96

19.06.97

20.07.98

22.03.01

15.05.99

11.06.99

Global 2001

US105756AD24

28.10.96

05.11.96

05.11.01

99.857

USD

DM 2007

Parallel 2002

Franco Francs

Florim Holands

Schilling Austraco

DE0001897502

04.02.97

26.02.97

26.02.07

101.900

DEM

FR0000109589

28.04.97

21.05.97

21.05.02

100.755

101.325

101.100

FRF

NLG

ATS

04.06.97

09.06.97

15.05.27

93.234

US105756AE07

5 anos

8,875 %

semestral

No

265

8%

anual

No

242

1,000,000,000

400,000,000

2,000,000,000

2,243,930,000

175,387,826

210,100,586

168,137,873

5 anos

6,625%

anual

No

195

190

190

(Exchange)

756,070,000

(New money)

756,070,000

30 anos

10,125 %

semestral

No

500,000,000

(Reabertura)

500,000,000,000

250,000,000,000

500,000,000

296,180,457

146,455,770

20 anos

11 %

anual

No

348

150,000,000

244,303,653

10 anos

10%

anual

No

268

500,000,000

546,675,122

5 anos

8.625%

anual

No

417

750,000,000

417,339,046

10 anos

anual

No

328

1,250,000,000

1,250,000,000

10 anos

10% (1 e 2 anos)

7%(seguintes)

9,375%

semestral

No

375

9.401

2,000,000,000

Salomon Smith Barney

Morgan Stanley D. Witter

2,000,000,000

(New money)

1,000,000,000

(Exchange)

5 anos

11.625%

semestral

No

675

11.882

Credit Suisse First Boston

Dresdner Bank

700,000,000

750,018,750

600

9.720

3 anos

9.50%

anual

No

Credit Suisse First Boston

Dresdner Bank

ABN Amro

Paribas

ABN Amro

Paribas

ABN Amro

Paribas

Chase Securities

J.P.Morgan

100,000,000

(Reabertura)

107,145,536

595

9.580

320,420,392

695

11.536

688

11.426

681

11.343

850

14.610

685

12.110

682

11.810

8.330

Goldman Sachs

98.350

101.300

ITL

Deustche M. Grenfell

Eurolibra 2007

XS0078548038

14.07.97

30.07.97

30.07.07

101.088

GBP

Euroeuro 2003

XS0084496602

09.02.98

03.03.98

03.03.03

99.863

XEU

EuroDM 2008

DE0002309002

23.04.98

23.04.98

23.04.08

101.450

DM

US105756AG54

31.03.98

07.04.98

07.04.08

99.738

US$

Barclays De Zoete

Credit Swisse F.Boston

Paribas

SBC Warburg

ABN Amro

Dresdner

Merril Lynch

J.P.Morgan

Goldman Sachs

1a Tranche

15.04.04

99.070

US$

2 Tranche

1a Tranche

Euro 2002

2a Tranche

08.07.99

XS0099753146

1a Tranche

2a Tranche

Euro 2004

XS0102005989

3a Tranche

Global 2009

29.07.99

29.07.02

1a Tranche

EUR

27.07.99

99.800

09.09.99

98.500

17.09.99

30.09.99

30.09.04

27.09.99

US105756AJ93

Euro 2006

99.440

98.900

18.10.99

25.10.99

15.10.09

99.444

28.10.99

17.11.99

17.11.06

99.500

04.11.99

17.11.99

17.11.06

100.875

XS0103912373

2a Tranche

EUR

99.200

USD

Yield

% per year

10 anos

26.06.17

26.06.17

30.04.99

Yield

% a.a

592,150,454

USD

19.04.99

em pontos base)

no Lanamento

Bonds with Collective

Action Clause - CAC

750,000,000

15.05.27

XS0049988636

Spread (moeda local

Spread (original currency

in base points)

on the issuance

481

410

320

226

250

26.06.97

10.07.97

Frequency

Ttulos com

Clusula de Ao

Coletiva - CAC

No

No

No

No

No

27.03.98

Global 2004

Res. SF no 20/2004

Coupon

% per year

Perodo

anual

anual

semestral

semestral

anual

03.06.97

Global 2008

Tenor (years)

Cupom

% a.a

6%

9%

5,5%

LIBOR + 2.4%

9,75 %

20.03.98

2 Tranche

Eurolira 2017

Prazo

Res. SF no 20/2004

2 anos

3 anos

5 anos

3 anos

3 anos

XS0077157575

Original Currency

Em USD(*)

Res. SF n 57/1995

Res. SF n 69/1996

Volumes

In USD

Res. SF n 57/1995

Res. SF n 69/1996

Settlement

Date

XS0057946922

DE0001288405

JP507600AS38

XS0065836107

XS0066835504

1a Tranche

Na moeda local

Issuance

Date

Yen 1997

DM 1998

Samurai 2001

Caravela 1999

Eurolibra 1999

Global 2027

Lder(es)

300,000,000.000

100,000,000

(Reabertura)

100,000,000

(Reabertura)

2,243,930,000

395

10.896

440

10.294

1,000,000,000

106,806,797

5 anos

11.125%

anual

No

106,806,797

2,000,000,000

2,000,000,000

Credit Suisse First Boston

500,000,000

520,540,529

Deutsche Bank

200,000,000

208,216,212

EUR

10 anos

14,50%

semestral

No

7 anos

12,00%

anual

No

Euro 2001

XS0104436109

12.11.99

26.11.99

26.11.01

99.850

EUR

Dresdner Bank

600,000,000

610,016,470

2 anos

8.25%

anual

No

450

Euro 2010

XS0106768608

14.01.00

04.02.00

04.02.10

98.540

EUR

750,000,000

736,955,881

10 anos

11.00%

anual

No

571

11.25

US105756AK66

19.01.00

26.01.00

15.01.20

96.394

USD

BNP Paribas

Deutsche Bank

Chase Securities

Goldman Sachs

1,000,000,000

1,000,000,000

20 anos

12.75%

semestral

No

650

13.270

24.02.00

06.03.00

06.03.30

93.299

1,000,000,000

1,000,000,000

679

13.151

30 anos

12.25%

semestral

No

22.03.00

29.03.00

06.03.30

98.250

635

12.470

30.03.00

17.04.00

17.04.03

100.000

474

4.500

20.06.00

05.07.00

05.07.05

99.226

417

9.200

Global 2020

1a Tranche

Global 2030

US105756AL40

2a Tranche

Samurai 2003

JP507600A043

Euro 2005

XS0128392510

1a Tranche

Global 2007

2a Tranche

Global 2040

a

1 Tranche

Euro 2007

2a Tranche

Morgan Stanley D. Witter

JPY

Nomura Sec.

EUR

Credit Suisse First Boston

Schroder Salomon Smith Barney

600,000,000

600,000,000

(Reabertura)

60,000,000,000

574,063,798

750,000,000

714,619,203

18.04.01

09.05.01

05.07.05

101.250

500,000,000

(Reabertura)

442,477,876

19.07.00

26.07.00

26.07.07

94.588

1,000,000,000

611,940,000

11.04.01

17.04.01

26.07.07

100.500

500,000,000

(Reabertura)

500,000,000

09.08.00

17.08.00

17.08.40

80.203

US105756AM23

US105756AP53

Merril Lynch

USD

USD

19.09.00

XS0118241883

USD

Goldman Sachs

Merril Lynch

Goldman Sachs, Chase e

Morgan Stanley D. Witter

98.772

05.10.00

05.10.07

02.10.00

EUR

99.500

J.P.Morgan

UBS Warburg

5,157,311,000

434,431,286

250,000,000

(Reabertura)

217,215,643

JP507600A0C1

28.11.00

22.12.00

22.03.06

100.000

JPY

Nomura, Bank of Tokyo-Mitsubishi, Kokusai

60,000,000,000

531,707,490

Global 2006

US105756AQ37

04.01.01

11.01.01

11.01.06

98.895

USD

1,500,000,000

1,500,000,000

Euro 2011

XS0123149733

09.01.01

24.01.01

24.01.11

97.357

EUR

1,000,000,000

924,240,044

Global 2024

US105756AR10

07.03.01

22.03.01

15.04.24

71.270

USD

Morgan Stanley D. Witter

Bear Sterns

Dresdner Kleinwort

Merril Lynch

Salomon Smith Barney

Credit Suisse First Boston

Samurai 2007

JP507600A142

16.03.01

10.04.01

10.04.07

100.000

JPY

Nomura Sec.

80,000,000,000

643,200,566

Global 2005

US105756AS92

10.05.01

15.05.01

15.07.05

94.660

USD

1,000,000,000

1,000,000,000

Samurai 2003 B

EC4309893

31.07.01

30.08.01

28.08.03

100.000

JPY

200,000,000,000

1,674,901,600

Global 2012

US105756AT75

07.01.02

11.01.02

11.01.12

91.040

USD

1,250,000,000

1,250,000,000

Global 2008 B

US105756AU49

05.03.02

12.03.02

12.03.08

99.004

USD

1,250,000,000

1,250,000,000

Euro 2009

XS0145659651

21.03.02

02.04.02

02.04.09

99.769

EUR

500,000,000

440,600,000

Global 2010

US105756AV22

10.04.02

16.04.02

15.04.10

98.086

USD

1,000,000,000

US105756AW05

29.04.03

06.05.03

16.01.07

97.939

USD

US105756AX87

10.06.03

17.06.03

17.06.13

97.993

USD

Deutsche Bank

J.P.Morgan Chase

Nomura Securities

Daiwa Securities

J.P. Morgan Sec. Inc.

Salomon Smith Barney

Goldman Sachs

Merril Lynch

ABN Amro

Dresdner Kleinwort

J.P. Morgan Chase

Morgan Stanley DW

UBS Warburg

Merril Lynch

Deutsche Bank

Goldman Sachs

US105756AY60

30.07.03

07.08.03

07.08.11

Global 2013

2a. Tranche

90.485

1

USD

Global 2024 B

US105756AZ36

30.07.03

07.08.03

15.04.24

75,581

USD

Global 2011 (Reabertura)

US105756AY60

11.09.03

18.09.03

07.08.11

96.500

USD

Global 2010 N

US105756BA75

15.10.03

22.10.03

22.10.10

98.992

USD

Global 2034

US105756BB58

12.01.04

20.01.04

20.01.34

94.723

USD

No

5 anos

9.00%

anual

No

7 anos

11.25%

semestral

No

40 anos

11.00%

semestral

No

9.50%

anual

399

8.644

610

12.430

615

11.130

788

13.732

446

9.750

441

9.642

No

5,3 anos

4.75%

semestral

No

355

4.750

6 anos

10.25%

semestral

No

570

10.540

10 anos

9.50%

anual

No

517.5

9.929

23 anos

8.875%

semestral

No

773

12.910

6 anos

4.75%

semestral

No

412

4.750

4,2 anos

9.625%

semestral

No

648

11.250

2 anos

3.750%

semestral

No

358

3.750

10 anos

11.000%

semestral

No

754

12.600

6 anos

11.500%

semestral

No

738

11.736

7 anos

11.500%

anual

No

646

11.550

1,000,000,000

8 anos

12.000%

semestral

No

719

12.384

1,000,000,000

1,000,000,000

3,7 anos

10.000%

semestral

Sim

783

10.700

1,250,000,000

1,250,000,000

10 anos

10.250%

semestral

Sim

738

10.580

726

11.210

7 anos

10.000%

semestral

Sim

757

11.875

20,7 anos

8.875%

semestral

Sim

764

12.590

7,9 anos

10.000%

semestral

Sim

664

10.663

2,150,000,000

93.717

1a. Tranche

Global 2011

semestral

7 anos

Samurai 2006

Global 2007 B

4.50%

388,060,000

5,157,311,000

500,000,000

3 anos

2,150,000,000

126,813,000

J.P.Morgan

Morgan Stanley

500,000,000

J.P.Morgan

Morgan Stanley

Citigroup

Goldman Sachs

Merril Lynch

Credit Suisse First Boston

Citigroup

Deutsche Bank

824,702,000

373,187,000

824,702,000

750,000,000

750,000,000

1,500,000,000

1,500,000,000

7 anos

9.250%

semestral

Sim

561

9.450

1,500,000,000

1,500,000,000

30 anos

8.250%

semestral

Sim

377

8.750

DVIDA MOBILIRIA EXTERNA

Caractersticas das Emisses Voluntrias

Foreign Bond Debt

Characteristics of the Voluntary Issuances

Valores (na emisso)

TTULOS

Data do

Lanamento

Data da

Emisso

Vencimento

ISIN

Preo

Emisso (%)

Moeda

Local

Lder(es)

Floater 2009

US105756BC32

21.06.04

28.06.04

29.06.09

99.245

USD

14.07.04

14.07.14

98.192

USD

08.09.04

24.09.04

24.09.12

98.881

EUR

22.09.04

30.09.04

24.09.12

101.875

EUR

US105756BE97

06.10.04

14.10.04

14.10.19

97.780

USD

Global 2014 (Reabertura)

US105756BD15

03.12.04

08.12.04

14.07.14

114.750

USD

Euro 2015

XS0211229637

20.01.05

03.02.05

03.02.15

98.800

EUR

Global 2025

US105756BF62

31.01.05

04.02.05

04.02.25

98.610

USD

Global 2015

US105756BG46

28.02.05

07.03.05

07.03.15

99.829

USD

Global 2019 (Reabertura)

US105756BE97

10.05.05

17.05.05

14.10.19

100.375

USD

Global 2034 (Reabertura)

US105756BB58

25.05.05

02.06.05

20.01.34

94.125

USD

Global 2015 (Reabertura)

US105756BG46

20.06.2005

27.06.2005

07.03.2015

100.945

USD

A-Bond 20186

US105756BH29

22.07.2005

01.08.2005

15.01.2018

101.250

USD

Global 2025 (Reabertura)

US105756BF62

06.09.2005

13.09.2005

04.02.2025

102.125

USD

Global BRL 2016

US105756BJ84

19.09.2005

26.09.2005

05.01.2016

98.636

BRL

Global 2015 (Reabertura 2)

US105756BG46

09.11.2005

17.11.2005

07.03.2015

100.702

USD

Global 2034 (Reabertura 2)

US105756BB58

29.11.2005

06.12.2005

20.01.2034

99.325

USD

Global 2037

US105756BK57

10.01.2006

18.01.2006

20.01.2037

94.856

USD

Euro 2015 (Reabertura)7

XS0211229637

30.01.2006

03.02.2006

03.02.2015

113.428

EUR

Global 2037 (Reabertura)

US105756BK57

16.03.2006

23.03.2006

20.01.2037

103.747

USD

Goldman Sachs

Merrill Lynch

Deutsche Bank

Morgan Stanley & Co.

UBS Limited

Dresdner Bank AG London Branch

UBS Limited

Dresdner Bank AG London Branch

Citigroup Global Markets Inc.

J.P. Morgan Securities Inc.

J.P. Morgan Securities Inc.

Morgan Stanley & Co.

BNP Paribas

Deutsche Bank A.G. London

Deutsche Bank Securities Inc.

UBS Securities LLC

Citigroup Global Markets Inc.

J.P. Morgan Securities Inc.

Goldman Sachs & Co

Merrill Lynch

Deutsche Bank

Bear Stearns

Citigroup Global Markets Inc.

HSBC Securities (USA) Inc.

J.P. Morgan Securities Inc.

Credit Suisse First Boston LLC

Morgan Stanley

Bear Stearns

J.P. Morgan Securities Inc.

Goldman Sachs & Co

Citigroup Global Markets Inc.

HSBC Securities (USA) Inc.

Merrill Lynch & Co.

Barclays Capital Inc.

Deutsche Bank Securities.

UBS Investment Bank

Dresdner Bank AG London Branch

Barclays Capital Inc.

J.P. Morgan Securities Inc.

HSBC Securities (USA) Inc.

Global 2014

US105756BD15

07.07.04

XS0201110037

XS0201110037

Global 2019

Global 2034 (Troca Global 2030)8

US105756BB58

25.05.2006

02.06.2006

20.01.2034

100.125

USD

Global 2037 (Exchange Offer )9

US105756BK57

03.08.2006

16.08.2006

20.01.2037

99.680

USD

Global BRL 202210

US105756BL31

06.09.2006

13.09.2006

05.01.2022

97.563

BRL

Global BRL 2022 (Reabertura)11

US105756BL31

05.10.2006

13.10.2006

05.01.2022

100.250

BRL

Global 2017

US105756BM14

07.11.2006

14.11.2006

17.01.2017

98.125

USD

Global BRL 2022 (Reabertura 2)12

US105756BL31

04.12.2006

11.12.2006

05.01.2022

105.875

BRL

Global 2037 (Reabertura 2)

US105756BK57

23.01.2007

30.01.2007

20.01.2037

106.338

USD

Global BRL 202813

US105756BN96

07.02.2007

14.02.2007

10.01.2028

96.451

BRL

Global BRL 2028 (Reabertura)14

US105756BN96

20.03.2007

27.03.2007

10.01.2028

99.750

BRL

Global 2017 (Reabertura)

US105756BM14

03.04.2007

11.04.2007

17.01.2017

100.796

USD

Global BRL 2028 (Reabertura 2)15

US105756BN96

10.05.2007

17.05.2007

10.01.2028

112.250

BRL

Global BRL 2028 (Reabertura 3)16

US105756BN96

19.06.2007

26.06.2007

10.01.2028

115.500

BRL

Global 2017 (Reabertura 2)

US105756BM14

07.05.2008

14.05.2008

17.01.2017

104.816

USD

Global 2019 N

US105756BQ28

06.01.2009

13.01.2009

15.01.2019

98.135

USD

Global 2019 N (Reabertura)

US105756BQ28

07.05.2009

14.05.2009

15.01.2019

100.539

USD

Global 2037 (Reabertura 3)

US105756BK57

29.07.2009

05.08.2009

20.01.2037

108.630

USD

Global 2041

US105756BR01

30.09.2009

07.10.2009

07.01.2041

97.498

USD

Global 2019 N (Reabertura 2)

US105756BQ28

15.12.2009

22.12.2009

15.01.2019

108.204

USD

Global 2021

US105756BS83

15.04.2010

22.04.2010

22.01.2021

98.978

USD

Global 2021 (Reabertura)

US105756BS83

27.07.2010

03.08.2010

22.01.2021

102.707

USD

Global 2041 (Reabertura)

US105756BR01

14.09.2010

21.09.2010

07.01.2041

106.407

USD

US105756BN96

20.10.2010

27.10.2010

10.01.2028

112.226

BRL

Global 2021 (Reabertura 2)

US105756BS83

07.07.2011

14.07.2011

22.01.2021

105.348

USD

Global 2041 (Reabertura 2)

US105756BR01

04.11.2011

10.11.2011

07.01.2041

114.700

USD

Global 2021 (Reabertura 3)

US105756BS83

03.01.2012

06.01.2012

22.01.2021

110.997

USD

Global 2024

US105756BT66

17.04.2012

27.04.2012

05.01.2024

99.292

BRL

Global 2023

US105756BU30

05.09.2012

12.09.2012

05.01.2023

99.456

Global 2023 (Reabertura)

US105756BU30

09.05.2013

16.05.2013

05.01.2023

98.946

USD

Global 2025

US105756BV13

23.10.2013

01.11.2013

07.01.2025

99.521

USD

Euro 20122

Euro 2012 (Reabertura)

Global BRL 2028 (Reabertura 4)

Total - Res. SF 20/2004

17

USD

Deutsche Bank Securities Inc.

Citigroup Global Markets Inc.

Citigroup Global Markets Inc.

J.P. Morgan Securities Inc.

Merrill Lynch

UBS Securities LLC

Deutsche Bank Securities Inc.

Barclays Capital Inc.

Morgan Stanley & Co.

Goldman Sachs & Co

Bear Sterns

Merril Lynch

J.P. Morgan Securities Inc.

UBS Securities LLC

Citigroup Global Markets Inc.

Barclays Capital Inc.

Morgan Stanley & Co.

Merril Lynch

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

J.P. Morgan Securities Inc.

Credit Suisse Securities (USA) LLC

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Goldman Sachs & Co

Merril Lynch

Barclays Capital Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

J.P. Morgan Securities Inc.

Barclays Capital Inc.

HSBC Securities (USA) Inc.

Morgan Stanley & Co.

Goldman Sachs & Co

Citigroup Global Markets Inc.

J.P. Morgan Securities Inc.

Deutsche Bank Securities

BofA Merrill Lynch

HSBC Securities (USA) Inc.

Ita USA Securities Inc.

Deutsche Bank Securities Inc.

Barclays Capital Inc.

Goldman Sachs & Co

Santander Investment Securities Inc.

Barclays Capital Inc.

BofA Merrill Lynch

BNP Paribas Securities Corp.

Itau BBA USA Securities, Inc.

Goldman Sachs & Co

HSBC Securities (USA) Inc.

Deutsche Bank Securities Inc.

BTG Pactual S.A. - Cayman Branch

Barclays Capital Inc.

Citigroup Global Markets Inc.

Bradesco BBI

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Disponvel >>

OBSERVAES:

O pagamento do principal ocorre integralmente na data do vencimento, com exceo do A-Bond 2018.

O sombreamento em cor cinza denota os ttulos que j venceram.

A fonte em cor azul denota os ttulos emitidos antes da vigncia da Resoluo SF n 20/2004.

1 Preo da emisso considerando preo sujo.

2 O valor em dlares apresentado para o Euro 2012 na Coluna J foi calculado utilizando-se a taxa PTAX de 24.09.2004: 1 EURO = US$ 1,2284.

3 O valor em dlares apresentado para o Euro 2012 (Reabertura) na Coluna J foi calculado utilizando-se a taxa PTAX de 30.09.2004: 1 EURO = US$ 1,2436.

4 A Resoluo do Senado Federal n 20, de 16.11.2004, revogou as Resolues SF n 57, de 1995, e n 69, de 1996, e estabeleceu novo limite para as emisses de ttulos no mercado internacional: US$ 75 bilhes.

5 Valor em dlares estimado pela cotao de 1 Euro = US$ 1,29685, de 03.02.2005.

6 O A-Bond com vencimento em 2018 ter seu montante de principal amortizado semestralmente em 18 parcelas iguais de US$ 250,5 milhes a partir de 15.07.2009, sendo os pagamentos de principal pagos em 15 de janeiro e 15 de julho de cada ano at seu vencimento.

7 O valor em dlares apresentado para o Euro 2015 (Reabertura) na Coluna J foi calculado utilizando-se a taxa PTAX de 03.02.2006: 1 EURO = US$ 1,2015.

8 A operao refere-se troca privada de novos ttulos Global 2034 por ttulos antigos Global 2030, sem a intermediao de agentes lderes.

9 Ttulos emitidos por meio da operao de Exchange Offer, envolvendo a troca de ttulos Global 2020, Global 2024, Global 2024 B, Global 2027 e Global 2030.

10 O valor em dlares apresentado para o BRL 2022 na Coluna M foi calculado utilizando-se a taxa do dia 13.09.2006: 1 US$ = R$ 2,1524.

11 O valor em dlares apresentado para o BRL 2022 na Coluna M foi calculado utilizando-se a taxa do dia 13.10.2006: 1 US$ = R$ 2,1614.

12 O valor em dlares apresentado para o BRL 2022 na Coluna M foi calculado utilizando-se a taxa do dia 11.12.2006: 1 US$ = R$ 2,1672.

13 O valor em dlares apresentado para o BRL 2028 na Coluna M foi calculado com base na taxa utilizada para liquidao no dia 14/02/2007: 1 US$ = R$ 2,09875.

Na moeda local

Em USD(*)

Res. SF n 57/1995

Res. SF n 69/1996

Volumes

Prazo

Res. SF no 20/2004

Cupom

% a.a

Perodo

Ttulos com

Clusula de Ao

Coletiva - CAC

Spread (moeda local

em pontos base)

no Lanamento

Yield

% a.a

750,000,000

750,000,000

5 anos

LIBOR de trs

meses + 575 bps

trimestral

Bonds with

Collective

Sim

Action Clause - CAC

593 bps acima da LIBOR

de trs meses

750,000,000

750,000,000

10 anos

10.500%

semestral

Sim

632

10.800

750,000,000

921,300,000

8 anos

8.50%

anual

Sim

310,900,000

477 bps acima

do DBR 5% 07/12

439 bps acima

do DBR 5% 07/12

8.700

250,000,000

1,000,000,000

1,000,000,000

15 anos

8.875%

semestral

Sim

492

9.150

8.170

500,000,000

500,000,000

10 anos

10.500%

semestral

Sim

398

8.244

500,000,000

648.425.000 5

10 anos

7.375%

anual

Sim

398,5 bps acima

do DBR 3,57% 01/15

7.550

1,250,000,000

1,250,000,000

20 anos

8.750%

semestral

Sim

431

8.900

1,000,000,000

1,000,000,000

10 anos

7.875%

semestral

Sim

352.5

7.900

500,000,000

500,000,000

14 anos

8.875%

semestral

Sim

458

8.830

500,000,000

500,000,000

29 anos

8.250%

semestral

Sim

440

8.814

600,000,000

600,000,000

9,5 anos

7.875%

semestral

Sim

363

7.732

4,508,571,000

4,508,571,000

12,5 anos

8.000%

semestral

Sim

336

7.580

1,000,000,000

1,000,000,000

19,5 anos

8.750%

semestral

Sim

417

8.522

3,400,000,000

1,478,839,546

10 anos

12.500%

semestral

Sim

12.750

500,000,000

500,000,000

9 anos

7.875%

semestral

Sim

312

7.765

500,000,000

500,000,000

28 anos

8.250%

semestral

Sim

362.5

8.311

1,000,000,000

1,000,000,000

31 anos

7.125%

semestral

Sim

295

7.557

300,000,000

360,450,000

9 anos

7.375%

anual

Sim

185 bps acima do

MidSwap de 9 anos

5.448

500,000,000

500,000,000

31 anos

7.125%

semestral

Sim

204

6.831

197,802,000

197,802,000

27 anos

8.250%

semestral

Sim

500,043,000

500,043,000

31 anos

7.125%

semestral

Sim

205

7.150

1,600,000,000

743,356,253

15 anos

12.500%

semestral

Sim

12.875

12.466

8.240

650,000,000

300,731,008

15 anos

12.500%

semestral

Sim

1,500,000,000

1,500,000,000

10 anos

6.000%

semestral

Sim

159

6.249

750,000,000

346,068,660

15 anos

12.500%

semestral

Sim

11.663

500,000,000

500,000,000

30 anos

7.125%

semestral

Sim

173

6.635

1,500,000,000

714,711,137

21 anos

10.250%

semestral

Sim

10.680

750,000,000

360,750,361

21 anos

10.250%

semestral

Sim

10.279

525,000,000

525,000,000

10 anos

6.000%

semestral

Sim

122

5.888

787,500,000

389,196,402

21 anos

10.250%

semestral

Sim

8.938

750,000,000

393,494,229

21 anos

10.250%

semestral

Sim

8.626

525,000,000

525,000,000

10 anos

6.000%

semestral

Sim

140

5.299

1,025,000,000

1,025,000,000

10 anos

5.875%

semestral

Sim

370

6.127

750,000,000

750,000,000

10 anos

5.875%

semestral

Sim

252

5.800

525,000,000

525,000,000

30 anos

7.125%

semestral

Sim

195

6.450

1,275,000,000

1,275,000,000

30 anos

5.625%

semestral

Sim

175

5.800

525,000,000

525,000,000

10 anos

5.875%

semestral

Sim

114

4.750

787,500,000

787,500,000

10 anos

4.875%

semestral

Sim

115

5.000

825,000,000

825,000,000

10 anos

4.875%

semestral

Sim

150

4.547

550,000,000

550,000,000

30 anos

5.625%

semestral

Sim

142

5.202

1,100,000,000

655,464,188

17 anos

10.250%

semestral

Sim

8.850

550,000,000

550,000,000

10 anos

4.875%

semestral

Sim

105

4.188

1,100,000,000

1,100,000,000

30 anos

5.625%

semestral

Sim

160

4.694

825,000,000

825,000,000

10 anos

4.875%

semestral

Sim

150

3.449

3,150,000,000

1,692,411,014

12 anos

8.500%

semestral

Sim

8.600

1,350,000,000

1,350,000,000

10 anos

2.625%

semestral

Sim

110

2.686

800,000,000

800,000,000

10 anos

2.625%

semestral

Sim

98

2.750

3,250,000,000

3,250,000,000

11 anos

4.250%

semestral

Sim

180

4.305

36,672,186,202

38,327,813,798

DVIDA MOBILIRIA EXTERNA

Caractersticas das Emisses Voluntrias

Foreign Bond Debt

Characteristics of the Voluntary Issuances

Valores (na emisso)

TTULOS

ISIN

Data do

Lanamento

Data da

Emisso

Vencimento

14 O valor em dlares apresentado para o BRL 2028 na Coluna M foi calculado com base na taxa utilizada para liquidao no dia 27/03/2007: 1 US$ = R$ 2,0790.

15 O valor em dlares apresentado para o BRL 2028 na Coluna M foi calculado com base na taxa utilizada para liquidao no dia 17/05/2007: 1 US$ = R$ 2,0234.

16 O valor em dlares apresentado para o BRL 2028 na Coluna M foi calculado com base na taxa utilizada para liquidao no dia 26/06/2007: 1 US$ = R$ 1,9060.

17 O valor em dlares apresentado para o BRL 2028 na Coluna M foi calculado com base na taxa utilizada para liquidao no dia 20/10/2010: 1 US$ = R$ 1,6782

Preo

Emisso (%)

Moeda

Local

Lder(es)

Na moeda local

Em USD(*)

Res. SF n 57/1995

Res. SF n 69/1996

Volumes

Prazo

Res. SF no 20/2004

Cupom

% a.a

Perodo

Ttulos com

Clusula de Ao

Coletiva - CAC

Bonds with Collective

Action Clause - CAC

Spread (moeda local

em pontos base)

no Lanamento

Yield

% a.a

Potrebbero piacerti anche

- Emissoes Soberanas Divida Publica Federal ExternaDocumento3 pagineEmissoes Soberanas Divida Publica Federal ExternaYakko PreonaNessuna valutazione finora

- Exemplos de Mecado MonetarioDocumento17 pagineExemplos de Mecado MonetarioHamide IlacinhoNessuna valutazione finora

- Evolucao Prestacoes Saldo DevedorDocumento15 pagineEvolucao Prestacoes Saldo DevedorPablo RicardoNessuna valutazione finora

- Balanços e Demonstrações FinanceirasDocumento62 pagineBalanços e Demonstrações FinanceirasFilipe DiassNessuna valutazione finora

- Tabela Collectgram Moedas Do Real 0x24e8Documento1 paginaTabela Collectgram Moedas Do Real 0x24e8allexNessuna valutazione finora

- Evolução da população portuguesa e análise de distribuidoresDocumento3 pagineEvolução da população portuguesa e análise de distribuidoresApec AP Ensino CegosNessuna valutazione finora

- SLIDES COMÉRCIO EXTERIORDocumento39 pagineSLIDES COMÉRCIO EXTERIORgabrielmarchetti1991Nessuna valutazione finora

- ITSA 2022-11-10 CAR Ofà - Cio B3 - Esclarecimentos Sobre Oscilaã à o Atã - PicaDocumento2 pagineITSA 2022-11-10 CAR Ofà - Cio B3 - Esclarecimentos Sobre Oscilaã à o Atã - PicaAlexandre AraujoNessuna valutazione finora

- Análise dos desvios na locação financeiraDocumento2 pagineAnálise dos desvios na locação financeiraAntónio Kinanga Paulo JoãoNessuna valutazione finora

- Lista 1 Leasing - SoluçãoDocumento17 pagineLista 1 Leasing - SoluçãoLuana CardosoNessuna valutazione finora

- MercFinançasDocumento6 pagineMercFinançasTomas HaleNessuna valutazione finora

- Exe2e3 UabDocumento9 pagineExe2e3 UabricardoNessuna valutazione finora

- Exerc Mat FinDocumento6 pagineExerc Mat FinLeísa CavalcanteNessuna valutazione finora

- Moeda Juros e A Taxa de CâmbioDocumento55 pagineMoeda Juros e A Taxa de CâmbioRayane ParreiraNessuna valutazione finora

- Slides de Aula - Unidade IIDocumento44 pagineSlides de Aula - Unidade IIMaybeeSanchezFerreyraNessuna valutazione finora

- Cap 5 Matem Financ AplicadaDocumento26 pagineCap 5 Matem Financ AplicadaClaudio AntunesNessuna valutazione finora

- Universidade Do Sul de Santa Catarina - Unisul Digital: Atividade de Avaliação A DistânciaDocumento4 pagineUniversidade Do Sul de Santa Catarina - Unisul Digital: Atividade de Avaliação A DistânciaRubens FelicianoNessuna valutazione finora

- Calculo de valor presente y futuro de inversionesDocumento36 pagineCalculo de valor presente y futuro de inversionesjonNessuna valutazione finora

- Planilha JurosDocumento22 paginePlanilha JuroserivanNessuna valutazione finora

- Maratona - Aula 1 - Marcação A MercadoDocumento31 pagineMaratona - Aula 1 - Marcação A MercadoJian AlvimNessuna valutazione finora

- Documento Descritivo Do CreditoDocumento8 pagineDocumento Descritivo Do CreditoRuan FelixNessuna valutazione finora

- Trabalho AV2 - Max RomanoDocumento9 pagineTrabalho AV2 - Max Romanowiz.gestao.146Nessuna valutazione finora

- Ranking Instituição 2016 06Documento34 pagineRanking Instituição 2016 06William AmaralNessuna valutazione finora

- Citi - Investimentos - Rentabilidade - DiariaDocumento4 pagineCiti - Investimentos - Rentabilidade - DiariaTiago DrubiNessuna valutazione finora

- Av2 - Cálculo Elementar - JurosDocumento6 pagineAv2 - Cálculo Elementar - JurosAdriana TomazNessuna valutazione finora

- Exercícios - Analise de Investimentos - Juros Simples e Compostos p7Documento4 pagineExercícios - Analise de Investimentos - Juros Simples e Compostos p7Robertinho SilvaNessuna valutazione finora

- Informativo MensalDocumento2 pagineInformativo MensalCarlos Frederico DominguezNessuna valutazione finora

- Perfil financeiro empresa de consultoria 2011-2007Documento193 paginePerfil financeiro empresa de consultoria 2011-2007Filipa Vicente MAtiasNessuna valutazione finora

- 4.3 - Efeitos de Alterações em Taxas de Câmbio - Proposta de ResoluçãoDocumento6 pagine4.3 - Efeitos de Alterações em Taxas de Câmbio - Proposta de ResoluçãoDeoclesio BauqueNessuna valutazione finora

- Teste 1 - AFDocumento4 pagineTeste 1 - AFcelso.salgadoNessuna valutazione finora

- Proposta de Resolução Dos EX 12 e 13 Da Ficha NR 2 ClassromDocumento3 pagineProposta de Resolução Dos EX 12 e 13 Da Ficha NR 2 ClassromNaz ExplanationNessuna valutazione finora

- Trabalho AV2 - Completo AtualDocumento9 pagineTrabalho AV2 - Completo Atualwiz.gestao.146Nessuna valutazione finora

- Matemática Financeira-Aula OmarDocumento61 pagineMatemática Financeira-Aula OmarJosé Augusto Rangel SilvaNessuna valutazione finora

- PT - 785 - Resumo Mensal de Informação Estatística - Maio 2022Documento18 paginePT - 785 - Resumo Mensal de Informação Estatística - Maio 2022Domingos NhamussusaNessuna valutazione finora

- Relatório da Administração de MAPFRE Affinity sobre resultados do 1o semestre de 2012Documento59 pagineRelatório da Administração de MAPFRE Affinity sobre resultados do 1o semestre de 2012Elisa MaranhoNessuna valutazione finora

- Exame de Calculo FinanceiroDocumento6 pagineExame de Calculo FinanceiroHeique Mario Antonio Sitoe0% (1)

- Seminário 6Documento2 pagineSeminário 6Hélder PomboNessuna valutazione finora

- Gestão Financeira NaturaDocumento7 pagineGestão Financeira NaturamurilocervatoNessuna valutazione finora

- CPC 06 - Mackenzie - ArrendamentosDocumento5 pagineCPC 06 - Mackenzie - ArrendamentosSantiago Moreira de MoraisNessuna valutazione finora

- 05 - Exercício DFC Método Direto - AlunosDocumento7 pagine05 - Exercício DFC Método Direto - AlunosJoao Batista Fernandes de OliveiraNessuna valutazione finora

- Rendimento dos principais fundos do BBDocumento4 pagineRendimento dos principais fundos do BBMarcelo Meireles Dos SantosNessuna valutazione finora

- Política Monetária: Definição, Instrumentos e ObjetivosDocumento56 paginePolítica Monetária: Definição, Instrumentos e ObjetivosMauricio MendesNessuna valutazione finora

- Compilação de Exercícios EACDocumento30 pagineCompilação de Exercícios EACCatiaVieira1979Nessuna valutazione finora

- (Planilha) Controle de VendasDocumento7 pagine(Planilha) Controle de VendasReinaldo SantosNessuna valutazione finora

- Resolução Com Explicações - DFCDocumento6 pagineResolução Com Explicações - DFCRaquel Della Cruz AssisNessuna valutazione finora

- 9solução FrankensteinDocumento4 pagine9solução FrankensteinScribdTranslationsNessuna valutazione finora

- Formulario Capitalização 200Documento5 pagineFormulario Capitalização 200daniellsalves1985Nessuna valutazione finora

- Demonstracoes Financeiras CLARO S A Diario Oficial 11 03 2010Documento1 paginaDemonstracoes Financeiras CLARO S A Diario Oficial 11 03 2010oliveiraudtqNessuna valutazione finora

- Raissa - Lista de Exercicios 02 - 08-12-2021Documento5 pagineRaissa - Lista de Exercicios 02 - 08-12-2021Raissa FelicidadeNessuna valutazione finora

- 2 - Introducao Matematica FinanceiraDocumento16 pagine2 - Introducao Matematica FinanceiraJuliaNessuna valutazione finora

- Fluxo C AixaDocumento2 pagineFluxo C AixaMatheus GomezNessuna valutazione finora

- Projeção DRE e Fluxo de CaixaDocumento12 pagineProjeção DRE e Fluxo de Caixamago da bronhaNessuna valutazione finora

- Workshop de Soluções Nº 2Documento12 pagineWorkshop de Soluções Nº 2ScribdTranslationsNessuna valutazione finora

- CBO com detalhes de pagamento e descontosDocumento1 paginaCBO com detalhes de pagamento e descontosFernando Lacerda67% (3)

- Plano de Negócios Trabalho UFCD 21,22Documento8 paginePlano de Negócios Trabalho UFCD 21,22lucienept7245Nessuna valutazione finora

- Atividades Formativas - Temática 1Documento3 pagineAtividades Formativas - Temática 1Apec AP Ensino CegosNessuna valutazione finora

- Inventário permanente com critério médiaDocumento12 pagineInventário permanente com critério médiaMateus FernandesNessuna valutazione finora

- Estudo de Caso - Gestão Do Capital de Giro - 2017.1Documento2 pagineEstudo de Caso - Gestão Do Capital de Giro - 2017.1alex-gama50% (4)

- Comprar o Dip?: Investindo em Finanças Descentralizadas e Comércio Criptoativos, 2022-2023 - Bull or bear? (Estratégias Inteligentes e Lucrativas para Iniciantes)Da EverandComprar o Dip?: Investindo em Finanças Descentralizadas e Comércio Criptoativos, 2022-2023 - Bull or bear? (Estratégias Inteligentes e Lucrativas para Iniciantes)Nessuna valutazione finora

- Anexo Vii - Tabela de Unidades AuxiliaresDocumento1 paginaAnexo Vii - Tabela de Unidades AuxiliaresCredServicos SANessuna valutazione finora

- Os benefícios da marapuama para saúde e bem-estarDocumento4 pagineOs benefícios da marapuama para saúde e bem-estarCredServicos SANessuna valutazione finora

- Escritórios de Representação Do MRE No BrasilDocumento2 pagineEscritórios de Representação Do MRE No BrasilUnexter IntercambioNessuna valutazione finora

- Cultivo de Horta Medicinal EsalqDocumento29 pagineCultivo de Horta Medicinal EsalqUnexter IntercambioNessuna valutazione finora

- Gestão Da Reputação OnlineDocumento12 pagineGestão Da Reputação OnlineCarlosLSSantosNessuna valutazione finora

- Artigo6 Ed2Documento10 pagineArtigo6 Ed2CredServicos SANessuna valutazione finora

- Escolha Seu DominioDocumento70 pagineEscolha Seu DominioAnizio MesquitaNessuna valutazione finora

- Guarana em Pó 1Documento6 pagineGuarana em Pó 1CredServicos SANessuna valutazione finora

- CavalinhaDocumento2 pagineCavalinhaCredServicos SANessuna valutazione finora

- Técnicas de MemorizaçãoDocumento11 pagineTécnicas de MemorizaçãoDaniel SoaresNessuna valutazione finora

- Lucas Lean Nascimento Microsoft A Empresa Dos MilhoesDocumento17 pagineLucas Lean Nascimento Microsoft A Empresa Dos MilhoesCredServicos SANessuna valutazione finora

- Criar Site - 26 Vídeo Aulas Com Passo A Passo Completo - Blog JM DIGITALDocumento5 pagineCriar Site - 26 Vídeo Aulas Com Passo A Passo Completo - Blog JM DIGITALCredServicos SANessuna valutazione finora

- Humanizando o conhecimento para inspirar pensadoresDocumento2 pagineHumanizando o conhecimento para inspirar pensadoresJeferson WruckNessuna valutazione finora

- Criar Site - 26 Vídeo Aulas Com Passo A Passo Completo - Blog JM DIGITALDocumento5 pagineCriar Site - 26 Vídeo Aulas Com Passo A Passo Completo - Blog JM DIGITALCredServicos SANessuna valutazione finora

- PSICOLOGIA DO INTERNAUTA - Marco BecharaDocumento50 paginePSICOLOGIA DO INTERNAUTA - Marco Becharaapi-3765383Nessuna valutazione finora

- Gestão de Equipes - LibertasDocumento40 pagineGestão de Equipes - LibertasCredServicos SANessuna valutazione finora

- Ensinamentos sobre avaliar riscos em marketing multinívelDocumento1 paginaEnsinamentos sobre avaliar riscos em marketing multinívelCredServicos SA100% (1)

- Google Adsense para Iniciantes - Blog JM DIGITALDocumento6 pagineGoogle Adsense para Iniciantes - Blog JM DIGITALCredServicos SANessuna valutazione finora

- 40 A639 ECd 01Documento18 pagine40 A639 ECd 01Daniel CantagaloNessuna valutazione finora

- Estoque Sebrae 1Documento3 pagineEstoque Sebrae 1CredServicos SANessuna valutazione finora

- Como deixar de fumar em 6 passosDocumento75 pagineComo deixar de fumar em 6 passosRivanilson MouraoNessuna valutazione finora

- Amor e Filosofia Cultural em Augusto CuryDocumento3 pagineAmor e Filosofia Cultural em Augusto CuryCredServicos SANessuna valutazione finora

- Auditoria Dos Estoques SebraeDocumento34 pagineAuditoria Dos Estoques SebraeCredServicos SANessuna valutazione finora

- A Construção Do Eu Adolescente Na Relacao Com Os OutrosDocumento12 pagineA Construção Do Eu Adolescente Na Relacao Com Os OutrosCredServicos SANessuna valutazione finora

- Subsidiaria IntegralDocumento4 pagineSubsidiaria IntegralCredServicos SANessuna valutazione finora

- Art. 1.053 Sociedade Limitada Regida Como Sociedade AnonimaDocumento1 paginaArt. 1.053 Sociedade Limitada Regida Como Sociedade AnonimaCredServicos SANessuna valutazione finora

- Abdir PDFDocumento1 paginaAbdir PDFCredServicos SANessuna valutazione finora

- 0006 - RESOLUÇÃO #2309 Disciplina e Consolida As Normas Relativas Ao ARRENDAMENTO MERCANTILDocumento9 pagine0006 - RESOLUÇÃO #2309 Disciplina e Consolida As Normas Relativas Ao ARRENDAMENTO MERCANTILCredServicos SANessuna valutazione finora

- X.da Cessão de Quotas Na Sociedade LimitadaDocumento8 pagineX.da Cessão de Quotas Na Sociedade LimitadaCredServicos SANessuna valutazione finora

- Subsidiaria IntegralDocumento4 pagineSubsidiaria IntegralCredServicos SANessuna valutazione finora

- TECIDOMUSCULAR2LISTADocumento9 pagineTECIDOMUSCULAR2LISTAJohn JohnNessuna valutazione finora

- Crônica de Akakor - PortuguesDocumento149 pagineCrônica de Akakor - PortuguesAlexandre Augustus100% (1)

- A Invisibilidade Dos Professores No ContDocumento10 pagineA Invisibilidade Dos Professores No ContIbilcemNessuna valutazione finora

- Manual de Atividades ESTÉTICA CORPORAL E AVALIAÇÃO CORPORALDocumento13 pagineManual de Atividades ESTÉTICA CORPORAL E AVALIAÇÃO CORPORALkaty magaNessuna valutazione finora

- Estudos Sobre GréciaDocumento9 pagineEstudos Sobre GréciaIGOR GOMES DA SILVANessuna valutazione finora

- Guia Do AlunoDocumento13 pagineGuia Do AlunosamukaNessuna valutazione finora

- Revista Bancorbrás Edição 79Documento140 pagineRevista Bancorbrás Edição 79Sérgio Luiz Alves CarvalhoNessuna valutazione finora

- Beneficiamento de sementes: etapas e equipamentosDocumento42 pagineBeneficiamento de sementes: etapas e equipamentosAfonso BuenoNessuna valutazione finora

- Instrucao de Trabalho - Andaimes SuspensosDocumento6 pagineInstrucao de Trabalho - Andaimes SuspensosMarçal Chiusoli TononNessuna valutazione finora

- Contrato de Atendimento Psicologico OnlineDocumento3 pagineContrato de Atendimento Psicologico Onlinemaria clara sousaNessuna valutazione finora

- Consultoria de Visagismo: 4 passos para uma imagem pessoal adequadaDocumento28 pagineConsultoria de Visagismo: 4 passos para uma imagem pessoal adequadaSilmara Silva100% (1)

- UFCD - 0350 - Comunicação Interpessoal - ÍndiceDocumento4 pagineUFCD - 0350 - Comunicação Interpessoal - ÍndiceMANUAIS FORMAÇÃONessuna valutazione finora

- Remap Fiesta 117cvDocumento2 pagineRemap Fiesta 117cvPedro AndradeNessuna valutazione finora

- Anlise de IncidentesDocumento4 pagineAnlise de Incidentesarlindo machavaNessuna valutazione finora

- Exercícios Resolvidos - Índices FisicosDocumento7 pagineExercícios Resolvidos - Índices FisicosGuilhermeNessuna valutazione finora

- Resposta Exercício - 2Documento2 pagineResposta Exercício - 2Joao Paulo LopesNessuna valutazione finora

- Pré-dimensionamento de dispositivos de controle pluvial na fonteDocumento12 paginePré-dimensionamento de dispositivos de controle pluvial na fonteMahelvson ChavesNessuna valutazione finora

- Ação e Aplicação Do Açúcar em SorveteDocumento7 pagineAção e Aplicação Do Açúcar em SorveteCleverton FerreiraNessuna valutazione finora

- Compressor Schulz MSL 10 ML-175 PDFDocumento13 pagineCompressor Schulz MSL 10 ML-175 PDFLuizNessuna valutazione finora

- BOLETODocumento1 paginaBOLETOMary SantosNessuna valutazione finora

- Prova Nacional Matemática Erasmus+ CidadesDocumento16 pagineProva Nacional Matemática Erasmus+ CidadesInês MarquesNessuna valutazione finora

- Marketing Estratégico e EndomarketingDocumento51 pagineMarketing Estratégico e EndomarketingClaudioNessuna valutazione finora

- Multilaser 692167Documento1 paginaMultilaser 692167Anonymous 9oUk7ttNessuna valutazione finora

- Bioquimica - EnzimasDocumento49 pagineBioquimica - EnzimasLuis Felipe Ferreira da SilvaNessuna valutazione finora

- 2015 - Avaliacao Das Habilidades MetafonologicasDocumento10 pagine2015 - Avaliacao Das Habilidades MetafonologicasFranciane Oliveira PinhoNessuna valutazione finora

- Exercícios RESOLVIDOS - Algoritmos e Estrutura Da InformaçãoDocumento17 pagineExercícios RESOLVIDOS - Algoritmos e Estrutura Da InformaçãoLucas PaludoNessuna valutazione finora

- Efr-Efi 8 1 001Documento24 pagineEfr-Efi 8 1 001Michel TellesNessuna valutazione finora

- Datagrama IP: introdução ao formato e encaminhamento de pacotes na InternetDocumento15 pagineDatagrama IP: introdução ao formato e encaminhamento de pacotes na InternetWendel SaintsNessuna valutazione finora

- Semiologia veterinária essencialDocumento48 pagineSemiologia veterinária essencialJéssica Queiroz60% (5)

- Estrutura de um programa em CDocumento46 pagineEstrutura de um programa em CSergio FigueiredoNessuna valutazione finora