Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Company Background: Enron Corporation

Caricato da

yatz24Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Company Background: Enron Corporation

Caricato da

yatz24Copyright:

Formati disponibili

Company Background

ENRON CORPORATION. Enron, a corporation headquartered in Houston, operated one of the largest natural gas

transmission networks in North America, totaling over 36,000 miles, in addition to being the largest marketer of

natural gas and electricity in the United States. Enron managed the world's largest portfolio of natural gas risk

management contracts and pioneered innovative trading products. The company was on Fortune's "Most Innovative"

in the United States listing for several years running and reached #7 on the Fortune 500 list in 2000. Its bankruptcy in

December 2001 was the largest such filing in United States history. The name Enron became synonymous with

corporate greed and corruption, and its demise cost investors and employees over $70 billion in lost capitalization

and retirement benefits.

Enron was formed by a merger between Houston Natural Gas (HNG) and InterNorth. HNG was formed from the

Houston Oil Co. in the 1920s and provided gas to retail customers in Houston. In 1976 it sold its retail gas business in

Houston to concentrate on gas exploration and production and other businesses. By 1984 HNG had assets of $3.7

billion, sales of over $2 billion, and profits of $123 million. InterNorth began as Northern Natural Gas Company,

organized in Omaha, Nebraska, in 1930. When InterNorth, with one of the nation's premier pipeline networks with

revenues of $7.5 billion in 1984, found itself the potential takeover target of corporate raiders, CEO Sam Segnar

sought to buy out HNG, and a deal was announced in May 1985 in which InterNorth would acquire HNG for $2.4

billion. The arrangement stipulated that the merged entities would be known as HNG/InterNorth and be

headquartered in Omaha with Segnar as chairman and CEO. However by 1986 Segnar had retired, Kenneth Lay was

chairman and CEO, and the company was renamed Enron with corporate headquarters in Houston. The new

company had the second largest pipeline network in the United States with over 36,000 miles of pipe stretching

across the continent and north into Canada.

In 1984 the Federal Energy Regulatory Commission eased some of the pricing restrictions on natural gas and

allowed local gas distribution companies to buy gas from anywhere and anyone. Ken Lay rapidly gained a reputation

for effectiveness during this period by negotiating Enron's escape from some of the more burdensome and expensive

"take-or-pay" contracts from the 1970s. In 1989 Enron created a new way to market natural gas to consumersthe

Gas Banka concept developed by Jeff Skilling, a consultant at McKinsey & Co. The Gas Bank served as an

intermediary between buyers and sellers of gas and became a success. Natural gas was now traded as a commodity,

and Skilling left McKinsey for Enron's trading operation in 1991. Enron began to view itself primarily as a trader rather

than as a gas producer and began to divest itself of heavy pipeline assets; by 2000 it owned five thousand fewer

miles of pipe than in 1985, but its gas financial transactions represented over twenty times its pipeline capacity. Enron

extended the natural gas model to become a financial trader and market maker in electric power, coal, steel, paper

and pulp, water, and broadband fiber optic capacity.

In 1994 Congress gave the states the authority to deregulate gas and electric utilities. The newly opened California

market was a major target, and Enron spent $100 million a year to generate business there. That effort was cancelled

in 1999, but Enron continued to supply wholesale power to California. The ensuing power shortage in California in

2000 rocked the state, and Enron was accused of manipulating supplies. Eventually two Enron traders were indicted

for criminal fraud.

In the mid-1990s it appeared that water, like natural gas, was on its way to being deregulated. In July 1998 Enron

purchased Wessex Water of Great Britain for more than $2 billion and renamed the new business Azurix. However,

economies of scale did not work because there were no means to interconnect the supply and transmission facilities.

Azurix was liquidated within two years after its public offering. Enron financed Azurix's debt with Special Purpose

Entities (SPEs) called Marlin and Osprey, which kept the debt off Enron's books for a period but was eventually

recognized during Enron's last few months before bankruptcy in 2001.

In January 2000 Enron announced its entry into the broadband fiber optic business and created Enron Broadband

Services. Enron Online, launched in late 1999, became the largest e-commerce site in the world. Many analysts saw

this expansion as a logical extension of Enron's commodity trading and transmission business. However there was an

oversupply of capacity, and technological innovation also more than doubled the carrying capacity of fiber already in

the ground. Within months of Enron's announcement, there was a glut of "dark fiber" (unused fiber connections)

across the country, and numerous Internet startups that had promised to swallow much of the anticipated bandwidth

failed, causing prices to fall by fifty percent. It was estimated that Enron lost over $1 billion in its broadband venture.

Nonetheless, Enron was able to use accounting mechanisms to record a profit of over $100 million on a deal with

Blockbuster that, in reality, never saw a single dollar of revenue.

Enron's increased reliance on trading also brought about some basic changes in accounting procedures. Under

Skilling the trading operation adopted mark-to-market accounting in which the present value of anticipated revenue is

realized and the expected costs of fulfilling the contract are expensed once a contract is signed. Unrealized gains and

losses in the market value of the long-term contracts were required to be reported later as a part of annual earnings

when they occurred. Mark-to-market accounting retains a valued place in commonly accepted accounting practices.

Enron and its outside auditor, Arthur Andersen, took the practice to previously untested parameters. The stock rose

56 percent in 1999 and another 87 percent in 2000; Enron was losing money on its operations but using certain

accounting practices to appear profitable and stable. Enron also made frequent and heavy use of prepaid

agreements which allow a company to raise cash, much like a loan, but not include the liability on the balance sheet.

In 2001 Enron signed over $5 billion worth of prepaid agreements as it attempted to raise cash and bury debt.

In the early 1990s Enron also began making heavy use of SPEs, shell firms created by a sponsor but funded by

independent equity investors and debt financing. Enron used SPEs to fund or manage risk associated with specific

projects and assets, and at first Enron set up the SPEs correctly. Enron has been accused of using strong-arm tactics

with investment bankers that did large amounts of business with Enron to persuade the bankers to invest in the

SPEs. Often prior arrangements included assurances from Enron that an investor's commitment would be for a

relatively short period, at which time Enron would find a new investor to assume the third-party role, allowing the

initial investor to secure a large profit. When Enron had difficulty finding replacement independent investors, however,

it has been asserted that it utilized key management personnel for this role, which cast doubt over the issue of control

of the entity. Enron used SPEs as hedge funds to lock-in mark-to-market profits or to hide losses of underperforming

assets; it was capitalizing with its own stock. In effect, it was hedging assets with itself.

An important relationship began in 1989 when Enron received $56 million in loans and guarantees for a plant in

Argentina from the Overseas Private Investment Corporation (OPIC). OPIC guarantees loans for companies investing

in overseas projects and uses its resources to generate investment in areas that may be politically advantageous for

United States interests but unattractive for sound business practices. Between 1993 and 2000 Enron was the

recipient of over $2.2 billion in loans and insurance for more than a dozen projects ranging from power plants to gas

pipelines to gas extraction plants.

By 2001 complaints about the opaqueness of Enron's financial reporting were raising concerns. The Raptors, entities

which had been created in 2000 to remove troubled international assets from Enron's books, were nearly insolvent. In

March the Raptors were restructured which allowed Enron to hide another $200 million in losses. Whitewing and

Osprey SPEs had liability points triggered when Enron's stock fell below forty-seven dollars, which happened in July

2001. In 2000 Enron had reported $4.8 billion in operating cash flow. In reality Enron had very little real cash flow.

The $100 billion in revenue that Enron had reported in 2000 was primarily revenue from trades in which cash did not

change hands. These transactions, however, all needed to be collateralized, demanding a huge amount of affordable

credit for Enron. Credit rating services were taking a hard look at Enron's financial position. At the same time prices in

the fiber market were plummeting, yet Enron insisted that its business plan for broadband was on target. This

improbable assertion generated much skepticism among analysts which further increased inspection of Enron's

finances and depressed the stock price.

The second quarter 10Q report filed with the SEC showed a negative cash flow of $1.3 billion YTD. The Marlin SPE,

which had been used to conceal Azurix losses, had a payment due to investors at the end of 2001. Enron was able to

refinance the obligation in July for $1 billion, however the entire note was due if the stock price fell below thirty-four

dollars. Energy prices continued to fall which meant that Enron would have to begin refunding $2 billion in deposits.

The rapidly deteriorating situation at Enron led to Jeff Skilling's resignation in July, an announcement withheld from

the public until August. Kenneth Lay reassumed the role of chief executive. Skilling's abrupt departure along with

other major personnel changes made analysts suspicious, and they began to look even more closely at Enron's

finances. Following a five-dollars-per-share decline the day of the Skilling announcement, the price dropped to

twenty-five dollars per share on September 12 after the 911 attacks.

Stocks continued to fall in October and hit a low of $20.65 a share. Enron replaced Andrew Fastow as CFO. A

liquidity crisis immediately ensued, and Enron was forced to draw upon $3 billion in backup credit lines which only

lasted a few days due to Enron's short-term commercial paper. The collapse of the stock price now made billions of

dollars of obligations due immediately. Enron secured another $1 billion in loans using the remaining pipelines as

collateral, the only asset that Enron had left that was deemed worthy to use as collateral. In November Enron entered

merger negotiations with Houston-based Dynegy, Inc., and Enron's stock rose to about ten dollars. Enron received

$1.5 billion in cash from Dynegy as well as the first $550 million from the pipeline loan. However, Enron's third-quarter

loss was restated to be $664 million, and Enron's fourth-quarter prospects appeared dismal. The merger was

reviewed when credit rating services lowered Enron's rating to just above junk status which triggered an immediate

repayment demand of $690 million for an SPE called Rawhide. The reduced rating meant that Enron now had more

than $9 billion in loans due in 2002. The Dynegy deal collapsed, and banks refused to extend any further credit. On

December 2, 2001, Enron filed for protection under United States bankruptcy laws, at that time the largest such filing

of its kind in United States history.

Congressional response to the debacle, in addition to highly-publicized hearings that sought to uncover the

underlying reasons for the collapse, included the passage of the Sarbanes-Oxley Act. The legislation, passed in July

2002, required more transparency in dealings between executives and corporations, provided more stringent

penalties for fraud, made corporate officers personally liable for the accuracy of financial reports, required more

independence for auditing firms, and legislated more access for investors to internal financial control procedures.

Twenty-two Enron executives and partners pleaded guilty or were convicted of criminal charges for their roles in

Enron's collapse. Arthur Andersen was found guilty of fraud; the conviction was later overturned on appeal, but the

reversal did not come before the firm was forced to dissolve. Several Andersen partners were also personally

convicted of crimes committed during their work at Enron. While several Enron executives received probation, others

received lengthy prison terms, including CFO Andrew Fastow; accounting chief Richard Causey; CEO of the trading

unit, David Delainey; and treasurer Ben Glisan. Former Chairman Ken Lay and CEO Jeff Skilling were found guilty in

May 2006. Skilling, guilty of nineteen counts of security and wire fraud, was sentenced to more than twenty-four years

in federal prison and began serving his term in December 2006. Ken Lay died suddenly in July 2006 while awaiting

sentencing. Federal precedent calls for convictions to be voided if the accused dies before the appeals process can

be exhausted. Consequently, Lay's conviction was voided in November 2006. At that time the Judiciary Department

announced plans to pursue Lay's estate in civil court in an attempt to recover some of Enron's lost billions.

The twenty thousand employees of Enron lost most of their savings and pension plans. Legal efforts managed to

recoup a small portion of the employee-invested funds, but the bulk of the plan's resources were tied to the price of

Enron stock. As the stock descended to worthless status, so did the economic security of the employees' funds. In

2004 Enron's name was changed to Enron Creditors Recovery Corporation with the mission to liquidate any

remaining assets and operations of Enron. Upon completion of its mission and final distribution to creditors, the

company would no longer exist.

Potrebbero piacerti anche

- Enron ScandalDocumento7 pagineEnron ScandalMirdual JhaNessuna valutazione finora

- From Paragon to Parish - Enron's Rise and FallDocumento44 pagineFrom Paragon to Parish - Enron's Rise and FalldesmondNessuna valutazione finora

- Enron Fraud Case SummaryDocumento5 pagineEnron Fraud Case Summaryamara cheema100% (3)

- The Enron Scandal: How Accounting Fraud Brought Down an Energy GiantDocumento8 pagineThe Enron Scandal: How Accounting Fraud Brought Down an Energy GiantJenny May GodallaNessuna valutazione finora

- Enron Scandal ReportDocumento15 pagineEnron Scandal ReportBatool DarukhanawallaNessuna valutazione finora

- Enron CompanyDocumento3 pagineEnron Companyjayvee OrfanoNessuna valutazione finora

- Enron Company Case StudyDocumento6 pagineEnron Company Case StudyRabia FazalNessuna valutazione finora

- The Rise and Fall of Enron CorporationDocumento2 pagineThe Rise and Fall of Enron Corporationsayujya DahalNessuna valutazione finora

- Enron CorporationDocumento8 pagineEnron CorporationNadine Clare FloresNessuna valutazione finora

- Enron PresentationDocumento12 pagineEnron PresentationmuffindangNessuna valutazione finora

- 19 Enron ShortDocumento5 pagine19 Enron ShortMuhlisNessuna valutazione finora

- What Was EnronDocumento8 pagineWhat Was EnronRika Nur CahyaniNessuna valutazione finora

- Enron's Desperate Remedial Actions Before BankruptcyDocumento3 pagineEnron's Desperate Remedial Actions Before BankruptcyblahblahblueNessuna valutazione finora

- Enron Scandal - Wikipedia, The Free EncyclopediaDocumento31 pagineEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88Nessuna valutazione finora

- America's Largest Corporate FraudDocumento16 pagineAmerica's Largest Corporate Fraudamrendra kumarNessuna valutazione finora

- The Rise and Fall of EnronDocumento7 pagineThe Rise and Fall of Enronyatz24Nessuna valutazione finora

- Enron ScandalDocumento25 pagineEnron ScandalNeemal EhsanNessuna valutazione finora

- ENRON Term Paper SummaDocumento10 pagineENRON Term Paper Summaamrendra kumarNessuna valutazione finora

- EnronDocumento6 pagineEnronHaseeb WaheedNessuna valutazione finora

- Enron 1Documento25 pagineEnron 1yashkhlaseNessuna valutazione finora

- The Enron ScandalDocumento5 pagineThe Enron ScandalafeeraNessuna valutazione finora

- Subject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151Documento23 pagineSubject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151ShrayNessuna valutazione finora

- Corprate Finance-Final AssignmentDocumento37 pagineCorprate Finance-Final Assignmentifti_MENessuna valutazione finora

- Enron PaperDocumento24 pagineEnron PaperJoshy_29100% (1)

- IntroductionDocumento5 pagineIntroductionLydia MasrudyNessuna valutazione finora

- Enron's rise and fall from America's largest energy companyDocumento10 pagineEnron's rise and fall from America's largest energy companyShunNessuna valutazione finora

- The Crooked EDocumento3 pagineThe Crooked EJahziel Lim Irabon100% (2)

- Enron IntroDocumento4 pagineEnron IntroFarvaNessuna valutazione finora

- The Enron ScandalDocumento20 pagineThe Enron ScandalQueenie Gallardo AngelesNessuna valutazione finora

- Audit CaseDocumento30 pagineAudit CaseAnnisa Kurnia100% (1)

- Enron CorpDocumento2 pagineEnron CorpEna Gen TripoliNessuna valutazione finora

- LLDocumento2 pagineLLLydia MasrudyNessuna valutazione finora

- Sythesis 8Documento7 pagineSythesis 8Jhonerl YbañezNessuna valutazione finora

- Enterprise Risk ManagementDocumento12 pagineEnterprise Risk ManagementAnoop Chaudhary67% (3)

- EnronDocumento6 pagineEnronabhdonNessuna valutazione finora

- Enron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Documento19 pagineEnron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Jamielyn Dy DimaanoNessuna valutazione finora

- Enron Scandal Agency Problem Case StudyDocumento3 pagineEnron Scandal Agency Problem Case StudyAhsan IqbalNessuna valutazione finora

- Midterm ActivityDocumento11 pagineMidterm ActivityPaulo Timothy AguilaNessuna valutazione finora

- Enron: The Smartest Guys in The Room (2005)Documento2 pagineEnron: The Smartest Guys in The Room (2005)Frances CarpioNessuna valutazione finora

- Case Study EnronDocumento15 pagineCase Study EnronPawar Shirish PrakashNessuna valutazione finora

- Enron ScandalDocumento7 pagineEnron ScandalDhruv JainNessuna valutazione finora

- Enron ScandalDocumento22 pagineEnron ScandalGaurav SavlaniNessuna valutazione finora

- Edades, Angelica T. Bsba-Fm The Enron'S CollapseDocumento7 pagineEdades, Angelica T. Bsba-Fm The Enron'S Collapsearman atipNessuna valutazione finora

- Report On Enron Company ScandalDocumento4 pagineReport On Enron Company ScandalHarpreet SinghNessuna valutazione finora

- Enron Scandal: Assignment 1Documento5 pagineEnron Scandal: Assignment 1Afnan TufailNessuna valutazione finora

- Enron ScandalDocumento2 pagineEnron ScandalIrene Bal-iyang DaweNessuna valutazione finora

- The Rise and Fall of Enron ExplainedDocumento10 pagineThe Rise and Fall of Enron ExplainedSohail Naushad SalmaniNessuna valutazione finora

- Enron Scandal: Prepared by Student of Group 6.02.072.080.18.1 Rita SyrovaDocumento11 pagineEnron Scandal: Prepared by Student of Group 6.02.072.080.18.1 Rita SyrovaRitaNessuna valutazione finora

- Enron ScandalDocumento3 pagineEnron ScandaltehreemNessuna valutazione finora

- EntrinaDocumento7 pagineEntrinaevemil berdinNessuna valutazione finora

- ENRON Group1Documento10 pagineENRON Group1Akanksha JaiswalNessuna valutazione finora

- How Enron's Fraud Led to Collapse and New RegulationsDocumento5 pagineHow Enron's Fraud Led to Collapse and New RegulationsShubhankar ThakurNessuna valutazione finora

- Enron Corporation: Rise and Collapse of an Energy GiantDocumento12 pagineEnron Corporation: Rise and Collapse of an Energy GiantAvijit DindaNessuna valutazione finora

- Case Study: 4.2 Enron-A Classic Corporate Governance CaseDocumento3 pagineCase Study: 4.2 Enron-A Classic Corporate Governance CaseTiago SampaioNessuna valutazione finora

- Enron Corporation: Enron's Energy OriginsDocumento7 pagineEnron Corporation: Enron's Energy Originsislam hamdyNessuna valutazione finora

- Enron Corporation: Enron's Energy OriginsDocumento7 pagineEnron Corporation: Enron's Energy Originsislam hamdyNessuna valutazione finora

- Enron's Dramatic Rise and Staggering CollapseDocumento7 pagineEnron's Dramatic Rise and Staggering Collapseislam hamdyNessuna valutazione finora

- Case 3.1 Enron Understanding The Client's Business and IndustryDocumento4 pagineCase 3.1 Enron Understanding The Client's Business and Industryniky ugi putriNessuna valutazione finora

- Summary of Bethany McLean & Peter Elkind's The Smartest Guys in the RoomDa EverandSummary of Bethany McLean & Peter Elkind's The Smartest Guys in the RoomNessuna valutazione finora

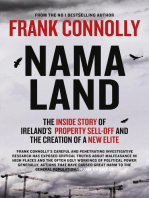

- NAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteDa EverandNAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteNessuna valutazione finora

- Songs 2016Documento1 paginaSongs 2016yatz24Nessuna valutazione finora

- The King and I AnalysisDocumento1 paginaThe King and I Analysisyatz24Nessuna valutazione finora

- Sonnets From PortugueseDocumento1 paginaSonnets From Portugueseyatz24Nessuna valutazione finora

- Professional SkepticismDocumento1 paginaProfessional Skepticismyatz24Nessuna valutazione finora

- Overview of Long-Term Construction ContractsDocumento3 pagineOverview of Long-Term Construction Contractsyatz24Nessuna valutazione finora

- Theory of AccountsDocumento27 pagineTheory of Accountsyatz24Nessuna valutazione finora

- CPA Reviewer Topic On TaxationDocumento1 paginaCPA Reviewer Topic On Taxationyatz24Nessuna valutazione finora

- Professional JudgmentDocumento1 paginaProfessional Judgmentyatz24Nessuna valutazione finora

- Transfer PricingDocumento1 paginaTransfer Pricingyatz24Nessuna valutazione finora

- Audit EvidenceDocumento1 paginaAudit Evidenceyatz24Nessuna valutazione finora

- Professional Judgment Needs To Be Exercised Throughout The AuditDocumento1 paginaProfessional Judgment Needs To Be Exercised Throughout The Audityatz24Nessuna valutazione finora

- Philippine Standard On Quality ControlDocumento1 paginaPhilippine Standard On Quality Controlyatz24Nessuna valutazione finora

- Cash Flow StatementDocumento2 pagineCash Flow Statementyatz24Nessuna valutazione finora

- Financial Statement AnalysisDocumento1 paginaFinancial Statement Analysisyatz24Nessuna valutazione finora

- Home Office and Branch AccountingDocumento1 paginaHome Office and Branch Accountingyatz24Nessuna valutazione finora

- 1) How Did Greece Get Into Such Trouble?Documento7 pagine1) How Did Greece Get Into Such Trouble?yatz24Nessuna valutazione finora

- Variance Analysis Price Variance Volume Variance Capacity Variance Efficiency VarianceDocumento1 paginaVariance Analysis Price Variance Volume Variance Capacity Variance Efficiency Varianceyatz24Nessuna valutazione finora

- Climate ChangeDocumento1 paginaClimate Changeyatz24Nessuna valutazione finora

- Steps To A Basic Company Financial AnalysisDocumento21 pagineSteps To A Basic Company Financial Analysisyatz24Nessuna valutazione finora

- Sonnet From PortugueseDocumento1 paginaSonnet From Portugueseyatz24Nessuna valutazione finora

- Cost Behavior Fixed Variable Mixed Step SunkDocumento1 paginaCost Behavior Fixed Variable Mixed Step Sunkyatz24Nessuna valutazione finora

- Bottlenecks and ConsequencesDocumento2 pagineBottlenecks and Consequencesyatz24Nessuna valutazione finora

- Efile A Tax ReturnDocumento2 pagineEfile A Tax Returnyatz24Nessuna valutazione finora

- Why Is Greece in Debt?Documento5 pagineWhy Is Greece in Debt?yatz24Nessuna valutazione finora

- Cost Accounting Terminology GuideDocumento2 pagineCost Accounting Terminology Guideyatz24Nessuna valutazione finora

- Financial Accounting and Managerial Accounting ComparedDocumento2 pagineFinancial Accounting and Managerial Accounting Comparedyatz24Nessuna valutazione finora

- GrexitDocumento6 pagineGrexityatz24Nessuna valutazione finora

- An Assessment of Corporate Governance Best PracticesDocumento8 pagineAn Assessment of Corporate Governance Best Practicesyatz24Nessuna valutazione finora

- Steps To A Basic Company Financial AnalysisDocumento21 pagineSteps To A Basic Company Financial Analysisyatz24Nessuna valutazione finora

- Notes For Madoff CaseDocumento3 pagineNotes For Madoff Caseyatz24100% (1)

- How to Immigrate to Australia GuideDocumento9 pagineHow to Immigrate to Australia GuideBárbara LimaNessuna valutazione finora

- ASUG Attendee ListDocumento90 pagineASUG Attendee ListSteve HuntNessuna valutazione finora

- Risks of Material Misstatement at Financial Statement and Assertion LevelsDocumento5 pagineRisks of Material Misstatement at Financial Statement and Assertion Levelskris mNessuna valutazione finora

- MTH Parcor Semifinal ExamDocumento3 pagineMTH Parcor Semifinal ExamAngelica N. EscañoNessuna valutazione finora

- Done OJTjvvvvvDocumento30 pagineDone OJTjvvvvvMike Lawrence CadizNessuna valutazione finora

- SAP Plant Maintenance Training PDFDocumento5 pagineSAP Plant Maintenance Training PDFRAMRAJA RAMRAJANessuna valutazione finora

- Evercore TearsheetDocumento1 paginaEvercore TearsheetJennifer KwonNessuna valutazione finora

- Target Market Strategies for The Royal PharmacyDocumento12 pagineTarget Market Strategies for The Royal PharmacyIsmail MustafaNessuna valutazione finora

- 10 Resource Management Best PracticesDocumento3 pagine10 Resource Management Best PracticesnerenNessuna valutazione finora

- Haystack Syndrome (Eliyahu M. Goldratt) (Z-Library)Documento270 pagineHaystack Syndrome (Eliyahu M. Goldratt) (Z-Library)jmulder1100% (3)

- Bank Panin Dubai Syariah GCG Report 2018Documento117 pagineBank Panin Dubai Syariah GCG Report 2018kwon jielNessuna valutazione finora

- Business Studies Redspot 2011-2019Documento943 pagineBusiness Studies Redspot 2011-2019amafcomputersNessuna valutazione finora

- Sample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyDocumento33 pagineSample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyPrathamesh ChawanNessuna valutazione finora

- Ciencia, Tecnología y Educación Al Servicio Del PaísDocumento3 pagineCiencia, Tecnología y Educación Al Servicio Del PaísAdrian JácomeNessuna valutazione finora

- Free SWOT Analysis Template MacDocumento1 paginaFree SWOT Analysis Template MacGirish Des ManchandaNessuna valutazione finora

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Documento6 paginePM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGNessuna valutazione finora

- Breakfast is the Most Important Meal: Starting a Pancake House BusinessDocumento28 pagineBreakfast is the Most Important Meal: Starting a Pancake House BusinessChristian Lim100% (1)

- Meaning of Transfer PricingDocumento2 pagineMeaning of Transfer Pricingpanda_alekh100% (1)

- Modern business challenges and budgeting rolesDocumento10 pagineModern business challenges and budgeting rolesSiare AntoneNessuna valutazione finora

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocumento8 pagineBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4Nessuna valutazione finora

- Baby Food IndustryDocumento13 pagineBaby Food IndustryPragati BhartiNessuna valutazione finora

- Account Analysis Statement GuideDocumento6 pagineAccount Analysis Statement GuideCr CryptoNessuna valutazione finora

- Payroll Systems in EthiopiaDocumento16 paginePayroll Systems in EthiopiaMagarsaa Hirphaa100% (3)

- CH 04Documento9 pagineCH 04jaysonNessuna valutazione finora

- AWE R15!2!20 1 OfferDefinition V14-Draft-080421-DwDocumento289 pagineAWE R15!2!20 1 OfferDefinition V14-Draft-080421-DwMohsin HabibNessuna valutazione finora

- Fuel Supply Agreement - LNG - UI 2021 (407769612.1)Documento54 pagineFuel Supply Agreement - LNG - UI 2021 (407769612.1)Edmund KhoveyNessuna valutazione finora

- CBCS Guidelines For B.comh Sem VI Paper No - BCH 6.1 Auditing and Corporate GovernanceDocumento2 pagineCBCS Guidelines For B.comh Sem VI Paper No - BCH 6.1 Auditing and Corporate GovernanceJoel DinicNessuna valutazione finora

- Forensic Accounting Notes - Lesson 1 2Documento11 pagineForensic Accounting Notes - Lesson 1 2wambualucas74Nessuna valutazione finora

- Sponsorship Proposal TemplateDocumento11 pagineSponsorship Proposal TemplateMichaell Moore100% (2)

- CFAS Chapter 2 Problem 3Documento1 paginaCFAS Chapter 2 Problem 3jelou ubagNessuna valutazione finora