Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Curriculam - Mbafm

Caricato da

Mithilesh Shinde0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

17 visualizzazioni1 paginamba fm document

Titolo originale

Curriculam _mbafm

Copyright

© © All Rights Reserved

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentomba fm document

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

17 visualizzazioni1 paginaCurriculam - Mbafm

Caricato da

Mithilesh Shindemba fm document

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

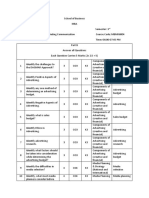

MODULE 1 MODULE 2 MODULE 3 MODULE 4

Portfolio Management (MCT-080)

Market Instruments and Processes -

Existing, New and Emerging (MCT-081)

Private Equity and Venture Capital (MCT-

082)

Securities and Business Law (MCT-083)

UNIT 1

INTRODUCTION TO PORTFOLIO

MANAGEMENT

EXCHANGE TRADED FUNDS INTRODUCTION TO VENTURE CAPITAL OVERVIEW OF SECURITIES LAW

1 Meaning and Necessity of Investment Meaning History Evolution of Securities Laws in India

2 Investment Motives Indexing Perspective

Characteristics and Objectives of Venture

Capital Investors

CCI Saga Vs SEBI

3 Risks in Investment Importance Main Market Players Pricing Control Vs Free Pricing

4 Portfolio Management Process

UNIT 2 INVESTMENT POLICY TREASURY BILLS

REVIEW OF VALUATION

FUNDAMENTALS

FUND RAISING METHODS

1

Types of Investors: their Needs and

Weaknesses

Meaning DCF Valuation Capital Market Instruments

2 Implementing Investment Strategies Perspective Equity Based Valuation Case Study

3 Psychology of Risk and Behavioral Finance Importance Asset and Option Based Valuations

Issue of NCD Directions Vs Acceptance of

Deposits

4 Drivers of Investment Policies

Valuation from the Perspective of Venture

Capitalist

5

Institutional Investors: Objective setting and

investment policies

6 Investment Management Mandate

UNIT 3

ASSET ALLOCATION: POLICIES AND

PROCEDURES

CONTRACTS

ORGANIZATION OF VENTURE CAPITAL

FUNDS

OTHERS

1 Asset Allocation Process Meaning Types of Investors Debt: Issue of Debt Securities Regulations

2 Types of Asset Allocation Perspective Fund Managers Required Skills Banks, NBFCs,HFCs, ARCs, Others

3 Approaches to Asset Allocation Decision Importance

How a VC Fund Approaches Potential

Investee Companies

Insider Trading and Liabilities for Violations

4 Asset Allocation Techniques

Investment Process of a Venture Capital

Fund

Offerings to Markets Abroad

UNIT 4 CAPITAL MARKET THEORY EMERGING MARKET INSTRUMENTS BASIC INVESTMENT STRUCTURE BUSINESS LAW

1 Evolution of Capital Asset Pricing Model Meaning Fund Indian Contract Act, 1872

2 Dominant Portfolio Perspective Shareholding structures Partnership Act, 1932

3 CAPM Importance Equity instruments Sale of Goods Act, 1930

4 Non-Standard Forms of CAPM Debt instruments: bonds, convertibles The Negotiable Instruments Act, 1881

5 Application of CAPM Consumer Protection Act, 1986

6 Companies Act 0f 1956

UNIT 5 ARBITRAGE PRICING THEORY DEPOSITORIES EMERGING MARKET ISSUES

Corporate Governance in Financial

Institutions - I

1 Arbitrage Pricing Model Genesis and Legal Framework

Differences in Information, Management and

Legal Environment

Overview of corporate governance

2 Arbitrage Mechanism Depositiry Role in Capital Market How a VC Fund can Deal with these Issues

Unique characteristics of financial institutions

and implications for their corporate

governance

3 Empirical Test of APT Custodians

Poor corporate governance as a contributing

cause of the global financial crisis

4 Comparison of CAPM and APT Compliance

Corporate governance trends and

developments

5 Applications of APT

Corporate governance approaches

Mandatory legislation vs. best practice codes

UNIT 6 NEW AND EMERGING PROCESSES - II POST INVESTMENT MONITORING

Corporate Governance in Financial

Institutions - II

1 Smart Order Routing Goal Setting

Evaluating corporate governance How

corporate governance is assessed

2 Mobile Trading Reporting

Importing corporate governance practices from

other countries

3 Algo Trading Action Plans

Roles and responsibilities of the board of

directors

4 New Processes Value Enhancement

Board induction and on-going knowledge

development

Semester Breakup

Semester 4

MODULE NAME

PROJECT

EVALUATION

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- 8 Reasons To Own GoldDocumento4 pagine8 Reasons To Own GoldMithilesh ShindeNessuna valutazione finora

- PROJECT FLOW SYNTHESIS (200 MARKSDocumento1 paginaPROJECT FLOW SYNTHESIS (200 MARKSMithilesh ShindeNessuna valutazione finora

- Smart Way To Invest in GoldDocumento7 pagineSmart Way To Invest in GoldNaveen BaskarNessuna valutazione finora

- RatiosDocumento3 pagineRatiosMithilesh ShindeNessuna valutazione finora

- WTODocumento17 pagineWTOVivekanand SonawadekarNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Demand EstimationDocumento3 pagineDemand EstimationMian UsmanNessuna valutazione finora

- Doupnik ch11Documento33 pagineDoupnik ch11Catalina Oriani0% (1)

- Chapter 10 Property Plant EquipmentDocumento27 pagineChapter 10 Property Plant EquipmentLancerAce22Nessuna valutazione finora

- Advanced Supply Chain OPME005 PDFDocumento46 pagineAdvanced Supply Chain OPME005 PDFNageshwar SinghNessuna valutazione finora

- EB Sales Process PDFDocumento5 pagineEB Sales Process PDFAndry YadisaputraNessuna valutazione finora

- Tong Hop T.anh Chuyen NganhDocumento23 pagineTong Hop T.anh Chuyen NganhVi PhươngNessuna valutazione finora

- Fundamental AnalysisDocumento24 pagineFundamental AnalysisNaresh Yadav0% (1)

- NITIE Casebook PDFDocumento162 pagineNITIE Casebook PDFSai Tapaswi ChNessuna valutazione finora

- Daythree Digital Berhad IPODocumento9 pagineDaythree Digital Berhad IPO健德Nessuna valutazione finora

- TOPIC 5-Budgetary PlanningDocumento73 pagineTOPIC 5-Budgetary PlanningDashania GregoryNessuna valutazione finora

- SAB 101 Revenue Recognition CriteriaDocumento4 pagineSAB 101 Revenue Recognition CriteriaPradeeba SwaminathanNessuna valutazione finora

- MRK - Fall 2023 - HRM619 - 4 - MC220205002Documento7 pagineMRK - Fall 2023 - HRM619 - 4 - MC220205002hssdj2hfdmNessuna valutazione finora

- Accounts Receivable q3Documento3 pagineAccounts Receivable q3Omnia HassanNessuna valutazione finora

- Logistics and Supply Chain Management: Dr. R. S. GhoshDocumento164 pagineLogistics and Supply Chain Management: Dr. R. S. Ghoshamitrao1983Nessuna valutazione finora

- Chap013 Target Costing Cost MNGTDocumento49 pagineChap013 Target Costing Cost MNGTSyifaNessuna valutazione finora

- Vegan Co MJ2023 TestReach QuestionDocumento2 pagineVegan Co MJ2023 TestReach QuestionIqmal khushairi100% (1)

- JollibeeDocumento8 pagineJollibeeDavid DoanhNessuna valutazione finora

- Marketing Plan For FTTHDocumento5 pagineMarketing Plan For FTTHsheinmin thuNessuna valutazione finora

- Chapter 7Documento21 pagineChapter 7Dawood AlqunaisNessuna valutazione finora

- Demographic Report by MatthDocumento2 pagineDemographic Report by Matthngoctuan_ntdNessuna valutazione finora

- RiskCalc 3.1 WhitepaperDocumento36 pagineRiskCalc 3.1 WhitepaperOri ZeNessuna valutazione finora

- AuditorDocumento7 pagineAuditorEsha JavedNessuna valutazione finora

- Deutsche Bank's Corporate and Investment Banking The Anshu Jain WayDocumento3 pagineDeutsche Bank's Corporate and Investment Banking The Anshu Jain WaySandeep MishraNessuna valutazione finora

- EMB 833 Assignment 1Documento11 pagineEMB 833 Assignment 1Aliyu GafaarNessuna valutazione finora

- Pengaruh Ukuran Perusahaan, Remunerasi Ceo Dan Modal IntelektualDocumento9 paginePengaruh Ukuran Perusahaan, Remunerasi Ceo Dan Modal IntelektualdayaninurhandayaniNessuna valutazione finora

- Final Question Paper For CAT-2 Part B & CDocumento4 pagineFinal Question Paper For CAT-2 Part B & CShailendra SrivastavaNessuna valutazione finora

- Network Externalities and Their EffectsDocumento14 pagineNetwork Externalities and Their EffectsTan Huey YinNessuna valutazione finora

- CAPITAL BUDGETING REPORTDocumento86 pagineCAPITAL BUDGETING REPORTtulasinad123Nessuna valutazione finora

- Accrual Accounting TaskDocumento5 pagineAccrual Accounting TaskBill SharmanNessuna valutazione finora

- FX INSTRUMENTS: Spot, Forward & SwapsDocumento152 pagineFX INSTRUMENTS: Spot, Forward & Swapshimanshugupta6Nessuna valutazione finora