Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Review Questions

Caricato da

ShaoPuYu0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni6 paginefine

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentofine

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni6 pagineReview Questions

Caricato da

ShaoPuYufine

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

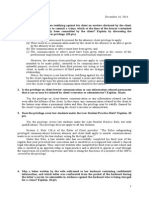

Econ 306 International Economics

Assistant Prof. Alper Duman 12/05/2012

Review uestions for !inal

1. "it# imperfect capital mo$ilit%& t#e 'P curve slopes upwar( $ecause& startin) from a

)iven $alance*of*pa%ments e+uili$rium position& a rise in national income will

ten( to cause a & w#ic# must $e counteracte( $% a rise in t#e interest rate

in or(er to cause a t#at will restore ',P e+uili$rium.

a. ',P (eficit- s#ort*term financial capital inflow

$. ',P (eficit- s#ort*term financial capital outflow

c. ',P surplus- s#ort*term financial capital inflow

(. ',P surplus- s#ort*term financial capital outflow

2. In a situation of fle.i$le e.c#an)e rates& ot#er t#in)s e+ual& a s#ift of t#e I/ curve to

t#e left will lea( to of t#e countr%0s currenc% if t#e 'P curve is steeper

t#an t#e 12 curve an( will of t#e countr%0s currenc% if t#e 12 curve is

steeper t#an t#e 'P curve.

a. an appreciation- also lea( to an appreciation

$. an appreciation- lea( to a (epreciation

c. a (epreciation- lea( to an appreciation

(. a (epreciation- also lea( to a (epreciation

3. In a situation of fle.i$le e.c#an)e rates an( w#ere t#e 'P curve is steeper t#an

t#e 12 curve&

a. monetar% polic% is less effective in raisin) national income t#an woul( $e t#e

case un(er fi.e( e.c#an)e rates.

$. e.pansionar% fiscal polic% will $e more effective in raisin) t#e level of national

income t#an woul( $e t#e case un(er fi.e( e.c#an)e rates.

c. e.pansionar% fiscal polic% will lea( to an appreciation of t#e countr%0s

currenc%.

(. t#e 'P curve sta%s fi.e( in t#e same position irrespective of an% s#ifts t#at

occur in t#e I/ an( 12 curves.

3. In a situation of fle.i$le e.c#an)e rates& an e.o)enous increase in forei)n interest

rates will cause of t#e (omestic currenc% an(& most li4el%& a in

t#e (omestic interest rate.

a. a (epreciation- a rise

$. an appreciation- a rise

c. a (epreciation- a fall

(. an appreciation- a fall

5. In t#e view of economists& w#ic# one of t#e followin) statements is true5

a. !iscal polic% is unam$i)uousl% more effective in influencin) national income

un(er fle.i$le e.c#an)e rates t#an un(er fi.e( e.c#an)e rates.

$. !iscal polic% is unam$i)uousl% more effective in influencin) national income

un(er fi.e( e.c#an)e rates t#an un(er fle.i$le e.c#an)e rates.

c. 2onetar% polic% is unam$i)uousl% more effective in influencin) national

income un(er fle.i$le e.c#an)e rates t#an un(er fi.e( e.c#an)e rates.

(. 2onetar% polic% is unam$i)uousl% more effective in influencin) national

income un(er fi.e( e.c#an)e rates t#an un(er fle.i$le e.c#an)e rates.

6. 6#e I//12/!E anal%sis su))ests t#at& if t#e 'P curve is flatter t#an t#e 12 curve

an( t#e e.c#an)e rate is fle.i$le& e.pansionar% fiscal polic% will lea( to

of t#e countr%0s currenc%& w#ic# will ma4e t#e fiscal polic% effective in

influencin) national income t#an if t#e countr% #a( a fi.e( e.c#an)e rate.

a. a (epreciation- more

$. a (epreciation- less

c. an appreciation- more

(. an appreciation- less

7. If& ot#er t#in)s e+ual& a countr% wit# a fle.i$le e.c#an)e rate (ecreases its mone%

suppl%& t#is will lea( to in t#e value of t#e countr%0s currenc%& w#ic#

will ten( to t#e countr%0s national income.

a. a (epreciation- increase

$. a (epreciation- (ecrease

c. an appreciation- increase

(. an appreciation- (ecrease

8. If we consi(er a situation of e.pansionar% monetar% polic% un(er fle.i$le

e.c#an)e rates& t#e monetar% e.pansion will lea( to of t#e #ome

currenc% an( t#us will $e effective in increasin) national income t#an

un(er fi.e( e.c#an)e rates.

a. an appreciation- more

$. an appreciation- less

c. a (epreciation- more

(. a (epreciation- less

9. /uppose t#at countr% A wit# a fle.i$le e.c#an)e rate un(erta4es

e.pansionar% monetar% polic%. Especiall% if s#ort*term fun(s are e.tremel%

mo$ile $etween countries& A0s currenc% will ten( to $ecause of t#is

polic%& an( t#is result su))ests t#at A0s monetar% polic% will $e

effective in influencin) national income t#an if A #a( a fi.e( e.c#an)e rate rat#er

t#an a fle.i$le e.c#an)e rate.

a. appreciate- less

$. appreciate- more

c. (epreciate- less

(. (epreciate- more

10. Proponents of fi.e( e.c#an)e rates woul( fin( t#e most support for t#eir position

in w#ic# one of t#e followin) empirical results re)ar(in) t#e relations#ip $etween

e.c#an)e rate variations an( t#e volume of international tra(e5 :Assume t#at t#e

empirical tests a(e+uatel% account for ot#er factors t#at influence t#e volume of

tra(e.;

a. no (iscerni$le relations#ip $etween e.c#an)e rate variations an( t#e volume of

tra(e

$. a ne)ative relations#ip $etween e.c#an)e rate variations an( t#e volume of

tra(e

c. a mil(l% positive relations#ip $etween e.c#an)e rate variations an( t#e volume

of tra(e

(. a stron)l% positive relations#ip $etween e.c#an)e rate variations an( t#e

volume of tra(e

11. A ma<or a(vanta)e of t#e s%stem of fle.i$le e.c#an)e rates :as oppose( to fi.e(

e.c#an)e rates; is commonl% t#ou)#t to $e

a. t#e li4eli#oo( t#at e.ternal monetar% s#oc4s will not influence (omestic

national income un(er fle.i$le e.c#an)e rates.

$. t#e stron) possi$ilit% t#at t#e )reater e.c#an)e rate ris4 un(er fle.i$le rates

will increase t#e volume of international tra(e.

c. t#e en#ance( effectiveness of monetar% polic% in influencin) national income

un(er fle.i$le e.c#an)e rates.

(. t#e =virtuous circle> t#at fle.i$le rates can $rin) $etween (epreciation an(

inflation.

12. 6#e optimal si?e of international reserves occurs for a countr% at t#e point w#ere

t#e

a. total $enefit of #ol(in) t#e reserves e+uals t#e total cost of #ol(in) t#e

reserves.

$. mar)inal $enefit of #ol(in) t#e reserves e.cee(s t#e mar)inal cost of #ol(in)

t#e reserves $% t#e )reatest amount.

c. mar)inal $enefit of #ol(in) t#e reserves e+uals t#e mar)inal cost of #ol(in) t#e

reserves.

(. mar)inal cost of #ol(in) t#e reserves is ?ero.

13. 6#e I//12/'P anal%sis su))ests t#at an e.ternal real sector s#oc4 suc# as a rise

in national income a$roa( will cause& un(er fixed e.c#an)e rates& a s#ift

in a #ome countr%0s 'P curve :assumin) t#at s#ort*term financial capital is not

perfectl% mo$ile;& a in t#e #ome countr%0s $alance of pa%ments& an(

in t#e #ome countr%0s national income.

a. ri)#twar(- surplus- an increase

$. ri)#twar(- (eficit- a (ecrease

c. ri)#twar(- surplus- a (ecrease

(. leftwar(- (eficit- a (ecrease

13. "#ic# one of t#e followin) is NOT an alle)e( (isa(vanta)e of a fle.i$le

e.c#an)e rate s%stem5

a. possi$ilit% of (esta$ili?in) speculation

$. wasteful resource movements $etween in(ustries

c. increase( nee( for international reserves

(. )reater =insulation> of a (omestic econom% from e.ternal real s#oc4s

15. A situation w#ere a countr% announces a parit% value for its currenc% an( permits

small variations aroun( t#at value& $ut also a(<usts t#e parit% re)ularl% $% small

amounts accor(in) to various in(icators& is 4nown as

a. a (irt% float.

$. a crawlin) pe).

c. a mana)e( float strate)% of =leanin) a)ainst t#e win(.>

(. a =wi(er $an(.>

16. If a countr%0s 'P curve is flatter t#an its 12 curve& t#en an e.ternal financial

s#oc4 of a rise in interest rates a$roa( woul(& un(er fle.i$le e.c#an)e rates& lea(

to in t#e #ome countr%0s national income. If e.c#an)e rates were fi.e(&

t#is e.ternal financial s#oc4 woul( in t#e #ome countr%0s national

income.

a. a (ecrease- lea( to an increase

$. a (ecrease- also lea( to a (ecrease

c. an increase- also lea( to an increase

(. an increase- lea( to a (ecrease

17. If a countr% a(opts a currenc% $oar( arran)ement& a result is t#at t#e countr%0s

mone% suppl% $e increase( $% t#e purc#ase of (omestic assets from t#e

countr%0s citi?ens $% t#e countr%0s central $an4- in t#is arran)ement& t#e countr%0s

mone% suppl%

$e increase( $% t#e purc#ase of forei)n assets from t#e countr%0s

citi?ens $% t#e countr%0s central $an4.

a. can- also can

$. can- cannot

c. cannot- can

(. cannot- also cannot

18. If a countr% #as a currenc% $oar( arran)ement :wit# a 100 percent reserve s%stem;

in place& t#en t#e countr%0s mone% suppl% can $e increase( $% a $% t#e

countr%0s central $an4.

a. purc#ase of (omestic assets from (omestic citi?ens.

$. purc#ase of forei)n :e.ternal; assets from (omestic citi?ens.

c. sale of (omestic assets to (omestic citi?ens.

(. sale of forei)n :e.ternal; assets to (omestic citi?ens.

Essa%s an( Pro$lems@

1. An(er a fle.i$le e.c#an)e rate s%stem& c#an)es in t#e forei)n rate of interest will

affect $ot# t#e financial mar4ets an( t#e real sector. E.plain w#% t#is comes a$out usin)

t#e I//12/'P mo(el. "#at influence& if an%& (oes t#e (e)ree of international capital

mo$ilit% #ave on t#e results5

2. E.plain& in t#e I//12/'P framewor4 wit# fle.i$le e.c#an)e rates& t#e impact of an

autonomous increase in forei)n (eman( for a countr%0s e.ports upon t#e countr%0s

national income& mone% suppl%& an( e.c#an)e rate. If t#ere is no impact on a varia$le&

e.plain w#%.

3. E.plain t#e features of a currenc% $oar( arran)ement. 6#en in(icate )eneral

con(itions un(er w#ic# t#e a(option of a currenc% $oar( $% a countr% woul( $e (esira$le

for t#e countr%.

Potrebbero piacerti anche

- Learning Objectives: Introduction To Statistics For Business DecisionsDocumento4 pagineLearning Objectives: Introduction To Statistics For Business DecisionsShaoPuYuNessuna valutazione finora

- Week 3 Chapter AssignmentsDocumento1 paginaWeek 3 Chapter AssignmentsShaoPuYuNessuna valutazione finora

- Amir68332920 - 2015 03 07 - 00 05 31Documento1 paginaAmir68332920 - 2015 03 07 - 00 05 31ShaoPuYuNessuna valutazione finora

- Week 3 Case StudyDocumento2 pagineWeek 3 Case StudyShaoPuYuNessuna valutazione finora

- Exam 1Documento4 pagineExam 1ShaoPuYuNessuna valutazione finora

- Week 3 Case StudyDocumento2 pagineWeek 3 Case StudyShaoPuYuNessuna valutazione finora

- 2 Chapter OpenerDocumento3 pagine2 Chapter OpenerShaoPuYuNessuna valutazione finora

- Summary of Key EquationsDocumento1 paginaSummary of Key EquationsShaoPuYuNessuna valutazione finora

- AnnuityDocumento2 pagineAnnuityShaoPuYuNessuna valutazione finora

- Chapter OpenerDocumento2 pagineChapter OpenerShaoPuYuNessuna valutazione finora

- CH 6Documento1 paginaCH 6ShaoPuYuNessuna valutazione finora

- Hypothesis W1Documento29 pagineHypothesis W1ShaoPuYuNessuna valutazione finora

- SUMMARY of Learning ObjectivesDocumento2 pagineSUMMARY of Learning ObjectivesShaoPuYuNessuna valutazione finora

- 3 Chapter OpenerDocumento2 pagine3 Chapter OpenerShaoPuYuNessuna valutazione finora

- QDocumento1 paginaQShaoPuYuNessuna valutazione finora

- Take Test - Practice With APA and PlagiarismDocumento4 pagineTake Test - Practice With APA and PlagiarismShaoPuYuNessuna valutazione finora

- p4 2aDocumento2 paginep4 2aShaoPuYuNessuna valutazione finora

- Work Breakdown Structure Guidelines and Rubric - KBDocumento1 paginaWork Breakdown Structure Guidelines and Rubric - KBShaoPuYuNessuna valutazione finora

- Work Breakdown Structure Guidelines and Rubric - KBDocumento1 paginaWork Breakdown Structure Guidelines and Rubric - KBShaoPuYuNessuna valutazione finora

- Work Breakdown Structure Guidelines and Rubric - KBDocumento1 paginaWork Breakdown Structure Guidelines and Rubric - KBShaoPuYuNessuna valutazione finora

- Answer: DDocumento2 pagineAnswer: DShaoPuYuNessuna valutazione finora

- Form-A - (PPF Opening) PDFDocumento2 pagineForm-A - (PPF Opening) PDFprithvirajd20Nessuna valutazione finora

- Answer: DDocumento2 pagineAnswer: DShaoPuYuNessuna valutazione finora

- Concluding Remarks: Electronic Voting and Counting TechnologiesDocumento6 pagineConcluding Remarks: Electronic Voting and Counting TechnologiesShaoPuYuNessuna valutazione finora

- CH 06 MBADocumento24 pagineCH 06 MBAtalvinderndimNessuna valutazione finora

- 1Documento1 pagina1ShaoPuYuNessuna valutazione finora

- Eco Unit 10 International Trade QuizDocumento4 pagineEco Unit 10 International Trade QuizShaoPuYuNessuna valutazione finora

- 19 Blue Print - 1Documento5 pagine19 Blue Print - 1ShaoPuYuNessuna valutazione finora

- Take Details: Return To The Previous PageDocumento8 pagineTake Details: Return To The Previous PageShaoPuYu100% (2)

- 19 Blue Print - 2Documento4 pagine19 Blue Print - 2ShaoPuYu100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Law On Adverse Possession in KenyaDocumento21 pagineThe Law On Adverse Possession in KenyaFREDRICK WAREGANessuna valutazione finora

- Tabangao Shell V Pilipinas ShellDocumento3 pagineTabangao Shell V Pilipinas ShellmeriiNessuna valutazione finora

- EvidenceDocumento4 pagineEvidenceRea Jane B. MalcampoNessuna valutazione finora

- Jurisdiction of Family Courts in Criminal ActionsDocumento2 pagineJurisdiction of Family Courts in Criminal ActionsnomercykillingNessuna valutazione finora

- Area 6 Correctional AdministrationDocumento54 pagineArea 6 Correctional Administrationcriminologyalliance100% (1)

- Perez v. Judge Concepcion, MTJ-99-1240, December 21, 1999 FulltextDocumento3 paginePerez v. Judge Concepcion, MTJ-99-1240, December 21, 1999 FulltextJem PagantianNessuna valutazione finora

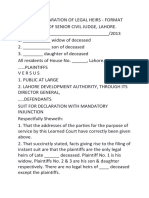

- Suit For Declaration of Legal HeirsDocumento3 pagineSuit For Declaration of Legal Heirssikander zamanNessuna valutazione finora

- Learning Activity No. 9 The Evolution of Phil. ConstitutionDocumento4 pagineLearning Activity No. 9 The Evolution of Phil. ConstitutionNelly CruzNessuna valutazione finora

- Besaga vs. Acosta - Full TextDocumento8 pagineBesaga vs. Acosta - Full TextMichael Prince del RosarioNessuna valutazione finora

- Beautifont VDocumento3 pagineBeautifont VCamille BritanicoNessuna valutazione finora

- 017-2013 - MR (MOA Kalahi Cidss)Documento3 pagine017-2013 - MR (MOA Kalahi Cidss)SbGuinobatanNessuna valutazione finora

- Group 2 Reporting: China Policing System! China Rank Police Officials! China Police Training!Documento18 pagineGroup 2 Reporting: China Policing System! China Rank Police Officials! China Police Training!mark carmenNessuna valutazione finora

- Unification of Hispaniola WikiDocumento5 pagineUnification of Hispaniola WikixambassadorNessuna valutazione finora

- Asian Regionalism - Contemporary World - Group 6Documento16 pagineAsian Regionalism - Contemporary World - Group 6Mariane Joyce MianoNessuna valutazione finora

- IRR of R.A 9255Documento7 pagineIRR of R.A 9255Tata Bentor100% (1)

- The Russian RevolutionDocumento33 pagineThe Russian RevolutionAnita Pant100% (1)

- 3 Inherent Powers of The StateDocumento1 pagina3 Inherent Powers of The StateCarla Abapo RCrim85% (39)

- Secret Wars Against Domestic Dissent. Boston, MA: South End, 1990. PrintDocumento18 pagineSecret Wars Against Domestic Dissent. Boston, MA: South End, 1990. Printateam143Nessuna valutazione finora

- Special Power of AttorneyorcrDocumento2 pagineSpecial Power of AttorneyorcrRM ManitoNessuna valutazione finora

- Libya-Pakistan Relations: History of Foreign RelationsDocumento5 pagineLibya-Pakistan Relations: History of Foreign RelationsAliNessuna valutazione finora

- PSPREG011 Knowledge Assessment: Give EvidenceDocumento10 paginePSPREG011 Knowledge Assessment: Give EvidenceSteve TowsonNessuna valutazione finora

- Code of Ethics With LawsDocumento37 pagineCode of Ethics With LawsGylle100% (1)

- Legal Research ReviewerDocumento18 pagineLegal Research ReviewerRache Gutierrez50% (2)

- In The High Court of South Africa Gauteng Local Division, JohannesburgDocumento9 pagineIn The High Court of South Africa Gauteng Local Division, JohannesburgColias DubeNessuna valutazione finora

- SB No. 1614Documento3 pagineSB No. 1614Simoun Montelibano SalinasNessuna valutazione finora

- 17.2 G.R. No. 164166 & 164173-80Documento5 pagine17.2 G.R. No. 164166 & 164173-80Nufa AlyhaNessuna valutazione finora

- Case Summary of Marbury V MadisonDocumento2 pagineCase Summary of Marbury V MadisonGilly Mae Gallego RPhNessuna valutazione finora

- Role of Judiciary: Decisions States ResourcesDocumento5 pagineRole of Judiciary: Decisions States Resourcestayyaba redaNessuna valutazione finora

- Establishment of All India Muslim League: Background, History and ObjectivesDocumento6 pagineEstablishment of All India Muslim League: Background, History and ObjectivesZain AshfaqNessuna valutazione finora

- Bangladesh Affairs (Written) PDFDocumento728 pagineBangladesh Affairs (Written) PDFSorwarNessuna valutazione finora