Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Table Showing India's Foreign Trade For The Period Of:-2012-2013 Particulars Amount in (Rupees Crores)

Caricato da

GreeshmaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Table Showing India's Foreign Trade For The Period Of:-2012-2013 Particulars Amount in (Rupees Crores)

Caricato da

GreeshmaCopyright:

Formati disponibili

CHAPTER 1

INTRODUCTION

The term export is derived from the conceptual meaning as to ship the goods and

services out of the port of a country. The seller of such goods and services is referred to

as an "exporter" who is based in the country of export whereas the overseas based

buyer is referred to as an "importer". In International Trade, "exports" refers to selling

goods and services produced in home country to other markets.

Any good or commodity, transported from one country to another country in a legitimate

fashion, typically for use in trade. Export goods or services are provided to

foreign consumers by domestic producers.

Export of commercial quantities of goods normally requires involvement of the customs

authorities in both the country of export and the country of import. The advent of small

trades over the internet such as through Amazon and e-Bay has largely bypassed the

involvement of Customs in many countries because of the low individual values of these

trades.

Nonetheless, these small exports are still subject to legal restrictions applied by

the country of export. An export's counterpart is an import.

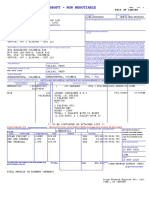

Table showing Indias Foreign Trade for the period of:-

2012-2013

Particulars Amount in (Rupees crores)

Total Exports 845125.2

Total Imports 1356468.7

Trade Balance for the period -511343.5

Fig 1

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

PROBLEMS

There are few problems which need to be solved before India makes a mark for itself in

the export sector. The Indian goods have to be of superior quality. The packaging and

branding should be such that countries are interested to export from India. At the same

time India must look for potential market to sell their goods. The government policies

amendments can give a boost to the exports.

Though India has not been affected to the same extent as other economies of the world,

yet our exports have suffered a decline in the last 10 months due to a contraction in

demand in the traditional markets of our exports

ADVANTAGES OF EXPORT IMPORT

Enhance your domestic competitiveness

Increase sales and profits

Gain your global market share

Reduce dependence on existing markets

Exploit international trade technology

Reduce dependence on existing markets

Extend sales potential of existing products

Stabilize seasonal market fluctuations

Enhance potential for expansion of your business

Sell excess production capacity

Maintain cost competitiveness in your domestic market

DISADVANTAGES OF EXPORT IMPORT

o You may need to wait for long-term gains

o Hire staff to launch international trading

o Modify your product or packaging

o Develop new promotional material

o Incur added administrative costs

o Wait long for payments

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 2

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

CHAPTER 2

INDUSTRY PROFILE

2.1 WORLD APPAREL INDUSTRY

Global garment exports are valued at more than US$ 310 billion a year, of which

the world's top 15 clothing exporters account for more than 80%.

Developing countries in Asia continue expanding their Garment Industry due to

their very-low-cost production.

India is the second most preferred country after China for textile and apparel

sourcing. Its Apparel industry is likely to achieve an export target of US$ 28

billion by 2012-13. Factors effecting like vast sources of raw materials, low labor

costs, entrepreneurship and design skills of Indian traders, changes in the policies

to open up Indian economy to the outside world etc.

Bangladesh has emerged as a key player in RMG sector (Ready Made Garment

Industry).

2.2 INDIAN APPAREL INDUSTRY

14% of total industrial Production and 30% of total exports (in India).

Current share in world clothing export 3.5-4 %

One of the largest foreign exchange earners.

2nd largest exporter and producer of Apparel Products.

NATIONNAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 3

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

30,000 manufacturing units and 35 million employed.

Industry is dominated by sub-contractors and consists mainly of small

units.

55% of investment in technology done for spinning.

Supply base is medium quality with small volume.

During 2008, exports of apparel and textile products to US declined by

0.43% in value terms though export volumes increased by 7.49% due

value increase in Rupee

PRODUCTS

Garments and Clothing

Home Decor and Furnishings:

The majority of home textiles are produced in Asia. Lower prices and high

volume products have contributed to the expansion of exports particularly from

China and India.

Handlooms:

30 lakh Weavers, 23% of total cloth produced, promoted through input support,

publicity, market support, up gradation of technology, welfare measures.

Textiles, Fabrics and Yarns:

8% of GDP, 30% of export earnings, 2nd highest mill area after china, facing

competition on quality and value addition factors.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 4

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Leather- Clothing and other Products:

Comprises of jackets, footwear, etc. with 7% share in exports, major centers

include Chennai, Kanpur, Agra, J alandhar & Delhi employing 15 lakh people.

50% consumption within India. Top importers: Germany, USA and UK.

Apparel Accessories- Industry and Products:

One of the major manufacturers of accessories with low price and quality

products.

PRODUCTION CENTRES

LUDHIANA

TIRUPUR

NEW DELHI

BANGALORE

MUMBAI

CHENNAI

J AIPUR

COMPETITIVENESS

Caters basic requirement of people.

Large skilled/ unskilled workforce with cheap rate.

Sound Export Potential

Comprises of effective Supply Chain( Diverse Fabrics to large market)

Heavy Production Capacity

India has a large fiber base

Have a large and organized mill area

Economic Upgraded Technology

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 5

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

DOMESTIC INDUSTRY

Domestic market has grown from US$ 23 billion to US$ 30 billion, exports has

increased from around US$ 14 billion to US$ 19 billion (04-06 to 06-07 )

Current share in world export 3.5-4%

Mens Apparel 46%, Women 17%, Kids 37%

50% of prod. need to be exported.

2,000 manufacturer-exporters export apparel, while the roughly 26,000 merchant-

exporters serve as export brokers.

India has more than 6,000 knitting units registered as producers or exporters; the

majority are SSI units

MAJOR EXPORTERS IN INDIA

Madura Garments (Indian Rayan)

Arvind Mills Ltd

Raymonds Ltd.

Alok Industries Ltd.

Welspun India Ltd.

Bombay Dyeing

J NS Fabrics & Exports.

Primex Apparel Sourcing Services

The Outlook Sourcing Services

Pratibha Syntex Pvt. Ltd

Provogue India Ltd.

Wills Lifestyle

Orient Craft Limited

Gokaldas Exports Limited

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 6

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

COMPETITORS

China

Vietnam

Bangladesh

Indonesia

Mexico

Hong Kong

Dominican Republic

Korea

Thailand

Philippines

QUALITY STANDARDS

For textile and apparel industry product quality is calculated in terms of quality

and standard of fibers, yarns, fabric construction, color fastness, surface designs

and the final finished garment products. However quality expectations for export

are related to the type of customer segments and the retail outlets.

Only limited use of various chemicals like azo dyes, heavy metals, odour, etc

should be permitted to prevent ecological requirements.

Apparel Industry have ISO Certification

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 7

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Operation incurs heavy expenditure to the manufacturers. ISO standards are

implemented to lower its operating costs and improve the quality of its output,

ultimately increasing the level of customer satisfaction.

ISO standards enable the industry to enhance the quality of raw material input,

thereby strengthening the quality of the ultimate/final product, which leads to

performance improvement, factual approach towards the decision making process,

and a mutually benefiting suppliers relationship.

Right from yarn purchase to shipment every activity is governed by documented

standard operating procedures and instructions, which complies with the

requirements of ISO 9001.

Each process is carried out with the PDCA process approach (i.e. Plan-Do-Check-

Act), which gives better results in achieving better quality and on time shipments.

Inspection and testing at each stage of manufacture assures quality requirements

are met.

Internal audit and external audit performed periodically ensures effective

implementation of Quality Management System

Periodical feedback from customers reveals their level of satisfaction

Standards are specified on selection of Cotton Yarn.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 8

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

FOREIGN TRADE POLICY

Clothing and accessories are classified under HS code 61 and 62. All the products

listed under these codes are freely importable. Further more the manufacturers of

these products are exempt from obtaining a license to manufacture though they

are required to file an Industrial Entrepreneur Memoranda (IEM) in Part 'A' with

the Secretariat of Industrial Assistance (SIA), and obtain an acknowledgement

and part B after the commencement of commercial production. Certain items of

clothing are reserved for small scale industries.

Most of the articles falling under HS 61-62 carry an import duty of 56.83 per cent

which includes 30 per cent basic duty, 16 per cent additional duty and 4 per cent

special additional duty. India has reduced peak rate of customs duty to 20%, in

view of the WTO Agreement.

In the foreign trade policy, certain amendments and inclusions have been done

pertaining to specific sectors of textiles and garment specially the handlooms.

Handlooms

Specific funds would be earmarked under MAI/ MDA Scheme for

promoting handloom exports.

Duty free import entitlement of specified trimmings and embellishments

shall be 5% of FOB value of exports during the previous financial year.

Duty free import entitlement of hand knotted carpet samples shall be 1%

of FOB value of exports during the previous financial year.

Duty free import of old pieces of hand knotted carpets on consignment

basis for re-export after repair shall be permitted.

New towns of export excellence with a threshold limit of Rs 250 crore

shall be notified.

NATIONNAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 9

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

The textile and apparel industry is an important one to India, contributing

1.6% of industrial production and 30 % of total exports.

Import duties on capital equipment are low (the majority of the capital

equipment used by the apparel industry, like sewing machines, can be

imported at 5% basic customs duty).

Fabrics can be imported duty-free if made up into garments and re-

exported

Import duties on fabrics and other raw materials are duty free for export

production.

The apparel industry can import duty free specified trimmings and

embellishments like Fasteners, Rivets, Garment Stay, textile, Badges,

Sewing Thread, Sequin, Tape & others for export production.

CHALLENGES TO INDIAN APPAREL INDUSTRY

Policies of the Government of India favoring small firms

Small units use low levels of technology and produce mostly low value-added

goods of low quality that are less competitive globally

Indias Apparel industry depends heavily on domestically produced cotton

Small Unit sector had restricted the entry of large-scale units and discouraged

investment in new apparel manufacturing technologies

India have high energy and capital costs, raw material costs, multiple taxation etc.

Appreciation of Rupee

Low Institutional Support

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 10

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

CHAPTER 3

3.1 EXPORT PROCESS

STEP 1 RECIEPT OF ENQUIRY

It refers to the set of enquiries received by the exporter from the importer to serve his

own purpose. For an exporter it may not be possible to respond to all enquiries, therefore

an exporter checks the worthiness of importer by framing various questions like:-

For how long they have been in that business?

Whether they intend to purchase goods on their own account or they intend to act

as commission agent?

The name and address of at least two firms which they already represent or have

represented in the past?

This process continues further only if the exporter is satisfied with the response.

STEP 2 ROLE OF MERCHANDISER

The merchandiser is an important intermediate between the buyer and the exporter. He

works under the supervision of the directors. He often accompanies the CMD or the head

of department for getting the orders from the overseas buyer. The merchandiser forwards

different styles of samples to the buyer through local buying house as every buyer or

agent wants to assure that the goods manufactured at last should match up to their

description and illustration. This is called ad samples. If these samples are approved by

the buyer or some alterations has to be made say, in color or size, the merchandiser of the

buyer informs the merchandiser of the exporter about the alterations. Accordingly, a new

sample is prepared and forwarded.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 11

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

To send samples to an enquirer is a costly business, specially as samples should always

be sent by air if possible, therefore the enquirer should be asked to pay for the samples

plus the cost of dispatch (or at least be asked to pay half of the cost) & if he is really

interested in that particular contract, he will do so.

To serve this purpose, a DEBIT NOTE is prepared by the exporter. In this context, the

firm has maintained a program which has the records of various buyers and the follow up

of sample payments.

The exporter after having satisfied himself that the enquirer abroad is capable of meeting

his obligations provides him with the price list, details of terms of business and payment

which he is expected to adhere to.

Once the samples and the other details regarding the process are approved by the buyer,

the process of Documentation starts

MERCHANDISER

BULK

SAMPLING

ORDER CONFIRMATION PURCHASE ORDER

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 12

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

BULK SHIPMENTS

FABRIC ORDERING 60 70 DAYS

TRIMS/ ACCESSORIES 30 40 DAYS

FABRIC IN HOUSE

TRIM IN HOUSE

TESTING

WASHING CUTTING FINISHING PACKING INSPECTION

15 20 Days prior to ex factory of goods.

Generate invoice (retail invoice)

Booking with nominated forwarder

Booking confirmed in two three days time.

Ex factory vessel cargo cut off date H/O

STEP 3 DOCUMENTATION

An exporter is required to deal with various documents both at the:

1. Pre shipment and

2. Post shipment stages

To complete the export transaction, these documents are important:

As an evidence of shipment and title of goods

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 13

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

For obtaining payments.

These documents are of vital interest to both the exporter and the importer. The importer

needs them to claim peaceful and legal possession and delivery of the goods in his

country. The exporter needs to hand them over to him to claim payment for the

shipment.

1. PURCHASE ORDER (P.O.)

Purchase order is the very first document which is being forwarded by the buyer to the

exporters merchandiser. It covers all the information regarding the goods. Once the

order is received, the first decision as to whether it will be filled is based upon the

approval of credit. i.e., the shipment should be contingent upon the ability of the

customer to secure foreign exchange in those countries where there are exchange

restrictions. This also applies to merchandiser destined for those countries where there

are import quotas and import license.

The Contents of P.O. Are as follows:

Year

Division

Company

Group

Shipping Group

Purchase order No.

Category

Factory

Proj. Issue

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 14

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Actual Issue

Style Division

Style No.

Prototype No.

Style Desc. No.

Type

Buying Office

Handling Buying Office

LC Beneficiary

Size- Scale

Fabric

Quality

Pack Method

Content

Construct

Finish

Gauge

Type

Garment Weight

LIC

Colour

Unit

Cost

Currency

Terms

Consignment_Date

Ship Mode

Quota category

Duty(%)

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 15

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Ship To

In Catalog

Size Breakdown

Issue By

Signature

Total Value

Scrutinizing the Purchase Order

In particular, the purchase order should be scrutinized on the following basis:

Terms of payments

Documents

TERMS OF PAYMENTS

In international trade, the payment for the goods can be made by means of any of the

following methods of payment. These payment methods are also known as payment

terms.

Advance payment

Open account Documentary Collection (documents against payments(d/p),

documents against acceptance(d/a)

Documentary credit(letter of credit)

ADVANCE PAYMENT:

Under this method the exporter receives payment from the overseas exporter in advance

in the form of demand draft or cheque denominated in foreign currency or by way of

direct telegraphic transfer against the supply of goods to be made later on. When an

exporter receives the advance payment, then he must have an evidence of advance

payment in the form of certificate of foreign inward remittance (FIRC).

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 16

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

OPEN ACCOUNT:

Open account is an arrangement between the exporter and the importer, where by the

goods are manufactured and delivered even before the payment is required. The importer

does not accept any negotiable instrument and thus, does not provide any evidence to the

exporter of his legal, commitment to make the payment. Importer makes the payment

only when he has received the goods and expected them to be quality satisfaction.

DOCUMENTARY COLLECTION:

It involves collection of given sum of money due from the importer by a bank against

delivery of certain documents at the instructions of the exporter. The parties involved in

the documentary collection are as follows-

The Exporter: The seller ships the goods and then hands over the document related to

the goods to their banks with the instruction on how and when the buyer would pay.

The Remitting Bank/ Exporter's Bank: the bank which presents documents to the

importer for collection of payments/acceptance of drafts as per instructions of the

collecting bank.

Role of remitting bank:

Check that the documents for consistency.

Send the documents to a bank in the buyer's country with instructions on

collecting payment.

Pay the exporter when it receives payments from the collecting bank.

The Collecting Bank: the bank which forwards the documents for collection or

obtaining acceptance of the draft from the importer as per instructions of the exporter.

Role of the collecting banks are:

Act as the remitting bank's agent

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 17

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Present the bill to the buyer for payment or acceptance.

Release the documents to the buyer when the exporter's instructions have been

followed.

Remit the proceeds of the bill according to the Remitting Bank's schedule

instructions.

The Importer i.e., the party to whom the documents are handed over against

payment/acceptance.

i. DOCUMENTS AGAINST PAYMENT:

Under this method, the shipping documents concerning the shipment of goods are given

to the importer against payment for the goods. The payment is made by the importer

against the sight draft sent along with the shipping documents. If the importer does not

honor the draft, he is not given the shipping documents.

Flow of documents against payment

1. 2. 3.

CREDIT MAKES

THE A/C OF PAYMENT

SENDS THE

REMITTANCE

HANDOVER DOX.

Fig. 2

Exporter

(Fwd dox to)

Exporters

bank

(Fwd dox to)

Importers

bank

(Ask

Payment)

Importer

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 18

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

ii. DOCUMENTS AGAINST ACCEPTANCE:

In this case the remitting bank hands over the shipping documents to the importer

only upon the acceptance of accompanying draft. The acceptance implies that he agrees

to pay the amount of the draft on the due date, under d/a terms, there is always a period of

credit (usance period), on the expiry of which the importer is required to make payment.

Flow of documents against Acceptance

1. 2. 3.

CREDIT

THE

REMITTANCE

SENT TO

MAKES

Fig. 3

LETTER OF CREDIT (DOCUMENTARY CREDIT)

Letter of credit refers to a written promise made by the importers bank to the exporter

that the payment shall be made to him provided the shipment is sent by him in strict

compliance with the terms and conditions to the export contract.

The terms and conditions of the export contract form the part of letter of credit and are

known as the terms and conditions of letter of credit. The essential characteristics of the

letter of credit is that it relies on the doctrine of strict compliance for release of payment

to the exporter against the draft (s) drawn by him. The banks do not deal in goods, they

Exporter

(Fwd dox to)

Exporters

bank

(Fwd dox to)

Importers

bank

(Ask

Payment)

Importer

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 19

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

deal in documents. As such, the importer has to specify to the bank the documents which

it should examine as the evidence to the effect that the exporter has sent the shipment in

strict compliance with the terms and conditions of the export contract.

Flow of Letter Of Credit

Fig. 4

PARTIES OF LETTER OF CREDIT

Applicant (Opener): Applicant which is also referred to as account party is

normally a buyer or customer of the goods, who has to make payment to beneficiary. LC

is initiated and issued at his request and on the basis of his instructions.

Issuing Bank (Opening Bank): The issuing bank is the one which create a letter

of credit and takes the responsibility to make the payments on receipt of the documents

from the beneficiary or through their banker. The payments has to be made to the

beneficiary within seven working days from the date of receipt of documents at their end,

Importer

Importers

bank

Exporter

Exporters

bank

Send goods. I'll pay

Send the dox.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 20

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

provided the documents are in accordance with the terms and conditions of the letter of

credit. If the documents are discrepant one, the rejection thereof to be communicated

within seven working days from the date of receipt of documents at their end.

Beneficiary: Beneficiary is normally stands for a seller of the goods, who has to

receive payment from the applicant. A credit is issued in his favor to enable him or his

agent to obtain payment on surrender of stipulated document and comply with the term

and conditions of the L/c. If L/c is a transferable one and he transfers the credit to another

party, then he is referred to as the first or original beneficiary.

Advising Bank: An Advising Bank provides advice to the beneficiary and takes

the responsibility for sending the documents to the issuing bank and is normally located

in the country of the beneficiary.

Second Beneficiary: Second Beneficiary is the person who represent the first or

original Beneficiary of credit in his absence. In this case, the credits belonging to the

original beneficiary is transferable. The rights of the transferee are subject to terms of

transfer.

TYPES OF LETTER OF CREDIT

1. Revocable Letter of Credit L/C:

A revocable letter of credit may be revoked or modified for any reason, at any time by the

issuing bank without notification. It is rarely used in international trade and not

considered satisfactory for the exporters but has an advantage over that of the importers

and the issuing bank. There is no provision for confirming revocable credits as per terms

of UCPDC, hence they cannot be confirmed. It should be indicated in LC that the credit

is revocable. If there is no such indication the credit will be deemed as irrevocable.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 21

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

2. Irrevocable Letter of Credit L/C:

In this case it is not possible to revoke or amended a credit without the agreement of the

issuing bank, the confirming bank, and the beneficiary. Form an exporters point of view

it is believed to be more beneficial. An irrevocable letter of credit from the issuing bank

insures the beneficiary that if the required documents are presented and the terms and

conditions are complied with, payment will be made.

3. Sight Credit and Usance Credit L/C:

Sight credit states that the payments would be made by the issuing bank at sight, on

demand or on presentation. In case of usance credit, draft is drawn on the issuing bank or

the correspondent bank at specified usance period. The credit will indicate whether the

usance draft is to be drawn on the issuing bank or in the case of confirmed credit on the

confirming bank.

Steps in an Import Transaction with Letter of Credit

The importer includes a purchase contract for the buying of certain goods.

The importer requests this bank to open a LC in favor of his supplier.

The importers bank opens the LC as per the application.

The opening bank will forward the original LC to the advising bank.

The advising bank, after satisfying itself about the authenticity of the credit, forwards the same to

the exporter.

The exporter scrutinizes the LC to ensure that it confirms to the terms of contract.

In case any terms are not as agreed, the importer will be asked to make the required

amendments to the LC.

In case the LC is as required, the exporter proceeds to make arrangements for the goods.

The exporter will effect the shipment of goods.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 22

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

After the shipment is effected, the exporter will prepare export documents, including Bills of

Exchange.

The exporters bank (negotiation bank) verifies all the documents with the LC.

If the documents are in the conformity with the terms of LC and all other conditions are

satisfied, the bank will negotiates the bill.

The exporter receives the payment in his bank account.

The LC Opening bank (Importers Bank) receives the bill and documents from the

exporters bank.

The importers bank checks the documents and informs the importer. The importer then

accepts/pays the bill (This would depend on the terms, Delivery against Acceptance or

Delivery against Payment). On acceptance/ payment, the importer gets the shipping documents

covering the goods purchased by him.

The LC issuing bank reimburses the negotiating bank, the amount, if the documents are found

in order.

Terms of Shipments Incoterms

The INCOTERMS (International Commercial Terms) is a universally recognized set of

definition of international trade terms, such as FOB, CFR & CIF, developed by the

International Chamber of Commerce (ICC) in Paris, France. It defines the trade contract

responsibilities and liabilities between buyer and seller. It is invaluable and a cost-saving

tool.

The exporter and the importer need not undergo a lengthy negotiation about the

conditions of each transaction. Once they have agreed on a commercial terms like FOB,

they can sell and buy at FOB without discussing who will be responsible for the freight,

cargo insurance and other costs and risks

The purpose of Incoterms is to provide a set of international rules for the interpretation of

the most commonly used trade terms in foreign trade. Thus, the uncertainties of different

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 23

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

interpretations of such terms in different countries can be avoided or at least reduced to a

considerable degree.

The scope of Incoterms is limited to matters relating to the rights and obligations of the

parties to the contract of sale with respect to the delivery of goods. Incoterms deal with

the number of identified obligations imposed on the parties and the distribution of risk

between the parties.

More Clarification on Incoterms

The sellers EXW (At the named place)

Ex-Works: Ex means from. Works means factory, mill or warehouse, which are the

sellers premises. EXW applies to goods available only at premises. Buyer is responsible

for loading the goods on truck or container at the sellers premises and for the subsequent

costs and risks. In practice, it is not uncommon that the seller loads the goods on truck or

container at the sellers premises without charging loading fee. The term EXW is

commonly used between the manufacturer (seller) and export-trader (buyer), and the

export-trader resells on other trade terms to the foreign buyers. Some manufacturers may

use the term Ex-Factory, which means the same as Ex Works.

FCA (At the named point of departure)

Free Carrier: The delivery of goods on truck, rail car or container at the specified point

(depot) of departure, which is usually the sellers premises, or a named railroad station or

a named cargo terminal or into the custody of the carrier, at sellers expense. The point

(depot) at origin may or may not be a customs clearance centre. Buyer is responsible for

the main carriage/freight, cargo insurance and other costs and risks.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 24

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

In the air shipment, technically speaking, goods placed in the custody of an air carrier are

considered as delivery on board the plane. In practice, many importers and exporters still

use the term FOB in the air shipment.

FAS (At the named port of origin)

Free Alongside Ship: Goods are placed in the dock shed or at the side of the ship, on the

dock or lighter, within reach of its loading equipment so that they can be loaded aboard

the ship, at sellers expense. Buyer is responsible for the loading fee, main

carriage/freight, cargo insurance, and other costs and risks In the export quotation,

indicate the port of origin(loading)after the acronym FAS, for example FAS New York

and FAS Bremen. The FAS term is popular in the break-bulk shipments and with the

importing countries using their own vessels.

FOB (At the named port of origin)

Free on Board: The delivery of goods on the board the vessel at the named port of origin

(Loading) at sellers expense. Buyer is responsible for the main carriage/freight, cargo

insurance and other costs and risks. In the export quotation, indicate the port of origin

(loading) after the acronym FOB, for example FOB Vancouver and FOB Shanghai.

Under the rules of the INCOTERMS 1990, the term FOB is used for ocean freight only.

However, in practice, many importers and exporters still use the term FOB in the air

freight. In North America, the term FOB has other applications. Many buyers and sellers

in Canada and the USA dealing on the open account and consignment basis are

accustomed to using the shipping terms FOB Origin and FOB destination.

FOB Origin means the buyer is responsible for the freight and other costs and risks. FOB

Destination means the seller is responsible for the freight and other costs and risks until

the goods are delivered to the buyers premises which may include the import custom

clearance and payment of import customs duties and taxes at the buyers country,

depending on the agreement between the buyer and seller. In international trade, avoid

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 25

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

using the shipping terms FOB Origin and FOB Destination, which are not part of the

INCOTERMS (International Commercial Terms).

CFR (At the named port of destination)

Cost and Freight: The delivery of goods to the named port of destination (discharge) at

the sellers expenses. Buyer is responsible for the cargo insurance and other costs and

risks. The term CFR was formerly written as C&F. Many importers and exporters

worldwide still use the term C&F.

CIF (At named port of destination)

Cost, Insurance and Freight: The cargo insurance and delivery of goods to the named

port of destination (discharge) at the sellers expense. Buyer is responsible for the import

customs clearance and other costs and risks.

In the export quotation, indicate the port of destination (discharge) after the acronym CIF,

for example CIF Pusan and CIF Singapore. Under the rules of the INCOTERMS 1990,

the term CIFI is used for ocean freight only. However, in practice, many importers and

exporters still use the term CIF in the air freight.

CPT (At the named place of destination)

Carriage Paid To: The delivery of goods to the named port of destination (discharge) at

the sellers expenses. Buyer assumes the cargo insurance, import custom clearance,

payment of custom duties and taxes, and other costs and risks. In the export quotation,

indicate the port of destination (discharge) after the acronym CPT, for example CPT Los

Angeles and CPT Osaka.

CIP (At the named place of destination)

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 26

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Carriage and Insurance Paid To: The delivery of goods and the cargo insurance to the

named place of destination (discharge) at sellers expense. Buyer assumes the importer

customs clearance, payment of customs duties and taxes, and other costs and risks.

DAF (At the names point at frontier)

Delivered at Frontier: The delivery of goods at the specified point at the frontier on

sellers expense. Buyer is responsible for the import custom clearance, payment of

custom duties and taxes, and other costs and risks.

DES (At named port of destination)

Delivered Ex Ship: The delivery of goods on board the vessel at the named port of

destination (discharge) at sellers expense. Buyer assumes the unloading free, import

customs clearance, payment of customs duties and taxes, cargo insurance, and other costs

and risks.

DEQ (At the named port of destination

Delivered Ex Quay: The delivery of goods to the Quay (the port) at the destination on

the buyers expense. Seller is responsible for the importer customs clearance, payment of

customs duties and taxes, at the buyers end. Buyer assumes the cargo insurance and other

costs and risks

DDU (At the named point of destination)

Delivered Duty Unpaid: The delivery of goods and the cargo insurance to the final point

of destination, which are often the project site or buyers premises at sellers expense.

Buyer assumes the import customs clearance, payment of customs duties and taxes. The

seller may opt not to insure the goods at his/her own risks.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 27

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

DDP (At the named point of destination)

Delivered Duty Paid: The seller is responsible for most of the expenses which include

the cargo insurance, import custom clearance, and payment of custom duties, and taxes at

the buyers end, and the delivery of goods to the final point of destination, which is often

the project site or buyers premise. The seller may opt not to insure the goods at his/her

own risk.

E-term, F-term, C-term & D-term: Incoterms 2000, like its immediate

predecessor, groups the term in four categories denoted by the first letter in the three-

letter abbreviation.

Under the E-TERM (EXW), the seller only makes the goods available to the

buyer at the sellers own premises. It is the only one of that category.

Under the F-TERM (FCA, FAS, &FOB), the seller is called upon to deliver the

goods to a carrier appointed by the buyer.

Under the C-TERM (CFR, CIF, CPT, & CIP), the seller has to contract for

carriage, but without assuming the risk of loss or damage to the goods or additional cost

due to events occurring after shipment or discharge.

Under the D-TERM (DAF, DEQ, DES, DDU & DDP), the seller has to

bear all costs and risks needed to bring the goods to the place of destination.

All terms list the sellers and buyers obligations. The respective obligations of

both parties have been grouped under up to 10 headings where each heading on the

sellers side mirrors the equivalent position of the buyer. Examples are Delivery,

Transfer of risks, and Division of costs. This layout helps the user to compare the

partys respective obligations under each Incoterms.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 28

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

DOCUMENTS

The main purpose of the documents accompanying a shipment is to provide a specific

and complete description of the goods so that they can be assessed correctly for Duty

purpose and meet the Import Licensing requirements or Import Quota Restrictions

imposed on the goods for clearance purpose. If there are any discrepancies in the

documents and or if the required documents are not produced, the shipment may not be

allowed for import or may even be confiscated by the Customs of the importing country.

There is a plethora of documents in export trade - different forms, applications and

documents are required to be filled in for obtaining Export Licenses, completing Pre-

shipment Inspection, for Customs Clearance and shipping, for obtaining payment and

export finance and for claiming export benefits like Duty Drawback, etc.

The experienced exporter, because of the complexity of documentation, will find it a

good idea to have the various documents prepared for him by a Shipping and Forwarding

Agent.

The documentation department can be divided into two parts:

i. Pre shipment documentation

ii. Post shipment documentation

PRE SHIPMENT DOCUMENTATION

As any large export firm, the orient craft export house also has separate documentation

department, which is further bifurcated into pre-shipment and the post-shipment

department.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 29

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Activities

Insurance Policy Quota Endorsement

Generation of documents.

Custom clearance.

QUOTA ENDORSEMENT

The items in respect of which annual levels of quantities are fixed are known as quota

items and other items are known as non-quota items, each bearing distinctive category

number. The textile committee provides facilities for the pre-shipment inspection items.

This inspection is not from the point of view of quality of goods. There is no judgment on

the quality of the garment or other textile products rather, the inspection is conducted to

determine whether the materials used in the ready made garment or the textile product is

in conformity with the requirement of the quota categories. This verification is known as

authentication of ready made garments, thus an exporter dealing in ready made garments

made of cotton, rayon or blended fabrics or other textile products is required to apply for

the same.

GENERATION OF DOCUMENTS

The pre-shipment documents are divided into two broad categories namely commercial

documents and regulatory documents:-

1. Commercial Documents: are the documents used by the exporter and the importer in

discharge of their respective legal and other incidental responsibilities under sales

contracts. These documents are in use because of the custom of trade in international

trade.

2. Regulatory Documents: are those documents that are prescribed in different

government departments /bodies for compliance of formalities under relevant laws , rules

and regulations covering export trade viz. foreign exchange management act , foreign

trade (development and regulation ) act , central excise rules , exports (quality control and

exception ) act , customs act and major port trusts act.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 30

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

1. COMMERCIAL DOCUMENTS

It is a document showing the value of goods exported. It may take the form of:

Customs invoice

Legalized invoice

Consular invoice

A general commercial invoice contains the following:

Invoice number and date

Buyers order number

Exporter

Consigning

Country of origin of goods

Country of final destination

Vessels /flight number

Port of discharge

Port of loading

Final destination

Description of goods

Quantity

Rates

Amount

Number and kinds of package

Total quantity

L.C. terms

Currency

Category

Customs invoice:

When the commercial invoice is prepared on the format prescribed by customs authorities

of importers countries, it is called customs invoice. This is the required in USA, Canada,

Australia.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 31

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Consular Invoice:

It is a commercial invoice duly verified by the embassy /consulate of the importers

country based in the country of exportation. .embassy/ consulate attested invoice

becomes legalized/ consular invoice. This is the requirement of countries like Mexico and

Middle East countries

Legalized Invoice:

It is the same as consular invoice this term is in use in countries like Turkey, Taiwan,

Latin America, Libya, etc

Packing List:

This document describes the various boxes in which the goods have been exported, it is a

vital document, it informs the buyer regarding the content of various item

A packing list contains

Exporter

Consignee

Invoice number

Purchase order number

L.C number

Color

Style

Total quantity

Fabric

Number of cartons

Certification of inspection:

The export inspection agency conducts pre shipment inspection of the goods notified for

compulsory pre shipment inspection of exports goods.

Certificate of insurance:

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 32

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

This is the document indicating insurance of the cargo. It is issued by the insurance

company. The difference between the two is that the certificate is just an evidence of

insurance. It does not state the terms and conditions of the insurance, on the other hand

the policy states the terms and conditions of the goods.

Bill of lading/airway bill:

This document is a transport document issued by the shipping line indicating the

following:

Title of goods shipped

Receipt for the goods shipped and an admission to their apparent condition and

quality at the time of shipment.

Bill of lading is issued by the shipping line against mates receipt.

Airway bill is the same as bill of lading, but is issued by the airlines carrying the

cargo.

Certificate of origin:

In most countries, importers are required to submit a certificate of origin in respect of

import consignment for obtaining their custom clearance. This can be issued by any

chamber of commerce. The application should be accompanied by two copies of the

commercial invoice and draft for the prescribed fee.

Combined Transport Document:

Combined Transport Document is also known as Multi modal Transport Document, and

is used when goods are transported using more than one mode of transportation. In the

case of multi modal transport document, the contract of carriage is meant for a combined

transport from the place of shipping to the place of delivery. It also evidence receipt of

goods but it does not evidence on board shipment, if it complies with ICC 500, Art. 26(a).

The liability of the combined transport operator starts from the place of shipment and

ends at the place of delivery. This documents need to be signed with appropriate number

of originals in the full set and proper evidence which indicates that transport charges have

been paid or will be paid at destination port.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 33

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

G.S.P certificate of origin:

The G.S.P certificate of origin is different from the CO. This is required under the

scheme of generalized system of preferences introduced by the developed countries in

pursuance to unclad resolution of 1971 the scheme enables the importer in developed

countries to import goods from developing countries like India at concessional rates of

import duty or without payment of duty. This is issued by textile committee {ready made

garments}

Bill of exchange

It is an unconditional written order requesting the buyer {drawee} to pay a specified sum

of money to a specified person at a specified time. One who prepares this order is called

drawer {seller}. This is also known as draft in international trade. When the buyer has to

pay for the amount at time of its presentation it is known as sight draft. If a credit time is

allowed by exporter it is called usance draft. It is important to note that bill of exchange

should be drawn to the order of the exporters bank i.e. the bank which would negotiate

the documents/ collect the proceeds.

Shipment advice:

This document is used to inform the exporter the details of the shipment in advance. The

required set of the documents are sent separately to the buyer through the bank. The

various auxiliary commercial documents are as follows:

Performa invoice

This document indicates the details of the goods to be exported. It is an offer to sell made

by an exporter to the importer. Once the offer is accepted by the importer, the Performa

invoice becomes an export order. It is prepared after negotiation with the buyer has been

concluded.

Shipping instructions

This document provides a check list of various instructions an exporter may like to give

to the shipping agent.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 34

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Insurance declaration

This is prescribed by the insurance companies where in the exporter seeking insurance of

the goods make the declaration with regard to the insurance policy desired and the nature

of the goods.

Shipping order:

This is a reservation slip issued by shipping line at the time of reservation of shipping

space for a particular export shipment. In case the shipment is being sent by air then the

reservation slip is known as carting order

Mates receipt:

It is a receipt issued by the mate (chief officer) of the ship acknowledging the loading of

cargo on the ship. It is used when goods are sent by sea only.

2. REGULATORY DOCUMENTS

Exchange control declaration form (GR Form)

Every exporter is required to declare to the reserve bank of India. The full export value of

the shipment and also submit an undertaking that the full export proceeds shall be

realized by him within a period of six months or due date of payment which ever is

earlier. This declaration is made in the prescribed exchange control declaration form.

These forms are known as gr/ softex/ pp/ sdf form.

Freight payment certificate

This indicates that the freight has been paid.

Insurance premium payment certificate

This is like a receipt for the payment of the freight.

Application for removal of excisable goods for exports

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 35

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

This is used for obtaining approval of the central excise authority to remove the goods

from the factory for sending export shipment.

Shipping bill/bill of export

This is the most important document required by the customs authorities for allowing

exports. It contains all the details of the goods shipped. The clearing and forwarding

agent (C.H.A.) or the exporter himself fills up the shipping bill. It is used when shipment

is sent by sea/air and the bill of export is used when the shipment is sent by road. Various

types of bills are as under

Claim for duty drawback (green bill)

For duty free goods(white bill)

For duty entitlement pass book scheme(blue bill)

SETS OF DOCUMENTS

There are three set of documents prepared in the pre shipment department:

1. Office set

The term itself specifies that this set is maintained by the pre shipment department for the

office purpose to be used further by post shipment department.

2. Consignee set

It is same as the office set. It is forwarded to the buyer for the purpose of getting the

delivery order for the release of goods. The set is received by the buyer before the

opening bank receives the original documents forwarded by the negotiating bank of the

exporter. The set contains:

Invoice

Packing list

Airway bill/ bill of lading

Export certificate (Canada and European countries.)

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 36

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Special custom invoice ( Canada)

G.S. P.( E. U. Countries)

Visa (U.S.A.)

Single country declaration (U.S.A.)

Multiple country declaration (if 100% E.O.U. for U.S.A)

Certificate of origin (E.U.)

Canada custom invoice

3. Custom clearance set

This set of document is forwarded to the agent when the goods are ex. Factory for getting

custom clearance. It contains:

Invoice

Packing list

Duplicate visa{U.S.A.}

Draw back declaration form

Export certificate {Canada & E.U.}

S.d.f. {E.U., Canada, non quota}

Certificate of origin{E.U.}

S.d.f (Canada, U.S.A, non quota countries)

Certificate from PhD. Chamber of Commerce( non quota countries)

The above mentioned documents are handed over to the custom house agent (C.H.A.) by

the agent. The C.H.A. in lieu of the same forwards a set of documents to the agent after

getting custom clearance who in turn forwards the same to pre- shipment department. The

set contains:

Custom attested invoice

Custom attested S.d.f

Exchange control copy ( signed by S.P)

Export performance copy

Airway bill/ bill of lading

Drawback / E.D.I.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 37

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

3.1.i EXPORT FINANCING

Financial assistance extended by the banks to the exporters pre-shipment and post-

shipment stages. Financial assistance extended to the exporter prior to shipment of goods

from India falls within the scope of pre-shipment finance while that extended after

shipment of the goods falls under post-shipment finance. While the pre-shipment finance

is provided for working capital for the purchase of raw material, processing & finishing

of the goods meant for export, post-shipment finance is generally provided in order to

bridge the gap between shipment of goods & realization of money.

RBI GUIDELINES TO LIBERAL EXPORT FINANCE

The Reserve Bank of India is learnt to be looking at reviewing the interest rate

structure on foreign currency denominated packing credit available to exporters.

PCFC provides an additional window for pre-shipment credit to exporters at

internationally competitive interest rates.

It is applicable to both domestic and imported inputs for export goods, in any

convertible currency, for a maximum of 180 days.

Pre-shipment credit is provided as a loan or advance by a bank to an exporter for

financing the purchase, processing, manufacturing or packing of goods prior to

shipment.

The RBI has already deregulated post-shipment credit beyond 90 days till 180

days, with effect from May 1, 2003.

The RBI is understood to be examining a proposal from exporters who were

facing difficulty in availing concessional foreign currency packing credit.

This is because with demand for dollar loans surpassing supply, banks could

manage a better margin by lending it to corporate, out of the purview of export

credit.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 38

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Banking sources said by removing the cap on PCFC, which is acting as a major

disincentive for banks, there will be some pressure on outflow of dollars in

addition to meeting the genuine dollar demand of exporters.

According to banking sources, while the RBI wants to deregulate interest rates

and leave it to the discretion of banks, there is a concern that small exporters

might be hit if rates turn too high. Hence, there is also a possibility of putting a

cap as well.

Exporters do not want rates to be deregulated as post deregulation; they will no

longer remain concessional.

At present, the spread charged by banks for pre-shipment credit in foreign

currency is related to the international reference rate such as London inter-bank

offered rate Euro Libor/Euribor (6 months).

The lending rate to the exporters should not exceed 75 basis point over

Libor/Euribor, excluding withholding tax.

In fact, excess dollar inflows are increasingly becoming a problem to manage as

with each dollar sucked out of the market, additional rupee funds is being added

to the liquidity-flush system.

In addition to PCFC, under the existing norm, banks may arrange for 'lines of

credit' from abroad and also negotiate lines of credit with overseas banks for

granting PCFC to exporters without the prior approval of RBI, provided the rate

of interest on the line of credit does not exceed 75 basis point over six months

Libor/Euro.

1. PRE SHIPMENT FINANCE

Pre Shipment Finance is issued by a financial institution when the seller wants the

payment of the goods before shipment. The main objectives behind pre shipment finance

or pre export finance is to enable exporter to:

Procure raw materials.

Carry out manufacturing process.

Provide a secure warehouse for goods and raw materials.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 39

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Process and pack the goods.

Ship the goods to the buyers.

Meet other financial cost of the business.

Export Duty or any other tax.

Freight and insurance charges

TYPES OF PRE SHIPMENT FINANCE:

Packing Credit

Advance against Cheques/Draft etc. representing Advance Payments.

Pre shipment finance is extended in the following forms:

Packing Credit in Indian Rupee

Packing Credit in Foreign Currency (PCFC)

Pre-shipment Credit in Foreign Currency (PCFC)

Authorized dealers are permitted to extend Pre shipment Credit in Foreign Currency

(PCFC) with an objective of making the credit available to the exporters at internationally

competitive price. This is considered as an added advantage under which credit is

provided in foreign currency in order to facilitate the purchase of raw material after

fulfilling the basic export orders. The rate of interest on PCFC is linked to London

Interbank Offered Rate (LIBOR). According to guidelines, the final cost of exporter

must not exceed 200 bps over 6 month LIBOR, excluding the tax. The exporter has

freedom to avail PCFC in convertible currencies like USD, Pound Sterling, Euro, Yen

etc. However, the risk associated with the cross currency transaction is that of the

exporter. The sources of funds for the banks for extending PCFC facility include the

Foreign Currency balances available with the bank are

Exchange, Earner Foreign Currency Account (EEFC),

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 40

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Resident Foreign Currency Accounts (RFC)

Foreign Currency (Non-Resident) Accounts.

Banks are also permitted to utilize the foreign currency balances available under Escrow

account and Exporters Foreign Currency accounts. It ensures that the requirement of

funds by the account holders for permissible transactions is met. But the limit prescribed

for maintaining maximum balance in the account is not exceeded. In addition, banks may

arrange for borrowings from abroad. Banks may negotiate terms of credit with overseas

bank for the purpose of grant of PCFC to exporters, without the prior approval of RBI,

provided the rate of interest on borrowing does not exceed 0.75% over 6 month LIBOR.

STAGES OF PRE SHIPMENT FINANCE

Appraisal and Sanction of Limits

Before making any allowance for Credit facilities banks need to check the different

aspects like product profile, political and economic details about country. Apart from

these things, the bank also looks in to the status report of the prospective buyer, with

whom the exporter proposes to do the business. To check all these information, banks

can seek the help of institution like ECGC or International consulting agencies like Dun

and Brad street etc. The Bank extended the packing credit facilities after ensuring the

following:

The exporter is a regular customer, a bona fide exporter and has a goods standing

in the market.

Whether the exporter has the necessary license and quota permit (as mentioned

earlier) or not.

Whether the country with which the exporter wants to deal is under the list of

Restricted Cover Countries (RCC) or not.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 41

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Disbursement of Packing Credit Advance

Once the proper sanctioning of the documents is done, bank ensures whether exporter has

executed the list of documents mentioned earlier or not. Disbursement is normally

allowed when all the documents are properly executed. Sometimes an exporter is not

able to produce the export order at time of availing packing credit. So, in these cases, the

bank provides a special packing credit facility and is known as Running Account

Packing.

Before disbursing the bank specifically check for the following particulars in the

submitted documents:

a. Name of buyer

b. Commodity to be exported

c. Quantity

d. Value (either CIF or FOB)

e. Last date of shipment / negotiation.

f. Any other terms to be complied with

Follow up of Packing Credit Advance

Exporter needs to submit stock statement giving all the necessary information about the

stocks. It is then used by the banks as a guarantee for securing the packing credit in

advance. Bank also decides the rate of submission of this stock.

Apart from this, authorized dealers (banks) also physically inspect the stock at regular

intervals.

Liquidation of Packing Credit Advance

Packing Credit Advance needs be liquidated out of as the export proceeds of the

relevant shipment, thereby converting pre shipment credit into post shipment credit. This

liquidation can also be done by the payment receivable from the Government of India and

includes the duty drawback, payment from the Market Development Fund (MDF) of the

Central Government or from any other relevant source. In case if the export does not

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 42

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

take place then the entire advance can also be recovered at a certain interest rate. RBI has

allowed some flexibility in to this regulation under which substitution of commodity or

buyer can be allowed by a bank without any reference to RBI. Hence in effect the

packing credit advance may be repaid by proceeds from export of the same or another

commodity to the same or another buyer. However, bank need to ensure that the

substitution is commercially necessary and unavoidable.

Overdue Packing

Bank considers a packing credit as an overdue, if the borrower fails to liquidate the

packing credit on the due date. And, if the condition persists then the bank takes the

necessary step to recover its dues as per normal recovery procedure.

Document to be submitted to the bank for sanction of limits:

Credit Monitoring Arrangement (CMA)

Monthly stock statement

Half yearly statement

Audited balance sheet

Funds flow statement

Credit Monetary Arrangement:

It is nothing but the bank financing for working capital. It was earlier known as Credit

Authorization Scheme. RBI prescribed certain forms to be filled for applying that is

called as CMA Data Base. It is done for arranging working capital finance information

about income, expenses, assets and liabilities.

2. POST SHIPMENT FINANCE:

Post Shipment Finance is a kind of loan provided by a financial institution to an exporter

or seller against a shipment that has already been made. This type of export finance is

granted from the date of extending the credit after shipment of the goods to the

realization date of the exporter proceeds. Exporters dont wait for the importer to deposit

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 43

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

the funds.

TYPES OF POST SHIPMENT FINANCE:

Export Bills purchased/discounted.

Export Bills negotiated

Export Bills Purchased/ Discounted (DP & DA Bills):

Export bills (Non L/C Bills) is used in terms of sale contract/ order may be discounted or

purchased by the banks. It is used in indisputable international trade transactions and the

proper limit has to be sanctioned to the exporter for purchase of export bill facility.

Export Bills Negotiated (Bill under L/C):

The risk of payment is less under the LC, as the issuing bank makes sure the payment.

The risk is further reduced, if a bank guarantees the payments by confirming the LC.

Because of the inborn security available in this method, banks often become ready to

extend the finance against bills under LC. However, this arises two major risk factors for

the banks:

The risk of non performance by the exporter, when he is unable to meet his terms

and conditions. In this case, the issuing banks do not honor the letter of credit.

The bank also faces the documentary risk where the issuing bank refuses to honor

its commitment. So, it is important for the negotiating bank, and the lending bank

to properly check all the necessary documents before submission.

POST SHIPMENT CREDIT

Post shipment credit is required to bridge the gap between the time of shipment of goods

and the actual payment received. Post shipment credit is provided against the security of

approved shipping documents submitted against letter of credit or otherwise.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 44

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

Post shipment loans normally are of three types:

Short term: short term period is normally for six months and is provided by

commercial banks.

Medium Term: medium term period is up to five years, loan is provided by the

Commercial banks in collaboration with export import banks.

Long Term: loans are provided for the purchase of capital goods or turnkey

projects. Period of credit is normally more than five years.

Banks enjoy certain benefits for advancing loans to the exporter:

Refinance by export and import bank or by RBI at a given rate of interest.

Guarantee provided by the ECGC or a substantial part of risk is covered by

ECGC.

3.2 IMPORT

Basic concepts relating to foreign trade in India:

As already mentioned, Orient Craft Ltd. is in the business of manufacturing garments for

exports. We manufacture a wide assortment of garments to suit all customer profiles,

viz., men, women and children. We also make garments to suit all usage types like

sportswear, casual wear, and formal wear and so on.

Understanding the garment manufacture process:

The first step is the order procurement. OCL has earned for itself an extremely

respectable reputation in the international market. This means that even in a highly

competitive industry, OCL is in a commanding position as regards the procurement of

orders. Because of its strong bargaining position, OCL never has to go out and hunt for

orders; rather they are in the enviable position of being overbooked.

Thus, the manufacturing process kicks off once the order has been accepted by OCL.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 45

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

IMPORT PROCESS

The first step in the process is the import of raw material from the suppliers. To ensure

the highest level of customer satisfaction, OCL has a unique policy of buyer specified

supplier. This means that every buyer has the discretion of specifying the name of the

supplier from whom the raw material is to be sourced.

This ensures that the specifications of the final product exactly meet customers

requirement. From the buyers perspective the main advantage is that the products

sourced from all the different manufacturers all over the world will be identical if the

supplier is the same. For example, suppose GAP USA, needs 1, 00,000 T-shirts. Now

consider that they place the order for this with 4 different manufacturers from different

corners of the world. If the discretion of selecting the supplier is left to manufacturers

like OCL, then the products coming from different manufacturers will have different

attributes. To standardize the final products, the buyers specify the supplier from whom

the material is to be procured.

Now OCL will need to import the raw material for processing the order from the supplier

as specified by the buyer.

This raw material comprises broadly of:

Fabric this comprises the major chunk of the imports.

Trims these include zippers, buttons, lining material etc.

Step 1: Placing the order with the supplier:

OCL sends its requirements to the supplier giving him the exact specifications of the

product required. Then the supplier replies to OCL giving the details of the material he

can supply along with the shipment dates of each of these.

Step 2: Raising a Letter of Credit (L/C):

To safeguard his interests, the supplier would require some sort of payment guarantee

from OCL. This guarantee is given in the form of a L/C.

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 46

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

A L/C is simply a proof of the credit-worthiness of the importer. It is issued by the

importers bank on the strength of the amount deposited by the importer with the bank or

on the basis of the accounts of the importer with the bank.

The following figure shows how the flow of funds moves from the importer (OCL) to the

supplier:

Requesting the bank to issue

The first step here is to send a request to the bank asking them to issue a L/C in favor of

the specified supplier.

This would typically include:

a. Amount of the L/C

b. Name and address of the beneficiary.

c. Import covered under [the sections or acts of the Import Export Policy pertaining to

the transaction.

In addition to the above specified items, OCL will also at this stage, undertake to submit

the relevant Bill of Entry to the bank upon successful completion of the transaction.

Step 3: Bank issues L/C

The bank with which the L/C has been raised next sends this L/C across to the

beneficiary bank. The most popular means of this transfer is SWIFT, a method similar in

function to the TELEX of old days.

Supplier, in say,

Italy

OCL, New Delhi

Bank, Italy

branch

XYZ Bank, New

Delhi Branch

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 47

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

At this stage, the commercial department of OCL raises what is known as L-Number

Step 4: Arrival of goods

When the goods finally reach the destination port as given in the L/C, a cargo collection

receipt is sent to the bank with which the L/C was raised.

At the same time, OCL also receives a Cargo Arrival Notice, which is an intimation of

the arrival of the goods. It must be noted here that this notice is merely intimation and no

collection of goods can take place against this. The commercial department at OCL

raises an R-Number against this notice.

R-Number is the requisition for release order and attestation of documents.

A representative of OCL goes to the bank with this requisition, and signs the declaration

that the payment due is made. The most common method of this payment is to deduct the

amount from the current account of OCL with that bank.

Once the payment order has been released, the bank endorses the cargo receipt and the

commercial department of OCL can then take delivery of the goods from the warehouse.

Step 5: Transfer of payments

The bank then sends the amount to the beneficiarys bank through via transfer or any

other method as mutually decided, from where it is sent on to the beneficiary.

Step 6: Submitting the Bill Of Entry

Since imports involve an outflow of foreign currency, the RBI guidelines in this regard

have to be met. Thus OCL needs to submit, within 90 days, a Bill of Entry, which is a

documentary proof of the receipt and delivery of goods.

3.2. i IMPORT FINANCING:

Import financing provides importers who have orders from customers backed by a letter

of credit, with the necessary financial backing to provide their overseas Supplier with a

letter of credit to guarantee payment of goods, it is the loan given to the importer to

provide liquidity for buying with sight payment to the exporter. Each loan must be related

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 48

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

to one specific import transaction and the term of the financing can vary depending on

the type of products imported and the requirements of the importer.

ADVANTAGES

Financing can be arranged for 100% of the transaction. This provides the importer with

sufficient financial strength to sell larger orders than they would be able to on their own

financial strength, below are some advantages:

Obtain liquidity to pay for imports.

The importer can receive better conditions for the purchase based on sight

payment.

Bank

can offer the structure, currency and terms that the business or transaction

requires. Depending on the case, it is possible to create a "tailor made" structure.

Depending on the strength of the buyer, this may be done on open account with

the domestic buyer, allowing the buyer to increase their buying power.

Import Trade Finance

International trade continues to grow every year as nations expand their global sales and

new nations join in. Today, over 225 nations are active in trade resulting in over nine

Trillion dollars in global business every year. Trade related financial services have

developed and expanded in depth, complexity and effectiveness to support the expansion

of world trade. Many trade finance options are now available. However, in North

America the Small to Mid- sized Enterprises (SME) trading community is relatively

unaware of many of the more sophisticated and/or the sources of the more effective trade

finance services. Traders commonly believe that the major international banks are the

primary providers of these services. For the SME community this is no longer the case.

A fragmented market of trade finance organizations has grown over the last 20 years to

fill the void left by the major international banks which retreated from trade finance

service in the 1980's.

Settlement of Import Trade Transactions

Various trade terms are available to balance the trade transaction risks for both the

NATIONAL INSTITUTE OF FASHION TECHNOLOGY(MFM) 49

DOCUMENTATION PROCEDURE OF GARMENT EXPORT HOUSE

importer and exporter. As an importer/distributor you will wish to negotiate the most

favorable terms of purchase with your overseas supplier. You will negotiate terms of

purchase to ensure that you receive your import purchase in the right quantity, right

quality, at the right price and on time. At the same time you can expect your overseas

supplier to negotiate terms that will minimize potential risks - particularly the risk of

nonpayment. Import trade transactions can be structured in a number of ways. The

structure used in a specific transaction reflects how well the participants know each other,

the countries involved, and the competition in the market.

MOST COMMON TERMS USED FOR PURCHASE

Consignment Purchase

In a consignment purchase arrangement, the importer/distributor makes payment to the

overseas supplier only after sales to end user is made and payment received.

Consignment purchase terms can be the most advantageous to an importer/distributor. It

is also considered the most risky term for the overseas supplier.

Cash-in-Advance (Advance Payment)

Under these terms of purchase, the importer must send payment to the supplier prior to