Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Study On Fundamental and Technical Analysis

Caricato da

Prasad SandepudiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Study On Fundamental and Technical Analysis

Caricato da

Prasad SandepudiCopyright:

Formati disponibili

EQUITY RESEARCH OF INFOSYS ON THE BASIS OF FUNDAMENTAL AND

TECHNICAL ANALYSIS

INTRODUCTION

TWO ANALYTICAL MODELS IN EVALUATING THE COMMON STOCK.

1.)Fundamental analysis maintains that markets may misprice a security in the short run

but that the "correct" price will eventually be reached. Profits can be made by trading the

mispriced security and then waiting for the market to recognize its "mistake" and reprice

the security.

2.) Technical analysis maintains that all information is reflected already in the stock

price, so fundamental analysis is a waste of time. Trends 'are your friend' and sentiment

changes predate and predict trend changes. Investors' emotional responses to price

movements lead to recognizable price chart patterns. Technical analysis does not care

what the 'value' of a stock is. Their price predictions are only extrapolations from

historical price patterns.

What is Fundamental Analysis?

A method of evaluating a security by attempting to measure its intrinsic value by

examining related economic, financial and other qualitative and quantitative factors.

Fundamental analysts attempt to study everything that can affect the security's value,

including macroeconomic factors (like the overall economy and industry conditions) and

individually specific factors (like the financial condition and management of

companies). Fundamental analysis is about using real data to evaluate a security's value.

The end goal of performing fundamental analysis is to produce a value that an investor

can compare with the security's current price in hopes of figuring out what sort of

position to take with that security. This method of fundamental analysis is exactly

opposite to the technical analysis.

What is Technical Analysis?

A Technical Analysis is a method of evaluating securities by analyzing statistics

generated by market activity, such as past prices and volume. Technical analysts do not

attempt to measure a security's intrinsic value, but instead use charts and other tools to

identify patterns that can suggest future activity. Technical analysts believe that the

historical performance of stocks and markets are indications of future performance.

Objectives

To learn how to do Equity Research.

Doing analysis of the company on the basis of secondary data using fundamental

and technical analysis.

Projecting their future on the basis of financial data and determining the reasons

for their good or bad performance in the market and also to estimate its future

Market value.

To determine whether the company stocks are worth buying or not and also what

Would be the probable market price if certain factor changes.

INDIA INFOLINE LIMITED

India Infoline is a one-stop financial services shop, most respected for quality of its

information, personalized service and cutting-edge technology.

Vision:

Our vision is to be the most respected company in the financial services space.

India Infoline Group:

The India Infoline group, comprising the holding company, India Infoline Limited and

its wholly-owned subsidiaries, include the entire financial services space with offerings

ranging from Equity research, Equities and derivatives trading, Commodities trading,

Portfolio Management Services, Mutual Funds, Life Insurance, Fixed deposits, GoI

bonds and other small savings instruments to loan products and Investment banking.

India Infoline also owns and manages the websites www.indiainfoline.com and

www.5paisa.com. The company has a network of over 2100 business locations

(branches and sub-brokers) spread across more than 450 cities and towns. The group

caters to approximately a million customers.

Founded in 1995 by Mr. Nirmal Jain (Chairman and Managing Director) as an

independent business research and information provider, the company gradually evolved

into a one-stop financial services solutions provider.

India Infoline received registration for a housing finance company from the National

Housing Bank and received the Fastest growing Equity Broking House - Large firms in

India by Dun & Bradstreet in 2009. It also received the Insurance broking license from

IRDA; received the venture capital license; received in principle approval to sponsor a

mutual fund; received Best broker- India award from Finance Asia; Most Improved

Brokerage- India award from Asia money.

COMPANY STRUCTURE:

India Infoline Limited is listed on both the leading stock exchanges in India, viz. the

Stock Exchange, Mumbai (BSE) and the National Stock Exchange (NSE) and is also a

member of both the exchanges. It is engaged in the businesses of Equities broking,

Wealth Advisory Services and Portfolio Management Services. It offers broking services

in the Cash and Derivatives segments of the NSE as well as the Cash segment of the

BSE. It is registered with NSDL as well as CDSL as a depository participant, providing

a one-stop solution for clients trading in the equities market. It has recently launched its

Investment banking and Institutional Broking business. A SEBI authorized Portfolio

Manager; it offers Portfolio Management Services to clients. These services are offered

to clients as different schemes, which are based on differing investment strategies made

to reflect the varied risk-return preferences of clients.

METHODOLOGY

A common training program was going to attend at IIFL, Secretariat, Hyderabad. For

general awareness of capital markets in India. The instructors of training program will

provide advisory support regarding the procedure of performing the project work and

with certain references for data collection. The investors use these methods and then

analyze the share price and they invest in the various companies.

Source of study

All the data for the analysis have been collected from respective company websites and

other websites. The fundamental data collected was regarding the Indian economy,

Industrial level performance, individual company balance sheet, income statements,

annual reports and shareholding patterns. The theoretical data will be gathered from text

books, websites and newspapers. Share price quotations will be collected from

newspapers.

Scope of study

Study was done on the basis of data available on net.

Visit of the company was not feasible

Newspapers, magazines and stock market scenario were also taken into

Consideration

LITERATURE REVIEW

Review of journals, websites, magazines, newspapers and reviewing the projects

already done related to the topic.

INDUSTRY PROFILE

Stock market

A stock market (equity market) is a private or public market for the trading of company

stock and derivatives of company stock at an agreed price; both of these are securities

listed on a stock exchange as well as those only traded privately. The expression 'stock

market' refers to the market that enables the trading of company stocks (collective

shares), other securities, and derivatives. Bonds are still traditionally traded in an

informal, over-the-counter market known as the bond market. Commodities are traded in

commodities markets, and derivatives are traded in a variety of markets (but, like bonds,

mostly 'over-the-counter'). The stocks are listed and traded on stock exchanges which

are entities (a corporation or mutual organization) specialized in the business of bringing

buyers and sellers of stocks and securities together. The stock market in the United

States includes the trading of all securities listed on the NYSE, the NASDAQ .

Trading

Participants in the stock market range from small individual stock investors to large

hedge fund traders, who can be based anywhere. Their orders usually end up with a

professional at a stock exchange, who executes the order.

Some exchanges are physical locations where transactions are carried out on a trading

floor, by a method known as open outcry. This type of auction is used in stock

exchanges and commodity exchanges where traders may enter "verbal" bids and offers

simultaneously. The other type of exchange is a virtual kind, composed of a network of

computers where trades are made electronically via traders.

Actual trades are based on an auction market paradigm where a potential buyer bids the

specific price for a stock and a potential seller asks a specific price for the stock.

(Buying or selling at market means you will accept any ask price or bid price for the

stock, respectively.) When the bid and ask prices match, a sale takes place on a first

come first served basis if there are multiple bidders or askers at a given price. The

purpose of a stock exchange is to facilitate the exchange of securities between buyers

and sellers, thus providing a marketplace (virtual or real). The exchanges provide real-

time trading information on the listed securities, facilitating price discovery.

METHODOLOGY:

CHAPTERIZATION OF THE STUDY:

The study is will be organize as under.

In the first chapter theoretical aspects relating to equity research using

fundamental and technical analysis of Infosys

In the second chapter profile of the industry and company will be incorporated.

In the third chapter objectives and methodology are presented.

In the fourth chapter study on equity research using fundamental and

technical analysis of Infosys will be analyzed.

In the fifth chapter summary of findings, suggestions, Recommendations and

conclusion of the study are given.

Potrebbero piacerti anche

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDocumento43 pagineCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNessuna valutazione finora

- Technical Analysis II - Share Market SchoolDocumento1 paginaTechnical Analysis II - Share Market Schoolbibhuti biswasNessuna valutazione finora

- Six Costliest Trading Mistakes: (And How To Immediately Fix Them)Documento13 pagineSix Costliest Trading Mistakes: (And How To Immediately Fix Them)Diego Ribeiro0% (1)

- Types of Trading Indicators - Wealth SecretDocumento4 pagineTypes of Trading Indicators - Wealth Secretqgy7nyvv62Nessuna valutazione finora

- Value Investing in Thailand Outperforms MarketDocumento13 pagineValue Investing in Thailand Outperforms MarketmytheeNessuna valutazione finora

- Inclusivebankingsuite User Guide: Parameters, Head Teller and TellerDocumento123 pagineInclusivebankingsuite User Guide: Parameters, Head Teller and TellerMark MahuaNessuna valutazione finora

- Financially Traded Products Readings PDFDocumento210 pagineFinancially Traded Products Readings PDFJaspreet ChawlaNessuna valutazione finora

- NSE DerivativesDocumento7 pagineNSE DerivativesVivek MishraNessuna valutazione finora

- The Mathematics of Finance Chapter 6 GuideDocumento55 pagineThe Mathematics of Finance Chapter 6 GuideGil John Awisen100% (1)

- Technical AnalyyysisDocumento95 pagineTechnical AnalyyysisSoumya Ranjan PandaNessuna valutazione finora

- G11 General-Mathematics Q2 L2Documento7 pagineG11 General-Mathematics Q2 L2Maxine ReyesNessuna valutazione finora

- Principles of Trading Based On Moving AveragesDocumento2 paginePrinciples of Trading Based On Moving AveragesJack XuanNessuna valutazione finora

- Bank Statement FinalDocumento2 pagineBank Statement FinalShemeem SNessuna valutazione finora

- A Project Report On "Market Behavior Towards Investment of Equity"Documento78 pagineA Project Report On "Market Behavior Towards Investment of Equity"Dhaval TrivediNessuna valutazione finora

- Technical Analysis: Expo-Nential Moving AverageDocumento89 pagineTechnical Analysis: Expo-Nential Moving Averageman_oj26Nessuna valutazione finora

- Orthodox Monetary Theory: A Critique From PostKeynesianism and Transfinancial Economics, Dante A. UrbinaDocumento10 pagineOrthodox Monetary Theory: A Critique From PostKeynesianism and Transfinancial Economics, Dante A. UrbinaDavid Arevalos100% (1)

- The Art of Chart Reading A Complete Guide For Day Traders and SwingDocumento272 pagineThe Art of Chart Reading A Complete Guide For Day Traders and SwingJoan MontserratNessuna valutazione finora

- 1649497527678investing Strategies To Create Wealth 61445e8aDocumento31 pagine1649497527678investing Strategies To Create Wealth 61445e8aVimalahar rajagopalNessuna valutazione finora

- Rule Based Approach For Stock Selection: An Expert SystemDocumento5 pagineRule Based Approach For Stock Selection: An Expert SystemIntegrated Intelligent ResearchNessuna valutazione finora

- Technical Analysis GuideDocumento37 pagineTechnical Analysis GuideNavleen Kaur100% (1)

- Stock SelectionDocumento32 pagineStock SelectionMonchai PhaichitchanNessuna valutazione finora

- Polymedicure TIADocumento28 paginePolymedicure TIAProton CongoNessuna valutazione finora

- Fundamental and Tecnical Analysis of Retail SectorDocumento50 pagineFundamental and Tecnical Analysis of Retail Sectorrobin hoodNessuna valutazione finora

- Technicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Documento76 pagineTechnicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Ankita DoddamaniNessuna valutazione finora

- Technical AnalysisDocumento94 pagineTechnical AnalysisPranav Vira100% (1)

- The Empowered Forex Trader: Strategies to Transform Pains into GainsDa EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNessuna valutazione finora

- Shruti Jain Smart Task 02Documento7 pagineShruti Jain Smart Task 02shruti jainNessuna valutazione finora

- Consumer BehaviourDocumento119 pagineConsumer Behaviourpomh0% (1)

- ForexScannerSpikeDetective PDFDocumento17 pagineForexScannerSpikeDetective PDFthucpwcNessuna valutazione finora

- Technical AnalysisDocumento44 pagineTechnical AnalysisRang NarayanNessuna valutazione finora

- Online TradingDocumento46 pagineOnline TradingVivek SonarNessuna valutazione finora

- Relative Strength Index For Developing Effective Trading Strategies in Constructing Optimal PortfolioDocumento11 pagineRelative Strength Index For Developing Effective Trading Strategies in Constructing Optimal PortfoliozooorNessuna valutazione finora

- An Analytical Study On Forex Market at J WingsDocumento52 pagineAn Analytical Study On Forex Market at J WingsMohit Patil100% (1)

- Demand and Supply - DineshDocumento78 pagineDemand and Supply - DineshSagar Ranjan Das100% (1)

- A Comparative Study On Fundamental and Technical AnalysisDocumento34 pagineA Comparative Study On Fundamental and Technical AnalysisTarun Chawla0% (1)

- Anchor Bank Shanghai Branch Income Tax ExclusionDocumento8 pagineAnchor Bank Shanghai Branch Income Tax ExclusiongraceNessuna valutazione finora

- A Project Reort On Technical Analysis OF Tata-MotorsDocumento11 pagineA Project Reort On Technical Analysis OF Tata-MotorsSahil ChhibberNessuna valutazione finora

- Equity ResearchDocumento4 pagineEquity ResearchChandanNessuna valutazione finora

- Technical Analysis of Usdcad CurrencyDocumento58 pagineTechnical Analysis of Usdcad CurrencyDhanalakshmi SelvarajNessuna valutazione finora

- Euro Market: Origin, Growth Factors and Types of BondsDocumento34 pagineEuro Market: Origin, Growth Factors and Types of BondsKushal PandyaNessuna valutazione finora

- Market For Currency FuturesDocumento24 pagineMarket For Currency FuturesSharad SharmaNessuna valutazione finora

- Indian Stock MarketDocumento24 pagineIndian Stock MarketGRAMY TRADERS SALEMNessuna valutazione finora

- Profitability of Momentum Strategies An Evaluation of Alternative Explanations 2001Documento23 pagineProfitability of Momentum Strategies An Evaluation of Alternative Explanations 2001profkaplanNessuna valutazione finora

- Analysis of Indian Derivatives MarketDocumento6 pagineAnalysis of Indian Derivatives MarketEhsaan IllahiNessuna valutazione finora

- Technical Analysis JSW SteelDocumento34 pagineTechnical Analysis JSW SteelNiket DattaniNessuna valutazione finora

- Fundamental and Technical AnalysisDocumento19 pagineFundamental and Technical AnalysisKarthi KeyanNessuna valutazione finora

- Project Report Titles For MBA in PharmaDocumento4 pagineProject Report Titles For MBA in Pharmaebrandingindia1Nessuna valutazione finora

- MPDocumento4 pagineMPJohn BestNessuna valutazione finora

- Fundamental and Technical Analysis of Portfolio Management.Documento17 pagineFundamental and Technical Analysis of Portfolio Management.Deven RathodNessuna valutazione finora

- Screen Based Trading, Financial MarketDocumento9 pagineScreen Based Trading, Financial MarketApu ChakrabortyNessuna valutazione finora

- Technical Analysis of Gold Price Trends in Forex MarketsDocumento19 pagineTechnical Analysis of Gold Price Trends in Forex MarketsVinod Kumar EmmadiNessuna valutazione finora

- SSRN Id3596245 PDFDocumento64 pagineSSRN Id3596245 PDFAkil LawyerNessuna valutazione finora

- TradeZilla 2.0 - Discover Your Trading EdgeDocumento2 pagineTradeZilla 2.0 - Discover Your Trading EdgeAyesha MariyaNessuna valutazione finora

- Lesson 1 - Supply and Demand With The TrendDocumento1 paginaLesson 1 - Supply and Demand With The TrendAlexis Edax100% (1)

- Forecasting Volatility With Smooth Transition Exponential Smoothing in Commodity MarketDocumento40 pagineForecasting Volatility With Smooth Transition Exponential Smoothing in Commodity MarketSrishti KailashNessuna valutazione finora

- Upstox Dartstocks HelpDocumento26 pagineUpstox Dartstocks HelpSanjay Sahoo0% (1)

- Gold Grand Project 2011Documento81 pagineGold Grand Project 2011ujjawal_rose100% (2)

- An Interim Report On Analytical Study On Forex MarketDocumento6 pagineAn Interim Report On Analytical Study On Forex MarketHimanshu Vishwakarma0% (1)

- Trading Systems IndicatorsDocumento3 pagineTrading Systems IndicatorsKam MusNessuna valutazione finora

- Institutional Order Flow and The Hurdles To Superior PerformanceDocumento9 pagineInstitutional Order Flow and The Hurdles To Superior PerformanceWayne H WagnerNessuna valutazione finora

- Algorithm Trading in Indian Financial MarketsDocumento3 pagineAlgorithm Trading in Indian Financial MarketswakhanNessuna valutazione finora

- A S I P O T N S E O I: Tudy of Nitial Ublic Fferings On HE Ational Tock Xchange F NdiaDocumento33 pagineA S I P O T N S E O I: Tudy of Nitial Ublic Fferings On HE Ational Tock Xchange F NdiarhtmhrNessuna valutazione finora

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Documento41 pagineAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Derivatives As A Hedging Tool For Instrumental PlanDocumento88 pagineDerivatives As A Hedging Tool For Instrumental Planjitendra jaushikNessuna valutazione finora

- Financial ServicesDocumento28 pagineFinancial ServicesPrasad Sandepudi100% (1)

- Questionnaire TJDocumento1 paginaQuestionnaire TJPrasad SandepudiNessuna valutazione finora

- FAQ S From NSE SiteDocumento7 pagineFAQ S From NSE SitePrasad SandepudiNessuna valutazione finora

- Project Work: Name: S. Sai Shruti Class: VIII TH Section: B School: Narayana Olympiad Topic: Mom & MeDocumento5 pagineProject Work: Name: S. Sai Shruti Class: VIII TH Section: B School: Narayana Olympiad Topic: Mom & MePrasad SandepudiNessuna valutazione finora

- Investment Decisions On Commodities Based On Technical AnalysisDocumento81 pagineInvestment Decisions On Commodities Based On Technical AnalysisPrasad SandepudiNessuna valutazione finora

- Fundamental and Technical AnalysisDocumento80 pagineFundamental and Technical AnalysisPrasad SandepudiNessuna valutazione finora

- Project On WCMDocumento75 pagineProject On WCMPrasad SandepudiNessuna valutazione finora

- Operating Systems: Windows-98, XP, Vista, Windows-07, Windows-08 Proficiency in Ms - Word, Ms-Excel, Ms-Powerpoint Typing Speed - 35 WPMDocumento3 pagineOperating Systems: Windows-98, XP, Vista, Windows-07, Windows-08 Proficiency in Ms - Word, Ms-Excel, Ms-Powerpoint Typing Speed - 35 WPMPrasad SandepudiNessuna valutazione finora

- Andra VanajaDocumento111 pagineAndra VanajaPrasad SandepudiNessuna valutazione finora

- Mutual Funds ArticlenewDocumento41 pagineMutual Funds ArticlenewPrasad SandepudiNessuna valutazione finora

- Abstract On Ps18thjuneDocumento13 pagineAbstract On Ps18thjunePrasad SandepudiNessuna valutazione finora

- Role of Commercial Banks in Priority Sector MODIFIEDDocumento5 pagineRole of Commercial Banks in Priority Sector MODIFIEDPrasad SandepudiNessuna valutazione finora

- Greece Debt Crisis: Dareen Atef Dina Wahba Safiya Galal Sarah Hani Dr. Amir NasryDocumento16 pagineGreece Debt Crisis: Dareen Atef Dina Wahba Safiya Galal Sarah Hani Dr. Amir Nasrypriyaagarwal26Nessuna valutazione finora

- SrinivasuluDocumento87 pagineSrinivasuluPrasad SandepudiNessuna valutazione finora

- ForeignDocumento70 pagineForeignadsfdgfhgjhkNessuna valutazione finora

- Unit 4 Derivatives Part 1Documento19 pagineUnit 4 Derivatives Part 1UnathiNessuna valutazione finora

- Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Documento29 pagineExcel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Dante CardonaNessuna valutazione finora

- 01 Fisher Account 5e v1 PPT ch01Documento29 pagine01 Fisher Account 5e v1 PPT ch01yuqi liuNessuna valutazione finora

- Effects of Inflation AlchianDocumento18 pagineEffects of Inflation AlchianCoco 12Nessuna valutazione finora

- PDFDocumento2 paginePDFParvez KhanNessuna valutazione finora

- MPSI BusinessCase 04 PDFDocumento41 pagineMPSI BusinessCase 04 PDFFeby RamadhaniNessuna valutazione finora

- Capital MarketDocumento16 pagineCapital MarketPriya MalhotraNessuna valutazione finora

- Eco 112 Course Outline 2021Documento5 pagineEco 112 Course Outline 2021Midzy BitzNessuna valutazione finora

- Translation of Foreign FSDocumento7 pagineTranslation of Foreign FSLloyd SonicaNessuna valutazione finora

- Guiding Principles of Monetary Administration by The Bangko SentralDocumento8 pagineGuiding Principles of Monetary Administration by The Bangko SentralEuphoria BTSNessuna valutazione finora

- ACCA P4 Past Paper AnalysisDocumento1 paginaACCA P4 Past Paper AnalysisAbdulAzeemNessuna valutazione finora

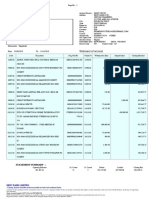

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocumento1 paginaTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaNessuna valutazione finora

- Ie00b8gkdb10 - 13 03 2023Documento3 pagineIe00b8gkdb10 - 13 03 2023Tanasa AlinNessuna valutazione finora

- Chapter 11 AISDocumento4 pagineChapter 11 AISMyka ManalotoNessuna valutazione finora

- ABRISH Final NEWDocumento40 pagineABRISH Final NEWGetachew AliNessuna valutazione finora

- Lecture 9 - International Investment and Financing DecisionDocumento22 pagineLecture 9 - International Investment and Financing DecisionAlice LowNessuna valutazione finora

- Credit Card Ownership Cheat Sheet TemplateDocumento2 pagineCredit Card Ownership Cheat Sheet TemplateRoxanne Santos JimenezNessuna valutazione finora

- PALS Mercantile Law-LibreDocumento161 paginePALS Mercantile Law-LibreDodong LamelaNessuna valutazione finora

- Equity - Reading 47 PDFDocumento11 pagineEquity - Reading 47 PDFKiraNessuna valutazione finora

- MBA/MSc 2021 Students Request Fee Installment ExtensionDocumento9 pagineMBA/MSc 2021 Students Request Fee Installment ExtensionChalitha DhananjaniNessuna valutazione finora

- DMELLOHTLDocumento1.023 pagineDMELLOHTLSneha RaoNessuna valutazione finora

- Fa2 Mock Exam 2Documento10 pagineFa2 Mock Exam 2Iqra HafeezNessuna valutazione finora

- A Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaDocumento49 pagineA Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaYeasir ArafatNessuna valutazione finora