Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Developing A Competitive Adavantage

Caricato da

Raunaq HayerTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Developing A Competitive Adavantage

Caricato da

Raunaq HayerCopyright:

Formati disponibili

Michael Dell's first foray into the computing world was at the age of 7, when he

owned his first computer, the Apple II, designed by the great Steven Wozniak. Now,

Apple has grown to become one of Dell's greatest competitors.

Introduction

In 2013, Dell was ranked 165 in Fortunes Global 500, a list of the largest

multinational corporations in the world. Since its incorporation, it has growing

steadily to become one of the largest MNEs in the world. As the market leader, it fell

from the top spot to the third place behind Hewlett Packard and Lenovo in 2012. This

article seeks to detail how it was able to achieve this initial success in the early 2000s

and eventually declined towards the end of the decade.

The report describes the Dells successful direct sales business model, superior supply

chain management and other sources of its initial competitive advantage. Dells

choice in the location of its manufacturing plants operations and decisions in its

outsourcing operations are also discussed.

Finally, the reasons behind Dells slump as a leading PC maker and loss of its

competitive advantage are explained. The report sums up with the possible strategies

that Dell could take to restore its competitive advantage can undertake are

recommended.

See all 2 photos

Replacing Inventory with Information

Replacing inventory with information is a supply chain management concept that

seeks to manage and reduce inventory through the use of information. The key is to

have the right amount of inventory to suffice supply and demand without

compromising the service level.

Replacing inventories with information has the main benefit of a lean and agile

supply, suggesting a minimal inventory level that is still flexible enough to adapt to

changes in supply and demand. This contributes to cost reduction.

Having a large inventory on hand acts as a buffer and protects against uncertainties in

the supply chain. This is because supply and demand is difficult to predict and

subjected to variation. However, excess inventory is not an asset and it is in fact

considered a liability. Such uncertainties take up 60% of the supply chain cost due to a

lack of available information.

Thus, having access to vital information (e.g. market trends, sales data etc.)

contributes to benefits such as improved forecasting and planning. For example, 3M

Canadas implementation of the i2 Factory Planner and Supply Chain Planner

software solutions has reaped rewards. The software solutions provide valuable real-

time information such as predicting demand and changes in the market. Since then,

planning and scheduling productivity has increased by 20% and inventory decreased

by 23%.

With its strategic use of information such as its internet-based ordering system and

updating its suppliers with the latest demand trends, Dell was able to perfect the

balance between demand and supply. Its inventory was reduced to only 3 days worth

which the lowest in the industry.

Dells Initial Competitive Advantage

As a multinational enterprise, Dell is very competent in executing its global strategy

and provided it with an initial competitive advantage that was unrivaled in the first

half of the 2000s.

One of the sources of Dells initial competitive advantage can be attributed to its

famous direct selling and built-to-order approach. This just-in-time (JIT) strategy that

was adopted allowed it to operate with minimal inventory, in fact the lowest level in

the industry. Reduction of excess inventory provided Dell with a significant cost

advantage as component costs depreciates as much as 1% weekly in the electronic

industry. Direct selling has also allowed Dell to bypass intermediaries such as

wholesalers and retailers, reducing costs even further. In addition, Dell offered

customizable options that proved to be customer centric and attractive.

Dells global force of 200 suppliers had access to automated and real-time information

such as demand trends and volume expectations of their components. This close

relationship with its suppliers and the direct selling model has allowed Dell to balance

demand and supply remarkably.

Dell conducts its business operations worldwide in many different foreign markets.

One of Dells motivations to internationalize is to secure supplies and gain access to

low cost factors. Dell situated manufacturing plants across the world provide location

specific advantages such as low labour costs and a highly productive workforce. The

manufacturing operations are also in close proximity to important regional markets to

minimize delay between purchase and delivery. Dells choice of the locations had

indeed armed it with an initial competitive advantage.

Dells Global Manufacturing Plants

Why did Dell choose to locate its manufacturing plants in certain geographic

locations?

Bartlett and Beamish (2011) identifies three conditions that must that must be fulfilled

if an MNE is to internationalise its operations. One of the conditions is that a foreign

market must offer location-specific advantages. Dell operates manufacturing plants in

Brazil, China, India, Ireland, Malaysia and Poland which offer Dell such advantages.

One of the main advantages is the lower costs of labour but high productivity of the

local workforce. For example, labour costs in Malaysia are cheaper than neighbouring

Singapore but the quality of labour remains comparatively high. When Dell

established its manufacturing operations in Malaysia, it received a 100% tax

exemption for 5 years, an initiative by the Malaysian government to attract

investments.

The next advantage is the proximity to important markets. Dell chose to locate its

manufacturing plants close to such regional markets for better market access, lower

shipping costs and responsiveness in delivery. The success of Dell in India was

attributed to its manufacturing plant in the country, which cuts delivery time by 50%

and improved its sales drastically. In the past, customers in India would have to wait

for up to a month for the delivery of computers as they were manufactured in

Malaysia.

However, akin to globalization, this choice of location is not without its

disadvantages. Locating its manufacturing operations beyond the United States comes

with certain disadvantages. Bartlett & Beamish (2011) describes the distance and the

liability of foreignness as some of these disadvantages. Generally, the greater the

distance from the home market, the more difficult it will be to conduct its operations.

To elaborate, there may be differences in culture, beliefs, language, political

landscape and infrastructure which can affect Dells global supply chain. The

geographical distance makes control over the manufacturing operations even more

difficult. In February 2007, a major fire broke out at one of the plants in Aisin Seiki,

one of Toyotas main suppliers. The crisis caused Toyota the loss of 70,000 vehicles

and 160 billion in revenue. However, due to similar culture, beliefs and proximity of

manufacturing operations, the recovery effort was incredibly fast with the aid of local

firms. If such an accident were to happen to Dells global manufacturing plants and

caused disruptions its supply chain, the consequences would be disastrous. Recovery

would also be difficult due to the distance and liability of foreignness.

Outsourcing Manufacturing

One of the main reasons for outsourcing the manufacture of PC components is the

choice of good components and suppliers rather than vying to produce one. Michael

Dell once said in an interview, If youve got a race with 20 players all vying to make

the fastest graphics chip in the world, do you want to be the twenty-first horse, or do

you want to evaluate the field of 20 and pick the best one? Dells strategy was to

build good relationships with its global network of suppliers rather than manufacture

components of their own.

Outsourcing would allow Dell to focus on its own competencies such as managing its

efficient supply chain, customer service, research and development of new products

etc.

In an interview with Louise OBrien, former Vice President of Dell, she emphasized

that Dells main business is personal computers and it should not give up its

capabilities in production. Since the incorporation of Dell, it has been outsourcing

components manufacture but not the final assembly itself. Dell does not want to

outsource its manufacturing operations entirely to prevent the unintended creation of

competitors. Outsourcing is often described as easy to replicate and the competitive

advantage that it provides it not sustainable. Outsourcing is only feasible if it is

separated from other supply chain activities, which is what Dell is trying to achieve.

See all 2 photos

How Dell Lost its Ranking as the Leading Global PC Maker

The desktop computer, which was Dells focus, was being overtaken by substitute

products such as portable computers in the late 2000s. Dells manufacturing and direct

sales model was not well suited for the portable PC market. Consumers prefer to

purchase laptops in retail outlets as they are able to look and feel at the design.

Moreover, competitors began restructuring efforts and had significant improvements

in their business models. This decline of the desktop PC was one of the main reasons

that caused Dell to lose its ranking as the leading global PC maker.

Dells major competitors such as Hewlett-Packard, Apple, Acer and Lenovo had

adopted a greater focus on worldwide innovation and learning in the knowledge era.

Knowledge as a source of competitive advantage has allowed these MNEs to surpass

Dell in market share. They were able to do so as they outsourced their manufacturing

operations entirely. However, Dell was still restricted by its firm decision of

outsourcing only components and having total control over the final assembly. A

notable example is Apple, who surpassed Dells market cap in 2006 with its catalogue

of innovations such as the iMac and MacBook Pro.

The cross collaboration efforts and entrance into foreign markets by its competitors

had caused Dells slip in rankings. For example, Lenovos acquisition of IBMs PC

Division in May 2005 had a significant impact on PC makers globally, including Dell.

It had become the world third largest personal computing company overnight and

allowed it to gain accelerated entrance to foreign markets beyond China.

Strategies for Sustained Competitive Advantage

Strategies and measures that Dell undertook to address the loss of its market share

were aplenty. For example, it reduced reliance on direct sales by selling through retail

channels and launch laptops and netbooks.

Bartlett and Beamish (2011) describes three types of strategic approaches that a MNE

can respond to challenges, through defending worldwide dominance, challenging the

global leader and protecting domestic niches.

In the competitive PC market, Dell was forced to develop new capabilities such as

selling through retail channels and playing catch-up to its competitors new products.

However, this eroded its core competencies. Instead, Dell should defend and reinforce

their existing capabilities rather than developing new ones.

Dell can do so by taking extra steps to improve its customer service. For example, it

introduced a concierge service for customers in April 2013 that provided personalized

and remote services for customers. Instead of seeking ways to improve sales through

retail channels, Dell could enhance its direct sales model such as utilizing social

media.

Dell is renowned for its direct sales model that provides optional customizability.

Taking advantage of this strength, it can delve deeper into this niche by providing

customers with more customizable options online. For example, Dell acquisition of

Alienware in 2006 allowed it to tap into the highly profitable but niche PC-gaming

market. PC Gaming Alliance reported that the PC gaming industry hit record revenues

of $6.8 billion in 2012.

Dell can strive to protect its domestic niches and defend against its competitors

global advantage. By responding to local needs, Dell can reshape its personal

computers to suit the consumers taste.

To offset competitors advantage, Dell can employ defensive strategies such as

lobbying for changes and assistance. In 2007, Dell lobbied for the Indian government

to reduce its PC tax. Finally, it can also go into mergers or joint ventures with other

global MNEs. For example, it entered into a partnership with one of its competitors,

EMC for a decade that led to sales of more than a billion dollars worth of midrange

and entry-level storage products.

Conclusion

Forecasts for the personal computer industry are bleak and IDC expects the sales of

personal computers to fall till at least 2017. The advent of new products such as smart

phones and tablets are out shadowing PCs.

The impact on Dell's business is great and it becomes ever more important for Dell to

restore its competitive advantage. Dell has a gargantuan task of catching up with the

rapid changes in technology and the evolving strategies of its competitors.

Dell was not able to gain a sustained competitive advantage due to its reliance on the

direct sales model and traditional business strategies. Like its competitors, it must

invest more effort in learning and innovation. It should also evolve its global strategy

such as responding to local needs and adopting other transnational strategies.

Dells rise and fall in PC industry have sent an important message and reminder to

itself - that a sustained competitive advantage, motivated by constant changes, is

crucial for the future of the company.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- A Case Study of Microsoft Corporation 1Documento21 pagineA Case Study of Microsoft Corporation 1Bea GarciaNessuna valutazione finora

- Daily Lesson Log in Tle I.Objectives: Lesson 3. Inspect and Test The Configured Computer Systems and NetworksDocumento61 pagineDaily Lesson Log in Tle I.Objectives: Lesson 3. Inspect and Test The Configured Computer Systems and NetworksANA LEE MENDOZANessuna valutazione finora

- ALPHA Commissioning ManualDocumento43 pagineALPHA Commissioning Manualgmegoulis_772534693100% (1)

- Janome - Digitizer MB - UserManualDocumento306 pagineJanome - Digitizer MB - UserManualassis_campos8950Nessuna valutazione finora

- 04-32-60-1 MiDocumento80 pagine04-32-60-1 Miigor gulevatiyNessuna valutazione finora

- 3D OCT-1 Maestro2 - RM - E - Ver.1.02 (R-OCT-1-1901-04) - PT - PARTE1Documento200 pagine3D OCT-1 Maestro2 - RM - E - Ver.1.02 (R-OCT-1-1901-04) - PT - PARTE1DFH Oftalmo ServiceNessuna valutazione finora

- Case Study 7 (Apple Inc)Documento13 pagineCase Study 7 (Apple Inc)Zaa Za100% (1)

- TSLADocumento30 pagineTSLARaunaq HayerNessuna valutazione finora

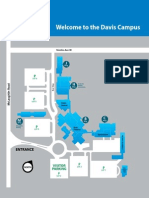

- Sheridan Davis Campus MapDocumento1 paginaSheridan Davis Campus MapRaunaq HayerNessuna valutazione finora

- New Event For Additive Manufacturing/3d Printing Event To Debut This FallDocumento2 pagineNew Event For Additive Manufacturing/3d Printing Event To Debut This FallRaunaq HayerNessuna valutazione finora

- The Effects of The External Environment On Internal Management Strategies Within Micro, Small and Medium Enterprises Kenyan CaseDocumento12 pagineThe Effects of The External Environment On Internal Management Strategies Within Micro, Small and Medium Enterprises Kenyan CaseRaunaq HayerNessuna valutazione finora

- 51 Depression Detection System Using Python PY051Documento7 pagine51 Depression Detection System Using Python PY051VijayKumar LokanadamNessuna valutazione finora

- Hardware Management Console For Pseries - Maintenance Guide PDFDocumento164 pagineHardware Management Console For Pseries - Maintenance Guide PDFCarlos FreitasNessuna valutazione finora

- WV-CS570: SeriesDocumento2 pagineWV-CS570: SeriesknightmknightNessuna valutazione finora

- Computers 1st Sem NotesDocumento26 pagineComputers 1st Sem NotesSugandha Agarwal88% (26)

- Control Acces ROSSLARE AC-015 - Manual Instalare PDFDocumento60 pagineControl Acces ROSSLARE AC-015 - Manual Instalare PDFCrisbogo68Nessuna valutazione finora

- WEYTEC White Heavy For The Cloud 01Documento4 pagineWEYTEC White Heavy For The Cloud 01Rahul MohiteNessuna valutazione finora

- Softqaen Client 701Documento32 pagineSoftqaen Client 701Mohd FaizalNessuna valutazione finora

- Lenovo Inventory Control Sheet - US - CADocumento3 pagineLenovo Inventory Control Sheet - US - CAPrashant ShahNessuna valutazione finora

- +++microsoft StyleguideDocumento58 pagine+++microsoft StyleguideuptoyouNessuna valutazione finora

- SCM Numerical 2011Documento13 pagineSCM Numerical 2011arvindpmNessuna valutazione finora

- A58ml2 20150629Documento4 pagineA58ml2 20150629Abdillah AbelNessuna valutazione finora

- 406MHz Sarsat Beacon Tester User ManualDocumento29 pagine406MHz Sarsat Beacon Tester User Manualtangocanh80Nessuna valutazione finora

- DCP Orientation HandbookDocumento30 pagineDCP Orientation HandbookOnin C. OpeñaNessuna valutazione finora

- MTS Temposonics 2011 CatalogDocumento179 pagineMTS Temposonics 2011 CatalogElectromateNessuna valutazione finora

- MarketingDocumento459 pagineMarketingMariana NichiteanNessuna valutazione finora

- 6400 BrochureDocumento8 pagine6400 BrochureTrần ChâuNessuna valutazione finora

- Uninterrupted Power Distribution System With Arduino PLC ControlDocumento72 pagineUninterrupted Power Distribution System With Arduino PLC ControlRAVISELVAN S67% (3)

- GC 1f 4921240310Documento9 pagineGC 1f 4921240310Khaleel KhanNessuna valutazione finora

- Hmi 6050iDocumento30 pagineHmi 6050iTường Minh NguyễnNessuna valutazione finora

- ECO138 Cheat Sheet 2Documento3 pagineECO138 Cheat Sheet 2Vasanth Sai Kumar ApperNessuna valutazione finora

- CNC3D User Guide PDFDocumento29 pagineCNC3D User Guide PDFLucas PabloNessuna valutazione finora

- Medit I500 User GuideDocumento61 pagineMedit I500 User GuideiuliaNessuna valutazione finora

- Value Creation of Dell's Marketing DepartmentDocumento13 pagineValue Creation of Dell's Marketing DepartmentSuki ZhangNessuna valutazione finora