Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pop Money

Caricato da

Devin Bush0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

54 visualizzazioni20 pagineThis is a research campaign conducted in the PRSSA with recommendations and research for future students to create and execute a campaign.

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis is a research campaign conducted in the PRSSA with recommendations and research for future students to create and execute a campaign.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

54 visualizzazioni20 paginePop Money

Caricato da

Devin BushThis is a research campaign conducted in the PRSSA with recommendations and research for future students to create and execute a campaign.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 20

PopMoney

Research & PR Campaign Book

Brad Millett, Devin Bush, Joanne Montoya,

Camie Hubert & Jill Kochel

Table of Contents

Situation Analysis

Goals & Objectives

Target Audience

SWOT

Research Methods

Since 1984, Fiserv has been one of the leading powers within the fnancial

services industry. In fact, Fiserv processes 70 percent of all billing payments

made at U.S. fnancial institutions. Fiserv has a massive presence in online and

mobile banking. Currently, Fiserv executes 20 billion digital transactions each

year. With over 16,000 clients worldwide, it is no surprise that many people use

Fiservs services without even knowing it. One service consumers should know

about is Popmoney. Popmoney is a service that makes sending money

between bank accounts easier. Rather than writing out a check or having to

fnd a bank account, users of Popmoney can transfer money from their bank

account to another bank account for a fat fee of $0.95. Popmoney can be

used directly from a laptop, or it can be accessed from iPhone, Windows

Phone, and Android apps. Even though Popmoney has partnered with over

1,900 institutions that offer, not many people know about the company. A lot

of this has to do with the poor displaying of Popmoney in the places it is

actually used.

Situation Analysis

Goals & Objectives

Goals:

- Be the number online innovative payment service through a mobile

device.

- Increase the likes on Popmoney Facebook page from 20,000 to

50,000.

- Increase awareness of Popmoney and the services they offer to a

wider audience.

- Increase Popmoneys reputation in the online banking community.

Objectives:

- Promote Popmoney to become a well-known mobile banking fea-

ture among consumers.

- Present the benefts of Popmoney to target audiences to encourage

ongoing use of their service.

Target Audience

Primary Audience:

The need for an accessible money transfer app is needed among a wide

audience. After analyzing our research and the Popmoney website it is

determined that our target audience consists of males and females ranging

in age from 18-30 years old. Many of these people are college students and

are active socially. Although a good percentage of our target audience

consists of college students, young adults who are socially active and spend

good amounts of money.

Secondary Audience:

Our secondary audience consists of the parents of those students who are in

need of an easy money transfer service. Popmoney gives parents the

opportunity to send their children money in the most effcient way possible.

SWOT

Strengths

- Potential for a massive reach.

- Maintains partners with the following banks: Ally Bank, Bank of America,

Chase Bank, Citibank, Fifth Third Bank, PNC Bank, N.A., Regions Bank,

SunTrust Bank, US Bank and Wells Fargo Bank.

Weakness

- Not well known among consumers.

- Poor maintenance of their social media profles.

- Established a poor reputation among previous customers.

- No brand loyalty.

Opportunities

- Establish a credible reputation among the target audience.

- Service college students and their need for easy money transfer.

- Establish a national brand.

Threats

- The fuctuation of college students spending money.

- Other money transfer mobile apps. For example, Venmo and Bank of

America.

Research Methods

Primary Research Method:

For our primary research we conducted a survey. We felt that this was the

most effective way to learn about how aware our target audience are of

Popmoney and similar services. We sent out the survey to 300 BYU-Idaho

students at random and posted the survey on Facebook targeting the survey

towards college students and young adults ranging in age from 18-30 years

old.

Research Methods

Results

From the survey, we learned frst and foremost, they are not very well known. Only six

percent of those surveyed had ever heard of Popmoney, and of those six percent,

less than a third of them currently use it. From this it is clear one major problem

Popmoney has an uphill climb when it comes to awareness. Only 32 percent of

those surveyed use mobile money transfer apps. Those that do use money transfer

apps, nearly all use the apps that are currently offered by their bank. These banks

included Bank of America, Chase Bank, or Wells Fargo. Those that did not have

a bank that provides a mobile money transferring service used services such as

Google Wallet, Venmo, or Paypal.

From this information, we can conclude that one target audience that will be very

fruitful for Popmoney is those that currently bank with smaller, more local banks or

credit unions. These banks do not have services that allow them to transfer money

with their mobile devices. It will be much more diffcult to pry someone away from

an app that is given them for free from their current bank. There was no stark

correlation between marital status, year in school, or age and what bank they used.

Another interesting thing discovered was the fact that 76 percent of students lived

within less than 5 miles of an ATM for their bank. This means a lot of students have

easy access to cash. This could prove to be a big threat to Popmoney.

Research Methods

One bit of promising information is that when people were asked what they do

when they owe their friends money but do not have any cash handy to give

them, the most common answer (34%) was to wait until they had access to an

ATM. This answer was followed closely (at 23%) with buy them something of equal

value at a later date. This information could provide an interesting angle for

future PR plans or advertisements. Hitting the fact that you no longer have to wait

to pay your friends, or get money from them should provide good returns. One

interesting side note is that single people were more likely to buy something at a

later date, write an IOU, or wait until they had access to an ATM, whereas married

people were more likely to write a check, transfer money to their bank account,

or get cash back at the nearest grocery store or gash station.

When asked if their parents transfer money into their account, 63% of students

said yes. 73% of those students have the same bank as their parents, and they just

transfer money from their account to the students account.

One major problem shown with this survey is that of trust. When asked to rate

how much they trust mobile banking/money transfer apps on a scale of 1 to 5 (1

being never in a million years, and 5 being with my life) 75% of students chose a

1. Those numbers are pretty revealing and suggest that not only will Popmoney

need to get their brand name recognized, but they will need to brand themselves

as a reliable and trustworthy service.

Strategies & Tactics

The following strategies and tactics are examples that can be executed to

reach Popmoneys objective and goals.

Strategies:

- Establish credibility and a mass amount of consumers through promotions.

- Reach target audience through several social media platforms.

- Hold events to increase awareness of the Popmoney brand.

Tactics:

- Set up a Popmoney booth in a mall or shopping center, with download for

a dollar (or something clever) as the slogan. People download the app right

there, the sales person will transfer a dollar to their account while they stand

there. Have the salesperson inform people about the app during the whole

process. Benefts. People get the app on their phone, and see the app in

action.

- Be featured in University newspapers across the country, for example, The

Universe at BYU. Write article on Pop Money and about the features and bene-

fts they provide for the college student market. Provide a coupon in the article

for a dollar a download. Shoot for an article a week in a different University

Newspaper for 3 months.

- Hold a beneft concert sponsored by Pop Money. All proceeds go to a

charity. Could be a seasonal event.

- Revamp Facebook by holding promotions and consistently having someone

maintain the page. Utilize the twitter page by connecting with partners and

local businesses that can promote Popmoney.

Appendix

Q1

Have you ever heard of Popmoney?

A. Yes

B. No

Q1A

Have you ever used Popmoney?

A. Yes

B. No

Q1B

Do you currently use Popmoney?

A. Yes

B. No

Q1C

How ofen do you use Popmoney?

A. Never

B. Less than Once a Month

C. Once a Month

D. 2-3 Times a Month

E. Once a Week

F. 2-3 Times a Week

G. Daily

Q2

1. Who do you currently bank with?

A. Bank of America

B. Wells Fargo

C. Chase

D. Zions Bank

E. Key Bank

F. Other (Specify) _____________________

Q3

Popmoney is a person-to-person payments service (P2P). Te service enables individuals to send and receive

payments electronically in a manner that is designed to displace traditional check payments.

Te Popmoney iPhone app lets you easily send or request money from friends, family, or anyone at all. All you

need is their name and email address or mobile phone number to move money from your bank account to

theirs.

Do you currently use a program that allows you to send money from your bank account to another persons

bank account (even if they do not share your same bank) using nothing but your phone in a similar way that

Popmoney does?

A. Yes

B. No

Q3A

What is the name of the mobile money transferring program you use that is similar to Popmoney?

________________________________________________________________________________________

______

Q4

Do you work while you are at school?

A. Yes

B. No

Q4A

Do you work on campus?

A. Yes

B. No

Q5

How far do you generally have to drive to fnd an ATM machine for your bank?

A. 0-2 miles

B. 2-5 miles

C. 5-15 miles

D. 15-50 miles

E. 50-100 miles

F. Other (Please specify)_________________________________

Appendix

Q6

You owe your friend money, but you dont have any cash. What do you do? (check all that apply)

A. Buy something else for them of equal value at a later date.

B. Write them an IOU

C. Write them a check

D. Transfer money to their bank account

E. Wait until you have access to an ATM machine

F. Other (please specify) ________________________________

Q7

Do your parents ever send you money while you are at school?

A. Yes

B. No

Q7A

How ofen do your parents transfer money to you?

A. Never

B. Less than Once a Month

C. Once a Month

D. 2-3 Times a Month

E. Once a Week

F. 2-3 Times a Week

G. Daily

Q7B

How do your parents normally send you money?

A. Money transfer online

B. Money transfer via mobile app

C. Mail Cash

D. Mail a check

E. Other (please specify) ________________________________

Q7C

Do you share the same bank as your parents?

A. Yes

B. No

Appendix

Q8

If I found a mobile money transfer system that was simple and efcient I would start using it on a regular

basis.

A. Already use one

B. Strongly Agree

C. Agree

D. No change

E. Disagree

F. Strongly Disagree

Q9

On a scale from 1-5 How much do you trust mobile banking and/or money transfer apps? (1 meaning never in

a million years would you trust one, 5 meaning you would trust it with your life, 3 meaning you are indiferent

to the thought of it.)

A. 1

B. 2

C. 3

D. 4

E. 5

Q10

What is your major?

________________________________

Q11

What year in school is this for you?

A. Freshman

B. Sophomore

C. Junior

D. Senior

Q12

Are you single or married?

A. Single

B. Married

Q13

How old are you?

________________________________

Appendix

Q26

Are you:

A. Male

B. Female

Appendix

Potrebbero piacerti anche

- PopmoneyfinalDocumento34 paginePopmoneyfinalapi-266203838Nessuna valutazione finora

- Marketing Branchless Banking: CGAP Group, Date Posted: Thursday, May 12, 2011Documento15 pagineMarketing Branchless Banking: CGAP Group, Date Posted: Thursday, May 12, 2011Manoj JhambNessuna valutazione finora

- Script For Brown BagDocumento11 pagineScript For Brown BagAnne TanNessuna valutazione finora

- Beyond the Aisle: Where Consumer Packaged Goods Brands Meet Technology to Drive Business ResultsDa EverandBeyond the Aisle: Where Consumer Packaged Goods Brands Meet Technology to Drive Business ResultsNessuna valutazione finora

- A Quick Guide To Attracting More Business With Mobile AppsDa EverandA Quick Guide To Attracting More Business With Mobile AppsNessuna valutazione finora

- VolunkarmaDocumento13 pagineVolunkarmaapi-309991394Nessuna valutazione finora

- Chapter 1Documento8 pagineChapter 1Cj Lopez100% (2)

- Mobile Banking by Irfan ArifDocumento20 pagineMobile Banking by Irfan ArifMuhammad Talha KhanNessuna valutazione finora

- Dissertation Report On Consumer Behavior Towards Online AdvertisingDocumento5 pagineDissertation Report On Consumer Behavior Towards Online AdvertisingHelpInWritingPaperIrvineNessuna valutazione finora

- The Problem and Its SettingDocumento25 pagineThe Problem and Its SettingMia Siong CatubigNessuna valutazione finora

- Chardel ResearchDocumento20 pagineChardel ResearchAnne MarielNessuna valutazione finora

- VantivPoints Factsheet: Retail Tablets Lead The Way To Mobile AdoptionDocumento2 pagineVantivPoints Factsheet: Retail Tablets Lead The Way To Mobile AdoptionVantivNessuna valutazione finora

- Accenture Digital Payments Survey North America Accenture Executive SummaryDocumento20 pagineAccenture Digital Payments Survey North America Accenture Executive SummarySatya PrakashNessuna valutazione finora

- Related LiteratureDocumento10 pagineRelated LiteratureFiona Kristel PalenciaNessuna valutazione finora

- Social Business Magazine - Q4 2011 - Quarterly Magazine of The Social Media Leadership ForumDocumento12 pagineSocial Business Magazine - Q4 2011 - Quarterly Magazine of The Social Media Leadership ForumIt's OpenNessuna valutazione finora

- Mastercard Challenge Diego Alvarez, Julio Vega, Sebastian Alzate, Yoiner Cardozo Proposal: Kipstr AppDocumento6 pagineMastercard Challenge Diego Alvarez, Julio Vega, Sebastian Alzate, Yoiner Cardozo Proposal: Kipstr AppDiego Alvarez RozoNessuna valutazione finora

- Work From Home. - .For Real!: 1. The On-Demand Economy ShiftDocumento3 pagineWork From Home. - .For Real!: 1. The On-Demand Economy ShiftCharles GalidoNessuna valutazione finora

- The Necessity of Facial Recognition inDocumento10 pagineThe Necessity of Facial Recognition inNujhat NawarNessuna valutazione finora

- A Survey On E-CommerceDocumento16 pagineA Survey On E-CommerceSupriya RamNessuna valutazione finora

- E-Wom, Brand Trust, Brand Loyalty: Affecting The Development of E-Commerce in Viietnam: Case Study of ShopeeDocumento8 pagineE-Wom, Brand Trust, Brand Loyalty: Affecting The Development of E-Commerce in Viietnam: Case Study of ShopeeNga nguyen thiNessuna valutazione finora

- Sales and Marketing Executive, DelhiDocumento4 pagineSales and Marketing Executive, Delhishivam shubhamNessuna valutazione finora

- Operation Strategy Se Lab 1Documento22 pagineOperation Strategy Se Lab 1Vishal GovindaniNessuna valutazione finora

- Case Study On: Operation Strategy ofDocumento22 pagineCase Study On: Operation Strategy ofVishal GovindaniNessuna valutazione finora

- Apps Vs Mobile BrowsersDocumento3 pagineApps Vs Mobile BrowsersSithartha GowthamNessuna valutazione finora

- Like My Stuff: How to Get 750 Million Members to Buy Your Products on FacebookDa EverandLike My Stuff: How to Get 750 Million Members to Buy Your Products on FacebookNessuna valutazione finora

- LOCALRRLDocumento3 pagineLOCALRRLPrincess kc Docot100% (1)

- 10 Chinese Consumer TrendsDocumento5 pagine10 Chinese Consumer TrendsfuturetalentNessuna valutazione finora

- Influence of Social Media Marketing On Brand Choice Behaviour AmongDocumento7 pagineInfluence of Social Media Marketing On Brand Choice Behaviour AmongSukashiny Sandran LeeNessuna valutazione finora

- Business Research - Fintech.Documento24 pagineBusiness Research - Fintech.koushik SahaNessuna valutazione finora

- Acting On The Evolution of The Canadian Smartphone User: March 2014Documento6 pagineActing On The Evolution of The Canadian Smartphone User: March 2014GroupM_NextNessuna valutazione finora

- Earn Money While Losing Weight With Jesus: How To Advertise Your Products, Services, and Content Like the Big Players: How To Advertise YourDa EverandEarn Money While Losing Weight With Jesus: How To Advertise Your Products, Services, and Content Like the Big Players: How To Advertise YourNessuna valutazione finora

- CasebookDocumento23 pagineCasebookapi-251499934Nessuna valutazione finora

- What If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGADocumento10 pagineWhat If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGAMike BurdickNessuna valutazione finora

- UMBResearchDocumento9 pagineUMBResearchrflindsayNessuna valutazione finora

- Research PaperDocumento35 pagineResearch PaperKim lobrete100% (1)

- Strategy Business: Mobile NowDocumento7 pagineStrategy Business: Mobile NowPhotographyaNessuna valutazione finora

- MMC Overview 11-08-2016Documento50 pagineMMC Overview 11-08-2016Anonymous uRUueVYe6iNessuna valutazione finora

- Marketing-Research 123946-1 125717Documento13 pagineMarketing-Research 123946-1 125717kimberly de veraNessuna valutazione finora

- UntitledDocumento7 pagineUntitledpramodNessuna valutazione finora

- Contact Me at Kgalmai@student - Umuc.edu For Tutorial: Study Case Analysis Bank of America: Mobile BankingDocumento8 pagineContact Me at Kgalmai@student - Umuc.edu For Tutorial: Study Case Analysis Bank of America: Mobile BankingABC XYZNessuna valutazione finora

- The Power of Print: Print Marketing in a Digital WorldDa EverandThe Power of Print: Print Marketing in a Digital WorldNessuna valutazione finora

- The Anthemis Newsletter: Trends in Mobile PaymentsDocumento28 pagineThe Anthemis Newsletter: Trends in Mobile PaymentsanthemisgroupNessuna valutazione finora

- 19help02 Huynh Tien Dat Proposal E2000462Documento11 pagine19help02 Huynh Tien Dat Proposal E2000462B DATNessuna valutazione finora

- Background of The StudyDocumento40 pagineBackground of The StudyJuhlia Hyacinth TorreonNessuna valutazione finora

- Marketing Research DraftDocumento15 pagineMarketing Research DraftJayaniNessuna valutazione finora

- Accenture Social Banking RetailDocumento12 pagineAccenture Social Banking RetailMikhail DashkovNessuna valutazione finora

- Report Draft 1 160615Documento5 pagineReport Draft 1 160615edmund forgoatNessuna valutazione finora

- Level of Fondness of Filipino's in Online ShoppingDocumento6 pagineLevel of Fondness of Filipino's in Online ShoppingKrishel GabucoNessuna valutazione finora

- Payment Methods Report 2019 - Innovations in The Way We PayDocumento144 paginePayment Methods Report 2019 - Innovations in The Way We PayPrakashNessuna valutazione finora

- Research AliDocumento14 pagineResearch AliAli AhmadNessuna valutazione finora

- Consumer Attitude On Online ShoppingDocumento37 pagineConsumer Attitude On Online ShoppingrkpreethiNessuna valutazione finora

- Effects of Mobile Banking To The Online Buying Habits of The Residents in PoblacionDocumento3 pagineEffects of Mobile Banking To The Online Buying Habits of The Residents in PoblacionTan RetardoNessuna valutazione finora

- The CMO's Guide To Beating The Engagement CrisisDocumento9 pagineThe CMO's Guide To Beating The Engagement CrisisKent WhiteNessuna valutazione finora

- NOVAAFRICA 2015 Working Paper 1Documento28 pagineNOVAAFRICA 2015 Working Paper 1SantialvaritoCrackNessuna valutazione finora

- Rough Draft 4Documento26 pagineRough Draft 4api-405080981Nessuna valutazione finora

- Style Guide Proposal For Azari Property ManagementDocumento21 pagineStyle Guide Proposal For Azari Property ManagementDevin BushNessuna valutazione finora

- Passion Is Key: Advertising PhotographyDocumento20 paginePassion Is Key: Advertising PhotographyDevin BushNessuna valutazione finora

- Style Guide 1.0Documento13 pagineStyle Guide 1.0Devin BushNessuna valutazione finora

- Center Stage ResearchDocumento24 pagineCenter Stage ResearchDevin BushNessuna valutazione finora

- Grandpa's Southern Bar-B-QDocumento28 pagineGrandpa's Southern Bar-B-QDevin BushNessuna valutazione finora

- Digital Payments Analysing The Cyber LandscapeDocumento37 pagineDigital Payments Analysing The Cyber LandscapeAzzam IkhsanNessuna valutazione finora

- ICP Receipt - ICP 370034Documento2 pagineICP Receipt - ICP 370034Salman TamboliNessuna valutazione finora

- Sales Contest Green Booster BSM - FINAL - LG AgustusDocumento6 pagineSales Contest Green Booster BSM - FINAL - LG AgustusSRIYAMTI SRIYAMTINessuna valutazione finora

- CircularsDocumento81 pagineCircularsahtshamahmedNessuna valutazione finora

- BibliographyDocumento14 pagineBibliographyshrikrushna javanjalNessuna valutazione finora

- Money Creation ProcessDocumento5 pagineMoney Creation ProcessFahad chowdhuryNessuna valutazione finora

- Goa Tour Package (3N, 4D)Documento10 pagineGoa Tour Package (3N, 4D)aayushmaan.singh9711Nessuna valutazione finora

- PLDT OctoberDocumento6 paginePLDT OctoberAkosi RizNessuna valutazione finora

- MIT15 S12F18 Ses2Documento38 pagineMIT15 S12F18 Ses2Nikhil PatelNessuna valutazione finora

- BSN Form - 20211104 - 0001Documento3 pagineBSN Form - 20211104 - 0001SUMARNA BT SUGIMAN Moe100% (1)

- Case Study-Service ManagementDocumento2 pagineCase Study-Service ManagementAmadea SutandiNessuna valutazione finora

- Downloadstatement 2Documento3 pagineDownloadstatement 2aamir shaikhNessuna valutazione finora

- Checking Account StatementDocumento4 pagineChecking Account StatementsherrieNessuna valutazione finora

- ImpDocumento6 pagineImpChandra SekaranNessuna valutazione finora

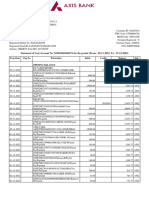

- View / Download Account Statement: Current Account No.: 50200059929672, KAITHAL, HARYANADocumento2 pagineView / Download Account Statement: Current Account No.: 50200059929672, KAITHAL, HARYANArudrabansal742Nessuna valutazione finora

- What Is BaselIII Norms For BanksDocumento3 pagineWhat Is BaselIII Norms For BanksCarbideman100% (1)

- Adding and Subtracting Integers Word Problems WorksheetDocumento2 pagineAdding and Subtracting Integers Word Problems Worksheetapi-23888000860% (10)

- Mba 3042F: Management of Banks Cia 1: Description: Financial Performance Analysis of A Central Bank and AXIS BankDocumento15 pagineMba 3042F: Management of Banks Cia 1: Description: Financial Performance Analysis of A Central Bank and AXIS BankNehal SharmaNessuna valutazione finora

- DepositSlip 10068722031011441572339Documento1 paginaDepositSlip 10068722031011441572339Jehad Ur RahmanNessuna valutazione finora

- Project Proposal SBI MicrofinanceDocumento7 pagineProject Proposal SBI MicrofinanceKiran Chopra100% (1)

- B.R.S. Test 3Documento5 pagineB.R.S. Test 3Sudhir SinhaNessuna valutazione finora

- Types of Loans: Executive SummaryDocumento3 pagineTypes of Loans: Executive SummarynishthaNessuna valutazione finora

- Statements 9261Documento6 pagineStatements 9261Jaun Tew Theory PhuorrNessuna valutazione finora

- Swot AnalysisDocumento5 pagineSwot AnalysisabhisekNessuna valutazione finora

- Barclays BankDocumento2 pagineBarclays BankarayNessuna valutazione finora

- Ledger Confirmation F.Y. 2019-20Documento1 paginaLedger Confirmation F.Y. 2019-20GaganDasPapaiNessuna valutazione finora

- Intacc 1 Notes Part 1Documento13 pagineIntacc 1 Notes Part 1Crizelda BauyonNessuna valutazione finora

- Marketing Paytm Wallet - Group5DDocumento23 pagineMarketing Paytm Wallet - Group5DAdwait Deshpande100% (1)

- Customers Reservation 12.31.2018Documento14 pagineCustomers Reservation 12.31.2018David Jhan CalderonNessuna valutazione finora