Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Managing The Managers

Caricato da

Madhu KumarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Managing The Managers

Caricato da

Madhu KumarCopyright:

Formati disponibili

Eric Kronenberg

Fadi Majdalani

Ekaterina Arsenieva

Jennifer Latka

Perspective

Managing the Managers

Effective PMC

Oversight on Large

Infrastructure Projects

Contact Information

Beirut

Fadi Majdalani

Partner

+961-1-985-655

fadi.majdalani@booz.com

Dubai

Ekaterina Arsenieva

Senior Associate

+971-4-390-0290

ekaterina.arsenieva@booz.com

Florham Park, NJ

Eric Kronenberg

Partner

+1-973-410-7621

eric.kronenberg@booz.com

Jennifer Latka

Senior Associate

+1-202-368-5877

jennifer.latka@booz.com

Booz & Company

1 Booz & Company

EXECUTIVE

SUMMARY

Cost overruns and schedule delays are endemic to completing

large infrastructure projects. Nine out of 10 projects incur

some cost escalation, and an even larger number of projects

are completed later than originally anticipated. Although

these issues cross all borders, they are very pronounced

in developing nations where new, less-experienced

institutionsin both the public and private sectorsare

embarking on large, complex projects. In the Middle East,

many companies engage seasoned program management

consultants (PMCs) with sterling reputations to oversee the

process of a large infrastructure project. But using a PMC

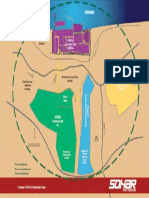

does not guarantee successful results. Burj Khalifa, Dubai

Metro, Masdar City, and Khalifa Port and Industrial Zone

(KPIZ) are among recent examples of large PMC-led projects

in the region. All of those projects experienced schedule

delays, which in many cases can lead to cost escalations.

From an external perspective, it is diffcult to pinpoint what

triggers delays and cost overruns in any specifc large-scale

project. However, many projects cost more and take longer

than anticipated because of a lack of coordination and

alignment of interests between the project owner and the

PMC. Owners can improve their relationships with PMCs

and increase the likelihood of project success by focusing

on three areas: defning the right management structure or

operating model, designing the PMC contract to provide

effective incentives, and developing adequate internal

capabilities to monitor the project.

2 Booz & Company

HIGHLIGHTS

Recent examples of large

infrastructure projects show that

the delays can run from months

into years, and costs can be up to

four times as much as estimated.

Properly structuring the

relationship between the owner

and the PMC, with the right

operating model, can increase

the likelihood of project success.

The right kind of contract for the

project will ensure alignment

between the owners interests

and those of the PMC.

The owner must have suffcient

internal capabilities to manage

those aspects of the project that

are critical to its business, as well

as the ability to provide suffcient

oversight on those areas

managed by the PMC.

THE CHALLENGES

OF MANAGING

INFRASTRUCTURE

DEVELOPMENT

For most organizations, successfully

managing large infrastructure

development is an extremely diffcult

task. Cost overruns and schedule

delays tend to be the norm rather

than the exception. There are

notorious examples of troubled

projects: The Panama Canal took

two years longer and cost three

times as much as anticipated.

1

The

Big Dig in Massachusettsa

three-decade-long quest to expand

Bostons major interstate highway,

bury it underground, and carve out

a new tunnel to its international

airporttook 22 months longer than

expected, and the cost was quadruple

initial expectations.

2

No sector is

immune to these challenges: Rail

development projects experience cost

overruns of 45 percent on average,

tunnel and bridge projects more

than 30 percent, and road projects

about 20 percent.

3

Problems in

project execution have signifcant

implications for ownersfnancial

losses and lost business opportunities,

as well as political pressures and

damaged reputations.

Project management issues are even

more pronounced in the Middle

East, where many newly formed

organizations are embarking on

unique and ambitious projects.

3 Booz & Company

Many project owners fnd that

they lack the resources, tools, and

processes required to manage projects

within their own organizations.

Furthermore, the beneft of building

a large internal workforce with these

capabilities often does not outweigh

the cost. Therefore, instead of serving

as the program manager themselves,

owners hire professional PMCs to

manage project execution, expecting

that they can ensure successful

project delivery. The PMC acts as

the owners representative and is

expected to provide skilled personnel,

relevant experience, and world-class

tools and processes.

But by no means does the hiring of

a PMC guarantee that a project will

be delivered on time and on budget.

Many recent regional projects

underscore this pointincluding the

building of the Burj Khalifa, Dubai

Metro, Masdar City, and KPIZ.

Each of these projects had a PMC of

good repute responsible for project

delivery. Yet, all incurred schedule

delays, which in many cases can lead

to cost escalation. Owners were left

wondering: How did these PMCs fail

to foresee, mitigate, and manage the

project risks?

It is diffcult for an outsider to know

what went wrong with any given

project. Many factors can prevent

a project from being completed

successfullyand some are outside

the control of either the owner or the

PMC, such as weather delays and

increases in the cost of materials.

Most projects, though, run into

severe trouble if the objectives of the

owner and the PMC are not aligned.

Over the next 20 years, spending on

transportation, industrial, and real

estate infrastructure in the MENA

region is expected to exceed US$680

billion (see Exhibit 1).

4

Owners must

develop a structure that aligns the

PMCs objectives with their own

objectives to ensure successful project

completion. A projects owners must

address three key areas: the operating

model, the contract with the PMC,

and their own internal capabilities

and organization.

Source: International Monetary Fund; Global Insight 2009; MEED; Zawya; Booz & Company analysis

Exhibit 1

Infrastructure Projects Require Substantial Investments

MENA INFRASTRUCTURE PROJECTS PROJECTED INVESTMENTS BY SECTOR

(20092030, US$ BILLIONS)

158

76

71

44

115

109

685 27

22

29

35

Railways

and

Metro

Airports Roads Ports Bridges,

Tunnels,

and

Waterways

Industrial

Zones

Free

Zones

Other

Develop-

ments

Mixed

Develop-

ments

Leisure,

Entertain-

ment,

Community,

Hotels

Total

Transportation

= $377 billion

Industrial

= $245 billion

Real Estate / Travel

and Tourism

= $62 billion

4 Booz & Company

An owner can choose between

several operating models to manage

a large-scale development effort.

First, for some projects, an owner

can and should serve as its own

program manager. This is especially

the case if the project requires

specialized capabilities that the

owner can apply to similar projects

in the future and that can serve as

a source of competitive advantage.

For example, The Walt Disney Co.

serves as program manager for

the development of all its theme

parks, as that is a recurrent area of

business expansion and one of its

core competencies. In the case where

project owners retain full control

of the development, all program

management activities are performed

in-house and the owner shoulders the

responsibility for integrating all parts

of the effort.

Other situations call for multiple

PMCs working on various pieces of

the development. The owner of the

project monitors all activities and is

responsible for overall integration,

while the project managers retain

some lower-level integration oversight.

Finally, a project owner can engage

a single PMC, handing over the full

responsibility of integration and

execution of the project while merely

tracking its activities.

There is no uniform prescription

for project management; the correct

model needs to consider elements

such as the size of the organization,

the owners willingness and ability

to be involved, the needed scope

of integration, and whether or not

the activity is critical to the owners

business model or obligation as a

public-sector organization.

In all instances, however, it is critical

to note that the owner ultimately

bears responsibility for the project

and should provide oversight

accordingly. As such, it must clearly

determine and assign responsibilities

at the outset to ensure that nothing

slips through the cracks.

CHOOSING

THE RIGHT

OPERATING

MODEL

5 Booz & Company

DESIGNING

AN EFFECTIVE

CONTRACT

STRUCTURE

The contract between the PMC and

the project owner is far from a mere

formality; it is the vehicle that aligns

the interests of the two parties. The

fnancial arrangement must provide

proper incentive for the PMC to act

in the best interest of the projector

else costs and delays could arise.

The contract must also formalize the

delegation of responsibilities that the

owner and the PMC agreed upon

when designing the operating model.

PMC contracts in the Middle East

typically have both fnancial and

nonfnancial issues. The primary

fnancial problem is the disconnect

between payment and performance,

caused by the terms typically

employed in PMC contracts in the

Middle East. The nonfnancial issues

often involve poorly defned scope

of work and minimal performance

standards.

Financial Structure Issues

Perhaps the most critical aspect of a

contract with a PMC is its fnancial

structure, as the PMC typically

is motivated by its own business

objectives. There are three primary

contract types: lump sum, time and

materials, and cost plus incentive fee.

Lump sum payment structures, in

which a fat price is agreed upon at

the outset, offer the lowest risk to

the owner and the highest risk to the

PMC, since the PMC will be forced

to eat the cost of any increased costs

or overruns. Although this model

offers the PMC a strong incentive to

fnish on time and on budget, it is

likely to make the PMC extremely

infexible regarding necessary changes

and could even lead to quality

concerns as it tempts the PMC to cut

corners. In lump sum arrangements,

the owner must also be prepared for

the PMC to submit claims, sometimes

of dubious merit, for increased costs

that it believes were directly or

indirectly incurred by the owner and

should not be borne by the PMC.

Many contracts in the Middle East

stipulate a simple time and materials

structure, in which the PMC

6 Booz & Company

negotiates hourly or daily labor rates

for each of the staff positions that

will support the project. These rates

typically cover both PMC costs and

proft. In contrast to the lump sum

approach, this assigns the majority

of risk to the owner and little to the

PMC. If the PMC is compensated

on this basis and the contract lacks

strong oversight mechanisms,

the PMC has little incentive to

complete the project on schedule,

as delays will actually increase its

revenue and proft. The time and

materials contract has advantages:

It is appropriate when technical

requirements are still evolving

or when there is a high degree of

specialization or technical diffculty.

However, it mandates that strong

oversight mechanisms are included

in the contract. Regular performance

evaluations must be rigorous, and

the owners right to terminate the

contract must be well defned.

An effective model for many

contracts is a cost plus incentive

fee structure, which covers costs

and provides a fee for bringing the

project to fruition on time or within

a budget range; this approach shares

the risk evenly between the owner

and the PMC. Although this type

of contract is a bit more complex

than the other two and not yet

common in the Middle East, such

performance and cost incentives are

commonly used in Europe and the

U.S. to align the objectives of the

owner and the PMC.

Nonfnancial Issues

There are several examples of

nonfnancial contract issues that

can have a signifcant impact on the

PMCs performance.

First, the scope of work must

be described thoroughly and

explicitly, including specifc tasks,

anticipated outcomes, and associated

deliverables. Without such clarity,

the owner has minimal recourse

7 Booz & Company

when disagreements arise over what

is required of the PMC to execute

the project. For example, if a quality

assurance function is not explicitly

required and detailed in the contract,

the owner will not be able to hold

the PMC accountable for lack of

oversight of contractor quality issues.

As a result, PMC contracts must

include a comprehensive set of

performance standards and metrics

that defne the measurement process

and the acceptable level of PMC

performance. The owner must

specify expectations on factors

such as timeliness, quality of work,

responsiveness, and contractor

management standards. If such

standards are not defned, there is no

way to establish and take action on

subpar performance. For instance,

an owner can require a certain

average number of days to review

design deliverables, set an average

number of days to solve urgent

issues, and specify a percentage of

milestones that need to be completed

on time during a certain period. It is

important to have a balanced set of

standards, covering both schedule and

quality, to ensure that the PMC does

not sacrifce either of those.

Additionally, contracts must make

staffng processes transparent, and

PMC personnel levels must be based

on workload. Unless the contract

is lump sum, the owner must have

some control over the number

of PMC staff to avoid escalating

staff costs. As part of contractual

negotiations, the owner and the

PMC should agree to a staffng

plan that details the PMCs tasks

and the level of effort required to

complete them. Changes to staffng

levels should be approved by the

owner. This is required for cost-plus

contracts, because the PMC will be

motivated to increase staffng levels

rather than improve performance of

existing personnel.

The owner and the PMC should agree

to a staffng plan that details the

PMCs tasks and the level of effort

required to complete them.

8 Booz & Company

Many owners are quick to use

a PMC without fully thinking

through what is required of their

organizations. It is important

to recognize that the owner of a

project always bears the ultimate

responsibilitygetting credit for

project success as well as blame

for failures. In the recent example

of the oil spill in the Gulf of

Mexico, it is not entirely clear what

happened or which companyBP

or its contractorsis to blame. But

regardless of who is at fault, BP is,

at the very least, bearing the brunt

of the negative publicity and the

resulting damage to its reputation

and brand.

If choosing to use a PMC, a project

owner must consider frst the

appropriate level of involvement

in day-to-day project management,

given its own capabilities and

manpower, the complexity of project

integration, and the knowledge that

the owner will need to retain within

the organization at the end of the

project. Second, the owner must

determine how to make decisions

effciently and what level of control

to delegate to the PMC.

Level of Involvement

Two distinct situations have

surfaced among many PMC-led

projectsone in which the owner

BUILDING

INTERNAL

CAPABILITIES

AND

ORGANIZATION

9 Booz & Company

is too involved in the daily program

management, performing duplicate

roles with the PMC, and one in

which the owner is too far removed

from the program management,

lacking any control over the

projects success.

In the first situation, the

responsibilities of the owner versus

the PMC are not defined clearly.

With blurred responsibilities, there

can be duplication of roles in the

two organizations, leading to a lack

of accountability. The Big Dig is

a notorious example of this: The

owner, Massachusetts Turnpike

Authority (MTA), had an internal

program management team that

worked as a partner with the PMC,

Bechtel/Parsons Brinckerhoff. This

duplication of roles resulted in no

supervising authority to hold the

program manager accountable

when a problem arose, it was

unclear who was accountable

because both the owner and the

PMC were functioning as program

manager.

5

When there is unclear

accountability, it is easy for cost

and schedule overruns to occur

as the owner and the PMC point

fingers at each other. In general,

when using a PMC, the owner

should assume the supervisory role,

overseeing the PMC and monitoring

the projects progress. The roles,

responsibilities, and governance

structure determined by the

operating model and spelled out in

the contract must be accounted for

within the organization.

In the second situation, owners

rely too heavily on the PMC

and underestimate their own

responsibilities. This also typically

results in cost and schedule

overruns; the PMC cannot be given

free rein because it has inherently

different objectives from the owner.

Again, this is true even in lump sum

contracts because the PMC may

cut corners or file excessive claims.

With blurred responsibilities, there

can be duplication of roles in the two

organizations, leading to a lack of

accountability.

10 Booz & Company

Once again, in its role as supervisor,

the owner should actively monitor

the PMCs performance and the

projects progress. This includes

a certain level of cost, schedule,

and quality auditing. It requires

that the owner have a small,

experienced staff capable of

performing the audits and asking

the right questions. Prior to hiring a

PMC and kicking off a project, the

owners should ensure these internal

capabilities are in place.

Owners need to retain control

over critical project decisions, such

as approvals of major changes to

scope and schedule or contractor

selection. These roles require a

certain level of program management

expertise and previous experience

to understand schedule and cost

trends, integration intricacies, risks

and quality issues, and contractor

agreements. These capabilities need

to be built without dramatically

expanding the workforce. The owner

can have a small staff comprising

experts in project controls; contracts;

engineering; construction; and health,

safety, and environment.

Decisions and Control

Furthermore, owners must establish a

clear, explicit, and effcient decision-

making chain for the project, both

between the PMC and the owner,

and within the owners organization.

Owners can delegate some decision-

making authority to the PMC in

11 Booz & Company

order to successfully execute the

project on time, based on dollar

amount or type of decision; the

maturity of the relationship and the

previous successes of the PMC will

determine how much control the

owner is willing to give up.

The key is to fnd a balance between

too much and too little authority.

For example, in a recent client

engagement, we encountered a

situation in which the PMC had no

monetary authority limit and had

to obtain client approval even on

$1 changes, delaying the projects

progress. Clearly, the owner here had

too much control, delegating almost

no authority to the PMC. But too

little control is equally problematic

for changes to the project that have

signifcant implications in terms of

cost, schedule, or scope, the PMC

must present the problem and

potential solutions to the owner, who

must make the fnal decision.

For a project to run smoothly

without schedule delays, this

control structure must be defned

before the PMC begins working.

A separate decision-making entity

(a small committee, for instance)

could facilitate project decisions.

Therefore, if approval from a board

is required for critical decisions, yet

that board meets only monthly, a

subset of the board members may

form a committee meeting weekly or

as necessary.

Owners must establish a clear, explicit,

and effcient decision-making chain,

both between the PMC and the owner,

and within the owners organization.

12 Booz & Company

Over the next 20 years, infrastructure

owners in the MENA region will make

massive investments in large projects.

Managing those projects will not

be a simple task: An overwhelming

number of large projects end up mired

in delays or over budget. As a result,

project owners will continue to turn

to professional program managers to

help them execute projects. That alone

is not enough. Signing up a PMC,

even a very good one with a strong

track record, does not guarantee

success. Project owners tend to

underestimate the amount of work

that needs to be done internallyeven

when bringing on a PMC.

To reap the benefts of engaging a

PMC and to increase the likelihood

of success, project owners need

to clearly defne the relationship

with the PMC up front. They

need to establish effective project

governance, enter into an effective

PMC contractwhich aligns all

parties interests and encourages

performanceand build internal

capabilities to track and monitor

the projects progress. Without

these measures in place, new

infrastructure projects are likely to

stumble over the same issues that

have plagued their predecessors.

CONCLUSION

13 Booz & Company

About the Authors

Eric Kronenberg is a partner

with Booz & Company

in Florham Park, N.J. He

specializes in developing

functional excellence

in program and project

management, engineering and

design, and manufacturing

and construction in multiple

industries, including aerospace

and defense, energy, and

transportation.

Fadi Majdalani is a partner with

Booz & Company in Beirut and

leads the frms transportation

practice in the Middle East. He

has advised on strategic and

operational topics for a number

of transport infrastructure

stakeholders, including

policymakers, regulators,

operators, and investors.

Ekaterina Arsenieva is

a senior associate with

Booz & Company in Dubai.

She specializes in market

assessment and strategy

development, strategic and

business planning, and

organizational development

and transformation for

public transport authorities,

investment entities,

infrastructure, transportation,

and logistics companies.

Jennifer Latka is a

senior associate with

Booz & Company in Florham

Park, N.J. She focuses on

improving organizational

effectiveness and operational

effciency for commercial

aerospace, defense, and

transportation companies.

Endnotes

1

Panama Canal Construction, 19031914, GlobalSecurity.org.

2

Bent Flyvbjerg, Cost Overruns and Demand Shortfalls in

Urban Rail and Other Infrastructure, Transportation Planning

and Technology, vol. 30, no. 1, February 2007 ; Raphael Lewis,

Big Dig overrun is just plain big, Boston Globe, July 14, 2002;

Raphael Lewis and Sean P. Murphy, Artery errors cost more than

$1b, Boston Globe, February 9, 2003.

3

Raphael Lewis, Big Dig overrun is just plain big, Boston Globe,

July 14, 2002; literature search; Booz & Company analysis.

4

International Monetary Fund; Global Insight 2009; MEED;

Zawya; Booz & Company analysis.

5

Completing the Big Dig: Managing the Final Stages of Bostons

Central Artery/Tunnel Project, The National Academies Press,

2003.

Booz & Company is a leading global management

consulting frm, helping the worlds top businesses,

governments, and organizations.

Our founder, Edwin Booz, defned the profession

when he established the frst management consulting

frm in 1914.

Today, with more than 3,300 people in 61 offces

around the world, we bring foresight and knowledge,

deep functional expertise, and a practical approach

to building capabilities and delivering real impact.

We work closely with our clients to create and deliver

essential advantage.

For our management magazine strategy+business,

visit www.strategy-business.com.

Visit www.booz.com to learn more about

Booz & Company.

The most recent

list of our offces

and affliates, with

addresses and

telephone numbers,

can be found on

our website,

www.booz.com.

Worldwide Offces

Asia

Beijing

Delhi

Hong Kong

Mumbai

Seoul

Shanghai

Taipei

Tokyo

Australia,

New Zealand &

Southeast Asia

Adelaide

Auckland

Bangkok

Brisbane

Canberra

Jakarta

Kuala Lumpur

Melbourne

Sydney

Europe

Amsterdam

Berlin

Copenhagen

Dublin

Dsseldorf

Frankfurt

Helsinki

Istanbul

London

Madrid

Milan

Moscow

Munich

Oslo

Paris

Rome

Stockholm

Stuttgart

Vienna

Warsaw

Zurich

Middle East

Abu Dhabi

Beirut

Cairo

Doha

Dubai

Riyadh

North America

Atlanta

Chicago

Cleveland

Dallas

DC

Detroit

Florham Park

Houston

Los Angeles

Mexico City

New York City

Parsippany

San Francisco

South America

Buenos Aires

Rio de Janeiro

Santiago

So Paulo

2010 Booz & Company Inc.

Potrebbero piacerti anche

- Nuts and Bolts of Project Management: Right Timing + Right Decision = SuccessDa EverandNuts and Bolts of Project Management: Right Timing + Right Decision = SuccessValutazione: 5 su 5 stelle5/5 (1)

- Implementation Guide On ICFR PDFDocumento67 pagineImplementation Guide On ICFR PDFVimal KumarNessuna valutazione finora

- Is 456 2000Documento114 pagineIs 456 2000Arun Verma100% (2)

- API Tank DesignDocumento189 pagineAPI Tank DesignDD3NZ91% (11)

- Management ReportingDocumento16 pagineManagement ReportingESTUTI AgarwalNessuna valutazione finora

- Oe Project Status Instructions: General InformationDocumento3 pagineOe Project Status Instructions: General Informationsayafrands6252Nessuna valutazione finora

- Sea Water IntakeDocumento29 pagineSea Water IntakeDanang Rahadian100% (1)

- Sea Water IntakeDocumento29 pagineSea Water IntakeDanang Rahadian100% (1)

- Hollow Sections Book WardenierDocumento199 pagineHollow Sections Book WardenierANUSSBAUMER100% (3)

- Rovuma LNG Project English PresentationDocumento45 pagineRovuma LNG Project English Presentationrahul nagareNessuna valutazione finora

- Capitalize Six Drivers Successful Capex Saving StrategiesDocumento12 pagineCapitalize Six Drivers Successful Capex Saving StrategiesMine BentachNessuna valutazione finora

- MAMansur 2006 Design of Reinforced Concrete Beams With Web Openings PDFDocumento17 pagineMAMansur 2006 Design of Reinforced Concrete Beams With Web Openings PDFvinthfNessuna valutazione finora

- Chapter-I: Capital BudgetingDocumento49 pagineChapter-I: Capital BudgetingYugandhar SivaNessuna valutazione finora

- Rail ConstructionDocumento74 pagineRail ConstructionChaithanya KumarNessuna valutazione finora

- Value Of Work Done A Complete Guide - 2020 EditionDa EverandValue Of Work Done A Complete Guide - 2020 EditionNessuna valutazione finora

- COP-WFP-WFD-29-2019-v2 Appendix A CWP Flowchart (54x34)Documento1 paginaCOP-WFP-WFD-29-2019-v2 Appendix A CWP Flowchart (54x34)Muhammad NaeemNessuna valutazione finora

- Infrastructure Americas Controls Management System: Planning & SchedulingDocumento4 pagineInfrastructure Americas Controls Management System: Planning & SchedulingkamlNessuna valutazione finora

- Chapter 10 PDFDocumento30 pagineChapter 10 PDFPandaNessuna valutazione finora

- Integrating Earned Value Management With CC ExecutionDocumento12 pagineIntegrating Earned Value Management With CC ExecutionAntonio CalcinaNessuna valutazione finora

- Hse Accountability FrameworkDocumento8 pagineHse Accountability FrameworkNisith SahooNessuna valutazione finora

- MOT-04210005-PR-02 - AWP Engineering and ProcurementDocumento52 pagineMOT-04210005-PR-02 - AWP Engineering and ProcurementpedroNessuna valutazione finora

- SPEED Update - PACEDocumento1 paginaSPEED Update - PACEANEESH KAVILNessuna valutazione finora

- Project Execution Excellence - On-Time and On-BudgetDocumento33 pagineProject Execution Excellence - On-Time and On-BudgetNilanjanBandyopadhyayNessuna valutazione finora

- Cost Premise - 2011Documento17 pagineCost Premise - 2011Olusegun OyebanjiNessuna valutazione finora

- Crack Width Calculation - Iit MadrasDocumento7 pagineCrack Width Calculation - Iit MadrasJeet DesaiNessuna valutazione finora

- Guide 05c - C and P Tactics DevelopmentDocumento25 pagineGuide 05c - C and P Tactics Developmentodunze1Nessuna valutazione finora

- CQA Plan - Full PDFDocumento75 pagineCQA Plan - Full PDFYedid AmqNessuna valutazione finora

- National Building Code 2005Documento1.161 pagineNational Building Code 2005api-2617216889% (47)

- Deliverables List For Projects in The Fertilizer Industry: Document Development GuidanceDocumento28 pagineDeliverables List For Projects in The Fertilizer Industry: Document Development GuidanceClément50% (2)

- MOU Jan22Documento8 pagineMOU Jan22Sujith Madatt ParambuNessuna valutazione finora

- Improvement and Efforts to Minimize Project DelaysDa EverandImprovement and Efforts to Minimize Project DelaysNessuna valutazione finora

- Dokumen - Tips - Epcprojectinterdepency and Work Flow 1pdfDocumento103 pagineDokumen - Tips - Epcprojectinterdepency and Work Flow 1pdfAhmed AggourNessuna valutazione finora

- WBI T06 Rev00 Management of ChangeDocumento2 pagineWBI T06 Rev00 Management of ChangeKunal SinghNessuna valutazione finora

- 13 Project ControlDocumento43 pagine13 Project Controlpranav guptaNessuna valutazione finora

- 6-Gorgon Project Downstream Execution OverviewDocumento19 pagine6-Gorgon Project Downstream Execution OverviewAnonymous TAkNn6Nessuna valutazione finora

- Notification LetterDocumento2 pagineNotification LetterMohammad Hadoumi SaldanNessuna valutazione finora

- PMT 10301Documento23 paginePMT 10301Yousef Adel HassanenNessuna valutazione finora

- AWP - E2E Approach - Rev 2Documento16 pagineAWP - E2E Approach - Rev 2PilarNessuna valutazione finora

- Project Presentation PDFDocumento13 pagineProject Presentation PDFMadhu KumarNessuna valutazione finora

- GPM OverviewDocumento158 pagineGPM OverviewSuresh MahalingamNessuna valutazione finora

- Project Risk Management Standard For Capital ProjectsDocumento16 pagineProject Risk Management Standard For Capital ProjectsAHMED AMIRA100% (1)

- CM-PE-902 Procedure For Progress and Performance Measurement PDFDocumento9 pagineCM-PE-902 Procedure For Progress and Performance Measurement PDFDavid PrastyanNessuna valutazione finora

- EP00 2 IntroductionDocumento6 pagineEP00 2 Introductionfisco4rilNessuna valutazione finora

- 9206 GE PP 001 Engineering Execution PlanDocumento14 pagine9206 GE PP 001 Engineering Execution PlanSyklik DataNessuna valutazione finora

- The Bechtel Report - 2016 PDFDocumento36 pagineThe Bechtel Report - 2016 PDFINZAMAM MUSHTAQNessuna valutazione finora

- Integrated Lean and Bim Processes For Modularised Construction - A Case StudyDocumento13 pagineIntegrated Lean and Bim Processes For Modularised Construction - A Case StudyJuan CorvalánNessuna valutazione finora

- Interface ScheduleDocumento6 pagineInterface Schedule19bcs 3769Nessuna valutazione finora

- Appropriate Contracting Strategy For Fast TrackDocumento7 pagineAppropriate Contracting Strategy For Fast TrackAsebaho BadrNessuna valutazione finora

- Presentacion Edward MerrowDocumento53 paginePresentacion Edward MerrowDaniel HuacoNessuna valutazione finora

- Chapter 5 - The Expenditure Cycle Purchasing To Cash DisbursementsDocumento3 pagineChapter 5 - The Expenditure Cycle Purchasing To Cash DisbursementsHads LunaNessuna valutazione finora

- Interface Engineer: Position Title Reports To DurationDocumento1 paginaInterface Engineer: Position Title Reports To DurationAnonymous ygQUvDKNessuna valutazione finora

- The Project For Capacity Development On Water Supply in Semi-Urban Areas in NepalDocumento221 pagineThe Project For Capacity Development On Water Supply in Semi-Urban Areas in NepalANKITNessuna valutazione finora

- (Buddy) TM7 - Lembaga Tabung HajiDocumento31 pagine(Buddy) TM7 - Lembaga Tabung HajiCIA190116 STUDENTNessuna valutazione finora

- Accenture Constructions Engineering Procurement US v1Documento12 pagineAccenture Constructions Engineering Procurement US v1Nilesh PatilNessuna valutazione finora

- Program and Project Developent and ManagementDocumento4 pagineProgram and Project Developent and ManagementBeñamine UbponNessuna valutazione finora

- Kick-Off - Codling Bank - Rev01Documento21 pagineKick-Off - Codling Bank - Rev01Rida DesyaniNessuna valutazione finora

- PO-GE-018 PROGRESS CONTROL ProcedureDocumento9 paginePO-GE-018 PROGRESS CONTROL ProcedureLUISNessuna valutazione finora

- PlannerTuts Decipher The Disaster 12 Primavera p6 Analysis TacticsDocumento28 paginePlannerTuts Decipher The Disaster 12 Primavera p6 Analysis TacticsDindimaNessuna valutazione finora

- Og&C Standard Work Process Procedure Welder Training and Instructor QualificationDocumento8 pagineOg&C Standard Work Process Procedure Welder Training and Instructor QualificationGordon LongforganNessuna valutazione finora

- PETROM Asset IntegrityDocumento18 paginePETROM Asset Integrityghostforever0Nessuna valutazione finora

- Omcl Management of ChangesDocumento7 pagineOmcl Management of ChangesHans LeupoldNessuna valutazione finora

- Using PDRI For Project Risk ManagementDocumento9 pagineUsing PDRI For Project Risk Management4jawwy markme026Nessuna valutazione finora

- CP 201Documento36 pagineCP 201kattabommanNessuna valutazione finora

- Escalation: Guidance Note 4Documento25 pagineEscalation: Guidance Note 4Marcos VendraminiNessuna valutazione finora

- CH 2 Project CycleDocumento16 pagineCH 2 Project CycleMebratu SimaNessuna valutazione finora

- Developing The Project PlanDocumento8 pagineDeveloping The Project PlanStephanie BucogNessuna valutazione finora

- Life Cycle Integrity Management: Pre-Feed & FeedDocumento1 paginaLife Cycle Integrity Management: Pre-Feed & FeedDana GuerreroNessuna valutazione finora

- 4D SchedulingDocumento6 pagine4D SchedulingPeterHesselbjergNessuna valutazione finora

- Minimum Technical Requirements (Indice Delle Norme Da Applicare in KSA)Documento183 pagineMinimum Technical Requirements (Indice Delle Norme Da Applicare in KSA)senkum279342100% (1)

- Impacted As-Planned Analysis Topic 6Documento13 pagineImpacted As-Planned Analysis Topic 6Ahmed MoubarkNessuna valutazione finora

- Piping and Instrumentation Diagram: Fixed Firewater System - Deluge Distribution Upper Deck / Main Deck System 53Documento1 paginaPiping and Instrumentation Diagram: Fixed Firewater System - Deluge Distribution Upper Deck / Main Deck System 53Mohd KhaidirNessuna valutazione finora

- DOE G 413.3-24 Planning and SchedulingDocumento70 pagineDOE G 413.3-24 Planning and SchedulingpedroNessuna valutazione finora

- Project Management Fundamentals CourseDocumento31 pagineProject Management Fundamentals CourseSachin ParmarNessuna valutazione finora

- Cop WFP TMP 14 2013 v1 Iwp PipingDocumento6 pagineCop WFP TMP 14 2013 v1 Iwp PipingAmine ElalliNessuna valutazione finora

- Is - 2062.2011 PDFDocumento17 pagineIs - 2062.2011 PDFN GANESAMOORTHYNessuna valutazione finora

- Sohar Seabury White Goods Mini ReportDocumento2 pagineSohar Seabury White Goods Mini ReportMadhu KumarNessuna valutazione finora

- Liebherr Brochure Duty Cycle Crawler Cranes HS Series EN PDFDocumento40 pagineLiebherr Brochure Duty Cycle Crawler Cranes HS Series EN PDFMadhu KumarNessuna valutazione finora

- Liebherr Brochure Duty Cycle Crawler Cranes HS Series EN PDFDocumento40 pagineLiebherr Brochure Duty Cycle Crawler Cranes HS Series EN PDFMadhu KumarNessuna valutazione finora

- Mooring Guidance For Tankers: Calling in Muuga HarbourDocumento23 pagineMooring Guidance For Tankers: Calling in Muuga HarbourulasNessuna valutazione finora

- Sohar Greater Sohar Industrial Zone Map A NewDocumento1 paginaSohar Greater Sohar Industrial Zone Map A NewMadhu KumarNessuna valutazione finora

- Sohar Greater Sohar Industrial Zone Map A New PDFDocumento1 paginaSohar Greater Sohar Industrial Zone Map A New PDFMadhu KumarNessuna valutazione finora

- Sohar Seabury White Goods Mini ReportDocumento2 pagineSohar Seabury White Goods Mini ReportMadhu KumarNessuna valutazione finora

- Sohar Seabury White Goods Mini ReportDocumento2 pagineSohar Seabury White Goods Mini ReportMadhu KumarNessuna valutazione finora

- Sohar Greater Sohar Industrial Zone Map A New PDFDocumento1 paginaSohar Greater Sohar Industrial Zone Map A New PDFMadhu KumarNessuna valutazione finora

- Formulas 1 - Section Properties(Area, Section Modulus, Moment of Inertia, Radius of Gyration) Structural calculation, strength of materials PDFDocumento4 pagineFormulas 1 - Section Properties(Area, Section Modulus, Moment of Inertia, Radius of Gyration) Structural calculation, strength of materials PDFMadhu KumarNessuna valutazione finora

- TenderDPRSatellite PDFDocumento70 pagineTenderDPRSatellite PDFMadhu KumarNessuna valutazione finora

- R Sohar Construction Permit PDFDocumento27 pagineR Sohar Construction Permit PDFMadhu KumarNessuna valutazione finora

- Sohar Seabury White Goods Mini ReportDocumento2 pagineSohar Seabury White Goods Mini ReportMadhu KumarNessuna valutazione finora

- Sohar Greater Sohar Industrial Zone Map A NewDocumento1 paginaSohar Greater Sohar Industrial Zone Map A NewMadhu KumarNessuna valutazione finora

- R Sohar Construction Permit PDFDocumento27 pagineR Sohar Construction Permit PDFMadhu KumarNessuna valutazione finora

- Formulas 1 - Section Properties(Area, Section Modulus, Moment of Inertia, Radius of Gyration) Structural calculation, strength of materials PDFDocumento4 pagineFormulas 1 - Section Properties(Area, Section Modulus, Moment of Inertia, Radius of Gyration) Structural calculation, strength of materials PDFMadhu KumarNessuna valutazione finora

- 6125 Low Alloyed Steel For Casting SCM25: Scana Steel Stavanger AsDocumento1 pagina6125 Low Alloyed Steel For Casting SCM25: Scana Steel Stavanger AsMadhu KumarNessuna valutazione finora

- 090151b2801f641c PDFDocumento93 pagine090151b2801f641c PDFMadhu KumarNessuna valutazione finora

- Infram, Pobox 688, 7500 Ar EnschedeDocumento15 pagineInfram, Pobox 688, 7500 Ar EnschedeMadhu KumarNessuna valutazione finora

- SBD For Procurement - of - Works - ICB - Two Envelope August 2019Documento118 pagineSBD For Procurement - of - Works - ICB - Two Envelope August 2019ANup GhiMireNessuna valutazione finora

- Disclosable Version of The ISR Vietnam Enhancing Teacher Education Program P150060 Sequence No 10Documento10 pagineDisclosable Version of The ISR Vietnam Enhancing Teacher Education Program P150060 Sequence No 10Linh TômNessuna valutazione finora

- 63189eac Compendium of Opinions Vol38Documento365 pagine63189eac Compendium of Opinions Vol38Arun Uae100% (1)

- Pri External Increase Tution Fee ApplicationDocumento2 paginePri External Increase Tution Fee ApplicationEvelyn MaligayaNessuna valutazione finora

- JCPS Complete AuditDocumento301 pagineJCPS Complete AuditCourier JournalNessuna valutazione finora

- 01-Sta - mariaIS2021 Audit ReportDocumento107 pagine01-Sta - mariaIS2021 Audit ReportAnjo BrillantesNessuna valutazione finora

- Engagement Letter TemplateDocumento1 paginaEngagement Letter TemplateKopi BrisbaneNessuna valutazione finora

- Chapter-1: Alleppy Co-Operative Spinning MillDocumento61 pagineChapter-1: Alleppy Co-Operative Spinning MillPrejin T Radhakrishnan100% (3)

- Written Assignment Week 4Documento5 pagineWritten Assignment Week 4Thai50% (2)

- Invoice TemplateDocumento1 paginaInvoice TemplateSami Shahid Al IslamNessuna valutazione finora

- SATU Annual Report 2018Documento187 pagineSATU Annual Report 2018sinta nuriaNessuna valutazione finora

- GalwaypcDocumento46 pagineGalwaypcthestorydotieNessuna valutazione finora

- LIC AR 2018 19 Final Web PDFDocumento344 pagineLIC AR 2018 19 Final Web PDFArshdeep KaurNessuna valutazione finora

- Ib Act of Foundation 2017 enDocumento3 pagineIb Act of Foundation 2017 enAghora Kali Peetham DeccanNessuna valutazione finora

- Finance Department Notifications 2006 323 549 PDFDocumento116 pagineFinance Department Notifications 2006 323 549 PDFnonoo macNessuna valutazione finora

- Kaiser Tax Sheltered Annuity 5500 For 2010Documento38 pagineKaiser Tax Sheltered Annuity 5500 For 2010James LindonNessuna valutazione finora

- Managing Director (1 Post) : Advertisement For Vacant PositionsDocumento3 pagineManaging Director (1 Post) : Advertisement For Vacant PositionsMichael LangatNessuna valutazione finora

- Voucher Payable System Report 2Documento10 pagineVoucher Payable System Report 2Krssh Kt DgNessuna valutazione finora

- Standards On Auditig Q& ADocumento27 pagineStandards On Auditig Q& Ageetha sai bodapatiNessuna valutazione finora

- Chapter Based Study Plan S.no. Chapter Size/Time ConsumptionDocumento13 pagineChapter Based Study Plan S.no. Chapter Size/Time ConsumptionchitraNessuna valutazione finora

- CMO No. 27, Series of 2017 - Revised Policies, Standards and Guidelines For Bachelor of Science in Accountancy (BSA)Documento10 pagineCMO No. 27, Series of 2017 - Revised Policies, Standards and Guidelines For Bachelor of Science in Accountancy (BSA)apacedera689Nessuna valutazione finora

- Audit Cash BalanceDocumento19 pagineAudit Cash BalanceAjisetiawans0% (2)

- ch07 PPT Moroney 2eDocumento37 paginech07 PPT Moroney 2eXuanChengyiTommyNessuna valutazione finora

- Bir Rao 01 03Documento3 pagineBir Rao 01 03Benedict Jonathan BermudezNessuna valutazione finora

- UBT MatsDocumento28 pagineUBT MatsMichael ArciagaNessuna valutazione finora