Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Raw Material Requirements and Production Schedule for Fly Ash Brick Manufacturing Plant

Caricato da

Tejas KotwalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Raw Material Requirements and Production Schedule for Fly Ash Brick Manufacturing Plant

Caricato da

Tejas KotwalCopyright:

Formati disponibili

Time

Activities

Purchase of Land

Company Registration

Approval & Sanction Loan

Planning & Construction of plant

Machine Ordering & Installation

Trial Runs & Training

SCHEDULE OF ACTIVITIES FOR THE INITIAL 2 MONTHS IN YEAR-1

10 Days

INTIAL GESTATION PERIOD : 2 MONTHS

10 Days

SCHEDULE OF ACTIVITIES FOR THE INITIAL 2 MONTHS IN YEAR-1

10 Days 10 Days 10 Days 10 Days

INTIAL GESTATION PERIOD : 2 MONTHS

Sr. No.

Particulars Quantity

Tonne

Rate Per

tonne

Consumpt

ion Per

Unit

Value of

Raw

material

1 Fly Ash 1,710 50 0.57 85,500

2

Stone

dust/Sand 660 2,000 0.22 1,320,000

3 Gypsum 150 300 0.05 45,000

4 Sludge Lime 480 2,200 0.16 1,056,000

Total 2,506,500

Raw material Requirement for Remaining years

Particulars

Quantity

Rate per

tonne Total Cost Quantity

Rate per

tonne Total Cost Quantity

Fly Ash 2,298 53.5 122,943 2,627 57 150,383 2,955

Stone

dust/Sand 887 2,140 1,898,180 1,014 2,290 2,321,857 1,140

Gypsum 202 321 64,842 230 343 78,998 259

Sludge Lime 645 2,354 1,518,330 737 2,519 1,856,341 829

Total 3,604,295 4,407,579

2nd Year 3rd Year 4th Year

Raw Materials For 1st year

Transportation

cost per tonne

Total cost

incurred in

1st year

Total cost

incurred in

2nd year

Total cost

incurred in

3rd year

Total cost

incurred in

4th year

Total cost

incurred in

5th year

50 85,500 122,943 150,383 181,000 215,167

100 66,000 94,909 116,093 139,655 166,078

800 120,000 172,912 210,662 253,829 302,007

300 144,000 207,045 253,137 304,668 362,566

Total 415,500 597,809 730,274 879,152 1,045,819

Rate per

tonne Total Cost Quantity

Rate per

tonne Total Cost

61 181,000 3,283 66 215,167

2,450 2,793,098 1,267 2,622 3,321,557

368 95,186 288 393 113,253

2,695 2,234,233 922 2,884 2,658,819

5,303,517 6,308,796

4th Year 5th Year

Transportation cost incurred

Notes

Sand

10/- per

cubic Ft.

Available

from Bina

From Wani, near nagpur

Sr. no. Particular Units

Unit

Price(Rs) Total Cost

1 Plant and Building

Land (sq.ft.) 15000 300,000

Civil work

Boundary

wall,Gate+Borewell

digging 125,000

total for civil

work

Civil work

Work shed + land

development(sq. ft.) 150,000 275,000

Total 575,000

2 Machinery

Fly ash Brick Machine 1 500,000 500,000

Pan Mixture 1 400,000 400,000

Conveyor 1 255,000 255,000

Hydraulic pallet truck 2 40,000 80,000

Borewell Motor 1 20,000 20,000

Total Of machinery 1,255,000

3

Office furniture and

fixtures 50,000

4 Electrification 25,000

5

Preliminary

expenses 100,000

6

Initial Working

capital expenditure 794,347

Total capital

Expenditure 2,799,347

Gross

Block

1,905,000

11.21%

Serial

Number

Labour Number Unit Cost

Total Cost (Per

Month)

Total Cost (Per

Annum Year 1)

Number

1 Plant supervisor 1 7,000 7,000 70000 1

2

Machine

operator 2 5,500 11,000 110,000 2

3 Helper(unskilled) 7 4,500 31,500 315,000 9

Sub Total 10 49,500 495,000

Total Cost (Per

Annum Year 2)

Number

Total Cost (Per

Annum Year 3)

Number

Total Cost (Per

Annum Year 4)

Number

Total Cost (Per

Annum Year 5)

92,400 2 203,280 2 223,608 2 245,969

145,200 3 239,580 3 263,538 3 289,892

534,600 10 653,400 12 862,488 14 1,106,860

772,200 1,096,260 1,349,634 1,642,720

Sr No

Machine

Name

Number of

machines

(HP)

connected

kW/Units

per hour

Total

working

hours per

day

Rate

per unit

for 1st

year

Cost per

day for 1st

year

Working

days per

year

1

Fly ash Brick

Machine 1 20 14.92 8 6.8 812 300

2 Pan Mixture 1 10 7.46 8 6.8 406 300

3 Conveyor 1 3 2.238 8 6.8 122 300

4

Borewell

motor 1 2 1.492 1 6.8 10 300

Total 26.11 1,349

Total cost

incurred in 1st

year

Rate per unit

for 2nd year

Total cost

incurred in

2nd year

Rate per unit

for 3rd year

Total cost

incurred in 3rd

year

Rate per unit

for 4th year

Total cost

incurred in 4th

year

202,912 7.3 260,539 7.8 278,777 8.3 298,291

101,456 7.3 130,270 7.8 139,388 8.3 149,146

30,437 7.3 39,081 7.8 41,817 8.3 44,744

2,536 7.3 3,257 7.8 3,485 8.3 3,729

337,341 433,146 463,466 495,909

Rate per unit

for 5th year

Total cost

incurred in 5th

year

9.1 325,674

9.1 162,837

9.1 48,851

9.1 4,071

541,433

Serial

Number Labour Units Unit Cost

Total Cost

(Per

Month)

Total Cost

(Per Annum

Year 1)

Total Cost

(Per Annum

Year 2)

1 Watchman 1 4,500 4,500 45,000 59,400

2 Salesman 1 7,000 7,000 70,000 184,800

3 Telephone expenses 500 5,000 6,600

4 Misc. electricity 1,500 15,000 19,800

5 Office supplies 25,000 5,500

6 Insurance 20,000 22,000

7 Maintenance cost 15,250 20,130

8 Director's salary 2 20,000 40,000 400,000 528,000

Total 595,250 846,230

Total Cost

(Per Annum

Year 3)

Total Cost

(Per Annum

Year 4)

Total Cost

(Per Annum

Year 5)

65,340 71,874 79,061

203,280 335,412 368,953

7,260 7,986 8,785

21,780 23,958 26,354

6,050 6,655 7,321

24,200 26,620 29,282

22,143 24,357 26,793

580,800 638,880 702,768

930,853 1,135,742 1,249,317

Depreciation as per companies act 1956

Particular Rate Cost 1st year(2014) 2nd year 3rd year 4th year

Plant 13.91% 300,000 34,775 36,893 31,761 27,343

Civil work 10.00% 300,000 25,000 27,500 24,750 22,275

Machinery 13.91% 1,255,000 145,475 154,335 132,867 114,385

Office

Furniture 18.10% 50,000 7,542 7,685 6,294 5,155

Depreciation 212,792 226,413 195,672 169,158

Depreciation according to IT act

Particular Rate Cost 1st year 2nd year 3rd year 4th year

Plant 13.91% 300,000 34,775 36,893 31,761 27,343

Civil work 10.00% 300,000 25,000 27,500 24,750 22,275

Machinery 15.00% 1,255,000 156,875 164,719 140,011 119,009

Office

Furniture 10.00% 50,000 4,167 4,583 4,125 3,713

Depreciation 220,817 233,695 200,647 172,340

5th year

23,540

20,048

98,474

4,222

146,283

5th year

23,540

20,048

101,158

3,341

148,086

Particulars Percentage Amount

Owner's

Capital 30% of FA 571,500

Term loan 70% of FA 1,333,500

Total 1,905,000

1st year 2nd year 3rd year 4th year 5th year

Particulars

Cash credit 595,761 526,150 0 0 0

Owner's

contribution 198,587 526,150 1,313,029 1,549,827 1,797,116

Total 794,347 1,052,299 1,313,029 1,549,827 1,797,116

Total capital

expenditure

generated 2,699,347

Fixed assests financing

Working capital financing

fixed assest financing 571,500

WC financing 198,587

Total 1,070,087

Total of Owner's Capital

Serial Number

Particulars Period(month)

Year 1

(62.5 %

Capacity)

1 Current Assets

Raw Material Stock 1 208,875

WIP 0.5 90,427

Finished Goods 0.5 163,920

Debtors 1 540,000

Total 1,003,222

2 Current Liabilities

Creditors 1 208,875

Total 208,875

Net Working Capital Requirement 794,347

permissible bank finance(maximum 75%) at 14% 595,761

Owner's contribution(25%) 198,587

Interest on working capital 14% 69,505

Year 2

(70% Capacity)

Year 3

(80% Capacity)

Year 4

(90%

Capacity)

Year 5

(100% Capacity)

300,358 367,298 441,960 525,733

130,261 161,615 193,620 212,619

256,758 315,062 378,721 446,013

665,280 836,352 977,486 1,138,484

1,352,657 1,680,327 1,991,787 2,322,849

300,358 367,298 441,960 525,733

300,358 367,298 441,960 525,733

1,052,299 1,313,029 1,549,827 1,797,116

526,150 - - -

526,150 1,313,029 1,549,827 1,797,116

73,661 - - -

Year 1 2 3 4

Rate 3.60 3.96 4.36 4.79

Capacity Utilization 62.50% 70% 80% 85%

Total Production 1,410,000 2,005,200 2,289,600 2,440,800

Revenue Generated 5,076,000 7,940,592 9,973,498 11,695,337

Estimated production 1,500,000 2,016,000 2,304,000 2,448,000

Per day production 6,000 6,720 7,680 8,160

Closing stock for the year 90,000 100,800 115,200 122,400

Total Production 1,410,000 2,005,200 2,289,600 2,440,800

5

5.27

90%

2,584,800

13,623,860

100% utilization

2,592,000 2,880,000

8,640

129,600

2,584,800

Particulars

Amount per year

1 (in Rs.)

Amount per year

2 (in Rs.)

Amount per

year 3 (in Rs.)

Opening Stock of Raw Materials 0 208,875 300,358

Add Purchase of Raw Material 2,506,500 3,604,295 4,407,579

Add Purchasing Expenses on Raw Material 415,500 597,809 730,274

Less Closing Stock of Raw Materials 208,875 300,358 367,298

RAW MATERIAL CONSUMED 2,713,125 4,110,621 5,070,913

Add Direct Wages 495,000 772,200 1,096,260

PRIME COST 3,208,125 4,882,821 6,167,173

Add Factory Overheads 337,341 433,146 463466.3279

Add opening WIP 0 90,427 130,261

Less Closing WIP 90,427 130,261 161,615

WORKS COST/Factory cost 3,455,039 5,276,133 6,599,286

Add Administration Overheads

COST OF PRODUCTION 3,455,039 5,276,133 6,599,286

Add Opening Stock of Finished Goods 0 163,920 256,758

Less Closing Stock of Finished Goods 163,920 256,758 315,062

COST OF GOODS SOLD 3,291,119 5,183,295 6,540,982

Add SGA 595,250 846,230 930,853

COST OF SALES 3,886,369 6,029,525 7,471,835

SALES 5,076,000 7,940,592 9,973,498

Unit Cost 2.76 3.01 3.26

SP 3.60 3.96 4.36

Per unit Value Addition 1.41 1.86 2.11

Per unit VAT(4%) (margin included in profit) 0.06 0.07 0.08

Cost Sheet

Amount per

year 4 (in Rs.)

Amount per

year 5 (in Rs.)

367,298 441,960

5,303,517 6,308,796

879,152 1,045,819

441,960 525,733

6,108,008 7,270,841

1,349,634 1,642,720

7,457,642 8,913,561

495,909 541,433

161,615 193,620

193,620 212,619

7,921,545 9,435,995

7,921,545 9,435,995

315,062 378,721

378,721 446,013

7,857,887 9,368,703

1,135,742 1,249,317

8,993,629 10,618,019

11,695,337 13,623,860

3.68 4.11

4.79 5.27

2.26 2.43

0.09 0.10

Term Loan Interest

1,333,500 13.50%

Year Interest Loan yet to be repaid Principal repayment

1 150,019 933,500 400,000

2 126,023 333,500 600,000

3 45,023 - 333,500

4 - - -

5 - - -

SR.NO PARTICULARS Year 1 Year 2

1 INCOME

Sales 5,076,000 7,940,592

VAT(4%) 79,637 149,540

NET SALES 4,996,363 7,791,052

2 EXPENDITURE

Raw Materials 2,506,500 3,604,295

Tranportation 415,500 597,809

Wages 495,000 772,200

Power 337,341 433,146

SGA 595,250 846,230

Total 4,349,591 6,253,680

3 PROFIT BEFORE INTEREST, DEP and TAX. 646,772 1,537,372

Depreciation 212,792 226,413

PROFIT BEFORE INTEREST and TAX. 433,980 1,310,960

4 less: Interest on term loan 150,019 126,023

less: Interest on WC 69,505 73,661

5 PROFIT BEFORE TAX 214,456 1,111,276

Tax(32.4%) 69,484 360,054

6 PROFIT AFTER TAX 144,972 751,223

7 DIVIDEND 0 40,000

8 DDT (@15%) 0 6,000

9 TRANSFER TO RESERVES AND SURPLUS 36,243 187,806

10 To Net Profit 108,729 517,417

PROJECTED PROFIT AND LOSS ACCOUNT

Year 3 Year 4 Year 5

9,973,498 11,695,337 13,623,860

193,426 220,507 250,770

9,780,072 11,474,831 13,373,091

4,407,579 5,303,517 6,308,796

730,274 879,152 1,045,819

1,096,260 1,349,634 1,642,720

463,466 495,909 541,433

930,853 1,135,742 1,249,317

7,628,433 9,163,955 10,788,084

2,151,639 2,310,876 2,585,007

195,672 169,158 146,283

1,955,967 2,141,718 2,438,724

45,023 0 0

0 0 0

1,910,945 2,141,718 2,438,724

619,146 693,917 790,147

1,291,799 1,447,801 1,648,577

200,000 200,000 400,000

30,000 30,000 60,000

322,950 361,950 412,144

738,849 855,851 776,433

Balance Sheet

SR. NO. PARTICULARS Year 1 Year 2

SOURCES OF FUNDS:

1 Owner's Capital

a) Capital 1,070,087 1,070,087

b) Net Profit(By P&L) 108,729 626,146

c) Reserves and Surplus 36,243 224,049

2 a) Term Loan from Bank 933,500 333,500

b) Cash Credit 595,761 526,150

c) Creditors 208,875 300,358

TOTAL 2,953,195 3,080,289

APPLICATION OF FUNDS:

1 FIXED ASSETS

a) Gross block 1,905,000 1,692,208

b) Depreciation 212,792 226,413

c) Net block 1,692,208 1,465,795

2 INVESTMENTS

3 CURRENT ASSETS

Inventories 463,222 687,377

Sundry debtors 540,000 665,280

Cash and bank balance 257,764 261,837

Loans & Advances

Total 1,260,987 1,614,494

TOTAL 2,953,195 3,080,289

Year 3 Year 4 Year 5

1,070,087 1,070,087 1,070,087

1,364,995 2,220,846 2,997,279

546,998 908,949 1,321,093

0 0 0

0 0 0

367,298 441,960 525,733

3,349,379 4,641,842 5,914,192

1,465,795 1,270,123 1,100,965

195,672 169,158 146,283

1,270,123 1,100,965 954,682

843,975 1,014,301 1,184,365

836,352 977,486 1,138,484

398,928 1,549,089 2,636,661

2,079,255 3,540,876 4,959,510

3,349,379 4,641,842 5,914,192

Year 1 Year 2 Year 3

Net profit before tax 214,456 1,111,276 1,910,945

add: Transfer to Reserve - - -

Adjustment for:

add: Depreciation 212,792 226,413 195,672

add: Preliminary Expenses 100,000 - -

add: Interest on Term Loan 150,019 126,023 45,023

add: Interest on Working Capital Loan 69,505 73,661 -

Operating profit before working capital

changes 746,772 1,537,372 2,151,639

Working capital changes:

Trade receivables(-) 540,000 125,280 171,072

Inventories(-) 463,222 224,155 156,598

Trade payables(+) 208,875 91,483 66,940

Cash generated from operating

activities: -47,575 1,279,420 1,890,910

Direct tax paid(-) 69,484 360,054 619,146

Net cash flow from operating activities -117,059 919,367 1,271,764

Cash flow from investing activities:

Purchase of fixed assets(-) 1,905,000 - -

Sale of fixed assets (+) - - -

Preliminary expenses (-) 100,000 - -

Net cash flow from investing activities -2,005,000 -

Cash flow from financing activites:

Term Loan 1,333,500 - -

Promoter's Funds 1,070,087 - -

Loan Repayment(-) 400,000 600,000 333,500

Interest on Term Loan(-) 150,019 126,023 45,023

Interest on Working Capital Loan(-) 69,505 73,661 -

Dividend paid (-) - 46,000 230,000

Net cash flow from financing activities 1,784,063 -845,683 -608,523

Total -337,996 73,683 663,241

PROJECTED CASH FLOW STATEMENT

Cash at beginning of the year (+) - 257,764 261,837

New Cash Credit (for WC) (+) 595,761 526,150 -

Previous Cash Credit (for WC) (-) 595,761 526,150

Total 257,764 261,837 398,928

Year 4 Year 5

2,141,718 2,438,724

- -

169,158 146,283

- -

- -

- -

2,310,876 2,585,007

141,134 160,998

170,326 170,064

74,662 83,773

2,074,077 2,337,718

693,917 790,147

1,380,161 1,547,572

- -

- -

- -

- -

- -

- -

0 -

- -

230,000 460,000

-230,000 -460,000

1,150,161 1,087,572

PROJECTED CASH FLOW STATEMENT

398,928 1549089

- -

- -

1,549,089 2,636,661

Total per unit Total per unit

R.M. 2,506,500 1.78 4,110,621 2.05

Labour 495,000 0.35 772,200 0.39

Electricity 337,341 0.24 433,146 0.22

Overheads 595,250 0.42 846,230 0.42

Total variable cost 3,934,091 2.79 6,162,197 3.07

S.P. 3.60 3.96

Contribution 1,141,909 0.81 1,778,395 0.89

Total Contribution

Fixed Cost

BEP (Period)

MARGINAL COSTING

Particulars

Year 1 Year 2

1,905,000

1 year 5 months 4 days

1141909 1778395

Total per unit Total per Unit Total per Unit

5,070,913 2.21 6,108,008 2.50 7,270,841 2.81

1,096,260 0.48 1,349,634 0.55 1,642,720 0.64

463,466 0.20 495,909 0.20 541,433 0.21

930,853 0.41 1,135,742 0.47 1,249,317 0.48

7,561,492 3.30 9,089,293 3.72 10,704,310 4.14

4.36 4.79 5.27

2,412,005 1.05 2,606,044 1.07 2,919,550 1.13

MARGINAL COSTING

Year 3 Year 4 Year 5

1,905,000

1 year 5 months 4 days

2412005 2606044 2,919,550

Particulars Cost Amount WACC Amount WACC

Equity 16% 1,070,087 1,070,087

Debt 9.13% 1,333,500 933500

Cash credit 9.46% 595,761 526,150

Year CFAT Depreciation CFAT + Dep. DF (1/(1+WACC))PVCF

0 -1,905,000 -1,905,000 1.00 -1,905,000

1 144,972 312,792 457,764 0.90 410,015

2 751,223 226,413 977,635 0.80 777,919

3 1,291,799 195,672 1,487,471 0.67 994,374

4 1,447,801 169,158 1,616,959 0.55 893,032

5 1,648,577 146,283 1,794,860 0.48 854,556

3,929,897

2,024,897

WACC Calculation

Year1 Year2

Profitability Index 2.06

NET PRESENT VALUE (NPV) CALCULATION (DISCOUNTED PAYBACK PERIOD)

Present value of cash inflows

NPV

12.10%

Discounted pay-back period 2 Year 8 months 20 days

11.65%

Amount WACC Amount WACC Amount WACC

1,070,087 1,070,087 1,070,087

333500 0 0

0 0 0

Year CFAT Depreciation CFAT + Dep. CF Cumulative CF

0 -1,905,000 - -1,905,000 -1,905,000 -1,905,000

1 144,972 312,792 457,764 457,764 457,764

2 751,223 226,413 977,635 977,635 1,435,400

3 1,291,799 195,672 1,487,471 1,487,471 2,922,870

4 1,447,801 169,158 1,616,959 1,616,959 4,539,829

5 1,648,577 146,283 1,794,860 1,794,860 6,334,690

6,334,690

4,429,690

Payback Period

WACC Calculation

year3 year4 year5

PAYBACK PERIOD CALCULATION

Present value of cash inflows

NPV

14.37% 16.00% 16.00%

1 year 11 months 27 days

Particulars Amount

Total equity (Rs.) 1,070,087

Face value of each share (Rs.) 1

Total shares 1,070,087

Number of promoters 4

Shares per promoter 267,522

SHAREHOLDING PATTERN

Year 1 Year 2 Year 3 Year 4

% of face value 0% 4% 19% 19%

Dividend per promoter - 10,000 50,000 50,000

Total dividend payout - 40,000 200,000 200,000

DIVIDEND PAYOUT

Year 5

37%

100,000

400,000

DIVIDEND PAYOUT

EQUITY AND LIABILITIES

Shareholders funds

Share capital 1,070,087

Reserves and surplus 36,243

By P&L Balance (Net Profit) 108,729

1,215,059

Non-current liabilities

Long-term borrowings 933,500

Other long-term liabilities -

Long-term provisions -

933,500

Current liabilities

Short-term borrowings 595,761

Trade payables 208,875

Other current liabilities -

Short-term provisions -

804,636

TOTAL 2,953,195

ASSETS

Non-current assets

Fixed assets

Tangible assets 1,692,208

Intangible assets -

Capital work-in-progress -

Intangible assets under development -

1,692,208

Non-current investments -

Long-term loans and advances -

Other non-current assets -

1,692,208

Current assets

Current investments -

Inventories 463,222

Trade receivables 540,000

Cash and bank balances 257,764

Loss (Current Year) -

By P&L Balance (Net Loss) -

1,260,987

Orient maufacturing Pvt. Ltd.

In Rs.

Years Year 1

TOTAL 2,953,195

1,070,087 1,070,087 1,070,087

224,049 546,998 908,949

626,146 1,364,995 2,220,846

1,920,282 2,982,080 4,199,882

333,500 - -

- - -

- - -

333,500 - -

526,150 - -

300,358 367,298 441,960

- - -

- - -

826,508 367,298 441,960

3,080,289 3,349,379 4,641,842

1,465,795 1,270,123 1,100,965

- - -

- - -

- - -

1,465,795 1,270,123 1,100,965

- - -

- - -

- - -

1,465,795 1,270,123 1,100,965

- - -

687,377 843,975 1,014,301

665,280 836,352 977,486

261,837 398,928 1,549,089

- -

- - -

1,614,494 2,079,255 3,540,876

Orient maufacturing Pvt. Ltd.

In Rs.

Year 2 Year 3 Year 4

3,080,289 3,349,379 4,641,842

1,070,087

1,321,093

2,997,279

5,388,459

-

-

-

-

-

525,733

-

-

525,733

5,914,192

954,682

-

-

-

954,682

-

-

-

954,682

-

1,184,365

1,138,484

2,636,661

-

-

4,959,510

Orient maufacturing Pvt. Ltd.

In Rs.

Year 5

5,914,192

Ratios Year 1 Year 2 Year 3 Year 4

Debt-equity 0.87 0.31 0.00 0.00

Interest coverage ratio 1.98 6.57 43.44 0.00

Current ratio 1.57 1.95 5.66 8.01

Quick ratio 0.99 1.12 3.38 5.72

Inventory turnover 8.10 7.87 7.94 7.92

Debtors turnover 9.40 11.94 11.93 11.96

Working capital turnover 6.29 7.40 7.45 7.40

Fixed assets turnover 2.95 5.32 7.70 10.42

Operating profit margin 24.86% 30.59% 31.52% 30.04%

EBIT margin 8.69% 16.83% 20.00% 18.66%

Net profit margin 2.90% 9.64% 13.21% 12.62%

Return on equity 13.55% 70.20% 120.72% 135.30%

Return on net worth 11.93% 39.12% 43.32% 34.47%

Return on investment 6.75% 33.33% 43.32% 34.47%

FUNDAMENTALS

Year 5

0.00

0.00

9.43

7.18

8.05 COP/Inventory

11.97 sales/receivables

7.44 Net Sales/Working capital requirement

14.01 Net Sales/ Net block Net Block= Tangible Assets

28.67% Operating Profit/Net Sales

18.24% EBIT/Net Sales

12.33% EAT/Net Sales

154.06% EAT/Share Capital

30.59% EAT/Share holder's funds

30.59% EAT/Sources of Funds

FUNDAMENTALS

Potrebbero piacerti anche

- Entry Strategy Into Green Construction For Mahindra EPC: Team: Rebel Yell Campus Name: IIM BangaloreDocumento39 pagineEntry Strategy Into Green Construction For Mahindra EPC: Team: Rebel Yell Campus Name: IIM BangaloreSaurabh DwivediNessuna valutazione finora

- Marketing Plan of EMCODocumento21 pagineMarketing Plan of EMCOM HABIBULLAH100% (1)

- Heading / Description: 1 - EARTHWORK, FILLING AND CONCRETINGDocumento9 pagineHeading / Description: 1 - EARTHWORK, FILLING AND CONCRETINGUmakant AryaNessuna valutazione finora

- Home Loan Vs Rent Calc 1Documento38 pagineHome Loan Vs Rent Calc 1Sathish KandasamyNessuna valutazione finora

- O & M Estimate KC-29 (531+000 To 785+000) 10.2.2022Documento465 pagineO & M Estimate KC-29 (531+000 To 785+000) 10.2.2022Muhammad TufailNessuna valutazione finora

- COMPARISON OF QUARRY COSTSDocumento111 pagineCOMPARISON OF QUARRY COSTSmaddumasooriyaNessuna valutazione finora

- Solar FeasibilityDocumento17 pagineSolar FeasibilitySteven BurnsNessuna valutazione finora

- UntitledDocumento18 pagineUntitledrahmat setiawanNessuna valutazione finora

- Fixed Chimney-Bull's Trench KilnDocumento9 pagineFixed Chimney-Bull's Trench KilnadagooodNessuna valutazione finora

- Model-Generated Data AnalysisDocumento24 pagineModel-Generated Data AnalysisJerry K Floater0% (2)

- Raw EO stream data analysis and glycol concentration resultsDocumento2 pagineRaw EO stream data analysis and glycol concentration resultsKaRol PadillaNessuna valutazione finora

- Daily production and dispatch reportDocumento4 pagineDaily production and dispatch reportvamsiNessuna valutazione finora

- Improved Clay Brick ProductionDocumento4 pagineImproved Clay Brick ProductionBrajesh SumanNessuna valutazione finora

- Model GP Building EstimateDocumento153 pagineModel GP Building Estimatekalyan_kolaNessuna valutazione finora

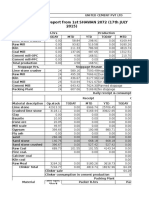

- Daily Production Report From 1st SHAWAN 2072 (17th JULY 2015)Documento6 pagineDaily Production Report From 1st SHAWAN 2072 (17th JULY 2015)Vinod Kumar VermaNessuna valutazione finora

- Production Report Production (MT) : On Date Month On Date MonthDocumento15 pagineProduction Report Production (MT) : On Date Month On Date MonthMahla Raj KumarNessuna valutazione finora

- SCZ1 - 02 - NSB Toko - 0223Documento200 pagineSCZ1 - 02 - NSB Toko - 0223Haaikal TrNessuna valutazione finora

- Real Estate PPT (Final)Documento63 pagineReal Estate PPT (Final)9920163728100% (1)

- Total 17,800 6.33 3,015 62 10,400 262 7.82: BrickworkDocumento2 pagineTotal 17,800 6.33 3,015 62 10,400 262 7.82: BrickworkFireSwarmNessuna valutazione finora

- Ar Sap Report GCV NCVDocumento34 pagineAr Sap Report GCV NCVAMITAVA RAYNessuna valutazione finora

- Project Report of Fly-Ash Bricks UdyogDocumento9 pagineProject Report of Fly-Ash Bricks UdyogVijayNessuna valutazione finora

- Is-3952 - (1988) - Burnt Clay Hollow Bricks For WallsDocumento10 pagineIs-3952 - (1988) - Burnt Clay Hollow Bricks For WallsStacy WilsonNessuna valutazione finora

- Bonded Labour and Brick KilnsDocumento137 pagineBonded Labour and Brick KilnsSobia AhmedNessuna valutazione finora

- SG 2011 Building A Sustainable FutureDocumento60 pagineSG 2011 Building A Sustainable FutureNeil SimpsonNessuna valutazione finora

- C and D WasteDocumento28 pagineC and D WasteAditya S KNessuna valutazione finora

- NCV Calculation With Factors: TM (Arb) ASH GCV (Adb) ADL (ARB) IM (ADB) VM (ADB) F.C (ADB) VM (DB) VM (ARB) GCV (DB)Documento2 pagineNCV Calculation With Factors: TM (Arb) ASH GCV (Adb) ADL (ARB) IM (ADB) VM (ADB) F.C (ADB) VM (DB) VM (ARB) GCV (DB)Irfan AhmedNessuna valutazione finora

- Hyderabad Property Construction Bill DetailsDocumento2 pagineHyderabad Property Construction Bill DetailsSrinivas SukhavasiNessuna valutazione finora

- Hyundai Master FileDocumento81 pagineHyundai Master FilePHAM PHI HUNGNessuna valutazione finora

- Construction of Boundary Wall For Mr. Kugan at Kokuvil: Removing of Fence and Site ClearingDocumento48 pagineConstruction of Boundary Wall For Mr. Kugan at Kokuvil: Removing of Fence and Site ClearingNavam NanthanNessuna valutazione finora

- 05 Jan 2015guidelines For Manufacturing Quality Fly Ash BricksDocumento11 pagine05 Jan 2015guidelines For Manufacturing Quality Fly Ash BricksJoy Prokash RoyNessuna valutazione finora

- Project: Proposed I-Tower 3 Subject: Structural Requirements For Sub Structure 1. Formworks and ConcreteDocumento15 pagineProject: Proposed I-Tower 3 Subject: Structural Requirements For Sub Structure 1. Formworks and ConcreteJhundel Factor PajarillagaNessuna valutazione finora

- Rab BPPTDocumento324 pagineRab BPPTMacros SantabieNessuna valutazione finora

- Población de Puerto Rico y Sus Municipios Por Grupos de Edad y Sexo 2010-2018 (Vintage 2018)Documento474 paginePoblación de Puerto Rico y Sus Municipios Por Grupos de Edad y Sexo 2010-2018 (Vintage 2018)Celyana Moreno SantiagoNessuna valutazione finora

- Sub Dealer I Sub Dealer Name Dealer Code Dealer Namesub Dealer Msub Dealer AcDocumento15 pagineSub Dealer I Sub Dealer Name Dealer Code Dealer Namesub Dealer Msub Dealer AcShubham SinghNessuna valutazione finora

- Presentation On Tennis Balls ManufacturingDocumento8 paginePresentation On Tennis Balls Manufacturingadiall4uNessuna valutazione finora

- Recovery of Valuable Metals From Fly Ash: A Sustainable ApproachDocumento2 pagineRecovery of Valuable Metals From Fly Ash: A Sustainable ApproachVeeranjaneyulu RayapudiNessuna valutazione finora

- 2.a.1 Cement Production GB2009Documento19 pagine2.a.1 Cement Production GB2009Venkata Subbareddy PoluNessuna valutazione finora

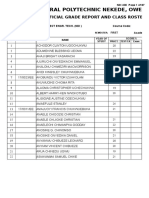

- Federal Polytechnic Nekede, Owerri Official Grade Report and Class RosterDocumento87 pagineFederal Polytechnic Nekede, Owerri Official Grade Report and Class RosterAkachi OkoroNessuna valutazione finora

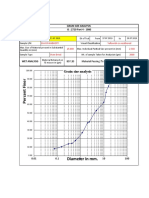

- ACI 318 deflection calculation sheet for reinforced concrete T-sectionsDocumento8 pagineACI 318 deflection calculation sheet for reinforced concrete T-sectionsabdul khaderNessuna valutazione finora

- Salah ProjectDocumento9 pagineSalah ProjectDkPrinceNessuna valutazione finora

- Newco Case AnalysisDocumento48 pagineNewco Case AnalysisAnubhav BigamalNessuna valutazione finora

- List of insurance participants and premium amountsDocumento1.219 pagineList of insurance participants and premium amountsAindra BudiarNessuna valutazione finora

- Calculation SHEETDocumento35 pagineCalculation SHEETIrfan AhmedNessuna valutazione finora

- NPV Template P&GDocumento15 pagineNPV Template P&GSanket ChatterjeeNessuna valutazione finora

- WRD Water ResourcesDocumento32 pagineWRD Water ResourcesatgsganeshNessuna valutazione finora

- Clay Brick Production ProcessDocumento26 pagineClay Brick Production ProcessWerku Koshe Hareru0% (1)

- Cost estimate for construction of RCC footing and wall shutteringDocumento2 pagineCost estimate for construction of RCC footing and wall shutteringAtulJainNessuna valutazione finora

- Proceedings PDFDocumento139 pagineProceedings PDFR RathiNessuna valutazione finora

- APBD2017 Per-Urusan Update20sept2017 SIKD UploadwebDocumento132 pagineAPBD2017 Per-Urusan Update20sept2017 SIKD UploadwebUcun BolotaNessuna valutazione finora

- Daily Production Report From 1st SHAWAN 2072 (17th JULY 2015)Documento3 pagineDaily Production Report From 1st SHAWAN 2072 (17th JULY 2015)vinodsnNessuna valutazione finora

- E194-837 - 842 Gases Conversion ChartDocumento3 pagineE194-837 - 842 Gases Conversion ChartadammzjinNessuna valutazione finora

- Valuation of Tata SteelDocumento3 pagineValuation of Tata SteelNishtha Mehra100% (1)

- DM BLDG U-Value Calculation-2Documento61 pagineDM BLDG U-Value Calculation-2Arul SankaranNessuna valutazione finora

- Steel Gauge ChartDocumento2 pagineSteel Gauge ChartrmeckotaNessuna valutazione finora

- All Type of Footing DesignDocumento26 pagineAll Type of Footing DesignDilon FernandoNessuna valutazione finora

- Construction Schedule 302 Units: Item Description W%Documento31 pagineConstruction Schedule 302 Units: Item Description W%Dick Anthony MabaoNessuna valutazione finora

- GRAIN SIZE ANALYSIS RESULTSDocumento13 pagineGRAIN SIZE ANALYSIS RESULTSImran KhanNessuna valutazione finora

- Financial Projections and Analysis of Company for 5 YearsDocumento2 pagineFinancial Projections and Analysis of Company for 5 YearsShriyash PatnaikNessuna valutazione finora

- PATEROS DUCK FARM BUSINESS PLANDocumento27 paginePATEROS DUCK FARM BUSINESS PLANAnna ChristineNessuna valutazione finora

- Group 1 - Hannson CasestudyDocumento16 pagineGroup 1 - Hannson Casestudyamanraj21Nessuna valutazione finora

- ConstitutionDocumento180 pagineConstitutionTejas KotwalNessuna valutazione finora

- Proposal for setting up a Neera plant in Palakkad, KeralaDocumento12 pagineProposal for setting up a Neera plant in Palakkad, KeralaTejas KotwalNessuna valutazione finora

- Neera ECManohar PCADocumento44 pagineNeera ECManohar PCAJoseph FloresNessuna valutazione finora

- Indian Polity Bit BankDocumento130 pagineIndian Polity Bit Bankhaarika1006Nessuna valutazione finora

- NeeraDocumento32 pagineNeeraTejas KotwalNessuna valutazione finora

- Indian Economy Bit BankDocumento25 pagineIndian Economy Bit BanksureshNessuna valutazione finora

- BPMC Act, 1949Documento28 pagineBPMC Act, 1949Tejas KotwalNessuna valutazione finora

- Indian History Bit BankDocumento15 pagineIndian History Bit Banksuresh100% (1)

- 10000 Litres Coconut Neera Unit Project ReportDocumento5 pagine10000 Litres Coconut Neera Unit Project ReportTejas KotwalNessuna valutazione finora

- Neera ICJ May2009Documento3 pagineNeera ICJ May2009Tejas KotwalNessuna valutazione finora

- Setting up an integrated unit for coconut neera and value added productsDocumento39 pagineSetting up an integrated unit for coconut neera and value added productsTejas Kotwal100% (1)

- Neera Energy DrinkDocumento44 pagineNeera Energy DrinkTejas KotwalNessuna valutazione finora

- Neera Energy DrinkDocumento44 pagineNeera Energy DrinkTejas KotwalNessuna valutazione finora

- Chauras MillsDocumento53 pagineChauras MillsTejas KotwalNessuna valutazione finora

- Icj 2013 05Documento48 pagineIcj 2013 05Tejas KotwalNessuna valutazione finora

- Chauras MillsDocumento20 pagineChauras MillsTejas KotwalNessuna valutazione finora

- Neera Energy DrinkDocumento50 pagineNeera Energy DrinkTejas Kotwal50% (2)

- Business PlanDocumento31 pagineBusiness PlanTejas KotwalNessuna valutazione finora

- Artcl Neera Icj Jan 13 SidhasDocumento3 pagineArtcl Neera Icj Jan 13 SidhasTejas KotwalNessuna valutazione finora

- History Class6 TN BoardDocumento53 pagineHistory Class6 TN BoardPragun JhaNessuna valutazione finora

- BrochureDocumento68 pagineBrochureHarsh DeshmukhNessuna valutazione finora

- 2013Documento40 pagine2013PrabhanshuKumarNessuna valutazione finora

- SSC CGL 2010 TierI Second Shift English ComprehensionDocumento7 pagineSSC CGL 2010 TierI Second Shift English ComprehensionTejas KotwalNessuna valutazione finora

- SBI PO Descriptive Test Reference GuideDocumento22 pagineSBI PO Descriptive Test Reference GuideSravan AddankiNessuna valutazione finora

- Sales Tax Inspector Priliminery Examination-2013Documento44 pagineSales Tax Inspector Priliminery Examination-2013Tejas KotwalNessuna valutazione finora

- UPSC Prelims 2013 Analysis: Paper I - GSDocumento0 pagineUPSC Prelims 2013 Analysis: Paper I - GSrajputrulesNessuna valutazione finora

- Competitive English Quick Reference GuideDocumento12 pagineCompetitive English Quick Reference GuideTejas KotwalNessuna valutazione finora

- Assistant Preliminary Examination - 2013Documento40 pagineAssistant Preliminary Examination - 2013Tejas KotwalNessuna valutazione finora

- Skydio 349659472Documento8 pagineSkydio 349659472karani mikeNessuna valutazione finora

- LorealDocumento3 pagineLorealHarsihiPratiwiNessuna valutazione finora

- Ascertainment of ProfitDocumento18 pagineAscertainment of ProfitsureshNessuna valutazione finora

- CMA Exam Content Specification OutlinesDocumento16 pagineCMA Exam Content Specification OutlinesMolly SchneidNessuna valutazione finora

- RedSKY Hospitality Company OverviewDocumento20 pagineRedSKY Hospitality Company Overviewnirmalsingh.27121996Nessuna valutazione finora

- BM Faculties & CoursesDocumento3 pagineBM Faculties & CoursesleylianNessuna valutazione finora

- Cost Accounting 7 & 8Documento26 pagineCost Accounting 7 & 8Kyrara79% (19)

- British American TobaccoDocumento121 pagineBritish American TobaccoShubro Barua100% (6)

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocumento4 pagine673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNessuna valutazione finora

- Econ NotesDocumento8 pagineEcon NotesRonita ChatterjeeNessuna valutazione finora

- A PROJECT REPORT ON THE TOPIC Process CoDocumento37 pagineA PROJECT REPORT ON THE TOPIC Process CoKrina ShahNessuna valutazione finora

- Travel and Tourism Promotion and SalesDocumento33 pagineTravel and Tourism Promotion and Salesnahnah2001Nessuna valutazione finora

- GEN009 - q2Documento14 pagineGEN009 - q2CRYPTO KNIGHTNessuna valutazione finora

- Annual Report 2075 76 EnglishDocumento200 pagineAnnual Report 2075 76 Englishram krishnaNessuna valutazione finora

- Strategic Sourcing Manager Director in NYC NJ Resume Harry HunterDocumento2 pagineStrategic Sourcing Manager Director in NYC NJ Resume Harry HunterHarryHunter2Nessuna valutazione finora

- Valuation of Ashok Leyland Fiev ReportDocumento31 pagineValuation of Ashok Leyland Fiev ReportVishalRathoreNessuna valutazione finora

- Standard Costing and Variance Analysis ExplainedDocumento115 pagineStandard Costing and Variance Analysis ExplainedAnne Thea AtienzaNessuna valutazione finora

- 4.sales ForecastDocumento28 pagine4.sales ForecastSourav SinhaNessuna valutazione finora

- The Management Level Case Study: Helping You To Pass Your ExamDocumento9 pagineThe Management Level Case Study: Helping You To Pass Your ExamsangNessuna valutazione finora

- ECON202-Quiz 6 (1) - 1Documento7 pagineECON202-Quiz 6 (1) - 1Meiting XuNessuna valutazione finora

- Acct CH.7 H.W.Documento8 pagineAcct CH.7 H.W.j8noelNessuna valutazione finora

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Documento15 pagineAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNessuna valutazione finora

- Marketing PlanDocumento20 pagineMarketing PlanSyed Junaid100% (2)

- NITIE Casebook PDFDocumento162 pagineNITIE Casebook PDFSai Tapaswi ChNessuna valutazione finora

- Doupnik ch11Documento33 pagineDoupnik ch11Catalina Oriani0% (1)

- Ebm 3Documento38 pagineEbm 3Mehak AsimNessuna valutazione finora

- Chapter 11Documento11 pagineChapter 11Joan LeonorNessuna valutazione finora

- COST CENTER ASSET RETIREMENTSDocumento3 pagineCOST CENTER ASSET RETIREMENTSrajdeeppawarNessuna valutazione finora

- Financial Statement Analysis On APEX and Bata Shoe CompanyDocumento12 pagineFinancial Statement Analysis On APEX and Bata Shoe CompanyLabiba Farah 190042118Nessuna valutazione finora

- Accounting Standards SummaryDocumento54 pagineAccounting Standards Summarynurmaisarahnurazim1Nessuna valutazione finora