Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Data Risks of Outsourcing Highlighted by IT Failures and Cyber Attacks

Caricato da

shajeerpcTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Data Risks of Outsourcing Highlighted by IT Failures and Cyber Attacks

Caricato da

shajeerpcCopyright:

Formati disponibili

4/13/2014 IT failures and cyber attacks on Middle East companies highlight data risks of outsourcing | Norton Rose Fulbright

http://www.nortonrosefulbright.com/knowledge/publications/111836/it-failures-and-cyber-attacks-on-middle-east-companies-highlight-data-risks-of-outsour 1/2

Use of cookies by

Norton Rose Fulbright

We use cookies to deliver our online services. Details and instructions on how to disable those cookies are

set out here. By continuing to use this website you agree to our use of our cookies unless you have disabled

them.

IT failures and cyber attacks on Middle East companies highlight

data risks of outsourcing

Up-to-date contracts and cyber insurance policies can help protect businesses from significant liability

February 2014

Introduction

Cyber crime laws

Data privacy laws

Mitigation by contract

Mitigation by insurance

Introduction

The US Justice Department's indictment of eight defendants in New York and the arrest of two Dutch nationals in Germany in

connection with a sophisticated cyber fraud last year highlighted the far-reaching implications of data breaches for Middle East

organisations and the need for careful management of risk in outsourcing projects. The two Middle East banks - National Bank of

Ras Al-Khaimah (RAKBANK) and Bank Muscat of Oman - were both victims of an incident that reportedly stemmed from a data

security breach at an Indian outsourced service provider. Elsewhere, the UK financial regulator is carrying out an enforcement

investigation relating to IT failures at a leading UK bank in June and July 2012, while the same bank suffered a further IT failure on

Cyber Monday in December 2013. Another leading UK bank is also investigating similar problems that left its customers unable to

use cash machines and debit cards in January this year.

This article considers the potential implications of this type of breach under cyber crime and data privacy laws and solutions for

mitigating the risks through contract and insurance.

Cyber crime laws

Cyber crime laws exist to a varying degree in several Middle East jurisdictions. In late 2012, the UAE updated its existing cyber crime

law with a number of enhancements aimed at addressing loopholes and confirming that many "real world" offences would be criminal

acts if carried out electronically. As a result, the cyber crime legislation in the UAE is one of the most comprehensive in the region.

Of particular relevance to UAE-based companies is the new protection afforded to some personal information online. UAE law

criminalises the disclosure of certain electronically-stored information including credit card and bank account details and electronic

payment methods, but it remains to be seen how this law will be enforced in practice. Further, the criminalisation of such activities

means that offenders may face prosecution by the relevant authorities but an affected business would still have to bring a civil

action to recover any losses it had suffered.

Elsewhere in the GCC, Bahrain and Qatar have draft laws on computer crimes under consideration while Saudi Arabia and Oman

have cyber crimes legislation in place.

In the case of breach by an offshore service provider, the application of the bank's local law may be limited and consideration would

need to be given to pursuing the service provider in its own jurisdiction.

Data privacy laws

In common with most Middle East countries, the UAE and Oman do not currently have specific data privacy legislation in place at a

national or federal level. For those financial institutions operating in the Dubai International Financial Centre (DIFC) economic free

zone, the position is different as the organisation would be subject to the European-style DIFC Data Protection Law. Other

obligations on a DIFC regulated entity include specific risk management obligations in relation to outsourcing arrangements

contained within the Dubai Financial Services Authority (DFSA) Rulebook.

4/13/2014 IT failures and cyber attacks on Middle East companies highlight data risks of outsourcing | Norton Rose Fulbright

http://www.nortonrosefulbright.com/knowledge/publications/111836/it-failures-and-cyber-attacks-on-middle-east-companies-highlight-data-risks-of-outsour 2/2

Notwithstanding the formal regulatory position, it is good practice from a legal and reputational risk management perspective to treat

data security as a key risk area for any corporate entity. Companies often process a significant amount of highly confidential

information on a daily basis and that data is collected, used and stored on behalf of employees, clients and customers. Where a

third party service provider is involved in any aspect of the data handling process, appropriate measures must be taken to ensure

the security and integrity of that data. Failure to do so exposes the organisation to reputational and financial risks in addition to any

potential regulatory implications.

Mitigation by contract

It is vital for organisations seeking to outsource any business functions that the contract with the service provider specifies

appropriate standards, safeguards and, where necessary, the precise data handling procedures to be implemented by the service

provider. It is important that compliance with these contractual obligations is monitored and enforced to ensure that they remain

effective throughout the life of the arrangement. Applicable laws may change, businesses will develop and business practices may

evolve over time: in each case, the contract must be considered in light of any new data processing practices or requirements.

Compliance and monitoring may take the form of contractual reporting obligations or rights to carry out audits and/or gain access to

a vendors premises, staff or systems. A robust governance model and regular performance reviews can also be useful for helping

to ensure that standards are consistently maintained in line with current best practice.

The contract should include appropriate remedies for failure to comply with data privacy and security obligations.These remedies

might include service credits or other financial recompense. While monetary remedies may not necessarily mitigate the damage to

reputation that an institution could ultimately suffer from a data loss incident, they can be a helpful tool for encouraging a service

providers compliance with contractual procedures and obligations.

Mitigation by insurance

In essence, cyber insurance provides cover for losses and/or liabilities arising out of unauthorised access to, or use of, an

organisations electronic information or the destruction or loss of that information. As an insurance product, cyber cover has been

available for a number of years in various forms. It is a complex cover offering a number of different protections. For example, it can

include cover for data liability (including personal or corporate data and outsourcing security), business or network interruption

(covering losses arising out a material interruption to an organisations network following a denial of service attack or network

security breach), multimedia liability (covering damages and defence costs incurred in connection with a breach of third party

intellectual property or negligence in connection with electronic content) and cyber extortion (covering ransom payments to third

parties incurred in resolving a security threat).

Some elements of cyber cover may overlap with an organisations existing insurance coverage, for example, its Crime and

Professional Indemnity cover. However, any such overlap may be restricted and, in particular, it should be noted that business

interruption resulting from unauthorised access to, or loss of, data is likely to be excluded. Nevertheless, it is important, before

considering what specialist cyber cover is required, for an organisation to understand the nature of its existing cover to combat

cyber threats and to then conduct a review of its business requirements to ensure that the cyber cover obtained is the most

appropriate for its business.

Where outsourcing is undertaken by an organisation, it will be important to carry out due diligence on the extent of the cyber

insurance cover held by the outsourcing company, the number of previous notifications or claims made under the cover and to

monitor the extent of the cover (and the notifications and claims made under it) during regular audits. It may also be the case that

an organisations existing cover provides an element of cover for third party contractors, for example, in relation to data breaches,

and so the coverage position should be clarified at the outset before engaging the outsourcing company to ensure that there is no

duplication of cover.

Potrebbero piacerti anche

- Data Protection 101: A Beginner's Guide to Digital SecurityDa EverandData Protection 101: A Beginner's Guide to Digital SecurityNessuna valutazione finora

- Babes-Bolyai University Business Faculty Cyber InsuranceDocumento5 pagineBabes-Bolyai University Business Faculty Cyber InsuranceNaty TeutNessuna valutazione finora

- Cyber Security: Essential principles to secure your organisationDa EverandCyber Security: Essential principles to secure your organisationNessuna valutazione finora

- CSR301 LabDocumento5 pagineCSR301 LabQuach Hoang Nam (K16HCM)Nessuna valutazione finora

- The Business Owner's Guide to Cybersecurity: Protecting Your Company from Online ThreatsDa EverandThe Business Owner's Guide to Cybersecurity: Protecting Your Company from Online ThreatsNessuna valutazione finora

- What Is Cybersecurity Insurance and Why Is It ImportantDocumento3 pagineWhat Is Cybersecurity Insurance and Why Is It ImportantJaveed A. KhanNessuna valutazione finora

- Security Testing Handbook for Banking ApplicationsDa EverandSecurity Testing Handbook for Banking ApplicationsValutazione: 5 su 5 stelle5/5 (1)

- Securing Digital Frontiers - Legal Tactics For Cybersecurity in The UKDocumento2 pagineSecuring Digital Frontiers - Legal Tactics For Cybersecurity in The UKfolasaderotibiNessuna valutazione finora

- Protecting Personal Data From Cyber Attacks May 2017Documento5 pagineProtecting Personal Data From Cyber Attacks May 2017The New WorldNessuna valutazione finora

- SEC Guidance on Public Company Cybersecurity DisclosuresDocumento24 pagineSEC Guidance on Public Company Cybersecurity DisclosuresReinaldo NevesNessuna valutazione finora

- Cyber Laws&ForensicDocumento20 pagineCyber Laws&ForensicJohn CenaNessuna valutazione finora

- Radware_GDPR_Compliance_ReportDocumento8 pagineRadware_GDPR_Compliance_Reporteliud.cardenasNessuna valutazione finora

- Conclusions Cyber LawDocumento2 pagineConclusions Cyber LawAnuradha AcharyaNessuna valutazione finora

- Meeting Agents Council Cyber GuideDocumento8 pagineMeeting Agents Council Cyber Guideleo5880Nessuna valutazione finora

- Prevention of Cybercrime: Best Practices As Proposed by FIATADocumento10 paginePrevention of Cybercrime: Best Practices As Proposed by FIATAVishal SharmaNessuna valutazione finora

- Ebook Beginners Guide To Cyber InsuranceDocumento8 pagineEbook Beginners Guide To Cyber InsuranceArifNessuna valutazione finora

- Buyer's Guide: Disclosing Security Breaches in SMEs - April 2012Documento3 pagineBuyer's Guide: Disclosing Security Breaches in SMEs - April 2012quocircaNessuna valutazione finora

- Securing Digital Frontiers - Legal Tactics For Cybersecurity in The UKDocumento4 pagineSecuring Digital Frontiers - Legal Tactics For Cybersecurity in The UKfolasaderotibiNessuna valutazione finora

- Data Breaches and Legal LiabilityDocumento5 pagineData Breaches and Legal LiabilityParth RastogiNessuna valutazione finora

- Hilton CSDocumento3 pagineHilton CSArishragawendhra NagarajanNessuna valutazione finora

- The Privacy, Data Protection and Cybersecurity Law Review - The Law ReviewsDocumento18 pagineThe Privacy, Data Protection and Cybersecurity Law Review - The Law ReviewsMUHAMMAD ASFALWAFIQ BIN ZAKRINessuna valutazione finora

- AssignmentDocumento4 pagineAssignmentCyrus cbkNessuna valutazione finora

- Securing Digital Frontiers - Legal Tactics For Cybersecurity in The UKDocumento5 pagineSecuring Digital Frontiers - Legal Tactics For Cybersecurity in The UKfolasaderotibiNessuna valutazione finora

- Impact of Data Breach: Financial Loss, Reputational Damage and Legal ActionDocumento3 pagineImpact of Data Breach: Financial Loss, Reputational Damage and Legal ActionJoymee BigorniaNessuna valutazione finora

- Application and Infrastructure Security of Banking and Insurance Applications by Anurag Shrivastava (M.C.A)Documento12 pagineApplication and Infrastructure Security of Banking and Insurance Applications by Anurag Shrivastava (M.C.A)Anurag ShrivastavaNessuna valutazione finora

- Cyber SecurityDocumento19 pagineCyber Securityjavaria_ashraf_5100% (2)

- Project 2020Documento25 pagineProject 2020dantheman82Nessuna valutazione finora

- cybersecurity legal program 2Documento12 paginecybersecurity legal program 2api-737202431Nessuna valutazione finora

- Nist DLP PDFDocumento5 pagineNist DLP PDFIvan Ernesto MillaNessuna valutazione finora

- Security and Privacy Current Cover and Risk Management ServicesDocumento12 pagineSecurity and Privacy Current Cover and Risk Management ServicesThe GuardianNessuna valutazione finora

- Actian GDPR Whitepaper 0318 v6Documento7 pagineActian GDPR Whitepaper 0318 v6Spit FireNessuna valutazione finora

- Allianz Global Corporate - Cyber Risk GuideDocumento32 pagineAllianz Global Corporate - Cyber Risk GuidetsgayaNessuna valutazione finora

- Cyber Security Regulations Impacting InsurersDocumento19 pagineCyber Security Regulations Impacting InsurersRobert SerenaNessuna valutazione finora

- Cyber Risk Presentation 2013 (AGIB)Documento17 pagineCyber Risk Presentation 2013 (AGIB)Anish Kumar PandeyNessuna valutazione finora

- Internet Privacy Executive SummaryDocumento2 pagineInternet Privacy Executive SummaryNaomi L. Baker PetersonNessuna valutazione finora

- Barrientos Ma. Cindirella CDocumento2 pagineBarrientos Ma. Cindirella CCindy BarrientosNessuna valutazione finora

- Managing Data Compliance RiskDocumento4 pagineManaging Data Compliance RiskthareNessuna valutazione finora

- Practical Guide To Data & Cyber Security FINAL1 PDFDocumento20 paginePractical Guide To Data & Cyber Security FINAL1 PDFmariiusssica9451Nessuna valutazione finora

- ISA - Cyber-Insurance Metrics and Impact On Cyber-SecurityDocumento8 pagineISA - Cyber-Insurance Metrics and Impact On Cyber-SecurityBennet KelleyNessuna valutazione finora

- GDPR What When WhyDocumento8 pagineGDPR What When WhyZsL6231Nessuna valutazione finora

- 2013 Data Privacy ReportDocumento11 pagine2013 Data Privacy ReportJim KinneyNessuna valutazione finora

- Cyber Crime Essay ThesisDocumento4 pagineCyber Crime Essay Thesisafcmausme100% (2)

- What To Expect in 2021 - An in House Perspective - revisedLIDocumento3 pagineWhat To Expect in 2021 - An in House Perspective - revisedLIEdieNessuna valutazione finora

- Review of The Attacks Associated With Lapsus$ and Related Threat Groups Executive Summary - 508cDocumento2 pagineReview of The Attacks Associated With Lapsus$ and Related Threat Groups Executive Summary - 508cDavidNessuna valutazione finora

- Information Assurance and Cybersecurity SolutionsDocumento18 pagineInformation Assurance and Cybersecurity Solutionszahra zahidNessuna valutazione finora

- 03 Task Performance 1 - ARGDocumento4 pagine03 Task Performance 1 - ARGPamela Clarisse FortunatoNessuna valutazione finora

- Cyber Risk InsuranceDocumento8 pagineCyber Risk InsuranceJOHN NDIRANGUNessuna valutazione finora

- Egal and Thical Ssues: Figure 5.1 The Change of Demand by Time in The E-Business Global MarketplaceDocumento9 pagineEgal and Thical Ssues: Figure 5.1 The Change of Demand by Time in The E-Business Global MarketplaceAhmad neutronNessuna valutazione finora

- Egal and Thical Ssues: Figure 5.1 The Change of Demand by Time in The E-Business Global MarketplaceDocumento9 pagineEgal and Thical Ssues: Figure 5.1 The Change of Demand by Time in The E-Business Global MarketplaceLoveyNessuna valutazione finora

- The Importance of Cybersecurity Department of Justice, Yahoo and JP Morgan ChasDocumento3 pagineThe Importance of Cybersecurity Department of Justice, Yahoo and JP Morgan ChasVesa LokuNessuna valutazione finora

- Simplify and Layer Your Security Approach To Protect Card DataDocumento5 pagineSimplify and Layer Your Security Approach To Protect Card DataJerome B. AgliamNessuna valutazione finora

- Cybersecurity ScriptDocumento12 pagineCybersecurity ScriptDhesserie PaglinawanNessuna valutazione finora

- Jessa CDocumento4 pagineJessa CAljude Barnachea SanoriaNessuna valutazione finora

- Write OffDocumento2 pagineWrite OffAnjali AllureNessuna valutazione finora

- 2014 Cybersecurity GuideDocumento36 pagine2014 Cybersecurity GuideBennet KelleyNessuna valutazione finora

- Cyber Risk Liabilit InsDocumento4 pagineCyber Risk Liabilit Inssentoubudo1647Nessuna valutazione finora

- Network Security and PrivacyDocumento8 pagineNetwork Security and PrivacyAjith PathiranaNessuna valutazione finora

- Englishreport 2010Documento8 pagineEnglishreport 2010api-253736647Nessuna valutazione finora

- Information Systems For ManagersDocumento10 pagineInformation Systems For ManagersRajni KumariNessuna valutazione finora

- Crime and Abuse in E-BusinessDocumento6 pagineCrime and Abuse in E-BusinessDody AdyNessuna valutazione finora

- ONAM MenuDocumento1 paginaONAM MenushajeerpcNessuna valutazione finora

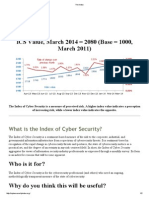

- ICS Value, March 2014 2080 (Base 1000, March 2011) : What Is The Index of Cyber Security?Documento2 pagineICS Value, March 2014 2080 (Base 1000, March 2011) : What Is The Index of Cyber Security?shajeerpcNessuna valutazione finora

- Excel TrainingDocumento6 pagineExcel TrainingshajeerpcNessuna valutazione finora

- Q3Documento1 paginaQ3shajeerpcNessuna valutazione finora

- BIAC Final Deck8Documento42 pagineBIAC Final Deck8barleenkaurNessuna valutazione finora

- Electrified, But Without ElectricityDocumento2 pagineElectrified, But Without ElectricityshajeerpcNessuna valutazione finora

- Quiz 2: Take Home Assignment Duration: 20 Minutes Marks: 100Documento2 pagineQuiz 2: Take Home Assignment Duration: 20 Minutes Marks: 100shajeerpcNessuna valutazione finora

- Quiz 2: Take Home Assignment Duration: 20 Minutes Marks: 100Documento2 pagineQuiz 2: Take Home Assignment Duration: 20 Minutes Marks: 100shajeerpcNessuna valutazione finora

- Napoli SilvioDocumento4 pagineNapoli Silvioshajeerpc50% (2)

- Comptia Comptia Voucher ProcessDocumento6 pagineComptia Comptia Voucher ProcessshajeerpcNessuna valutazione finora

- ZaraDocumento2 pagineZarashajeerpcNessuna valutazione finora

- DinnerDocumento2 pagineDinnershajeerpcNessuna valutazione finora

- Comptia Comptia Voucher ProcessDocumento6 pagineComptia Comptia Voucher ProcessshajeerpcNessuna valutazione finora

- Biscuit Sales and Market Share Analysis 2008-2013Documento21 pagineBiscuit Sales and Market Share Analysis 2008-2013shajeerpcNessuna valutazione finora

- Successful Use of EProcurement in Supply ChainsDocumento19 pagineSuccessful Use of EProcurement in Supply ChainsshajeerpcNessuna valutazione finora

- MayflowerDocumento1 paginaMayflowershajeerpcNessuna valutazione finora

- Paragon Menu For - 700 Pax: MENU - 1 at Rs.400/-TO 450/ - + TAX (APPROXIMATELY) Welcome DrinkDocumento1 paginaParagon Menu For - 700 Pax: MENU - 1 at Rs.400/-TO 450/ - + TAX (APPROXIMATELY) Welcome DrinkshajeerpcNessuna valutazione finora

- Non-Life Insurance Loss, Notice, Payment and SubrogationDocumento16 pagineNon-Life Insurance Loss, Notice, Payment and SubrogationgraceNessuna valutazione finora

- Reelcraft CatalogDocumento60 pagineReelcraft CatalogCentral HydraulicsNessuna valutazione finora

- Alpha Insurance Loss RulingDocumento2 pagineAlpha Insurance Loss RulingKarl CabarlesNessuna valutazione finora

- Offer letter for Systems Administrator roleDocumento3 pagineOffer letter for Systems Administrator roleAryan ChoudharyNessuna valutazione finora

- Limited Liability Partnership (LLP) - Advantages and DisadvantagesDocumento3 pagineLimited Liability Partnership (LLP) - Advantages and DisadvantagesMyo Kyaw SwarNessuna valutazione finora

- Digital Nomads - PreviewDocumento43 pagineDigital Nomads - PreviewEsther Jacobs100% (2)

- Case DigestDocumento7 pagineCase DigestEar SallesNessuna valutazione finora

- Hinoguin V ECCDocumento4 pagineHinoguin V ECCmailah awingNessuna valutazione finora

- Carpenters Annuity Fund 2007Documento19 pagineCarpenters Annuity Fund 2007Latisha WalkerNessuna valutazione finora

- ATK - Building Value-Based Healthcare Business ModelsDocumento11 pagineATK - Building Value-Based Healthcare Business Modelsapritul3539Nessuna valutazione finora

- IC - 67 Marine InsuranceDocumento23 pagineIC - 67 Marine InsuranceMahendra Kumar YogiNessuna valutazione finora

- Basic Banking MCQsDocumento8 pagineBasic Banking MCQsShashank Majhee100% (1)

- Application Credibility TheoryDocumento39 pagineApplication Credibility TheorySIDHARTH TiwariNessuna valutazione finora

- Contingent Fee Agreement TemplateDocumento3 pagineContingent Fee Agreement Templaterapc2010100% (1)

- Class Action LawsuitDocumento78 pagineClass Action LawsuitLindsey BasyeNessuna valutazione finora

- General Banking Law ReviewerDocumento89 pagineGeneral Banking Law ReviewerKarla Marie Tumulak67% (3)

- Policy PDFDocumento3 paginePolicy PDFELDHO C JOHNSONNessuna valutazione finora

- Digitally Signed Two Wheeler Insurance PolicyDocumento1 paginaDigitally Signed Two Wheeler Insurance PolicyMaahi namdevNessuna valutazione finora

- Mapua Scholarship FormDocumento5 pagineMapua Scholarship FormKzandra KatigbakNessuna valutazione finora

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDocumento3 pagineHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNessuna valutazione finora

- Group InsuranceDocumento60 pagineGroup Insurancedanialraza67% (3)

- Pledge, Mortgage & AntichrisesDocumento10 paginePledge, Mortgage & Antichrisesjericho sarmiento0% (1)

- THDC Tender For HDPE BoatDocumento29 pagineTHDC Tender For HDPE BoatRavi Yadav0% (1)

- Change Order Protocol 2010 - MCA of TorontoDocumento9 pagineChange Order Protocol 2010 - MCA of TorontoAnonymous 19hUyemNessuna valutazione finora

- Comprehensive Arabic Motor Insurance Cover for DriveSecureDocumento100 pagineComprehensive Arabic Motor Insurance Cover for DriveSecureSama88823Nessuna valutazione finora

- Abbr Title - Ontario Immigrant Nominee Program - OINP - Abbr - Document ChecklistsDocumento41 pagineAbbr Title - Ontario Immigrant Nominee Program - OINP - Abbr - Document Checklistsjmm01004Nessuna valutazione finora

- CONSTRUCTIVE FULFILLMENTDocumento15 pagineCONSTRUCTIVE FULFILLMENTDennis Aran Tupaz Abril100% (1)

- Relocation Policy For Altran Technologies India PVT LTDDocumento3 pagineRelocation Policy For Altran Technologies India PVT LTDswathi100% (1)

- Nikita Pashine - Investment OpportuinitesDocumento44 pagineNikita Pashine - Investment OpportuinitesprashantNessuna valutazione finora

- Essential Guide to Motor InsuranceDocumento68 pagineEssential Guide to Motor InsuranceShaikh Ayaan67% (6)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.Da EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Valutazione: 5 su 5 stelle5/5 (43)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryDa EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryValutazione: 5 su 5 stelle5/5 (1)

- Nicole Brown Simpson: The Private Diary of a Life InterruptedDa EverandNicole Brown Simpson: The Private Diary of a Life InterruptedValutazione: 3.5 su 5 stelle3.5/5 (16)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIDa EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIValutazione: 4 su 5 stelle4/5 (19)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansDa EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansValutazione: 4 su 5 stelle4/5 (17)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenDa EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenValutazione: 3.5 su 5 stelle3.5/5 (36)

- The Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalDa EverandThe Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalValutazione: 4.5 su 5 stelle4.5/5 (45)

- The Gardner Heist: The True Story of the World's Largest Unsolved Art TheftDa EverandThe Gardner Heist: The True Story of the World's Largest Unsolved Art TheftNessuna valutazione finora

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodDa EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodValutazione: 4.5 su 5 stelle4.5/5 (1788)

- The Bigamist: The True Story of a Husband's Ultimate BetrayalDa EverandThe Bigamist: The True Story of a Husband's Ultimate BetrayalValutazione: 4.5 su 5 stelle4.5/5 (101)

- The Last Outlaws: The Desperate Final Days of the Dalton GangDa EverandThe Last Outlaws: The Desperate Final Days of the Dalton GangValutazione: 4 su 5 stelle4/5 (2)

- Double Lives: True Tales of the Criminals Next DoorDa EverandDouble Lives: True Tales of the Criminals Next DoorValutazione: 4 su 5 stelle4/5 (34)

- Swamp Kings: The Story of the Murdaugh Family of South Carolina & a Century of Backwoods PowerDa EverandSwamp Kings: The Story of the Murdaugh Family of South Carolina & a Century of Backwoods PowerNessuna valutazione finora

- Gotti's Rules: The Story of John Alite, Junior Gotti, and the Demise of the American MafiaDa EverandGotti's Rules: The Story of John Alite, Junior Gotti, and the Demise of the American MafiaNessuna valutazione finora

- Unanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownDa EverandUnanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownValutazione: 4 su 5 stelle4/5 (178)

- The Nazis Next Door: How America Became a Safe Haven for Hitler's MenDa EverandThe Nazis Next Door: How America Became a Safe Haven for Hitler's MenValutazione: 4.5 su 5 stelle4.5/5 (77)

- The Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceDa EverandThe Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceValutazione: 4 su 5 stelle4/5 (1)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemDa EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemValutazione: 4 su 5 stelle4/5 (25)

- Our Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownDa EverandOur Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownValutazione: 4.5 su 5 stelle4.5/5 (86)

- To the Bridge: A True Story of Motherhood and MurderDa EverandTo the Bridge: A True Story of Motherhood and MurderValutazione: 4 su 5 stelle4/5 (73)

- Beyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceDa EverandBeyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceValutazione: 4 su 5 stelle4/5 (107)

- Cold-Blooded: A True Story of Love, Lies, Greed, and MurderDa EverandCold-Blooded: A True Story of Love, Lies, Greed, and MurderValutazione: 4 su 5 stelle4/5 (53)

- The Truth About Aaron: My Journey to Understand My BrotherDa EverandThe Truth About Aaron: My Journey to Understand My BrotherNessuna valutazione finora

- The Better Angels of Our Nature: Why Violence Has DeclinedDa EverandThe Better Angels of Our Nature: Why Violence Has DeclinedValutazione: 4 su 5 stelle4/5 (414)

- A Special Place In Hell: The World's Most Depraved Serial KillersDa EverandA Special Place In Hell: The World's Most Depraved Serial KillersValutazione: 4 su 5 stelle4/5 (52)