Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indonesian Energy Report PDF 468 KB 30287

Caricato da

hdychiao78Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Indonesian Energy Report PDF 468 KB 30287

Caricato da

hdychiao78Copyright:

Formati disponibili

Indonesian

energy report

FINANCIAL INSTITUTIONS

ENERGY

INFRASTRUCTURE AND COMMODITIES

TRANSPORT

TECHNOLOGY

A NORTON ROSE GROUP GUIDE

AUGUST 2010

Indonesian energy report

Norton Rose Group August 2010 Edition No. NR8180 08/10

The whole or extracts thereof may not be copied or reproduced without the publishers prior

written permission.

This publication is written as a general guide only. It does not contain denitive legal advice and

should not be regarded as a comprehensive statement of the law and practice relating to this area.

Up-to-date specic advice should be sought in relation to any particular matter. For more information

on the issues reported here, please get in touch with us.

No individual who is a member, partner, shareholder, employee or consultant of, in or to any

constituent part of Norton Rose Group (whether or not such individual is described as a partner)

accepts or assumes responsibility, or has any liability, to any person in respect of this publication.

Any reference to a partner means a member of Norton Rose LLP or Norton Rose Australia or

a consultant or employee of Norton Rose LLP or one of its afliates with equivalent standing

and qualications.

Preface

Indonesia is a resource rich country with a growing demand

for energy. The established oil and gas industries continue

to offer good opportunities for developers, but unconventional

forms of energy also offer exciting new upstream potential.

Coalbed methane, shale gas and geothermal energy are among

the sizeable and under-developed opportunities available

in Indonesia.

On the downstream side, Indonesias need for new electricity

generating capacity continues. The nancial closing of recent

independent power projects (IPPs) in March 2010 indicates that

Indonesian IPPs are clearly back in business. The troubled times

of the 1997 Asian nancial crisis are a distant memory: existing

IPPs have performed well and PLN has shown a strong payment

record. The condence of developers and nanciers has now

reached a critical tipping point.

This report looks at current developments in the Indonesian

oil, gas and power industries. We look at the industry structure,

the regulatory environment and current opportunities for investors.

This report has been produced from publicly available information

sources. Care has been taken to check the reliability of the

source, but we have been unable to verify the accuracy of all

the information contained in this report. The facts contained

in this report are subject to change.

Please refer to the contacts listed at the back of this report,

if we can assist you with any further information.

Contents

08 Executive summary

11 Oil

24 Gas

34 Electricity

48 Denitions

50 Norton Rose Group

51 Contacts

Indonesian energy report

08 Norton Rose Group

Executive summary

Oil

Indonesia currently produces nearly 950,000 bbl/d of oil, but many of its elds are mature

and production is declining. Indonesia became a net importer of oil in 2004 and for that

reason, it opted to withdraw from OPEC in 2008.

Chevron operates Indonesias two largest oil elds the Minas and Duri elds where

Chevron employs steam ooding techniques to enhance production. Indonesias largest

new eld development is the Cepu block operated by ExxonMobil.

The Oil and Gas Law (Law 22 of 2001) (Law 22) ended the monopoly control of the state-

owned oil enterprise, Pertamina, in the downstream sector. Since the enactment of Law 22

and the implementing downstream regulations, more than 25 companies have obtained

licences for various downstream activities.

In 2003 Pertamina was converted from a state-owned enterprise into a state-owned limited

liability company. Pertamina will be privatised at some point in the future, but tangible

plans to carry out this goal are some way off. One of the key obstacles to further reform

of the downstream oil sector in Indonesia is the consumption subsidies for domestic retail

fuel consumers. Whilst subsidies have been reduced, they have not yet been eliminated.

Indonesia recently awarded 14 oil and gas blocks. Repsol, Talisman and PTT Exploration

& Production were some of the biggest winners of the blocks mostly offshore Papua and

the Makassar Strait.

Indonesia caps the cost recovery available to contractors, as well as restricting the category

of recoverable costs. This move has been widely blamed for the poor results in the 2008

and 2009 bid rounds. In January 2010 the Government of Indonesia (GoI) announced plans

to abandon the practice of capping cost recovery in order to encourage more investment

in the upstream sector. Revised regulation is keenly awaited.

MIGAS launched an informal pre-bid round on 3 February 2010 for a total of 35 blocks.

We understand that MIGAS will ofcially open a bid round after gauging the level of interest

gathered during this pre-bid round.

Gas

Indonesia has proven gas reserves of approximately 98 tcf making it the tenth largest holder

of gas reserves in the world. Indonesia is home to Southeast Asias largest gas eld, the Natuna

D-Alpha block estimated to contain 46 tcf of recoverable reserves, which are largely undeveloped.

Indonesia ranks eighth in world gas production. Indonesia produced approximately 7.9 bcf/d

of natural gas in 2009, about half of which was consumed domestically. Several elds are

expected to come on stream in 2010 and will boost production. Indonesia exports gas to

Malaysia and Singapore via pipeline. Indonesia is also the worlds third largest LNG exporter

Indonesian energy report

Norton Rose Group 09

Executive summary

with projects at Arun, Bontang and Tangguh. Further liquefaction projects are planned,

as well as regasication terminals to service east and west Java.

The GoI requires gas producers with a PSC signed after 23 November 2001 to supply 25

per cent of their gas production to the domestic market. However, this domestic obligation

has failed to keep pace with growing domestic demand for gas from both the power and

fertiliser industries. As a result the GoI introduced a policy to redirect gas intended for export

to domestic projects. To this end, gas has been diverted from the Bontang and Arun LNG

projects. Recently the GoI has stated that producers will be allowed to export gas provided

there are no domestic buyers. The Ministry of Energy & Mineral Resources (MEMR) claims

domestic customers will be given the rst opportunity to negotiate the purchase of gas.

Total is the largest gas producer with production of 2.57 bcf/d of gas. Total produces 80 per

cent of the feedstock gas for the Bontang LNG project. Several gas developments are taking

place including Chevrons Ganal-Rapak deepwater gas development, Pertaminas Natuna

D-Alpha eld and ConocoPhillips North Belut eld development.

Coal bed methane (CBM) offers huge potential to Indonesia given that it holds the worlds

second largest reserves, estimated to be 453 tcf. As yet there is no commercial production

of CBM in Indonesia. Uncertainty in the legal and regulatory regime is the reason behind the

lack of development to date, but this could change rapidly with the new regulations enacted

in 2008. The rst CBM cooperation contracts were awarded in 2008 and a further four are

expected to be auctioned in mid 2010.

Electricity

Indonesia has approximately 36 GW of installed generating capacity. Some 87 per cent

of Indonesias generating capacity comes from conventional thermal sources oil, natural

gas and coal. The electrication ratio is 65 per cent and there is a shortage of power with

frequent black outs.

Indonesias power sector is dominated by PLN, formerly known as Perusahaan Listrik Negara.

PLN is a vertically integrated monopoly and, until recently, was the sole buyer and seller of

electricity in Indonesia. PLN operates around 85 per cent of the countrys generating capacity

and all transmission and distribution activities. In recent years the majority of new projects

have been developed by PLN.

Indonesia passed a new law for the electricity sector in September 2009, Law No. 30 of 2009,

(Law 30). Law 30 ends PLNs monopoly over supply and distribution but does not go so far

as to unbundle PLNs vertically integrated status. Law 30, however, is already controversial

and subject to judicial review. It is alleged by some to be unconstitutional. It will likely be

some months before the outcome of the judicial review is made public.

Like the oil industry, one of the key impediments to reforming Indonesias electricity sector

is the subsidisation of electricity prices. Traditionally, the GoI has set the retail tariff payable

for electricity, which is often less than the cost of production, leaving PLN with a funding

shortfall for new generation projects. Subsidies have been reduced, but not yet eliminated.

PLN has suggested retail prices for electricity may rise by 10 per cent in 2010.

10 Norton Rose Group

Indonesian energy report

In order to speed the development of much needed generating capacity the GoI introduced

the Fast Track Programme in 2006 with the aim of adding more than 10,000 MW of new

capacity. Much of the programme has been implemented by PLN using Chinese contractors

and equipment suppliers, with Chinese export nance and domestic loans. Nearly half

of the new capacity has now come on line and the rest is expected on line by 2013.

There had been little IPP activity in Indonesia for ten years, but it appears that Indonesia is

entering into a new phase of IPP activity. In March 2010 the Cirebon and Paiton 3 coal-red

IPPs reached nancial close with a combined capital cost of more than US$2.7 billion. Debt

was provided by Korea Eximbank and/or Japan Bank for International Cooperation (JBIC),

alongside international commercial lenders.

PLN is now implementing the second phase of the Fast Track Programme. Unlike the rst

phase of the programme, IPPs will have a more signicant role in the second phase. There

are plans for 10,147 MW of new capacity comprised of 3,977 MW of geothermal, 3,312

coal-red, 1,660 gas-red and 1,198 hydro projects.

In parallel to the Fast Track Programme, PLN is progressing the 2 x 800 MW coal-red

Central Java IPP which is currently subject to tender. PLN is expected to offer seven other

coal-red projects for private investment in 2010.

Indonesia is thought to offer excellent geothermal potential with resources sufcient for as

much as 28,000 MW of power generating capacity. The MEMR has issued 26 new geothermal

working areas. Of that number seven have been tendered, six are in the bidding process

and 13 are ready to bid. Up to 50 working areas are expected to be offered at a later date.

In total, there are 44 geothermal projects included in the second phase of the Fast Track

Programme, of which approximately 30 are intended to be awarded to IPPs. In April

the 330 MW Sarulla IPP successfully agreed a revised tariff with PLN securing the future

for the project and boding well for other geothermal IPPs.

Indonesian energy report

Norton Rose Group 11

Oil

Oil

Introduction

Indonesia had 3.7 billion barrels of proved oil reserves as at the end of 2008. Much of

these reserves are located onshore. Central Sumatra is the countrys largest oil producing

province and is the location of the large Duri and Minas oil elds. Other signicant oil eld

development and production is located offshore northwestern Java, East Kalimantan and

the Natuna Sea. Indonesia currently produces nearly 950,000 bbl/d of oil, but many of its

elds are mature and production is declining.

Institutional framework

Under Indonesias 1945 Constitution all natural resources within Indonesian territory are

owned and controlled by the state. The Ministry of Energy & Mineral Resources (MEMR) is

responsible for overseeing the states ownership and management of oil and gas resources

in Indonesia.

Oil and gas remains within the primary jurisdiction of the central GoI, however, local

governments have certain controls and rights to share in the nancial benets of the oil

and gas business. The degree of control retained by the GoI continues to be a key area

of contention for the governments of the oil and gas rich regions.

Law 22 and Pertamina

Indonesia introduced a new legal regime for its oil and gas industry with the passing of the Oil

and Gas Law (Law 22 of 2001) (Law 22). There have been several implementing regulations

promulgated under Law 22, as well as directions and decrees, to give effect to the broad

outline principles laid out in the primary legislation.

Law 22 introduced a number of changes with clear political signicance. The law restructured

and liberalised the state control over the oil and gas industry. Law 22 conrms the grant

by the State to the GoI of exclusive control over petroleum natural resources and the rights

for oil and gas exploration and development. More signicantly, it ends the monopoly control

of the state-owned oil enterprise, Pertamina. The law aims to encourage competition and

open the downstream sector to private investment.

The law, together with subsequent implementing regulations, transferred Pertaminas

upstream and downstream supervisory role to two separate government agencies. The

two regulatory agencies are Badan Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi

(BPMIGAS) and Badan Pengatur Hilir Minyak dan Gas Bumi (BPH MIGAS), which implement

and supervise Indonesian upstream and downstream activities respectively. Both agencies

are responsible directly to the President of Indonesia.

12 Norton Rose Group

Indonesian energy report

BPMIGAS has succeeded to all of Pertaminas interests it held in PSCs and other contracts

in which Pertamina acted on behalf of the GoI (and not in respect of participating interests

held by Pertamina as a contractor under those contracts). The key exception relates to

production sharing arrangements with contractors under technical assistance agreements.

Such interests have been retained by Pertamina for the balance of the term of those

agreements. One of BPMIGASs roles is to select the representative to sell the GoIs share

of oil and gas production. There is no presumption that Pertamina will be appointed in

this role, and in practice it is usually the operator of the relevant block that is appointed.

BPH MIGAS supervises all downstream activities, which include rening, storage,

transportation, distribution and marketing of petroleum and petroleum products.

In 2003 Pertamina was converted from a state-owned enterprise into a state-owned limited

liability company, known as PT Pertamina (Persero) (Pertamina). Theoretically, Pertamina

now functions like any other private sector commercial oil and gas company. It does,

however, enjoy a number of benets or privileged positions, and also assumes several

additional responsibilities, due to it being a state-owned business enterprise (BUMN) and

also specically in its own right. Some of these are discussed in more detail below. The GoI

has expressed an intention that Pertamina will be privatised at some point in the future,

but tangible plans to carry out this goal are some way off.

Pertamina engages in upstream and downstream oil and gas activities, as well as some

grandfathered rights to exploit geothermal energy. Pertamina pursues its own operations,

as well as through partnerships.

Law 22 ended Pertaminas monopoly in the downstream sector. Private companies may now

engage in downstream activities provided that they have been granted a business licence

by the GoI. With distribution to over 2,500 fuel stations, Pertamina continues to be dominant

in the retail market, but this is expected to erode over time. Since the enactment of Law 22

and the implementing downstream regulations, more than 25 companies have obtained

licences for various downstream activities. Shell opened the rst internationally branded

petrol station in Indonesia in October 2005. Others now include Petronas and Total.

One of the key obstacles to further reform of the downstream oil sector in Indonesia is

the consumption subsidies for domestic retail fuel consumers. Consumers are entitled

to purchase oil products at a discount from market prices. Discounted fuels are supplied

under a public service obligation that has been awarded by tender or direct appointment

by BPH MIGAS each year since 2004. Pertamina has been the sole selected distributor

each year. However, in 2010 two private companies, PT AKR Corporindo and a subsidiary

of Petronas, have also been awarded distribution rights in discrete locations. A signicant

portion of GoI expenditure is consumed by funding these subsidies. Over the years the

GoI has made attempts to reduce the subsidies, which was met with much political ill will.

In 2005 subsidies were rolled back causing petrol and diesel prices to rise by 125 per cent.

Whilst subsidies have been reduced, they have not yet been eliminated.

Norton Rose Group 13

Indonesian energy report Oil

The GoI has been running initiatives to encourage consumers to reduce their consumption

of subsidised fuels. In one recent initiative, consumers have been encouraged to switch from

kerosene to LPG. The GoI claims that over US$1.3 billion in subsidies has been saved since

the programme commenced in 2007 through to April 2010.

Pertamina has ambitious investment plans for 2010 amounting to US$4.2 billion. It plans to

fund its capital expenditure from borrowings of US$2.5 billion, which would include a 1 trillion

rupiah domestic bond issuance. In April Pertamina secured US$1.4 billion on loans from a

syndicate of foreign banks including Citi, HSBC and ANZ. The US$4.2 billion war chest would

be split between upstream projects (65 per cent) and downstream (35 per cent). Pertamina is

looking to make ve to ten acquisitions, including taking licences in oil and gas businesses.

Pertamina is also looking to invest in new rening capacity (see Oil Rening below) and

oating liqueed natural gas receiving terminals (see Gas LNG Regasication below).

Private sector

More than 230 private contractors are active in Indonesia, the largest including Chevron,

ConocoPhillips, ExxonMobil, Total and CNOOC Ltd. Of these, about 170 are engaged

in exploration activities.

Chevron is Indonesias largest oil producer and operates the Duri and Minas oil elds,

which together account for more than 30 per cent of Indonesias total oil production.

ConocoPhillips operates seven PSCs in Indonesia, four offshore and three onshore.

The largest producing blocks are the mature Block B in the South Natuna Sea and the

Corridor Block in Sumatra.

VICO Indonesia, the joint venture between ENI and BP, is the third largest production

sharing contractor in Indonesia.

ExxonMobils oil production is expected to substantially increase in coming years as

it continues its development of the Cepu contract area onshore Java.

Cooperation contracts

All private companies wishing to explore or exploit oil and gas reserves must do so via

cooperation contracts with BPMIGAS. Under these cooperation contracts the GoI retains

ownership of the oil and gas and the contractor bears all the risk and costs of exploration,

development and production in return for an agreed share of the proceeds derived from

subsequent sale of production.

14 Norton Rose Group

Indonesian energy report

Under the prevailing regulations, cooperation contracts may have a term of up to 30 years,

with provision for a further 20 year extension. They provide for an initial exploration period

of six years, which can be extended once by up to four years. There are also provisions

for the gradual relinquishment of a portion of the operational area, or complete

relinquishment where approval for the initial eld development has not been obtained or

where the relevant activities have not been commenced within a ve year period after the

expiry of the exploration period. Under regulations introduced in February 2010, a eld may

also be required to be relinquished if the Contractor does not submit a development program

within new expedited timeframes, and BPMIGAS is required to recommend termination of the

cooperation contract in the event of breach of the contract and/or legislation and regulations.

Additional MEMR regulations are expected to be passed in 2010 relating to the extension

of cooperation contracts, and it is expected that these will contain certain preferential rights

in favour of Pertamina.

Every cooperation contract entered into with BPMIGAS must be approved by the MEMR

and notied in writing to the Peoples Representative Assembly (DPR). Whilst the DPR does

not have the right to approve the cooperation contract, the implication is that the terms

of contract will be transparent.

The form of cooperation contract most commonly entered into in respect of upstream activities

is the production sharing contract (PSC). The rst signicant Indonesian PSC was signed

in 1966 and since that time more than 200 PSCs have been signed.

The current PSC used by BPMIGAS, on behalf of the GoI, is substantially similar to the former

version used by Pertamina, with the key exception of the domestic supply requirement for

natural gas. Key terms of the recent form of PSC are summarised below:

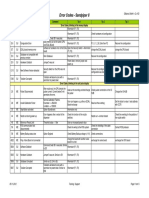

Table: Typical key terms of the current Indonesian PSC

Key terms

Term 30 years, of which:

Exploration: Six years, with one four year extension permissible.

Participating interest At the time of approving the first development plan, a local government

business enterprise (BUMD) is given the opportunity to take a 10 per

cent participating interest by paying a 10 per cent share of operating

costs to date (in cash). If the BUMD does not take up the 10 per cent

interest, it must then be offered to a BUMN, or a private national

company wholly owned by Indonesian citizens.

Time limits Six months to commence petroleum operations from the date of signing.

Three years to submit a development plan in respect of any discovery

(may be extended by two years for technically difficult areas or where

there is delay in determining gas sale and purchase arrangements).

Five years to commence petroleum operations from the end of the

exploration period (which may be extended for gas discoveries).

Indonesian energy report

Norton Rose Group 15

Oil

Key terms

Relinquishment Within three years of signing the PSC, the contractor must relinquish

a portion of the original contract area, usually between 20-25 per cent.

A further 15 per cent must be relinquished if the work commitment has

not been completed in this time. By the end of the sixth contract year

a total of 80 per cent must be relinquished. Contractor may relinquish

the contract after the first three years.

Performance bond A sum as security in respect of the work commitment for the first three

years. The amount will be reduced annually by deducting the amount

included in the work program and budget for the required activity.

Development plans,

work programs

and budgets

BPMIGAS, MEMR and the applicable provincial government have the

right to approve the initial development plans. BPMIGAS approves

all annual work programmes and budgets.

Domestic market

obligation

Crude oil: 25 per cent, to be sold at 25 per cent of the market

price (such discounted price to apply for each field from

the sixth year of production from that field onwards).

Natural gas: 25 per cent of the contractors gas entitlement. Domestic

buyers are given a one year period in which to opt to

purchase natural gas. Failing which the contractor may

market the gas internationally with the GoIs consent.

Production share First tranche petroleum (FTP): FTP is taken each year before any

deduction for operating costs. It is either taken solely by BPMIGAS

(typically around 10 per cent of petroleum produced for the year), or it

is shared with the contractor in the same proportion as the profit oil/gas

allocation (below) (typically around 20 per cent of petroleum produced

for the year). FTP effectively operates as a cap on cost recovery and

guarantees BPMIGAS a minimum income from the development.

Thereafter, for volumes remaining after cost recovery:

Crude oil: 37.5 per cent BPMIGAS, 62.5 per cent contractor.

Natural gas: 28.5714 per cent BPMIGAS, 71.4286 per cent contractor.

The percentage splits may vary, and will usually be more attractive

for the contractor for eg, deepwater and frontier blocks.

Title to equipment Title to equipment purchased by the Contractor passes to BPMIGAS

on importation. Title to leased equipment does not pass and may be

freely re-exported.

Decommissioning Contractor must conduct an environmental baseline assessment

and will be responsible for decommissioning at the end of the term.

For PSCs signed from 1995 onwards, the contractor must deposit

abandonment and restoration funds as equity for decommissioning

costs in an escrow account in an Indonesian bank. Such funds

will be included within the allowable operating costs for cost

recovery purposes.

16 Norton Rose Group

Indonesian energy report

Key terms

Transfers No transfers of a majority interest within the first three years. Any

transfer of an interest to an affiliated or non-affiliated company,

and any proposed change of control, requires the prior approval

of BPMIGAS and the GoI.

Tax Contractors are subject to income tax and such tax is maintained

under a tax equalisation clause.

Bonus payments A payment upon signature of the contract (secured by a signature

bonus bond delivered pre-execution).

Equipment and services to be provided, if requested, during the first

contract year.

Further bonus payments due upon cumulative production reaching

specified thresholds.

These bonus payments are not cost recoverable.

Arbitration Under UNCITRAL Rules at a location to be agreed.

Historically the general after tax split between the GoI and the contractors for natural gas

has been 70:30 after the contractor has recovered its costs. Generally, the current split is

between 60:40 and 70:30, but, theoretically, the production split is open for negotiation.

In addition to the production sharing, the GoI also levies corporate taxes on the contractors.

In response to concerns over the nature of certain items being cost recovered by contractors,

and the annual value of cost recoverable items during a period of declining production,

Ministerial regulations were recently passed setting out a negative list of cost items not

eligible for cost recovery. New regulations are proposed for 2010 that will further regulate

the cost recovery mechanism, potentially setting out an exhaustive list of cost items that

are eligible for cost recovery and capping the annual cost recovery amount for a block by

reference to its annual work program & budget for the year. The GoI also moved cost recovery

into the state budget process, thereby introducing an effective annual cap on cost recovery at

the level stated in the budget. In 2009 the state budget capped aggregate cost recovery at

US$11.05 billion. This was increased to US$12 billion for 2010. This move has been widely

blamed for the poor results in recent bid rounds. In the period running from December

2008 through to November 2009, only 25 per cent of blocks offered for tender attracted

a qualifying bid. In January 2010 the GoI announced plans to abandon the practice

of capping cost recovery, via the state budget, in order to encourage more investment in

the upstream sector, and in April 2010 announced that the cap would not be included

in the forthcoming draft legislation on the cost recovery mechanism.

Indonesian energy report

Norton Rose Group 17

Oil

Licensing rounds

2010 round

Indonesia offered 24 new oil and gas blocks for tender in 2010 (launched on 28 December

as the Second Round of 2009), consisting of 12 blocks offered by way of direct proposal

and 12 by way of regular auction. The majority of the new blocks offered are in central and

eastern Indonesia, particularly Cendrawasih Bay in Papua and the Makassar Straits. The

MEMR announced the winners of 14 blocks in May 2010, who include Repsol (with three

blocks offshore Papua) and Talisman and PTTEP (offshore Makassar Strait).

MIGAS launched an informal pre-bid round on 3 February 2010 for a total of 34 blocks

with 18 blocks under regular tender and 16 blocks under direct proposal tender. It is not

an ofcial bid round. Thus a bid deadline and bid documents are not available. It was

understood that BPMIGAS will ofcially open a bid round after gauging the level of interest

gathered during this pre-bid round, and removing from the round blocks which fail to

generate interest.

2009 round

The GoIs licensing rounds for 2009 met with a lack luster response from oil and gas

companies. Only three of the 24 blocks made available in the First Round between June

and November secured investors. The reason for the lack of interest is said to stem from

uncertainty amongst oil and gas companies given the GoIs plans to amend cost recovery

legislation (see Oil Cooperation Contracts above), as well as the remote location of the

blocks and a lack of data on the blocks.

The energy minister, Darwin Saleh, has stated his intention to regain investor condence

and is said to be considering new upstream incentives for oil and gas producers, including

a more favourable tax regime, amendment to the cost recovery regime, better production

splits under new PSCs and a more consultative ministry.

Seven of the 24 blocks offered in the 2009 First Round were offered by way of direct tender,

drawing bids for ve of the blocks. Only two cooperation contracts were awarded. The North

Makassar block was awarded to Niko Resources together with Baruna Nusantara Energy.

The block covers 414,904 acres and lies adjacent and to the north of Niko Resources

Southeast Ganal Block. Niko Resources and Baruna Nusantara Energy have committed to

a signature bonus of US$1 million and a work programme of US$15 million. The Blora block

in Central Java was awarded to Sele Raya who has committed to a three-year exploration

programme of US$3.44 million.

Seventeen blocks were auctioned via regular tender, but attracted only one bid. The

successful bidder was Brilliance Energy who was awarded the Sula I block in Central

Sulawesi. The PSC for the block requires Brilliance Energy to spend US$1 million by way

of a signature bonus and US$16.3 million during a three-year exploration phase.

In 2009 Sarana Pembangunan Riau and Kingswood Capital signed a PSC for the Langgak

block in Riau province.

18 Norton Rose Group

Indonesian energy report

2008 round

In 2008 Indonesia held two licensing rounds with a combination of regular tender and

direct proposal tender methods. The rst round offered 25 blocks, 22 of which were awarded

to bidders. The second round offered 31 blocks, 16 of which were awarded to bidders.

Indonesia continued to auction blocks from the 2008 bid round during 2009. In December

2009 the GoI awarded ve blocks from the 2008 round, details of which are set out in the

table below. Eleven blocks remain unallocated.

Table: Awards made in December 2009

Block Awarded to

East Bula, offshore east Indonesia

Halmahera Kofiau, offshore South Halmahera

West Papua IV, offshore West Papua

Niko Resources and Black Gold Energy

Andaman III, offshore North Sumatra Talisman Energy

West Glagah Kambuna, offshore North Sumatra Petronas and Pertamina

Together the successful bidders committed to spending US$20 million in signature bonuses,

US$5.5 million in geological and geophysical studies, US$33 million in seismic studies and

US$53 million on the drilling of three exploration wells.

Production

Oil production in Indonesia has steadily fallen over the last few years due to declining

production at mature oil elds and exploration efforts that have failed to keep pace with

the decline. Indonesia produced approximately 950,000 bbl/d in 2009 from 969 wells.

This compares to production of some 1.4 million bbl/d in 2000 and current domestic oil

consumption of 1.5 million bbl/d.

Indonesia became a net importer of oil in 2004. Given the subsidies offered to domestic

oil users, the acquisition of foreign oil has been a major drain on GoI budgets. Indonesia

is keenly looking at ways of reducing its reliance on oil and as a consequence there is

increased interest in the use of gas, coal, coalbed methane (CBM), crude palm oil and

geothermal energy.

Having joined OPEC in 1962 Indonesia withdrew from the organisation in 2008 acknowledging

that it had become a net importer of oil and was no longer able to meet its production quota.

Indonesias two largest elds, Minas and Duri, are located off the eastern coast of Sumatra

and are operated by Chevron. Both are mature elds and production is declining. Together,

these elds account for over 30 per cent of Indonesias total oil production.

Indonesian energy report

Norton Rose Group 19

Oil

It is generally thought that all of Indonesias giant oil elds have now been discovered,

exploited and production is now on the decline. The biggest oil eld discovered in recent

years is the Cepu block in the border areas of Central Java and East Java (discussed in

Oil Production Cepu below).

Indonesia offers potential for increased production via enhanced oil recovery (EOR)

techniques. There are several old wells that could benet from EOR technology, but of crucial

importance to this issue is the cost recovery mechanism adopted by the GoI. With uncertainty

surrounding regulation on cost recovery, appetite from IOCs has been dampened.

Pertamina is keen to see production increase by 10.93 per cent in 2010. To that end, the

GoI is keen to encourage new exploration, but recent bid rounds have been disappointing

(see Oil Licensing rounds above). In 2009, only ten contractors increased their total oil

production, and most contractors failed to meet their target production levels.

In 2009 contractors committed to spending US$16 billion via work plans agreed with the

GoI. Most of the expected investment relates to producing elds and US$2.36 billion was

committed to exploration activities. The GoI estimates that 122 exploration wells will be

drilled in 2010, including 42 relating to CBM reserves.

In addition, the GoI has earmarked US$9.52 billion for investment in oil facilities in the

period 2010-2014. The planned investment will take the form of rigs and reneries.

Cepu

Indonesias largest new oil eld development is the Cepu oil project offshore Java. The

block contains proved reserves of 600 million barrels of oil and 1.7 tcf of gas. It consists

of four elds Banyu Urip, Jambaran, Alas Tua and Kedung Keris. Cepu is operated by

ExxonMobil with a 45 per cent stake in the project, alongside Pertamina (45 per cent) and

local governments (10 per cent). Pertamina has expressed an interest in raising its stake

in the project to 50 per cent.

The fast-track phase one development of the Banyu Urip eld came on stream in late 2008

and as at April 2010 was reported to be producing 14,000 bbl/d, signicantly lower than

the 20,000 bbl/d that was initially anticipated. Full-scale production from the Banyu Urip

eld is targeted at 165,000 bbl/d by 2011, but that deadline is expected to slip at least

until 2012 and possibly as far as 2014.

Production was suspended between April and August 2009, reportedly due to pipeline

problems. The GoI has blamed ExxonMobil for the delays at the project and has cancelled

an incentive given to the project on the basis that it had not achieved a production output

of 20,000 bbl/d by August 2009. The production company had been granted a 60 month

exemption from the obligation to sell 25 per cent of its crude production in the domestic

market. The operator refers to delays in receiving regulatory approval from BPMIGAS, which

is essential before the operator can open bidding for the EPC work on the blocks, as well

as land acquisition issues and technical problems.

The project includes an FPSO moored off Tuban in the Java Sea.

20 Norton Rose Group

Indonesian energy report

Duri

Discovered in 1941, the Duri eld is one of the worlds largest oilelds and the biggest

steamood operation. Steamooding is an EOR method that injects steam into the reservoir

to increase oil recovery. At the Duri eld, steamooding has more than tripled oil production,

and has enabled the recovery of more than 2 billion barrels of crude oil. Duri is located in

the Rokan block with current oil production of nearly 200,000 bbl/d. The eld is operated by

PT Chevron Pacic Indonesia, a Chevron wholly-owned subsidiary. Production commenced

from the North Duri Field Area 12, an expansion of the main mature eld development,

at the end of 2008 and is expected to reach 34,000 bbl/d by 2012.

Chevron has entered into an agreement with ConocoPhillips for the long term supply

of natural gas destined for EOR operations at the Duri oileld. Chevron also plans to buy

50 mcf/d of natural gas from PT Medco Energi for a three year period, also destined for

Duris steamood operations.

Minas

Minas, Chevrons oil eld in Sumatra, is the largest eld in Asia with oil in place exceeding

4 billion barrels. Chevron has invested in EOR operations for the eld, including a US$400

million steamooding system installed in 1995 serving the elds 13 zones. Chevron is

carrying out a chemical injection project with the aim of boosting oil recovery.

Bukit Tua

Petronas Cargali owns and operates the Bukit Tua project, part of the Ketapang PSC,

having acquired the project from ConocoPhillips in 2008. Recoverable reserves at the eld

are estimated at between 50-80 million barrels of oil and 100 bcf of gas. The development

calls for an FPSO to handle between 20,000-30,000 bbl/d of oil and a total of 50,000 bbl/d

of liquids, with a minimum storage capacity of 600,000 barrels. WorleyParsons has been

awarded the FEED contract for the Bukit Tua development. Bukit Tua is scheduled to start

production in 2011 with production of 20,000 bbl/d and 50 mcf/d of are gas.

The Ketapang PSC also includes the Jenggolo oil and gas discovery and the Payang gas

discovery, both yet undeveloped.

Mahakam

Total commenced development of the South Mahakam, Stupa, West Stupa and East Mandu

discoveries in 2008 and production is scheduled to begin in late 2011. The South Mahakam

development is expected to yield 14,700 bbl/d of liquids and 114 mcf/d of gas.

Indonesian energy report

Norton Rose Group 21

Oil

Rening

Despite liberalisation, Pertamina is still dominant in Indonesias downstream sector.

It operates all nine of Indonesias reneries.

Indonesia imports 350,000-450,000 bbl/d of nished products per year, which is one-third

of its total demand. The majority of the imported products are imported by Pertamina.

Indonesias nine reneries have a total production capacity of over one million bbl/d.

All are operated by Pertamina and are in need of modernisation.

Table: Indonesias largest reneries (by capacity)

Location Capacity (bbl/d)

Dumai, Central Sumatra 120,000

Musi, South Sumatra 16,200

30,000

30,000

35,000

16,000

Cilicap, Southern Java 118,000

230,000

Balikpapan, Kalimantan 60,000

200,000

Balongan, West Java 125,000

Sei Pakning, Riau Province 50,000

Kasim, West Papua 10,000

Pangkalan Brandan, North Sumatra 5,000

Cepu 3,800

Pertamina is planning to build three new reneries over the next eight years with a combined

capacity of 650,000 bbl/d. The rst of which is the 200,000 bbl/d renery upgrade at

Balongan, West Java, which is scheduled for completion in 2014. It will produce 103,000

bbl/d of premium, 54,000 bbl/d of kerosene and 103,000 bbl/d of diesel.

22 Norton Rose Group

Indonesian energy report

The second renery on the schedule is the Banten Bay Renery to be built in Bojanegara,

Banten. STX Pan Ocean Limited, National Iranian Oil Rening Industries Devt Co, Petroeld

and Pertamina have formed a joint venture to construct and operate the renery. The initial

processing capacity of the plant is expected to be 150,000 bbl/d and is expected to be

operational by 2013 at a cost of US$4 billion. It will produce 42,000 bbl/d of premium,

30,000 bbl/d of kerosene and 58,000 bbl/d of diesel. A further 150,000 bbl/d capacity

is also planned in a subsequent stage. The feasibility study is still in progress.

The third planned renery is the East Java Renery to be located at Tuban, East Java. It has

a planned capacity of 200,000 bbl/d and is targeted for completion by 2017. This plant

will produce 75,000 barrels of premium, 32,000 barrels of kerosene and 51,000 barrels

of diesel per day.

Pertamina has further plans to expand the Cilacap renery by an additional 60,000 bbl/d,

the Balikpapan renery by 40,000 bbl/d, the Dumai renery by 50,000 bbl/d and the Pare

Pare renery by 300,000 bbl/d.

There are also plans for private sector investment in a US$2 billion renery project in Batam,

near Singapore.

Indonesia has struggled to attract foreign investment in the rening sector given low internal

rates of return and low margins on sale of oil products in the domestic market, which remain

subsidised by the state. Foreign lenders have in the past refused to nance renery projects

in Indonesia. Not only is the internal rate of return small, but they fear that once subsidies

are eventually removed, demand for rened products will decline and rening capacity

may then exceed demand.

Transport

Indonesia has a relatively modest network of oil pipelines. The largest pipelines link elds

in central Sumatra with ports on the Straits of Malacca, offshore northwest Java and eastern

Kalimantan. Pertamina operates 170 oil terminals.

Laga Ligo International has received initial approval from the city administration of Batam

to build an US$800 million oil export terminal on the island of Sambu Kecil. Construction

is schedule to start within the year and will take two years.

The Port of Sabang in Aceh province on the island of Pulau Weh, at the northern entrance

to the Malacca Strait, is being made ready to accommodate super tankers and super

cargo ships at a cost of some US$426-533 million. As an initial step, the port authority

has appointed Dublin Port Co. to manage the port.

Indonesian energy report

Norton Rose Group 23

Oil

Storage

AKR Corporindo and Vopak have established a joint venture, Jakarta Tank Terminal, to

construct and operate a petroleum terminal located at the Tanjung Priok Port. The terminal

will be the rst independent petroleum storage terminal in Indonesia and is expected to

have a total storage capacity of 450,000 cubic meters. The rst phase of 250,000 cubic

meters, was commissioned in December 2009 and the project was ofcially inaugurated in

April 2010. The second phase is expected to be completed in 2012, depending on market

demand. Once completed the facility will be one of the largest tank terminals in the private

sector in Indonesia.

Sinopec is said to be in talks with Batam Sentralindo for the purpose of forming a joint

venture to construct and operate an oil storage complex with a 2.6 million cubic metres

capacity and a supporting quay at a cost of US$815 million.

Coal-to-liquids

Sasol Group signed an MOU with the GoI in late 2009 to study the viability of an 80,000

barrel coal-to-liquid project in Indonesia, estimated to cost approximately US$10 billion.

Sasol will partner with Tambang Batubara Bukit Asam (PTBA) who will contribute reserves

of 1.8 billion tonnes to the project. The parties are seeking further partners to contribute

coal reserves to the project. They are currently conducting due diligence on coal mines

in Kalimantan.

24 Norton Rose Group

Indonesian energy report

Gas

Introduction

Indonesia had proved natural gas reserves of approximately 112 tcf as at the end of 2008,

making it the tenth largest holder of gas reserves in the world. The majority of gas reserves

are located offshore from Natuna Island and in East Kalimantan, South Sumatra and West

Papua. Indonesia is home to Southeast Asias largest gas eld, the Natuna D-Alpha block

estimated to contain over 200 tcf of high carbon-dioxide gas, of which 46 tcf is considered

likely to be commercially recoverable.

Industry structure and legal framework

See Oil Institutional framework and Oil Law 22 and Pertamina above for the role of the

GoI, MEMR, BPMIGAS, BPH MIGAS and Pertamina in the gas sector.

Indonesias state gas pipeline company is PT Perusahaan Gas Negara (PGN), which carries

out natural gas transmission and distribution activities. This role should be distinguished

both from BPMIGAS, the oil and gas upstream regulatory agency, and from that of BPH

MIGAS, the oil and gas downstream regulatory agency who issues rights to private companies

intending to distribute or transport natural gas through pipelines (as well as licences for

other downstream business activities).

The GoIs gas pipelines are considered to be a natural monopoly and Law 22 imposes the

requirement for open access. Otherwise, there is no requirement on operators of pipelines

and storage facilities to expand their projects to accommodate third party access. BPH

MIGAS is responsible for regulation, stipulation and supervision of tariffs for pipeline and

storage services. There is yet no developed regulatory system for natural gas distribution.

Law 22 liberalised the supply and trading of natural gas. The law permits the direct

negotiation of gas sales contracts by sellers and buyers and the trading of natural gas.

The price of natural gas for households and small scale consumers is determined by

BPH MIGAS. BPH MIGAS also grants business licences to those wishing to engage in gas

trading. A licence is either for wholesale purposes or for limited trading purposes.

Pertamina remains an important participant in Indonesias natural gas industry. Pertamina,

together with Total, ExxonMobil, VICO (BP Eni joint venture), ConocoPhillips, BP, Chevron

and PetroChina account for the vast majority of gas production. Total is the largest producer

with production of 2.57 bcf/d of gas. Total produces 80 per cent of the feedstock gas for

the Bontang LNG project.

Indonesian energy report

Norton Rose Group 25

Gas

Production

Indonesia produced approximately 7.9 bcf/d of natural gas in 2009, about half of which

was consumed domestically. Indonesia ranks eighth in world gas production. Several elds

are expected to come on stream in 2010 and will boost production.

Indonesia exports gas by way of LNG to markets in South Korea, Japan, Taiwan, China

and Mexico and by pipeline to Singapore and Malaysia.

The GoI requires gas producers to supply 25 per cent of their gas production to the domestic

market. This applies to all gas ventures with a PSC signed after 23 November 2001. However,

this domestic obligation has failed to keep pace with growing domestic demand for gas.

The fertiliser industry has suffered from a lack of gas feedstock resulting in reduced fertiliser

production. PLN also claims that it needs 2.233 bcf/d of gas for power generation in 2010,

but estimated supply is only 1.258 bcf/d.

As a result the GoI introduced a policy to redirect gas intended for export to domestic projects.

The policy has not been without cost to GoI as the cost of gas supplied domestically is subsided

by the GoI. The gas price is between one third and one half of the sale price which could

be obtained from LNG export. To this end, gas has been diverted from the Bontang and Arun

LNG projects reducing the total number of cargoes of LNG exported to customers. The cost

to the GoI in 2009 has been estimated to be in excess of US$1 billion.

More recently, the GoI has stated that producers will be allowed to export gas provided

there are no domestic buyers. The MEMR claims domestic customers will be given the rst

opportunity to negotiate the purchase of gas. If the producers and domestic customers fail

to reach agreement, the producer may export gas with the consent of the Minister.

Development

General

Indonesia has ambitious plans to spend US$21.68 billion on new gas investments in the 2010-

2014 period. It is not clear how much of this will be funded by the GoI and how much will come

from the private sector. The plans include two new gas rigs in Lapangan Rambutan in South

Sumatra and in Pondok Tengah in West Java at a total cost of US$2.42 billion. There are also

plans for ve new gas plants at Blok A in Nanggroe Aceh Sarussalam, Jambi Merang in Jambi,

Randublatung in Central Java, Gajah Baru in Natuna offshore Riau Islands and Kepodang in

Bawean offshore East Java. There are also plans for gas reneries in the form of LNG and LPG.

Ganal-Rapak

Chevron is undertaking the Ganal-Rapak deep-water gas development off East Kalimantan.

The development is expected to consist of two large barge based oating production units,

similar to Chevrons nearby development at West Seno. The water depth of the two developments

range from 3200 to 6000 feet. The project requires two barge based production units, 130 kms

of gas export lines and 30 subsea wells. The Maha, Gendalo and Gandang discoveries will be tied

26 Norton Rose Group

Indonesian energy report

to a processing facility at Gendalo, which will be designed to process 700 mcf/d of gas

and 25,000 bbl/d of liquids. A further production facility at Gehem will process 420 mcf/d

of gas and 30,000 bbl/d of liquids. The gas from the development will feed the Bontang

LNG project. The project is expected to cost US$7-8.5 billion.

Chevron announced in December 2009 that it is looking for a partner to invest in the project.

Chevron currently holds 80 per cent, along with Eni (20 per cent). Pertamina is said to

be interested in acquiring a 10 per cent interest in the project. Chevron and its partner(s)

are expected to make the nal investment decision on the project in 2011. First output

is targeted for 2013 at an initial rate of 150,000 mcf/d, rising to 900,000 mcf/d by 2016.

Natuna D-Alpha block

Pertamina is awaiting approval of terms by BPMIGAS before it selects a partner to develop

the remote offshore Natuna D-Alpha block. Pertamina is thought to be looking for partners

to take a 60 per cent share of the project. The block is estimated to contain 46 tcf of

recoverable reserves, with a strong concentration of carbon dioxide. The GoI has said

that after the domestic market obligation has been met (25 per cent), the balance can be

exported. This is good news for IOCs interested in participating in the project given the

opportunity to maximise revenues from an export led project.

ExxonMobil was the former operator of the block, but the GoI transferred it to Pertamina stating

that ExxonMobil did not deliver a development plan for the block in the timeframe required.

Offshore Mahakam

Total is undertaking various developments of the elds within the offshore Mahakam PSC, off

East Kalimantan. The block produces the majority of the feedstock for the Bontang LNG project.

Total holds the elds jointly with Inpex. The block currently produces 2.6 bcf/d of gas and

further developments in South Mahakam are expected to add an additional 114 mcf/d of gas

and 14,700 bbl/d of liquids. Pertamina has also expressed an interest in acquiring equity in

the Mahakam block, either when the contract is set for renewal in 2017, or possibly earlier.

North Belut

ConocoPhillips produced the rst gas and condensate from its North Belut eld at the

end of 2009. The eld produced 6,000 bbl/d of oil and 80,000-90,000 mcf/d of gas and

production is expected to rise to 200,000 mcf/d of gas and 20,000 barrels of oil equivalent

in condensates. The eld is in Natuna block B located in the South Natuna Sea. Natuna block

B produced 78,000 barrels of oil equivalent in 2008 and was expected to produce 53,000

barrels of oil equivalent in 2009. ConocoPhillips operates the block with a 40 per cent

stake, together with Inpex (35 per cent) and Chevron (24 per cent).

Indonesian energy report

Norton Rose Group 27

Gas

Block A

Medco Energi is awaiting approval for a 20-year extension of its PSC for Block A in Aceh.

Medco Energie applied for the extension in 2008, but the approval process has stalled

at the local government level in Aceh. Medco Energie holds a 41.67 per cent stake in the

development, along with Premier Oil (41.66 per cent) and Japan Petroleum Exploration Co.

(16.67 per cent) The block is estimated to contain gas reserves of 500 bcf and can produce

around 50-100 mcf/d for about 15 years.

Jambaran

ExxonMobil expects to produce 500 mcf/d of gas from the Jambaran eld in the Cepu block

commencing 2015. The block is estimated to contain 1.3 tcf of gas reserves. The GoI is keen

to accelerate the production schedule.

Gajah Baru (New Elephant)

Development works are continuing at Premier Oils delayed Gajah Baru (New Elephant)

offshore project in the Natuna Sea. Gajah Baru is expected to produce 140 mcf/d of gas,

which will be sold to customers in Singapore and Batam Island via an existing subsea

pipeline. First gas is expected in late 2011.

Ruby

Pearl Energy is proceeding with the FEED work for its Ruby gas project off East Kalimantan.

Ruby, the renamed Makassar Straits eld, is expected to produce 100 mcf/d of gas, which

will be sold into the domestic market. A possible destination for the gas is the Bontang

LNG project.

Wortel and Oyong

The GoI has recently approved Santoss plans to develop the Wortel gas eld. The Wortel

eld in the Sampang block, offshore East Java, is estimated to contain recoverable reserves

of about 150 bcf. Santos operates the block with a 45 per cent share, along with Singapore

Petroleum Company (40 per cent) and Cue Energy (15 per cent). The eld is expected to start

producing gas in 2011. Santos has started gas production from its Oyong phase two development

in the same Sampang block. The project is expected to reach plateau production of 50-60

mcf/d of gas, which will be sold to Power Grati for use at the Grati power plant.

Kerendan

Elnusa (of Indonesia) and Sound Oil are seeking new partners to help restart exploration

activity at their Bangkanai PSC in Central Kalimantan. Elnusa is aiming to commence

production from the Keredan gas eld in 2011. The eld contains proven gas reserves

of 187 bcf and proven and probable reserves of 238.5 bcf. The gas will likely be used for

domestic power generation.

28 Norton Rose Group

Indonesian energy report

Pipelines

Most gas pipelines in Indonesia are project specic and are not interconnected. PT

Transgasindo, a company owned 60 per cent by PGN and 40 per cent by a consortium

of ConocoPhillips, Petronas, Talisman Energy and Singapore Petroleum, owns and

operates two gas transmission pipelines, and PGN owns and operates the remaining two:

Table: Indonesias gas transmission lines

Pipeline Operational since Length (km) Owned by

Grissik-Duri 1998 536 PT Transgasindo

Grissik-Singapore 2003 470 PT Transgasindo

Medan and Jakarta/Bogor 2000 536 PGN

South Sumatra-West Java 2003 1,116 PGN

In January 1999, SembGas, signed an agreement to purchase West Natuna gas from

Pertamina. The gas is transported to Singapore via pipelines from three separate blocks.

Since January 2001, West Natuna has supplied 325 mcf/d as part of a 22-year deal, while

a pipeline from South Sumatra began supplying 350 mcf/d of gas to Singapore in 2006.

In 2008 a further gas sales agreement was signed to export gas from West Natuna Sea Block

A to SembGas in Singapore. Another 100 mcf/d of natural gas is anticipated to be delivered

via the South Sumatra pipeline from the ConocoPhillips operated Corridor Block to power

Singapores planned Island Power station, but the project has experienced numerous delays.

Indonesia also pipes natural gas to Malaysia via a 250 mcf/d pipeline from the

ConocoPhillips-operated Natuna Sea Block B.

PGN operates more than 3,187 kms of natural gas pipelines across nine regional networks,

which serve around 84 million customers. However, the limited size of the network and the

lack of interconnectivity has been an obstacle to further domestic consumption. As a result,

Indonesia still relies heavily on oil, but the GoI has stated that it is keen to promote the

use of gas.

Indonesia is a keen proponent of the Trans-ASEAN Gas Pipeline, which is a project

aiming to link the gas networks of major consumers and producers in Southeast Asia.

Indonesian energy report

Norton Rose Group 29

Gas

LNG

Liquefaction

Indonesia exported some 26.85 bcm of LNG during 2008 to countries such as Japan,

South Korea, China, Taiwan and Mexico, making it the worlds third largest LNG exporter

behind Qatar and Malaysia.

Indonesia has three LNG liquefaction projects in operation, detailed in the table below:

Table: Indonesias LNG liquefaction projects

Project Location

Capacity

(mtpa)

Shareholders

Gas sourced

from

Export

destination

Bontang Badak,

East Kalimantan

22.5

(8 trains)

Pertamina 55%

Vico 20%

Total 10%

JILCO 15%

Total

Chevron

VICO

Japan

South Korea

Taiwan

Arun North Sumatra 10

(6 trains)

Pertamina 55%

ExxonMobil 30%

JILCO 15%

ExxonMobil Japan

South Korea

Tangguh West Papua 7.6

(2 trains)

BP 37.16%

CNOOC 16.96%

Mitsubishi 16.3%

Nippon Oil 12.23%

KG 10%

LNG Japan 7.35%

BP China

South Korea

Mexico

Japan

Bontang

From a peak production level in 2001 of a bit over 21 mtpa, Bontangs production levels

have dropped so that in 2009 it produced about 17.3 mtpa of LNG. It began experiencing

LNG shortfalls in 2004, causing the GoI to ask its Japanese buyers to cancel cargoes. Maintaining

Bontangs production has been difcult in part because of declining gas production, but

also as a result of GoI policy to divert gas for domestic use for fertiliser and LPG production.

The Bontang plant is expected to produce 279 cargos of LNG in 2010, down from 296

cargoes in 2009.

Total supplies 80 per cent of Bontangs natural gas from its elds in the Mahakam PSC area.

Totals PSC for the Mahakam block expires in 2017 and it has requested an extension from the

GoI. Total is committed to spending US$8 billion on developing the block in the period to 2015.

Mahakam is expected to produce 2.55 bcf/d of gas and 97,200 bbl/d of condensates in 2010.

Pertamina is said to be interested in acquiring up to a 25 per cent interest in the block.

The Mahakam block is currently held by Total and Inpex in equal shares.

30 Norton Rose Group

Indonesian energy report

Arun

The Arun LNG facility receives gas from ExxonMobils gas elds in Aceh. ExxonMobil estimates

that it has depleted more than 90 per cent of the reserves in these elds. As a consequence,

Arun LNG expects that it will ship 36 cargoes of LNG in 2010, down from 42 in 2009.

Each cargo is 125,000 cubic meters.

Like Bontang, the GoI redirected gas produced from the Aceh elds towards domestic

consumption, thereby decreasing the natural gas available for export. To meet long term

contractual obligations, the GoI defers cargoes or purchases cargoes of LNG on a spot basis.

Tangguh

The Tangguh LNG project consists of six gas eld developments in the Wiriagar, Berau and

Muturi production sharing contracts in the Bentuni area of Papua. Gas is produced from

two offshore platforms and transported via 22 kms of pipeline to two onshore liquefaction

trains, each with a capacity of 3.8 mtpa.

The Tangguh LNG project exported its rst cargo of LNG in July 2009 and that year a total

of 16 cargoes were shipped to buyers. The project suffered from initial technical problems

causing delays and the project fell short of output targets for 2009. As a consequence, BP

was forced to purchase swap cargos from Bontang to meet its contractual commitments.

In 2010 the project expects to ship 116 cargoes of LNG to customers.

Earlier this year, the Minister of Energy and Mineral Resources approved a long term supply

deal between the Tangguh project and Tohoku Electric Power of Japan. Pursuant to the

agreement, Tangguh LNG will supply 125,000 tonnes for 15 years.

In March 2010 Chubu Electric Power agreed to purchase 2 mtpa of LNG from the Tangguh

project over a ve year period.

Donggi Senoro LNG

A consortium of Mitsubishi Corp (51 per cent), Pertamina (29 per cent) and PT Medco Energi

Internasional (20 per cent) have been planning a 2 mtpa project utilising gas from the Senoro

and Matindok gas elds in Central Sulawesi at a cost of US$8 billion. The nal investment

decision is due within weeks and if positive, the project would be operational by 2014.

Plans for the single train LNG project in Central Sulawesi received a positive boost recently

when the GoI gave its approval for gas from the senoro elds to be exported, subject to

minimum domestic obligations (expected to be 25-30 per cent).

Preliminary heads of terms have been agreed with Kyushu Electric Power Company,

Chubu Power Company and Korea Gas Corporation for long term offtake of LNG.

Indonesian energy report

Norton Rose Group 31

Gas

Abadi LNG

Inpex has plans to develop the Abadi eld as a oating LNG project at an estimated cost

of US$19.6 billion. Whilst the project has received initial approval from the GoI on the basis

of a oating LNG design, the decision whether to base the liquefaction project onshore

or offshore is still under consideration. The Abadi eld is located in the Arafura Sea in the

Masela PSC about 170 kms west of Saumlaki. The eld is located at depths of 400 and

750 meters and is thought to contain reserves of up to 10 tcf.

Sengkang LNG

Energy World Corporation is planning an LNG project for its Sengkang block in South Sulawesi.

The project would be developed in phases, starting with an initial phase of 2 mtpa increasing

to 5 mtpa. The current reserves of the Sengkang block are said to be 583 bcf of gas, but

Energy World Corporation claims potential reserves could be as high as 7 tcf.

PGN has signed a preliminary agreement with Energy World Corporation for a ve year supply

of LNG for domestic usage starting in 2012. This would be the rst sale of LNG for domestic

use. The future of this sales agreement, of course, depends on plans to develop an LNG

regasication terminal in Indonesia. Energy World has also reportedly signed an agreement

to sell LNG to Tokyo Gas, however BPMIGAS has suggested this was done without GoIs approval.

Regasication

Pertamina and PGN are seeking an EPC contractor for a oating regasication terminal in

West Java with the capacity of 3 mtpa of gas. The terminal will supply gas to a receiving point

in Muara Karang, north Jakarta, and eventually supply a power plant and other industry

in West Java. PLN has recently announced that it will no longer take part in the project, but

would be a customer for the regasied LNG. The parties aspire to have the project operational

by 2012. Gas would be sourced from gas elds in East Kalimantan.

Pertamina is also considering building a oating LNG receiving terminal in East Java, with

a capacity of 1.5 mtpa. State gas distributor, PGN was originally associated with the project,

but appears to have withdrawn from it.

PGN has plans to build an LNG receiving terminal in North Sumatra with capacity of 1.5 mtpa.

Coal bed methane

Indonesia has the second largest CBM reserves in the world, after China. Indonesia is

estimated to have over 450 tcf of CBM reserves, which is about three times as much as

Indonesias potential and proved conventional natural gas reserves. Proven CBM reserves

are 112 tcf. Clearly this is a key energy source for Indonesia and is expected to grow in

importance and activity in the coming years.

32 Norton Rose Group

Indonesian energy report

The potential for CBM development has been identied in all 11 of Indonesias coal basins,

but the South Sumatra and Kutai basins offer the most promise with estimated reserves

of 183 tcf and 80.4 tcf respectively.

As yet there is no commercial production of CBM reserves in Indonesia. Uncertainty in the

legal and regulatory regime is one of the reasons behind the lack of development to date,

but this could rapidly change with the new regulations enacted in 2008. The GoI is targeting

production of 1 bcf/d by 2025.

In 2008 the GoI enacted regulations to facilitate the development of CBM projects. The

CBM regulations clarify that CBM exploration and exploitation are subject to Indonesian

oil and gas regulations. The regulations create a new type of CBM tenure distinct from oil

and gas concessions. They establish a competitive direct offer procedure for the award

of CBM concessions.

Under this procedure the contractor offers to carry out a joint study with BPMIGAS involving

seismic data collection and evaluation. The contractor bears the costs of this joint study.

The GoI evaluates the data and based on this evaluation will delineate the CBM block into

a working area, which is tendered for open bidding from interested parties. The contractor

that carried out the seismic study has the option of matching the highest bid received

by BPMIGAS in relation to the particular block in question.

CBM projects are conducted under a PSC with BPMIGAS. Twenty one such contracts have

been awarded to date. The PSC for CBM projects is broadly similar to PSCs for oil and gas

projects. The GoI has the right to take a minority participating interest in the development.

The PSC also contains a domestic market obligation requiring a proportion of the gas

to be dedicated to the Indonesian market. The GoI provides a relatively better production

split for CBM projects than oil and gas projects, with the contractors production share

at 45 per cent.

In March 2010 the MEMR announced that four CBM blocks will be auctioned in June or July

2010 offering two contractual options a net PSC (as described in the previous paragraph)

or a gross PSC. Under a gross PSC revenue is calculated from the CBM gross production,

meaning that the output will be divided directly between the GoI and the contractor without

any reduction for cost recovery ie, there will be no cost recovery payments. This model

of contract may nd favour with contractors because it allows the commercialisation

of CBM from the beginning of the exploration phase. Unlike net PSCs, contractors would

not be obliged to complete the exploration phase and receive approval for the plan of

development before commercialising the gas discovered.

One of the key areas of uncertainly before the new regulations were enacted was the priority

to be given to overlapping concession holders as between oil and gas PSC contracts and

coal concession holders. The general rule is that the contractor of an existing concession

(coal or oil and gas) has a preferential right over third parties to make a direct offer for CBM

exploration or exploitation within its concession area. Where there are both oil and gas

and coal concessions priority is given to the oil and gas contractor in overlapping areas.

Indonesian energy report

Norton Rose Group 33

Gas

Medco Energi International, Arrow Energy, Batavia Energy and PT Energi Pasir Hitam Indonesia

were awarded the rst CBM PSC in May 2008. They spudded their rst CBM exploration well on

their Sekayu PSC in the South Sumatra basin in September 2009. They are targeting production to

begin in 2011. In August 2009, CBM Asia Development acquired a 24 per cent interest in the PSC.

VICO, Opicoil, Universe Gas and Oil and the GoI signed a PSC for the CBM reserves of the

Sanga-Sanga block in East Kalimantan in December 2009. Preliminary studies have revealed that

the block may contain 4 tcf of CBM. It will potentially be the rst CBM commercially produced

in Indonesia and is destined for the Bontang LNG plant. In another rst, Indonesia is likely

to become to rst CBM to LNG producer in the world. The PSC for the CBM overlays the same

acreage as the existing Sanga-Sanga conventional PSC. The existing infrastructure is expected

to allow rapid and efcient development of the CBM reserves. VICO is reported to have paid

US$4 million by way of signature bonus and will implement a US$38 million work programme.

In November 2009 the GoI awarded six CBM blocks, as set out in the table below:

Table: CBM awarded November 2009

Block Operator and partners

Barito PT Transasia Resources (operator)

PT Jindal Stainless Indonesia

Sanga-Sanga Virginia Indonesia Co (operator)

BP

OPIC

Lasmo (an Eni subsidiary)

Universe Oil & Gas

Virginia International Co

Rengat Indon CBM Ltd

Muara Enim PT Pertamina Hulu Energi Metana Sumatera

PT Trisula CBM Energy

Batang Asin Bumi Perdana Energy Ltd

Glory Wealth Pacific Ltd

Langgak P Sarana Pembangunan Riau

Shale gas

The GoI plans to commence studies in 2010 on the use of gas extracted from shale.

Preliminary studies have shown that Indonesia has sizable shale gas reserves in its soil,

but the exact volume has yet to be measured.

34 Norton Rose Group

Indonesian energy report

Electricity

Capacity

Indonesia has about 36 GW of installed generating capacity. The state-owned electricity

utility, PT Perusahaan Listrik Negara (Persero) (PLN), controls about 21 GW and the balance

is produced by captive power producers (13.5 GW) and independent power producers (IPPs)

(1.6 GW). Many of PLNs plants are old and inefcient meaning that productive capacity is

less than installed capacity.

Some 87 per cent of Indonesias generating capacity comes from conventional thermal

sources oil, natural gas and coal. About 8 per cent comes from hydroelectric and 5 per cent

from geothermal and other renewable sources.

Indonesia suffers from a shortage of power and blackouts are frequent. PLN anticipates that

Indonesia will need additional generation capacity of 57.4 GW by 2018, with PLN controlling

61.5 per cent and 38.5 per cent controlled by IPPs.

PLN is Indonesias largest consumer of oil, but as oil production declines in Indonesia,

the GoI is keen to diversify the fuel sources for power generation in Indonesia. PLN plans

to make greater use of gas, coal and geothermal energy.

The electrication ratio is 65 per cent and the GoI plans to increase access to electricity

to 93 per cent by 2025.

Institutional framework

Ministry of Energy and Mineral Resources

The MEMR is the main policy making body for electricity. It is responsible for developing the

electricity master plan and preparing laws and regulations related to electricity. MEMR establishes

tariff and subsidy policies. It is also responsible for the issue of business licences.

PLN

Indonesias power sector is dominated by PLN, formerly known as Perusahaan Listrik Negara.

PLN is a vertically integrated monopoly and, until recently, was the sole buyer and seller of

electricity in Indonesia. PLN operates around 85 per cent of the countrys generating capacity

and all transmission and distribution activities. In recent years the majority of new projects

have been developed by PLN.

PLN has struggled to keep up with the demand for new power generation and transmission

facilities. Fuel costs make up over 85 per cent of its operating expenses and tariffs are

insufcient to cover the full costs of generation. The GoI pays a subsidy to PLN, in the nature

of a Public Service Obligation, but this has been inadequate to provide for PLNs capital

expenditure requirements.

Indonesian energy report

Norton Rose Group 35

Electricity

Regulatory framework

Law 30

Indonesia passed a new law for the electricity sector in September 2009, Law No. 30 of 2009,

(Law 30). Law 30 replaces Law No. 22 of 2002, which was revoked by the Constitutional

Court on the basis that its key provisions contravened the Indonesian Constitution.

Law No. 22 replaced the earlier Law. No. 15 of 1985.

The new Law 30, however, is already controversial and subject to judicial review. It is alleged

by some to be unconstitutional. It will likely be some months before the outcome of the

judicial review is made public.

Law 30 introduces three key reforms:

PLN will no longer have a monopoly in supply and distribution of electricity to consumers

Private businesses may provide electricity for public use, but subject to a right of rst

priority granted to state-owned companies (ie, PLN)

A greater role for provincial and regional governments in terms of support for future

projects, licence granting and tariff xing.

Like many other Indonesian laws, the statute itself provides broad outline principles and

much of the detail will only become clear as implementing regulations are enacted. Until this

time, the implementation of the new law remains unclear.

Law 30 does not contemplate the unbundling of PLN, the creation of any independent

market or network operator, or provide open access to PLNs transmission network. These

were key aspects of the former Law No. 22 of 2002 which were thought to contravene the

Indonesian Constitution. However Law 30 does refer to the lease price of electric power

network suggesting that some form of open access is contemplated. This will require further

clarication through regulation.

Law 30 does, theoretically, end PLNs monopoly over supply and distribution of electricity

to end users. The provision of electricity for public use may be carried out by state-owned

companies (ie, PLN), regional owned companies, private business entities, cooperatives and

non-governmental organisations. A generator of electricity will now be able to sell power to

parties other than PLN.