Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Argus LNG Daily

Caricato da

Debika Chakraborty0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

213 visualizzazioni11 pagineMay 2014 edition

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoMay 2014 edition

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

213 visualizzazioni11 pagineArgus LNG Daily

Caricato da

Debika ChakrabortyMay 2014 edition

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 11

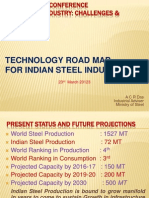

Latest price snapshot $/mn Btu

Copyright 2014 Argus Media Ltd

Argus LNG Daily

Issue 14-103 Wednesday 28 May 2014

PRICES

Daily LNG prices, news and analysis

Argus Asia-Pacifc des spot LNG $/mn Btu

Delivery Bid Offer Midpoint

Northeast Asia (ANEA) 1H Jul 12.96 13.57 13.265 -0.085

2H Jul 12.96 13.57 13.265 -0.085

1H Aug 13.02 13.61 13.315 -0.095

China 1H Jul 12.98 13.55 13.265 -0.085

2H Jul 12.98 13.55 13.265 -0.085

1H Aug 13.00 13.63 13.315 -0.095

India 1H Jul 12.63 13.04 12.835 -0.100

2H Jul 12.63 13.04 12.835 -0.100

1H Aug 12.63 13.04 12.835 -0.100

Argus fob spot LNG $/mn Btu

Loading Bid Offer Midpoint

Iberian peninsula reload 2H Jun 11.22 12.55 11.885 +0.010

1H Jul 11.30 12.57 11.935 -0.015

West Africa (AWAF) 2H Jun 11.27 12.60 11.935 +0.010

1H Jul 11.37 12.65 12.010 -0.015

Trinidad and Tobago 2H Jun 11.37 12.68 12.025 0.000

1H Jul 11.38 12.68 12.030 +0.005

European des prices

NW Europe des (2H Jun): 9.815

Iberian peninsula des (2H Jun): 11.635

Iberian peninsula reload (2H Jun): 11.885

Italy des (2H Jun): 10.435

Greece des (2H Jun): 11.200

Turkey des (2H Jun): 11.700

Middle East fob

To Europe: 9.72

To Asia: 12.10

Asia des prices

Northeast Asia (ANEA) (1H Jul): 13.265

Southeast Asia (ASEA) (1H Jul): 12.880

China des (1H Jul): 13.265

India des (1H Jul): 12.835

West Africa (AWAF) price

(2H Jun): 11.935

Trinidad and Tobago fob

(2H Jun): 12.025

Australia fob

12.45

Argus Latin America des spot LNG $/mn Btu

Delivery Price

Argentina Prompt 12.95 -0.01

Brazil Prompt 12.74 -0.01

Chile Prompt 13.48 0.00

Mexico Gulf coast Prompt 13.24 0.00

Mexico Pacifc coast Prompt 12.50 -0.05

Angola LNG off line until mid-2015

The 5.2mn t/yr Soyo LNG export facility in Angola is expect-

ed to be off line until mid-2015, operator Angola LNG said.

The prolonged outage is necessary to enable contractor

US engineering company Bechtel to carry out repairs on

the plant following an incident on 10 April. The plant was

taken off line after a pipe connection failure associated

with the fare system caused a hydrocarbon release.

Works will also address capacity issues at the plant,

Angola LNG said. Prior to the incident the facility had

operated at reduced capacity, producing fve cargoes so far

in 2014. The plant could produce over 87 standard-sized

cargoes each year if it operated at full capacity.

The plant will remain shut down until mid-2015, and

will not produce either LNG or LPG. Gas produced in as-

sociation with crude production will either be fared or

re-injected into wells.

Whether the plant will reach full operational capacity

in 2015 is subject to the results of tests conducted after

the restart, Angola LNG said.

The outage had been expected to be shorter, after

minority shareholder BP said in late April that the plant was

expected to be off line for a couple of quarters. But the lat-

est announcement on the length of the outage follows addi-

tional investigations into the cause of the 10 April incident.

Even before the incident, the facility was not expected

to operate at full capacity in 2014. Lead shareholder Chev-

MArkET CoMMENTAry

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 2 of 11

Argus Northeast Asia swaps $/mn Btu

Delivery Price

Aug 13.40 0.00

Sep 13.65 0.00

Oct 14.38 0.00

Key netbacks $/mn Btu

Delivery Price

Southeast Asia (ASEA) 1H Jul 12.88 -0.09

2H Jul 12.88 -0.09

1H Aug 12.92 -0.10

Australia fob Prompt 12.45 -0.08

Middle East fob (Asia-Pacifc bound) Prompt 12.10 -0.08

Middle East fob (Europe-bound) Prompt 9.72 -0.03

Benchmark price snapshot

Market Delivery Price

Natural gas $/mn Btu

Nymex Jun 4.60

NBP Jun 6.94

Zeebrugge Jun 7.55

Peg Nord Jun 7.74

PSV Jun 8.28

Crude $/bl

WTI Jul 103.38

Brent Jul 109.87

JCC* Feb 110.92

*Japanese Cocktail Crude

Argus Victoria Index (AVX) - Friday 23 May 2014

Delivery Units Bid Offer Midpoint

June A$/GJ 4.06 4.38 4.220 0.000

June $/mn Btu 3.95 4.27 4.107 -0.059

The AVX index, the frst month-ahead index for Australias east coast Victorian

natural gas market, is assessed each Friday and reproduced through the week. The

date shown is the date of the assessment. The index will also appear in the east

coast Australian markets page each Friday

Argus European des spot LNG $/mn Btu

Delivery Bid Offer Midpoint

NW Europe 2H Jun 7.23 12.40 9.815 -0.135

1H Jul 7.60 12.40 10.000 -0.025

Iberian peninsula 2H Jun 10.77 12.50 11.635 -0.015

1H Jul 10.77 12.50 11.635 -0.015

Italy 2H Jun 8.47 12.40 10.435 +0.035

1H Jul 8.53 12.40 10.465 +0.065

Greece 2H Jun 10.00 12.40 11.200 0.000

1H Jul 10.00 12.40 11.200 0.000

Turkey 2H Jun 11.00 12.40 11.700 0.000

1H Jul 11.00 12.40 11.700 0.000

ron said in February that the plant would run at half of

its full capacity for the rest of this year and not reach full

capacity until early 2015.

The outage has had a limited impact on the Argus West

Africa fob (AWAF) price for the front half-month, which

has lost over $1.50/mn Btu since 10 April. Ample supply

and limited demand has weighed on LNG prices in both the

Pacifc and Atlantic basins in recent weeks, despite the halt

of production at Angola LNG.

Bechtel has described its work on the construction of

the LNG train at Soyo and port expansion work as one of its

"most challenging recent projects" because of the plant's

remote location and limited infrastructure. It was awarded

a four-year contract for the construction of the 5.2mn t/yr

train, tanks and supporting facilities in 2007.

Angola LNG is a joint venture between Chevron, which

own 36.4pc, Angolan state-owned Sonangol with 22.8pc

and BP, Total and Italy's Eni, each holding 13.6pc.

July-August spread narrows in Asia-Pacifc

Northeast Asian spot prices continued to fall today on increased

supply availability and weak demand. August prices came

under particular pressure, narrowing the contango to July.

August spot prices are now seen at a 5/mn Btu contango

to July, down from 15/mn Btu on 23 May. Some market

participants had earlier anticipated a possible 20-30/mn

Btu contango for August to July, mainly on expectations of

increased gas demand in the summer. Spot suppliers early

last week indicatively offered some August cargoes in the

low-$14s/mn Btu, at a premium to the high-$13/mn Btu level

for July volumes.

But fresh August supplies from Australias 16.3mn t/yr

North West Shelf (NWS) LNG plant, the start-up of the 6.9mn

t/yr Papua New Guinea (PNG) LNG facilitys second liquefac-

tion train and continued expectations of a mild summer have

depressed August prices and capped the contango to July.

NWS Australia LNG has issued a tender for one or more

des or fob cargoes for late-July and late-August deliveries.

The tender closes on 9 June, with bids to remain valid until

13 June. The tender is likely to draw limited interest from

consumers in Asia-Pacifc, many of which have high invento-

ries. The cargoes are expected to be awarded to portfolio

suppliers or trading frms, which could be seeking volumes

for optimisation or to cover short positions. Shareholders of

the NWS plant may also be inclined to bid for the cargoes at

higher levels to support market prices. BP, Shell, Chevron,

Australias Woodside and BHP Billiton and Japanese trading

houses Mitsui and Mitsubishi have equity stakes in NWS.

NWS possibly sold two June-delivery cargoes to portfolio

suppliers in its last spot tender issued at the end of April

MArkET CoMMENTAry

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 3 of 11

Global supply highlights

Supply Loading period First reported Last updated Comments

Up to 10 cargoes/month from PNG From Jul/Aug 28 May 28 May

Plant expected to reach full capacity by

end-June

8 reloads from Spain scheduled May 31 Mar 27 May All full size. Three to load in next few days

Unspecifed number of cargoes from

Bintulu

May through Sep 24 Apr 27 May All cargoes heard sold

6 reloads from Spain scheduled Jul 27 May 27 May All full size

5 reloads from Spain scheduled June 01 May 27 May All full size.

Unspecifed number of cargoes from NWS 17-19 Jul; 16-21 Aug 27 May 27 May

Fob or des; 28-30 Jul and 27 Aug-1 Sep deliv-

ery in NE Asia

Up to 6 Nigerian cargoes offer by Galp Oct 2015 for up to fve years 01 Apr 21 May

At least 4-6 cargoes awarded on fob basis,

likely not for fve years

1 re-export from France Late May/early June 14 May 21 May Likely sold to Brazil

2 Nigerian cargoes June - August 09 May 20 May

1 June cargo may have been sold, 1 August

may still be available

Up to 6 a month from PNG LNG From June 06 May 06 May Commissioning cargo to be shipped mid-year

1-2 cargoes from Pluto LNG June delivery 04 Apr 02 May Cargoes heard to have been sold

Up to 20 cargoes from Bontang LNG 2H 2014 02 May 02 May

Pertamina and SKK Migas marketing the

cargoes

Atlantic fob prices lack support

Atlantic fob prices were relatively fat on Wednesday, as they

lacked support amid weak demand expectations in both basins.

There was limited buying interest in the Atlantic basin.

Although Brazils Petrobras was said to be making tentative

bids for fob cargoes, it was not expected to have urgent

demand. Dubai may have secured some of the three cargoes

it was seeking for delivery between June and August.

And demand in the Pacifc basin was also limited. North-

east Asian buyers have ample LNG in stock. South Koreas Ko-

gas is facing excess supply, and is seeking to reduce or defer

its long-term deliveries. And any spot demand in the Pacifc is

likely to be absorbed by supply from liquefaction projects in

and awarded in early May.

PNG LNGs second 3.45mn t/yr production train has started

operations and the plant could reach full capacity by the end

of June, instead of end-2014 as originally planned. PNG LNG

can produce up to 10 cargoes a month when operating at full

capacity. These potential supplies are also exerting downward

pressure on forward prices for August and further out.

Around seven or possibly more July cargoes are available

from Asia-Pacifc projects such as Indonesias 22.6mn t/yr

Bontang and Australias 4.3mn t/yr Pluto plants, as well as

NWS and PNG LNG.

Indicative July offers range from slightly under the mid-

$13s/mn Btu to the high-$13s/mn Btu. Sellers of Asia-Pacifc

cargoes are possibly offering below the mid-$13/mn Btu

level, while those with Atlantic basin cargoes are offering

in the high-$13s/mn Btu. But weak Asia-Pacifc prices are

closing the Atlantic-Pacifc arbitrage, with Atlantic offers

remaining supported by tentative South American demand.

Japans meteorological agency continues to predict mild

summer weather because of an expected El Nino weather

phenomenon. Such forecasts are behind weak and opportu-

nistic July and August demand. Demand for these months is

limited to northeast Asian buyers with tank space that are

looking for opportunistic purchases or portfolio suppliers

looking to cover short positions, although there could be

more August purchases on warmer weather. Most indicative

July and August bids are in the high-$12s/mn Btu.

The ANEA price, the Argus assessment for northeast Asia

des, is down by 8.5/mn Btu at $13.265/mn Btu for frst- and

second-half July and down by 9.5/mn Btu at $13.315/mn

Btu for frst-half August deliveries. Chinas des prices are as-

sessed in line with the ANEA.

Indian spot prices also fell, tracking losses in the north-

east Asian market. July and August deals are expected to

be done below $13/mn Btu, as price-sensitive importers cut

buying ideas in response to softening bids in northeast Asia.

Indicative July bids are around the mid-$12s/mn Btu,

while offers for mostly Middle Eastern cargoes are tenta-

tively in the low-$13s/mn Btu.

Only one state-controlled importer is seeking a July

cargo. Other buyers remain on the sidelines, possibly be-

cause their requirements have been fulflled by short-term

or strip deals, as a result of a lack of available berthing slots

at receiving terminals for spot cargoes, and on expectations

prices could fall further.

Indias des prices are assessed down by 10/mn Btu

across the board at $12.835/mn Btu for frst- and second-half

July and frst-half August deliveries.

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 4 of 11

Global demand highlights

Demand Delivery period First reported Last updated Comments

3-5 cargoes from Japanese utilties May 07 Mar 28 May May requirements fulflled

Around 3 cargoes from Dubai June - August 09 May 28 May

One cargo a month Jun-Aug. Some may have

been awarded

Short-term tender from Egas For 2 years from end 2014 22 May 22 May

Tender to be issued in June. In addition to

12 cargoes negotiated

1 cargo by India's GSPC July 20 May 20 May For 7-15 July delivery

2 cargoes by PTT June 06 May 19 May

Two tenders issued. For 13-25 June and 22-

28 June delivery

6 from Argentina's YPF June - August 02 May 14 May

3 to Bahia Blanca awarded to Excelerate,

Gazprom, and Vitol; 1 to Escobar for Vitol

2 cargoes from Chile 1 June, 1 July 29 Apr 09 May June cargo bought - July cargo still sought

1 cargo by PTT May 01 Apr 06 May

2 bought, one from producer, one from

portfolio player

3-6 cargoes from Japanese utilities June 24 Mar 15 Apr

Around 50-70pc of requirements possibly

fulflled

438,000 t/yr from India's NTPC For 10-12 yrs from 4Q 2014 19 Mar 15 Apr

Bid deadline extended to 7 May. For deliv-

ery to Kochi terminal

1 cargo from a US importer By end of June 28 Mar 02 Apr

For operational purposes. May have been

awarded to a major

2 cargoes from India By end of May 02 Apr 02 Apr

A state-owned buyer and a private importer

seeking one each

West Africa (AWAF) LNG fob $/mn Btu

11.5

12.0

12.5

13.0

13.5

14.0

10 Apr 14 28 Apr 14 13 May 14 28 May 14

that basin, which could be more competitively priced because

of lower shipping costs than from the Atlantic basin.

Supply from the Atlantic basin may be priced less com-

petitively than from other sources. Cargoes from the recent

tender issued by Argentinas YPF which were awarded to

Excelerate, Vitol, and Gazprom are likely to be supplied

from Qatar, a source involved in the deal said.

But offers for Atlantic basin cargoes remained high. Sell-

ers opted to keep volumes in storage rather than offer them

at lower levels on the spot market. The cost of holding LNG

in storage in Spanish terminals could be contained, as the

boil-off could be sold to the Spanish domestic gas market.

The Spanish AOC gas hub was last week said to trade at

about $10.90/mn Btu for June delivery.

But there is limited storage capacity available at Span-

ish terminals. The 8.6mn t/yr Huelva and 8.4mn t/yr Sagunto

terminals, for example, are both expected to reach maximum

storage capacity of around 600,000m in July. Capacity holders

may need to lower offers in order to increase storage availabil-

ity, depending on the fexibility of long-term contracts.

The outage at the 5.2mn t/yr Soyo liquefaction terminal

has done little to reverse the decline to the Argus West Africa

fob (AWAF) price. News that the facility would be off line until

mid-2015 did not change the short-term supply outlook, as the

facility had been expected to be off line for several months

at least. But tighter supply from West Africa could support

Atlantic fob prices during periods of strong demand.

The Greek and Turkish gas markets were well-supplied,

with limited LNG demand. Despite maintenance on the West-

ern pipeline which imports gas from Russia, customers have

been able to buy alternative supply including from Azerbai-

jan. The maintenance was scheduled at least six months ago,

giving gas consumers plenty of time to fnd alternatives. The

maintenance is schedule for the whole of June.

Turkey would most likely not be interested in paying

more than $11/mn Btu for spot cargoes due to ample pipe-

line and long-term LNG supplies. Greece also has limited de-

mand for spot volumes, unless offers are below prices under

long-term contracts, subject to contract fexibility.

Argus spot LNG freight $/day

Price

Freight west of Suez 54,000 +2,000

Freight east of Suez 48,500 -500

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 5 of 11

Middle East bunker fuel - Fujairah $/t

570

580

590

600

610

620

630

640

17 Feb 14 20 Mar 14 23 Apr 14 28 May 14

380cst 180cst

Asia Pacifc bunker fuel $/t

550

575

600

625

650

675

17 Feb 14 20 Mar 14 23 Apr 14 28 May 14

380cst Sing 180cst Sing 380cst SKorea

180cst SKorea

European bunker fuel - Rotterdam $/t

550

575

600

625

650

675

700

14 Feb 14 19 Mar 14 23 Apr 14 28 May 14

180cst 380cst 1.5% 180cst 1.5% 380cst

Global shipping highlights

Vessel Capacity m From To Loading Arrival Notes

Valencia Knutsen 173,400 Point Fortin, Trinidad Mina Al-Ahmadi, Kuwait 02 May 27 May Shell vessel

Arctic Spirit 89,880 Point Fortin, Trinidad Escobar, Argentina 16 May 28 May

Castillo de Villalba 138,000 Bonny, Nigeria Dahej, India 29 Apr 28 May

Lena River 155,000 Sagunto, Spain Bahia Blanca, Argentina 05 May 29 May Re-export

Gaslog Seattle 155,000 Bonny, Nigeria South Korea 23 Apr 30 May

Gaslog Skagen 155,000 Sagunto, Spain Asia-Pacifc 09 May 31 May Re-export

Madrid Spirit 138,000 Point Fortin, Trinidad Bilbao, Spain 18 May 01 Jun

LNG River Niger 141,000 Bonny, Nigeria South Korea 06 May 02 Jun

Cool Runner 160,000 Huelva, Spain Mina Al-Ahmadi, Kuwait 20 May 03 Jun Re-export

Polar Spirit 87,300 Point Fortin, Trinidad Escobar, Argentina 13 May 03 Jun

Spirit of Hela 177,000 Papua New Guinea Futtsu, Japan 24 May 03 Jun First PNG cargo

Wilenergy 125,000 Huelva, Spain Nagoya, Japan 05 May 03 Jun Re-export - for orders?

Seri Balhaf 152,300 Bonny, Nigeria Pyeongtaek, S Korea 13 May 07 Jun

LNG Libra 126,400 Point Fortin, Trinidad Escobar, Argentina 28 May 09 Jun

LNG Ondo 148,300 Bonny, Nigeria Guangdong, China 16 May 10 Jun

Wilforce 155,900 Zeebrugge, Belgium South America 27 May 10 Jun Re-export

Seri Bijaksana 152,300 Arzew, Algeria Oita, Japan 12 May 11 Jun

LNG Oyo 140,500 Bonny, Nigeria Chita, Japan 15 May 12 Jun

Gemmata 138,100 Fos Cavaou, France Brazil 20 May 15 Jun

LNG Borno 149,600 Bonny, Nigeria Futtsu, Japan 18 May 17 Jun

Magellan Spirit 165,000 Bonny, Nigeria Senboku, Japan 16 May 18 Jun

Golar Arctic 140,600 Bonny, Nigeria Tokyo, Japan 22 May 24 Jun

Sestao Knutsen 138,100 Point Fortin, Trinidad Mina Al-Ahmadi, Kuwait 24 May 27 Jun

Freight $/d

48,000

50,000

52,000

54,000

56,000

58,000

4 Apr 14 23 Apr 14 9 May 14 28 May 14

East Suez West Suez

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 6 of 11

NEws

Eon signs three-year LNG deal with rasgas

German utility Eon has signed a three-year deal with Qatars

Rasgas to deliver LNG to the UKs Isle of Grain terminal.

The fexible deal is for up to around 2bn m of gas

(1.45mn t of LNG) over a three-year term and is effective

immediately.

Eon said the "LNG is destination-fexible" but declined to

comment on whether the LNG price is linked to the UK's NBP

or oil.

Eon has around 7bn m/yr of regasifcation capacity in

the UK, the Netherlands, and Spain as well as a stake in

Italy's Offshore LNG Toscana terminal.

In October last year, fellow state-run LNG producer

Qatargas signed a fve-year supply deal with Eon to deliver

1.5mn t/yr to the Netherlands' Gate terminal from 2014. Eon

said at the time that the LNG price would be linked to a con-

tinental gas hub basis, but declined to comment on whether

the LNG would be divertible.

Qatargas also signed a supply deal with Malaysia's Petro-

nas in 2013 to deliver LNG to the UK Dragon facility. That

supply was divertible, subject to timings and fees.

UK energy system operator National Grid said earlier

this month that the Isle of Grain LNG import terminal near

London was under-utilised last fnancial year, as a result of

high global LNG prices in other regions.

The Grain LNG import terminal received 17 cargoes in

the fnancial year 2013-14 ending on 31 March, compared

with 22 during the previous year. The UK as a whole re-

ceived 71 cargoes, down from 84 in fnancial year 2012-13.

The UK's other import terminals are the 15.6mn t/yr

South Hook LNG terminal and the 4.4mn t/yr Dragon LNG

import terminal, both in southwest Wales.

Qatargas to supply eight LNG cargoes to kuwait

Qatargas will supply eight LNG cargoes to Kuwait through

the country's Mina al-Ahmadi foating storage and regasifca-

tion unit (FSRU) this year.

The cargoes will be sourced from Qatargas' 7.8mn t/yr

train four facility and delivered on Q-fex vessels. A Q-fex

tanker has 210,000-217,000m of capacity. Train four is 70pc

owned by Qatari state-owned QP and 30pc by ExxonMobil.

Kuwaiti state-owned KNPC has also signed supply deals

with Shell and BP this year, and the three suppliers are

expected to deliver around 2.5mn t/yr of LNG for up to the

next six years.

Kuwait imported a Qatari LNG cargo aboard the

216,200m Al Gattara in April. KNPC has also chartered the

170,000m newly built Golar Igloo FSRU to operate as an

import facility at Mina al-Ahmadi for nine months of the year

to supply Kuwait during the summer months.

Challenging year for LNG shipowners: Awilco

The short-term market for LNG shipping looks weak because

of the scheduled arrival of newly-built vessels and limited

new demand, according to ship owner Awilco.

The Norwegian shipping frm expects sparse trading

activity and low charter rates to continue throughout the

second quarter and summer months of 2014. Older vessels

will be more affected than more recent tankers, with soft

charter rates expected to speed up the scrapping of old

vessels.

Planned maintenance in the second quarter is reducing

LNG production, but the lack of demand is limiting trades

and pressuring charter rates for LNG tankers. In addition, the

early start-up of the 6.9mn t/yr PNG export facility in Papua

New Guinea, which saw at least four vessels chartered for the

project, has been offset by the unexpected shutdown of the

5.2mn t/yr Angola LNG liquefaction terminal. Operator Angola

Netbacks $/mn Btu (front half month)

India China Japan

South

Korea

Taiwan

Iberian

peninsula

Greece Italy Turkey

Nw

Europe

North-

east US

Us Gulf

Middle East 12.57 12.01 11.86 11.93 12.13 10.26 10.13 9.24 10.62 8.33 3.76 2.72

Australia 12.03 12.56 12.47 12.49 12.69 9.52 9.38 8.60 9.86 7.71 3.23 2.22

Nigeria 11.32 11.10 10.96 11.02 11.22 10.87 10.19 9.51 10.65 8.97 4.57 3.60

Norway 10.94 10.48 10.33 10.40 10.60 11.10 10.35 9.66 10.80 9.46 4.87 3.76

Algeria 11.52 11.05 10.90 10.97 11.17 11.47 11.01 10.22 11.48 9.55 4.86 3.79

Trinidad and Tobago 10.60 10.47 10.33 10.40 10.60 10.86 10.16 9.47 10.61 9.01 5.09 4.25

Russia 11.56 12.93 12.99 13.00 12.88 9.02 8.92 8.14 9.40 7.26 3.11 2.10

Latest estimated LNG distribution by destination m

Asia-Pacifc 13,925,227

Europe 3,593,907

North America 303,248

South America 1,241,490

Upstream 19,638,493

Based on vessels at sea, fnal destination and estimated arrival time. Upstream

fgure includes all major production regions.

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 7 of 11

LNG has offered its project vessels to the spot market.

Awilco expects 32 new LNG tankers to be delivered to

the market in 2014, of which 13 are currently uncommitted.

Next year, the company sees 27 deliveries, four of which are

uncommitted.

The company also estimates that charter rates fell

to around $64,000/d by the end of the frst quarter from

$98,000/d at the start of January, a decline of 34.7pc.

Argus assessed freight rates west of Suez fell to

$55,000/d from $97,000/d across the frst quarter, a de-

cline of 43.3pc. East of Suez rates fell to $56,000/d from

$88,000/d, a decrease of 34.3pc.

Awilco owns fve LNG tankers: the 160,000m Wilforce

and the 156,000m Wilpride, both tri-fuel diesel electric

vessels; and the second-generation steam turbine tankers

Wilgas, Wilenergy and Wilpower, all of which are 125,000m.

The Wilforce was chartered by an oil and gas major in

January for three years, with a possible one-year extension.

The Wilpride, a new vessel delivered in November 2013, is

trading on the spot market, and is available from mid-July

2014.

The Wilgas is chartered to Brazilian oil and gas company

Petrobras until the fourth quarter of 2014, and the Wile-

nergy is on charter until the end of the third quarter. The

Wilpower is currently offshore Singapore in lay-up and is not

operational. It is being marketed for project work.

Awilco reports vessel utilisation of 95pc in the frst quar-

ter, compared with 90pc in the fourth quarter of 2013.

second June cargo planned for Zeebrugge

Zeebrugge has scheduled its second LNG delivery for next

month, which is expected to arrive on the 145,500m Milaha

Qatar on 15 June with a Qatari cargo.

The tanker is expected 12 days after the 145,800m Al

Jassasiya is scheduled to arrive on 3 June with a similarly-

sourced cargo.

Zeebrugge's June schedule broadly maintains the aver-

age arrival interval of one cargo every 11 days established

this year and last. The regular deliveries to Zeebrugge are

in sharp contrast to the UK, where LNG imports from Qatar

have quickened considerably since the start of the year,

amid weak shoulder season demand in northeastern Asia.

The UK's quick LNG receipts have increased sendout at

South Hook, and Belgium's imports through the intercon-

nector have risen in turn and prompt prices at the NBP and

Zeebrugge have sunk to a discount to the rest of Europe in

recent weeks.

Fos Cavaou to receive fourth May LNG cargo

Fos Cavaou will receive an Algerian cargo aboard the

138,000m Berge Arzew on 30 May.

The cargo will be the fourth to berth at Marseille's larger

LNG terminal, where the berthing schedule was revised

down from fve to four delivery slots earlier this month.

The arrival of the Berge Arzew would lift LNG receipts at

Fos Cavaou to around 556,000m in May to judge by tanker

size, compared with the 542,500m unloaded last May. But

this year a re-export cargo of around 110,000m was loaded

for export to Brazil, bringing Fos Cavaou's net May receipts

to around 446,000m well below last year's receipts, when

no re-exports were loaded in May.

Yesterday morning LNG inventories at Fos Cavaou were

around 89,000m, enough to sustain recent sendout rates of

91 GWh/d for six more days. Nominated sendout until 30 May

is at the same rate, suggesting that stocks will fall as low as

30,500m before the arrival of the Berge Arzew.

russian Novatek eyes gas trading assets

Russia's biggest independent gas producer, Novatek, is interest-

ed in buying assets related to gas trading in Europe, the frm's

chairman and co-owner Leonid Mikhelson said yesterday.

"Novatek is looking for a broader range of assets related

to gas trading in the EU, not necessarily another gas trader,"

the company said.

This could involve buying a share in an EU gas trading

hub, a trading platform or a share in gas storage in the EU.

Buying storage capacity could increase the frm's fexibility

to trade around short-term movements in the European gas

market.

Novatek has already established a gas trading subsidiary

in the EU, Novatek Gas and Power. It has been buying gas

on the spot market to resell to German utility EnBW since

October 2012. But the 1.9bn m/yr deal, valid for 10 years, is

of limited proftability to Novatek.

Novatek is likely to be able to trade its own gas in the EU

once its Yamal LNG project produces frst LNG late in 2017.

Yamal LNG is expected to be producing at least 16.5mn t/yr

by the end of 2019.

NBP $/mn Btu

Delivery Bid Offer Midpoint

Day-ahead 7.23 7.26 7.244 -0.137

Jun 6.94 6.95 6.946 -0.240

Jul 7.47 7.49 7.479 -0.142

Aug 7.78 7.81 7.794 -0.097

3Q14 7.73 7.76 7.748 -0.110

4Q14 9.71 9.74 9.727 -0.087

1Q15 10.54 10.58 10.559 -0.100

Winter 2014-15 10.13 10.16 10.144 -0.093

Summer 2015 9.33 9.35 9.342 -0.047

Winter 2015-16 10.65 10.68 10.664 -0.066

2015 9.89 9.92 9.906 -0.064

2016 10.05 10.08 10.062 -0.074

2017 10.05 10.09 10.071 -0.082

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 8 of 11

EU's Van rompuy renews calls for energy union

Following a meeting last night of EU leaders to discuss the

results of European elections, European Council president

Herman Van Rompuy called for an energy union and de-

creased energy dependency.

"There must also be a strong response to the climate

change challenge and a determined push towards an energy

union and also a push for lessening energy dependency," said

Van Rompuy.

But he gave no details on what an energy union would

look like. The concept came to the fore with the deterio-

ration of EU relations with Russia over Ukraine and fears

that the fow of Russian gas to some EU countries through

Ukraine could be disrupted if Moscow and Kiev fail to reach

agreement over payments for gas for Ukrainian consumption.

The idea has been championed by Polish Prime Minister

Donald Tusk. In addition to common gas purchasing, Tusk's

proposal includes strengthened solidarity mechanisms,

investment in energy infrastructure, particularly gas, better

use of own energy sources, and diversifcation including

importing LNG from the US.

Tusk concedes that EU leaders doubt the bloc could make

common gas purchases, despite generally supporting the

idea of an EU energy union.

Van Rompuy chaired a meeting yesterday evening of 28

EU heads of state and government. The meeting was called

to discuss who will take up the key position of European

Commission president from October 2014 and EU priorities

for the next fve years.

It remains unclear how the EU elections and new Com-

mission will affect the energy industry. Aside from expected

legislative measures for a 2030 climate and energy frame-

work, the energy sector will need to consider the effects of

new proposals including a fnancial transaction tax, revisions

to capital requirements and a benchmarks regulation.

A loss of seats in the European Parliament by the UK's

governing coalition parties may weaken the infuence on

legislation of UK-based fnancial industries and companies,

including those in the energy sector.

Iran outlines kish gas feld development plan

Iran expects to start producing 1bn ft/d (10.3bn m/yr) of

gas from its Kish gas feld by November 2015, state-owned

Pedec managing director Abdolreza Haji Hossainnejad said.

The Kish feld contains 50 trillion ft (1.4 trillion m) of

gas.

A drilling rig will be taken to the feld by the end of June

and a tender for constructing the processing unit will be is-

sued in two months, Hossainnejad said.

Iran previously planned to export 1bn ft/d of gas from

the Kish feld to Oman, but recently revived talks between

the two countries have focused on Iranian gas exports to

Oman being sourced from the South Pars gas feld instead.

Gas from the feld is expected to be connected to the

country's seventh trunk line (IGAT7). The cost of the project

is expected to be $2.2bn, which is expected to be fnanced

by a consortium of Iranian banks and investors.

LNG underpins Australian resource investment

Upstream oil and gas accounts for 86pc of the $229bn

($213bn) invested in resource projects under development

in Australia, the governments commodity forecaster the

Bureau of Resource and Energy Economics (Bree) said.

Most of this investment is being spent on the construc-

tion of seven LNG projects. Bree identifed A$197.04bn of

committed investment on 14 LNG, oil and gas projects. No

new LNG, oil or gas projects have been approved or com-

pleted in the six months to April, although there was a

A$2bn cost increase to the $54bn, 15.6mn t/yr Gorgon LNG

project offshore Western Australia operated by Chevron.

Four of the six onshore LNG projects at the committed

stage are scheduled to start production within the next two

years and will underpin a substantial decline in the number

of committed projects.

Three of the 14 upstream oil and gas projects at the

construction stage are investments in either existing LNG

projects or feld developments associated with LNG projects

under construction. The A$2.3bn Greater Western Flank gas

project is associated with extending the life of the 16.3mn

t/yr North West Shelf (NWS) LNG venture operated by Aus-

tralian independent Woodside Petroleum, Bree said.

The A$370mn development of the Xena gas feld is part

of the 4.3mn t/yr Pluto LNG project operated by Woodside,

while the A$1.2bn development of the Julimar gas feld by

US independent Apache and Kuwaiti state-controlled Kufpec

is part of Chevrons 8.9mn t/yr Wheatstone LNG project.

The inclusion of these three projects takes LNGs share

to A$194.97bn or 85pc of total resource investment.

LNG, gas and oil projects have the highest combined

value of projects at the publicly announced stage at

A$28.5bn-30.5bn. This has increased by around A$4bn as

a result of the Arrow LNG project that is jointly owned

by Shell and Chinese state-controlled PetroChina being

moved back from the feasibility stage and the addition of

Woodsides Persephone gas feld project, which is also part

of NWS LNG. These together more than offset the value

of three projects that have been removed from the major

projects list.

Woodsides Browse foating LNG (FLNG) project is one of

the largest that remains on the major projects list. There

are eight LNG, gas and oil projects at the feasibility stage

with a combined value of A$43bn.

FLNG projects account for the majority of the value of

LNG, oil and gas projects at the feasibility stage, with the

Scarborough and Bonaparte FLNG projects making up around

60pc of the value of projects at this stage.

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 9 of 11

Japan:Crude vs LNG $/mn Btu

13.0

14.0

15.0

16.0

17.0

18.0

19.0

20.0

25 Feb 14 25 Mar 14 24 Apr 14 28 May 14

ANEA front half month

Minas prompt inc freight

Dubai front month inc freight

Japan: Fuel oil vs LNG S/mn Btu

13.0

13.5

14.0

14.5

15.0

15.5

16.0

16.5

17.0

17.5

18.0

18.5

19.0

19.5

25 Feb 14 25 Mar 14 24 Apr 14 28 May 14

ANEA front half month

Fuel oil LSWR V-500 Indonesia inc freight

South Korea: Fuel oil, coal vs LNG $/mn Btu

13.0

14.0

15.0

16.0

17.0

18.0

19.0

20.0

25 Feb 14 25 Mar 14 24 Apr 14 28 May 14

3.40

3.45

3.50

3.55

3.60

3.65

ANEA front half month (LHS)

Fuel oil HS 180cst South Korea del (LHS)

Coal del Indonesia - South Korea 5,800 kcal (RHS)

India: Fuel oil, gasoil vs LNG $/mn Btu

12

14

16

18

20

22

24

25 Feb 14 25 Mar 14 24 Apr 14 28 May 14

Argus LNG India front half month

Fuel oil HS 180cst Mideast Gulf inc freight

Gasoil 0.05% Mideast Gulf inc freight

CoMPETING FUELs IN AsIA AND PowEr MArkET INDICATors

India: Coal vs LNG $/mn Btu

12.0

13.0

14.0

15.0

16.0

17.0

18.0

25 Feb 14 25 Mar 14 24 Apr 14 28 May 14

2.85

2.90

2.95

3.00

3.05

3.10

Argus India LNG front half month (LHS)

Coal del Indonesia - India 4,200 kcal (RHS)

India: Naptha vs LNG $/mn Btu

12

13

14

15

16

17

18

19

20

28 Feb 14 28 Mar 14 28 Apr 14 28 May 14

Argus India LNG front half month

Naphtha LR1 Mideast Gulf fob

Copyright 2014 Argus Media Ltd

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

Page 10 of 11

China historic receipts mn m LNG

0

1

2

3

4

5

6

7

Sep 11 Mar 12 Sep 12 Mar 13 Sep 13 Mar 14

Spain historic receipts mn m LNG

0

1

2

3

4

Aug 11 Feb 12 Aug 12 Feb 13 Aug 13 Feb 14

South Korea historic receipts mn m LNG

0

2

4

6

8

10

12

Sep 11 Mar 12 Sep 12 Mar 13 Sep 13 Mar 14

Japan historic receipts mn m LNG

0

5

10

15

20

25

Sep 11 Mar 12 Sep 12 Mar 13 Sep 13 Mar 14

MoNThLy LNG IMPorT VoLUMEs

PowEr MArkET INDICATors: BrEAkEVEN GAs PrICEs For GENErATIoN

Latin America $/mn Btu

0

5

10

15

20

25

30

Jan 12 Jul 12 Jan 13 Jul 13 Jan 14

Brazil wholesale clearing price

Argentina MEM monthly average

6

7

8

9

10

11

12

9 Apr 14 25 Apr 14 12 May 14 27 May 14

Spain UK Turkey

Europe: Front month base load $/mn Btu

illuminating the markets

Natural gas/LNG

Issue 14-103 Wednesday 28 May 2014 Argus LNG Daily

registered offce

Argus House, 175 St John St, London, EC1V 4LW

Tel: +44 20 7780 4200 Fax: +44 870 868 4338

email: sales@argusmedia.com

IssN: 2046-2301

Copyright notice

Copyright 2014 Argus Media Ltd. All rights

reserved.

All intellectual property rights in this publication and

the information published herein are the exclusive

property of Argus and/or its licensors and may only

be used under licence from Argus. Without limiting

the foregoing, by reading this publication you agree

that you will not copy or reproduce any part of its

contents (including, but not limited to, single prices

or any other individual items of data) in any form or

for any purpose whatsoever without the prior written

consent of Argus.

Publisher

Adrian Binks

Chief operating offcer

Neil Bradford

Global compliance offcer

Jeffrey Amos

Commercial manager

Jo Loudiadis

Editor in chief

Ian Bourne

Managing editor, Global

Cindy Galvin

Managing editor, Generating

Fuels

Peter Ramsay

Editor

Kwok Wain Wan

Tel: +44 20 7780 4217

lng@argusmedia.com

Customer support and sales

Technical queries

technicalsupport@argusmedia.com

All other queries

support@argusmedia.com

London, Uk

Tel: +44 20 7780 4200

Astana, kazakhstan

Tel: +7 7172 54 04 60

Beijing, China Tel: + 86 10 6515 6512

Dubai Tel: +971 4434 5112

Moscow, russia Tel: +7 495 933 7571

rio de Janeiro, Brazil

Tel: +55 21 3514 1402

Singapore Tel: +65 6496 9966

Tokyo, Japan Tel: +81 3 3561 1805

Argus Media Inc, houston, Us

Tel: +1 713 968 0000

Argus Media Inc, New york, Us

Tel: +1 646 376 6130

Argus LNG Daily is published by Argus Media Ltd.

Trademark notice

ARGUS, ARGUS MEDIA, the ARGUS logo, ARGUS

LNG Daily, other ARGUS publication titles

and ARGUS index names are trademarks of

Argus Media Ltd. Visit www.argusmedia.com/

trademarks for more information.

Disclaimer

The data and other information published

herein (the Data) are provided on an as

is basis. Argus makes no warranties, express

or implied, as to the accuracy, adequacy,

timeliness, or completeness of the Data or

ftness for any particular purpose. Argus shall

not be liable for any loss or damage arising

from any partys reliance on the Data and

disclaims any and all liability related to or

arising out of use of the Data to the full extent

permissible by law.

USGC diesel vs LNG $/mn Btu

12

14

16

18

20

22

26 Feb 14 26 Mar 14 24 Apr 14 27 May 14

ANEA front half month USGC diesel

Atlantic benchmarks vs LNG S/mn Btu

0

5

10

15

20

25

2 Dec 13 29 Jan 14 26 Mar 14 27 May 14

ANEA front half month NBP front month

Nymex gas front month Ice Brent front month

US Nymex $/mn Btu

4.0

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

Jun 14 3Q 2014 1Q 2016 3Q 2017 1Q 2019

Ice brent front month $/bl

105

110

115

11 Apr 14 28 Apr 14 12 May 14 27 May 14

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- SL Arora Part 1 PDFDocumento778 pagineSL Arora Part 1 PDFDebika ChakrabortyNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Vietnam Energy Outlook Report 2019 ENDocumento100 pagineVietnam Energy Outlook Report 2019 ENNguyen Thuy AnNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Letter of CreditDocumento11 pagineLetter of CreditDebika ChakrabortyNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- SecuritizatnDocumento8 pagineSecuritizatnAkansha PrakashNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Mr.A.C.R.Das Ministry of SteelDocumento20 pagineMr.A.C.R.Das Ministry of SteelDebika ChakrabortyNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Tech SharmitDocumento16 pagineTech SharmitRishu SinhaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Internship (1) FinalDocumento12 pagineInternship (1) FinalManak Jain50% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Dekker V Weida Amicus Brief by 17 AGsDocumento35 pagineDekker V Weida Amicus Brief by 17 AGsSarah WeaverNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Python Programming Laboratory Manual & Record: Assistant Professor Maya Group of Colleges DehradunDocumento32 paginePython Programming Laboratory Manual & Record: Assistant Professor Maya Group of Colleges DehradunKingsterz gamingNessuna valutazione finora

- Astm C119-16Documento8 pagineAstm C119-16Manuel Antonio Santos Vargas100% (2)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- 3-CHAPTER-1 - Edited v1Documento32 pagine3-CHAPTER-1 - Edited v1Michael Jaye RiblezaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- MHR Common SFX and LimitsDocumento2 pagineMHR Common SFX and LimitsJeferson MoreiraNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- (Biophysical Techniques Series) Iain D. Campbell, Raymond A. Dwek-Biological Spectroscopy - Benjamin-Cummings Publishing Company (1984)Documento192 pagine(Biophysical Techniques Series) Iain D. Campbell, Raymond A. Dwek-Biological Spectroscopy - Benjamin-Cummings Publishing Company (1984)BrunoRamosdeLima100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- CBSE Class 12 Informatics Practices Marking Scheme Term 2 For 2021 22Documento6 pagineCBSE Class 12 Informatics Practices Marking Scheme Term 2 For 2021 22Aryan BhardwajNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Detailed Lesson Plan in Mathematics (Pythagorean Theorem)Documento6 pagineDetailed Lesson Plan in Mathematics (Pythagorean Theorem)Carlo DascoNessuna valutazione finora

- Week1 TutorialsDocumento1 paginaWeek1 TutorialsAhmet Bahadır ŞimşekNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Narrative FixDocumento6 pagineNarrative Fixfitry100% (1)

- Deictics and Stylistic Function in J.P. Clark-Bekederemo's PoetryDocumento11 pagineDeictics and Stylistic Function in J.P. Clark-Bekederemo's Poetryym_hNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- English 8 q3 w1 6 FinalDocumento48 pagineEnglish 8 q3 w1 6 FinalJedidiah NavarreteNessuna valutazione finora

- Quadratic SDocumento20 pagineQuadratic SAnubastNessuna valutazione finora

- Mythology GreekDocumento8 pagineMythology GreekJeff RamosNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Flange CheckDocumento6 pagineFlange CheckMohd. Fadhil JamirinNessuna valutazione finora

- Higher Vapor Pressure Lower Vapor PressureDocumento10 pagineHigher Vapor Pressure Lower Vapor PressureCatalina PerryNessuna valutazione finora

- ICON Finals Casebook 2021-22Documento149 pagineICON Finals Casebook 2021-22Ishan ShuklaNessuna valutazione finora

- Photoshoot Plan SheetDocumento1 paginaPhotoshoot Plan Sheetapi-265375120Nessuna valutazione finora

- Group 3 Presenta Tion: Prepared By: Queen Cayell Soyenn Gulo Roilan Jade RosasDocumento12 pagineGroup 3 Presenta Tion: Prepared By: Queen Cayell Soyenn Gulo Roilan Jade RosasSeyell DumpNessuna valutazione finora

- Application of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsDocumento12 pagineApplication of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsKuldeep BhattacharjeeNessuna valutazione finora

- Xbox One S Retimer - TI SN65DP159 March 2020 RevisionDocumento67 pagineXbox One S Retimer - TI SN65DP159 March 2020 RevisionJun Reymon ReyNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A List of 142 Adjectives To Learn For Success in The TOEFLDocumento4 pagineA List of 142 Adjectives To Learn For Success in The TOEFLchintyaNessuna valutazione finora

- Data SheetDocumento14 pagineData SheetAnonymous R8ZXABkNessuna valutazione finora

- CA Level 2Documento50 pagineCA Level 2Cikya ComelNessuna valutazione finora

- A-Z Survival Items Post SHTFDocumento28 pagineA-Z Survival Items Post SHTFekott100% (1)

- Grade 7 Hazards and RisksDocumento27 pagineGrade 7 Hazards and RisksPEMAR ACOSTA75% (4)

- Al-Farabi Fusul Al MadaniDocumento107 pagineAl-Farabi Fusul Al MadaniDaniel G.G.100% (1)

- Security Policy 6 E CommerceDocumento6 pagineSecurity Policy 6 E CommerceShikha MehtaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)