Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Exchange Rate Regimes and Competitiveness The Case of Greece

Caricato da

Dimitris RoutosTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Exchange Rate Regimes and Competitiveness The Case of Greece

Caricato da

Dimitris RoutosCopyright:

Formati disponibili

Exchange Rate Regimes and

competitiveness

The case of Greece

Dimitris Routos

Trade and Economic Integration in Eastern

and South-Eastern Europe

Exchange rate Regimes & Competitiveness - Routos 2

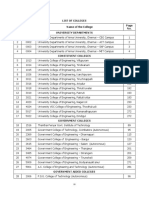

CONTENTS

Abstract 3

Introduction 4

Exchange rate regime and competitiveness 5

The case of Greece 7

Conclusions 15

References 16

Exchange rate Regimes & Competitiveness - Routos 3

ABSTRACT

The optimal choice of an exchange rate regime is often connected with inflation

expectations, output growth, and economic integration. The impact of the

exchange rate regime on the competitiveness of a country, although

controversial, is considered to be a major factor in this respect. The case of

Greece is portrayed as an example regarding the consequences of either a

floating exchange rate regime or a fixed one, on the competitiveness of the

country towards its trading partners and the rest of the world. The adoption of

the Euro as Greeces national currency, affected its ability to intervene through

monetary measures in order to fix the balance of trade disequilibria, and

deteriorated its export performance during the last decade.

Exchange rate Regimes & Competitiveness - Routos 4

INTRODUCTION

Exchange rate regimes can be categorized in three major groups: a) fixed or pegged

exchange rate regimes, where a currency's value is fixed against the value of another single

currency or to a basket of other currencies, or to another measure of value, such as gold, b)

flexible or floating exchange rate regimes, where the value of a currency against other

currencies is determined by the market forces of supply and demand, and c) managed

floating exchange rate regimes, that are hybrids of fixed and floating exchange rate regimes.

The choice of an exchange rate regime is directly associated with country-specific

characteristics. Three competing approaches in the relevant literature explain the choice of

an exchange rate regime and underline those characteristics: The optimal currency area

(OCA), the financial view, and the political view. According to the OCA theory, the choice of

the exchange rate regime is related with the countrys size, trade links, openness, and the

kind of shocks that the country is vulnerable to. The financial view is concentrated on the

consequences of international financial integration, while the political view interprets the

choice of an exchange rate regime as a buffer in the absence of nominal and institutional

credibility.

1

The concept of competitiveness as applied to economies has no clear or agreed definition

among scholars. Still less is there any consensus regarding the factors that contribute to

national competitiveness. Nevertheless improving a nations competitiveness is frequently

presented as a central goal of economic policy and in this respect the following definition by

OECD (OECD, Technology and the Economy: the Key Relationships, 1992) can describe the

outlines of the term: "Competitiveness may be defined as the degree to which, under open

market conditions, a country can produce goods and services that meet the test of foreign

competition while simultaneously maintaining and expanding domestic real income". What

would be the characteristics of a competitive economy are described in the EU report

European Competitiveness Report (2000) as follows: An economy is competitive if its

population can enjoy high and rising standards of living and high employment on a

sustainable basis. More precisely, the level of economic activity should not cause an

unsustainable external balance of the economy nor should it compromise the welfare of

future generations.

The impact of the exchange rate regime on competitiveness and economic development of a

country was extensively debated during the last fifty years. One general understanding is

that the nominal depreciation of the currency of a country with a floating exchange rate

supports its competitiveness in the short-term by making its exports cheaper. However

there are other factors that can neutralize the short-term effects of a nominal depreciation

such as, rise in the prices of imported goods, inflation pressures, wages and inflation

expectations. These factors are playing a decisive role in small open economies, with limited

1

Levy-Yeyati Eduardo, Sturzenegger Federico, and Reggio Iliana (2009), On the Endogeneity of Exchange Rate

Regimes, European Economic Review V. 54 No. 5 (2010) pp. 659677.

Exchange rate Regimes & Competitiveness - Routos 5

opportunities for implementing autonomous monetary policies. Therefore in the medium

term the nominal depreciation of the currency does not lead to a sustainable improvement

of competitiveness.

2

In this respect McKinnon (1963) argued that a floating exchange rate

regime is desirable if a nations exports are limited to one or few goods, while a pegged

regime is chosen if tradable goods represent a large proportion in a nations GDP.

EXCHANGE RATE REGIME and COMPETITIVENESS

Earlier studies on the difference between floating and pegged exchange rate regimes are

based on the external shocks, and the OCA theory. More recent approaches focus on the

trade-off between flexibility and credibility, or the economic performance and currency

crisis.

In the classical literature the choice is portrayed as either completely fixed exchange rate, or

fully flexible. The general approach of the classical literature is that the prices of the

commodities are relatively sticky regarding exchange rates, thus shocks to the economy lead

to fluctuations in the economic activity. Major contributors to the classical exchange rate

literature are among others Friedman (1953), Fleming (1962), Mundell (1961, 1963),

McKinnon (1963), and Kenen (1969). Friedman argued that in the presence of sticky prices,

floating exchange rates would insulate the economy from foreign shocks, by allowing

relative prices to adjust faster. Mundell (1963), explored the role of capital mobility in the

choice of exchange rate regimes. Under this approach, the choice between fixed and floating

depends on the sources of shocks in an economy, whether they are real or nominal, and the

degree of capital mobility. In an open economy with high degree of capital mobility a

floating exchange rate provides insulation against real shocks, such as a change in the

demand for exports or in the terms of trade, because under a floating rate system the

exchange rate can adjust quickly and restores equilibrium, rather than requiring price level

changes. On the other hand, a fixed exchange rate is desirable in the case of nominal shocks

such as a shift in money demand, because money supply automatically adjust to changes in

money demand without interest rate changes or price level changes (Mundell, 1963;

Fleming, 1962). The assumption in Mundell Fleming framework is that capital mobility

implies international arbitrage across countries in the form of uncovered interest parity. And

the conclusion is that it is impossible to achieve simultaneously the three domestic goals:

exchange rate stabilization, capital market integration and independent monetary policy,

known as the impossible trinity. Also Mundell (1961) stressed the fundamentals of the

optimal currency theory (OCA), defining the characteristics of areas in which it is optimal to

adopt a single currency. The OCA approach weights out the trade and welfare gains from a

stable exchange rate against the benefits of exchange rate flexibility as a shock absorber in

the presence of nominal rigidities. According to OCA theory, the advantages of fixed

exchange rates increase with the degree of economic integration among countries.

2

See: Rose A. (1999); Klein M. & Shambaugh J.(2006); Adam C.& Cobham D. (2007).

Exchange rate Regimes & Competitiveness - Routos 6

McKinnon (1963) focused on the criterion of the openness of an economy. He argued that

economic size and openness of an economy are the fundamentals for OCA theory, and that

small and open economies tend to adopt fixed exchange rate regimes than large and

relatively close economies. Also Kenen (1969) argued that product diversification in trade,

should be considered as a major determinant of whether a country should adopt a fixed

exchange rate regime, or not. He also argues that countries with very concentrated

production structures are more likely to adopt flexible exchange rates than countries with

diversified production.

Inflation and growth play an important role on a governments choice of exchange rate

regimes. Recent literature has attempted to explain the impact of exchange rate regimes on

economic performance. Ghosh et al. (1997) examine the effects of the exchange rate regime

on inflation and economic growth. Their results suggest that both the level and variability on

inflation is lower under fixed exchange rates than floating ones. Levy-Yeyati and

Sturzenegger (2001) demonstrate that developing countries with pegged regimes are

associated with lower inflation than developing countries under floating rates, but pegged

regimes are associated with slower growth. Rogoff et al. (2003) study the link between

exchange rate regimes and economic performance and according to their results, for

countries at a relatively early stage of financial development and integration, fixed regimes

appear to offer anti-inflation credibility gain without compromising growth objectives. On

the contrary, flexible exchange rate regimes seem to offer higher growth without any cost to

credibility for developed countries that are not in a currency union. Obstfeld and Taylor

(2002) link the evolution of exchange rate regimes to the various phases of financial

globalization, based on this impossible trinity argument. They argue that, while capital

mobility prevailed at a time when monetary policy was subordinated to exchange rate

stability (as in the gold standard), as soon as countries attempted to use monetary policy to

revive their economies during WWI, they had to impose controls to curtail capital

movements.

Another approach in modern literature has studied the use of the exchange rate as a

nominal anchor to reduce inflation. In particular, Giavazzi and Pagano (1988) argue that

governments with a preference for low inflation but facing low institutional credibility, in

order to convince the public of their commitment to nominal stability, may chose a peg as a

policy crutch to tame inflationary expectations. They also argue that countries with a poor

institutional track record may be more eager to rely on fixed exchange rate arrangements as

a second best solution to a commitment problem. As the argument goes, weak governments

that are more vulnerable to expansionary pressures (i.e., pressures from interest groups

with the power to extract fiscal transfers), may choose to use a peg as a buffer against these

pressures.

The variety of definitions regarding competitiveness not only among scholars but also

between national and international organizations dealing with its measurement,

demonstrates the ambiguity of the term. Prominent academics decline even its use as an

indicator of nations international performance and called it a dangerous obsession; it has

Exchange rate Regimes & Competitiveness - Routos 7

been also characterized as vague and ill-measured concept, while some argue that it is

productivity that matters for a nations international advantage, and not competitiveness.

3

Nevertheless as the rhetoric for competitiveness has become predominant among opinion

leaders throughout the world, arguments in favor of competitiveness as an indicator of

national competitive success are pervasive in the academic literature. Labor costs, interest

rates, exchange rates and economies of scale are considered to be the most influential

determinants of competitiveness. In terms of preconditions for the achievement of a

nations competitive advantage, four attributes are playing a decisive role: a) Factor

conditions, that is the nations position in factors of production, such as skilled labor or

infrastructure, necessary to compete in a given industry, b) Demand conditions, that is the

nature of home-market demand for products or services, c) Related and supporting

industries, that is the presence or absence in the nation of supply industries that are

internationally competitive, and d) Firm strategy, structure and rivalry, that is the conditions

in the nation governing how companies are created, organized, and managed, as well as the

nature of domestic rivalry.

4

The ideal indicator for measuring competitiveness has been a controversial issue among

scholars for more than a decade. Real Effective Exchange Rates (REER), and Unit Labor Costs

(ULC), are used more frequently for this purpose. Nevertheless other indicators such as

relative export prices are also used for competitiveness measurement.

5

THE CASE of GREECE

The options for choosing an exchange rate regime after WW II, were mainly determined for

Greece by international developments, particularly the choices of Western European

countries and the subsequent priorities of the political and economic leadership of the

country. Immediately after the war, the allied countries with the initiative of USA and the UK

established a new international monetary order, focusing on the dollar, with which other

currencies were pegged. This system, known as the monetary system of Bretton Woods,

managed to ensure international monetary stability for almost two decades. Greece

participated in this system in 1953. After the collapse of the Bretton Woods system in 1971,

Greece chose in line with other Western European countries a floating exchange rate

regime, up to 1997. Since 1998 Greece participated in ERM I and ERM II, while since January

1

st

2002 adopted the Euro as its national currency.

The period of the Bretton Woods system was for Greece a period of stability regarding

exchange rate fluctuations and the Drachma remained pegged with the US Dollar with its

initial rate 1 USD=30 drachmas (it must be noted that drachma devaluated 50% against the

US dollar, just before the participation of Greece in the Bretton Woods system). This

3

See: Krugman P. (1994); Thompson R. (2003).

4

Porter Michael (1990), The Competitive Advantage of Nations, Harvard Business Review, MarchApril 1990,

pp.73-91.

5

Ca Zorzi Michele, Schnatz Bernd (2007), Explaining and Forecasting Euro Area Exports- Which Competitiveness

Indicator Performs Best?, ECB Working Paper Series, No 833, November 2007.

Exchange rate Regimes & Competitiveness - Routos 8

remarkable stability was mainly derived from the fact that after the civil war of 1944-1949,

there were no pressures from any credible political opposition towards the alteration of the

economic and political goals of the elites. The adoption of the floating exchange rate regime

in Greece was simultaneous with the first oil crisis. Upon the announcement of the end of

the gold standard (end of the Bretton Woods system, August 1971), drachma remained in a

fixed parity with the US dollar (1 USD=30 drachmas), despite the fact that other Western

European countries created a new monetary mechanism known as the snake in the tunnel,

which allowed major European currencies to fluctuate 2,25% relatively the US dollar. Due

to the fact that the US dollar devaluated against the European currencies, Greece managed

to improve its current account balance as Greek tradable goods became cheaper compared

with those of its European trade partners. On the other hand, Greek economy suffered from

high rates of imported inflation, as imported goods became more expensive, and of course

due to the oil crisis effects. Therefore the fixed parity of drachma with the US dollar lasted

up to October 1973, when it started to fluctuate freely against all currencies after a 10%

revaluation. Since then and up to 1998, drachma entered in a period of continuous sliding

against major currencies, in an attempt to neutralize the negative consequences from huge

differences in the level of inflation in comparison with the European trade partners of

Greece.

6

In table 1 the de jure drachma devaluations are depicted.

DRACHMA DEVALUATIONS (and a revaluation)

1953 50% against USD (1USD = 30.000 GRD from 1USD = 15.000 GRD).

1983 15,5% against major currencies.

1985 15% against major currencies.

1998 12,3% against ECU. Drachmas participation in ERM. 1 ECU = 357 GRD.

1999 Drachma participates in ERM II. 1 = 353,11 GRD.

2000 3,5% revaluation against the Euro. 1 = 340,75 GRD.

Table 1

Devaluations of the Greek drachma were used extensively during the 80s and 90s, as a tool

for fixing the disequilibria in the balance of trade. In the period April 1981 December

2000, drachma devaluated (either de jure or de facto) against the US dollar and the

German mark, 714% and 709% respectively (figure 1).

6

. (2006), :

..., unpublished.

Exchange rate Regimes & Competitiveness - Routos 9

Source: Federal Reserve Bank of St. Louis, own calculations Figure 1

The main policy objective of the devaluation, apart from taming imported inflation, is to

improve the balance of payments performances through external competitiveness allowing

the nominal exchange rate to depreciate. The price ratio of tradable to non-tradable is a

method, which generally measures the internal competitiveness). Domestic price level has

substantial influence on RER. Increasing of domestic price level at a higher rate relative to

foreign price levels directly affects the RER in terms of appreciation of domestic currency in

real terms eroding the external competitiveness. Nominal devaluation in turn leads to

increase in the domestic price level (Hinkle and Montiel, 1999). As stated earlier, the main

objective of the devaluation or depreciation is to gain external competitiveness and balance

of payments improvement in an economy. Under this scenario the policy makers should face

certain dilemma in terms of increasing price level and eroding competitiveness under a

single policy variable if the pass-through of exchange rate is substantial (figure 2).

0,00

50,00

100,00

150,00

200,00

250,00

300,00

350,00

400,00

450,00

A

p

r

-

8

1

O

c

t

-

8

1

A

p

r

-

8

2

O

c

t

-

8

2

A

p

r

-

8

3

O

c

t

-

8

3

A

p

r

-

8

4

O

c

t

-

8

4

A

p

r

-

8

5

O

c

t

-

8

5

A

p

r

-

8

6

O

c

t

-

8

6

A

p

r

-

8

7

O

c

t

-

8

7

A

p

r

-

8

8

O

c

t

-

8

8

A

p

r

-

8

9

O

c

t

-

8

9

A

p

r

-

9

0

O

c

t

-

9

0

A

p

r

-

9

1

O

c

t

-

9

1

A

p

r

-

9

2

O

c

t

-

9

2

A

p

r

-

9

3

O

c

t

-

9

3

A

p

r

-

9

4

O

c

t

-

9

4

A

p

r

-

9

5

O

c

t

-

9

5

A

p

r

-

9

6

O

c

t

-

9

6

A

p

r

-

9

7

O

c

t

-

9

7

A

p

r

-

9

8

O

c

t

-

9

8

A

p

r

-

9

9

O

c

t

-

9

9

A

p

r

-

0

0

O

c

t

-

0

0

DRACHMA against USD and DEM

GRD / USD

GRD / DEM

Exchange rate Regimes & Competitiveness - Routos 10

Figure 2

The competitiveness of the Greek economy remained weak after WW II, regardless the

adoption of a floating or a fixed exchange rate regime. An indication of this argument is

shown in table 2. Greek exports as a percentage of GDP, never exceeded 25% on average for

various periods with different exchange rate arrangements.

Source: EU AMECO Database, Own Calculations Table 2

Measuring competitiveness of the Greek economy is an inherently difficult issue. Estimates

can differ, depending on whether competitiveness is measured on the basis of relative prices

or relative unit labor costs, on whether one uses nominal or real unit labor costs, on which

countries one compares Greece with and, finally, on the relative weight of each country in

the index. In addition to that measurement of competitiveness must be focused on the

export sector, i.e. tradable goods and services, not the whole economy, since a large part of

goods and services produced in the Greek economy are non-tradable due to the fact that

the Greek public sector is quite large. REERs for Greece either UCL based or CPI based, as

well nominal ULCs are presented in table 3. The differences occurred are due to different

methodologies and different base years.

Exchange Rate

Devaluation/Revaluation

Depreciation/Appreciation

Improvement/Deterioration of

Competitiveness

Exchange Rate Pass-Through on

Domestic Prices

Banance of Payments Results

EXPORTS as % of GDP

1953 1971 Bretton Woods. 10,48% (1960-1971 )

1972 1987 Free Floating. 19,12%

1988 1997 Hard drachma policy. 18,36%

1998 2001 Participation in ERM and ERM II. 23,27%

2002 2012 Participation in the Euro zone. 23,06%

Exchange rate Regimes & Competitiveness - Routos 11

Source: Eurostat Ameco database, Bank of Greece Table 3

The following analysis will be based on the CPI based REERs produced by Bank of Greece

because CPI based REERs are demonstrating in relative accuracy the competitive advantages

or disadvantages of the Greek economy. In order to quantify the competitiveness of the

Greek economy, the structure of the economy (proportion in GDP of the primary, secondary,

and tertiary sectors) must be taken into account. According to EU statistics the relative

numbers are 7%, 23,9% and 69%.

7

Moreover, it must be taken into account that exporters of

goods often face different competitors than exporters of services such as the tourist

industry. For example, Germany is one of the biggest export markets of Greek goods and

Greek exporters of industrial goods face fierce competition from German producers.

However, Germany is not a competitor for Greeces tourist industry because it offers winter

tourism, whereas Greece offers summer vacations. As a result, in measuring

competitiveness of Greek exports of industrial goods, Germany should have a large weight,

7

http://ec.europa.eu/agriculture/statistics/rural-development/2012/indicators_en.pdf

REERs and nominal ULCs

REER (ULC

based)

2005=100*

BROAD

REER (CPI

based)

2000=100**

EU REER (CPI

based)

2000=100***

NOMINAL

ULC ****

1995 101,3 N/A N/A 66,5

1996 100,9 N/A N/A 70,4

1997 100,6 N/A N/A 76,9

1998 100,3 N/A N/A 80,7

1999 99,5 N/A N/A 83,4

2000 98,0 100 100 85,0

2001 92,2 101,1 99,9 84,7

2002 98,9 103,7 101,5 93,3

2003 97,3 109,4 102,8 94,7

2004 98,6 111,5 103,7 96,8

2005 100 111,4 105,1 100

2006 97,4 112,2 106,3 98,9

2007 97,4 114 107,2 101,4

2008 97,6 116,8 108,1 106,6

2009 99,3 118,7 109,2 113,2

2010 99,2 118,1 112,6 113,1

2011 96,3 118,5 113 111,0

2012 88,2 114,6 112,1 104,1

* AMECO: REER, based on ULC (total economy)- Performance relative to the rest of 36 industrial countries: double

**BOG: REER Broad CPI based index, includes the 28 main trading partners of Greece

***BOG: REER EU CPI based index includes the rest 16 Euro area countries

****AMECO: Nominal unit labour costs: total economy (Ratio of compensation per employee to real GDP per person

employed).

Exchange rate Regimes & Competitiveness - Routos 12

while in measuring competitiveness of Greek services, Germany should have a low (in fact

zero) one. The opposite holds for Spain, or Portugal, which have a low weight in Greeces

manufacturing exports but are at the same time some of Greeces major competitors in

tourist services. Greece is one of the major European tourist destinations and the tourist

sector is Greeces biggest export industry. In contrast to the goods exporters,

competitiveness of exporters of services such as tourism may depend more on prices of

services in Greece relative to competitor countries than on relative ULCs. A tourist in Greece

does not care so much about how much personnel is paid in a Greek hotel, but he definitely

cares about how much one week of his stay in Greece will cost him relative to one week in a

similar tourist resort in Spain or Portugal. Therefore CPI based REERs are considered better

indicators for measuring the competitiveness of the Greek economy.

Since the adoption of Euro as Greeces national currency, the ability of autonomous

monetary policy has been abolished. Consequently, the Greek authorities had not in their

possession any more, a useful tool in order to intervene in monetary terms for fixing

disequilibria in the balance of trade. The deterioration in the REER Index is shown in figure 3,

relatively to 28 main trading partners and the rest Euro area countries, for the period 2000-

2012. Since 2001 we observe an acute deterioration, especially towards the 28 main trading

partners, which continues up to 2009. From 2010 a gradual reversal is being observed.

Source: Bank of Greece, Bulletin of conjunctural indicators 148, Jan-Feb 2013 Figure 3

The sharp deterioration in the competitiveness of the Greek economy is also clearly depicted

in figures 4, 5 & 6. In figure 4 it can be noticed that while from 1996 till 2000, there is a

positive trend in Greek exports as a percentage of GDP relative to three core Eurozone

countries (Germany, Austria and the Netherlands), since 2000 there is a negative downturn

which is being reversed in 2003, when a stagnation period follows up to 2008.

100

102

104

106

108

110

112

114

116

118

120

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

CPI based REER INDEX (2000=100)

Broad index (28

main trading

partners)

EU17 Index (the rest

16 EA countries)

Exchange rate Regimes & Competitiveness - Routos 13

Source: EU AMECO Statistical Database Figure 4

In a comparison of the Greek exports as a percentage of GDP with three Eurozone periphery

countries (Spain, Italy and Portugal) in figure 5, the convergence noticed from 1993 till 2000,

is reversed in 2000, a more sharp decline is depicted through 2003, and a relative

deterioration from 2004 up to 2008.

Source: EU AMECO Statistical Database Figure 5

15,00%

25,00%

35,00%

45,00%

55,00%

65,00%

75,00%

85,00%

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

EXPORTS as % of GDP

Germany Greece Netherlands Austria

15,00%

20,00%

25,00%

30,00%

35,00%

40,00%

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

EXPORTS as % of GDP

Greece Spain Italy Portugal

Exchange rate Regimes & Competitiveness - Routos 14

Finally in figure 6 the comparison of the Greek exports as a percentage of GDP relative to the

27 European countries and the 17 Eurozone countries shows the convergence period from

1996 up to 2000, the negative trend from 2000 till 2003, and the stagnation period from

2004 until 2008.

Source: EU AMECO Statistical Database Figure 6

Since 2009, the Greek exports as a percentage of GDP, follow an upside trend similar to the

one experienced by the rest Eurozone and EU27 countries. This is a result of the

improvement in the CPI REERs as shown in figure 3.

15,00%

20,00%

25,00%

30,00%

35,00%

40,00%

45,00%

50,00%

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

EXPORTS as % of GDP

European Union (27 countries) Euro area (17 countries) Greece

Exchange rate Regimes & Competitiveness - Routos 15

CONCLUSIONS

The choice of an exchange rate regime affects the international competitiveness of a

country. Greece was suffering from chronic disequilibria in its balance of payments.

Devaluation of the drachma was a cure to its well lasting imbalances up to 2000. Greeces

entrance into the EMU was based rather on political than economic criteria. It was clearly

evident that Greece in 2001 was lacking behind the rest of the EMU countries in terms of

economic development and convergence. Although considerable improvement had been

recorded in various economic indicators in the years preceding the entrance to EMU,

alarming signals of structural problems in the Greek economy were present. Upon the

adoption of the Euro as its national currency, and the subsequent abolition of an

independent monetary policy, its competitiveness towards its trading partners both in the

EU, and internationally worsened. Although EMU joining decision was cheerfully celebrated

in Greece, it concealed the need for an incremental adjustment of the Greek economy in the

years following the accession, due to the fact that it was not adequately reformed, before

adopting the Euro as its national currency. Greek political and economic elites proved to be

incapable in imposing the needed reforms that would enable Greece to experience

sustainable growth along with fiscal discipline and social prosperity. The inability of the

Greek elites to impose these necessary reforms for the Greek economy and society is the

main cause for todays problems.

Exchange rate Regimes & Competitiveness - Routos 16

REFERENCES

Adam Christopher, Cobham David (2007), Exchange Rate Regimes and Trade, The

Manchester School Vol. 75, Iss. Supplement s1, pp. 44-63.

Altomonte Carlo, Aquilante Tommaso and Ottaviano Gianmarco (2012), The triggers of

competitiveness: the EFIGE cross-country report, Bruegel Blueprint Series , Vol. XVII,

Bruegel, Brussels.

Bank of Greece (2013), Bulletin of conjunctural indicators 148, Jan-Feb 2013.

Beker Emilija (2006), Exchange Rate Regime Choice, Panoeconomicus, Vol. 3, pp. 313-334.

Buldorini Luca, Makrydakis Stelios And Thimann Christian (2002), The Effective Exchange

Rates Of The Euro, ECB Occasional Paper Series No. 2, ECB, Frankfurt, February 2002.

Cambridge Econometrics, Ecorys-Nei (2003), A Study on the Factors of Regional

Competitiveness - A draft final report for The European Commission Directorate-

General Regional Policy.

Ca Zorzi Michele, Schnatz Bernd (2007), Explaining and Forecasting Euro Area Exports.

Which Competitiveness Indicator Performs Best?, ECB Working Paper Series, No 833,

November 2007.

Commission of The European Communities (2000), European competitiveness report 2000,

Commission Staff Working Paper SEC(2000) 1823, Brussels.

Darvas Zsolt (2012), Productivity, Labour Cost and Export Adjustment: Detailed Results for

24 EU Countries, Brugel Working Paper No. 2012/11, July 2012.

De Broeck Mark, Guscina Anastasia, and Mehrez Gil (2012), Assessing Competitiveness Using

Industry Unit Labor Costs: an Application to Slovakia, IMF Working Paper No.

WP/12/107, IMF, April 2012.

De Grauwe Paul (2012), In search of symmetry in the Eurozone, CEPS Policy Brief No. 268,

May 2012.

Detragiache Enrica and Hamann Alfonso (1997), Exchange Rate-Based Stabilization in

Western Europe: Greece, Ireland, Italy and Portugal, IMF Working Paper No.

WP/97/75, IMF, June 1997.

ECORYS Nederland BV and Cambridge Econometrics (2011), Study on the cost

competitiveness of European industry in the globalisation era - empirical evidence on

the basis of relative unit labour costs (ULC) at sectoral level, EU DG ENTERPRISE,

Cambridge, 28 September 2011.

Exchange rate Regimes & Competitiveness - Routos 17

Eichengreen, B. (1994), International Monetary Arrangements for the 21st Century, The

Brookings Institution, Washington D.C., USA.

Eichengreen B. (1999), Kicking the Habit: Moving from Pegged Rates to Greater Exchange

Rate Flexibility, The Economic Journal Vol. 109, Iss. 454, pages 114, March 1999.

Felipe Jesus and Kumar Utsav (2011), Unit Labor Costs in the Eurozone: The Competitiveness

Debate Again, Asian Development Bank Working Paper No. 651, February 2011,

Manila, Philippines.

Fleming M. J. (1962), Domestic Financial Policies under Fixed and under Floating Exchange

Rates, IMF staff paper 9, pp. 369-379.

Frankel Jeffrey (1996), Recent Exchange-Rate Experience and Proposals for Reform, The

American Economic Review, Vol. 86, No. 2, pp. 153-158.

Friedman M. (1953), Choice, Chance and the Personal Distribution of Income, Journal of

Political Economy, Vol. 61, No. 4, pp. 277-290.

Garelli Stphane (2012), The Fundamentals and History of Competitiveness, IMD World

Competitiveness Yearbook 2012, pp. 488-503.

Giavazzi F. and Pagano M. (1998), The Advantage of Tying Ones Hands: EMS Discipline and

Central Bank Credibility, European Economic Review No. 32, pp. 1055-1075.

Ghosh A. R., Gulde A. M., Ostry J.D., and Wolf H. (1997), Does the Nominal Exchange Rate

Regime Matter?, National Bureau of Economic Research Working Paper 5874.

Hinkle Lawrence, Montiel Peter (1999), Exchange Rate Misalignment: Concepts and

Measurement for Developing Countries, Oxford University Press, USA.

Hughes Hallett Andrew and Oliva Juan Carlos Martinez (2013), The Importance of Trade and

Capital Imbalances in the European Debt Crisis, Peterson Institute for International

Economics Working Paper No. 13-01, January 2013.

Husain Aasim, Mody Ashoka, Rogoff Kenneth (2004), Exchange Rate Regime Durability and

Performance in Developing Versus Advanced Economies, Journal of Monetary

Economics, 52 (2005) Iss. 1, pp. 35-64.

Kenen Peter (2000), Currency Areas, Policy Domains, and the Institutionalization of Fixed

Exchange Rates, Centre for Economic Performance, London School of Economics and

Political Science, UK.

Klein Michael, Shambaugh Jay (2006), Fixed exchange rates and trade, Journal of

International Economics, Volume 70, Issue 2, December 2006, Pages 359383.

Krugman Paul (1994), Competitiveness: A Dangerous Obsession, Foreign Affairs, March/April

1994.

Exchange rate Regimes & Competitiveness - Routos 18

Kenen P. B. (1969), The Theory of Optimum Currency Areas: An Eclectic View, in Mundell R.

A. and Swoboda A.K. eds., Monetary Problems of the International Economy, The

university of Chicago Press, USA.

Lafrance Robert, Osakwe Patrick, and St-Amant Pierre (1998), Evaluating Alternative

Measures of the Real Effective Exchange Rate, Bank of Canada Working Paper 98-20,

November 1998.

Lauro Bernadette and Schmitz Martin (2012), Euro Area Exchange Rate-Based

Competitiveness Indicators: A Comparison of Methodologies and Empirical Results,

ECB paper presented at the Sixth IFC Conference on Statistical Issues and Activities in

a Changing Environment BIS, 28-29 August 2012.

Leichter Jules,Cristina Mocci, and Pozzuoli Stefania (2010), Measuring External

Competitiveness: An Overview, Italian Ministry of Economy and Finance Working

Paper No. 2, April 2010.

Levy-Yeyati Eduardo, Sturzenegger Federico (2001), Exchange Rate Regimes and Economic

Performance, IMF Staff Paper No. 47, pp. 62-98.

Levy-Yeyati Eduardo, Sturzenegger Federico, and Reggio Iliana (2009), On the Endogeneity of

Exchange Rate Regimes, European Economic Review V. 54 No. 5 (2010) pp. 659677.

McKinnon R. I. (1963), Optimum Currency Areas, American Economic Review, Vol. 53, No. 4,

pp. 717-725.

Mundell R. A. (1961), A Theory of Optimum Currency Areas, American Economic Review, Vol.

51, No. 4, pp. 657-665.

Mundell R. A. (1963), Capital Mobility and Stabilization Policy under Fixed and Flexible

Exchange Rates, Canadian Journal of Economics and Political Science, Vol. 29, pp. 421-

431.

OECD (1992), Technology and the Economy: the Key Relationships, Paris.

Obstfeld Maurice and Taylor Alan (2002), Globalization and Capital Markets, NBER Working

Paper Series No. 8846, March 2002.

Porter Michael (1990), The Competitive Advantage of Nations, Harvard Business Review,

MarchApril 1990, pp. 73-91.

Rogoff K. S., Husain A. M., Mody A., Brooks R., and Oomes N. (2003), Evolution and

Performance of Exchange Rate Regimes, IMF Working Paper 03/243.

Rose Andrew (1999), One Money, One Market: Estimating the Effect of Common Currencies

on Trade, NBER Working Paper 7432, December 1999.

Exchange rate Regimes & Competitiveness - Routos 19

Stockman Alan (1999), Choosing an exchange-rate system, Journal of Banking and Finance

23 (1999), pp. 1483-1498.

Thompson E R, 2003, "A grounded approach to identifying national competitive advantage: a

preliminary exploration" Environment and Planning A 35(4) pp. 631 657.

Torrisi C., Uslu G. (2010), Transitioning Economies: A Calculus of Competitiveness, Journal of

Applied Business and Economics vol.11(3) pp. 39-54.

Van Ark Bart, Stuivenwold Edwin and Ypma Gerard (2005), Unit Labour Costs, Productivity

and International Competitiveness, Research Memorandum GD-80, Groningen Growth

and Development Centre, August 2005.

(2006), :

..., unpublished.

Potrebbero piacerti anche

- Friedman Periodizing ModernismDocumento20 pagineFriedman Periodizing ModernismDimitris RoutosNessuna valutazione finora

- Economic Crisis in GreeceDocumento25 pagineEconomic Crisis in GreeceDimitris RoutosNessuna valutazione finora

- Economics After The Crisis and The Crisis in EconomicsDocumento12 pagineEconomics After The Crisis and The Crisis in EconomicsDimitris RoutosNessuna valutazione finora

- Examples On Computing Present Value and Yield To Maturity: (Econ 121: Mishkin Chapter 4 Materials) Instructor: Chao WeiDocumento2 pagineExamples On Computing Present Value and Yield To Maturity: (Econ 121: Mishkin Chapter 4 Materials) Instructor: Chao WeiDimitris RoutosNessuna valutazione finora

- Chapter4 (Money and Banking)Documento2 pagineChapter4 (Money and Banking)ibraheemNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Jewish Standard, September 16, 2016Documento72 pagineJewish Standard, September 16, 2016New Jersey Jewish StandardNessuna valutazione finora

- CebuanoDocumento1 paginaCebuanoanon_58478535150% (2)

- PropertycasesforfinalsDocumento40 paginePropertycasesforfinalsRyan Christian LuposNessuna valutazione finora

- Task 1: MonologueDocumento4 pagineTask 1: MonologueLaura Cánovas CabanesNessuna valutazione finora

- LBST 2102 Final EssayDocumento9 pagineLBST 2102 Final Essayapi-318174977Nessuna valutazione finora

- Rudolf Steiner - Twelve Senses in Man GA 206Documento67 pagineRudolf Steiner - Twelve Senses in Man GA 206Raul PopescuNessuna valutazione finora

- PSIG EscalatorDocumento31 paginePSIG EscalatorNaseer KhanNessuna valutazione finora

- 19-Microendoscopic Lumbar DiscectomyDocumento8 pagine19-Microendoscopic Lumbar DiscectomyNewton IssacNessuna valutazione finora

- Kutune ShirkaDocumento11 pagineKutune ShirkaAnonymous CabWGmQwNessuna valutazione finora

- English HL P1 Nov 2019Documento12 pagineEnglish HL P1 Nov 2019Khathutshelo KharivheNessuna valutazione finora

- Consortium of National Law Universities: Provisional 3rd List - CLAT 2020 - PGDocumento3 pagineConsortium of National Law Universities: Provisional 3rd List - CLAT 2020 - PGSom Dutt VyasNessuna valutazione finora

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Documento11 pagineReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluNessuna valutazione finora

- You Are The Reason PDFDocumento1 paginaYou Are The Reason PDFLachlan CourtNessuna valutazione finora

- Placement TestDocumento6 paginePlacement TestNovia YunitazamiNessuna valutazione finora

- Best Interior Architects in Kolkata PDF DownloadDocumento1 paginaBest Interior Architects in Kolkata PDF DownloadArsh KrishNessuna valutazione finora

- Tesmec Catalogue TmeDocumento208 pagineTesmec Catalogue TmeDidier solanoNessuna valutazione finora

- Book Review On PandeymoniumDocumento2 pagineBook Review On PandeymoniumJanhavi ThakkerNessuna valutazione finora

- Foundations For Assisting in Home Care 1520419723Documento349 pagineFoundations For Assisting in Home Care 1520419723amasrurNessuna valutazione finora

- Filehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)Documento52 pagineFilehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)razvan_9100% (1)

- TNEA Participating College - Cut Out 2017Documento18 pagineTNEA Participating College - Cut Out 2017Ajith KumarNessuna valutazione finora

- 1b SPC PL Metomotyl 10 MG Chew Tab Final CleanDocumento16 pagine1b SPC PL Metomotyl 10 MG Chew Tab Final CleanPhuong Anh BuiNessuna valutazione finora

- ANI Network - Quick Bill Pay PDFDocumento2 pagineANI Network - Quick Bill Pay PDFSandeep DwivediNessuna valutazione finora

- Chemical BondingDocumento7 pagineChemical BondingSanaa SamkoNessuna valutazione finora

- Notice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramDocumento3 pagineNotice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramJustia.comNessuna valutazione finora

- Hankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesDocumento16 pagineHankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesNatalia Ney100% (1)

- 978-1119504306 Financial Accounting - 4thDocumento4 pagine978-1119504306 Financial Accounting - 4thtaupaypayNessuna valutazione finora

- Pasahol-Bsa1-Rizal AssignmentDocumento4 paginePasahol-Bsa1-Rizal AssignmentAngel PasaholNessuna valutazione finora

- Death and The King's Horseman AnalysisDocumento2 pagineDeath and The King's Horseman AnalysisCelinaNessuna valutazione finora

- Research PaperDocumento9 pagineResearch PaperMegha BoranaNessuna valutazione finora

- Lindenberg-Anlagen GMBH: Stromerzeugungs-Und Pumpenanlagen SchaltanlagenDocumento10 pagineLindenberg-Anlagen GMBH: Stromerzeugungs-Und Pumpenanlagen SchaltanlagenБогдан Кендзер100% (1)