Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

12 Chapter 4

Caricato da

Ali Ahmed0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni33 pagineBIFR - Chapter 4

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBIFR - Chapter 4

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni33 pagine12 Chapter 4

Caricato da

Ali AhmedBIFR - Chapter 4

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 33

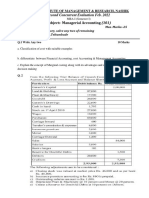

CHAPTER 4

EVALUATION OF THE EFFECTIVENESS OF THE

REHABIILITATION SCHEMES OF THE BIFR

4.1 Introduction

The BIFR initiates steps to rehabilitate all viable sick industrial

undertakings reported to it. In this process the Board sanctions a rehabilitation

scheme to be implemented for a period of seven to ten years. A rehabilitation

scheme is considered successful only if the company is able to make its networth

positive during the period of implementation of the scheme. Hence an evaluation

of the success and the failure rates of the rehabilitation schemes is the only

measure to judge their efTectiveness in rehabilitating sick units.

As on 3 1 July 2000, the BIFR had registered 3 1 10 references of which

rehabilitation schemes were implemented in 708 companies, winding up notices

issued in 960 cases and 572 cases were dismissed as non-maintainable. Eight

hundred and seventy references remained at the preliminary stage of enquiry.

Among the 708 companies for which rehabilitation schemes were sanctioned only

277 companies were declared as successful after making their networth positive.

This shows that the success rate is only 8.9 percent of the total number of cases

registered by the BIFR.

4.2 Reasons for the Low Success Rate of Companies Reported to

the BIFR

The high failure rate of the companies reported to the BIFR may be due to

many reasons. The policy of the BIFR to give stress to rehabilitation of sick

companies 'in the public interest' rather than winding up might have increased the

chances of failure. The delay in reporting sickness and determining sickness might

have delayed the timely implementation of the rehabilitation schemes, which

might have adversely affected the success rate. The extension of the cut off dates

for implementing the rehabilitation schemes and the revision of the schemes might

have caused delay in their implementation and failure in many cases. Similarly the

inherent weaknesses of the rehabilitation schemes and their defective

implementation might have resulted in failure in many cases.

In order to verify the reasons for the low success rate with the BIFR, this

chapter aims to evaluate the effectiveness of the implementation of the

rehabilitation schemes in two sections. 'The policy of the BIFR in rehabilitating

sick units, the time taken for reporting sickness and determining sickness along

with the efficiency of the Operating Agencies in determining sickness are analysed

in the first section. The effectiveness of the rehabilitation schemes are evaluated

in the second section by analysing in detail the time taken for sanctioning

rehabilitation schemes, their implementation along with the inherent weaknesses,

if any.

Chapter 4

4.3 Section 1

4.3.1 Delay in Reporting and Determining Sickness

Timely detection of sickness and implementation of a properly drawn

rehabilitation scheme are prerequisites for reviving a viable sick unit. This makes

it clear that timely reporting of sickness and timely determination of sickness are

essential for the timely implementation of a rehabilitation scheme. In order to

study whether timely reporting of sickness by companies and timely determination

of sickness by the Operating Agencies were made, a sample size of 203 companies

reported to the BIFR has been taken and analysed. The present status of those

companies is given in Table 4.1 and its diagrammatic representation in Fig. 4.1

and Fig. 4.2.

Rehabilitation schemes sanctioned:

Declared no longer sick:

Not declared no longer sick:

Rehabilitation measures not initiated:

Winding up recommended:

Dismissed as non-maintainable:

Table 4.1:- Status of Companies Reported to the BIFR

(as on 3 1-07-2000)

References pending with the BIFR

Total

Percentage

to 'Cotal

Status of Companies

Source: Primary data.

Number of

Companies

Chapter 4 89

Table 4.1 points out that out of the 203 cases selected for the study, only

28 companies were declared no longer sick by the BlFR This shows that the

success rate is only 13.8 percent of the total number of cases registered. The

success rate when compared to the 89 companies, for which rehabilitation schemes

were implemented, is only 31.5 percent. In 91 cases winding up notices were

issueddismissed as non-maintainable after an enquiry by the BIFR. This makes it

clear that the performance of the BIFR in rehabilitating sick industrial units has

not been satisfactory.

4.3.2 Policy of the BIFR

The BIFR has clear preference for rehabilitation over winding upi.

Consequently many winding up cases were considered for rehabilitation.

Companies becoming sick due to macro-economic reasons like technological

obsolescence, adverse impact of globalisation, government policy, market

recession and heavy taxation will remain sick so long as such reasons exist. Any

attempt to rehabilitate such units will become futile. But companies, which

became sick due to anomalies in various function& areas such as finance,

production, marketing and personnel, can be rehabilitated by properly

implementing rehabilitation schemes. To evaluate the effectiveness of the

rehabilitation schemes sanctioned by the BIFR in reviving sick industrial units,

180 companies2 were selected and their causes of sickness has been analysed. The

present status of those companies is given in Table 4.2.

1

Goswmi Committee Report as quoted by Pahwa and Puliani in Sick Industries and

BIFR (2000), 5 15.

'Out of the 203 companies selected for the study, 23 companies remained at the

preliminary stage of enquiry. Rehabilitation schemes were implemented only in 89 cases, of

which 28 companies were declared no longer sick.

Among the 180 companies, 124 companies became sick due to the

Table 4.2:- Causes of Sickness and the Status of Companies

anomalies in various functional areas such as production, finance, marketing and

personnel (firm specific reasons). Along with other causes, macro economic

reasons like obsolete technology, adverse impact of globalisation, government

%

68.9

31.1

100.0

Causes

of

sickness

Firm

specific

reasons

Macro-

economic

reasons

Total

Source:

Status of companies

policy and market recession were the main causes of sickness in 56 companies.

No.

of Cos

124

56

180

Primary data.

Among the 124 companies, which became sick due to firm specific reasons 26

companies were declared no longer sick, the success rate being 2 1 percent. Among

Not declared no

longer sick

Declared no

longer sick

the 56 companies, which became sick due to macro economic reasons only two

No. of

Cos

43

18

-- -

6 1

References

rejected

No, of

Cos

26

2

28

companies were declared no longer sick This shows that only 3.6 percent of

Yo

34.6

32.1

No. of

Cos

5 5

36

---

91

%

21.0

3.6

companies that became sick due to macm economic reasons were declared no

Yo

44.4

64.3

longer sick. This shows that it is drflcult to rehabilitate those comjmpies, which

became sick due to macro economic reasons so long as such reasons exist.

Chapter 4 9 1

There is also difference in success rate of the rehabilitation schemes in

companies, which became sick due to firm specific reasons and macro economic

reasons. Among the 124 companies, which became sick due to firm specific

reasons rehabilitation schemes were sanctioned in 69 companies, of which 26

companies were declared no longer sick. The success rate of the rehabilitation

schemes was 37.7 percent. Rehabilitation schemes were implemented in 20

companies selected out of 56 companies, which became sick due to macro

economic reasons. Among them only two companies were declared successfbl.

The success rate of the rehabilitation schemes sanctioned was only 10 percent.

In order to test whether there is any significant relation between the

success rate in companies which became sick due to firm specific reasons and

macro economic reasons, a Chi-square test3 was conducted taking the null

hypothesis that there is no signiJicant difference in success rates between

companies which became sick due to firm speciJic reasurn and macro economic

reasons. The test revealed that at five percent significance level the calculated

value (5.528) is higher than the table value (3.84 1) at one degree of freedom. This

result leads to the rejection of the null hypothesis and it is concluded that the

dlg'erence in success rates between companies, which became sick due to firm

spec f l c reasons and macro economic reasons is statisticalrly significant.

4.3.3 Delay in Reporting Sickness

Proper and timely implementation of a rehabilitation scheme is essential

for the revival of a sick unit. This requires identification and reporting of sickness

in time. Hence SlCA makes it mandatory for a sick industrial unit to make a report

to the BIFR within 60 days from the date of finalisation of the duly audited

accounts. But companies delay the reporting of their sickness to the BIFR, which

For the test only those companies, which were 'declared no longer sick' and 'not

declared no longer sick' afker implementing the rehabilitation schemes were taken.

in turn delays the implementation of the rehabilitation schemes. Delayed reporting

of sickness might have adversely affected the success of the rehabilitation

schemes. The relationship between the time taken by the companies for reporting

their sickness to the BIFR and the success rate among the 180 companies

considered for the study are analysed and given in Table 4.3.

Table 4.3 shows that no company was able to report its sickness to the

BIFR within the prescribed time limit of 60 days. Sixty-one companies took three

to six months to report their sickness to the BIFR. Among them 2 1.3 percent cases

were declared no longer sick by the BIFR. Eighty-one companies took seven to

twelve months to report their sickness to the BIFR and among them 14.8 percent

cases were successful. The reporting of sickness was delayed for more than one

year in the case of 38 companies and among them only 7.9 percent cases were

Table 4.3:- Time Taken for Reporting Sickness and the Status of Companies

Time taken

for reporting

sickness

Less than 2

months

3-6 months

7-12 months

One year and

above

Total

Source: Primary data

No. of

Cos

6 1

8 1

38

180

%

33.9

45.0

21.1

100.0

Declared no

longer sick

No. of

Cos

13

12

3

28

%

2 1.3

14.8

7.9

Status of companies

References

rejected

No. of

Cos

27

40

24

9 1

Not declared

no longer sick

%

44.3

49.4

63.2

No. of

Cos

2 1

29

11

6 1

%

34.4

35.8

28.9

Chapter 4 93

declared no longer sick. This makes it clear that early reporting of sickness to the

BIFR increased the chances of the revival of sick companies.

In order to verify this Karl Pearson's Correlation Coefficient is calculated

(r = -0.135: p = .036). Thus it can be concluded that there is an inverse correlation

between time taken for reporting sickness and the success rate of the rehabilitation

schemes.

4.3.4 Time Taken for Determining Sickness

All references received by the BIFR in the prescribed form are scrutinised

and registration is granted only to those cases, which come under the purview of

the BIFR. But before initiating the rehabilitation measures the Board conducts a

detailed enquiry to determine whether the company has become sick within the

meaning of SICA. Any delay in conducting the enquiry to determine the sickness

in companies reported to the BIFR might have delayed the implementation of the

rehabilitation schemes and their chances of success.

To determine the sickness in a company, the Board may require the

Operating Agency to conduct a detailed enquiry and report the finding within a

period of 60 days. The Board reserves the right to extend this time limit in

desirable circumstances. Taking this loophole as a privilege, the Operating

Agencies might have conducted the enquiry in a leisurely manner resulting in an

extension of the time allotted for enquiry. This delays the implementation of the

4

For conducting the correlation test dummy variables are used. Companies 'declared

no longer sick' and 'not declared no longer sick' are designated as '1' and '0'. Time taken for

reporting sickness to the BIFR is classified into four groups: 1 = up to 2 months, 2 = 3 to 6

months, 3 = 7 to 12 months and 4 = more than one year.

Chapter 4 94

rehabilitation schemes. Table 4.4 points out the time taken for determining the

sickness regarding 180 companies selected for the study and their present status.

Table 4.4:-Time Taken for Determining Sickness and the Status of Companies

Source: Primary data.

The Board was able to determine the sickness of only 16 companies

within the prescribed time limit of 60 days and among them 25 percent cases were

declared successfui. In the case of 86 companies the Board took three to six

months for determining their sickness, in which 17.5 percent cases were declared

successful and 48.8 percent cases were rejected. There was an inordinate delay of

more than six months in the case of 78 companies and among them the success

rate was only 11 -5 percent. This shows that early determination of sickness

increased the chances of rmiving sick industrial units.

Time taken for

enquiry

Within 60 days

3-6 months

More than 6

months

Total 1

To test whether there is any relationship between the time taken for

determining the sickness and the success rate of the rehabilitation schemes Karl

No. of

Cos

16

86

78

180

Status of companies

%

8.9

47.8

43.3

100.0

Not declared no

longer sick

Declared no

longer sick

No. of

Cos

6

29

26

61

No. of

Cos

4

15

9

28

References

rejected

%

37. 5

33.7

33.4

%

25.0

17.5

11.5

No. of

Cos

6

42

43

9 1

%

37.5

48.8

55. f

Person's coefficientS of correlation is calculated (r = -0.08 1 : p = -140). This clearly

points out that there is an imerse correlation between the time taken for

determining sickness a d the success rate of the rehabilitation schemes.

Determination of sickness in a company without delay can help timely

implementation of the rehabilitation scheme. It can also increase the chances of

reviving the company.

There may be differences in the time taken by different Operating

Agencies for determining the sickness in companies allotted to them. The time

taken for determining the sickness in companies allotted to various Operating

Agencies might have varied according to the efficiency of the Operating Agencies

in dealing with the cases allotted. Certain Operating Agencies might be able to

complete the enquiry within the minimum possible time. This might have helped

in the early implementation of the rehabilitation schemes and increased the

chances of revival in those cases.

To evaluate the individual performance of Operating Agencies the time

taken by them to determine the sickness in 180 companies allotted has been

analysed and given in Table 4.5.

%or conducting the correlation test dummy variable are used. Companies

'declared no longer sick and 'not declared no longer sick" are designated as 'I' and '0'.

Time taken for reporting sickness of industrial units are classified into three groups: I =

within 60 days, 2 = 3 to 6 months and 3 = more than 6 months.

Chapter 4 96

Table 4.5:- Time Taken by the Operating Agencies to Determine Sickness

Source: Primary data.

Among the 180 companies taken for the study 157 companies were

allotted to All India Development Banks like IDBI, LFCI, ICICI and IIBI. This

represents 87.2 percent of the total number of references. Among the different

Operating Agencies, ICICI was the most efficient in dealing with the cases allotted

to it. At the same time the performance of IIBI was the worst. ICICI was able to

complete the enquiry of 11.8 percent cases allotted to it within the prescribed time

limit of 60 days, 70.6 percent cases within three to six months and 17.6 percent

cases took more than six months. IIBI completed the enquiry of only 4.5 percent

cases within the stipulated time limit of 60 days, 36.4 percent cases within three to

six months, and in 59.1 percent cases it took more than six months to complete the

enquiry. This shows that there is dzflerence in time taken by various Operating

Agencies in determining the sickness of companies allotted to them.

%

100

100

100

100

100

To test whether there is any significant difference in time taken by

various Operating Agencies a Chi-square test was conducted by taking the null

hypothesis that there is no sipifcant drference in time taken by various

Operating

Agencies

IIBI

1 FCl

IDBI

ICICI

Banks &

SFCs

Total

Within 60 days 3-6 months

No. of

Cos

1

1

8

4

2

16

No. of

Cos

8

11

30

24

13

86

~~~~l no.

of Cos

22

28

73

34

23

180

Above 6 Inonths

%

4.5

3.6

11.0

11.8

8.7

%

36.4

39.3

41.1

70.6

56.5

No, of

Cos

13

16

35

6

8

78

%

59.1

57.1

47.9

17.6

34.8

Operating Agencies. Since at five percent significance level the calculated value

( 1 6.347) is higher than the table value (1 5.507) at eight degrees of freedom the

null hypothesis is rejected and it is concluded that the d~ference in time taken by

various Operating Agencies for determining the sickness of companies a Elotted to

them is sfati~:sticuE/y sigpt@cunt.

There were differences in the time taken by various Operating Agencies

for determining the sickness in companies allotted to them. Certain Operating

Agencies with efficiency and expertise were able to determine the sickness taking

less time compared to others. This points out the difference in the success rate

among different Operating Agencies. The present status of 180 companies has

been malysed and given in Table 4.6 to show the differences in success rate

among the Operating Agencies.

Table 4.6:- Status of Companies Allotted to Operating Agencies

'Table 4.6 shows that among the different Operating Agencies, ICICI was

Operating

Agency

IJBI

IFCI

IDBI

ICICI

Banks and

SFCs

Total

-

the most efficient in dealing with the cases allotted to it. Thirty-four cases were

allotted to the ICICI in which nine companies were declared no longer sick. This

%

No. of

Cos

allotted

Source: Primaty data

22

28

73

34

23

180

-

Status of companies

Declared no

longer sick

12.2

15.6

40.6

18.9

12.7

100.0

References

rejected

Not declared

no longer sick

No. of

Cos

1

1

13

9

4

28

%

4.6

3.6

17.8

26.5

17.4

No. of

Cos

14

18

39

12

8

91

No.of

Cos

7

9

2 1

13

1 1

6 1

%

63.6

64.3

53.4

35.3

34.8

%

-

31.8

32.1

28.8

38.2

47.8

represents a success rate of 26.5 percent. IFC1 reported the lowest success rate of

3. 6 percent. Among the 28 cases allotted to IFCl only one company was declared

successful. This shows that there is difference in success rates among dzferent

Operating Agencies.

To test whether there is any significant difference in success rates among

different Operating Agencies a chi-square6 test was conducted by taking the null

hypothesis that there is no sign dfcant drflerence in the success rates among

dz@rent Operating Agencies. The test revealed that at five percent significance

level the calculated value (5.1 75) is lower than the table value (9.48) at four

degrees of freedom. It leads to the acceptance of the null hypothesis and it can be

concluded that the dzference in success rates among different Operating Agencies

is statistically not significant.

4.4 Section 2

4.4.1 Evaluation of the Effectiveness of the Rehabilitation Schemes

The BIFR does not initiate steps to rehabilitate all sick companies

reported to it. Only those units, which are found 'viable' after a techno-economic

viability study and those found necessary 'in public interest' are rehabilitated. This

makes it clear that only a portion of the sick companies reported to the RIFR are

rehabilitated and all non-viable sick companies are advised to wind up. But

majority of the rehabilitation schemes sanctioned by the BlFR were not declared

successful. That might be due to many reasons.

Timely implementation of the rehabilitation schemes being a prerequisite

for their success, delay in preparing and sanctioning the rehabilitation schemes

after arriving at a consensus among all participating agencies might have affected

o or the test only those companies, which were declared 'no longer sick' and 'not

declared no longer sick' after implementing the rehabilitation schemes were taken.

their success adversely. The defective implementation and the inherent

weaknesses of the rehabilitation schemes also might have affected their chances of

success.

Timely implementation of a properly drawn rehabilitation scheme is a

prerequisite for its success. Where the sick company has already implemented a

rehabilitation scheme the Board may approve the continuation of such a scheme

when it is satisfied that the company would be able to make its networth positive

within a reasonable period. Normally well-managed companies may take steps to

cure sickness by implementing their own rehabilitation schemes as soon as

symptoms of sickness are discovered. This helps the BIFR to implement the

rehabilitation schemes without any delay.

Where the company has no rehabilitation scheme of its own, the Board

appoints the Operating Agency to formulate a rehabilitation scheme for the

company. The Operating Agency has to prepare the scheme in consultation with

all participating agencies and the BIFR can sanction the scheme only after arriving

at a consensus among the participating agencies. It is a time consuming process

and it may affect the timely implementation of the rehabilitation scheme and the

chances of revival of the company.

To test whether there is any difference in success rates among the

rehabilitation schemes of companies and that of the Operating Agencies, 89

rehabilitation sc,hernes sanctioned by the RIFR have been analysed and given in

I'able 4.7.

Table 4.7 shows that in seven companies the BIFR had given approval for

the continuation of already implemented rehabilitation schemes and among them

five companies were declared no longer sick, the success rate being 7 1.4 percent.

In the case of 82 companies rehabilitation schemes prepared by the Operating

Agencies were sanctioned and among them 23 companies were declared

successful, the success rate being 28 percent. This shows that there is drfSerence

in success rates among the rehabilitation schemes of companies and that of the

Operati~zg Agencies.

Table 4.7:- Nature of Rehabilitation Schemes and Status of Companies

To test whether the difference in success rate among the rehabilitation

schemes of companies and that of the Operating Agencies is statistically

significant, a chi-square7 test was conducted by taking the null hypothesis that

there is no signr;ficant dzflerence in the success rates among the rehabilitation

schemes of the companies and that of the Operating Agencies. It was found that at

five percent significance level he calculated value (5.641) is higher than the table

o or the test only those companies, which were 'declared no longer sick' and

'not declared no longer sick' after implementing the rehabilitation schemes, were taken.

-.

Nature of rehabilitation

schemes

Schemes of companies

Schemes of BIFR or OAs

Total

-- -

Source: ~rimarydata.

%

7.9

92.1

100.0

No-of

Cos

7

82

89

Status of companies

Declared no longer

sick

Not declared no

longer sick

No, ofCos

5

23

28

No. ofCos

2

59

6 1

%

71.4

28.0

P

%

28.6

72.0

value (3.84 1 ) at one degree of freedom. This result leads to the rejection of the

null hypothesis and hence the conclusion is that the diference in success rates

between the rehabilitation schemes of companies and that of the Operating

Agencies is statistically signzjkant.

?'he adoption of an already implemented rehabilitation scheme helped to

avoid all procedural delays associated with the BIFR in arriving at a consensus

among the participating agencies. That might be the main reason for their high

success rate. The low success rate of the new rehabilitation schemes prepared by

the Operating Agencies might be due to the delay in preparing, sanctioning and

implementing them.

To test the relationship between the time taken for sanctioning the

rehabilitation schemes and their success rate, the time taken by the Operating

Agencies for preparing and sanctioning new rehabilitation schemes in 82

companies have been analysed and their present status is given in Table 4.8.

Table 4.8

Time Taken for FinaIising Rehal

1 1

Time taken for sanctioning

rehabilitation schemes

/ Within I year

I

1-2 years

1 l 9

2-3 years

I 35

3-4 years

1 20

/ 4 years and above

I

LL.. to^^ .-

ilitation Schemes and Status of Com~anies

Status of companies

kcl ared no longer I Not declared no

longer sick

" k k k

Source: Primary data.

Table 4.8 shows that the BIFR could not sanction any rehabilitation

scheme within one year. There was a success rate of 42.1 percent in cases where

rehabilitation schemes were sanctioned within a period of one to two years and it

has reduced to 37.1 percent and 10 percent respectively in cases of rehabilitation

schemes sanctioned within two to three years and three to four years. No revival

is reported in cases where it took more than four years to finalise rehabilitation

schemes, This shows that the delay in implementing the rehabilitation schemes

reduced the chances for revival of the companies.

To test whether there is any relationship between the time taken for

implementing the rehabilitation schemes and the success rate of the schemes, Karl

Pearson's correlation coefficientX is calculated (r = -0.322: p= ,002). Thus it can

be concluded that there is an inverse correlation between the time taken for

implementing the rehabilitation schemes and the success rate of the schemes.

The delay in finalising the rehabilitation schemes might be due to the

delay by the Operating Agencies or due to the time consuming BIFR process in

arriving at a consensus among the participating agencies. Table 4.9 analyses the

difference in time taken by different Operating Agencies for finalising the

rehabilitation schemes in companies allotted to them.

a

For conducting the correiation test dummy variables are used. Companies

'declared no longer sick' and 'not declared no longer sick' are designated as ' I ' and '0'.

Time taken for sanctioning the rehabilitation scheme is classified into five groups: 1 =

less than one year, 2 = 1 to 2 years, 3 = 2 to 3 years, 4 = 3 to 4 years and 5 = more

than 4 years

Chapter 4

Among the Operating Agencies ICTCI was the most efficient in finalising

the rehabilitation schemes for companies allotted to it while the performance of

IlBl was the worst. Fifteen companies were allotted l o the ICICI in which

rehabilitation schemes for six companies were finalised within a period of one to

two years, seven schemes within two to three years and only two schemes took

more than two years for their finalisation. Among the nine companies allotted,

IIBl was able to finalise rehabilitation schemes of only one company within a

period of one to two years. Two cases took two to three years, five cases, three to

four years and in the case of one company it took more than four years to finalise

its rehabilitation schemes.

Table 4.9:- Time Taken for Finalising Rehabilitation Schemes - OA wise

To test whether there is any Operating Agency-wise difference in time

taken for finalising the rehabilitation schemes a Chi-square test was conducted

taking the null hypothesis that there is no sign$cant dlference in the time faken

by the Operating Agencies in f i finalising the rehabilitation schemes. The test

revealed that at five percent significance level the calculated value (12.901) is

lower than the table value (21.026) at 12 degrees of freedom. It leads to the

acceptance of the null hypothesis and it can be concluded that the difference in

ppdI 1 1 : 1 ; 1 ; 1

1 ; : I

' r~t d 19 3 5 20 82

Source: Primary data. Note: OA = Operating Agency.

4 years

and above

I

. --

2

3

3-4

years

5 -

4

6

Total

9

. -

13

34

--

2-3

years

. 2

5

18

-

1-2

year

I

2

7

Operating

Agency

IlBI

-- "

IFCI

lDBl

JCICI

Less than

one year

. -

Chapter 4 1 04

time taken hy various Operating Agencies in finalising the rehabilitation schemes

is statisaicallj~ not signi>cunt.

4.4.1.1 Extension of Cut-off Date and Revision of the Schemes

The quasi-judicial nature of the BIFR proceedings, which depends on

consensus at all stages, is a time consuming process. The conflicting interests of

the participating agencies makes it difficult to arrive at a consensus. Financial

Institutions are only interested in recovering their dues, employees try to limit

their sacrifices and the promoters are interested in protecting their interests by

implementing their own schemes. This results in exercising veto power by the

participating agencies when the scheme includes terms and conditions detrimental

to their interest. This necessitates repeated sitting of the Board to arrive at a

consensus on the scheme to be sanctioned. Throughout the process debates are

carried out without sufficient analyses and understanding of discounted cash

flows, balance sheet projections, the market position of the firm and the status of

the industryg, As the deliberations meander on, the delays create their own

complications necessitating extension of cut off dates and/or revision of the

schemes.

Among the 89 companies selected for the study, cut off' dates for the

implementation of the rehabilitation schemes were extended in 68 cases. In 21

cases, schemes were implemented without the extension of cut off dale. This

shows that the cut off dates for the implementation of the rehabilitation schemes

were extended in 76.4 percent cases. Among the 68 companies, which extended

the cut off'dates, revision of the schemes were made in 40 cases. This accounts

for 44.9 percent of the total number of companies for which rehabilitation schemes

were implemented. Table 4.10 exhibits the present status of 89 companies.

-

'~oswarni Committee report as quoted by Pahwa and-~uliani in Sick Industries and

BIFR (20001, 5 16.

classified on the basis of rehabilitation schemes implemented with and without the

extension of cut off dates and revision of the schemes.

Table 4.10:-Extension of Cut off date and Revision of Rehabilitation Schemes

Table 4.10 shows that among the 2 1 companies, which implemented the

rehabilitation schemes without the extension of cut off dates, 57.1 percent cases

were declared no longer sick and in the case of rehabilitation schemes

implemented afier the extension of cut offk dates the success rate was only 23.5

percent. This low success rate was mainly due to the delay caused in implementing

the rehabilitation schemes due to the extension of cut off dates and revision of the

schemes.

4.4.1.2 Defective Implementation of the Rehabilitation Schemes

Status of companies

Proper implementation of a rehabilitation scheme is a prerequisite for its

success. The proper implementation of the rehabilitation scheme is possible only

if all the participating agencies make their commitments in time. Any failure in

extending the agreed support or partial fulfillment of the promises by any of the

participating agencies will result in partial implementation of the rehabilitation

scheme. Normally, participating agencies withdraw their suppon to the scheme

when the performance of the company does not improve as envisaged in the

%

76.4

Cut of f

date

Extended

--

Nature of schemes

No

of

Cos

68

Original

28

Declared "O

longer sick

Source: Primary data.

23.6

100.0

Not

extended

Total

Revised

40

2 1

49

Not declared no

longer sick

No:of

Cos

16

21

89

0 -

-- 40

No:of

Cos

52

%

23.5

%

76.5

rehabilitation scheme. To study the impact of the extent of support provided by the

participating agencies on the success of the rehabilitation schemes the present

status of 89 companies selected for the study has been analysed and given in Table

4.11.

Table 4.1 1 :- Extent of Implementation of Rehabilitation Schemes

Nature of rehabilitation

schemes

Fully implemented

Partially implemented

Total

Status of companies

No.of / / Declared no I Not declared no

Cos 1 % 1 longer sick / longer sick

Source: Primary data.

The table shows that in 74 companies the implementation of ihe

rehabilitation schemes were completed and among them 37.8 percent cases were

declared no longer sick. In 15 companies the implementation of the rehabilitation

schemes could not be completed and none of them were declared no longer sick.

This shows that the failure of the participating agencies in extending their

commitments affected the implementation of the rehabilitation schemes in 1 6.9

percent cases and resulted in their total failure.

The delay in extending support by the participating agencies also might

have delayed the implementation of the rehabilitation schemes, which in turn

might have affected their chances of success. In order to verify that, the timeliness

of the extension of support by the participating agencies to the 74 rehabilitation

schemes implemented has been analysed and given in Table 4.12

Table 4.12:- Extent of Support by the Participating Agencies

Primary data.

Note: DNLS = Declared No Longer Sick NDNLS = Not Declared No Longer Sick.

Participating

Agencies

Financial

Institutions and

Banks

Governments

The Banks and Financial lnstitutions extended timely support tu 53

companies and among them 26 companies were declared no longer sick. This

shows that the success rate is 49 percent. They have delayed the extension of

support to 21 rehabilitation schemes. Among them only two companies were

declared no longer sick, the success rate being 9.5 percent. The governments

timely extended support only to 3 1 rehabilitation schemes and delayed the support

in 43 cases. Among them 17 timely support cases and 1 1 delayed cases were

declared no longer sick. The success rates were 54.8 percent and 25.6 percent

respectively. Promoters and labour delayed the support in nine and four cases

respectively and none of them were declared successful.

4.4.1.3 Weaknesses of the Rehabilitation Schemes

Promoters

-.

A sick industrial unit can be brought back to normal health only by

improving its operating efficiency. Hence the rehabilitation schemes included

proposals for increasing sales, enhancing productivity, reduction in cost of

production and interest to improve the operating efficiency of the sick units. In

I'imely supported cases

NO. of

Cos

5 3

3 1

No. of

COs

74

74

Support with extended time

No. of

Cos

2 1

43

DNLS

26

17

NDNLS

2 7

-.

14

DNLS

2

1 1

NDNLS

19

3 2

order to verify the effectiveness of various measures adopted in the rehabilitation

schemes to improve the operating efficiency of the sick units the present status of

89 companies considered for the study has been analysed and given in Table 4.13

Table 4.13:- Measures for Improving the Operating Efficiency

Table 4.13 shows that all the 89 rehabilitation schemes included proposals

to increase sales and among them 3 1.5 percent cases were declared no longer sick.

Measures to improve

operating emciency

.-- -

Increase in sales

Financial restructuring

Increase in productivity

Reduction in cost of

production

Diversification

Along with increase in sales, 77 companies adopted financial restructuring

Source: Primary data.

Status of companies

including measures like reduction in interest, rescheduling of loans, funding of

No. of

Cos

89

77

18

18

I I

interest and One Time Settlement (OTS) of dues. Among them 24 companies

%

100.0

86.5

20.2

20.2

12.4

Declared no

longer sick

were declared no longer sick, the success rate being 31.2 percent.

Eighteen

companies each adopted measures to increase productivity and reduction in cost of

production and they reported a success rate of 38.9 percent and 16.7 percent

Not declared

no longer sick

No. of

Cos

28

24

7

3

7

respectively. Among the 1 1 companies, which diversified their activities, seven

No. of

Cos

6 1

5 3

1 I

15

4

%

31.5

31.2

38.9

16.7

63.6

companies were declared successful, the success rate being 63.6 percent.

Increase in sales and financial restructuring involving reduction in interest

%

68.5

68.8

61.1

83.3

36.4

are the commonly adopted measures to improve the operating efficiency of sick

units. Hence it is essential to evaluate the measures adopted for increasing sales

and reduction in interest to analyse the effectiveness of the rehabilitation schemes

in improving the operating efficiency of sick units.

4.4.1.4 Measures for increasing Sales

Every company requires a desired level of sales to maintain its operating

efficiency and profitability, Poor sales result in poor operating efficiency and in

the accumulation of losses. This is true especially in the case of a sick unit

reported to the BIFR after the erosion of its total networth by accumulated losses.

Hence every rehabilitation scheme projects a desired level of sales to be achieved

in order to bring back the sick unit to normal health.

Sales can be increased by increasing the scale of operation of existing

products or by diversifying the activities of the company into new products.

Among the 89 companies selected for the study, only 11 companies diversified

their activities whereas the remaining 78 companies proposed increase in capacity

utilisation to boost sales. To verify the effectiveness of the measures adopted to

increase sales companies were classified into two groups viz., diversified and non

diversified and their present status has been analysed and given in Table 4.14.

( 1 8 9 1 1 0 0 . 0 ( 2 8 I 1 6 1 1 1

Source: Primary data.

Table 4.14: Effectiveness of Diversification and Nondiversification Measures

Nature of companies

Diversified

No.of

Cos

1 1

1

%

12.4

Status of companies

Declared no

longer sick

No-of

Cos

7

Not declared no

longer sick

%

63.6

No. of

COS

4

%

36.4

Table 4.14 points out that thert: was a high success rate in those

rehabilitation schemes, which included measures to diversify the activities of the

companies into new products when compared to the non-diversified companies.

Diversified companies reported a success rate of 63.6 percent as against 26.9

percent among the non-diversified companies. This makes it clear that

diversification of activities in to new products is the best measure to increase sales

especially in the case ofcompanies which become sick due to low demand for their

producrs.

To test whether there is any significant relationship between the success

rates in the diversified and non-diversified companies a chi-squareto test was

conducted taking the null hypothesis that there is no significant dtfference in

success rates among diversified and non-diversified companies. The test revealed

that at five percent significance level the calculated value (5.862) is greater than

the table value (3.84 1 ) at one degree of freedom. This result leads to the rejection

of the null hypothesis and it is concluded that the d~ference in success rates

between the diversified and nun-diversified sick industrial units is statistically

sign1;ficanl.

One of the main reasons for the failure of the rehabilitation schemes was

the inability of the companies to attain the sales targets envisaged to make the

operations of the company viable. Among the 89 companies selected for the study

55 companies could not achieve the targeted sales envisaged in the rehabilitation

schemes. That might be due to the fixation of sales target at a higher level,

inadequate sales promotion measures and low demand for the products due to the

recession in the industry, technological obsolescence, changes in fashion etc. The

' O~or the test only those companies, which were 'declared no longer sick' and 'not

declared no longer sick' after implementing the rehabilitation schemes were taken.

main reasons for the non-attainment of sales targets in 55 companies considered

for the study have been analysed and given in Table 4.15.

Table 4.1 5:- Reasons for Non-Attainment of Sales Target

1' 1 I 1

I Reasons for non-attainment of sales targets I Number of I Percentage /

I--,

.-A

1 companies / to total

I

Higher sales targets

Inadequate sales promotion

L__ * * I

1 Low demand for the products ( 6 1 10.9 1

Total ( 55 1 100.0 1

Other reasons

. -

1 I I

Source: Primary data

Table 4.1 5 points out that in 43.6 percent cases rehabilitation schemes

fuced sales targets ad higher levels not attainable to the sick companies. In 40

3

percent cases inadequate sales promotion measures and in 10.9 percent cases low

demand for the products were the reas~ns~f or poor sales.

5.5

4.4.1 .S Measures for Reducing Interest

Increased use of borrowed hnds and heavy burden of interest is a

common feature of every sick unit. The inability of the promoters to provide

additional funds required to recoup the cash losses incurred often result in heavy

borrowing. The increased borrowing and its servicing cost affect the profitability

of the company adversely. Hence rehabilitation schemes took measures to reduce

debt and interest cost thereon to improve the operating efficiency of the companies

to make them viable.

One Time Settlement (OTS) of dues with own funds helps industrial units

to get rid of interest charges totally. But the difficulty in raising the required

finance and the unwillingness of the funding agencies make OTS of dues often

diff~cult. Where QTS of dues is not possible reduction in interest cost is made by

making arrangements for rescheduling term loans at reduced rates of interest

waiving penal interest and penal charges. Among the 89 rehabilitation schemes

sanctioned by the BlFR financial restructuring were arranged in 77 cases. The

present status of those companies has been analysed and given in Table 4.1 6.

Table 4.1 6:- Measures of Financial Restructuring

Table 4.16 shows that six companies were able to arrange OTS of dues in

Measure of

financial

restructuring

OTS of dues

Reduction in

interest rate

Other measures

'Total

which four companies were declared no longer sick, the success rate being 66.7

percent. In 67 cases rehabilitation schemes included measures to reduce

Source: Primary data

No. of

Cos

6

67

4

77

interestlinterest rate and among them 32.8 percent cases were declared successful.

Other measures of financial restructuring were adopted in four cases and among

yo

7.8

87.0

5.2

100.0

them only 25 percent cases were declared successful. This points out that the total

eliminationheduction of interest, cost enhanced the chances of revival ofsick units.

Status of companies

Declared no

longer sick

No.of

Cos

4

22

1

27

Not declared no

longer sick

%

66.7

32.8

25.0

No. of

Cos

2

45

3

5 0

9'0

33.3

67.2

75.0

4.5 Factors influencing Success of the Rehabilitation Schemes

The rehabilitation of a sick unit is done by implementing a rehabilitation

scheme. In order to make the operations of the company viable the rehabilitation

schemes include measures to increase sales, reduce cost of production, financial

restructuring and change in management.

Tncrease in sales requires increase in scale of operation andlor

diversification of the activities of the company. Financial restructuring includes

measures to increase capital, increase/decrease borrowed funds and facilitate

rearrangement of borrowed funds. The policies of the government, effects of

globalisation, and the level of implementation of the rehabilitation schemes also

influence the success of the rehabilitation schemes. In order to analyse the impact

of different factors on the success of the rehabilitation schemes Multiple

Regression (linear) analysis is made. For the purpose of the regression analysis

data regarding 40 companies for which detailed fmancial data are available are

considered. These companies are classified in to three groups, 'successhl',

'failed' and 'schemes in operation.' 'Successful' companies include companies

declared no longer sick by the BIFR. 'Failed' companies include those closed

dowdwound up and companies for which, new rehabilitation schemes were

sanctioned. Companies which continue the implementation of the original

rehabilitation schemes sanctioned are classified as 'schemes in operation.' Based

un the aforesaid details it is hypothesised that the success of a rehabilitation

scheme is influenced by sales, costs of production, government policies, effects

of globalisation, extent of implementation of the rehabilitation schemes etc.,

y

= a + b l x l + b2x2 + b3x3 t ............ + bnxn

= result

a = constant

b 1 , b2.. . . . . bn = Regression coefficient.

X I = Delay in reporting sickness.

x2 = Time taken for determining sickness.

x3 = Time taken for implementing rehabilitation schemes.

x4 = Nature of the rehabilitation scheme.

x5 = Extent of implementation of the rehabilitation scheme.

x6 = Implementation of the schemes withlwithout extension of cut off date.

x7 = Co-operation of the Participating Agencies.

x8 = Diversification of the activities of the company..

x9 = Financial restructuring.

x10 = OTSofdues.

x l 1 = Increase in sales.

x12 = lncrease in scale of operation.

x 1 3 = Reduction in cost of production

x 1 4 = Effects of government policy.

x 1 5 = Effect of globalisation

x 1 6 = Increase in equity.

x 1 7 = Additional borrowings.

x18 = Waiver of loans.

x19 = Waiver of interest.

x20 = Reduction in interest.

x2 I = Funding of interest

x22 = Waiver of penal charges.

x23 = Change in management

The test was conducted by taking dummy variables, which are given in

Table 4.1 7.

Table 4.17:- Values of Various Parameters

1

0

2

1

0

1

0

I

0

Result

Reporting sickness

Time taken for determining

sickness

Time taken for implementing

the rehabilitation scheme

Success

Failed

Schemes in operation

Timely Reporting

Late Reporting

Within three months

More than three months

Within one year '

More than one year

-

,.- -

Nature of rehabi litation

scheme

Extent of implementation of

the rehabilitation scheme.

Cut off date for implementing

the rehabilitation schemes

Co-operation of the

participating agencies

Diversification of the activities

of the company.

Financial restructuring

OTS of dues

Increase in sales

-

Increase in scale of operation.

Reduction in cost of

production

Management change

Effect of government policy

Effects of globalisation

lncrease in equity

lncrease in borrowings

Waiver of loans

Waiver of'interest

Reduction in interest

pp-pL.,...--- ,.".

Funding of interest

Waiver of penal charges

Implementation of the

rehabilitation scheme

Already implemented scheme sanctioned

Scheme evolved by the BIFR

Fully implemented

lmplementation not completed

Not extended

Extended

Time1 y supported

Delayedlno support

Activities diversified

Activities not diversified

implemented

Not implemented

OTS of dues arranged

OTS of dues not arranged

Sales increased

Sales not increased

-Scaleof operation increased

Scale of operation not increased

Cost reduced

Cost not reduced

Change in management made

Change in management not made

Positively effected

Negatively/not effected

Positively effected

Negativelno effects

Additional equity raised

Not raised

Additional borrowings made

Not made

Loans waived

Loans not waived

Interest waived

lnterest not waived

Interest reduced

Interest not reduced

Funding of interest made

Funding of interest not made

Penal charges waived

Penal charges not waived

Proper

Not proper

1

0

1

0

I

0

I

0

1

0

1

0

1

0

1

0

I

0

1

0

1

0

I

0

1

0

1

0

I

0

1

0

1

0

1

0

1

0

I

0

I

0

Chapter 4 116

The result of the Multiple Regression test is given in Table 4.18.

Table 4.18:- Multiple Regressions

BORROWM

COST

CUT OFF

DETER

DIVERS

EQUITY

EXTENT

GLOBAL

GOPL

N T FUND

rNT RED

MGTCHG

NATURE

OTS

PENAL

RESTRUCT

SALES

SCALE

SUPPORT

(Constant)

Variables in the Equation

The following variables are excluded because of insignificant values:

IMPLEM LOANWAIV REPORTIN TNTWAIVE

Multiple R 0.87345

R Square 0.76292

Adjusted R Square 0.53769

Standard Error 0.6405

Analysis of Variance

DF Sum of Squares Mean

Regression 19 26.53038 1.39634

Residual 20 8.24462 0.4 1223

Variable B SE B T Beta Sig T

Table 4.18 points out that the regression result is statistically significant

and since R~ = ,7629, it can be stated that 76.29% of the result is explained by the

above-mentioned 23 variables. Among them five variables viz., sales, scale of

operation, support of the Operating Agencies, One Time Settlement of dues and

government policy are statistically significant.

Potrebbero piacerti anche

- MSME Sickness FactorsDocumento45 pagineMSME Sickness FactorsLiza LizuNessuna valutazione finora

- Industrial Sickness FinalDocumento42 pagineIndustrial Sickness Finalalpz4scribd100% (1)

- Factors Influencing Auditor Switching and Timeliness of Audit CompletionDocumento16 pagineFactors Influencing Auditor Switching and Timeliness of Audit CompletionAlifah KurniaNessuna valutazione finora

- 14 Chapter 8Documento14 pagine14 Chapter 8Arun MozhiNessuna valutazione finora

- SICK COMPANY REVIVAL BLOGDocumento10 pagineSICK COMPANY REVIVAL BLOGVishalNessuna valutazione finora

- Multiple Choice Questions 1 The Aicpa Audit and Accounting Guide HealthDocumento2 pagineMultiple Choice Questions 1 The Aicpa Audit and Accounting Guide HealthMuhammad ShahidNessuna valutazione finora

- Industrial Sickness: Presenter: Farana KureshiDocumento17 pagineIndustrial Sickness: Presenter: Farana KureshiRekha BhojwaniNessuna valutazione finora

- Key Performance Indicators (KPI) Within Maintenance EngineeringDocumento8 pagineKey Performance Indicators (KPI) Within Maintenance EngineeringAyman EL AghaNessuna valutazione finora

- Sick Industries - Causes, Symptoms, Consequences and SICADocumento5 pagineSick Industries - Causes, Symptoms, Consequences and SICAAshish BharadwajNessuna valutazione finora

- Internship ReportDocumento72 pagineInternship ReportKhan Rayed Rehan Nitol100% (1)

- Industrial Sickness-Causes & RemediesDocumento3 pagineIndustrial Sickness-Causes & RemediesdeepshrmNessuna valutazione finora

- Future PharmaDocumento40 pagineFuture PharmaRobert GrayNessuna valutazione finora

- Tertiary Education and Other Entities: Results of The 2009 AuditsDocumento6 pagineTertiary Education and Other Entities: Results of The 2009 AuditsJayson Ramirez SorianoNessuna valutazione finora

- Reasons and Remedies For Sickness in Smes by Amritraj D BangeraDocumento13 pagineReasons and Remedies For Sickness in Smes by Amritraj D BangeraAmritraj D.Bangera100% (1)

- Performance of Sick Companies Reported To The: and HasDocumento39 paginePerformance of Sick Companies Reported To The: and HasAli AhmedNessuna valutazione finora

- Chapter One 1.1 Background of The StudyDocumento95 pagineChapter One 1.1 Background of The Studymuhammed umarNessuna valutazione finora

- UV Health System LTAC Hospital Project Financial AnalysisDocumento4 pagineUV Health System LTAC Hospital Project Financial AnalysisAde Ade100% (1)

- The Impact of Covid-19 On Accounting ProfessionDocumento9 pagineThe Impact of Covid-19 On Accounting ProfessionShuvo HowladerNessuna valutazione finora

- Hmo Msa OverviewDocumento28 pagineHmo Msa Overviewmamatha mamtaNessuna valutazione finora

- Far 2 AssignmentDocumento10 pagineFar 2 AssignmentHaripragash ThangaveluNessuna valutazione finora

- Managing Industrial SicknessDocumento5 pagineManaging Industrial Sicknessuma_mathoorNessuna valutazione finora

- PCAOB Report Economic CrisisDocumento26 paginePCAOB Report Economic CrisisGaurav AgarwalNessuna valutazione finora

- Final Project Submission - Edited.editedDocumento15 pagineFinal Project Submission - Edited.editedSammy DeeNessuna valutazione finora

- Effect of Covid-19 Pandemic On Corporate Governanace: By-Mananshu Jain V-C 11417703818Documento11 pagineEffect of Covid-19 Pandemic On Corporate Governanace: By-Mananshu Jain V-C 11417703818mananshu jainNessuna valutazione finora

- The Impact of Just in Time Manufacturing System On The Overall Competitive Advantage of A (Company) in The Pharmaceutical SectorDocumento12 pagineThe Impact of Just in Time Manufacturing System On The Overall Competitive Advantage of A (Company) in The Pharmaceutical Sectoracademic researchNessuna valutazione finora

- 33-Merger&acquisition-Amalgamation of Sick Company-Sem 3 Div A - Aditi SrivastavaDocumento7 pagine33-Merger&acquisition-Amalgamation of Sick Company-Sem 3 Div A - Aditi SrivastavaaditiNessuna valutazione finora

- Final Project Submission - Edited.editedDocumento15 pagineFinal Project Submission - Edited.editedSammy DeeNessuna valutazione finora

- CA Final - Paper 3 - CH - 1 - AUDITING STANDARDSDocumento21 pagineCA Final - Paper 3 - CH - 1 - AUDITING STANDARDSLathaNessuna valutazione finora

- NavenDocumento4 pagineNavenNaveen GodaraNessuna valutazione finora

- EIA (Assignment 02)Documento7 pagineEIA (Assignment 02)Eshfaque Alam DastagirNessuna valutazione finora

- Financial Performance of Square PharmaceuticalsDocumento24 pagineFinancial Performance of Square PharmaceuticalsMD. MUNTASIR MAMUN SHOVONNessuna valutazione finora

- Coa: Philhealth'S All Case Rate Payment Scheme Sped Up Reimbursement Process But Lacked Control Mechanisms To Detect and Prevent Improper PaymentsDocumento2 pagineCoa: Philhealth'S All Case Rate Payment Scheme Sped Up Reimbursement Process But Lacked Control Mechanisms To Detect and Prevent Improper Paymentsjay vincent diamanteNessuna valutazione finora

- Performance Audit Report: Pennsylvania Department of Community and Economic Development COVID-19 Business Waiver Request ProgramDocumento159 paginePerformance Audit Report: Pennsylvania Department of Community and Economic Development COVID-19 Business Waiver Request ProgramKristina KoppeserNessuna valutazione finora

- Muhammad Adri Hakim 27082017Documento16 pagineMuhammad Adri Hakim 27082017nikadekdiwayamiNessuna valutazione finora

- ACCOUNTING PRACTICES OF HEALTHCARE INSTITUTIONS IN THE GHANAIAN PUBLIC SECTOR - A Case of 37 Military HospitalDocumento59 pagineACCOUNTING PRACTICES OF HEALTHCARE INSTITUTIONS IN THE GHANAIAN PUBLIC SECTOR - A Case of 37 Military HospitalAkwasi Adu Biggs II100% (1)

- Market Study Statutory Audit Services Summary ResponsesDocumento28 pagineMarket Study Statutory Audit Services Summary ResponsesVinayrajNessuna valutazione finora

- Result - 10 - 21 - 2022, 2 - 03 - 26 AMDocumento1 paginaResult - 10 - 21 - 2022, 2 - 03 - 26 AMNaushin Fariha Jalal 1821146630Nessuna valutazione finora

- 2013 PWCDocumento33 pagine2013 PWCCaleb NewquistNessuna valutazione finora

- Diagnosis To Find Out Reason For Sickness in SME by Amritraj D BangeraDocumento6 pagineDiagnosis To Find Out Reason For Sickness in SME by Amritraj D BangeraAmritraj D.BangeraNessuna valutazione finora

- Designing and Implementing An Effective Health and Safety Management SystemDocumento52 pagineDesigning and Implementing An Effective Health and Safety Management SystemLuis AguilarNessuna valutazione finora

- Rick GroupDocumento5 pagineRick Grouprajip sthNessuna valutazione finora

- Medical Device Recall ReportDocumento20 pagineMedical Device Recall ReportyudiNessuna valutazione finora

- Case Study SPBLDocumento18 pagineCase Study SPBLMonirul IslamNessuna valutazione finora

- 10.2478 - Mdke 2021 0016Documento15 pagine10.2478 - Mdke 2021 0016Khaled BarakatNessuna valutazione finora

- Auditing in New (Ab) Normal: Prepared By: Mohammad Abdur Rahman Jaber ID-24/202Documento11 pagineAuditing in New (Ab) Normal: Prepared By: Mohammad Abdur Rahman Jaber ID-24/202JaberNessuna valutazione finora

- RecoveryAudits BookletDocumento110 pagineRecoveryAudits Bookletsitu6100% (1)

- Fau Set 2Documento7 pagineFau Set 2BuntheaNessuna valutazione finora

- Audit Risk Alert 2010Documento93 pagineAudit Risk Alert 2010harrybear1937Nessuna valutazione finora

- The COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsDocumento6 pagineThe COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsMaria GeorgiouNessuna valutazione finora

- According To RBI:: Magnitude of SicknessDocumento7 pagineAccording To RBI:: Magnitude of SicknessbiotechengineerNessuna valutazione finora

- Maintenance in Hospitals of Saudi ArabiaDocumento8 pagineMaintenance in Hospitals of Saudi ArabiaAbood AliNessuna valutazione finora

- Climate Change Sustainablity ServicesDocumento4 pagineClimate Change Sustainablity ServicesParas MittalNessuna valutazione finora

- SSRN Id2447613Documento15 pagineSSRN Id2447613Noureddine MezianiNessuna valutazione finora

- Result - 10 - 21 - 2022, 1 - 36 - 52 AMDocumento1 paginaResult - 10 - 21 - 2022, 1 - 36 - 52 AMNaushin Fariha Jalal 1821146630Nessuna valutazione finora

- Turnaround Management Project On Industrial SicknessDocumento17 pagineTurnaround Management Project On Industrial Sicknessalokrai1638Nessuna valutazione finora

- Total Quality Management in The Food IndustryDocumento7 pagineTotal Quality Management in The Food IndustryHUSSEIN ABED AL KARIMNessuna valutazione finora

- 4 Key COVID-19 Audit Risks For 2020 Year Ends: Alan Jowers, CPADocumento4 pagine4 Key COVID-19 Audit Risks For 2020 Year Ends: Alan Jowers, CPARona SilvestreNessuna valutazione finora

- UK CIA Sustainable Health Metrics Indicator ToolDocumento16 pagineUK CIA Sustainable Health Metrics Indicator ToolsidNessuna valutazione finora

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Da EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Nessuna valutazione finora

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19Da EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Nessuna valutazione finora

- 5 DR Farhat MoazamDocumento9 pagine5 DR Farhat MoazamAjit Govind SonnaNessuna valutazione finora

- Outlook 2007 ShortcutDocumento4 pagineOutlook 2007 ShortcutAli AhmedNessuna valutazione finora

- Material Requirement PlanningDocumento2 pagineMaterial Requirement PlanningAli AhmedNessuna valutazione finora

- 25 Ways To Lower Supply Chain Inventory CostsDocumento8 pagine25 Ways To Lower Supply Chain Inventory CostsAli AhmedNessuna valutazione finora

- Heparin Sodium USPDocumento1 paginaHeparin Sodium USPAli AhmedNessuna valutazione finora

- History of Cabot-SanmarDocumento1 paginaHistory of Cabot-SanmarAli AhmedNessuna valutazione finora

- COA ClonazepamDocumento1 paginaCOA ClonazepamAli AhmedNessuna valutazione finora

- Outlook 2010 ShortcutDocumento3 pagineOutlook 2010 ShortcutAli AhmedNessuna valutazione finora

- Vadodara - Chennai - Train - ScheduleDocumento1 paginaVadodara - Chennai - Train - ScheduleAli AhmedNessuna valutazione finora

- List of Halal and HaramDocumento14 pagineList of Halal and HaramMohd AliNessuna valutazione finora

- SpeechesDocumento2 pagineSpeechesAli AhmedNessuna valutazione finora

- Cab o Sil M 5p MsdsDocumento8 pagineCab o Sil M 5p MsdsAli AhmedNessuna valutazione finora

- Rehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Documento30 pagineRehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Ali AhmedNessuna valutazione finora

- Ramadan The Month of Fasting (Tamil) : For More Information, ContactDocumento2 pagineRamadan The Month of Fasting (Tamil) : For More Information, ContactAli AhmedNessuna valutazione finora

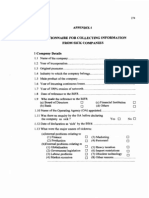

- Questionnaire Information From Sick Companies: For CollectingDocumento6 pagineQuestionnaire Information From Sick Companies: For CollectingAli AhmedNessuna valutazione finora

- Performance of Sick Companies Reported To The: and HasDocumento39 paginePerformance of Sick Companies Reported To The: and HasAli AhmedNessuna valutazione finora

- Heparin Sodium PH - Eur. DRAFTDocumento1 paginaHeparin Sodium PH - Eur. DRAFTAli AhmedNessuna valutazione finora

- 14 Chapter 6Documento88 pagine14 Chapter 6Ali AhmedNessuna valutazione finora

- 16 BibliographyDocumento7 pagine16 BibliographyAli AhmedNessuna valutazione finora

- 15 Chapter 7Documento22 pagine15 Chapter 7Ali AhmedNessuna valutazione finora

- 10 Chapter 2Documento36 pagine10 Chapter 2Ali AhmedNessuna valutazione finora

- 09 Chapter 1Documento18 pagine09 Chapter 1Ali AhmedNessuna valutazione finora

- List of Tables: Description No India Details Companies byDocumento3 pagineList of Tables: Description No India Details Companies byAli AhmedNessuna valutazione finora

- Of Diagrams And: List ChartsDocumento1 paginaOf Diagrams And: List ChartsAli AhmedNessuna valutazione finora

- List Abbreviations: AAI Appellate FinancialDocumento1 paginaList Abbreviations: AAI Appellate FinancialAli AhmedNessuna valutazione finora

- Acknowledgements: I Take Sincere in SuccessfulDocumento2 pagineAcknowledgements: I Take Sincere in SuccessfulAli AhmedNessuna valutazione finora

- Fffectivenes.s Of: The Rehabilitation SchemesDocumento1 paginaFffectivenes.s Of: The Rehabilitation SchemesAli AhmedNessuna valutazione finora

- Table of Contents AnalysisDocumento6 pagineTable of Contents AnalysisAli AhmedNessuna valutazione finora

- 02 DeclarationDocumento1 pagina02 DeclarationAli AhmedNessuna valutazione finora

- Xtreme Power UST ObjectionDocumento6 pagineXtreme Power UST ObjectionChapter 11 DocketsNessuna valutazione finora

- Emtel LTD V The Information and Communication Technologies AuthorityDocumento89 pagineEmtel LTD V The Information and Communication Technologies AuthorityDefimediagroup LdmgNessuna valutazione finora

- JAFZA Submission FormDocumento1 paginaJAFZA Submission FormhameedNessuna valutazione finora

- Voith Sustainability Report 2010Documento76 pagineVoith Sustainability Report 2010voithNessuna valutazione finora

- Sara Lee Vs MacatlangDocumento11 pagineSara Lee Vs MacatlangEuneun BustamanteNessuna valutazione finora

- Skill Seminar: Burn Baby Burn - Alexander Pinter: Lesson 1 - 18.05.2020 Business ModelDocumento3 pagineSkill Seminar: Burn Baby Burn - Alexander Pinter: Lesson 1 - 18.05.2020 Business ModelHarald MeiserNessuna valutazione finora

- Promotional Sales Strategy Survey ResultsDocumento24 paginePromotional Sales Strategy Survey ResultsCelso I. MendozaNessuna valutazione finora

- Session - 046Documento8 pagineSession - 046Abcdef GhNessuna valutazione finora

- Estimating Uzawa-Lucas Model for US and Germany GrowthDocumento25 pagineEstimating Uzawa-Lucas Model for US and Germany GrowthrrrrrrrrNessuna valutazione finora

- Customer Satisfaction in Kancheepuram 2003Documento11 pagineCustomer Satisfaction in Kancheepuram 2003Shano InbarajNessuna valutazione finora

- Chapter 1 - Introduction To Records ManagementDocumento7 pagineChapter 1 - Introduction To Records ManagementNorazliah EenNessuna valutazione finora

- 1.2 Introduction To Labour Economics and Personnel EconomicsDocumento5 pagine1.2 Introduction To Labour Economics and Personnel EconomicsSayfullahKhanNessuna valutazione finora

- Ellen - Moore - Living - and - Working - in - Korea ANALYSISDocumento13 pagineEllen - Moore - Living - and - Working - in - Korea ANALYSISBlackBunny103Nessuna valutazione finora

- NTU Cat Management Network Annual General Report For Academic Year 2016/2017Documento42 pagineNTU Cat Management Network Annual General Report For Academic Year 2016/2017Cat Management NetworkNessuna valutazione finora

- TESCO - The Customer Relationship Management ChampionDocumento8 pagineTESCO - The Customer Relationship Management ChampionBulbul JainNessuna valutazione finora

- Student ID: 19-5286-85A: Fee Payment DetailsDocumento1 paginaStudent ID: 19-5286-85A: Fee Payment DetailsRusty TorioNessuna valutazione finora

- Suman Chaudhary (CG Company)Documento3 pagineSuman Chaudhary (CG Company)Suman Chaudhary100% (1)

- NPV Irr Mirr XirrDocumento6 pagineNPV Irr Mirr XirrRaju PandaNessuna valutazione finora

- HDFC Bank ProfileDocumento6 pagineHDFC Bank ProfileARDRA VASUDEVNessuna valutazione finora

- Land Law Cracks On The MirrorDocumento12 pagineLand Law Cracks On The MirrorTimothy Yu Gen HanNessuna valutazione finora

- Proceedings of The 11th Tourism Outlook Conference, 2 - 5 Octobre, 2018Documento663 pagineProceedings of The 11th Tourism Outlook Conference, 2 - 5 Octobre, 2018M. Tekin KOÇKARNessuna valutazione finora

- MBA I Sem I Assignments PDFDocumento10 pagineMBA I Sem I Assignments PDFharish chaudhariNessuna valutazione finora

- Topic 9 Additional Revision ExerciseDocumento5 pagineTopic 9 Additional Revision ExerciseDương LêNessuna valutazione finora

- Construction Business Plan TemplateDocumento18 pagineConstruction Business Plan Templatejohn philip s garcia89% (9)

- Writing Chapter 3 Methodology: Prepared By: Chona V. Cayabat, DbaDocumento25 pagineWriting Chapter 3 Methodology: Prepared By: Chona V. Cayabat, DbaamenaNessuna valutazione finora

- The Business Case For Next Generation AWS Managed Services Providers Oc...Documento33 pagineThe Business Case For Next Generation AWS Managed Services Providers Oc...Saniya100% (1)

- DiksharambhDocumento6 pagineDiksharambhwebiisNessuna valutazione finora

- Swot Analysis Pomelo JamDocumento4 pagineSwot Analysis Pomelo JamCHANA ARIELA MAGNONessuna valutazione finora

- ACC08101 Introductory AccountingDocumento12 pagineACC08101 Introductory AccountingBólájí AkínyemíNessuna valutazione finora

- 86 698 1 PBDocumento21 pagine86 698 1 PBSemen PutihNessuna valutazione finora