Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

W5 Team C Case Studies

Caricato da

tk12834966100%(1)Il 100% ha trovato utile questo documento (1 voto)

874 visualizzazioni10 pagineQRB/501

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoQRB/501

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

874 visualizzazioni10 pagineW5 Team C Case Studies

Caricato da

tk12834966QRB/501

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 10

Question 1

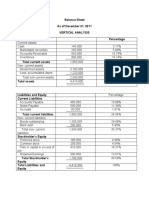

Assets Amounts % of total Assets

Cash $1,844 1.0%

Accounts Receivable 11,807 6.5%

Inventory 9,628 5.3%

Total Current Assets 23,279 12.8%

Plant and Equipment 158,700 87.2%

Total Assets $181,979 100.0%

Liabilities Amounts % of total

Accounts payable $13,446 7.4%

Wages payable 650 0.4%

Property and taxes payable 4,124 2.3%

Total Current Liabilities 18,220 10.0%

Long Term Debt 92,800 51.0%

$111,020 61.0%

Owner's Equity $70,959 39.0%

Total Liabilities and Equity $181,979 100.0%

2011 2010

Assets Amounts Amounts

Cash $1,844 $3,278

Accounts Receivable 11,807 6,954

Inventory 9,628 17,417

Total Current Assets 23,279 27,649

Plant and Equipment 158,700 144,500

Total Assets $181,979 $172,149

Liabilities Amounts Amounts

Accounts payable $13,446 $9,250

Wages payable 650 1,110

Property and taxes payable 4,124 3,650

Total Current Liabilities 18,220 14,010

Long Term Debt 92,800 75,800

$111,020 $89,810

Owner's Equity $70,959 $82,339

Total Liabilities and Equity $181,979 $172,149

Comparative Balance Statement

Contemporary Wood Furniture

December 31, 2011

Total Liabilities

Total Liabilities

Vertical Analysis

Horizontal Analysis

Percent of total assets= amount of item/total assets x100%

Question 2

current assets $23,279

Current Ratio= current liabilities $18,220

total liabilities $111,020

total assets $181,979

$1,844+$11,807+$9,628

$13446+$650+$4124

$23,279

$18,220

$3,278+$6,954+$17,417

$9,250+$1110+$3650

$27,649

$14,010

total assets

$111,020

$181,979

$89,810

$172,149

Question 3

Percent increase (decrease) = amount of increase (decrease)/earlier years amount x 100%

1.27 to 1

Total debt to total ratio= 0.61 to 1

2010 Current Ratio = 1.97

Total debt to total asset ratio = total liabilities

1.28

2011 Current Ratio =

2011 Current Ratio =

2010 Current Ratio =

2011 total debt to total assets ratio =

0.61

2010 total debt to total assets ratio =

0.52

Total debt has increased from 2010 to 2011. The current ratio is much better in 2010, and is approaching the value of 1 for 2011, which is a major concern. The total debt

to total assets ratio is approaching the high range for 2011, which could be a problem. In total, the trends are something to be concerned about. It will be important to

continue to monitor the balance shetts for 2012 to make sure this trend does not continue.

Amounts % of total Assets

$3,278 1.9%

6,954 4.0%

17,417 10.1%

27,649 16.1%

144,500 83.9%

$172,149 100.0%

Amounts % of total

$9,250 5.4%

1,110 0.6%

3,650 2.1%

14,010 8.1%

75,800 44.0%

$89,810 52.2%

$82,339 47.8%

$172,149 100.0%

Percent

Increase Increase

(decrease) (decrease)

($1,434) (43.7)

$4,853 69.8

($7,789) (44.7)

($4,370) (15.8)

$14,200 9.8

$9,830 5.7

$4,196 45.4

($460) (41.4)

$474 13.0

$4,210 30.0

$17,000 22.4

$21,210 23.6

($11,380) (13.8)

$9,830 5.7

Comparative Balance Statement

Contemporary Wood Furniture

December 31, 2010

Percent of total assets= amount of item/total assets x100%

Percent increase (decrease) = amount of increase (decrease)/earlier years amount x 100%

Total debt has increased from 2010 to 2011. The current ratio is much better in 2010, and is approaching the value of 1 for 2011, which is a major concern. The total debt

to total assets ratio is approaching the high range for 2011, which could be a problem. In total, the trends are something to be concerned about. It will be important to

continue to monitor the balance shetts for 2012 to make sure this trend does not continue.

Assets Amounts % of total Assets

Cash $4,000 2.2%

Accounts Receivable 6,000 3.3%

Inventory 15,000 8.2%

Total Current Assets 25,000 13.6%

Plant and Equipment 158,700 86.4%

Total Assets $183,700 100.0%

Liabilities Amounts % of total

Accounts payable $3,500 1.9%

Wages payable 1,500 0.8%

Property and taxes payable 4,124 2.2%

Total Current Liabilities 9,124 5.0%

Long Term Debt 92,800 50.5%

$101,924 55.5%

Owner's Equity $81,776 44.5%

Total Liabilities and Equity $183,700 100.0%

Amounts % of total Net Sales

Net sales $120,000 31.2%

Cost of good sold $85,000

Beginning inventory 6,000 1.6%

Purchases 15,000 3.9%

Goods available for sale 226,000 58.7%

Less: ending inventory 158,700 41.3%

Cost of good sold $384,700 100.0%

Amounts % of total

Gross profits from sales $3,500 0.9%

Operating Expenses 1,500 0.4%

Net Income 4,124 1.1%

9,124 2.4%

December 31, 2011

Income Statement

Balanced Books Bookkeeping

Balance Statement

Balanced Books Bookkeeping

December 31, 2011

Total Liabilities

Percent of total assets= amount of item/total assets x100%

92,800 24.1%

$101,924 26.5%

$282,776 73.5%

$384,700 100.0%

Question 2

current assets

Current Ratio= current liabilities

quick current assets

current liabilities Acid-Test Ratio =

Percent of net sales = amount of item/net sales x 100%

Income Statement

Balanced Books Bookkeeping

Balance Statement

Balanced Books Bookkeeping

Percent of total assets= amount of item/total assets x100%

Assets Amounts Percent

Cash $4,000 10.0%

Accounts Receivable 6,000 15.0%

Inventory 15,000 37.5%

Total Current Assets 25,000 62.5%

Plant and Equipment

Equipment 15,000 37.5%

Total Assets $40,000 100.0%

Liabilities Amounts Percent

Current liabilities

Accounts payable $3,500 8.75%

Wages payable 1,500 3.75%

Insurance payable 500 1.25%

Total Liabilities 5,500 13.75%

Owner's Equity $34,500 86.25%

Total Liabilities and Equity $40,000 100.0%

Amounts Percent

Net sales $120,000 100.0%

Cost of good sold $85,000 70.8%

Gross profit $35,000 29.2%

Operating Expenses

Amounts % of total

Rent $15,000 12.5%

Utilities 6,500 5.4%

Depreciation 2,000 1.7%

Wages 8,000 6.7%

Misc Expenses 1,500 1.3%

Total Operating Expenses 33,000 27.5%

Net Income 2,000 1.7%

December 31, 2011

December 31, 2011

Balanced Books Bookkeeping

Balance Sheet

December 31, 2011

Balanced Books Bookkeeping

Income Statement

For Year Ending December 31

Ratio Analysis:

Current Ratio = Current assets

Current liabilities

$25,000

$5,500

Acit Test Ratio =

Cash + Marketable

securities +

Accounts

Receivables

Current Liabilities

$4000 + 0 + $6000

$5,500

1.82

4.55

Potrebbero piacerti anche

- Chapter - 3Documento58 pagineChapter - 3habtamuNessuna valutazione finora

- Du Pont Analysis: Divided byDocumento1 paginaDu Pont Analysis: Divided byJayaram ParlikadNessuna valutazione finora

- Chapter 5Documento59 pagineChapter 5mokeNessuna valutazione finora

- Common Size AnalysisDocumento25 pagineCommon Size AnalysisYoura DeAi0% (1)

- Amazon ValuationDocumento22 pagineAmazon ValuationDr Sakshi SharmaNessuna valutazione finora

- Chap014 Financial and Managerial Accountting WilliamsDocumento57 pagineChap014 Financial and Managerial Accountting WilliamsOther Side100% (1)

- Tutorial 5 Part 1-Fin Stat Analysis - Answer PDFDocumento4 pagineTutorial 5 Part 1-Fin Stat Analysis - Answer PDFfy rafikNessuna valutazione finora

- Tutorial Week 2 - Working With Financial StatementsDocumento9 pagineTutorial Week 2 - Working With Financial StatementsQuốc HưngNessuna valutazione finora

- Module 3Documento53 pagineModule 3prabhakarnandyNessuna valutazione finora

- Financial Analysis of PEPSICODocumento8 pagineFinancial Analysis of PEPSICOUsmanNessuna valutazione finora

- FCF 10th Edition Chapter 03Documento32 pagineFCF 10th Edition Chapter 03Khánh LyNessuna valutazione finora

- Financial Statement AnalysisDocumento53 pagineFinancial Statement Analysisremon4hrNessuna valutazione finora

- Supplement Scientific GlassDocumento7 pagineSupplement Scientific GlassDrew ShepherdNessuna valutazione finora

- Chapter No 06 Final Afs-1Documento58 pagineChapter No 06 Final Afs-1salwaburiroNessuna valutazione finora

- Assets 2012 2011 2012% 2011% Current Assets Long-Term Investment Plant Assets Intangible Assets Total AssetsDocumento2 pagineAssets 2012 2011 2012% 2011% Current Assets Long-Term Investment Plant Assets Intangible Assets Total AssetsSudin AmatyaNessuna valutazione finora

- CASE-STUDY Growing PainsDocumento9 pagineCASE-STUDY Growing PainsZion EliNessuna valutazione finora

- Problem BankDocumento10 pagineProblem BankSimona NistorNessuna valutazione finora

- Dharmin - Shah - Final - Exam - Section - 71Documento11 pagineDharmin - Shah - Final - Exam - Section - 71hani.sharma324Nessuna valutazione finora

- Financial Statement and Ratio AnalysisDocumento182 pagineFinancial Statement and Ratio AnalysisAsad AliNessuna valutazione finora

- Dwnload Full Cases in Finance 3rd Edition Demello Solutions Manual PDFDocumento35 pagineDwnload Full Cases in Finance 3rd Edition Demello Solutions Manual PDFcherlysulc100% (11)

- Financial Statement AnalysisDocumento55 pagineFinancial Statement AnalysisHassanNessuna valutazione finora

- Financial AnalysisDocumento8 pagineFinancial AnalysisRey Mariel YbasNessuna valutazione finora

- Financial ModelingDocumento18 pagineFinancial ModelingGabriella Elizabeth Khoe MunandarNessuna valutazione finora

- Financial Statement Analysis 1Documento15 pagineFinancial Statement Analysis 1Ladymie MantoNessuna valutazione finora

- Accrual Basis AccountingDocumento149 pagineAccrual Basis AccountingManzoor AlamNessuna valutazione finora

- EFM3 CHMDL 04 FinAnalysisDocumento13 pagineEFM3 CHMDL 04 FinAnalysisVeri KurniawanNessuna valutazione finora

- Assignment 3 SolutionDocumento7 pagineAssignment 3 SolutionAaryaAustNessuna valutazione finora

- FIN-AW4 AnswersDocumento14 pagineFIN-AW4 AnswersRameesh DeNessuna valutazione finora

- New Microsoft Office Excel WorksheetDocumento3 pagineNew Microsoft Office Excel WorksheetMostakNessuna valutazione finora

- Financial Statements, Cash Flow, and TaxesDocumento23 pagineFinancial Statements, Cash Flow, and TaxesSaad KhanNessuna valutazione finora

- Understanding Financial Statements: Chris DroussiotisDocumento23 pagineUnderstanding Financial Statements: Chris Droussiotisnimitjain10Nessuna valutazione finora

- CaseDocumento11 pagineCasengogiahuy12082002Nessuna valutazione finora

- Chapter 4 Financial Statement AnalysisDocumento63 pagineChapter 4 Financial Statement AnalysismindayeNessuna valutazione finora

- Horizontal and Vertical Analysis DetailsDocumento9 pagineHorizontal and Vertical Analysis DetailsJann KerkyNessuna valutazione finora

- Case Study 2Documento10 pagineCase Study 2Cheveem Grace Emnace100% (1)

- Chapter3 4Documento24 pagineChapter3 4kakolalamamaNessuna valutazione finora

- Financial Statement AnalysisDocumento53 pagineFinancial Statement AnalysisNeeraj KumarNessuna valutazione finora

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocumento3 pagineBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNessuna valutazione finora

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocumento3 pagineBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNessuna valutazione finora

- Long-Term Financial Planning and GrowthDocumento34 pagineLong-Term Financial Planning and GrowthBussines LearnNessuna valutazione finora

- Common Size Income StatementDocumento7 pagineCommon Size Income StatementUSD 654Nessuna valutazione finora

- Woof-JunctionDocumento13 pagineWoof-Junctionlauvictoria29Nessuna valutazione finora

- Ch03 P15 Build A ModelDocumento2 pagineCh03 P15 Build A ModelHeena Sudra77% (13)

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocumento7 pagineHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNessuna valutazione finora

- PP For Chapter 6 - Financial Statement Analysis - FinalDocumento67 paginePP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNessuna valutazione finora

- Chapter 9 Making Capital Investment DecisionsDocumento32 pagineChapter 9 Making Capital Investment Decisionsiyun KNNessuna valutazione finora

- Problems 1-30: Input Boxes in TanDocumento24 pagineProblems 1-30: Input Boxes in TanSultan_Alali_9279Nessuna valutazione finora

- Browning Ch03 P15 Build A ModelDocumento3 pagineBrowning Ch03 P15 Build A ModelAdam0% (1)

- Chapter 13 - Build A Model SpreadsheetDocumento6 pagineChapter 13 - Build A Model Spreadsheetdunno2952Nessuna valutazione finora

- Financial Analysis of Ebay IncDocumento8 pagineFinancial Analysis of Ebay Incshepherd junior masasiNessuna valutazione finora

- FM AssignmentDocumento7 pagineFM Assignmentkartika tamara maharaniNessuna valutazione finora

- Business FinanceDocumento43 pagineBusiness FinanceKimNessuna valutazione finora

- Principles of Accounting Chapter 14Documento43 paginePrinciples of Accounting Chapter 14myrentistoodamnhighNessuna valutazione finora

- Analysis of Financial StatementsDocumento46 pagineAnalysis of Financial StatementssiddharthrajNessuna valutazione finora

- Solution To Case 2: Bigger Isn't Always Better!Documento9 pagineSolution To Case 2: Bigger Isn't Always Better!Muhammad Iqbal Huseini0% (1)

- Activity 3 123456789Documento7 pagineActivity 3 123456789Jeramie Sarita SumaotNessuna valutazione finora

- Corporate Finance Chapter 4Documento15 pagineCorporate Finance Chapter 4Razan EidNessuna valutazione finora

- Business Metrics and Tools; Reference for Professionals and StudentsDa EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Rental-Property Profits: A Financial Tool Kit for LandlordsDa EverandRental-Property Profits: A Financial Tool Kit for LandlordsNessuna valutazione finora

- Interpreting Financial ResultsDocumento4 pagineInterpreting Financial Resultstk12834966Nessuna valutazione finora

- Business Structures: Business Structures Tierney Kennedy FIN/571 David Binder April 13, 2015Documento7 pagineBusiness Structures: Business Structures Tierney Kennedy FIN/571 David Binder April 13, 2015tk12834966Nessuna valutazione finora

- Riordan Manufacturing Team PaperDocumento7 pagineRiordan Manufacturing Team Papertk12834966Nessuna valutazione finora

- Leadership StyleDocumento4 pagineLeadership Styletk12834966Nessuna valutazione finora

- Compensation and BenefitsDocumento6 pagineCompensation and Benefitstk12834966Nessuna valutazione finora

- Week 4 Case BriefDocumento5 pagineWeek 4 Case Brieftk12834966100% (1)

- Cash Management ScenarioDocumento5 pagineCash Management Scenariotk12834966Nessuna valutazione finora

- Recruitment and Selection Strategies RecommendationsDocumento7 pagineRecruitment and Selection Strategies Recommendationstk12834966100% (1)

- Performance Management PlanDocumento7 paginePerformance Management Plantk12834966Nessuna valutazione finora

- Business Ethics CaseDocumento3 pagineBusiness Ethics Casetk12834966Nessuna valutazione finora

- Business Communication Trends PaperDocumento4 pagineBusiness Communication Trends Papertk12834966Nessuna valutazione finora

- Aircraft FatigueDocumento1 paginaAircraft FatigueSharan RajNessuna valutazione finora

- Greek Gods & Goddesses (Gods & Goddesses of Mythology) PDFDocumento132 pagineGreek Gods & Goddesses (Gods & Goddesses of Mythology) PDFgie cadusaleNessuna valutazione finora

- Case 1. Is Morality Relative? The Variability of Moral CodesDocumento2 pagineCase 1. Is Morality Relative? The Variability of Moral CodesalyssaNessuna valutazione finora

- Hilti 2016 Company-Report ENDocumento72 pagineHilti 2016 Company-Report ENAde KurniawanNessuna valutazione finora

- AI Intelligence (Sam Charrington and Abeba Birhane)Documento2 pagineAI Intelligence (Sam Charrington and Abeba Birhane)Ethel Shammah Waoulda Acleta90% (10)

- Case Study For Southwestern University Food Service RevenueDocumento4 pagineCase Study For Southwestern University Food Service RevenuekngsniperNessuna valutazione finora

- KPMG Our Impact PlanDocumento44 pagineKPMG Our Impact Planmuun yayo100% (1)

- DPS Quarterly Exam Grade 9Documento3 pagineDPS Quarterly Exam Grade 9Michael EstrellaNessuna valutazione finora

- Alpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MuDocumento3 pagineAlpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MulanNessuna valutazione finora

- Bos 2478Documento15 pagineBos 2478klllllllaNessuna valutazione finora

- Edu 414-1Documento30 pagineEdu 414-1ibrahim talhaNessuna valutazione finora

- BorgWarner v. Pierburg Et. Al.Documento9 pagineBorgWarner v. Pierburg Et. Al.PriorSmartNessuna valutazione finora

- Introduction The Myth of SomaliaDocumento14 pagineIntroduction The Myth of SomaliaKhader AliNessuna valutazione finora

- Modern Dispatch - Cyberpunk Adventure GeneratorDocumento6 pagineModern Dispatch - Cyberpunk Adventure Generatorkarnoparno2Nessuna valutazione finora

- Ronaldo FilmDocumento2 pagineRonaldo Filmapi-317647938Nessuna valutazione finora

- Ta 9 2024 0138 FNL Cor01 - enDocumento458 pagineTa 9 2024 0138 FNL Cor01 - enLeslie GordilloNessuna valutazione finora

- Unit Iv - Lesson 1Documento2 pagineUnit Iv - Lesson 1SHIERA MAE AGUSTINNessuna valutazione finora

- Public Service Application For ForgivenessDocumento9 paginePublic Service Application For ForgivenessLateshia SpencerNessuna valutazione finora

- AssignmentDocumento25 pagineAssignmentPrashan Shaalin FernandoNessuna valutazione finora

- Wendy in Kubricks The ShiningDocumento5 pagineWendy in Kubricks The Shiningapi-270111486Nessuna valutazione finora

- Republic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962Documento2 pagineRepublic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962DAblue ReyNessuna valutazione finora

- BÀI TẬP TRẮC NGHIỆM CHUYÊN ĐỀ CÂU BỊ ĐỘNGDocumento11 pagineBÀI TẬP TRẮC NGHIỆM CHUYÊN ĐỀ CÂU BỊ ĐỘNGTuyet VuNessuna valutazione finora

- Social Dimensions OF EducationDocumento37 pagineSocial Dimensions OF Educationjorolan.annabelleNessuna valutazione finora

- British Airways Vs CADocumento17 pagineBritish Airways Vs CAGia DimayugaNessuna valutazione finora

- Sales Channel: ABB Limited, BangladeshDocumento4 pagineSales Channel: ABB Limited, BangladeshMehedyNessuna valutazione finora

- Project On Hospitality Industry: Customer Relationship ManagementDocumento36 pagineProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariNessuna valutazione finora

- Bangladesh Labor Law HandoutDocumento18 pagineBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadNessuna valutazione finora

- Sbi Rural PubDocumento6 pagineSbi Rural PubAafrinNessuna valutazione finora

- TolemicaDocumento101 pagineTolemicaPrashanth KumarNessuna valutazione finora

- Company Analysis of Axis BankDocumento66 pagineCompany Analysis of Axis BankKirti Bhite100% (1)