Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Management of Working Capital in Adansi Rural Bank LTD

Caricato da

kwame1986Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Management of Working Capital in Adansi Rural Bank LTD

Caricato da

kwame1986Copyright:

Formati disponibili

1

CHAPTER ONE

INTRODUCTION

1.0 BACKGROUND OF THE STUDY

Every organization or firm requires some level of financing. This applies to businesses already in

operation and those planning to start new businesses. Financing is a major area to be considered by

stakeholders (government, entrepreneurs, creditors etc among others).

It has become a foundation which all forms of businesses and organizations such as banks thrive on

for survival.

Financing is generally categorised as either equity or debt, due to its nature, I was more interested in

the type of equity capital called working capital.

Working capital is the money or capital available for the day to day operations of the business. It is

the money used to buy materials or goods for manufacturing or for resale. This is in direct contrast

with fixed capital, which is the money used to buy fixed assets such as buildings, plants, motor

vehicles etc. Working capital is usually defined as the net current assets consisting of stock, debtors

and cash minus current liabilities mainly trade creditors. The main sources of working capital are the

current assets as these are the short term finance that a firm can use to generate cash. However, firms

also have some obligation to fulfill and as such, careful consideration must be given to working

capital management.

It is vital for a business to have sufficient working capital to meet all its requirements. Most

businesses are not doing well as a result of poor working capital management. For businesses to

grow, it needs to be careful with how they manage their finances, especially the working capital.

Since an organization must have a sufficient amount of cash, debtors and stock, management must

give attention to working capital management.

2

1.1 STATEMENT OF THE PROBLEM

The main driving force behind this research is to establish the practicality of running a business or an

organization with respect to the management of working capital of the business or the organization.

This research also seeks to enquire into how management professionally handles the issues of

working capital management in business organizations in Ghana.

1.2 HYPOTHESIS

It has been noted that the improper methods of bookkeeping have resulted in the folding up of many

businesses in the Ghanaian economy. Effective management of working capital will mean that

proper accounts will be kept by businesses or organizations which go a long way to have a positive

impact on working capital. This will help sustain business organizations to achieve their

organizational goals.

1.3 OBJECTIVE OF THE STUDY

The study is aimed at identifying the effectiveness of the management of working capital in Ghana.

The course of this study is to find ways to deal with proper working capital cycle within businesses

in Ghana which will help organizational growth.

1.4 THE SCOPE AND LIMITATION OF THE STUDY

The delicate nature of an organization working capital disclosure to Individual or group of people

who may have less or no interest in the business organization made it difficult for many thriving

businesses to release information that concern their working capital, so that I can form an opinion on

their working capital and its operation. Due to this reluctance, we focused on businesses such as

Banks and other Financial Institutions set up by individuals or group of people who were more

willing to help me to carry out this research study on working capital. The study covered present

3

methods of managing working capital and the probable problems associated with working capital in

these organizations.

The limitations to this research include the limited time within which we were supposed to come up

with a credible study. There was also a financial constraint in gathering data and in-depth audit of

information given to ascertain its credibility.

1.5 SIGNIFICANCE OF THE STUDY

The project will help improve the working capital management of businesses not even banks only

but other financial institutions in Ghana by identifying the most suitable ways of managing working

capital. The research will help to determine and maintain the appropriate level of working capital

that maximizes profit by preventing excess or idle working capital and the shortage of working

capital. This will go a long way to improve the financial position of businesses in Ghana and also to

take proper management decisions. The project will also help individuals or group of people who

will do research on working capital management in future.

1.6 METHODOLOGY

There are different methods which were used in gathering the relevant information for the project.

These include;

Literature review and documentary research

Personal interviews

Submitted questionnaires

Published literature and financial reports was used for the study and background information as

guidance. In addition, a careful study of published reports and magazines of businesses was

reviewed for relevant information.

Other journals and brochures were obtained from the small scale businesses which were used as a

case study. Apart from the above, some relevant information and facts from the financial magazines,

4

journals, The National Board for Small Scale Industries and the Ghana Stock Exchange was

consulted. Questionnaires were submitted to Adansi Rural Bank ltd and their management.

The facts gathered from documentary sources and responses received from interviews and submitted

questionnaires were collected to form the basis of this project.

1.7 ORGANIZATION OF THE STUDY

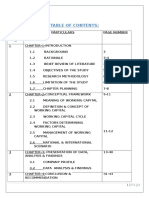

The study is structured or organized into five main chapters.

Chapter one shall mainly be concerned with a briefing about the study that is introducing the

research, statement of the problem, hypothesis, objectives of the study as well as the limitations and

the methodology.

Chapter two shall be devoted to reviewing past literature on earlier researches conducted by

individuals or group of people on working capital management.

Chapter three: In chapter three the population in the business organization shall be sampled to

obtain data based on the methodology being used which shall be analyzed to suit our research.

Chapter four: In this chapter we shall be concerned with evaluating the data at hand.

Chapter five: This is the stage where we draw our conclusion using the results obtained from these

business organizations in comparism with how theoretical the working capital of an organization

needs to be managed to ascertain how professionally these businesses are managing their working

capital.

5

CHAPTER TWO

2.0 INTRODUCTION

The purpose of this literature review is to report on the previous work that others have done in the

area of the study which also focuses on relevant articles, journals and other relevant materials.

The review has been put under these sub headings:

Management of stock

Management of debtor

Cash management

Creditors control

Management of bank overdraft

According to Artill and Maclanuey (1994), the size and composition of working capital varies

between industries. For some businesses, the investment in working capital can be substantial, for

example a manufacturing company as compared with a retail business.

2.1 OPERATING CYCLE

The operating cycle is the length of time between the company outlay of raw materials, wages and

other expenditure and the inflow of cash from the sale of the goods. It is also known as the working

capital cycle which is the length of time that elapses between a business paying for its raw materials

and the business receiving payments from its customers for the goods made from the raw materials.

Nyarkoh K.O (in press).

6

2.2 WORKING CAPITAL CYCLE OF A MANUFACTURER

A firm buys raw materials on credit. The raw materials will be held for some time in stores before

being issued to the production department and turned into finished products. The finished goods

must be kept in a warehouse for sometime before they are sold to customers. By this time, the firm

will have paid for the raw materials purchased. If customers buy goods on credit, it will take some

time before the cash from the sale is realized. Each activity takes some time. The time taken by each

activity is an element of working capital cycle. Nyarkoh K.O (in press)

2.3 MANAGEMENT OF STOCK

A firm needs a continuous supply of materials to ensure that production and sale of goods goes on

every day in order to maximize profit. Holding higher levels of stocks will enable the company to be

more flexible in supplying customers, even when there is an abnormal demand. More customers will

receive immediate delivery rather than waiting for new goods to be produced. There might be a

smaller chance of sales being delayed through interruptions in production. On the other hand,

keeping a high level of stocks brings in additional cost of financing in keeping stocks.

Stock management may be defined as keeping the optimum or the appropriate level of stocks that

will maximize the benefit of holding and minimize the cost of holding stock.

It is also the process of determining and keeping the appropriate level which will minimize the cost

of storing and also ensure that the firm does not run out of stock in other to maximize profit.

Keeping a minimum level of stock will release cash for future investment. Nyarkoh K.O (in press)

2.3.1 BUDGETS FOR FUTURE DEMAND

The best way a business can ensure that there is stock available to meet future sales, is to prepare an

appropriate budget. This budget should include each product that the business deals in. It is

important to make every attempt to ensure the accuracy of those budgets as they will decide future

ordering and production level. The budget may be driven in various ways. The budget may be

7

developed using statistical techniques such as time series analysis or may be based on the judgment

of the sales and the marketing staff.

2.3.2 FINANCIAL RATIOS

The ratio that can be used to monitor stocks is the stock turnover period. This ratio is calculated as;

Stock turnover period = Average stock 365 days

Cost of sales

This will provide the basis to know the average period for which stocks are held and can be useful as

a basis for comparison. It is possible to calculate the stock turnover period for individual product

lines as well as for stocks as a whole. Shorter stock turnover period indicates how effective

management has worked hard to earn profit.

2.3.3 RECORDING AND REODERING SYSTEM

The management of stock requires a sound system of recording stock movement. There must be a

proper procedure for recording purchases. Periodic stock checks may be required to ensure that the

amount of physical stock held is consistent with the stock records. The authorization of both

purchases and the issue of stocks should be confined to a few senior staff which will help reduce

pilfering. To determine the point at which stock should be reordered, the information concerning the

lead- time (time between the placing an order and the receipt of the goods) and the likely level of

demand will be required.

2.3.4 STOCK MANAGEMENT MODELS

It is possible to use decision models to help manage stocks. The economic order quantity (EOQ) is

concerned with answering the question, how much stocks should be ordered. In its simplest form, the

EOQ models assumes that demand is constant so that stocks will be depleted evenly overtime and

8

will be replenished just at the point that stocks runs out. The most used method of stock

management is;

JUST IN TIME (JIT) STOCK MANAGEMENT

In recent years, some manufacturing industries have tried to eliminate the need to hold stock by

adopting just in time stock management. This method was first used by the US defense industry

during World War II and in more recent times. It has been widely used by the Japanese business

men. The essence of JIT is, as the name suggests, to have suppliers delivered to a business just in

time for them to be used in the production process. By adopting this approach, the stock holding

problems rest with the suppliers rather than the business itself. For this approach to be successful, it

is important that the business inform suppliers of its production plans and in turn deliver materials of

the right quantity at the agreed time. Failure to do so could lead to a dislocation of production and

could be very costly. Thus, a close relationship between a business and its suppliers is required.

Though a business will not have to hold stock, there may be certain cost associated with JIT

approach. Finally, the close relationship is necessary between the business and its suppliers may

prevent the business from taking advantage of cheaper source of supply if they become available.

The philosophy underlining this method is concerned with eliminating waste, and striving to deliver

goods. There will be no expectation that the production process will operate at maximum efficiency.

This means that there will be no production breakdowns. Whiles these expectations may be

impossible to achieve, they do help to create a management culture that is dedicated to quality

service.

2.4 MANAGEMENT OF DEBTORS

Debtors come about when an organization decides to sell goods on credit to customers. Selling

goods on credit results in, cost accruing to the business in the form of bad debt, opportunity foregone

in realizing cash promptly and others.

When a business decides to sell goods and provides services on credit, it must have clear policies

concerning;

1. Type of customers to sell goods on credit to.

2. Setting credit limit

9

3. Conditions attached to sales

4. Means of cash collection to be adopted.

It is important to note that cash flow is very significant especially when collected at a faster rate. It is

also important for every business to know their debtors, how much is involved and for how long it is

standing in the books.

2.4.1 RELATIONSHIP BETWEEN PROFIT AND LATE RECEIPT OF CASH

Late receipt of cash as a result of offering credit sales has a crippling effect of rendering a business

cash trapped. This is much felt among industries whose sources of finance are not strong, thereby

uncontrollably, allowing the business to be managed according to the inflow of cash as it occurs. In

business finance, it is advisable to manage debtors of the business. The following measures could be

adopted in dealing with trade debtors;

1. Set up credit limit for each customer.

2. Ensure that the credit sales are within the set limit.

3. Immediately after credit sales prepare a sales invoice.

4. Send a reminder at frequent intervals

5. Threaten difficult customers with court action

6. Take court action if persuasion fails

7. Factor the debt after invoicing

Factoring as an alternative to debt retrieval, is the sale of debt or the amount owed by a debtor to a

third party called the factor at a discount in return for prompt cash (immediate payment). In

factoring, there can be a factor with a recourse where the supplier bears the risk of bad debt for debt

not been paid or a factor without recourse in this case the factor or the third party bears the risk of

bad debt. Nyarkoh K.O (in press)

10

2.4.2 DETERMINING RELIABLE CUSTOMERS

An organization which cannot erode selling on credit must plan efficiently and effectively on how

to retrieve monies owed from debtors. It is important to take the following factors into

consideration;

CAPITAL STRUCTURE

When a business is considering proposals from a customer to sell on credit, it is important to access

the capital base of this customer to be sure of how sound they are financially. It is advisable to

access the profitability and liquidity of the customer. In addition any major financial commitments

of the customer must be taken into consideration (standing orders, etc)

CAPACITY

The customer must have the capacity of paying their debt. Where possible, the credit record of the

customers must be examined. If the customer is already in operation, looking at the physical and

operational resources of the business will be relevant for forming a justifiable opinion about the

business.

COLLATERAL

It is more relieving to have a form of security for goods supplied on credit. When this occurs, the

business is convinced that the customer is reliable and as such goods can be sold on credit to

customers without fear of being deprived of their money. It also gives the assurance of doing away

with bad debt.

CREDIT WORTHINESS OF A CUSTOMER

It is important to access the credit worthiness of a customer with reference to past dealings of the

customer with your organization or your competitors. Once the customer is considered to have a

good record, then goods can be supplied to the customer without any fear.

CREDIT PERIOD

The business must determine the credit period it is prepared to offer to its customers. The duration

of credit offered can vary significantly between businesses and is influenced by factors such as:

11

1. The degree of competition within the industry

2. The bargaining power of a particular customer

3. The risk of non- payment

4. The capacity of the business to offer credit, and others.

CASH DISCOUNT AND INTEREST ON DEBT

The organization can decide to offer cash discount as a means of encouraging prompt payment from

its customers. The amount of cash discount given can influence whether to purchase on credit or not,

from the organizations point of view it is important to weigh the cost of offering discount against the

likely benefit derived from financing debtors.

Charging interest on overdue debts can also be a stringent measure to collect cash from debtors, but

it is also important to note that, this is mostly possible when the organization sells a peculiar product

in the area to avoid loss of customers

2.5 DEBT COLLECTION POLICY

The organization offering credit must ensure that the amount owing is collected as quickly and

efficiently as possible. An efficient collection policy requires an efficient accounting system.

Management can monitor the effectiveness of cash collection policies in a number of ways. One

method that is commonly used in most businesses is the determination of the debtors collection

period. It is calculated as;

Debtors collection periods = Trade debtors 365days

Credit sales

This ratio is useful but not 100% reliable since it gives the average days within which debt will be

realized useful in budgeting.

12

2.6 MANAGEMENT OF CASH

Cash management is concerned with optimizing the amount of cash available to the entity or the

company and maximizing the interest on any spare or idle funds not required immediately by the

company.

In other words cash management involves making sure that business always has enough cash on

hand to meet its bills expenses and other day-to-day activities and also invest surplus cash for profit

and interest. There are three motives of holding cash. These are;

2.6.1 TRANSACTIONARY MOTIVE

To meet the day-to-day commitments, a business requires a certain amount of cash that will take

care of their daily transactions. Cash has been described as the life blood upon which most

businesses thrives on.

2.6.2 PRECAUTIONARY MOTIVE

Future uncertainty of regular cash flow is a factor to consider in cash management. To curtail any

incidental spending, it is advisable to hold a cash balance on hand as a precautionary measure.

2.6.3 SPECULATIVE MOTIVE

A business may decide to hold cash in order to be in a position to exploit profitable opportunities as

and when they arise, by holding cash a business may be able to enter into a new market that open up,

which may require an immediate entry. Ray Powell (1989)

13

2.7 CONTROLLING CASH BALANCE

Several models have been proposed to help control the cash balance of a business. One of such

models proposed the use of upper and lower control limits for cash balances and the use of a target

cash balance. The model assumes that the business invest in businesses that can easily be turned into

cash. The business proposes two limits thus the upper and the lower. If the business exceeds the

outer limit then management decide whether the cash balance is likely to return over the following

few days to a point within the inner control limit set. If this seems likely, then no action is required.

If on the other hand this seems unlikely then management must change the cash position of the

business by buying or selling marketable securities or simply by borrowing or lending.

Y

80 outer limit

Higher

60

(%)

40

Lower

20 inner limit

0 1 2 3 4 5 6 7 8 x

The graph depicts a model for controlling the cash balance that relies on the use of inner and outer

control limits. Where outer control limits are breached and there is no prospect of an early return to a

14

point within these limits, management must take action. A breach of a higher limit will involve

buying marketable securities (to ensure that cash is not lying idle) a breach of the lower limit will

involve selling marketable securities to ensure there is sufficient cash to meet obligation.

There are other models that do not rely on management judgment and we use quantitative techniques

to determine an optimal cash balance.

2.7.1CASH BUDGET

To manage cash effectively, it is important for business to prepare a cash budget. Cash budget is a

statement which shows the expected cash to be received and paid as well as the expected cash

balance for each day, month or in future. Cash budget is a very important cost control mechanism for

both planning and control purposes. It is worth repeating the point that cash budget enable managers

to see the expected outcome of planned events. The cash budget will identify periods when cash

surpluses are expected.

2.7.2 THE OPERATING CYCLE

When managing cash, it is important to be aware of the operating cash cycle of the business. This

may be defined as the time period between the outlay of cash necessary for the purchase of stock and

the ultimate receipt of cash from the sale of goods. The operating cash cycle of a business that

purchase goods on credit for subsequent resale are shown diagrammatically:

Purchase of

goods on credit

Payment for

goods

Sale of goods on

credit

Cash received

from debtors

Stock holding

period

15

The diagram shows that goods purchased on credit will be paid for at a later date and so no

immediate cash outflow will occur. Similarly, credit sales will not lead to an immediate inflow of

cash. The operating cash cycle is the period between the payments made to the supplier and the cash

received from the customer. The operating cash cycle is important because it has a significant

influence on the financial requirements of the business. The longer the cash cycle, the greater the

financial requirements of the business and the greater the financial risk. For this reason, the business

is likely to reduce the operating cash cycle to the minimum possible period.

2.7.3 MANAGEMENT OF TRADE CREDITORS

Running an organization on credit terms has its own advantages and disadvantages. Trade credit is

an important source of finance for most businesses. Buying on credit helps delay the payment of

cash thereby allowing the organization to invest cash in other sectors of the economy to attract

interest before paying out. In a situation where demand exceeds supply, trade creditors are given less

attention as compared to those who pay prompt cash. In addition customers who buy goods on credit

are less favored in terms of payment periods. Sometimes the goods or services may be more costly if

credit is required. However, in most businesses trade credit is the norm and as a result, credit

facilities are sometimes abused by customers leading to bad debts.

2.7.4 MANAGEMENT OF BANK OVERDRAFTS

Bank overdraft is short term finance whereby the business is allowed to withdraw money more than

what is in its bank account. It is a flexible form of borrowing and is cheap relative to other sources or

finance. Although in theory, bank overdraft is a short term source of finance, in practice it can

extend over a long period of time. This is because many businesses continually renew their overdraft

facility with their banks. Though renewal may not be a problem there is always the danger that the

bank will demand repayment at a short notice as it has the right to do so.

If the business is highly dependent on bank overdraft, other alternative sources of short term

finance, this could raise several problems. When considering whether to have a bank overdraft, the

Operating cash

cycle

16

business should first consider the purpose of the borrowing. Overdraft is most suitable for

overcoming short term funding problems (for example increase in stockholding requirement owing

to seasonal fluctuations). To determine the amount of overdraft facility, the business should produce

a cash budget. There should also be regular reporting of cash flows overtime to ensure that the

overdraft limit is not exceeded.

CHAPTER THREE

METHODOLOGY AND COMPANY PROFILE

3.0 INTRODUCTION

This chapter describes the method employed in the conduct of the research. It contains research

framework, data collection instruments and methods of data analysis. The study was designed to

investigate how small scale businesses manage their working capital.

3.1 RESEARCH FRAMEWORK

The research was conducted using a case study approach.

A case study is a type of research which gives an opportunity on one aspect of a problem to be

studied in-depth.

17

3.2 DATA COLLECTION INSTRUMENT

The research was conducted using a self constructed questionnaire in collecting the data needed for

the study. The questionnaire was used because people were able to express their opinion objectively

and the cost involved was low. It also allowed the respondents enough time to answer the questions.

3.3 DATA COLLECTION METHOD

The questionnaire were collected back and compiled together for in-depth assessment. Attention was

given to the organization of study to allow management suggests possible corrections that must be

done to enable the provision of a credible report of the organization.

Due to this, alternative questionnaire was design to meet the correct format needed to establish the

true report attained from the answers.

The questionnaire covers areas like the financial inflows and outflows of cash, how deficits are

financed and how revenue is generated from excess funds.

3.4 METHODS OF DATA ANALYSIS

The researcher used descriptive statistics in analyzing the data collected. The responses were

analyzed and presented mainly in narrative form. However, some quantitative tools such as

percentages and averages were used in the analysis. The findings were illustrated by the use of tables

and charts.

3.5 SAMPLING PROCEDURE

A purposive sampling and snowballing was used and with a population size of sixty. The views

concerning working capital management were sought and used in the analyses of the study.

18

3.6 PROFILE OF ADANSI RURAL BANK LTD

Britak steel complex was incorporated in 5th April, 1998 and a certificate to commence business on

29

th

October, 1998. They manufacture all kinds of Prepainted and Plain Aluzinc, Galvanised

Chromadex, Aluminium Roofing Sheets and Wire Nails. Britak steel complex is located at krapa

near Ejisu off Kumasi Accra road. Britak steel complex is among one of the best providers of

building materials in the Kumasi metropolis and beyond.

3.7 ORGANIZATIONAL CHART OF BRITAK STEEL COMLEX

Managing

Director

Production

Manager

Finance &

Administration

Sales &

Marketing

Manager

Human Resource

Manager

Head Quality

Surveyor

Accountant

Account Clerk

Cashier

Production Staff

Factory

Supervisor

Sales Staff Estimators

19

Source: Secondary-Researchers Fieldwork

CHAPTER FOUR

WORKING CAPITAL MANAGEMENT AND ITS IMPACT ON THE SOURCES OF

FINANCE IN GHANA

4.0 INTRODUCTION

The study was designed to investigate how small scale businesses manage their working capital and

its impact on the sources of finance. The research was conducted in the Ashanti Region of Ghana. A

total number of sixty (60) respondents were interviewed. The purposive sampling and snowballing

techniques were adopted to obtain responses.

4.1 BACKGROUND OF RESPONDENTS

20

4.1.1 Gender

Table 4.0 Gender of Respondents

Frequency Percentage

Male 39 65

Female 21 35

Total 60 100

Source: Field Survey, 2009

Table 4.0 above depicts that there were more males interviewed than females. Out of the total

sample size chosen (that is 60 respondents), 65% of the respondents were males with females taking

up the remaining 35%.4.1.2 Age Range

Out the total respondents, thirty-six (36) were between the ages of 18-39, twenty-three (23) of them

between the ages of 40-59 and the remaining one (1) above 60 years as evidenced in table 4.1 below.

Table 4.1 Age Range of Respondents

Frequency Percentage

18-39 36 60

40-59 23 38.3

60 and above 1 1.7

Total 60 100

Source: Field Survey, 2009

4.1.3 Educational Background of Respondents

Since education has now become a prerequisite for jobs, all of the respondents had some level of

education. 30% of the respondents had a degree, 38.3% had HNDs, 20% of the respondents were

SSS leavers, and 1.7% of the respondents had their masters degree.

21

Table 4.2 Educational Backgrounds of Respondents

Frequency Percentage

SSS 12 20

HND 23 38.3

Degree 18 30

Masters 1 1.7

not applicable 6 10

Total 60 100

Source: Field Survey, 2009

4.1.4 Occupational Breakdown of Respondents

Most of the respondents were in the following departments in their companies; management,

finance and sales departments, twenty-four (24) of the respondents were found at the management

level, twenty-one (21) respondents were in the finance department, and the remaining fifteen (15)

respondents were found in the sales department. The respondents were taken from different

departments in other to have divergent views from the respondents. This is better illustrated in

figure 4.0 below.

Figure 4.0 Occupations of Respondents

Source: Field Survey, 2012

The respondents held various positions such as; managerial which made up 45% of the respondents

whose main duties at their work places were administrative; 30% of the respondents were sales

assistants tasked mainly with selling of their companies products and services; 15% were cashiers,

who were mainly responsible for receiving and paying monies and the remaining 10% were

22

accountants also assuming administrative and monitoring roles in their various departments as

shown in table 4.3 below.

Table 4.3 Positions of Respondents In Their Organizations

Frequency Percentage

Managerial 27 45

sales assistant 18 30

Accountant 6 10

Cashier 9 15

Total 60 100

Source: Field Survey, 2009

All of the respondents claimed that, their institution have a finance department as evidenced in figure

4.1 below. This showed that almost all respondents worked in a well structured institution.

Figure 4.1 Presences of Finance Departments In Institution

Source: Field Survey, 2012

4.1.5 Respondents Views about Working Capital Management

23

The respondents when asked how they would define working capital management came out with the

following definitions; twentyseven (27) of respondents defined working capital management as

managing invested capital to yield expected results; twenty-four (24) of the respondents defined it as

proper management capital invested, debts incurred, and profit accrued; the remaining nine (9)

respondents defined it as managing finances in the company.

Source: Field Survey, 2012

Out of the total respondents, 70% were of the view that working capital management was necessary.

The remaining 30% of the respondents were of the view that working capital management was not

very necessary as shown in table 4.4 below.

Table 4.4 Is Working Capital Management Necessary

Frequency Percentage

Yes 42 70

No 18 30

Total 60 100

Source: Field Survey, 2009

Some of the reasons given by the respondents for asserting that working capital management is

necessary are;

i. It helps in selling the products faster and easier.

ii. Helps in ascertaining profit and loss in the business.

iii. It helps in managing stocks.

iv. It is the basis for growth of companies.

v. It helps the company meet set objectives.

Out of the total respondents, 60% claimed that trade credit was the main form of financing that their

organizations operated. They claimed that it was the simplest and easiest form of financing, 20%

stated that their organizations operated on short-term securities whiles the remaining 20% asserted

that their organization operated on long-term securities as evidenced in figure 4.3 below.

Figure 4.4 Financing Options of organization

24

Source: Field Survey, 2012

Most of the respondents claimed that the means by which their organizations acquire fixed assets

was through real cash. 50 % of the respondents were of that view. The main reason they gave was

that the company did not want to owe any other organization. 35% of the respondents claimed that

their organization acquired fixed assets through credit, 10% of the respondents claimed their

organization acquired assets through leasing as shown in Table 4.5 below.

Table 4.5 Means of Acquiring Assets

Frequency Percentage

Credit 21 35

Cash 30 50

Hire purchase 3 5

Leasing 6 10

Total 60 100

Source: Field Survey, 2012

Out of the total respondents, 75% of them claimed that their organizations sold on credit to their

clients twenty-four (24) respondents claimed that when they sell on credit to customers, they are paid

back within less than one (1) month; eighteen (18) of the respondents claimed that their debtors paid

back between 1-3 months; three (3) respondents claimed that even given them the benefit of the

doubt there is still non-payment from the customers as shown in figure 4.5 below.

Figure 4.5 Length of Debtors Pay Back

25

Source: Field Survey, 2012

Out of the total respondents, 40% of the respondents claimed that the credit limit for their customer

was less than a month; 30% of the respondents claimed that the credit limit for their clients was

between two-three months and the remaining 30% between four-six months as shown in table 4.6

below.

Table 4.6 Customer Credit Limit

Frequency Percentage

less than a month 24 40

2-3 months 18 30

4-6 months 18 30

Total 60 100

Source: Field Survey, 2012

The remaining 25% of the respondents claimed that their organization did not sell on credit to

customers. They claimed that they did not sell on credit to their clients because most of their clients

0

5

10

15

20

25

30

less than 1 month 1-3 months non payments not applicable

26

refused to pay up. All the respondents claimed that records of customers and creditors were kept in

their organization.

Out of the respondents, 75% asserted that their organizations permitted advance payment from the

customers. 10% out of the 75% respondents stated that the advance payments received from the

customers enabled their organizations have enough circulating funds which helps the company run

better, the remaining 15% claimed that the advance payments they received from the customers

helped made their business run easier.

The remaining 25% claimed that their organizations did not accept advance payments although no

reason was given for that.

When asked about the means through which overdue debt was collected, 55% of the respondents

claimed that the debtors were issued with a debit note from their organization stating the amount

they owe and when they are to pay the amount, 15% claimed that their outfit wrote formal letters to

their debtors indicating their debt, another 15% stated that they wrote to their debtors through their

lawyers and the remaining 15% asserted that they gave their debtors enough time to come and pay

their debt as indicated in figure 4.6 below.

Figure 4.6 Mode of Collecting Overdue Debt

Source: Field Survey, 2012

45% of the respondents stated that their outfits receives stock from their creditors monthly and their

creditors or suppliers are also paid monthly, 25% of the respondents claimed that their companies

27

receive stock weekly and their suppliers are also paid monthly, 30% of the respondents claimed that

they were supplied by their creditors daily.

Out of the total respondents, 55% claimed that their companies were not listed on the stock market

with the remaining 45% of the respondents claiming that their institutions were listed on the stock

market with their organization dealing in shares.

Out of the 60 respondents, 42 of the respondents claimed that their institutions had access to bank

loans, this they claimed was possible because of the good relations their institutions had with their

bankers, with only 18 respondents asserting that their institutions did not have access to bank loans

as shown in figure 4.7 below.

Figure 4.7 Access to Bank Loans

Source:

Field

Survey,

2012

Only 20% of the respondents asserted that their organizations disposed off assets for cash when they

were really in dire need for money, whiles the remaining 80% claimed that their company did not

dispose assets for cash as shown in figure 4.8 below.

0

5

10

15

20

25

30

35

40

45

Yes No

28

Figure 4.8 Disposals of Fixed Assets

Source: Field Survey, 2012

In respect to organizations being able to meet their budget, only 5% of the respondents claimed that

their company could not reach their budget. The remaining 95% of the respondents affirmed that

their institution were able to meet their budget as shown in table 4.7 below.

Table 4.7 Ability to Meet Budget

Frequency Percentage

Yes

57 95

No 3 5

Total 60 100

Source: Field Survey, 2012

The following reasons were given by the respondents for their companys ability to meet their

budget;

i) The company is objective oriented.

ii) The institutions have determined workers.

29

iii) Determination

iv) The institutions are customer oriented.

All sixty (60) respondents representing 100% asserted that their organizations were able to generate

profit from their respective business fields. 40% of the respondents claimed that their companies

ploughed back into the business, 25% of the respondents asserted that their companies invested their

profit in the stock market, 20% of the respondents claimed that their organization purchased fixed

assets with their profit and the remaining 15% of the respondents declared that the profit from their

organizations are invested in other companies, as shown in table 4.8 below.

Table 4.8 Management of Profit

Frequency Percent

Plough back profit 24 40

Invested in other businesses 9 15

Invest in stock market 15 25

Purchase fixed assets

12 20

Total

60 100

Source: Field Survey, 2012

65% of the respondents claimed that their outfits had access to bank overdraft which bails the

companies out when ready cash is needed. Out of the 65%, nine (9) of the respondents claimed that

their companies overdraft limit ranged between 5,000-19,000 Ghana cedis; three (3) claiming

overdraft limit above 40,000 Ghana cedis and only one (1) asserting overdraft limit ranging between

30,000-39,000 Ghana cedis as shown in figure 4.9 below:

Figure 4.9 Overdraft Limits of Organizations

30

Source: Field Survey, 2012

When asked how the respondents companies financed deficits, it was revealed that;

i) Dividends received from investments were used to finance deficits.

ii) Some respondents claimed that their institutions took loans to help clear deficits.

iii) Bank overdrafts were identified as another method used by some institutions to clear their

deficits.

iv) Four of the respondents also claimed that in times of serious deficits, the owner of the

company cleared the deficit through his own means.

CHAPTER FIVE

0

5

10

15

20

25

30

5,000-19,000

Ghana cedis

30,000-39,000

Ghana cedis

above 40,000

Ghana cedis

not applicable

31

CONCLUSION AND RECOMMENDATION

5.0 INTRODUCTION

All business organizations face some level of financial problems. It is for this reason that these

businesses must be more concerned about the management of their working capital. This chapter

focuses on conclusion and recommendation on the working capital problems of Adansi Rural Bank

Limited to know the path to take when managing their working capital.

5.1 CONCLUSION

The management of working capital has been a major constraint to most business organizations in

Ghana and Adansi Rural Bank is no exception. Most business has collapsed due to the misuse of

working capital. Conclusions of this work were based on questionnaires, interviews and personal

observations of all activities concerned with the management of working capital in Adansi Rural

Bank. Although Adansi Rural Bank has qualified personnel who manage the activities of the

company, investigations revealed the following areas which require much attention with respect to

working capital management.

Field survey (2012) page 27 of this work revealed that Adansi Rural Bank Limited bank

borrowings of 20% exceed the companys personal savings of 10%. This explains the

companys means of financing their deficit, which affect the working capital of the company.

The over dependency on bank borrowings as a major source of finance for Britak Steel

complex will affect their working capital management. The company does not save enough

to attract interest for some period of time. The banks will be reluctant to grant them loans

which must be paid with interest at some time to come or institute very stringent policies in

acquiring loans by the company.

It was revealed through personal observation that low level management of Britak Steel

Complex Limited keeps singleentry records of bookkeeping. This will adversely affect the

working capital of the company because the amount of working capital needed at a time will

not be known accurately.

32

There is no separation between finance and administration in the organizational structure of

Britak Steel Complex Limited (Fieldwork, page 18 of this work). Vital information relating

to either finance or administration can be easily leaked to wrong hands.

5.2 RECOMMENDATION

Working capital represent a net investment in short term assets. These assets are continually

flowing in and out of a business and are essential for the day-to-day operations. The various

elements of working capital are interrelated and can be seen as a short-term cycle which is an

essential part of a business short-term process. Management must decide how much of each element

of the working capital should be held. Management must be aware of these costs in order to manage

effectively. Management must also be aware that there may be other more profitable uses for the

funds of the business. Hence, the potential benefit must be weighed against the likely cost in order

to achieve the optimum investment. The working capital in a particular business is likely to change

overtime because of changes in the commercial environment.

This means that working capital decisions are rarely one-off decisions. Management must ensure

that, the level of investment in working capital is appropriate.

In conclusion, there is the need for commitment by the management of Britak Steel Complex

Limited in their approach to manage working capital effectively. Management of Britak Steel

Complex Limited (especially the finance and administration department) must be willing to put in

place measures that will help prevent loss of funds to the company.

In line with this, these recommendations were provided by the researcher but not limited to the

following:

Britak Steel Complex Limited must separate its finance department from the administration.

These two departments perform different tasks and must not be merged. The separation will

help the departments to focus on matters of finance and administration respectively.

Information relating to either finance or administration will not fall into the wrong hands.

33

Britak Steel Complex Limited must endeavour to keep double entry records in the lower

management level. Since the company has professionals at the middle level which lower

level management report to, the middle management (particularly the finance department)

must be willing to aid the lower management to keep double entry records.

Britak Steel Complex Limited must establish institute an internal audit department to serve as

a watch dog on the finance department. This will help in proper accountability and

transparency with respect to working capital of the business. External auditors who mostly

rely on internal auditors will obtain the right information about finance to form their opinion.

Britak Steel Complex Limited over relies in bank borrowing. The company must strengthen

the other alternative sources of finance available to them. This means that when banks are

unable to fulfill their borrowing requirements, there will still be other sources available to

meet their financial needs particularly their working capital.

REFERNCE

34

Artill, Peter, Maclaneuy and Eddie; 1994. Management for Non-Specialist, 3

rd

Edition, Prentice Hall, Page 345.

Nyarkoh K.O; Business Finance for students (in press).

Powell R; 1989. Economics for Professional and business studies, 1

st

Edition.

London: DP Publication Ltd.

APPENDIX

QUESTIONNAIRE

35

TOPIC: MANAGEMENT OF WORKING CAPITAL IN BUSINESS ORGANIZATIONS

AND ITS IMPACT ON THE SOURCES OF FINANCE IN GHANA

NOTE: This research is purely for academic purposes and information given will be treated with the

necessary confidentiality. Please tick as applicable and provide relevant explanation where

appropriate.

1. Sex male [ ] female [ ]

2. Age 18 39 [ ] 40 59 [ ] 60 and above [ ]

3. Level of qualification:

SSS [ ] HND [ ] DEGREE [ ] MASTERS [ ]

If any other, please specify

.

4. What department do you work under?

..................................................................................................

5. What is your current position in the organization?

..

6. What role do you play in your department?

......

7. Does your organization have a finance department?

YES [ ] NO [ ]

36

If no to question (7), which department deals with financial matters in the organization?

..

8. In your view, what do you think is the meaning of working capital management?

..................................................................................................................................................................

9. Do you think working capital management is necessary in your organization? YES [ ] NO [ ]

10. Please give reasons to question (9)

11. What form of financing does your organization operate?

Trade credit [ ]

Short -term securities [ ]

Long-term securities [ ]

If any other, please specify

12. What is the means of acquiring assets in the organization?

Credit [ ] Cash [ ] Hire purchase [ ] Leasing [ ]

If any other, please specify ................................

13. Do you sell on credit? YES [ ] NO [ ]

If yes, how long does it take for debtors to pay back?

37

1-6 days [ ] 1 week [ ] 2 weeks [ ]

1 month [ ] 2 months [ ]

If any other, please specify.

14. Do you keep records of customers and creditors?

YES [ ] NO [ ]

15. What is the customers credit limit? .................................................................................................

16. Do you permit advance payments from customers?

YES [ ] NO [ ]

If yes, what benefit do you derive? ...

17. What means do you adopt in collecting overdue debts?

.

.

18. How often do you receive stock from your creditors?

Daily [ ] Weekly [ ] Monthly [ ]

38

If any other, please specify................................

19. How long does it take to pay your creditors?

Days [ ] Weeks [ ] Months [ ]

If any other, please specify ...

20. Is your company listed on the stock market?

YES [ ] NO [ ]

If yes, what do they deal in?

Shares [ ] Debentures [ ] Government bonds [ ]

If any other, please specify ..

21. Does your organization have access to bank loan at all times?

YES [ ] NO [ ]

22. Does the organization dispose of fixed assets for cash?

YES [ ] NO [ ]

23. Is the organization able to meet its budget?

YES [ ] NO [ ]

39

Give reasons................................

24. Are you able to generate profit? YES [ ] NO [ ]

If yes, how does the organization manage profit? ................................

25. Does the organization have access to bank overdraft?

YES [ ] NO [ ]

If yes, what is the limit? .....................................................................................................................

26. How do you finance your deficit?

..

..

27. Does the organization factor debt?

YES [ ] NO [ ]

If yes, is it; re-course [ ]

Or non recourse [ ]

Potrebbero piacerti anche

- Report On Working Capital ManagementDocumento88 pagineReport On Working Capital ManagementTony VargheseNessuna valutazione finora

- Farha WCM Project-1Documento110 pagineFarha WCM Project-1a NaniNessuna valutazione finora

- Noor Mohamed - Working Capital Management-Full ReportDocumento94 pagineNoor Mohamed - Working Capital Management-Full ReportananthakumarNessuna valutazione finora

- Worrking Capital Anika Bajaj-2Documento65 pagineWorrking Capital Anika Bajaj-2Roshini KandagatlaNessuna valutazione finora

- WCM 16Documento35 pagineWCM 16Gideon AndersonNessuna valutazione finora

- Kavita Final YearDocumento54 pagineKavita Final YearVinayNessuna valutazione finora

- Working Capital On WIPRO & ITCDocumento50 pagineWorking Capital On WIPRO & ITCMainak Bose75% (8)

- Thesis of CASH MANAGEMENT OF TRADERSDocumento16 pagineThesis of CASH MANAGEMENT OF TRADERSinfo techNessuna valutazione finora

- Chapter - 1: 1.1 Introduction of The StudyDocumento55 pagineChapter - 1: 1.1 Introduction of The StudyVedha JoeNessuna valutazione finora

- Synopsis of WCDocumento5 pagineSynopsis of WCRuchika PandeyNessuna valutazione finora

- Optimize Working Capital ManagementDocumento8 pagineOptimize Working Capital ManagementAnnapurna VinjamuriNessuna valutazione finora

- Working Capital Management Literature ReviewDocumento4 pagineWorking Capital Management Literature ReviewKalicharan PanchalNessuna valutazione finora

- Raymond WC MGMTDocumento66 pagineRaymond WC MGMTshwetakhamarNessuna valutazione finora

- Chapter 1Documento93 pagineChapter 1shanmukha avvaNessuna valutazione finora

- CHAPTER 2 Part 2 Working CapitalDocumento19 pagineCHAPTER 2 Part 2 Working CapitalMaria AngelaNessuna valutazione finora

- UntitledDocumento90 pagineUntitledsam coolNessuna valutazione finora

- Project Report1Documento136 pagineProject Report1Anonymous NNTKn2Nessuna valutazione finora

- Siddik Min ProjectDocumento27 pagineSiddik Min ProjectSiddik ShaikNessuna valutazione finora

- Working Capital Final WorkDocumento66 pagineWorking Capital Final WorkbagyaNessuna valutazione finora

- Cumi 1Documento33 pagineCumi 1dineraji07Nessuna valutazione finora

- Aji ProjectDocumento105 pagineAji ProjectRoopa Ranjith100% (1)

- Analyzing Working Capital Management at BritanniaDocumento8 pagineAnalyzing Working Capital Management at Britanniadiwakar0000000Nessuna valutazione finora

- Table of Contents and Introduction to Working Capital ManagementDocumento50 pagineTable of Contents and Introduction to Working Capital ManagementB Swaraj100% (1)

- Working Capital Management in VARUN MOTORSDocumento96 pagineWorking Capital Management in VARUN MOTORSSanju ReddyNessuna valutazione finora

- Kse ProjectDocumento116 pagineKse ProjectBasil Joseph100% (1)

- A Study On Working CapitalDocumento92 pagineA Study On Working CapitalNeehasultana ShaikNessuna valutazione finora

- Working Capital Management - ultrATECHDocumento63 pagineWorking Capital Management - ultrATECHBalakrishna Chakali71% (7)

- BibliographyDocumento15 pagineBibliographyGoNessuna valutazione finora

- WCM Kotak MahindraDocumento70 pagineWCM Kotak MahindraSkillpro KhammamNessuna valutazione finora

- KPL Working Capital StudyDocumento7 pagineKPL Working Capital Studyraj22indNessuna valutazione finora

- Working Capital ManagementDocumento55 pagineWorking Capital Managementamundhra01100% (2)

- Sample of Thesis 987 For CorpoDocumento19 pagineSample of Thesis 987 For Corpoinfo techNessuna valutazione finora

- Working CapitalDocumento82 pagineWorking Capitalnancyagarwal100% (1)

- Chapter-I: Research DesignDocumento66 pagineChapter-I: Research DesignSuman JaiswalNessuna valutazione finora

- Synopsis 29.12.2022 - Amale Pradip GanpatDocumento8 pagineSynopsis 29.12.2022 - Amale Pradip Ganpatarchana bagalNessuna valutazione finora

- Working CapitalDocumento125 pagineWorking CapitalNeeraj Singh RainaNessuna valutazione finora

- Cash Management Analysis of Yamaha ShowroomDocumento4 pagineCash Management Analysis of Yamaha ShowroomshaileshNessuna valutazione finora

- Working Capital Management of HCL InfosystemsDocumento10 pagineWorking Capital Management of HCL InfosystemsYuvaraj PatilNessuna valutazione finora

- WCM VbeDocumento59 pagineWCM VbeMohmmedKhayyumNessuna valutazione finora

- Final Copy Current Assets ManagementDocumento77 pagineFinal Copy Current Assets ManagementAnil Raj0% (1)

- Working CapitalDocumento56 pagineWorking CapitalharmitkNessuna valutazione finora

- Cash Management ProjectDocumento43 pagineCash Management ProjectSATHISH SHAGANTINessuna valutazione finora

- Working Capital Project Report 1Documento44 pagineWorking Capital Project Report 1Evelyn Keane100% (1)

- A Study On Funds Flow AnalysisDocumento82 pagineA Study On Funds Flow AnalysisNeehasultana ShaikNessuna valutazione finora

- Project ProposalDocumento5 pagineProject ProposalAffo Alex100% (3)

- Marcoz 1 CompleteDocumento64 pagineMarcoz 1 Completemaaz bangiNessuna valutazione finora

- Capital Management Doc ReportDocumento93 pagineCapital Management Doc ReportSweety RoyNessuna valutazione finora

- WCM of Wings Biotech - SynopsisDocumento4 pagineWCM of Wings Biotech - SynopsisNageshwar SinghNessuna valutazione finora

- Working Capital OriginalDocumento53 pagineWorking Capital Originalaurorashiva1100% (1)

- Working Plag FileDocumento48 pagineWorking Plag Fileaurorashiva1Nessuna valutazione finora

- CAMS Journal PDFDocumento78 pagineCAMS Journal PDFamuliya v.sNessuna valutazione finora

- Working Capital ManagementDocumento92 pagineWorking Capital ManagementHarish ChintuNessuna valutazione finora

- Working Capital Management of Ashok LeylandDocumento45 pagineWorking Capital Management of Ashok LeylandPraveen Ganesan100% (1)

- Fixed AssetDocumento59 pagineFixed AssetSameer HussainNessuna valutazione finora

- Working Capital ManagementDocumento53 pagineWorking Capital ManagementRIYA ROHILLANessuna valutazione finora

- Working Capital Management - Dodla DAIRYDocumento67 pagineWorking Capital Management - Dodla DAIRYBalakrishna Chakali60% (5)

- JisnaDocumento45 pagineJisnaSarin SayalNessuna valutazione finora

- Problem and Its Setting Background of The StudyDocumento54 pagineProblem and Its Setting Background of The StudyVince Cinco ParconNessuna valutazione finora

- The Leader's Dilemma: How to Build an Empowered and Adaptive Organization Without Losing ControlDa EverandThe Leader's Dilemma: How to Build an Empowered and Adaptive Organization Without Losing ControlValutazione: 4 su 5 stelle4/5 (2)

- 0 - Dist Officers List 20.03.2021Documento4 pagine0 - Dist Officers List 20.03.2021srimanraju vbNessuna valutazione finora

- A History of Oracle Cards in Relation To The Burning Serpent OracleDocumento21 pagineA History of Oracle Cards in Relation To The Burning Serpent OracleGiancarloKindSchmidNessuna valutazione finora

- English JAMB Questions and Answers 2023Documento5 pagineEnglish JAMB Questions and Answers 2023Samuel BlessNessuna valutazione finora

- Green CHMDocumento11 pagineGreen CHMShj OunNessuna valutazione finora

- Research ProposalDocumento7 pagineResearch Proposalswarna sahaNessuna valutazione finora

- Ra 4136Documento12 pagineRa 4136Rizaida DiestoNessuna valutazione finora

- Dismantling My Career-Alec Soth PDFDocumento21 pagineDismantling My Career-Alec Soth PDFArturo MGNessuna valutazione finora

- Ancient To Roman EducationDocumento5 pagineAncient To Roman EducationJonie Abilar100% (1)

- Social Work in Mental Health SettingsDocumento364 pagineSocial Work in Mental Health Settingsjohnny atman100% (3)

- Soil Color ChartDocumento13 pagineSoil Color ChartIqbal AamerNessuna valutazione finora

- Phone, PTCs, Pots, and Delay LinesDocumento1 paginaPhone, PTCs, Pots, and Delay LinesamjadalisyedNessuna valutazione finora

- Document 6Documento32 pagineDocument 6Pw LectureNessuna valutazione finora

- Immersion-Reviewer - Docx 20240322 162919 0000Documento5 pagineImmersion-Reviewer - Docx 20240322 162919 0000mersiarawarawnasahealingstageNessuna valutazione finora

- Module 6 ObliCon Form Reformation and Interpretation of ContractsDocumento6 pagineModule 6 ObliCon Form Reformation and Interpretation of ContractsAngelica BesinioNessuna valutazione finora

- The Christian WalkDocumento4 pagineThe Christian Walkapi-3805388Nessuna valutazione finora

- Karnataka State Nursing Council: Nrts (Nurses Registration and Tracking SystemDocumento6 pagineKarnataka State Nursing Council: Nrts (Nurses Registration and Tracking Systemhoqueanarul10hNessuna valutazione finora

- Gender and Human SexualityDocumento23 pagineGender and Human SexualityTricia CavanesNessuna valutazione finora

- Turnabout AirportDocumento100 pagineTurnabout AirportBogdan ProfirNessuna valutazione finora

- Virgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Documento23 pagineVirgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Enoch ObatundeNessuna valutazione finora

- 320-326 Interest GroupsDocumento2 pagine320-326 Interest GroupsAPGovtPeriod3Nessuna valutazione finora

- Demographic and Clinical Pattern of Uveitis in Tertiary Eye Care Institute of Central IndiaDocumento7 pagineDemographic and Clinical Pattern of Uveitis in Tertiary Eye Care Institute of Central Indiajassi nishadNessuna valutazione finora

- Dinie Zulkernain: Marketing Executive / Project ManagerDocumento2 pagineDinie Zulkernain: Marketing Executive / Project ManagerZakri YusofNessuna valutazione finora

- Qualities of Officiating OfficialsDocumento3 pagineQualities of Officiating OfficialsMark Anthony Estoque Dusal75% (4)

- Understanding Risk and Risk ManagementDocumento30 pagineUnderstanding Risk and Risk ManagementSemargarengpetrukbagNessuna valutazione finora

- Final PaperDocumento5 pagineFinal PaperJordan Spoon100% (1)

- HRM-4211 Chapter 4Documento10 pagineHRM-4211 Chapter 4Saif HassanNessuna valutazione finora

- Dean Divina J Del Castillo and OtherDocumento113 pagineDean Divina J Del Castillo and OtheracolumnofsmokeNessuna valutazione finora

- Class 3-C Has A SecretttttDocumento397 pagineClass 3-C Has A SecretttttTangaka boboNessuna valutazione finora

- 27793482Documento20 pagine27793482Asfandyar DurraniNessuna valutazione finora

- Transformation of The Goddess Tara With PDFDocumento16 pagineTransformation of The Goddess Tara With PDFJim Weaver100% (1)