Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Virgin Easy Access Cash E ISA Issue 5-Terms Conditions

Caricato da

mistryh0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

35 visualizzazioni12 pagineTerms and Conditions of a regular uk Cash ISA account

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTerms and Conditions of a regular uk Cash ISA account

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

35 visualizzazioni12 pagineVirgin Easy Access Cash E ISA Issue 5-Terms Conditions

Caricato da

mistryhTerms and Conditions of a regular uk Cash ISA account

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 12

Savings

Terms and Conditions

1

Contents

1. Opening your account

2. Payments into your account

3. Taking money out of your account

4. Notice periods

5. Contact

6. Keeping us informed

7. Keeping you informed

8. Operating your account

9. Interest

10. Tax

11. Charges

12. Changes to the terms and conditions, charges and

interest rates

13. Joint accounts

14. Events which may affect your account

15. Confidentiality and Data Protection

16. Closing your account

17. Our liability

18. Your liability

19. Set off

20. General

21. Complaints

Introduction

These terms and conditions, together with the key product

information sheet explain the entire rights and obligations of

you and us regarding your account. If there is an inconsistency

between these terms and conditions and anything contained in

the key product information sheet, the latter will take priority.

We will provide you with further copies of these terms and

conditions and the key product information sheet upon

request. Where a term used in these terms and conditions

has a particular meaning it is explained in the section headed

meanings.

Alternative Format

If you require this in an alternative format such as Braille,

large print, audio or require interpreter services, please call

our Disability Awareness Team on 0191 279 5300. Lines are

open 9am to 5pm business days and are charged at your

service providers prevailing rate. Alternatively our text

phone number is 0191 279 8505 or you can contact us at

disability.awareness@virginmoney.com.

Meanings

In these terms and conditions:

account means your savings account with us;

BACS means Bankers Automated Clearing Service;

Bank of England Base Rate means the Bank of England

official dealing rate (the Official Bank Rate) as set by the

Monetary Policy Committee;

store account means accounts which the key product

information sheet states may be operated via our stores. Not

all of our stores can offer a full banking service. Any facility

which is not available, excluding cash deposits and general

cash transactions, can be processed at our Main Office;

business day means Monday to Friday excluding Bank

Holidays;

CHAPS means Clearing House Automated Payment Systems;

electronic transfer means any funds transfer by CHAPS,

or FPS;

fixed rate account means an account where interest is

paid at a fixed rate for all of the term;

FPS means Faster Payments Service;

online account means an account which the key product

information sheet states may be operated via our internet

service;

internet service means the service provided by us via the

world wide web at our website virginmoney.com;

ISA means an Individual Savings Account;

key product information sheet means the specific leaflet

for each product we offer setting out specific features of

that product;

nominated account means the bank account (if any) you

nominate to receive certain payments from your account;

non-payment account means an account which is not a

payment account. This will be confirmed in the key product

information sheet. Examples of non-payment accounts are

fixed rate bonds and savings accounts with notice periods.

If your account is a non-payment account slightly different

provisions apply to notice periods for certain changes;

notice period means any minimum period of days notice

you must give for withdrawals or closure explained in the

key product information sheet;

our registered office or our Main Office means Jubilee

House, Gosforth, Newcastle upon Tyne NE3 4PL;

password means your personal password used to log into

your account details (where applicable);

payment account means an account which is described as

a payment account in the key product information sheet.

Examples of payment accounts are variable rate accounts

with no notice periods which are generally used to make

payment transactions;

2.2.1 Where your account permits, the initial and any

subsequent deposit can be made into your account by:

BACS;

cash (store accounts only. Not all of our stores can

offer a full banking service. Any facility which is not

available, excluding cash deposits and general cash

transactions, can be processed at our Main Office.);

cheque;

electronic transfer; or

transfer from another account with us (subject to any

restrictions on the terms and conditions applying to

that account).

2.3 Additional conditions applying to payments into your

account by cheque

2.3.1 We do not accept or issue post-dated cheques. If,

however, you send a post-dated cheque and it is

processed by us for any reason, we will not be liable to

you for any costs incurred in its collection.

2.3.2 If a cheque you have deposited is returned unpaid, the

amount of the cheque will be debited from your account.

You will not earn interest on this deposit and the cheque

will be returned to you and will only be re-presented

with your authority.

2.3.3 Cheques must be made payable to Virgin Money plc

for the Account of (insert Account Holder(s) name(s))

and crossed A/c Payee only. Please include your

account number where applicable on the reverse of the

cheque. By including this information it will help to

prevent fraud, especially if you are sending a cheque

through the post. You should also draw a line through

any unused spaces.

2.3.4 We will only accept and deposit cheques that are less

than six months old. If a cheque you have presented is

older than this it will not be credited to your account and

will be returned to you. If, however, we do process such

a cheque for any reason we will not be liable for any

costs incurred in its collection.

2.3.5 Banking of cheques for payment will at all times be

subject to the rules and clearing processes of any

cheque clearing system(s) we use.

2.3.6 Where you pay a cheque into your account before 3pm

on a business day, it will be processed on the day of

receipt. If, however, a cheque is received by us after 3pm

or on a non-business day, it will not be processed until

the next business day. The money will be available for

withdrawal on the fourth business day after we process

the cheque. The standard clearing cycle for clearing

banks is three business days but we are not a clearing

personalised security feature means any security feature

relating to your account that is specific to you such as a

password;

reference rate account means an account where changes

in the interest rate are based on a reference rate, for

example the Bank of England Base Rate, as set out in the

key product information sheet;

secure message service means our internet message

service on our website site which is provided only to those

customers registered to use our internet services;

you and the account holder(s) means the person(s) in

whose name(s) the account is stated to be held;

your correspondence address means the address which

we hold for the first named account holder;

we, us, or our, means Virgin Money plc and includes

our successors and assigns.

Words and expressions in the singular shall, where applicable,

include the plural and the reverse shall also apply.

Terms and Conditions

1. Opening your account

1.1 Unless the key product information sheet provides

otherwise an account cannot be opened if:

it is to be operated for business purposes or for a

club or association;

your address is care of or not within the UK;

a prospective account holder is not resident in the

UK for tax purposes;

the sums are held in trust or settlement, however,

parents or guardians may open an account to hold

sums for the benefit of each of their children (unless

the account is an ISA or an online account); or

the applicant does not meet the age requirement or

any other specific requirements for that account as

explained in the key product information sheet.

1.2 We may also decline your application to open an account.

1.3 Please note that some accounts, as described in the

relevant key product information sheet, may only be

opened and operated via our Main Office. For security

reasons, if you would like to invest 1 million or over in

your account it must be opened and operated by post

via our Main Office.

2. Payments into your account

2.1 All payments into your account must be in Sterling.

2.2 How to pay into your account

2

3

bank. Please note you can only be certain the money is

yours by the end of the sixth business day after we

process the cheque, from which point the money cannot

be taken from you without your agreement unless you

are a knowing party to fraud. Please see condition 9.4

for further information.

2.3.7 Unless the key product information sheet provides

otherwise, where you are allowed to make a payment

into your account by cheque, you may deposit cheques

with us drawn against a bank with an address outside the

UK. Such cheques will not be credited to your account

until the cheque has been processed and the funds

actually received by us. The amount credited will be the

actual amount received by us after any conversion costs.

This process can take a number of weeks before the

funds are available for withdrawal.

2.4 Additional conditions applying to cash payments into

your account

2.4.1 Where your account permits and you pay cash into

your account at one of our stores, it will be credited

to your account and available for immediate withdrawal

on the same business day (or the next business day if

paid in after 3pm).

2.5 Additional conditions applying to payments into your

account from another account with us

2.5.1 Where you transfer money into your account from

another account with us it will be available for immediate

withdrawal on the same business day (or the next

business day if your instruction is received after 3pm).

2.6 Additional conditions applying to payments into your

account from an account with another provider

2.6.1 Where you transfer money into your account from an

account with another provider it will be credited to your

account and made available for immediate withdrawal on

the business day it is received by us.

2.7 Please note that payments in the UK are processed

using sort code and account number, and not name.

Therefore, it is essential that these details are given

correctly. Similarly if you are expecting a payment from

someone else direct to your account, it is important that

you give them the correct information. If these details

are given incorrectly it may result in the payment being

delayed, misapplied or returned to the payer.

3. Taking money out of your account

3.1 You can only take money out of your account if you have

sufficient cleared funds in it. Withdrawals are subject to

any minimum and maximum amounts set out in the key

product information sheet.

3.2 You can authorise us to make payment by giving us

instructions in writing or, for a limited number of account

types, by telephone or online. Please see your key

product information sheet for specific instructions.

3.3 Unless the key product information sheet states

otherwise you can take money out of your account by:

cash via our store network;

cheque via our store network or by sending us your

signed written instructions by post;

electronic transfer; or

transfer to another account with us (subject to the

terms and conditions of that other account).

but not by

BACS;

giving us instructions by email, facsimile or where we

are provided with only a copy of your instructions;

postal order;

standing order or direct debit instructions;

giving us an instruction to send money abroad; or

giving us instructions through a third party other than

a registered trustee (unless permitted by condition 14.3).

3.4 To make withdrawals at stores, you will need to provide

suitable identification and, where relevant, present your

passbook.

3.5 When you make a withdrawal we will, at your request,

inform you of:

(a) the maximum time it takes us to effect the

withdrawal; and

(b) a breakdown of any charges payable by you for

that withdrawal.

3.6 Additional conditions:

3.6.1 Cash withdrawals

Withdrawals will be debited on the same business day.

You will need to provide suitable identification.

Withdrawals of up to 500 in cash in any one day can

be made at our stores. At our discretion, and by prior

arrangement, larger cash withdrawals may be made

available.

3.6.2 Electronic transfers

All electronic transfers will be processed at our

Main Office.

You cannot cancel instructions to send electronic

payments once given unless you do so at least one

business day before the payment is due to be made.

We may contact you by telephone following receipt of

an instruction to send an electronic payment to

confirm security details prior to releasing the

payment. We may not release the payment to a third

party or to any nominated account until we have

obtained such confirmation from you.

If possible, we will send your payments by FPS which

means we will debit your account the same day or any

future date for which you authorised the transfer (if

relevant). The payment should reach your nominated

account within a few hours but no later than the end

of the next business day. Please see your key product

information sheet for further details.

We may not be able to send your payment if your

nominated account is not able to accept payments

sent by FPS, please see condition 3.7.

If you request a CHAPS transfer and we receive your

authority and full instructions before 1pm on a business

day, we will send your payment and debit your

account the same day or on any future date for which

you authorised the payment (if relevant). CHAPS

payments can be made from 250 up to your account

balance and should reach your nominated account by

close of business on the same business day they are

sent. Instructions received after 1pm or on a non-

business day will be processed the next business day.

CHAPS is a service that we make a charge for, please

see condition 11 for details.

3.6.3 Cheque withdrawals

Any cheque issued by post will be posted to your

correspondence address only.

Your account will be debited on the same business

day the cheque is issued.

Cheques are valid for a period of six months from the

date on the cheque. We will not issue post-dated cheques.

Where permitted cheque withdrawals for more than

500,000 can only be processed at our Main Office

on a business day.

If a cheque withdrawn from your account is

subsequently lost or stolen you must tell us as soon as

possible. You may also need to provide documentary

evidence that it has been lost by a signed statement

(an indemnity) or police crime number if stolen.

If a cheque is issued from an account and that cheque

is not used and is subsequently paid back into the

account, no interest will be paid for the period from

the date the cheque was issued to the date it was re-

credited to the account.

3.6.4 Transfer to another account with us

Where your account permits, you can authorise us to

transfer funds by giving us instructions in writing, or for a

limited number of account types, by telephone. Such

requests will be processed as cleared funds and available

in the receiving account on the same business day (or the

next business day if we receive authorisation after 3pm).

3.7 Refusal

If we refuse to carry out a payment instruction from you

(such as stopping a payment on your account) we will

notify you in writing as soon as possible giving the reasons

for our refusal (where it is lawful and appropriate to do

so) and the procedure for rectifying any factual errors

that led to the refusal. You will receive notification in any

event (where it is lawful and appropriate to do so) by the

time your payment should have reached the recipient

bank. You may also contact us to find out why we have

refused to carry out your payment instruction. Please

also see condition 8.7 for further information.

3.8 Minimum Balances

If the balance in your account falls below the minimum

set our prevailing basic savings rate will apply. Please

refer to the key product information sheet for details.

4. Notice periods

4.1 Where an account specifies a notice period for

withdrawals you must give us notice if you want to make

a withdrawal or to close the account. You may incur a

charge if you make withdrawals or close the account

without providing the notice as detailed in the key

product information sheet. Any such charge will be offset

against any accrued interest not yet paid. If there is

insufficient accrued interest any outstanding charge will

be debited to your account, either when interest is paid

or on closure, (whichever is earlier). If this causes the

account to become overdrawn we will tell you and you

will pay us the amount by which you are overdrawn.

4.2 HM Revenue & Customs (HMRC) has advised us that a

charge of the type referred to in condition 4.1 is not a

reduction of interest but loss of capital. Therefore any

portion of charge deducted from capital is not a reduction

of interest but a specific charge for early withdrawal.

4.3 The notice you give us under condition 4.1 will be valid

for up to 14 days after the notice period has expired.

After this has passed if you want to make a withdrawal or

close the account you must give us fresh notice, and the

notice period will start again. Continuous notice is not

permitted. The total amount of money you can have on

4

5

notice at any one time must not exceed the current

balance of your account.

4.4 Please note that you must contact us again and give us

separate instructions when you wish to make the

withdrawal or close the account. Withdrawal or closure

will not be automatically processed on the basis of the

notice given under condition 4.1.

5. Contact

5.1 We will only send notices and communications to you

at your correspondence address or via email if you have

an online account. We cannot accept requests to issue

communications to an address that is not your

correspondence address.

5.2 You will be taken to have received any letters or other

personal notices 72 hours after we have sent them to you.

5.3 With the exception of nil balance accounts (please see

condition 16.2), if you do not make any transactions,

enquiries or changes to your account within any three

year period (or in the three years after maturity of a fixed

rate account), it may become inactive. You may be asked

for evidence of your identity when you attempt to use

an inactive account. If correspondence is returned to us

undelivered, we will flag your account so that no further

mail is sent to you until you contact us and we have

confirmation of your address. These measures are for

security and to protect you and your funds.

6. Keeping us informed

6.1 If your correspondence address, email address (for

online accounts) or telephone number changes, you

must tell us as soon as possible.

6.2 If the name of any account holder changes, you must

tell us the change of name and provide documentary

evidence (e.g. original or certified copy of a marriage

certificate) before we amend our records.

6.3 If the account is held in your sole name, you cannot

change the account to another sole account holder. The

account must be closed and a new account opened in

the name of the new account holder.

7. Keeping you informed

7.1 In accordance with our Savings Promise we will write to

you at least once per year with details of our variable rate

savings accounts and the interest rates that apply to them.

7.2 Your account record will either be in the form of a

passbook, certificate or regular statement as advised in

your key product information sheet. For online accounts

your account record can be viewed online.

7.3 Where the account record is a passbook, we will update

it at your request. You may do this at a store or by

sending it to our Main Office.

7.4 Your account records will show (among other information):

(a) the dates and amounts of any transactions on

your account;

(b) any charges on such transactions with a

breakdown (where appropriate);

(c) a reference enabling you to identify each

transaction made electronically and the payer or

payee as applicable.

7.5 The account records issued will show all amounts added

to or taken from your account. You must check this

record carefully. If you think there is something wrong,

you must let us know immediately so that we can correct

any mistakes.

7.6 We participate in the unclaimed assets scheme

established under the Dormant Bank and Building

Society Accounts Act 2008. This means if there has

been no activity on your account, or we have received

no contact from you regarding your account for at least

the previous 15 years, we will close your account in

accordance with condition 16.3 and transfer the balance

plus any accrued interest to the external fund. You retain

the right to reclaim your money at all times, please

contact us for further information.

8. Operating your account

8.1 Account documentation

Any passbook or other account documentation issued

to you is our property and must be returned to us upon

request. All account documentation must only be used

in accordance with these terms and conditions.

8.2 Loss of account documentation

If you are supplied with a passbook or other account

documentation, or notified of any personalised security

features relating to the account, you must use all reasonable

steps to keep them safe. If any account documentation

or details of any personalised security feature is lost or

stolen you must notify us as soon as you can. Please

refer to your key product information sheet for details.

8.3 Security

Never give your account details or other security

information to anyone unless you know who they are and

why they need them. You should never disclose your online

account passwords to anyone under any circumstances.

Take care when storing or disposing of information about

your account.

8.4 Postal Services

We aim to deal with all deposit and withdrawal

transactions within one business day, but we cannot

guarantee this.

8.5 Third Parties

We are not obliged to recognise the interest or claim of

any person other than you in respect of money held in

your account. We will not be liable in any way for not

recognising such an interest or claims except as and

when required by law.

8.6 References

We do not normally provide references about you to a

third party.

8.7 Refusal of Instructions

We will refuse to act on an instruction if for any reason

we believe (for example):

It was not given by you.

It was not clear.

The sort code is invalid for the payment method.

It might cause us to break the law (such as where

we have a reasonable suspicion that the funds are

the proceeds of crime) or a contractual duty.

Your account is being used for an illegal purpose.

9. Interest

9.1 Interest is calculated daily and adjusted automatically as

the balance in your account changes. We will calculate

interest on the cleared funds in your account at the end

of each business day.

9.2 Cash paid into your account will earn interest from the

day of receipt.

9.3 Deposits by BACS and electronic transfer will earn

interest from the day we receive them.

9.4 Cheques paid into your account (other than those drawn

on a bank with an address outside the UK) will start to

earn interest two business days after we process them.

Please note, however, that the periods for a cheque to

clear are explained in conditions 2.3.6 and 2.3.7. If a

cheque does not clear please see condition 2.3.2.

9.5 On some products we can pay interest on your account

monthly or annually as set out in the key product

information sheet. You choose how you wish interest to be

paid when you open your account. If you wish to change

the payment frequency after the account is opened, we

will close your account and open a new account for you.

9.6 The dates when interest is paid are shown in the key

product information sheet. We will calculate your interest

up to and including these dates. We will credit interest to

your account on your interest payment date or the next

business day if your interest payment date is not a

business day.

9.7 If you have asked us to transfer the interest to another

account, we will make the transfer on the business day

following the calculation. Transactions carried out after

interest payments have been calculated may require an

adjustment to the capital balance on your account to

offset any over or under payment of interest.

9.8 Where you have asked for interest to be transferred to

another account, this will only be actioned when the

interest payment is 1.00 or over. Any interest payment

less than 1.00 will be credited direct to your account.

9.9 Where you transfer money between accounts with us

we will pay interest up to the date prior to the transfer

on the account from which the funds are withdrawn and

from the date of transfer on the account to which the

money is sent.

9.10 Interest payments from another account with us into an

ISA with us are not permitted.

9.11 For joint accounts, interest can be paid part net/part

gross, so if you do not pay tax you can still claim gross

interest on your equal share.

9.12 We will provide you with details of any annual interest

paid either by updating your passbook or as part of your

next account statements depending on your specific

account. Monthly interest will show on your receiving

bank account record and we will not send you a separate

advice of interest paid.

9.13 Details of the current interest rates for all our savings

accounts can be viewed online at virginmoney.com,

by contacting one of our stores, by telephoning us

or writing to us at our Main Office.

9.14 We will provide a full explanation of how we work out

interest on request.

10. Tax

10.1 Where required by law, we will pay interest net of

income tax at the basic rate unless you are eligible for,

and have applied to us to receive, gross interest. Each

account holder must then complete a separate

registration form for each account they hold.

10.2 Tax Certificates are not issued automatically. However,

once you have requested and received a Tax Certificate

we will also provide further certificates in April each

subsequent year that the account remains open, and for

closed accounts in the tax year the account is closed.

6

11. Charges

11.1 We may make charges for some standard services that

we provide to you. These charges are detailed below:

Service Charge

CHAPS transfer 35 per transfer

Special presentation of a cheque 5 per cheque

Copy cheque 5 per cheque

Copy statement 10 per statement

Bank Giro Credit payments 1 per payment

11.2 If you have sufficient funds in your account we will

deduct the amount of any charges from your account.

Alternatively, you may pay any charges by cheque. We

may refuse to provide you with any such service if you

do not have sufficient funds to cover the charge(s).

11.3 We are not obliged to provide you with any non-

standard services, however, if we do provide you with

such a service, we may make a reasonable charge for it.

We will tell you the amount of our charges before we

act on your instructions.

12. Changes to the terms and conditions, charges and

interest rates

12.1 Terms and Conditions

We may change the terms and conditions of your

account (other than those relating to changes in interest

rates and charges, which are dealt with in conditions

12.2-12.5 and 12.6-12.8 respectively below) for any

one or more of these reasons:

12.1.1 to reflect, in a reasonable way, changes in the practice

of other providers which offer savings accounts to

customers;

12.1.2 so that we are better able to attract and retain savers

and borrowers;

12.1.3 to improve efficiency (which may include reducing

costs), to take account of changes in technology and to

reflect changes that we reasonably make in the way we

look after your account or in the way we offer savings

services and facilities to our customers generally;

12.1.4 because our administrative costs and charges have

increased or reduced or we reasonably believe they are

likely to do so;

12.1.5 so that we can meet the requirements of our regulator;

12.1.6 to reflect any change in the law or decision by an

Ombudsman, code of practice or regulatory guidance

or change in the regulatory system governing us;

12.1.7 to make the terms and conditions easier to understand

and to correct errors;

12.1.8 to allow us to harmonise the terms and conditions should

we acquire the accounts of or take over or merge with

another provider;

12.1.9 if it is necessary for us to make changes to maintain our

financial stability. We will notify you in writing of these

changes at least two months before they take effect.

At the expiry of this period you will be deemed to have

accepted the changes and in the meanwhile, if your

account is a payment account, you will be free to close

your account immediately without charge.

12.2 Interest Rates

We will not vary the interest rate if you have a fixed rate

account and you are still in the period the rate is fixed.

12.3 Where your account is not a reference rate account, our

rights to vary the interest rate are as follows. We may

increase interest rates at any time. We may reduce a

variable interest rate for any one or more of these reasons:

12.3.1 because there has been a reduction in the Bank of

England Base Rate (or any rate that replaces it) or in

interest rates generally offered by other providers of

savings accounts with whom we compete;

12.3.2 because we need to reduce the interest rate charged

on our mortgages to attract and retain business from

borrowers;

12.3.3 because our administrative costs and charges have

increased or we reasonably believe they are likely to do so;

12.3.4 to allow us to harmonise the interest rates we pay should

we acquire the accounts of or take over or merge with

another provider;

12.3.5 if it is necessary for us to make changes to maintain our

financial stability.

12.4 Where your account is a reference rate account, we will

only vary the interest rate when the reference rate varies.

Please refer to the key product information sheet for details.

12.5 We will write to advise you of a change in interest rate

on your account.

(a) If the rate is reduced then we will give you notice

of the change at least equivalent to the notice

period if any on your account.

(b) Where you have no notice period we will give you

at least two months notice of the change, after the

expiry of which period you will be deemed to

have accepted the change. In the meantime you

will be free to close the account immediately

without charge.

7

12.6 Changes to charges

12.6.1 We may introduce new charges or increase existing

charges because our administrative costs and charges for

doing the work or providing the service concerned have

increased or we reasonably believe they are likely to do so.

12.6.2 We may change the list of services or the stated service

charges in condition 11 from time to time. In exercising

this power to change a service charge we must comply

with the following requirements:

12.6.2.1 We will write to advise you of any new charge or

change in the level of charges at least two months

before they take effect. At the expiry of this period

you will be deemed to have accepted the changes. In

the meantime you will be free to close the account

immediately and without charge;

12.6.2.2 We will only increase a service charge:

(a) if we reasonably need to make the change in

order to manage our business prudently and/or

reasonably profitably by responding to changes

or expected changes in other costs which are

outside our control and/or external circumstances

affecting our business;

(b) if we reasonably need to make the change in

order to fund steps to maintain or improve

our competitive position overall against other

providers and/or our ability to attract and retain

customers generally;

(c) if our costs have increased and we reasonably

decide to take the increase into consideration;

(d) to reflect any change in the law or decision by

an Ombudsman, code of practice or regulatory

guidance or change in the regulatory system

governing us;

(e) to allow us to harmonise the service charges

charged should we acquire the accounts of or

take over or merge with another provider of

accounts;

(f) if it is necessary for us to make changes to

maintain our financial stability.

12.7 For a full list of cost related charges and service charges,

please refer to condition 11.

12.8 Any change we make for one or more of the reasons

detailed in conditions 12.1-12.6 we will do so in a

reasonable and proportionate manner.

13. Joint accounts

13.1 Where more than one person applies for the account:

13.1.1 we may act on instructions given by any one of you,

unless one of you has advised us not to, in which case

we will only act upon the written instructions of all joint

account holders;

13.1.2 each of you, both individually and together, are bound by

the terms and conditions of your account and are fully

responsible for any money which may become due to us

under them;

13.1.3 we will post all letters, statements and other material

relating to the account to you at your correspondence

address. All joint account holders will be bound by the

contents of these;

13.1.4 you may in the future wish to request your account to

be changed from a joint account to a sole account or to

change one of the account holders. In that event we may

insist upon the account being closed with the authority

of all joint account holders and a new account being

opened in the name of the new sole or joint account

holder(s);

13.1.5 if the account is held in your sole name, you can add

further account holders, providing they supply the

relevant identification, subject to the maximum number

of account holders allowed on a particular account.

13.2 Breakdown of relationship between joint account

holders: If you advise us (or we become aware) of a

dispute between you, we may require all future

instructions to be in writing from all of you.

13.3 Please also see the joint account provisions within

condition 14.2.1.

14. Events which may affect your account

14.1 Moving abroad

If you move abroad the account may be closed unless

your account is an ISA. This will be charge-free (unless

you opt for a CHAPS transfer, where the usual charge

as explained in condition 11 will apply).

14.2 Death of an account holder

14.2.1 Joint account: if a joint account holder dies, the account

will be transferred into the name of the survivor(s). Until

documentary evidence of death is supplied to us the

transfer cannot be completed. If there are no survivors,

the money in the account will belong to the estate of the

last survivor.

14.2.2 Sole account: If you die, your personal representative(s)

will be noted on the account. Your personal

representative(s) will subsequently be required to

close your account upon completion of the necessary

formalities.

8

14.3 Illness or incapacity: In circumstances where you are

unable to operate your account due to a physical or

mental illness or incapacity, we may, subject to such

conditions, authorities and checks which we consider

appropriate, allow the operation of your account

(including withdrawals) by a third party following the

completion of a third party mandate.

15. Confidentiality and Data Protection

15.1 We may record telephone calls with you, so that we

have a record of the conversations. We may also listen

to calls to help us monitor the quality of our service and

for security and training purposes.

15.2 We will hold and process personal information about you

by computer or otherwise. We will treat all such personal

information as private and confidential other than in the

following exceptional cases permitted by law:

where we are required or legally compelled to disclose;

where there is a duty to the public to disclose;

where our interests require disclosure. This will not

be used as a reason for disclosing information about

you or your accounts to anyone else, including other

companies in our group for marketing purposes; or

where disclosure is made at your request or with

your consent.

15.3 Unless you object, you agree that we may provide you

with information from time to time about our products

and services. We may also provide you with information

about other firm's products and services but we will not

disclose your information to them. You can ask us to stop

sending this information at any time.

15.4 You have a legal right to apply for a copy of your personal

records with us. This should be done in writing and a

small fee (currently 10) may be charged for this service.

You have the right to have any inaccuracies corrected

and/or deleted. Further information is available via your

local store or our Main Office.

16. Closing your account

16.1 We may close your account if there are good

commercial reasons for doing so. We will give you at

least two months notice in writing unless conditions

16.2 or 16.3 apply.

16.2 Where the account has a nil balance, we may close

your account after giving you 30 days written notice.

16.3 We can close your account immediately and without

notice if we have been unable to verify your identity or

we reasonably believe that:

You have been abusive or threatening to our staff.

You are not eligible for the account.

The security of the account has been compromised.

You have given us false or incomplete information in

connection with the account.

Your account is being or has been used illegally.

You have been in serious or persistent breach of the

terms and conditions of your account.

Your account has been identified as being dormant in

accordance with condition 7.6.

16.4 Subject to condition 19, if we close your account we will

repay the funds in the account (where applicable),

together with all accrued interest, to you. Where your

identity has not been verified, however, we will return

the funds to the account from which we received them.

16.5 We may stop you making any transactions on your

account temporarily without notice where we are

required to do so by law or for any of the reasons

referred to in conditions 16.2 or condition 16.3 above.

We may close your existing account and open a new

one in these circumstances.

16.6 Unless there is anything to the contrary in the key

product information sheet, you may close your account

at any time.

17. Our liability

17.1 Where a transaction on your account occurs which was

not authorised in accordance with these terms and

conditions we will refund the transaction amount and

where applicable restore your account to the state it

would have been had the transaction not occurred.

17.2 Where we have not correctly executed any payment

instructions that you have given us in accordance with

these terms and conditions we will refund the amount

of the incorrectly executed transaction and restore the

account to the condition it would have been in had the

incorrect transaction not taken place.

17.3 We will be liable to you for any charges or interest you

incur as a consequence of any valid transaction which

you have correctly instructed us to undertake under

these terms and conditions where we do not execute

or execute incorrectly.

17.4 We shall not be liable to you for any financial loss or

damage you may suffer as a result of:

17.4.1 our having acted upon your instruction or following

receipt of any information from you;

9

17.4.2 your security details having been disclosed to someone

else (other than due to our having disclosed it).

17.4.3 our services being unavailable through any cause

beyond our reasonable control;

17.4.4 your instructions being inaccurate, invalid, incomplete

or incorrect.

17.5 We shall not be liable to you in any circumstances for

any financial loss or damage that:

17.5.1 does not arise directly from the matters for which we

are responsible;

17.5.2 is due to abnormal circumstances beyond our reasonable

control the consequence of which would have been

unavoidable despite all efforts to the contrary;

17.5.3 arises from us complying with legal requirements

(including compliance with money laundering

regulations).

17.6 In this condition 17 where we refer to things being

beyond our reasonable control, this would include,

but is not limited to, strikes, industrial action or the

failure of equipment or power supplies.

17.7 If you wish to claim from us for the matters referred to

in conditions 17.1-17.3 you must notify us as soon as

possible after becoming aware of any unauthorised or

incorrect transaction and in any event no later than 13

months after the debit date. This time limit will not apply

if we have failed to provide you with the relevant

information about the transaction.

18. Your Liability

18.1 Subject to the provisions of condition 18 you will be

liable up to a maximum of 50 for any losses incurred in

respect of unauthorised payment transactions arising:

(a) from the use of a lost or stolen passbook; or

(b) where you have failed to keep any personalised

security features of your account safe.

18.2 You will be liable for all losses incurred in respect of any

unauthorised transaction on your account where you:

(a) have acted fraudulently; or

(b) have with intent or gross negligence failed to

comply with the terms and conditions (including

in particular conditions 8.2 and 8.3).

18.3 Except where you have acted fraudulently you are

not liable for any losses incurred in respect of any

unauthorised transactions on your account:

(a) arising after you have notified us under condition

8.2; or

(b) where we have failed to provide appropriate

means for you to notify us under condition 8.2.

19. Set off

We may use any credit balance on any account you have

with us to reduce or repay any overdrawn balance or

other undisputed amounts you owe us (including but not

limited to any loan or mortgage balances or liability for

any guarantees you have given us) either in your own

name or jointly with anyone else.

20. General

20.1 If we waive any breach of these terms and conditions

that shall not be considered to be a waiver of any

subsequent breach.

20.2 These terms and conditions will be governed by the laws

of England and Wales and any dispute which arises in

relation to these terms and conditions shall be dealt with

by any court in the United Kingdom which is able to hear

the case.

20.3 These terms and conditions are written in English and all

communication between us for the purposes of your

account will be in English.

20.4 We are authorised by the Prudential Regulation Authority

and regulated by the Financial Conduct Authority and

the Prudential Regulation Authority. We are entered in

the Financial Services Register under number 503963.

21. Complaints

21.1 If you have a complaint, you should visit your local

store, telephone us or write to us as soon as possible

so that we may investigate the circumstances. You

can write with details of your complaint to the

Customer Relations Team, Virgin Money plc, Jubilee

House, Gosforth, Newcastle upon Tyne NE3 4PL or via

email to customerrelations@virginmoney.com.

21.2 If we cannot resolve the complaint to your satisfaction

you have the right to refer your complaint to the Financial

Ombudsman Service, which provides independent

adjudication of complaints. Their address is Financial

Ombudsman Service, South Quay Plaza, 183 Marsh Wall,

London E14 9SR. Tel: 0845 080 1800.

A copy of our Internal Complaints Procedures leaflet is

available on request.

10

Virgin Money plc Registered in England and Wales (Company No. 6952311). Registered Oce Jubilee House, Gosforth,

Newcastle upon Tyne NE3 4PL.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential

Regulation Authority.

Telephone: 0845 600 7301 or 0191 279 4405.

Lines are open 8am to 8pm business days, 8am to 4pm Saturday and 10am to 3pm Sunday. Calls are charged at your service

providers prevailing rate and may be monitored and recorded.

virginmoney.com

VMP69V3 Valid from 22.07.2013

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Compound Units Problems 3Documento3 pagineCompound Units Problems 3mistryhNessuna valutazione finora

- Sieve of Eratosthenes - WorksheetDocumento1 paginaSieve of Eratosthenes - WorksheetmistryhNessuna valutazione finora

- Division - The Bus Stop MethodDocumento9 pagineDivision - The Bus Stop MethodmistryhNessuna valutazione finora

- Sorting Data Carroll and Venn3Documento4 pagineSorting Data Carroll and Venn3mistryhNessuna valutazione finora

- Pie Charts From A 6 To A 7Documento1 paginaPie Charts From A 6 To A 7mistryhNessuna valutazione finora

- More - Less Bridging and HundredDocumento2 pagineMore - Less Bridging and HundredmistryhNessuna valutazione finora

- Ordering Decimals Card GameDocumento2 pagineOrdering Decimals Card GamemistryhNessuna valutazione finora

- BBC - IWonder - Elizabeth II - Britain's Diamond QueenDocumento32 pagineBBC - IWonder - Elizabeth II - Britain's Diamond QueenmistryhNessuna valutazione finora

- 1003 - Agent Event by Period (HHMMSS) - 2014120203003232Documento1 pagina1003 - Agent Event by Period (HHMMSS) - 2014120203003232mistryhNessuna valutazione finora

- 1b) 1003 - Agent Performance by Make Busy DND Code - 2014110703003883Documento1 pagina1b) 1003 - Agent Performance by Make Busy DND Code - 2014110703003883mistryhNessuna valutazione finora

- 1003 - Agent Event by Period (HHMMSS) - 2014120203003232Documento1 pagina1003 - Agent Event by Period (HHMMSS) - 2014120203003232mistryhNessuna valutazione finora

- How One Couple Affords To Work and Travel The World - Business InsiderDocumento20 pagineHow One Couple Affords To Work and Travel The World - Business InsidermistryhNessuna valutazione finora

- 1003 - Agent Event by Period (HHMMSS) - 2014120203003232Documento1 pagina1003 - Agent Event by Period (HHMMSS) - 2014120203003232mistryhNessuna valutazione finora

- Sainsburys AddressDocumento1 paginaSainsburys AddressmistryhNessuna valutazione finora

- Academic Application Form, Jan, 2014Documento5 pagineAcademic Application Form, Jan, 2014mistryhNessuna valutazione finora

- Postgraduate Routes Into Teaching - PGCE and Much More - UCASDocumento9 paginePostgraduate Routes Into Teaching - PGCE and Much More - UCASmistryhNessuna valutazione finora

- Uk-student-recruitment-Officer London Srao ToddDocumento5 pagineUk-student-recruitment-Officer London Srao ToddmistryhNessuna valutazione finora

- House of Lies TextDocumento1 paginaHouse of Lies TextmistryhNessuna valutazione finora

- Sainsburys AddressDocumento1 paginaSainsburys AddressmistryhNessuna valutazione finora

- Data Analyst - Management Information - Sainsbury's CareersDocumento4 pagineData Analyst - Management Information - Sainsbury's CareersmistryhNessuna valutazione finora

- CountdownDocumento1 paginaCountdownmistryhNessuna valutazione finora

- Push - Pull.kini - LR Braddock Soldier of Fortune!Documento4 paginePush - Pull.kini - LR Braddock Soldier of Fortune!mistryhNessuna valutazione finora

- Read MeDocumento2 pagineRead MeAutumn JJNessuna valutazione finora

- 7 Tricks To Learn Any Language in Your Hometown (In One Week) - BabbelDocumento7 pagine7 Tricks To Learn Any Language in Your Hometown (In One Week) - BabbelmistryhNessuna valutazione finora

- Dating Market Value Test For Women - Chateau HeartisteDocumento126 pagineDating Market Value Test For Women - Chateau Heartistemistryh0% (1)

- How To TalkDocumento17 pagineHow To TalkmistryhNessuna valutazione finora

- How To TalkDocumento17 pagineHow To TalkmistryhNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- BuCor Citizens Charter 2019Documento106 pagineBuCor Citizens Charter 2019jeh angNessuna valutazione finora

- New Microsoft Word DocumentDocumento57 pagineNew Microsoft Word DocumentRashed KhanNessuna valutazione finora

- Forensic Accounting and Fraud Investigation CH 14 QuestionDocumento4 pagineForensic Accounting and Fraud Investigation CH 14 QuestionAnastasia Stella HannyNessuna valutazione finora

- Kumar Exports V Sharma Carpet PDFDocumento11 pagineKumar Exports V Sharma Carpet PDFMurali ChandanaNessuna valutazione finora

- 10 Lecture 10Documento2 pagine10 Lecture 10Ahmad HasnainNessuna valutazione finora

- Business Law: Institute of Management TechnologyDocumento5 pagineBusiness Law: Institute of Management Technologyarun1974Nessuna valutazione finora

- Module1 Internal Control Checklist en 0Documento12 pagineModule1 Internal Control Checklist en 0Mohammad Abd Alrahim ShaarNessuna valutazione finora

- For Claim Registration, Please Call On Toll Free Number 1800 2 666Documento4 pagineFor Claim Registration, Please Call On Toll Free Number 1800 2 666RehaanNessuna valutazione finora

- Diccionario Terminos Legales y Contables A-IDocumento38 pagineDiccionario Terminos Legales y Contables A-IromeroortizNessuna valutazione finora

- Answer Key: Sample Exam 1 Dr. Goh Beng WeeDocumento8 pagineAnswer Key: Sample Exam 1 Dr. Goh Beng Weeqwerty1991srNessuna valutazione finora

- Mutual FundDocumento49 pagineMutual FundvimalNessuna valutazione finora

- An Analysis of Personal Financial Lit Among College StudentsDocumento22 pagineAn Analysis of Personal Financial Lit Among College StudentsRamanarayana BharadwajNessuna valutazione finora

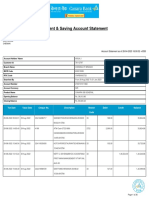

- Current & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiDocumento26 pagineCurrent & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiArun Jayaprakash NarayananNessuna valutazione finora

- National Senior Certificate: Grade 12Documento17 pagineNational Senior Certificate: Grade 12StellieKiiNessuna valutazione finora

- Stanbic Business Account Opening Form 2021Documento4 pagineStanbic Business Account Opening Form 2021Edwin MhlabaNessuna valutazione finora

- Nego Reaction PaperDocumento2 pagineNego Reaction PaperTeacherEliNessuna valutazione finora

- SAP Sales Order Via E-CommerceDocumento6 pagineSAP Sales Order Via E-CommercePraveen RudagiNessuna valutazione finora

- Tutorial 10 Bank Reconciliations (Q)Documento4 pagineTutorial 10 Bank Reconciliations (Q)lious liiNessuna valutazione finora

- EC Assignment 1Documento9 pagineEC Assignment 1Shubhankar BansalNessuna valutazione finora

- Negotiable Instrument Act 1881Documento22 pagineNegotiable Instrument Act 1881Akash saxenaNessuna valutazione finora

- How To Discharge Debts With Promissory NotesDocumento10 pagineHow To Discharge Debts With Promissory Notesscrappywildly100% (1)

- LTOM Final Book 3Documento183 pagineLTOM Final Book 3Aerwin Abesamis80% (10)

- Accounting Problem Book 2011Documento103 pagineAccounting Problem Book 2011Sveta Chernica100% (1)

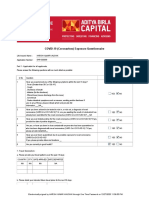

- Life Insurance: COVID-19 (Coronavirus) Exposure QuestionnaireDocumento11 pagineLife Insurance: COVID-19 (Coronavirus) Exposure QuestionnaireAnkit singhNessuna valutazione finora

- Promotion Material 2023-2024-11-20Documento10 paginePromotion Material 2023-2024-11-20CREDIT BHARATPURNessuna valutazione finora

- All-India Anna Dravida Munnetra KazhagamDocumento6 pagineAll-India Anna Dravida Munnetra KazhagamPraveen VijayNessuna valutazione finora

- Partial Withdrawal FormDocumento2 paginePartial Withdrawal FormPinkys Venkat100% (1)

- Additional Rights & Obligations (Voluntary)Documento17 pagineAdditional Rights & Obligations (Voluntary)Shankar RajNessuna valutazione finora

- Money Math WorkbookDocumento109 pagineMoney Math WorkbookIamangel1080% (10)

- 00000785-CURRENT ACCOUNT - I-4129-Feb-19Documento2 pagine00000785-CURRENT ACCOUNT - I-4129-Feb-19AUTO online VTONessuna valutazione finora