Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Super Sol

Caricato da

acastillo13390 valutazioniIl 0% ha trovato utile questo documento (0 voti)

33 visualizzazioni2 pagineCopyright

© © All Rights Reserved

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

33 visualizzazioni2 pagineSuper Sol

Caricato da

acastillo1339Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Super Project

The Super Project

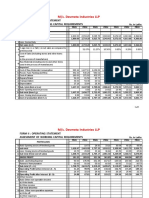

Project Request Detail 1st per.

1. Land RETURN ON NEW FUNDS EMPLOYED - 10YR AVG.

2. Buildings 80

3. Machinery and Equipment 120 A. New funds employed (line 21) 380 380

4. Engineering B. Profit before taxes (line 35) 240

5. Other C. Net profit (line 37) 116

6. Expense Portion (before tax) D. Calculated return 30.49% 63.08%

7. Sub-total 200 PAYBACK YEARS FROM OPERATIONAL DATE

8. Less: Salvage value (old asset) Part year calculation for first period

9. Total project cost 200 Number of full years to payback 6

10. Less:Taxes on Exp. portion Part year calculation for last period 0.83

11. Net project cost 200 Total years to payback 6.83

1st per. 2nd per. 3rd per. 4th per. 5th per. 6th per. 7th per. 8th per. 9th per. 10th per.

Funds Employed Fiscal 68 Fiscal 69 Fiscal 70 Fiscal 71 Fiscal 72 Fiscal 73 Fiscal 74 Fiscal 75 Fiscal 76 Fiscal 77 10-yr avg

12. Net project cost (line 11) 200 200 200 200 200 200 200 200 200 200

13. Deduct depreciation (cum.) 19 37 54 70 85 98 110 121 131 140

14. Capital funds employed 181 163 146 130 115 102 90 79 69 60 114

15. Cash 124 134 142 151 160 160 169 169 178 178 157

16. Receivables

17. Inventories 207 222 237 251 266 266 281 281 296 296 260

18. Prepaid and deferred exp.

19. Less: current liabilities (2) (82) (108) (138) (185) (184) (195) (195) (207) (207) (150)

20. Total working funds (15 thru 19) 329 274 271 264 241 242 255 255 267 267 267

21. Total new funds employed (14+20) 510 437 417 394 356 344 345 334 336 327 380

Profit and Loss

22. Unit volume 1,100 1,200 1,300 1,400 1,500 1,500 1,600 1,600 1,700 1,700 1,460

23. Gross Sales 2,200 2,400 2,600 2,800 3,000 3,000 3,200 3,200 3,400 3,400 2,920

24. Deductions 88 96 104 112 120 120 128 128 136 136 117

25. Net sales 2,112 2,304 2,496 2,688 2,880 2,880 3,072 3,072 3,264 3,264 2,803

26. Cost of goods sold 1,100 1,200 1,300 1,400 1,500 1,500 1,600 1,600 1,700 1,700 1,460

27. Gross Profit 1,012 1,104 1,196 1,288 1,380 1,380 1,472 1,472 1,564 1,564 1,343

28. Advertising expense

29. Selling expense 1,100 1,050 1,000 900 700 700 730 730 750 750 841

30. General and Admin. costs

31. Research expense

32. Start-up costs 15 2

33. Other: Test market 360 36

34. Adjustments: Erosion 180 200 210 220 230 230 240 240 250 250 225

35. Profit before taxes (643) (146) (14) 168 450 450 502 502 564 564 240

36. Taxes (334) (76) (7) 87 234 234 261 261 293 293 125

36A. Add: Investment credit (1) (1) (1) (1) (1) (1) (1) (1) - - (1)

37. Net profit (308) (69) (6) 82 217 217 242 242 271 271 116

Super Project

38. Cumulative net profit (308) (377) (382) (301) (84) 133 375 617 888 1,159

39. New funds to repay (21 less 38) 818 814 799 695 440 211 (30) (283) (552) (832)

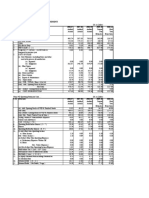

Base Case Assumptions: Senstivity

Jell-O erosion factor 50% base case 44

Building and agglom 100% (after 3 years) Jello to 60% (15)

Facilities overhead 100% (after 3 years) Jello to 100% (250)

Additional overhead 75% Facilities to 1971 107

Distribution system alloc 0% Facilities to 1969 (23)

Internal rate of return 10.7% Bldg & Agglom usage allocation 230

NPV @ 10% $44 NPV at 11% 65

Inflation in cost of bldg & agglom. 25%

1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977

Depreciation rates 9.5% 9.0% 8.5% 8.0% 7.5% 6.5% 6.0% 5.5% 5.0% 4.5%

Net sales 2,112 2,304 2,496 2,688 2,880 2,880 3,072 3,072 3,264 3,264

COGS (1,100) (1,200) (1,300) (1,400) (1,500) (1,500) (1,600) (1,600) (1,700) (1,700)

Selling expense (1,100) (1,050) (1,000) (900) (700) (700) (730) (730) (750) (750)

Depreciation (new) (19) (18) (17) (16) (15) (13) (12) (11) (10) (9)

Depreciation (Jell-O) (100) (95) (89) (84) (79) (68) (63)

Depreciation (dist system) - - - - - - - - - -

Start-up costs (15)

Facilities overhead (28) (28) (28) (28) (28) (28) (28)

Additional overhead (68) (68) (68) (68) (68) (68)

Jell-O erosion - (90) (100) (105) (110) (115) (115) (120) (120) (125) (125)

Profit before taxes (15) (197) (64) 74 134 360 367 431 437 515 522

Taxes @ 52% 8 102 33 (38) (70) (187) (191) (224) (227) (268) (271)

Investment tax credit - 8 - - - - - - - - -

Net profit (7) (87) (31) 36 64 173 176 207 210 247 250

Depreciation add-back - 19 18 17 116 110 102 96 90 78 72

Operating cash flow (7) (68) (13) 53 180 282 279 303 299 326 322

New plant & equipment 200

Jell-O building 250

Jell-O equipment 800

Distribution system -

Change in NWC - 329 (55) (3) (7) (23) 1 13 - 12 -

Investment outflow 200 329 (55) 1,047 (7) (23) 1 13 - 12 -

Recovery of working capital 267

Recovery of pl&eq (book) 533

Net cash flow (207) (397) 42 (994) 187 305 278 290 299 314 1,122

NPV $44

Potrebbero piacerti anche

- Super PropjectDocumento25 pagineSuper PropjectJackeline Charapaqui ReluzNessuna valutazione finora

- Wovensacks Projections in ExcelDocumento57 pagineWovensacks Projections in ExcelPradeep TlNessuna valutazione finora

- Unaudited Financial Results Quarter Ended 31 12 2011Documento1 paginaUnaudited Financial Results Quarter Ended 31 12 2011Rakshit MathurNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Q2FY19 Standalone ResultDocumento4 pagineQ2FY19 Standalone ResultDivyansh SinghNessuna valutazione finora

- CMA NewDocumento7 pagineCMA NewKrishna MohanNessuna valutazione finora

- MAN ACC ProjectDocumento7 pagineMAN ACC ProjectNurassylNessuna valutazione finora

- TML Standalone Results Sept 2023 1Documento5 pagineTML Standalone Results Sept 2023 1NagendranNessuna valutazione finora

- Tata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Documento10 pagineTata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Anil Kumar AkNessuna valutazione finora

- Asan CmaDocumento6 pagineAsan CmaRanjan MishraNessuna valutazione finora

- FM Assignment SolutionDocumento18 pagineFM Assignment SolutionumeshNessuna valutazione finora

- LVB Audited Financials 31032019Documento9 pagineLVB Audited Financials 31032019Maran VeeraNessuna valutazione finora

- (Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Documento4 pagine(Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Ravi AgarwalNessuna valutazione finora

- Ice Make Refrigeration LimitedDocumento8 pagineIce Make Refrigeration LimitedPositive ThinkerNessuna valutazione finora

- Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchDocumento4 pagineIncome Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchSab KeelsNessuna valutazione finora

- CMADocumento14 pagineCMAKostubh SharmaNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- $R4UFVSNDocumento3 pagine$R4UFVSNGrace StylesNessuna valutazione finora

- TCL Standalone Sebi Results March 2020Documento6 pagineTCL Standalone Sebi Results March 2020Adesh ChauhanNessuna valutazione finora

- ITC Financial Result Q1 FY2024 SfsDocumento3 pagineITC Financial Result Q1 FY2024 SfsAlricNessuna valutazione finora

- SGXNET FY2016 - 21feb17Documento12 pagineSGXNET FY2016 - 21feb17phuawlNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- HOME DEPOT FCF Template PracticeDocumento17 pagineHOME DEPOT FCF Template PracticeAnihaNessuna valutazione finora

- Island Power (IPWR) Incremental Earning Forecast 2017-2022Documento4 pagineIsland Power (IPWR) Incremental Earning Forecast 2017-2022Ruma RashydNessuna valutazione finora

- Instructor: Assumptions / InputsDocumento17 pagineInstructor: Assumptions / InputsJoAnna MonfilsNessuna valutazione finora

- Standalone Financial Results for Q4 and FY 2016Documento7 pagineStandalone Financial Results for Q4 and FY 2016Headshot's GameNessuna valutazione finora

- 3 Statement Financial Analysis TemplateDocumento14 pagine3 Statement Financial Analysis TemplateCười Vê LờNessuna valutazione finora

- Spandana Sporthy Balance SheetDocumento1 paginaSpandana Sporthy Balance SheetMs VasNessuna valutazione finora

- Devmeta Project Report CmaDocumento9 pagineDevmeta Project Report CmaharshNessuna valutazione finora

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Documento13 pagineTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNessuna valutazione finora

- FY2023 Quarterly FY2023 Quarterly LTResults Q4 FY23Documento10 pagineFY2023 Quarterly FY2023 Quarterly LTResults Q4 FY23sreekeshavrajuNessuna valutazione finora

- Assessment of Working Capital Requirements Form # II: OperatingDocumento10 pagineAssessment of Working Capital Requirements Form # II: OperatingSuzanne Davis100% (2)

- Hanson Annual ReportDocumento296 pagineHanson Annual ReportmohanesenNessuna valutazione finora

- TCL Consolidated Sebi Results 31 December 2022Documento3 pagineTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNessuna valutazione finora

- Financial Results Consolidated Q2 FY 2023 2024Documento10 pagineFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNessuna valutazione finora

- Afm Shree 2Documento8 pagineAfm Shree 2Niraj JhajhariaNessuna valutazione finora

- Sep 2010-Audited ResultsDocumento2 pagineSep 2010-Audited Resultssalilsingh86Nessuna valutazione finora

- DCF Valuation ModelDocumento25 pagineDCF Valuation Modelgwheinen100% (2)

- Statements of Comprehensive IncomeDocumento7 pagineStatements of Comprehensive IncomewawanNessuna valutazione finora

- 40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC WorkingsDocumento24 pagine40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC Workingsshahin selkarNessuna valutazione finora

- Group B&D Case 19 FonderiaDocumento12 pagineGroup B&D Case 19 FonderiaVinithi ThongkampalaNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento7 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- AAICDocumento63 pagineAAICJohn wickNessuna valutazione finora

- APOLLO TYRE - Financial-Results-June-30-2019 PDFDocumento6 pagineAPOLLO TYRE - Financial-Results-June-30-2019 PDFvandana sahuNessuna valutazione finora

- Final Projected AccountsDocumento29 pagineFinal Projected Accountsjunaid buttNessuna valutazione finora

- Q2 18 19Documento4 pagineQ2 18 19Surya SudheerNessuna valutazione finora

- AAGB Quarter1 Ended 31.03.2021Documento26 pagineAAGB Quarter1 Ended 31.03.2021NUR RAHIMIE FAHMI B.NOOR ADZMAN NUR RAHIMIE FAHMI B.NOOR ADZMANNessuna valutazione finora

- Yanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109Documento31 pagineYanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109WeR1 Consultants Pte LtdNessuna valutazione finora

- Balance of PaymentsDocumento9 pagineBalance of PaymentsBhanu Pratap SinghNessuna valutazione finora

- 1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDocumento6 pagine1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDHRUV SONAGARANessuna valutazione finora

- XLS EngDocumento11 pagineXLS EngHarshit AroraNessuna valutazione finora

- Year 0 1 2 3 4 Income Statement: Cash and Marketable SecuritiesDocumento8 pagineYear 0 1 2 3 4 Income Statement: Cash and Marketable SecuritiesFarah NazNessuna valutazione finora

- ACC EPS and Valuation ReportDocumento25 pagineACC EPS and Valuation ReportprathamNessuna valutazione finora

- Netflix Financial StatementDocumento1 paginaNetflix Financial Statementnuraliahbalqis03Nessuna valutazione finora

- Standalone Result Sep, 17Documento4 pagineStandalone Result Sep, 17Varun SidanaNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- ECSH 3Q 2009 Announcement 111109Documento16 pagineECSH 3Q 2009 Announcement 111109WeR1 Consultants Pte LtdNessuna valutazione finora

- Touc NG Lives Over: YearsDocumento15 pagineTouc NG Lives Over: YearsRavi AgarwalNessuna valutazione finora

- Acova Radiateurs SolutionDocumento14 pagineAcova Radiateurs SolutionSarvagya Jha100% (1)

- Industrial gearbox operating dataDocumento1 paginaIndustrial gearbox operating dataacastillo1339Nessuna valutazione finora

- Writing: Short Compositon Using ConnectorsDocumento1 paginaWriting: Short Compositon Using Connectorsacastillo1339Nessuna valutazione finora

- KROSS sizing report for melasa fluidDocumento2 pagineKROSS sizing report for melasa fluidacastillo1339Nessuna valutazione finora

- Sizing Optimass 2000 - s150 (32000mpas)Documento2 pagineSizing Optimass 2000 - s150 (32000mpas)acastillo1339Nessuna valutazione finora

- BV S Reddy Sweet Sorghum Potential AlternativeDocumento8 pagineBV S Reddy Sweet Sorghum Potential Alternativeacastillo1339Nessuna valutazione finora

- Dozier Hedging Alternatives GuideDocumento2 pagineDozier Hedging Alternatives Guideacastillo1339Nessuna valutazione finora

- DeltamodelDocumento9 pagineDeltamodeljodrouiNessuna valutazione finora

- Clamp and Flang CouplingDocumento12 pagineClamp and Flang CouplingptafercantNessuna valutazione finora

- KIOSDocumento1 paginaKIOSacastillo1339Nessuna valutazione finora

- DeltamodelDocumento9 pagineDeltamodeljodrouiNessuna valutazione finora

- Dozier Case StudyDocumento6 pagineDozier Case Studywhitelizard20010% (5)

- Bioethanol ComplexDocumento4 pagineBioethanol Complexacastillo1339Nessuna valutazione finora

- FinanceDocumento8 pagineFinancebella123123321Nessuna valutazione finora

- FxExposure (Class2) TMBA5Documento55 pagineFxExposure (Class2) TMBA5aizentaijoNessuna valutazione finora

- American Chains OnDocumento31 pagineAmerican Chains OnmichaelNessuna valutazione finora

- Expansion Joint ManuelDocumento20 pagineExpansion Joint Manuelgplese0Nessuna valutazione finora

- Flow MasterDocumento2 pagineFlow Masteracastillo1339Nessuna valutazione finora

- Carbonated Soft Drink (CSD) Industry: Economics of The USDocumento27 pagineCarbonated Soft Drink (CSD) Industry: Economics of The USacastillo1339Nessuna valutazione finora

- Vertical PumpDocumento1 paginaVertical Pumpacastillo1339Nessuna valutazione finora

- 7 EstadosdeFlujosdeEfectivoDocumento76 pagine7 EstadosdeFlujosdeEfectivoMeneses Chino ChinoNessuna valutazione finora

- SuperDocumento15 pagineSuperEuniceNessuna valutazione finora

- Belt StackerDocumento1 paginaBelt Stackeracastillo1339Nessuna valutazione finora

- Introduction To Cost and Management AccountingDocumento6 pagineIntroduction To Cost and Management AccountingvpcirhNessuna valutazione finora

- Vertical PumpDocumento1 paginaVertical Pumpacastillo1339Nessuna valutazione finora

- Vertical PumpDocumento1 paginaVertical Pumpacastillo1339Nessuna valutazione finora

- Decision Making Its Not What You ThinkDocumento5 pagineDecision Making Its Not What You Thinkpakde jongkoNessuna valutazione finora

- Chapter 05Documento36 pagineChapter 05acastillo1339Nessuna valutazione finora

- Vertical PumpDocumento1 paginaVertical Pumpacastillo1339Nessuna valutazione finora

- MX-403 3 HP: - Engineered To Meet The Most Severe OperatingDocumento1 paginaMX-403 3 HP: - Engineered To Meet The Most Severe Operatingacastillo1339Nessuna valutazione finora

- Price Comparisson - Bored Piling JCDC, Rev.02Documento2 paginePrice Comparisson - Bored Piling JCDC, Rev.02Zain AbidiNessuna valutazione finora

- Starbucks PDFDocumento14 pagineStarbucks PDFanimegod100% (1)

- Unincorporated Business TrustDocumento9 pagineUnincorporated Business TrustSpencerRyanOneal98% (42)

- Concord Final Edition For GBSDocumento35 pagineConcord Final Edition For GBSMahamud Zaman ShumitNessuna valutazione finora

- P15 Business Strategy Strategic Cost Management PDFDocumento4 pagineP15 Business Strategy Strategic Cost Management PDFkiran babuNessuna valutazione finora

- Cheniere Energy Valuation ModelDocumento11 pagineCheniere Energy Valuation Modelngarritson1520100% (1)

- 2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerDocumento20 pagine2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerGabitaGabitaNessuna valutazione finora

- Executive SummaryDocumento32 pagineExecutive SummaryMuhammad ZainNessuna valutazione finora

- 02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFDocumento3 pagine02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFNikhil KumarNessuna valutazione finora

- PH.D BA - Class Schedule 1-2018Documento1 paginaPH.D BA - Class Schedule 1-2018Adnan KamalNessuna valutazione finora

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocumento8 pagineKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)

- Case Study Royal Bank of CanadaDocumento10 pagineCase Study Royal Bank of Canadandgharat100% (1)

- Stanford Antigua ComplaintDocumento74 pagineStanford Antigua ComplaintFOXBusiness.com100% (2)

- Platinum Gazette 29 July 2011Documento12 paginePlatinum Gazette 29 July 2011Anonymous w8NEyXNessuna valutazione finora

- Exam 500895 - PPMC - Senior Capstone - Excel SpreadsheetDocumento7 pagineExam 500895 - PPMC - Senior Capstone - Excel Spreadsheetshags100% (6)

- Management Accounting Tutorial QuestionsDocumento2 pagineManagement Accounting Tutorial Questionskanasai1992Nessuna valutazione finora

- MS CAL Licensing Cheat SheetDocumento1 paginaMS CAL Licensing Cheat SheetbitoogillNessuna valutazione finora

- KFC Case Study by MR OtakuDocumento36 pagineKFC Case Study by MR OtakuSajan Razzak Akon100% (1)

- CH 11Documento6 pagineCH 11Saleh RaoufNessuna valutazione finora

- Abdulghany Mohamed CVDocumento4 pagineAbdulghany Mohamed CVAbdulghany SulehriaNessuna valutazione finora

- Business ProposalDocumento4 pagineBusiness ProposalCatherine Avila IINessuna valutazione finora

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocumento6 pagineFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNessuna valutazione finora

- Project To Expand Puerto Rico - Vieques - Culebra Maritime Service OK'd For Federal Funding - News Is My BusinessDocumento2 pagineProject To Expand Puerto Rico - Vieques - Culebra Maritime Service OK'd For Federal Funding - News Is My BusinessCORALationsNessuna valutazione finora

- CDM Regulations EbookDocumento14 pagineCDM Regulations EbookZeeshan BajwaNessuna valutazione finora

- MC - Assign Q - 1-2014 - Marketing CommunicationsDocumento6 pagineMC - Assign Q - 1-2014 - Marketing CommunicationsBilal SaeedNessuna valutazione finora

- FM11 CH 10 Capital BudgetingDocumento56 pagineFM11 CH 10 Capital Budgetingm.idrisNessuna valutazione finora

- Chap 001Documento6 pagineChap 001Vicky CamiNessuna valutazione finora

- Water Crisis Collection: Payment1 Payment2 Payment3Documento8 pagineWater Crisis Collection: Payment1 Payment2 Payment3Raghotham AcharyaNessuna valutazione finora

- Consumer Satisfaction of Aircel NetworkDocumento5 pagineConsumer Satisfaction of Aircel NetworkSaurabh KumarNessuna valutazione finora

- BBA Syllabus - 1Documento39 pagineBBA Syllabus - 1Gaurav SaurabhNessuna valutazione finora