Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

203 Cat Generalbrochure Topnotch NEW

Caricato da

Michael ShafferCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

203 Cat Generalbrochure Topnotch NEW

Caricato da

Michael ShafferCopyright:

Formati disponibili

Topnotch CAT Reviewers www.catreviewers.

com

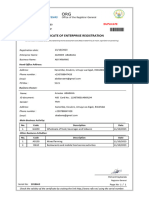

Certified Accounting Technician

Registered Cost Accountant

Certified Bookkeeper

Topnotch CAT Reviewers www.catreviewers.com

The Program

The CAT Program is a globally recognized program of the National

Institute of Accounting Technicians (NIAT) that grants the CAT

designation to the successful professional here and abroad.

The CATProgram focuses on developing a strong base of technical

accounting knowledge and skills; analytical, organizational and inter-

personal skills; and professional values essential for todays successful

accounting professionals.

The CATProgram is designed to be an intensive bookkeeping program

that will equip the participant all the necessary skills for real life accounting

work.

The CAT Program is recognized to be equivalent to the CAT

designations of different institutes in the world, giving NIAT CATs access

to memberships and recognition in countries such as Canada, United

Kingdom, Australia, New Zealand, Europe, Hong Kong, China, Taiwan,

Macau, the Middle East and Singapore.

What is an Accounting Technician?

Accounting Technician is a new terminology in the Philippine marketplace

but is widely used in Australia and the United Kingdom to identify a range

of accounts or bookkeeping occupations working in all industries and

sectors. An Accounting Technician carries out valuable accounting and

related jobs. They work at all levels from account clerks to financial

controllers. They work in all industries and sectors and in organizations

large and small. In small organization, accounting technicians maybe the

only trained and qualified finance staff employed. In large corporation, they

are crucial part of a balanced team working alongside auditors and

management staffs.

Topnotch CAT Reviewers www.catreviewers.com

Like many professions, accountancy is changing. Rapid technology

development, tax reform and organizational restructures require broader

and more flexible skills. Today's Accounting Technicians play an integral

role in the overall business management function and need to be equipped

not only with core technical accountancy skills, but also vital

complementary skills in areas such as IT, communication, leadership and

time management.

Certified Accounting Technician (CAT) Examination

The CATexamination consists of three (3) levels:

Part 1: Practical Accounting

Part 2: Management Accounting

Part 3: Taxation Accounting

Certified Bookkeeper (CB) CAT Part

1 Examination

Successful passers of the Part 1

Examination are immediately eligible to

apply as Certified Bookkeeper (CB)

member of the Institute of Certified

Bookkeepers of UK, the largest

bookkeeping institute in the world with over 150,000 members globally. CB

members who wish to provide bookkeeping service, particularly in the UK

can avail of the Practicing Certificate sealed by the Institute, equivalent to

Licensed Bookkeeper status in the UK.

The Institute of Certified Bookkeepers of UK is the largest bookkeeping

institute in the world with over 150,000 members globally. It promotes and

maintains the standards of bookkeeping as a profession, through the

establishment of series of relevant qualifications and the award of grade of

memberships that recognize academic attainment and competence.

Topnotch CAT Reviewers www.catreviewers.com

IAT Canada is the premiere professional body of Accounting Technicians in

North America. The CAT designation of IAT is accredited by various

universities from the UK and Australia as equivalent to Bachelors degree in

International Accounting and recognized by many professional

Registered Cost Accountant (RCA) CAT Part 2 Examination

The part 2 examination of CATis

accredited by the Institute of Certified

Management Accountants (ICMA) of

Australia to be equivalent to Registered

Cost Accountant (RCA) designation.

CATcandidates can take this exam

independently and qualified to apply as

RCA upon passing.

Institute of Certified Management Accountants (ICMA) of Australia

The Institute of Certified Management

Accountants of Australia is the premiere

professional body of management

accountants in the Australasian region.

ICMA offers it eduCATion programs,

including the master level post graduate

certification program, the CMA in all its

branches in the region such as Australia,

New Zealand, India, China, Singapore,

Middle East, Hong Kong and now the

Philippines.

Certified Accounting Technician CAT Part 3 Examinati on

The part 3 examination of CAT consists of payroll and taxation

examination. This is the final exam to complete the CATexamination.

Candidates who pass all three levels of the CATexamination can apply

as CATfrom the Institute of Accounting Technicians of North America.

Topnotch CAT Reviewers www.catreviewers.com

institutes, including the Association of Chartered Certified Accountants

(ACCA) of UK, the largest accounting body in the world. CATmembers

from IAT can in fact become as CAT of ACCA UK without further

examination.

Benefits of CAT Certification

When you attain the Certified Accounting Technician designation, you:

Offer an employer proven specific skills and knowledge.

Advance your career and increase your compensation.

Put CAT after your name, giving you the same distinction among

bookkeepers that CPA gives to certified public accountants.

Increase your value to your company or clients Certified

Accounting Technicians can and do take on new responsibilities.

Topnotch CAT Reviewers www.catreviewers.com

Certified Accounting Technician =a student may apply to become a CAT if

he or she finished and passed ALL the Examinations (Parts 1, 2 and 3).

CAT Examination Pathway

In Summary:

Certified Bookkeeper =a student may apply to become a CB if he or she

finished and passed Part 1 only.

Registered Cost Accountant =a student may apply to become an RCA if

he or she finished and passed Part 2 only.

3

Topnotch CAT Reviewers www.catreviewers.com

CAT Challenge Exam Syllabus

PART I FINANCIAL ACCOUNTING

Module 1 Recording Business Transactions

This module covers the following learning objectives:

Understand the basic principles of double entry accounting

Understand the nature and accounting of a merchandising business and how

it differs with a service business

Analyze and record transactions in the accounts such as purchases and

sales

Prepare chart of accounts for a merchandising and service business

Use T accounts to analyze transactions into debit and credit parts

Compute total balances of accounts

Prepare trial balance and learn its purpose

This module covers the following learning objectives:

Understand how the matching concept relates to and supports the accrual

basis of accounting

Analyze and clarify why adjustments are necessary

Make adjusting journal entries that will update the matching process

Use six (6) column worksheet and prepare an adjusted trial balance

Use worksheet serves as a device for collecting and summarizing data

Prepare classified financial statement from a worksheet

Prepare the adjusting and closing entries from a worksheet

Post the adjusting and closing entries

Prepare a post closing trial balance

Prepare a multi-step and single-step income statement, statement of owners

equity and balance sheet for a merchandising and service business.

Complete the accounting cycle

Prepare Financial Statements

Module 3 Maintaining Financial Records

This module covers the following learning objectives:

Understand how Special J ournals, Controlling Accounts and Subsidiary

Ledgers are used to summarize classes of business transactions

Record Sales on account transactions in a Sales J ournal

Record Cash Receipts transactions in a Cash Receipts J ournal

Record Purchases on account transactions in Purchases J ournal

Module 2 Drafting Financial Statements

Topnotch CAT Reviewers www.catreviewers.com

Record Cash Disbursements transactions in a Cash Payments J ournal

Record Other transactions and adjustments in a General J ournal

Post and reconcile subsidiary account balances with controlling account

Learn the basic steps in computerizing an Accounting System using Microsoft

Excel

Use Voucher system to control expenditures

Prepare a voucher and record transactions in a Voucher Register

Module 4 Reconstructing Incomplete Records

This module covers the following learning objectives:

Establish internal controls to safeguard assets, most especially cash

Understand Single-Entry Bookkeeping systems

Reconstruct incomplete records and looking for missing information

Audit and review the accounting records of a business entity

Convert cash basis of accounting to accrual basis of accounting

Locate, analyze, and correct the errors committed

Prepare of correcting entries, if necessary

Recast of financial statements, if necessary or practical

Detect the presence of frauds or misappropriations

Reconcile a bank statement and prepare necessary entries

Prepare reconstructed financial statements

Analyze and interpret the financial statements prior to making an informed

decision

PART 2 MANAGEMENT ACCOUNTING

Module 5 Understanding Management Information

This module covers the following learning objectives:

Appreciate the importance of financial and non-financial information for

planning, control and decision-making purposes

Recognize the variety of cost units, cost centers and profit centers

Differentiate between direct and indirect costs; fixed and variable costs;

period and product costs; controllable and uncontrollable costs; avoidable

and unavoidable costs; etc

Identify cost classification for decision-making and planning

Appreciate cost behavior patterns including linear, curvilinear and step

functions

Appreciate the importance of unit costs for both financial and management

decision making

Topnotch CAT Reviewers www.catreviewers.com

Module 6 Accounting for Materials, Labor and Overhead costs

This module covers the following learning objectives:

Describe the methods and procedure of storekeeping, stocktaking and

inventory control

Explain and illustrate the perpetual inventory system and its procedures

documentation

Explain and illustrate the methods available for pricing stores issues and for

inventory valuation

Explain the impact of different remuneration methods on the cost of finished

goods

Explain and illustrate the problems and procedures of identifying, analyzing,

allocating and absorbing overhead costs

Explain the different bases for overhead absorption rates

Compute overhead absorption rate

Differentiate and calculate plant-wide overhead rates and departmental

overhead rates

Explain and illustrate the principles and methods of treatment of under and

over absorption of overhead costs

Module 7 Accumulating Costs for Products and Services

This module covers the following learning objectives:

Explain the flow and accumulation of costs when using job costing

Describe the purpose and content of job cost sheet

Identify appropriate units for accumulation of control costs

Explain the treatment of profit/loss on contracts including uncompleted

contracts

Demonstrate the application and identification of cost units

Explain and determine the equivalent units and cost per equivalent unit

Demonstrate how costs are assigned to equivalent units using process

costing

Demonstrate cost accounting methods used in cost processes, process

losses and work in progress

Explain the difference between joint product and byproduct costing

Module 8 Budgeting for planni ng and control

This module covers the following learning objectives:

Identify and apply techniques for forecasting revenue and expenditures

Prepare operational, cash, and capital expenditure budgets

Explain the differences between fixed budgets, flexible budgets and

reforecast

Calculate variances and identify their cases

Topnotch CAT Reviewers www.catreviewers.com

Explain and illustrate the concept of zerobased budgeting

Explain the uses and limitations of standard costing

Identify and determine different standards; basic, ideal, attainable and current

standards

Identify and calculate sales and cost variances

Prepare standard product cost and analyze different types of variances

between standard and actual product costs

Identify the significance of, and interrelationship between, variances

Module 9 Estimating Costs and Revenues for Decision Making

This module covers the following learning objectives:

Calculate and explain the usefulness of contribution margin and contribution

margin ratio

Determine the sales volume required to earn a desired level of operating

income

Identify the purposes of breakeven analysis

Illustrate and determine the margin of safety

Use Cost Volume Profit (CVP) relationships to evaluate a new marketing

strategy

Identify assumptions underlying CVP analysis

PART 3 TAXATION ACCOUNTING

Module 10 Preparing Payroll Computations

This module covers the following learning objectives:

Prepare the Withholding Tax, SSS, and Phil Health Tables

Prepare payroll and pay slip formats

Make the Formulas for Withholding Tax, SSS, Phil Health and Pag Ibig

deductions and Payslips using Link, Lookup and IF functions

Customize Printing the Payroll and Payslips and use of macros

Record gross pay and payroll deductions

Module 11 Preparing Income Tax Computations

This module covers the following learning objectives:

Understand the different sources of Income

Identify allowable deductions and business expenses

Compute Minimum Corporate Income Tax, Improperly Accumulated Earnings

Tax and Gross Income Tax for Corporations

Prepare BIR (Bureau of Internal Revenue) Form 1702 Annual Income Tax

Return

Topnotch CAT Reviewers www.catreviewers.com

Prepare BIR Form 1702Q Quarterly Income Tax Return

Understand compliance requirements such as keeping of Book of Accounts

and preservation of Book of Accounts.

Understand Registration Requirements of BIR

Understand Issuance and Printing of Receipts, Sales Invoice or Commercial

Invoice

Module 12 Preparing Transfer and Business Tax Computations

This module covers the following learning objectives:

Understand the concept and scope of Value Added Tax

Compute VAT on Sale of Goods or Property, Sale of Service and Use or

Lease of Property, and Importation of Goods

Compute Output and Input Taxes and VAT payable

Prepare VAT accounting entries

Understand VAT Exempt Transactions

Understand compliance requirements for VAT as of registration, invoicing,

accounting and return and payment of VAT

Apply rates and bases of Percentage Tax

Prepare BIR Form 1600 Monthly Remittance of VAT and Other Percentage

Tax

Topnotch CAT Reviewers www.catreviewers.com

Academe Partners

In cooperation with NIAT International partners, the CATis recognized in

selected UK and Australian universities for credit exemptions and

advanced standing. They can enroll in the following universities with year

level exceptions:

Universities that accept CATmembers at second year (level two) of the

BA (Hons) Accounting and Finance degree:

Universities that accept CATmembers at third year (level three) of the

BA (Hons) Accounting and Finance degree:

Universities that accept CATmembers at final year (level four) of the BA

(Hons) International Accounting degree:

Universities that provide course exemptions to CATmembers for

Bachelor of Business degree:

Topnotch CAT Reviewers www.catreviewers.com

Global Employers trust the CAT

The CATis first and foremost an occupational qualification. You learn

and develop by actually doing the work, rather than just preparing for the

exam. We recognize your professional ability not just your memory which

is why CATstaffs are in such demand by employers.

The CATis recognized by employers across all sectors and all industries.

The respect that employers hold for the CATcan be a massive boost to

your career prospects, whether you have already started out in your career

or are taking your first steps. The CAT will help develop your existing

skills and help you gain new ones, which will open up new opportunities

and give you the chance to prove yourself.

The CATtitle will also help you gain practical understanding and develop

first-class skills in other areas, including IT communications and personal

effectiveness. These skills not only give you extra confidence to make the

most of your career, but they are held in high regard by employers.

Rewards of CAT

The CATProgram is the ideal certification for anyone wanting to work as

an accounting technician. This vocational course provides the knowledge

and skills to perform the tasks demanded by this role; it offers you the

chance to gain a useful and practical qualification while studying at your

own pace.

The CATProgram offers great rewards. That is the reason so many

people around the world take courses to become CAT. But you will also

know that the rewards are only earned if you are prepared to work hard

towards your qualification.

The CATwill give you valuable new skills and increase the value you can

add to your organization thus paving the way for career development.

Topnotch CAT Reviewers www.catreviewers.com

National Institute of Accounting Technicians of the Philippines (NIAT Phils)

The National Institute of Accounting

Technician of the Philippines is the largest

bookkeeping institute in the Philippines representing

over 30,000 accounting professionals. It conducts

training and examination for bookkeepers and

accounting technicians who want to enhance their

bookkeeping and accounting skills through the

Certified Accounting Technician (CAT) program.

It is a professional organization for accountants recognized for their practical

bookkeeping skills. The NIAT is committed to raising standards in the accounting

technician industry through developing direct and practical educational and certification

programs promoting an enhanced profile for accounting technicians with the highest level

of professional and ethical conduct.

The NIAT was formed to represent the accounting professionals in the Philippines

who work as accounting technicians in industry, government, academia and private

practice. It has a mission to raise the level of recognition for its members, their specialized

skills and the accounting profession in general.

Mission & Vision

The NIAT is a premier body of accounting technicians that strives for the recognition and

employability of the accounting technician profession across all business sectors.

The Institute thus aims:

To promote and develop accounting technology and to encourage education and

disseminate knowledge related to or connected with accounting technology;

To provide a professional organization for accounting technicians and by means of

examination and other methods of assessment to test the skill and knowledge of

persons desiring to enter the profession;

To further the development of accounting technology in the industry, government,

academe, and private practice;

To provide continuing education programs as a means for disseminating updates

and information in the discipline of accounting technology, and for promoting the

CAT qualification

Topnotch CAT Reviewers www.catreviewers.com

Relationship Diagram of Organizations

organizations which awards the international certifications

ICB UK

CMA AU IAT CA

ACCA UK

NIAT Phils.

Topnotch

CAT

Reviewers

NIAT Phils.

largest institute of accounting

technicians in the country

conducts review and exam for

the international certifications

administers the exams of the

international certificates here in

the country

coordinates and process the

requirements of exam passers

for the application of

certifications (and

memberships) to the

corresponding organization

which awards the international

certifications

Topnotch CAT Reviewers

one of the first accredited

review/learning provider

for the CAT program

(CAT, RCA, CB)

conducts review classes

for the CAT program

coordinates with NIAT

Phils for the CAT exam

assist students/participants

for the preparation of their

requirements to be

submitted to NIAT

Topnotch CAT Reviewers www.catreviewers.com

Topnotch CAT Revi ewers

Topnotch CAT Reviewers is one of the first review provider duly accredited by NIAT

to provide CAT Review Classes.

The review group started in August 2008 and is continually growing to be the

premier review provider for examinees preparing for the CAT exams. The review group

has class and exam schedules almost every month and has produced many exam passers

with competitive passing percentage in every batch of exam.

Topnotch CAT Reviewers aims to:

promote CAT in alignment with its growth of becoming one of the in-demand

certification, and promote NIAT Phils goals and objectives

provide proven teaching and learning techniques and, develop new methodologies

to assist review participants thru the CAT exam

promote and develop students and professionals alike to become locally and

globally competitive in the accounting profession

Topnotch CAT Reviewers has review and exam in the following areas:

Topnotch Manila @ NRC CPA Review, Recto, Manila (NCR)

Topnotch Batangas @ Lyceum Batangas (LPUB), Batangas (Region4)

Topnotch Laguna @ San Pablo & Calamba, Laguna (Region4)

Topnotch Quezon @ Lucena, Quezon Province (Region4)

Topnotch Pampanga @ Angeles City, Pampanga (Region3)

Topnotch Nueva Ecija @ Munoz and Cabanatuan, Nueva Ecija (Region3)

Topnotch Baguio @ Baguio City and Pangasinan (Region 1/CAR)

Ralph Michael Licaros, CPA, CAT, RCA, MICB

Head, Topnotch CAT Reviewers

Accredited Review Provider, NIAT Phils.

0917-8827111

rmlicaros_cat@yahoo.com

Visit us Online

www.catreviewers.com

www.facebook.com/topnotch.catreviewers

Visit us at National Review Center

(NRC CPA Review School)

2/F Conanan Bldg., 2017 C.M. Recto Ave., Manila

Telefax No. 733-7832

Potrebbero piacerti anche

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDa EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNessuna valutazione finora

- Afar 1 Module On Accounting For LaborDocumento5 pagineAfar 1 Module On Accounting For LaborJessica IslaNessuna valutazione finora

- COST ACCOUNTING JOB-ORDER COSTING ProbleDocumento2 pagineCOST ACCOUNTING JOB-ORDER COSTING ProbleEleonora MarinettiNessuna valutazione finora

- CAT Module 1 Payroll Accounting (Updated)Documento47 pagineCAT Module 1 Payroll Accounting (Updated)Anonymous Lz2qH7Nessuna valutazione finora

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocumento33 pagineModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNessuna valutazione finora

- Income-Tax-Assignment No. 3 SolutionDocumento18 pagineIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoNessuna valutazione finora

- Nature of Accountancy ResearchDocumento29 pagineNature of Accountancy ResearchRodNessuna valutazione finora

- Exercises in Adjusting EntriesDocumento5 pagineExercises in Adjusting EntriesJhon Robert BelandoNessuna valutazione finora

- Dahlia DahliaDocumento21 pagineDahlia Dahliaambrosia96Nessuna valutazione finora

- MODULE 6 ExerciseDocumento2 pagineMODULE 6 ExerciseomsfadhlNessuna valutazione finora

- TAX. M-1401 Estate Tax: Basic TerminologiesDocumento33 pagineTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNessuna valutazione finora

- 5 ANS KEY Principles of Auditing and Other Assurance Services by Whittington Chapter 5Documento16 pagine5 ANS KEY Principles of Auditing and Other Assurance Services by Whittington Chapter 5Frue LoveNessuna valutazione finora

- A1 Financial Statements PDFDocumento30 pagineA1 Financial Statements PDFattiva jadeNessuna valutazione finora

- Advanced Accounting Vol 2 Guerrero and Peralta ManDocumento1 paginaAdvanced Accounting Vol 2 Guerrero and Peralta ManEli PerezNessuna valutazione finora

- Substantive Tests of Expenditure Cycle Accounts Substantive TestsDocumento3 pagineSubstantive Tests of Expenditure Cycle Accounts Substantive TestsJuvelyn RedutaNessuna valutazione finora

- Regular Income Tax: Bacc8 TaxationDocumento18 pagineRegular Income Tax: Bacc8 TaxationsoonsNessuna valutazione finora

- Qualifying Exam - 1Documento5 pagineQualifying Exam - 1Eleazer Ego-oganNessuna valutazione finora

- Performance of Bsa Graduates in The Cpa Licensure ExaminationDocumento4 paginePerformance of Bsa Graduates in The Cpa Licensure ExaminationJeong MeungiNessuna valutazione finora

- Midterms - 2 - Capital - Budgeting - Techniques - PDF Filename UTF-8''Midterms 2 CapiDocumento17 pagineMidterms - 2 - Capital - Budgeting - Techniques - PDF Filename UTF-8''Midterms 2 CapiAirille CarlosNessuna valutazione finora

- Reviewer ItappDocumento13 pagineReviewer ItappKelly Fernandico IntalNessuna valutazione finora

- AIS SummaryDocumento5 pagineAIS SummaryKimboy Elizalde PanaguitonNessuna valutazione finora

- Lecture Notes On Payroll Accounting Payroll AccountingDocumento4 pagineLecture Notes On Payroll Accounting Payroll AccountingOdult Chan100% (2)

- Thesis, Performance 2Documento25 pagineThesis, Performance 2Jezmelyn Antimano60% (5)

- Cost Accounting Practice Set (L. Payongayong)Documento60 pagineCost Accounting Practice Set (L. Payongayong)rocketkaye100% (2)

- BUSINESS AND TRANSFER TAXATION 6th Edition - BY VALENCIA & ROXAS - C8 PDFDocumento14 pagineBUSINESS AND TRANSFER TAXATION 6th Edition - BY VALENCIA & ROXAS - C8 PDFJEPZ LEDUNANessuna valutazione finora

- Absorption and Variable Costing Act3Documento2 pagineAbsorption and Variable Costing Act3Gill Riguera100% (1)

- Valuation Concepts and Methods Sample ProblemsDocumento2 pagineValuation Concepts and Methods Sample Problemswednesday addams100% (1)

- 19 (4) - Cost Behavior and Cost-Volume-Profit AnalysisDocumento42 pagine19 (4) - Cost Behavior and Cost-Volume-Profit AnalysisJoan AvanzadoNessuna valutazione finora

- Conceptual FrameworkDocumento125 pagineConceptual FrameworkJonah Marie Therese Burlaza50% (4)

- Chapter 9 Part 1 Input VatDocumento25 pagineChapter 9 Part 1 Input VatChristian PelimcoNessuna valutazione finora

- Train Law THEORIESDocumento2 pagineTrain Law THEORIESKathleen Maeve Gardoque0% (1)

- TAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsDocumento1 paginaTAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsGie MaeNessuna valutazione finora

- Accounting For LaborDocumento43 pagineAccounting For LaborAmy Spencer100% (1)

- Quiz - Intangible Assets With QuestionsDocumento3 pagineQuiz - Intangible Assets With Questionsjanus lopezNessuna valutazione finora

- 7 Percentage TaxesDocumento38 pagine7 Percentage Taxesqaz qwertyNessuna valutazione finora

- Accounting 7 07 Cost Acctg Cost ManagementDocumento7 pagineAccounting 7 07 Cost Acctg Cost ManagementAvegail MagtuboNessuna valutazione finora

- Theory of AccountsDocumento8 pagineTheory of AccountsAcain RolienNessuna valutazione finora

- RA 9298 - Powerpoint PresentationDocumento60 pagineRA 9298 - Powerpoint PresentationCharrie Grace Pablo100% (3)

- 1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditDocumento4 pagine1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditXexiannaNessuna valutazione finora

- Activity-Based CostingDocumento2 pagineActivity-Based CostingClaire BarbaNessuna valutazione finora

- IMT Custom MachineDocumento3 pagineIMT Custom MachineSonia A. UsmanNessuna valutazione finora

- Decision Making and Relevant Costing TestDocumento61 pagineDecision Making and Relevant Costing TestSUBMERIN100% (1)

- Cpale Subjects & TopicsDocumento12 pagineCpale Subjects & Topicsnikol sanchezNessuna valutazione finora

- AP 08 Substantive Audit Tests of EquityDocumento2 pagineAP 08 Substantive Audit Tests of EquityJobby JaranillaNessuna valutazione finora

- Adjusting EntriesDocumento30 pagineAdjusting EntriesRizza Morada100% (1)

- High Low MethodDocumento4 pagineHigh Low MethodSamreen LodhiNessuna valutazione finora

- Paper T5 Managing People and Systems: Sample Multiple Choice Questions - June 2009Documento6 paginePaper T5 Managing People and Systems: Sample Multiple Choice Questions - June 2009asad27192Nessuna valutazione finora

- Fa 3 Chapter 2 Statement of Financial PositionDocumento22 pagineFa 3 Chapter 2 Statement of Financial PositionKristine Florence TolentinoNessuna valutazione finora

- Ge Elec 6 Flexible Obtl A4Documento9 pagineGe Elec 6 Flexible Obtl A4Alexandra De LimaNessuna valutazione finora

- Strategic Tax Management ReviewerDocumento47 pagineStrategic Tax Management ReviewerJoyce Macatangay100% (1)

- Q5 Items of Gross IncomeDocumento10 pagineQ5 Items of Gross IncomeNhaj0% (2)

- Solution - IntangiblesDocumento9 pagineSolution - IntangiblesjhobsNessuna valutazione finora

- Chapter 10 Tabag - Serrano NotesDocumento5 pagineChapter 10 Tabag - Serrano NotesNatalie SerranoNessuna valutazione finora

- Principles of TaxationDocumento32 paginePrinciples of TaxationTyra Joyce Revadavia100% (1)

- 203 Cat Generalbrochure Topnotch NEWDocumento16 pagine203 Cat Generalbrochure Topnotch NEWjhienellNessuna valutazione finora

- 203 Cat Generalbrochure Topnotch 2020 0502Documento13 pagine203 Cat Generalbrochure Topnotch 2020 0502Jayson DelfinoNessuna valutazione finora

- CAT Accelerated Level 1Documento4 pagineCAT Accelerated Level 1aliciarigonan100% (1)

- ICA GH - SyllabusDocumento124 pagineICA GH - SyllabusEnusah AbdulaiNessuna valutazione finora

- Recognition of Acca and CatDocumento4 pagineRecognition of Acca and CatMonir HossainNessuna valutazione finora

- Ukraine Grain TransportationDocumento15 pagineUkraine Grain TransportationMohammed RaafatNessuna valutazione finora

- GodsBag Invoice PDFDocumento1 paginaGodsBag Invoice PDFambarsinghNessuna valutazione finora

- AB Farming - CERTIFICATE OF ENTERPRISE REGISTRATIONDocumento2 pagineAB Farming - CERTIFICATE OF ENTERPRISE REGISTRATIONAmedeeAbNessuna valutazione finora

- Bologna To VeniceDocumento2 pagineBologna To VeniceFarzad IlaNessuna valutazione finora

- Overview of Intercompany InvoicingDocumento35 pagineOverview of Intercompany InvoicingpbobbiNessuna valutazione finora

- Indirect Tax Meaning Merits and Demerits of Indirect Taxes PDFDocumento15 pagineIndirect Tax Meaning Merits and Demerits of Indirect Taxes PDFdinesh kumarNessuna valutazione finora

- Fact Erp - NG: The Next Generation ERP SoftwareDocumento20 pagineFact Erp - NG: The Next Generation ERP SoftwareAbhijit BarmanNessuna valutazione finora

- Tax Invoice: Customer Information Store InformationDocumento2 pagineTax Invoice: Customer Information Store InformationMohamed Zedan100% (1)

- Sales PitchesDocumento12 pagineSales PitchesDaniel DsouzaNessuna valutazione finora

- Central Sales Tax ActDocumento38 pagineCentral Sales Tax ActEr Shekhar PrakashNessuna valutazione finora

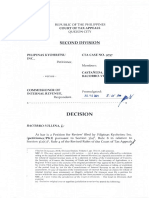

- TSC VS CirDocumento3 pagineTSC VS CirJeffrey MagadaNessuna valutazione finora

- Terminal Handling Charges: London Heathrow AirportDocumento2 pagineTerminal Handling Charges: London Heathrow AirportMuhammad SiddiuqiNessuna valutazione finora

- (Tax On Wholesalers, Distributors or Dealers) (Tax On Retailers) Per AnnumDocumento6 pagine(Tax On Wholesalers, Distributors or Dealers) (Tax On Retailers) Per AnnumGillian Alexis ColegadoNessuna valutazione finora

- S Cond Divisio: DecisionDocumento53 pagineS Cond Divisio: DecisionDyrene Rosario UngsodNessuna valutazione finora

- Primetech Dta 08-03-2019Documento2 paginePrimetech Dta 08-03-2019Vikk SuriyaNessuna valutazione finora

- Monthly VAT ReturnDocumento34 pagineMonthly VAT ReturnEdris MatovuNessuna valutazione finora

- Chair Order DetailsDocumento1 paginaChair Order DetailsSurendra InnamuriNessuna valutazione finora

- This Study Resource Was: Business Taxes ProblemsDocumento6 pagineThis Study Resource Was: Business Taxes ProblemsChris Jay LatibanNessuna valutazione finora

- 3 Months Study Plan With A, B, C Analysis CS Executive New Syllabus Dec-21Documento15 pagine3 Months Study Plan With A, B, C Analysis CS Executive New Syllabus Dec-21MayizNessuna valutazione finora

- TAX-402 (Other Percentage Taxes - Part 2)Documento5 pagineTAX-402 (Other Percentage Taxes - Part 2)lyndon delfinNessuna valutazione finora

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Documento3 pagineG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraNessuna valutazione finora

- Chamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesDocumento30 pagineChamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesUmarNessuna valutazione finora

- PB Fees and ChargesDocumento32 paginePB Fees and ChargesechipbkNessuna valutazione finora

- New Certificate Course in TallyDocumento2 pagineNew Certificate Course in TallyRonny HedaooNessuna valutazione finora

- Zurich HotelDocumento2 pagineZurich HotelHassan Anwer100% (1)

- KSDL Right To Information Act 2005Documento34 pagineKSDL Right To Information Act 2005himanshu_jhanjhariNessuna valutazione finora

- 2018 Sigma Rho Fraternity Bar Operations TAX LAW Bar QA 1999 2017 PDFDocumento68 pagine2018 Sigma Rho Fraternity Bar Operations TAX LAW Bar QA 1999 2017 PDFMa-an SorianoNessuna valutazione finora

- Business Tax: Francis Ysabella S. BalagtasDocumento6 pagineBusiness Tax: Francis Ysabella S. BalagtasFrancis Ysabella BalagtasNessuna valutazione finora

- 081994GST 8-8-2018 PDFDocumento18 pagine081994GST 8-8-2018 PDFAKHILESH YADAVNessuna valutazione finora

- The Layman's Guide GDPR Compliance for Small Medium BusinessDa EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessValutazione: 5 su 5 stelle5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideDa Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideValutazione: 2.5 su 5 stelle2.5/5 (2)

- Internal Audit Checklists: Guide to Effective AuditingDa EverandInternal Audit Checklists: Guide to Effective AuditingNessuna valutazione finora

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessDa EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNessuna valutazione finora

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersDa EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersValutazione: 4.5 su 5 stelle4.5/5 (11)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowDa EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNessuna valutazione finora

- Bribery and Corruption Casebook: The View from Under the TableDa EverandBribery and Corruption Casebook: The View from Under the TableNessuna valutazione finora

- Business Process Mapping: Improving Customer SatisfactionDa EverandBusiness Process Mapping: Improving Customer SatisfactionValutazione: 5 su 5 stelle5/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyDa EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNessuna valutazione finora

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekDa EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNessuna valutazione finora

- Frequently Asked Questions in International Standards on AuditingDa EverandFrequently Asked Questions in International Standards on AuditingValutazione: 1 su 5 stelle1/5 (1)

- Financial Statement Fraud: Prevention and DetectionDa EverandFinancial Statement Fraud: Prevention and DetectionNessuna valutazione finora

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsDa EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNessuna valutazione finora

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksDa EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksValutazione: 4 su 5 stelle4/5 (1)

- Internet Fraud Casebook: The World Wide Web of DeceitDa EverandInternet Fraud Casebook: The World Wide Web of DeceitNessuna valutazione finora

- How to Audit Your Account without Hiring an AuditorDa EverandHow to Audit Your Account without Hiring an AuditorNessuna valutazione finora

- Audit and Assurance Essentials: For Professional Accountancy ExamsDa EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNessuna valutazione finora

- Musings on Internal Quality Audits: Having a Greater ImpactDa EverandMusings on Internal Quality Audits: Having a Greater ImpactNessuna valutazione finora

- Audit. Review. Compilation. What's the Difference?Da EverandAudit. Review. Compilation. What's the Difference?Valutazione: 5 su 5 stelle5/5 (1)