Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NBFCS: A Regulatory Round Up: Place: Kolkata - India Venue: To Be Announced Date: To Be Announced

Caricato da

visucharm10 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni9 pagineThis document announces a one-day workshop on regulatory developments for Non-Banking Financial Companies (NBFCs) in India. It notes that over the past year, NBFCs have seen significant regulatory reforms from financial regulators in India. The workshop aims to provide a comprehensive round-up of these regulatory changes, including developments under the Companies Act 2013 and new guidelines on corporate debt restructuring. It will cover topics like sub-sector changes for NBFCs, public deposit rules, and debt issuance norms. The event is intended to help NBFC professionals understand and navigate the evolving regulatory landscape in India.

Descrizione originale:

NBFC related informations

Titolo originale

NBFC Workshop

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document announces a one-day workshop on regulatory developments for Non-Banking Financial Companies (NBFCs) in India. It notes that over the past year, NBFCs have seen significant regulatory reforms from financial regulators in India. The workshop aims to provide a comprehensive round-up of these regulatory changes, including developments under the Companies Act 2013 and new guidelines on corporate debt restructuring. It will cover topics like sub-sector changes for NBFCs, public deposit rules, and debt issuance norms. The event is intended to help NBFC professionals understand and navigate the evolving regulatory landscape in India.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni9 pagineNBFCS: A Regulatory Round Up: Place: Kolkata - India Venue: To Be Announced Date: To Be Announced

Caricato da

visucharm1This document announces a one-day workshop on regulatory developments for Non-Banking Financial Companies (NBFCs) in India. It notes that over the past year, NBFCs have seen significant regulatory reforms from financial regulators in India. The workshop aims to provide a comprehensive round-up of these regulatory changes, including developments under the Companies Act 2013 and new guidelines on corporate debt restructuring. It will cover topics like sub-sector changes for NBFCs, public deposit rules, and debt issuance norms. The event is intended to help NBFC professionals understand and navigate the evolving regulatory landscape in India.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 9

NBFCs: A regulatory round up

Place: Kolkata | India

Venue: To be announced

Date: To be announced

Organised by: Vinod Kothari Consultants Pvt. Ltd

Over the years, Non Banking Financial Companies (NBFCs) have acquired immense

significance and they now constitute the very core of the financial system. Within a period of

one year, the NBFC sector saw a blast of regulatory reforms, with all the financial regulators

coming out with something very relevant to the industry. The Reserve Bank of India, which

is the main regulator of the NBFCs, has from time to time come out with various guidelines,

and most recently with extensive and elaborate guidelines and norms on corporate

restructuring for the NBFCs, which we think has come out in tune with the soaring concerns

over NPAs in the country. This has created a lot of buzz among the NBFCs. In addition, the

enactment of the Companies Act, 2013 which replaced the 60-year old Companies Act, 1956

also has many things in store for NBFCs.

With so many relevant regulatory changes transpiring simultaneously, we have decided to

organise a one-day workshop to round up all the regulatory developments for NBFCs. We

shall cover the regulations in details, starting from the Companies Act 2013 to the Corporate

Debt Restructuring norms, and the wider implications of the regulations on the business of

NBFCs and also provide valuable practical tips to steer your business through the tides. For

those in the business of NBFCs, this would surely be a great opportunity to sharpen and

refine your knowledge and expertise, avoid and recover from mistakes and stay ahead in the

competition.

Non Banking Financial Companies

Consultants

Regulators

Why this workshop?

Who can attend?

Session 1: Overview of NBFCs sector and the recent changes

Current sub-sectors and classifications

Sub-sector changes and the implications

NBFC-Factors

Gold loan companies

Pricing of credit for NBFC-MFIs

ECB to AFCs

Other import amendments

CERSAI registration for equitable mortgages

Insurance sector participation

Branch Info

Session 2: Applicability of the Companies Act, 2013 on NBFCs

Section 36 empowerment

Public deposit guidelines

Provisions for appointment of nominee directors

Applicability of sec 185, 186 and relevant exemptions to certain classes of

NBFCs

Applicability of Sections 42, 62, 71

Session 3: New regime for issue of debt

Private placement guidelines

Shelf prospectus requirement

Securities and Exchange Board Of India (Issue and Listing Of Debt Securities)

(Amendment) Regulations, 2014

Issues on fund raising

Session 4: Practical insights into Corporate Debt Restructuring

Session 5: Corporate Debt Restructuring by NBFCs

NBFCs restructuring under the CDR framework

NBFCs restructuring outside the CDR framework

Implications

Computation of fair value of the restructured debt

Computation of promoters sacrifice

Session 6: Framework for distressed assets by RBI

Course Outline

Nidhi Bothra

Qualification: Associate Company Secretary

Present Engagement: Executive Vice President, Vinod

Kothari Consultants P Ltd.

ARTICLES & PUBLICATIONS:

Article on Euromoney Handbook on Structured Finance on Securitisation in

Asia

Article on Solar securitisation in renewable energy magazine.

Co-Authored article on Islamic Lease published in World Leasing News

Articles on Islamic Finance News, Red Money publication Understanding of

Sukuk and Islamic securitisation structures more needs to be done?

Articles in Asset Finance International on -

Indias leasing rebirth in the wake of economic boom

Indian leasing set to grow as non-banking finance companies benefit from

new regulations

Commented on the lease sector India in New hopes for Indian leasing as

gloom lifts in the economy

Ghosts of sale and leaseback -- will we exercise now

Articles in moneylife.com on FDI in Retail FAQs and Securitisation

Guidelines impact on India and on issues relating to securitisation, leasing,

derivatives, ECBs, affordable housing finance and other relevant topics on

finance. http://moneylife.in/author/nidhi-bothra.html

Articles in Indiancorplaw.

Articles in Easter India Regional Council Newsletter, ICSI on Microfinance in

India

Article on Credit Derivatives: Risk Mitigation device in Chartered Secretary

Articles on Easter India Regional Council Newsletter, ICAI on Carbon Credits

Regulatory, Accounting, Taxation Issues

Articles and reviews on the microfinance industry in microfinancefocus.com

Several articles published in www.vinodkothari.com, www.india-financing.com,

www.credit-deriv.com and www.suvidha.com on Micro finance, laws of venture

capital, mortgage industry and carbon credits, leasing, cost management,

Introduction to Financial Markets etc

Analysis of the state of securitization and leasing industry in several countries

Research reports on NBFCs, leasing sector, commercial vehicles industry - India

Faculty

CONSULTING EXPERIENCE:

Led a capacity building program for IFC on developing a toolkit on Housing

Microfinance and Micro-mortgages in India, 2012

Engaged on study on Covered Bonds into India for a Working Committee set up

by National Housing Bank India, 2012

Currently acting as a leasing consultant to several NBFCs in India

Assisted on project for leasing in Egypt for a microfinance entity in Egypt in

2010

Assisted on Affordable Housing Project for the Govt. of Jordan in 2009

TRAINING & LECTURING:

Domestic trainings and lectures:

2 days at 16th Securitisation & Covered Bonds Masterclass, a public

workshop open for corporates held in Mumbai.

2 days public workshop for corporate on Asset Backed Lending & Operating

Leases, in Mumbai, November, 2012, April, and August, 2013.

2 day workshop on Cashflow modeling in Securitisation for corporate in

Mumbai in May, 2013.

Co-faculty for in-house training for Philips India Limited

Co-faculty in 2 day public workshop on Asset-backed lending & Operating

leases organised by VKC in July, 2012

Lectured in Calcutta University on Functioning of Financial Markets

Corporate trainings, trained over 200 employees across India on asset

backed funding

Part of training team for SME lending business for a leading NBFC in India

Guest Lecture at NUJS on Securitisation and SARFAESI

Guest Lecture at ICAIs Masters of Business Finance course

Lectured in Institute of Chartered Accountants of India on Carbon Credits

Lectured several CS students in Institute of Company Secretaries of India

(ICSI)

International trainings and lectures:

5 days Training on securitization at African Securitization & Bonds School

at Ghana, Africa

AREAS OF EXPERTISE:

Securitization & Covered Bonds

Affordable housing

Mortgage lending

Leasing

Asset reconstruction business

OTHER ENGAGEMENTS:

On the Correspondent Board for Islamic Finance News, Red Money Publications

for Securities and Securitisation.

Profile of the month for January, 2012, in Asset Finance International, an

international online journal focused on asset backed lending.

Presently retained as an expert with Globalexperts4u as an expert on legal and

financial topics

Participated in Doing Business 2010, 2012, 2013 & 2014 by IFC, World Bank

on regulatory scenario in India

Naveen Gupta

Qualification: Chartered Accountant

Mr. Gupta has more than 17 years of experience in Corporate Affair, Finance & Accounts,

with prestigious listed business organizations. Naveens core capabilities are in mobilizing

working capital, long term financing needs to support plant operations/projects though

banks/FIs, Private Equity, Loan Syndication and Debt Restructuring.

Naveen began his career with Technical Associates Pvt. Ltd. a transformer manufacturing

Company based in Lucknow and joined Ramsarup Industries Ltd., Kolkata in 1998. Naveen

served Ramsarup for 15 years at various capacities. During his engagement with Ramsarup,

Naveen was instrumental in listing the Equity Shares of Ramsarup with BSE and NSE,

arranging finances through off-shore funding, raising/restructuring of debt of Rs 2000 Crores.

Naveen has handled BIFR and DRT matters for various companies. Naveen left Ramsarup in

2013 to start his own advisory services in the field of Investment Banking and Corporate

Advisory.

Naveen is member of various organisations namely Steel Wire Manufacturing Association,

Merchant Chamber of Commerce, CII and VIP Chartered Accountants Study Circle. Naveen

is active participant at social camps and various help-age services organized by NSS of St.

Xaviers College.

Naveen has completed his Bachelors in Commerce from St. Xaviers College and is a Fellow

Member of The Institute of Chartered Accountants of India.

Guest Speaker

Ashish Bajaj

Qualification: Company Secretary

Mr. Bajaj has more than 10 years of experience in Corporate Law Matters, Private Equity,

Loan Syndication, Debt Restructuring besides other Corporate Advisory services.

Ashish began his career with Meghalaya Cement Limited as Sr. Manager (Secretarial &

Accounts) and soon moved to Tantia Constructions Ltd. to handle the IPO of the Company as

Company Secretary & Compliance Officer. After the IPO of Tantia Constructions, Ashish

joined Microec Capital Ltd. as VP (Investment Banking). During his engagement with

Microsec Ashish handled various IPOs, Private Equity, Loan Syndication and Corporate

Advisory matters. Ashish left Micorsec in June, 2009 to co-promote Aspire Capital Pvt. Ltd..

Ashish left Aspire in May, 2012 to set up Pasofino Advisory Services Pvt. Ltd., an integrated

financial services firm in Kolkata with a focus on mid-market space. Today inter alia Ashish

is handling five CDR cases ranging from Rs 30 Crores to Rs 250 Crores.

Ashish has completed his Bachelors in Commerce, Chartered Accountancy (Inter) and

Company

Secretary. Ashish secured All India 3

rd

Rank from The Institute of Company Secretaries of

India in its Final Examination.

Guest Speaker

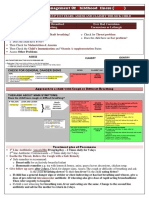

Name:

Designation:

Organization:

Approving Manager:

Address:

City: State: Pin Code:

Please keep me informed via email about this and other related events.

I cannot attend, but please keep me informed of all future events.

Please send your cheque for the participation fees along with the following details to the

address mentioned above. Registration shall be confirmed on the realization of the

cheque.

For more details please drop a mail to fintrain@vinodkothari.com or

pooja@vinodkothari.com or abhirup@vinodkothari.com

Websites: www.india-financing.com

www.vinodkothari.com

Registration Form

Potrebbero piacerti anche

- Interim Report 21BSP3460 - Pooja SureshDocumento19 pagineInterim Report 21BSP3460 - Pooja SureshChahat PartapNessuna valutazione finora

- MT 2 NPADocumento30 pagineMT 2 NPAPri AgarwalNessuna valutazione finora

- Investment Banking & Private EquityDocumento73 pagineInvestment Banking & Private Equitymakarandr_1100% (1)

- Magma Project ReportDocumento39 pagineMagma Project Report983858nandini80% (5)

- Interim Report 15Documento14 pagineInterim Report 15Prasant Kumar PradhanNessuna valutazione finora

- Final Project of Fin 433Documento43 pagineFinal Project of Fin 433UpomaAhmedNessuna valutazione finora

- Dipa Sip ProjectDocumento91 pagineDipa Sip ProjectdeepajivtodeNessuna valutazione finora

- NBFC Edelweise Retail FinanceDocumento14 pagineNBFC Edelweise Retail FinancesunitaNessuna valutazione finora

- SYNOPSIS ON-WPS OfficeDocumento9 pagineSYNOPSIS ON-WPS OfficeNeha AhireNessuna valutazione finora

- Study of Portfolio Management System: With Special Reference To Bajaj CapitalDocumento119 pagineStudy of Portfolio Management System: With Special Reference To Bajaj CapitalhemubnnaNessuna valutazione finora

- Icici Bank ReportDocumento71 pagineIcici Bank ReportGaurav ShrivastavNessuna valutazione finora

- Genesis Institute of Business ManagementPuneDocumento22 pagineGenesis Institute of Business ManagementPunemanoj jaiswalNessuna valutazione finora

- NBFC Final ProjectDocumento56 pagineNBFC Final ProjectYogesh PatilNessuna valutazione finora

- Dipa Sip ProjectDocumento53 pagineDipa Sip ProjectdeepajivtodeNessuna valutazione finora

- Financial Instruments: Summer Training ReportDocumento42 pagineFinancial Instruments: Summer Training ReportSamuel DavisNessuna valutazione finora

- Summer Internship Project ON "To Study Equity Vs Non Equity Investment Option and Its Awarness in India"Documento60 pagineSummer Internship Project ON "To Study Equity Vs Non Equity Investment Option and Its Awarness in India"VipulChauhanNessuna valutazione finora

- NBFCs - Vinod KothariDocumento7 pagineNBFCs - Vinod KothariVijay AgrawalNessuna valutazione finora

- NBFC ProjectDocumento97 pagineNBFC Projectsanjaydesai173_8631850% (2)

- Project ReportDocumento20 pagineProject ReportVarun AryaNessuna valutazione finora

- Untitled 1Documento63 pagineUntitled 1Kuldeep BagdeNessuna valutazione finora

- Icici Prudential - Channel Distribution20Documento69 pagineIcici Prudential - Channel Distribution20Vikas BansalNessuna valutazione finora

- A Study and Analysis of Financial Scheme: Joy Ankit Suna - BBA 6 Semester - Section - CDocumento10 pagineA Study and Analysis of Financial Scheme: Joy Ankit Suna - BBA 6 Semester - Section - CJoy Ankit SunaNessuna valutazione finora

- Research Paper On Corporate Debt Restructuring in IndiaDocumento6 pagineResearch Paper On Corporate Debt Restructuring in Indiaehljrzund100% (1)

- Icici Home Loan FinanceDocumento78 pagineIcici Home Loan FinanceParshant GargNessuna valutazione finora

- COMPANY ANALYSIS BAJAJ FINANCE NIKUNJ GohilDocumento44 pagineCOMPANY ANALYSIS BAJAJ FINANCE NIKUNJ GohilURVISH GAJJAR100% (1)

- Bajaj Capital ProjectDocumento17 pagineBajaj Capital Projectharman singh50% (2)

- Evaluating Financial Performance of Life Insurance CorporationDocumento49 pagineEvaluating Financial Performance of Life Insurance CorporationManika MalikNessuna valutazione finora

- Financial Services: BY Saddam HussainDocumento26 pagineFinancial Services: BY Saddam HussainsanjitaNessuna valutazione finora

- Sumit Training ReportDocumento56 pagineSumit Training ReportSumit BansalNessuna valutazione finora

- Jayesh Gupta PDF 1Documento12 pagineJayesh Gupta PDF 1Jayesh GuptaNessuna valutazione finora

- NBFC FinalDocumento100 pagineNBFC FinalDivyangi WaliaNessuna valutazione finora

- NBFC in IndiaDocumento23 pagineNBFC in IndiaSankar Rajan100% (4)

- Final To Print ORDocumento70 pagineFinal To Print ORpraveen10986Nessuna valutazione finora

- Thesis On Merchant Banking in IndiaDocumento6 pagineThesis On Merchant Banking in Indiaveronicagarciaalbuquerque100% (2)

- A Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionDocumento88 pagineA Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionMohammad Ejaz AhmedNessuna valutazione finora

- Study On Consumer Durable Loans and GoodsDocumento73 pagineStudy On Consumer Durable Loans and GoodsRoshan Ghatge RG100% (1)

- Fund Structuring Operations PDFDocumento65 pagineFund Structuring Operations PDFranjanjhallbNessuna valutazione finora

- Banking Portfolio ManagementDocumento95 pagineBanking Portfolio ManagementManoj NayakNessuna valutazione finora

- MCD - Bank Report 3Documento55 pagineMCD - Bank Report 3FaizanNessuna valutazione finora

- Pandey FileDocumento62 paginePandey FileAkshat AgarwalNessuna valutazione finora

- Project 2Documento115 pagineProject 2Anjana PatlanNessuna valutazione finora

- Hidayatullah National Law University Raipur (C.G)Documento22 pagineHidayatullah National Law University Raipur (C.G)mukteshNessuna valutazione finora

- Merchant BankingDocumento81 pagineMerchant BankingSeema SawantNessuna valutazione finora

- Icici Bank ReportDocumento80 pagineIcici Bank ReportDivyansh DhamijaNessuna valutazione finora

- Amity Business School Amity University, Uttar PradeshDocumento79 pagineAmity Business School Amity University, Uttar PradeshBohra RavishNessuna valutazione finora

- Lecture Topic Financial InstitutionsDocumento20 pagineLecture Topic Financial InstitutionsVikash kumarNessuna valutazione finora

- Icici BankDocumento99 pagineIcici BankAshutoshSharmaNessuna valutazione finora

- Project Report On Icici BankDocumento77 pagineProject Report On Icici BankMohit RohillaNessuna valutazione finora

- 20211217091025MBFS NotesDocumento112 pagine20211217091025MBFS Noteskomalsidhu1235Nessuna valutazione finora

- ICICI Bank by Anant Jain)Documento128 pagineICICI Bank by Anant Jain)Anant JainNessuna valutazione finora

- CG AssignmentDocumento9 pagineCG AssignmentAarifa ZahraNessuna valutazione finora

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsDa EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNessuna valutazione finora

- CCGRTDocumento39 pagineCCGRTManoj Kumar KoyalkarNessuna valutazione finora

- Icici Bank ReportDocumento80 pagineIcici Bank ReportAshish SinglaNessuna valutazione finora

- Strengthening Partnerships: Accountability Mechanism Annual Report 2014Da EverandStrengthening Partnerships: Accountability Mechanism Annual Report 2014Nessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- Innovative Infrastructure Financing through Value Capture in IndonesiaDa EverandInnovative Infrastructure Financing through Value Capture in IndonesiaValutazione: 5 su 5 stelle5/5 (1)

- Mutual Funds in India: Structure, Performance and UndercurrentsDa EverandMutual Funds in India: Structure, Performance and UndercurrentsNessuna valutazione finora

- 11 - Morphology AlgorithmsDocumento60 pagine11 - Morphology AlgorithmsFahad MattooNessuna valutazione finora

- Annotated Bib-BirthingDocumento3 pagineAnnotated Bib-Birthingapi-312719022Nessuna valutazione finora

- Vegetable Rates - 02-01-2021Documento454 pagineVegetable Rates - 02-01-2021Saurabh RajputNessuna valutazione finora

- DLL - Mapeh 6 - Q2 - W8Documento6 pagineDLL - Mapeh 6 - Q2 - W8Joe Marie FloresNessuna valutazione finora

- TXN Alarms 18022014Documento12 pagineTXN Alarms 18022014Sid GrgNessuna valutazione finora

- Course On Quantum ComputingDocumento235 pagineCourse On Quantum ComputingAram ShojaeiNessuna valutazione finora

- The Royal Commonwealth Society of Malaysia: Function MenuDocumento3 pagineThe Royal Commonwealth Society of Malaysia: Function MenuMynak KrishnaNessuna valutazione finora

- Barium SulphateDocumento11 pagineBarium SulphateGovindanayagi PattabiramanNessuna valutazione finora

- BiPAP ST Clinical ManualDocumento37 pagineBiPAP ST Clinical ManualEng. Edelson Martins100% (2)

- Goal 6 Unesco Water SanatationDocumento5 pagineGoal 6 Unesco Water Sanatationapi-644347009Nessuna valutazione finora

- Outerstellar Self-Impose RulesDocumento1 paginaOuterstellar Self-Impose RulesIffu The war GodNessuna valutazione finora

- Magical ExercisesDocumento5 pagineMagical ExercisesAnonymous ytxGqZNessuna valutazione finora

- Air System Sizing Summary For NIVEL PB - Zona 1Documento1 paginaAir System Sizing Summary For NIVEL PB - Zona 1Roger PandoNessuna valutazione finora

- Etl 213-1208.10 enDocumento1 paginaEtl 213-1208.10 enhossamNessuna valutazione finora

- Chapter 1 - Part 1 Introduction To Organic ChemistryDocumento43 pagineChapter 1 - Part 1 Introduction To Organic ChemistryqilahmazlanNessuna valutazione finora

- IMCI UpdatedDocumento5 pagineIMCI UpdatedMalak RagehNessuna valutazione finora

- Practical - 2: Preparation of The FixativeDocumento14 paginePractical - 2: Preparation of The FixativeIseth ISethNessuna valutazione finora

- CSEC Chemistry June 2018 P2 AnswersDocumento7 pagineCSEC Chemistry June 2018 P2 AnswerscxcchemistryNessuna valutazione finora

- Introduction To The New 8-Bit PIC MCU Hardware Peripherals (CLC, Nco, Cog)Documento161 pagineIntroduction To The New 8-Bit PIC MCU Hardware Peripherals (CLC, Nco, Cog)Andres Bruno SaraviaNessuna valutazione finora

- Scalextric Arc One GuideDocumento46 pagineScalextric Arc One GuidenotifyatpriNessuna valutazione finora

- Medical CodingDocumento5 pagineMedical CodingBernard Paul GuintoNessuna valutazione finora

- QIAGEN Price List 2017Documento62 pagineQIAGEN Price List 2017Dayakar Padmavathi Boddupally80% (5)

- XYZprint User Manual en V1 1003Documento25 pagineXYZprint User Manual en V1 1003reza rizaldiNessuna valutazione finora

- Aesa Based Pechay Production - AbdulwahidDocumento17 pagineAesa Based Pechay Production - AbdulwahidAnne Xx100% (1)

- PT4115EDocumento18 paginePT4115Edragom2Nessuna valutazione finora

- WD 02Documento1 paginaWD 02Elezer BatchoNessuna valutazione finora

- Unit 3 InfiltrationDocumento5 pagineUnit 3 InfiltrationHRIDYA MGNessuna valutazione finora

- EndressHauser HART CommunicatorDocumento1 paginaEndressHauser HART CommunicatorGhafur AgusNessuna valutazione finora

- Theory of Earth's Magnetism and It's Relation ToDocumento15 pagineTheory of Earth's Magnetism and It's Relation ToMaster Irvin100% (1)

- The Hollow Boy Excerpt PDFDocumento52 pagineThe Hollow Boy Excerpt PDFCathy Mars100% (1)