Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating Statement

Caricato da

Pravin Namokar100%(1)Il 100% ha trovato utile questo documento (1 voto)

263 visualizzazioni16 paginehi

Titolo originale

6909761-CMA-Format

Copyright

© © All Rights Reserved

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentohi

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

263 visualizzazioni16 pagineICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating Statement

Caricato da

Pravin Namokarhi

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 16

ICICI Banking Corporation Ltd.

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS

FORM II - OPERATING STATEMENT

Name:

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited accounts) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

1. Gross Sales

i. Domestic Sales

ii. Export Sales

Total

2. Less Excise Duty

3. Net Sales (1 - 2)

4. % age rise (+) or fall (-) in net sales

as compared to previous year (annualised ) N/A N/A N/A N/A

5. Cost of Sales

i. Raw materials (including stores and

other items used in the process of

manufacture)

a. Imported

b. Indigenous

ii. Other Spares

a. Imported

b. Indigenous

iii. Power and Fuel

iv. Direct Labour (Factory wages & salaries)

v. Other manufacturing expenses

vi. Depreciation

vii. Sub-total (i to vi)

viii. Add: Opening Stock-in-process

Sub-total (vii + viii)

ix. Deduct: Closing Stock-in-process

x. Cost of Production

6/2/2014 231998868.xls.ms_office (Form-II) Page 1

ICICI Banking Corporation Ltd.

xi. Add: Opening Stock of finished goods

Sub-total (x + xi)

xii. Deduct: Closing Stock of finished goods

xiii. Sub-total (Total Cost of Sales)

6. Selling, general and administrative expenses

7. Sub-total (5 + 6)

8. Operating Profit before Interest (3 - 7)

9. Interest

10. Operating Profit after Interest (8 - 9)

11. i. Add: Other non-operating Income

a.

b.

c.

d.

Sub-total (Income)

ii. Deduct: Other non-operating expenses

a.

b.

c.

d.

Sub-total (Expenses)

iii. Net of other non-operating income /

expenses [net of 11(i) & 11(ii)]

12. Profit before tax/loss [10 + 11(iii)]

13. Provision for taxes

14. Net Profit / Loss (12 -13)

15. a. Equity dividend paid-amount

(Already paid + B.S. provision)

b. Dividend Rate (% age)

16. Retained Profit (14 - 15)

17. Retained Profit / Net Profit (% age)

6/2/2014 231998868.xls.ms_office (Form-II) Page 2

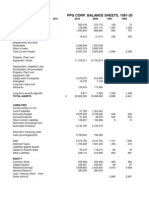

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET

LIABILITIES

Name:

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited BS) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

CURRENT LIABILITIES

1. Short-term borrowing from banks (including

bills purchased, discounted & excess

borrowing placed on repayment basis)

i. From applicant bank

ii. From other banks

iii. (of which BP & BD)

Sub-total [i + ii] (A)

2. Short term borrowings from others

3. Sundry Creditors (Trade)

4. Advance payments from customers /

deposits from dealers

5. Provision for taxation

6. Dividend payable

7. Other statutory liabilities (due within 1 year)

8. Deposits / instalments of term loans /

DPGs / debentures etc. (due within 1 year)

9. Other current liabilities & provisions

(due within 1 year) - specify major items

a.

b.

c.

d.

Sub total [2 to 9] (B)

10. Total current liabilities [A + B]

6/2/2014 231998868.xls.ms_office (Form-III) Page 3

ICICI Banking Corporation Ltd.

TERM LIABILITIES

11. Debentures (not maturing within 1 year)

12. Preference Shares (redeemable after 1 year)

13. Term loans (excluding instalments

payable within 1 year)

14. Deferred Payment Credits (excluding

instalments due within 1 year)

15. Term deposits (repayable after 1 year)

16. Other term liabilities

17. Total Term Liabilities [11 to 16]

18. Total Outside Liabilities [10 + 17]

NET WORTH

19. Ordinary Share Capital

20. General Reserve

21. Revaluation Reserve

22. Other Reserves (excluding Provisions)

23. Surplus (+) or deficit (-) in Profit & Loss a/c

23. a. Others

Share Premium

Capital Redemption Reserve

24. Net Worth

25. TOTAL LIABILITIES [18 + 24]

6/2/2014 231998868.xls.ms_office (Form-III) Page 4

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET (Continued)

ASSETS

Name:

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited BS) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

CURRENT ASSETS

26. Cash and Bank Balances

27. Investments (other than long term)

i. Govt. and other trustee securities

ii. Fixed Deposits with banks

28. i. Receivables other than deferred &

exports (incldg. bills purchased and

discounted by banks)

ii. Export receivables (incldg. bills

purchased/discounted by banks)

29. Instalments of deferred receivables

(due within 1 year)

30. Inventory:

i. Raw materials (including stores and

other items used in the process of

manufacture)

a. Imported

b. Indigenous

ii. Stocks-in-process

iii. Finished goods

iv. Other consumable spares

a. Imported

b. Indigenous

31. Advances to suppliers of raw materials

and stores/spares

32. Advance payment of taxes

33. Other current assets (specify major items)

a. Interest Receivable

b. Prepaid Expenses

c. Loans and Advances

d.

34. Total Current Assets (26 to 33)

6/2/2014 231998868.xls.ms_office (Form-III) Page 5

ICICI Banking Corporation Ltd.

FIXED ASSETS

35. Gross Block (land, building, machinery,

work-in-progress)

36. Depreciation to date

37. Net Block (35 - 36)

OTHER NON-CURRENT ASSETS

38. Investments/book debts/advances/deposits

which are not current assets

i. a. Investments in subsidiary

companies / affiliates

b. Others

ii. Advances to suppliers of capital goods

and contractors

iii. Deferred receivables (maturity

exceeding 1 year)

iv. Others

a. Security Deposits

b. Loans to Subsidiaries

c. Receivables over 6 months

d.

39. Non-consumable stores and spares

40. Other non-current assets including

dues from directors

41. Total Other Non-current Assets (38 to 40)

42. Intangible Assets (patents, good will,

prelim.expenses, bad / doubtful debts not

provided for, etc.

43. Total Assets (34+37+41+42)

44. Tangible Net Worth (24 - 42)

45. Net Working Capital (34 - 10)

46. Current Ratio (34 / 10)

47. Total OUTSIDE Liabilities / Tangible

Net Worth (18 / 44)

48. Total TERM Liabilities / Tangible

Net Worth (17 / 44)

ADDITIONAL INFORMATION

A. Arrears of depreciation

B. Contingent Liabilities:

i. Arrears of cumulative dividends

ii. Gratuity liability not provided for

iii. Disputed excise / customs /

tax liabilities

iv. Other liabilities not provided for

6/2/2014 231998868.xls.ms_office (Form-III) Page 6

ICICI Banking Corporation Ltd.

FORM IV

COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES

Name:

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

Norms Actuals Estimates Projections Requirement

Year 2000 2001 2002

A. CURRENT ASSETS

1. Raw materials (incl. stores & other items

used in the process of manufacture)

a. Imported

Month's Consumption

b. Indigenous

Month's Consumption

2. Other Consumable spares, excluding

those included in 1 above

a. Imported

Month's Consumption

b. Indigenous

Month's Consumption

3. Stock-in-process

Month's cost of production

4. Finished goods

Month's cost of sales

5. Receivables other than export & deferred

receivables (incl. bills purchased &

discounted by bankers)

Month's domestic sales: excluding

deferred payment sales

6. Export receivables (incl. bills purchased

and discounted)

Month's export sales

7. Advances to suppliers of raw materials &

stores / spares, consumables

8. Other current assets incl. cash & bank

balances & deferred receivables due

within one year

Cash and Bank Balances

Investments (other than long term):

i. Govt. and other trustee securities

ii. Fixed Deposits with banks

Instalments of deferred receivables

(due within 1 year)

Advance payment of taxes

Other current assets

9. Total Current Assets

(To agree with item 34 in Form III)

6/2/2014 231998868.xls.ms_office (Form-IV) Page 7

ICICI Banking Corporation Ltd.

FORM IV

COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES

Name:

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

Norms Actuals Estimates Projections Requirement

Year 2000 2001 2002

B. CURRENT LIABILITIES

(Other than bank borrowings for working capital)

10. Creditors for purchase of raw materials,

stores & consumable spares

Month's purchases

11. Advances from customers

12. Statutory liabilities

13. Other current liabilities:

Short term borrowings from others

Provision for taxation

Dividend payable

Deposits / instalments of term loans / DPGs

/ debentures etc. (due within 1 year)

Other current liabilities & provisions

(due within 1 year)

14. Total (To agree with total B of Form-III)

6/2/2014 231998868.xls.ms_office (Form-IV) Page 8

I C I C I Banking Corporation Ltd.

FORM V

COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL

Name:

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

First Method of Lending Actuals Estimates Projections Requirement

Year 2000 2001 2002

1. Total Current Assets (Form-IV-9)

2. Other Current Liabilities (other than

bank borrowings (Form-IV-14)

3. Working Capital Gap (WCG) (1-2)

4. Min. stipulated net working capital:

(25% of WCG excluding export receivables)

5. Actual / Projected net working capital

(Form-III-45)

6. Item-3 minus Item-4

7. Item-3 minus Item-5

8. Max. permissible bank finance

(item-6 or 7, whichever is lower)

9. Excess borrowings representing

shortfall in NWC (4 - 5)

Second Method of Lending

1. Total Current Assets (Form-IV-9)

2. Other Current Liabilities (other than

bank borrowings (Form-IV-14)

3. Working Capital Gap (WCG) (1-2)

4. Min. stipulated net working capital:

(25% of total Current Assets excluding

export receivables)

5. Actual / Projected net working capital

(Form-III-45)

6. Item-3 minus Item-4

7. Item-3 minus Item-5

8. Max. permissible bank finance

(item-6 or 7, whichever is lower)

9. Excess borrowings representing

shortfall in NWC (4 - 5)

6/2/2014 231998868.xls.ms_office (Form-V) Page 9

ICICI Banking Corporation Ltd.

FORM VI

FUNDS FLOW STATEMENT

Name:

Amounts in Rs. Crore

Last Year Current Yr. Next Year

Actuals Estimates Projections

Year 2000 2001 2002

1. SOURCES

a. Net Profit

b. Depreciation

c. Increase in Capital

d. Increase in Term Liabilities

(including Public Deposits)

e. Decrease in

i. Fixed Assets

ii. Other non-current Assets

f. Others

g. TOTAL

2. USES

a. Net loss

b. Decrease in Term Liabilities

(including Public Deposits)

c. Increase in

i. Fixed Assets

ii. Other non-current Assets

d. Dividend Payments

e. Others

f. TOTAL

3. Long Term Surplus (+) / Deficit (-) [1-2]

6/2/2014 231998868.xls.ms_office (Form-VI) Page 10

ICICI Banking Corporation Ltd.

4. Increase/decrease in current assets

* (as per details given below)

5. Increase/decrease in current liabilities

other than bank borrowings

6. Increase/decrease in working capital gap

7. Net Surplus / Deficit (-) [3-6]

8. Increase/decrease in bank borrowings

9. Increase/decrease in NET SALES N/A

* Break up of item-4

i. Increase/decrease in Raw Materials

ii. Increase/decrease in Stocks-in-Process

iii. Increase/decrease in Finished Goods

iv. Increase/decrease in Receivables

a) Domestic

b) Export

v. Increase/decrease in Stores & Spares

vi. Increase/decrease in other current assets

TOTAL

6/2/2014 231998868.xls.ms_office (Form-VI) Page 11

I C I C I Banking Corporation Ltd.

Key Indicators

1999 2000 2001 2002

Actual Actual Estimate Projection

1 Net Sales

2 P B I L D T

3 P B T

4 P A T

5 Net Cash Accruals

6 P B I L D T/ Net Sales (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

7 PAT/ Net Sales (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

8 Dividend/PAT (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

9 Gross Block

10 Net Block

11 Paid up Capital

12 Tangible Networth (TNW)

13 Group Invetsments

14 Adjusted T N W

15 L T D / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

16 D F S / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

17 T O L / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

18 Current Assets

19 Current Liabilities

20 Net Working Capital

21 Current Ratio

Other Indicators

22 R O C E (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

23 Interest Coverage Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0!

24 #DIV/0! #DIV/0! #DIV/0!

Fund Flow Analysis

2000 2001 2002

#DIV/0! #DIV/0! #DIV/0! Surplus / Incremental build up of current assets (%)

For year ended / ending

September 30,

S. No

Long Term Sources

Long Term uses

DSCR

Surplus/Deficit

Year Ended / Ending September 30,

6/2/2014 231998868.xls.ms_office (Financials) Page 12

I C I C I Banking Corporation Ltd.

Pattern of TCA Funding

1999 2000 2001 2002

Sundry Creditors #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Other Current Liabilities #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Bank Borrowings #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Long Term funds #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Year ended / Ending 30 September

6/2/2014 231998868.xls.ms_office (Financials) Page 13

I C I C I Banking Corporation Limited

(Rs in crore)

2001 5% inc 5% dec 2002 5% inc 5% dec 1999 2000 2001 2002

Net Sales - - - - - - Actuals Actuals Estimates Projections

Variable Cost* - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! RM / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Spares / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Contribution - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! P & F / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Fixed Costs** - - - - - - Labour / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

SGA / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Operating Profit - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! OME / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Operating

Profit/Sales

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total (Excl Dep) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! Operating Margin #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Change in SIP / Net

Sales

Change in FG/ Net

Sales

Break Even Sales

Depreciation / Net

Sales

Sensitivity Ananlysis

Trend Analysis of Components of Cost of Sales

* RM, Packing material, Consumable stores & spares, stock adj and other mfg expenses

**Power & fuel, Direct labour, Depreciation, SGA and Interest

Cash Breakeven

6/2/2014 231998868.xls.ms_office (Sensitivity & costing) Page 14

I C I C I Banking Corporation Limited

5% - 0% - 5% - 10% - 0% - 10% -

0% - 5% - 5% - 0% - 10% - 10% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

20% - 0% - 20% - -5% - 0% - -5% -

0% - 20% - 20% - 0% - -5% - -5% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

-10% - 0% - -10% - -20% - 0% - -20% -

0% - -10% - -10% - 0% - -20% - -20% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

SCENARIOS FOR OPERATIONS FOR FY ENDING 30/9/2001

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6

Scenario 9 Scenario 10

Change In Net Sales

Change In Variable costs

P B I L D T

P B T

P B I L D T

P B T

Scenario 13 Scenario 14

Scenario 11 Scenario 12

Change In Net Sales

Change In Variable costs

Scenario 7 Scenario 8

Change In Net Sales

Change In Variable costs

P B I L D T

P B T

Scenario 15 Scenario 16 Scenario 17 Scenario 18

6/2/2014 231998868.xls.ms_office (Sensitivity & costing) Page 15

I C I C I Banking Corporation Limited

5% - 0% - 5% - 10% - 0% - 10% -

0% - 5% - 5% - 0% - 10% - 10% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

20% - 0% - 20% - -5% - 0% - -5% -

0% - 20% - 20% - 0% - -5% - -5% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

-10% - 0% - -10% - -20% - 0% - -20% -

0% - -10% - -10% - 0% - -20% - -20% -

Contribution - - - - - -

- - - - - -

- - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Scenario 6

Change In Net Sales

Change In Variable costs

P B I L D T

P B T

SCENARIOS FOR OPERATIONS FOR FY ENDING 30/9/2002

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5

Scenario 11 Scenario 12

Change In Net Sales

Change In Variable costs

Scenario 7 Scenario 8 Scenario 9 Scenario 10

Scenario 17 Scenario 18

P B I L D T

P B T

Scenario 13 Scenario 14

Change In Net Sales

Change In Variable costs

P B I L D T

P B T

Scenario 15 Scenario 16

6/2/2014 231998868.xls.ms_office (Sensitivity & costing) Page 16

Potrebbero piacerti anche

- Handout # 1 Solutions (L)Documento10 pagineHandout # 1 Solutions (L)Prabhawati prasadNessuna valutazione finora

- Q1. What Are The Organizational and Operational Issues That Underlie The Problems Facing BPS?Documento5 pagineQ1. What Are The Organizational and Operational Issues That Underlie The Problems Facing BPS?Munsif JavedNessuna valutazione finora

- Group 5 FLASHION v.23Documento6 pagineGroup 5 FLASHION v.23Zero MustafNessuna valutazione finora

- T8 RevivalDocumento6 pagineT8 RevivalSumit AggarwalNessuna valutazione finora

- Presented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulDocumento13 paginePresented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulBhanu NirwanNessuna valutazione finora

- Kim FullerDocumento3 pagineKim FullerVinay GoyalNessuna valutazione finora

- Valuation of HDFCDocumento21 pagineValuation of HDFCG Nagarajan0% (1)

- PGP I 2021 Fra Quiz 1Documento3 paginePGP I 2021 Fra Quiz 1Pulkit SethiaNessuna valutazione finora

- Online Marketing at Big Skinny: Submitted by Group - 6Documento2 pagineOnline Marketing at Big Skinny: Submitted by Group - 6Saumadeep GuharayNessuna valutazione finora

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocumento7 pagineModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNessuna valutazione finora

- Waltham Oil Solution Journal EntriesDocumento4 pagineWaltham Oil Solution Journal EntriesVinayak SinglaNessuna valutazione finora

- Vayutel Case StudyDocumento10 pagineVayutel Case StudyRenault RoorkeeNessuna valutazione finora

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocumento14 pagineAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNessuna valutazione finora

- Assignment 3Documento1 paginaAssignment 3p11Nessuna valutazione finora

- Alpha CorporationDocumento8 pagineAlpha CorporationBharat NarulaNessuna valutazione finora

- WorldCom Bond IssuanceDocumento9 pagineWorldCom Bond IssuanceAniket DubeyNessuna valutazione finora

- Marriott CaseDocumento1 paginaMarriott CasejenniferNessuna valutazione finora

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDocumento5 pagineEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNessuna valutazione finora

- Q1. How Did The Understanding of Customer Behavior Help With Its Marketing Strategy?Documento3 pagineQ1. How Did The Understanding of Customer Behavior Help With Its Marketing Strategy?Pulkit LalwaniNessuna valutazione finora

- 83592481 (1)Documento3 pagine83592481 (1)MedhaNessuna valutazione finora

- Jakson Evolution of A Brand - Section A - Group 10Documento4 pagineJakson Evolution of A Brand - Section A - Group 10RAVI RAJNessuna valutazione finora

- Problem Set 1 PDFDocumento3 pagineProblem Set 1 PDFrenjith0% (2)

- Vertical Analysis For Att and VerizonDocumento4 pagineVertical Analysis For Att and Verizonapi-299644289Nessuna valutazione finora

- Ultratech JaypeeDocumento8 pagineUltratech JaypeeDeepak Badlani0% (1)

- Artificial Intelligence & Marketing: Anujk@iima - Ac.inDocumento6 pagineArtificial Intelligence & Marketing: Anujk@iima - Ac.inKartik MittalNessuna valutazione finora

- InductionDocumento2 pagineInductionNeeta NainaniNessuna valutazione finora

- Eureka Forbes DM Case StudyDocumento32 pagineEureka Forbes DM Case StudyNiks Nikhil SharmaNessuna valutazione finora

- Cash Budget - QuesDocumento3 pagineCash Budget - QuesSaima EliteNessuna valutazione finora

- Surendar Pal CaseDocumento2 pagineSurendar Pal CaseSKBNessuna valutazione finora

- COVID-19 R M&A TransactionsDocumento3 pagineCOVID-19 R M&A TransactionsrdiazeplaNessuna valutazione finora

- Sec-A - Group 8 - SecureNowDocumento7 pagineSec-A - Group 8 - SecureNowPuneet GargNessuna valutazione finora

- Financial Modelling AssignmentDocumento6 pagineFinancial Modelling AssignmentMomin AbrarNessuna valutazione finora

- Team No. 11 Section 3 NAB - THE PLANNING TEMPLATEDocumento11 pagineTeam No. 11 Section 3 NAB - THE PLANNING TEMPLATEPRAVESH TRIPATHINessuna valutazione finora

- Case Analysis: Prithvi ElectricalsDocumento4 pagineCase Analysis: Prithvi ElectricalsOishik BanerjiNessuna valutazione finora

- Case-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Documento6 pagineCase-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Anirban KarNessuna valutazione finora

- FMCG Gyaan and Then Some - Calculating Dealer ROI PDFDocumento6 pagineFMCG Gyaan and Then Some - Calculating Dealer ROI PDFAmit Maheshwari100% (1)

- Competing On Customer JourneysDocumento10 pagineCompeting On Customer JourneysBhupesh NegiNessuna valutazione finora

- Termination Case Study Presentation Group6Documento10 pagineTermination Case Study Presentation Group6KrishnanandShenaiNessuna valutazione finora

- Impairing The Microsoft - Nokia PairingDocumento54 pagineImpairing The Microsoft - Nokia Pairingjk kumarNessuna valutazione finora

- Assessment 3 (Dominos Case Study)Documento5 pagineAssessment 3 (Dominos Case Study)RishabNessuna valutazione finora

- DCF Valuation Sheet For CiplaDocumento114 pagineDCF Valuation Sheet For CiplaGourav BansalNessuna valutazione finora

- MIS IndividualAssignment1 Case LNT BBBYDocumento2 pagineMIS IndividualAssignment1 Case LNT BBBYPriyank Acharya0% (1)

- Identify The IndustriesDocumento11 pagineIdentify The Industrieslouiegoods2450% (2)

- Ludhiana City Bus Service-Muhammad Rafeeq-MBA-12577Documento4 pagineLudhiana City Bus Service-Muhammad Rafeeq-MBA-12577Muhammad Rafeeq100% (1)

- ZS Associates Cover LetterDocumento1 paginaZS Associates Cover LetterAnkit Agrawal100% (1)

- Dabur IndiaDocumento37 pagineDabur IndiaBandaru NarendrababuNessuna valutazione finora

- BM Session Brand Value ChainDocumento27 pagineBM Session Brand Value ChainPadmanabhan Ns100% (1)

- Sample Question Paper On Operations ManagementDocumento12 pagineSample Question Paper On Operations ManagementD Astable50% (2)

- Spencer Tire PurchaseDocumento28 pagineSpencer Tire PurchaseJitendra Choudhary0% (2)

- Syndicate 2-Industry 4.0Documento11 pagineSyndicate 2-Industry 4.0Dina Rizkia RachmahNessuna valutazione finora

- Workshop 3Documento7 pagineWorkshop 3freweight100% (1)

- Balancesheet As On 31st May 2012 Liabilities Rs Assets RsDocumento3 pagineBalancesheet As On 31st May 2012 Liabilities Rs Assets Rsrahul.iamNessuna valutazione finora

- Turnkey Case StudyDocumento20 pagineTurnkey Case Studyharsh kumarNessuna valutazione finora

- MKT1 DHM2Documento9 pagineMKT1 DHM2bala sanchitNessuna valutazione finora

- Projectonindianautomotiveindustry and Case Study of Tata MotorsDocumento26 pagineProjectonindianautomotiveindustry and Case Study of Tata MotorsMukesh Manwani100% (1)

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento16 pagineICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraNessuna valutazione finora

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento12 pagineAssessment of Working Capital Requirements Form Ii - Operating Statementsluniya88Nessuna valutazione finora

- Year No - of MonthsDocumento84 pagineYear No - of MonthsMatrudutta DasNessuna valutazione finora

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsDocumento20 pagineAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsAnuj NijhonNessuna valutazione finora

- CMA DataDocumento35 pagineCMA Dataashishy99Nessuna valutazione finora

- Pravin Betala: Pankaj GrantiesDocumento2 paginePravin Betala: Pankaj GrantiesPravin NamokarNessuna valutazione finora

- Second UDocumento1 paginaSecond UPravin NamokarNessuna valutazione finora

- Upload UDocumento1 paginaUpload UPravin NamokarNessuna valutazione finora

- We Need To Have List of Publicity and Media Marketing Like Paper, Internet, Rickshaw, Hoardings, Radio, Online Etc List of Credai List of BrokersDocumento1 paginaWe Need To Have List of Publicity and Media Marketing Like Paper, Internet, Rickshaw, Hoardings, Radio, Online Etc List of Credai List of BrokersPravin NamokarNessuna valutazione finora

- DEDS - Office Circular - 16-17 PDFDocumento33 pagineDEDS - Office Circular - 16-17 PDFPravin NamokarNessuna valutazione finora

- We Need To Have List of Publicity and Media Marketing Like Paper, Internet, Rickshaw, Hoardings, Radio, Online Etc List of Credai List of BrokersDocumento1 paginaWe Need To Have List of Publicity and Media Marketing Like Paper, Internet, Rickshaw, Hoardings, Radio, Online Etc List of Credai List of BrokersPravin NamokarNessuna valutazione finora

- Best Photo Frame at Home Lucky One Get Antiques From MumbaiDocumento1 paginaBest Photo Frame at Home Lucky One Get Antiques From MumbaiPravin NamokarNessuna valutazione finora

- Akhil Bhartiya Terapanth Yuvak Parishad: Theme For 5 JuneDocumento2 pagineAkhil Bhartiya Terapanth Yuvak Parishad: Theme For 5 JunePravin NamokarNessuna valutazione finora

- Louw 3Documento27 pagineLouw 3ZeabMariaNessuna valutazione finora

- South Asia TechDocumento6 pagineSouth Asia TechA M FaisalNessuna valutazione finora

- 7th CPC Pay Matrix Table For Central Government EmployeesDocumento8 pagine7th CPC Pay Matrix Table For Central Government EmployeesChellappa Gangadhar KNessuna valutazione finora

- Etf Playbook 1Documento12 pagineEtf Playbook 1langlinglung1985Nessuna valutazione finora

- Maria Hernandez and AssociatesDocumento9 pagineMaria Hernandez and Associatesvineet383Nessuna valutazione finora

- Eliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick ForumDocumento122 pagineEliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick Forumbruce1976@hotmail.comNessuna valutazione finora

- Birla Power Industry AnalysisDocumento11 pagineBirla Power Industry Analysissandysandy11Nessuna valutazione finora

- Leasing ProblemsDocumento11 pagineLeasing ProblemsAbhishek AbhiNessuna valutazione finora

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Documento39 pagineBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNessuna valutazione finora

- Number of Barangays City Household Population Household NumberDocumento40 pagineNumber of Barangays City Household Population Household NumberIvan Jon FerriolNessuna valutazione finora

- Accounting PrinciplesDocumento6 pagineAccounting Principlesmohamed rahilNessuna valutazione finora

- Commerzbank AG: Issuer Rating ReportDocumento12 pagineCommerzbank AG: Issuer Rating ReportvaishnaviNessuna valutazione finora

- Questionnaire For 2018 Tax Returns: Worksheets AvailableDocumento7 pagineQuestionnaire For 2018 Tax Returns: Worksheets Availableparesh shiralNessuna valutazione finora

- Special Purpose Vehicle (SPV)Documento10 pagineSpecial Purpose Vehicle (SPV)Daksh TayalNessuna valutazione finora

- LifeInsRetirementValuation M05 LifeValuation 181205Documento83 pagineLifeInsRetirementValuation M05 LifeValuation 181205Jeff JonesNessuna valutazione finora

- Week 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Documento18 pagineWeek 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Alleona EmbolodeNessuna valutazione finora

- Dodd Frank CertificationDocumento1 paginaDodd Frank CertificationTara IsmineNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviNessuna valutazione finora

- Statement 1688358203630Documento3 pagineStatement 1688358203630Chinmay RajNessuna valutazione finora

- Tax 2. QuizDocumento2 pagineTax 2. QuizCara SantosNessuna valutazione finora

- Credit RatingDocumento24 pagineCredit RatingpsnithyaNessuna valutazione finora

- Year Project A Project B: Total PV NPVDocumento19 pagineYear Project A Project B: Total PV NPVChin EENessuna valutazione finora

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDocumento28 pagineYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNessuna valutazione finora

- Winter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"Documento79 pagineWinter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"ShubhampratapsNessuna valutazione finora

- Gabriel A.D. Preireich - The Nature of Dividends, 1934Documento248 pagineGabriel A.D. Preireich - The Nature of Dividends, 1934Pedro GamaNessuna valutazione finora

- Investment Decision RulesDocumento14 pagineInvestment Decision RulesprashantgoruleNessuna valutazione finora

- Soneri Bank Internship+ (Marketing)Documento66 pagineSoneri Bank Internship+ (Marketing)qaisranisahibNessuna valutazione finora

- Modern BankingDocumento15 pagineModern BankingRavi ChavdaNessuna valutazione finora

- Man307 2017 18 Final Exam Questions SiUTDocumento4 pagineMan307 2017 18 Final Exam Questions SiUTKinNessuna valutazione finora

- MARSHALL 3RD BOOK - Tragics MistakesDocumento55 pagineMARSHALL 3RD BOOK - Tragics MistakesChris Pearson100% (3)