Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Pensford Letter - 6.2.14

Caricato da

Pensford FinancialCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Pensford Letter - 6.2.14

Caricato da

Pensford FinancialCopyright:

Formati disponibili

Leveling the Playing Field June 2, 2014

_______________________________________________________________________

Do they make photoshop for newsletters? Im on a nasty streak over the last month,

repeatedly expecting the short squeeze on rates to run its course and for rates to finally

start heading back upand I am repeatedly proven wrong

In last weeks newsletter with the 10T at 2.54%, I said I thought the rally had stalled and

wouldnt be surprised to see it close at 2.60%. It closed Friday at 2.48%. Ugh.

Q1 GDP contracted 1.0%, largely attributable to the brutal winter and an inventory

correction, but that was already priced into expectations. Most economists still expect a

large correction in Q2 GDP that would put us on track for 2014 GDP of about 2.0%.

Perhaps the issue here is that the Fed itself has been forecasting 2014 GDP at 2.9%,

which is keeping with the central banks tradition of being overly optimistic in just about

every regard.

The Feds preferred measure of inflation is the core personal consumption

expenditures, or core PCE. Sticking the word core means it excludes volatile food and

energy pricesbecause who needs to pay for those? The idea is that it excludes prices

that can be influenced by futures markets so that short term market volatility doesnt

dictate Fed policy.

Core PCE came in at 1.4%, up quite a bit from last months 1.1%. Headline PCE came in

at 1.6%, up considerably from last months 1.2%. In other words, inflation just moved

sharply towards the Feds long term target of 2.0%.

While this may pull forward expectations for the first rate hike, we wouldnt overreact to

this number. The Fed is looking for long term inflation of 2.0% as a desired target, not

necessarily the trigger to begin hiking rates. With rates being so low for so long, we

would expect the Fed to be comfortable with inflation readings north of 2.0% before they

actually begin hiking. Without upward pressure on wages (wage expectations remain

near all-time lows), its challenging for inflation to really take off. Long term inflation of

2.0% is probably a 2016 event, not a 2015 event.

One wild card here is the changing composition of the voting members of the FOMC.

Loretta Mester replaces Sandra Pianalto today and brings a much more hawkish view. In

fact, her speech on Friday sent several hawkish signals, including a concern that current

inflation measures may paint a more benign view of recent inflation, suggesting that

readings are understating the inflation. If thats the case, then a hike may come sooner

than expected.

ECB Decision Thursday June 5

Rarely are the job reports relegated to the undercard, but this weeks headliner will be

Thursdays ECB meeting. Eurozone inflation is forecasted at 0.7%, which is below

Draghis 1.0% danger zone. Markets fully expect a bold move from the ECB,

including cuts across the board on interest rates and taking the deposit rate negative,

effectively charging banks for keeping deposits at the central bank. The intent here it to

encourage banks to lend out money rather than sitting on it as Eurozone business loans

are down 3% over the last year.

Draghi is setting the stage for Bernanke-style QE later this year by initiating an ABS

purchase facility now. Remember central banks are cartels and serve banks, not us.

Draghi is likely going to facilitate the purchase of quasi-toxic assets from banks so they

can start recording profit.

The near term risk is that Draghis announcement is viewed as too timid, but we view

that as highly unlikely as the ECB has done nothing to squelch the market consensus

leading into this meeting.

Job Reports

Last months report of 288k gain looked strong on the surface, but rates actually declined

after traders read the details. Part of that spike was probably attributable to the late

Easter. We think Fridays report will likely come in around the long-term trend of 200k

new hires last month. The unemployment rate would probably tick down to 6.2%.

This should be another volatile week and so I will just refrain from making any more

predictions on rates that will backfire.

Generally, this material is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of

any financial instrument or as an official confirmation of any transaction. Your receipt of this material does not create a client

relationship with us and we are not acting as fiduciary or advisory capacity to you by providing the information herein. All market

prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. This

material may contain information that is privileged, confidential, legally privileged, and/or exempt from disclosure under applicable

law. Though the information herein may discuss certain legal and tax aspects of financial instruments, Pensford Financial Group,

LLC does not provide legal or tax advice. The contents herein are the copyright material of Pensford Financial Group, LLC and shall

not be copied, reproduced, or redistributed without the express written permission of Pensford Financial Group, LLC.

Economic Data

Day Time Report Forecast Previous

Monday 10:00AM ISM Manufacturing 55.5 54.9

10:00AM ISM Prices Paid 57.0 56.5

10:00AM Construction Spending (MoM) 0.6% 0.2%

Tuesday 9:45AM ISM New York 50.6

10:00AM Factory Orders 0.5% 1.1%

10:00AM IBD/TIPP Economic Optimism 46.5 45.8

Wednesday 7:00AM MBA Mortgage Applications -1.2%

8:15AM ADP Employment Change 210k 220k

8:30AM Trade Balance -$40.6B -$40.4B

8:30AM Nonfarm Productivity -2.9% -1.7%

8:30AM Unit Labor Costs 5.0% 4.2%

10:00AM ISM Non-manufacturing Composite 55.5 55.2

Thursday 8:30AM Initial Jobless Claims 310k 300k

8:30AM Continuing Claims 2623k 2631k

Friday 8:30AM Change in Nonfarm Payrolls 218k 288k

8:30AM Change in Private Payrolls 210k 273k

8:30AM Unemployment Rate 6.4% 6.3%

8:30AM Underemployment Rate (U6) 12.3%

8:30AM Avg Weekly Hours All Employees 34.5 34.5

3:00PM Consumer Credit $15.000B $17.529B

Speeches and Events

Day Time Place

Monday 3:00AM Fed's Evans speaks on Monetary Policy Istanbul

Tuesday 1:50PM Fed's George speaks on US Economy Breckenridge, CO

Wednesday 2:00PM Fed releases Beige Book

Thursday 1:30PM Fed's Kocherlakota speaks on Interest Rates Boston, MA

Treasury Auctions

Day Time Size

Report

Report

Potrebbero piacerti anche

- The Pensford Letter - 4.21.14Documento3 pagineThe Pensford Letter - 4.21.14Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 6.24.13Documento3 pagineThe Pensford Letter - 6.24.13Pensford FinancialNessuna valutazione finora

- FOMCpresconf 20230503Documento25 pagineFOMCpresconf 20230503Edi SaputraNessuna valutazione finora

- Fed Doves No Longer Rule The Roost: Economic and Financial AnalysisDocumento5 pagineFed Doves No Longer Rule The Roost: Economic and Financial AnalysisOwm Close CorporationNessuna valutazione finora

- March 22, 2023 - Fed Chair Prepared RemarksDocumento5 pagineMarch 22, 2023 - Fed Chair Prepared RemarksRam AhluwaliaNessuna valutazione finora

- The Pensford Letter - 12.8.14Documento4 pagineThe Pensford Letter - 12.8.14Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field October 21, 2013Documento4 pagineLeveling The Playing Field October 21, 2013Pensford FinancialNessuna valutazione finora

- Jerome Powell's Written TestimonyDocumento5 pagineJerome Powell's Written TestimonyTim MooreNessuna valutazione finora

- Christopher WallerDocumento29 pagineChristopher WallerTim MooreNessuna valutazione finora

- FOMCpresconf20230503 PDFDocumento4 pagineFOMCpresconf20230503 PDFJavierNessuna valutazione finora

- The Pensford Letter - 7.14.14Documento4 pagineThe Pensford Letter - 7.14.14Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 06.01.2015Documento4 pagineThe Pensford Letter - 06.01.2015Pensford FinancialNessuna valutazione finora

- The World Overall 04:12 - Week in ReviewDocumento6 pagineThe World Overall 04:12 - Week in ReviewAndrei Alexander WogenNessuna valutazione finora

- Is Qe4 Really ComingDocumento1 paginaIs Qe4 Really ComingDavid S ChenNessuna valutazione finora

- Weekly Economic Commentary: CH - CH - CH - Changes Time To Focus On The Fed's ForecastsDocumento5 pagineWeekly Economic Commentary: CH - CH - CH - Changes Time To Focus On The Fed's ForecastsKaren RogersNessuna valutazione finora

- The Pensford Letter - 5.6.13Documento4 pagineThe Pensford Letter - 5.6.13Pensford FinancialNessuna valutazione finora

- Yellen HHDocumento7 pagineYellen HHZerohedgeNessuna valutazione finora

- Unconventional Wisdom. Original Thinking.: Bulletin BoardDocumento12 pagineUnconventional Wisdom. Original Thinking.: Bulletin BoardCurve123Nessuna valutazione finora

- Fomc Pres Conf 20230614Documento26 pagineFomc Pres Conf 20230614LAKHAN TRIVEDINessuna valutazione finora

- The Pensford Letter - 7.9.12Documento5 pagineThe Pensford Letter - 7.9.12Pensford FinancialNessuna valutazione finora

- Weekly Economic Commentary: Taper, No Taper, or Somewhere in Between?Documento5 pagineWeekly Economic Commentary: Taper, No Taper, or Somewhere in Between?monarchadvisorygroupNessuna valutazione finora

- FOMCpresconf 20220615Documento27 pagineFOMCpresconf 20220615S CNessuna valutazione finora

- MFM Jun 17 2011Documento13 pagineMFM Jun 17 2011timurrsNessuna valutazione finora

- Bond Market Perspectives 03172015Documento4 pagineBond Market Perspectives 03172015dpbasicNessuna valutazione finora

- The World Overall 05:24 - Week in ReviewDocumento6 pagineThe World Overall 05:24 - Week in ReviewAndrei Alexander WogenNessuna valutazione finora

- The Pensford Letter - 4.30.12 v3Documento5 pagineThe Pensford Letter - 4.30.12 v3Pensford FinancialNessuna valutazione finora

- FOMCpresconf 20230614Documento5 pagineFOMCpresconf 20230614Jhony SmithYTNessuna valutazione finora

- The Market's Shocking Shock at The Fed's Non-Taper Shock: Economic ResearchDocumento9 pagineThe Market's Shocking Shock at The Fed's Non-Taper Shock: Economic Researchapi-227433089Nessuna valutazione finora

- Fomc Pres Conf 20141217Documento23 pagineFomc Pres Conf 20141217JoseLastNessuna valutazione finora

- The Pensford Letter - 4.15.13Documento4 pagineThe Pensford Letter - 4.15.13Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 11.25.13Documento7 pagineThe Pensford Letter - 11.25.13Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 8.25.14Documento3 pagineThe Pensford Letter - 8.25.14Pensford FinancialNessuna valutazione finora

- Westpac - Fed Doves Might Have Last Word (August 2013)Documento4 pagineWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenNessuna valutazione finora

- FOMCpresconf 20220316Documento26 pagineFOMCpresconf 20220316marchmtetNessuna valutazione finora

- The Pensford Letter - 5.11.15Documento3 pagineThe Pensford Letter - 5.11.15Pensford FinancialNessuna valutazione finora

- Powell 20230621 ADocumento5 paginePowell 20230621 ADaily Caller News FoundationNessuna valutazione finora

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Documento23 pagineTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNessuna valutazione finora

- The Pensford Letter - 05.04.2015Documento3 pagineThe Pensford Letter - 05.04.2015Pensford FinancialNessuna valutazione finora

- FOMCpresconf 20230920Documento4 pagineFOMCpresconf 20230920KHAIRULNessuna valutazione finora

- Fed Hikes 50bp With Much More To Come: Economic and Financial AnalysisDocumento5 pagineFed Hikes 50bp With Much More To Come: Economic and Financial AnalysisOwm Close CorporationNessuna valutazione finora

- WeatherDocumento1 paginaWeatherpathanfor786Nessuna valutazione finora

- Weekly Trends March 20, 2015Documento4 pagineWeekly Trends March 20, 2015dpbasicNessuna valutazione finora

- Mauldin Weekly Letter 28 JanuaryDocumento11 pagineMauldin Weekly Letter 28 Januaryrichardck61Nessuna valutazione finora

- Global Macro Commentary Dec 4Documento3 pagineGlobal Macro Commentary Dec 4dpbasicNessuna valutazione finora

- Ect4 PDFDocumento5 pagineEct4 PDFChad Thayer VNessuna valutazione finora

- The Pensford Letter - 12.1.14Documento5 pagineThe Pensford Letter - 12.1.14Pensford FinancialNessuna valutazione finora

- The World Overall 03:01 - Week in ReviewDocumento4 pagineThe World Overall 03:01 - Week in ReviewAndrei Alexander WogenNessuna valutazione finora

- Weekly Market Compass - 7 Dec 22Documento3 pagineWeekly Market Compass - 7 Dec 22YasahNessuna valutazione finora

- Fomc Pres Conf 20160615Documento21 pagineFomc Pres Conf 20160615petere056Nessuna valutazione finora

- Hike Now, Pay LaterDocumento10 pagineHike Now, Pay LaterrexNessuna valutazione finora

- Transcript of Chair Powell's Press Conference May 4, 2022Documento24 pagineTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活Nessuna valutazione finora

- 2011-06-08 DBS Daily Breakfast SpreadDocumento6 pagine2011-06-08 DBS Daily Breakfast SpreadkjlaqiNessuna valutazione finora

- Transient Inflation: Virus and VaccinationsDocumento6 pagineTransient Inflation: Virus and Vaccinationsgenid.ssNessuna valutazione finora

- The Pensford Letter - 4.1.13Documento3 pagineThe Pensford Letter - 4.1.13Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 8.5.13Documento4 pagineThe Pensford Letter - 8.5.13Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 12.9.13-1Documento6 pagineThe Pensford Letter - 12.9.13-1Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field October 12, 2015Documento5 pagineLeveling The Playing Field October 12, 2015Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 11.11.13 PDFDocumento4 pagineThe Pensford Letter - 11.11.13 PDFPensford FinancialNessuna valutazione finora

- Yellen TestimonyDocumento7 pagineYellen TestimonyZerohedgeNessuna valutazione finora

- Leveling The Playing Field February 4, 2016Documento5 pagineLeveling The Playing Field February 4, 2016Pensford FinancialNessuna valutazione finora

- Pensford Rate Sheet - 02.22.2016Documento1 paginaPensford Rate Sheet - 02.22.2016Pensford FinancialNessuna valutazione finora

- Pensford Rate Sheet - 01.19.2016Documento1 paginaPensford Rate Sheet - 01.19.2016Pensford FinancialNessuna valutazione finora

- Broker Rate Sheet - 12.07.2015Documento1 paginaBroker Rate Sheet - 12.07.2015Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field December 7, 2015: Why Did Rates Spike This Week?Documento4 pagineLeveling The Playing Field December 7, 2015: Why Did Rates Spike This Week?Pensford FinancialNessuna valutazione finora

- Broker Rate Sheet - 12.28.2015Documento1 paginaBroker Rate Sheet - 12.28.2015Pensford FinancialNessuna valutazione finora

- Pensford Rate Sheet - 11.16.2015Documento1 paginaPensford Rate Sheet - 11.16.2015Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field October 26, 2015Documento4 pagineLeveling The Playing Field October 26, 2015Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 11.9.15Documento7 pagineThe Pensford Letter - 11.9.15Pensford FinancialNessuna valutazione finora

- Pensford Rate Sheet - 10.26.2015Documento1 paginaPensford Rate Sheet - 10.26.2015Pensford FinancialNessuna valutazione finora

- Pensford Rate Sheet - 11.09.2015Documento1 paginaPensford Rate Sheet - 11.09.2015Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field October 12, 2015Documento5 pagineLeveling The Playing Field October 12, 2015Pensford FinancialNessuna valutazione finora

- Leveling The Playing Field October 19, 2015Documento5 pagineLeveling The Playing Field October 19, 2015Pensford FinancialNessuna valutazione finora

- The Pensford Letter - 10.5.15Documento6 pagineThe Pensford Letter - 10.5.15Pensford FinancialNessuna valutazione finora

- Historical Exchange Rates - OANDA AUD-MYRDocumento1 paginaHistorical Exchange Rates - OANDA AUD-MYRML MLNessuna valutazione finora

- Project Manager PMP PMO in Houston TX Resume Nicolaas JanssenDocumento4 pagineProject Manager PMP PMO in Houston TX Resume Nicolaas JanssenNicolaasJanssenNessuna valutazione finora

- TrellisDocumento1 paginaTrellisCayenne LightenNessuna valutazione finora

- Avid Final ProjectDocumento2 pagineAvid Final Projectapi-286463817Nessuna valutazione finora

- Schneider Contactors DatasheetDocumento130 pagineSchneider Contactors DatasheetVishal JainNessuna valutazione finora

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Documento13 pagineNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllNessuna valutazione finora

- BS en Iso 06509-1995 (2000)Documento10 pagineBS en Iso 06509-1995 (2000)vewigop197Nessuna valutazione finora

- The International Poker RulesDocumento2 pagineThe International Poker RulesOutontheBubbleNessuna valutazione finora

- IIM L: 111iiiiiiiDocumento54 pagineIIM L: 111iiiiiiiJavier GonzalezNessuna valutazione finora

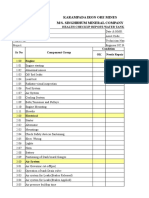

- Settlement Report - 14feb17Documento10 pagineSettlement Report - 14feb17Abdul SalamNessuna valutazione finora

- Course Projects PDFDocumento1 paginaCourse Projects PDFsanjog kshetriNessuna valutazione finora

- Presentation Municipal Appraisal CommitteeDocumento3 paginePresentation Municipal Appraisal CommitteeEdwin JavateNessuna valutazione finora

- Rockwell Collins RDRDocumento24 pagineRockwell Collins RDRMatty Torchia100% (5)

- Water Tanker Check ListDocumento8 pagineWater Tanker Check ListHariyanto oknesNessuna valutazione finora

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Documento94 pagineN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESNessuna valutazione finora

- Assignment Csi104Documento11 pagineAssignment Csi104Minh Lê KhảiNessuna valutazione finora

- F5 Chem Rusting ExperimentDocumento9 pagineF5 Chem Rusting ExperimentPrashanthini JanardananNessuna valutazione finora

- How Can Literary Spaces Support Neurodivergent Readers and WritersDocumento2 pagineHow Can Literary Spaces Support Neurodivergent Readers and WritersRenato Jr Bernadas Nasilo-anNessuna valutazione finora

- Planning EngineerDocumento1 paginaPlanning EngineerChijioke ObiNessuna valutazione finora

- OVDT Vs CRT - GeneralDocumento24 pagineOVDT Vs CRT - Generaljaiqc100% (1)

- Redirection & PipingDocumento16 pagineRedirection & PipingPraveen PatelNessuna valutazione finora

- Audi R8 Advert Analysis by Masum Ahmed 10PDocumento2 pagineAudi R8 Advert Analysis by Masum Ahmed 10PMasum95Nessuna valutazione finora

- Eu Schengen Catalogue enDocumento54 pagineEu Schengen Catalogue enSorin din ConstanțaNessuna valutazione finora

- Fmicb 10 02876Documento11 pagineFmicb 10 02876Angeles SuarezNessuna valutazione finora

- Automated Dish Washer v1.1Documento21 pagineAutomated Dish Washer v1.1Anonymous XXCCYAEY6M67% (3)

- Business Statistic Handout Bba - Sem 2Documento7 pagineBusiness Statistic Handout Bba - Sem 2hanirveshNessuna valutazione finora

- Use of Travelling Waves Principle in Protection Systems and Related AutomationsDocumento52 pagineUse of Travelling Waves Principle in Protection Systems and Related AutomationsUtopia BogdanNessuna valutazione finora

- Eng21 (Story of Hamguchi Gohei)Documento9 pagineEng21 (Story of Hamguchi Gohei)Alapan NandaNessuna valutazione finora

- Building For The Environment 1Documento3 pagineBuilding For The Environment 1api-133774200Nessuna valutazione finora

- A Review of Stories Untold in Modular Distance Learning: A PhenomenologyDocumento8 pagineA Review of Stories Untold in Modular Distance Learning: A PhenomenologyPsychology and Education: A Multidisciplinary JournalNessuna valutazione finora