Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

It Probable 2014-15

Caricato da

nithansaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

It Probable 2014-15

Caricato da

nithansaCopyright:

Formati disponibili

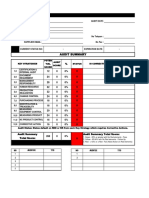

NAME:- DESG.

MALE PAN:-

MONTH BASIC SP PAY D.A. HRA M.A. CLA T.A. GROSS GPF/cpf IT1 GIS PTAX ITEM AMOUNT

Mar-13 0 0 0 0 0 0 DLM

Apr-13 0 0 0 0 0 0 0 0 0 0 0 0 GTU

May-13 0 0 0 0 0 0 0 0 0 0 0 0 TEB

Jun-13 0 0 0 0 0 0 0 0 0 0 0 0 trg

Jul-13 0 0 0 0 0 0 0 0 0 0 0 0 GTU

Aug-13 0 0 0 0 0 0 0 0 0 0 0 0 GTU

Sep-13 0 0 0 0 0 0 0 0 0 0 0 0 GTU

Oct-13 0 0 0 0 0 0 0 0 0 0 0 0 GTU

Nov-13 0 0 0 0 0 0 0 0 0 0 0 0 O.L.

Dec-13 0 0 0 0 0 0 0 0 0 0 0 0 el encash

Jan-14 0 0 0 0 0 0 0 0 0 0 0 0 other

Feb-14 0 0 0 0 0 0 0 0 0 0 0 RECOVERY (-)

DA1 0

DA2 0

PAY ARR.20% 0

TOTAL 0 0 0 0 0 0 0 0 0 0 0 0 0

GROSS 0 100% Deduction Deduction U/S 80C for tax rebate

INT 0 1.P.TAX 0 1. GPF 0

OTHER 2.T.A. 0 2. GIS 0

TOTAL 0 3.HBA INT. 0 3. HBA principal

DEDUCTIONS 4.MEDICLAIM 4. PPF 0

U/S B 0 5. HRA RENT 5. LIC 0

U/S 80C 0 6 6. PLI

TOT DED 0 7 fees

TAXABLE 0 8 8. MUTUAL FUND

TAX 0 SUM (1 TO 8) 0

TAX CREDIT IF TAXABLE INCOME LESS THAN 5.0 LACS 2000

NET TAX -2000

EDU CESS 3% -60 TOTAL (1 TO 8) 0

TOAL TAX TO BE PAID -2060 TOTAL (1 TO 10) 0

MONTLY TAX TO BE DUDEUCTED -172

Rajiv Gandhi equity

schme( for gross ncome

less than 12 lacs)

GOVERNMENT POLYTECHNIC RAJKOT

Statement showing PROBABLE income tax calculation for the F.Y. 2014.15

IT2

0

GOVERNMENT POLYTECHNIC RAJKOT

Statement showing PROBABLE income tax calculation for the F.Y. 2014.15

SR.NO. NAME:- Sex MALE PAN:-

Designation : 0

1 GROSS INCOME RS. 0

Interest RS. 0

Any other RS.

Rent free quarter RS. 0

TOTAL RS. 0

2 SECTION (B) <DEDUCTION FROM GROSS INCOME>

I. Proffetional Tax U/S 16(III) RS. 0

II. T.A. 10(4)( Maxmum Rs. 9600) RS. 0

III. HBA Interest RS. 0

IV. Mediclaim u.s. 80-D( Max. 15000) RS. 0

V. HRA RS. 0

IV Deduction u/s 80-U for PH person (40,000) RS. 0

TOTAL DEDUCTION RS. 0

3

1. GPF RS. 0

2. GIS RS. 0

3. HBA principal RS. 0

4. PPF RS. 0

5. LIC RS. 0

6. PLI RS. 0

7. NSC RS. 0

8. MUTUAL FUND RS. 0

SUM (1 TO 8) MAX. RS. 1,00,000 0 0

9. Rajiv Gandhi equity schme( for gross ncome less than 12 lacs) 0 0

TOTAL (1 TO 9) RS. 0

4 RS. 0

5 RS. 0

6 RS.

0

0

0

0

7 I.T. PAYABLE (A+B+C+D) 0

7a tax credit if income less than Rs.500000( Rs.2000) 2000

Net tax payable -2000

8 EDU CESS (3%) RS -60

9 TOTAL TAX PAYABLE (7+8) RS -2060

10 MONTHLY TAX PAYABLE= -172

11 IT TO BE DUDUCTED FROM SALARY OF MARCH -2014 ONWARDS

12 GPF TOBE DEUCTED FROM SALARY OF MACH-2014 ONWARDS

PLACE RAJKOT SIGNATURE OF EMPLOYEE

DATE

PRINCIPAL

G.P. RAJKOT

A. NIL (Income Upto 2.0 Lac)

B. 10% (Income Between 2 Lac & 5.0 Lac)

C. 20% (Income Between 5.0 Lac & 10 Lac)

D. 30% (Income above 10 Lac )

I undersigned hereby undertake to invest a sum whichever is claimed as Tax rebate

by 31st march 2015 and will produce the attested copies of the documents thereof latest by

5th april 2015

Total Taxable Income (1-4)

Calculation Of Income Tax

GOVERNMENT POLYTECHNIC RAJKOT

Statement showing income tax calculation for the F.Y. 2014-15

Investment U/S 80C

Total Deduction 2 & 3

0 0

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- M-Di Nitro BenzeneDocumento4 pagineM-Di Nitro Benzenenithansa100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- DensityDocumento3 pagineDensitynithansaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Preparation of B-NaphtholDocumento4 paginePreparation of B-NaphtholnithansaNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Identification of PolymersDocumento5 pagineIdentification of Polymersnithansa100% (1)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Preparation of PotassiumSulphateDocumento5 paginePreparation of PotassiumSulphatenithansaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Kadva Patidar HistoryDocumento2 pagineKadva Patidar HistorynithansaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- VehicleDriveCalculation PDFDocumento1 paginaVehicleDriveCalculation PDFnithansaNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- PesticidesDocumento12 paginePesticidesNachiappan CN100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Government Polytechnic, Rajkot: Academic Calendar - 2017Documento1 paginaGovernment Polytechnic, Rajkot: Academic Calendar - 2017nithansaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Natural Gas ConversionDocumento91 pagineNatural Gas ConversionHassan HaiderNessuna valutazione finora

- Program Educational Objectives (Peos)Documento1 paginaProgram Educational Objectives (Peos)nithansaNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Indian Rail Fare Effective 25-Dec-2015Documento34 pagineIndian Rail Fare Effective 25-Dec-2015nithansaNessuna valutazione finora

- C A L E N D A R 2 0 1 7: Public HolidayDocumento2 pagineC A L E N D A R 2 0 1 7: Public HolidaynithansaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Course Out ComesDocumento3 pagineCourse Out ComesnithansaNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Rav'no (Moxnl P#aDocumento5 pagineRav'no (Moxnl P#anithansaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Suggestions/Inputs of Parent/Guardian in Framing Vision/Mission and Program Educational Objectives (Peos) of Diploma Chemical EngineeringDocumento2 pagineSuggestions/Inputs of Parent/Guardian in Framing Vision/Mission and Program Educational Objectives (Peos) of Diploma Chemical EngineeringnithansaNessuna valutazione finora

- Contribution of Pos Toward Attainment of Peos in Diploma Chemical EngineeringDocumento2 pagineContribution of Pos Toward Attainment of Peos in Diploma Chemical EngineeringnithansaNessuna valutazione finora

- CDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)Documento2 pagineCDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)NASEER AHMAD100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Form Audit QAV 1&2 Supplier 2020 PDFDocumento1 paginaForm Audit QAV 1&2 Supplier 2020 PDFovanNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Project ManagementDocumento37 pagineProject ManagementAlfakri WaleedNessuna valutazione finora

- Correctional Case StudyDocumento36 pagineCorrectional Case StudyRaachel Anne CastroNessuna valutazione finora

- 05 Vision IAS CSP21 Test 5Q HIS AM ACDocumento17 pagine05 Vision IAS CSP21 Test 5Q HIS AM ACAvanishNessuna valutazione finora

- Susan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDocumento2 pagineSusan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDouglas MuthNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 1-Introduction - Defender (ISFJ) Personality - 16personalitiesDocumento6 pagine1-Introduction - Defender (ISFJ) Personality - 16personalitiesTiamat Nurvin100% (1)

- Introduction To Anglo-Saxon LiteratureDocumento20 pagineIntroduction To Anglo-Saxon LiteratureMariel EstrellaNessuna valutazione finora

- Depreciation, Depletion and Amortization (Sas 9)Documento3 pagineDepreciation, Depletion and Amortization (Sas 9)SadeeqNessuna valutazione finora

- 7wonders ZeusDocumento18 pagine7wonders ZeusIliana ParraNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Shop Decjuba White DressDocumento1 paginaShop Decjuba White DresslovelyNessuna valutazione finora

- Ekotoksikologi Kelautan PDFDocumento18 pagineEkotoksikologi Kelautan PDFMardia AlwanNessuna valutazione finora

- Chapter 11: Re-Situating ConstructionismDocumento2 pagineChapter 11: Re-Situating ConstructionismEmilio GuerreroNessuna valutazione finora

- Chapter 2 - AuditDocumento26 pagineChapter 2 - AuditMisshtaCNessuna valutazione finora

- Travisa India ETA v5Documento4 pagineTravisa India ETA v5Chamith KarunadharaNessuna valutazione finora

- Covid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialDocumento3 pagineCovid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialLuxNessuna valutazione finora

- "If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsDocumento21 pagine"If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsIsadora Mandarino OteroNessuna valutazione finora

- Functional Skill: 1. Offering HelpDocumento36 pagineFunctional Skill: 1. Offering HelpAnita Sri WidiyaaNessuna valutazione finora

- Consolidation Physical Fitness Test FormDocumento5 pagineConsolidation Physical Fitness Test Formvenus velonza100% (1)

- CT 1 - QP - Icse - X - GSTDocumento2 pagineCT 1 - QP - Icse - X - GSTAnanya IyerNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Documento2 pagineRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYNessuna valutazione finora

- (BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeDocumento5 pagine(BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeMiklós GrécziNessuna valutazione finora

- An Introduction To The Catholic Charismatic RenewalDocumento5 pagineAn Introduction To The Catholic Charismatic RenewalNoah0% (1)

- Teens Intermediate 5 (4 - 6)Documento5 pagineTeens Intermediate 5 (4 - 6)UserMotMooNessuna valutazione finora

- 10th Grade SAT Vocabulary ListDocumento20 pagine10th Grade SAT Vocabulary ListMelissa HuiNessuna valutazione finora

- The Approach of Nigerian Courts To InterDocumento19 pagineThe Approach of Nigerian Courts To InterMak YabuNessuna valutazione finora

- Glories of Srimad Bhagavatam - Bhaktivedanta VidyapithaDocumento7 pagineGlories of Srimad Bhagavatam - Bhaktivedanta VidyapithaPrajot NairNessuna valutazione finora

- CompTIA Network+Documento3 pagineCompTIA Network+homsom100% (1)

- "Working Capital Management": Master of CommerceDocumento4 pagine"Working Capital Management": Master of Commercekunal bankheleNessuna valutazione finora

- Turtle Walk WaiverDocumento1 paginaTurtle Walk Waiverrebecca mott0% (1)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesDa EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesValutazione: 4.5 su 5 stelle4.5/5 (504)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentDa EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentValutazione: 4.5 su 5 stelle4.5/5 (8)