Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

COA Presentation - RRSA

Caricato da

Kristina Dacayo-GarciaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

COA Presentation - RRSA

Caricato da

Kristina Dacayo-GarciaCopyright:

Formati disponibili

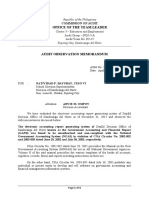

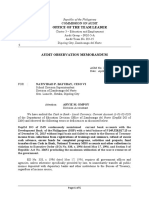

SETTLEMENT OF ACCOUNTS

SETTLEMENT OF ACCOUNTS

SETTLEMENT OF ACCOUNTS

SETTLEMENT OF ACCOUNTS

SETTLEMENT OF ACCOUNTS

RRSA

and

Pertinent Provisions

under the 2009 RRPC

Resource Person:

Atty. LITO Q. MARTIN

Director III

Commission on Audit

SESSION OBJECTIVE

To orient AGAP convention

participants on the provisions of

COA Circular No. 2009-006 dated

September 15,2009 on RRSA &

2009 RRPC which is effective

October 28, 2009.

BACKGROUND/Previous Issuances

COA Circular 81-156

Restating the Requirements for

the Use of the CSB and Providing

Guidelines on Its Issuance

Including the Accounting

Treatment Thereof

Previous Issuances

COA Circular 85-156B

Prescribing the Use of the

Manual on CSB

COA Circular 94-001

Prescribing the Use of the 1993

Revised Manual on CSB

Previous Issuances

COA Memorandum 2002-053

Guidelines on the Delineation of

Auditing and Adjudication Functions

COA Resolution 2006-001, 1/31/06

Responsibility to Issue NS/ND/NC

Arising From the Settlement of

Accounts and Audit of Transactions

Chapter I -

Introduction

Section 1. Title

The set of rules

shall be known as

the RRSA

Sec. 2 - Legal Authority

1. Power/authority/duty to examine/

audit/settle all accounts pertaining

to revenues & receipts of &

expenditures or uses of funds,

owned or held in trust by, or

pertaining to the Govt. [Sec. 2 (1),

Art. IX-D, Constitution]

Legal Authority [Sec. 2 (2), Art. IX-D)

2. Exclusive authority to define the scope of

its audit & examination;

3. Establish the techniques & methods

required therefore;

4. Promulgate accounting & auditing rules

& regulations, including those for the

prevention & disallowance of IEEUU

expenditures, or uses of govt. funds &

property.

Other Legal Authority

5. To certify the balances in the

accounts of AOs (Sec. 81, PD 1445)

6. To notify in writing the officer whose

accounts have been audited & settled

(Sec. 82, PD 1445)

7. To render accounts by local auditors

(Sec. 347, RA 7160)

Sec. 3 - Scope of RRSA

All accounts audited pertaining to

revenues & receipts of &

expenditures or uses of govt.

funds

Settlement of property accounts

not covered.

Chapter II -

General Principles, Rules and

Regulations

Settlement of Accounts

is the process of determining the

balance of the account of an AO,

thru an audit, to determine the

transactions that may be allowed or

not allowed.

The balance refers to total

suspensions, disallowances &

charges (SDC) which shall be his

accountability.

Settlement of Accounts

Audit shall be done in

accordance with LRR

(laws/rules/regulations) &

standards to determine

whether transactions may be

allowed, suspended,

disallowed or charged.

When to issue an AOM

1. audit decision cannot yet be made

due to incomplete

documentation or

information;

2. the deficiencies noted refers to

financial/operational matters w/c

do not involved pecuniary loss.

Auditors Adverse Decisions

1. Suspension of a transaction that

needs more requirements, & w/c may

result in pecuniary loss to the govt.,

until such requirements are complied

with.

A NS shall be issued indicating the

requirements to be complied w/ by

the officers concerned.

Sec. 4. Definition

Suspension is a temporary

disallowance of a transaction w/c

appear illegal, improper or irregular

unless satisfactorily

explained/justified by the responsible

officers or until the requirements on

matters raised in the course of audit

are submitted or complied with

Sec. 4, Rule IV of RRPC

NS may be issued for

transactions of doubtful

legality/ validity/propriety to

obtain further explanation

or documentation.

Auditors Adverse Decisions

2. Disallowance of a

transaction on expenditure,

either in whole or in part, for

being an IIEEUU. A ND is

issued for the disallowed

amount

Auditors Adverse Decisions

3. Charge of a transaction when

the correct amount of

revenue/receipt due the govt. is

not received as a result of

under-appraisal/ assessment/

collection. A NC is issued for the

uncollected amount

Evidence of Audit

By appropriate markings in the

documents audited

If allowed in audit, indicate Allowed

in Audit.

If not allowed, issue NS/ND/NC, &

indicate amount suspended/

disallowed/ charged in the

documents audited.

Suggested Post-Audit Stamp

POST-AUDITED

Transaction Amount : __________

Allowed : __________

Disallowed/Charged/

Suspended : ___________

ND/NC/NS Number : ___________

Dated : ___________

Audited by: (ATL) _________ Date: ___________

Standard size is _ by __ cms

Auditor sign using RED ink

How Notices are Settled

NS - by persons responsible thru

compliance w/ requirements

ND/NC - by persons liable thru

payment, restitution or by

other modes of extinguishment

of obligation, such as

compensation, dation in payment,

condonation.

Notice of Settlement

The auditor issue an

NSSDC for settled

NS/ND/NC

Balance of Account

The auditor shall issue :

SASDC within 15 days after the

end of each QTR;

Updated list of outstanding

SDC within 5 days from receipt of

request by a retiring/ transferring

officer.

Linkages to the AAR

Total unsettled SDC at the end

of CY as reflected in the 4

th

QTR

SASDC shall be reported in the

AAR

Other deficiencies noted as

indicated in the AOM shall be

included in Part II of the AAR

Responsibilities for

Audit and

Settlement of

Accounts

Responsibilities of

Agency Head

Primarily responsible for all

govt. funds & property

pertaining to his agency.

Fiscal responsibility rests

directly with him.

Responsibilities of Agency Head

1) Ensure that:

a) Required financial/other reports/

statements are submitted by the

concerned agency officials in

prescribed form and within the

prescribed period;

b) Settlement of disallowances/ charges

is made within the prescribed period;

Responsibilities of Agency Head

c) Requirements of

transactions suspended are

complied with;

d) Appropriate actions are

taken on the deficiencies

noted as contained in the

AOM.

Responsibilities of Agency Head

2) Initiate the necessary

administrative and/or criminal

action in case of unjustified

failure/refusal to effect

compliance with the

foregoing requirements by

subordinate officials.

Responsibilities of Agency Head

Gross negligence in

disciplining subordinates who

are the subject of repeated

adverse audit findings shall

subject him to disciplinary

action by proper authorities.

Responsibilities of Agency Head

3) Enforce the COE by requiring the

withholding of salaries/other

compensation due the person liable

in satisfaction of the

disallowance/charge.

4) Ensure that all employees who are

retiring/transferring shall first settle

the disallowances & charges for w/c

they are liable.

Responsibilities of Agency Accountants/Bookkeepers

1. Ensure that reports &

supporting documents

submitted by the AOs are

immediately recorded &

submitted to the Auditor

w/in 1

st

10 days of the

ensuing month;

Responsibilities of Accountants

2. Ensure that financial

records are made

accessible at

reasonable hours to the

auditors when needed;

Powers & functions of Auditors

(Sec. 3, Rule II of RRPC)

To exercise such powers &

functions as provided by law & as

may be authorized by COA in the

audit & settlement of the accounts,

funds, financial transactions &

resources of the agencies under

their respective audit jurisdiction.

Role of Auditors

(Sec. 2, Rule IV of RRPC)

To maintain complete

independence & exercise

professional care & be guided

by applicable LRR & the

GAAAP in the performance

of audit work &

preparation audit reports.

Responsibilities of Auditors

(Sec. 3, Rule IV of RRPC)

To obtain sufficient evidence to

provide an appropriate factual bases

for his opinions, conclusions,

judgments & recommendations;

To safeguard this evidence to

support his findings, which may

include physical, testimonial,

documentary, analytical & electronic

evidences.

Responsibilities of Auditor

(Sec. 7.3 of RRSA)

1. Enforce submission of

prescribed/ necessary

reports of receipts/

disbursements w/ all paid

vouchers, ORs, &

supporting documents;

Responsibilities of Auditor

2. Conduct audit on the above-

submitted documents covering

transactions under the identified

audit areas;

3. Prepare, as a result of audit,

the pertinent

NS/ND/NC/AOM/NFD;

Responsibilities of Auditor

4. Prepare the COE for

disallowances/charges issued by

him for his Directors signature

5. Serve the NS/ND/NC/

AOM/NFD/COE to persons

concerned/responsible/liable;

Responsibilities of Auditor

6. Monitor the enforcement of

COE issued & report to Director

the action taken by the agency

thereon pursuant to Sec. 24;

7. Issue the NSSDC when there

is settlement pursuant to Sec. 13;

Responsibilities of Auditor

8. Prepare & transmit

SASDC to the agency head

& the Accountant pursuant

to Sec. 14;

9. Others

Responsibilities of Director

1. Exercise general supervision &

review in audit & settlement

of accounts;

2. Act on appeals pursuant to

Sec. 18;

3. Sign the NFD for decisions

rendered pursuant to Sec. 22;

Responsibilities of Director

4. Sign the COE for decisions

rendered by him & by the

Auditor pursuant to Sec. 23;

5. Consolidate the SASDC for all

auditees under his jurisdiction;

Payment of Filing Fees

2009 RRPC

Every petition/appeal filed before an

adjudicating body/office of COA

pertaining to the following cases shall be

imposed a filing fee equivalent to 1/10

of 1% (0.1%) of the amount involved,

but not exceeding P10,000.

Filing Fees

a) Appeal from audit disallowance/charge

b) Appeal from disapproval of request for relief

from accountability

c) Money claims, except if the claimant is a

govt. agency

d) Request for condonation of settled claim or

liability except if between govt. agencies

Legal Research Fund

(Section 4, RA 3870, as amended, & LOI 1183

dated Dec. 16, 1981)

In addition, LRF of 1% of

filing fee imposed, but not

lower than P10 shall be

collected

Where to Pay Fees

At the Cashier of COA Central

Office or Regional Office

if not practicable, may be

remitted thru postal money

order payable to the

Commission on Audit

Payment of Fees

OR shall be attached to

the pleading

If no OR, adjudicating

bodies/offices shall not take

action thereon

Chapter III

Guidelines in issuance

of AOM/NS/ND/NC

and SASDC

Sec. 8 AOM & Management Reply

1. The Auditor shall issue an AOM (Form

1) for observation relating to

financial/operational deficiencies such as

accounting, internal control or property

management which do not involve

pecuniary loss, including for

documentary or other information

requirements to enable the auditor to

make a decision in audit.

Sec. 8 - AOM & Mngt. Reply

2. AOM is addressed to agency head and

officers concerned stating the

deficiencies noted and/or requirements

to be complied with and requiring a

response thereon. Signed both by the

ATL and SA.

3. AOM shall be replied to by agency

officials concerned w/in 15 CDs from

receipt thereof.

Sec. 8 - AOM and Management Reply

4. If agency officials failed to reply, the

observation shall be deemed accepted

and shall be included in the audit report

(ML and/or AAR). In case of failure to

submit documents/ information needed

to reach an audit decision, an NS/ND/NC

may be issued after a re-evaluation of

those available.

Sec. 8 - AOM & Mngt. Reply

5. The Auditor shall evaluate the agencys

reply/comments and shall inform the

agency head and officer concerned in

writing of the results of evaluation.

6. The documents/information submitted in

response to an AOM may provide basis for

the allowance, SDC in audit.

Sec. 9 Notice of Suspension

1. The Auditor may issue an NS

(Form 2) for transactions of

doubtful legality/propriety/

regularity which may result in

pecuniary loss of the government to

obtain further explanation or

documentation.

Sec. 9 Notice of Suspension

2. Addressed to agency head and the

Accountant; served on the persons

responsible; stated the amount

suspended, the reason/s for

suspensions, the justification/

explanation/legal basis/documents

needed to lift the suspension, and the

persons responsible for compliance.

Signed both by the ATL and SA.

Sec. 9 Notice of Suspension

3. Issued as often as suspensions are made

4. Suspension shall be settled within 90

CDs from date of receipt by the

responsible officers; otherwise, the

transaction shall be disallowed/ charged

after the Auditor shall had satisfied

himself of such action and consequently,

issue the ND/NC.

Sec. 10 Notice of Disallowance

1. The Auditor shall issue an ND (Form 3)

for transactions w/c are IEEU (COA Circ.

85-55A) and illegal (contrary to law) and

unconscionable (unreasonable and

immoderate; no man in his right sense

would make, nor fair and honest man

would accept as reasonable; and those

incurred in violation of ethical and moral

standards)

Sec. 10 Notice of Disallowance

2. Addressed to agency head and the

Accountant; served on the persons

liable; indicated the transaction and

amount disallowed, the reasons for

disallowance, the LRR violated,

and the persons liable. Signed both

by the ATL and SA.

Sec. 10 Notice of Disallowance

3. Issued as often as

disallowances are made.

4. Disallowances shall be settled

within 6 months from date

of receipt by the persons

liable.

Sec. 11 Notice of Charge (NC)

1. The Auditor shall issue the NC (Form 4)

on the difference of the following, which

are proper audit charge:

a) Amount assessed/appraised is less than

what is due;

b) Amount billed is less than what is due;

c) Amount collected is less than what is due.

Sec. 11 Notice of Charge

2. Addressed to agency head and the

Accountant; served on the persons

liable; indicated the transaction and

amount charged, the reasons for

the charge, the LRR violated, and

the persons liable. Signed both by

the ATL and SA.

Sec. 11 Notice of Charge

3. Issued as often as charges

are made.

4. Charge shall be settled within

6 months from date of

receipt by the persons liable.

ND/NC

ND/NC shall be adequately

established by evidence and the

conclusion, recommendations or

dispositions shall be supported

by applicable LRR, jurisprudence

and the GAAAP.

ND/NC/NS/decisions/other orders

Shall be prepared in such number of

copies as may be necessary for:

1) head of audited agency (original);

2) Auditor for record (duplicate);

ND/NC/NS/decisions/other orders

3) agency officials directly affected

by the decision and from whom

specified action/response is

expected.

Sec. 12 Service of Copies of ND/NS/NC

1. To each persons liable/responsible, by

the Auditor, thru personal service.

If not practicable, by registered

mail. If several payees, such as

disallowed payroll, service to the

Accountant, who shall be

responsible for informing all payees

concerned, constitute constructive

service to all payees in the payroll.

Sec. 12 Service of Copies

2. Personal service by:

a) delivering personally to the party,

b) leaving in his office w/ his clerk or with

a person having charge thereof.

Sec. 12 Service of Copies

c) by leaving at the partys residence

between 8 AM to 6 PM, with a person of

sufficient age and discretion then

residing thereon.

Sec. 12 Service of Copies

3. Register mail by a) sending to the

office address of the party, if known;

otherwise, b) at his residence with

instruction to the Postmaster to return

the mail to sender after 10 days, if

undelivered. Ordinary mail, if no

service is available in locality of either

sender or addressee.

Sec. 12 Service of Copies

4. Record of date of actual or constructive

service for purpose of determining the

running of 90 days maturity period of

the suspension & the 6 months period

to appeal the disallowance/charges.

These information shall be included in

the Record of COA Decisions (ROCD)

Sec. 13 NSSDC

1. The Auditor shall issue the NSSDC

(Form 5) whenever a SDC is settled.

2. Addressed to agency head and the

Accountant; copy furnished the persons

responsible/liable; indicated the

NS/ND/NC settled, amount, nature of

transaction and mode of settlement.

Signed both by the ATL and SA.

Responsibility of Auditor . . . .

Under Section 7.3

Auditor shall issue a Notice of

Finality of Decision (NFD) to inform the

agency head that a decision of COA or its

authorized representative has become final &

executory, which shall be the basis for

recording the disallowance/charge in the

agencys books.

Sec. 13 NSSDC

3. Settlements -

a) Suspension by submission of

justification/explanation and/or

documentation required and after

the Auditor is satisfied that the

transaction is regular/legal/proper.

If the Auditor is not satisfied, he

shall issue the ND/NC;

Sec. 13 Settlement

b) Disallowance/charge

i) by payment of the amount disallowed;

ii) by such other applicable modes of

extinguishment of obligation as provided

by law, w/c the Auditor may refer to the

General Counsel, for evaluation & advice,

the propriety of the settlement;

Sec. 13 Settlement

b) Disallowance/charge

iii) from a decision of the Director, the ASB,

or the CP, lifting the same.

Sec. 14 SASDC

1. The Auditor shall prepare the SASDC

(Form 6) summarizing the total SDC for

the current period. It shall indicate

beginning balance for each NS/ND/NC,

the NS/ND/NC and NSSDC for the period

and the ending balance of the

NS/ND/NC. Signed both by the ATL and

SA.

Sec. 14 SASDC

2. Issued to agency head & the Accountant

within 15 CDs from the end of each QTR,

copy furnished the COA Director

concerned.

3. The Auditors SASDC shall be the basis

for the preparation by the Directors

consolidated quarterly SASDC for his

cluster/region showing the total

unsettled SDC per auditee.

Sec. 14 SASDC

4. The Sector Ascom shall be furnished

copy of the consolidated SASDC of each

cluster/region for purpose of national

consolidation into a Sector SASDC as an

input into a database to be maintained

by the ITO showing the total unsettled

SDC per Sector.

Liable for Audit Disallowances/Charges

1. Determined on the basis of:

a) nature of disallowance/charge;

b) duties/responsibilities or obligations of

officers/employees concerned;

c) extent of participation in the

transaction;

d) amount of damage or loss to the govt.;

(Sec. 16.1)

Liability of Public Officers (POs)

a) Custodians of government funds

are liable for failure to ensure that

funds are safely guarded against

loss or damage; expended, utilized,

disposed of or transferred in

accordance w/ LRR; and on the

basis of prescribed documents and

necessary records.

Liability of POs

b) Who certify as to the

necessity, legality and

availability of funds or

adequacy of documents are

liable according to their

respective certifications.

Liability of POs

c) Who approve or authorize

expenditures are liable for

losses arising out of their

negligence or failure to

exercise the diligence of a

good father of a family.

Liability of POs & Other Persons

d) Who confederated or

conspired in a transaction

which is disadvantageous or

prejudicial to the government

are liable jointly and severally

w/ those who benefited

therefrom.

Liability of the PAYEE

e) Personally liable for a

disallowance where the ground

thereof is his failure to

submit the required

documents, and the Auditor is

convinced that the disallowed

transaction did not occur or

has no basis in fact.

Liability for Audit Charges

2. Measured by the individual

participation and involvement

of POs whose duties require

appraisal/assessment/

collection of govt. revenues &

receipts in the charged

transaction. (Sec. 16.2)

Liability of persons determined

to be liable under an ND/NC

3. Solidary. COA may go

against any person liable

without prejudice to the

latters claim against the

rest of the persons liable.

DECISIONS AND APPEALS

WHAT CASES

WHOSE

JURISDICTION/

APPROVING

OFFICIAL

FILING FEE

REQUIRED

Request for write-off of

unliquidated cash advances

and dormant accounts

receivables

- not exceeding P1 M

- exceeding P1 M

- ASB (original)

- CP (original)

- None

- None

WHAT CASES

WHOSE

JURISDICTION/

APPROVING

OFFICIAL

FILING FEE

REQUIRED

Request for relief from cash and

property accountabilities

-

not exceeding P100,000

[fortuitous events and natural

calamities or acts of man (theft,

robbery, arson)]

-

exceeding P100,000 for losses due

to fortuitous event or natural

calamities (no limit)

- Auditor

(original)

- Director

(original)

None

- None

DECISIONS AND APPEALS

WHAT CASES

WHOSE

JURISDICTION/

APPROVING

OFFICIAL

FILING FEE

REQUIRED

Request for relief from cash

and property accountabilities

-

exceeding P100,000 but not

more than P500,000 for acts

of man

-

exceeding P500,000 but not

more than P5M (for acts of

man)

-

exceeding P5M (for acts of

man)

- Director

(original)

- ASB (original)

- CP (original)

- None

- None

- None

DECISIONS AND APPEALS

WHAT CASES

WHOSE JURISDICTION/

APPROVING OFFICIAL

FILING FEE

REQUIRED

Request for COAs concurrence

on the hiring of legal

consultants and appeals/Motion

for Reconsiderations thereto

- CP (exclusive) - None

Appeals from audit dis-

allowance/charge involving

amounts:

- not exceeding P1,000,000

- exceeding P1,000,000

- Director (appellate)

- ASB (appellate)

- CP (appellate)

- 1/10 of 1% but not

less than P10 but

not to exceed

P10,000

- Do -

- Do -

DECISIONS AND APPEALS

WHAT CASES

WHOSE

JURISDICTION/

APPROVING

OFFICIAL

FILING FEE

REQUIRED

Appeals from disapproved

request for relief from

accountability

- for acts of God (no limit)

- for acts of man exceeding

P100,000 but not more than

P500,000

- For acts of man exceeding

P500,000

- ASB (appellate)

- ASB (appellate)

- CP (appellate)

- 1/10 of 1% but not

less than P10 but

not to exceed

P10,000

- Do -

- Do -

- Do -

DECISIONS AND APPEALS

WHAT CASES

WHOSE

JURISDICTION/

APPROVING

OFFICIAL

FILING FEE

REQUIRED

Money claims, except if claimant

is a government agency

(regardless of amount)

Request for condonation of

settled claims or liability except

if between government agencies

Approval of private sale of

government property in LGUs

- CP (original)

- CP (original)

- CP (original)

- 1/10 of 1% but not

less than P10 but

not to exceed

P10,000

- Do -

- Do -

DECISIONS AND APPEALS

LEVEL OF APPEALS

Director

ASB

CP

Sec. 17 Period to Appeal

Any person aggrieved may within 6 months

from receipt of ND/NC appeal in writing;

If not appealed within the prescribed period

shall become final & executory;

Filing of an appeal will suspend the running of

the prescribed period;

Running of 6 month period shall resume upon

receipt of a decision from the Director or the

ASB.

Proceedings before the Director

1) An aggrieved party may file an

Appeal Memorandum (AM) from

an Auditors Decision/ND/

NC to the Director concerned, copy

furnished the Auditor, within 6

months from receipt of

Decision/ND/NC;

2. Caption

Proceedings before the Director

Appellant - party appealing

Appellee - Auditor who

rendered the decision

3) The receipt by the Director of the

AM shall stop the running of the

period to appeal which shall

resume to run upon receipt by

the appellant of the Directors

decision.

Proceedings before the Director

Proceedings before the Director

4) Within 5 CDs from receipt of the AM,

the Director shall order the Auditor to

submit his Answer, copy furnished the

appellant, together with the entire

records of the case including the

EDSE, duly numbered at the bottom of

each page.

5) The Auditor shall comply w/

the Directors Order within

15 CDs from receipt. The

appellant may file a Reply

within the same period from

receipt of the Answer.

Proceedings before the Director

6) The Director shall decide the

Appeal within 15 CDs from

receipt of the complete

documents necessary for

evaluation & decision.

Proceedings before the Director

The Director may affirm the decision of

the Auditor; If he reverses, modifies or

alters, the case shall be elevated directly

to the CP for automatic review of the

Directors Decision.

The dispositive portion shall categorically

state that the decision is not final & is

subject to automatic review of the CP.

Proceedings before the Director

7)

8) The Director shall not

entertain a motion for

reconsideration (MR)

of his decision.

Proceedings before the Director

Sec. 19 Proceedings before the ASB

1) Any person aggrieved by a

Directors Decision involving an

amount not exceeding P1

Million may appeal to the

ASB within the time remaining

of the 6 months period to

appeal.

2) Upon receipt of the AM, the ASB,

thru the Ascom of LSS, shall require

the Director to submit an Answer,

copy furnished the Appellant,

together w/ the entire records of the

case including the EDSE, duly

numbered at the bottom of each

page.

Sec. 19 Proceedings before the ASB

3) The Director shall comply w/ the

ASBs Order within 15 CDs from

receipt. The appellant may file a

Reply within the same period

from receipt of the Answer.

Sec. 19 Proceedings before the ASB

4) The ASB shall decide the

Appeal within 15 CDs from

receipt of the complete

documents necessary for

evaluation & decision.

Sec. 19 Proceedings before the ASB

5) The ASB may affirm, reverse,

modify or alter the Directors

Decision.

6) The ASB shall not entertain an

MR of its Decision.

Proceedings before the ASB

Proceedings before the CP

1) The party aggrieved by a

decision of the Director or

the ASB may appeal to

the CP by filing a

Petition for Review.

2) A party aggrieved by a Directors Decision

involving ND/NC exceeding P1 Million may

file an appeal to the CP within the time

remaining of the 6 months period taking

into consideration the suspension of the

running thereof.

3) The CP shall decide within 60 CDs from the

date of its submission for decision or

resolution.

Proceedings before the CP

4) A case is deemed submitted for

decision/resolution upon the filing of last

pleading/brief/memorandum required by

COA rules.

5) If the account/claim involved in the case

needs reference to other persons, office, or

party interested, the period shall be

counted from the time the last comment

necessary to a proper decision is received

by it.

Proceedings before the CP

Automatic Review of Directors Decision

a) The CP shall within 60 CDs from

receipt of the Directors Decision

& the entire records of the case,

review the same & render its

own decision.

MR of CP Decision

a) Only one MR shall be entertained

on the basis of new & material

evidence, or that the evidence is

insufficient to justify the decision,

or the said decision is contrary to

law.

b) The MR shall be filed within the

remaining of the 6 months period to

appeal.

Appeal to the SC

1) The party aggrieved may appeal the CPs

decision/order/ruling within 30 days from

his receipt, appeal on Certiorari to the

SC in the manner provided by law & Rules

of Court.

2) When the CPs decision/order/ruling

adversely affects the interest of any govt.

agency, the appeal may be taken by the

agency head.

LACHES

Defined as the failure or neglect, for an unreasonable

length of time, to do that by which by exercising due diligence

could or should have been done earlier.

It is negligence or omission to assert a right within a reasonable

time, warranting a presumption that the party entitled to assert

it either has abandoned it or declined to assert it.

Relief has been denied to litigants who, by sleeping on their

rights for an unreasonable length of time either by

negligence, folly or inattention have allowed their claims to

become stale. The laws aid the vigilant, not those who slumber

on their rights.

ELEMENTS OF LACHES

1. Conduct on the part of the defendant

that gave rise to the situation complained

of; or the conduct of another which the

defendant claims gave rise to the same;

2. Delay by the complainant in asserting his

right after he has had knowledge of the

defendants conduct and after he has had

an opportunity to sue;

ELEMENTS OF LACHES

3. Lack of knowledge by or notice to the

defendant that the complainant will

assert the right on which he bases his

suit; and

4. Injury or prejudice to the defendant in

the event relief is accorded to the

complainant.

SUPREME COURT RULING:

Soliva vs. Intestate Estate of Marcelo M. Villaliba,

G.R. No. 154017, Dec. 8, 2008

even a registered owner of property may be barred

from recovering possession of property by virtue of

laches

The same is not true with regard to laches.

stale demand.

TEOTIMO EDUARTE vs. CA, G.R. No.

121038, July 22, 1999

It has been consistently held that laches does

not concern itself with the character of the

defendants title, but only with the issue of

whether or not the plaintiff by reason of long

inaction or inexcusable neglect should be

barred entirely from asserting the claim,

because to allow such action would be

inequitable and unjust to the defendant.

(underscoring and emphasis ours)

EXCEPTION TO THE GENERAL RULE:

Durban Apartments Corp. vs. Catacutan, G.R. No.

167136, Dec 14, 2005

the Court may disregard procedural lapses so that a

case may be resolved on its merits. Rules of Procedure

should promote, not defeat, substantial justice.

A strict and rigid application of the rules that would

result in technicalities that tend to frustrate rather

than promote justice must be avoided.

CANDO vs. Olazo, G.R. No. 160741,

March 22, 2007

Ultimately, the interest of

substantial justice must

transcend rigid observance

of the rules of

procedure.xxx

Department of Agrarian Reform vs. Ma.

Regina I. Samson, et al., G.R. 161910,

June 17, 2008

It is well-settled that rules of

procedure are construed liberally

in proceedings before

administrative bodies and are not

to be applied in a very rigid and

technical manner, .

Finality and Enforcement

of Decisions

EXECUTION OF DECISION

Execution shall issue upon a decision

that finally disposes of the case. Such

execution shall issue as a matter of

right upon the expiration of the

period to appeal there from if no

appeal has been fully perfected.

(Section 1 Rule XIII, Revised Rules of

Procedure)

Finality and

Enforcement of Decisions

a) Notice of Finality

of Decisions

NOTICE OF FINALITY OF DECISION (NFD)

1) A decision of the CP, ASB, Director or Auditor

upon any matter within their respective

jurisdiction, if not appealed, shall become final

& executory.

2) The NFD (Form 7) shall be issued by the

authorized COA official to agency head to notify

that a decision has become final & executory,

there being no appeal or MR filed within the

reglementary period.

NOTICE OF FINALITY OF DECISION (NFD)

Republic of the Philippines

COMMISSION ON AUDIT

JKL City, Manila

Date: December 12, 2009

NOTICE OF FINALITY OF DECISION (NFD)

Hon. Lito M. Paras

City Mayor

JKL City, Metro Manila

Attention: Mr. Lauro T. Lorenzo

City Accountant

Reference: ND/NC No. - _________________

Date of NC - _________________

Amount - _________________

Nature of ND/NC - Collection of City License tax in the amount of P63,189.00 which was deficient by P2,700.00 since the

correct amount should be P65,889.00.

Persons Liable and date 1. Edna P. Gamba Assessment Clerk II - ______________

of receipt of ND/NC 2. Joseph R. Santos Chief, License Division - ______________

3. ABC Enterprise payor - ______________

Please be informed that the above ND/NC has become final and executory, there being no appeal filed within the reglementary period.

Accordingly, the above named persons liable shall pay the above amount immediately to the agency cashier. Failure to pay the same shall authorize the agency cashier to

withhold payment of salary and other money due to persons liable in accordance with COA Order of Execution to be issued to the agency cashier.

Carlito G. Odullo

CARLITO G. ODULLO

Audit Team Leader

Gina H. Landicho

GINA H. LANDICHO

Supervising Auditor

PROOF OF SERVICE OF NFD TO PERSONS LIABLE

Name Position Received by Date

1. Edna P. Gamba _______________ _____________ ___________

2. Joseph R. Santos _______________ _____________ ___________

3. ABC Enterprise _______________ _____________ ___________

Copy furnished:

The Director

Local Government Sector

If decision of the Director/ASB or CP attains finality,

par 1 may be restated as follows:

Please be informed that the decision of the Director/

Adjudication and Settlement Board/Commission Proper

No. __________ dated _________ has become final and

executory in the absence of an appeal filed within the

prescribed period. The said decision affirmed the above

ND/NC.

(Signatory shall be the Director, General Counsel or

Commission Secretary as provided under Section 22.3 of

these Rules. A copy of the CFD issued by the Commission

Secretary shall be furnished the General Counsel)

3) Signing Authority:

ATL & SA for their ND/NC;

Director for ND/NC issued by SAT under his supervision;

Director for his decision;

General Counsel for ASB decision;

Commission Secretary for CP decision

4) Addressed to the Agency Head, Attention: the

Chief Accountant & shall indicate the particulars

of the COA decision that has become final &

executory & the persons liable.

NOTICE OF FINALITY OF DECISION (NFD)

5) A copy shall be served by the Agency Auditor on

the persons liable or their authorized

representatives who shall indicate their printed

name & signature & the date of receipt.

6) The Chief Accountant shall, on the basis of the

NFD, record the disallowance/charge as a

receivable.

NOTICE OF FINALITY OF DECISION (NFD)

b) COAs Order of Execution

Finality and

Enforcement of Decisions

COA Order of Execution (COE)

COE (Form 8) is issued to

enforce the settlement of

disallowance/charge, whenever

the persons liable refuse or fail

to settle them after the decision

become final & executory.

COA Order of Execution (COE)

Republic of the Philippines

COMMISSION ON AUDIT

Office of the General Counsel

Date: July 20, 2010

COA ORDER OF EXECUTION (COE)

Mr. Romeo Formoso

President, GHI Corp.

Roxas Blvd., Manila

Attention: Ms. Erlinda Manrique

Cashier

Reference: CP/ASB Decision No. & date - 2009-023 dated March 10, 2009

ND No. & date - 06-051-101-05 dated July 14, 2006

Amount - P42,000.00

Date of NFD - July 5, 2008

Nature of transaction - Payment for sports equipment under DV No. 03- 07-25 dated 5/28/2006 in the total amount of P142,826.00

Persons Liable 1. Jose L. Unciano Property Inspector - ___________

2. Gloria G. Manalili Chief, General Services - ___________

3. Sandra P. Baylon Chief, Research Division - ___________

You are hereby instructed to withhold the payment of the salaries or any amount due to the above-named persons liable, for the settlement of their liabilities pursuant to the ND/Decision referred to

above, copy attached and made an integral part hereof.

Payment of salaries or any money due them in violation of this instruction will be disallowed in audit and you will be held liable therefore.

Wilma C. Jardin

WILMA C. JARDIN

Assistant Commissioner

General Counsel

PROOF OF SERVICE OF COE TO AGENCY OFFICIALS

Name Position Received by Date

1. Mr. Romeo Formoso President, GHI Corp. _____________ _______________

2. Ms. Erlinda Manrique Cashier _____________ _______________

Copy furnished:

Persons liable:

Mr. Jose L. Unciano

Ms. Gloria G. Manalili

Ms. Sandra P. Baylon

All of GHI Corp., Manila

The Accountant

GHI Corp.

The Auditor

GHI Corporation, Manila

The Director, Cluster C

Corporate Government Sector

COE shall be approved not earlier than 5 days

from receipt of the NFD by the agency head,

by the following:

Director for NFD issued by him or by the Auditor;

General Counsel for NFD issued by him or by the

Commission Secretariat, or for judgment rendered by

the SC

COA Order of Execution (COE)

Addressed to the agency head,

Attention: the Cashier/ Treasurer, &

shall indicate the NFD, the

particulars of the decision being

enforced & the persons liable.

COA Order of Execution (COE)

The Auditor monitor the

implementation of the COE &

report to the Director the action

taken by the agency. Unsettled

COEs shall be referred to the GC

for appropriate action, including

referral to the OSG & the

Ombudsman.

COA Order of Execution (COE)

Non-Compliance with the COE

Section 3. Non-compliance with the COE. - In case of failure by

the Cashier/Treasurer/Disbursing Officer to comply with the COE, the

Auditor shall notify the agency head concerned of the non-

compliance. At the same time, the Auditor shall report the matter

through the COA Director concerned, to the General Counsel who

shall take any or all of the following actions:

Recommend to the Commission Proper to cite defaulting party in

contempt;

Refer the matter to the Solicitor General for the filing of

appropriate civil suit;

Refer the case to the Ombudsman for the filing of appropriate

administrative or criminal action.

Remedies for Non-Compliance with the COE

Section 4. Holding the Defaulting Party in

Contempt. Any party who fails to comply with

the COE may be held in contempt pursuant to

Section 2, Rule XI of these Rules. The LSS shall study

and evaluate the report of such non-compliance as

cited in the preceding section and submit its

recommendation to the Commission Proper within

fifteen (15) days from receipt thereof (Section 4

Revised Rules of Procedure)

Section 1. Direct Contempt Punished Summarily. - A person

guilty of misbehavior in the presence of or so near the

Commission Proper or any of its members as to obstruct or

interrupt the proceedings before it or them, including

disrespect toward the Commission or its members, offensive

personalities toward others or refusal to be sworn or to

answer as a witness, or to subscribe to an affidavit or

deposition when lawfully required to do so, may be

summarily adjudged in contempt by the Commission or any

of its members and shall be punished in accordance with the

penalties prescribed in the Rules of Court.(Section 1 Rule XI,

Revised Rules of Procedure)

Remedies for Non-Compliance with the COE

Section 2. Indirect Contempt. After a charge in writing has

been filed by an aggrieved party before the Commission Proper or

its members, and after an opportunity shall have been given to

respondent to be heard by himself or counsel, a person guilty of the

following acts may be punished for contempt:

Misbehavior of any officer of the Commission in the performance of his

official duties or in his official transactions;

Disobedience of or resistance to a lawful writ, process, order, judgment

or command of the Commission or any of its members;

Any abuse of or any unlawful interference with the process or

proceedings of the Commission or any of its members not constituting

direct contempt under Section 1 of this rule;

Any improper conduct tending, directly or indirectly, to impede,

obstruct, or degrade the administration of justice by the Commission or

any of its members;

Failure to obey a subpoena duly served.

Remedies for Non-Compliance with the COE

Section 3. Penalty for Indirect

Contempt. - If adjudged guilty, the

accused may be punished in

accordance with the penalties

prescribed in the Rules of

Court.(Sections 2 and 3, Revised Rules

of Procedure)

Remedies for Non-Compliance with the COE

Section 5. Referral to the Solicitor General. - To enforce civil

liability, the Auditor shall submit to the Director concerned

a report on COEs which have not been complied with. The

report shall be duly supported with certified copies of the

subsidiary records, and the payrolls/vouchers disallowed

and collections charged, together with all necessary

documents for the filing of the appropriate civil suit. The

Director shall forward the report to the General Counsel

who shall study and evaluate the same and submit his

recommendations to the COA Chairman within fifteen(15)

days from receipt thereof. Referral to the Office of the

Solicitor General for its appropriate action may be made.

(Section 5, Rule XIII, Revised Rules of Procedure)

Remedies for Non-Compliance with the COE

Section 6. Referral to the Ombudsman. - The Auditor shall

report to his Director all instances of failure or refusal to

comply with the decisions or orders of the Commission

contemplated in the preceding sections. The COA Director

shall see to it that the report is supported by the sworn

statement of the Auditor concerned, identifying among

others, the persons liable and describing the participation

of each. He shall then refer the matter to the Legal Services

Sector who shall refer the matter to the Office of the

Ombudsman or other appropriate office for the possible

filing of appropriate administrative or criminal action.

Remedies for Non-Compliance with the COE

Section 7. Effect of Non-

compliance. - Any delay in

complying or refusal to comply with

the order or decision of the

Commission shall constitute a ground

for contempt, and/or administrative

disciplinary action against the officer

or employee concerned.

Remedies for Non-Compliance with the COE

Section 1. Applicability of Civil Service Law

and Other Rules. - The procedures set forth in

the pertinent provisions of the Civil Service

Law, The Omnibus Rules Implementing

Executive Order 292 and COA Memorandum

No. 76-48, in administrative cases against

officers and employees of the Commission, are

hereby adopted and read into these rules.

(Section 1, Rule IV of the Revised Rules of

Procedure)

Remedies for Non-Compliance with the COE

Dropping from the Books of Accounts of

Settled ND/NC

Recorded final disallowances/charges

w/c are settled shall be dropped

from the books upon receipt by the

Accountant of the NSSDC (Section

24 Rules and Regulations on the

Settlement of Accounts)

Record of COA Decisions (ROCD)

1. Maintained by the Auditor showing the

ND/NCs issued, appeals taken, decisions

on appeals, NFDs & COE issued & the

NSSDC;

2. The Director & the LSS Ascom shall keep

copies of the Decisions rendered by their

respective offices, & the NFD & COEs;

The Director, LSS Ascom &

Commission Secretary shall ensure

that the Auditor is furnished w/

copies of their decisions, & NFDs &

COEs, to update the ROCD.

Record of COA Decisions (ROCD)

Opening/Revision of Settled Accounts

1. In no case shall finally settled accounts be

opened or reviewed by COA, except on the

following before the expiration of the 3 years

after the settlement of any account:

a) motu propio review & revise the account or

settlement & certify a new balance. It may require

any account, voucher or other papers connected w/

the matter be forwarded to it.

b) Open the account when appearing to be tainted w/ fraud, collusion,

or error of calculation, or when new & material evidence is

discovered, & after a reasonable time for reply or appearance of the

party concerned, may certify thereon a new balance. An Auditor

may exercise the same upon prior authorization of the COA

Chairman.

Opening/Revision of Settled Accounts

2. If a settled account is re-opened/

reviewed, & a new balance is certified in

accordance w/ Sec. 52 of PD 1445, the aggrieved

party may appeal in accordance w/ Rule IV of

RRSA.

As Accountants

Let us consider 3

simple rules.

1 - Do no harm

2 - Do good

3- Stay in love with

GOD

OPEN FORUM

THANK

YOU!!!

Potrebbero piacerti anche

- Coa Memo 2005-027 - Check ListannexesDocumento24 pagineCoa Memo 2005-027 - Check ListannexesAbdul Nassif Faisal60% (5)

- 05 Exercise 1.1 - 3 - AOM - IAR LinkagesDocumento2 pagine05 Exercise 1.1 - 3 - AOM - IAR LinkagesMark Anthony TibuleNessuna valutazione finora

- 03 Exercise 1.1 - 2 - AOM - PPSA LinkagesDocumento1 pagina03 Exercise 1.1 - 2 - AOM - PPSA LinkagesMark Anthony TibuleNessuna valutazione finora

- Coa - M2013-004 Cash Exam Manual PDFDocumento104 pagineCoa - M2013-004 Cash Exam Manual PDFAnie Guiling-Hadji Gaffar88% (8)

- COA - M2014-011 - Per AARDocumento13 pagineCOA - M2014-011 - Per AARLalaLaniba100% (2)

- Documentary Requirements For Common Government TransactionsDocumento74 pagineDocumentary Requirements For Common Government TransactionsChristine Meralpes100% (8)

- Audit Observation MemorandumDocumento8 pagineAudit Observation MemorandumMiriam Hannah Bordallo100% (1)

- BOM For LGUs 2023 Edition - Fin1 - UnlockedDocumento329 pagineBOM For LGUs 2023 Edition - Fin1 - UnlockedNatacia Rimorin-Dizon100% (2)

- J - Exit Conference GuideDocumento2 pagineJ - Exit Conference GuideHoven Macasinag75% (4)

- Manual For Barangays Under The New Government Accounting System Ngas PDFDocumento4 pagineManual For Barangays Under The New Government Accounting System Ngas PDFcherlgaux25% (4)

- Memo98 569ADocumento1 paginaMemo98 569ALino GumpalNessuna valutazione finora

- Remedies On COA DisallowanceDocumento20 pagineRemedies On COA DisallowanceIan dela Cruz Encarnacion100% (2)

- LTOM Book 1 FinalDocumento210 pagineLTOM Book 1 FinalGïi Pì100% (2)

- COA Resolution 2018-07Documento2 pagineCOA Resolution 2018-07Gerard DGNessuna valutazione finora

- GAAM Volume 1Documento288 pagineGAAM Volume 1Ynnejesor Aruges100% (3)

- Commission On Audit 1, .-: %LV.. ') Tz. Itepublit of The 1:11tilimaints Peiv EDocumento2 pagineCommission On Audit 1, .-: %LV.. ') Tz. Itepublit of The 1:11tilimaints Peiv Eerrol100% (1)

- 11 DOF BLGF Local Revenue Generation and LGU ForecastingDocumento20 pagine11 DOF BLGF Local Revenue Generation and LGU ForecastingDilg Sadakbayan100% (2)

- Local Government Units Public Financial Management Implementation StrategyDocumento47 pagineLocal Government Units Public Financial Management Implementation StrategyDBM CALABARZONNessuna valutazione finora

- COA Documentary RequirementsDocumento165 pagineCOA Documentary Requirementsrubydelacruz83% (6)

- Coa M2013-004Documento104 pagineCoa M2013-004Jobel Sibal CapunfuerzaNessuna valutazione finora

- Commonwealth Avenue, Quezon CityDocumento3 pagineCommonwealth Avenue, Quezon CityAngeli Lou Joven VillanuevaNessuna valutazione finora

- 2007-004 Relief of AccountabilityDocumento2 pagine2007-004 Relief of AccountabilityAcu Z Marcus100% (4)

- Inventory 2022 PipDocumento10 pagineInventory 2022 PipGSS emb10100% (1)

- New Laws and Rules On Expenditures and Disbursements (ATA)Documento52 pagineNew Laws and Rules On Expenditures and Disbursements (ATA)Maria Julieta Stephanie TacogueNessuna valutazione finora

- AOM 2020-005 (16-19) Ila Iyam ReimbursementsDocumento2 pagineAOM 2020-005 (16-19) Ila Iyam Reimbursementsvivian cavidaNessuna valutazione finora

- ICLTE-A.1-Data Analytics - Investment Programming and FRMDocumento31 pagineICLTE-A.1-Data Analytics - Investment Programming and FRMNash A. Dugasan100% (1)

- Lala2017 Audit ReportDocumento146 pagineLala2017 Audit ReportEm SanNessuna valutazione finora

- Addressing COA DisallowancesDocumento57 pagineAddressing COA DisallowancesJoshua Pattal100% (2)

- Doh 2011 Coa Observation RecommendationDocumento71 pagineDoh 2011 Coa Observation RecommendationAnthony Sutton87% (15)

- Local Funds Management and UtilizationDocumento89 pagineLocal Funds Management and UtilizationJennylyn Favila Magdadaro100% (7)

- Sourcebook On Local Public FinanceDocumento84 pagineSourcebook On Local Public FinanceAlce Quitalig0% (1)

- Sample Aom - Bloated ABC-non-compliance With IRR ProvisionsDocumento4 pagineSample Aom - Bloated ABC-non-compliance With IRR Provisionsjaymark camacho100% (1)

- Coa M2015-007Documento12 pagineCoa M2015-007Abraham Junio80% (5)

- Aom - GafrDocumento4 pagineAom - Gafrrussel1435Nessuna valutazione finora

- Updates About COA Strategic Plan and ProjectsDocumento3 pagineUpdates About COA Strategic Plan and ProjectsJulie Khristine Panganiban-ArevaloNessuna valutazione finora

- COA - M2013-004 Revised Cash Examination ManualDocumento106 pagineCOA - M2013-004 Revised Cash Examination Manualerrol100% (3)

- COA Cir No. 2009-001-Submission of Pos, ContractsDocumento28 pagineCOA Cir No. 2009-001-Submission of Pos, Contractscrizalde de dios100% (1)

- Basics of Local Finance and Taxation and Responsibilities and Accountabilities of Accountable OfficerDocumento16 pagineBasics of Local Finance and Taxation and Responsibilities and Accountabilities of Accountable Officeranne villarinNessuna valutazione finora

- Request For Manual EntriesDocumento4 pagineRequest For Manual EntriesEppie SeverinoNessuna valutazione finora

- Audit Program DueFromNGAsDocumento2 pagineAudit Program DueFromNGAsCOA-PCA CONessuna valutazione finora

- BLGF Local Treasury Operations Manual LTOMDocumento1 paginaBLGF Local Treasury Operations Manual LTOMangel0916100% (1)

- SAOR 2015 Additional AOM DO ZDNDocumento9 pagineSAOR 2015 Additional AOM DO ZDNrussel1435Nessuna valutazione finora

- AOM - Cash in Bank-LCCA Without Legal BasisDocumento5 pagineAOM - Cash in Bank-LCCA Without Legal Basisrussel1435Nessuna valutazione finora

- Office of The Municipal Mayor: Republic of The Philippines Province of Isabela Municipality of GamuDocumento3 pagineOffice of The Municipal Mayor: Republic of The Philippines Province of Isabela Municipality of GamuEduard Ferrer100% (1)

- LGU-Cawayan PRIME-HRM ToolDocumento122 pagineLGU-Cawayan PRIME-HRM ToolBenj Delavin100% (1)

- LGU BudgetingDocumento14 pagineLGU BudgetingYasminNessuna valutazione finora

- Iclte Press Release 2018 BLGFDocumento2 pagineIclte Press Release 2018 BLGFElla LagorraNessuna valutazione finora

- Coa m2022-004 Gad Audit GuideDocumento96 pagineCoa m2022-004 Gad Audit GuideJeffrey AmigoNessuna valutazione finora

- Things To Know About Basic Competency On Local Treasury ExaminationDocumento1 paginaThings To Know About Basic Competency On Local Treasury ExaminationPatrick RellesNessuna valutazione finora

- ICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleDocumento22 pagineICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleNash A. Dugasan100% (3)

- COA Decision Re: Splitting of ContractsDocumento9 pagineCOA Decision Re: Splitting of ContractsNadine DiamanteNessuna valutazione finora

- Sample Audit Observation - PPEDocumento3 pagineSample Audit Observation - PPEGiovanni MartinNessuna valutazione finora

- Accounting For Budgetary Accounts CompleteDocumento60 pagineAccounting For Budgetary Accounts CompleteMarinel FelipeNessuna valutazione finora

- COA PresentationDocumento155 pagineCOA PresentationRonnie Balleras Pagal100% (1)

- Trainer's Training - Settlement of Accounts FinalDocumento39 pagineTrainer's Training - Settlement of Accounts Finalcao.lilydawnfNessuna valutazione finora

- Core Text Module 3Documento8 pagineCore Text Module 3apple_doctoleroNessuna valutazione finora

- Audit Mannual - PPT FinalDocumento25 pagineAudit Mannual - PPT FinalitelsindiaNessuna valutazione finora

- Appendix 1.2 - Engagement Letter UNPDocumento4 pagineAppendix 1.2 - Engagement Letter UNPJasmine Kay ReyesNessuna valutazione finora

- Republic of The Philippines Commission On AuditDocumento4 pagineRepublic of The Philippines Commission On AuditTahani Awar GurarNessuna valutazione finora

- New Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPDocumento56 pagineNew Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPRainier NabarteyNessuna valutazione finora

- COA Key Services Procedural Flow - pdf-437299431Documento74 pagineCOA Key Services Procedural Flow - pdf-437299431Ruth JacksonNessuna valutazione finora

- WB Consultant EvaluationDocumento32 pagineWB Consultant EvaluationKristina Dacayo-GarciaNessuna valutazione finora

- 6 - FAQs For FIDELITY BONDINGDocumento3 pagine6 - FAQs For FIDELITY BONDINGRapha JohnNessuna valutazione finora

- Irr Ra 6713Documento18 pagineIrr Ra 6713icebaguilatNessuna valutazione finora

- Elba Oven Manual S 66 X 330 IsDocumento52 pagineElba Oven Manual S 66 X 330 IsKristina Dacayo-Garcia33% (3)

- SC Decision Quo Warranto Sereno PDFDocumento153 pagineSC Decision Quo Warranto Sereno PDFYe Seul DvngrcNessuna valutazione finora

- RA No 4103Documento2 pagineRA No 4103Kristina Dacayo-GarciaNessuna valutazione finora

- Coa C95-011 PDFDocumento2 pagineCoa C95-011 PDFBeboy Paylangco EvardoNessuna valutazione finora

- Resolution-Creation of Sorsogon Provincial OfficeDocumento2 pagineResolution-Creation of Sorsogon Provincial OfficeLeo Archival ImperialNessuna valutazione finora

- Clr2 DigestsDocumento3 pagineClr2 DigestsAce Quebal100% (2)

- "Gender, Welfare, and Citizenship in Britain During The Great War" by Susan Pedersen, The American Historical ReviewDocumento25 pagine"Gender, Welfare, and Citizenship in Britain During The Great War" by Susan Pedersen, The American Historical ReviewSilvia PonceNessuna valutazione finora

- Villanueva vs. QuerubinDocumento12 pagineVillanueva vs. QuerubinTrisha Paola TanganNessuna valutazione finora

- Reaction Paper On FederalismDocumento3 pagineReaction Paper On FederalismKurt Javier50% (12)

- Zzsample - Affidavit of JoinderDocumento4 pagineZzsample - Affidavit of Joinderapi-3744408100% (2)

- Bilag v. Ay-Ay DigestDocumento2 pagineBilag v. Ay-Ay DigestJoan Eunise FernandezNessuna valutazione finora

- N o T I C e - Deepak Shirbhate GratuityDocumento5 pagineN o T I C e - Deepak Shirbhate GratuityDIPAK VINAYAK SHIRBHATENessuna valutazione finora

- Reading The Internal Fraud SignsDocumento5 pagineReading The Internal Fraud SignsMuhammad Farhan Ahmad AllybocusNessuna valutazione finora

- Crimpro - SanJuan Vs Sandiganbayan - VilloncoDocumento3 pagineCrimpro - SanJuan Vs Sandiganbayan - VilloncoCHEENSNessuna valutazione finora

- Towards Local Democracy in Nepal - by Damodar AdhikariDocumento1 paginaTowards Local Democracy in Nepal - by Damodar Adhikaridamodar.adhikari@gmail.com100% (2)

- Implementation of StrategicDocumento5 pagineImplementation of StrategicAnjang PranataNessuna valutazione finora

- DiplomacyDocumento45 pagineDiplomacyMukeshChhawariNessuna valutazione finora

- Eco Class 10Documento12 pagineEco Class 10SajalNessuna valutazione finora

- JudgementDocumento20 pagineJudgementElamugilan N SNessuna valutazione finora

- Social Security System 2017Documento35 pagineSocial Security System 2017NJ Geerts100% (1)

- Complainants, Vs Vs Respondents: en BancDocumento6 pagineComplainants, Vs Vs Respondents: en BancChristie Joy BuctonNessuna valutazione finora

- V K Krishna Menons UN Speech Excerpts-Part 1Documento8 pagineV K Krishna Menons UN Speech Excerpts-Part 1KP GaneshNessuna valutazione finora

- Succn-Edroso v. SablanDocumento2 pagineSuccn-Edroso v. SablanRaf Ruf100% (1)

- Senator Koko Pimentel - DnrsfrncscoDocumento11 pagineSenator Koko Pimentel - DnrsfrncscoMark CatiponNessuna valutazione finora

- NCSTDocumento3 pagineNCSTGowdham PNessuna valutazione finora

- Candidate Personal Information Form (CPIF)Documento2 pagineCandidate Personal Information Form (CPIF)Prem NathNessuna valutazione finora

- Report of The Independent Inquiry Into The Media and Media Regulation WebDocumento474 pagineReport of The Independent Inquiry Into The Media and Media Regulation WebprowlingNessuna valutazione finora

- The Punjab Land Revenue (Amendment) Act 2011Documento4 pagineThe Punjab Land Revenue (Amendment) Act 2011Ghulam FaridNessuna valutazione finora

- Human Rights by Irfan AliDocumento5 pagineHuman Rights by Irfan AliShaista ParveenNessuna valutazione finora

- Alternative Sentencing WordDocumento2 pagineAlternative Sentencing WordArun Vignesh MylvagananNessuna valutazione finora

- Municipality of San Fernando V Judge FirmeDocumento2 pagineMunicipality of San Fernando V Judge FirmeZonix LomboyNessuna valutazione finora

- Pilipinas Bank V CADocumento2 paginePilipinas Bank V CAdinv100% (1)

- Motion For Rehearing and Hearing With Exhibits PDFDocumento14 pagineMotion For Rehearing and Hearing With Exhibits PDFDaniel UhlfelderNessuna valutazione finora

- Articles of IncorporationDocumento8 pagineArticles of IncorporationKlein FerdieNessuna valutazione finora