Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kist Bank's Financial Performance Analysis

Caricato da

Deepesh Sharma0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

201 visualizzazioni14 pagineThis document provides background information on Kist Bank, including its mission, vision, management team, branches, products and services, and share capital. It also includes a SWOT analysis of the bank highlighting strengths such as high profitability and existing distribution networks, as well as weaknesses like future competition and small business units. The objective of the study is stated as analyzing and evaluating the financial performance of Kist Bank by answering research questions about its financial position in the market and ability to meet shareholder expectations.

Descrizione originale:

kist bank nepal

Titolo originale

Financial Performance of Kist Bank

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document provides background information on Kist Bank, including its mission, vision, management team, branches, products and services, and share capital. It also includes a SWOT analysis of the bank highlighting strengths such as high profitability and existing distribution networks, as well as weaknesses like future competition and small business units. The objective of the study is stated as analyzing and evaluating the financial performance of Kist Bank by answering research questions about its financial position in the market and ability to meet shareholder expectations.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

201 visualizzazioni14 pagineKist Bank's Financial Performance Analysis

Caricato da

Deepesh SharmaThis document provides background information on Kist Bank, including its mission, vision, management team, branches, products and services, and share capital. It also includes a SWOT analysis of the bank highlighting strengths such as high profitability and existing distribution networks, as well as weaknesses like future competition and small business units. The objective of the study is stated as analyzing and evaluating the financial performance of Kist Bank by answering research questions about its financial position in the market and ability to meet shareholder expectations.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 14

FINANCIAL PERFORMANCE OF KIST BANK

In partial fulfillment of the requirement for the degree of

Bachelor in Business Administration (BBA)

March 2014

Kathmandu, Nepal

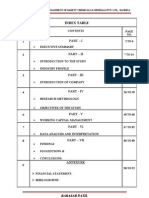

Table of Contents

CHAPTER 1

1. Introduction

1.1 Background of the study

1.2 Background of the Company

1.3 Statement of Problem

1.4 Objective of Study

1.5 Significance of the Study

1.6 Limitation of Study

1.7 Organization of Study

1.0 Introduction

1.1 Background of study

The bank is an institution established by law, which deals with money and credit is called

banking. In other words, it is obvious that an institution which deals with money, receiving it on

deposits from customers, honoring customers drawings against such deposits and demand,

collecting cheques from customers, and lending or investing surplus deposits until they are

required for repayment.

The financial institutions or banks are the crucial ways not only for financing activities but also

provides all types of activities related to finance. Financial performance of financial institutions

is well advanced in its measurement within the field of finance and management. The core aim

of the study is to analyze the financial data of Kist bank ltd..

A sound banking system is important because of the key role it plays in the economy

intermediation, maturity transformation, facilitating payment flows, credit allocation and

maintaining financial discipline among the borrowers In any economy whether highly developed

financial market or less well developed financial markets, bank remain at the centre of

economic and financial activity and stand apart from other institution as primary providers of

payment services and a fulcrum for monetary policy implementation.

Financial analysis is an integral aspect of operating a successful business. Analysis of firms

income statement and balance sheet can provide valuable data that executives and managers can

use to make informed business decision. A bank should be certain that its financial statements

are accurate. Data gleaned from inaccurate financial statement will yield financial analysis that

may not be helpful in making proper decision. A greater awareness of financial statements and

their interrelationship can lead to improved profitability or cash flow.

1.2 Background of the Company

Kist bank stands for the customers convenience, support and providing Power to Succeed.

Kist Bank, established in 2003, with a vision of becoming the best Bank on operational

excellence and superior financial performance, has the authorized Capital of NPR 10 billion;

issued capital of NPR 2 billion and Paid-Up Capital NPR 2 billion.

60% of the paid-up capital is held by the promoters and remaining 40% by the general public.

The share of the Bank is listed at Nepal Stock Exchange Limited (NEPSE), the only Stock

Exchange in the country, as 'A' category company...The Bank has a seven member Board of

Directors with the representation of three Directors from the promoters' group, two Directors

from general public and one as Professional Director.

Kist Bank stands for customers' convenience and support. The Bank is driven by values of

efficiency in operations, integrity and a strong focus on catering the needs of every customer by

offering high quality and cost effective products and services.

The Bank has wider range of products and services, which covers Business Banking,

Institutional Banking, Small and Medium Enterprises Banking, Consumer Banking, Micro-

financing, Transaction Banking. The Bank has also been providing Cards, Remittance, Internet

Banking, Mobile Banking (both through four wheeler vehicle and cell phone), etc services.

The Bank has 365 days banking and provides evening banking services from all branches.

Deposit and Withdrawal services are available from all branches at free of cost.

The Bank is equipped with a robust system for Risks Management. The professional

management team, along with dedicated employees, is always looking forward to serving the

customers, understanding their needs and designing the tailored-made products and services,

who are equipped with a state-of-art technology and IT infrastructures.

Mission

Our mission is to become the leading bank by providing the best quality financial products and

services to our customers, enhancing our shareholders value, contributing to the economic

prosperity of the country and creating excellent opportunity for our employees.

Vision

Our vision is to become the best bank based on operational excellence and superior financial

performance.

Board of directors

Mr. Ram Prasad Dahal

Chairman

Mr. Bishnu Gopal Shrestha

Director

Mr. Pushpa Bahadur Pradhan

Director

Mr. Dakshya Poudyal "Subhash"

Director

Ms. Kusum Lama

Director

Mr. Parmeshwor Lal Pradhan

Director

MR. Rishi Ram Gautam

Professional Director

Management team

Mr. Kumar Lamsal

(Chief Executive Officer)

Mr. Bal Kumar Pandey

(Chief Legal & Compliance Officer)

Mr. Bhesh Raj Khatiwada

( Chief Credit Officer)

Mr. Ashok Sherchan

(Deputy Chief Executive Officer)

Mr. Bam Dev Dahal

(Chief Operating Officer)

Mr. Mukunda Subedi

(Head - Central Finance)

Mr. Tara Manandhar

(Chief Business Officer)

Mr. Rishi Ram Neupane

(Head - IT Department)

Mr. Pradeep Khanal

(Head-Deposit Marketing/ Branch Co-ordination)

Mr. Ranjan Pandey

(Manager-Central Credit Risk Assessment)

Mr. Surendra Chand

(Head-Central Credit Administration)

Share capital

The Authorized Capital of the Bank is Rupees 10 billion and the Issued & Paid-Up Capital is

Rupees 2 billion. 60 percent of the Paid-Up Capital is held by the promoter and remaining 40%

is held by the general public. The Bank is listed at Nepal Stock Exchange Limited (NEPSE).

Authorized Capital

The authorized capital of the Bank is Rupees 10,000,000,000.00 (Rupees Ten billion Only)

divided into 100 million equity shares of Rupees 100.00 each.

Issued Capital

The issued capital of the Bank is Rupees 2,000,000,000.00 (Rupees Two billion Only) divided

into 20 million equity share of Rupees 100.00 each.

Paid-Up Capital

The Paid up capital of the Bank is Rupees 2,000,000,000.00 (Rupees Two billion Only) divided

into 20 million equity share of Rupees 100.00 each.

Year Total Paid up capital

Commencement of

business

30 Million

2005 IPO of Rupees 20 million totaling Paid-Up Capital Rupees 50 million

2006

1:1 right share issue of Rupees 50 million totaling Paid-Up Capital to

Rupees 100 million

2007

1:1 right share issue of Rupees 100 million totaling Paid-Up Capital to

Rupees 200 million

Early 2008

1:3 right share issue of Rupees 600 million totaling Paid-Up Capital to

Rupees 800 million

By the end of 2008

1:1.5 right share issue of Rupees 1.2 billion totaling to Paid-Up Capital

to Rupees 2 billion

Share capital structure of the Bank

Group Share Holders

No. of

Share

Share Capital in

%

Paid Up Capital

Payment in

%

A Promoter 12,000,000 60 1,200,000,000.00 100

B

General Public (Including

Staff)

8,000,000 40 800,000,000.00 100

Total: 20,000,000 100 2,000,000,000.00 100

BRANCHES

The Bank has been providing its service to its customers through its own office building at

Anamnagar in the capital, as well as in other different parts of country. We are available with 51

branches spread throughout the country with the eagerness to serve the customers.

ATM SERVICES

Kist is providing self service banking (SSB) to its esteem customers through Kist SSB Card

using own ATM Switching software. Till date we have 78 ATM outlets. Our customer can

transact from our terminal free of cost. In additional to this customers can use any other SCT

member banks' terminal paying charges.

Our customers can now have access to 24 hours banking service through our 78 ATM locations

among which 46 ATMs are inside the valley and the rest 32 are outside the valley.

PRODUCTS AND SERVICES

Personal Banking

Savings Account

Fixed Deposit Account

NaraNari Nikshep-2

Call Deposit

Current Account

Coporate Banking

Term Loan

Chelibeti Laghu Udyamshil Karja

Kist Microfinance Wholesale Loan

Salary Solutions

Bank Guarantee Business

Transaction Banking

Ncell Pre-paid Top-Up

Card Transaction Limits

NCell Pro Payment

Kist Mobile Wallet

E-Banking

SWOT ANALYSIS

This free sample SWOT analysis shows strengths, weaknesses, opportunities and threats. We

cover over 40,000 companies and industries. This sample SWOT analysis for Kist Bank can

provide a competitive advantage.

Strengths

-high profitability and revenue

-existing distribution and sales networks

-barriers of market entry

-domestic market

Weaknesses

-small business units

-future competition

Opportunities

-venture capital

-income level is at a constant increase

-global markets

-growth rates and profitability

-new markets

Threats

-growing competition and lower profitability

-increasing rates of interest

-rising cost of raw materials

-government regulations

-increase in labor costs

-price changes

-tax changes

-external business risks

-global economy

1.3 Statement of Problem

The present study has tried to analyze and evaluate the financial performance of bank taking a

case of Kist Bank ltd.. Furthermore the study has tried to answer the following research

questions:

What is financial position of Kist bank ltd. in market?

How far the bank has been able to meet the shareholders expectation?

How viable the bank is in long term?

1.4 Objective of study

Each activity of human being is driven to world the following objective

To evaluate liquidity, leverage, and profitability ratios of Kist bank limited.

To study the cash flow statement of banks.

To make neces s ar y s ugges t i ons and r ecommendat i ons f or ef f ect i ve

f i nanci al performance in future.

1.5 Significance of the Study

The topic under study will help different parties since the significance of banking business for a

national development is obvious. The study has multidimensional significance:

Holding of Share

Shareholders are the owners of the company. Time and again, they may have to take decisions

whether they have to continue with the holdings of the company's share or sell them out. The

financial statement analysis is important as it provides meaningful information to the

shareholders in taking such decisions.

Decisions and Plans

The management of the company is responsible for taking decisions and formulating plans and

policies for the future. They, therefore, always need to evaluate its performance and effectiveness

of their action to realize the company's goal in the past. For that purpose, financial statement

analysis is important to the company's management.

Extension of Credit

The creditors are the providers of loan capital to the company. Therefore they may have to take

decisions as to whether they have to extend their loans to the company and demand for higher

interest rates. The financial statement analysis provides important information to them for their

purpose.

Investment Decision

The prospective investors are those who have surplus capital to invest in some profitable

opportunities. Therefore, they often have to decide whether to invest their capital in the

company's share. The financial statement analysis is important to them because they can obtain

useful information for their investment decision making purpose.

1.7 Limitations of study

The major limitations of this research are related with the ratio analysis of

financial p e r f o r ma n c e o f Ki s t b a n k l i mi t e d . Use and Limitations of

Financial statement analysis (using Ratios) attention should be given to the following

issues when using financial ratios: A reference point is needed. To be meaningful, most

ratios must be compared to historical values of the same firm, the firm's forecasts, or

ratios of similar firms. Most ratios by themselves are not highly meaningful. They should

be viewed as indicators, with several of them combined to paint a picture of the firm's

situation. Year-end values may not be representative. Certain account balances that are

used to calculate ratios may increase or decrease at the end of the accounting period

because of seasonal factors. Such changes may distort the value of the ratio. Average

values should be used when they are available. Ratios are subject to the limitations of

accounting methods. Different accounting choices may result in significantly different

ratio values. Va r i o u s limitations have been faced while preparing this report which is

expressed below:

This study is conducted mainly based on secondary type of data i.e. annual

reports and textbooks factors.

Study conducted only on the basis of five years data.

Limited interaction with concerned heads due to busy schedule

This study only explains about ratio and cash flow statements.

1.8 Organization of study

This study has been divided in to five chapters

Chapter1:- Introduction

Chapter2:-Research Methodology

Chapter3:- Presentation and Analysis Of data

Chapter4:- Summary, Conclusion and Recommendation

INTRODUCTION

Thi s chapt er cover s t he gener al backgr ound of t he gener al per f or mance

anal ys i s , introduction of the organization, statement of problem, objective and limitations of

the study and organization of the research study Kist Bank Ltd.

RESEARCH METHODOLOGY

This chapter focuses the research design, sample data analysis tools and their using

techniques.

PRESENTATION AND ANALYSIS OF DATA

This chapter concern with measurement of financial performance using ratio

analysis tools and their trend analysis.

SUMMARY, CONCLUSION AND RECOMMENDATION

This chapter gives summarization, conclusion and recommendation of the study

Potrebbero piacerti anche

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceDa EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceValutazione: 4 su 5 stelle4/5 (9)

- Corporate CreditDocumento69 pagineCorporate CreditAshish chanchlani100% (1)

- Performance Appraisal PracticesDocumento80 paginePerformance Appraisal PracticesKirti Singh50% (2)

- Roc Roic Roe PDFDocumento69 pagineRoc Roic Roe PDFCharlie NealNessuna valutazione finora

- Marketing and Sales ManualDocumento17 pagineMarketing and Sales ManualWendimagen Meshesha Fanta89% (9)

- PwC Fact Sheet: Global Accounting Firm by the NumbersDocumento1 paginaPwC Fact Sheet: Global Accounting Firm by the NumbersZel tanuNessuna valutazione finora

- Yes BankDocumento30 pagineYes BankVivek PrakashNessuna valutazione finora

- Bank Fundamentals: An Introduction to the World of Finance and BankingDa EverandBank Fundamentals: An Introduction to the World of Finance and BankingValutazione: 4.5 su 5 stelle4.5/5 (4)

- Fringe Benefits AnswersDocumento5 pagineFringe Benefits AnswersJonnah Grace SimpalNessuna valutazione finora

- Commercial Excellence Your Path To GrowthDocumento6 pagineCommercial Excellence Your Path To GrowthBiswajeet PattnaikNessuna valutazione finora

- Activity Based CostingDocumento13 pagineActivity Based CostingSudeep D'SouzaNessuna valutazione finora

- Execution The Discipline of Getting Things Done Book Summary PDFDocumento9 pagineExecution The Discipline of Getting Things Done Book Summary PDFMohd syukri Hashim100% (2)

- ALL Quiz Ia 3Documento29 pagineALL Quiz Ia 3julia4razoNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Working Capital Management PROJECT REPORT MBADocumento90 pagineWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)100% (14)

- WORKING CAPITAL OF AXIS BANKDocumento84 pagineWORKING CAPITAL OF AXIS BANKSami Zama100% (2)

- Internship Report On MCB Bank LimitedDocumento40 pagineInternship Report On MCB Bank Limitedbbaahmad89Nessuna valutazione finora

- Employee Job Satisfaction OF THE City Bank LimitedDocumento35 pagineEmployee Job Satisfaction OF THE City Bank LimitedRidwan Ferdous100% (1)

- Summit BankDocumento53 pagineSummit BankJaved Iqbal50% (2)

- Final Report Part 2Documento14 pagineFinal Report Part 2Megh Nath Regmi100% (2)

- The Bank of Punjab Latest Internship Report With Three Years Financial DataDocumento23 pagineThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanNessuna valutazione finora

- City Bank Is One of BangladeshDocumento4 pagineCity Bank Is One of BangladeshFarhana Rashed 2035196660Nessuna valutazione finora

- ExtraDocumento12 pagineExtraSujit Kumar YadavNessuna valutazione finora

- Proposal BinodDocumento16 pagineProposal BinodbinuNessuna valutazione finora

- HDFC Bank CAMELS Analysis and DuPont ModelDocumento31 pagineHDFC Bank CAMELS Analysis and DuPont Modelasifbhaiyat33% (3)

- Overall Analysis of Commercial Banks in NepalDocumento32 pagineOverall Analysis of Commercial Banks in Nepalsushil pokharelNessuna valutazione finora

- Anu ThesisDocumento62 pagineAnu ThesisRoman NepalNessuna valutazione finora

- Oriental Bank Of Commerce Achieves 32.45% Net Profit GrowthDocumento112 pagineOriental Bank Of Commerce Achieves 32.45% Net Profit GrowthNitesh KhannaNessuna valutazione finora

- Internship Report: NOON Business School University of SargodhaDocumento25 pagineInternship Report: NOON Business School University of Sargodhaanees razaNessuna valutazione finora

- Soneri Bank LimittedDocumento24 pagineSoneri Bank LimittednawidscribdNessuna valutazione finora

- Organizational Profile and AnalysisDocumento6 pagineOrganizational Profile and AnalysisAyush ShresthaNessuna valutazione finora

- Proposal For ThesisDocumento8 pagineProposal For ThesisDestiny Tuition Centre50% (2)

- Sarswat Bank in ShortDocumento22 pagineSarswat Bank in ShortKrishan BhagwaniNessuna valutazione finora

- Basharat Documents 2Documento30 pagineBasharat Documents 2aashir chNessuna valutazione finora

- Project of MCBDocumento55 pagineProject of MCBSana JavaidNessuna valutazione finora

- Project Work On Remittance Service of Kumari BankDocumento40 pagineProject Work On Remittance Service of Kumari BankRegan CapichinoNessuna valutazione finora

- Assignment #1 MarketingDocumento5 pagineAssignment #1 MarketingUsman SheikhNessuna valutazione finora

- Summit Bank ReportDocumento92 pagineSummit Bank Reportamna1860% (2)

- Internship Report On MCB Bank LimitedDocumento42 pagineInternship Report On MCB Bank Limitedbbaahmad89Nessuna valutazione finora

- Final Internship Report On Bop New 2003Documento65 pagineFinal Internship Report On Bop New 2003Saba RiazNessuna valutazione finora

- Financial Performance Analysis of City Bank Ltd and Dutch Bangla Bank LtdDocumento49 pagineFinancial Performance Analysis of City Bank Ltd and Dutch Bangla Bank LtdfahimNessuna valutazione finora

- An Economy of A Country Depends On BankingDocumento22 pagineAn Economy of A Country Depends On BankingOnline CornerNessuna valutazione finora

- Summit Bank Final-1Documento48 pagineSummit Bank Final-1ABDUL BASIT100% (2)

- Chapter-I: Background of StudyDocumento19 pagineChapter-I: Background of StudyGanga RamNessuna valutazione finora

- Economics Board ProjectDocumento24 pagineEconomics Board ProjecttashaNessuna valutazione finora

- Base Dividend PolicyDocumento77 pagineBase Dividend PolicySantosh ChhetriNessuna valutazione finora

- REPORTDocumento27 pagineREPORTB safe nirman and suppliers pvt. ltd.Nessuna valutazione finora

- Ratio and Profitability Analysis On Himalayan Bank LimitedDocumento18 pagineRatio and Profitability Analysis On Himalayan Bank Limitedparajuli2001kuNessuna valutazione finora

- Credit Risk Grading (CRG) in Southest Bank LimitedDocumento49 pagineCredit Risk Grading (CRG) in Southest Bank LimitedSirak AynalemNessuna valutazione finora

- Axis Bank Term Paper on Strategic ManagementDocumento16 pagineAxis Bank Term Paper on Strategic ManagementRoshan KamathNessuna valutazione finora

- Chapter-I Introduction 1.1 BackgroundDocumento14 pagineChapter-I Introduction 1.1 BackgroundSanjay KhadkaNessuna valutazione finora

- Introduction To Banking SectorDocumento6 pagineIntroduction To Banking Sectorshweta khamarNessuna valutazione finora

- Prime BankDocumento24 paginePrime BankNazmulHasanNessuna valutazione finora

- Ankita's Summer Project ReportDocumento29 pagineAnkita's Summer Project ReportKamal More100% (7)

- Financial Performance of EXIM BankDocumento52 pagineFinancial Performance of EXIM BankMirtun Joy100% (2)

- Bharat Yadav ThesisDocumento41 pagineBharat Yadav Thesisशुन्य बिशालNessuna valutazione finora

- Finance Internship Report: Subject: TopicDocumento22 pagineFinance Internship Report: Subject: TopicMahfujur RahmanNessuna valutazione finora

- By . . Campus Roll No. .. T.U. Regd. No. 7-2Documento9 pagineBy . . Campus Roll No. .. T.U. Regd. No. 7-2Pratikshya KarkiNessuna valutazione finora

- Annual Report On SBI Habib - 65Documento20 pagineAnnual Report On SBI Habib - 65Shashikala RajwadeNessuna valutazione finora

- Swagat 2010 2011 Training BookletDocumento108 pagineSwagat 2010 2011 Training Bookletbitus92Nessuna valutazione finora

- Commercial Bank Loan ManagementDocumento13 pagineCommercial Bank Loan ManagementBinod PoudelNessuna valutazione finora

- A Comparative Study On Working Capital Management of Nepalese Commercial Banks (With Reference To SCBNL & HBL) A Thesis Proposal (P13)Documento13 pagineA Comparative Study On Working Capital Management of Nepalese Commercial Banks (With Reference To SCBNL & HBL) A Thesis Proposal (P13)AmritSjbRanaNessuna valutazione finora

- Service Quality Gap Analysis in State Bank of IndiaDocumento26 pagineService Quality Gap Analysis in State Bank of IndiaArun Koshy Thomas100% (22)

- Ranjit Kumar Sah (Field Work Report)Documento40 pagineRanjit Kumar Sah (Field Work Report)Dee MaddyNessuna valutazione finora

- Standard Chartered BankDocumento31 pagineStandard Chartered BankAl Imran100% (3)

- Performance Comparison: EBL vs UCBLLong termAAAAStableApril 9 2012Short termST-2ST-2Documento31 paginePerformance Comparison: EBL vs UCBLLong termAAAAStableApril 9 2012Short termST-2ST-2Aniruddha RantuNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- Marketing of Consumer Financial Products: Insights From Service MarketingDa EverandMarketing of Consumer Financial Products: Insights From Service MarketingNessuna valutazione finora

- Performance, Risk and Competition in the Chinese Banking IndustryDa EverandPerformance, Risk and Competition in the Chinese Banking IndustryNessuna valutazione finora

- Strategy in Global EnvironmentDocumento1 paginaStrategy in Global EnvironmentDeepesh SharmaNessuna valutazione finora

- Strategy in Global EnvironmentDocumento1 paginaStrategy in Global EnvironmentDeepesh SharmaNessuna valutazione finora

- Student Declaration: Comparative Study On Financial Performance of Himalaya Bank Limited and Nabil Bank LimitedDocumento1 paginaStudent Declaration: Comparative Study On Financial Performance of Himalaya Bank Limited and Nabil Bank LimitedDeepesh SharmaNessuna valutazione finora

- Comparative Study on Financial Performance of Himalayan Bank and Nabil BankDocumento2 pagineComparative Study on Financial Performance of Himalayan Bank and Nabil BankDeepesh SharmaNessuna valutazione finora

- RahulDocumento25 pagineRahulDeepesh SharmaNessuna valutazione finora

- Bonafide Certificate: Certified That This Project Report Titled "A Comparative Study OnDocumento2 pagineBonafide Certificate: Certified That This Project Report Titled "A Comparative Study OnDeepesh SharmaNessuna valutazione finora

- Particulars Jul-12 AssetsDocumento14 pagineParticulars Jul-12 AssetsDeepesh SharmaNessuna valutazione finora

- Ariba Working Capital ManagementDocumento2 pagineAriba Working Capital ManagementDeepesh SharmaNessuna valutazione finora

- Chap 1Documento4 pagineChap 1Deepesh SharmaNessuna valutazione finora

- cfs{ifs 5fkf lj1fkg agfpg ;fdfGo l;4fGtDocumento3 paginecfs{ifs 5fkf lj1fkg agfpg ;fdfGo l;4fGtDeepesh SharmaNessuna valutazione finora

- Projectreport Daburindialimited 1st 101008044158 Phpapp01Documento57 pagineProjectreport Daburindialimited 1st 101008044158 Phpapp01Deepesh SharmaNessuna valutazione finora

- GodDocumento1 paginaGodDeepesh SharmaNessuna valutazione finora

- DaburDocumento98 pagineDaburRam KumarNessuna valutazione finora

- DaburDocumento1 paginaDaburDeepesh SharmaNessuna valutazione finora

- DaburDocumento1 paginaDaburDeepesh SharmaNessuna valutazione finora

- Coal India LimitedDocumento92 pagineCoal India LimitedChanchal K Kumar100% (3)

- Relaxo Footwear Summer Training ReportDocumento43 pagineRelaxo Footwear Summer Training ReportRitesh DeyNessuna valutazione finora

- Observation Commercial Banks PDFDocumento52 pagineObservation Commercial Banks PDFyash_dalal123Nessuna valutazione finora

- EPS Practice ProblemsDocumento8 pagineEPS Practice ProblemsmikeNessuna valutazione finora

- Mohd Arbaaz Khan Digital Marketing UAEDocumento2 pagineMohd Arbaaz Khan Digital Marketing UAEArbaaz KhanNessuna valutazione finora

- Top 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Documento5 pagineTop 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Anonymous Xb3zHioNessuna valutazione finora

- Kotler Chapter 14Documento33 pagineKotler Chapter 14ratih95100% (1)

- Evaly PR Plan by PDFDocumento20 pagineEvaly PR Plan by PDFAl-Rafi Ahmed100% (1)

- Maria Flordeliza L. Anastacio, Cpa Phd. Dbe: Vice President Centro Escolar University MalolosDocumento31 pagineMaria Flordeliza L. Anastacio, Cpa Phd. Dbe: Vice President Centro Escolar University MalolosCris VillarNessuna valutazione finora

- Unit 3-Strategy Formulation and Strategic Choices: Group MemberDocumento12 pagineUnit 3-Strategy Formulation and Strategic Choices: Group MemberBaken D DhungyelNessuna valutazione finora

- Business Model and Sustainability AnalysisDocumento11 pagineBusiness Model and Sustainability AnalysisAseem GargNessuna valutazione finora

- SCM Project - Final ReportDocumento10 pagineSCM Project - Final Reportmuwadit AhmedNessuna valutazione finora

- Syllabus PGDERPDocumento6 pagineSyllabus PGDERPAsif Ali H100% (1)

- Statement of Cash FlowDocumento45 pagineStatement of Cash FlowJay Bianca Abera Alistado100% (1)

- MTO CSO Interview Customer Service TrendsDocumento4 pagineMTO CSO Interview Customer Service Trendsgl02ruNessuna valutazione finora

- Promotion DecisionsDocumento21 paginePromotion DecisionsLagishetty AbhiramNessuna valutazione finora

- Lokakarya 0Documento14 pagineLokakarya 0Edelweiss HenriNessuna valutazione finora

- Group Presentation Guides: Real Company Analysis Improvement InitiativesDocumento9 pagineGroup Presentation Guides: Real Company Analysis Improvement InitiativesVy LêNessuna valutazione finora

- DebenturesDocumento7 pagineDebenturesHina KausarNessuna valutazione finora

- Malaysia and Singapore Company Sina Weibo V Badge Application FeesDocumento2 pagineMalaysia and Singapore Company Sina Weibo V Badge Application FeesTQ2020Nessuna valutazione finora

- Project Scope Management - V5.3Documento62 pagineProject Scope Management - V5.3atularvin231849168Nessuna valutazione finora

- Coffee Shop ThesisDocumento6 pagineCoffee Shop Thesiskimberlywilliamslittlerock100% (2)

- Company Profile Law Firm Getri, Fatahul & Co. English VersionDocumento9 pagineCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDNessuna valutazione finora