Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cost of Capital

Caricato da

Areeb BaqaiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cost of Capital

Caricato da

Areeb BaqaiCopyright:

Formati disponibili

1

3. Cost of Capital

Problem No: 1 Introduction

a) A Share Has a Current Market Value of Rs.96 last Dividend Was Rs.12. Calculate the cost of

Equity Capital.

b) A Share Has a Current Market Value of Rs.96 last Divided Was Rs.12.If the expected annual

growth rate of divided is 4%.Calculate the cost of equity Capital.

c) AB Ltd. has in Issue 10%Debentures of a nominal Value of Rs.100. The market price is Rs.90 (ex-

interest). Calculate the cost of Debentures if (i) Irredeemable: (!l) Redeemable at par after 10

years.

d) Some 8%Convertible Debentures have a market value of Rs-106. Very recently interest was

paid.The debentures will be convertible into Equity in 3 years time, at a rate of 4 shares per

Rs.10 of Debentures. The shares are expected to have a market value of Rs.3.50 at that time and

all the debenture Holders are expected to convert their Debentures. What is the cost of capital

to the company for the convertible Debentures? Assume a corporate tax rate of 33%(including

Surcharge)

Problem No.2 Introduction

The current market price of an equity share is Rs.130 (face value Rs.10) and the amount of divided per

share is expected to be Rs.13.00 next year. Determine the cost of equity capital if the rate of divided is

expected to grow @ 6%p.a. Also compute the expected value of share after year 1 and year 2.

Problem no.3 Introduction

The Romeo Ltd. Has 1, 00,000 equity shares with ruling market price of Rs.100 per share. The company

has no debts and total earning are Rs.10 lakhs per annum. The company wants to raise additional equity

capital amounting to Rs.5 lakhs. Compute cost of equity capital assuming flotation cost are 5%.

Problem no.4 Introduction

Your companys share is quoted in the market at Rs.20 currently. the company pays as dividend of Rs.1

per share and the investor expects a growth rate of 5 per cent per year.

Compute:

The companys cost of equity capital.

a) If the anticipated growth rate is 6%p.a., calculate the indicated market price per share.

b) If the companys cost of capital is 8%and the anticipated growth rate is 5%p.a., calculate the

indicated market price of the dividend of Rs.1 per share is to be maintained.

Problem no: 5 Introductions

a) Humpty Dumpty Ltd. Has issued 14%preference shares of the face value of Rs.100 each to be

redeemed after 10 years. Floatation cost is expected to be 4%.Determine the cost of preference

shares.

2

b) Equity shares of Humpty Dumpty Ltd. Are currently selling for Rs.125 per share. The company

expects to pay Rs.15 per share as divided at the end of the coming year,and the estimated

growth rate is 6%. It is expected that new equity shares can be sold at Rs.123: the company

expects to incur Rs.3 per share as flotation cost.what is the cost of equity capital?

Problem no:6 Introduction

a) A company issues Rs.10, 00,000, 16%debentures of Rs.100 each. The company is in 35%tax

bracket. you are required to calculate the cost of debt after tax. If debentures are issued at (i)

par (ii) 10%discount and (iii) 10%premium

b) If brokerage is paid at 2%What will be cost of debentures if issue is at par

Problem no: 7 Introductions

Assuming the corporate tax of 55%, compute the after tax cost of capital in the following situations:

1) Perpetual 15%debentures of Rs 1,000, sold at a premium of 10%with no flotation costs.

2) Ten-years 14%debentures of Rs 2,000, redeemable at par ,with 5% flotation costs.

3) Ten-years 14%preference shares of Rs 1,00, redeemable at premium of 5%with 5%flotation

costs.

4) An equity share selling at Rs 50 and paying a dividend of Rs 6 per share ,when is expected to be

continued indefinitely.

5) The above equity share if dividends are expected to grow at the rate of (a) 5%

6) An equity share of a company is selling at Rs 120 per share .The earning per share is Rs 20 of

which 50%is paid in dividends. The shareholders expect the company to earn a constant after

tax rate of 10%on its investment of retained earnings.

Problem no.8 Computation of cost of retained earnings

Y ltd. Retains Rs. 7, 50,000 out of its current earnings. The expected rate of return to the Shareholders, if

they had invested their had invested their funds elsewhere is 10%. Brokerage is 3%,and the

shareholders come in 30%tax bracket. Calculate cost of Retained Earnings.

Problem no. 9 Debenture Valuations

VHP company had sold Rs. 1,000 12%perpetual debenture 10years ago. Interest rates have risen since

then, so that debentures of this company are now selling at 15%yield basis.

1) Determine the current indicated/expected market price of the debentures. Would you buy the

debentures for Rs. 700?

2) Assume that the debentures of the company are selling at Rs.825. If the debentures have 8

years to turn to maturity. Compute the approximate effective yield an investor would earn on its

investment?

Problem No: 10 DGM and its application in cost of capital

A companys share is quoted in market at Rs.60 currently. A company pays a divided of Rs.5 per share

and investors expect a growth rate of 12%per year. Compute:

3

1) The companys cost of equity capital.

2) If anticipated growth rate is 13%p.a. calculate the indicated market price per share.

3) If the companys cost of capital is 18%and anticipated growth rate 15%p.a., calculate the

market price per share, if dividend of Rs.5 per share is to be maintained.

Problem No:11 Identify Growth Rate

The Risk free return is 10%and the risk premium is 5%with beta of a company is 1.6. The company had

declared the latest divided @ Rs.3 (2000) whereas it had declared a dividend of Rs.2.115 in the year

1994. The companys earnings and the dividend experienced constant growth. Find out the intrinsic

value of the shares.

Problem No: 12 Computation of Growth

A Ltd, intends to issued new equity shares. Its present equity shares are being sold in the market at

Rs.125 a share. The companys past record regarding payment of dividends is as follows:

1984: 10.70: 1985: 11.45: 1986: 12.25; 1987: 13.11; 1988: 14.03;

The floatation costs are estimated at 3%of the current selling price of the shares. You are required to

calculate:

a) Growth rate in dividends.

b) Cost of funds raised by issue of equity shares assuming that the growth rate as calculated above

will continue forever.

Problem no: 13 WACC

The serves Company has the following capital structure on June 30

th

, 1988:

Rs

Ordinary shares (2, 00,000 Shares) 40, 00,000

10%Preference Shares 10, 00,000

14%debentures 30, 00,000

TOTAL 80, 00,000

The share of company sells @ Rs.20, and it is expected that the company will pay next year a divided of

Rs.2 per share which will grow @ 7%forever. Assume a 50%tax rate. You are required to compute a

weighted average cost of capital based on the existing capital structure.

Problem no: 14 WACC

The following Information is available from the balance sheet of a company:

Equity share capital 20,000 shares of Rs.10 each : 2, 00,000

Reserve and surplus : 1, 30,000

8%Debentures : 1, 70,000

The rate of tax for the company is 50%. Current level of equity Divided is 12%. & Market price per share

is Rs 15

Calculate the weighted average cost of capital?

4

Problem No: 15 WACC

Hansolcompany was recently formed to manufacture a new product. The company has the following

capital structure in market value terms:

13%Debentures of 2005 Rs. 60, 00,000

12%preferred Stock Rs. 20, 00,000

Common Stock (3, 20,000 shares) Rs. 80, 00,000

Rs. 1, 60, 00,000

The company stock sells for Rs.25 a share and the company has a marginal tax rate of 40%. A study of

publicity held companies in this line of business suggests that the required return on equity is about 17%

for a company of this sort.

a) Compute the firms present weighted average cost of capital

b) Is the figure computed an appropriate acceptance criterion for evaluating investment

proposals?

Problem no: 16 WACC

Excel industrial Ltd has assets of Rs. 1, 60,000/- which have been financed with Rs. 52,000/- of debt and

Rs. 90, 000/- of equity and a general reserve of Rs, 18, 000/-. The firms total profits after interest and

taxes for the year ended 31

st

March, 1988 were Rs 13, 500/- . It pays 8%interest on borrowed funds and

is in the 50%tax bracket. It has 900 equity shares of Rs.100 each selling at a market price of Rs. 120 per

share. What is the weighted average cost of capital?

Problem No: 17 WACC

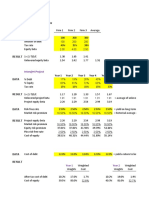

Three companies A, B& C are in the same type of business and hence have similar operating risks.

However, the capital structure of each of them is different and the following are the details:

A B C

Equity Share Capital

Face value Rs.10 per share

Rs.4, 00,000 2, 50,000 5, 00,000

Market Value per share Rs.15 20 12

Dividend per share 2.70 4 2.88

Debentures

Face value per debenture Rs.100

Nill 1, 00,000 2, 50,000

Market Value per debenture -- 125 80

Interest rate -- 10% 8%

Assume that the current levels of dividends are generally expected to continue indefinitely and the

income tax rate at 50%.

You are required to compute the weighted average cost of capital of each company.

Problem No: 18 WACC

The Capital structure of swan & Co, comprising 12%debentures, 9%preference shares and equity shares

of Rs 100 each, is in the proportion of 3:2:5.

The company is contemplating introduction of further capital to meet the expansion needs by seeking

14%term loan from financial institutions. As a result of this proposal, the proportions of debentures,

preference share and equity would get reduced by 1/10,1/15 and 1/6, respectively. In the light of above

5

proposal, calculate the impact on weighted average cost of capital, assuming 50%tax rate, expected

dividend of Rs 9 per share at the end of the year, and growth rate of dividends at 5%. No change in the

dividend, dividend growth rate and market price of share is expected after availing the proposed term

loan.

Problem No. 19 WACC

Calculate the WACC using the following data by using:

a) Book value weights

b) Market value weights

The capital structure of the company is as under:

Rs.

Debentures ( Rs. 100 per debenture) 5, 00,000

Preference shares (Rs. 100 per share) 5, 00,000

Equity shares (Rs. 10 per shares) 10,00,000

Total 20,00,000

The Market prices of these securities are:

Debenture Rs. 105 per debenture

Preference Rs. 110 per preference share

Equity Rs. 24 each

Additional information

(1) Rs. 100 per debenture redeemable at par, 10%coupon rate, 4%floatation cots, 10 year

maturity.

(2) Rs .100 per preferences share redeemable at par, 5%coupon rate, 2%floatation cost and 10

years maturity.

(3) Equity shares have Rs. 4 floatation cost and market price Rs.24 per share.

The next year expected dividend is Rs.1 with annual growth of 5%. The firm has practice of paying all

earning in the form of dividend.

Corporate tax rate is 50%

Problem no 20 MWACC

The following is the capital structure of a company. The company plans to raise additional Rs.5, 00,000

for expansion of its plant. It is estimated that Rs.2, 00,000 will be available as retained earnings and the

balance funds of Rs.3, 00,000 shall be raised from issuance of additional debentures.

Source Amount Rs After tax cost

Equity share capital 3, 00,000 15%

Retained Earnings 2, 00,000 14%

Preference Share capital 3, 00,000 10%

Debentures 2, 00,000 5%

Total 10, 00,000

Problem No: 21 Marginal WACC

Alert Ltd. has the following capital structure, which it considers to be optimum:

Rs.in Lacs

6

5,000 @ 9%Debentures of Rs.100 each 5

2,000 @ 10% PREF.shares of Rs.100 each 2

1, 30,000 @ Equity shares of Rs.10 each 13

Total 20

The prevailing market price is Rs.24 per share. The company pays 50%of EPS by way of dividend. The

company also expects and also consistently withstand in the past a 10%growth rate in the EPS. The

company can issue new debt at 10%interest. The current market rate of existing debenture is Rs 98 per

debenture. New preference shares can be issued @ 11%dividend getting 98 per share (net). Assume

corporate tax as 50%.

a) Calculate cost of new debt, cost of new pref.share capital, cost of retained earnings.

b) The marginal (weighted) cost of new capital assuming that no further equity capital is raised,

c) How much amount can the company spend for capital investment in 2009 before raising new

equity capital and without disturbing the existing capital,

d) What will be the marginal cost of capital of the company requires in excess of the amount

computed in (3) above assuming that the company can sell new Equity shares @ Rs 20 per share

(net) . The cost of debt and pref. shares remains unchanged.

Note: The EPS for the latest year ending 2008 was Rs, 2.83

Problem No: 22 WACC Book Value Basis and Market Value Basis

A Paper company has the following specific cost of capital along with the indicated book and market

value weights:

Type of Capital Cost Book Value Weights Market Value Weights

Equity 18% 0.50 0.58

Preference Shares 15% 0.20 0.17

Long term debt 7% 0.30 0.25

a) Calculate the weighted cost of capital, using book and market value weights,

b) Calculate the weighted average cost of capital, using marginal weights, if the company intended

to raise the needed funds using 50%long-term debt, 35%preference shares and 15%retained

earnings.

Problem No: 23. WACC Book Value Basis and Market Value Basis

A Companys after tax cost of different sources of finance is as follows:

Cost of equity capital : 14%

Cost of Retained earnings : 13%

Cost of Preference Shares : 10%

Cost of Debt : 5%

The capital structure of the company is as under:

Source Book Value Market Value

Equity Share capital 4, 00,000 10, 00,000

Retained earnings 1, 00,000 ---

Preference Share Capital 2, 00,000 2, 00,000

Debt 3, 00,000 3, 00,000

Total 10, 00,000 15, 00,000

Calculate the weighted average cost of capital using (a) Book Value Weight and (b) Market value weights

7

Problem No: 24 WACC-Book Value weights and Market value weights

A Transport Company is interested in measuring its cost of specific types of capital, as well as its overall

cost. The finance department of the company indicates that the following costs would be associated

with the sale of debentures, preference shares and equity shares. The corporate tax rate is 55%. The

shareholders are in the 30%marginal tax bracket.

Debentures: The Company can sell 15 years 14%debentures of the face value of Rs 1,000 for Rs 970, In

addition, an underwriting fee of 1.5%of the face value would be incurred in this process.

Preference Shares: 15%preference shares, having a face value of Rs 100, can be sold at a premium of

10%. An underwriting fee of Rs 2 per shares is to be paid to the underwriters.

Equity Shares: The Companys equity shares are currently selling for Rs 125 per share. The firm expects

to pay Rs 15 per share at the end of the coming year. Its dividend Payments over the past 6 years per

share are given below:

Year Dividend (Rs)

1 10.60

2 11.24

3 11.91

4 12.62

5 13.38

6 14.19

It is expected that the new equity shares can be sold at Rs 123 per share. This company must also pay Rs

3 per share as underwriting fee.

Market and book values for each type of capital are as follows:

Book Value (Rs) Market Value (Rs)

Long- term bedt 18, 00,000 19, 30,000

Preference Shares 4, 50,000 5, 20,000

Equity Shares 60, 00,000 100, 00,000

Retained earnings 15, 00,000

Total 97, 50,000 124,50,000

(i) Calculate the specific cost of each sources of financing,

(ii) Determine the weighted average cost of capital using,

(iii) (a) Book value weights, and (b)market value weights.

Problem No.25 Revised WACC

XYZ & CO has following capital structure on 31

st

December

11%Debentures Rs 5, 00,000

10%Preference Shares Rs 1, 00,000

4000 Equity shares of Rs 100 each Rs 4, 00,000

Total Rs 10, 00,000

Equity shares are quoted at Rs 102, and it is expected that the company will declare a dividend of Rs 10

per share at the end of current year. The dividend is expected to grow at 10%for the next 5 years. The

companys tax rate is 50%.

a) Calculate from the foregoing data the cost of equity capital, and weighted average cost of

capital

8

b) Assuming the company can rise additional debentures for Rs 3 lakhs at 12%, calculate the

revised weighted average cost of capital, if the resultant changes are:

(i) Increase in dividend rate from 10 to 12%

(ii) Reduction in growth rate from 10 to 8%

(iii) Fall in market price of shares from Rs 102 to Rs 92.

Problem No: 26 CAPM

M Ltd Share beta factor is 1.40. The risk free of interest on government securities is 9%. The expected

rate of rate of return on company equity shares is 16%. Calculate cost of equity capital?

Problem No: 27 CAPM

The following facts relate to Hypothetical Ltd.

(i) Risk-free interest in the market is 10%

(ii) The firms beta coefficient b is 1.50

Determine the firms cost of equity capital using the capital asset pricing model assuming an

expected return on the market of 14%for next year. What would be the K, if the firms b (a) rises to

2, and (b) falls to 1.

Problem No: 28 Project Evaluation Cost of Capital

M/S Efficient Corporation has a capital structure of 40%debt and 60%equity. The company is presently

considering several alternately investment proposals consisting less than Rs, 20,00,000. The corporation

always raises the required funds without diluting its present debt equity ratio. The cost od raising debt

and equity are as under.

Cost Of

Debt

Equity

Upto Rs 2,00,000 10% 12%

Above 2,00,000 and up to 5,00,000 11% 13%

Above 5,00,000 and up to 10,00,000 12% 14%

Above 10,00,000 and up to 20,00,000 13% 14.5%

Assuming the tax rate at 50%calculates:

1. Cost of capital of two projects X and Y Whose funds requirements are Rs, 6.5 Lacs and Rs.14 lacs

respectively.

2. If a project is expected to give after tax return of 10%determine under what conditions it would

be acceptable.

Problem No: 29 Convertible Debentures

Logitech Ltd. has issued 50,000 units of convertible debentures, each with a nominal value of Rs.100 and

a coupon rate of interest of 10%payable yearly. Each Rs. 100 of convertible debentures may be

converted into 40 ordinary shares of Logitech Ltd. In three years time. Any stock not converted will be

redeemed at 110 (that is at rs.110 per 100 nominal value of stock Logitech Ltd Ordinary share on the

conversion day is A Rs 2.5 Per share B) Rs.3 per share . Compute cost of debt

Potrebbero piacerti anche

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Da EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Nessuna valutazione finora

- Risks and Cost of CapitalDocumento8 pagineRisks and Cost of CapitalSarah BalisacanNessuna valutazione finora

- Common Size Analysis TemplateDocumento4 pagineCommon Size Analysis TemplateMuhammad FarooqNessuna valutazione finora

- Cost of Capital Lecture Slides in PDF FormatDocumento18 pagineCost of Capital Lecture Slides in PDF FormatLucy UnNessuna valutazione finora

- Pharmaceuticals Industry Comps TemplateDocumento6 paginePharmaceuticals Industry Comps TemplateManoj KumarNessuna valutazione finora

- Couresot LineDocumento2 pagineCouresot LineSeifu BekeleNessuna valutazione finora

- Vadeo Inc Exercise: Strictly ConfidentialDocumento3 pagineVadeo Inc Exercise: Strictly ConfidentialRaja ShahabNessuna valutazione finora

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Documento8 pagineMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNessuna valutazione finora

- Lecture Notes For FSA (Credit Analysis)Documento43 pagineLecture Notes For FSA (Credit Analysis)durga03100% (1)

- Introduction To Management AccountingDocumento55 pagineIntroduction To Management AccountingUsama250100% (1)

- UQAM CFA ResearchChallenge2014Documento22 pagineUQAM CFA ResearchChallenge2014tomz678Nessuna valutazione finora

- Functional Organizational StructureDocumento10 pagineFunctional Organizational StructureShimaa MohamedNessuna valutazione finora

- Dipifr 2004 Dec QDocumento8 pagineDipifr 2004 Dec QAhmed Raza MirNessuna valutazione finora

- Ias 20 - Gov't GrantDocumento19 pagineIas 20 - Gov't GrantGail Bermudez100% (1)

- Quiz 2 - QUESTIONSDocumento18 pagineQuiz 2 - QUESTIONSNaseer Ahmad AziziNessuna valutazione finora

- Credit Analysis LiquidityDocumento40 pagineCredit Analysis Liquidityzainahmedrajput224Nessuna valutazione finora

- What Is Comparable Company Analysis?: Valuation Methodology Intrinsic Form of ValuationDocumento4 pagineWhat Is Comparable Company Analysis?: Valuation Methodology Intrinsic Form of ValuationElla FuenteNessuna valutazione finora

- 1acca f9 Atc June 2012 Study Text PDFDocumento358 pagine1acca f9 Atc June 2012 Study Text PDFJoud H Abu Hashish100% (1)

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDocumento44 pagineConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- CFI Interview QuestionsDocumento5 pagineCFI Interview QuestionsSagar KansalNessuna valutazione finora

- Sensitivity Analysis TableDocumento3 pagineSensitivity Analysis TableBurhanNessuna valutazione finora

- CFA Equity Research Challenge 2011 - Team 9Documento15 pagineCFA Equity Research Challenge 2011 - Team 9Rohit KadamNessuna valutazione finora

- Chapter-9, Capital StructureDocumento21 pagineChapter-9, Capital StructurePooja SheoranNessuna valutazione finora

- Lecture 3 - Portfolio Theory PDFDocumento41 pagineLecture 3 - Portfolio Theory PDFAryan PandeyNessuna valutazione finora

- Critical Financial Review: Understanding Corporate Financial InformationDa EverandCritical Financial Review: Understanding Corporate Financial InformationNessuna valutazione finora

- Fitch RatingsDocumento7 pagineFitch RatingsTareqNessuna valutazione finora

- RatioDocumento24 pagineRatioSadika KhanNessuna valutazione finora

- Financial Statement AnalysisDocumento20 pagineFinancial Statement AnalysisBezawit Tesfaye100% (1)

- Parte 2 Segundo ParcialDocumento23 pagineParte 2 Segundo ParcialJose Luis Rasilla GonzalezNessuna valutazione finora

- IGNOU MBA MS - 04 Solved Assignment 2011Documento12 pagineIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNessuna valutazione finora

- Lecture 7 Adjusted Present ValueDocumento19 pagineLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Kota Tutoring: Financing The ExpansionDocumento7 pagineKota Tutoring: Financing The ExpansionAmanNessuna valutazione finora

- Corporate Finance AssignmentDocumento3 pagineCorporate Finance AssignmenttahaalkibsiNessuna valutazione finora

- Problem Set - Cost of CapitalDocumento19 pagineProblem Set - Cost of CapitalSagar Bansal100% (1)

- Business Valuation PresentationDocumento43 pagineBusiness Valuation PresentationNitin Pal SinghNessuna valutazione finora

- LN01 Rejda99500X 12 Principles LN04Documento40 pagineLN01 Rejda99500X 12 Principles LN04Abdirahman M. SalahNessuna valutazione finora

- Comparable Companies: Inter@rt ProjectDocumento9 pagineComparable Companies: Inter@rt ProjectVincenzo AlterioNessuna valutazione finora

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocumento5 pagineBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANessuna valutazione finora

- Chapter 7 Notes Question Amp SolutionsDocumento7 pagineChapter 7 Notes Question Amp SolutionsPankhuri SinghalNessuna valutazione finora

- Debt RatioDocumento7 pagineDebt RatioAamir BilalNessuna valutazione finora

- ITC Analysis FMDocumento19 pagineITC Analysis FMNeel ThobhaniNessuna valutazione finora

- Case No. 1 BWFM5013Documento8 pagineCase No. 1 BWFM5013Shashi Kumar NairNessuna valutazione finora

- Capital StructureDocumento59 pagineCapital StructureRajendra MeenaNessuna valutazione finora

- Equity Research Report On Mundra Port SEZDocumento73 pagineEquity Research Report On Mundra Port SEZRitesh100% (11)

- Cost of CapitalDocumento4 pagineCost of Capitalshan50% (2)

- Research Challenge Acb Report National Economics UniversityDocumento21 pagineResearch Challenge Acb Report National Economics UniversityNguyễnVũHoàngTấnNessuna valutazione finora

- Financiam Modling FileDocumento104 pagineFinanciam Modling FileFarhan khanNessuna valutazione finora

- Marginal Cost of Capital - CFA Level 1 - InvestopediaDocumento4 pagineMarginal Cost of Capital - CFA Level 1 - InvestopediajoysinhaNessuna valutazione finora

- Financial Analyst Interview Questions and AnswersDocumento18 pagineFinancial Analyst Interview Questions and AnswersfitriafiperNessuna valutazione finora

- 6 Dividend DecisionDocumento31 pagine6 Dividend Decisionambikaantil4408Nessuna valutazione finora

- Weighted Average Cost of Capital: Banikanta MishraDocumento21 pagineWeighted Average Cost of Capital: Banikanta MishraManu ThomasNessuna valutazione finora

- Valuation Models: Aswath DamodaranDocumento47 pagineValuation Models: Aswath DamodaranSumit Kumar BundelaNessuna valutazione finora

- SMCH 12Documento101 pagineSMCH 12FratFool33% (3)

- SBDC Valuation Analysis ProgramDocumento8 pagineSBDC Valuation Analysis ProgramshanNessuna valutazione finora

- ACCT 60100 Fall 2020 - Pioneer Advertising Month of November Case - Instructions PDFDocumento2 pagineACCT 60100 Fall 2020 - Pioneer Advertising Month of November Case - Instructions PDFTruckNessuna valutazione finora

- Mini Case 29Documento3 pagineMini Case 29Avon Jade RamosNessuna valutazione finora

- Investment Appraisal Taxation, InflationDocumento8 pagineInvestment Appraisal Taxation, InflationJiya RajputNessuna valutazione finora

- Quantitative Analytics in Debt Valuation & ManagementDa EverandQuantitative Analytics in Debt Valuation & ManagementNessuna valutazione finora

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Sub Rma 503Documento10 pagineSub Rma 503Areeb BaqaiNessuna valutazione finora

- Cost GraphingDocumento18 pagineCost GraphingAreeb BaqaiNessuna valutazione finora

- Crisis of Brain Drain in PakistanDocumento16 pagineCrisis of Brain Drain in PakistanAreeb BaqaiNessuna valutazione finora

- Variable and Absorption CostingDocumento3 pagineVariable and Absorption CostingAreeb Baqai100% (1)

- Non Parametric TestDocumento15 pagineNon Parametric TestAreeb BaqaiNessuna valutazione finora

- Arun Project FinalDocumento73 pagineArun Project FinalArun R NairNessuna valutazione finora

- General InformationDocumento5 pagineGeneral InformationPawan KumarNessuna valutazione finora

- Aon Corp Identity Standards-RevDec2004Documento22 pagineAon Corp Identity Standards-RevDec2004ChiTownITNessuna valutazione finora

- DBSV - Asian Consumer DigestDocumento119 pagineDBSV - Asian Consumer DigesteasyunittrustNessuna valutazione finora

- Wipro WInsights Sustainability ReportingDocumento3 pagineWipro WInsights Sustainability ReportingHemant ChaturvediNessuna valutazione finora

- The Investment Portfolio: Maria Aleni B. VeralloDocumento11 pagineThe Investment Portfolio: Maria Aleni B. VeralloMaria Aleni100% (1)

- Introduction For ResearchDocumento9 pagineIntroduction For ResearchWindell RamosNessuna valutazione finora

- Reviewer in AgencyDocumento13 pagineReviewer in AgencyKrissie Guevara100% (2)

- Mrs Fields CookiesDocumento12 pagineMrs Fields CookiesAditya Maheshwari100% (2)

- Final Lego CaseDocumento20 pagineFinal Lego CaseJoseOctavioGonzalez100% (1)

- BGV Form - CrisilDocumento3 pagineBGV Form - CrisilAkshaya SwaminathanNessuna valutazione finora

- Case Problem The Hands On CEO of JetblueDocumento3 pagineCase Problem The Hands On CEO of JetblueMarinelEscotoCorderoNessuna valutazione finora

- IMTMA Training CalendarDocumento2 pagineIMTMA Training Calendarashish shrivasNessuna valutazione finora

- Dollar General Case StudyDocumento26 pagineDollar General Case StudyNermin Nerko Ahmić100% (1)

- Encyclopaedia Britannica vs. NLRCDocumento1 paginaEncyclopaedia Britannica vs. NLRCYsabel PadillaNessuna valutazione finora

- Module 1: Personal Entrepreneurial CompetenciesDocumento6 pagineModule 1: Personal Entrepreneurial CompetenciesToniksOlitaNessuna valutazione finora

- ASSIGNMENT 407 - Audit of InvestmentsDocumento3 pagineASSIGNMENT 407 - Audit of InvestmentsWam OwnNessuna valutazione finora

- Business in Inf Age1newDocumento13 pagineBusiness in Inf Age1newarchana_sree13Nessuna valutazione finora

- Chapter 16 Personal SellingDocumento26 pagineChapter 16 Personal SellingKaloyNessuna valutazione finora

- IP ValuationDocumento4 pagineIP ValuationAbhi RicNessuna valutazione finora

- Case Study: (GROUP 5)Documento3 pagineCase Study: (GROUP 5)Jay Castro NietoNessuna valutazione finora

- KFC ProjectDocumento29 pagineKFC ProjectAsif AliNessuna valutazione finora

- Risk/Opportunity Analysis: DOH - National Capital Regional OfficeDocumento3 pagineRisk/Opportunity Analysis: DOH - National Capital Regional Officejai ebuenNessuna valutazione finora

- Session 13 - Brand Management PDFDocumento32 pagineSession 13 - Brand Management PDFpeeking monkNessuna valutazione finora

- Dimensional Modeling PDFDocumento14 pagineDimensional Modeling PDFAnilKumar ReddyNessuna valutazione finora

- H Paper EastWest Bank 2Documento4 pagineH Paper EastWest Bank 2Justin Dan A. OrculloNessuna valutazione finora

- NCUA NGN 2010-R1 - Final Prelim Offering MemorandumDocumento72 pagineNCUA NGN 2010-R1 - Final Prelim Offering Memorandumthe_akinitiNessuna valutazione finora

- Resource Based Theory (RBT) - AK S1Documento9 pagineResource Based Theory (RBT) - AK S1cholidNessuna valutazione finora

- Airline Alliance PDFDocumento2 pagineAirline Alliance PDFSimran VermaNessuna valutazione finora

- Digital Banking, Customer PDFDocumento27 pagineDigital Banking, Customer PDFHafsa HamidNessuna valutazione finora