Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IPCC Auditing Notes

Caricato da

Ashish BhojwaniCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IPCC Auditing Notes

Caricato da

Ashish BhojwaniCopyright:

Formati disponibili

Preparedby:YogeshGupta PageNo:1 http://facebook.com/mr.

yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

Summarize Notes

On Audit for CA-I/PCC

Please read your book first and after go through these notes, it is

writing in a summarizing manner, when you read this at the time of

revision, this will help you. Best of luck for your exams. Yogesh Gupta

2013

Yogesh Gupta

http://yogeshguptarohtak.wordpress.com

http://yogeshguptarohtak.blogspot.com

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:2 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-1 (NATURE OF AUDITING)

Audit: Independent Examination of financial information contained in financial statements for expressing

an opinion regarding true & fair view.

Fraud & Errors Detection & preventions duty is by management not by auditor, while auditors

duty to consider the impact of fraud & investigation.

ACCOUNTING AUDITING INVESTIGATION

Concerned with recording of

Transactions and Preparation of

Financial Statements

Independent Examination of financial

information contained in financial

statements.

Systematic, critical examination of records for a

special purpose.

SA 200 (AAS - 1) SA 200A (AAS 2) SA 240 (AAS 4)

Basic Principles Governing an Audit Objectives and Scope of the Audit of

Financial Statements

Auditors Responsibility relating to Fraud in an

Audit of Financial Statements.

GENERAL PURPOSE

FINANCI AL STATEMENTS

TYPES OF AUDI T TYPES OF AUDI TORS QUALI TIES OF AUDITOR

Include:

(a) Balance Sheet

(b) Profit & Loss Account

(c) Cash Flow Statement

(d) Notes on accounts and

Explanatory statements

Statutory Audit

(Required under

Law)

Voluntary Audit

(Not required

under law)

1. Internal Auditor-

Appointed by

Management

2. External Auditor

(Statutory Auditor) -

Appointed by

Company

1. Technical Qualities: Sound knowledge of

accountancy, auditing, taxation &

corporate laws.

2. Personal Qualities: Objectivity, integrity,

independence, confidentiality,

communication skills reliability and trust.

OBJ ECTIVES OF AUDIT

PRIMARY OBJ ECTI VE(SA 200A) SECONDARY OBJ ECTI VE (SA 240)

Expression of Opinion on True & Fair view of Financial

Statements

Consideration of Risk of Material misstatements resulting from Fraud

and Error

SA 200

BASIC PRINCIPLES GOVERNING AN AUDIT

SA 200A (AAS 2)

SCOPE OF AUDIT

I NHERENT LI MI TATIONS OF AUDI T

1. Integrity, Objectivity and Independence

2. Confidentiality

3. Skills and Competence

4. Work performed by others

5. Documentation

6. Planning

7. Audit Evidence

8. Accounting Systems and Internal Controls

9. Conclusion and Reporting

Determined by:

1. The terms of the

engagement

2. The requirements of the

relevant legislation e.g.

CARO 2004

3. The pronouncements of the

Institute (ICAI)

Due to:

1. Use of judgment

2. Use of Test Checking

3. Weaknesses in internal control

4. Persuasive nature of evidence

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:3 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-2 (BASIC CONCEPTS IN AUDITING)

AUDIT EVIDENCE

AUDI TORS

INDEPENDENCE

TRUE AND FAIR VIEW

Meaning:

Any information, verbal or written obtained by the auditor on

which he bases his opinion.

Objective:

Audit evidence is one of the basic principles and requires that

the auditor should obtain sufficient and appropriate audit

evidence through the performance of compliance and

substantive procedures to enable him to draw reasonable

conclusions there from on which to base his opinion on the

financial statements.

Sufficient and Appropriate Audit Evidence:

Sufficiency of evidence refers to quantum of evidence; and

appropriateness refers to relevance and reliability.

Types of Audit Evidence:

Depending upon its source may be classified as: Internal,

and External.

Depending upon nature, may be classified as: Visual,

Documentary, and Oral Evidence

Reliability of Audit Evidence:

(a) External evidence is usually more reliable than internal

evidence.

(b) Internal evidence will be more reliable, when related

internal controls are satisfactory

(c) Evidence obtained by the auditor himself is more

reliable than evidence obtained from entity.

(d) Documentary evidences are more reliable than oral

representations.

Audit procedures:

A) Compliance B) Substantive

A) Existence, Effectiveness & Continuity of the control system)

B) Completeness, Accuracy & Validity of data produced by the

accounting system)

i) Vouching & Verification

ii) Analytical Review Procedures

Methods of Obtaining Audit Evidence:

Inspection, Observation, Inquiry and confirmation, Computation

and Analytical Review.

SA-200 Independence

implies that the judgment of

a person is not subordinate

to the wishes or directions

of another person who

might have engaged him. It

stipulates that the

independence is a condition

of minds and personal

character and should not be

confused with the visible

standards of independence.

Visibility:

Independence of auditors

must not only exist infact,

but should also appear to

exist to all reasonable

persons.

Objective:

The main objective of an

independent audit is to lend

credibility to financial

information contained in

financial statements by

expressing an independent

opinion.

According to Sec-226 of

companies law these are

not authorized as

auditor:

a) Employer

b) Security Holder

c) Indebtness > Rs.

1000/-

The phrase true and fair in

the auditor's report signifies

that the auditor is required

to express his opinion as to

whether the state of affairs

and the results of the entity

as ascertained by him in the

course of his audit are truly

and fairly represented in the

accounts under audit.

What constitutes true and

fair has not been defined in

the legislation.

In specific terms to ensure

truth and fairness, an

auditor has to see:

(i) that the assets

and liabilities are neither

undervalued or overvalued;

(ii) the charge on assets,

if any, is disclosed;

(iii) accounting policies

have been followed

consistently;

(iv) all unusual,

exceptional, non recurring

items have been disclosed

separately;

(v) Accounts have been

drawn as per requirement

of Schedule VI to the

Companies Act & AS.

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:4 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

MATERIALI TY SA-320 DISCLOSURE OF ACCOUNTING POLI CI ES AS 1)

AS-1 - Material items are items, the knowledge of

which might influence the decisions of the users of

the financial statements.

Information is material if its mis-statement could

influence the economic decisions of users taken on

the basis of the financial information.

Factors influencing materiality:

Materiality may be influenced by

Legal and regulatory requirements

Considerations which may have a significant

bearing on the financial information, and

Considerations relating to individual account

balances and relationships.

Relation in audit materiality & audit risk:

INVERSE

High Material error: Low Audit risk

Low Material error: High Audit risk

Auditor has to show separately which are

material in book

Materiality can be judged from two items:

P&L or B/Sheet AND with comparison from

last year.

1) Meaning of Accounting Policies: Specific accounting principles

and the method of applying those principles in the preparation &

presentation of financial statements.

2) Factors affecting accounting policies: Prudence, Substance over form

and Materiality

3) Fundamental Accounting Assumptions: Going Concern, Consistency

and Accrual\

4) Areas in which different accounting policies may be encountered:

Method of depreciation, Treatment of expenditure during

construction Valuation of inventories, Treatment of goodwill,

Valuation of investment etc.

5) Disclosure requirements: AS1 recommends as under:

a) All significant accounting policies adopted in the preparation and

presentation of financial statements should be disclosed.

b) The disclosure should form part of financial statements and

should normally be at one place

c) If the fundamental accounting assumptions are followed, specific

disclosure is not required. If a fundamental accounting

assumption is not followed, the fact should be disclosed.

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:5 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-3 (PREPARATION FOR AN AUDIT)

AUDIT PROGRAM AUDIT WORKING PAPERS

Detailed plan of work

Prepared by auditor

For carrying out audit

An Audit programme is a detailed plan

of work, prepared by the auditor for

carrying out an audit. It is comprised of

a set of techniques and procedures,

which the auditor plans to apply in the

given audit for forming an opinion

about the clients statement of account.

It not only constitutes the plan of the

work but also provides a basis for the

supervision and control of the audit

work

Meaning: Working papers are written records prepared /kept by the auditor for:

i. aiding in the planning and performance of the audit;

ii. aiding in the supervision and review of the audit work; and

iii. Providing evidence of the audit work performed to support the auditors opinion.

I mportance:

Guidelines to audit staff

Auditor able to fix responsibility on staff member

Evidence

Planning

Type of Audit File:

Permanent Audit File

Current Audit File

PERMANENT AUDIT FI LE CURRENT AUDIT FILE

a) Memorandum and Articles of Association.

b) Copies of important legal documents

c) Details of study & evaluation of internal

controls in the form of narrative record,

questionnaires or flow charts etc.

d) Copies of audited statements of previous

years.

e) Analysis of significant ratios and trends.

f) Copies of management letter, if any

g) Record of communication with the retiring

auditor.

h) Notes regarding significant accounting

policies.

i) Significant audit observations of earlier

years.

Correspondence relating to

acceptance of annual reappointment.

Copies of minutes of Board

Meetings and General Meetings as

are relevant to audit.

Audit Programme

Analysis of transactions and

balances.

Record of the nature, timing, and

extent of audit procedures.

Evidence to show that the work

performed by assistants was

supervised and reviewed.

Copies of communication with other

auditors, experts and other third

parties.

Matters discussed with client

ADVANTAGE DISADVANTAGE

Provide

guideline &

instruction

Clear record of

work

Audit work can

be reviewed

Nil Chance of

duplication

Nil Chance of

overlooking

Easily evidence

Save as guide

for auditor in

future.

Mechanical &

monotonous

work

Partly work

has no value

Initiative of

audit staff is

discouraged if

program is

rigidly

followed.

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:6 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

AUDIT PLANNING AUDITORS ENGAGEMENT:

KNOWLEDGE OF CLIENT

BUSINESS

Scope of Audit Planning:

Plans should be made to cover, among other things

the followings:

Acquiring knowledge of clients business;

Establishing the expected degree of reliance to be

placed on internal control;

Determining the nature, timing and extent of the

audit procedures to be performed;

Coordinating the work to be performed.

Objectives of Audit Planning:

Adequate audit planning facilitates:

Devoting appropriate attention to important areas of

the audit;

Prompt identification of potential problems;

Expeditious completion of work;

Coordination of work done by other auditors &

experts.

Documentation of Audit Plan: The auditor should

document his overall plan. And develop the audit

Programme.

The auditor should send an

engagement letter to the client,

before the commencement of the

engagement, to help avoid any

misunderstanding with respect to

the engagement. It generally

include reference to:

(a) Objective of audit of

financial statements.

(b) Managements

responsibility regarding the

followings:

(c) Scope of Audit

(d) Test nature of audit and

inherent limitations of non-

detection of some material

misstatement resulting

from fraud.

(e) Unrestricted access to

records, documentation

and other information

required.

Knowledge of the business is a

frame of reference within which

the auditor exercises professional

judgment. The auditor can obtain

knowledge of the industry and the

entity from a number of sources.

For example:

Previous experience with the

entity and its industry,

discussion with people with

the entity (for example,

directors & operating

personnel),

discussion with internal audit

personnel; and

review of internal audit

reports, etc.

AUDIT NOTE BOOK AUDIT TECHNIQUES CONTINUOUS AUDIT: AUDIT SAMPLING

An audit note book is

usually a bound book in

which a large variety of

matters observed during

the course of audit are

recorded. Audit note

book form part of audit

working papers and for

each year a fresh audit

note book is maintained

Methods and means

adopted by an auditor

for collection and

evaluation of audit

evidence in different

auditing situations. For

Example: physical

examination,

confirmation, inquiry,

calculation of ratios;

etc.

Concurrent audit, thus, aims to

examine transactions almost

instantaneously as soon as the

transaction occurs leading to

shortening of the time interval

between a transaction and its

examination by an

independent person not

involved in its documentation.

The application of audit procedures to less

than 100% of the items within an account

balance or class of transactions to enable

the auditor to obtain and evaluate audit

evidence about some characteristic of the

items selected in order to form or assist in

forming a conclusion concerning the

population.

Methods of Sampling:

Random Sampling,

Systematic Sampling

Haphazard Sampling.

QUALI TY CONTROL FOR AUDI T WORK SURPRISE CHECK: REPRESENTATION BY MANAGEMENT

AAS-17, "Quality Control for Audit Work" requires

that the audit firm should implement quality control

policies and procedures designed to ensure that all

audits are conducted in accordance with

Statements on Auditing and Assurance Standards

(AASs).

Surprise checks are mainly

intended to ascertain whether

the internal control system is

working effectively, and

whether all accounting and

other records are kept up to

date and as per the statutory

regulations. Such checks and

surprise visit can exercise good

moral checks on the client's

staff.

Management representation constitutes

audit evidence furnished by management to

auditor in respect of any transaction

entered into by the entity. Management

Representation is of great use to the

auditor when other sufficient appropriate

audit evidence cannot reasonably be

expected to exist.

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:7 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

TEST CHECKING AUDI T RISK:

Audit procedure wherein an audit is conducted on the basis of a part

checking.

Precautions in the application of test-checking techniques:

Appropriate classification and stratification of the transactions.

Sequential study of transactions from beginning to end

Evaluation of efficiency and soundness internal control system

Biasness should not enter into the selection.

Identification of the areas where test check may not be done.

The number of transactions to be selected should be

predetermined.

I tems not suitable for test-checking:

Opening and closing entries.

Bank reconciliation statement.

Balance sheet items.

Matters involving estimation as well as computation, e.g.,

depreciation, royalty, etc.

Transactions which may be small in number but may be

important and material.

Transactions which are recognized by law to be looked into by

the auditor carefully, e.g., managerial remuneration, etc.

In case of seasonal industry, the auditor should not resort to

test checking on annual basis.

Transactions of non-recurring nature or exceptional transactions

may not be conducive for test checking.

Audit risk is the risk that an auditor may give an

inappropriate opinion on financial information which is

materially misstated.

COMPONENTS OF AUDIT RISK:

nherent risk,

ontrol Risk

etection Risk.

The inherent and control risks are functions of the

entitys business and its environment and the nature of

the account balances or classes of transactions,

regardless of whether an audit is conducted. Even

though inherent and control risks cannot be controlled

by the auditor, the auditor can assess them and design

his substantive procedures to produce on acceptable

level of detection risk, thereby reducing audit risk to an

acceptable low level.

Elaboration in simple way:

Inherent: Susceptibility of transaction to be

record wrongly or fraudulent activity of mgmt.

Control: Material, but would not be prevented

or quickly detected by the mgmt. control.

Detection: Risk, which is not detected by the

auditor.

RELATIONSHIP BETWEEN MATERIALITY AND

AUDI T RISK

There is an inverse relationship between Materiality and

the degree of audit risk. Higher the materiality level, the

lower the audit risk and vice-versa.

DOCUMENTATION:

Recording of important

observations and

information in a systematic

manner to enable

formation of audit

conclusions at the end of

audit

PROCEDURES VS AUDIT TECHNIQUE:

Procedures are a BROAD term while audit technique is

method to carrying on the procedures.

Procedures require an examination of documentary

evidence. This job is performed by the other procedures

known as vouching which include techniques of inspection &

checking of documentary evidence.

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:8 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-4 (INTERNAL CONTROL)

I NTERNAL CONTROL I NTERNAL CHECK INTERNAL AUDI T:

System of internal control may be defined as

the plan of organization, and all the methods

and procedures adopted by the management of

an entity to assist in achieving management's

objective

Review of Internal Control by mgmt:

It is required to ascertain:

Whether the prescribed management

policies are being properly interpreted by the

employees and are faithfully implemented.

Whether the prescribed procedures need a

revision because of changed circumstances

or whether they have becomes obsolete or

cumbersome.

Whether effective measures are taken

promptly when the system appears to break

down.

Review of Internal Control by Auditor:

The auditors objective in studying and

evaluating internal controls is to establish the

reliance he can place thereon in determining the

nature, timing and extent of his substantive audit

procedures.

Methods of collecting information:

Narrative record, Check List, Internal Control

Questionnaire, Flow-chart

Testing of Internal Control System:

It may include:

Inspection of documents supporting

transactions and other events to gain audit

evidence that internal controls have

operated properly.

Inquiries about and observation of internal

controls which leave no audit trail.

Re-performance of internal controls.

Testing of internal controls operating on

specific computerised applications.

Examination in Depth:

It implies examination of a few selected

transactions from the beginning to the end

through the entire flow of the transaction, i.e.,

from initiation to the completion of the

transaction by receipt or payment of cash and

delivery or receipt of the goods.

Internal check has been

defined by the Institute of

Chartered Accountants in

England and Wales, as the

checks on day-to-day

transactions;

which operate

continuously as part of

the routine system;

whereby the work of

one person is proved

independently or

complimentary to the

work of another,

the object being the

prevention or earlier

detection of error or

fraud.

General considerations

in framing a system of

Internal Check:

No single person should

have an independent

control over any

important aspect.

The duties of members

of the staff should be

changed from time to

time.

Persons having physical

custody of assets must

not be permitted to

have access to the

books.

Budgetary control would

enable the management

to review from time to

time the progress of

trading activities.

The financial and

administrative powers

should be distributed

very judiciously.

Procedures should be

laid down for periodical

verification and testing

of different sections of

accounting records to

ensure that they are

accurate.

Independent appraisal activity within an

organisation, for the review of operations as a

service to the organisation. It is a managerial

control which functions by measuring and

evaluating the effectiveness of other controls.

Scope Appraisal

Review of

accounting system

& related internal

controls

Examination for

management of

financial and

operating

information

Examination of the

economy, efficiency

and effectiveness of

operations including

non-financial

controls of an

organisation

Physical

examination and

verification

Organisational

status:

Scope of function

Technical

competence

Due professional

care

Follow up of

recommendations

Relationship between the Statutory Auditor

and I nternal Auditor: is a professional

relationship wherein both can benefit from each

other.

Reliance on the Work of I nternal Auditor: It

is a matter of individual judgment in a given set

of circumstances. The ultimate responsibility for

reporting on the financial statements is that of

the statutory auditor.

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:9 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-4B (AUDIT IN AN CIS ENVIRONMENT)

MEANING &

OBJ ECTI VE

OBJ ECTI VE AND SCOPE OF

AUDIT IN CI S

ENVIRONMENT:

INTERNAL CONTROL IN

A COMPUTER-BASED

SYSTEM

COMPUTER AIDED AUDIT

TECHNI QUES (CAATs)

Distinction between

computer-based

system of accounting

and conventional

nature:

Absence of Input

documents

Design

Complexity &

Reliability

Organizational

structure

Lack of Visible Audit

Trail

Problems encountered

while shifting from

manual based

accounting records to

computer based

accounting records:

Difficulty in Visual

Observation.

Inability to observe

the processing due to

internal storage

Making changes in

Programmes without

the auditors

knowledge.

Disappearance of

Audit Trail:

Use of High-level

languages:

The overall objective and scope

of an audit does not change in

an CIS environment but the use

of a computer changes the

processing and storage of

financial information and may

affect the organisation and

procedures employed by the

entity to achieve adequate

internal control.

General considerations in

framing a system of Internal

Check:

No single person should have

an independent control over

any important aspect.

The duties of members of the

staff should be changed from

time to time.

Persons having physical

custody of assets must not be

permitted to have access to

the books.

Budgetary control would

enable the management to

review from time to time the

progress of trading activities.

The financial and

administrative powers should

be distributed very judiciously.

Procedures should be laid

down for periodical

verification and testing of

different sections of

accounting records to ensure

that they are accurate.

1. GENERAL CIS

CONTROLS:

2. CIS APPLICATION

CONTROLS:

GENERAL CIS

CONTROLS:

The purpose of general CIS

controls is to establish a

framework of overall control

over the CIS activities and to

provide a reasonable level of

assurance that the overall

objectives of internal control

are achieved. These controls

may include:

Organisation and

management controls

Application systems

development and

maintenance controls

Computer operation

controls

Systems software

controls

Data entry and

program controls

CIS APPLICATION

CONTROLS:

The purpose of CIS

application controls is to

establish specific control

procedures over the

accounting applications to

provide reasonable

assurance that all

transactions are authorised

and recorded, and are

processed completely,

accurately and on a timely

basis. These include:

Controls over input

Controls over

processing and

computer data files

Controls over output

Techniques with the help of which

auditor carried out the work of audit

are known as CAAT. The auditor can

use the computer to test:

the logic and controls existing

within the system, and

the records produced by the

system.

System characteristics resulting

from the nature of CIS

processing that demand the use

of (CAAT) are:

Absence of input documents

Lack of visible transaction trail

Lack of visible output

Ease of Access to data and

computer programmes

Advantages of CAAT:

Audit effectiveness, Savings in time,

Effective test checking and

examination in depth:

Approaches to audit in CI S

environment

Two approaches - auditing around

the computer and auditing through

the computer.

AUDIT TRAIL:

It refers to a situation where it is possible to relate, on a one-to-one basis, the original

input with the final output.

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:10 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

AUDITING AROUND THE COMPUTER VS. AUDITING THROUGH THE COMPUTER

BASE Auditing around the computer Auditing through the computer

Recognition of

computers

Computers are recognised as mechanical aids for

book keeping only.

Computers are recognized as targets of auditing

and are used live for auditing.

Focus of Audit

Compare input vouchers with system outputs to

obtain audit assurance.

To peruse the accounting systems and software

used to provide audit assurance on various

aspects of control.

Use of computers

Computers are used as Black Box only. Computers are used to check calculations,

comparing the contents, analyzing the accounting

ratio by comparing them etc.

Use of CAATs CAATs are not used. CAATs and other audit software tools are used for

auditing.

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:11 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-5 (COMPANY AUDIT-1)

APPOINTMENT &

REMUNERATION OF AN

AUDITOR

APPOINTMENT OF AN

AUDI TOR BY

PASSING SPECIAL

RESOLUTION

PROVISIONS AS TO

APPOINTING/ REMOVI

NG AUDITOR REMOVAL

OF AN AUDITOR AFTER

EXPIRY OF HIS TERM)

QUALI FICATIONS AND

DISQUALI FICATIONS OF AN

AUDI TOR

UNDER SECTION 224 &

SUBSECTION:

( (1 1) ) A Ap pp po oi in nt tm me en nt t b by y

S Sh ha ar re eh ho ol ld de er rs s a at t a an n A AG GM M. .

( (1 1A A) ) I I n nt ti im ma at ti io on n t to o R RO OC C

w wi it th hi in n 3 30 0 d da ay ys s t th hr ro ou ug gh h

F Fo or rm m N No o. . 2 23 3B B. .

( (1 1B B) ) C Ce ei il li in ng g o on n n nu um mb be er r

o of f A Au ud di it t a as ss si ig gn nm me en nt ts s. .

( (2 2) ) R Re e- -a ap pp po oi in nt tm me en nt t o of f

a an n Auditor.

(3) Appointment by

Central Government.

(4)Intimation to ROC for

non-appointment within

7 days from the date of

an AGM.

(5) Appointment of the

First Auditor within 1

month of Reg.

(6) Filling of Casual

Vacancy.

(6A) Filling of Casual

Vacancy by Board of

Directors.

(6B)Tenure of such

appointment till

conclusion of next AGM.

(7) Removal of an

Auditor before expiry of

his term.

(8) Remuneration of an

auditor.

UNDER SECTION

224A:

A Al ll l t th ho os se e c co om mp pa an ni ie es s i in n

w wh hi ic ch h n no ot t l le es ss s t th ha an n 2 25 5% %

o of f t th he e S Su ub bs sc cr ri ib be ed d S Sh ha ar re e

C Ca ap pi it ta al l i is s h he el ld d b by y: :

A A p pu ub bl li ic c f fi in na an nc ci ia al l

i in ns st ti it tu ut ti io on n o or r a a

g go ov ve er rn nm me en nt t c co om mp pa an ny y

o or r C Ce en nt tr ra al l

g go ov ve er rn nm me en nt t o or r a an ny y o of f

t th he e s st ta at te e

g go ov ve er rn nm me en nt t; ;

( (b b) ) A An ny y f fi in na an nc ci ia al l o or r

o ot th he er r i in ns st ti it tu ut ti io on n

e es st ta ab bl li is sh he ed d b by y a an ny y

p pr ro ov vi in nc ci ia al l o or r s st ta at te e

A Ac ct t i in n w wh hi ic ch h a a s st ta at te e

g go ov vt t. . h ho ol ld ds s n no ot t l le es ss s

t th ha an n 5 51 1% % o of f t th he e

s su ub bs sc cr ri ib be ed d s sh ha ar re e

c ca ap pi it ta al l; ;

( (c c) ) A A N Na at ti io on na al li is se ed d

B Ba an nk k o or r a an ny y

I I n ns su ur ra an nc ce e C Co om mp pa an ny y

c ca ar rr ry yi in ng g G Ge en ne er ra al l

I I n ns su ur ra an nc ce e B Bu us si in ne es ss s; ;

( (d d) ) A An ny y o of f t th he e a ab bo ov ve e

c co om mb bi in na at ti io on ns s. .

UNDER SECTION 225 &

SUBSECTION:

1 1. . S Sp pe ec ci ia al l 1 14 4 d da ay ys s n no ot ti ic ce e

i is s t to o b be e g gi iv ve en n t to o a al ll l

t th he e m me em mb be er rs s- -

a a. . A Ap pp po oi i

n nt ti in ng g a an no ot th he er r

p pe er rs so on n a as s a an n

a au ud di it to or r; ;

b b. . P Pr ro op p

o os si in ng g t th ha at t r re et ti ir ri in ng g

a au ud di it to or r s sh ha al ll l n no ot t

b be e r re ea ap pp po oi in nt te ed d. .

2 2. . A A c co op py y o of f s su uc ch h n no ot ti ic ce e

i is s t to o b be e g gi iv ve en n t to o t th he e

r re et ti ir ri in ng g a au ud di it to or r a al ls so o. .

3 3. . P Pr ro oc ce ed du ur re e f fo or r s su uc ch h a a

r re em mo ov va al l a an nd d f fo or r

f fo or rw wa ar rd di in ng g t th he e c co op py y o of f

r re ep pr re es se en nt ta at ti io on n f fr ro om m

t th he e r re et ti ir ri in ng g a au ud di it to or r i in n

a an n A AG GM M. .

U/ S 226 & SUBSECTION:

1 1. . A An n a au ud di it to or r s sh ho ou ul ld d b be e a a

C Ch ha ar rt te er re ed d A Ac cc co ou un nt ta an nt t

d de ef fi in ne ed d u un nd de er r T Th he e

C Ch ha ar rt te er re ed d A Ac cc co ou un nt ta an nt t A Ac ct t o of f

1 19 94 49 9

2 2. . R Re es st tr ri ic ct te ed d S St ta at te e A Au ud di it to or rs s

3 3. . D Di is sq qu ua al li if fi ic ca at ti io on ns s: :

a a. . a a b bo od dy y c co or rp po or ra at te e; ;

b b. . a an n o of ff fi ic ce er r o or r a an n

e em mp pl lo oy ye ee e o of f t th he e

c co om mp pa an ny y; ;

c c. . a a p pe er rs so on n w wh ho o i is s a a

p pa ar rt tn ne er r, , o or r w wh ho o i is s i in n

e em mp pl lo oy ym me en nt t o of f a an n o of ff fi ic ce er r

o or r e em mp pl lo oy ye ee e o of f t th he e

c co om mp pa an ny y; ;

d d. . a a p pe er rs so on n w wh ho o i is s i in nd de eb bt te ed d

t to o t th he e c co om mp pa an ny y f fo or r m mo or re e

t th ha an n R Rs s. .1 1, ,0 00 00 0 o or r w wh ho o

h ha av ve e p pr ro ov vi id de ed d a an ny y

s se ec cu ur ri it ty y o or r g gu ua ar ra an nt te ee e

a ag ga ai in ns st t a a t th hi ir rd d p pe er rs so on n

w wh ho o i is s i in nd de eb bt te ed d t to o t th he e

c co om mp pa an ny y f fo or r m mo or re e t th ha an n

R Rs s. .1 1, ,0 00 00 0; ; a an nd d

e e. . A A p pe er rs so on n w wh ho o h ho ol ld ds s t th he e

s se ec cu ur ri it ty y o of f t th he e c co om mp pa an ny y. .

4 4. . I I f f a a p pe er rs so on n i is s d di is sq qu ua al li if fi ie ed d t to o

b be e a an n a au ud di it to or r o of f a a

s su ub bs si id di ia ar ry y c co om mp pa an ny y, , t th he en n

h he e i is s d di is sq qu ua al li if fi ie ed d t to o b be e

a au ud di it to or r o of f i it ts s H Ho ol ld di in ng g

C Co om mp pa an ny y a an nd d i it ts s o ot th he er r

s su ub bs si id di ia ar ri ie es s

5 5. . I I f f a a p pe er rs so on n i is s d di is sq qu ua al li if fi ie ed d t to o

b be e a an n a au ud di it to or r u un nd de er r s su ub b- -

s se ec ct ti io on ns s ( (3 3) ) a an nd d ( (4 4) ), , t th he en n

h he e h ha av ve e t to o v va ac ca an nt t h hi is s o of ff fi ic ce e

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:12 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

POWERS AND DUTIES OF AN AUDI TOR AUDIT OF ACCOUNTS OF

BRANCH OFFICE OF THE

COMPANY

UNDER SECTION 227 & SUBSECTION:

227(1) Right of access to books of accounts & right to require information and

explanation from officers.

Duties of an Auditor:

Loans & Advances made by the company secured & prejudicial to the

interest of the company,

Whether transactions of the company which are represented merely by book

entries are not prejudicial to the interests of the company.

Where the company is not an Investment Company as defined in Sec.372 or

Banking Company, which sells its assets & securities at the price less than its

purchase price.

Loans & Advances have been shown as deposits.

Whether personal expenses have been charged to revenue account.

If no cash has been received in respect of shares then whether the position

stated in balance sheet is correct, regular and not misleading.

(Auditor have to give reason for both negative & positive remarks)

227(2) Auditors should report whether the said accounts complies with all the

compliances of The Companies Act, 1956.

227(2bb) If proper returns as required by auditor of the branches not visited by him

are not received by him then he must state this fact in his audit report.

227(3) The auditor should report on the following matters:

a) Whether he has obtained all the information and explanations which to the

best of his knowledge and belief were necessary for his audit.

b) Whether in his opinion proper books of accounts as required by law are

kept by the company and proper returns have been received by him of the

branches not visited by him.

(bb) Whether the reports on accounts of any branch offices audited u/s 228

have been forwarded to him as required u/s 228(3) (c) & the manner in

which he have dealt with it for preparing auditors report.

c) Whether the companys Balance Sheet & P/L Account are in agreement

with the books of accounts & returns.

d) Whether in his opinion Balance Sheet & P/L A/c complies with the

accounting standards u/s 211(3c).

e) The auditor has highlighted adverse effects in companies functioning by

thick or italic type.

f) Whether any director has been disqualified from being appointed as

director u/s 274(1) (g).

g) Whether cess payable u/s 441A (levy & collection of cess on turnover or

gross receipts of the company) has been paid, if not, details of amount not

so paid.

Issuance of Companies (Auditors Report) Order, 2003, (CARO, 2003) vide

notification no. G.S.R 480(E) dated J une 12th, 2003

(Auditor must state the reasons only for negative remarks made by him in his report).

UNDER SECTION 228 &

SUBSECTION:

1 1) ) A Au ud di it t o of f a ac cc co ou un nt ts s o of f b br ra an nc ch h

o of ff fi ic ce e o of f t th he e c co om mp pa an ny y c ca an n b be e

c co on nd du uc ct te ed d b by y t th he e p pe er rs so on n

a ap pp po oi in nt te ed d u u/ /s s 2 22 24 4 o or r t th he e

p pe er rs so on n q qu ua al li if fi ie ed d u u/ /s s 2 22 26 6 o or r, , i if f

b br ra an nc ch h i is s i in n f fo or re ei ig gn n c co ou un nt tr ry y

t th he en n b by y a an ny y c co om mp pe et te en nt t p pe er rs so on n

q qu ua al li if fi ie ed d t to o d do o t th he e a au ud di it t a as s p pe er r

t th he e r ru ul le es s o of f t th ha at t n na at ti io on n. .

2 2) ) I I f f t th he e a ac cc co ou un nt ts s o of f t th he e b br ra an nc ch h

o of ff fi ic ce e a ar re e a au ud di it te ed d b by y t th he e p pe er rs so on n

o ot th he er r t th ha an n t th he e c co om mp pa an ni ie es s

a au ud di it to or r, , t th he en n t th he e l la at tt te er r h ha av ve e

r ri ig gh ht t t to o v vi is si it t t th he e b br ra an nc ch h o of ff fi ic ce e & &

t to o a ac cc ce es ss s t to o t th he e b bo oo ok ks s o of f

a ac cc co ou un nt ts s, , e ex xc ce ep pt t i in n c ca as se e o of f t th he e

b ba an nk ki in ng g c co om mp pa an ni ie es s h ha av vi in ng g

f fo or re ei ig gn n b br ra an nc ch h o of ff fi ic ce es s, , t th he e

a ac cc co ou un nt ts s o of f s su uc ch h b br ra an nc ch he es s m ma ay y

b be e t tr ra an ns sm mi it tt te ed d t to o t th he e h he ea ad d

o of ff fi ic ce e i in n I I n nd di ia a f fo or r t th he e a au ud di it to or r s s

i in ns sp pe ec ct ti io on n. .

3 3) ) I I t t w wi il ll l b be e d du ut ty y o of f t th he e b br ra an nc ch h

a au ud di it to or r t to o p pr re ep pa ar re e t th he e a au ud di it t

r re ep po or rt t f fo or r t th ha at t b br ra an nc ch h & &

f fo or rw wa ar rd d i it t t to o t th he e c co om mp pa an ny y s s

a au ud di it to or r, , w wh ho o s sh ha al ll l w wh hi il le e

p pr re ep pa ar ri in ng g h hi is s r re ep po os st t d de el l w wi it th h

t th he e s sa am me e i in n t th he e m ma an nn ne er r h he e

c co on ns si id de er rs s n ne ec ce es ss sa ar ry y. .

4 4) ) P Po ow we er r o of f C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t

t to o e ex xe em mp pt t t th he e b br ra an nc ch h o of ff fi ic ce es s

f fr ro om m a au ud di it t t to o t th he e e ex xt te en nt t a as s

s sp pe ec ci if fi ie ed d i in n r ru ul le es s, , e en nt ti it tl le ed d T Th he e

C Co om mp pa an ni ie es s ( (B Br ra an nc ch h A Au ud di it t

E Ex xe em mp pt ti io on n) ) R Ru ul le es s, , 1 19 96 61 1 . .

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:13 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

2 22 29 9

S Si ig gn ni in ng g o of f t th he e A Au ud di it t R Re ep po or rt t

W Wh he en n a a s si in ng gl le e C C. .A A i is s p pr ra ac ct ti is si in ng g, , t th he er re e c ca an n t t b be e a an ny y q qu ue es st ti io on n o of f a an ny y f fi ir rm m n na am me e. .

W Wh he en n a a f fi ir rm m o of f a a C C. .A A i is s a ap pp po oi in nt te ed d a as s a an n a au ud di it to or r, , t th he en n o on nl ly y a a p pa ar rt tn ne er r m ma ay y s si ig gn n t th he e r re ep po or rt t. .

2 23 30 0

R Re ea ad di in ng g a an nd d I I n ns sp pe ec ct ti io on n o of f t th he e A Au ud di it to or r s s R Re ep po or rt t

A Au ud di it t r re ep po or rt t o of f t th he e c co om mp pa an ny y m mu us st t b be e r re ea ad d o ou ut t b be ef fo or re e t th he e s sh ha ar re eh ho ol ld de er rs s a at t a an n a an nn nu ua al l G Ge en ne er ra al l M Me ee et ti in ng g a an nd d

s sh ho ou ul ld d b be e k ke ep pt t f fo or r i in ns sp pe ec ct ti io on n a at t t th he e c co om mp pa an ny y s s r re eg gi is st te er re ed d o of ff fi ic ce e f fo or r t th he e i in ns sp pe ec ct ti io on n o of f e ev ve er ry y m me em mb be er r o of f

t th he e c co om mp pa an ny y. .

2 23 31 1

R Ri ig gh ht t o of f a an n a au ud di it to or r t to o a at tt te en nd d a an n A An nn nu ua al l G Ge en ne er ra al l M Me ee et ti in ng g

T Th he e a au ud di it to or r c ca an n a at tt te en nd d a an ny y A An nn nu ua al l G Ge en ne er ra al l M Me ee et ti in ng g o of f t th he e c co om mp pa an ny y ( (n no ot t r re es st tr ri ic ct te ed d t to o t th ho os se e a at t w wh hi ic ch h t th he e

a ac cc co ou un nt ts s a au ud di it te ed d b by y t th he em m a ar re e t to o b be e d di is sc cu us ss se ed d) ) a an nd d i is s e en nt ti it tl le ed d t to o a al ll l t th he e n no ot ti ic ce es s a an nd d o ot th he er r c co om mm mu un ni ic ca at ti io on ns s

r re el la at te ed d t to o t th he e g ge en ne er ra al l m me ee et ti in ng g f fo or r w wh hi ic ch h a a m me em mb be er r o of f t th ha at t c co om mp pa an ny y i is s e en nt ti it tl le ed d, , b bu ut t i it t i is s n no ot t o ob bl li ig ga at to or ry y a at t

h hi is s p pa ar rt t t to o a at tt te en nd d t th he e A AG GM M. . H He e c ca an n h he ea ar r i in n t th he e m me ee et ti in ng g b bu ut t c ca an n t t t ta ak ke e p pa ar rt t i in n t th he e d di is sc cu us ss si io on ns s. .

2 23 32 2

P Pe en na al lt ty y f fo or r n no on n- -c co om mp pl li ia an nc ce e w wi it th h S Se ec ct ti io on ns s 2 22 25 5- -2 23 31 1

F Fo or r n no on n- -c co om mp pl li ia an nc ce e o of f S Se ec ct ti io on ns s 2 22 25 5- -2 23 31 1, , t th he e c co om mp pa an ny y, , a an nd d e ev ve er ry y o of ff fi ic ce er r o of f t th he e c co om mp pa an ny y w wh ho o i is s i in n

d de ef fa au ul lt t, , w wi il ll l b be e l li ia ab bl le e t to o t th he e f fi in ne e w wh hi ic ch h m ma ay y e ex xt te en nd d u up p t to o R Rs s. .5 5, ,0 00 00 0/ /- -. .

2 23 33 3

P Pe en na al lt ty y f fo or r n no on n- -c co om mp pl li ia an nc ce e b by y t th he e a au ud di it to or r w wi it th h S Se ec ct ti io on n 2 22 27 7 a an nd d 2 22 29 9

A An n a au ud di it to or r m ma ay y b be e p pe en na al li is se ed d a at t t th he e e ex xt te en nt t o of f R Rs s. .1 10 0, ,0 00 00 0/ /- - f fo or r n no on n- -c co om mp pl li ia an nc ce e o of f t th he e S Se ec ct ti io on ns s 2 22 27 7 a an nd d

2 22 29 9. .

2 23 33 3A A

( (1 1) ) & & ( (2 2) )

( (3 3) )

( (4 4) )

( (5 5) )

( (6 6) )

P Po ow we er rs s o of f C Ce en nt tr ra al l G Go ov vt t. . t to o d di ir re ec ct t s sp pe ec ci ia al l a au ud di it t i in n c ce er rt ta ai in n c ca as se es s

T Th he e a au ud di it t m ma ay y b be e c co on nd du uc ct te ed d b by y t th he e c co om mp pa an ny y s s a au ud di it to or r o or r b by y a an ny y C C. .A A, , w wh ho o m ma ay y o or r m ma ay y n no ot t b be e

e en ng ga ag ge ed d i in n p pr ra ac ct ti is si in ng g. .

A Au ud di it to or r s so o a ap pp po oi in nt te ed d i is s c co on nf fe er rr re ed d w wi it th h a al ll l t th ho os se e p po ow we er rs s a as s m me en nt ti io on ne ed d u u/ /s s 2 22 27 7, , e ex xc ce ep pt t h he e h ha av ve e

t to o r re ep po or rt t t to o t th he e C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t i in ns st te ea ad d o of f t th he e m me em mb be er rs s o of f t th he e c co om mp pa an ny y. .

S Sp pe ec ci ia al l a au ud di it to or r s s r re ep po or rt t m mu us st t i in nc cl lu ud de e a al ll l t th he e m ma at tt te er r t th ha at t i is s c co on nt ta ai in ne ed d i in n t th he e n no or rm ma al l a au ud di it t r re ep po or rt t & &

a al ls so o t th he e s st ta at te em me en nt t o on n a an ny y m ma at tt te er rs s a as s r re eq qu ui ir re ed d b by y t th he e g go ov ve er rn nm me en nt t. .

A Au ud di it to or r w wi il ll l b be e p pe en na al li is se ed d f fo or r R Rs s. .5 50 00 0/ /- - f fo or r n no on n- -c co om mp pl li ia an nc ce e o of f t th he e o or rd de er r t th ha at t i is s i is ss su ue ed d b by y t th he e

c ce en nt tr ra al l g go ov ve er rn nm me en nt t. .

A Al ll l t th he e e ex xp pe en ns se es s f fo or r c co on nd du uc ct ti in ng g s su uc ch h s sp pe ec ci ia al l a au ud di it t a al lo on ng g w wi it th h t th he e a au ud di it to or r s s r re em mu un ne er ra at ti io on n s sh ho ou ul ld d

b be e p pa ai id d b by y t th he e c co om mp pa an ny y a an nd d i if f t th he e c co om mp pa an ny y f fa ai il ls s t to o m ma ak ke e s su uc ch h p pa ay ym me en nt t t th he en n s su uc ch h a am mo ou un nt t c ca an n

b be e r re ec co ov ve er re ed d f fr ro om m t th he e c co om mp pa an ny y a as s a ar rr re ea ar rs s o of f l la an nd d r re ev ve en nu ue e. .

2 23 33 3B B

( (1 1) )

( (2 2) )

( (4 4) )

A Au ud di it t o of f C Co os st t A Ac cc co ou un nt ts s i in n c ce er rt ta ai in n c ca as se es s

A An n a au ud di it to or r i is s e ex xp pe ec ct te ed d t to o c co on nd du uc ct t t th he e a au ud di it t i in n m ma an nn ne er r a as s m ma ay y b be e s sp pe ec ci if fi ie ed d i in n t th he e o or rd de er r i is ss su ue ed d b by y

t th he e C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t. .

C Co os st t a au ud di it to or r s sh ha al ll l b be e a ap pp po oi in nt te ed d b by y t th he e B Bo oa ar rd d o of f D Di ir re ec ct to or rs s w wi it th h t th he e p pr ri io or r a ap pp pr ro ov va al l o of f t th he e C Ce en nt tr ra al l

G Go ov ve er rn nm me en nt t. .

T Th he e c co os st t a au ud di it to or r m mu us st t f fo or rw wa ar rd d h hi is s r re ep po or rt t t to o t th he e C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t a an nd d t th he e r re es sp pe ec ct ti iv ve e c co om mp pa an ny y

w wi it th hi in n 1 12 20 0 d da ay ys s o of f c co om mp pl le et ti io on n o of f h hi is s a au ud di it t. .

6 61 17 7

A Ap pp po oi in nt tm me en nt t o of f a an n a au ud di it to or r b by y C Co om mp pt tr ro ol ll le er r a an nd d A Au ud di it to or r G Ge en ne er ra al l o of f I I n nd di ia a f fo or r a an ny y g go ov ve er rn nm me en nt t

c co om mp pa an ny y d de ef fi in ne ed d u u/ /s s 6 61 19 9 a an nd d f fo or r a al ll l t th ho os se e c co om mp pa an ni ie es s d de ef fi in ne ed d u u/ /s s 6 61 19 9B B. .

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:14 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

CHAPTER-5B (COMPANY AUDIT-2)

S SE EC CT TI I O ON N P PR RO OV VI I S SI I O ON N / / C CO ON NT TE EN NT TS S

2 20 09 9

( (1 1) )

( (2 2) )

( (3 3) )

( (4 4) )

( (4 4A A) )

( (5 5) )

( (6 6) )

( (7 7) )

M MA AI I N NT TE EN NA AN NC CE E O OF F B BO OO OK KS S O OF F A AC CC CO OU UN NT TS S B BY Y T TH HE E C CO OM MP PA AN NY Y

E Ev ve er ry y c co om mp pa an ny y m mu us st t m ma ai in nt te en na an nc ce e p pr ro op pe er r B Bo oo ok ks s o of f A Ac cc co ou un nt ts s a at t i it ts s r re eg gi is st te er re ed d o of ff fi ic ce e. .

P Pr ro op pe er r b bo oo ok ks s o of f a ac cc co ou un nt ts s o of f b br ra an nc ch h o of ff fi ic ce es s s sh ho ou ul ld d a al ls so o b be e m ma ai in nt ta ai in ne ed d b by y t th he e c co om mp pa an ny y & &

r re et tu ur rn ns s o of f t th ho os se e b br ra an nc ch h o of ff fi ic ce es s s sh ho ou ul ld d b be e f fo or rw wa ar rd de ed d t to o t th he e h he ea ad d o of ff fi ic ce es s a af ft te er r s su ui it ta ab bl le e i in nt te er rv va al ls s

w wh hi ic ch h s sh ho ou ul ld d n no ot t e ex xc ce ee ed d t th hr re ee e m mo on nt th hs s. .

F Fo or r t th he e p pu ur rp po os se e o of f s su ub b- -s se ec c. .( (1 1) ) & & ( (2 2) ), , p pr ro op pe er r b bo oo ok ks s o of f a ac cc co ou un nt ts s s sh ha al ll l n no ot t b be e d de ee em me ed d t to o b be e k ke ep pt t

i if f: :

o o t th he e b bo oo ok ks s d do oe es sn n t t e ex xh hi ib bi it ts s t tr ru ue e a an nd d f fa ai ir r v vi ie ew w o of f t th he e s st ta at te e o of f a af ff fa ai ir rs s o of f t th he e c co om mp pa an ny y; ;

o o I I f f s su uc ch h b bo oo ok ks s a ar re e n no ot t m ma ai in nt ta ai in ne ed d o on n A Ac cc cr ru ua al l B Ba as si is s a an nd d D Do ou ub bl le e E En nt tr ry y A Ac cc co ou un nt ti in ng g

s sy ys st te em m. .

B Bo oo ok ks s o of f A Ac cc co ou un nt ts s a an nd d o ot th he er r p pa ap pe er rs s s sh ha al ll l b be e k ke ep pt t o op pe en n f fo or r i in ns sp pe ec ct ti io on n b by y a an ny y d di ir re ec ct to or r a at t

b bu us si in ne es ss s h ho ou ur rs s. .

B Bo oo ok ks s o of f A Ac cc co ou un nt ts s & & a al ll l t th he e r re el le ev va an nt t v vo ou uc ch he er rs s f fo or r p pr re ec ce ed di in ng g e ei ig gh ht t y ye ea ar rs s f fr ro om m t th he e c cu ur rr re en nt t y ye ea ar r

s sh ho ou ul ld d b be e k ke ep pt t s sa af fe el ly y b by y t th he e c co om mp pa an ny y i in n g go oo od d c co on nd di it ti io on n. .

I I f f t th he e p pe er rs so on n a as s m me en nt ti io on ne ed d i in n s se ec ct ti io on n 2 20 09 9( (6 6) ) f fa ai il ls s t to o c co om mp pl ly y w wi it th h t th he e a af fo or re em me en nt ti io on ne ed d s su ub b

s se ec ct ti io on ns s, , t th he en n h he e s sh ha al ll l b be e p pu un ni is sh ha ab bl le e f fo or r e ea ac ch h o of ff fe en nc ce e w wi it th h i im mp pr ri is so on nm me en nt t f fo or r s si ix x m mo on nt th hs s

a an nd d f fi in ne e w wh hi ic ch h m ma ay y e ex xt te en nd d t to o R Rs s. .1 10 0, ,0 00 00 0/ / - - o or r w wi it th h b bo ot th h. .

( (H He e m ma ay y b be e r re el li ie ev ve ed d f fr ro om m s su uc ch h l li ia ab bi il li it ty y, , i if f o on n r re ea as so on na ab bl le e g gr ro ou un nd ds s h he e p pr ro ov ve es s t th ha at t a an ny y c co om mp pe et te en nt t p pe er rs so on n

w wa as s a ap pp po oi in nt te ed d f fo or r s su uc ch h c co om mp pl li ia an nc ce es s) ). .

R Re es sp po on ns si ib bi il li it ty y o of f t th he e a af fo or re em me en nt ti io on ne ed d c co om mp pl li ia an nc ce es s v ve es st ts s w wi it th h: :

o o A Al ll l t th he e o of ff fi ic ce er rs s & & o ot th he er r e em mp pl lo oy ye ee es s o of f t th he e c co om mp pa an ny y a al lo on ng g w wi it th h M Ma an na ag gi in ng g D Di ir re ec ct to or r

o or r M Ma an na ag ge er r, , i if f t th he e c co om mp pa an ny y h ha as s a a M Ma an na ag gi in ng g D Di ir re ec ct to or r o or r M Ma an na ag ge er r. .

o o E Ev ve er ry y d di ir re ec ct to or r o of f t th he e c co om mp pa an ny y, , i if f n no o M Ma an na ag gi in ng g D Di ir re ec ct to or r o or r m ma an na ag ge er r. .

I I f f t th he e r re es sp po on ns si ib bi il li it ty y f fo or r c co om mp pl li ia an nc ce e o of f l le eg ga al l r re eq qu ui ir re em me en nt ts s w wi it th h r re eg ga ar rd ds s t to o t th he e b bo oo ok ks s o of f a ac cc co ou un nt ts s

v ve es st ts s w wi it th h a an ny y o ot th he er r p pe er rs so on n o ot th he er r t th ha an n a as s m me en nt ti io on ne ed d i in n s se ec ct ti io on n 2 20 09 9( (6 6) ) a an nd d i if f h he e f fa ai il ls s t to o c co om mp pl ly y

a al ll l l le eg ga al l r re eq qu ui ir re em me en nt ts s, , t th he en n h he e s sh ha al ll l b be e p pe en na al li is se ed d w wi it th h t th he e f fi in ne e w wh hi ic ch h m ma ay y e ex xt te en nd d t to o

R Rs s. .1 10 0, ,0 00 00 0/ /- - f fo or r e ea ac ch h s su uc ch h o of ff fe en nc ce e. .

2 20 09 9A A

I I N NS SP PE EC CT TI I O ON N O OF F T TH HE E C CO OM MP PA AN NY Y S S B BO OO OK KS S O OF F A AC CC CO OU UN NT TS S

C Co om mp pa an ny y s s b bo oo ok ks s o of f a ac cc co ou un nt ts s, , o ot th he er r b bo oo ok ks s a an nd d p pa ap pe er rs s s sh ha al ll l b be e k ke ep pt t o op pe en n f fo or r i in ns sp pe ec ct ti io on n b by y: :

o o R Re eg gi is st tr ra ar r; ;

o o a an n o of ff fi ic ce er r a au ut th ho or ri is se ed d b by y C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t; ; a an nd d

o o A An ny y o of ff fi ic ce er r a au ut th ho or ri is se ed d b by y S SE EB BI I . .

( (N No o p pr ri io or r n no ot ti ic ce e o or r i in nt ti im ma at ti io on n i is s r re eq qu ui ir re ed d t to o b be e g gi iv ve en n b by y s su uc ch h a au ut th ho or ri it ti ie es s f fo or r s su uc ch h a an n i in ns sp pe ec ct ti io on n) )

I I t t s sh ha al ll l b be e t th he e d du ut ty y o of f e ev ve er ry y d di ir re ec ct to or r, , o ot th he er r o of ff fi ic ce er r o or r a an n e em mp pl lo oy ye ee e o of f t th he e c co om mp pa an ny y t to o f fu ur rn ni is sh h

a an ny y s st ta at te em me en nt t, , e ex xp pl la an na at ti io on ns s, , i in nf fo or rm ma at ti io on n a an nd d a as ss si is st ta an nc ce e t to o s su uc ch h a an n a au ut th ho or ri it ty y w wh hi il le e i in ns sp pe ec ct ti io on n, ,

a as s r re eq qu ui ir re ed d b by y t th he em m. .

T Th he e p pe er rs so on n m ma ak ki in ng g i in ns sp pe ec ct ti io on n i is s a al ls so o e em mp po ow we er re ed d t to o m ma ak ke e c co op pi ie es s o of f b bo oo ok ks s o of f a ac cc co ou un nt ts s a an nd d

o ot th he er r p pa ap pe er rs s a an nd d p pu ut t a an ny y m ma ar rk k o of f i id de en nt ti if fi ic ca at ti io on n o on n t th he e b bo oo ok ks s o or r p pa ap pe er rs s. .

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:15 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

2 21 10 0

D Du ut ty y o of f B Bo oa ar rd d t to o p pr re es se en nt t t th he e A An nn nu ua al l A Ac cc co ou un nt ts s & & B Ba al la an nc ce e S Sh he ee et t a at t a an n A An nn nu ua al l G Ge en ne er ra al l

M Me ee et ti in ng g

T Th he e b bo oa ar rd d s sh ho ou ul ld d p pr re es se en nt t b be ef fo or re e A AG GM M, , t th he e B Ba al la an nc ce e S Sh he ee et t a an nd d P Pr ro of fi it t & & L Lo os ss s A Ac cc co ou un nt t f fo or r t th he e p pe er ri io od d o of f: :

I I n n c ca as se e o of f f fi ir rs st t A AG GM M, , p pe er ri io od d b be eg gi in nn ni in ng g w wi it th h i in nc co or rp po or ra at ti io on n a an nd d e en nd di in ng g w wi it th h t th he e p pr re ec ce ed di in ng g d da ay y o of f a an n

A AG GM M. .

I I n n c ca as se e o of f s su ub bs se eq qu ue en nt t A AG GM M, , p pe er ri io od d f fr ro om m t th he e b be eg gi in nn ni in ng g o of f t th he e f fi in na an nc ci ia al l y ye ea ar r a an nd d e en nd di in ng g w wi it th h t th he e

p pr re ec ce ed di in ng g d da ay y o of f a an n A AG GM M. .

( (A An n A AG GM M s sh ho ou ul ld d b be e h he el ld d w wi it th hi in n s si ix x m mo on nt th hs s o of f t th he e c co om mp pl le et ti io on n o of f f fi in na an nc ci ia al l y ye ea ar r, , e ex xt te en ns si io on n o of f t th hr re ee e

m mo on nt th hs s c ca an n b be e t ta ak ke en n w wi it th h t th he e p pe er rm mi is ss si io on n o of f t th he e r re eg gi is st tr ra ar r o of f c co om mp pa an ni ie es s. . D Di if ff fe er re en nc ce e b be et tw we ee en n t to o

s su uc cc ce es ss si iv ve e A AG GM M s sh ho ou ul ld d n no ot t e ex xc ce ee ed d f fi if ft te ee en n m mo on nt th hs s ( (E Ei ig gh ht te ee en n m mo on nt th hs s i in n c ca as se e o of f a an n e ex xt te en ns si io on n) ). .

2 21 10 0A A

H He ea ad d

C Co on ns st ti it tu ut ti io on n o of f N Na at ti io on na al l A Ad dv vi is so or ry y C Co om mm mi it tt te ee e o on n A Ac cc co ou un nt ti in ng g S St ta an nd da ar rd ds s

T Th he e C Co om mp pa an ni ie es s ( (A Am me en nd dm me en nt t) ) A Ac ct t 1 19 99 99 9, , p pr ro ov vi id de es s c ce en nt tr ra al l g go ov ve er rn nm me en nt t t th ha at t i it t m ma ay y c co on ns st ti it tu ut te e a a N Na at ti io on na al l

A Ad dv vi is so or ry y C Co om mm mi it tt te ee e o on n A Ac cc co ou un nt ti in ng g S St ta an nd da ar rd ds s b by y i is ss su ui in ng g a a n no ot ti if fi ic ca at ti io on n i in n a an n o of ff fi ic ci ia al l g ga az ze et tt te e t to o a ad dv vi is se e

t th he e c ce en nt tr ra al l g go ov ve er rn nm me en nt t o on n f fo or rm mu ul la at ti io on n a an nd d l la ay yi in ng g d do ow wn n o of f a ac cc co ou un nt ti in ng g s st ta an nd da ar rd ds s f fo or r a ad do op pt ti io on n o of f

c co om mp pa an ni ie es s o or r c cl la as ss s o of f c co om mp pa an ni ie es s u un nd de er r t th he e C Co om mp pa an ni ie es s A Ac ct t, , 1 19 95 56 6

( (A A n no ot ti if fi ic ca at ti io on n f fo or r c co on ns st ti it tu ut ti io on n o of f N Na at ti io on na al l A Ad dv vi is so or ry y C Co om mm mi it tt te ee e o on n A Ac cc co ou un nt ti in ng g S St ta an nd da ar rd ds s w wa as s i is ss su ue ed d b by y

t th he e C Ce en nt tr ra al l G Go ov ve er rn nm me en nt t i in n J J u ul ly y 2 20 00 01 1) ). .

YOGESH GUPTA

Student CA-Final, CS-Executive

Bachelor in Buss. Admn. (June 11)

Tel: +91 80596-35006

Write me at: yogeshgupta.mdu@gmail.com

Preparedby:YogeshGupta PageNo:16 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

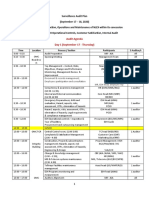

How to Learn CARO:

Last Minute Study Trick

Preparedby:YogeshGupta PageNo:17 http://facebook.com/mr.yogeshgupta

Formorenotes:notes4cacs.yg@gmail.com visitmeat:http://bit.ly/yogeshgupta

About the Author:

Hey friends, myself Yogesh Gupta, pursuing Chartered Accountancy

and company secretary Course. Im not so much minded as some other

people; I just share my notes which help me in cracking my exams. I passed

senior secondary in 2008 in first division, after I passed Graduation Degree in

Business Administration (BBA) in June 2011.

There are some difficulties in my life thats why I cant do CA after

senior secondary. But Jo bhi hota hai, ache ke liye hi hota hai, to mujhe is

baat ki koi tensions nahi hai. In December, 2010 in passed CA-CPT & CS-

Foundation in first attempt, In November 2011; I gave both groups for CA-

IPCC, but only one group was cleared. So, I wrote papers in May 2012 for

Group-2, and cleared also second group. In December 2012, also clear the CS-

Executive in first sitting. Now, turn of crack inter stage of CShope for the

best.

I also feel happy in preparing notes for my friends & studymates. Im

always working on my motto sirf apne liye hi to sab jeete hm different

so, kuch dusro ke liye b kru!

Im also a student, and Im always waiting for yours reviews. If you

have any complaint or suggestion about it, so please feel free to write me.

info.yogeshgupta@gmail.com http://fb.com/mr.yogeshgupta

http://fb.com/CAYogeshGuptaa http://yogeshguptarohtak.blogspot.com

Potrebbero piacerti anche

- Summary Notes IPCC Auditing 2Documento11 pagineSummary Notes IPCC Auditing 2Nishant Singh78% (9)

- PPTDocumento5 paginePPTStarNessuna valutazione finora

- Types of AuditDocumento58 pagineTypes of Auditvinay sainiNessuna valutazione finora

- Alan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Documento28 pagineAlan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Alan FernandesNessuna valutazione finora

- M2-Acceptance and Risk AssessmentDocumento10 pagineM2-Acceptance and Risk AssessmentSanjay PradhanNessuna valutazione finora

- Acca - F 8 - L2Documento14 pagineAcca - F 8 - L2shazyasgharNessuna valutazione finora

- Audit NotesDocumento67 pagineAudit NotesGaganBabel100% (1)

- Auditing Question Bank - StudentsDocumento25 pagineAuditing Question Bank - StudentsAashna JainNessuna valutazione finora

- Module 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFDocumento8 pagineModule 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFNiño Mendoza Mabato100% (1)

- Ch1 AuditObjectivesDocumento7 pagineCh1 AuditObjectivesHarris LuiNessuna valutazione finora

- Audit 1Documento25 pagineAudit 1Mohammad Saadman100% (1)

- CA Inter Audit Question BankDocumento315 pagineCA Inter Audit Question BankKhushi SoniNessuna valutazione finora

- Introduction To Financial Statement AuditDocumento28 pagineIntroduction To Financial Statement AuditJnn CycNessuna valutazione finora

- Concepts and Need for AssuranceDocumento14 pagineConcepts and Need for Assurancetusher pepolNessuna valutazione finora

- Standards On AuditingDocumento59 pagineStandards On AuditingCa Siddhi GuptaNessuna valutazione finora

- Unit A: Overview of Audit ProcessDocumento18 pagineUnit A: Overview of Audit Processchloebaby19Nessuna valutazione finora

- POA 1 (Prepared)Documento22 paginePOA 1 (Prepared)Mohit ShahNessuna valutazione finora

- Aud Theo - 3Documento5 pagineAud Theo - 3Cyra EllaineNessuna valutazione finora

- F8 Auditing & AssuranceDocumento291 pagineF8 Auditing & AssuranceSharon Sara SunilNessuna valutazione finora

- AT-03 (Introduction To Auditing)Documento4 pagineAT-03 (Introduction To Auditing)Soremn PotatoheadNessuna valutazione finora

- Chapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsDocumento10 pagineChapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsNasir RifatNessuna valutazione finora

- Audit Notes - CompressedDocumento214 pagineAudit Notes - CompressedAlexis ParrisNessuna valutazione finora

- Acca F8 LecturesDocumento143 pagineAcca F8 LecturesANASNessuna valutazione finora

- Stages of An AuditDocumento4 pagineStages of An AuditDerrick KimaniNessuna valutazione finora

- Audit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Documento9 pagineAudit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Shehan AnuradaNessuna valutazione finora

- Unit - 3: 1.preparation Before The Commencement of AuditDocumento12 pagineUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNessuna valutazione finora

- Auditors' Reports ChapterDocumento11 pagineAuditors' Reports Chapterdejen mengstieNessuna valutazione finora

- Philippine Accountancy Act and Auditing StandardsDocumento35 paginePhilippine Accountancy Act and Auditing StandardsKezNessuna valutazione finora

- Chapter 2 Basic Concepts in Auditing PM PDFDocumento25 pagineChapter 2 Basic Concepts in Auditing PM PDFViene CanlasNessuna valutazione finora

- Reading Notes and MC answersDocumento7 pagineReading Notes and MC answersDe Nev OelNessuna valutazione finora

- Acca F8 Lectures PDFDocumento143 pagineAcca F8 Lectures PDFBin SaadunNessuna valutazione finora

- Basic Concepts in AuditingDocumento29 pagineBasic Concepts in Auditinganon_672065362100% (1)

- Assignment - 1 - AuditDocumento9 pagineAssignment - 1 - AuditMuskan singh RajputNessuna valutazione finora

- AuditingDocumento47 pagineAuditingImran Alam ChowdhuryNessuna valutazione finora

- Standards On AuditingDocumento37 pagineStandards On AuditingAryan ShaikhNessuna valutazione finora

- Lecture One - Assurance & Auditing - An Overview and Structure of The ProfessionDocumento20 pagineLecture One - Assurance & Auditing - An Overview and Structure of The ProfessionPranto KarmokarNessuna valutazione finora

- Auditing Quiz + NotesDocumento16 pagineAuditing Quiz + NoteswamahibawiNessuna valutazione finora

- 07 FS Audit Process - Audit PlanningDocumento6 pagine07 FS Audit Process - Audit Planningrandomlungs121223Nessuna valutazione finora

- Planning and Conducting AuditaDocumento12 paginePlanning and Conducting AuditaJc QuismundoNessuna valutazione finora

- Chapter - 1 (Short Notes)Documento7 pagineChapter - 1 (Short Notes)Aakansha SinghNessuna valutazione finora

- Auditing Assurance Test 1 CH 1 Unscheduled Solution 1670225228Documento8 pagineAuditing Assurance Test 1 CH 1 Unscheduled Solution 1670225228Vinayak PoddarNessuna valutazione finora

- 1498721945audit JoinerDocumento70 pagine1498721945audit JoinerRockNessuna valutazione finora

- The Overview of AuditingDocumento4 pagineThe Overview of AuditingJelyn RuazolNessuna valutazione finora

- Auditing Techniques and Audit ProgramDocumento20 pagineAuditing Techniques and Audit Programgemixon120Nessuna valutazione finora

- Internal Audit, Management and Operational Audit GuideDocumento14 pagineInternal Audit, Management and Operational Audit GuideNeetu gargNessuna valutazione finora

- Preengagement and PlanningDocumento4 paginePreengagement and PlanningAllyssa MababangloobNessuna valutazione finora

- (Midterm) Aap - Module 4 Psa-200 - 210 - 240Documento7 pagine(Midterm) Aap - Module 4 Psa-200 - 210 - 24025 CUNTAPAY, FRENCHIE VENICE B.Nessuna valutazione finora

- IAR Auditing ConclusionDocumento23 pagineIAR Auditing Conclusionmarlout.sarita100% (1)

- Audit Icai FullDocumento720 pagineAudit Icai Fullnsaiakshaya16Nessuna valutazione finora

- Nature, Objective and Scope of Audit: Learning OutcomesDocumento46 pagineNature, Objective and Scope of Audit: Learning OutcomesAniketNessuna valutazione finora

- 02 Introduction To AuditingDocumento3 pagine02 Introduction To Auditingrandomlungs121223Nessuna valutazione finora

- Audit Planning Analytical Procedures GuideDocumento9 pagineAudit Planning Analytical Procedures GuideDahlia BloomsNessuna valutazione finora

- BA4 - CONTROLS - LMS - BOOK - 03 External Audit - Part 01Documento11 pagineBA4 - CONTROLS - LMS - BOOK - 03 External Audit - Part 01Sanjeev JayaratnaNessuna valutazione finora

- Steps in Audit Engagement CDocumento5 pagineSteps in Audit Engagement CReland CastroNessuna valutazione finora

- Chapter 3 General Types of Audit - PPT 123915218Documento32 pagineChapter 3 General Types of Audit - PPT 123915218Clar Aaron Bautista100% (2)

- HO2-A - Risk-Based Audit of Financial Statements Part 1 (Overview) - RevisedDocumento8 pagineHO2-A - Risk-Based Audit of Financial Statements Part 1 (Overview) - RevisedJaynalyn MonasterialNessuna valutazione finora

- Audit Planning & Documentation - Taxguru - inDocumento8 pagineAudit Planning & Documentation - Taxguru - inNino NakanoNessuna valutazione finora

- Midterms Quiz 1 GdocsDocumento41 pagineMidterms Quiz 1 GdocsIris FenelleNessuna valutazione finora

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19Da EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Nessuna valutazione finora

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Da EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Nessuna valutazione finora

- Audit Standards ChalisaDocumento19 pagineAudit Standards ChalisaSri PavanNessuna valutazione finora

- INTOSAI Principles for External Audit of International InstitutionsDocumento18 pagineINTOSAI Principles for External Audit of International InstitutionsMuhammed Haj HasnNessuna valutazione finora

- Applied Auditing Module 2Documento6 pagineApplied Auditing Module 2Sherri BonquinNessuna valutazione finora

- 3audit ReportsDocumento67 pagine3audit ReportsmuinbossNessuna valutazione finora

- Ireneo Answer Key 2017Documento29 pagineIreneo Answer Key 2017Elisabeth HenangerNessuna valutazione finora

- Convergence of Public Sector Audit StandardsDocumento36 pagineConvergence of Public Sector Audit StandardsInternational Consortium on Governmental Financial ManagementNessuna valutazione finora

- TralseDocumento15 pagineTralseGLORY MALIGANGNessuna valutazione finora

- Timeline IIADocumento1 paginaTimeline IIAMiljane PerdizoNessuna valutazione finora

- Quiz 2 Audtheo PDFDocumento4 pagineQuiz 2 Audtheo PDFCharlen Relos GermanNessuna valutazione finora

- Surveillance Audit PlanDocumento3 pagineSurveillance Audit PlanJessa VillanuevaNessuna valutazione finora

- Test Bank With Answers of Accounting Information System by Turner Chapter 07Documento28 pagineTest Bank With Answers of Accounting Information System by Turner Chapter 07Ebook free100% (3)

- Audit Reports: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/Beasley 3 - 1Documento45 pagineAudit Reports: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/Beasley 3 - 1Setia NurulNessuna valutazione finora

- Chapter 10 Completing The AuditDocumento8 pagineChapter 10 Completing The AuditKayla Sophia PatioNessuna valutazione finora

- Test Bank For Auditing A Risk Based Approach To Conducting A Quality Audit 9th Edition by Johnstone PDFDocumento15 pagineTest Bank For Auditing A Risk Based Approach To Conducting A Quality Audit 9th Edition by Johnstone PDFa878091955Nessuna valutazione finora

- Aud Theory Comprehensive Self Review Quizzer MC PDFDocumento20 pagineAud Theory Comprehensive Self Review Quizzer MC PDFZi VillarNessuna valutazione finora

- Practice QUIZ - SEC and PCAOBDocumento4 paginePractice QUIZ - SEC and PCAOBAaditya ManojNessuna valutazione finora

- PC 22 - Practice Set 1Documento14 paginePC 22 - Practice Set 1Shadab RashidNessuna valutazione finora

- Test Bank Auditing Theory Proprofs - Quiz PDFDocumento2 pagineTest Bank Auditing Theory Proprofs - Quiz PDFEmellaine Arazo de GuzmanNessuna valutazione finora

- Analisis Perkembangan Return On Assets (Roa) Dan KeuanganDocumento12 pagineAnalisis Perkembangan Return On Assets (Roa) Dan KeuanganMuhammad DylanNessuna valutazione finora

- Audit and Auditor in EthiopiaHistorical DevelopmeDocumento1 paginaAudit and Auditor in EthiopiaHistorical DevelopmeHabtamu Fiyssa100% (1)

- GTAG3 Audit KontinyuDocumento37 pagineGTAG3 Audit KontinyujonisupriadiNessuna valutazione finora

- Data San Jawaban-Soal-Chapter-15-SebagianDocumento10 pagineData San Jawaban-Soal-Chapter-15-Sebagiansan_tbaiplgNessuna valutazione finora

- TTTDocumento6 pagineTTTAngelika BalmeoNessuna valutazione finora

- ICEPhilwaniAUD679 Lesson Plan (Okt 2020)Documento5 pagineICEPhilwaniAUD679 Lesson Plan (Okt 2020)Nur Dina AbsbNessuna valutazione finora

- 9 CTA JusticesDocumento9 pagine9 CTA JusticesJomar TenezaNessuna valutazione finora

- Sim # Topics Research?Documento2 pagineSim # Topics Research?Arnel RemorinNessuna valutazione finora

- Audit CommitteeDocumento4 pagineAudit CommitteeAnkit SharmaNessuna valutazione finora

- 17 Modification To The Auditor's ReportDocumento5 pagine17 Modification To The Auditor's Reportrandomlungs121223Nessuna valutazione finora

- Chapter 13 - QuestionsDocumento10 pagineChapter 13 - QuestionsMinh AnhNessuna valutazione finora

- Independent Auditors ReportDocumento2 pagineIndependent Auditors ReportKaren May LusungNessuna valutazione finora