Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Job Costing and Process Costing

Caricato da

Umair SiyabDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Job Costing and Process Costing

Caricato da

Umair SiyabCopyright:

Formati disponibili

Job Order Costing and Process Costing

This unit pertains to job-order and process costing. Companies can be divided into two major types,

depending on whether or not their products/services are unique. Manufacturing and service firms

producing unique product or services require a job-order accounting system. On the other hand, those

firms producing simiar products or services can use a process-costing accounting system. !n a job-order

costing system, the cost of one job differs from the cost of another and must be accounted and

accumuated by job. "hereas with a process-costing system, a jobs are simiar and are accounted and

accumuated by department.

!n job-order costing, it is imperative the company has an idea of the cost that wi be invoved with the

production of the products/services for a their potentia jobs. "hie the cost associated with materias

and abor is reativey easy to account for, the cost associated with overhead can be chaenging. This is

because overhead incudes a the cost not reated to abor, materias, and/or administration costs. #ince

overhead is difficut to account for, a prediction is made caed predetermined overhead. The

predetermined overhead is based off estimates for the coming year. $y utii%ing the predetermined

overhead, companies are abe to have a rough figure to incude in their job-order costs.

There are times with process costing where the production of a product/service wi span mutipe

accounting periods. "hen this happens, there is a need to estimate the amount of ending wor& in process.

This theory utii%es the concept of equivaent units of output, which are the competed units that coud

have been produced given the tota amount of manufacturing effort e'pended for the accounting period.

Process Costing Overview

Process costing is used in situations where job costing cannot be used( that is, for the mass production of

simiar products, where the costs associated with individua units of output cannot be differentiated from

each other. !n other words, the cost of each product produced is assumed to be the same as the cost of

every other product.

)'ampes of the industries where this type of production occurs incude oi refining, food production, and

chemica processing. *or e'ampe, how woud you determine the precise cost required to create one

gaon of aviation fue, when thousands of gaons of the same fue are gushing out of a refinery every

hour+ The cost accounting methodoogy used for this scenario is process costing.

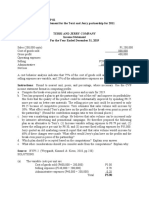

Example of Process Cost Accounting

,s a process costing e'ampe, ,$C !nternationa produces purpe widgets, which require processing

through mutipe production departments. The first department in the process is the casting department,

where the widgets are initiay created. -uring the month of March, the casting department incurs

./0,000 of direct materia costs and .120,000 of conversion costs 3comprised of direct abor and factory

overhead4. The department processes 10,000 widgets during March, so this means that the per unit cost of

the widgets passing through the casting department during that time period is ./.00 for direct materias

and .12.00 for conversion costs. The widgets then move to the trimming department for further wor&, and

these per-unit costs wi be carried aong with the widgets into that department, where additiona costs

wi be added.

Types of Process Costing

1. Weighted average costs. This version assumes that a costs, whether from a preceding period or

the current one, are umped together and assigned to produced units. !t is the simpest version to

cacuate.

2. Standard costs. This version is based on standard costs. !ts cacuation is simiar to weighted

average costing, but standard costs are assigned to production units, rather than actua costs( after

tota costs are accumuated based on standard costs, these totas are compared to actua

accumuated costs, and the difference is charged to a variance account.

The different cacuations are required for different cost accounting needs. The weighted average method

is used in situations where there is no standard costing system, or where the fuctuations in costs from

period to period are so sight that the management team has no need for the sight improvement in costing

accuracy. ,ternativey, process costing that is based on standard costs is required for costing systems

that use standard costs. !t is aso usefu in situations where companies manufacture such a broad mi' of

products that they have difficuty accuratey assigning actua costs to each type of product( under the

other process costing methodoogies, which both use actua costs, there is a strong chance that costs for

different products wi become mi'ed together.

Cost Flow in Process Costing

The typica manner in which costs fow in process costing is that direct materia costs are added at the

beginning of the process, whie a other costs 3both direct abor and overhead4 are graduay added over

the course of the production process. *or e'ampe, in a food processing operation, the direct materia is

added at the beginning of the operation, and then various rendering operations graduay convert the

direct materia into finished products. 5rocess costing is a method of aocating manufacturing cost to

products to determine an average cost per unit. !t is used by companies which mass produce identica or

simiar products. #ince every unit is essentiay the same, each unit receives the same manufacturing

input as every other unit. 6efineries, paper mis, and food processing companies are e'ampes of

businesses which use process costing.

, compication arising in process costing is that not a units may be competed at the baance sheet date.

To cacuate unit costs, it wi be necessary to compute equivaent units of production. )quivaent units

can be defined as the product of the number of partiay competed units times the percentage competion

of these units. !f there are 700 of partiay competed units at year-end which are 809 compete, then

there are 120 equivaent units. !f say /000 units were competed during the period, the manageria

accountant woud add /000 and 120 to arrive at /120 equivaent units competed during the period. Then

tota department costs for the period 3direct materia, direct abor, and overhead4 woud be divided by the

/120 equivaent units to arrive at cost per unit. )quivaent units can be computed weighted average

method.

There are some important differences between job order and processing costing as described beow.

Job Order Costing Process Costing

)ach job is different , products are identica

Costs are accumuated by job Costs are accumuated by department

Costs are captured on a job cost sheet Costs are accumuated on a department production

report

:nit costs are computed by job :nit costs are computed by department

Advantages & isadvantages of Job Order Costing & Process Costing

;ob order costing can be we suited for contract wor&.

Costing is an accounting technique used to determine the e'act e'penses for materias, abor and

overhead incurred in operations. ;ob order costing records the actua materias and abor e'penses for

specific jobs, and assigns overhead to jobs at a pre-determined rate. 5rocess costing appies costs to

departments based on the average number of units produced per day. ;ob order and process costing have

unique advantages and disadvantages that ma&e them best suited for specific situations.

Assigning Costs

One advantage of job order costing is that it aows managers to cacuate the profit earned on individua

jobs, heping them to better ascertain whether specific jobs are desirabe to pursue in the future. This is

best for businesses that do highy custom wor&, such as construction contractors and consutants. ,n

advantage of process costing is that it aows managers to get detaied information on the production

statistics of individua departments or wor&groups. This is best suited for continuous manufacturing

settings, such as factories and utiity companies.

!ecord "eeping

, disadvantage of job order costing is that empoyees are required to trac& a materias and abor used

during the job. 5rocess costing simpifies record &eeping by reying on statistica cacuations rather than

actua inputs. ,s an e'ampe, consider a construction contractor using a job order costing system. The

contractor has to &eep trac& of a the wood, nais, screws, eectrica fi'tures, paint and other materias

used on the job, as we as trac&ing wor&ers< unch brea&s and hours wor&ed. !n a factory setting, on the

other hand, materias are cacuated using an average of units produced, and saaries e'penses are often

reativey consistent between pay periods.

!eporting

;ob order costing gives managers the advantage of being abe to &eep trac& of individuas< and teams<

performance in terms of cost-contro, efficiency and productivity. 5rocess costing, on the other hand,

gives managers the advantage of being abe to ascertain the same quaities in entire departments and

compare performance over time.

#nit Cost Calculation

;ob order and process costing are adequate to determine the average cost of each unit produced.

,ccording to mdc.edu, the formua for unit cost cacuation in a job order costing system is= :nit Cost >

Tota ;ob Cost / ?umber of :nits 5roduced in ;ob !n many cases, such as the construction contractor

e'ampe, ony one unit is technicay being produced per job. The formua for unit cost cacuation in a

process cost system is= :nit Cost > -epartment<s 5eriodic Cost / ?umber of :nits 5roduced in the 5eriod

:nit cost considerations are generay more reevant in situations suited for process costing.

Potrebbero piacerti anche

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityDa EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNessuna valutazione finora

- Cost Accouting-JOCDocumento3 pagineCost Accouting-JOCAli ImranNessuna valutazione finora

- Variable & Absorption CostingDocumento23 pagineVariable & Absorption CostingRobin DasNessuna valutazione finora

- Chap8 PDFDocumento63 pagineChap8 PDFFathinus SyafrizalNessuna valutazione finora

- AC 10 - MODULE 5 - Joint Products and By-Products - FINALDocumento7 pagineAC 10 - MODULE 5 - Joint Products and By-Products - FINALAnne Danica TanNessuna valutazione finora

- Ma Bep01Documento4 pagineMa Bep01Grace SimonNessuna valutazione finora

- Cost Accounting ReviewerDocumento2 pagineCost Accounting ReviewerHenry Cadano HernandezNessuna valutazione finora

- Differential Cost Analysis ExamplesDocumento8 pagineDifferential Cost Analysis ExamplesMuhammad azeem100% (2)

- Variable Costing vs. Absorption CostingDocumento7 pagineVariable Costing vs. Absorption CostingGêmTürÏngånÖNessuna valutazione finora

- Formulas of Standard CostingDocumento3 pagineFormulas of Standard CostingQaisar Abbas100% (3)

- Cost Accounting Imporatant FormulasDocumento3 pagineCost Accounting Imporatant FormulassanthimbaNessuna valutazione finora

- Variable Costing and Absorption CostingDocumento15 pagineVariable Costing and Absorption CostingRomilCledoro100% (1)

- MAS CVP Analysis HandoutsDocumento8 pagineMAS CVP Analysis HandoutsMartha Nicole MaristelaNessuna valutazione finora

- Process Costing NotesDocumento3 pagineProcess Costing NotesVenu Gudla100% (1)

- Cost Concepts, Cost Analysis, and Cost EstimationDocumento2 pagineCost Concepts, Cost Analysis, and Cost EstimationGêmTürÏngånÖNessuna valutazione finora

- Module 11 - Standard Costing and Variance AnalysisDocumento10 pagineModule 11 - Standard Costing and Variance AnalysisAndrea Valdez100% (1)

- I Introduction To Cost AccountingDocumento8 pagineI Introduction To Cost AccountingJoshuaGuerreroNessuna valutazione finora

- Chapter 7 - Accounting For Joint and by ProductsDocumento8 pagineChapter 7 - Accounting For Joint and by ProductsJoey LazarteNessuna valutazione finora

- Process CostingDocumento28 pagineProcess Costingbhavinpoldiya0% (1)

- Notes On Responsibility AccountingDocumento6 pagineNotes On Responsibility AccountingFlorie-May GarciaNessuna valutazione finora

- Ac102 ch2Documento21 pagineAc102 ch2Fisseha GebruNessuna valutazione finora

- 23 Service Cost AllocationDocumento16 pagine23 Service Cost AllocationKim TaengoossNessuna valutazione finora

- Managerial Accounting Chapter 1 The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocumento9 pagineManagerial Accounting Chapter 1 The Changing Role of Managerial Accounting in A Dynamic Business Environmenttravelling100% (4)

- ACC 115 Ch.18 QuizDocumento3 pagineACC 115 Ch.18 QuizJoy Olivia MerrimanNessuna valutazione finora

- Financial Statement Analysis 1Documento23 pagineFinancial Statement Analysis 1MedicareMinstun Project100% (1)

- COST ACCOUNTING JOB-ORDER COSTING ProbleDocumento2 pagineCOST ACCOUNTING JOB-ORDER COSTING ProbleEleonora MarinettiNessuna valutazione finora

- Fixed and Variable CostDocumento3 pagineFixed and Variable CostRashid Ahmed ShaikhNessuna valutazione finora

- Multiple Choice Questions: Hilton, Managerial Accounting, Seventh Edition 48Documento20 pagineMultiple Choice Questions: Hilton, Managerial Accounting, Seventh Edition 48ivy100% (2)

- Cpa Review School of The Philippines Manila Management Advisory Services Relevant CostingDocumento13 pagineCpa Review School of The Philippines Manila Management Advisory Services Relevant CostingLive LoveNessuna valutazione finora

- Module 5 Short Term Decision MakingDocumento26 pagineModule 5 Short Term Decision MakingPang Siulien100% (1)

- Segment ReportingDocumento12 pagineSegment ReportingChloe Miller100% (1)

- Standard Costs and Variance AnalysisDocumento13 pagineStandard Costs and Variance AnalysisJanicaNoiraC.ZunigaNessuna valutazione finora

- MasDocumento27 pagineMaskevinlim186Nessuna valutazione finora

- Departmentalized OverheadDocumento23 pagineDepartmentalized OverheadAngel Alejo Acoba100% (1)

- Variable Costing and Absorption CostingDocumento2 pagineVariable Costing and Absorption CostingPauline Bogador Mayordomo0% (1)

- Standard Costing and Variance AnalysisDocumento11 pagineStandard Costing and Variance AnalysisMd AzimNessuna valutazione finora

- HO6 - Responsibility Accounting and Transfer Pricing PDFDocumento9 pagineHO6 - Responsibility Accounting and Transfer Pricing PDFPATRICIA PEREZNessuna valutazione finora

- Segment ReportingDocumento20 pagineSegment ReportingNick254Nessuna valutazione finora

- Gross Profit AnalysisDocumento4 pagineGross Profit AnalysisLady Lhyn LalunioNessuna valutazione finora

- MAS 2 Responsibility Accounting Part 1Documento4 pagineMAS 2 Responsibility Accounting Part 1Jon garciaNessuna valutazione finora

- Accounting For Foreign Currency TransactionsDocumento3 pagineAccounting For Foreign Currency TransactionsMaureen Derial PantaNessuna valutazione finora

- 19733ipcc CA Vol2 Cp4Documento70 pagine19733ipcc CA Vol2 Cp4m kumar100% (1)

- Transfer Pricing: Acc 7 - Management Consultancy Test BankDocumento14 pagineTransfer Pricing: Acc 7 - Management Consultancy Test BankHiraya ManawariNessuna valutazione finora

- PrelimA2 - CVP AnalysisDocumento8 paginePrelimA2 - CVP AnalysishppddlNessuna valutazione finora

- Cost Accounting Reviewer Chapter 1: Introduction To Cost AccountingDocumento38 pagineCost Accounting Reviewer Chapter 1: Introduction To Cost AccountingJoyce MacatangayNessuna valutazione finora

- Joint Cost and by Products PDFDocumento20 pagineJoint Cost and by Products PDFJhoana HernandezNessuna valutazione finora

- 3 Activity Based Costing MCQsDocumento41 pagine3 Activity Based Costing MCQsBhup Esh0% (1)

- Chapter 1 Introduction To Cost AccountingDocumento42 pagineChapter 1 Introduction To Cost AccountingPotato FriesNessuna valutazione finora

- Activity Based CostingDocumento31 pagineActivity Based CostingProfessorTextech100% (4)

- Relevant Costing - HandoutDocumento10 pagineRelevant Costing - HandoutUsra Jamil SiddiquiNessuna valutazione finora

- 1 TaxplanningchapterDocumento60 pagine1 TaxplanningchapterGieanne Prudence Venculado100% (1)

- 04 Relevant CostingDocumento5 pagine04 Relevant CostingMarielle CastañedaNessuna valutazione finora

- Process CostingDocumento9 pagineProcess Costingmousy_028Nessuna valutazione finora

- Ethics, Fraud, and Internal ControlDocumento49 pagineEthics, Fraud, and Internal ControlAzizah Syarif100% (3)

- Chapter 5 - Cost EstimationDocumento36 pagineChapter 5 - Cost Estimationalleyezonmii0% (2)

- Unit 4th Cost Acc.Documento4 pagineUnit 4th Cost Acc.Harish PrajapatNessuna valutazione finora

- Proses Costing and Job Order CostingDocumento9 pagineProses Costing and Job Order CostingNefvi Desqi AndrianiNessuna valutazione finora

- Steps in Job CostingDocumento8 pagineSteps in Job CostingBhagaban DasNessuna valutazione finora

- Definition of Job Order CostingDocumento8 pagineDefinition of Job Order CostingWondwosen AlemuNessuna valutazione finora

- Acctg201 JobOrderCostingLectureNotesDocumento20 pagineAcctg201 JobOrderCostingLectureNotesaaron manacapNessuna valutazione finora

- Business Administration New CurriculumDocumento86 pagineBusiness Administration New CurriculumUmair SiyabNessuna valutazione finora

- Programs Courses BZ UniversityDocumento4 paginePrograms Courses BZ UniversityUmair SiyabNessuna valutazione finora

- Brain DrainDocumento21 pagineBrain DrainUmair SiyabNessuna valutazione finora

- Emu Farming Business PlanDocumento26 pagineEmu Farming Business PlanUmair SiyabNessuna valutazione finora

- The Biggest Problem of Pakistan (Iiliteracy)Documento2 pagineThe Biggest Problem of Pakistan (Iiliteracy)Umair SiyabNessuna valutazione finora

- The Biggest Problem of Pakistan (Ignorance)Documento1 paginaThe Biggest Problem of Pakistan (Ignorance)Umair SiyabNessuna valutazione finora

- Schiffman CB10 PPT 01Documento32 pagineSchiffman CB10 PPT 01via86100% (1)

- Recruitment and SelectionDocumento10 pagineRecruitment and SelectionUmair SiyabNessuna valutazione finora

- My Own Understanding About CultureDocumento12 pagineMy Own Understanding About CultureUmair SiyabNessuna valutazione finora

- IOS Developer - ExperiencedDocumento37 pagineIOS Developer - Experiencedswornavidhya.mahadevanNessuna valutazione finora

- Liquid Solutions: Physical Chemistry by Prince SirDocumento14 pagineLiquid Solutions: Physical Chemistry by Prince SirSunnyNessuna valutazione finora

- Modeling and Optimization of FermentativDocumento13 pagineModeling and Optimization of FermentativThayna Rhomana da Silva CandidoNessuna valutazione finora

- Gen Nav WeOneDocumento272 pagineGen Nav WeOnecaptvivekNessuna valutazione finora

- Soil Mechanics: Triaxial Stress Measurement Test (Uu-Cu-Cd Tests)Documento3 pagineSoil Mechanics: Triaxial Stress Measurement Test (Uu-Cu-Cd Tests)Opu DebnathNessuna valutazione finora

- Introduction To Fission and FusionDocumento19 pagineIntroduction To Fission and FusionZubair Hassan100% (1)

- Chem 152 Lab ReportDocumento21 pagineChem 152 Lab Reportapi-643022375Nessuna valutazione finora

- Electrical Systems (Engine) - (S - N 512911001 - 512911999) - 331Documento3 pagineElectrical Systems (Engine) - (S - N 512911001 - 512911999) - 331Ronaldo Javier Vergara AnayaNessuna valutazione finora

- Application Note: Vishay General SemiconductorDocumento4 pagineApplication Note: Vishay General SemiconductorMamoon AlrimawiNessuna valutazione finora

- Detection of Mastitis and Lameness in Dairy Cows UsingDocumento10 pagineDetection of Mastitis and Lameness in Dairy Cows UsingKalpak ShahaneNessuna valutazione finora

- Engineering Materials CE-105: ConcreteDocumento27 pagineEngineering Materials CE-105: Concretenasir khanNessuna valutazione finora

- MID TEST Integer, Fraction 20092010Documento5 pagineMID TEST Integer, Fraction 20092010mathholic111Nessuna valutazione finora

- HSM Info and CommandsDocumento17 pagineHSM Info and CommandsapmountNessuna valutazione finora

- No Load Test: ObjectiveDocumento5 pagineNo Load Test: ObjectiveyashNessuna valutazione finora

- Wolkite University Department of Information TechnologyDocumento27 pagineWolkite University Department of Information Technologytamirat alemayewNessuna valutazione finora

- AirCheck Detail Report - PK8AP01Documento116 pagineAirCheck Detail Report - PK8AP01Trion Ragil NugrohoNessuna valutazione finora

- DRG ch4Documento33 pagineDRG ch4Muhammad Ashiqur Rahaman NoorNessuna valutazione finora

- Click125 82K60H30Y 0Documento169 pagineClick125 82K60H30Y 0yeoj manaNessuna valutazione finora

- Service Factors BaldorDocumento1 paginaService Factors BaldornautelNessuna valutazione finora

- 21 10 26 Tastytrade ResearchDocumento7 pagine21 10 26 Tastytrade ResearchCSNessuna valutazione finora

- Branches of Science and Sub SciencesDocumento5 pagineBranches of Science and Sub SciencesSha BtstaNessuna valutazione finora

- Article - Designing Sand Cores and ToolingDocumento4 pagineArticle - Designing Sand Cores and ToolingroyhanNessuna valutazione finora

- Prelims Solution Ce18Documento6 paginePrelims Solution Ce18Mark Lester LualhatiNessuna valutazione finora

- 10 People and 10 HatsDocumento1 pagina10 People and 10 HatsCassandra JohnsonNessuna valutazione finora

- Roll Forging.Documento36 pagineRoll Forging.jaydee420Nessuna valutazione finora

- Norma JIC 37Documento36 pagineNorma JIC 37guguimirandaNessuna valutazione finora

- 9.coordination CompoundsDocumento46 pagine9.coordination CompoundsSeenu MNessuna valutazione finora

- The Structure of The AtomDocumento26 pagineThe Structure of The AtomUnknownKidNessuna valutazione finora

- CS 515 Data Warehousing and Data MiningDocumento5 pagineCS 515 Data Warehousing and Data MiningRahumal SherinNessuna valutazione finora

- Geo Technical Ii Quiz QuestionsDocumento11 pagineGeo Technical Ii Quiz QuestionsSukritiDanNessuna valutazione finora

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersDa EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersValutazione: 4.5 su 5 stelle4.5/5 (95)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobDa EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobValutazione: 4.5 su 5 stelle4.5/5 (36)

- The First Minute: How to start conversations that get resultsDa EverandThe First Minute: How to start conversations that get resultsValutazione: 4.5 su 5 stelle4.5/5 (57)

- Summary of Noah Kagan's Million Dollar WeekendDa EverandSummary of Noah Kagan's Million Dollar WeekendValutazione: 5 su 5 stelle5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverDa EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverValutazione: 4.5 su 5 stelle4.5/5 (186)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsDa EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsValutazione: 4.5 su 5 stelle4.5/5 (52)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Da EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Valutazione: 5 su 5 stelle5/5 (1)

- The 7 Habits of Highly Effective PeopleDa EverandThe 7 Habits of Highly Effective PeopleValutazione: 4 su 5 stelle4/5 (2565)

- Transformed: Moving to the Product Operating ModelDa EverandTransformed: Moving to the Product Operating ModelValutazione: 4 su 5 stelle4/5 (1)

- The Introverted Leader: Building on Your Quiet StrengthDa EverandThe Introverted Leader: Building on Your Quiet StrengthValutazione: 4.5 su 5 stelle4.5/5 (35)

- Spark: How to Lead Yourself and Others to Greater SuccessDa EverandSpark: How to Lead Yourself and Others to Greater SuccessValutazione: 4.5 su 5 stelle4.5/5 (132)

- Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every CompanyDa EverandOnly the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every CompanyValutazione: 3.5 su 5 stelle3.5/5 (122)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionDa EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionValutazione: 5 su 5 stelle5/5 (337)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceDa EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceValutazione: 5 su 5 stelle5/5 (22)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsDa EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsValutazione: 4.5 su 5 stelle4.5/5 (28)

- Transformed: Moving to the Product Operating ModelDa EverandTransformed: Moving to the Product Operating ModelValutazione: 4 su 5 stelle4/5 (1)

- Coach the Person, Not the Problem: A Guide to Using Reflective InquiryDa EverandCoach the Person, Not the Problem: A Guide to Using Reflective InquiryValutazione: 5 su 5 stelle5/5 (64)

- 25 Ways to Win with People: How to Make Others Feel Like a Million BucksDa Everand25 Ways to Win with People: How to Make Others Feel Like a Million BucksValutazione: 5 su 5 stelle5/5 (36)

- Superminds: The Surprising Power of People and Computers Thinking TogetherDa EverandSuperminds: The Surprising Power of People and Computers Thinking TogetherValutazione: 3.5 su 5 stelle3.5/5 (7)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsDa EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsValutazione: 4.5 su 5 stelle4.5/5 (411)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsDa EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsValutazione: 4.5 su 5 stelle4.5/5 (48)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthDa Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthValutazione: 5 su 5 stelle5/5 (52)

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- Leadership Skills that Inspire Incredible ResultsDa EverandLeadership Skills that Inspire Incredible ResultsValutazione: 4.5 su 5 stelle4.5/5 (11)