Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MDAllocate PDF

Caricato da

Vish YrdyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MDAllocate PDF

Caricato da

Vish YrdyCopyright:

Formati disponibili

Allocations, Activity Based Costing and

Essbase Functions

By TopDown Team on February 1, 2012

One of the prevalent Costing models, primarily used in manufacturing is Activity-based Costing. Activity-based Costing or ABC gained popularity as Overhead and Indirect

Costs were scrutinized by management, production lines became more complex, and cost center managers were held more accountable for detailed product P&Ls and

overhead cost controls. Traditionally, a fixed percentage was applied to all products, service lines or segments to allocate Indirect Costs such as Rent expense, Depreciation

and Home Office salaries. Most companies these days, use some form of ABC methodology orResponsibility Accounting for internal management reporting, budgeting and

forecasting and sometimes for measuring the performance of departments, managers and divisions. This normally involves a pooling of costs at summary and cascading it

down to cost centers and SBUs through sometimes complex allocation spreadsheet models. In summary, cost allocations are done for any one of the following reasons:

Fully Loaded P&L statements by Customer, Product or Segment

Activity-based Costing (ABC)

Managerial Cost Accounting

Performance Measurement or Bonus Payout

Lets now explore how most allocations are performed in a Essbase cube. The steps are typically the following:

1. Determine the Total Amount to be allocated, i.e. Advertising Cost at Corporate HQ

2. Determine the Basis or Cost Driver for the allocation, for example, Unit Sold by Entity and Segment

3. Determine where the target range for the allocated amount, such as divisional rollups or individual cost centers

4. Establish the rule for spreading and calculate the percentage

In the most simplistic allocation model, cost drivers are first selected to determine the basis of the allocation, for exampl e, cost driver for allocating Rent Expense might be

Square Footage occupied by relevant cost centers. Other driver may be:

Headcount

Unit Sales

Unit Count

Labor Hours

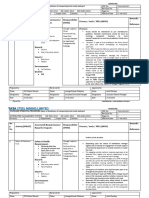

The Basis or Cost Driver in this example is the Units Sold by Segment and Entity:

Lets assume, we want 50% of the Allocation amount to be allocated to TV Segments and Cost Centers based on Units Sold which is loaded to BegBalance in this case. This

is a multi-dimensional allocation and @MDALLOCATE function can be easily used as follows:

FIX(HSP_InputValue,Input,FY12,Local,Actual,Final)

Advertising =@MDALLOCATE (Corporate HQ->No Segment * .5, 2, @RELATIVE(USA,0),@RELATIVE(TV,0),Units->BegBalance, ,Share);

AGG(Entity,Segments);

ENDFIX

The first variable in the function is Allocated Amount, the second is the number of dimensions used in the allocation followed by the target distribution of the allocation. Units is

the Basis of the allocation and the last variable Share indicates an even distribution based on units sold. The allocation is done at Level0, thus, an aggregation is needed to

rollup the parent values.

Now, alternatively, the other 50% of the Corporate overhead is to be allocated to Digital Video segment, however, company wants to allocate a flat rate to each cost center that

happened to sell Digital Video regardless of volume, in other words, the allocation is based on Count of possible combination of Entity and Segment. In other words, the total

amount of $500,000 is spread evenly based on all entities/segment combinations that have units and the multi -dimensional allocation function is written like:

Advertising=@MDALLOCATE (Corporate HQ->No Segment * .5,2, @RELATIVE(USA,0),@RELATIVE(DV,0),Units->BegBalance,,Spread,SKIPMISSING);

Note that only the last 2 variables changed to make this happen, last one excludes Null values for the Units Sold in the combinations. There are other methods (next to last

variable) to be used in this function, such as Percent, Add, Subtract, Multiply and Divide.

Other combinations of these variables can yield different distribution of allocated amounts and sometimes to erroneous results, therefore, it is advisable to choose the allocation

criteria, drivers and methods carefully when dealing with the Essbase prebuilt allocation functions. Also note that this function is relatively costly in terms of memory usage and

calculation times, so apply the FIX/ENDFIX filters and increase Cache size when working with these functions.

Off course, these functions do not apply to all allocation concepts and sometimes custom code must be wri tten to calculate percentages and allocated amounts based on

percentages. For example, the first allocation can be written as:

FIX(HSP_InputValue,Input,FY12,Local,Actual,Final,@RELATIVE(USA,0),@RELATIVE(AllSegments,0))

Advertising =Corporate HQ->No Segment * .5 * (@CURRMBR(Segments)->@CURRMBR(Entity)->Units->Begbalance/Units->Segments->USA->Begbalance);

ENDFIX

A second pass through the database is required now to aggregate all segments and entities, so it takes more time to execute:

FIX(HSP_InputValue,Input,FY12,Local,Actual,Final)

AGG(Entity,Segments);

ENDFIX

And this assumes that the rates are already aggregated for BegBalance->Segments->Entity. The advantage of using the @MDALLOCATE function is that no pre-aggregation

of the total Basis is required and Essbase performs that at the same time is allocating in the memory. Plus there is less of clutter in the Calc Script, making it more efficient.

- See more at: http://blog.topdownconsulting.com/2012/02/allocations-activity-based-costing-and-essbase-functions/#sthash.uAu4yVvb.dpuf

Potrebbero piacerti anche

- SAP Cost AllocationDocumento14 pagineSAP Cost Allocation5starsNessuna valutazione finora

- Vishnu Sahasranamam - TeluguDocumento20 pagineVishnu Sahasranamam - TeluguIndrani Gorti100% (2)

- Cost of Sales AccountingDocumento147 pagineCost of Sales AccountingClaudio Cafarelli50% (2)

- Prior and MDshift FunctionsDocumento2 paginePrior and MDshift FunctionsVish Yrdy0% (1)

- MIF Int ControlsDocumento15 pagineMIF Int ControlsjefrsnNessuna valutazione finora

- ISTQB ATA (Advanced Test Analyst) Certification Exam Practice Questions For Testing ProcessDocumento10 pagineISTQB ATA (Advanced Test Analyst) Certification Exam Practice Questions For Testing ProcessShanthi Kumar Vemulapalli100% (1)

- Aviva StadiumDocumento12 pagineAviva StadiumSakshi Bodkhe0% (1)

- Mil STD 1388 1aDocumento121 pagineMil STD 1388 1aalvarezkev100% (1)

- Global Partner Program - Training and Certification - Learning Path OptionsDocumento51 pagineGlobal Partner Program - Training and Certification - Learning Path OptionsFabioNessuna valutazione finora

- Jeppview For Windows: List of Pages in This Trip KitDocumento63 pagineJeppview For Windows: List of Pages in This Trip KitorionclassNessuna valutazione finora

- Cost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Documento12 pagineCost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Ekta AnejaNessuna valutazione finora

- 5 Steps To Understanding Product CostingDocumento8 pagine5 Steps To Understanding Product CostingAmarnath RaveendranathNessuna valutazione finora

- And Management AccountingDocumento8 pagineAnd Management AccountingJhon EdNessuna valutazione finora

- 5 Steps To Understanding Product Costing Part 2Documento1 pagina5 Steps To Understanding Product Costing Part 2Srinivas YerriboinaNessuna valutazione finora

- Product Costing, Part of The Controlling Module, Is Used To Value TheDocumento9 pagineProduct Costing, Part of The Controlling Module, Is Used To Value TheSunil GNessuna valutazione finora

- Part - 2 Product Costing - Activity Rate Calculation: Cost Center in A PlantDocumento3 paginePart - 2 Product Costing - Activity Rate Calculation: Cost Center in A PlantAvengers endgameNessuna valutazione finora

- 5 Steps To Understanding Product Costing PDFDocumento10 pagine5 Steps To Understanding Product Costing PDFCristianGrey92% (12)

- Activity Based CostingDocumento4 pagineActivity Based CostingmuktaNessuna valutazione finora

- COPA Interview QuestionsDocumento6 pagineCOPA Interview QuestionsPriyaNessuna valutazione finora

- CO - TopicsDocumento5 pagineCO - TopicsnataliasouzabrametalNessuna valutazione finora

- Product Costing NotesDocumento8 pagineProduct Costing NotesThirunavukkarasu SelvarajNessuna valutazione finora

- My Document-5Documento4 pagineMy Document-5Ramesh ReddyNessuna valutazione finora

- 5 Steps To Understanding Product Costing - Part 1 Cost Center PlanningDocumento1 pagina5 Steps To Understanding Product Costing - Part 1 Cost Center PlanningSantosh RotheNessuna valutazione finora

- Profitability AnalysisDocumento11 pagineProfitability AnalysisShrikantMurnalNessuna valutazione finora

- Allocations in SAP ControllingDocumento9 pagineAllocations in SAP Controllinganandbajaj0Nessuna valutazione finora

- Indirect Activity Allocation May 2013Documento16 pagineIndirect Activity Allocation May 2013Naveen KumarNessuna valutazione finora

- Unit 3: Cost Element AccountingDocumento9 pagineUnit 3: Cost Element AccountingneppoanandNessuna valutazione finora

- Unit 3Documento11 pagineUnit 3K.V. De Rojo-SantelicesNessuna valutazione finora

- Finance Terms SAPDocumento22 pagineFinance Terms SAPsagarchirdeNessuna valutazione finora

- Intro S4HANA Using Global Bike Case Study CO-CCA en v4.1Documento36 pagineIntro S4HANA Using Global Bike Case Study CO-CCA en v4.1jspm3912Nessuna valutazione finora

- What Is Activity Based CostingDocumento4 pagineWhat Is Activity Based CostingSajib DevNessuna valutazione finora

- Transfer Pricing Made Easy in SAPDocumento16 pagineTransfer Pricing Made Easy in SAPjohn boganNessuna valutazione finora

- Cost CentersDocumento44 pagineCost CentersPallaviNessuna valutazione finora

- Chart of AccountsDocumento11 pagineChart of AccountsWaleed ElhabashyNessuna valutazione finora

- Cost CentersDocumento46 pagineCost CentersPallavi ChawlaNessuna valutazione finora

- How To Calculate Indirect CostsDocumento10 pagineHow To Calculate Indirect CostsThi My Linh NguyenNessuna valutazione finora

- Controlling in DetailDocumento284 pagineControlling in DetailAnonymous nDTiiq6UNessuna valutazione finora

- Rel - My SAP CO Material FullDocumento284 pagineRel - My SAP CO Material FullJyotiraditya BanerjeeNessuna valutazione finora

- CCA Master DataDocumento61 pagineCCA Master Datapmenocha8799Nessuna valutazione finora

- Rel - My SAP CO Material FullDocumento284 pagineRel - My SAP CO Material Fullkalicharan1350% (2)

- 2.1 SAP Cost Center Master DataDocumento6 pagine2.1 SAP Cost Center Master DataFitria AnggraeniNessuna valutazione finora

- Chapter One Cost-Volume-Profit (CVP) Analysis: Learning ObjectivesDocumento19 pagineChapter One Cost-Volume-Profit (CVP) Analysis: Learning ObjectivesTESFAY GEBRECHERKOSNessuna valutazione finora

- Cost CH 6Documento10 pagineCost CH 6Abayineh MesenbetNessuna valutazione finora

- Primary Cost Planning - Asset Accounting (FI-AA) - SAP LibraryDocumento4 paginePrimary Cost Planning - Asset Accounting (FI-AA) - SAP LibraryRiddhi MulchandaniNessuna valutazione finora

- Costingmaterials and LabourDocumento12 pagineCostingmaterials and LabourANISAHMNessuna valutazione finora

- Conquering The Challenges - Costing PRDocumento8 pagineConquering The Challenges - Costing PRSoorav MlicNessuna valutazione finora

- Phoenix 99Documento12 paginePhoenix 99Bundasak PuangchindaNessuna valutazione finora

- Costing Assignment 1 Report 2020Documento7 pagineCosting Assignment 1 Report 2020rachel 1564Nessuna valutazione finora

- Article Primary CostDocumento8 pagineArticle Primary Costcwa.sumit100% (1)

- Profitability AnalysisDocumento70 pagineProfitability Analysisjiljil1980Nessuna valutazione finora

- 11 Steps For Changing A Cost Center HierarchyDocumento6 pagine11 Steps For Changing A Cost Center HierarchyAmitabh Das GuptaNessuna valutazione finora

- Damodaran Online - Home Page For Aswath DamodaranDocumento7 pagineDamodaran Online - Home Page For Aswath DamodaranleekiangyenNessuna valutazione finora

- Configuration Document (Fi) On S/4 Hana - 1809 Created By: Ashish AggarwalDocumento18 pagineConfiguration Document (Fi) On S/4 Hana - 1809 Created By: Ashish Aggarwalshaik100% (1)

- Break Even Point Analysis-Definition, Explanation Formula and CalculationDocumento5 pagineBreak Even Point Analysis-Definition, Explanation Formula and CalculationTelemetric Sight100% (2)

- Sap Co Material FullDocumento284 pagineSap Co Material FullS VenkatakrishnanNessuna valutazione finora

- Cooper and Slagmulder ABC EVADocumento3 pagineCooper and Slagmulder ABC EVAEnrique GarciaNessuna valutazione finora

- 'Cost Benefit Analysis': Dela Cruz, Alfredo Solomon Bsce-IiiDocumento6 pagine'Cost Benefit Analysis': Dela Cruz, Alfredo Solomon Bsce-IiiBen AdamsNessuna valutazione finora

- 60451-R12 - MassAllocation Across Ledgers in GLDocumento29 pagine60451-R12 - MassAllocation Across Ledgers in GLasdfNessuna valutazione finora

- Cost Accounting and BudgetDocumento16 pagineCost Accounting and BudgetCeclie DelfinoNessuna valutazione finora

- Using Activity Based Costing in Service Industries.: Cost AllocationsDocumento7 pagineUsing Activity Based Costing in Service Industries.: Cost AllocationsWaqar AkhtarNessuna valutazione finora

- CostDocumento16 pagineCostSandeep KulkarniNessuna valutazione finora

- Chapter 5 NotesDocumento6 pagineChapter 5 NotesXenia MusteataNessuna valutazione finora

- Intro S4HANA Using Global Bike Case Study CO-CCA Fiori en v3.3Documento39 pagineIntro S4HANA Using Global Bike Case Study CO-CCA Fiori en v3.3Erwin MedinaNessuna valutazione finora

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesDa EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNessuna valutazione finora

- Cost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelDa EverandCost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelNessuna valutazione finora

- Build Big Data Enterprise Solutions Faster On Azure HDInsight PresentationDocumento28 pagineBuild Big Data Enterprise Solutions Faster On Azure HDInsight PresentationVish YrdyNessuna valutazione finora

- Sample BudgetDocumento2 pagineSample BudgetVish YrdyNessuna valutazione finora

- HadoopDocumento23 pagineHadoopVish YrdyNessuna valutazione finora

- Kscope Tools For RulesDocumento22 pagineKscope Tools For RulesVish YrdyNessuna valutazione finora

- Venkateswara AshtotramDocumento2 pagineVenkateswara AshtotramVish YrdyNessuna valutazione finora

- Earnings Calendar US Markets FinscreenerDocumento9 pagineEarnings Calendar US Markets FinscreenerVish YrdyNessuna valutazione finora

- Sharepoint 2010 Developer IT Pro Learning Guide 101909Documento2 pagineSharepoint 2010 Developer IT Pro Learning Guide 101909raven_3023Nessuna valutazione finora

- A Fresh Approach To Essbase BackupsDocumento14 pagineA Fresh Approach To Essbase BackupsVish YrdyNessuna valutazione finora

- Smartview Part 2 User GuideDocumento23 pagineSmartview Part 2 User GuideVish YrdyNessuna valutazione finora

- Lingashtakam TeluguDocumento2 pagineLingashtakam TelugukommsuNessuna valutazione finora

- Copy UtilityDocumento1 paginaCopy UtilityVish YrdyNessuna valutazione finora

- Performance TestDocumento1 paginaPerformance TestVish YrdyNessuna valutazione finora

- Performance Test-TempDocumento1 paginaPerformance Test-TempVish YrdyNessuna valutazione finora

- Replace ZeroDocumento1 paginaReplace ZeroVish YrdyNessuna valutazione finora

- Allocatin in ASODocumento2 pagineAllocatin in ASOVish YrdyNessuna valutazione finora

- Visa PDFDocumento17 pagineVisa PDFStuti Sharma Gaur100% (1)

- SE411 - Matt Heinzelman Software Quality Assurance PresentationDocumento39 pagineSE411 - Matt Heinzelman Software Quality Assurance Presentationannaji03Nessuna valutazione finora

- Visual Basic 6 BlackbookDocumento1.182 pagineVisual Basic 6 Blackbookapi-19711924Nessuna valutazione finora

- Durga AshtothramDocumento2 pagineDurga AshtothramVish YrdyNessuna valutazione finora

- Epma 101 Loading Dim Members Via Flat FileDocumento14 pagineEpma 101 Loading Dim Members Via Flat FileVish YrdyNessuna valutazione finora

- Essbase BSO TuningDocumento14 pagineEssbase BSO TuningfahimNessuna valutazione finora

- Sons To Be DownloadedDocumento1 paginaSons To Be DownloadedVish YrdyNessuna valutazione finora

- Hyp LinesDocumento1 paginaHyp LinesVish YrdyNessuna valutazione finora

- Oracle 11 New FeaturesDocumento8 pagineOracle 11 New FeaturesVish YrdyNessuna valutazione finora

- FoodDocumento1 paginaFoodVish YrdyNessuna valutazione finora

- FoodDocumento1 paginaFoodVish YrdyNessuna valutazione finora

- BRCDocumento70 pagineBRCtomallor101Nessuna valutazione finora

- SWA Classified Adverts 160215Documento4 pagineSWA Classified Adverts 160215Digital MediaNessuna valutazione finora

- Case Study Ground HandlingDocumento5 pagineCase Study Ground HandlingHimansh SagarNessuna valutazione finora

- Oracle IprocurementDocumento157 pagineOracle IprocurementRam ManikandanNessuna valutazione finora

- Boeing 787:case Analysis: Ashish Jude MichaelDocumento15 pagineBoeing 787:case Analysis: Ashish Jude MichaelprashantNessuna valutazione finora

- SOP For Breakdown of Vehicle - 17. Rev-2Documento3 pagineSOP For Breakdown of Vehicle - 17. Rev-2syed aquibNessuna valutazione finora

- Global Report Construction Equipment 2017Documento76 pagineGlobal Report Construction Equipment 2017FirasAlnaimiNessuna valutazione finora

- Porsche Financial Services BrochureDocumento8 paginePorsche Financial Services BrochureAndre BarnesNessuna valutazione finora

- The Silk Ax1445 Flange Facing MachineDocumento2 pagineThe Silk Ax1445 Flange Facing MachineSamsam SamNessuna valutazione finora

- BQ - PreliminariesDocumento10 pagineBQ - PreliminariesMichael TanNessuna valutazione finora

- Cost of Poor Quality in Construction: Eng. Vishal Vasant Waje, Eng. Vishal PatilDocumento7 pagineCost of Poor Quality in Construction: Eng. Vishal Vasant Waje, Eng. Vishal PatilandrianioktafNessuna valutazione finora

- B2TBSPF102: All Dimension in Charts and Drawing Are in MillimetersDocumento3 pagineB2TBSPF102: All Dimension in Charts and Drawing Are in Millimeterskhaled aliNessuna valutazione finora

- Lab2 Physical DesignDocumento25 pagineLab2 Physical DesignBíNessuna valutazione finora

- Pages From Research Report Dispersion Modelling and Calculation in Support of EI MCoSP Part 15 Mar 2008Documento11 paginePages From Research Report Dispersion Modelling and Calculation in Support of EI MCoSP Part 15 Mar 2008Blake White0% (2)

- 1314450a en Citroen c5 Peugeot 407 2008 27 Hdi AutomatikgetriebeDocumento20 pagine1314450a en Citroen c5 Peugeot 407 2008 27 Hdi AutomatikgetriebeJorge100% (2)

- Mep Hse PlanDocumento25 pagineMep Hse PlanMahammadNessuna valutazione finora

- CPTC Capability Statement - Competence Based Training in CPTC - R8 - 20100604Documento20 pagineCPTC Capability Statement - Competence Based Training in CPTC - R8 - 20100604kavehNessuna valutazione finora

- Intro To ScrumDocumento40 pagineIntro To ScrumAvay KumarNessuna valutazione finora

- ABAP MaterialDocumento104 pagineABAP MaterialgvrahulNessuna valutazione finora

- Columna DTH Simba M4C ITH - CondestbleDocumento9 pagineColumna DTH Simba M4C ITH - CondestbleRonald OsorioNessuna valutazione finora

- ISO 1167 4 2007, ThermoplasticsDocumento12 pagineISO 1167 4 2007, ThermoplasticsAzima Zalfa AuliyakNessuna valutazione finora

- 148NK08 BridonDocumento15 pagine148NK08 BridonTara SnyderNessuna valutazione finora

- IotaITS 75C SwitchDocumento4 pagineIotaITS 75C SwitchJohn Melanathy IINessuna valutazione finora