Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

How To Deal With Banks and Financing in Brazil

Caricato da

Heitor Carpigiani de PaulaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

How To Deal With Banks and Financing in Brazil

Caricato da

Heitor Carpigiani de PaulaCopyright:

Formati disponibili

FINANCE & ADMINISTRATIVE

Sponsor:

DEAL WITH BANKS

AND FINANCING IN

BRAZIL

4

TH

EDITION

American Chamber of Commerce for Brazil - AMCHAM

International Afairs Department

Brazil, 2013/2014

*Este guia faz parte do projeto

ACKNOWLEDGMENTS

Operating since 1982 in the security and surveillance segment, GRABER has been expanding its

participation in the sectors of surveillance, personal security, specialized services, electronic

security projects, and cargo and vehicle tracking. The company is a pioneer in the provision of

integrated security services in Brazil and the rst Latin American company to be granted the ISO

9001 Certication. Now holds the ISO 14001 and OHSAS 18001, minimizing environmental

impact and meeting all the legal requirements of quality, health, workplace safety and

environment. It was also the rst to introduce the e-learning concept, to offer a 24-hour assistance

service for expatriates, and to create a Corporate University to train and provide specialization

courses for its over 15,000 employees. We have been partnering with AMCHAM since the

beginning of the How To Series because we believe, not only in this project, but also in the

professionalism with which the information is provided to international companies. Being able to

contribute in such a simple and objective way is a great pleasure to our company.

The American Chamber of Commerce for Brazil, being the largest Amcham outside the United

States is constantly serving its members by building bridges for Brazilian businessses worldwide.

Our foreign investment attraction efforts have also been a key leading point for Amcham. The How

to Series is part of this initiative. With the support of some of our corporate members we are putting

together strategic information on the most various aspects of doing business in Brazil. As part of

BRICS (Brazil, Russia, India, China and South Africa) and representing the 7

th

largest economy

of the world, Brazil has clearly demonstrated its importance in the global market. The countrys

business environment as well as foreign investment numbers, despite international crisis, continues

very positive. Medium and high classes are increasing, which creates a solid internal market and

contributes to maintain good results in the economy. The 2014 FIFA World Cup has been esimated

in US$ 56.8 billions and the 2016 Olympics in US$ 19.3 billions in investments. These events have

had an impact on direct investments in Brazil and in infrastructure projects needed to hold them

in the country. It is now more than ever a strategic time for businesses opportunities in Brazil. We

welcome you and hope that the information you are about to read serves you best.

The How to Do Business and Invest in Brazil initiative, conducted by the American

Chamber of Commerce is a key instrument to disseminate information about the countrys

business environment, one of the markets that has most attracted attention of investors

in recent years. With operations that span over 30 years, Santander Brasil also has an

optimistic view of the country. We strongly believe in Brazils potential for growth due to

the countrys combination of a robust domestic market, a dynamic business environment

and stable institutions. For these reasons, Santander Brasil (which current boasts a 24%

contribution to Santanders profts worldwide), will remain as a key player in the Groups

strategy.

Jess Zabalza - CEO, Santander Brasil

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Disclaimer: This document is for information purposes. Any

decisions to contract products herein should be based solely on

the customers analysis. No assumption, projection or example

contained herein should be deemed to guarantee future events and/

or performance. This document does not constitute any binding

obligation on banks.

CONTENT

01 GENERAL VIEW 06

02 BANK ACCOUNTS 09

03 FOREIGN EXCHANGE (FX) 11

04 HEDGING 15

05 MAIN FINANCING PRODUCTS 19

06 BANK GUARANTEES 36

07 INTERNATIONAL GUARANTEES 38

08 INVESTMENTS 39

09 ABOUT OUR SPONSOR 41

5.4%

13.4%

55.4%

9.6%

Northeast

North

Middle-West

South-East

South

16.2%

The changes on the demographics pyramid played

an important role, as Brazil is now passing through a

window of opportunity called demographic bonus. This

bonus occurs when the number of citizens in working

age is higher than the number of people who depend on

them (children and elders). Also more than 8 million

jobs have been created in Brazil since 2003 and average

unemployment rate has dropped down from 12.3% (2003)

Brazil is the 7th largest economy in the world, with a vibrant

business environment and a huge consumer market size. In the

last 20 years, Brazil was able to overcome high infation rates,

stabilize economy, balance external debt and create a good

framework for development. In this positive environment,

Brazil was able to improve its income distribution and,

summed with a better balance in the demographics pyramid,

low unemployment rates and advances on the credit market,

brought more than 36 million additional people to the

consumer market. This tendency is expected to keep on in the

forthcoming years, giving a boost to the social condition.

199.8 Mi

2.2 trln USD

10,957 USD

(EST.2013)

2.79

01.

GENERAL VIEW

0

6

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Source: IBGE, FGV e LCA

Assembly: Ministry of Finance

POPULATION OF BRAZIL

Trend of Social Mobility

*in Millions of people

Regions: Participation in total GDP (%)

improve the investment environment and cut down taxes

to stimulate some sectors.

The total amount of investment in infrastructure from

2011-2016 is estimated in 1 Trillion BRL (around 0.5

Trillion US$) according to the distribution below:

PAC

Source: Ministry of Development, Industry and Foreign

Trade (MDIC), Brazil World Cup Offcial Website and

Santander estimative.

CREDIT MARKET

The positive social economic environment was followed

by an expansion on the Brazilian credit market. From

2005, growth in income has been matched by more

credit in the fnancial system. Total outstanding credit

almost doubled since then, reaching 55.5% of GDP

(BRL2.2 Trillion, Exp. 2013), and there is still room

for improvement if we compare it to global standards.

0

7

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

to 5.4% (2013), being the last three years considered

under a full employment condition by specialists (6%).

This means that the majority of the population is indeed

working and creating wealth.

Source: IBGE

This social phenomenon, added to the increase in the credit

market, multiplied the power of purchase of Brazilian

families, boosting consume and supporting the growth and

development of local and international companies in the

country. This new dynamics brought the need for investment

in almost all segments and mainly in infrastructure.

Launched in 2007 by the Brazilian government, the Program

for the Acceleration of Growth (PAC) is the umbrella

program for thousands of infrastructural projects around the

country, such as building and repairing highways, airports

and ports, energy development, housing, water and sewage

systems, many of which aim to improve the situation of

disadvantaged members of Brazilian society. The program

also consists of measures to boost low interest rate credit,

Brazil - Total Credit as % of GDP

Source: Brazilian Central Bank (BACEN).

0

8

This growth did not come just because there were new

people accessing the credit market but also because, as

market evolved, the tenors became longer and the credit

cost lower. With this combination, there was an increase

in the purchasing power of the Brazilian consumer market

without pressuring household debt service.

Considering all this local elements inserted in a global

context of economic and fnancial crisis, Brazil turns out to

be a very attractive and potential market for international

companies searching for sustainable growth, geographic

diversifcation and better returns.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Source: Central Bank of Brazil

Disposable Income (%)

02.

BANK ACCOUNTS

Brazil has a well regulated fnancial market, with a

strong autonomous Central Bank and a set of specifc

regulations that must be followed. Once the regulations

are followed, any company, be it local or international,

shouldnt have any problems on operating in the country

and repatriating dividends.

When it comes to bank accounts, the basic points that an

international company needs to know are:

Demand and Deposit accounts are opened for

companies legally established in Brazil, with

local resident representation (at least one

local administrator);

Accounts are only allowed in local currency

(Brazilian Real, represented by R$). Banks are not

allowed to deal with multi-currency accounts;

Neither netting nor interest compensation cash

pooling are allowed (for more information on cash

management, please consult publication How to

do cash management in Brazil);

Although regulated by law, banks in Brazil do

not usually provide non-resident accounts.

DOCUMENTATION

The standard documentation commonly required for

opening an account is:

1. Local Company social contract including

the CNPJ Number (local fiscal number)

approved by the local state commercial organ,

called Junta Comercial;

2. Parent Company Social contract translated to

Portuguese and notarized

1

;

3. Local Administrator Copy of personal documents:

local ID, CPF number and proof of address in Brazil

(electricity bill, phone bill or similar);

4. Bank Forms fulflled signed by the

local administrator.

0

9

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

1

i) Document already required by the Junta Comercial approval, the bank will only need a copy of the documentation already presented for obtaining

the document in 1. ii) If there are foreign individuals as shareholders of the local company: copy of international personal documents.

1

0

KNOW YOUR CUSTOMER

PROCEDURES:

As part of Money Laundry avoidance, Brazilian banks

are subjected to Compliance policies, and it is common

to ask for the diagram of shareholders composition until

getting to an individual or an open/listed company (when

participation on the local company is relevant).

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

03.

FOREIGN EXCHANGE (FX)

All fnancial operations inside the country must be done

in Brazilian Reais, so all payments, collections, contracts,

receivables, etc. must be done in local currency. For an

international company willing to operate in the country, this

means that the subsidiary is going to operate in a currency

different from the one used by the parent company. This

also means that a currency exchange operation will be

needed in all capital transfers between subsidiary and

parent company, be it sending or repatriating money.

HOW IT WORKS:

When sending money into Brazil (inflow), it

will arrive at your subsidiary bank account in

foreign currency (US$, EUR, etc.) and while

it stays in this currency, no local financial

operation is allowed. Once the company orders

the currency exchange transaction and the

money is converted to Reais, local transactions

can be done;

When remitting capitals into Brazil (infow) the

proper registration in the Brazilian Central Bank FX

System is mandatory;

Foreign currencies exchange operations must be

done through Institutions authorized by Central

Bank to operate in the FX Market;

Currency exchange operations must be formalized

through forms called FX contract;

FX contracts must be signed between local client

and local FX agent;

FX operations must be followed by specifc

documentation that proves and matches the

transaction value;

There are specifc taxes involved, depending

on the nature of the operation. Values may

vary from time to time. A legal tax advisor is

strongly recommended.

INFLOW AND OUTFLOW OF CAPITAL:

There are not capital repatriation barriers or limits

in Brazil, as long as the capital entered the country

with the proper registration beforehand. Capital

1

1

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

1

2

Infow nature will determine primarily the way it will be

repatriated in the future. The two most common natures

are described in the following.

CAPITAL INJECTION:

If infow purpose is to inject capital in a local vehicle in

Brazil it should be treated, registered and documented

as Capital Injection. The values should have the specifc

registration on Central Bank and must be refected in the

social contract of the local vehicle. In the future those

values should be repatriated as dividends. Operational fow

and taxation involved:

Capital Injection Comprehensive Step by Step Process:

Step 1: Registration of the Foreign Entity at the

Cademp (Cadastro de Empresas rea Designada).

Step 2: Registration of the RDE Electronic

Declaratory Registration at the Sisbacen (Brazilian

Central Bank system).

Foreign Direct Investment: IED

Documentation: IED approved by the Central

Bank and power of attorney to register the IED

on behalf of the Brazilian company.

Tax: IOF of 0.38% over the notional in BRL.

Step 3: Foreign Exchange Flow:

a) The Foreign entity delivers the amount in US$

in a correspondent bank abroad agreed with the

bank in Brazil, on the settlement date.

b) Bank in Brazil delivers the equivalent amount

in BRL, at the agreed exchange rate, on the

Brazilian Entitys onshore account, on the

settlement date.

The future outfow would be done as dividends or Interests

on Equity Reserve. Dividends are not taxable at local level

(as long as you are not operating from a tax heaven in

which case they would be taxed at 15%) and Interests on

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

BRL

Offshore

Local

Bank

USD, EUR,

etc

Parent

Company

Brazilian

Entity

b

a

Payment instructions to Brazil in Dollars (USD)

Data Involved: Swift (BIC CODE) of Correspondent Bank,

Clearing Code, Account Number, Beneficiary Bank Swift (BIC

CODE), Company Beneficiary Name:

Equity Reserve are taxable from 10% to 25% over the

notional in BRL, depending on where the benefciary lies.

Outfow Registration:

Documentation: IED approved by the Central

Bank and power of attorney to register the IED

on behalf of the Brazilian company.

Copy of Minute of deliberation Registered

in the Junta Comercial and the last Balance of

the company.

Foreign Exchange Flow:

Brazilian entity delivers the equivalent amount

in BRL, at the agreed exchange rate, to the bank

in Brazil.

Bank in Brazil delivers the amount in US$, on

an offshore account of the clients entity, on the

settlement date.

INTERCOMPANY LOAN:

If inflow purpose is to lend money from the parent

company or another offshore vehicle to a local vehicle in

Brazil, it should be treated, registered and documented

as Intercompany Loan. The values should have the

specific registration on Central Bank and must be

documented in a loan contract, stating the loan tenor,

interests and payments. In the future those values

should be repatriated as loan payments (principal and

interests). Bellow we describe the operational flow

and taxation involved:

Intercompany Loan Comprehensive Step by Step Process

Step 1: Registration of the Foreign Entity at the

Cademp (Cadastro de Empresas rea Designada).

Step 2: Registration of the ROF Financial

Operation Register at the Sisbacen (Brazilian

Central Bank system).

Step 3: Foreign Exchange Flow: same as

Capital Injection.

1

3

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

BRL

Offshore

Local

Bank

USD, EUR,

etc

Parent

Company

Brazilian

Entity

b

a

Payment instructions to Brazil in Dollars (USD)

Data Involved: Swift (BIC CODE) of Correspondent Bank,

Clearing Code, Account Number, Beneficiary Bank Swift (BIC

CODE), Company Beneficiary Name:

1

4

Some documents are necessary to obtain

an intercompany loan, as copy of the loan

agreement, form with terms & conditions of

the loan signed by the Brazilian company and

power of attorney to register the ROF on behalf

of the Brazilian company.

About taxes, 0% of IOF will be applied over

notional in BRL for loans with duration longer

than 360 days

2

and 6.00% over notional in BRL

for loans with duration shorter or equal than

360 days. If a company decides to prepay a

contract at any point in time, changing duration

previously settled to a period inferior than 360

days

2

, a 6% IOF will be charged over the whole

notional at the moment of prepayment.

The future outfow should be done as loan payments

(principal and interests). Interests are taxable at local level

from 15% to 25% depending on where the benefciary lies.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

2 3

According to Decree 7853/2012 of Dec/05/12. Please consult banks to verify legislation in force.

Summary Table Tax Incurrence on Foreign Exchange Operations

3

.

04.

HEDGING

There are many fnancial instruments for protecting a

companys asset, investment or liability against currency

risk. Considering that Brazil has a free foat exchange rate

regime and also that innumerous variables can affect its

value, it is important that international companies consider

having a hedging strategy.

There are many fnancial instruments for hedging like

options, forwards, swaps and other structured derivatives.

By analyzing the fow of resources and company operations,

a bank will be able to advise you on the best alternatives

for each case.

On the following topics, two hedging products commonly

used are detailed.

NON DELIVERABLE FORWARD (NDF)

Target Market:

Companies with assets, investments or liabilities indexed

to foreign currencies which are seeking protection against

an appreciation/depreciation by such currencies against

the Real.

Description:

The non-deliverable forward (NDF) entails purchasing

or selling a given amount of currency at a predetermined

rate. There is no physical payment, i.e. the settlement

is made by the difference between the contracted

Forward Rate and the reference price quotation adopted

for the expiration of the operation (usually the Ptax

exchange rate for the US dollar). Thus, if the quotation

at expiration is greater than the Forward Rate, the

purchaser of the currency receives the payoff from the

seller. If it is less, the seller receives the payoff from

the purchaser.

Benefts:

No cash outlay at the inception of the transaction.

No daily payoffs, as would be the case with BM&F (Brazilian

Mercantile & Futures Exchange) futures contracts.

Same standard as used by the international market (Non-

Delivery Forward).

Terms:

There are no minimum amounts or terms imposed

1

5

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

EXAMPLE

A company which imports raw materials from the U.S. to

be paid on credit has a liability in dollars on its books. In

order not to run the risk of gains made by the US dollar

against the Brazilian real, the company could contract a

Currency Agreement with a bank, supposing the company

buys an amount of US Dollars of 1,000,000 (Base amount)

at a rate of R$/US$ 1.72 (Future Rate) to be settled in 180

days at the PTAX exchange rate.

On the expiration date, supposing the Ptax rate is R$/

US$ 1.75, the payoff amount for the company would be

calculated as the following:

US$ 1,000,000.00 (1.75-1.72) = R$ 30,000.00.

Since the quotation adopted as a reference is greater than

the contracted rate, the customer shall receive the difference

between these rates. The example below sets forth the

payoff amounts under different values of the dollar:

1

6

on the operations. The terms are freely agreed by the

parties. Currencies other than the US$ can be traded,

including: Euro (EUR), Yen (JPY), Sterling (GBP)

amongst other (but for the maximum term of one year,

in these cases). The reference quotation at expiration

can be: PTAX (Official rate published by the Central

Bank of Brazil) and Currency Feeder (Ex: Reuters).

It is not possible to perform forward transactions for

this product.

Regulations:

The transactions are governed by Resolutions N 2873

and N 3505 issued by the CMN (National Monetary

Committee) and registered at CETIP (Central Securities

Depositary). The Currency Agreements are executed by:

Signing a master agreement which sets forth the general

terms and conditions of the transaction, and signing a

Trading Bill for each operation performed, refecting the

specifc conditions of the deal engaged.

Taxes Applicable:

Income Tax of 15% over positive results received by the

company. Additionally, there will be a complementary

Income Tax withheld at source of 0.005% over positive

results received by the company

4

. For currency

selling positions over US$ 10 million, incurrence of

1% IOF over the exceeding value, to be collected

by the company. There are legal tax exemptions for

exporters, please consult a tax advisor for rule detail

and calculation.

4

There will be no retention at source if the sum of the adjustments received from the same counterpart during the same month is below R$ 20,000.00.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

FX DELIVERABLE FORWARD

Target Market:

Companies with receivables due in the future in foreign

currency that want to protect themselves from any

unfavorable exchange rate variation.

Description:

Foreign exchange transactions with future delivery of both

foreign and Brazilian currency. Exchange rate is determined

upon the closing of the foreign exchange transaction (T+0),

but the foreign currency and Reais are deliverable on a

future date (T+n).

Benefts:

A hedge option for receivables in foreign currencies.

100% Market Risk free on the settlement day. Eliminates

the risk of mismatch between the PTAX used to settle

the swap and the exchange rate used to transfer the funds

(the risk-base). Potential premium depends on the

market conditions at the time of closing. FX Deliverable

Forward transactions are executed by the standard

exchange contract itself. All terms and conditions agreed

by the customer and the Bank are established within the

FX contract agreement. Supporting documentation must

be presented until settlement.

Regulations:

This transaction is regulated by the Brazilian Central

Bank and other complementary norms published by other

authorized entities.

Tenor of transactions can be up to 360 days from the

closing date.

The settlement of the transaction may be anticipated as

long as it is recorded within the presented documents.

Taxes Applicable:

Withholding Tax applied on the possible premium

(income), according to transactions term (regressive

1

7

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

A short position in a NDF would therefore be as follows:

1

8

rate) of Law 11033/2004 (22.5% transactions up to 180

days and 20% transactions with term between 181 and

360 days).

IOF: According to Summary Table Tax Incurrence on

Foreign Exchange Operations (Please see on chapter 3 -

Foreign Exchange).

EXAMPLE

Below is an example of a receivable to be settled at a

future date.

Amount: US$ 1,000,000.00;

Closing date of the Deliverable Forward transaction:

Jan/05/2012;

Spot Exchange rate at Jan/05: 1.8500;

Settlement date for the Brazilian currency:

May/04/2012;

Exchange rate for future settlement: 1.86;

Maturity of the obligation abroad: May/03/2012.

Jan/05/2012 May/03/2012

May/04/2012

Closing of the FX

Deliverable Forward

Foreign Currency Payment

(US$ 1,000,000.00)

Brazilian Currency Payment

(R$ 1,860,000.00)

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

05.

MAIN FINANCING PRODUCTS

WORKING CAPITAL

Target Customer:

Companies in general with predictable cash fows which

require short-term or medium-term funding to support their

working capital needs.

Description:

Local currency loan for a given term, intended to support

short or medium-term funding needs.

Benefts:

Amortization according to the schedule chosen by the

Customer in order to be most suitable to its cash fow.

Disbursement either immediately or at a scheduled date in

the future.

Customer does not need to evidence the resources destination.

Contract length may be adapted to the customer necessity.

Terms:

Amount: Established in the Credit Loan Agreement,

according to the credit limit. Rates: Fixed or Floating

(CDI, TR, IGP-M)

5

;

Minimum Terms:

Fixed/Floating rates: one day; Reference Rate (TR):

two months; IGP-M (general prices index: one year);

Payment schedule: in installments or at the maturity date.

Documentation:

Loan Agreement: An agreement which formally establishes

the amount, term, and other conditions of the loan.

Promissory Note: An instrument of credit which

represents the Customers Obligation.

Agreement of Collateral: Instrument which formally

establishes the collateral rendered by the Company,

when applicable.

Taxes:

IOF (fnancial transaction tax):

0.0041% per day (consecutive days) over the principal

amount, limited to 365 days; Plus 0.38% over the

principal amount.

1

9

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

5

Subjected to bank approval.

2

0

OVERDRAFT ACCOUNT

Target Customer:

Companies with non-predictable cash fows, which require

short or medium-term funding to support their working

capital needs, or which do not wish to prematurely

withdraw funds that have been invested.

Description:

Revolving line of credit whereby the awarded credit limit

can be fully or partially used and outstanding balances

can be settled at any time during the agreements term.

The established credit line shall always be linked to an

unblocked current account.

Benefts:

Speedy and manageable. Funding available at any time.

Interest and IOF (Financial Transaction Tax) over the

daily outstanding balance used.

Terms:

Term: At least 30 days.

Maximum: To be established according to the credit limit,

limited to 6 months.

Rates Fixed or foating (CDI)

6

.

Interest Payment: monthly (on the frst working day of

the month) or at the maturity date.

Types: a) Regular: any withdrawal or repayment must be

requested; b) Deposit: previous requests are not necessary.

Documentation:

Revolving Credit Agreement: An agreement which

formally establishes the amount, term and other conditions

of the overdraft account.

Promissory Note: An instrument of credit which represents

the Customers Obligation.

Agreement of Collateral: Instrument which formally

establishes the collateral rendered by the Company,

when applicable.

Taxes:

IOF (Financial Transaction Tax): 0.0041% to be paid

on the sum of the daily outstanding balances for the

month, charged on the frst working day of the following

month; 0.38% to be paid on the sum of the total amount

after each day increase, on the frst working day of the

following month.

SUPPLY CHAIN FINANCING

CREDIT ASSIGNMENT WITH RECOURSE

Target Customer:

Industrial and commercial companies, interested in a working

capital transaction and improving balance sheet ratios.

6

Subjected to bank approval.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Description:

Assets transference deal, qualifed generically as accounts

receivables (credits). These credits must be represented by

credit securities (Trade note receivables, promissory notes,

others) and must be already performed.

Characteristics:

The credits negotiated may be from commercial activity of

the company or operations described by their activity roll.

The credits may be represented by credit securities

(trade notes payable or promissory notes) or via contract

formalized and may be performed.

The credits may have no legal impediment (allowing the

assignment to the bank).

Banks Customer (Assignor) is the credit risk for this transaction

(since it is the guarantor of all Payers indebtedness).

Benefts:

Possibility to concede better duration conditions, negotiated

with the bank.

Interest rate negotiated with the bank for the transaction

may be different than interest rate negotiated with

the Payers for the credit sale, keeping a different sales

strategy control.

Possibility to improve balance sheet ratios, depending

on the accountancy rules used by the companies: i) this

operation may be not accounted as a bank loan; ii)

accounts receivable may suffer reduction and increase

cash/bank deposits.

Negotiation Details:

Acquisition Value: Price paid for the credits acquisition,

considering the interest rate and the term negotiated for

the transaction.

Minimum and maximum value: There are no restrictions

being the maximum value established by the credit limit

approved for the Payers.

Operations Terms: No minimum term. According to the

credit limit approval.

Disbursement: via TED (Eletronic Transfer) or credit in

current account.

Repayment: Directly by the Payers to the bank, through

settlement of payment slip order, TED or debit in current

account, under the Payer authorization.

Documentation:

Credit Assignment Contract: Formalizing the credit

assignment, the responsibility of the customer for the

credits existence and for the Payers indebtedness.

Notifcation: The document is delivered to the Payers,

communicating the cession and supplying payment

2

1

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

2

2

roll instructions.

Notes:

Floating indexed credits must be approved by the Bank.

Taxes:

IOF: no incidence.

EXAMPLE

1) Customer/Assignor practices credit sales with its

clients (sales strategy);

2) Customer/Assignor assigns its receivables (credits against

its clients/Payers) to the bank with non-recourse (by signing

a Credit Assignment Agreement with no recourse);

3) a) Customer/Assignor notifes clients/Payers regarding

the assignment transaction;

b) Customer/Assignors clients/ Payers sign a notifcation

letter agreeing to pay the bank directly as their new creditor;

c) Bank makes the assignment payment to Customer/Assignor;

4) Payers effect the payment (in the maturity date)

directly to the bank;

5) In case of indebtedness, the Assignor effects the

payment to the bank as the Payers guarantor.

CREDIT ASSIGNMENT WITH NO

RECOURSE

Target Customer:

Industrial and commercial companies, interested in

Bank

Payers

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

a working capital transaction and improving balance

sheet ratios.

Description:

Assets transference deal, qualifed generically as accounts

receivables (credits). These credits must be represented by

credit securities (Trade note receivables, promissory notes,

others) and must be already performed.

Characteristics:

The credits negotiated may be from commercial activity of

the company or operations described by their activity roll.

May be represented by credit securities (trade notes payable

or promissory notes) or via contract formalized and must

be already performed.

May have no legal impediment (allowing the assignment

to the bank).

Bank will check the availability of credit limit to each

Payer indicated by its Customer.

Benefts:

Possibility to concede better duration conditions, negotiated

with the bank.

The Credit risk is transferred to the bank.

Interest rate negotiated with the bank for the transaction

may be different than interest rate negotiated with the

Payers for the credit sale, keeping a different sales

strategy control.

Possibility to improve balance sheet ratios, depending

on the accountancy rules used by the companies: i)

this operation may be not accounted as a bank loan; ii)

accounts receivable may suffer reduction and increase

cash/bank deposits.

Regulation:

Credit Assignment Contract: The contract that formalizes

the cession and responsibility of the customer for the

credits existence.

Notifcation: The document is delivered to the Payers,

communicating the cession and supplying payment

roll instructions.

Negotiation Details:

Acquisition Value: Price paid for the credits acquisition,

considering the interest rate and the term negotiated for

the transaction.

Minimum and maximum value: There are no restrictions,

being the maximum value established by the credit limit

approved for the Payers.

Operations Terms: No minimum term. According to the

credit limit approval.

2

3

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

4. Payment

3. a. Payment

3. c. Payment

2

4

Disbursement: via TED (Electronic Transfer) or credit in

current account.

Repayment: Directly by the Payers to the bank, through

settlement of payment slip order, TED or debit in current

account, under the Payer authorization.

Notes:

Floating indexed credits must be approved by the Bank.

Taxes:

IOF: no incidence.

EXAMPLE

1) Customer/assignor practices credit sales with it clients

(sale strategy).

2) Customer/assignor assigns its receivables (credits

against its clients/Payers) to the bank by signing a Credit

Assignment Agreement with no recourse.

3) a) Customer/Assignor notifes clients/Payers regarding

the assignment transaction;

b) Customer/Assignors clients/Payers sign a notifcation letter

agreeing in paying the bank directly as their new creditor;

c) The bank makes the assignment payment to

customer/assignor.

4) Payers effect the payment (in the maturity date) directly

to the bank.

5) In case of indebtedness, the assignor effects the payment

to the bank as the payers guarantor.

CONFIRMING

Confrming is an administrative and fnancial service

through which the bank intermediates the payment process

to suppliers, without any modifcations of the terms agreed

between CLIENT and its suppliers. It is a type of credit

assignment with no recourse operation.

Target Customer:

Companies with an interest in fnancing their supply chain and

improve their balance sheet through the extension of payments

terms with suppliers benefting from Confrming advantages.

Product Description:

A Supply Chain Finance Service through which the

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

bank intermediates in the payment process to suppliers,

without any modifcation of the terms agreed between

PURCHASER and its suppliers.

Benefts:

PURCHASER

Purchasers are better positioned to negotiate lower cost

of goods or extended payment terms, helping improve

companys working capital and cash fows.

Purchaser gets fewer supplier queries about invoice status,

while providing valuable information and support through

the banks platform and services.

Costs control and cost reduction.

Easier administration and reconciliation, as bank manages

payments to suppliers.

Easy implementation through fexible integration with

purchasers ERP.

SUPPLIER

Early payment of invoices at a competitive discount, with

no IOF, as the operation is priced at the buyers credit risk.

Easy access to fnance without presenting fnancial statements

to banks and a lower conventional bank borrowing.

Suppliers get access to invoice status through web

platform, confrming desk and contact center, improving

the visibility and control of their accounts receivables

and collection processes.

No need to be an account holder of bank doing the

confrming operation.

Improves companys working capital and cash fow.

Negociation Parameters:

Contract Volume: Established according to the buyers

credit line.

Transaction Deadline: 15 Day minimum & 360 Day Max.

Min volume/operation: R$ 1,000.00.

Interest rates: Pre-negotiated.

Payment Method: Electronic transfer to the suppliers

bank account.

Operational Method: File Exchange.

Sales channel (Supplier): Operation Desk, Call Center

e Internet.

Formalization:

BUYER

Confrming Contract: Formalization of the confrming

2

5

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

2

6

contract. Credit line approval .

SUPPLIER

Account Holder: Signature card authenticated.

Non Account Holder: Companys Social Contract and

modifcations or Social Statute and Minutes of directors

election (original or authenticated copy), Attorney

empowered (original or authenticated copy), Application

Form Confrming, Signature Card (authenticated), CPF,

RG and company address confrmation document (original

or authenticated).

Interest Rates:

IOF: Not charged.

VENDOR

Target Customer:

Industrial and commercial companies interested in provide

fnancing to their clients, in order to improve sales.

Description:

Sales fnancing program for goods and services. The bank

pays the seller on a cash basis and the purchasers pay the

bank at the maturity date or in installments. The seller is the

purchasers guarantor under this program.

Benefts:

SELLER

Liquidity: The seller receives the sale amount on a cash basis.

Possibility to Raise Sales: The sellers products become

more attractive and more competitive in terms of price due

to the Purchaser, in terms of fnancing and interest rates.

Better Accounting Performance: The seller (according

to the internal accounting procedures) may record

the sales as Cash Basis, thereby reducing the item

Accounts Receivable.

Taxes Benefts: Reduced tax cost (IPI, ICMS, among

others), since the seller receives on a cash basis and the

sellers invoice does not incorporate the fnancial cost.

Reduced Cost of funding: The seller no longer provides

credit to customers using its own funds.

Interest Rate Adjustment: The seller can maintain different

price strategies for its customers (purchasers).

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Electronic Vendor: Reduced operational costs due to the

Electronic Data Interchange (EDI) of fnancing terms.

(Remittance/Reply).

PURCHASER

Better Financing Conditions, such as terms, interest rates

and payment plans, resulting from the credit extended by

the seller to its customers.

Credit Facility to the purchasers, since the Vendor Master

Agreement between the bank and the seller (in which the

seller undertakes the responsibility to analyze and guarantee

the credit risk of each purchaser) when signed, allows the

seller to contract, during the settled term, transactions (as

its Solicitor) for the Purchaser.

Flexibility on the payments fow.

Terms:

Minimum Transaction Amount: There is no minimum

amount, however there are processing, printing and postage

payment slip costs which shall be evaluated on a case-by-

case basis.

Transaction Term: Minimum seven days (to allow the

payment slip to be sent) and maximum term according to

the credit line.

Interest Rate Adjustment: It is the difference between the

interest rate charged by the seller from its customers and

the interest rate charged by the bank from the seller. It is

paid by the bank to the seller or by the seller to the bank

(according to the sellers sales strategy) at disbursement

or maturity date.

Rates/Indexes: fxed in BRL.

Guarantee: A guarantee, rendered by the seller to the

bank, which covers any default by the purchasers.

Term for Honoring the Guarantee: 30 days at most, to be

agreed by the seller and the bank.

Disbursement: Deposit in the sellers current account.

IOF (Financial Transaction Tax): Paid by the seller or by

the purchasers.

Payment Plans: Bullet payment or in installments.

Repayment Types: Payment slip or debit in the sellers

current account.

Deduction/Discount: Permitted when requested up

to seven days prior the mature date. The deduction/

discount amount shall be debited from the sellers

current account.

Subrogation Assignment: Issued when requested by

the seller.

2

7

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

2

8

Performed by: Electronic transmission or manual sending

of the information on each fnancing.

Regulation:

Vendor programs are subject to the rules established by the

National Monetary Council (CMN) and the Central Bank,

covering loans and fnancing in general.

The fow is agreed with the bank and seller.

The contract is signed between the bank/seller and

the purchaser.

Documentation:

Master Agreement: signed by seller and the bank (in order

to indicate the purchasers to be fnanced and to settle all

guarantees conditions).

Financing Contract: signed by seller, the bank, and the

purchaser (in order to formalize the fnancing to be and

to nominate the seller as Purchasers Solicitor allowing

the seller to negotiate the fnancing conditions with the

bank directly).

Deal Slip: signed by seller (as Purchasers Solicitor) and

the bank to contract all deal conditions (Purchaser Data,

tax, term, IOF payment, etc.).

Taxes:

IOF (fnancial transaction tax): Over the principal amount.

Paid by seller at the disbursement date: 0.0041% per day

(consecutive days), limited to 1.5% and 365 days; 0.38%

over the principal amount, independently of contract

length and payments fow.

NOTE: The tax is owed by the purchaser, however, it can

be paid: (i) by the Purchaser (by increasing the fnancing

principal amount); (ii) by the seller (by deducting the

owned amount from the principal to be disbursed).

EXAMPLE

1) The SELLER and the BANK execute a Financing

Agreement and Promissory Note, establishing the general

terms and conditions, guarantees, term and fnancing limit.

2) The SELLER, the BANK and the PURCHASER execute

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

a Financing agreement. The Agreement may be signed by

the SELLER by proxy. Both the Financing Agreement and

Financing Spreadsheets are deposited with the SELLER.

3) The SELLER issues Invoices on a cash basis to

its PURCHASERS.

4) The BANK pays the SELLER in cash according to the

Financing Spreadsheet and/or electronic fle.

5) The BANK issues a payment slip to the PURCHASERS

to settle the credit.

6) If the PURCHASER does not pay the fnancing on

the due date, the BANK debits the credit amount plus

the previously established charges from the SELLERs

current account.

IMPORT FINANCING

Target Market:

Companies in Brazil that are importing goods.

Description:

Financing to Brazilian importers of goods in foreign

currency whereby the international supplier receives the

payment on an agreed date. This allows the importer a

longer period to settle its obligations and increases cash

fow fexibility. The loan is granted by a foreign bank

directly to the Brazilian importer.

Benefts:

The supplier receives the payment on the due date and

the importer has a longer period to pay his debt.

More competitive interest rates versus the domestic market.

Parameters for Negotiation:

All operations will be subject to credit analysis by

the bank.

Amounts are limited to 100% of the price of the goods to

be imported.

Terms and conditions for operations will be freely

agreed between the parties, subject to offcial import

documentation and the foreign exchange regulations

in force.

Key indexers for the operations: Interest rates prevailing

in the international market (LIBOR, EURIBOR,

PRIME, etc.).

Regulation:

The operations are regulated by the International

Capital and Foreign Exchange Market Regulation and

other standards issued by the Brazilian Central Bank

and other agencies.

Operations are entered into by executing an agreement

setting out general conditions.

2

9

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

Foreign

Bank

3

0

FINIMP - Import Financing

(Direct Line - Firce 25)

Taxation:

Income tax: Levied on revenues wired to a foreign country.

Depending on the type of income it may be either exempt

from taxation or it may be taxable at the rates of 12.5%,

15%, and 25%, varying according to the nature of the

transfer, the relevant creditors country and any covenants

in place in order to avoid double taxation. IOF: 0%.

1) Trade Agreement;

2) Shipping and document remittance;

3) Securing of ROF;

4) Delivery of shipment documents (exchange

guarantee);

5) Import Financing Agreement;

6) Foreign Currency Funding;

7) Resource Disbursement;

8) Foreign Exchange Purchase (at maturity);

9) Payment Foreign Currency Debt Settlement;

10) Payment funding.

EXPORT FINANCING

ADVANCES ON EXCHANGE

CONTRACTS ACC

Target Market:

Brazilian companies that perform export operations.

Description:

This type of fnancing is given to Brazilian exporters in the

pre-shipping phase in connection with goods and services

to be exported. It may consist in a total or partial fnancing

(versus the export contract price) and will be the equivalent

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

in local currency to the amount of the foreign currency

operation on the exchange contract date.

The goal is to help exporters obtain the funds they need

to purchase raw materials and to produce goods for

export purposes.

Benefts:

Financing to the production of goods at lower costs than

those prevailing in the domestic market.

Parameters for Negotiation:

Amounts are limited to 100% of the price of the goods/

services to be exported.

Operation term is limited to 360 days.

Terms and conditions for operations will be freely agreed

between the parties, subject to foreign exchange regulations

in force.

Key indexers for the operations: Interest rates prevailing in

the international market (LIBOR, EURIBOR, PRIME, etc.).

All operations will be subject to credit analysis.

EXPORT CREDIT NOTE NCE

Target Customer:

Companies exporting goods and services and its suppliers

which intend to obtain credit in local currency.

Description:

Local currency fnancing to supply short-term or medium-

term working capital needs or to acquire goods, services

and raw materials to be used in production. The funds

must be invested in export-related activities.

Benefts:

Export fnancing without exposure to exchange rate variation.

Exempt from the IOF tax (Financial Transaction Tax) in

accordance with Law 6313 of December 16, 1975.

Funds can be directly transferred to suppliers by the bank.

Repayment according to the plan chosen by the Company

in order to be the most suitable to its cash fow.

There is no legal obligation to link the export fnancing

funds to one or more shipping documents of goods and

services for export.

Documentation:

Export Credit Note: An instrument of credit which

formally establishes the amount, term and other

conditions of the transaction.

Budget: This is an integral part of the Export Credit Note

and provides a description of how the funds will be used.

3

1

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

Bank

Supplier

3

3

2

It is a legal obligation for establishing a NCE.

Terms:

Currency: BRL (Brazilian Reais)

7

.

Amount: To be established according to the credit limit

and budget.

Minimum term: 30 days.

Maximum term: negotiated by the exporter and the bank,

according to the credit limit available, budget and general

market conditions.

Rates: Fixed or foating (CDI).

Payment schedule: In installments or at the maturity date.

Taxes:

IOF (Financial Transaction Tax): Exempt in accordance

with Law 6313 of December 16, 1975.

1) The Customer submits the Exporter Classifcation form

to the BANK, detailing the use of the funds. Such document

shall be subject to analysis and approval by the BANK.

2) The BANK issues and forwards the Export Credit Note

and Budget to the CUSTOMER to be signed.

3) a) The BANK credits the CUSTOMERs current account,

or. b) The BANK pays the CUSTOMERs SUPPLIERS for

the acquisition of goods, services and materials intended

for export (Compror NCE).

4) The CUSTOMER settles the loan.

Other indexes may be submmited to the banks approval.

BNDES

The Brazilian Development Bank (BNDES) is the main

fnancing agent for development in Brazil and has played a

fundamental role in stimulating the expansion of industry

and infrastructure in the country. The Bank offers several

fnancial support mechanisms to Brazilian companies of

all sizes as well as public administration entities, enabling

investments in all economic sectors. BNDES emphasizes three

factors it considers strategic: innovation, local development

and socio-environmental development.

The BNDES has several tools to fnance the investment needs

of its clients on a long-term basis with very attractive rates.

7

Under the banks formal approval.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Requests are usually made through fnancial institutions

but, in some cases, can be made directly to BNDES. BNDES

does not have branches, so the majority of operations are

carried out indirectly through a partnership with a network

of accredited fnancial institutions located nationwide.

Financial resources are transferred to accredited agents,

which are responsible for credit analysis and approval.

Target Customer:

Companies in general, established under Brazilian laws, which

require long-term fnancing for the following objectives:

Development of investment projects;

Acquisition or commercialization of domestically

manufactured machinery and equipment accredited

with BNDES;

Production of goods to be exported, in a pre-

shipment phase.

Forms of Operating:

INDIRECT: Demands a bank to present the project

to BNDES. The bank absorbers the companys

credit risk.

DIRECTLY: The company presents the project directly

to BNDES. The BNDES absorbers the companys

credit risk or the company presents a bank guarantee

to BNDES.

Products & Financing Lines:

Products are the most basic lending instruments, available

for long tenor, offered by BNDES.

Each Product has its own fnancial conditions and

operational procedures.

Main products lines: BNDES FINEM; BNDES

Automatic; BNDES Finame; BNDES Exim.

3

3

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

20 20

3

4

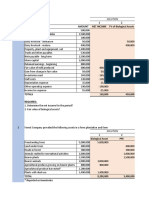

Overview of the Main Products:

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

Financial costs that are used in the BNDES transactions:

3

5

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

3

6

06.

BANK GUARANTEES

Brazilian Credit Market is relatively new compared to

other countries. The country does not have a positive credit

bureau, which shares credit history of all customers. So it

is common that, for most of commercial transactions, it is

required a bank guarantee. Examples:

Rental payments;

Performance;

Advance payments;

Participating in Public Tender Bids;

Collateral on Margin: Stock Exchanges, Commodity

Exchanges and Future Markets;

Collateral for legal proceedings: tax and labor law

liabilities, etc.

Target Customer:

Companies in general which require a bank guarantee to

cover obligations with third parties.

Description:

A commitment undertaken by the bank to pay a given

amount, in local currency (BRL) to the benefciary of

the Guarantee, in the event of non-performance, fully or

partially, of the obligations by the banks customer.

Benefts:

Companies can obtain a guarantee covering obligations

undertaken with third parties, without any immediate

impact on their cash fow.

Documentation:

Private Agreement of Guarantee: Agreement which

formally establishes the undertaking executed between the

bank and the Company to guarantee the obligations made.

Letter of Guarantee: A document delivered to the benefciary

of the Guarantee, which formally establishes the guarantee

rendered by the bank.

Agreement of Collateral: Instrument which formally

establishes the collateral rendered by the Company,

when applicable.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

3

7

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

Terms:

Amount/Maximum Term/Fees/Payment of Fees: These terms

are freely agreed by the company and the bank on a case-by-

case basis, based upon the credit limit awarded and the type of

obligation underwritten.

Specifc Terms And Conditions:

Letters of Guarantee other than the standard model used by

the bank shall be analyzed in advance.

Letters of Guarantee covering funds related to Federal

taxes and payroll taxes shall undergo prior analysis and

may be subject to the availability of the technical limit, in

due accordance with the regulations of the Central Bank

of Brazil.

3

8

07.

INTERNATIONAL GUARANTEES

As for most of commercial transactions in Brazil it is

required a bank guarantee, banks also ask for guarantees for

mitigating credit risk. Additionally, fnancial institutions

have been focused on risk management improvement,

which includes a more careful process for credit analysis

and approval by the banks. For international companies

starting business in Brazil with no credit history, an

international guarantee may be a good solution for

obtaining credit lines.

COMMON TYPES

Standby Letter of Credit: Across the board guarantee;

may be used to cover a transaction (purchase & sale or

fnancial) with the purpose of preventing a potential default

or nonperformance as provided in the guarantee. Always

issued by a bank.

Advanced Payment Bond: This guarantee ensures

the reimbursement of prepayments made by the

importer and it is payable in case of nonperformance of

contractual clauses.

Corporate Guarantee: Issued by a parent company,

this guarantee has legal value and ensures payment of

a subsidiary credit operation in case of default by the

subsidiary on the respective contract.

Comfort Letter: Issued by a parent company, it shows

parent companys good will towards the subsidiary

business, intention to invest and support on credit lines.

Although stated in a letter (even in a strong one), it doesnt

have legal value in the majority of countries, except from

Austria and Germany. Therefore, it may be not accepted as

a guarantee for most of Brazilian banks.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

3

9

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

08.

INVESTMENTS

Due to the level of the interests rates in Brazil, fnancial

investments are a good option for any exceeding cash.

Banks have a whole set of investment options including

ones with immediate liquidity, very low risk and

interesting returns. Because of those factors investments

may be a good opportunity for surplus cash, even for

short periods of time. The Certifcate of Deposit (CDB),

detailed below, is commonly used by companies.

CDB CERTIFICATE OF DEPOSIT

Target Customer:

Clients with available cash looking for a conservative

investment with a bank credit risk.

Description:

Fixed income alternative of investment that pays fxed or

foating interests at the maturity/redemption.

Benefts:

Conservative alternative of investment with a bank credit

risk plus the additional guarantee of the FGC Credit

Guarantor Fund (Governed by The Brazilian Central Bank

it provides complementary guarantee for applications in

Certifcates of Deposit in case of a default of the issuer

until R$ 60,000.00 per investor).

Conditions:

Interests: Fixed/Floating Rates/Prices Indexes. Term:

negotiable for Fixed/Floating Rates. Minimum of one

year for prices indexes. Early redemptions will be

carried according to the market conditions.

Regulation/Taxation:

Governed by the Brazilian Central Bank. Registered at

the CETIP settlement agency. Federal Income Tax (IRF)

Regressive rate on earnings: 22.5% - transactions up to

180 days; 20% - transactions with term between 181 and

360 days; 17.5% - transactions with term between 361

and 720 days; 15% - transactions with term superior to

720 days; Financial Operations Tax (IOF) according to

a regressive fnancial application table, for settlements

in up to 29 days after investments.

EXAMPLE

On March 3rd, 2008, a company invested R$

1,000,000.00 for 360 consecutive days in a certifcate of

4

0

deposit with earns indexed to 100% of the Brazilian CDI.

Initial Amount: R$ 1,000,000.00

Investment Yield: 100% CDI

Issue date: 03-03-2008

Maturity Date: 02-26-2009

CDI for the period: 11.27%

Future value: 1,000,000 * [1,1127^ (250/252)] = R$

1,103,869.05

Gross income: R$ 103,869.05

Income Tax (20%): R$ 20,773.81

Net income: R$ 83,095.24

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

4

1

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

09.

ABOUT OUR SPONSOR

Named Worlds Sustainable Bank 2013 by Financial

Times and IFC (International Finance Corporation), with a

strong global presence and a wide range of local products

and services, Santander is always on the lookout for new

business opportunities.

SANTANDER KEY FACTS

Has provided its customers with security and

service for more than 150 years;

Named the South Americas Strongest Bank in

2013 by Bloomberg;

Over 14,500 branches, more than any other

international bank in the world, and more than

40,000 ATMs;

3.3 million shareholders.

Branches Clients (MM) Mkt share

6,173 36,3

M

E

X

Mexico

P

R

Puerto R.

B

R

A

Brazil

C

H

I

Chile

U

R

U

Uruguay

A

R

G

Argentina

13%

3,872

1,125

499

480

119

78

20.4

9.3

3.4

2.5

0.4

0.3

11%

16%

21%

9%

10%

18%

Ranking

3

o

3

o

1

o

1

o

3

o

1

o

GEOGRAPHICAL DIVERSIFICATION

One of the Groups defning features is its international

scope, refected in the geographical diversifcation of

its businesses. The bank develops its business in three

core areas:

Latin America

Santander is the leading financial institution in

Latin America, with more than US$ 34 billion

of investments and a Market Share of 10% on

Assets and 10% on deposits.

Branches Clients (MM)

5,953 45.0

M

E

X

Mexico

P

R

Puerto Rico

B

R

A

Brazil

C

H

I

Chile

U

R

U

Uruguay

A

R

G

Argentina

10.4%

3,661

1,229

488

377

115

83

28.0

10.5

3.3

2.5

0.4

0.3

8.0%

13.8%

19.0%

8.8%

11.1%

18.0%

Ranking

3

o

3

o

1

o

1

o

3

o

1

o

4

2

Europe

No. 1 bank in the Euro zone by market capitalization

and proft, with more than 6,700 branches in the region:

Lead position in Spain;

Important presence in the United Kingdom;

Wholesale banking operations in Spain,

Portugal, UK, Italy, Germany and France;

Consumer finance operations in Norway,

Poland, Spain, Russia, Portugal, Italy

and Germany.

United States

Santander US focuses on serving the needs of its retail,

commercial & corporate clients by providing the highest level

of service and offering comprehensive fnancial solutions.

With strong retail presence in Connecticut, Delaware,

Massachusetts, Maryland, New Hampshire, New Jersey,

New York, Pennsylvania and Rhode Island; Santander

US is well capitalized with a 13.85% capital ratio and

operates as a fnancially independent domestic bank in

terms of capital and liquidity.

SANTANDER VALUE PROPOSITION

Santander has the largest retail banking infrastructure

in Latin America;

Strongest collection capabilities: electronic collections,

paper-based collections, cards, direct debit, pick up

services, etc.;

Complete payment solutions: all types of domestic

and international suppliers payments, but also the

widest range of tax payment and Payroll services;

Local services, regional delivery and global relationship;

Relationship Model allows for resource allocation

and mobilization at Global, Regional and Local levels;

A highly experienced team of implementation

and client service professionals for both local and

regional management;

Supply Chain Finance solutions: range of payables

and receivables fnancing options, like Factoring,

Confrming, etc.

F

I

N

A

N

C

E

&

A

D

M

I

N

I

S

T

R

A

T

I

V

E

4

3

H

O

W

T

O

D

E

A

L

W

I

T

H

B

A

N

K

S

A

N

D

F

I

N

A

N

C

I

N

G

I

N

B

R

A

Z

I

L

SANTANDER IN BRAZIL

Focus on Consumer & Commercial Clients, but it

is a universal bank and also operates in the wholesale,

third-party asset management and insurance sectors.

Santander in Brazil is the third largest private

bank in total assets in the country.

For further information, please contact:

Grupo Santander, Brasil

Av. Presidente Juscelino Kubitscheck, 2235

So Paulo/SP - Brazil - CEP 04543-011

Telephone: (55 11) 3553-1000 / (55 11) 3553-2000

Website: www.santander.com.br

Local Contacts:

Santander Brasil - International Desk

Helena Fulgencio Vieira

Tel: +55 (11) 3553-5390

helena.fulgencio@santander.com.br

Ricardo Santaella Gestal

Tel: +55 (11) 3553-2794

ricardogestal@santander.com.br

2,352

Branches

1,309

Mini Branches

17,518

ATMs

29 million Clients,

50 thousand Employees

... with a wide geographic diversification

and global scale to compete and grow.

Santander Brasil is the 3

rd

private bank in total assets...

BELO HORIZONTE

Rua da Paisagem, 220

34000-000 Nova Lima, MG

Tel.: (55 31) 2126-9750 Fax: (55 31) 2126-9772

amcham.belohorizonte@amchambrasil.com.br

BRASLIA

SHIS QI 5, Comrcio Local - Bloco C 1 andar - Lago Sul

71615-530 Braslia, DF

Tel.: (55 61) 3704-8017 Fax: (55 61) 3704-8037

amcham.brasilia@amchambrasil.com.br

CAMPINAS

Rua Dr. Jos Bonifcio Coutinho Nogueira, 150

Edf. Galleria Plaza 7 andar, sala 701

13091-611 Campinas, SP

Tel./Fax: (55 19) 2104-1250 / 2104-1275

amcham.campinas@amchambrasil.com.br

CAMPO GRANDE

Rua Hlio Yoshiaki Ikieziri, 34

Ed. Evidence Prime Ofce Sala 206 Royal Park

79100-000 Campo Grande, MS

Tel.: (55 67) 3211-0906

amcham.campogrande@amchambrasil.com.br

CURITIBA

Rua Joo Marchesini, 139 Prado Velho

80215-060 Curitiba, PR

Tel.: (55 41) 2104-9350

amcham.curitiba@amchambrasil.com.br

GOINIA

Avenida T-63, Qd. 145 Lt. 08/09

Edf. New World, sala 105 Setor Bueno

74230-100 Goinia, GO

Tel.: (62)3275-6010 Fax.: (62)4006-1172

amcham.goiania@amchambrasil.com.br

JOINVILLE

Rua Dr. Placido Gomes, 610

Edf. Dona Tereza Sala 202 Anita Garibaldi

89202-050 Joinville, SC

Tel.: (55 47) 3028-1239

amcham.joinville@amchambrasil.com.br

PORTO ALEGRE

Av. Dom Pedro II, 861 8 andar

Prdio do CIEE

90550-142 Porto Alegre, RS

Tel.: (55 51) 2118-3700 Fax: (55 51) 2118-3738

amcham.portoalegre@amchambrasil.com.br

RECIFE

Av. Eng. Antnio de Ges, 742

51110-000 - Recife, PE

Tel.: (55 81) 3205-1850

Fax: (55 81) 3205-1865

amcham.recife@amchambrasil.com.br

RIBEIRO PRETO

Avenida Wladimir Meirelles Ferreira, 1525

Ufcio Commerciale San Paolo, salas 1 e 2

14021-630 Ribeiro Preto, SP

Tel.: (55 16) 2132-4599 Fax: (55 16) 2132-4563

amcham.ribeiraopreto@amchambrasil.com.br

SALVADOR

Avenida Tancredo Neves, 1632