Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gartner Says Worldwide Sales of Mobile Phones Declined 3 Percent in Third Quarter of 2012

Caricato da

Christianto Vedro Hamonangan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni7 pagineSales of mobile phones to end users reached almost 428 million units in the third quarter of 2012. Smartphone sales accounted for 39. Percent of total mobile phone sales. Analysts said there were positive signs for the industry during the third quarter.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoSales of mobile phones to end users reached almost 428 million units in the third quarter of 2012. Smartphone sales accounted for 39. Percent of total mobile phone sales. Analysts said there were positive signs for the industry during the third quarter.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni7 pagineGartner Says Worldwide Sales of Mobile Phones Declined 3 Percent in Third Quarter of 2012

Caricato da

Christianto Vedro HamonanganSales of mobile phones to end users reached almost 428 million units in the third quarter of 2012. Smartphone sales accounted for 39. Percent of total mobile phone sales. Analysts said there were positive signs for the industry during the third quarter.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 7

Gartner Says Worldwide Sales of Mobile

Phones Declined 3 Percent in Third Quarter

of 2012; Smartphone Sales Increased 47

Percent

Samsung Extended Its Lead in the Smartphone Market Widening the Gap with Apple

Worldwide sales of mobile phones to end users reached almost 428 million units in the third

quarter of 2012, a 3.1 percent decline from the third quarter of 2011, according to Gartner, Inc.

Smartphone sales accounted for 39.6 percent of total mobile phone sales, as smartphone sales

increased 46.9 percent from the third quarter of 2011.

While the mobile phone market declined year-on-year, Gartner analysts said there were positive

signs for the industry during the third quarter.

"After two consecutive quarter of decline in mobile phone sales, demand has improved in both

mature and emerging markets as sales increased sequentially," said Anshul Gupta, principal

research analyst at Gartner. In China, sales of mobile phones grew driven by sales of

smartphones, while demand of feature phones remained weak. In mature markets, we finally saw

replacement sales pick up with the launch of new devices in the quarter.

Smartphones continued to fuel sales of mobile phones worldwide with sales rising to 169.2

million units in the third quarter of 2012. The smartphone market was dominated by Apple and

Samsung. Both vendors together controlled 46.5 percent of smartphone market leaving a

handful of vendors fighting over a distant third spot, said Mr. Gupta.

Nokia slipped from No. 3 in the second quarter of 2012 to No. 7 in smartphone sales in the third

quarter of 2012. RIM moved to the No. 3 spot with HTC not far behind, at No. 4. Both HTC

and RIM have seen their sales declining in past few quarters, and the challenges might prevent

them from holding on to their current rankings in coming quarters, added Mr. Gupta.

While seasonality in the fourth quarter of 2012 will help end-of-year mobile phone sales to end

users, Gartner analysts said that there will be a lower-than-usual boost from the holiday season.

Consumers are either cautious with their spending or finding new gadgets like tablets, as more

attractive presents.

Samsungs mobile phones sales continued to accelerate, totaling almost 98 million units in the

third quarter of 2012 (see Table 1), up 18.6 percent year-on-year. Samsung saw strong demand

for Galaxy smartphones across different price points, and it further widened the gap with Apple

in the smartphone market, selling 55 million smartphones in the third quarter of 2012. It

commanded 32.5 percent of the global smartphone market in the third quarter of 2012.

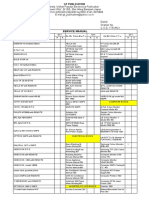

Table 1

Worldwide Mobile Device Sales to End Users by Vendor in 3Q12 (Thousands of Units)

Company 3Q12

Units

3Q12 Market Share (%) 3Q11

Units

3Q11 Market Share (%)

Samsung 97,956.8 22.9 82,612.2 18.7

Nokia 82,300.6 19.2 105,353.5 23.9

Apple 23,550.3 5.5 17,295.3 3.9

ZTE 16,654.2 3.9 14,107.8 3.2

LG Electronics 13,968.8 3.3 21,014.6 4.8

Huawei Device 11,918.9 2.8 10,668.2 2.4

TCL Communication 9,326.7 2.2 9,004.7 2.0

Research in Motion 8,946.8 2.1 12,701.1 2.9

Motorola 8,562.7 2.0 11,182.7 2.5

HTC 8,428.6 2.0 12,099.9 2.7

Others 146,115.1 34.2 145,462.2 32.9

Total 427,729.5 100.0 441,502.2 100.0

Source: Gartner (November 2012)

Nokia's mobile phone sales declined 21.9 percent in the third quarter of 2012, but overall sales at

82.3 million were better than Gartners early estimate, largely driven by increased sales of the

Asha full touch range. Nokia had a particularly bad quarter with smartphone sales, and it

tumbled to the No. 7 worldwide position with 7.2 million smartphones sold in the third

quarter. The arrival of the new Lumia devices on Windows 8 should help to halt the decline in

share in the fourth quarter of 2012, although it wont be until 2013 to see a significant

improvement in Nokias position.

Apples sales to end users totaled 23.6 million units in the third quarter of 2012, up 36.2 percent

year-on-year. We saw inventory built up into the channel as Apple prepared for the coming

holiday season, global expansions and the launch into China in the fourth quarter of 2012, said

Mr. Gupta. With iPhone 5 launching in more territories in the fourth quarter of 2012, including

China, and the upcoming holiday season Gartner analysts expect Apple will have its traditionally

strongest quarter.

In the smartphone market, Android continued to increase its market share, up 19.9 percentage

points in the third quarter of 2012. Although RIM lost market share, it climbed to the No. 3

position as Symbian is nearing the end of its lifecycle. There was also channel destocking in

preparation of new device launches for RIM, which resulted into 8.9 million sales to end users in

the third quarter of 2012. With the launch of iPhone 5, Gartner analysts expect iOS share will

grow strongly in the fourth quarter of 2012 because users held on to their replacements in many

markets ahead of the iPhone 5 wider roll out. Windows Phones share weakened quarter-on-

quarter as the Windows Phone 8 launch dampened demand of Windows Phone 7 devices.

Table 2

Worldwide Mobile Device Sales to End Users by Operating System in 3Q12 (Thousands of

Units)

Operating System 3Q12

Units

3Q12 Market Share (%) 3Q11

Units

3Q11 Market Share (%)

Android 122,480.0 72.4 60,490.4 52.5

iOS 23,550.3 13.9 17,295.3 15.0

Research In Motion 8,946.8 5.3 12,701.1 11.0

Bada 5,054.7 3.0 2,478.5 2.2

Symbian 4,404.9 2.6 19,500.1 16.9

Microsoft 4,058.2 2.4 1,701.9 1.5

Others 683.7 0.4 1,018.1 0.9

Total 169,178.6 100.0 115,185.4 100.0

Source: Gartner (November 2012)

Additional information can be found in the Gartner report "Market Share: Mobile Phones by

Region and Country, 3Q12." The report is available on Gartner's website at

http://www.gartner.com/resId=2236115.

Gartner: Apple and Samsung exploded in Q2

while BlackBerry sales slid 37%

By Zach Epstein on Aug 14, 2012 at 7:45 AM

mobile

Share on Twitter

Share on Facebook

Share on Google Plus

Share on LinkedIn

Huge growth from Apple (AAPL) and Samsung (005930) in the second quarter wasnt enough to

offset the declines seen across most of the rest of the industry, and the global mobile phone

market shrank by 2.3% as a result. Market research firm Gartner on Tuesday released its report

on worldwide cell phone sales, which shows that an estimated 419 million cell phones were sold

to end users in the second quarter this year, down from just over 1 billion in the second quarter of

2011. IDC, which estimates channel sales and not end-user sales, said earlier this month that the

market grew by 1% year-over-year in the second quarter.

According to Gartners numbers, Apple and Samsung were the two biggest winners by a mile in

the June quarter. Apple sold an estimated 28.94 million iPhones compared to 19.63 million in the

same quarter last year, while Samsungs end-user sales climbed to 90.43 million mobile phones

from 69.83 million in the second quarter of 2011.

The only other vendors that saw growth in the quarter were Huawei and ZTE, which sold 17.94

million phones last quarter compared to 13.07 million during the same period last year. All other

vendors saw year-over-year declines according to Gartner, including HTC (2498), which sold

9.30 million phones compared to 11.02 million in Q2 2011, and RIM, which saw sales drop 37%

to 7.99 million units from 12.65 million during the same quarter last year.

Gartners full press release follows below.

Gartner Says Worldwide Sales of Mobile Phones Declined 2.3 Percent in Second Quarter of

2012

Android Extended Lead While Apple iOS Market Share Growth Paused

Egham, UK, August 14, 2012Worldwide sales of mobile phones to end users reached 419

million units in the second quarter of 2012, a 2.3 percent decline from the second quarter of

2011, according to Gartner, Inc. Smartphone sales accounted for 36.7 percent of total mobile

phone sales and grew 42.7 percent in the second quarter of 2012.

Demand slowed further in the second quarter of 2012, said Anshul Gupta, principal research

analyst at Gartner. The challenging economic environment and users postponing upgrades to

take advantage of high-profile device launches and promotions available later in the year slowed

demand across markets. Demand of feature phones continued to decline, significantly weakening

the overall mobile phone market.

High-profile smartphone launches from key manufacturers such as the anticipated Apple iPhone

5, along with Chinese manufacturers pushing 3G and preparing for major device launches in the

second half of 2012, will drive the smartphone market upward. However, feature phones will

continue to see pressure, Mr. Gupta said.

In the second quarter of 2012, Samsungs mobile phone sales remained very strong up 29.5

percent from the second quarter of 2011 (see Table 1), and managed to extend its lead over both

Apple and Nokia quarter on quarter. This quarters growth was driven by record sales of Galaxy

smartphones, meaning smartphones now account for 50.4 percent of all Samsung mobile

devices, or 45.6 million units. Demand for the new Galaxy S3 was particularly strong, exceeding

Samsungs own expectations, with a reported 10 million units reached in the two months after its

release. The Galaxy S3 was the best-selling Android product in the quarter and could have been

higher but for product shortages.

In the second quarter of 2012, consumer demand for the Apple iPhone weakened as sales fell

12.6 percent from the first quarter of 2012, but grew 47.4 percent year on year. Depending on the

exact launch date of the new iPhone, Apple might experience another weaker-than-usual quarter

in the third quarter of 2012, while Apple will be ready to take advantage of the strong holiday

sales in North America and Western Europe that have historically remained immune to economic

pressure.

Samsung and Apple continued to dominate the smartphone market, together taking about half

the market share, and widening the gap to other manufacturers. No other smartphone vendors

had share close to 10 percent, Mr. Anshul said. In the race to be top smartphone manufacturer

in 2012, Samsung has consistently increased its lead over Apple, and its open OS market share

increased to one-and-a-half times that of Apple in the second quarter of 2012.

Table 1

Worldwide Mobile Device Sales to End Users by Vendor in 2Q12 (Thousands of Units)

Company 2Q12

Units

2Q12 Market Share (%) 2Q11

Units

2Q11 Market Share (%)

Samsung 90,432.1 21.6 69,827.6 16.3

Nokia 83,420.1 19.9 97,869.3 22.8

Apple 28,935.0 6.9 19,628.8 4.6

ZTE 17,936.4 4.3 13,070.2 3.0

LG Electronics 14,345.4 3.4 24,420.8 5.7

Huawei Device 10,894.2 2.6 9,026.1 2.1

TCL Communications 9,355.7 2.2 7,938.9 1.9

HTC 9,301.2 2.2 11,016.1 2.6

Motorola 9,163.2 2.2 10,221.4 2.4

Research In Motion 7,991.2 1.9 12,652.3 3.0

Others 137,233.4 32.8 152,989.70 35.7

Total 419,007.90 100.0 428,661.15 100.0

Source: Gartner (August 2012)

Nokias mobile phone sales declined 14.8 percent in the second quarter of 2012. Nokia is

battling fiercely with white-box and new emerging device manufacturers to defend its feature

phones sales. Nokia succeeded, to a certain extent, in winning feature phone market share as its

sales grew quarter-on-quarter. While posting sequential growth in the feature phone market,

Nokias Lumia devices continue to struggle to find a place in consumers minds as a replacement

for Android.

Declining smartphone sales is worsening Nokias overall position, as it had already lost the No.

1 position to Samsung in the previous quarter and is facing reduced profitability due to

continuous declining sales of premium smartphones, said Mr. Gupta.

In the smartphone OS market, Android extended its lead with an increase of 20.7 percentage

points in market share in the second quarter of 2012 (see Table 2). While Apples iOS market

share slightly grew year over year (0.6 percent), it declined 3.7 percentage points quarter on

quarter, as users postponed their upgrade decisions in most markets ahead of the upcoming

launch of the iPhone 5.

Gartner analysts said the arrival of the iPhone 5 should provide the greatest upgrade opportunity

yet as the expected new design with a larger screen and likely other stylistic changes to the form

factor will certainly make a strong case for iPhone 4 users to upgrade.

Table 2

Worldwide Mobile Device Sales to End Users by Operating System in 2Q12 (Thousands of

Units)

Operating System 2Q12

Units

2Q12 Market Share (%) 2Q11

Units

2Q11 Market Share (%)

Android 98,529.3 64.1 46,775.9 43.4

iOS 28,935.0 18.8 19,628.8 18.2

Symbian 9,071.5 5.9 23,853.2 22.1

Research In Motion 7,991.2 5.2 12,652.3 11.7

Bada 4,208.8 2.7 2,055.8 1.9

Microsoft 4,087.0 2.7 1,723.8 1.6

Others 863.3 0.6 1,050.6 1.0

Total 153,686.1 100.0 107,740.4 100.0

Source: Gartner (August 2012)

Additional information can be found in the Gartner report Market Share: Mobile Devices,

Worldwide, 2Q12. The report is available on Gartners website

at http://www.gartner.com/resId=2117915.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- InkOcean Catloge UpdatedDocumento6 pagineInkOcean Catloge UpdatedrameshvkattiNessuna valutazione finora

- Android BareboneDocumento1 paginaAndroid BarebonejsoekaharNessuna valutazione finora

- (English Release) HONOR Magic V2 RSR Available For Exclusive Access in MalaysiaDocumento2 pagine(English Release) HONOR Magic V2 RSR Available For Exclusive Access in Malaysiag-79300284Nessuna valutazione finora

- Smart Watch InfoDocumento9 pagineSmart Watch InfoAkinwumi AkintayoNessuna valutazione finora

- Sangam SinghDocumento64 pagineSangam Singh9415697349Nessuna valutazione finora

- App ListDocumento6 pagineApp ListS.Parthipan Akv050% (1)

- It 1Documento2 pagineIt 1Noor ShahbazNessuna valutazione finora

- Stock Disponible Televentas Lima 18.03.2023Documento419 pagineStock Disponible Televentas Lima 18.03.2023Matheus CaamañoNessuna valutazione finora

- XIAOMIDocumento10 pagineXIAOMISrinath Saravanan75% (4)

- MDP Report Assignment 1Documento36 pagineMDP Report Assignment 1Varshan SupramaniamNessuna valutazione finora

- Onkyo TX 8050 Service Manual PDFDocumento78 pagineOnkyo TX 8050 Service Manual PDFPaulius Kaminskas50% (2)

- Modelo Ec 1 Substitui Modelo Ec 2 Modelo Equipamento ONEDocumento5 pagineModelo Ec 1 Substitui Modelo Ec 2 Modelo Equipamento ONEjjoaquimmartinsNessuna valutazione finora

- Prefix # Mobile Prefix # Mobile: 932 Sun Cellular 933 Sun Cellular 934 Sun CellularDocumento1 paginaPrefix # Mobile Prefix # Mobile: 932 Sun Cellular 933 Sun Cellular 934 Sun CellularHaia CawiaNessuna valutazione finora

- 20080605-Specifications Hdforum v2.5 EngDocumento17 pagine20080605-Specifications Hdforum v2.5 EngLong KingNessuna valutazione finora

- Smart Home - Customer Manual - Ring PDFDocumento3 pagineSmart Home - Customer Manual - Ring PDFYoungLeeNessuna valutazione finora

- IBS Hyderabad Academic Year - 2020-22: Group Project: Strategic DriftDocumento14 pagineIBS Hyderabad Academic Year - 2020-22: Group Project: Strategic DriftArsh DawraNessuna valutazione finora

- Echip Mobile So277Documento60 pagineEchip Mobile So277hvt1965Nessuna valutazione finora

- 1st Summative - Set ADocumento2 pagine1st Summative - Set Awinslet villanuevaNessuna valutazione finora

- Slftrd25: Foldable TreadmillDocumento16 pagineSlftrd25: Foldable TreadmillJuliano PereiraNessuna valutazione finora

- Framework Laptop 13 Review Cracking Modular PC Gets All-Round UpgradeDocumento5 pagineFramework Laptop 13 Review Cracking Modular PC Gets All-Round UpgradeOnggo iMamNessuna valutazione finora

- Soundbar SJ5 Spec Sheet - 040417Documento2 pagineSoundbar SJ5 Spec Sheet - 040417ArunNessuna valutazione finora

- EOL Notice - Alpha-4L Series - 20230301Documento1 paginaEOL Notice - Alpha-4L Series - 20230301Dennis KhongNessuna valutazione finora

- Introduction To USIM - ESIM - UICC - ISIM - 5G SIMDocumento4 pagineIntroduction To USIM - ESIM - UICC - ISIM - 5G SIMagmebaldNessuna valutazione finora

- Nilai Persediaan Mstoregudangpus 231031112226Documento94 pagineNilai Persediaan Mstoregudangpus 231031112226wirahudantoNessuna valutazione finora

- List LCD ChinaDocumento17 pagineList LCD ChinaFedryanRinaldiFauzie100% (1)

- Service Manual: Rs.15/-36cm B/W TV Qty. Rs.15/ - 51cm B/W T.V. Qty. Rs.30/ - 51cm C.T.v. Qty. H E H E H EDocumento6 pagineService Manual: Rs.15/-36cm B/W TV Qty. Rs.15/ - 51cm B/W T.V. Qty. Rs.30/ - 51cm C.T.v. Qty. H E H E H Eamit_fineboy67% (3)

- Alexa Kit Setup GuideDocumento10 pagineAlexa Kit Setup Guidethebboymp3Nessuna valutazione finora

- Ipad and The Tablet Market Wars, A Discussion of An Oligopolistic Market ModelDocumento6 pagineIpad and The Tablet Market Wars, A Discussion of An Oligopolistic Market Modelert3535Nessuna valutazione finora

- Quick Charge Device ListDocumento20 pagineQuick Charge Device ListDivyanshu BhushanNessuna valutazione finora

- Blue - VDA - Product Creation, Manufacturing and Delivery - Electronic ComponetsDocumento37 pagineBlue - VDA - Product Creation, Manufacturing and Delivery - Electronic ComponetsOmar TellezNessuna valutazione finora