Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

006 KeynoteCapitals CromptonGreaves InitiatingCoverage

Caricato da

Ashish KumarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

006 KeynoteCapitals CromptonGreaves InitiatingCoverage

Caricato da

Ashish KumarCopyright:

Formati disponibili

Initiating Coverage

November 9, 2010

Keynote Capitals Institutional Research is also available on

Bloomberg KNTE <GO>, Thomson One Analytics, Reuters Knowledge, Capital IQ, TheMarkets.com and securities.com

Keynote Capitals Institutional Research - awarded Indias Best IPO Analyst 2009" by MCX-Zee Business

K E Y N O T E

INSTITUTIONAL RESEARCH

Ashwin Chavan, Analyst

(ashwin@keynoteindia.net)

(+9122-30266059)

Crompton Greaves Ltd.

2 Keynote Capitals Institutional Research

K E Y N O T E

E - Keynote Capitals Institutional Research Estimates

(continued...)

(` `` ``Cr)

Key Financials

Crompton Greaves Ltd.

Powering India ... November 9, 2010

Crompton Greaves Limited (CG), an Avantha Group company, is one of the key

private sector companies in India engaged in designing, manufacturing high technology

electrical products, which caters the needs of power geneneration, transmission and

distribution companies. Indian governments recent thrust with huge investments in

Power and T&D sectors will see a substantial progress in the years ahead. We initiate

coverage on CG due to its execution and marketing capabilities in electrical products

as well as recent international acquisitions, which will drive the revenue of the

company.

Executive Summary

First mover advantage in high voltage substation business: India is likely

to see a major shift from low-medium voltage substation to high voltage substation

viz., 400kV, 765kV, and 1100kV power transmission networks to create huge

potential opportunities for the players like CG, which has an edge over its peers.

We see a major trigger for CG as fresh order inflows for 765kV substations

is likely to expect from PGCIL in FY11. Power Grid is a major customer of CG,

which has a capex plan of `260bn in FY2011-12.

Diversified business Verticals: CG is a diversified into different business

verticals such as Power System, Consumer Products, and Industrial Systems.

The companys growth momentum is well connected to the growth in Indian

economy. The companys diversification differentiates it from its peers and

makes it less vulnerable to sector slowdown. CG has strong brand name in

consumer products and enjoys market leadership in electric fans in India.CG

is expecting an increase in order flow for motor division and improved activity

in industrial engineering space

Immense Opportunity in power business: As government has huge investment

plan in power transmission & distribution segment in XI five year plan, CG

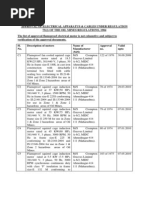

Particulars 2009 A 2010A 2011E 2012E

Net Sales 8737 9141 10172 11678

Growth 27.9% 4.6% 11.3% 14.8%

PAT 567 862 921 1071

Growth 36.1% 52.1% 6.8% 16.3%

EBDITA Margin 12.1% 15.4% 15.4% 15.4%

ROE 31.0% 34.4% 27.8% 25.1%

ROCE 39.2% 42.9% 34.8% 32.6%

EPS (Unit Curr.) 15.27 13.40 14.36 16.70

Book Value 28.5 39.0 51.7 66.5

P/E (x) 21.3 24.2 22.7 19.5

P/BV (x) 11.41 8.34 6.29 4.90

EV/EBIDTA (x) 19.99 14.71 13.16 11.23

Paid-up Equity Capital 73.32 128.3 128.3 128.3

Key Stock Data

Sector Heavy Electric

Equipment

CMP `325.6

52-wk High / Low 341 / 207

Market Cap `208.87bn

($4706.44mn)

Avg 12m daily vol. 168572

BSE Sensex 20852

Reco Buy

TP `374

Price Performance (%)

1 Mth 3 Mths 6 Mths 1 Yr

0.8% 16.0% 32.4% 48.3%

Price Performance (%)

Stock Codes

Bloomberg Code CRG IN

Reuters Code CROM.BO

BSE Code 500093

NSE Code CROMPGREAV

Face Value `2per share

Shareholding Pattern (30 Sept, 2010)

Price Performance (%)

Stock Price Performance

Others,

16.5%

DII,

22.2%

FII,

20.4%

Promoter

40.9%

90

100

110

120

130

140

150

N

o

v

-

0

9

D

e

c

-

0

9

J

a

n

-

1

0

F

e

b

-

1

0

M

a

r

-

1

0

A

p

r

-

1

0

M

a

y

-

1

0

J

u

n

-

1

0

J

u

l

-

1

0

A

u

g

-

1

0

S

e

p

-

1

0

O

c

t

-

1

0

Crompton Greaves

BSE CG BSE SENSEX

Keynote Capitals Institutional Research 3

K E Y N O T E

certainly has better position to take advantage of this favourable scenario. Through

recent international acquisitions, the company has already made footprint in global

power sector which will fuell its top line growth with main thrust on power system

division. The demand for transformers in US & Europe market is likely to be improved

based on the proposed plans of generating 20% of total power from renewable

sources by 2020,which may benefit the company to grow inorganically in the international

market.

Functional Efficiency: On account of various value engineering initiatives, better

product design and higher efficiency in supply chain management, the profit margin

of the company might increase by 50bps and sustain the operating margins at current

levels of 13-14%. Increase in manufacturing capacity and changes in plant layout will

create additional shop floor space to further improve its productivity.

Healthy Financial Position: The company has cash balance to the tune of `669Cr

and positive operational cash flows of `1000Cr demonstrates healthy financial position.

Valuation: At the CMP, the stock is trading at 22.6x and 19.5x of FY11 & FY12

respectively. Based on the DCF valuation ,we recommend a buy with a target price

of `374/- per share.

4 Keynote Capitals Institutional Research

K E Y N O T E

Power Systems: Power Systems unit includes the consolidated global transmission and

distribution businesses, and a largest contributor to CGs revenues. The company

manufactures i)Power transformers, Distribution transformers, ii)Extra high voltage (EHV)

and iii) medium voltage (MV)Circuit breakers iv) Gas insulated switchgear (GIS), vi)EHV

instrument transformers vii) Lightning arrestors & isolators viii) Vacuum interrupters and

Electronic energy meters.

Source: Company & Keynote Capitals Institutional Research

Power Systems Product Break up

Chart 1

Tranformers,

Reactors &

Acces., 73%

Service

Revenue, 2%

Switchgears/Control

Equipments,

25%

Company Background

Crompton Greaves (CG) is market leader in most business areas where it operates and

has employee strength of 8,000 all over the world. CG's business operations consist of

22 manufacturing divisions spread across in Gujarat, Maharashtra, Goa, Madhya Pradesh

and Karnataka, supported by well knitted marketing and service network through 14

branches in various states under overall management of four regional sales offices located

in Delhi, Kolkata, Mumbai and Chennai.

CG's exports its products over more than 60 countries viz., the US, the UK, the European

Union, Australia and New Zealand. CG's international operations are spread over all the

continents in the world to become the largest from India in each segment of transformers,

Switchgear, Motors and Fans. Apart from developed countries, CG enjoys its export

presence also in the emerging South-East Asian and Latin American countries.

Business Segment

Crompton Greaves

Power Systems Industrial Systems Consumer Products

Fans

Lights

Pumps

Transformers

Switchgear

Power Quality

Engineering Products

High Tension Motors

Low Tension Motors

DC Machines

AC Generators

Stampings

Rail Transporation

FractionalHorse Power

Keynote Capitals Institutional Research 5

K E Y N O T E

Industrial Systems: CG's Industrial Systems manufactures High tension (HT) motors,

Railway transportation equipment, Low tension (LT) motors, Direct current (DC) motors,

AC drives, Railway signalling equipment, fractional horse power (FHP) motors, AC generators,

Stampings.

Source: Company & Keynote Capitals Institutional Research

Industrial System Product Breakup

Chart 2

Motors &

Alternators ,

94% Energy Meter ,

2%

Steel Stampings-

Electrical , 4%

Consumer Products: CG's Consumer Products division supplies fans, lighting equipment

(light sources and luminaries), pumps, integrated security systems, home automation and

a range of electrical household appliance.

Source: Company & Keynote Capitals Institutional Research

Consumer Product Breakup

Chart 3

Lamps-Electric,

30%

Fans-Electric-

Venti.Pollution,

47%

Power Driven

Pump 3, 23%

6 Keynote Capitals Institutional Research

K E Y N O T E

Recent Acquisition

Years Company Description Price

May 2005 Pauwels Operates Operates in the areas of power

(Belgium) and distribution transformers `195Cr

Oct 2006 Ganz Consistent track record in power

(Hungary) transformers, GIS switchgear and rotating

machines, as well as in the supporting

areas of design, erection and commissioning. `200Cr

May 2007 Microsol Expertise is in sub-station automation for

(Ireland) (MV) and (HV) sub-stations. `158Cr

May 2008 Sonomatra Specializes in providing services of on-site

(France) maintenance/repair of power transformers

and on-load tap changers, oil analysis, oil

treatment and retro-filing. `8.06Cr

Sep 2008 MSE Engaged in engineering, procurement and

(USA) construction (EPC) of high voltage electric

power applications. It is a systems integrator

in international EPC business, especially in

the renewable energy (wind) segment. `72Cr

Mar 2010 Power Provides consulting as well as technical and

Technology engineering support to regional electricity

Solutions(UK) companies in the UK `200Cr

Sep 2010 3 businesses of This acquisition should enable CG to become

Nelco Ltd a stronger and more comprehensive player

in its railways business and also build

capabilities in drives. This is a significant

acquisition for CGs Systems business `92Cr

Keynote Capitals Institutional Research 7

K E Y N O T E

Industry Overview

India is worlds 6th largest electricity-consuming country with annual electricity consumption

of about 4% of the world. It is set to grow by 8-10% per year.

India has targeted to increase its generation capacity from current 1,63,669MW to

2,00,000MW by 2012. The National Electricity Policy (NEP) stipulates power for all by 2012

and annual per capita consumption of electricity to rise to 1000 units from the present

level of 771 units whereas world average is 2,596 units. India has adopted a blend of

thermal, hydel and nuclear sources with a view to increasing the availability of electricity.

Thermal plants at present account for 1, 05,646 MW of the total power generation, hydro-

electricity plants contribute 37,303 MW and the rest comes from nuclear power and wind

energy. The overall generation in the country has increased to 771.51 BU in 2009-10 from

723.79 in 2008-09.

Source: Industry & Keynote Capitals Institutional Research

Per Capita Consumption (Kwh)

Chart 4

567

592

613

632

672

704

723

771

0

100

200

300

400

500

600

700

800

900

FY 03 FY 04 FY 05 FY 06 FY 07 FY 08 FY 09 FY 10

Source: Industry & Keynote Capitals Institutional Research

Power Generation Per Unit (BU)

Chart 5

618

662

704

724

772

5%

7%

6%

3%

7%

0

100

200

300

400

500

600

700

800

900

FY06 FY07 FY08 FY09 FY10

0%

1%

2%

3%

4%

5%

6%

7%

8%

Source:CEA & Keynote Capitals Institutional Research

Generation Capacity (%)

Chart 7

Central, 34

State, 52.5

Private, 13.5

Source:CEA & Keynote Capitals Institutional Research

All India Generation Capacity Source Wise

Chart 6

Hydro, 24.7

Nuclear, 2.9

Renewable, 7.7

Thermal, 64.6

India's energy sector falls under the control of the government sector entities. Various

central public sector corporations like National Hydroelectric Power Corporation, National

Thermal Power Corporation and other state level corporations (State Electricity Boards

or SEB's) are entrusted with the responsibility of managing the electric power generation

in India. At present State sector has current installed capacity of 80,775MW, Central Sector

51,727 MW and Private sector 31,167 MW respectively.

8 Keynote Capitals Institutional Research

K E Y N O T E

Source:CEA & Keynote Capitals Institutional Research

Power Shortage Scenerio(%)

Chart 8

11.7%

12.3%

13.8%

16.6%

11.9%

12.6%

10

11

12

13

14

15

16

17

FY05 FY06 FY07 FY08 FY09 FY10

Switchgear Market: As the Indian power sector strives hard to plug the huge demand-

supply gap caused by rapid economic growth, new opportunities are presenting themselves

for switchgear manufacturers. For example, the poor financial health of the State Electricity

Boards (SEBs) due to huge transmission and distribution (T&D) losses around 28%-35% of

the generation capacity, government funding and power capacity additions open the doors

for switchgear anufacturers.

Transformer Industry

The transformer market is pegged at `10,000 crore and is expected to grow 2-3 times in

another five years. The investment outlook for Transmission & Distribution (T&D) sector

remains strong, at more than ~`4, 27,000 Cr of investments are expected in the XI th plan.

Transformers account ~10% of the cost of the network line, which will create a market

opportunity of `42,700Crs over the XI th five year plans. Given that India has targeted to add

1.6 lakh mw of new power generation capacity in the 11th & 12th Plan periods, there is a

huge demand for transformers. The Transformer Industry in India has evolved and now has

a well matured technology base up to 800 KV class. Further, the country is majorly focusing

on cutting down transmission & distribution losses, and strengthening the national regional

grid. Going forward, this is likely to hold the key for the transformer industry.

Power transformers account for 50 % of the total value of the industry with remaining accounted

for distribution and special transformers. Industry is witnessing a major shift from 400kV

765kV class transformer. Reason being High Voltage Direct Current (HVDC) / Ultra H (UHV)

system is being developed in a very big way as India envisage a capacity addition of ~200,000

mw in 11th & 12th Plan periods. The transformer at UHV level has a capacity of 20,000 mw,

which will be augmented to 38,000 mw by 2012. The major demand will be derived from the

operation of national grid due to the linking of trunk lines for inter-transfer of bulk power from

surplus to deficit states. Since the transformer industry is matured enough as a reliable

supplier, it is already exporting transformer in various part of the world including even to the

western countries, some parts of USA and the developing countries such as Middle East,

Gulf and African countries etc.

Transmission & Distribution: Transmission of electricity is defined as bulk transfer of power

over a long distance at a high voltage, generally of 132 kV and above. In India, bulk

transmission has increased from 3708 ckm to more than 265,000 ckm. The sector can be

divided in to five regions for transmission systems namely, Northern Regions, North Eastern

Regions, Eastern Regions, Southern Regions and Western Regions. While the predominant

technology for electricity transmission and distribution has been Alternating Current (AC)

technology, High Voltage Direct Current (HVDC) technology has also been used for

interconnection of all regional grids across the country and for bulk transmission of power

over long distances. The total generating capacity is 163 GW in the country and total number

of consumers is over 144mn. Apart from an extensive transmission system network at 500kV

Keynote Capitals Institutional Research 9

K E Y N O T E

HVDC,400kV,220kV,132kV and 66kV which has developed to transmit the Power from

generating stations to the grid substations, a vast network of sub transmission in distribution

systems has also come up for the utilization for power by the ultimate consumer. With the

initiative of the Government of India and of the States, the Accelerated Power Development

& Reform Programmed (APDRP) was launched in 2001, for the strengthening of Sub -

Transmission and Distribution network and reduction in AT&C losses.

Consumer Product Market: A focus area for the Consumer Products business is tapping

the vast potential of the Indian rural markets, estimated at `65,000 crore for FMCG products

and `5000 crore for consumer durables. Indian consumer industry grew by 12.5% FY10.

The Indian consumer durable industry has experienced several changes for the last few

years on account of greater affordability and changing lifestyle, better housing, commercial

advertisements, easy financing schemes etc. witnessing revolution in the Indian consumer

behavior Pattern.

Engineering Segment: With signs that the global economic recession is fading away, we

believe the industrial sector in India is slated for tremendous growth, as reflected in the

Index of Industrial Production (IIP) growth for FY10 (at 14%). The indices of industrial

production for the Mining, Manufacturing and Electricity sectors for April 2010 stood at 197.0,

341.5, and 246.9 respectively, up 11.4%, 19.4% and 6.0% respectively y-o-y. The revised

annual growth in the three sectors during April-March, 2009-10 y-o-y, has been 9.8%,10.9%

and 6.0% respectively, which moved the overall growth in the General Index to

10.4%According to UNIDO estimates, Indias manufacturing value added (MVA) per capita

is $283. With Indias GDP likely to grow 8% during FY11, For the Indian business, the most

encouraging event was the recovery of capital goods industry with 11.1% growth and

resurgence of the consumer durables industry with 12.5% growth, which resulted in growth

for the The companys Industrial Systems and Consumer Products Businesses.

Source: CSO & Keynote Capitals Institutional Research

Improved GDP & IIP Numbers %

Chart 9

12% 11% 4% 2% 14%

9.82

9.37

7.35

5.36

7.2

0

2

4

6

8

10

12

14

16

FY06 FY07 FY08 FY09 FY10

0

2

4

6

8

10

12

IIP GDP

Color Key:

Black: Generation

Blue: Transmission

Green: Distribution

Generating Station

Generating

Step Up

Transformer

Transmission Customer

138kV or 230kV

Transmission lines

765,500, 345, 230 and 138 kV

Substation Step

Down Transformer

Subtransmission

Customer

26kV and 69kV

Primary Customer

13kV and 4kV

SecondaryCustomer

120V ans 240V

10 Keynote Capitals Institutional Research

K E Y N O T E

Investment Rationale

Early mover advantage in 765kV transmission segment with market share of 35%:

CG has an edge over its peers in terms of introduction of 765kV transmission network.

As India envisages a major shift from low voltage, 220kV transmission network to high

voltage viz., 400kV, 765kV, and 1100kV power transmission network, we see a major

opportunity for CG. Power Grid Corporation India Ltd. is a major customer of the company.

CG bagged order for 86 units of 765kV Ultra high voltage reactors and setting up of the

765kV/400kV Unna substation project in UP in FY10. The companys order book to revenue

was at 86% in FY10. The company will be in a better position to receive order book due

to its presence in higher voltage category of 400-765kV transformers and its tie up with

ZTR for reactors. Transmitting electricity at high voltage reduces the fraction of energy

lost to resistance for a given amount of power; a higher voltage reduces the current and

thus the resistive losses in the conductor. At extremely high voltages, more than 2MV

between conductor and ground corona discharge losses are so large that they can offset

the lower resistances loss in line conductors. As a result Going forward, we believe to

minimize power losses during power transmission, there will be increase in 765kV and

1200kV transformers which will augur well for the company like Crompton Greaves.

Source: Company & Keynote Capitals Institutional Research

Order Backlog in (`Crs)

Chart 10

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

Q

2

F

Y

0

8

Q

3

F

Y

0

8

Q

4

F

Y

0

8

Q

1

F

Y

0

9

Q

2

F

Y

0

9

Q

3

F

Y

0

9

Q

4

F

Y

0

9

Q

1

F

Y

1

0

Q

2

F

Y

1

0

Q

3

F

Y

1

0

Q

4

F

Y

1

0

Q

1

F

Y

1

1

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

Subsidiary Order Book % Growth

Standalone Order Book % Growth

At present the company's consolidated order book stands at `71.2 bn which reflects

revenue visibility for next two years. Domestic order book is accounted for 55% of the

total order book and has grown at a CAGR of 26% during FY2008-10. The higher growth

rate implies that a sustained order inflow has witnessed in India despite of severe

slowdown. This fact can be reconciled with its international order book, which registered

muted CAGR of 0.13% during FY08-10. In 2Q FY11, the company had order inflows of

`25.6bn.

Keynote Capitals Institutional Research 11

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Revenue Mix Standalone

Chart 12

48%

43%

45% 46%

47% 46%

27%

26%

27%

29%

32% 33%

24%

21%

21%

21%

22% 22%

2% 10% 7% 5%

0%

20%

40%

60%

80%

100%

FY07 FY08 FY09 FY10 FY11E FY12E

Power System Consumer Products Industrial System Others

Source: Company & Keynote Capitals Institutional Research

Order Inflow (`Crs)

Chart 11

Subsidiary Order Book % Growth

Standalone Order Book % Growth

1000

6000

11000

16000

21000

26000

Q

2

F

Y

0

8

Q

3

F

Y

0

8

Q

4

F

Y

0

8

Q

1

F

Y

0

9

Q

2

F

Y

0

9

Q

3

F

Y

0

9

Q

4

F

Y

0

9

Q

1

F

Y

1

0

Q

2

F

Y

1

0

Q

3

F

Y

1

0

Q

4

F

Y

1

0

-45%

-25%

-5%

15%

35%

55%

75%

95%

Crompton Greaves expects fresh order inflow for 765-KV substations from Power Grid

Corporation of India in FY11. Power Grid has capex plan of `260bn in FY2011-12, which

augurs well for CG. Crompton Greave has 24% of total market share in PGCILs orders

of transformer. Also, PGCIL is setting up seven transmission corridors at an investment

of `500 bn over the next five years.

CGs domestic order intake has grown at CAGR of 31% during FY2008-10 while

international order intake has shown muted CAGR de-growth of negative 4% during

FY2008-10. We expect a revival in international order intake scenario as the demand

for wind energy transformers which constitute 15% and power transformers which

constitute 60% of international revenues will grow on account of replacement demand

in Europe and the US.

Well Diversified business Model: CG is the diversified company compare to its peers

and operates in different business verticals such as Power System, Consumer Products,

and Industrial Systems All the segments are well connected to the macro economic

development of India and offer sustain growth over a long-term.

12 Keynote Capitals Institutional Research

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Revenue Contribution Consolidate

Chart 13

67% 68%

71%

68%

65% 63%

17%

16%

15%

18%

19% 20%

15% 14% 13% 14%

14% 15%

1% 1% 1%

1% 1%

1%

0%

20%

40%

60%

80%

100%

FY07 FY08 FY09 FY10 FY11E FY12E

Power System Consumer Products Industrial System Others

We expect the consolidated revenue contribution of power system remains stable during

the year FY11 and FY12, whereas marginal increase seen in consumer products during

the same period.

Source: Industry & Keynote Capitals Institutional Research

Standalone EBIT segment wise contribution

Chart 14

45% 45%

50% 48% 49% 47%

23%

21%

21% 24% 25%

25%

32%

34%

29% 27% 26% 27%

0%

20%

40%

60%

80%

100%

FY07 FY08 FY09 FY10 FY11E FY12E

Power System Consumer Products Industrial System

Power System segment contributes 48% to CG's standalone EBIT in FY10 . We expect

the contribution to reduce slightly to 47% in FY12 due to contribution from other segments.

Industrial systems business of the company accounts higher EBIT margins which will

remain more or less constant over next 2 years.

Keynote Capitals Institutional Research 13

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Consolidate PBIT segment contribution

Chart 15

58% 58%

62% 61%

60%

57%

18%

16%

16% 18% 21%

22%

24%

26%

22% 21%

20%

21%

0%

20%

40%

60%

80%

100%

FY07 FY08 FY09 FY10 FY11E FY12E

Power System Consumer Products Industrial System

Power systems contributes 60% of CG's consolidated EBIT in FY10. The higher contribution

from power system division in EBIT is on account of the company's international operations.

We assume a lower EBIT (57%) due to subdued growth in international markets.

i) Steady increase in power system: We believe that CG will be a key beneficiary from the

governments investments in power transmission & distribution businesses. To meet Indias

growing power demand, investments of $600 billion is required. Of this, around $300 billion

for generation, around $110 billion for transmission, and the balance $190 billion for

distribution. Crompton Greaves has market share of 25% and 55% in domestic transformer

and reactor market respectively.CGs Power business is a capital intensive high turnover

business with strong international presence.

International business is a major contributor to CGs power segment. International business

demonstrated a CAGR of 14% during FY2008-10., However, we believe the growth during

FY2010-12 will be steady at 4% from de-growth in FY10 on account of demand from wind

power in renewable energy and replacement demand for power transformer. We expect

the companys domestic power business to grow at a CAGR of 19% during FY2010-12 as

against 17% during FY08-10.

Consolidated (`Crs) FY07 FY08 FY09 FY10 FY11E FY12E

Revenue 3990 4667 6174 6204 6615 7401

Growth % 42% 17% 32% 0% 7% 12%

PBIT 327 437 625 769 794 888

PBIT margin 8% 9% 10% 12% 12% 12%

Standalone (`Crs) FY07 FY08 FY09 FY10 FY11E FY12E

Revenue 1741 1805 2224 2510 2884 3371

Growth % 43% 4% 23% 13% 15% 17%

PBIT 183 258 349 462 519 607

PBIT margin 11% 14% 16% 18% 18% 18%

14 Keynote Capitals Institutional Research

K E Y N O T E

CG's consolidated power business is estimated to grow at a CAGR of 9% during FY10-

12 on account of strong growth in domestic power business. We are more positive on

transformer business, which we expect to report a CAGR of 20% during FY2010-12.

The company's standalone power system business EBIT margin improved by almost 200

bps in FY10 on account of low commodity prices. Going forward, we believe the company's

power segment margin to sustain @ 18% levels as the company enjoys better positioning

& local manufacturing advantage in 765kV space where there will be incremental order

flow expected from PGCIL. We expect EBIT of power system business to report a CAGR

@ 15% during FY2010-12.

CG's consolidated EBIT margins will remain constant @ 12% whereas its EBIT will

demonstrate CAGR growth of 15% during 2010-12.

CG's ROCE of power business stands at 46% and 93% in consolidated and standalone

respectively in FY10 as against 41% and 81% in FY09.

Source: Company & Keynote Capitals Institutional Research

High Voltage Capcity Addition 10th Plan /11th Plan (MVA)

Chart 16

2000

33,000

40,000

51,000

52,000

74,000

0

10000

20000

30000

40000

50000

60000

70000

80000

765kV 400kV 220kV

10th Plan 11th Plan

Source: Company & Keynote Capitals Institutional Research

Power System Growth Trajectory Geographywise

Chart 18

43%

4%

23%

13%

15%

17%

40%

27%

38%

-6%

1%

8%

1000

1500

2000

2500

3000

3500

4000

4500

FY07 FY08 FY09 FY10 FY11E FY12E

-10%

0%

10%

20%

30%

40%

50%

Domestics International % Growth % Growth

Keynote Capitals Institutional Research 15

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Power System ROCE

Chart 22

27%

31%

41%

46%

43%

63%

81%

93%

0%

20%

40%

60%

80%

100%

FY07 FY08 FY09 FY10

Power Systems (Consolidated) Power Systems (Standalone)

ii) Consumer product Business to registered strong CAGR growth of 22% in FY2010-12:

CG has strong brand name in consumer products and enjoys market leadership in Electric

Fans in India. The company occupies number 2 position in lighting market, and expanding

its product portfolio at a rapid rate. It is one of the fastest growing brands in home

appliances. The company has also a leadership presence in the domestic pumps market.

CGs fans retained its Super brand status, for the fourth time in succession. The company

is a market leader in fans segment with 24% market share. It sold 6.5 million fans in FY10.

New products accounted for over 25% of total fan sales. The pumps division achieved sales

growth of 33% in FY2010, which was significantly greater than the market growth of 18%.

CGs pumps retained their leadership position in the domestic segment. Led by the

agricultural growth in India, CG turned its focus towards the rural market and is seriously

considering it to a major growth driver. The company also entered in the industrial pumps

segment with horizontal split case pumps and end suction pumps. New products accounted

for 37% of total pump sales. Consumer products division is the most liquid business for

the company. Consumer Products business has been growing at a CAGR of 20% during

FY2008-10 which we expect further to grow @ CAGR of 22% in FY2010-12.

Consolidated (`Crs) FY07 FY08 FY09 FY10 FY11E FY12E

Revenue 994.03 1117.74 1321.82 1611.93 1952 2393

% Growth 20% 12% 18% 22% 21% 23%

PBIT 95.46 120.81 146.28 229.86 273 335

PBIT Margin 10% 11% 11% 14% 14% 14%

The company's EBIT margins for consumer product segment have improved in FY10 by

300bps from 11% to 14%. Going forward, we believe the company will be able to sustain

growth and profitability on account of strong branding, new design, innovative products

and improving penetration in urban semi urban market. The company's Consumer busi-

ness has renewed its thrust on enhanced after sales service by commissioning its cus-

tomer care centre and a network of franchise based authorized service centre in metro

cities. Consumer products EBIT has registered 14% growth in FY10, we believe the

company EBIT is expected to grow at a CAGR of 19% during FY2010-12 on account of

incremental volume growth in Electrics fans and motor pumps of 24% & 33% respectively

in next two years.

16 Keynote Capitals Institutional Research

K E Y N O T E

CG's ROCE of industrial systems business stands at 120% and 139% in consolidated and

standalone respectively in FY10 as against 89% and 139% in FY09 which indicates im-

proved efficiency.

Source: Company & Keynote Capitals Institutional Research

Consumer Products (ROCE)

Chart 25

123%

138%

262%

450%

0%

100%

200%

300%

400%

500%

FY 07 FY 08 FY 09 FY 10

CG ROCE of consumer business stands at 450% in FY10 as against 262% in FY 09.

iii) Domestic Industrial growth will provide impetus to CG's industrial system: Industrial

system accounts for highest EBIT margin of 22% for the company. CG expects a strong

pick up in demand for motors driven by the growth in the manufacturing sector. CG has

around 40% of order for motors, which has higher margins. We expect the company to

register a CAGR of 17% and 9% in revenue and EBIT respectively on account of increase

in industrial capex and real infrastructure projects. LT Motors has maintained the number

1 position in India for AC motors; improved from number 2 to number 1 in India for

alternators by quantity and maintained its number 2 position in DC motors. As far as rail

transportation and railways signaling equipment goes, CG maintains a very strong pres-

ence in relays, point machines and BLDC fans - with market shares varying from 32%

to 85% and it maintains the number 1 position in all the three products.

Consolidated (`Crs) FY07 FY08 FY09 FY10 FY11E FY12E

Revenue 897.14 964.94 1149.77 1258.65 1462.09 1723.83

% Growth 31% 8% 19% 9% 16% 18%

PBIT 130.24 195.63 213.27 275.98 263 328

PBIT Margin 15% 20% 19% 22% 18% 19%

Standalone (`Crs) FY07 FY08 FY09 FY10 FY11E FY12E

Revenue 862.51 893.36 1024.2 1136.96 1336 1588

% Growth 29% 4% 15% 11% 17% 19%

PBIT 130.37 194.6 203.84 259.98 280.5 349.5

PBIT Margin 15% 22% 20% 23% 21% 22%

Keynote Capitals Institutional Research 17

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Industrial System (ROCE)

Chart 28

67%

121%

89%

120%

82%

116%

109%

139%

0%

25%

50%

75%

100%

125%

150%

FY 07 FY 08 FY 09 FY 10

Industrial Systems Consolidated Industrial Systems (Standalone)

Inorganic Growth to act as a catalyst for Power & Industrial business: Through

acquisitions, the company is looking ahead of development in business, which may enhance

the top line growth. Since the US and Europe have decided to generate 20% of the total

power from renewable resources by 2020, there may be signs of a revival in demand for

transformers from the renewable sector in the international business of the company. In

its drive to becoming a Provider of Integrated Solutions, Services and Products, CG

acquired Power Technology Solutions Limited (PTS), a UK-based high voltage electrical

engineering company. PTS provides consulting as well as technical and engineering support

to regional electricity companies in the UK. The approximate acquisition value was 30

million. CG concluded an arrangement for the acquisition of three businesses of Nelco Ltd-

traction electronics, SCADA and industrial drives for a value of approximately `92 crore.

This acquisition should enable CG to become a stronger and more comprehensive player

in its railways business and also build capabilities in drives. This is a significant acquisition

for CGs Industrial Systems business.

CG holds 32% in Avantha Power and Infrastructure Limited (APIL). This translates to 206.36

million equity shares of APIL at `11 per share or an of `227 crore. APIL, an Avantha Group

the company, is engaged in the generation, transmission and distribution of electricity.

Source: Company & Keynote Capitals Institutional Research

Sales & Service Revenue(Geography-wise) 2010

Chart 30

Source: Company & Keynote Capitals Institutional Research

Sales & Service Revenue(Geography-wise) 2009

Chart 29

22%

41%

3%

8%

20%

6%

Asia Africa North America

South America Europe Australia

Asia Africa North America

South America Europe Australia

21%

6%

1%

49%

3%

20%

18 Keynote Capitals Institutional Research

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Consolidated Margins

Chart 31

10.4%

11.9%

12.1%

15.4% 15.4%

15.4%

8.7%

10.1%

10.7%

13.7% 13.8%

14.0%

5.2%

6.1%

6.5%

9.4%

9.1%

9.2%

4%

6%

8%

10%

12%

14%

16%

FY07 FY08 FY09 FY10 FY11E FY12E

EBIDTA Margin EBIT Margin PAT Margin

Source: Company & Keynote Capitals Institutional Research

Standalone Margins

Chart 32

14.3%

14.6%

18.3%

18.7%

18.6%

13.2%

13.6%

17.3% 17.1%

17.2%

8.1%

8.6%

11.7%

11.4%

11.5%

6%

8%

10%

12%

14%

16%

18%

20%

FY08 FY09 FY10 FY11E FY12E

EBDITA Margin EBIT Margin PAT Margin

Increase in manufacturing capacity as well as changes in the plant layout will create

additional shop floor space, which will improve productivity. Overall improvement in supply

chain management including new vendor development, helped with costs in reducing the

raw material to sales ratio. Going forward, we believe margin to stabilize in the range of

13-14% on account of higher inflows in its order book from higher rating 765kV transmission

systems which have better margins than systems of up to 400kV.

New Product Development: CG has a clear metric to measure new product (NP)

developments. In FY10, for CG Power India, NP accounted for 17% of revenues. For CG

Industrial Systems, it was 22%. And for CG Consumer Products, it was 23%. Some of

the new products include a 200MVA, 420/21kV single phase generator transformer, 315MVA,

400/220/33 kV 3 phase auto transformer, 800 kV 50kA gas circuit breaker, NEMA premium

efficiency motors for range 90-132, high efficiency alternators, a 10 Bar pressure geyser

and fans for automobile applications.

Margin Expansion & Operational Efficiency: On account of various value engineering

initiatives, better product design and higher efficiency in supply chain management, the

company may increase its PAT margin by 50 bps and sustain the operating margins at

current levels of 13-14% over FY2010-12. Increase in manufacturing capacity and changes

in plant layout will create additional shop floor space to further improve its productivity.

Keynote Capitals Institutional Research 19

K E Y N O T E

379

579

944

1056

358

633

241 244

566

669

801

1171

0

200

400

600

800

1000

1200

FY07 FY08 FY09 FY10 FY11E FY12E

Cash flow from operations Cash

Source: Company & Keynote Capitals Institutional Research

Raw Material% of Net Sales (Consolidated)

Chart 34

Source: Company & Keynote Capitals Institutional Research

Raw Material % of Net Sales (Standalone)

Chart 33

73%

70%

67%

67%

66%

65%

60%

62%

64%

66%

68%

70%

72%

74%

FY07 FY08 FY09 FY10 FY11E FY12E

69%

66%

63%

61% 61%

61%

0.56

0.58

0.6

0.62

0.64

0.66

0.68

0.7

0.72

FY07 FY08 FY09 FY10 FY11E FY12E

Strong cash Position: The company has a strong cash balance to the tune of `669Cr

with positive operational cash flows of `1000Cr symbolizes healthy financial position. At

the same time, the company may look in for further acquisition in Power and Industrial

segment for future business growth.

Source: Company & Keynote Capitals Institutional Research

(Con) Strong Cash Position

Chart 35

20 Keynote Capitals Institutional Research

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

EUR Vs INR

Chart 36

50

55

60

65

70

75

N

o

v

-

0

9

D

e

c

-

0

9

J

a

n

-

1

0

F

e

b

-

1

0

M

a

r

-

1

0

A

p

r

-

1

0

M

a

y

-

1

0

J

u

n

-

1

0

J

u

l

-

1

0

A

u

g

-

1

0

S

e

p

-

1

0

O

c

t

-

1

0

Source: Company & Keynote Capitals Institutional Research

Copper Prices

Chart 38

5000

5500

6000

6500

7000

7500

8000

8500

O

c

t

-

0

9

O

c

t

-

0

9

N

o

v

-

0

9

N

o

v

-

0

9

D

e

c

-

0

9

J

a

n

-

1

0

J

a

n

-

1

0

F

e

b

-

1

0

M

a

r

-

1

0

M

a

r

-

1

0

A

p

r

-

1

0

A

p

r

-

1

0

M

a

y

-

1

0

J

u

n

-

1

0

J

u

n

-

1

0

J

u

l

-

1

0

J

u

l

-

1

0

A

u

g

-

1

0

S

e

p

-

1

0

S

e

p

-

1

0

O

c

t

-

1

0

USD / MT

Source: Company & Keynote Capitals Institutional Research

USD Vs INR

Chart 37

44

44.5

45

45.5

46

46.5

47

47.5

48

48.5

49

S

e

p

-

0

9

O

c

t

-

0

9

N

o

v

-

0

9

D

e

c

-

0

9

J

a

n

-

1

0

F

e

b

-

1

0

M

a

r

-

1

0

A

p

r

-

1

0

M

a

y

-

1

0

J

u

n

-

1

0

J

u

l

-

1

0

A

u

g

-

1

0

S

e

p

-

1

0

O

c

t

-

1

0

Key Risks/Concerns

Dependence on Power Generation: Company is entirely dependent on power

generation projects in India. In case of any inordinate delays in execution, the Company

may face obstacles to meet its targets.

Weak Global Macro Factors: CG has significant exposure in Europe and the US

markets. Any downturn in these region may have significant impact.

Sharp increase in Commodity Prices: The rise in price of raw material will adversely

affect the margins of the company.

Increase in competition: CG may face competition from China and Korea due to

there low manufacturing cost and higher inventories.

Currency Risk: CG derives nearly 50% of its revenues from the International business.

The fluction in currency may affect its revenues and margins.

Source: Company & Keynote Capitals Institutional Research

CRGO price (C&F)

Chart 39

Keynote Capitals Institutional Research 21

K E Y N O T E

Source: Company & Keynote Capitals Institutional Research

Peer Comparision

Chart 40

ABB

(9.2%, 17.6)

Siemens

(9.2%, 16.2)

Crompton Greaves

(13.4%, 11.23)

Areva T&D

( 5.5%, 14.3)

5

7

9

11

13

15

17

19

21

0 0.025 0.05 0.075 0.1 0.125 0.15

FY 12E- ROA(%)

F

Y

1

2

E

-

E

V

/

E

B

D

I

T

A

Peer Comparison

Name of the Company CMP M CAP EPS P/E P/BV EV/EBDITA ROE

Siemens 830 27997 16.84 49.3 10.1 13.5 35%

Crompton Greaves 326 20887 13.44 24.2 8.3 14.7 34%

ABB 865 18335 16.4 110.0 7.6 25.4 16%

Areva T&D 293 7009 7.72 42.0 8.1 16.4 24%

Crompton Greaves is best placed against its competitors on EV/EBDITA basis and ROA

which implies that the company has higher potential to grow since it is undervalued than

its peers.

Forward Valuation

FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E

Sales 11,520 13,464 10,172 11,678 8,466 10,070 4659 4792

EBDITA 1,442 1,643 1,564 1,799 858 1,089 511.5 548.5

PAT 953 1,106 921 1071 547 705 229 268.2

EBDITA% 12.5% 12.2% 15.4% 15.4% 10.14% 10.81% 10.98% 11.45%

PAT% 8.3% 8.2% 9.1% 9.2% 6.5% 7.0% 4.9% 5.6%

EPS 27.97 31.43 14.36 16.70 25.77 32.84 9.37 11.22

P/BV 6.91 5.86 6.29 4.90 6.12 5.07 6.00 5.33

EV/EBDITA 18.55 16.27 13.16 11.23 22.27 17.56 15.34 14.32

Particulars

Siemens ABB Areva T&D

Crompton Greaves

Source: Bloomberg Estimates & Keynote Institutional Research

Source: Company & Keynote Capitals Institutional Research

Transformer Capacity (MVA)

Chart 41

31,608

30,075

27,000

23,200

18,375

15,000

13,000

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000

Crompton

Greaves

Areva

BHEL

TRIL

ABB

Siemens

Voltamp

22 Keynote Capitals Institutional Research

K E Y N O T E

Valuation

Crompton Greaves revenues are estimated at a CAGR of 13% during FY2010-12. Based

on its order book in domestic and international markets, we have valued the company on

DCF methodology and arrived at a price of `374/- per share.

Source: Industry & Keynote Capitals Institutional Research

P/B Bands

Chart 42

Source: Industry & Keynote Capitals Institutional Research

PE Bands

Chart 43

0

50

100

150

200

250

300

350

A

p

r

-

0

5

J

u

l

-

0

5

N

o

v

-

0

5

F

e

b

-

0

6

J

u

n

-

0

6

S

e

p

-

0

6

J

a

n

-

0

7

M

a

y

-

0

7

A

u

g

-

0

7

D

e

c

-

0

7

M

a

r

-

0

8

J

u

l

-

0

8

N

o

v

-

0

8

M

a

r

-

0

9

J

u

n

-

0

9

O

c

t

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

S

e

p

-

1

0

24x

21x

18x

16x

0

50

100

150

200

250

300

350

A

p

r

-

0

5

J

u

l

-

0

5

N

o

v

-

0

5

F

e

b

-

0

6

J

u

n

-

0

6

S

e

p

-

0

6

J

a

n

-

0

7

M

a

y

-

0

7

A

u

g

-

0

7

D

e

c

-

0

7

M

a

r

-

0

8

J

u

l

-

0

8

N

o

v

-

0

8

M

a

r

-

0

9

J

u

n

-

0

9

O

c

t

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

S

e

p

-

1

0

15x

10x

7x

5x

DCF Valuation

Market Return 15.0%

Beta 0.85

WACC 12.9%

Long Term Growth Rate 4%

Terminal Value 15037

PV of Cash Flow 8819

Enterprise Value 23855

Net Debt -168

Value of firm 24023

No of Outstanding Share 64.15

Equity Value Per Share 374

Keynote Capitals Institutional Research 23

K E Y N O T E

Particulars Q1 Q2 Q1 Q2 Y-o-Y Q-o-Q H1 H1 Y-o-Y

FY10 FY10 FY11 FY11 FY11 FY10

Net Sales 2198 2189 2302 2398 9.5% 4.2% 4700 4387 7%

Other Income 25 16 20 23 43.6% 17.6% 42 41 5%

Total Income 2222 2205 2322 2421 9.8% 4.3% 4743 4427 7%

Raw Material Consumed 1146 1170 1197 1284 9.8% 7.3% 2481 2316 7%

Stock Adjustment -32 -51 -89 -64 24.3% -28.6% -153 -83 85%

Purchase of Finished Goods 243 220 310 243 10.9% -21.6% 554 462 20%

Employee Expenses 287 283 299 309 9.4% 3.3% 609 569 7%

Other Expenses 306 261 287 292 11.6% 1.6% 579 567 2%

Total Expenditure 1950 1882 2005 2065 9.7% 3.0% 4070 3832 6%

PBIDT 272 323 317 356 10.4% 12.4% 673 595 13%

Interest 5 5 5 5 -5.8% -3.2% 10 10 2%

PBDT 268 318 312 351 10.6% 12.7% 663 585 13%

Depreciation 37 39 42 46 18.1% 10.3% 87 76 15%

Tax 62 81 78 82 1.9% 5.8% 160 142 12%

Deferred Tax 8 4 2 10 128.1% 467.1% 12 12 -3%

Reported Profit After Tax 161 194 191 214 10.2% 11.9% 405 355 14%

Net Profit after Minority Int. 160 193 191 214 10.5% 11.9% 404 354 14%

EPS (Adj)(Unit Curr.) 2.5 3.02 2.98 3.33 10.3% 11.7% 6.31 5.52 14%

Consolidated Quaterly Income Statement

Particulars Q1 Q2 Q1 Q2 Y-o-Y Q-o-Q H1 H1 Y-o-Y

FY10 FY10 FY11 FY11 FY11 FY10

Revenues

Revenue from Operations 2206.83 2197.61 2317.8 2410.76 9.7% 4.0% 4729 4404 7%

Power Systems 1483.77 1477.28 1456.41 1577.81 6.8% 8.3% 3034 2961 2%

Consumer Products 412.87 373.98 531.8 463.43 23.9% -12.9% 995 787 26%

Industrial Systems 279.38 321.67 321.02 360.61 12.1% 12.3% 682 601 13%

Others 30.81 24.68 8.57 8.91 -63.9% 4.0% 17 55 -68%

Less: Inter Segment

Revenues 9.31 8.57 15.59 12.88 50.3% -17.4% 28 18 59%

Total Segment Revenue 2197.52 2189.04 2302.21 2397.88 9.5% 4.2% 4700 4387 7%

Net Revenue from

Operations 2197.52 2189.04 2302.21 2397.88 9.5% 4.2% 4700 4387 7%

Profit/Loss Before

Interest and Tax 255.27 304.99 297.24 331.69 8.8% 11.6% 629 560 12%

Power Systems 139.46 179.18 155.58 193.46 8.0% 24.3% 349 319 10%

Consumer Products 58.04 52.35 80.29 67.07 28.1% -16.5% 147 110 33%

Industrial Systems 52.61 70.45 59.78 70.16 -0.4% 17.4% 130 123 6%

Others 5.16 3.01 1.59 1 -66.8% -37.1% 3 8 -68%

Less: Interest 4.51 5.15 5.01 4.85 -5.8% -3.2% 10 10 2%

Other Un-allocable Exp. 20.86 21.76 23.12 21.47 -1.3% -7.1% 45 43 5%

Net Profit/Loss Before Tax 229.9 278.08 269.11 305.37 9.8% 13.5% 574 508 13%

Consolidated Segment Wise Quaterly Income Statement

24 Keynote Capitals Institutional Research

K E Y N O T E

Financials

FY09 FY10 FY11E FY12E

Revenue from Operations

Power System 6174.48 6204.46 6614.85 7401.10

% Growth 32% 0% 7% 12%

Consumer Products 1321.82 1611.93 1952 2393

% Growth 18% 22% 21% 23%

Industrial System 1149.77 1258.65 1462.09 1723.83

% Growth 19% 9% 16% 18%

Power System 624.97 769.35 794 888

PBIT Margin 10% 12% 12% 12%

Consumer Products 146.28 229.86 273 335

PBIT Margin 11% 14% 14% 14%

Industrial System 213.27 275.98 263 328

PBIT Margin 19% 22% 18% 19%

Consolidated Segment Revenue (Crs)

Source: Company & Keynote Capitals Institutional Research

FY09 FY10 FY11E FY12E

Revenue

Power System 2316.61 2448.77 2883.64 3371.40

Power System Total 2224.26 2510.2 2884 3371

% Growth 23% 13% 15% 17%

Consumer Products 1346.24 1642.25 1952 2393

Total Consumer Products (Domestics ) 1321.82 1611.93 1952 2393

% Growth 18% 22% 21% 23%

Industrial Systems 1107.86 1187.05 1336 1588.4

Industrial System 1024.2 1136.96 1336 1588

Net Revenue from Operations 4610.66 5283.99 6233 7426

19% 15% 18% 19%

PBIT

Power System 349.28 462.17 519.1 606.9

PBIT % 16% 18% 18% 18%

Consumer Products 146.28 229.86 263.6 323.0

PBIT % 11% 14% 14% 14%

Industrial System 203.84 259.98 280.5 349.5

PBIT % 20% 23% 21% 22%

Profit/Loss Before Interest & Tax 700.15 953.02 1063 1279

Standalone Segment Revenue (Crs)

Source: Company & Keynote Capitals Institutional Research

Keynote Capitals Institutional Research 25

K E Y N O T E

Consolidated Income Statement (`Cr)

Consolidated Balance Sheet (`Cr)

2008 2009 2010 2011E 2012E

SOURCES OF FUNDS :

Share Capital 73.32 73.32 128.3 128.3 128.3

Reserves Total 1228.47 1757.73 2375.98 3191 4139

Total Shareholders Funds 1302 1831 2504 3319 4267

Total Debt 842 718 501 495 490

Total Liabilities 2156 2563 3010 3818 4761

APPLICATION OF FUNDS :

Gross Block 2685 3029 2986 3086 3206

Less: Accumulated Depreciation 1483 1704 1723 1885 2054

Net Block 1197 1325 1262 1200 1152

Capital Work in Progress 47.58 53.7 113.69 93.0 76.0

Investments 93.43 167.21 553.57 554 554

Inventories 1066 1095 1041 1338 1728

Sundry Debtors 1720 2056 2146 2592 3167

Cash and Bank 244 566 669 801 1171

Loans and Advances 370 229 246 509 584

Total Current Assets 3401.64 3945.17 4101.84 5239 6649

Current Liabilities 2100 2602 2657 2909 3311

Provisions 542.53 373.87 360.25 360 360

Total Current Liabilities 2642 2976 3017 3269 3671

Net Current Assets 759.34 969.15 1084.87 1970 2978

Total Assets 2156 2563 3010 3817 4760

2008 2009 2010 2011E 2012E

Net Sales 6832 8737 9141 10172 11678

Other Income 67.22 58.7 132.04 132 152

Total Income 6899 8796 9273 10304 11829

Raw Material Consumed 3622.96 4584.4 4624.03 5188 5956

Stock Adjustment -80.69 -24.13 22.47 22.47 22.47

Purchase of Finished Goods 861.46 932.1 945.81 1017 1168

Employee Expenses 796.81 1064.62 1113.14 1241 1425

Other Expenses 885.85 1185.58 1158.47 1271.481459.708

Total Expenditure 6086.39 7742.57 7863.92 8739.7110030.23

EBIDTA 813 1053 1409 1564 1799

EBIDTA Margin 11.90% 12.06% 15.41% 15.38% 15.41%

Depreciation 126.26 121.6 155.09 162.00 168.30

EBIT 687 932 1254 1402 1631

Interest 69.96 65.51 26.49 27.2 31.9

PBT 617 866 1227 1375 1599

Tax 197.04 261.3 313.72 454 528

Reported Profit After Tax 416 567 862 921 1071

PAT Margin 6% 6% 9.43% 9.06% 9.17%

EPS (Unit Curr.) 11.1 15.27 13.4 14.36 16.70

26 Keynote Capitals Institutional Research

K E Y N O T E

Consolidated Cash Flow (Cr)

2008 2009 2010 2011E 2012E

PBT & Extraordinary Items 615.24 867.17 1189.05 1375 1599

Add: Depreciation 126 122 155 162 168

Add: Interest Expense 70 66 26 27 32

Less: Tax Paid 197 261 314 454 528

Operating Profit Before Working

Capital Change 616 792 1095 1111 1272

(Increase)/Decrease in Inventories 151 29 -54 296 390

(Increase)/Decrese in Sundary debtors 299 335 91 445 576

(Increase)/Decrease in loans & advances 6 -141 17 263 75

Increase/(Decrease ) in sundary creditors/

liabilites/provision 407 334 41 252 402

Change in Working Capital -48 111 -13 -753 -639

Net Cash from Operating Activities 578.81 944.38 1056.09 358 633

Net Cash Used in Investing Activities -346.91 -321.56 -575.07 -100 -120

Net Cash Used in Financing Activities -228.88 -301.67 -377.84 -126 -143

Net Inc/(Dec) in Cash and Cash Equivalent 3 321 103 132 370

Cash and Cash Equivalents at End

of the year 244 566 669 801 1171

Ratio Analysis

Particulars 2008A 2009A 2010A 2011E 2012E

Profitabilty Margins

EBIT Margin 10.1% 10.7% 13.7% 13.8% 14.0%

EBITDA Margin 11.9% 12.1% 15.4% 15.4% 15.4%

PAT Margin 6.1% 6.5% 9.4% 9.1% 9.2%

Coverage Ratio

Interest Coverage ratio 10.8 15.3 48.7 48.9 48.6

Profitability Ratios

ROE 32% 31% 34% 28% 25%

ROCE 35% 39% 43% 35% 33%

Asset Turnover Ratio 2.54 2.88 3.06 3.30 3.64

Leverage Ratios

Debt Equity Ratio 0.65 0.39 0.20 0.15 0.11

Debt/PAT 2.02 1.27 0.58 0.54 0.46

Current Ratio 1.29 1.33 1.36 1.60 1.81

Efficiency Ratios

Inventory Turnover Days 57 46 42 48 54

Debtors Days 92 86 86 93 99

Creditor Days 266 237 238 230 225

Valuation Ratios

P/E 29.3 21.3 24.2 22.7 19.5

P/BV 16.04 11.41 8.34 6.29 4.90

EV/EBIDTA 26.44 19.99 14.71 13.16 11.23

EPS 11.1 15.27 13.44 14.36 16.70

Source: The company & Keynote Capitals Institutional Research

Keynote Capitals Institutional Research 27

K E Y N O T E

Annexure:

In power industry, every 1 MW of the generating capacity addition entails an addition of 7

MVA of transformer capacity. According to 11th Plan, the power capacity addition target is

about 78,577 MW. However, we believe that the capacity addition for this period is expected

to be 50 -60% of the target taking into consideration implementation record of government.

Thus, it will result into demand of 60,500 MVA of transformers each year. Further, the average

demand for special transformers is approximately around 30,000 MVA. Additionally, a

transformer has a useful life of about 25-30 years. Hence, the transformers installed in 8th

Plan (1980-85) 88,000 MVA are now coming up for replacement which will create a

replacement demand of 17,700 MVA each year.

And finally there is export demand of 10,000 MVA/annum. Thus, total demand estimation

equals to 1, 18,200 MVA/annum. These estimates have been made on conservative basis

considering the global recession and slowdown in project execution in power sector. However,

the total capacities of transformer manufacturers add up 1, 10,000 MVA, which means a

demand supply gap, is of ~8,000 MVA each year. The favorable demand dynamics will give

pricing power to transformer manufactures and thus the realizations are also expected to

remain firm in the near future.

List of Shareholder holding more than 1%

Description %

Azim Hasham Premji 1.22

Birla Sun Life Trustee The company Pvt Ltd A/C Birla Sun Life Frontline Equity Fund 1.65

Corella Investments Ltd 1.12

HDFC Standard Life Insurance The company Ltd 2.66

HDFC Trustee The company Ltd HDFC Top 200 Fund 4.7

HSBC Global Investment Funds 1.19

Life Insurance Corporation of India Profit plus 4.89

Lustre International Ltd 0.67

Penbryn International Ltd 1.54

Reliance Capital Trustee Co Ltd A/C Reliance Diversified Power Sector Fund 1.52

SBI MF Magnum Sector Funds Umbrella Emerging Businesses Fund 2.2

Solaris Holdings Ltd 39.13

Tata Young Citizens Fund 1.3

Templeton Mutual Fund A/c Franklin India Opportunities Fund 1.8

28 Keynote Capitals Institutional Research

K E Y N O T E

Subramanyam Ravisankar

Director - Equities sravisankar@keynotecapitals.net +91 22 3026 6018

Institutional Equity Team

Analysts / Associates

Krishna Mahale krishna@keynoteindia.net +91 22 3026 6059

Denil Savla denil@keynoteindia.net +91 22 3026 6043

Hetal Shah hetal@keynoteindia.net +91 22 22694325

Ashwin Kumar ashwin@keynoteindia.net +91 22 30266059

Rohan Admane rohan@keynoteindia.net +91 22 2269 4322

Rajesh Sinha rajesh@keynotecapitals.net +91 22 30266057

Farha Shaikh farha@keynoteindia.net +91 22 30266057

Sanjay Bhatia sanjay@keynotecapitals.net +91 22 3026 6065

Technical Analyst

Nilesh Dhruv nilesh@keynoteindia.net +91 22 3026 6040

Puja Shah puja.shah@keynoteindia.net +91 22 3026 6041

Dealing / Sales

KEYNOTE CAPITALS LTD.

Member

Stock Exchange, Mumbai (INB 010930556)

National Stock Exchange of India Ltd. (INB 230930539)

Over the Counter Exchange of India Ltd. (INB 200930535)

Central Depository Services Ltd. (IN-DP-CDSL-152-2001)

4th Floor, Balmer Lawrie Building, 5, J. N. Heredia Marg, Ballard Estate, Mumbai 400 001. INDIA

Tel. : 9122-2269 4322 / 24 / 25 www.keynoteindia.net

DISCLAIMER

This report has been prepared and issued by Keynote Capitals Limited, based solely on public information and sources believed to be reliable.

Neither the information nor any opinion expressed herein, constitutes an offer, or an invitation to make an offer, to buy or sell any securities

or any options, futures or other derivatives related to such securities and also for the purpose of trading activities.

Keynote Capitals Limited makes no guarantee, representation or warranty, express or implied and accepts no responsibility or liability as to

the accuracy or completeness or correctness of the information in this report.

Keynote Capitals and its affiliates and their respective officers, directors and employees may hold positions in any securities mentioned in this

Report (or in any related investment) and may from time to time add to or dispose of any securities or investments.

Keynote Capitals may also have proprietary trading positions in securities covered in this report or in related instruments.

An affiliate of Keynote Capitals Limited may also perform or seek to perform broking, investment banking and other banking services for the

company under coverage.

If Buy, Sell, or Hold recommendation is made in this Report, such recommendation or view or opinion expressed on investments in this

Report is not intended to constitute investment advice and should not be intended or treated as a substitute for necessary review or validation

or any professional advice. The views expressed in this Report are those of the analyst which are subject to change and do not represent

to be an authority on the subject. Keynote Capitals may or may not subscribe to any and/ or all the views expressed herein.

The opinions presented herein are liable to change without any notice.

Though due care has been taken in the preparation of this report, Keynote Capitals limited or any of its directors, officers or employees shall

be in any way be responsible for any loss arising from the use thereof.

Investors are advised to apply their judgment before acting on the contents of this report.

This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of Keynote Capitals Limited.

Potrebbero piacerti anche

- BV WECC TransCostReport FinalDocumento40 pagineBV WECC TransCostReport FinalAshish KumarNessuna valutazione finora

- Ps6530b Ess ManualDocumento9 paginePs6530b Ess ManualAshish KumarNessuna valutazione finora

- Active Harmonic FilterDocumento4 pagineActive Harmonic FilterGurdev SainiNessuna valutazione finora

- A 0145021112Documento6 pagineA 0145021112Ashish KumarNessuna valutazione finora

- Decomposition of Energy Consumption and Energy Intensity in Indian Manufacturing IndustriesDocumento33 pagineDecomposition of Energy Consumption and Energy Intensity in Indian Manufacturing IndustriesAshish KumarNessuna valutazione finora

- Different MiningDocumento2 pagineDifferent MiningAshish KumarNessuna valutazione finora

- MotorsDocumento11 pagineMotorsAshish KumarNessuna valutazione finora

- CGL Radix Series Unitized Sub Stations CatlogueDocumento2 pagineCGL Radix Series Unitized Sub Stations CatlogueAshish KumarNessuna valutazione finora

- Switchgears MiningDocumento10 pagineSwitchgears MiningAshish KumarNessuna valutazione finora

- Custom PDF SignerDocumento24 pagineCustom PDF SignerAshish KumarNessuna valutazione finora

- Mining EqipmentDocumento4 pagineMining EqipmentAshish KumarNessuna valutazione finora

- MSEDCL Approved Vendors ListDocumento33 pagineMSEDCL Approved Vendors Listsunilgvora86% (7)

- Hazardous MinigDocumento5 pagineHazardous MinigAshish KumarNessuna valutazione finora

- Estimating Total Cost For OB RemovalDocumento12 pagineEstimating Total Cost For OB RemovalKuldeep SinghNessuna valutazione finora

- Study of Equipment Prices in The Power SectorDocumento121 pagineStudy of Equipment Prices in The Power Sector이주성100% (1)

- Coal India MachineryDocumento48 pagineCoal India MachineryAshish KumarNessuna valutazione finora

- MMCP Paper 5 - 0Documento28 pagineMMCP Paper 5 - 0Ashish KumarNessuna valutazione finora

- Study of Equipment Prices in The Power SectorDocumento121 pagineStudy of Equipment Prices in The Power Sector이주성100% (1)

- Mining GEDocumento28 pagineMining GEAshish KumarNessuna valutazione finora

- ISM Dhandab SyallabusDocumento36 pagineISM Dhandab SyallabusAshish KumarNessuna valutazione finora

- Mining ABBDocumento8 pagineMining ABBAshish KumarNessuna valutazione finora

- Estimating Total Cost For OB RemovalDocumento12 pagineEstimating Total Cost For OB RemovalKuldeep SinghNessuna valutazione finora

- Break Even Analysis of Mining ProjectsDocumento60 pagineBreak Even Analysis of Mining ProjectsAnil Kumar100% (1)

- Coal India MachineryDocumento48 pagineCoal India MachineryAshish KumarNessuna valutazione finora

- 9460 Colombia Fact Sheet Mining Equipment and Technology PrintDocumento3 pagine9460 Colombia Fact Sheet Mining Equipment and Technology PrintAshish KumarNessuna valutazione finora

- Strategic Plan Mnre 2011 17Documento85 pagineStrategic Plan Mnre 2011 17Umasankar ChilumuriNessuna valutazione finora

- Schneider MRKT ShareDocumento16 pagineSchneider MRKT ShareAshish KumarNessuna valutazione finora

- Coal India MachineryDocumento48 pagineCoal India MachineryAshish KumarNessuna valutazione finora

- CSS AmericaDocumento48 pagineCSS AmericaAshish KumarNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 07 Koolhaas Downtown Athletic ClubDocumento10 pagine07 Koolhaas Downtown Athletic ClubAndreea DituNessuna valutazione finora

- AK30 NC Turret User ManualDocumento7 pagineAK30 NC Turret User ManualgsergeyulnNessuna valutazione finora

- FORM Inspection Test Plan MMPDocumento8 pagineFORM Inspection Test Plan MMPRicky Stormbringer ChristianNessuna valutazione finora

- Kubota Dual Fuel Series SpecificationDocumento10 pagineKubota Dual Fuel Series Specificationפטריה מוזרNessuna valutazione finora

- NPT Thread Dimensions PDFDocumento1 paginaNPT Thread Dimensions PDFRamnandan MahtoNessuna valutazione finora

- Vibration Diagnosis and CorrectionDocumento54 pagineVibration Diagnosis and Correctionbhanuka2009Nessuna valutazione finora

- Precast Capping Beam Formers DatasheetDocumento2 paginePrecast Capping Beam Formers Datasheetsantoshgpr100% (1)

- Pds Microstran LTR en LRDocumento2 paginePds Microstran LTR en LRthaoNessuna valutazione finora

- The Punjab Factory RuleDocumento313 pagineThe Punjab Factory Rulesafety_rliNessuna valutazione finora

- Ericsson Essentials Health & Safety Plan Sample: Good For Smaller Projects and Bid QualificationsDocumento18 pagineEricsson Essentials Health & Safety Plan Sample: Good For Smaller Projects and Bid QualificationsmohammedelrabeiNessuna valutazione finora

- Admission Form STHP-2020 Nov-4-2019Documento2 pagineAdmission Form STHP-2020 Nov-4-2019Farjad AhmedNessuna valutazione finora

- HSE-Acoustic & Fire DoorsDocumento6 pagineHSE-Acoustic & Fire DoorsInterior ProjectsNessuna valutazione finora

- Vmware ManualDocumento512 pagineVmware ManualMohd Safian ZakariaNessuna valutazione finora

- Understanding IBR 1950Documento7 pagineUnderstanding IBR 1950sammar_10Nessuna valutazione finora

- Vineeth - Curriculum VitaDocumento8 pagineVineeth - Curriculum VitaVineeth NBNessuna valutazione finora

- Urethane UB-7 Catalog 2013Documento32 pagineUrethane UB-7 Catalog 2013yfontalvNessuna valutazione finora

- RE14092021Documento2 pagineRE14092021francis puthuserilNessuna valutazione finora

- HandRail Specsgf For CfvdrfsDocumento3 pagineHandRail Specsgf For CfvdrfsTarek TarekNessuna valutazione finora

- Dax Patel CVDocumento1 paginaDax Patel CVPriyanshNessuna valutazione finora

- Panduit Electrical CatalogDocumento1.040 paginePanduit Electrical CatalognumnummoNessuna valutazione finora

- Actividad 1 Lorena GuerreroDocumento4 pagineActividad 1 Lorena GuerreroAlfonso GutierrezNessuna valutazione finora

- Butterworth Filter Design With A Low Pass ButterworthDocumento8 pagineButterworth Filter Design With A Low Pass ButterworthashishkkrNessuna valutazione finora

- Cap Screws: Sae J429 Grade IdentificationDocumento6 pagineCap Screws: Sae J429 Grade IdentificationHomer SilvaNessuna valutazione finora

- ELSAP11Documento11 pagineELSAP11Angelo Sanchez Iafanti0% (1)

- Activity9 PDFDocumento5 pagineActivity9 PDFSmitNessuna valutazione finora

- Automotive DevicesDocumento152 pagineAutomotive DevicesLeticia PaesNessuna valutazione finora

- Positector Calibration ProcedureDocumento6 paginePositector Calibration ProcedureluigimasterNessuna valutazione finora

- SQAP For Pumps 2017Documento79 pagineSQAP For Pumps 2017MukeshNessuna valutazione finora

- Owatch VR Games Quotation - 2017!4!24Documento3 pagineOwatch VR Games Quotation - 2017!4!24ali4957270Nessuna valutazione finora

- Recondition BatteryDocumento46 pagineRecondition Batteryafic219473100% (1)