Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

B W Digitized 030614

Caricato da

Jay GalvanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

B W Digitized 030614

Caricato da

Jay GalvanCopyright:

Formati disponibili

Thursday, March 6, 2014

TODAYS ISSUE:

3SECTIONS

24PAGES

P25

METRO MANILA,

PHILIPPINES

S1/1-12

www.bworldonline.com

Debt ratio

better as of

Q3 last year

Debt, S1/3

GENERAL GOVERNMENT (GG)

debt as a percentage of the econo-

my improved as of the third quar-

ter of 2013 from a year earlier as

the state continued to manage its

liabilities.

The Finance department, in a

statement, placed the obligations

at P4.468 trillion as of September

2013, comprising 39.7% of gross

domestic product (GDP).

The GG-debt-to-GDP ratio is

an improvement from the 40.3%

recorded a year earlier as well as

the 40.6% recorded at the end of

2012.

General government debt con-

solidates the outstanding debt of

the national government (NG)

less those held by the Bond Sink-

ing Fund, local government units

(LGUs), Central Bank Board of

Liquidators (CB-BOL) and social

security institutions (SSIs).

It also excludes intra-sector

debt holdings, which comprise NG

debt held by SSIs and LGUs, and

LGU debt held by the Municipal

Development Fund Ofce.

February infation

lower than expected

INFLATION EASED to 4.1% in

February, the Philippine Statis-

tics Authority (PSA) reported on

Wednesday, giving monetary au-

thorities the leeway to keep policy

rates steady later this month.

The February headline number,

which was traced to lower price

hikes for alcoholic beverages, to-

bacco and transport, was down

from Januarys 4.2%. It was, how-

ever, signicantly faster than the

3.4% registered a year earlier.

The result fell within the Bang-

ko Sentral ng Pilipinas (BSP) 3.8-

4.6% outlook for the month and

was lower than the 4.3% median

forecast in a BusinessWorld poll.

Core ination, which excludes

items such as food and energy with

volatile price movements, also

went down to 3.0% in February

from 3.2% in January.

Ination, S1/3

Halted

Police block farmers at the gates of the House of Representatives in Quezon City in this photo taken yesterday. The farmers

were protesting the extension of the Comprehensive Agrarian Reform Program and proposed amendments to the Constitution.

By Judy Danibelle T. Chua Co

Senior Researcher

REUTERS

Philippines

under pressure over

high rice prices

Meralco says rates to go down

CUSTOMERS of Manila Electric

Co. (Meralco) can expect to pay

less for power this month, the dis-

tribution utility yesterday said,

given lower costs incurred from

suppliers.

We have good news for our

customers. They may see another

decrease in the generation charge

in their March bills [following a re-

duction last month], the company

said in a statement.

Februarys generation charge

was P5. 54 per kilowatt-hour

(kWh), down from the P5.67/kWh

imposed in January.

RICE PRICES in the Philippines

have risen for six straight weeks,

piling pressure on the government

to import more of the national

staple to stabilize markets and

curb infation already at two-year

highs.

While bumper harvests in other

countries have stoked a global

rice glut, prices in the Philippines

have climbed around 4% in the

last three months after super

typhoon Haiyan devastated key

growing regions and as the gov-

ernment clamps down on smug-

glers looking to avoid hefty taxes.

Increased purchases by the

Philippines, one of the worlds

largest rice buyers, would help

ease global oversupply, with

Vietnam and Thailand likely to bid

aggressively for any new deal from

their Southeast Asian neighbor.

National Food Authority (NFA)

spokesman Rex C. Estoperez

confrmed reports that Manila

has since late January doubled

the amount of rice being released

into markets from stockpiles most

days, looking to curb price gains.

Private traders are running out

of stocks, thats why we have re-

leased [more] rice into the market

from our warehouses, he said.

That has further drained

NFA stocks that had dwindled

to around 275,000 tons at the

start of the year equivalent to

eight days worth of consumption,

nearly half normal levels. Figures

for January are due to be released

next week.

The US Department of

Agriculture has already said it

expects Philippine imports to hit

1.4 million tons in 2014, which

would be the highest in four years.

The country has yet to confrm

any purchases beyond 500,000

tons it bought from Vietnam in a

government-to-government deal in

November. Vietnam, the worlds

second-biggest rice exporter after

India, is traditionally the Philip-

pines biggest supplier as it usu-

ally offers cheaper rice.

For Thailand, a deal to sell

rice to the Philippines would help

offoad some of its huge reserves

and raise much-needed money to

pay farmers that participated in a

controversial subsidy scheme.

The average retail price of well-

milled rice in the Philippines rose

a further 1.2% in February from

the previous month to P40.12

per kg, and was up 13.7% from a

year ago, data from the Bureau of

Agricultural Statistics showed on

Tuesday.

Mr. Estoperez said the NFA had

doubled the rice allocated each

day to government accredited

outlets to 2,500 kg per location.

Details on the number of accred-

Based on initial figures, the

cost of supply from our power

supply agreements, independent

power producers and from the

Wholesale Electricity Spot Market

have all gone down during the Feb-

ruary supply month, which will

impact on the March bill, Meralco

said.

The generation charge the

cost of power sold to a power dis-

tributor accounts for around

57% of total charges in Meralcos

electricity bill. The rest comprises

the distribution charge (17.6%),

transmission charge (9%), system

loss charge (5%), and taxes and

other charges (11.5%).

The rm said the March gener-

ation rate was still being nalized.

Meralco utility economics head Meralco, S1/3

By Claire-Ann C. Feliciano

Reporter

Larry S. Fernandez said the gure

could be announced by Monday.

There are no gures yet. There

are strong indications that genera-

tion charge will be lower than Feb-

ruarys, Mr. Fernandez reiterated

in a text message.

Meralco also urged customers

to prepare for the summer months

as electricity consumption histori-

cally goes up during the period.

According to our weather

bureau... we could start experi-

encing... hot weather starting

next month. Given this advisory,

we would like to encourage our

customers to practice energy ef-

ciency, the rm said.

Meralco suggested unplugging

appliances when not in use and

Rice, S1/3

SECTION 1

2 THE ECONOMY

4-5 OPINION

6 CORPORATE NEWS

7 PROPERTY

8 AGRIBUSINESS

9 WORLD

10-12 THE NATION

SECTION 2

1&3 BANKING & FINANCE

2 STOCK MARKET

4-5 WORLD SPORTS

6-7 ARTS & LEISURE

8 SPECIAL FEATURE

SECTION 3

1-2 FINANCIAL TIMES

3 WORLD BUSINESS

4 WORLD MARKETS

CONTENTS VOL. XXVII, ISSUE 154

WORLD REVIEW

GENEVA

Mercedes, Inniti to cooperate

Daimlers Mercedes and Nissans Inniti

plan to pool development of compact

cars to cut costs, expand the German

car makers North American production

and broaden the Inniti lineup, people

familiar with the matter said. S3/3

NEW YORK

Stocks rise on reduced tensions

US stocks rallied on Tuesday, with the

S&P 500 at a record high, as fears eased

of a confrontation between Russia and

Ukraine and Russian President Vladimir

Putin said there was no need to use military

force in the Crimea region for now. S3/4

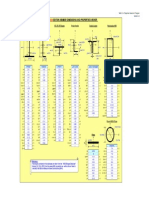

5050

5120

5190

5260

5330

5400

4850

4960

5070

5180

5290

5400

STOCK MARKET

ASIAN MARKETS MARCH 5, 2014

JAPAN (NIKKEI 225) 14897.63 176.15 1.20

HONG KONG (HANG SENG) 22579.78 -77.85 -0.34

TAIWAN (WEIGHTED) 8632.93 78.39 0.92

THAILAND (SET INDEX) 1351.64 5.82 0.43

S.KOREA (KSE COMPOSITE) 1971.24 17.13 0.88

SINGAPORE (STRAITS TIMES) 3116.64 11.93 0.38

SYDNEY (ALL ORDINARIES) 5446.23 46.00 0.85

MALAYSIA (KLSE COMPOSITE) 1829.11 2.65 0.15

JAPAN (YEN) 102.390 101.810

HONG KONG (HK DOLLAR) 7.760 7.761

TAIWAN (NT DOLLAR) 30.265 30.291

THAILAND (BAHT) 32.290 32.460

S. KOREA (WON) 1070.300 1071.550

SINGAPORE (DOLLAR) 1.270 1.271

INDONESIA (RUPIAH) 11580 11590

MALAYSIA (RINGGIT) 3.270 3.276

WORLD MARKETS MARCH 4, 2014

WORLDCURRENCIES MARCH 5, 2014

ASIAN CURRENCIES MARCH 5, 2014

PESO DOLLAR RATE

DOW JONES 16395.880 227.85

NASDAQ 4351.972 74.671

S&P 500 1873.910 28.18

FTSE 100 6823.770 115.42

EURO STOXX50 2957.040 56.27

$/UK POUND 1.6685 1.6702

$/EURO 1.3722 1.3753

$/AUST DOLLAR 0.8959 0.8955

CANADA DOLLAR/US$ 1.1085 1.1084

SWISS FRANC/US$ 0.8878 0.8836

INDEX

30 DAYS TO MARCH 5, 2014

OPEN: 6,399.67

HIGH: 6,482.15

LOW: 6,399.67

CLOSE: 6,456.14

VOL.: 1.741 B

VAL(P): 12.951 B

FX

OPEN P44.690

HIGH P44.680

LOW P44.790

CLOSE P44.765

W. AVE. P44.759

VOL. 758.50 M

LATEST BID

0900GMT PREVIOUS

CLOSE NET %

CLOSE NET

CLOSE PREVIOUS

30 DAYS TO MARCH 5, 2014

61.54 PTS.

0.96%

COMPOSITE

WEIGHTED AVE.

5.6

CTVS.

By Bettina Faye V. Roc

Senior Reporter

Lenten symbol

A devotee with a cross marked on her

forehead takes part in the commemo-

ration of Ash Wednesday outside a

Roman Catholic church in Paraaque,

Metro Manila in this photo taken yes-

terday. Ash Wednesday, which serves

as a reminder that as a man is dust,

so unto dust he shall return, marked

the beginning of the 40-day Lenten Sea-

son in the Roman Catholic calendar.

R

E

U

T

E

R

S

By Daryll Edisonn D. Saclag

Reporter

ASEAN-HK trade deal

studied

Malaysia, Philippines

agree to see biz

prospects

Two more

bidders for

Southwest

Terminal PPP

Committee set up for petroleum,

coal contract transparency

Public hearings

set for plastic materials,

steel products

Thursday, March 6, 2014 2/S1

The

Economy

THE PHILIPPINES is studying a

possible ASEAN free trade agree-

ment (FTA) with Hong Kong,

Trade Secretary Gregory L. Do-

mingo yesterday said.

Were conducting studies and

scoping, Mr. Domingo said on the

proposed FTA.

But, so far, the Philippines is

likely to benet from the proposed

trade pact as the balance is in the

countrys favor.

Data from the Trade depart-

ment Web site showed that Phil-

ippine exports to Hong Kong

reached $4.8 billion in 2012 while

imports amounted to $1.5 billion,

with electronics being the top

traded goods between the two.

An FTA will reduce the friction

in terms of procedures and regula-

tory measures thereby speeding

up the entry and exit of goods,

said Mr. Domingo.

IN ANTICIPATION of the next

Philippine Energy Contracting

Rounds (PECR), slated to take

place this year, the Energy depart-

ment has ordered the creation of a

committee to ensure a more trans-

parent and competitive system of

granting the rights to explore and

develop the countrys coal and pe-

troleum resources.

The department, in a circular

posted on its Web site, has out-

lined procedures to govern the

system of awarding petroleum

service contracts and coal operat-

ing contracts.

This circular shall apply to the

determination of the legal, techni-

cal, and nancial qualications of

applicants, the evaluation of their

applications, and the award of cor-

responding service and operating

contracts for petroleum and coal

resources, the document, dated

Feb. 24, stated.

The circular creates a Review

and Evaluation Committee (REC)

to consist of the undersecretary in

charge of the Energy Resource De-

velopment Bureau, his assistant,

and the directors of the ERDB, le-

gal services, and nancial services.

As part of its responsibilities, the

REC is tasked to identify the pro-

spective coal and petroleum areas

within the countrys territory.

In this regard, the REC shall

notify the local government units of

the ofered areas within their terri-

torial jurisdiction, prior to the inclu-

THE TARIFF Commission has set

a public hearing for petitions to

modify tarif lines for plastic mate-

rials and steel products, according

to a notice published in a newspa-

per yesterday.

The Tariff Commission will

conduct a public hearing on Mar.

20 at 9:00 a.m. regarding the pe-

titions on the tariff modification

of polylactic acid (PLA) film and

semi-finished products of iron

or non-alloy steel. Venue of the

hearing is at the Tariff Commis-

sion Conference Room, 5

th

floor,

Philippine Heart Center Building,

East Avenue, Quezon City, the

notice said.

Products that will be covered

by the hearing are other plates,

sheets, film, foil and strip, of

other polyesters with tarif code

3920.69.00 and semi-finished

products of iron or non-alloy

steel with tarif codes 7207.11.00,

7207.12.90, 7207.19.00, 7207.21.21,

7207. 20. 29, 7207. 20. 92, and

7207.20.99.

The petition to modify the tarif

line on PLA lm was led by plas-

tic maker First In Colours, Inc.

which imports the product from

Japan. The petition to modify the

tariff line on steel products was

not immediately provided, how-

ever. Daryll Edisonn D. Saclag

TAXWISE

OR OTHERWISE

Carlos R. Mateo

The right to due process in a tax assessment

THE BUREAU of Internal Reve-

nue (BIR) has the gargantuan task

of collecting P1.4 trillion in tax

revenue for 2014. Consequently,

various revenue issuances have

been circulated to enhance tax

compliance and intensify collec-

tion eforts. One such issuance is

Revenue Memorandum Circular

(RMC) No. 11-2014, clarifying cer-

tain issues arising from amend-

ments introduced by Revenue

Regulations No. 18-2013 on RR 12-

99 relative to the tax assessment

process. In ne-tuning policy in-

terpretations, the RMC raises sev-

eral points of interest.

Foremost, the RMC operation-

ally denes the term duly autho-

rized representative as referring

to Revenue Regional Directors,

Assistant Commissioner - Large

Taxpayers Service and Assistant

Commissioner - Enforcement

and Advocacy Service. Upon re-

ceipt of a preliminary assessment

notice (PAN) or Formal Letter of

Demand/Final Assessment Notice

(FLD/FAN) from the BIR, the tax-

payer must le a response or pro-

test letter with the duly authorized

representative who signed the

PAN or FAN. Filing with the wrong

ofce/person is fatal to the pursuit

as it will render such response or

protest as not led at all. Conse-

quently, the ndings become nal,

resulting in the issuance of a FAN

(for wrongly led response to the

PAN) or a non-appealable assess-

ment (for wrongly filed protest

letter to the FAN).

Although RR 18-2013 had elimi-

nated the need for the BIR to issue

a notice of informal conference

(NIC) as part of the assessment

process, taxpayers still have the

option of paying the deficiency

taxes and penalties prior to the

issuance of the PAN. In such cases,

voluntary payment stops the run-

ning of the 20% per annum pen-

alty interest. While this provides

momentary relief from escalating

tax liabilities, the option ofers no

guarantee that the ndings of the

Revenue District Office (RDO)

will be sustained by the reviewing

office (i.e., Regional Office, Legal

Service or equivalent office). In

other words, early settlement of

deciency taxes may not provide

any benefit if the initial findings

are set aside and a new assessment

is issued by the reviewing office

that is different from the earlier

recommendations by the RDO.

Further, the RMC states that a

nal demand letter for payment of

delinquent taxes may be considered

a decision on a disputed assess-

ment. Although such statement

finds basis in certain court deci-

sions, it would only seem fair to tax-

payers if the BIR will unequivocally

state that the final decision will

follow the specic form of a Final

Decision on Disputed Assessment

(FDDA) as provided in Section 3.1.5

of RR 18-2013. This would dispel

any confusion on whether a notice

is considered an FDDA or not.

Under the rules, once an FDDA is

issued by the BIR, the taxpayer has

only 30 days from receipt thereof to

le an appeal.

Under RR 18-2013, If the tax-

payer within 15 days from date of

receipt of PAN responds that he/it

disagrees with the ndings of de-

ciency tax or taxes, an FLD/FAN

shall be issued within 15 days from

ling/submission of the taxpayers

response, calling for payment of

the taxpayers deficiency tax li-

ability, inclusive of the applicable

penalties. While the non-obser-

vance of the 15-day period for the

issuance of the FAN shall not afect

its validity, the RMC provides that

the revenue ofcer who caused the

delay shall be subject to adminis-

trative sanctions.

The foregoing provision under

the RR denotes that any response

to the PAN will automatically be

denied and, thus, efectively negates

the pre-assessment notice stage.

This appears to violate the spirit of

the due process requirement under

Section 228 of the Tax Code, which

requires the BIR to rst notify the

taxpayer of the ndings and to re-

quire a response. If the taxpayer

fails to respond, the BIR shall issue

a FAN based on said ndings.

It is also worthy to state that,

in a number of cases, the courts

have held that the 15-day period

for the taxpayer to formally reply

to the PAN is mandatory, and the

non-observance thereof is con-

sidered a violation of due process.

Thus, the CTA has, on occasion,

ruled against the BIR and nullied

assessments where the FAN was

issued without waiting for the tax-

payers reply to the PAN or before

the lapse of the 15-day period.

Though the current assessment

process still gives taxpayers a 15-

day period to respond to the PAN,

the fact that any such response

will automatically be denied with

the issuance of the FAN another

15 days after, effectively makes

the taxpayers response a mere

formality. One could say that the

grant of the 15-day period is with-

out any real value and thus goes

against the spirit of the due pro-

cess requirement under our laws.

Fundamentally, No person shall

be deprived of life, liberty and prop-

erty without due process of law, nor

shall any person be denied the equal

protection of the laws. (Article III,

Section I of the Bill of Rights of the

Philippine Constitution).

The power of taxation must be

exercised with restraint since it

deprives a taxpayer of his proper-

ty. Thus, in Roxas vs. Court of Tax

Appeals, G.R. No. L-25043, dated

April 26, 1968, the Supreme Court

held: The power of taxation is

sometimes called also the power to

destroy. Therefore it should be ex-

ercised with caution to minimize

injury to the proprietary rights of

a taxpayer. It must be exercised

fairly, equally and uniformly, lest

the tax collector kill the hen that

lays the golden egg. And, in order

to maintain the general publics

trust and confidence in the Gov-

ernment, this power must be used

justly and not treacherously.

The constitutional right to

due process has primacy over the

power of taxation, such that In

balancing the scales between the

power of the State to tax and its

inherent right to prosecute per-

ceived transgressors of the law on

one side, and the constitutional

rights of a citizen to due process of

law and the equal protection of the

laws on the other, the scales must

tilt in favor of the individual, for a

citizens right is amply protected

by the Bill of Rights under the Con-

stitution. Thus, while taxes are

the lifeblood of the government,

the power to tax has its limits, in

spite of all its plenitude. (CIR vs.

Metro Star Superama, Inc.)

Based on the foregoing, it is sin-

cerely hoped that the BIR would

revisit the provision of RR 18-2013

(as reiterated in RMC 11-2014) and

consider the arguments raised by

the taxpayer in response to the

PAN, instead of issuing an outright

denial by the issuance of a FAN.

In creating consonance, there is

wisdom to reconciling conicting

interests. While citizens must pay

taxes without much hindrance,

the authority to tax must also be

wielded with utmost consider-

ation for the common good.

The author is a director at the tax

services department of Isla Lipana

& Co., the Philippine member rm

of the PwC network. Readers may

call (02) 845-2728 or e-mail the

author at carlos.mateo@ph.pwc.

com for questions or feedback. The

views or opinions presented in this

article are solely those of the author

and do not necessarily represent

those of Isla Lipana & Co. The rm

will not accept any liability arising

from the article.

BUSINESSMEN from Malaysia and

the Philippines have agreed to ex-

plore investment opportunities in

each others palm oil, rubber, infra-

structure, and tourism sectors, Trade

Secretary Gregory L. Domingo yester-

day said.

These interests were expressed

at business matching activities held

last week in Kuala Lumpur, which co-

incided with President Benigno S.C.

Aquino IIIs state visit there, the Trade

offcial noted.

In one of the business meet-

ings, Mr. Domingo said government

offcials met with representatives of

Malayan Banking Bhd (Maybank), re-

sort operator Genting Malaysia Bhd,

and low-cost airline AirAsia Bhd.

TWO more rms are bidding for

the P2.5-billion Integrated Trans-

port System (ITS) Southwest

Terminal Project under the De-

partment of Transportation and

Communications (DoTC).

The DoTCs Special Bids and

Awards Committee on Tuesday

released General Bid Bulletin

No. 07-2014, which added State

Properties Corp. and Expedition

Properties Corp. to the nine com-

panies vying for the public-private

partnership (PPP) project.

The second of two rounds of

meetings was initially to take place

Mar. 17-19 but was extended for

the new entrants, which will both

be present on Mar. 20.

The bid bulletin also required

participants to submit any ques-

tions three calendar days before

their scheduled conference with

the DoTC.

Bid submission deadline and

opening of qualification docu-

ments have been set for May 15,

with scrutiny of the latter occur-

ring within ten days of submission.

Technical proposals will be

opened in June and evaluated

within 20 days of submission. Fi-

nancial proposals will also be

opened that month and evaluated

in 15 days.

The Notice of Award (NoA) will

be released within ve days from

the winners selection.

Upon receiving the NoA, the

winning bidder must prove com-

pliance before signing the Date of

Concession Agreement.

The nine other participant com-

panies, in order of scheduled meet-

ings, are D.M. Wenceslao and As-

sociates, Inc.; the co-bidding Ayala

Land, Inc. and Ayala Corp.; Metro

Pacic Tollways Corp.; San Miguel

Corp.; Vicente T. Lao Construction;

Egis Projects SA; Robinsons Land

Corp.; Filinvest Land, Inc.; and

Megawide Construction Corp.

The ITS Southwest Terminal

Project will be built southwest of

Metro Manila near the Manila-

Cavite Expressway and will serve

Manila-bound commuters from

Cavite.

According to the PPP Center

Web site, previously awarded

contracts for PPPs as of Feb. 14,

2014 are the P2.01-billion Daang

Hari-SLEX Link Road Project,

P16.28-billion PPP for School

Infrastructure Project Phase I,

P15.52-billion NAIA Expressway

Project, P3.86-billion PSIP Phase

II, P5.69-billion Modernization of

the Philippine Orthopedic Center,

and the P1.72-billion Automatic

Fare Collection System. Anton

Joshua M. Santos

According to the Hong Kong

governments Web site, the FTA

is expected to cover elimination

of tariff and non-tariff barriers;

preferential rules of origin; lib-

eralization of trade in services;

liberalization, promotion and pro-

tection of investment; and dispute

settlement mechanism.

Hong Kong, according to the

ASEAN (Association of Southeast

Asian Nations) Web site, initially

proposed to join the ASEAN-Chi-

na FTA in 2011.

But, Mr. Domingo said the

10-member bloc counter-pro-

posed a separate trade pact with

Hong Kong last year.

At that time, Hong Kong was

requesting accession into ASEAN-

China FTA. But we thought it is

better to negotiate a separate one

since accession is more difcult,

the Trade ofcial said.

Since then, he said, ASEAN

member-states Brunei, Cam-

bodia, Indonesia, Laos, Malaysia,

Myanmar, the Philippines, Sin-

gapore, Thailand, and Vietnam

have started their own studies on

the proposed trade pact.

Aside from the FTA with China,

the bloc also has trade agreements

with Japan, Australia, New Zea-

land, South Korea, and India.

Mr. Domingo said ASEAN and

Hong Kong have not yet set a time-

table for the agreement.

The Trade official also said he

does not see the Manila hostage

crisis involving Hong Kong na-

tionals in 2010 as a roadblock.

For me, its business as usual,

he said.

ASEAN is Hong Kongs second

largest trading partner after China

for trade in goods. Daryll Edi-

sonn D. Saclag

We invited Maybank to look at

shariah banking in the Philippines.

They said they will look at it. For

AirAsia, they said they will study very

seriously a Kuala Lumpur-Davao link.

For Genting, we requested them to

make an all-Philippine-islands tour,

and they said they will consider it.

They also expressed interest in palm

oil plantation in Mindanao, said Mr.

Domingo.

Investor interest in the Philip-

pines is expected to increase

further once the Comprehensive

Agreement on the Bangsamoro be-

tween the government and the Moro

Islamic Liberation Front is signed

this year, he added.

The Trade chief also said that the

Philippines offered Malaysia assis-

tance in accrediting halal products.

Philippine exports to Malaysia

reached $1.017 billion in 2012 while

imports amounted to $2.503 billion.

sion to the PECR, the circular read.

The committee will also have

the obligation to examine, evaluate

and review the technical, nancial,

and legal capabilities of project ap-

plicants and, after which, recom-

mend to the Secretary the award

of contracts.

It is also the RECs responsibil-

ity to [r]esolve issues in relation

to the legal, technical and nancial

capabilities of applicants, includ-

ing motions for reconsideration.

The circular also detailed the

procedure for awarding petroleum

service contracts and coal operat-

ing contracts.

Since the REC will determine

the prospective areas, it should

also prepare the PECR documents

with description of available data.

Such data should include the

location map and technical de-

scription of areas being ofered and

schedule of activities for the PECR.

A pre-submission conference

for PECR applications should be

scheduled to discuss relevant rules

and entertain clarications from

prospective applicants.

Submission of applications

should be based on the existing

guidelines.

The evaluation should be based

on legal qualication using a pass or

fail criterion; work program (40%);

technical qualication (20%); and

nancial qualication (40%).

The highest ranked applicant

who meets the... requirements

shall be selected, the circular read.

The legal department and

ERDB should prepare the final

contract that will be awarded.

Applicants, within seven days

from the receipt of the award no-

tice, should pay necessary fees and

charges.

State-owned PNOC Exploration

Corp. (PNOC-EC) has been given a

reserved option to acquire a maxi-

mum of 10% interest in a contract

involving one or more Filipino

participants and 15% for a contract

with no Filipino participant.

All rights, privileges, benets,

costs, expenses, obligations and

liabilities of PNOC-EC shall be

in proportion to its participating

interest in the proposed service

contract, the circular noted.

Previous contractors with can-

celled to terminated contracts due

to outstanding work and nancial

obligations are no longer allowed

to join the PECR.

The circular will take efect f-

teen days following its publication

in two newspapers.

Under the PECR 4 which

took place last year the Energy

department ofered 38 coal and 15

petroleum blocks for exploration

and development.

The auction received 69 bids

for 28 coal contracts and 20 ofers

for 11 petroleum contracts, but the

department only awarded 11 coal

and four petroleum contracts.

Claire-Ann Marie C. Feliciano

TARIFF lines for steel products are up for possible modifcation.

Thursday, March 6, 2014 S1/3

Infation,

fromS1/ 1

Year-to-date ination averaged

4.2%, still within the BSPs 3-5%

target for 2014.

Central bank Governor Aman-

do M. Tetangco, Jr., in a text mes-

sage to reporters, said the latest re-

sults would help keep the average

inflation over the policy horizon

within the governments [3-5%]

target range.

Moving forward, Mr. Tetangco

said monetary authorities would

continue to monitor global de-

velopments, adding: We will also

be watchful of trends in domestic

liquidity and lending.

He noted that the policy-mak-

ing Monetary Board would make

adjustments to policy levers as

appropriate to ensure that liquid-

ity continues to be channeled to

productive sectors of the economy

and that ination expectation re-

main well-anchored.

During its first policy meet-

ing for the year last Feb. 6, the

Monetary Board kept the BSPs

overnight borrowing and lending

rates at record lows of 3.5% and

5.5%, respectively. The inflation

forecast for this year, however, was

trimmed to 4.3% from 4.5% while

that for 2015 was hiked to 3.3%

from 3.2%.

The BSP has kept its overnight

borrowing and lending rates at

3.5% and 5.5% since October 2012.

The rate on all special deposit ac-

count (SDA) maturities has been

steady at a uniform 2% since June

2013.

Economists were in agreement

that the central bank was likely to

keep key rates steady at its March

27 policy-setting meeting. Tight-

ening, they said, could start in the

second half of the year.

We expect both the policy

overnight rate and the special de-

posit accounts rate to stay steady

through the rst half, as the central

bank has enough space to main-

tain a wait-and-see approach until

its third policy rate meeting, said

Eugenia Fabon Victorino, ANZ

economist for the Asia-Pacic.

We forecast the tightening

cycle to commence by the second

half and expect the interest rate

to rise by at least 50 basis points

(bps) by yearend, she added.

Jef Ng, economist at Standard

Chartered Bank in Hong Kong,

agreed, adding that domestic price

pressures remain in food and en-

ergy.

We expect the central bank

to keep rates unchanged in the

rst half as ination remains man-

ageable. Nonetheless, we expect

a 25-bps hike in the third quarter

and another 25 bps in the fourth

quarter, as price pressures remain

in food and energy, especially with

recent uptrends in international

food and crude oil prices, he said.

Gundy Cahyadi, economist at

DBS Bank Ltd., meanwhile, said

inflation was coming in below

expectations given that some of

the cost-push factors werent as

strong.

We are re-looking at our ina-

tion forecast for the year and we

maintain our stance that the cen-

tral bank will continue to stay put

for now. But we still expect them

to raise rates by at least 50 bps by

yearend to prevent the economy

from overheating, he said.

The PSA, meanwhile, said in a

statement that the February ina-

tion reading was due to slower

annual movements registered in

the indices of alcoholic beverages

and tobacco and transport.

Prices of alcoholic beverages

and tobacco rose by 7.1% in Febru-

ary, easing from 17.6% in January,

while transport costs rose by 1.0%,

down from 1.2%.

Citi economist Jun Trinidad

noted temporary relief from up-

side inflation risk coming from

easing excise tax effects on ciga-

rettes and alcoholic beverages.

Prices of cigarettes and al-

coholic beverages rose by high

double digits last year after excise

taxes were adjusted in January

2013. Taxes will be adjusted again

in 2015.

The heavily weighted food and

non-alcoholic beverages index,

meanwhile, rose by 5.5%, un-

changed from the previous month.

The food alone index, however,

accelerated to 5.9% from 5.7%.

Prices of rice, milk, cheese, eggs,

oils and fats, fruits, sugar, jam,

honey, chocolate, and other food

products rose at a faster pace.

Higher increases were also

recorded in the indices of cloth-

ing and footwear; housing, water,

electricity, gas and other fuels;

furnishing, household equipment

and routine maintenance index;

and health. with a report from

A. R. R. Gregorio

ited outlets in the Philippines were

not immediately available.

He also noted that government

moves to crack down on smugglers

had pushed prices higher. Philip-

pines customs have been on a drive

to curb smuggling that has been rife

as some importers look to avoid a

whopping 40% duty on private ship-

ments of rice and to get around a

quota system.

Critics have long argued the tariff

should be reduced to encourage legal

imports, but President Benigno S.

C. Aquino IIIs government says it is

necessary to support local farmers.

Reuters

Rice,

fromS1/ 1

Debt,

fromS1/ 1

Before President Benigno

S. C. Aquino III took office, GG

debt to GDP was 44.3% in 2009.

By reducing government debt, we

are attempting to ensure the sus-

tainability of our recent economic

resurgence, Finance Secretary

Cesar V. Purisima was quoted as

saying in the statement.

The Aquino administration

continues working towards the

virtuous cycle of good govern-

ance through proactive liability

management. As a result of these

initiatives, we are creating fiscal

space in the budget to increase

investments in our people, our key

driver of economic growth, he

added.

The Finance department said

the annual decline was mainly due

to the national governments pur-

chase of more debt from domestic

sources at cheaper interest and

longer maturities.

Of the total NG debt as of the

third quarter, 66% came from do-

mestic sources and 34% from for-

eign creditors an improvement

from the 61:39 mix recorded in the

comparable 2012 period.

This was likewise reflected in

the overall GG debt mix, which in

the period was at 59:41 in favor of

domestic sources versus the 51%

domestic and 48% foreign mix re-

corded as of September 2012, the

department said.

A decline in Local Government

Unit debt to P70.7 billion, or 0.6%

of GDP, as compared to the Sep-

tember 2012 level of P71.3 billion,

or 0.7% of GDP, also contributed to

the decline in GG debt, it added.

Debt as a percentage of GDP

is a measure used by many debt

watchers to assess the creditwor-

thiness of sovereigns.

Meralco,

fromS1/ 1

setting a timer for air conditioners

before bedtime so that the units

would not have to run the entire

night.

In buying appliances, check

and compare the energy efcien-

cy factor (EEF) of the different

brands, it added, explaining that

a higher EEF means better energy

efciency.

The utilitys announcement of

possible lower March generation

charges comes in the wake of com-

plaints on a bill format that has

caused confusion.

The Energy Regulatory Com-

mission has asked Meralco to ex-

plain the format, which included

components such as the Balance

from Previous Billing, Total Cur-

rent Amount and Total Amount

Due.

The Balance From Previous

Billing covers unpaid amounts

relating to a planned rate hike that

is being reviewed by the Supreme

Court.

A P4.15/kWh increase sup-

posed to have been implemented

in tranches beginning last Decem-

ber has been ordered shelved by

the high court, which is hearing a

complaint led by party-list legis-

lators and consumer groups.

An additional P5.33/kWh rate

hike, also to be charged in stages,

is being sought by Meralco, which

says that this covers unpaid bal-

ances to power suppliers.

Meralco has said that it has no

intention to collect the deferred

amount, which it claimed was

included in the bill only for trans-

parency purposes.

In recognition of the feed-

back we got from our customers,

though, we will make it clearer

in their March bills as to which

amount they will only have to pay.

In addition, the deferred amount

will no longer be included in the

Total Amount Due, the company

said.

Meralco also said that only

7% of its 5.5 million customers

received bills with the deferred

amount itemized, adding that

those who paid in full would be

refunded.

Meralcos controlling stake-

holder, Beacon Electric Asset

Holdings, Inc., is partly owned

by Philippine Long Distance

Telephone Co. (PLDT). Hastings

Holdings, Inc., a unit of PLDT

Benecial Trust Fund subsidiary

MediaQuest Holdings, Inc., has a

majority stake in BusinessWorld.

BERKELEY

Reading through

the just-released

transcriptsoftheUS

Federal Reserves

Federal Open Mar-

ket Committee

(FOMC) meetings

in 2008, I found

myself asking the same overarching question: What accounted for the

FOMCs blinkeredmindset as crisis eruptedall aroundit?

To be sure, some understood the true nature of the situation. As Jon

Hilsenrathof the Wall Street Journal points out, WilliamDudley, thenthe

executive vice-president of the NewYork Feds Markets Group, presented

staf research that sought, politely and compellingly, to turn the princi-

pals attention to where it needed to be focused. And FOMC members

Janet Yellen, Donald Kohn, Eric Rosengren, and Frederic Mishkin, along

with the Board of Governors in Washington clearly got the message. But

the FOMCs other eight members, and the rest of the senior staf? Not so

much(albeit to greatly varying degrees).

As I readthe transcripts, I recalledthe long history dating backto1825,

and before, in which the uncontrolled failure of major banks triggered

panic, a ight to quality, the collapse of asset prices, and depression. But

thereintheFOMCs mid-September 2008report, manymembers express

self-congratulation for having found the strength to take the incompre-

hensible decisionnot to bail out LehmanBrothers.

I nd myself thinking back to the winter of 2008, when I stole and

used as much as possible an observation by the economist Larry Sum-

mers. Inthe aftermathof the housing bubbles collapse and extraordinary

losses in the derivatives market, Summers noted, banks would have to

diminishleverage. While it wouldnot matter muchtoany individual bank

whether it did so by reducing its loan portfolio or by raising its capital, it

matteredvery muchto the economy that the banks chose the second.

Eventoday, I cannot comprehendthen-NewYorkFedPresident Timo-

thy Geithners declarationinMarch2008that, it is very hardtomake the

judgment nowthat the nancial systemas a whole or the banking system

as awholeis undercapitalized. Geithners viewat thetimewas that there

is nothing more dangerous... than for people... to feed... concerns about...

the basic core strength of the nancial system. Of course, we now know

that indiference to suchconcerns turnedout to be far more dangerous.

Likewise, I look at history and see that it is core ination (which strips

out volatile food and energy prices), not headline ination, that matters

for predictingfutureination(evenfutureheadlineination). ThenI read

declarations like that by Dallas Federal Reserve President RichardFisher,

that dangerous inationary pressure was building during the summer of

2008, andI ndmyself at a loss.

Some of the 2008-era mindset (most of it?) most likely stemmed from

the fact that there are things that are very real and solid to monetary

economists. We cansee, touch, andfeel howa nancial-deleveraging cycle

depressesaggregatedemand. Weknowthat thisyearschangeinaninertial

price, suchas wages, tells us alot about next years wagechanges, whilethis

years change in a non-inertial price, such as oil, tells us next to nothing.

And we know how herd behavior by investors means that a single salient

bank failure canturna nancial mania intoa panic, andthena crash.

But others donot see, touch, andfeel thesethings. For non-economists,

they are simply shadows onthe walls of a cave.

That distinction was less relevant in the past. The Fed of old usually had

a charismatic, autocratic, professional central banker at its head: Benjamin

Strong, MarrinerEccles, WilliamMcChesneyMartin, Paul Volcker, andAlan

Greenspan. When it worked which was not always true the chair ruled

the FOMC with an iron hand and with the near-lockstep voting support of

the governors. The views of the other members with their varying back-

groundsinbanking, regulation, andelsewherewereof littleor noconcern.

But former Chairman Ben Bernankes FOMC was different. It was

collegial, respectful, andconsensus-oriented. As a result, there was a deep

disconnect between Bernankes policy views, which followed from his

analyses in the 1980s and 1990s of the Great Depression and Japans lost

decades, andtheFOMCs failurein2008tosensewhat was comingandto

guardagainst the major downside risks.

So I nd myself wondering: What if those who understood the nature

of the crisis and those who did not had been compelled to make their

cases toBernanke inprivate? If Bernanke had thensaid, This is what we

are going to do, rather than seeking consensus that is, if Bernankes

Fed had been like the old Fed would better monetary-policy decisions

have been made in 2008?

(The author, a former deputy assistant secretary of the US Treasury, is

Professor of Economics at the University of California at Berkeley and a

research associate at the National Bureau of Economic Research. www.

project-syndicate.org)

Thursday, March 6, 2014 4/S1 Thursday, March 6, 2014 S1/5 Opinion Opinion

Revisiting

the Feds crisis

Transportation mobility

and sustainability

Game play remains at heart

of changing lifestyles

THE VIEW

FROM TAFT

Brian C. Gozun

ASwe goonour dailygrind of mov-

ing fromour homes to our ofces,

the big T that is trafc has been

getting worse by the minute, by

the hour, by the day, and through

the years. The government,

through the Metropolitan Manila

Development Authority (MMDA)

and other departments, has been

working full-time and overtime

to alleviate this seemingly endless

agony of trafc. The newly coined

term carmageddon, combin-

ing car and Armageddon, is

truly appropriate for the death of

vehicular movement along EDSA

and other major thoroughfares in

the metro. If vehicles do come to a

complete halt, what would happen

to people like us who commute

hours per day using various modes

from cars that have never experi-

enced going beyond 10 kilometers

per hour to trains that have never

ever experienced under-capacity

in their lifetimes?

For commuters, traffic goes

beyond the huge parking lot that

EDSA has become. It is all about

the ability to move from our

homes to our destinations with

ease, comfort, security and, above

all, satisfaction. Our ability to do

our duties to our families, clients,

and friends as we move from one

place to another rests on inclusive

mobility, which is a holistic con-

cept that promotes the movement

from a car-centric paradigm to

more people- and environment-

friendly transportation modes.

Dr. Danielle Guillen, an expert

on transportation policy and plan-

ning from the Ateneo Institute of

Sustainability, espouses inclusive

mobility through the concept of

sustainable transportation, which

entails expansion of levels of ser-

vice, diversication of transporta-

tion modes, a balanced land-use

plan, more efcient use of energy

and low polluting technologies,

reduction of health and safety

risks, reduction of environmental

impact and integrating the con-

cept of social equity and citizen

transportation.

The definition of sustainable

transportation is similar to our

denitionof sustainability inbusi-

ness, which espouses balance not

only in our financials but also in

our relationships with our stake-

holders, community, country,

and Mother Earth. The start of

this so-called carmageddon has

made us more aware of the need

to understand the trade-ofs that

we make as commuters. Should

we take our cars and be part of

the thousands of cars idling along

roads that were once highways in

the not-so-distant past? Should

we take the LRT and MRT in the

wee hours of the morning evenif it

is not yet Simbang Gabi (midnight

mass) season? Should we walk or

even cycle to work even if it means

losing thousands of pesos on our

glutathioneinjections and whiten-

ing soaps, creams, and whatnots?

The risks that we take as we

move from the security of our

homes to the insecurity of our

streets entail the need for trans-

portationsolutions that gobeyond

the construction of roads, which

eventually leads to the increase in

vehicles. Laws, ordinances, rules,

and regulations that have been

tried and tested (and are still being

tweaked) by the MMDA and the

City of Manila will all go to waste

if we do not do our small yet im-

pactful share in alleviating trafc

congestion.

These are the things that ir-

ritate me the most. As a pedes-

trian, I pray my rosary every time

I cross our intersections because

pedestrians and drivers alike have

become terribly colorblind. A few

seconds of waiting will not hurt

as we wait for the trafc lights to

change color! Also, LRT and MRT

management can make the level of

service in our trains a little more

humane. Even sardines would

not want to squeeze themselves

into our sauna-like train carriages

packed with sweating passengers

who can barely breathe. And for

our vehicle-driving commuters,

it would be great if we could car-

pool with friends and family alike

and choose wisely when to use

our cars over cabs. Let us not text

while driving, and let us have hap-

py thoughts to avoid road rage.

Heavy trafc, sad to say, is now

the norm in our metropolis, but

let us all do our part in trying to

alleviate congestion through sus-

tainable transportation.

All aboard, please!

(The author is an associate

professor of the Decision Sciences

and Innovation Department of the

Ramon V. Del Rosario College of

Business of De La Salle University.

Although the author is from the

green school while Dr. Guillen is

fromthe blue school, both universi-

ties adhere to the principles that

Mother Earths cover must forever

be green and her skies and oceans

forever be blue. The green guy can

be reached at brian.gozun@dlsu.

edu.ph. The views expressed above

are the authors and do not neces-

sarily reect the ofcial position of

DLSU, its faculty, and its adminis-

trators.)

SANFRANCISCO For almost as

long as there have been comput-

ers, there have been people intent

in playing games with them.

Since young programmers at

the Massachusetts Institute of

Technology came up with Space-

war! some 50 years ago, the world

of videogames has exploded into a

multibillion-dollar industry.

From the earliest days of

computer, these folks went after

computer graphics and went after

videogames, Gartner consumer

technologies research director

Brian Blau told AFP.

People enjoy games, and mar-

rying the concept of real-world

games with a computer and inter-

activity is really powerful.

Gartner predicts the world-

wide videogame market combin-

ing console, online, mobile, and

personal computer offerings will

expand from$101 billion this year

to $111 billion next year and top

$128 billion in 2017.

Whileplayonhigh-performance

desktop or laptop computers has

long captivated hardcore video-

game lovers, rival console makers

Microsoft, Sony, andNintendohave

successfully turned games into

standard family household enter-

tainment during the past 20 years,

with Xbox, PlayStation and Wii

hardware respectively.

CONSOLE KINGS

New-generation Xbox One and

PlayStation 4 consoles released

late last year are credited with

bringing new

life to a section

of the market

under pressure from the popular-

ity of smartphones and tablets.

But Nintendos latest console,

Wii U, has had trouble gaining

traction among players.

Console kings are also the big

names behind titles for play on

their hardware, but third-party

studios such as Activision Bliz-

zard, Electronic Arts, Ubisoft,

Disney Interactive, and Warner

Brothers are established titans in

game software.

While movie-like immersion

in play and broadening entertain-

ment menus to include streamed

films and television shows has

consoles proving their worth, mo-

bile games are on re.

There are more game apps

for smartphones or tablets than

any other type of mini-program

for mobile devices and it is the top

revenue-producing category, ac-

cording to Gartner.

APPS ON FIRE

Smartphones and tablets have

lured players from dedicated

handheld mo-

bile game de-

vices that, for a

time, were a hit with people who

wanted to play on the go.

Mobile game revenues can

come frompeople paying to down-

load apps or fromin-game trans-

actions in which players poney-up

to advance more quickly through

levels or buy abilities or digital

items.

Britain-based King Digital En-

tertainment, which is behind the

Candy Crush Saga game craze,

is set for a keenly anticipated

stock market debut. Other sizzling

mobile game rms include Rovio,

Wooga, and Supercell.

Even Zynga, which pioneered

online social games only to get

caught on its heels when players

turned tomobiledevices, is not out

for the count.

The San Francisco company is

intent on reviving a lineup that

includes Farmville and Words

With Friends along with a popu-

lar Zynga Poker title.

Mobile game revenue globally

is set to nearly double in the next

two years to $22 billion, according

to Gartner.

SPECTATOR SPORT

A new and ourishing eSport cat-

egory in which videogame play

is spectator sport complete with

commentators, sponsors and ads

has yet to be factored into the

global videogame revenue model.

Computer graphics represent

a new interaction paradigm, Blau

said. Todays high-detail graphics

and more immersive experiences

are almost science ction-like.

Innovations in game hardware

and software fromInternet-linked

eyewear to augmented reality pro-

grams are expected tofuel increas-

ing demand for play.

Too late

the ( justice) hero

STRATEGIC

PERSPECTIVE

Ren B. Azurin

IS SENATE President Franklin

Drilon already trying to create

some distance between himself

and his boss, President Aquino,

perhaps to re-insinuate himself

into the conversation on viable

presidential or vice-presidential

candidates for the 2016 elections?

When, last weekend, he publicly

assailed the Sandiganbayans

slow disposition of cases, he was

clearly contradicting party mate

Aquino who boasted recently, We

are moving closer to obtaining

true justice through the cases led

against those who have committed

crimes... (and) We are destroying

the last bastions of corruption.

Since observers had jeered the

Presidents boasts as patently ri-

diculous, it may be that Mr. Drilon

is now trying to curry favor with a

public openly frustrated at the tai

chi-like movement of justice in

this country.

Maybe Mr. Dri l on wants

to paint himself as the justice

champion. The hero who rides

into town and, with six-guns

blazing, brings back law and

order to the lawless frontier.

The long-sought answer to the

peoples prayers. If so, its not

a bad image to cultivate for an

aspiring president or vice-presi-

dent. The problem is persuading

people that the image is even

credible. And, as far as thats

concerned, one could reason-

ably argue that in some 28 years

in the public service as sena-

tor, Senate president (twice),

and Justice secretary (twice)

Mr. Drilon has had more than

enough chances to do the save-

the-people bit and implement

his Justice Agad ( justice at

once) vision. But, in fact, as a

long-time member of the Sen-

ate and several years as its

leader it is hard for him to

claim not to have at least sanc-

tioned assuming, charitably,

that he wasnt actually a part of

all the pork barrel scams and

influence peddling going on all

around him all these years.

Mr. Drilon is quoted as say-

ing, If we are to outrun graft and

corruption, it is imperative that

we resuscitate and recondition

our existing prosecutorial and

adjudicatory institutions against

this opponent. Sure. Of course.

But many reform advocates have

been saying the same thing for

years. And those in positions of

power to institute meaningful

improvements to our law en-

forcement and legal system like

Mr. Drilon have typically, over

the years, just played deaf, dumb,

and suspiciously blind.

If anything can illustrate viv-

idly the gaping holes in our justice

system, it is the pork barrel scam

investigations that the President

(strangely) imagines must dem-

onstrate his administrations com-

mitment to a campaign against

corruption and to a daang matu-

wid (straight path). Eight months

after it was rst exposed bya news-

paper (the Inquirer) note, not by

a law enforcement body or justice

ofcial there has been virtually

nothing happening in the subject

case other than press conferences

and televised hearings in the Sen-

ate that are no more than occa-

sions for posturing senators to lay

out for the public their intellectual

shortcomings.

Irritatingly, moreover, the cur-

rent Justice secretary, Atty. Leila

de Lima, maybe mirroring her

boss, boasts in media statements

of slam dunk evidence and yet

cannot explain why no one has

thus far been arrested, much less

COMMENTARY

J. Bradford DeLong

China, S1/ 5

China

fromS1/ 4

ANSHUN, China After a lifetime

of farming and mining in the hills

of southwest China, Zhang Zongfu

was thrust intosubsidized housing

closer to town, and into a monu-

mental urbanization drive aimed

at boosting growth.

Zhang likes his newly built digs,

which are efectively free, but city

life has been harder to settle into.

The 48-year-old villager lacks job

skills or prospects putting a ma-

jor wrinkle in Beijings blueprint

for prosperity.

Without work Im in trouble,

he said in his living room, over-

looking neat rows of freshly paint-

ed apartment blocks onthe edge of

Anshun in Guizhou, one of Chinas

poorest provinces.

The house is fine. But if you

have a house to live in and cant

feed yourself, whats the point?

he asked.

Zhangs situation illustrates

thedevelopmental dilemma facing

China as its rubberstamp parlia-

ment, the National Peoples Con-

gress, meets this week.

Economic growth and rising

prosperity are key to the Commu-

nist Partys claimto a right to rule,

and the legislators will put their

imprimatur on

reforms it has

promised.

By 2030, projections say a bil-

lion Chinese will live in cities

up 300 million from now, nearly

equal to the population of the

United States.

Beijing hopes that if the urban

inux earn and spend more it will

both reduce poverty faster and

help switch the economy to grow-

ing through consumption rather

than investment.

But if local governments simply

build the shells of cities with no

economy that former farmers can

participate in, they may simply be

digging a deeper investment hole

and creating neighborhoods full

of idle inhabitants.

This is certainly something

Ive seen in other places, where

you have people cut of from the

way theyve made their living their

entire life. Then theres nothing

really that they can do, said Tom

Miller, the Beijing-based author of

Chinas Urban Billion.

And if this

ha ppe ns on

a grand scale

across the country, then poten-

tially youre building up enormous

problems, hesaid. Thats thefear,

if you look 10 to 15 years ahead.

Guizhou is constructing 180

sites to resettle two million people

by 2020, surpassing even the 1.3

million relocated for the vast

Three Gorges Dam.

But while the first batches of

villagers have been taken to their

newwhite-trimhomes in Anshun,

it has not yet taken the country-

side out of the villagers.

Several said they missed the se-

curity of growing their own food.

Just in case, Zhang and his wife

who heaved a basket packed with

vegetables up four ights of stairs

to their apartment have filled

one of their three bedrooms with

giant sacks of rice.

NOWAYTOGOBACK

Under Xi Jinping the Communist

party has promised to speed up

changes to a hukou residency

systemwhich denies rural incom-

ers equal access to services such as

schooling and healthcare.

But specifics are still pending

and cities, especially large and

crowded ones, have resisted lifting

hukou restrictions and spending

more on migrants.

Experts call such reforms criti-

cal, as a social safety net would

encouragemigrants tospend more

and better education would im-

prove the prospects of the next

generation.

Relocated villagers in Anshun

complained that government of-

cials promised compensation and

jobs but, since the move in June

2013, have only provided a few

days training on smarter farming.

ANALYSIS

Chinas urban drive risks

digging economic hole

tried and convicted. Further, for

the last ve months, the Ofce of

the Ombudsman has been inves-

tigating the evidence but has yet

to le a case against those accused

in this massive plunder of the

peoples money.

My, my. The Filipino people

are well in their rights to throw

up their hands in sheer exaspera-

tion and ask, is this slow motion,

snail-paced, tai chi-like move-

ment at all appropriate for the

administration of justice in a

society? And, are the drawn-out,

protracted, purported investiga-

tions into the pork barrel scam

not actually an attempt to just

limit the damage and cover up the

involvement of key administra-

tion allies?

President Aquino is clearly

delusional if he thinks his govern-

ment has adequately demonstrat-

ed its stand with justice, honesty,

and accountability or that he is

shaping a better society for a

justice-deprived Filipino people.

Indeed, he has yet to answer sat-

isfactorily the question, what are

these so-called reforms you say

you have instituted?

Mr. Drilon is reported to have

lamented the fact that the San-

diganbayan takes an average of

seven years to decide a case, from

the ling of the information to the

promulgation of judgment, He

then is said to have added, rather

superuously, Such a drawn-out

process of litigation is injustice in

itself. The people donot need him

to tell themthat.

From a wider perspective,

though, Mr. Drilon is guilty of

selective targeting because the

glaring faults in our justice sys-

tem encompass more than just

the Sandiganbayan. According to

the Davide-era Action Program

for Judicial Reform, the crucial

issues that need to be addressed

if we are to have a justice sys-

tem that is fair, accessible and

efficient, independent and self-

governed are: i) case congestion

and delay, ii) budget deficiencies,

iii) the politicized system of ju-

dicial appointments, iv) the lack

of judicial autonomy, v) human

resource inadequacies, vi) dys-

functional administrative struc-

ture and operating systems, vii)

insufficient public information

and collaboration with society,

viii) perceived corruption in the

judiciary, and ix) limited access

to justice by the poor. To that, one

has to add other elements neces-

sary to bring about reform in our

system for bringing lawbreakers

to justice. These would include

programs and equipment invest-

ments to enhance law enforce-

ment capabilities (for the preven-

tion and solution of crimes) and

to improve correction facilities

(for the punishment and reha-

bilitation of criminals). Action is

such areas is directly within the

sole power of the President and,

four years into Mr. Aquinos ad-

ministration, nothing significant

has been done in this connection.

Buying the police Glock pistols

does not qualify as institutional

reform.

Indisputably, since Mr. Aquino

has not taken meaningful action

to introduce reforms in the areas

that he has repeatedly stressed

are the focus of his administration

corruption and lack of justice

then he can no longer qualify as

the peoples hero and savior. Thus,

perhaps, the attempt by Aquino

ally (and once-rabid Arroyo sup-

porter) Drilon to begin to portray

himself nowinthat role. It is prob-

ably much too late.

Several ridiculed the idea, say-

ing they had left their land and

sold their farming equipment.

Theres no way to go back and

farm, said 60-year-old Nuo Min-

gsheng. Its too far away, the land

has not been cultivated, the farm-

ing tools are gone, the houses have

been dug up.

Right now Im living off the

farming tools and other things I

sold from my old home, and Im

not sure what Ill do after that,

he said.

For urbanisation to work local

authorities will have to adapt to

reality, said University of Wash-

ington professor KamWing Chan.

With some exceptions, he

said, Local bureaucrats are very

bureaucratic, they just follow

the plan without seriously con-

sidering the local situation.

But the trend of urbanisation

is inexorable, especially among

young people, said Jonathan

Woetzel, a Shanghai-based direc-

tor at consultancy McKinsey and

Company and co-chair of the Ur-

ban China Initiative.

Even without a job guarantee

or hukou reform, he pointed out,

it hasnt stopped anybody from

migrating so far.

As productivity increases you

expect to see better standards of

living, he said.

Yet back in Anshun, Guo Taifu, a

43-year-oldformerminer, wondered

howhewouldsupport his threechil-

dren. Ofcials had ofered work at a

construction site but villagers con-

sideredthepaytoolow, hesaid.

Imworried, period.

BusinessWorldis published

Monday through Friday by

BusinessWorld Publishing

Corporation, with editorial ofces

at 95 Balete Drive Extension,

NewManila, Quezon City,

Metro Manila, Philippines 1112.

Telephone numbers: 535-9901

private exchange connecting all

departments; Editorial 535-9919,

Fax No. 535-9918; Advertising

535-9941, Fax No. 535-9939;

Circulation 535-9940; Finance

535-9933; Personnel 535-9936,

Fax No. 535-9937. ALL RIGHTS

RESERVED. No material in this

newspaper can be reproduced

in part or in full without

previous written permission

fromthe BusinessWorld

Publishing Corporation.

PHILIPPINE PRESS INSTITUTE

The National Association of Philippine Newspapers

How to reach BusinessWorld

We prefer to receive letters via e-mail, without attachments. Writers should disclose any connection or

relationship with the subject of their comments. All letters must include an address and daytime and

evening phone numbers. We reserve the right to edit letters for clarity and space and to use them in all

electronic and print editions. E-mail: editor@bworldonline.com Fax: +632-535 9918

BusinessWorld can be accessed online at www.bworldonline.com

RAULL. LOCSIN

Founder

ROBYALAMPAY

Editor-in-Chief

ARNOLD E. BELLEZA

Executive Editor

WILFREDOG. REYES

Managing Editor

MARIAELOISAI. CALDERON

News Editor

ALICIAA. HERRERA

Associate Editor

FRANCISCOP. BALTAZAR

Foreign News Editor

KATRINAPAOLAB. ALVAREZ

Sub-Editor

JUDYT. GULANE

Research Head

MIRACATHERINEB. GLORIA

Online Editor

By Carol Huang AFP

FEATURE

TORKHAM GATE, Afghanistan

Trundling across the Afghan-

Pakistani border in a handcart,

Shayma dismisses militant

threats and conspiracy theories

about polio vaccinators while her

four children receive drops that

could nally eradicate the crip-

pling disease.

About 1.3 million oral vacci-

nations are administered every

year to children at the Torkham

Gate crossing, the focal point of

an intense global campaign to

eradicate polio by 2018.

But Afghanistan and Pakistan

two of the three remaining en-

demic polionations faceatough

task due to ghting on either side

of the border, Taliban opposition

to vaccinations and rumors that

the drops could cause impotency.

Families hurrying through

the Torkham mountain pass are

diverted down a channel where

health workers deftly deliver two

liquid drops into the mouths of all

children aged under ve.

We want the vaccinations so

that my children dont become

disabled, Shayma told AFP from

behind an all-enveloping blue

burqa as she headed home from

Peshawar in Pakistan to the Af-

ghan city of Jalalabad.

It is not true that the vacci-

nation is bad. I dont agree with

this, she said. I believe it stops

polio.

Pakistan is a major concern for

anti-polio experts with 93 cases

last year, up from 58 in 2012.

Vaccinators have been shot

dead, bombed or taken hostage in

Peshawar, Karachi and elsewhere,

and some anti-polio programs

have been suspended.

Twelve people were killed and

11 injured when three roadside

bombs targeting a polio vaccina-

tion team in Pakistans restive

northwest exploded Saturday.

The Pakistan Taliban oppose

immunisation, saying it is a cover

for US spying, and some people be-

lieve it is also a plot to poison Mus-

limchildrenandcause infertility.

Polios last stand on the Afghan-Pakistan border

By Ben Sheppard AFP

By Glenn Chapman AFP

While Afghanistan has had

notable success in tackling polio,

with 80 cases in 2011 and just 14

in 2013, eradication may be a long

way of due to the constant ood

of people back and forth across

the porous border.

SOME FAMILIES REFUSE

VACCINE

It does pose a big challenge in

trying to ensure each and every

child is vaccinated every sin-

gle time, UNICEF spokesman

Kshitij Joshi said.

Afghanistan and Pakistan are

the same epidemiological block

and it is important that children

on either side of the border are

vaccinated to ensure absolute pro-

tection.

Vacci nat ed chi l dren are

marked on the thumb with a pen

that lasts one month, but catch-

ing every child is nearly impos-

sible in the crush of people on

the colonial-era

frontier, which

is not officially

recognised by Afghanistan.

The vaccine is voluntary and

is rejected by some families. One

elderly man shouted at health

workers and refused to allow his

child to receive drops.

Sometimes we find a person

like this, but the majority of

people know that it is good, said

vaccination supervisor Asifullah

who, like many Afghans, only uses

one name.

In Jalalabad city, on the main

road to Kabul, UNICEF also tar-

gets migrant communities who

move regularly between the two

count r i es i n

search of work.

One father

living in a makeshift tent said he

had been told that the drops had

a bad efect and would make his

children naughty.

After a discussion, UNICEF fe-

male coordinator Rana persuaded

him to allow his family to receive

the vaccine.

Female volunteers are crucial

to the anti-polio campaign as they

areabletoenter privatehomes, but

they cant access more dangerous

areas inthe Afghanborder region.

It is difcult for women to go

to several districts, said Rana.

We are not allowed as the secu-

rity is not good.

Taliban militants in southern

Afghanistan generally support

vaccination a result, says UNI-

CEF, of years of work ensuring

that the program is seen as strict-

ly neutral.

But in Pakistan and some

parts of eastern Afghanistan, the

Taliban have stopped vaccinators

reaching children in key polio

enclaves.

The Taliban in Kunar and

Nangarhar provinces oppose

the vaccinations, so we have

20,000 children there who have

been unvaccinated for several

months, Faizullah Kakar, the

Afghan presidents polio special-

ist, told AFP.

These places are near Kabul,

so we are very nervous that if it

gets to the capital it could spread

quickly.

The risk was highlighted last

month when Kabul recorded its

rst polio case since 2001 after a

three-year-old girl was diagnosed,

probably due to her father carry-

ing the disease from Pakistan.

TACKLING TALIBAN

PROPAGANDA

The problem is rstly the Tali-

ban, but it is also refugees in Ku-

nar who are somehow convinced

that vaccinations are not good for