Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AIBEA Press Release Disclosing List of Loan Defaulters

Caricato da

Aakash GuptaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AIBEA Press Release Disclosing List of Loan Defaulters

Caricato da

Aakash GuptaCopyright:

Formati disponibili

ALL INDIA BANK EMPLOYEES' ASSOCIATION

Central Office: PRABHAT NIVAS Regn. No.2037

Singapore Plaza, 164, Linghi Chetty Street, Chennai-600001

Phone: 2535 1522, 6543 1566 Fax: 4500 2191, 2535 8853

e mail ~ chv.aibea@gmail.com & aibeahq@gmail.com

PRESS RELEASE

6-5-2014

AIBEAs campaign against Bad Loans in Banks

Against alarming increase in bad loans in Banks

Opposing the corporate loot of public money

Demanding stringent measures to recover the bad loans

TO STOP THE LOOT OF PUBLIC MONEY AND START RECOVERY

OF BAD LOANS

TO KICK OUT BAD LOANS BEFORE THEY KILL THE BANKS

All India Bank Employees Association, the oldest and the largest trade union of bank

employees in India representing more than 5 lacs of bank employees working in

public sector banks, private banks, foreign banks, co-operative Banks and Regional

Rural Banks observed 5th December, 2013 as All India Demands Day to highlight the

issue of huge increase in the bad loans in the Banks. We also released the list of top

50 bad loan accounts.

While Government is also alarmed and concerned about the huge increase in bad

loans in the Banks, no effective measures have been taken by the Government to

recover these loans.

We have been demanding the following:

Make Willful default of bank loan a criminal offence

Order investigation to probe nexus and collusion

Amend Recovery Laws to speed up recovery of bad loans

Take stringent measures to recover bad loans

Do not incentivise corporate delinquency

RBI should periodically publish the list of bank loan defaulters

Since Government is not taking adequate steps to meet our above demands, we

have decided to continue our campaign.

DO YOU KNOW DAYLIGHT ROBBERY ?

Bad Loans in Public Sector Banks

Rs. 39,000 crores

(March 2008)

Bad Loans in Public Sector Banks

Rs. 1,64,000 crores

(March 2013)

Bad Loans in Public Sector Banks

Rs. 2,36,000 crores

( September 2013)

Bad Loans restructured

Rs. 3,25,000 crores

& shown as good loans

Fresh Bad loans in the last 7 years

Rs. 4,95,000 crores

Profits transferred and adjusted

for provisions towards bad loans

Rs. 1,40,000 crores:

(2008 to 13)

Bad Loans in 172 Corporate Accounts (Rs.100 crores and

above)

Bad Loans constituted by

Rs. 37,000 crores

Rs. 23,000 crores

top 4 defaulters in PSBs

Bad Loans in top 30 bad loan accounts in 24 Banks

Rs. 70,300 crores

Bad Loans ( Suit Filed ) in 3250 Accounts

Rs. 43,795 crores

(Rs. 1 crore & above)

Bad loans written off

Rs. 2,04,000 crores

in the last 13 years

AIBEA is now publishing the list of top 400 bank loan defaulters:

Since the RBI or the Government is not publishing the list of loan defaulters, AIBEA

is publishing the list containing the names of the top 400 defaulters of Public Sector

Banks. Rs. 70,3000 crores are involved in these 400 accounts. Why these loans are

not coming back? Who is responsible and accountable ? If the Bank Executives

have given the name, let there be a probe. If there is a political nexus, let it come

out. Country should not be for somebodys default. People should not be punished

for corporate default.

C.H. VENKATACHALAM

GENERAL SECRETARY

Bulging bad loans in Banks

180000

160000

140000

120000

100000

80000

60000

40000

20000

0

Bad loans increasing year after year

31.03.2008

39,030 crores

31.03.2009

44,954 crores

31.03.2010

59,927 crores

31.03.2011

74,664 crores

31-03-2012

117,000 crores

31-3-2013

1,64,461 crores

31-3-2013 PSBs + Private/Foreign

Banks

1,94,000 crores

Fresh Bad Loans

Rs. 4,95,000 crores in 7 years

Public Sector Banks

Fresh/new NPAs during 2009-10

44,818 Crores

Fresh/new NPAs during 2010-11

58,226 Crores

Fresh/new NPAs during 2012-13

92,808 Crores

Fresh/new NPAs during 2012-13

1,19,613 Crores

Fresh bad loans in the last 4 years (2009

to 2013 )

3,15,465 Crores

Fresh bad loans in the last 7 years (2007

to 2013 )

4,94,836 Crores

46,000 Crores in Private Sector Banks

Fresh/new NPAs during 2009-10

14,817 Crores

Fresh/new NPAs during 2010-11

8,657 Crores

Fresh/new NPAs during 2012-13

9,874 Crores

Fresh/new NPAs during 2012-13

12,883 Crores

Fresh bad loans in the last 4 years (2009

to 2013 ) in Private Banks

46,231 Crores

BAD LOANS WRITTEN OFF FROM 2001 TO 2013

Rs. 2,04,000 CRORES

PSBs

OLD PVT

BANKS

NEW PVT

BANKS

FOREIGN

BANKS

ALL BANKS

MARCH 2001

5555

331

580

20

6486

2002

6428

588

896

798

8710

2003

9448

653

1564

356

12021

2004

11308

525

1286

440

13559

2005

8048

464

1682

628

10822

2006

8799

544

1409

905

11657

2007

9189

610

1232

590

11621

2008

8019

724

1577

1334

11654

2009

6966

616

5063

3350

15995

2010

11185

884

6712

6238

25019

2011

17794

682

2336

3083

23895

2012

15551

671

3024

1646

20892

2013

27013

863

3487

855

32218

TOTAL

1,45,303

8,155

30,848

20,243

2,04,549

Gross NPAs of above Rs. 1 crore accounts:

Rs.68,000 crores stuck up:

IN PUBLIC SECTOR BANKS

NO. OF

AMOUNT

ACCOUNTS

RS. IN CRORES

MARCH, 2010

4099

26,629

MARCH, 2011

4589

34,633

MARCH, 2011

7295

68,262

SOURCE : LOK SABHA

Bad loans in top 30 accounts

GROSS NPA

Rs. in Crores

BANKS

Nationalised Banks

SBI Group

Public Sector Banks

Bad loans in top 30

accounts

AS OF JUNE 2013

Rs. in Crores

As % of

Gross NPA

48,406

43 %

15,266

21 %

63,671

35 %

1,11,209

71,620

1,82,829

Rs. 22,000 crores of loans are bad in

top 4 accounts in Public Sector Banks

Rs. In crores

Year

2009-10

2010-11

2011-12

2012-13

NPAs in top 4

Accounts

8,418

16,957

17,029

22,666

Gross NPA

59,927

74,664

117,262

1,64,461

Rs. 4,600 crores of loans are bad in

top 4 accounts in Private Sector Banks

Rs. In crores

Year

2009-10

2010-11

2011-12

2012-13

Gross NPA

17,640

18,240

18,768

21,070

NPAs in top 4

Accounts

2,400

2,385

2,802

4,663

PROVISIONS MADE FOR BAD LOANS

IN 5 YEARS - Rs. 1,40,000 crores

YEAR

GROSS PROFIT

BEFORE

PROVISIONS FOR

BAD LOANS

PROVISIONS

MADE FOR

BAD

LOANS/NPAs

PUBLISHED

NET PROFIT

2008-09

2009-10

2010-11

2011-12

2012-13

2008 TO 2013

45,494

57,293

74,731

87,691

93,684

3,58,893

11,121

18,036

29,830

38,177

43,102

1,40,266

34,373

39,257

44,901

49,514

50,582

2,18,627

GROSS NPA IN PUBLIC SECTOR BANKS:

Rs. In crores

March 2012

Mar 2013

1.

Allahabad Bank

2058

5137

2.

Andhra Bank

1798

3714

3.

Bank of India

5894

8765

4.

Bank of Baroda

4465

7982

5.

Bank of Maharashtra

1297

1138

6.

Canara Bank

4032

6260

7.

Central Bank of India

7273

8456

8.

Corporation Bank

1274

2048

9.

Dena Bank

956

1452

10.

Indian Bank

1850

3565

11.

Indian Overseas Bank

3920

6607

12.

Oriental Bank of Commerce

3580

4183

13.

Punjab National Bank

8719

13465

14.

Punjab & Sind Bank

763

1536

15.

Syndicate Bank

3183

2978

16.

UCO Bank

4086

7130

17.

Union Bank of India

5450

6314

18.

United Bank of India

2176

2964

19.

Vijaya Bank

1718

1532

64,496

95,233

39676

51189

Nationalised Banks

20.

State Bank of India

21.

22.

State Bank of Bikaner & Jaipur

State Bank of Hyderabad

1651

2007

2120

3186

23.

State Bank of Mysore

1503

2081

24.

State Bank of Patiala

1888

2453

25.

State Bank of Travancore

1489

1750

26.

IDBI Bank

4551

6450

1,17,262

1,64,461

Total Public Sector Banks

PRIVATE BANKS GROSS NPAS 2012 & 2013

31.03.2012

31.03.2013

1. City Union Bank Ltd

123.54

173.10

2. ING Vysya Bank Ltd

149.51

121.39

3. Tamilnad Mercantile Bank Ltd

177.48

214.45

4. The Catholic Syrian Bank Ltd

182.93

210.86

5. Dhanlaxmi Bank Ltd

104.27

380.27

1,300.83

1,554.01

7. The Jammu & Kashmir Bank Ltd

516.60

643.77

8. The Karnataka Bank Ltd

684.72

638.86

9. The Karur Vysya Bank Ltd

320.99

285.86

10. The Lakshmi Vilas Bank Ltd

307.73

459.17

11. The Nainital Bank Ltd

30.99

67.26

12. The Ratnakar Bank Ltd

33.11

25.90

267.16

433.87

4,199.86

5,208.77

1,806.30

2,393.42

241.80

214.98

16. HDFC Bank Ltd

1,999.39

2,334.64

17. ICICI Bank Ltd

9,475.33

9,607.75

18. IndusInd Bank Ltd

347.08

457.78

19. Kotak Mahindra Bank Ltd

614.19

758.11

83.86

94.32

TOTAL OF NEW PVT SECTOR BANKS

14,567.95

15,861.00

TOTAL OF PVT SECTOR BANKS

18,767.81

21,069.78

6. The Federal Bank Ltd

13. The South Indian Bank Ltd

TOTAL OF OLD PVT SECTOR BANKS

14. Axis Bank Ltd

15. Development Credit Bank Ltd

20. Yes Bank Ltd

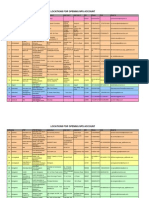

FRESH BAD LOANS - PUBLIC SECTOR BANKS

2011-12

2012-13

1. Allahabad Bank

2,232.06

5,891.89

2. Andhra Bank

1,287.31

2,741.67

3. Bank of Baroda

3,443.31

6,843.80

4. Bank of India

5,401.24

7,379.56

875.88

807.55

6. Canara Bank

4,589.84

5,819.30

7. Central Bank of India

6,849.00

5,125.00

8. Corporation Bank

1,202.78

1,797.30

722.19

1,119.79

10. Indian Bank

1,879.51

2,892.54

11. Indian Overseas Bank

3,184.76

5,600.61

12. Oriental Bank of Commerce

3,897.59

3,213.30

550.74

1,093.60

14. Punjab National Bank

6,671.64

8,647.04

15. Syndicate Bank

3,156.28

2,142.04

16. UCO Bank

2,401.16

5,161.59

17. Union Bank of India

3,760.11

3,973.75

18. United Bank of India

1,964.22

2,484.84

19. Vijaya Bank

2,056.97

1,601.42

56,126.59

74,336.59

24,712.22

31,993.35

21. State Bank of Bikaner & Jaipur

1,571.93

1,627.88

22. State Bank of Hyderabad

2,219.07

2,816.81

23. State Bank of Mysore

1,310.59

1,658.39

24. State Bank of Patiala

1,567.43

2,033.83

25. State Bank of Travancore

2,740.51

2,406.55

26. IDBI Bank Ltd.

2,560.24

2,739.69

92,808.58

1,19,613.09

5. Bank of Maharashtra

9. Dena Bank

13. Punjab & Sind Bank

NATIONALISED BANKS

20. State Bank of India (SBI)

TOTAL OF PUBLIC SECTOR BANKS

FRESH BAD LOANS - PRIVATE SECTOR BANKS

2011-12

2012-13

1. City Union Bank Ltd

144.41

223.43

2. ING Vysya Bank Ltd

172.83

193.86

3. Tamilnad Mercantile Bank Ltd

176.25

185.41

4. The Catholic Syrian Bank Ltd

100.20

171.31

5. Dhanlaxmi Bank Ltd

91.82

504.78

6. The Federal Bank Ltd

695.31

807.00

7. The Jammu & Kashmir Bank Ltd

314.68

455.00

8. The Karnataka Bank Ltd

378.31

413.45

9. The Karur Vysya Bank Ltd

174.00

200.54

10. The Lakshmi Vilas Bank Ltd

282.97

400.15

11. The Nainital Bank Ltd

28.24

57.44

12. The Ratnakar Bank Ltd

18.13

40.85

171.51

530.06

2,748.66

4,183.28

1,841.94

2,023.36

68.17

75.29

16. HDFC Bank Ltd

1,574.90

1,859.24

17. ICICI Bank Ltd

2,986.12

3,587.06

18. IndusInd Bank Ltd

286.45

446.62

19. Kotak Mahindra Bank Ltd

303.61

464.32

64.37

243.74

7,125.56

8,699.63

13. The South Indian Bank Ltd

TOTAL OF OLD PVT SECTOR BANKS

14. Axis Bank Ltd

15. Development Credit Bank Ltd

20. Yes Bank Ltd

TOTAL OF 7 NEW PVT SECTOR BANKS

TOTAL OF 20 PVT SECTOR BANKS

9,874.23

12,882.91

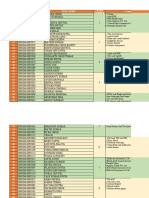

TOP 50 BANK LOAN DEFAULTERS OWE Rs. 40,000 crores

(Rupees In Crores)

BORROWER

LOAN NOT REPAID

1.

KINGFISHER AIRLINES

2673

2.

WINSOME DIAMOND & JEWELLERY CO. LTD.

2660

3.

ELECTROTHERM INDIA LIMITED

2211

4.

ZOOM DEVELOPERS PRIVATE LIMITED

1810

5.

STERLING BIO TECH LIMITED

1732

6.

S. KUMARS NATIONWIDE LIMITED

1692

7.

SURYA VINAYAK INDUSTRIES LTD.

1446

8.

CORPORATE ISPAT ALLOYS LIMITED

1360

9.

FOREVER PRECIOUS JEWELLERY & DIAMONDS

1254

10.

STERLING OIL RESOURCES LTD.

1197

11.

VARUN INDUSTRIES LIMITED

1129

12.

ORCHID CHEMICALS & PHARMACEUTICAL LTD.

938

13.

KEMROCK INDUSTRIES & EXPORTS LTD.

929

14.

MURLI INDUSTRIES & EXPORTS LIMITED

884

15.

NATIONAL AGRICULTURAL CO-OPERATIVE

862

16.

STCL LIMITED

860

17.

SURYA PHARMA PVT. LTD.

726

18.

ZYLOG SYSTEMS (INDIA) LIMITED

715

19.

PIXION MEDIA PVT. LIMITED

712

20.

DECCAN CHRONICLE HOLDINGS LIMITED

700

21.

K.S. OIL RESOURCES LTD.

678

22.

ICSA (INDIA) LTD.

646

23.

INDIAN TECHNOMAC CO. LTD.

629

24.

CENTURY COMMUNICATION LIMITED

624

25.

MOSER BAER INDIA LTD. & GROUP COMPANIES

581

26.

PSL LIMITED

577

27.

ICSA INDIA LIMITED

545

28.

LANCO HOSKOTE HIGHWAY LIMITED

533

29.

HOUSING DEVELOPMENT & INFRA LTD.

526

30.

MBS JEWELLERS PVT. LTD.

524

31.

EUROPEAN PROJECTS AND AVIATION LTD.

510

32.

LEO MERIDIAN INFRA PROJECTS

488

33.

PEARL STUDIOS PVT. LTD.

483

34.

EDUCOMP INFRASTRUCTURE & SCHOOL MAN

477

35.

JAIN INFRAPROJECTS LIMITED

472

36.

KMP EXPRESSWAY LIMITED

461

37.

PRADIP OVERSEAS LIMITED

437

38.

RAJAT PHARMA/ RAJAT GROUP

434

39.

BENGAL INDIA GLOBAL INFRASTRUCTURE LTD.

428

40.

STERLING SEZ & INFRASTRUCTURE PVT. LTD.

408

41.

SHAH ALLOYES LTD.

408

42.

SHIV VANI OIL AND GAS EXPLORATION LIMITED

406

43.

ANDHRA PRADESH RAJIV SWAGRUHA CORP. LTD.

385

44.

PROGRESSIVE CONSTRUCTIONS LTD

351

45.

DELHI AIRPORT MET EX LTD.

346

46.

GWALIOR JHANSI EXPRESSWAY LIMITED

346

47.

ALPS INDUSTRIES LIMITED

338

48.

STERLING PORT LIMITED

334

49.

ABHIJEET FERROTECH LIMITED

333

50.

SUJANA UNIVERSAL INDUSTRIES

330

40,528 crores

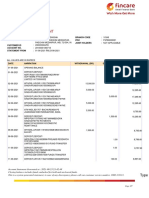

AMOUNT INVOLVED IN TOP 30 BAD LOAN ACCOUNTS

Rs. In crores

1.

Allahabad Bank

3867

2.

Andhra Bank

3766

3.

Bank of India

3630

4.

Bank of Baroda

5468

5.

Bank of Maharashtra

1195

6.

Canara Bank

3037

7.

Central Bank of India

6257

8.

Corporation Bank

2534

9.

Dena Bank

1424

10.

Indian Bank

1947

11.

Indian Overseas Bank

3013

12.

Oriental Bank of Commerce

3021

13.

Punjab National Bank

6680

14.

Punjab & Sind Bank

1318

15.

Syndicate Bank

1707

16.

UCO Bank

3861

17.

Union Bank of India

4511

18.

United Bank of India

2135

19.

Vijaya Bank

2333

20.

SBBJ

1067

21.

SBH

2655

22.

SBM

1599

23.

SBP

2252

24.

SBT

1021

Total

70,300 crores

Potrebbero piacerti anche

- Azerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentDa EverandAzerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentNessuna valutazione finora

- Top 10 Private Sector Banks by AssetsDocumento129 pagineTop 10 Private Sector Banks by AssetsrohitcshettyNessuna valutazione finora

- Types of Bank AcDocumento92 pagineTypes of Bank AcVish Amit KandaNessuna valutazione finora

- School of Management Studies: Summer Internship Program 16Documento13 pagineSchool of Management Studies: Summer Internship Program 16samalanuNessuna valutazione finora

- BDC (March) 2010Documento209 pagineBDC (March) 2010Lakshmi Narayanan SharmNessuna valutazione finora

- Issue15 - Chirag JiyaniDocumento6 pagineIssue15 - Chirag JiyaniDipankar SâháNessuna valutazione finora

- What Ails Indian Banking SectorDocumento9 pagineWhat Ails Indian Banking SectorparthiNessuna valutazione finora

- Axis Bank - ConsolidatedDocumento43 pagineAxis Bank - ConsolidatedamolkhadseNessuna valutazione finora

- Non-Performing Assets: in Bank of IndiaDocumento23 pagineNon-Performing Assets: in Bank of Indiaindhu yaluNessuna valutazione finora

- Fund Release During June-2011Documento2 pagineFund Release During June-2011rattanbansalNessuna valutazione finora

- Analysis EcoDocumento7 pagineAnalysis EcoAbhay KhandelwalNessuna valutazione finora

- Panjab National BankDocumento30 paginePanjab National BankRavi VarmaNessuna valutazione finora

- Account Project OrginalDocumento41 pagineAccount Project OrginalshankarinadarNessuna valutazione finora

- Evaluation of VRS in BanksDocumento16 pagineEvaluation of VRS in Banksramesh.kNessuna valutazione finora

- Samachar Lehar March 2012 IssueDocumento198 pagineSamachar Lehar March 2012 IssueSanjay KumarNessuna valutazione finora

- Origin and Performance of Regional Rural Bank of IndiaDocumento13 pagineOrigin and Performance of Regional Rural Bank of IndiaHetvi TankNessuna valutazione finora

- March 2012Documento8 pagineMarch 2012Dileep MishraNessuna valutazione finora

- Economics Project - Docx 2Documento7 pagineEconomics Project - Docx 2Gurpreet Singh100% (3)

- Term Paper Service Marketing RT1802A10Documento35 pagineTerm Paper Service Marketing RT1802A10rajiv kumarNessuna valutazione finora

- Financial Analysis of The Surat Mercantile Co-Op. Bank LTD."Documento19 pagineFinancial Analysis of The Surat Mercantile Co-Op. Bank LTD."Ankur MeruliyaNessuna valutazione finora

- Abridged Version of ProspectusDocumento12 pagineAbridged Version of ProspectusAbbasi Hira100% (1)

- 4.1 Emergence of Retail Banking BusinessDocumento18 pagine4.1 Emergence of Retail Banking BusinessSteffy AntonyNessuna valutazione finora

- Chapter - Iii Customer Satisfaction in The Banking Industry - An OverviewDocumento49 pagineChapter - Iii Customer Satisfaction in The Banking Industry - An Overviewvahid desaiNessuna valutazione finora

- Performance Analysis of Public Sector Banks in India: March 2015Documento12 paginePerformance Analysis of Public Sector Banks in India: March 2015Abhijeet JaiswalNessuna valutazione finora

- Naval Dockyard CoDocumento45 pagineNaval Dockyard CoUmesh Gaikwad100% (2)

- HR Issues and Challenges in Indian Banking Sector: Research ScholarDocumento17 pagineHR Issues and Challenges in Indian Banking Sector: Research ScholarsownikaNessuna valutazione finora

- Banking Sector Liberalization in IndiaDocumento4 pagineBanking Sector Liberalization in IndiabbasyNessuna valutazione finora

- State Bank of PatialaDocumento5 pagineState Bank of PatialaBaljinderrai7Nessuna valutazione finora

- Annual Report 2010: Dhaka Electric Supply Company LimitedDocumento66 pagineAnnual Report 2010: Dhaka Electric Supply Company LimitedRubayed Bin JahidNessuna valutazione finora

- Axis BankDocumento22 pagineAxis Bankअक्षय गोयल67% (3)

- Structure and Functions of Commercial BanksDocumento6 pagineStructure and Functions of Commercial BanksShanky RanaNessuna valutazione finora

- Gujarat State Financial Corporation-Bba-Mba-Project ReportDocumento84 pagineGujarat State Financial Corporation-Bba-Mba-Project ReportpRiNcE DuDhAtRaNessuna valutazione finora

- A Summer Internship Report: Multistate Scheduled BankDocumento23 pagineA Summer Internship Report: Multistate Scheduled BankHetalKachaNessuna valutazione finora

- India Bank Ifsc CodeDocumento3.466 pagineIndia Bank Ifsc CodespakumaranNessuna valutazione finora

- AAAAAPresentation 1Documento15 pagineAAAAAPresentation 1SmartAkilNessuna valutazione finora

- An Empirical Study On The Retiral Benefits in Public Sector BankingDocumento48 pagineAn Empirical Study On The Retiral Benefits in Public Sector BankingPriyanka ShardaNessuna valutazione finora

- Contemporary Issues and Challenges of Banking in IndiaDocumento4 pagineContemporary Issues and Challenges of Banking in Indiagolden abidemNessuna valutazione finora

- 10th BP DemandsDocumento26 pagine10th BP DemandsRohitha VaidyanNessuna valutazione finora

- Management of Non Performing Assests in Tiruchirapalli District Central Co-Operative Bank LTDDocumento6 pagineManagement of Non Performing Assests in Tiruchirapalli District Central Co-Operative Bank LTDYadunandan NandaNessuna valutazione finora

- APGVB InformationDocumento63 pagineAPGVB InformationSwamy GaddikopulaNessuna valutazione finora

- Rekha Jatev 6thDocumento63 pagineRekha Jatev 6thMayank Jain NeerNessuna valutazione finora

- Vishnu CBS AxisDocumento13 pagineVishnu CBS AxisArun KumarNessuna valutazione finora

- B B F A R: ANK OF Aroda Inancial Nalysis EportDocumento31 pagineB B F A R: ANK OF Aroda Inancial Nalysis Eportlaxmi_bodduNessuna valutazione finora

- Bfs2 Evolution of Banking in IndiaDocumento26 pagineBfs2 Evolution of Banking in IndiaRitesh RamanNessuna valutazione finora

- Common Charter of DemandsDocumento35 pagineCommon Charter of DemandsChiranjive Ravindra JagadalNessuna valutazione finora

- Share Sansar Samachar of 27th November' 2011Documento3 pagineShare Sansar Samachar of 27th November' 2011sharesansarNessuna valutazione finora

- NCL Industries (NCLIND: Poised For GrowthDocumento5 pagineNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNessuna valutazione finora

- Industry Analysis On Banking IndustryDocumento6 pagineIndustry Analysis On Banking IndustryPulkit JainNessuna valutazione finora

- Performance: PROFIT (In Lakhs)Documento5 paginePerformance: PROFIT (In Lakhs)Albert ReynoldsNessuna valutazione finora

- The United Mercantile CoDocumento15 pagineThe United Mercantile ConehaseththedonNessuna valutazione finora

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocumento9 pagineStatement I: Public Sector Banks: Deposits/Investments/AdvancesNekta PinchaNessuna valutazione finora

- Sbi Power CapsuleDocumento23 pagineSbi Power CapsuleRakesh Ranjan JhaNessuna valutazione finora

- Bulletin 16 - 09Documento22 pagineBulletin 16 - 09Lakshmi MuvvalaNessuna valutazione finora

- COMPANY PROFILE - OdtDocumento13 pagineCOMPANY PROFILE - OdtkailashNessuna valutazione finora

- Promotion March2016 Final Updated Upto 24-02-2016Documento147 paginePromotion March2016 Final Updated Upto 24-02-2016pankaj gargNessuna valutazione finora

- Competitiveness of The Indian Banking Sector-Public Sector BanksDocumento41 pagineCompetitiveness of The Indian Banking Sector-Public Sector Bankssahil_saini298Nessuna valutazione finora

- Financial Statement Analysis of RNSBDocumento23 pagineFinancial Statement Analysis of RNSBHetalKacha100% (1)

- A Study On Comparative and Common Size Statement, Trend AnalysisDocumento62 pagineA Study On Comparative and Common Size Statement, Trend AnalysisPraveen Kumar67% (3)

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- List of Top 400 Bad Loan AccountsDocumento22 pagineList of Top 400 Bad Loan AccountsMoneylife FoundationNessuna valutazione finora

- Investor's Guide To Shareholder Meetings in IndiaDocumento61 pagineInvestor's Guide To Shareholder Meetings in IndiaAakash GuptaNessuna valutazione finora

- Essar Energy Annual Reports and AccountsDocumento125 pagineEssar Energy Annual Reports and AccountsAakash GuptaNessuna valutazione finora

- DTC Impact On Indian IndustryDocumento2 pagineDTC Impact On Indian IndustryAakash GuptaNessuna valutazione finora

- RFLR v6 n2 1Documento33 pagineRFLR v6 n2 1rosenbagNessuna valutazione finora

- Carbon Black GradesDocumento1 paginaCarbon Black GradesAakash GuptaNessuna valutazione finora

- Thought Leadership Harish BijoorDocumento3 pagineThought Leadership Harish BijoorAakash GuptaNessuna valutazione finora

- Down To The Wire 07-21-11Documento13 pagineDown To The Wire 07-21-11jamestl8211Nessuna valutazione finora

- Market Price of Risk For IRDDocumento32 pagineMarket Price of Risk For IRDAakash GuptaNessuna valutazione finora

- Labs Centres: SR No Lab Name Mobile Address EmailDocumento5 pagineLabs Centres: SR No Lab Name Mobile Address EmailDIKSHA VERMANessuna valutazione finora

- NIFTY Dividend Opportunities 50 Apr2020Documento2 pagineNIFTY Dividend Opportunities 50 Apr2020amitNessuna valutazione finora

- E StatementDocumento13 pagineE StatementRohit GoleNessuna valutazione finora

- S.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateDocumento2 pagineS.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateRajuNessuna valutazione finora

- Top Companies of IndiaDocumento19 pagineTop Companies of IndiaNidhi_Rawat_7890100% (1)

- 47074675Documento10 pagine47074675Pradeep KumarNessuna valutazione finora

- ST509 (B) Group ListDocumento6 pagineST509 (B) Group ListKonark AirconNessuna valutazione finora

- NSE Futures Lot SizeDocumento4 pagineNSE Futures Lot SizePeter SamualNessuna valutazione finora

- List of Self Certified Syndicate Banks (SCSBS) For Syndicate ASBA - 120920141631 - 260220151225Documento543 pagineList of Self Certified Syndicate Banks (SCSBS) For Syndicate ASBA - 120920141631 - 260220151225Durwas Mohite100% (1)

- Statewise Compressed PDFDocumento64 pagineStatewise Compressed PDFPrem BabuNessuna valutazione finora

- Client MasterDocumento1 paginaClient Masterpauljones7975Nessuna valutazione finora

- 501 Stocks Filtered 23-09-2022Documento26 pagine501 Stocks Filtered 23-09-2022MohammadRahemanNessuna valutazione finora

- Centre Annexure ADocumento60 pagineCentre Annexure ANikhitesh HenrageNessuna valutazione finora

- Report 20230604125900Documento8 pagineReport 20230604125900AbhimanyuNessuna valutazione finora

- Midcap FundDocumento1 paginaMidcap FundPradeep KumarNessuna valutazione finora

- Reliance Monthly Portfolios 28 02 2013Documento280 pagineReliance Monthly Portfolios 28 02 2013luvisfact7616Nessuna valutazione finora

- Banks& Their Mobile Applications: FREE SBI PO 2020 Special E-BookDocumento7 pagineBanks& Their Mobile Applications: FREE SBI PO 2020 Special E-Bookshukla dhavalNessuna valutazione finora

- TransactionsDocumento7 pagineTransactionsBHARAT TECHNessuna valutazione finora

- Fraud PDF Aisa HaiDocumento5 pagineFraud PDF Aisa Haipakyabhai143Nessuna valutazione finora

- Wa0021.Documento16 pagineWa0021.KunalNessuna valutazione finora

- POP-SP Location To Open New Pension Scheme AccountDocumento17 paginePOP-SP Location To Open New Pension Scheme AccountkpugazhNessuna valutazione finora

- LodnaareaDocumento4 pagineLodnaareaAnwesha SenNessuna valutazione finora

- Life Insurance Company India LTDDocumento1 paginaLife Insurance Company India LTDRob JoslinNessuna valutazione finora

- Anand Area Telephone NosDocumento15 pagineAnand Area Telephone NosBhautik PatelNessuna valutazione finora

- List of Qualified Bidder For NH-12, Nh-75-E & NH-7)Documento7 pagineList of Qualified Bidder For NH-12, Nh-75-E & NH-7)AneeshNessuna valutazione finora

- Public Issues Data (19th July 2017)Documento180 paginePublic Issues Data (19th July 2017)Mrinal MNessuna valutazione finora

- Average Market Capitalization of Listed Companies During Jul - Dec - 2020 - FinalDocumento44 pagineAverage Market Capitalization of Listed Companies During Jul - Dec - 2020 - FinalPankaj SankholiaNessuna valutazione finora

- 6781 I-VII & IX STD Students DetailsDocumento127 pagine6781 I-VII & IX STD Students Detailsk_vk2000Nessuna valutazione finora

- Task StatusDocumento80 pagineTask StatusAmit KumarNessuna valutazione finora

- BANKINGDocumento6 pagineBANKINGDhananjayan GopinathanNessuna valutazione finora