Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Monthly Report: 1. General Information

Caricato da

Beatrice NicoletaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Monthly Report: 1. General Information

Caricato da

Beatrice NicoletaCopyright:

Formati disponibili

Monthly report

1. General Information

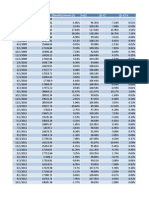

Macroeconomic Indicators and Projections*

2009

2010

2011

Real GDP (% y-o-y)

-6.6

-1.1

2.3

0.6

3.5 (1)

2.3

Budget balance (% GDP, cash)

-7.3

-6.4

-4.3

-2,5

-1.56 (2)

2.2

Budget balance (% GDP, ESA95)

-9.0

-6.8

-5.6

-3.0

-0.9

(F)

2.2

(3)

(10)

Current account deficit (% GDP)

-4.2

-4.4

-4.5

-4.4

-1.1

5.6

6.1

5.8

3.33

3.98 (4)

2.4

Monetary Policy Rate

8.00

6.25

6.00

5.25

3.5 (5)

Average exchange rate (RON/EUR)

4.24

4.21

4.24

4.46

4.42 (6)

4.45

(7)

5.3

Annual average inflation

Registered unemployment rate(%)

GDP, bln. RON

-1.2

st

January 2014

0.8% 2.3%

9.1%

RON

EURO

USD

7.8

7.0

5.2

5.4

5.6

23.6

30.5

34.7

38.0

38.2 (8)

39.0

501.1

523.7

557.3

586.7

631.1 (9)

664.4

Public debt (% GDP, EU meth.)

Public debt structure as of 31

2013

Preliminary 2014 Forecast

annual figure

2012

JPY

Others

46.0%

41.9%

*Source: MoPF, NBR, NIS, NCP (1) end 2013 acc. to INS, (2) end Nov. (3) Figure refers to end 2013., (4) Jan-Dec 2013/Jan-Dec 2012 acc to NIS, (5) As of Nov.

2013 (6) average rate for Jan-Dec 2013, (7) end of Dec.. 2013, (8) end of Dec. 2013, (9) end 2013, acc NCP (10) source NCP

Exchange Rate Evolution up to date

USD/RON, EUR/RON

Moody's

Baa3

Credit rating

S&P

BB+

Fitch

BBB-

4.5097

4.5

4

3.5

3.2465

The State Treasury has built a fiscal buffer covering more than four months of gross financing needs.

By the end of January Romania has covered 24,4% of this years's gross funding needs (preliminary data).

Public Debt (EU meth.) end January 2014 - 39.8% of GDP.

3

2.5

Euro

Dollar

03

/0

1/

26 201

1

/0

2/

21 201

1

/0

4/

2

0

14

/0 11

6/

07 201

1

/0

8/

30 201

/0

1

9/

2

0

23

/1 11

1/

16 201

1

/0

1/

10 201

2

/0

3/

2

0

03

/0 12

5/

2

0

26

/0 12

6/

19 201

/0

2

8/

12 201

2

/1

0/

2

0

05

/1 12

2/

28 201

2

/0

1/

23 201

3

/0

3/

2

0

16

/0 13

5/

09 201

/0

3

7/

01 201

3

/0

9/

25 201

3

/1

0/

2

0

18

/1 13

2/

10 201

3

/0

2/

20

14

2. Domestic government securities

Domestic auctions February 2014

Date

Size Announced

(RON MIL)

Size Borrowed

(RON MIL)

06.02.2014

07.02.2014

10.02.2014

11.02.2014

13.02.2014

14.02.2014

17.02.2014

18.02.2014

20.02.2014

20.02.2014

24.02.2014

25.02.2014

TOTAL RON

TOTAL EUR

600

60

800

80

100

10

500

50

1200

200

600

60

4060

200

0

0

800

80

0

0

500

50

0

200

440

60

1930

200

Non-resident holdings of government securities RON and EUR denominated,

end January 2014 ( mil.)

Domestic auctions March 2014

Tenor (yrs)

Yield (%)

Date

10

10*

10

10*

10

10*

5

5*

1

5

5

5*

4.06

4.08

3.30

5.10

-

03.03.2014

04.03.2014

06.03.2014

07.03.2014

10.03.2014

11.03.2014

17.03.2014

19.03.2014

20.03.2014

24.03.2014

25.03.2014

27.03.2014

TOTAL RON

TOTAL EUR

Size Announced Size Borrowed

(RON MIL)

(RON MIL)

400.00

39.00

700.00

55.65

100.00

11.70

400

60

400

60

700

105

100

15

400

60

200

300

45

500

2185

200

Tenor (yrs)

Yield (%)

Date

Total, o/w

Issued on short

term

Issued on

medium and

long term

4

4*

10

10*

10

10*

5

5*

5

10

10*

1

3.87

4.25

5.30

4.94

-

31.12.2009

31.12.2010

31.12.2011

31.12.2012

31.01.2014

761.7

1,660.0

2,322.8

3,199.9

4,905.0

562.7

1,445.4

1,851.5

1,134.4

296.4

199.0

214.6

471.3

2,065.5

4,608.6

Holdings of government securities denominated in RON/EUR, in January 2014

Category

1. Banking System

2. Central Depository

3 Clients holdings

non residents*)

residents, o/w:

private pension funds

1766

*Supplementary sessions of noncompetitive offers

Total

Outstanding of government securities issued on domestic market, end of February 2014:

Outstanding government securities, RON denominated

Outstanding government securities, EUR denominated

113.3 bln Ron

94.4 bln Ron

4.2 bln Eur/18.9 bln Ron

Available

(mln Ron)

52,889.5

352.7

40,504.0

17,565.7

22,938.3

8,354.4

93,746.2

(%) total

56.8%

43.2%

100.0%

Available

(mln Eur)

2,420.4

1,593.7

999.5

594.2

195.6

4,014.1

(%) total

60.3%

39.7%

100.0%

*) includes government securities held by Clearstream

Outstanding government securities issued on domestic market end

February 2014 (by initial maturity)

Yield curve*) of government securities traded in January 2014 by

remaining maturity

5.75

Share in total

issuances on

domestic

market (%)

6.8%

10.4%

11.7%

14.2%

19.7%

5.34

5.50

T-Bills 6 Months

5.19

5.25

4.91

5.00

1.2%

4.63

4.75

4.25

11.2%

4.02

4.00

T-Bills 12 Months

22.5%

4.37

4.50

11.4%

Benchmark Bonds 3 Years

Benchmark Bonds 5 Years

3.75

3.34

3.50

9.2%

3.22

Benchmark Bonds 10 Years

3.25

Benchmark Bonds 15 Years

3.00

2.75

2.50

2.25

44.4%

2.12

2.00

<1 Y

1Y

2Y

3Y

5Y

6Y

7Y

9Y

13 Y

*) the yield curve is constructed based on the average YTM (SAFIR source) over the remaining years for each

maturity bucket of government securities denominated in lei issued on primary market

3. Eurobonds

Outstanding Eurobonds issued on External Markets, EUR and USD denominated, end of period

Outstanding government securities, EUR denominated

7.50 bln EUR

Outstanding government securities, USD denominated

5.75 bln USD

Treasury and Public Debt Department

tefan Nanu

Diana Popescu

Ministry of Public Finance

contractare.dgtdp@mfinante.ro

General Director

+4.0723.186.625

General Deputy Director

+4.0749.064.972

More information on Treasury and Public Debt section

www.mfinante.ro

www.mbuget.gov.ro

Bloomberg Page:

ROMF <GO>

Potrebbero piacerti anche

- Informare Investitori 25iunie 2014Documento9 pagineInformare Investitori 25iunie 2014MihailMarcuNessuna valutazione finora

- Romanian GDP and inflation dynamics in Q3Documento6 pagineRomanian GDP and inflation dynamics in Q3Boldeanu Florin TeodorNessuna valutazione finora

- 1st Half Report - June 30, 2010Documento75 pagine1st Half Report - June 30, 2010PiaggiogroupNessuna valutazione finora

- Biocon - Ratio Calc & Analysis FULLDocumento13 pagineBiocon - Ratio Calc & Analysis FULLPankaj GulatiNessuna valutazione finora

- KPMG Budget BriefDocumento52 pagineKPMG Budget BriefAsad HasnainNessuna valutazione finora

- Yemen, Rep. at A Glance: (Average Annual Growth)Documento2 pagineYemen, Rep. at A Glance: (Average Annual Growth)tahaalkibsiNessuna valutazione finora

- Economic Data Release Calendar: June 19, 2011 - June 24, 2011Documento4 pagineEconomic Data Release Calendar: June 19, 2011 - June 24, 2011Tarek NabilNessuna valutazione finora

- 2q 2011 European UpdateDocumento47 pagine2q 2011 European Updatealexander7713Nessuna valutazione finora

- OECD's Interim AssessmentDocumento23 pagineOECD's Interim AssessmentTheGlobeandMailNessuna valutazione finora

- MRE120313Documento3 pagineMRE120313naudaslietas_lvNessuna valutazione finora

- Albanian Banking System & Islamic BankingDocumento15 pagineAlbanian Banking System & Islamic BankingDavudNessuna valutazione finora

- United Kingdom EconomyDocumento4 pagineUnited Kingdom EconomyGobinath MannNessuna valutazione finora

- Ccil Wma-31-May-14Documento5 pagineCcil Wma-31-May-14vjignesh1Nessuna valutazione finora

- Group Ariel StudentsDocumento8 pagineGroup Ariel Studentsbaashii4Nessuna valutazione finora

- Profit Before Tax Ratio: (PBT/Total Income)Documento6 pagineProfit Before Tax Ratio: (PBT/Total Income)sana noreenNessuna valutazione finora

- Ftse 100Documento10 pagineFtse 100mikolass22Nessuna valutazione finora

- Thai Union Frozen Products: Insights Into 3q14-Earnings Recovery in PlayDocumento7 pagineThai Union Frozen Products: Insights Into 3q14-Earnings Recovery in PlaybodaiNessuna valutazione finora

- Eco 2Documento10 pagineEco 2wayneallencarbonellNessuna valutazione finora

- USDJPY Approaching 100: Morning ReportDocumento3 pagineUSDJPY Approaching 100: Morning Reportnaudaslietas_lvNessuna valutazione finora

- 2013 Mar 13 - Pernod Ricard SADocumento21 pagine2013 Mar 13 - Pernod Ricard SAalan_s1Nessuna valutazione finora

- Taxation Trends in The European Union - 2012 42Documento1 paginaTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNessuna valutazione finora

- Ftse 250Documento14 pagineFtse 250mikolass22Nessuna valutazione finora

- Santa Fe Valores - HolcimDocumento1 paginaSanta Fe Valores - HolcimWALTER SPENCERNessuna valutazione finora

- The European Economy: An OverviewDocumento17 pagineThe European Economy: An OverviewChandrashekhara V GNessuna valutazione finora

- Is Fiscal Union The Answer To The Euro's Problems?: Morning ReportDocumento3 pagineIs Fiscal Union The Answer To The Euro's Problems?: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Presentation On Union Budget: 2010-11 & Current Fiscal Situation by prof-SC SharmaDocumento53 paginePresentation On Union Budget: 2010-11 & Current Fiscal Situation by prof-SC Sharmavinod_varyaniNessuna valutazione finora

- Derivatives Update Derivatives Update Derivatives Update Derivatives UpdateDocumento19 pagineDerivatives Update Derivatives Update Derivatives Update Derivatives UpdatethwishaansNessuna valutazione finora

- IOCL Key IndicatorsDocumento4 pagineIOCL Key IndicatorsBrinda PriyadarshiniNessuna valutazione finora

- Ex c3 19.10 FinalDocumento10 pagineEx c3 19.10 FinalPirvuNessuna valutazione finora

- Deterioration of Financial Conditions: Morning ReportDocumento3 pagineDeterioration of Financial Conditions: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Inddec 10Documento12 pagineInddec 10Surbhi SarnaNessuna valutazione finora

- MRE121010Documento3 pagineMRE121010naudaslietas_lvNessuna valutazione finora

- III) ECONOMIC GROWTH (GDP, Annual Variation in %) : LithuaniaDocumento3 pagineIII) ECONOMIC GROWTH (GDP, Annual Variation in %) : LithuaniaShamaarajShankerNessuna valutazione finora

- What Is The Economic Outlook For OECD Countries?: An Interim AssessmentDocumento24 pagineWhat Is The Economic Outlook For OECD Countries?: An Interim AssessmentAnna DijkmanNessuna valutazione finora

- Surge in Chinese Imports: Morning ReportDocumento3 pagineSurge in Chinese Imports: Morning Reportnaudaslietas_lvNessuna valutazione finora

- What Is The Economic Outlook For OECD Countries?: An Interim AssessmentDocumento24 pagineWhat Is The Economic Outlook For OECD Countries?: An Interim Assessmentapi-25892974Nessuna valutazione finora

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDocumento2 pagineKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasNessuna valutazione finora

- Morning Report 14oct2014Documento2 pagineMorning Report 14oct2014Joseph DavidsonNessuna valutazione finora

- Economic Data Release Calendar June-July 2011Documento5 pagineEconomic Data Release Calendar June-July 2011Tarek NabilNessuna valutazione finora

- Financial Decision Making: AssignmentDocumento19 pagineFinancial Decision Making: AssignmentMutasem AmrNessuna valutazione finora

- Economic Instability in PakistanDocumento35 pagineEconomic Instability in PakistanJunaid NaseemNessuna valutazione finora

- WEO DataDocumento1 paginaWEO Datacasarodriguez8621Nessuna valutazione finora

- EUR Interest Rate Outlook - Jul11Documento4 pagineEUR Interest Rate Outlook - Jul11timurrsNessuna valutazione finora

- The Stock Market in AprilDocumento3 pagineThe Stock Market in AprilJohn Paul GroomNessuna valutazione finora

- Book 1Documento2 pagineBook 1Neeraj SrivastavaNessuna valutazione finora

- 2008 Moodys Together: Tests of Equality of Group MeansDocumento18 pagine2008 Moodys Together: Tests of Equality of Group Meansmainmei56Nessuna valutazione finora

- 1.1 Core Economic Indicators: Indicators FY 02 FY 03 FY 04 FY 05 FY 06Documento4 pagine1.1 Core Economic Indicators: Indicators FY 02 FY 03 FY 04 FY 05 FY 06Abu AlkhtatNessuna valutazione finora

- NMDC Result UpdatedDocumento7 pagineNMDC Result UpdatedAngel BrokingNessuna valutazione finora

- Morning Report 03nov2014Documento2 pagineMorning Report 03nov2014Joseph DavidsonNessuna valutazione finora

- Date SENSEX Adj Close Monthly Return (S) 1+ (S) (S-S') (S-S') 2Documento22 pagineDate SENSEX Adj Close Monthly Return (S) 1+ (S) (S-S') (S-S') 2Litesh MahakalkarNessuna valutazione finora

- Purchasing Managers Are Oceans Apart: Morning ReportDocumento3 paginePurchasing Managers Are Oceans Apart: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Financial Management Assignment: MarchDocumento8 pagineFinancial Management Assignment: MarchSurya KiranNessuna valutazione finora

- Indonesias Economic Outlook 2011Documento93 pagineIndonesias Economic Outlook 2011lutfhizNessuna valutazione finora

- Strong Credit Growth For Enterprises: Morning ReportDocumento3 pagineStrong Credit Growth For Enterprises: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Daily Comment RR 06jul11Documento3 pagineDaily Comment RR 06jul11timurrsNessuna valutazione finora

- No Greek Deal Before March: Morning ReportDocumento3 pagineNo Greek Deal Before March: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Markets Waiting For The Summit: Morning ReportDocumento3 pagineMarkets Waiting For The Summit: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Analisis Determinan Defisit Anggaran Dan Utang Luar Negeri Di Indonesia Oleh: Alpon SatriantoDocumento25 pagineAnalisis Determinan Defisit Anggaran Dan Utang Luar Negeri Di Indonesia Oleh: Alpon SatriantoYatsin GaniNessuna valutazione finora

- Final Market: Towards A New Hierarchy of Risks ?Documento19 pagineFinal Market: Towards A New Hierarchy of Risks ?Morningstar FranceNessuna valutazione finora

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDa EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNessuna valutazione finora

- FAMP Conf - DLConstantinDocumento26 pagineFAMP Conf - DLConstantinBeatrice NicoletaNessuna valutazione finora

- 1 BakhshyanDocumento20 pagine1 BakhshyanBeatrice NicoletaNessuna valutazione finora

- Windows 8 - Notice PDFDocumento1 paginaWindows 8 - Notice PDFSanthosh KumarNessuna valutazione finora

- EnglishDocumento344 pagineEnglishBeatrice NicoletaNessuna valutazione finora

- Alphabet Writing Practice PDFDocumento64 pagineAlphabet Writing Practice PDFFrank100% (3)

- Scrisoare Florica FeierDocumento1 paginaScrisoare Florica FeierBeatrice NicoletaNessuna valutazione finora

- EnglezaDocumento3 pagineEnglezaBeatrice NicoletaNessuna valutazione finora

- Misbehaviour - Nges Rgyur - I PDFDocumento32 pagineMisbehaviour - Nges Rgyur - I PDFozergyalmoNessuna valutazione finora

- The Wavy Tunnel: Trade Management Jody SamuelsDocumento40 pagineThe Wavy Tunnel: Trade Management Jody SamuelsPeter Nguyen100% (1)

- Bpo Segment by Vitthal BhawarDocumento59 pagineBpo Segment by Vitthal Bhawarvbhawar1141100% (1)

- 7 Q Ans Pip and The ConvictDocumento3 pagine7 Q Ans Pip and The ConvictRUTUJA KALE50% (2)

- Is The Question Too Broad or Too Narrow?Documento3 pagineIs The Question Too Broad or Too Narrow?teo100% (1)

- Garner Fructis ShampooDocumento3 pagineGarner Fructis Shampooyogesh0794Nessuna valutazione finora

- Monson, Concilio Di TrentoDocumento38 pagineMonson, Concilio Di TrentoFrancesca Muller100% (1)

- Identification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceanDocumento80 pagineIdentification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceancavrisNessuna valutazione finora

- Best Safety Practices in The Philippine Construction PDFDocumento16 pagineBest Safety Practices in The Philippine Construction PDFDione Klarisse GuevaraNessuna valutazione finora

- What Are Open-Ended Questions?Documento3 pagineWhat Are Open-Ended Questions?Cheonsa CassieNessuna valutazione finora

- Mariam Kairuz property dispute caseDocumento7 pagineMariam Kairuz property dispute caseReginald Matt Aquino SantiagoNessuna valutazione finora

- Prof Ed 7 ICT Policies and Issues Implications To Teaching and LearningDocumento11 pagineProf Ed 7 ICT Policies and Issues Implications To Teaching and Learnings.angelicamoradaNessuna valutazione finora

- FE 405 Ps 3 AnsDocumento12 pagineFE 405 Ps 3 Anskannanv93Nessuna valutazione finora

- WEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismDocumento6 pagineWEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismVencint LaranNessuna valutazione finora

- Scantype NNPC AdvertDocumento3 pagineScantype NNPC AdvertAdeshola FunmilayoNessuna valutazione finora

- Web Design Course PPTX Diana OpreaDocumento17 pagineWeb Design Course PPTX Diana Opreaapi-275378856Nessuna valutazione finora

- Successfull Weight Loss: Beginner'S Guide ToDocumento12 pagineSuccessfull Weight Loss: Beginner'S Guide ToDenise V. FongNessuna valutazione finora

- Instant Download Ebook PDF Energy Systems Engineering Evaluation and Implementation Third 3rd Edition PDF ScribdDocumento41 pagineInstant Download Ebook PDF Energy Systems Engineering Evaluation and Implementation Third 3rd Edition PDF Scribdmichael.merchant471100% (43)

- LESSON 2 - Nguyễn Thu Hồng - 1917710050Documento2 pagineLESSON 2 - Nguyễn Thu Hồng - 1917710050Thu Hồng NguyễnNessuna valutazione finora

- NAME: - CLASS: - Describing Things Size Shape Colour Taste TextureDocumento1 paginaNAME: - CLASS: - Describing Things Size Shape Colour Taste TextureAnny GSNessuna valutazione finora

- Exam SE UZDocumento2 pagineExam SE UZLovemore kabbyNessuna valutazione finora

- Whois contact details list with domainsDocumento35 pagineWhois contact details list with domainsPrakash NNessuna valutazione finora

- FOREIGN DOLL CORP May 2023 TD StatementDocumento4 pagineFOREIGN DOLL CORP May 2023 TD Statementlesly malebrancheNessuna valutazione finora

- MadBeard Fillable Character Sheet v1.12Documento4 pagineMadBeard Fillable Character Sheet v1.12DiononNessuna valutazione finora

- Ruby Tuesday LawsuitDocumento17 pagineRuby Tuesday LawsuitChloé MorrisonNessuna valutazione finora

- Compassion and AppearancesDocumento9 pagineCompassion and AppearancesriddhiNessuna valutazione finora

- UNIMED Past Questions-1Documento6 pagineUNIMED Past Questions-1snazzyNessuna valutazione finora

- Bhojpuri PDFDocumento15 pagineBhojpuri PDFbestmadeeasy50% (2)

- Unit 6 Lesson 3 Congruent Vs SimilarDocumento7 pagineUnit 6 Lesson 3 Congruent Vs Similar012 Ni Putu Devi AgustinaNessuna valutazione finora