Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reverse Mergers vs. IPOs

Caricato da

prasannarb0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni15 pagineDifference between Reverse merger & IPOs

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoDifference between Reverse merger & IPOs

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni15 pagineReverse Mergers vs. IPOs

Caricato da

prasannarbDifference between Reverse merger & IPOs

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

A seminar report on

Reverse Mergers vs. IPOs

Submitted to:

Dr G.V Joshi

Submitted by:

Prasanna Bhat

Submitted on:

03/03/2011

Justice K.S Hegde Institute of Management, Nitte

Introduction

When a company decides to go public they have an option to have a private company take

over the public company also known as a shell company by exchanging information and

merger terms, allowing for two companies to combine assets and share in the profits of IPO

stock. Reverse takeovers have historically been used by businesses that wish to start trading

in a very short time.

The public shell is a publicly listed company with no assets or liabilities. It is called a "shell"

considering all that exists of the original company is its corporate shell structure. By merging

into such an entity, a private company becomes public.

Reverse takeovers or Reverse Merger is popular because a private company can take the

stock from the merger and finance acquisitions as well as retain more investors. So this

method is an alternative to the traditional initial public offerings to raise capital. . In other

words A Reverse merger is a way by which a private company can become a public

company and take advantage of the greater financing options available to public companies.

The private company shareholders receive a substantial majority of the shares of the public

company (normally 85% to 90% or more) and the control of the board of directors. The

transaction can be accomplished in as little as two weeks, resulting in the private company

becoming a public company. The transaction does not go through a review process with state

and federal regulators because the public company has already completed the process. The

transaction involves the private and shell company exchanging information on each other,

negotiating the merger terms, and signing a share exchange agreement. At the closing the

public shell company issues a substantial majority of its shares and the board control to the

shareholders of the private company. The private company shareholders pay for the shell and

contribute their private company shares to the shell company and the private company is now

public.

Upon completion of the reverse merger, the name of the shell company is usually changed to

the name of the private company. An information statement, called an 8-K, must be filed

within 15 days of the closing. The 8-K describes the newly combined company, stock issued,

information of new officers and directors, and financial statements audited to US GAAP,

standards. The 8-K must disclose the same type of information that it would be required to

provide in registering a class of securities under the Securities Exchange Act of 1934.

If the shell company is listed on the Bulletin board, the registered or free trade shares can

continue to trade. The company can do a private placement immediately. To trade new shares

offered by the public shell the newly combined public company must first register the shares

with the SEBI.

Reasons for reverse mergers are:

a) The transferee company is a sick company and has carried forward losses and

Transferor Company is profit making company. If Transferor Company merges with

the sick transferee company, it gets advantage of setting off carry forward losses

without any conditions. If sick company merges with healthy company, many

restrictions are applicable for allowing set off.

Many times, reverse mergers are also accompanied by reduction in the unwieldy

capital of the sick company. This capital reduction helps in unity of the accumulated

losses and other assets which are not represented by the share capital of the company.

Thus, a capital reduction aim rehabilitation scheme is an ideal antidote for sick

company.

b) The transferee company may be listed company. In such case, if Transferor Company

merges with the listed company, it gets advantages of listed company, without

following strict norms of listing of stock exchanges. In such cases, it is provided that

on date of merger, name of Transferee Company will be changed to that of Transferor

Company. Thus, outside people even may not know that the transferor company with

which they are dealing after merger is not the same as earlier one.

Other strategic reasons are:

Stock options:

If your company wants to compensate employees with stock options without initiating a

public offering, a reverse merger can provide a ready supply of public stock.

Acquisition financing:

If your company intends to make business acquisitions, you could use a reverse merger to

access publicly traded stock that can then be used to finance deals.

Retaining a majority:

If your private company fears ownership dilution, a reverse merger may be preferable to

losing control to outside investors in the public market. Reverse mergers allow private

company owners to retain large majority stakes in their companies.

Lower risk:

A reverse merger protects your company from the whims of the public marketplace. An IPO

can live or die depending on timing and other market variables, but reverse mergers are

completed at your pace and are under your control.

Funding for growth:

If you need to be able to offer public shares to pursue your growth plans, but would prefer to

avoid the risk and expense of an IPO, a reverse merger may just be the ticket. Selling off your

company- at least on paper- can make you the owner of a company with the possibility of

much greater potential.

Advantages:

Some of the advantages of Going Public through a Reverse Merger or a Public Shell

Purchase are:

Increased Valuation: Typically publicly traded companies enjoy substantially higher

valuations than private companies.

Capital Formation: Raising capital is usually easier because of the added liquidity

for the investors, and it often takes less time and expense to complete an offering.

Acquisitions: Making acquisitions with public stock is often easier and less

expensive.

Incentives: Stock options or stock incentives can be useful in attracting management

and retaining valuable employees.

Financial Planning: Public company stock is often easier to use in estate planning

for the principals. Public stock can provide a long term exit strategy for the founders.

Reduced Costs: The costs are significantly less than the costs required for an initial

public offering.

Reduced Time: The time frame requisite to securing public listing is considerably

less than that for an IPO.

Reduced Risk: Additional risk is involved in an IPO in that the IPO may be

withdrawn due to an unstable market condition even after most of the up front costs

have been expended.

Reduced Management Time: Traditional IPOs generally require greater attention

from senior management.

Reduced Business Requirements: While an IPO requires a relatively long and stable

earnings history, the lack of an earnings history does not normally keep a privately

held company from completing a reverse merger.

Reduced Dilution: There is less dilution of ownership control, compared to a

traditional IPO.

Reduced Underwriter Requirements: No underwriter is needed: (a significant

factor to consider given the difficulty companies face in attracting an investment

banking firm to commit to an offering.)

IPO- Meaning:

An Initial Public Offer (IPO) is the selling of securities by a company to the public in the

primary market for the first time.

Disadvantages of traditional IPOs:

a) The costs required for an IPO is high

b) The time required is considerably more for an IPO

c) An IPO may be withdrawn due to an unstable market condition even after most of the

up-front costs have been expended

d) IPOs generally require greater attention from top management

e) The lack of an earning history normally keep a privately held company from

completing an IPO

f) The Company requires an underwriter

Reverse Triangular Merger:

According to securities law institute: They state that in a reverse triangular merger, the

merger proceeds with the subsidiary being merged into the target corporation and the

outstanding shares of stock of the subsidiary are now owned by the acquiring corporation and

then are converted into shares of stock of the target corporation.

The shares of stock of the target corporation are converted into securities of the acquiring

corporation, with the advantage being that the target corporation will become a wholly-

owned subsidiary of the acquiring corporation without any change in its corporate existence.

Two steps in Triangular Reverse Merger:

1. Reorganization Diagram

2. Post-Transaction Structure

Reverse Merger vs. Merger:

Normally, a small company merges with large company or a sick company with healthy

company. However in some cases, reverse merger is done. When a healthy company merges

with a sick or a small company is called reverse merger. This may be for various reasons.

Some reasons for reverse merger are:

a) The transferee company is a sick company and has carried forward losses and

Transferor Company is profit making company. If Transferor Company merges with the sick

transferee company, it gets advantage of setting off carry forward losses without any

conditions. If sick company merges with healthy company, many restrictions are applicable

for allowing set off.

b) The transferee company may be listed company. In such case, if Transferor Company

merges with the listed company, it gets advantages of listed company, without following

strict norms of listing of stock exchanges.

In such cases, it is provided that on date of merger, name of Transferee Company will be

changed to that of Transferor Company. Thus, outside people even may not know that the

transferor company with which they are dealing after merger is not the same as earlier one.

The combination of a reverse merger and PIPE is powerful:

Many private companies face challenges raising capital while private, yet without that capital

they cannot grow to a size that would allow them to become public. The alternative public

offering addresses this conundrum by providing promising private companies with access to

the public markets and a greater ability to attract capital. By accessing the PIPE market at the

time of a reverse merger, newly public companies can raise capital as soon as they go public,

which is exactly what would happen in an IPO. For those private companies that have access

to the IPO market, an alternative public offering still can offer significant advantages.

In an alternative public offering, the registration statement is filed after the reverse merger

and PIPE financing, which greatly accelerates the timing of the completion of the transaction.

Second, alternative public offerings are far less expensive than IPOs, which entail the burden

of upfront registration and underwriting fees. Third, alternative public offerings are less risky

than IPOs since alternative public offerings are negotiated between the shell owner and the

institutional investors, as compared to an IPO which involves red herrings being distributed

to a significant number of investors. The success of an IPO is highly dependent on market

conditions beyond the control of a private companys management. Lastly, alternative public

offerings can be completed for much smaller companies than a high cost IPO.

Issues in Reverse Mergers:

Approval: There was no provision in the Banking Regulation Act that stated that banks need

to acquire prior RBI approval before approaching the court. The RBI in July 2004 had

issued a circular making central banks prior approval mandatory for merger of an NBFC

with a bank. The Reserve Bank of India (RBI) directed banking companies to obtain its

approval for proposed mergers between banks and non-banking finance companies (NBFCs)

before submitting the scheme of amalgamation to the high court for approval. The Securities

and Exchange Board of India (SEBI) regulations on prohibition of insider trading will be

applicable for NBFC merger with listed and unlisted banks. It also stated that the bank board

should ensure that the NBFC has not violated or is likely to violate any of the RBI/Sebi

norms and must comply with Know Your Customer norms for all accounts, which will

come under the banking company after amalgamation.

Human Resources: In the context of consolidation, one of the major issues, which need to

be handled, is in regard to the treatment of the employees of the transferor bank consequent

upon the merger. Various laws under which the banking institutions are constituted contain

provisions about mergers as also continuation of the existing employees of the transferor

bank. In the case of New Bank of India Vs. Union of India (1996 (8) SCC 407) the Supreme

Court held that the Central Government had the powers to frame such a scheme and the Court

would be entitled to interfere with such a scheme only if it comes to the conclusion that either

the scheme is arbitrary or irrational or based on extraneous considerations. In all cases of

mergers, the Central Government will have to formulate a suitable scheme for continuation

and other service conditions, applicable to the employees of the transferor bank consequent

upon merger.

Taxation: Under section 72A (1) of the Income Tax Act where there has been an

amalgamation of a banking company with a specified bank, the accumulated loss and the

unabsorbed depreciation of the amalgamating company shall be deemed to be the loss and the

provisions of the Income Tax Act relating to set-off and carry forward of loss and allowance

for depreciation shall apply accordingly. The effect of this provision is that benefit of carry

forward loss and unabsorbed depreciation is available only in case where a banking company

is merged with SBI or subsidiary of SBI or a corresponding new bank.

Accounting: The system of maintaining accounts and accounting practices, are standardized

and uniform in banks. Standards in regard to income recognition, classification of accounts

and provisioning have also been standardized by RBI directives. Section 29 of the Banking

Regulation Act, 1949 requires every bank to prepare a balance-sheet and profit and loss

account in the forms set out in the Third Schedule to the Act. Sub-section (3) of section 29

further provides that provisions of the Companies Act, 1956 relating to balance-sheet and

profit and loss account shall apply to banking companies to the extent they are not

inconsistent with the Banking Regulation Act. Hence, in view of such standardization,

merger may not pose problems in relation to accounting practices except the need to fine-tune

any divergent practices, in respect of specific heads of accounts.

IT integration : One critical area that would need careful consideration is integration of

different technology platforms and software which not only have process and control

implications but may involve substantial costs in terms of money and time and retraining of

personnel. Integration of products and services: In regard to actual banking operations, each

bank has different nomenclatures for deposit schemes and loan products. Similarly, in

internal working and inter-branch transactions, banks have different nomenclatures for debit

and credit vouchers. On any merger, such variations in the schemes and products and other

practices need to be integrated.

Swap Ratio: As regards the shareholders' interest, the swap ratio could be decided mutually

at the time of merger and normally does not pose much problem. In the merger, the operating

companys shareholders are issued shares of the shell in exchange for the operating

companys shares. Post-merger, the former operating companys shareholders own 85-95%

of the shell, which now contains the assets and liabilities of the operating company, with the

remaining 5-15% owned by the existing shell companys shareholders.

Drawbacks of a Reverse Merger:

a) Managers must conduct appropriate diligence regarding the profile of the investors of

the public shell company. What are their motivations for the merger? Have they done

their homework to make sure the shell is clean and not tainted? Are there pending

liabilities (such as those stemming from litigation) or other deal warts hounding the

public shell? If so, shareholders of the public shell may merely be looking for a new

owner to take possession of these deal warts. Thus, appropriate due diligence should

be conducted, and transparent disclosure should be expected (from both parties).

Otherwise, the new entity could become responsible for those liabilities.

b) If the public shell's investors sell significant portions of their holdings right after the

transaction, this can materially and negatively affect the stock price. To reduce or

eliminate the risk that the stock will be dumped, important clauses can be

incorporated into a merger agreement such as required holding periods. It is important

to note that, as in all merger deals, the risk goes both ways. Investors of the public

shell should also conduct reasonable diligence on the private company, including its

management, investors, operations, financials and possible pending liabilities (i.e.,

litigation, environmental problems, safety hazards, labour issues).

c) After a private company executes a reverse merger, will its investors really obtain

sufficient liquidity? Smaller companies may not be ready to be a public company,

including lack of operational and financial scale. Thus, they may not attract analyst

coverage from stock exchanges; after the reverse merger is consummated, the original

investors may find out that there is no demand for their shares. Reverse mergers do

not replace sound fundamentals. For a company's shares to be attractive to prospective

investors, the company itself should be attractive operationally and financially.

d) A potentially significant setback when a private company goes public is that managers

are often inexperienced in the additional regulatory and compliance requirements of

being a publicly-traded company. These burdens (and costs in terms of time and

money) can prove significant, and the initial effort to comply with additional

regulations can result in a stagnant and underperforming company if managers devote

much more time to administrative concerns than to running the business. To alleviate

this risk, managers of the private company can partner with investors of the public

shell who have experience in being officers and directors of a public company. The

CEO can additionally hire employees (and outside consultants) with relevant

compliance experience. Managers should ensure that the company has the

administrative infrastructure, resources, road map and cultural discipline to meet these

new requirements after a reverse merger.

ICICI reverse merger:

RBI gave approval for the reverse merger of ICICI Ltd with its banking arm ICICI Bank and

made it formal. ICICI Bank with Rs 1 lakhs crore asset bases is second only to State Bank of

India, which is well over Rs 3 lakhs crore in size. RBI also cleared the merger of two ICICI

subsidiaries, ICICI Personal Financial Services and ICICI Capital Services with ICICI Bank.

The merger is effective from the appointed dated of March 30, 02, and the swap ratio has

been fixed at two ICICI shares for one ICICI Bank share. Initially ICICI shareholders were

against the hefty premium that they had to pay by parting with two ICICI shares for one share

of the ICICI Bank despite the per share book value of Rs. 111.81 for ICICI as against Rs.

65.33 for ICICI Bank.

RBI approval was subject to the following conditions:

(i) Compliance with Reserve Requirements:

The ICICI Bank Ltd. would comply with the Cash Reserve Requirements (under Section 42

of the Reserve Bank of India Act, 1934) and Statutory Liquidity Reserve Requirements

(under Section 24 of the Banking Regulation Act, 1949) as applicable to banks on the net

demand and time liabilities of the bank, inclusive of the liabilities pertaining to ICICI Ltd.

from the date of merger. Consequently, ICICI Bank Ltd. would have to comply with the

CRR/SLR computed accordingly and with reference to the position of Net Demand and Time

Liabilities as required under existing instructions.

(ii) Other Prudential Norms:

ICICI Bank Ltd. will continue to comply with all prudential requirements, guidelines and

other instructions as applicable to banks concerning capital adequacy, asset classification, and

income recognition and provisioning, issued by the Reserve Bank from time to time on the

entire portfolio of assets and liabilities of the bank after the merger.

(iii) Conditions relating to Swap Ratio:

As the proposed merger is between a banking company and a financial institution, all matters

connected with shareholding including the swap ratio, will be governed by the provisions of

Companies Act, 1956, as provided. In case of any disputes, the legal provisions in the

Companies Act and the decision of the Courts would apply.

(iv)Appointment of Directors:

The bank should ensure compliance with Section 20 of the Banking Regulation Act, 1949,

concerning granting of loans to the companies in which directors of such companies are also

directors. In respect of loans granted by ICICI Ltd. to companies having common directors,

while it will not be legally necessary for ICICI Bank Ltd. to recall the loans already granted

to such companies after the merger, it will not be open to the bank to grant any fresh loans

and advances to such companies after merger. The prohibition will include any renewal or

enhancement of existing loan facilities. The restriction contained in Section 20 of the Act

ibid, does not make any distinction between professional directors and other directors and

would apply to all directors.

(v) Priority Sector Lending:

Considering that the advances of ICICI Ltd. were not subject to the requirement applicable to

banks in respect of priority sector lending, the bank would, after merger, maintain an

additional 10 per cent over and above the requirement of 40 per cent, i.e., a total of 50 per

cent of the net bank credit on the residual portion of the bank's advances. This additional 10

per cent by way of priority sector advances will apply until such time as the aggregate

priority sector advances reaches a level of 40 per cent of the total net bank credit of the bank.

The Reserve Banks existing instructions on sub-targets under priority sector lending and

eligibility of certain types of investments/funds for reckoning as priority sector advances

would apply to the bank.

(vi)Equity Exposure Ceiling of 5%:

The investments of ICICI Ltd. acquired by way of project finance as on the date of merger

would be kept outside the exposure ceiling of 5 per cent of advances towards exposure to

equity and equity linked instruments for a period of five years since these investments need to

be continued to avoid any adverse effect on the viability or expansion of the project. The

bank should, however, mark to market the above instruments and provide for any loss in their

value in the manner prescribed for the investments of the bank. Any incremental accretion to

the above project-finance category of equity investment will be reckoned with in the 5 per

cent ceiling for equity exposure for the bank.

(vii) Investments in Other Companies:

The bank should ensure that its investments in any of the companies in which ICICI Ltd. had

investments prior to the merger are in compliance with Section 19 (2) of Banking Regulation

Act, 1949, prohibiting holding of equity in excess of 30 per cent of the paid-up share capital

of the company concerned or 30 per cent of its own paid-up share capital and reserves,

whichever is less.

(viii) Subsidiaries:

(a) While taking over the subsidiaries of ICICI Ltd. after merger, the bank should ensure that

the activities of the subsidiaries comply with the requirements of permissible activities to be

undertaken by a bank under Section 6 of the Banking Regulation Act, 1949 and Section 19(1)

of the Act ibid.

(b) The takeover of certain subsidiaries presently owned by ICICI Ltd. by ICICI Bank Ltd.

will be subject to approval, if necessary, by other regulatory agencies, viz., IRDA, SEBI,

NHB, etc.

(ix) Preference Share Capital:

Section 12 of the Banking Regulation Act, 1949 requires that capital of a banking company

shall consist of ordinary shares only (except preference share issued before 1944). The

inclusion of preference share capital of Rs. 350 crore (350 shares of Rs.1 crore each issued by

ICICI Ltd. prior to merger), in the capital structure of the bank after merger is, therefore,

subject to the exemption from the application of the above provision of Banking Regulation

Act, 1949, granted by the Central Government in terms of Section 53 of the Act ibid for a

period of five years.

(x) Valuation and Certification of the Assets of ICICI Ltd:

ICICI Bank Ltd. should ensure that fair valuation of the assets of the ICICI Ltd. is carried out

by the statutory auditors to its satisfaction and that required provisioning requirements are

duly carried out in the books of ICICI Ltd. before the accounts are merged. Certificates from

statutory auditors should be obtained in this regard and kept on record.

ICICI after reverse merger:

The new entity ICICI Bank, after the reverse merger of ICICI and ICICI Bank, came out with

its first operational results for the year to March 2002 signalling the dawn of a new era in the

fast changing Indian financial sector. It marked the arrival of the first Universal Bank in the

country. It also symbolises the demise of one of the oldest development finance institutions

(DFI), ICICI, after 47 years of existence.

A Banking Behemoth

ICICI Bank boasts of net worth of Rs 6,249 crore and total assets of Rs 1,04,100 crore as

against assets of Rs 38,100 crore on a standalone basis. Quite clearly, the magnitude of the

reverse merger between ICICI and ICICI Bank was unparallel in the Indian financial sector

history and therefore there were no comparative benchmarks.

It wrote off Rs 3,780 crore worth of assets, lowered the equity base. An important point is

that under the purchase method of merger accounting, the assets of ICICI were acquired by

the bank on a fair value basis that was lower than the cost. Hence, these assets could be

written down significantly without the write-down being accounted for through the P&L

account (future loan loss charges were avoided). Meanwhile, a change in the asset mix in

favour of government bonds lowered capital intensity.

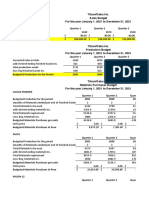

Financial Performance

The banks total income rose 86 per cent to Rs 2,226 crore. Interest income grew 73 per cent

to Rs 1242 crore, helped largely by interest income on investments that more than doubled to

Rs. 555.3 crore. Net interest earned (NIE) stood at Rs. 593 crore (404 crore) but, NIE/TIE

expectedly declined by 500 basis points. This was largely owing to the reserve requirements

that outweighed the lower cost of funds. Low interest rate regime aided the reverse merger.

The softening of interest rates meant that government securities had appreciated in value

thereby provided the bank with a buffer to set off non-performing loans.

Other income rose 161 per cent to Rs. 574 crore thanks to a hefty jump of 459 per cent in

trading profits that enabled the other income to total income ratio to jump by 600 basis points

at 21 per cent. Expenses remained under control with operating expenses as percentage of

total income remained flat at 22.8 per cent. The effects of huge provisioning of Rs. 255.6

crore (Rs 63.6 crore) was negated to an extent through tax breaks amounting to Rs. 90.3 crore

enabling net profit growth of 60 per cent to Rs. 258.3 crore.

Though NPAs stood at 4.7 per cent capital adequacy was comfy at 11.4 per cent, the bank

with its size owing to benefits of scale was expected to mop up greater retail funds that

enable higher margins through increased fee-income. However, its imperative for the bank to

successfully leverage corporate relationships.

Conclusion:

A reverse merger is an attractive strategic option for managers of private companies to gain

public company status. It is a less time consuming and less costly alternative than the

conventional IPO. As a public company, management can enjoy greater flexibility in terms of

financing alternatives, and the company's investors can also enjoy greater liquidity.

Managers, however, should be cognizant of the additional compliance burdens faced by

public companies, and ensure that sufficient time and energy continues to be devoted to

running and growing the business. It is after all a strong company, with robust prospects, that

will attract sufficient analyst coverage as well as prospective investor interest. Attracting

these elements can increase the value of the stock and its liquidity for shareholders.

Potrebbero piacerti anche

- Definition: The Corporate Restructuring Is The Process ofDocumento8 pagineDefinition: The Corporate Restructuring Is The Process ofHARSHITA SOANNessuna valutazione finora

- What Are RTO's (Reverse Takeovers) PrimerDocumento6 pagineWhat Are RTO's (Reverse Takeovers) PrimerPropertywizzNessuna valutazione finora

- CFM TP FinDocumento13 pagineCFM TP FinsantoshpatnaikNessuna valutazione finora

- corpoRTE RESTRUCTURING OD DELL COMPUTERSDocumento32 paginecorpoRTE RESTRUCTURING OD DELL COMPUTERSsarvaianNessuna valutazione finora

- Merger Acquisition RestructuringDocumento97 pagineMerger Acquisition RestructuringMBaralNessuna valutazione finora

- Mergers and AcquisitionDocumento12 pagineMergers and AcquisitionJeswel RebatoNessuna valutazione finora

- Chapter 8 of BBS 3rd YearDocumento26 pagineChapter 8 of BBS 3rd YearAmar Singh SaudNessuna valutazione finora

- 1CR NotesDocumento30 pagine1CR NotesYASHIRA PATELNessuna valutazione finora

- Chapter-1 Concept of MergerDocumento58 pagineChapter-1 Concept of MergerKamal JoshiNessuna valutazione finora

- New Microsoft Word DocumentDocumento3 pagineNew Microsoft Word Documentishagoyal595160100% (1)

- Unit 5 Reverse MergersDocumento10 pagineUnit 5 Reverse MergersdivlingvarshneyNessuna valutazione finora

- Final Seminar 4.Documento9 pagineFinal Seminar 4.Punam GuptaNessuna valutazione finora

- Corporate RestructuringDocumento13 pagineCorporate RestructuringSubrahmanya SringeriNessuna valutazione finora

- Reverse MergersDocumento16 pagineReverse MergersIshita AroraNessuna valutazione finora

- A Study On Reverse MergerDocumento9 pagineA Study On Reverse MergerAsim ChoudhuryNessuna valutazione finora

- Mergers and Acquisitions, Answer Sheet MF0011Documento5 pagineMergers and Acquisitions, Answer Sheet MF0011Ganesh ShindeNessuna valutazione finora

- Chapter 18Documento16 pagineChapter 18Faisal AminNessuna valutazione finora

- Reverse Mergers in IndiaDocumento9 pagineReverse Mergers in IndiaRachit MunjalNessuna valutazione finora

- Chapter 13 PDFDocumento73 pagineChapter 13 PDFMUKESH KUMARNessuna valutazione finora

- Exploring The Fishnet of Reverse Merger and Debt To Equity SwapsDocumento13 pagineExploring The Fishnet of Reverse Merger and Debt To Equity SwapsJay ShahNessuna valutazione finora

- Definition of 'Divestiture'Documento10 pagineDefinition of 'Divestiture'purple0123Nessuna valutazione finora

- Merger Acquisition: DEFINITION of 'Synergy'?Documento6 pagineMerger Acquisition: DEFINITION of 'Synergy'?Neel PannaNessuna valutazione finora

- 0 Share: Meaning and Need For Corporate RestructuringDocumento11 pagine0 Share: Meaning and Need For Corporate Restructuringdeepti_gaddamNessuna valutazione finora

- Reverse Merger: Features of Reverse MergersDocumento3 pagineReverse Merger: Features of Reverse MergerssangeetagoeleNessuna valutazione finora

- SFM NotesDocumento58 pagineSFM NotesNabinSundar NayakNessuna valutazione finora

- Meregers and AquisationDocumento122 pagineMeregers and AquisationAmit GanjiNessuna valutazione finora

- Mergers & Acquisitions and Financial RestructuringDocumento30 pagineMergers & Acquisitions and Financial Restructuringloving_girl165712Nessuna valutazione finora

- Merger, Acquisition, TakeoverDocumento25 pagineMerger, Acquisition, Takeoverpintu_brownyNessuna valutazione finora

- Business Law Class 10 Legal Aspect of Financing A CorporationDocumento24 pagineBusiness Law Class 10 Legal Aspect of Financing A Corporationmr singhNessuna valutazione finora

- Unit 1Documento10 pagineUnit 1Anwar KhanNessuna valutazione finora

- Mergers & AcquisitionDocumento29 pagineMergers & AcquisitionKunal Chaudhry100% (2)

- Topic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Documento14 pagineTopic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Veneranda vedastusNessuna valutazione finora

- Introduction To Mergers and AcquisitionDocumento5 pagineIntroduction To Mergers and AcquisitionVishal SalveNessuna valutazione finora

- Various Forms of RestructuringDocumento43 pagineVarious Forms of RestructuringAnkita GaikwadNessuna valutazione finora

- The Basic Forms of AcquisitionsDocumento6 pagineThe Basic Forms of AcquisitionsVinesh KumarNessuna valutazione finora

- 047-Ashish Shah-M & ADocumento78 pagine047-Ashish Shah-M & ADipesh JainNessuna valutazione finora

- MergersDocumento3 pagineMergersAmit PandeyNessuna valutazione finora

- December 2018 Summary Points BY TAHA POPATIADocumento3 pagineDecember 2018 Summary Points BY TAHA POPATIASriram RatnamNessuna valutazione finora

- Giddy Introduction To Mergers & Acquisitions PDFDocumento14 pagineGiddy Introduction To Mergers & Acquisitions PDFCharles GarrettNessuna valutazione finora

- M&a AssignmentDocumento63 pagineM&a AssignmentJason Baird50% (4)

- Corporate RestructuringDocumento41 pagineCorporate Restructuringchintan shah100% (1)

- FRP FinalDocumento88 pagineFRP Finalgeeta44Nessuna valutazione finora

- Hostile Takeover PanjangDocumento3 pagineHostile Takeover PanjangDimar ReandraNessuna valutazione finora

- Mergers and AcquisitionDocumento71 pagineMergers and AcquisitionAnonymous k2ZXzsNessuna valutazione finora

- Merger Write UpDocumento17 pagineMerger Write UpKhushal ThakkarNessuna valutazione finora

- Strategic Management Management Companies Entities: Mergers and Acquisitions Are Both Aspects ofDocumento47 pagineStrategic Management Management Companies Entities: Mergers and Acquisitions Are Both Aspects ofdamini warangNessuna valutazione finora

- MERGERS & 2 ProjectDocumento16 pagineMERGERS & 2 ProjectripzNessuna valutazione finora

- Dr. Rakesh Kumar Sharma SBSBS, Thapar University, PatialaDocumento29 pagineDr. Rakesh Kumar Sharma SBSBS, Thapar University, PatialaSaburao ChalawadiNessuna valutazione finora

- ACCT 1113 (Accounting For Business Combination) Lesson 1: Business Combination Part 1Documento6 pagineACCT 1113 (Accounting For Business Combination) Lesson 1: Business Combination Part 1cooperNessuna valutazione finora

- Types of TakeoverDocumento105 pagineTypes of TakeoverShephard Jack100% (1)

- Corporate RestructuringDocumento38 pagineCorporate RestructuringArzoo BansalNessuna valutazione finora

- Project of Merger AcquisitionDocumento65 pagineProject of Merger AcquisitionPreetishRSuvarnaNessuna valutazione finora

- M&a 1Documento34 pagineM&a 1shirkeoviNessuna valutazione finora

- Demerger of A Company Takes Place When: 1. Part ofDocumento9 pagineDemerger of A Company Takes Place When: 1. Part ofsubarna84100% (1)

- Corporate Restructuring - Meaning, Types, and CharacteristicsDocumento6 pagineCorporate Restructuring - Meaning, Types, and CharacteristicsPrajwalNessuna valutazione finora

- Conceptual QuestionsDocumento5 pagineConceptual QuestionsSarwanti PurwandariNessuna valutazione finora

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingDa EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNessuna valutazione finora

- Dividend Investing for Beginners & DummiesDa EverandDividend Investing for Beginners & DummiesValutazione: 5 su 5 stelle5/5 (1)

- Reading A Forex Quote and Understanding The JargonDocumento18 pagineReading A Forex Quote and Understanding The JargonprasannarbNessuna valutazione finora

- Will & SuccessionDocumento3 pagineWill & SuccessionprasannarbNessuna valutazione finora

- Some Topics For KASDocumento6 pagineSome Topics For KASprasannarbNessuna valutazione finora

- Property DisputesDocumento5 pagineProperty DisputesprasannarbNessuna valutazione finora

- The Himalayas "The Roof of The World": Report OnDocumento10 pagineThe Himalayas "The Roof of The World": Report OnprasannarbNessuna valutazione finora

- Will & SuccessionDocumento3 pagineWill & SuccessionprasannarbNessuna valutazione finora

- Foreign Banks in IndiaDocumento7 pagineForeign Banks in IndiaprasannarbNessuna valutazione finora

- FB SeminarDocumento16 pagineFB SeminarprasannarbNessuna valutazione finora

- Reliance Industries Is The Highest Profit Making Company. What Are The Secrets of Retaining This Position ?Documento39 pagineReliance Industries Is The Highest Profit Making Company. What Are The Secrets of Retaining This Position ?prasannarbNessuna valutazione finora

- ICICI RevMergerDocumento5 pagineICICI RevMergerprasannarbNessuna valutazione finora

- FB SeminarDocumento16 pagineFB SeminarprasannarbNessuna valutazione finora

- Getting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportDocumento139 pagineGetting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportalbimorkalNessuna valutazione finora

- Leave Trading System-1Documento3 pagineLeave Trading System-1Darshan ToreNessuna valutazione finora

- Foreign Banks and GuidelinesDocumento7 pagineForeign Banks and GuidelinesprasannarbNessuna valutazione finora

- Excise AccountingDocumento50 pagineExcise AccountingMd Monwar HussainNessuna valutazione finora

- Notification Regarding Vat D-3 - HaryanaDocumento1 paginaNotification Regarding Vat D-3 - HaryanaprasannarbNessuna valutazione finora

- Him SlidesDocumento16 pagineHim SlidesprasannarbNessuna valutazione finora

- Physicians ListingDocumento1 paginaPhysicians ListingprasannarbNessuna valutazione finora

- Physicians ListingDocumento1 paginaPhysicians ListingprasannarbNessuna valutazione finora

- Kannada LTTR Qs - Dist. Education - Dravida UniversityDocumento4 pagineKannada LTTR Qs - Dist. Education - Dravida UniversityprasannarbNessuna valutazione finora

- Getting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportDocumento139 pagineGetting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportalbimorkalNessuna valutazione finora

- Excise AccountingDocumento50 pagineExcise AccountingMd Monwar HussainNessuna valutazione finora

- Excise AccountingDocumento50 pagineExcise AccountingMd Monwar HussainNessuna valutazione finora

- TallyDocumento319 pagineTallyAshish MahajanNessuna valutazione finora

- Income Tax: Tally - ERP 9 Series A Release 3.0Documento20 pagineIncome Tax: Tally - ERP 9 Series A Release 3.0prasannarbNessuna valutazione finora

- Getting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportDocumento139 pagineGetting Started With Excise For Manufacturers - Tally Customization Services - Tally Implementation Services - Tally Remote SupportalbimorkalNessuna valutazione finora

- Saindhava Lavana - The Rock SaltDocumento2 pagineSaindhava Lavana - The Rock SaltprasannarbNessuna valutazione finora

- Consolidation in BanksDocumento32 pagineConsolidation in BanksprasannarbNessuna valutazione finora

- Not Include Customs Duties, Taxes, Brokerage Fees or Any Other Charges That May Be Incurred. They Are The Responsibility of The Recipient/consigneeDocumento2 pagineNot Include Customs Duties, Taxes, Brokerage Fees or Any Other Charges That May Be Incurred. They Are The Responsibility of The Recipient/consigneeALIZON JAZMIN OROSCO QUISPENessuna valutazione finora

- 2189XXXXXXXXX316721 09 2019Documento3 pagine2189XXXXXXXXX316721 09 2019Sumit ChakrabortyNessuna valutazione finora

- Construction International Innovation Ability - The Mode of Huawei Abstract After Reviewing Huawei's Twenty Years of Innovation andDocumento1 paginaConstruction International Innovation Ability - The Mode of Huawei Abstract After Reviewing Huawei's Twenty Years of Innovation andDwitya AribawaNessuna valutazione finora

- Configuring and Managing JDBC Data Sources For Oracle WebLogic Server 11.1Documento148 pagineConfiguring and Managing JDBC Data Sources For Oracle WebLogic Server 11.1mdalaminNessuna valutazione finora

- Politica de Dezvoltare Regională În RomâniaDocumento34 paginePolitica de Dezvoltare Regională În RomânialaNessuna valutazione finora

- Acctg 202 Di Pa FinalDocumento10 pagineAcctg 202 Di Pa FinalJoshua CabinasNessuna valutazione finora

- Outline - Estate and DonorsDocumento24 pagineOutline - Estate and DonorsCarlo BarrientosNessuna valutazione finora

- Frauds in Indian Banking SectorDocumento5 pagineFrauds in Indian Banking SectorPayal Ambhore100% (1)

- CRM Course No. 10 - 2020 - Complaints and Claims ManagementDocumento11 pagineCRM Course No. 10 - 2020 - Complaints and Claims ManagementMihaela ZăbavăNessuna valutazione finora

- Kotak Mahindra GroupDocumento6 pagineKotak Mahindra GroupNitesh AswalNessuna valutazione finora

- Business Plan On HIRING A MAIDDocumento21 pagineBusiness Plan On HIRING A MAIDharsha100% (1)

- MBA Result 2014 16Documento7 pagineMBA Result 2014 16SanaNessuna valutazione finora

- Best Practices Guide For IT Governance & ComplianceDocumento14 pagineBest Practices Guide For IT Governance & ComplianceAnonymous 2WKRBqFlfNessuna valutazione finora

- Sample Format FSDocumento2 pagineSample Format FStanglaolynetteNessuna valutazione finora

- EPC Vs EPCmDocumento4 pagineEPC Vs EPCmjsaulNessuna valutazione finora

- IP-A1 SiddharthAgrawal 19A2HP405Documento2 pagineIP-A1 SiddharthAgrawal 19A2HP405Debanjan MukherjeeNessuna valutazione finora

- Introduction of Icici BankDocumento6 pagineIntroduction of Icici BankAyush JainNessuna valutazione finora

- Organizational StructureDocumento7 pagineOrganizational StructureSiva Prasad KantipudiNessuna valutazione finora

- Importance of Project Management in ConstructionDocumento10 pagineImportance of Project Management in ConstructionNicole SantillanNessuna valutazione finora

- GEOVIA Whittle BrochureDocumento4 pagineGEOVIA Whittle BrochureMahesh PandeyNessuna valutazione finora

- B2B E-Marketplace Adoption in Agriculture: Zheng XiaopingDocumento8 pagineB2B E-Marketplace Adoption in Agriculture: Zheng XiaopingNikhil MalhotraNessuna valutazione finora

- Appendix V-Honda CSR 003Documento11 pagineAppendix V-Honda CSR 003SowdayyaNessuna valutazione finora

- Roles & Responsibilities of A Maintenance Engineer - LinkedInDocumento4 pagineRoles & Responsibilities of A Maintenance Engineer - LinkedInEslam MansourNessuna valutazione finora

- E Health Business PlanDocumento36 pagineE Health Business PlanZaman Ali100% (1)

- Mid Term Exam 1 - Fall 2018-799Documento3 pagineMid Term Exam 1 - Fall 2018-799abdirahmanNessuna valutazione finora

- Management Study Case - Martinez ConstructionDocumento5 pagineManagement Study Case - Martinez ConstructionCristina IonescuNessuna valutazione finora

- MBA Course StructureDocumento2 pagineMBA Course StructureAnupama JampaniNessuna valutazione finora

- Training Levies: Rationale and Evidence From EvaluationsDocumento17 pagineTraining Levies: Rationale and Evidence From EvaluationsGakuya KamboNessuna valutazione finora

- TVE Phase-1 Addendum No 8Documento1 paginaTVE Phase-1 Addendum No 8Anonymous Un3Jf6qNessuna valutazione finora

- The Need For Time Management Training Is Universal: Evidence From TurkeyDocumento8 pagineThe Need For Time Management Training Is Universal: Evidence From TurkeyAnil AkhterNessuna valutazione finora